Deck 3: Financial Planning and Growth

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/33

العب

ملء الشاشة (f)

Deck 3: Financial Planning and Growth

1

One key reason a long term financial plan is developed is because:

A) the plan determines your financial policy.

B) the plan determines your investment policy.

C) there are direct connections between achievable corporate growth and the financial plan.

D) there is unlimited growth possible in a well-developed financial plan.

A) the plan determines your financial policy.

B) the plan determines your investment policy.

C) there are direct connections between achievable corporate growth and the financial plan.

D) there is unlimited growth possible in a well-developed financial plan.

there are direct connections between achievable corporate growth and the financial plan.

2

A firm has a fixed debt-to-equity ratio and dividend policy. Assets and net income are proportional to sales, and new equity will not be issued. Which of the following statements is most correct?

A) Almost any growth rate is theoretically possible.

B) Only one growth rate is possible.

C) The firm cannot grow.

D) The firm's growth rate must be less than some maximum.

A) Almost any growth rate is theoretically possible.

B) Only one growth rate is possible.

C) The firm cannot grow.

D) The firm's growth rate must be less than some maximum.

Only one growth rate is possible.

3

A firm's planning model has assets and cash proportional to sales. The firm maintains a constant dividend payout ratio and a constant debt to equity ratio. Keying in on the asset to sales ratio, the firm's sustainable growth is _________ the ________ the asset to sales ratio.

A) higher; higher

B) higher; lower

C) lower; lower

D) constant; higher

E) constant; lower

A) higher; higher

B) higher; lower

C) lower; lower

D) constant; higher

E) constant; lower

higher; lower

4

Financial planning models frequently assume that many variables are proportional to:

A) economic growth.

B) industry growth.

C) interest rates.

D) company sales.

A) economic growth.

B) industry growth.

C) interest rates.

D) company sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

5

In the financial planning model, external funds needed (EFN) is equal to:

A) assets less (liabilities - equity).

B) assets less (liabilities + equity).

C) (assets + liabilities) less equity.

D) (assets + equity) less liabilities.

E) assets less equity.

A) assets less (liabilities - equity).

B) assets less (liabilities + equity).

C) (assets + liabilities) less equity.

D) (assets + equity) less liabilities.

E) assets less equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

6

If a firm holds the dividend payout, the debt to equity ratio and outstanding shares constant while maintaining income and assets proportional to sales, the plug variable is:

A) short term debt.

B) retained earnings.

C) sustainable growth.

D) long term debt.

E) accounts receivable.

A) short term debt.

B) retained earnings.

C) sustainable growth.

D) long term debt.

E) accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

7

In estimating pro-forma balance sheets, projected retained earnings are computed as present retained earnings plus:

A) projected retained earnings and cash dividends.

B) projected retained earnings plus debt.

C) projected retained earnings plus assets.

D) projected net income minus cash dividends.

E) projected net income earnings minus debt.

A) projected retained earnings and cash dividends.

B) projected retained earnings plus debt.

C) projected retained earnings plus assets.

D) projected net income minus cash dividends.

E) projected net income earnings minus debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

8

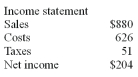

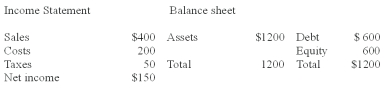

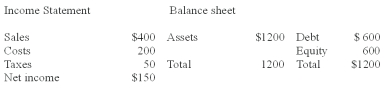

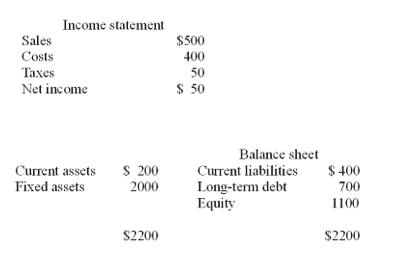

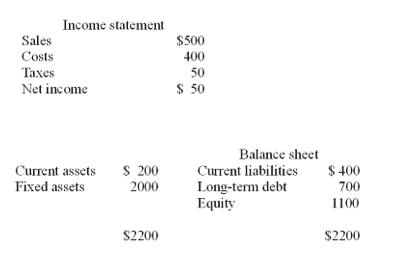

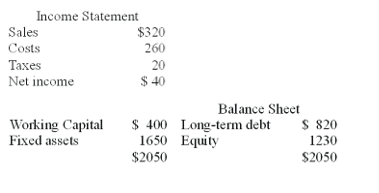

The most recent financial statements for Matrix Chip are shown below.

Assets, costs, and current liabilities are proportional to sales. Matrix Chip maintains a constant 50% dividend payout. No external financing is possible. What is the maximum percentage increase in sales that can be sustained?

Assets, costs, and current liabilities are proportional to sales. Matrix Chip maintains a constant 50% dividend payout. No external financing is possible. What is the maximum percentage increase in sales that can be sustained?

A) 5.55%.

B) 8.14%.

C) 10.22%.

D) 22.72%.

Assets, costs, and current liabilities are proportional to sales. Matrix Chip maintains a constant 50% dividend payout. No external financing is possible. What is the maximum percentage increase in sales that can be sustained?

Assets, costs, and current liabilities are proportional to sales. Matrix Chip maintains a constant 50% dividend payout. No external financing is possible. What is the maximum percentage increase in sales that can be sustained?A) 5.55%.

B) 8.14%.

C) 10.22%.

D) 22.72%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

9

The sustainable growth rate will be equivalent to the internal growth rate when:

A) a firm has no debt.

B) the growth rate is positive.

C) the plowback ratio is positive but less than 1.

D) a firm has a debt-equity ratio exactly equal to 1.

E) net income is greater than zero.

A) a firm has no debt.

B) the growth rate is positive.

C) the plowback ratio is positive but less than 1.

D) a firm has a debt-equity ratio exactly equal to 1.

E) net income is greater than zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

10

Altering the inputs to a financial plan by changing one of the assumptions is called:

A) a redundancy check.

B) a pro forma evaluation.

C) goal seeking.

D) sensitivity analysis.

A) a redundancy check.

B) a pro forma evaluation.

C) goal seeking.

D) sensitivity analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

11

Growth can be reconciled with the goal of maximizing firm value:

A) because greater growth always adds to value.

B) because growth must be an outcome of decisions that maximize NPV.

C) because growth and wealth maximization are the same.

D) because growth of any type can not decrease value.

A) because greater growth always adds to value.

B) because growth must be an outcome of decisions that maximize NPV.

C) because growth and wealth maximization are the same.

D) because growth of any type can not decrease value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

12

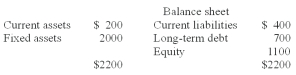

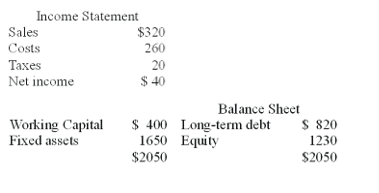

The most recent financial statements for REM Co. are shown below.  Assets and costs are proportional to sales. Debt is not. A dividend of $90 was paid, and REM wishes to maintain a constant payout to net income. Next year's sales are projected to be $480. What is external funds needed (EFN)?

Assets and costs are proportional to sales. Debt is not. A dividend of $90 was paid, and REM wishes to maintain a constant payout to net income. Next year's sales are projected to be $480. What is external funds needed (EFN)?

A) $240.00.

B) $132.00.

C) $60.00.

D) $168.00.

Assets and costs are proportional to sales. Debt is not. A dividend of $90 was paid, and REM wishes to maintain a constant payout to net income. Next year's sales are projected to be $480. What is external funds needed (EFN)?

Assets and costs are proportional to sales. Debt is not. A dividend of $90 was paid, and REM wishes to maintain a constant payout to net income. Next year's sales are projected to be $480. What is external funds needed (EFN)?A) $240.00.

B) $132.00.

C) $60.00.

D) $168.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

13

Financial planning is concerned with the basic policy elements of:

A) investment decision, decisions on the amount of cash payments to shareholders, and the decision of which investment banker to choose.

B) the method of raising capital, investment decisions, and the level of growth to attain.

C) investment decisions, degree of financial leverage, and the decision on the amount of cash payments to shareholders.

D) degree of financial leverage, level of growth to attain, and investment decisions.

A) investment decision, decisions on the amount of cash payments to shareholders, and the decision of which investment banker to choose.

B) the method of raising capital, investment decisions, and the level of growth to attain.

C) investment decisions, degree of financial leverage, and the decision on the amount of cash payments to shareholders.

D) degree of financial leverage, level of growth to attain, and investment decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

14

If forecasted net income is $3,600.00 and the expected dividend is $1,098 and the tax rate is 34%, what is the retention ratio?

A) .30.

B) .198.

C) .802.

D) .70.

A) .30.

B) .198.

C) .802.

D) .70.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

15

An example of an economic assumption would be:

A) growth in sales.

B) growth in the capital spending requirement.

C) a plug variable.

D) change in interest rates.

E) growth in dividends.

A) growth in sales.

B) growth in the capital spending requirement.

C) a plug variable.

D) change in interest rates.

E) growth in dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

16

Sustainable growth is defined as the level of growth than an entity can:

A) maintain if it stays in the same business.

B) maintain if it does not change the accounting relationships or capital structure.

C) maintain if the net working capital is increased.

D) maintain if the sales force grows at the rate of inflation.

A) maintain if it stays in the same business.

B) maintain if it does not change the accounting relationships or capital structure.

C) maintain if the net working capital is increased.

D) maintain if the sales force grows at the rate of inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

17

If accounts receivable are $45,000 and are directly proportional to total sales, the forecast accounts receivable for next year's 5% increase in sales to $125,000 would be:

A) $47,250.

B) $40,500.

C) $49,950.

D) impossible to calculate without last year's credit sales.

A) $47,250.

B) $40,500.

C) $49,950.

D) impossible to calculate without last year's credit sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

18

The process of combining smaller projects into a large budget for planning purposes is called:

A) aggregation.

B) consolidation.

C) accumulation.

D) capital allocation.

A) aggregation.

B) consolidation.

C) accumulation.

D) capital allocation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

19

The addition to retained earnings for the financial planning period is equal to:

A) Net Income + Taxes - Dividends.

B) Net Income - Dividends.

C) Net income + Depreciation - Dividends.

D) Sales - Dividend.

A) Net Income + Taxes - Dividends.

B) Net Income - Dividends.

C) Net income + Depreciation - Dividends.

D) Sales - Dividend.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

20

Projected future financial statements are called:

A) plug statements.

B) pro forma statements.

C) reconciled statements.

D) aggregated statements.

A) plug statements.

B) pro forma statements.

C) reconciled statements.

D) aggregated statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

21

A firm follows the objective of maximizing sales growth. Is maximizing growth always consistent with the shareholders objective and can a firm always achieve this objective if they are at the desired financial relationships for payout, debt to equity and asset structure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

22

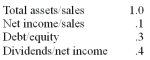

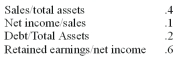

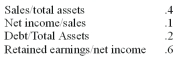

Assuming the following ratios are constant, what is the sustainable growth rate?

A) 6.67%.

B) 5.13%.

C) 4.06%.

D) 8.46%.

A) 6.67%.

B) 5.13%.

C) 4.06%.

D) 8.46%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

23

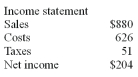

The most recent financial statements for Nosa Co. are:

Assets, costs, and current liabilities are proportional to sales. Long-term debt is not. Nosa maintains a constant 50% dividend payout. Next year's sales are projected to be $540. What is external funds needed (EFN)?

Assets, costs, and current liabilities are proportional to sales. Long-term debt is not. Nosa maintains a constant 50% dividend payout. Next year's sales are projected to be $540. What is external funds needed (EFN)?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

24

A firm wishes to maintain a growth rate of 4% per year, a debt-to-equity ratio of .26, and a dividend payout of 40%. If the profit margin is 10%, and next year's sales are projected at $500, what is the total asset projection?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

25

A firm wishes to maintain a growth rate of 12% per year and a dividend payout of 10%. The ratio of total assets to sales is constant at 1.5, and profit margin is 10%. What must be the debt-to-equity ratio?

A) .52.

B) .67.

C) .79.

D) .84.

A) .52.

B) .67.

C) .79.

D) .84.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

26

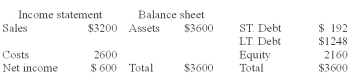

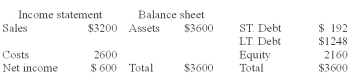

The most recent financial statements for Valley View Distributors are:

Assets, short term debt and costs are proportional to sales. Long term debt is not. Dividends are 20%. Next year's sales are projected to be $3,600. What is external funds needed (EFN)?

Assets, short term debt and costs are proportional to sales. Long term debt is not. Dividends are 20%. Next year's sales are projected to be $3,600. What is external funds needed (EFN)?

Assets, short term debt and costs are proportional to sales. Long term debt is not. Dividends are 20%. Next year's sales are projected to be $3,600. What is external funds needed (EFN)?

Assets, short term debt and costs are proportional to sales. Long term debt is not. Dividends are 20%. Next year's sales are projected to be $3,600. What is external funds needed (EFN)?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

27

Why is it important for managers to understand the importance of both the internal and the sustainable rates of growth?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

28

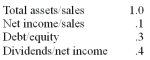

Assuming the following ratios are constant, what is the sustainable growth rate?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

29

A firm wishes to maintain a growth rate of 15% per year while maintaining a debt-to-equity ratio of 1.0, a profit margin of 20% and a dividend payout of 60%. What level of asset efficiency must it achieve?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

30

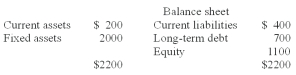

The most recent financial statements for Quik-chip Co. are:

Assets and costs are proportional to sales. Quik-chip maintains a constant 30% dividend payout and a constant debt-to-equity ratio. What is the maximum sustainable increase in sales assuming no new equity?

Assets and costs are proportional to sales. Quik-chip maintains a constant 30% dividend payout and a constant debt-to-equity ratio. What is the maximum sustainable increase in sales assuming no new equity?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

31

State the assumptions that underlie the sustainable growth rate and interpret what the sustainable growth rate means.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

32

A firm wishes to maintain a growth rate of 10% per year and a debt-to-equity ratio of 1/2. The dividend payout is .2, and the ratio of total assets to sales is constant at 1.2. What must the profit margin be?

A) 10.00%.

B) 9.09%.

C) 11.11%.

D) 8.00%.

A) 10.00%.

B) 9.09%.

C) 11.11%.

D) 8.00%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following will increase sustainable growth?

A) Buy back existing stock

B) Decrease debt

C) Increase profit margin

D) Increase dividend payout ratio

A) Buy back existing stock

B) Decrease debt

C) Increase profit margin

D) Increase dividend payout ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck