Deck 4: Job Costing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/161

العب

ملء الشاشة (f)

Deck 4: Job Costing

1

Cost tracing is a specific term for assigning indirect costs.

False

2

Assigning direct costs to a cost object is called

A)cost allocation.

B)job costing.

C)cost pooling.

D)process costing.

E)cost tracing.

A)cost allocation.

B)job costing.

C)cost pooling.

D)process costing.

E)cost tracing.

E

3

Direct costs are allocated to the cost object using a cost-allocation method.

False

4

The cost driver of an indirect cost is often used as the cost allocation base.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

5

For each cost pool, the indirect cost rate equals the indirect cost pool divided by the cost allocation base.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following would most likely be a direct cost in a manufacturing company?

A)supervision and engineering

B)utilities

C)repairs

D)utilities and repairs

E)raw materials

A)supervision and engineering

B)utilities

C)repairs

D)utilities and repairs

E)raw materials

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

7

The objective of allocating indirect costs is to measure the underlying usage of indirect resources by jobs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

8

A cost allocation base is only financial in nature, and is usually the cost driver of the particular costs being measured.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

9

Cost pools are often organized in conjunction with

A)direct labour pools.

B)the general ledger control accounts.

C)variable and fixed costs.

D)direct cost tracing techniques.

E)cost-allocation bases.

A)direct labour pools.

B)the general ledger control accounts.

C)variable and fixed costs.

D)direct cost tracing techniques.

E)cost-allocation bases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

10

Cost pools are defined as groupings of individual cost items which can range from broad, company-wide categories to very narrow categories.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

11

A grouping of individual cost items is called a

A)cost objective.

B)costing group.

C)cost department.

D)cost pool.

E)cost base.

A)cost objective.

B)costing group.

C)cost department.

D)cost pool.

E)cost base.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

12

Transferring costs from indirect cost pools to cost objects is called

A)cost allocation.

B)cost control.

C)cost pool.

D)cost factoring.

E)cost processing.

A)cost allocation.

B)cost control.

C)cost pool.

D)cost factoring.

E)cost processing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

13

Cost assignment includes cost allocation for indirect costs and direct costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following includes both traced direct costs and allocated indirect costs?

A)cost tracing

B)cost pools

C)assigned costs

D)cost allocation

E)cost recording

A)cost tracing

B)cost pools

C)assigned costs

D)cost allocation

E)cost recording

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

15

In a costing system

A)cost tracing allocates indirect costs.

B)cost allocation assigns direct costs.

C)there may never be more than one indirect cost pool.

D)a cost object should be a product and not a department or a geographic territory.

E)a cost allocation base can be either financial or nonfinancial.

A)cost tracing allocates indirect costs.

B)cost allocation assigns direct costs.

C)there may never be more than one indirect cost pool.

D)a cost object should be a product and not a department or a geographic territory.

E)a cost allocation base can be either financial or nonfinancial.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

16

Fixed and variable costs may be allocated to a cost object.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following is NOT possible to use as a cost allocation base for manufacturing overhead?

A)direct labour dollars

B)direct labour hours

C)direct material dollars

D)direct labour hours or dollars

E)indirect labour hours

A)direct labour dollars

B)direct labour hours

C)direct material dollars

D)direct labour hours or dollars

E)indirect labour hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

18

Raw materials that can be traced to a cost object are an example of an indirect cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

19

A factor used to systematically link an indirect cost to a cost object is called

A)a cost allocation base.

B)a cost pool.

C)cost assignment.

D)a traceable cost.

E)a non-traceable cost.

A)a cost allocation base.

B)a cost pool.

C)cost assignment.

D)a traceable cost.

E)a non-traceable cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

20

In general terms the process of assigning costs to a particular product or service is called

A)a cost allocation system.

B)a cost assignment system.

C)a job costing system.

D)a process costing system.

E)a cost recording system.

A)a cost allocation system.

B)a cost assignment system.

C)a job costing system.

D)a process costing system.

E)a cost recording system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

21

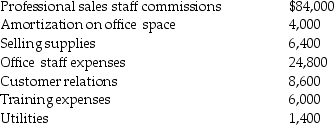

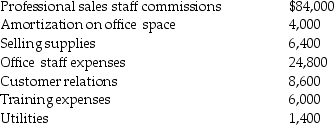

Larry's Appliance Shop operates retail stores that sell appliances.The cost objects are the individual sales of a given type of appliance and sales support.For refrigerators in July, the following costs were recorded:

Required:

Required:

a.Which of the costs will be subject to direct cost tracing?

b.What is the total cost for refrigerators?

c.What is the total cost of the Sales Support for refrigerators?

Required:

Required:a.Which of the costs will be subject to direct cost tracing?

b.What is the total cost for refrigerators?

c.What is the total cost of the Sales Support for refrigerators?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

22

The difference between the actual costing and normal costing methods is that actual costing uses a budgeted indirect cost rate while normal costing uses an actual indirect cost rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

23

A process costing system assigns costs to groups of similar units during a specified time period and then computes the average unit cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

24

For normal costing, even though the budgeted indirect-cost rate is based on estimates, indirect costs are allocated to products based on actual levels of the cost-allocation base.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

25

In each period, job costing divides the total cost of producing an identical or similar product by the total number of units produced to obtain a per-unit cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

26

A job costing system assigns costs to a distinct unit or set of units of a product or service.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

27

Direct costs are traced the same way for actual costing and normal costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

28

In a job cost system, the cost object is a unit or multiple units of a distinct product or service called a job.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

29

The new manager of the insurance division does not understand how the company can have so many overhead rates for assigning costs to the activities of the company's life insurance underwriters.There is one rate schedule for average assignable costs when agents write standard policies.There is another rate schedule which the agents must complete when they write special policies, and these policies are costed out differently from those that are categorized as standard policies.Required:

Why might the company have different costing systems with different overhead rates for the standard and specialized policies?

Why might the company have different costing systems with different overhead rates for the standard and specialized policies?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

30

In the five-step decision-making process which of the following is an element of the last step in the process?

A)evaluate performance

B)choose among alternatives

C)identify uncertainties

D)identify the problems

E)make predictions about the future

A)evaluate performance

B)choose among alternatives

C)identify uncertainties

D)identify the problems

E)make predictions about the future

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

31

Describe job-costing and process-costing systems.Explain when it would be appropriate to use each.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

32

Process costing is a useful system for tracking the costs of building a house.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following would be appropriately costed using a process costing system?

A)oil refining

B)a law firm managing individual legal cases

C)assembly of individual aircraft by Bombardier

D)movies produced by Lions Gate Entertainment

E)audit engagements performed by KPMG

A)oil refining

B)a law firm managing individual legal cases

C)assembly of individual aircraft by Bombardier

D)movies produced by Lions Gate Entertainment

E)audit engagements performed by KPMG

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following would be appropriately costed using a job costing system?

A)oil refining

B)bank clearing at TD Canada Trust

C)beverage production

D)replacing a homeowner's furnace

E)lumber dealing by Weyerhaeuser

A)oil refining

B)bank clearing at TD Canada Trust

C)beverage production

D)replacing a homeowner's furnace

E)lumber dealing by Weyerhaeuser

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

35

Actual costing can also be a method of job costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

36

Actual costing systems are commonly found in practice because the indirect cost information is readily available.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

37

At the end of the year, the direct costs traced to jobs using the budgeted rates will equal actual direct costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

38

Actual costing traces direct costs to a cost object by multiplying the budgeted direct cost rate and the actual quantity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

39

Actual costing allocates indirect costs based on the predetermined indirect-cost rates multiplied by the actual quantities of the cost-allocation bases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

40

Provide examples of three companies that would likely use job costing, and three companies that would likely use process costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

41

A job cost record (or job cost sheet)is a document where the costs are recorded and accumulated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

42

A local financial consulting firm employs 30 full-time staff.The budgeted compensation per employee is $50,000, for 2,000 hours.All direct labour costs are charged to clients.Any other costs are included in a single indirect-cost pool, allocated according to labour-hours.Actual indirect costs were $750,000.Budgeted indirect costs for the year are $525,000 and the firm expects to have 60 clients during the coming year.What is the total cost of a job which took 27 hours, using normal costing?

A)$911.25

B)$1,012.50

C)$27,337.50

D)$30,375.00

E)$50,000.00

A)$911.25

B)$1,012.50

C)$27,337.50

D)$30,375.00

E)$50,000.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

43

Fixed costs remain constant at $200,000 per month.During high-output months variable costs are $160,000, and during low-output months variable costs are $40,000.What are the respective high and low indirect cost allocation rates if professional labour-hours are 8,000 for high-output months and 2,000 for low-output months?

A)$45.00 per hour; $120.00 per hour

B)$45.00 per hour; $45.00 per hour

C)$25.00 per hour; $20.00 per hour

D)$56.20 per hour; $120.00 per hour

E)$25.00 per hour; $100.00 per hour

A)$45.00 per hour; $120.00 per hour

B)$45.00 per hour; $45.00 per hour

C)$25.00 per hour; $20.00 per hour

D)$56.20 per hour; $120.00 per hour

E)$25.00 per hour; $100.00 per hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following is one of the steps used in assigning manufacturing overhead costs to individual jobs?

A)combine different cost objects into pools

B)assign direct costs to the cost object

C)identify the direct cost pools associated with the job

D)calculate the direct cost allocation rate for each direct cost pool

E)select the cost-allocation base to use in allocating indirect costs to the cost object

A)combine different cost objects into pools

B)assign direct costs to the cost object

C)identify the direct cost pools associated with the job

D)calculate the direct cost allocation rate for each direct cost pool

E)select the cost-allocation base to use in allocating indirect costs to the cost object

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

45

Managers and accountants gather the information that goes into their cost systems through source documents, which are the original records that support journal entries in an accounting system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

46

The difference between actual costing and normal costing is

A)normal costing uses actual direct cost rates.

B)actual costing uses actual quantities of direct cost inputs.

C)normal costing uses budgeted quantities of actual direct cost inputs and budgeted indirect cost rates.

D)actual costing uses actual quantities of cost allocation bases.

E)normal costing uses budgeted indirect cost rates.

A)normal costing uses actual direct cost rates.

B)actual costing uses actual quantities of direct cost inputs.

C)normal costing uses budgeted quantities of actual direct cost inputs and budgeted indirect cost rates.

D)actual costing uses actual quantities of cost allocation bases.

E)normal costing uses budgeted indirect cost rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

47

The main advantage of using budgeted cost rates rather than actual cost rates is

A)budgeted costs allow managers to have cost information on a timely basis.

B)budgeted costs may be subject to short-run fluctuations.

C)budgeted indirect-cost rates are known prior to the inception of a new job.

D)actual indirect-cost rates are affected by work done on other jobs.

E)budgeted rates are just as accurate and require less effort.

A)budgeted costs allow managers to have cost information on a timely basis.

B)budgeted costs may be subject to short-run fluctuations.

C)budgeted indirect-cost rates are known prior to the inception of a new job.

D)actual indirect-cost rates are affected by work done on other jobs.

E)budgeted rates are just as accurate and require less effort.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

48

To smooth seasonal fluctuating levels of output, separate indirect-cost rates should be calculated for each month.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

49

Normal costing refers to

A)the average cost.

B)costs within the relevant range.

C)costs that behave like other similar costs.

D)costs included in normal pools.

E)allocating indirect costs at budgeted rates.

A)the average cost.

B)costs within the relevant range.

C)costs that behave like other similar costs.

D)costs included in normal pools.

E)allocating indirect costs at budgeted rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following statements about normal costing is TRUE?

A)Direct costs and indirect costs are allocated using an actual rate.

B)Direct costs and indirect costs are traced using budgeted rates.

C)Direct costs are traced using a budgeted rate, and indirect costs are allocated using an actual rate.

D)Direct costs are traced using an actual rate, and indirect costs are allocated using a budgeted rate.

E)Direct costs are traced by using the actual direct-cost rate times the budgeted quantity of the direct costs input.

A)Direct costs and indirect costs are allocated using an actual rate.

B)Direct costs and indirect costs are traced using budgeted rates.

C)Direct costs are traced using a budgeted rate, and indirect costs are allocated using an actual rate.

D)Direct costs are traced using an actual rate, and indirect costs are allocated using a budgeted rate.

E)Direct costs are traced by using the actual direct-cost rate times the budgeted quantity of the direct costs input.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

51

The first step in job costing is to

A)identify the cost object.

B)identify the direct costs.

C)select the cost allocation base.

D)identify the indirect costs.

E)compute the rate per unit.

A)identify the cost object.

B)identify the direct costs.

C)select the cost allocation base.

D)identify the indirect costs.

E)compute the rate per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

52

A local financial consulting firm employs 30 full-time employees.The budgeted compensation per employee is $50,000.The annual maximum chargeable time to each client is 1,000 hours.Clients always receive their full amount of time.All labour costs are included in a single direct-cost category and are traced to jobs on a per-hour basis.Any other costs are included in a single indirect-cost pool, allocated according to professional labour-hours.Budgeted indirect costs for the year are $1,050,000, and the firm expects to have 60 clients during the coming year.What is the budgeted indirect-cost rate per hour?

A)$1,050.00 per hour

B)$50.00 per hour

C)$35.00 per hour

D)$17.50 per hour

E)$10.00 per hour

A)$1,050.00 per hour

B)$50.00 per hour

C)$35.00 per hour

D)$17.50 per hour

E)$10.00 per hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

53

A materials requisition record and a labour time record are examples of which of the following?

A)normal cost schedule

B)job cost sheets

C)job cost records

D)cost object statements

E)source documents

A)normal cost schedule

B)job cost sheets

C)job cost records

D)cost object statements

E)source documents

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

54

Budgeted fixed indirect costs remain constant at $150,000 per month.During high-output months variable indirect costs are budgeted at $120,000, and during low-output months budgeted variable costs are $60,000.What are the respective high and low indirect cost rates if budgeted professional labour-hours are 6,000 for high-output months and 2,000 for low-output months?

A)$31.25 per hour, $87.50 per hour

B)$45.00 per hour, $95.00 per hour

C)$45.00 per hour, $105.00 per hour

D)$56.20 per hour, $105.00 per hour

E)$59.00 per hour, $105.00 per hour

A)$31.25 per hour, $87.50 per hour

B)$45.00 per hour, $95.00 per hour

C)$45.00 per hour, $105.00 per hour

D)$56.20 per hour, $105.00 per hour

E)$59.00 per hour, $105.00 per hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

55

Using normal costing the amount of supervisory salaries to allocate is determined by calculating

A)actual direct-cost rates times actual quantities of direct-cost inputs.

B)actual indirect-cost rates times actual quantities of cost-allocation bases.

C)actual direct-cost rates times budgeted quantities of input.

D)budgeted indirect-cost rates times actual quantities of cost-allocation bases.

E)budgeted indirect-cost rates times budgeted quantities of cost-allocation bases.

A)actual direct-cost rates times actual quantities of direct-cost inputs.

B)actual indirect-cost rates times actual quantities of cost-allocation bases.

C)actual direct-cost rates times budgeted quantities of input.

D)budgeted indirect-cost rates times actual quantities of cost-allocation bases.

E)budgeted indirect-cost rates times budgeted quantities of cost-allocation bases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

56

Place the following steps in the order suggested by the seven steps used to assign costs to individual jobs: A.Select the cost-allocation bases to use for allocating indirect costs to the job

B.Compute the rate per unit of each cost-allocation base used to allocate indirect costs to the job

C.Compute the total cost of the job by adding all direct and indirect costs assigned to the job

D.Identify the direct costs of the job

E.Compute the indirect costs allocated to the job

F.Identify the indirect costs associated with each cost-allocation base

G.Identify the job that is the chosen cost object

A)G, F, A, B, E, D, C

B)G, D, A, B, F, E, C

C)G, A, F, B, E, D, C

D)G, A, D, F, B, E, C

E)G, D, A, F, B, E, C

B.Compute the rate per unit of each cost-allocation base used to allocate indirect costs to the job

C.Compute the total cost of the job by adding all direct and indirect costs assigned to the job

D.Identify the direct costs of the job

E.Compute the indirect costs allocated to the job

F.Identify the indirect costs associated with each cost-allocation base

G.Identify the job that is the chosen cost object

A)G, F, A, B, E, D, C

B)G, D, A, B, F, E, C

C)G, A, F, B, E, D, C

D)G, A, D, F, B, E, C

E)G, D, A, F, B, E, C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

57

A company employs 25 full-time staff.The company spent $75,000 in advertising in the year (this amount is a period cost with a constant amount spent each year).Budgeted indirect manufacturing costs total $250,000 and the direct labour rate is $15 per hour.Budgeted labour hours were 500,000, and actual labour hours were 524,000.Actual indirect overhead was $274,600.What are the actual and normal indirect-cost rates respectively?

A)$0.52 and $0.50

B)$0.50 and $0.52

C)$0.55 and $0.48

D)$0.67 and $0.65

E)$0.65 and $0.67

A)$0.52 and $0.50

B)$0.50 and $0.52

C)$0.55 and $0.48

D)$0.67 and $0.65

E)$0.65 and $0.67

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

58

Managers and accountants collect most of the cost information that goes into their information systems through

A)an information databank.

B)computer programs.

C)source documents.

D)time surveys.

E)interviewing workers.

A)an information databank.

B)computer programs.

C)source documents.

D)time surveys.

E)interviewing workers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following is part of the approach to computing the budgeted indirect cost allocation rate?

A)identify the costs which are part of the indirect cost pool

B)identify costs associated with the direct cost pool

C)estimate the cost items for direct cost pool

D)adjust the cost allocation base for variances

E)divide the total quantity of the cost allocation base into the total costs in the direct cost pool

A)identify the costs which are part of the indirect cost pool

B)identify costs associated with the direct cost pool

C)estimate the cost items for direct cost pool

D)adjust the cost allocation base for variances

E)divide the total quantity of the cost allocation base into the total costs in the direct cost pool

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

60

A machine shop has direct materials cost of $1,800,000 direct labour of $4,200,000 (direct labour rate is $50 per hour)and budgeted indirect manufacturing costs of $850,000.Management believes that indirect manufacturing costs increase with direct labour hours.What is the budgeted indirect manufacturing cost rate?

A)$2.12

B)$2.33

C)$4.94

D)$10.12

E)$17.00

A)$2.12

B)$2.33

C)$4.94

D)$10.12

E)$17.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

61

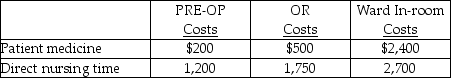

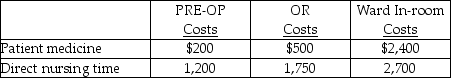

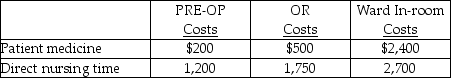

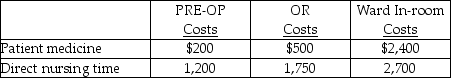

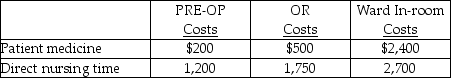

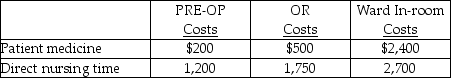

Use the information below to answer the following question(s).A Hospital uses a job cost system for all surgery patients.In February, the pre-operating room (PRE-OP)and operating room (OR)had budgeted allocation bases of 1,000 nursing hours and 500 nursing hours, respectively, and budgeted nursing overhead charges were $28,000 and $22,000, respectively.The hospital ward rooms for surgery patients had budgeted overhead costs of $200,000 and 2,500 nursing hours for the month.PRE-OP, OR and the hospital ward have separate indirect cost pools.The hospital uses a budgeted overhead rate for applying overhead to patient stays.For patient Jones, actual hours incurred were six and eight hours, respectively, in the PRE-OP and OR rooms.He was in the hospital for 5 days (120 hours).Other costs related to Jones were:

What was the total OR cost for patient Jones?

A)$2,418

B)$2,514

C)$2,250

D)$2,602

E)$2,474

What was the total OR cost for patient Jones?

A)$2,418

B)$2,514

C)$2,250

D)$2,602

E)$2,474

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

62

Use the information below to answer the following question(s).A Hospital uses a job cost system for all surgery patients.In February, the pre-operating room (PRE-OP)and operating room (OR)had budgeted allocation bases of 1,000 nursing hours and 500 nursing hours, respectively, and budgeted nursing overhead charges were $28,000 and $22,000, respectively.The hospital ward rooms for surgery patients had budgeted overhead costs of $200,000 and 2,500 nursing hours for the month.PRE-OP, OR and the hospital ward have separate indirect cost pools.The hospital uses a budgeted overhead rate for applying overhead to patient stays.For patient Jones, actual hours incurred were six and eight hours, respectively, in the PRE-OP and OR rooms.He was in the hospital for 5 days (120 hours).Other costs related to Jones were:

What is the budgeted overhead rate for the hospital floor for surgery?

A)$28.00

B)$44.00

C)$45.75

D)$47.75

E)$80.00

What is the budgeted overhead rate for the hospital floor for surgery?

A)$28.00

B)$44.00

C)$45.75

D)$47.75

E)$80.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

63

Use the information below to answer the following question(s).Capable Carts manufactures custom carts for a variety of uses.The following data have been recorded for Job 892, which was recently completed.Direct materials used cost $6,300, the budgeted direct materials were $5,900.There were 180 direct labour hours worked on this job at a direct labour wage rate of $20 per hour; the budgeted direct labour wage rate was $21 per hour.There were 75 machine hours used on this job.The budgeted and actual indirect cost allocation rates are $32 and $29 per machine hour used, respectively.

What is the total manufacturing cost of Job 892 using actual costing?

A)$9,900

B)$12,300

C)$12,080

D)$12,255

E)$12,075

What is the total manufacturing cost of Job 892 using actual costing?

A)$9,900

B)$12,300

C)$12,080

D)$12,255

E)$12,075

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

64

Use the information below to answer the following question(s).Capable Carts manufactures custom carts for a variety of uses.The following data have been recorded for Job 892, which was recently completed.Direct materials used cost $6,300, the budgeted direct materials were $5,900.There were 180 direct labour hours worked on this job at a direct labour wage rate of $20 per hour; the budgeted direct labour wage rate was $21 per hour.There were 75 machine hours used on this job.The budgeted and actual indirect cost allocation rates are $32 and $29 per machine hour used, respectively.

What is the total manufacturing cost of Job 892 using normal costing?

A)$9,900

B)$12,300

C)$12,080

D)$12,255

E)$12,075

What is the total manufacturing cost of Job 892 using normal costing?

A)$9,900

B)$12,300

C)$12,080

D)$12,255

E)$12,075

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

65

Use the information below to answer the following question(s).A dental office is in the process of changing their costing system.Their system currently uses a single direct cost pool (professional labour)and a single indirect cost pool (staff support).The direct categories in the new, refined costing system include:

1.Professional partner labour.Average total annual compensation of the two partners is $100,000; and, each partner has 2,000 hours of budgeted billable time.2.Dental assistant labour.Average total annual compensation of the four assistants is $22,500 each, and each assistant has 2,000 hours of budgeted billable time.3.Office staff.Average total annual compensation of the two staff members is $15,000 each, and each has 2,000 hours of budgeted billable time.The indirect category in the new refined costing system includes professional liability insurance.The budgeted indirect amount is $200,000, and the allocation base is budgeted professional labour hours.The dentist and dental assistants are considered professional labour hours.

What would be the percentage change in the budgeted direct cost rate if they consider hiring one more employee, as part of the office staff?

A)3.0%

B)2.0%

C)1.0%

D)0.5%

E)0%

1.Professional partner labour.Average total annual compensation of the two partners is $100,000; and, each partner has 2,000 hours of budgeted billable time.2.Dental assistant labour.Average total annual compensation of the four assistants is $22,500 each, and each assistant has 2,000 hours of budgeted billable time.3.Office staff.Average total annual compensation of the two staff members is $15,000 each, and each has 2,000 hours of budgeted billable time.The indirect category in the new refined costing system includes professional liability insurance.The budgeted indirect amount is $200,000, and the allocation base is budgeted professional labour hours.The dentist and dental assistants are considered professional labour hours.

What would be the percentage change in the budgeted direct cost rate if they consider hiring one more employee, as part of the office staff?

A)3.0%

B)2.0%

C)1.0%

D)0.5%

E)0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

66

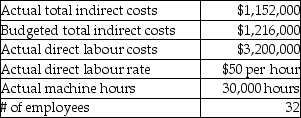

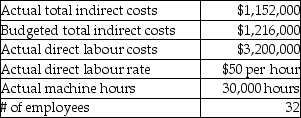

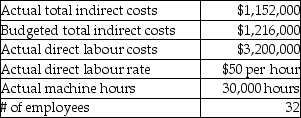

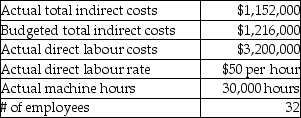

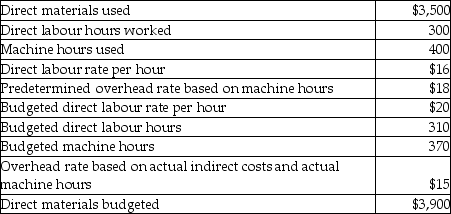

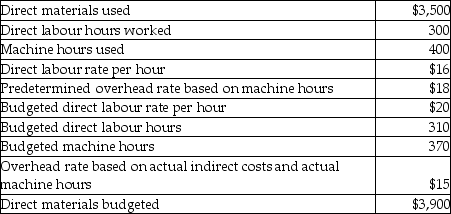

Use the information below to answer the following question(s).The following data were taken from the records of Big Sky Ltd., a manufacturing company.The company has been calculating the actual indirect cost allocation rate using direct labour hours as the allocation base.

What is the actual indirect cost rate at Big Sky Ltd.using machine hours as the allocation base?

A)$60.67

B)$10.67

C)$7.89

D)$4.05

E)$3.84

What is the actual indirect cost rate at Big Sky Ltd.using machine hours as the allocation base?

A)$60.67

B)$10.67

C)$7.89

D)$4.05

E)$3.84

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

67

Use the information below to answer the following question(s).A dental office is in the process of changing their costing system.Their system currently uses a single direct cost pool (professional labour)and a single indirect cost pool (staff support).The direct categories in the new, refined costing system include:

1.Professional partner labour.Average total annual compensation of the two partners is $100,000; and, each partner has 2,000 hours of budgeted billable time.2.Dental assistant labour.Average total annual compensation of the four assistants is $22,500 each, and each assistant has 2,000 hours of budgeted billable time.3.Office staff.Average total annual compensation of the two staff members is $15,000 each, and each has 2,000 hours of budgeted billable time.The indirect category in the new refined costing system includes professional liability insurance.The budgeted indirect amount is $200,000, and the allocation base is budgeted professional labour hours.The dentist and dental assistants are considered professional labour hours.

What would be the new budgeted direct cost rate if they decided to give all of the dental assistants a 10% raise?

A)$13.000 per hour

B)$12.375 per hour

C)$11.250 per hour

D)$9.875 per hour

E)$9.125 per hour

1.Professional partner labour.Average total annual compensation of the two partners is $100,000; and, each partner has 2,000 hours of budgeted billable time.2.Dental assistant labour.Average total annual compensation of the four assistants is $22,500 each, and each assistant has 2,000 hours of budgeted billable time.3.Office staff.Average total annual compensation of the two staff members is $15,000 each, and each has 2,000 hours of budgeted billable time.The indirect category in the new refined costing system includes professional liability insurance.The budgeted indirect amount is $200,000, and the allocation base is budgeted professional labour hours.The dentist and dental assistants are considered professional labour hours.

What would be the new budgeted direct cost rate if they decided to give all of the dental assistants a 10% raise?

A)$13.000 per hour

B)$12.375 per hour

C)$11.250 per hour

D)$9.875 per hour

E)$9.125 per hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

68

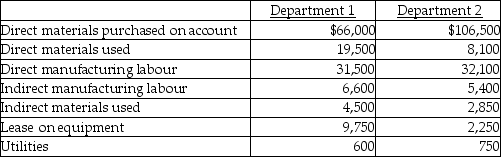

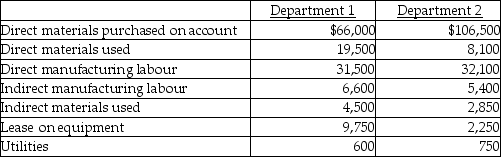

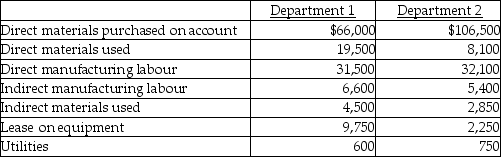

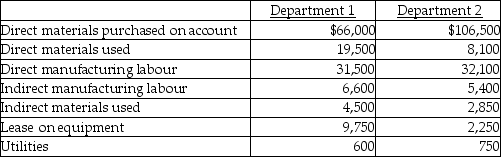

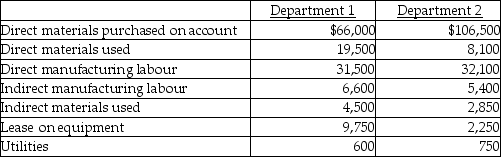

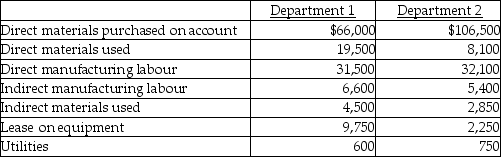

Use the information below to answer the following question(s).Jim's Computer Products manufactures keyboards for computers.In June, the two production departments had budgeted allocation bases of 10,000 machine hours in Department 1 and 5,000 direct manufacturing labour hours in Department 2.The budgeted manufacturing overheads for the month were $34,500 and $37,500, respectively.For Job 501, the actual costs incurred in the two departments were as follows:

Job 501 incurred 1,000 machine hours in Department 1 and 300 manufacturing labour hours in Department 2.The company uses a budgeted departmental overhead rate for applying overhead to production.

Job 501 incurred 1,000 machine hours in Department 1 and 300 manufacturing labour hours in Department 2.The company uses a budgeted departmental overhead rate for applying overhead to production.

What is the total cost assigned to Job 501 based on normal costing?

A)$27,600

B)$91,200

C)$96,900

D)$123,900

E)$126,500

Job 501 incurred 1,000 machine hours in Department 1 and 300 manufacturing labour hours in Department 2.The company uses a budgeted departmental overhead rate for applying overhead to production.

Job 501 incurred 1,000 machine hours in Department 1 and 300 manufacturing labour hours in Department 2.The company uses a budgeted departmental overhead rate for applying overhead to production.What is the total cost assigned to Job 501 based on normal costing?

A)$27,600

B)$91,200

C)$96,900

D)$123,900

E)$126,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

69

Use the information below to answer the following question(s).A dental office is in the process of changing their costing system.Their system currently uses a single direct cost pool (professional labour)and a single indirect cost pool (staff support).The direct categories in the new, refined costing system include:

1.Professional partner labour.Average total annual compensation of the two partners is $100,000; and, each partner has 2,000 hours of budgeted billable time.2.Dental assistant labour.Average total annual compensation of the four assistants is $22,500 each, and each assistant has 2,000 hours of budgeted billable time.3.Office staff.Average total annual compensation of the two staff members is $15,000 each, and each has 2,000 hours of budgeted billable time.The indirect category in the new refined costing system includes professional liability insurance.The budgeted indirect amount is $200,000, and the allocation base is budgeted professional labour hours.The dentist and dental assistants are considered professional labour hours.

What is the budgeted indirect cost allocation rate per unit of the allocation base for the professional liability insurance?

A)$16.67

B)$25.00

C)$1.67

D)$26.67

E)$12.50

1.Professional partner labour.Average total annual compensation of the two partners is $100,000; and, each partner has 2,000 hours of budgeted billable time.2.Dental assistant labour.Average total annual compensation of the four assistants is $22,500 each, and each assistant has 2,000 hours of budgeted billable time.3.Office staff.Average total annual compensation of the two staff members is $15,000 each, and each has 2,000 hours of budgeted billable time.The indirect category in the new refined costing system includes professional liability insurance.The budgeted indirect amount is $200,000, and the allocation base is budgeted professional labour hours.The dentist and dental assistants are considered professional labour hours.

What is the budgeted indirect cost allocation rate per unit of the allocation base for the professional liability insurance?

A)$16.67

B)$25.00

C)$1.67

D)$26.67

E)$12.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

70

Use the information below to answer the following question(s).Jim's Computer Products manufactures keyboards for computers.In June, the two production departments had budgeted allocation bases of 10,000 machine hours in Department 1 and 5,000 direct manufacturing labour hours in Department 2.The budgeted manufacturing overheads for the month were $34,500 and $37,500, respectively.For Job 501, the actual costs incurred in the two departments were as follows:

Job 501 incurred 1,000 machine hours in Department 1 and 300 manufacturing labour hours in Department 2.The company uses a budgeted departmental overhead rate for applying overhead to production.

Job 501 incurred 1,000 machine hours in Department 1 and 300 manufacturing labour hours in Department 2.The company uses a budgeted departmental overhead rate for applying overhead to production.

What is the budgeted indirect cost allocation rate for Department 2?

A)$3.45

B)$3.75

C)$4.60

D)$7.50

E)$8.00

Job 501 incurred 1,000 machine hours in Department 1 and 300 manufacturing labour hours in Department 2.The company uses a budgeted departmental overhead rate for applying overhead to production.

Job 501 incurred 1,000 machine hours in Department 1 and 300 manufacturing labour hours in Department 2.The company uses a budgeted departmental overhead rate for applying overhead to production.What is the budgeted indirect cost allocation rate for Department 2?

A)$3.45

B)$3.75

C)$4.60

D)$7.50

E)$8.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

71

Use the information below to answer the following question(s).A dental office is in the process of changing their costing system.Their system currently uses a single direct cost pool (professional labour)and a single indirect cost pool (staff support).The direct categories in the new, refined costing system include:

1.Professional partner labour.Average total annual compensation of the two partners is $100,000; and, each partner has 2,000 hours of budgeted billable time.2.Dental assistant labour.Average total annual compensation of the four assistants is $22,500 each, and each assistant has 2,000 hours of budgeted billable time.3.Office staff.Average total annual compensation of the two staff members is $15,000 each, and each has 2,000 hours of budgeted billable time.The indirect category in the new refined costing system includes professional liability insurance.The budgeted indirect amount is $200,000, and the allocation base is budgeted professional labour hours.The dentist and dental assistants are considered professional labour hours.

What is the budgeted direct cost rate per hour for office staff?

A)$11.250 per hour

B)$9.625 per hour

C)$7.500 per hour

D)$6.875 per hour

E)$6.125 per hour

1.Professional partner labour.Average total annual compensation of the two partners is $100,000; and, each partner has 2,000 hours of budgeted billable time.2.Dental assistant labour.Average total annual compensation of the four assistants is $22,500 each, and each assistant has 2,000 hours of budgeted billable time.3.Office staff.Average total annual compensation of the two staff members is $15,000 each, and each has 2,000 hours of budgeted billable time.The indirect category in the new refined costing system includes professional liability insurance.The budgeted indirect amount is $200,000, and the allocation base is budgeted professional labour hours.The dentist and dental assistants are considered professional labour hours.

What is the budgeted direct cost rate per hour for office staff?

A)$11.250 per hour

B)$9.625 per hour

C)$7.500 per hour

D)$6.875 per hour

E)$6.125 per hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

72

Use the information below to answer the following question(s).A dental office is in the process of changing their costing system.Their system currently uses a single direct cost pool (professional labour)and a single indirect cost pool (staff support).The direct categories in the new, refined costing system include:

1.Professional partner labour.Average total annual compensation of the two partners is $100,000; and, each partner has 2,000 hours of budgeted billable time.2.Dental assistant labour.Average total annual compensation of the four assistants is $22,500 each, and each assistant has 2,000 hours of budgeted billable time.3.Office staff.Average total annual compensation of the two staff members is $15,000 each, and each has 2,000 hours of budgeted billable time.The indirect category in the new refined costing system includes professional liability insurance.The budgeted indirect amount is $200,000, and the allocation base is budgeted professional labour hours.The dentist and dental assistants are considered professional labour hours.

What is the budgeted direct cost rate for dental assistant labour?

A)$17.875 per hour

B)$16.125 per hour

C)$13.750 per hour

D)$11.250 per hour

E)$9.125 per hour

1.Professional partner labour.Average total annual compensation of the two partners is $100,000; and, each partner has 2,000 hours of budgeted billable time.2.Dental assistant labour.Average total annual compensation of the four assistants is $22,500 each, and each assistant has 2,000 hours of budgeted billable time.3.Office staff.Average total annual compensation of the two staff members is $15,000 each, and each has 2,000 hours of budgeted billable time.The indirect category in the new refined costing system includes professional liability insurance.The budgeted indirect amount is $200,000, and the allocation base is budgeted professional labour hours.The dentist and dental assistants are considered professional labour hours.

What is the budgeted direct cost rate for dental assistant labour?

A)$17.875 per hour

B)$16.125 per hour

C)$13.750 per hour

D)$11.250 per hour

E)$9.125 per hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

73

Use the information below to answer the following question(s).Jim's Computer Products manufactures keyboards for computers.In June, the two production departments had budgeted allocation bases of 10,000 machine hours in Department 1 and 5,000 direct manufacturing labour hours in Department 2.The budgeted manufacturing overheads for the month were $34,500 and $37,500, respectively.For Job 501, the actual costs incurred in the two departments were as follows:

Job 501 incurred 1,000 machine hours in Department 1 and 300 manufacturing labour hours in Department 2.The company uses a budgeted departmental overhead rate for applying overhead to production.

Job 501 incurred 1,000 machine hours in Department 1 and 300 manufacturing labour hours in Department 2.The company uses a budgeted departmental overhead rate for applying overhead to production.

What is the budgeted indirect cost allocation rate for Department 1?

A)$3.45 per hour

B)$3.75 per hour

C)$6.90 per hour

D)$7.50 per hour

E)$8.00 per hour

Job 501 incurred 1,000 machine hours in Department 1 and 300 manufacturing labour hours in Department 2.The company uses a budgeted departmental overhead rate for applying overhead to production.

Job 501 incurred 1,000 machine hours in Department 1 and 300 manufacturing labour hours in Department 2.The company uses a budgeted departmental overhead rate for applying overhead to production.What is the budgeted indirect cost allocation rate for Department 1?

A)$3.45 per hour

B)$3.75 per hour

C)$6.90 per hour

D)$7.50 per hour

E)$8.00 per hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

74

Answer the following question(s)using the information below.A law office employs full-time attorneys and five paraprofessionals.For the current year indirect costs were budgeted at $225,000, but actually amounted to $350,000.Direct and indirect costs are applied on a professional labour-hour basis which includes both attorney and paraprofessional hours.Total budgeted labour-hours were 25,000; however, actual labour-hours were 30,000.

What is the overhead applied to jobs if the law office uses normal costing?

A)$225,000

B)$350,000

C)$291,667

D)$270,000

E)$420,000

What is the overhead applied to jobs if the law office uses normal costing?

A)$225,000

B)$350,000

C)$291,667

D)$270,000

E)$420,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

75

Answer the following question(s)using the information below.A law office employs full-time attorneys and five paraprofessionals.For the current year indirect costs were budgeted at $225,000, but actually amounted to $350,000.Direct and indirect costs are applied on a professional labour-hour basis which includes both attorney and paraprofessional hours.Total budgeted labour-hours were 25,000; however, actual labour-hours were 30,000.

What is the overhead applied to a 500 hour job if the law office uses actual costing?

A)$5,200

B)$4,500

C)$3,750

D)$5,000

E)$5,835

What is the overhead applied to a 500 hour job if the law office uses actual costing?

A)$5,200

B)$4,500

C)$3,750

D)$5,000

E)$5,835

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

76

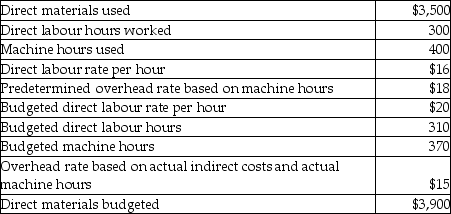

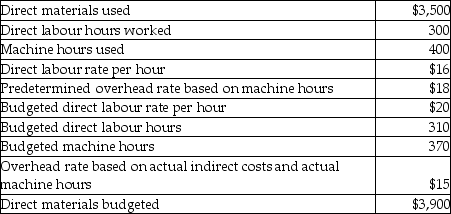

Use the information below to answer the following question(s).World Engines Ltd.manufactures custom engines for use in the lawn and garden equipment industry.The company allocates manufacturing overhead based on machine hours.Selected data for costs incurred for Job 787 are as follows:

What is the total manufacturing cost of Job 787 using normal costing?

A)$17,100

B)$14,960

C)$12,800

D)$15,500

E)$14,300

What is the total manufacturing cost of Job 787 using normal costing?

A)$17,100

B)$14,960

C)$12,800

D)$15,500

E)$14,300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

77

Use the information below to answer the following question(s).A dental office is in the process of changing their costing system.Their system currently uses a single direct cost pool (professional labour)and a single indirect cost pool (staff support).The direct categories in the new, refined costing system include:

1.Professional partner labour.Average total annual compensation of the two partners is $100,000; and, each partner has 2,000 hours of budgeted billable time.2.Dental assistant labour.Average total annual compensation of the four assistants is $22,500 each, and each assistant has 2,000 hours of budgeted billable time.3.Office staff.Average total annual compensation of the two staff members is $15,000 each, and each has 2,000 hours of budgeted billable time.The indirect category in the new refined costing system includes professional liability insurance.The budgeted indirect amount is $200,000, and the allocation base is budgeted professional labour hours.The dentist and dental assistants are considered professional labour hours.

What is the budgeted direct cost rate per hour for professional partner labour?

A)$25.00 per hour

B)$50.00 per hour

C)$44.50 per hour

D)$38.00 per hour

E)$46.00 per hour

1.Professional partner labour.Average total annual compensation of the two partners is $100,000; and, each partner has 2,000 hours of budgeted billable time.2.Dental assistant labour.Average total annual compensation of the four assistants is $22,500 each, and each assistant has 2,000 hours of budgeted billable time.3.Office staff.Average total annual compensation of the two staff members is $15,000 each, and each has 2,000 hours of budgeted billable time.The indirect category in the new refined costing system includes professional liability insurance.The budgeted indirect amount is $200,000, and the allocation base is budgeted professional labour hours.The dentist and dental assistants are considered professional labour hours.

What is the budgeted direct cost rate per hour for professional partner labour?

A)$25.00 per hour

B)$50.00 per hour

C)$44.50 per hour

D)$38.00 per hour

E)$46.00 per hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

78

Use the information below to answer the following question(s).A Hospital uses a job cost system for all surgery patients.In February, the pre-operating room (PRE-OP)and operating room (OR)had budgeted allocation bases of 1,000 nursing hours and 500 nursing hours, respectively, and budgeted nursing overhead charges were $28,000 and $22,000, respectively.The hospital ward rooms for surgery patients had budgeted overhead costs of $200,000 and 2,500 nursing hours for the month.PRE-OP, OR and the hospital ward have separate indirect cost pools.The hospital uses a budgeted overhead rate for applying overhead to patient stays.For patient Jones, actual hours incurred were six and eight hours, respectively, in the PRE-OP and OR rooms.He was in the hospital for 5 days (120 hours).Other costs related to Jones were:

What was the total PRE-OP cost for patient Jones?

A)$1,400

B)$1,568

C)$1,624

D)$1,664

E)$1,752

What was the total PRE-OP cost for patient Jones?

A)$1,400

B)$1,568

C)$1,624

D)$1,664

E)$1,752

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

79

Use the information below to answer the following question(s).The following data were taken from the records of Big Sky Ltd., a manufacturing company.The company has been calculating the actual indirect cost allocation rate using direct labour hours as the allocation base.

What is the actual indirect cost rate at Big Sky Ltd.using direct labour hours as the allocation base?

A)$384.00

B)$7.68

C)$18.00

D)$19.00

E)$138.89

What is the actual indirect cost rate at Big Sky Ltd.using direct labour hours as the allocation base?

A)$384.00

B)$7.68

C)$18.00

D)$19.00

E)$138.89

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck

80

Use the information below to answer the following question(s).World Engines Ltd.manufactures custom engines for use in the lawn and garden equipment industry.The company allocates manufacturing overhead based on machine hours.Selected data for costs incurred for Job 787 are as follows:

What is the total manufacturing cost of Job 787 using actual costing?

A)$17,100

B)$14,960

C)$12,800

D)$15,500

E)$14,300

What is the total manufacturing cost of Job 787 using actual costing?

A)$17,100

B)$14,960

C)$12,800

D)$15,500

E)$14,300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 161 في هذه المجموعة.

فتح الحزمة

k this deck