Deck 2: An Introduction to Cost Terms and Purposes

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

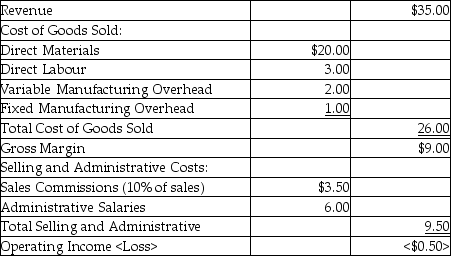

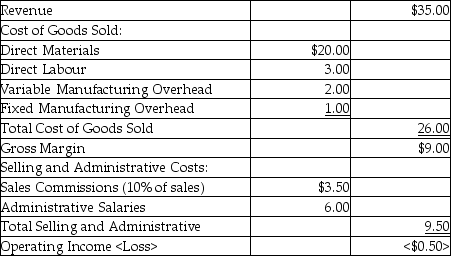

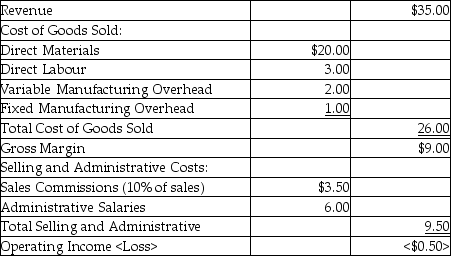

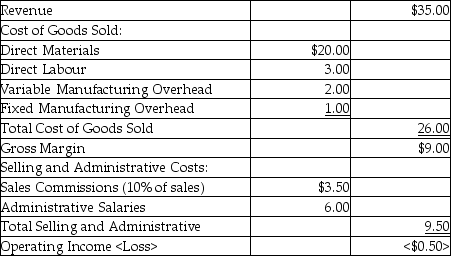

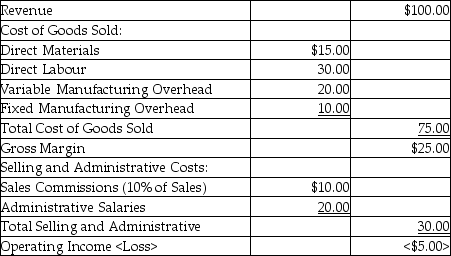

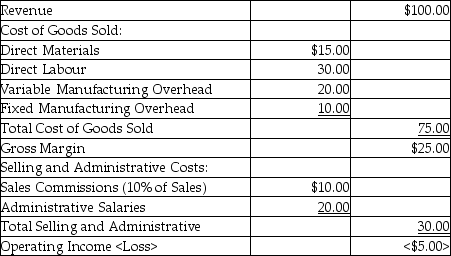

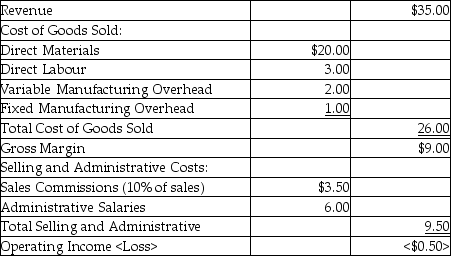

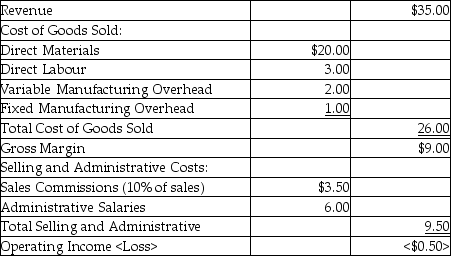

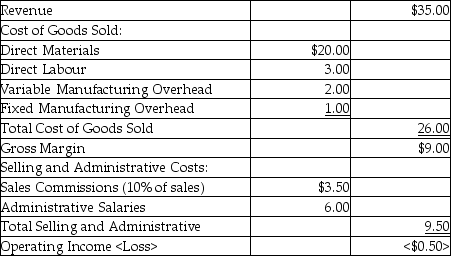

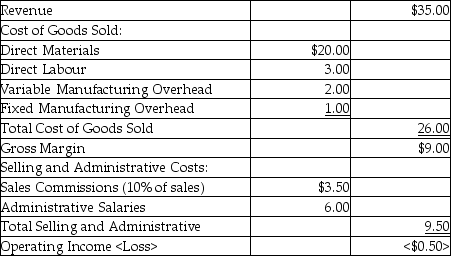

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

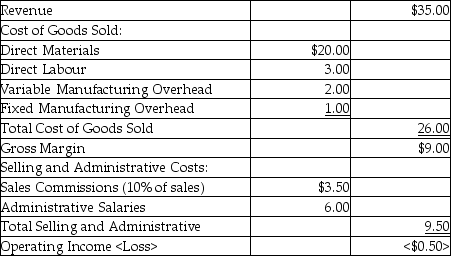

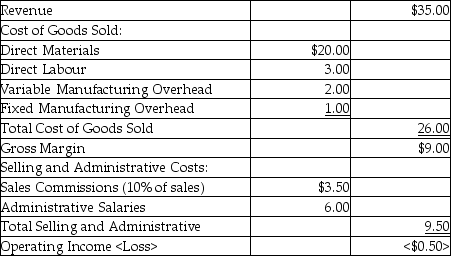

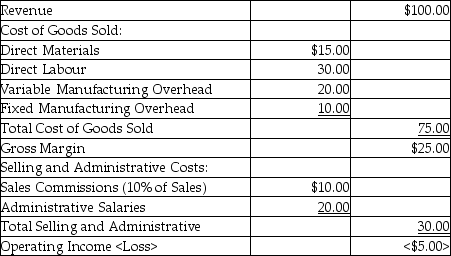

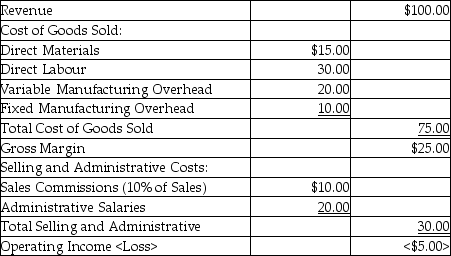

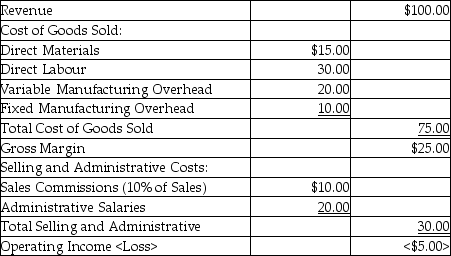

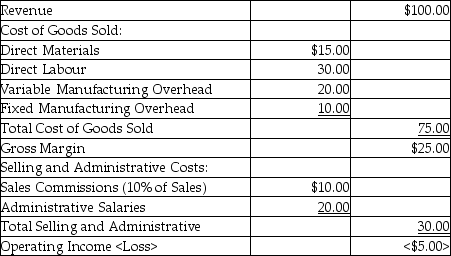

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/202

العب

ملء الشاشة (f)

Deck 2: An Introduction to Cost Terms and Purposes

1

A cost object is anything for which a separate measurement of costs is desired.

True

2

The plant supervisor's salary is a direct labour cost.

False

3

Products, services, departments, and customers may be cost objects.

True

4

Prime costs consist of direct and indirect manufacturing labour.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

5

Delivery charges are typically considered to be an indirect cost because it cannot be traced to each customer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

6

A cost is classified as a direct or indirect cost based on the applicable cost object.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

7

Costs are accounted for in two basic stages: assignment followed by accumulation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

8

Conversion costs are all manufacturing costs other than direct materials.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

9

A department could be considered a cost object.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

10

A cost object is always either a product or a service.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

11

Nearly all accounting systems accumulate forecasted costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

12

An actual cost is a predicted cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

13

Conversion costs include all direct manufacturing costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

14

Assigning direct costs poses more problems than assigning indirect costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

15

Costs of Sales is another way of phrasing Cost of Goods Sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

16

Factors affecting direct/indirect cost classifications are the materiality of the cost in question, the information-gathering technology used, and the operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

17

Rent for the building that contains the manufacturing and engineering departments can all be charged as manufacturing overhead costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

18

Indirect costs cannot be economically traced directly to the cost objective.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

19

"Cost" is defined by accountants as a resource sacrificed or foregone to achieve a specific objective.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

20

Cost tracing assigns indirect costs to the chosen cost object.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

21

A manufacturing plant produces two product lines: football equipment and hockey equipment.An indirect cost for the hockey equipment line is the

A)material used to make the hockey sticks.

B)labour to bind the shaft to the blade of the hockey stick.

C)shift supervisor for the hockey line.

D)plant supervisor.

E)salesperson travelling expenses.

A)material used to make the hockey sticks.

B)labour to bind the shaft to the blade of the hockey stick.

C)shift supervisor for the hockey line.

D)plant supervisor.

E)salesperson travelling expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

22

Cost tracing is

A)the assignment of direct costs to the chosen cost object.

B)a function of cost allocation.

C)the process of tracking both direct and indirect costs associated with a cost object.

D)the process of determining the actual cost of the cost object.

E)the assignment of both direct and indirect costs associated with a cost object.

A)the assignment of direct costs to the chosen cost object.

B)a function of cost allocation.

C)the process of tracking both direct and indirect costs associated with a cost object.

D)the process of determining the actual cost of the cost object.

E)the assignment of both direct and indirect costs associated with a cost object.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

23

Classifying a cost as either direct or indirect depends upon

A)the behaviour of the cost in response to volume changes.

B)whether the cost is expensed in the period in which it is incurred.

C)whether the cost can be traced to the cost object.

D)whether an expenditure is avoidable or not in the future.

E)the inventory classification system.

A)the behaviour of the cost in response to volume changes.

B)whether the cost is expensed in the period in which it is incurred.

C)whether the cost can be traced to the cost object.

D)whether an expenditure is avoidable or not in the future.

E)the inventory classification system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

24

Cost assignment is a term that refers solely to allocating indirect costs among diverse cost objects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

25

Wages paid to machine operators on an assembly line are an example of which type of cost?

A)direct manufacturing labour costs

B)direct manufacturing overhead costs

C)direct materials costs

D)indirect manufacturing overhead costs

E)indirect material costs

A)direct manufacturing labour costs

B)direct manufacturing overhead costs

C)direct materials costs

D)indirect manufacturing overhead costs

E)indirect material costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

26

Cost allocation is

A)the process of tracking both direct and indirect costs associated to a cost object.

B)the process of determining the actual cost of the cost object.

C)the assignment of indirect costs to the chosen cost object.

D)a function of cost tracing.

E)the assignment of direct costs to the chosen cost object.

A)the process of tracking both direct and indirect costs associated to a cost object.

B)the process of determining the actual cost of the cost object.

C)the assignment of indirect costs to the chosen cost object.

D)a function of cost tracing.

E)the assignment of direct costs to the chosen cost object.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

27

Whether a company traces costs directly to an output unit or not depends upon

A)the materiality of the contribution a cost makes to the total cost per output unit.

B)the amount of similar costs in the cost assignment.

C)the effect of cost tracing on overhead.

D)the employment of cost management.

E)the amount of customer satisfaction.

A)the materiality of the contribution a cost makes to the total cost per output unit.

B)the amount of similar costs in the cost assignment.

C)the effect of cost tracing on overhead.

D)the employment of cost management.

E)the amount of customer satisfaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which one of the following examples could be classified as a direct cost?

A)The costs of an entire factory's electricity related to a product; the product line is the cost object.

B)The printing costs incurred for payroll cheque processing; the payroll cheque processing is the cost object.

C)The salary of a maintenance supervisor in the manufacturing plant; Product A is the cost object.

D)The costs incurred for electricity in the office; the accounting office is the cost object.

E)The cost of advertising the products.

A)The costs of an entire factory's electricity related to a product; the product line is the cost object.

B)The printing costs incurred for payroll cheque processing; the payroll cheque processing is the cost object.

C)The salary of a maintenance supervisor in the manufacturing plant; Product A is the cost object.

D)The costs incurred for electricity in the office; the accounting office is the cost object.

E)The cost of advertising the products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

29

Anything for which a separate measurement of costs is desired is known as

A)a cost item.

B)a cost object.

C)a fixed cost item.

D)a variable cost object.

E)a cost driver.

A)a cost item.

B)a cost object.

C)a fixed cost item.

D)a variable cost object.

E)a cost driver.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

30

Actual costs are defined as

A)costs incurred.

B)direct costs.

C)indirect costs.

D)predicted costs.

E)sunk costs.

A)costs incurred.

B)direct costs.

C)indirect costs.

D)predicted costs.

E)sunk costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following is an indirect production cost?

A)materials placed into production

B)calibrating factory equipment

C)labour placed into production

D)cost of shipping a product to the customer

E)advertising

A)materials placed into production

B)calibrating factory equipment

C)labour placed into production

D)cost of shipping a product to the customer

E)advertising

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following is TRUE concerning prime costs?

A)Prime costs are direct manufacturing costs.

B)They include indirect manufacturing labour.

C)They equal the sum of direct manufacturing costs plus conversion costs.

D)They equal the sum of fixed manufacturing costs plus conversion costs.

E)They are indirect manufacturing costs.

A)Prime costs are direct manufacturing costs.

B)They include indirect manufacturing labour.

C)They equal the sum of direct manufacturing costs plus conversion costs.

D)They equal the sum of fixed manufacturing costs plus conversion costs.

E)They are indirect manufacturing costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following is a cost object?

A)direct materials

B)customers

C)conversion costs

D)cost assignments

E)indirect labour

A)direct materials

B)customers

C)conversion costs

D)cost assignments

E)indirect labour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

34

Prime costs can include

A)conversion costs.

B)direct material costs.

C)indirect manufacturing labour.

D)machine set up costs.

E)advertizing costs.

A)conversion costs.

B)direct material costs.

C)indirect manufacturing labour.

D)machine set up costs.

E)advertizing costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which one of the following items is typically an example of an indirect cost of a cost object?

A)courier charges for shipment delivery

B)manufacturing plant electricity

C)direct manufacturing labour

D)wood used for furniture manufacture

E)refundable sales tax on direct materials

A)courier charges for shipment delivery

B)manufacturing plant electricity

C)direct manufacturing labour

D)wood used for furniture manufacture

E)refundable sales tax on direct materials

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

36

Materiality refers to the significance of the cost in question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

37

Cost assignment is

A)always arbitrary.

B)linking actual costs to cost objects.

C)the same as cost accumulation.

D)finding the difference between budgeted and actual costs.

E)the same as cost conversion.

A)always arbitrary.

B)linking actual costs to cost objects.

C)the same as cost accumulation.

D)finding the difference between budgeted and actual costs.

E)the same as cost conversion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

38

The determination of a cost as being either direct or indirect depends upon

A)the accounting system.

B)the allocation system.

C)the cost tracing system.

D)only the cost object chosen to determine its individual costs.

E)the choice of the cost object, and the materiality of the cost in question.

A)the accounting system.

B)the allocation system.

C)the cost tracing system.

D)only the cost object chosen to determine its individual costs.

E)the choice of the cost object, and the materiality of the cost in question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

39

A manufacturing plant produces two product lines: football equipment and hockey equipment.Direct costs for the football equipment line are the

A)beverages provided daily in the plant break room.

B)monthly lease payments for a specialized piece of equipment needed to manufacture the football helmet.

C)salaries of the clerical staff that work in the company administrative offices.

D)utilities paid for the manufacturing plant.

E)advertising costs.

A)beverages provided daily in the plant break room.

B)monthly lease payments for a specialized piece of equipment needed to manufacture the football helmet.

C)salaries of the clerical staff that work in the company administrative offices.

D)utilities paid for the manufacturing plant.

E)advertising costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

40

Factors affecting direct/indirect cost classification include all of the following EXCEPT the

A)cost assignment method.

B)materiality of the cost in question.

C)selection of the cost object.

D)available information-gathering technology.

E)design of operations.

A)cost assignment method.

B)materiality of the cost in question.

C)selection of the cost object.

D)available information-gathering technology.

E)design of operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

41

A relevant range is the range of the cost driver in which a specific relationship between cost and driver is valid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

42

Sheen Manufacturing has four manufacturing cost pools and many types of costs, some of which are e listed below.Match the type of cost with the most appropriate cost pool or as a period cost.

A)Period cost

B)Cost pool - indirect factory operating costs

C)Cost pool - indirect factory labour

D)Cost pool - direct factory labour

safety hats and shoes

A)Period cost

B)Cost pool - indirect factory operating costs

C)Cost pool - indirect factory labour

D)Cost pool - direct factory labour

safety hats and shoes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

43

Sheen Manufacturing has four manufacturing cost pools and many types of costs, some of which are e listed below.Match the type of cost with the most appropriate cost pool or as a period cost.

A)Period cost

B)Cost pool - indirect factory operating costs

C)Cost pool - indirect factory labour

D)Cost pool - direct factory labour

factory worker overtime premiums

A)Period cost

B)Cost pool - indirect factory operating costs

C)Cost pool - indirect factory labour

D)Cost pool - direct factory labour

factory worker overtime premiums

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

44

Sheen Manufacturing has four manufacturing cost pools and many types of costs, some of which are e listed below.Match the type of cost with the most appropriate cost pool or as a period cost.

A)Period cost

B)Cost pool - indirect factory operating costs

C)Cost pool - indirect factory labour

D)Cost pool - direct factory labour

fringe benefits for factory workers

A)Period cost

B)Cost pool - indirect factory operating costs

C)Cost pool - indirect factory labour

D)Cost pool - direct factory labour

fringe benefits for factory workers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

45

Sheen Manufacturing has four manufacturing cost pools and many types of costs, some of which are e listed below.Match the type of cost with the most appropriate cost pool or as a period cost.

A)Period cost

B)Cost pool - indirect factory operating costs

C)Cost pool - indirect factory labour

D)Cost pool - direct factory labour

lubricants for machines

A)Period cost

B)Cost pool - indirect factory operating costs

C)Cost pool - indirect factory labour

D)Cost pool - direct factory labour

lubricants for machines

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

46

Sheen Manufacturing has four manufacturing cost pools and many types of costs, some of which are e listed below.Match the type of cost with the most appropriate cost pool or as a period cost.

A)Period cost

B)Cost pool - indirect factory operating costs

C)Cost pool - indirect factory labour

D)Cost pool - direct factory labour

property taxes on the administration office

A)Period cost

B)Cost pool - indirect factory operating costs

C)Cost pool - indirect factory labour

D)Cost pool - direct factory labour

property taxes on the administration office

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

47

Sheen Manufacturing has four manufacturing cost pools and many types of costs, some of which are e listed below.Match the type of cost with the most appropriate cost pool or as a period cost.

A)Period cost

B)Cost pool - indirect factory operating costs

C)Cost pool - indirect factory labour

D)Cost pool - direct factory labour

utilities on the factory

A)Period cost

B)Cost pool - indirect factory operating costs

C)Cost pool - indirect factory labour

D)Cost pool - direct factory labour

utilities on the factory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

48

What are the differences between direct costs and indirect costs? Give an example of each.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

49

A fixed cost is a cost that changes per unit as cost driver volume changes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

50

Sheen Manufacturing has four manufacturing cost pools and many types of costs, some of which are e listed below.Match the type of cost with the most appropriate cost pool or as a period cost.

A)Period cost

B)Cost pool - indirect factory operating costs

C)Cost pool - indirect factory labour

D)Cost pool - direct factory labour

property insurance on the factory

A)Period cost

B)Cost pool - indirect factory operating costs

C)Cost pool - indirect factory labour

D)Cost pool - direct factory labour

property insurance on the factory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

51

What is the meaning of the term "cost object"? Give an example of a cost object that would be used in a manufacturing company, a merchandising company, and a service sector company?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

52

Sheen Manufacturing has four manufacturing cost pools and many types of costs, some of which are e listed below.Match the type of cost with the most appropriate cost pool or as a period cost.

A)Period cost

B)Cost pool - indirect factory operating costs

C)Cost pool - indirect factory labour

D)Cost pool - direct factory labour

amortization on buildings and equipment

A)Period cost

B)Cost pool - indirect factory operating costs

C)Cost pool - indirect factory labour

D)Cost pool - direct factory labour

amortization on buildings and equipment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

53

Sheen Manufacturing has four manufacturing cost pools and many types of costs, some of which are e listed below.Match the type of cost with the most appropriate cost pool or as a period cost.

A)Period cost

B)Cost pool - indirect factory operating costs

C)Cost pool - indirect factory labour

D)Cost pool - direct factory labour

night security

A)Period cost

B)Cost pool - indirect factory operating costs

C)Cost pool - indirect factory labour

D)Cost pool - direct factory labour

night security

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

54

Changes in particular cost drivers automatically result in decreases in overall costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

55

Sheen Manufacturing has four manufacturing cost pools and many types of costs, some of which are e listed below.Match the type of cost with the most appropriate cost pool or as a period cost.

A)Period cost

B)Cost pool - indirect factory operating costs

C)Cost pool - indirect factory labour

D)Cost pool - direct factory labour

utilities on the administrative building

A)Period cost

B)Cost pool - indirect factory operating costs

C)Cost pool - indirect factory labour

D)Cost pool - direct factory labour

utilities on the administrative building

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

56

Sheen Manufacturing has four manufacturing cost pools and many types of costs, some of which are e listed below.Match the type of cost with the most appropriate cost pool or as a period cost.

A)Period cost

B)Cost pool - indirect factory operating costs

C)Cost pool - indirect factory labour

D)Cost pool - direct factory labour

factory worker overtime premiums

A)Period cost

B)Cost pool - indirect factory operating costs

C)Cost pool - indirect factory labour

D)Cost pool - direct factory labour

factory worker overtime premiums

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

57

Sheen Manufacturing has four manufacturing cost pools and many types of costs, some of which are e listed below.Match the type of cost with the most appropriate cost pool or as a period cost.

A)Period cost

B)Cost pool - indirect factory operating costs

C)Cost pool - indirect factory labour

D)Cost pool - direct factory labour

factory supervisor's salaries

A)Period cost

B)Cost pool - indirect factory operating costs

C)Cost pool - indirect factory labour

D)Cost pool - direct factory labour

factory supervisor's salaries

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

58

Sheen Manufacturing has four manufacturing cost pools and many types of costs, some of which are e listed below.Match the type of cost with the most appropriate cost pool or as a period cost.

A)Period cost

B)Cost pool - indirect factory operating costs

C)Cost pool - indirect factory labour

D)Cost pool - direct factory labour

idle time wages

A)Period cost

B)Cost pool - indirect factory operating costs

C)Cost pool - indirect factory labour

D)Cost pool - direct factory labour

idle time wages

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

59

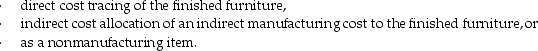

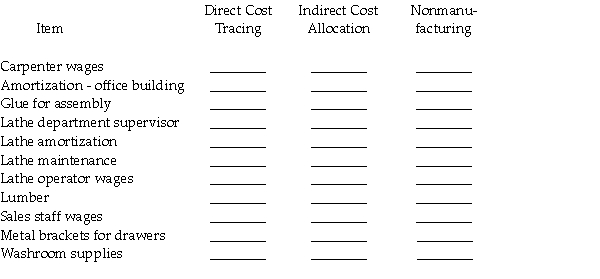

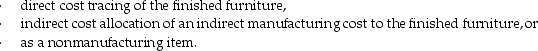

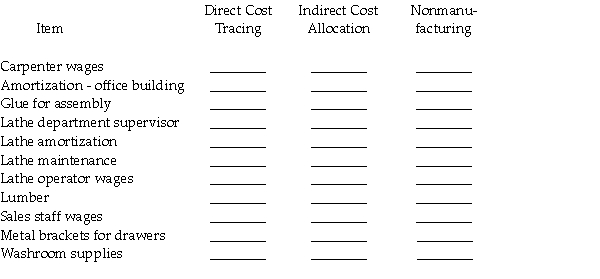

Office Supply Company manufactures office furniture.Recently the company decided to develop a formal cost accounting system.The company is currently converting all costs into classifications as related to its manufacturing processes.Required:

For the following items, label each as being appropriate for

For the following items, label each as being appropriate for

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

60

Manufacturing overhead includes

A)corporate insurance cost.

B)the executive officers' salaries.

C)marketing costs.

D)supplies used in the human resources department.

E)plant utilities.

A)corporate insurance cost.

B)the executive officers' salaries.

C)marketing costs.

D)supplies used in the human resources department.

E)plant utilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

61

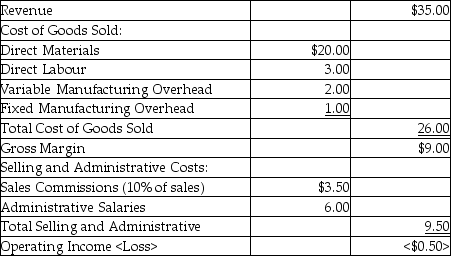

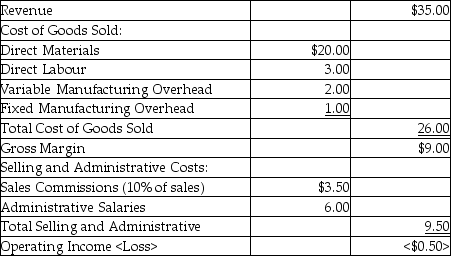

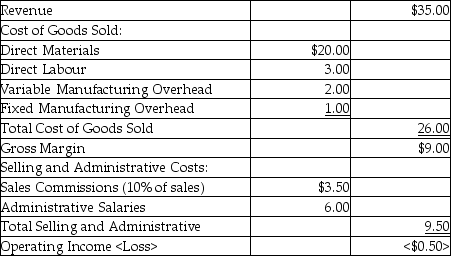

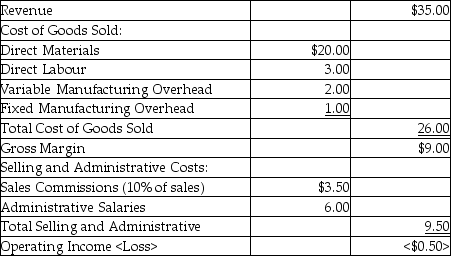

Use the information below to answer the following question(s).Big Island Coffee Co.produced and sold 120,000 units last year.Per unit revenue and costs were as follows:

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

Calculate this year's operating income if the company plans to produce and sell 60,000 units.

A)$120,000

B)$0

C)$<30,000>

D)$<100,000>

E)$<450,000>

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.Calculate this year's operating income if the company plans to produce and sell 60,000 units.

A)$120,000

B)$0

C)$<30,000>

D)$<100,000>

E)$<450,000>

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which one of the following is a variable cost in a grocery store?

A)rent

B)president's salary

C)inventory of vegetables

D)property taxes

E)administrative salaries

A)rent

B)president's salary

C)inventory of vegetables

D)property taxes

E)administrative salaries

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

63

If each furnace required a hose that costs $20 and 2,000 furnaces are produced for the month, the $40,000 total cost for hoses

A)is considered to be a direct fixed cost.

B)is considered to be a direct variable cost.

C)is considered to be an indirect fixed cost.

D)is considered to be an indirect variable cost.

E)is considered to be variable or fixed, depending on the relevant range.

A)is considered to be a direct fixed cost.

B)is considered to be a direct variable cost.

C)is considered to be an indirect fixed cost.

D)is considered to be an indirect variable cost.

E)is considered to be variable or fixed, depending on the relevant range.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

64

Use the information below to answer the following question(s).Big Island Coffee Co.produced and sold 120,000 units last year.Per unit revenue and costs were as follows:

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

Variable costs

A)are always indirect costs.

B)increase in total when the actual level of activity increases.

C)include most personnel costs and depreciation on machinery.

D)can always be traced directly to the cost object.

E)change in relation to selling price.

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.Variable costs

A)are always indirect costs.

B)increase in total when the actual level of activity increases.

C)include most personnel costs and depreciation on machinery.

D)can always be traced directly to the cost object.

E)change in relation to selling price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

65

Use the information below to answer the following question(s).Big Island Coffee Co.produced and sold 120,000 units last year.Per unit revenue and costs were as follows:

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

The relevant range is important because

A)it specifies which costs should be used for a given decision.

B)it provides a basis for determining a range of acceptable cost alternatives.

C)it is required to determine inventoriable costs under ASPE/IFRS.

D)it specifies the limits beyond which the relationship of cost to cost drivers may not be valid.

E)it determines the time horizon.

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.The relevant range is important because

A)it specifies which costs should be used for a given decision.

B)it provides a basis for determining a range of acceptable cost alternatives.

C)it is required to determine inventoriable costs under ASPE/IFRS.

D)it specifies the limits beyond which the relationship of cost to cost drivers may not be valid.

E)it determines the time horizon.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

66

Total variable costs change in direct proportion to changes in cost driver volume.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

67

The variable cost per unit of a product should stay the same throughout the relevant range of production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

68

Competition places an increased emphasis on cost reductions.For an organization to reduce costs it must focus on

A)maximizing the cost allocation system.

B)reporting non-value added costs separately from value-added costs.

C)efficiently managing the use of the cost drivers in those value-added activities.

D)the cost allocation process.

E)reducing the number of cost drivers.

A)maximizing the cost allocation system.

B)reporting non-value added costs separately from value-added costs.

C)efficiently managing the use of the cost drivers in those value-added activities.

D)the cost allocation process.

E)reducing the number of cost drivers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

69

Costing systems that identify the cost of each activity such as testing, design, or setup are called management-based costing systems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

70

Use the information below to answer the following question(s).Big Island Coffee Co.produced and sold 120,000 units last year.Per unit revenue and costs were as follows:

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

A mixed cost is

A)a fixed cost.

B)a cost with fixed and variable elements.

C)a variable cost.

D)always an indirect cost.

E)a cost with direct and indirect elements.

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.A mixed cost is

A)a fixed cost.

B)a cost with fixed and variable elements.

C)a variable cost.

D)always an indirect cost.

E)a cost with direct and indirect elements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

71

Use the information below to answer the following question(s).Macadamia Co.produced and sold 40,000 units last year.Per unit revenue and costs were as follows:

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

Calculate this year's operating income if the company plans to produce and sell 50,000 units.

A)$50,000

B)$0

C)$<250,000>

D)$<550,000>

E)$250,000

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.Calculate this year's operating income if the company plans to produce and sell 50,000 units.

A)$50,000

B)$0

C)$<250,000>

D)$<550,000>

E)$250,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

72

Use the information below to answer the following question(s).Big Island Coffee Co.produced and sold 120,000 units last year.Per unit revenue and costs were as follows:

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

Calculate this year's operating income if the company plans to produce and sell 200,000 units.

A)$460,000

B)$0

C)$<100,000>

D)$900,000

E)$980,000

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.Calculate this year's operating income if the company plans to produce and sell 200,000 units.

A)$460,000

B)$0

C)$<100,000>

D)$900,000

E)$980,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

73

Use the information below to answer the following question(s).Big Island Coffee Co.produced and sold 120,000 units last year.Per unit revenue and costs were as follows:

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

Cost behaviour refers to

A)how costs react to a change in the level of activity.

B)whether a cost is incurred in a manufacturing, merchandising, or service company.

C)classifying costs as either inventoriable or period costs.

D)whether a particular expense has been ethically incurred.

E)how costs react to a change in selling price.

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.Cost behaviour refers to

A)how costs react to a change in the level of activity.

B)whether a cost is incurred in a manufacturing, merchandising, or service company.

C)classifying costs as either inventoriable or period costs.

D)whether a particular expense has been ethically incurred.

E)how costs react to a change in selling price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

74

Use the information below to answer the following question(s).Macadamia Co.produced and sold 40,000 units last year.Per unit revenue and costs were as follows:

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

Calculate this year's operating income if the company plans to produce and sell 60,000 units.

A)$150,000

B)$0

C)$<300,000>

D)$<650,000>

E)$300,000

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.Calculate this year's operating income if the company plans to produce and sell 60,000 units.

A)$150,000

B)$0

C)$<300,000>

D)$<650,000>

E)$300,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

75

Use the information below to answer the following question(s).Big Island Coffee Co.produced and sold 120,000 units last year.Per unit revenue and costs were as follows:

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

Calculate last year's operating income when the company produced and sold 120,000 units.

A)$0

B)$<60,000>

C)$<500,000>

D)$<800,000>

E)$<1,000,000>

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.Calculate last year's operating income when the company produced and sold 120,000 units.

A)$0

B)$<60,000>

C)$<500,000>

D)$<800,000>

E)$<1,000,000>

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

76

An appropriate cost driver for shipping costs might be the number of units shipped.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

77

Use the information below to answer the following question(s).Macadamia Co.produced and sold 40,000 units last year.Per unit revenue and costs were as follows:

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

Calculate last year's operating income when the company produced and sold 40,000 units.

A)$0

B)$<200,000>

C)$<500,000>

D)$<800,000>

E)$<1,000,000>

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.

Fixed manufacturing overhead and administrative salaries are fixed costs.The per unit amounts are based on last year's production.Calculate last year's operating income when the company produced and sold 40,000 units.

A)$0

B)$<200,000>

C)$<500,000>

D)$<800,000>

E)$<1,000,000>

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

78

Fixed costs do not have cost drivers, at least in the short-run.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following is a fixed cost in a clothing store?

A)store manager's salary

B)electricity

C)sales commissions

D)inventory

E)paper for the cash register

A)store manager's salary

B)electricity

C)sales commissions

D)inventory

E)paper for the cash register

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following statements about cost management is TRUE?

A)It requires that managers actively strive to increase revenues.

B)It only focuses on inventoriable costs.

C)It is not affected by the organization's customers.

D)It only applies to period costs.

E)It requires efficient management of the use of the cost drivers in the value-added activities.

A)It requires that managers actively strive to increase revenues.

B)It only focuses on inventoriable costs.

C)It is not affected by the organization's customers.

D)It only applies to period costs.

E)It requires efficient management of the use of the cost drivers in the value-added activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 202 في هذه المجموعة.

فتح الحزمة

k this deck