Deck 10: Risk and Return: Lessons From Market History

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/58

العب

ملء الشاشة (f)

Deck 10: Risk and Return: Lessons From Market History

1

A portfolio will usually contain:

A) one riskless asset.

B) one risky asset.

C) two or more assets.

D) no assets.

A) one riskless asset.

B) one risky asset.

C) two or more assets.

D) no assets.

two or more assets.

2

If IS and DS are combined in a portfolio with 50% invested in each, the expected return and risk would be:

A) 5.625%; 37.2%

B) 4.5%; 5.48%

C) 8.0%; 8.2%

D) 5.0%; 0%

E) 4.5%; 0%

A) 5.625%; 37.2%

B) 4.5%; 5.48%

C) 8.0%; 8.2%

D) 5.0%; 0%

E) 4.5%; 0%

4.5%; 5.48%

3

When a security is added to a portfolio the appropriate return and risk contributions are:

A) the expected return of the asset and its standard deviation.

B) the most probable return and the beta.

C) the expected return and the beta.

D) the most probable return and its standard deviation.

A) the expected return of the asset and its standard deviation.

B) the most probable return and the beta.

C) the expected return and the beta.

D) the most probable return and its standard deviation.

the expected return and the beta.

4

The correlation between the returns of IS and DS is:

A) +1.0

B) -1.0

C) + .3

D) - .3

E) 0.03

A) +1.0

B) -1.0

C) + .3

D) - .3

E) 0.03

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

5

If the correlation between two stocks is -1, the returns:

A) generally move in the same direction

B) move perfectly opposite one another

C) are unrelated to one another as it is <0

D) have standard deviations of equal size but opposite signs

A) generally move in the same direction

B) move perfectly opposite one another

C) are unrelated to one another as it is <0

D) have standard deviations of equal size but opposite signs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

6

Stock A has an expected return of 20%, and stock B has an expected return of 4%. However, the risk of stock A as measured by its variance is 3 times that of stock B. If the two stocks are combined equally in a portfolio, what would be the portfolio's expected return?

A) 20.0%.

B) 4.0%.

C) 12.0%.

D) Greater than 20%.

A) 20.0%.

B) 4.0%.

C) 12.0%.

D) Greater than 20%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

7

The means of IS and DS are:

A) 4.4; 4.6

B) 5.5; 5.75

C) 10; 6

D) 4; 6

A) 4.4; 4.6

B) 5.5; 5.75

C) 10; 6

D) 4; 6

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

8

If the correlation between two stocks is +1, then a portfolio combining these two stocks will have a variance that is:

A) less than the weighted average of the two individual variances.

B) greater than the weighted average of the two individual variances.

C) equal to the weighted average of the two individual variances.

D) less than or equal to average variance of the two weighted variances, depending on other information.

A) less than the weighted average of the two individual variances.

B) greater than the weighted average of the two individual variances.

C) equal to the weighted average of the two individual variances.

D) less than or equal to average variance of the two weighted variances, depending on other information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

9

The covariance between the IS and DS returns is:

A) .00187

B) .00240

C) .00028

D) .000056

A) .00187

B) .00240

C) .00028

D) .000056

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

10

Covariance measures the interrelationship between two securities in terms of:

A) both expected return and direction of return movement.

B) both size and direction of return movement.

C) the standard deviation of returns.

D) both expected return and size of return movements.

E) the correlations of returns.

A) both expected return and direction of return movement.

B) both size and direction of return movement.

C) the standard deviation of returns.

D) both expected return and size of return movements.

E) the correlations of returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

11

You have plotted the data for two securities over time on the same graph, ie., the month return of each security for the last 5 years. If the pattern of the movements of the two securities rose and fell as the other did, these two securities would have:

A) no correlation at all.

B) a weak negative correlation.

C) a strong negative correlation.

D) a strong positive correlation.

A) no correlation at all.

B) a weak negative correlation.

C) a strong negative correlation.

D) a strong positive correlation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

12

If you have a portfolio of two risky stocks which turns out to have no diversification. The reason you have no diversification is:

A) the returns are too small

B) the returns move perfectly opposite of one another

C) the returns are too large to offset

D) the returns move perfectly with one another

E) the returns are completely unrelated to one another

A) the returns are too small

B) the returns move perfectly opposite of one another

C) the returns are too large to offset

D) the returns move perfectly with one another

E) the returns are completely unrelated to one another

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

13

The variance and standard deviation of GenLabs returns are:

A) 428.75; 20.71

B) 71.46; 8.45

C) 939.58; 30.65

D) 1127.50; 33.58

A) 428.75; 20.71

B) 71.46; 8.45

C) 939.58; 30.65

D) 1127.50; 33.58

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

14

The expected return on GenLabs is:

A) 20.5

B) 12.5

C) 8.5

D) 3.3

A) 20.5

B) 12.5

C) 8.5

D) 3.3

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

15

A portfolio is entirely invested into Buzz's Bauxite Boring Equity, which is expected to return 16%, and Zum's Inc. bonds, which are expected to return 8%. Sixty percent of the funds are invested in Buzz's and the rest in Zum's. What is the expected return on the portfolio?

A) 9.6%.

B) 12.8%.

C) 24%.

D) 6.4%.

A) 9.6%.

B) 12.8%.

C) 24%.

D) 6.4%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

16

If the covariance of stock 1 with stock 2 is -.0065, then what is the covariance of stock 2 with stock 1?

A) -.0065.

B) less than -.0065.

C) greater than +.0065.

D) +.0065.

A) -.0065.

B) less than -.0065.

C) greater than +.0065.

D) +.0065.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

17

When stocks with the same expected return are combined into a portfolio:

A) the expected return of the portfolio is less than the average expected return of the stocks.

B) the expected return of the portfolio is greater than the average expected return of the stocks.

C) the expected return of the portfolio is equal to the average expected return of the stocks.

D) there is no relationship between the expected return of the portfolio and the expected return of the stocks.

A) the expected return of the portfolio is less than the average expected return of the stocks.

B) the expected return of the portfolio is greater than the average expected return of the stocks.

C) the expected return of the portfolio is equal to the average expected return of the stocks.

D) there is no relationship between the expected return of the portfolio and the expected return of the stocks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

18

Systematic risk is measured by:

A) the mean.

B) beta.

C) the geometric average.

D) the standard deviation.

A) the mean.

B) beta.

C) the geometric average.

D) the standard deviation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

19

The variances of IS and DS are:

A) .0145; .00038

B) .011584; .000304

C) .006454; .000154

D) .0008068; .000193

A) .0145; .00038

B) .011584; .000304

C) .006454; .000154

D) .0008068; .000193

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

20

The opportunity set of portfolios is:

A) all possible return combinations of those securities

B) all possible risk combinations of those securities

C) all possible risk-return combinations of those securities

D) the best or highest risk-return combination

E) the lowest risk-return combination

A) all possible return combinations of those securities

B) all possible risk combinations of those securities

C) all possible risk-return combinations of those securities

D) the best or highest risk-return combination

E) the lowest risk-return combination

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

21

The elements along the diagonal of the Variance Covariance matrix are:

A) covariance's.

B) security weights.

C) security selections.

D) variances.

A) covariance's.

B) security weights.

C) security selections.

D) variances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

22

A well-diversified portfolio has negligible:

A) expected return.

B) systematic risk.

C) unsystematic risk.

D) variance.

A) expected return.

B) systematic risk.

C) unsystematic risk.

D) variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

23

Beta measures:

A) the ability to diversify risk

B) how an asset covaries with the market

C) the actual return on an asset

D) the standard of the assets' returns

A) the ability to diversify risk

B) how an asset covaries with the market

C) the actual return on an asset

D) the standard of the assets' returns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

24

When many assets are included in a portfolio or index the risk of the portfolio or index will be:

A) greater than the risk of the securities because the correlations are greater than 1.

B) equal to the risk of the securities because the correlations are equal to 1.

C) less than the risk of the securities because the correlations are usually less than 1.

D) unaffected by the risk of securities because their correlations are less than 1.

A) greater than the risk of the securities because the correlations are greater than 1.

B) equal to the risk of the securities because the correlations are equal to 1.

C) less than the risk of the securities because the correlations are usually less than 1.

D) unaffected by the risk of securities because their correlations are less than 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

25

The dominant portfolio with the lowest possible risk measures is:

A) the efficient frontier.

B) The minimum variance portfolio.

C) The upper tail of the efficient set.

D) The tangency portfolio.

A) the efficient frontier.

B) The minimum variance portfolio.

C) The upper tail of the efficient set.

D) The tangency portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

26

A stock with a beta of zero would be expected to:

A) have a rate of return equal to the risk-free rate.

B) have a rate of return equal to the market rate.

C) have a rate of return equal to zero.

D) have a rate of return equal to the one.

A) have a rate of return equal to the risk-free rate.

B) have a rate of return equal to the market rate.

C) have a rate of return equal to zero.

D) have a rate of return equal to the one.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

27

Total risk can be divided into:

A) standard deviation and variance.

B) standard deviation and covariance.

C) portfolio risk and beta.

D) portfolio risk and unsystematic risk.

E) portfolio risk and covariance.

A) standard deviation and variance.

B) standard deviation and covariance.

C) portfolio risk and beta.

D) portfolio risk and unsystematic risk.

E) portfolio risk and covariance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

28

The combination of the efficient set of portfolios with a riskless lending and borrowing rate results in:

A) the capital market line which shows that all investors will only invest in the riskless asset.

B) the capital market line which shows that all investors will invest in a combination of the riskless asset and the tangency portfolio.

C) the security market line which shows that all investors will invest in the riskless asset only.

D) the security market line which shows that all investors will invest in a combination of the riskless asset and the tangency portfolio.

A) the capital market line which shows that all investors will only invest in the riskless asset.

B) the capital market line which shows that all investors will invest in a combination of the riskless asset and the tangency portfolio.

C) the security market line which shows that all investors will invest in the riskless asset only.

D) the security market line which shows that all investors will invest in a combination of the riskless asset and the tangency portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

29

Diversification can effectively reduce risk. Once a portfolio is diversified the type of risk remaining is:

A) individual security risk.

B) riskless security risk.

C) risk related to the market portfolio.

D) total standard deviations.

A) individual security risk.

B) riskless security risk.

C) risk related to the market portfolio.

D) total standard deviations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

30

You've owned a share of stock for 6 years. It returned 5% in 3 of those years and -5% in the other 3. What was the variance?

A) 15.

B) 150.

C) 30.

D) 0.

A) 15.

B) 150.

C) 30.

D) 0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

31

The CML is the pricing relationship between:

A) efficient portfolios and beta

B) the risk-free asset and standard deviation of the portfolio return

C) the optimal portfolio and the standard deviation of portfolio return

D) beta and the standard deviation of portfolio return

A) efficient portfolios and beta

B) the risk-free asset and standard deviation of the portfolio return

C) the optimal portfolio and the standard deviation of portfolio return

D) beta and the standard deviation of portfolio return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

32

For a highly diversified equally weighted portfolio, the portfolio variance is:

A) the average covariance.

B) the average expected value.

C) the average variance.

D) the weighted average expected value.

E) the weighted average variance.

A) the average covariance.

B) the average expected value.

C) the average variance.

D) the weighted average expected value.

E) the weighted average variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

33

A portfolio has 25% of its funds invested in Security C and 75% of its funds invested in Security D. Security C has an expected return of 8% and a standard deviation of 6. Security B has an expected return of 10% and a standard deviation of 10. The securities have a coefficient of correlation of .6. Which of the following values is closest to portfolio return and variance?

A) .095; .001675.

B) .095; .0072.

C) .100; .00849.

D) .090; .0081.

A) .095; .001675.

B) .095; .0072.

C) .100; .00849.

D) .090; .0081.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

34

The total number of variance and covariance terms in portfolio is N2. How many of these would be (including non-unique) covariance's?

A) N B) N2

B) N2- N

C) N2- N/2

A) N B) N2

B) N2- N

C) N2- N/2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

35

The elements in the off-diagonal positions of the Variance Covariance matrix are:

A) covariance's.

B) security selections.

C) variances.

D) security weights.

A) covariance's.

B) security selections.

C) variances.

D) security weights.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

36

An efficient set of portfolios is:

A) the complete opportunity set.

B) the portion of the opportunity set below the minimum variance portfolio.

C) only the minimum variance portfolio.

D) the dominant portion of the opportunity set.

E) only the maximum return portfolio.

A) the complete opportunity set.

B) the portion of the opportunity set below the minimum variance portfolio.

C) only the minimum variance portfolio.

D) the dominant portion of the opportunity set.

E) only the maximum return portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

37

Security One has a standard deviation of 6. Security Two has a standard deviation of 12. The securities have a coefficient of correlation of .5. Which of the following values is closest to portfolio variance?

A) 81.

B) 90.

C) 27.

D) 6561.

A) 81.

B) 90.

C) 27.

D) 6561.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which one of the following would indicate a portfolio is being effectively diversified?

A) an increase in the portfolio beta

B) a decrease in the portfolio beta

C) an increase in the portfolio rate of return

D) a decrease in the portfolio standard deviation

A) an increase in the portfolio beta

B) a decrease in the portfolio beta

C) an increase in the portfolio rate of return

D) a decrease in the portfolio standard deviation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

39

Given the range of betas on actual companies reported in Table 11.7, a very low beta would be ___, and a very high beta would be _____ in comparison.

A) 1.00; 1.00

B) .86; .96

C) .22; 2.29

D) 1.08; 1.08

E) .37; 1.58

A) 1.00; 1.00

B) .86; .96

C) .22; 2.29

D) 1.08; 1.08

E) .37; 1.58

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

40

The measure of beta associates most closely with:

A) idiosyncratic risk.

B) risk-free return.

C) systematic risk.

D) unexpected risk.

E) unsystematic risk.

A) idiosyncratic risk.

B) risk-free return.

C) systematic risk.

D) unexpected risk.

E) unsystematic risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

41

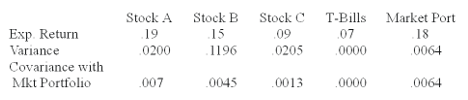

Given the following information on three stocks:

σ = -.05333

bc

Suppose you desire to invest in any one of the stocks listed above. Can any be recommended?

σ = -.05333

bc

Suppose you desire to invest in any one of the stocks listed above. Can any be recommended?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

42

The characteristic line is graphically depicted as:

A) the plot of the relationship between beta and expected return

B) the plot of the returns of the security against the beta

C) the plot of the security against the market index returns

D) the plot of the beta against the market index returns

A) the plot of the relationship between beta and expected return

B) the plot of the returns of the security against the beta

C) the plot of the security against the market index returns

D) the plot of the beta against the market index returns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

43

A portfolio exists containing stocks D, E, and F held in proportions 30%, 40%, and 30% respectively. The expected returns on the three stocks are given by 12%, 20%, and 28% respectively. Calculate the portfolio's expected return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

44

Suppose the MiniCD Corporation's common stock has a return of 12%. Assume the risk-free rate is 4%, the expected market return is 9%, and no unsystematic influence affected Mini's return. The beta for MiniCD is:

A) 0.89.

B) 1.60.

C) 2.40.

D) 3.00.

A) 0.89.

B) 1.60.

C) 2.40.

D) 3.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

45

You want your portfolio beta to be 1.20. Currently, your portfolio consists of $100 invested in stock A with a beta of 1.4 and $300 in stock B with a beta of .6. You have another $400 to invest and want to divide it between an asset with a beta of 1.6 and a risk-free asset. How much should you invest in the risk-free asset?

A) $0

B) $140

C) $200

D) $320

A) $0

B) $140

C) $200

D) $320

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

46

Suppose the JumpStart Corporation's common stock has a beta of 0.8. If the risk-free rate is 4% and the expected market return is 9%, the expected return for JumpStart's common is:

A) 3.2%.

B) 4.0%.

C) 7.2%.

D) 8.0%.

E) 9.0%.

A) 3.2%.

B) 4.0%.

C) 7.2%.

D) 8.0%.

E) 9.0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

47

A portfolio is made up of 75% of stock 1, and 25% of stock 2. Stock 1 has a variance of .08, and stock 2 has a variance of .035. The covariance between the stocks is -.001. Calculate both the variance and the standard deviation of the portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

48

The beta of a security is calculated by:

A) dividing the covariance of the security with the market by the variance of the market

B) dividing the correlation of the security with the market by the variance of the market

C) dividing the variance of the market by the covariance of the security with the market

D) dividing the variance of the market by the correlation of the security with the market

A) dividing the covariance of the security with the market by the variance of the market

B) dividing the correlation of the security with the market by the variance of the market

C) dividing the variance of the market by the covariance of the security with the market

D) dividing the variance of the market by the correlation of the security with the market

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

49

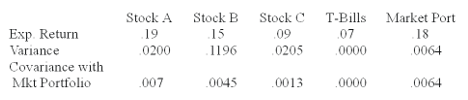

Given the following information on 3 stocks:

Using the CAPM, calculate the expected return for Stock's A, B, and C. Which stocks would you recommend purchasing?

Using the CAPM, calculate the expected return for Stock's A, B, and C. Which stocks would you recommend purchasing?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

50

The diagram below represents an opportunity set for a two asset combination. Indicate the correct efficient set with labels; explain why it is so.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

51

Returns for the IC Company and for the S&P 500 Index over the previous 4-year period are given below:

What are the average returns on IC and on the S&P 500 index? If you had invested $1.00 in IC, how much would you have had after 4 years? What is the correlation between the returns on IC and the S&P?

What are the average returns on IC and on the S&P 500 index? If you had invested $1.00 in IC, how much would you have had after 4 years? What is the correlation between the returns on IC and the S&P?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

52

Given the following information on three stocks:

σ = -.05333

bc

Now suppose you diversify into two securities. Given all choices, can any portfolio be eliminated? Assume equal weights.

σ = -.05333

bc

Now suppose you diversify into two securities. Given all choices, can any portfolio be eliminated? Assume equal weights.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

53

Draw and explain the relationship between the opportunity set for a two asset portfolio when the correlation is: [Choose from -1, -.5, 0, +.5, and +1]

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

54

The separation principle states that an investor will:

A) choose any efficient portfolio and invest some amount in the riskless asset to generate the expected return.

B) choose an efficient portfolio based on individual risk tolerance or utility.

C) never choose to invest in the riskless asset because the expected return on the riskless asset is lower over time.

D) invest only in the riskless asset and tangency portfolio choosing the weights based on individual risk tolerance.

A) choose any efficient portfolio and invest some amount in the riskless asset to generate the expected return.

B) choose an efficient portfolio based on individual risk tolerance or utility.

C) never choose to invest in the riskless asset because the expected return on the riskless asset is lower over time.

D) invest only in the riskless asset and tangency portfolio choosing the weights based on individual risk tolerance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

55

Illustrate and explain the impact of adding securities to a portfolio assuming the securities are of average correlation with each other. see Figure 10.7 note that as N increases portfolio risk decreases as N gets large portfolio risk approaches the market risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

56

A portfolio contains four assets. Asset 1 has a beta of .8 and comprises 30% of the portfolio. Asset 2 has a beta of 1.1 and comprises 30% of the portfolio. Asset 3 has a beta of 1.5 and comprises 20% of the portfolio. Asset 4 has a beta of 1.6 and comprises the remaining 20% of the portfolio. If the riskless rate is expected to be 3% and the market risk premium is 6%, what is the beta of the portfolio, the expected return on the portfolio and the market?

A) 1.19; 6.57; 6

B) 1.19; 7.14; 6

C) 1.19; 10.14; 9

D) 1.25; 10.5; 6

E) 1.25; 10.5; 9

A) 1.19; 6.57; 6

B) 1.19; 7.14; 6

C) 1.19; 10.14; 9

D) 1.25; 10.5; 6

E) 1.25; 10.5; 9

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

57

Why are some risks diversifiable and some nondiversifiable? Give an example of each.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

58

Draw the SML and plot asset C such that it has less risk than the market but plots above the SML, and asset D such that it has more risk than the market and plots below the SML. (Be sure to indicate where the market portfolio is on your graph.) Explain how assets like C or D can plot as they do and explain why such pricing cannot persist in a market that is in equilibrium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck