Deck 17: Job Order and Process Costing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

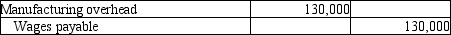

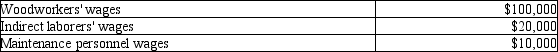

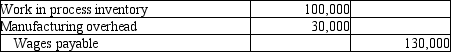

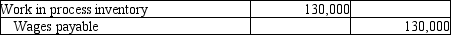

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

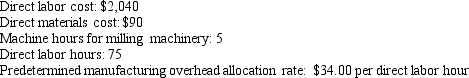

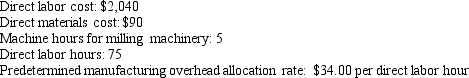

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

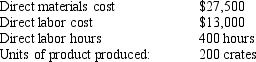

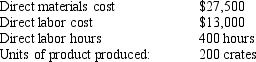

سؤال

سؤال

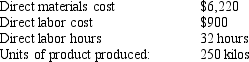

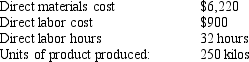

سؤال

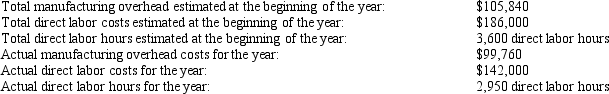

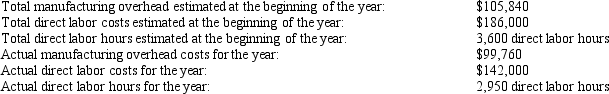

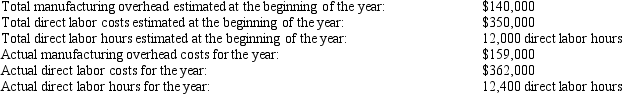

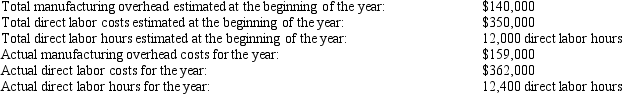

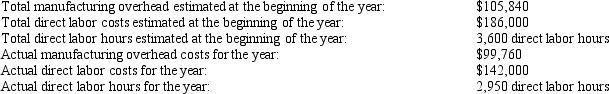

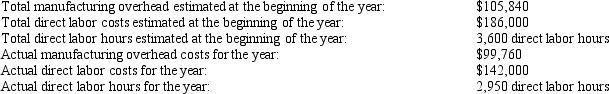

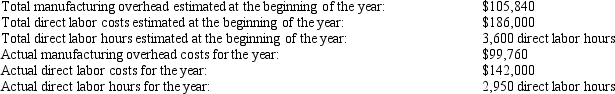

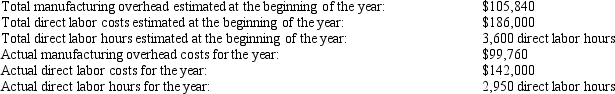

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

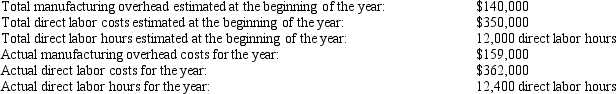

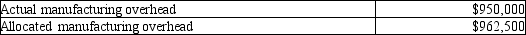

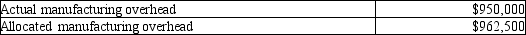

سؤال

سؤال

سؤال

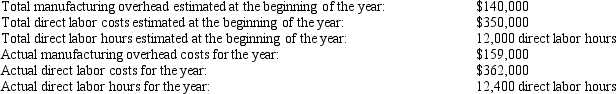

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/172

العب

ملء الشاشة (f)

Deck 17: Job Order and Process Costing

1

A process costing system is useful in which of the following circumstances?

A)Providing specialized services

B)Production of unique products

C)Production of multiple products in separate batches

D)Mass production of a single type of product

A)Providing specialized services

B)Production of unique products

C)Production of multiple products in separate batches

D)Mass production of a single type of product

D

2

Direct materials and direct labor are assigned to individual job cost records, and recorded with a debit to Work in process.

True

3

The entry to record the purchase of materials on account using a job order costing system would include a:

A)debit to materials inventory.

B)debit to accounts payable.

C)debit to work in process inventory.

D)credit to materials inventory.

A)debit to materials inventory.

B)debit to accounts payable.

C)debit to work in process inventory.

D)credit to materials inventory.

A

4

Process costing is used by companies that produce large numbers of identical units in a continuous fashion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

5

Job order costing is most likely used in which of the following industries?

A)Pharmaceutical manufacturing

B)Medical clinic

C)Oil refinery

D)Food and beverage manufacturing

A)Pharmaceutical manufacturing

B)Medical clinic

C)Oil refinery

D)Food and beverage manufacturing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following would be included in the journal entry to record direct labor costs actually incurred?

A)Debit to Work in process Inventory

B)Debit to Wages payable

C)Debit to Manufacturing overhead

D)Debit to Finished goods inventory

A)Debit to Work in process Inventory

B)Debit to Wages payable

C)Debit to Manufacturing overhead

D)Debit to Finished goods inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

7

Work in process inventory is debited for the incurrence of both direct and indirect labor in a job costing system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following companies would NOT use job order costing?

A)A lawn maintenance company

B)A legal firm

C)An auto repair shop

D)A beverage manufacturer

A)A lawn maintenance company

B)A legal firm

C)An auto repair shop

D)A beverage manufacturer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

9

When direct materials are requisitioned, the Work in process account will be debited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

10

A job order costing system is useful in which of the following circumstances?

A)Mass production of a commodity

B)Manufacturing multiple products in separate batches

C)Continuous flow production of a single product

D)Manufacturing a product in a multi-step flow of production

A)Mass production of a commodity

B)Manufacturing multiple products in separate batches

C)Continuous flow production of a single product

D)Manufacturing a product in a multi-step flow of production

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

11

In job order costing, the journal entry to issue indirect materials to production should include which of the following?

A)Credit to Finished goods inventory

B)Credit to Materials inventory

C)Credit to Manufacturing overhead

D)Credit to Work in process inventory

A)Credit to Finished goods inventory

B)Credit to Materials inventory

C)Credit to Manufacturing overhead

D)Credit to Work in process inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

12

Indirect materials issued and indirect labor costs incurred are debited to the Manufacturing overhead account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

13

Accounting firms, building contractors, and healthcare providers are companies that use job order costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following would be included in the journal entry to record the requisition of indirect materials?

A)Debit to Manufacturing overhead

B)Debit to Work in process inventory

C)Debit to Materials inventory

D)Debit to Finished goods inventory

A)Debit to Manufacturing overhead

B)Debit to Work in process inventory

C)Debit to Materials inventory

D)Debit to Finished goods inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following is an industry that would use a process costing system rather than a job order costing system?

A)Custom furniture manufacturer

B)Music production studio

C)Paint manufacturer

D)Home remodeling contractor

A)Custom furniture manufacturer

B)Music production studio

C)Paint manufacturer

D)Home remodeling contractor

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following statements is FALSE?

A)A job order costing system would be used by manufacturers of custom made products.

B)A process costing system would be used by manufacturers of commodities, such as flour or sugar.

C)A service firm would likely use a job order costing system.

D)A print and copy shop would likely use a process costing system.

A)A job order costing system would be used by manufacturers of custom made products.

B)A process costing system would be used by manufacturers of commodities, such as flour or sugar.

C)A service firm would likely use a job order costing system.

D)A print and copy shop would likely use a process costing system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following would be included in the journal entry to record the incurrence of indirect labor costs?

A)Debit to Manufacturing overhead

B)Debit to Wages payable

C)Debit to Finished goods inventory

D)Debit to Work in process inventory

A)Debit to Manufacturing overhead

B)Debit to Wages payable

C)Debit to Finished goods inventory

D)Debit to Work in process inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following would be included in the journal entry to record the requisition of direct materials?

A)Debit to Cost of goods sold

B)Debit to Work in process inventory

C)Debit to Finished goods inventory

D)Debit to Materials inventory

A)Debit to Cost of goods sold

B)Debit to Work in process inventory

C)Debit to Finished goods inventory

D)Debit to Materials inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

19

When materials are requisitioned for a job, the materials inventory account is debited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

20

Indirect materials and indirect labor are tracked to individual job costing records and recorded in the Work in process account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following correctly describes the term conversion costs?

A)The combination of direct plus indirect labor costs

B)The combination of indirect labor plus indirect materials cost

C)The combination of direct materials, direct labor, and manufacturing overhead costs

D)The combination of direct labor and manufacturing overhead costs

A)The combination of direct plus indirect labor costs

B)The combination of indirect labor plus indirect materials cost

C)The combination of direct materials, direct labor, and manufacturing overhead costs

D)The combination of direct labor and manufacturing overhead costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

22

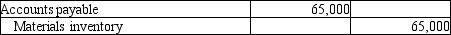

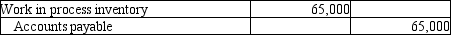

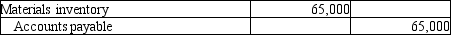

Carlton Manufacturing Company purchased $65,000 of raw materials on account. The materials will be used to produce furniture. Please provide the journal entry for the purchase of materials.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

23

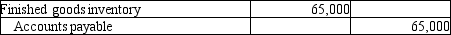

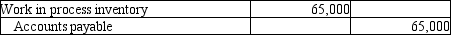

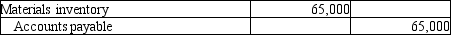

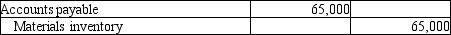

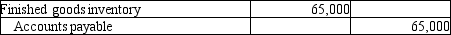

Carlton Manufacturing Company purchased $65,000 of raw materials on account. The materials will be used to produce furniture. Which of the following journal entries correctly records this transaction?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

24

The entry to allocate manufacturing overhead costs to work in process requires a debit to Manufacturing overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

25

When manufacturing overhead costs are incurred, the amounts are recorded as a credit to Manufacturing overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

26

In a manufacturing operation, depreciation of the plant and plant equipment should be debited to Depreciation expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

27

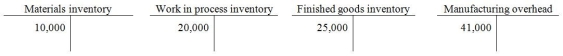

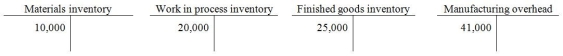

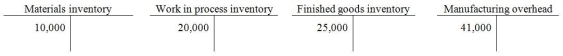

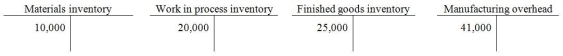

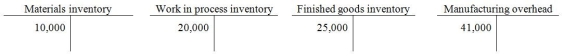

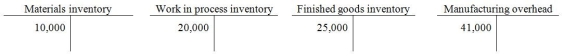

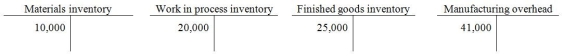

On June 1, 2012, Dalton Production Company had beginning balances as shown in the T-accounts below.  During June, the following transactions took place:

During June, the following transactions took place:

June 2: Issue $2,400 of direct materials and $200 of indirect materials to production.

June 13: Pay $7,500 of direct factory labor cost, and $14,100 of indirect factory labor cost.

Following these transactions, what was the balance in the Manufacturing overhead account?

A)$50,900

B)$55,300

C)$44,200

D)$65,200

During June, the following transactions took place:

During June, the following transactions took place:June 2: Issue $2,400 of direct materials and $200 of indirect materials to production.

June 13: Pay $7,500 of direct factory labor cost, and $14,100 of indirect factory labor cost.

Following these transactions, what was the balance in the Manufacturing overhead account?

A)$50,900

B)$55,300

C)$44,200

D)$65,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

28

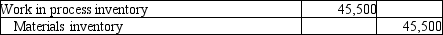

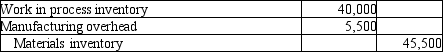

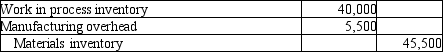

Broxsie Fabrication Company issued $40,000 of direct materials to production and $5,500 of indirect materials to production. Please prepare the journal entry to record the transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

29

All manufacturing overhead costs incurred are accumulated as debits to a general ledger account titled Manufacturing overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

30

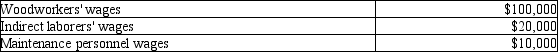

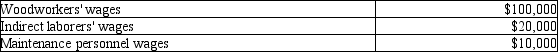

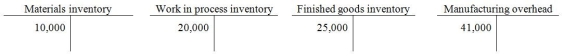

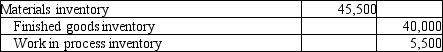

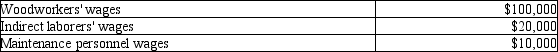

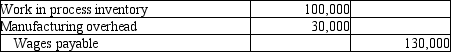

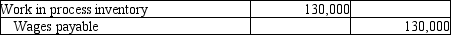

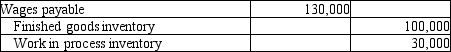

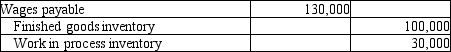

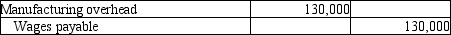

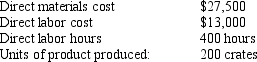

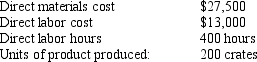

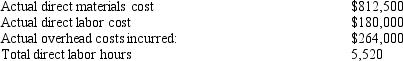

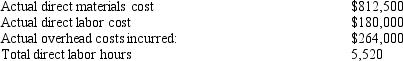

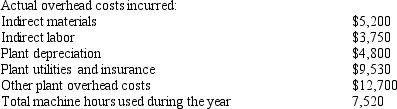

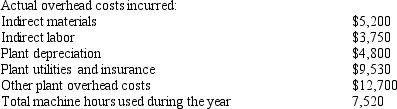

Specialty Wood Products company had the following manufacturing labor costs last month:

Please provide the journal entry to record the incurrence of these labor costs.

Please provide the journal entry to record the incurrence of these labor costs.

Please provide the journal entry to record the incurrence of these labor costs.

Please provide the journal entry to record the incurrence of these labor costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

31

The journal entry to issue $500 of direct materials and $30 of indirect materials to production includes which of the following?

A)Debit to Work in process for $500 and debit to Finished goods for $30

B)Debit to Manufacturing overhead for $530

C)Debit to Work in process for $500 and debit to Manufacturing overhead for $30

D)Debit to Work in process inventory for $530

A)Debit to Work in process for $500 and debit to Finished goods for $30

B)Debit to Manufacturing overhead for $530

C)Debit to Work in process for $500 and debit to Manufacturing overhead for $30

D)Debit to Work in process inventory for $530

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

32

On June 1, 2012, Dalton Production Company had beginning balances as shown in the T-accounts below.  During June, the following transactions took place:

During June, the following transactions took place:

June 2: Issue $2,400 of direct materials and $200 of indirect materials to production.

June 13: Pay $7,500 of direct factory labor cost, and $14,100 of indirect factory labor cost.

Following these transactions, what was the balance in the Work in process inventory account?

A)$29,900

B)$9,900

C)$44,200

D)$22,200

During June, the following transactions took place:

During June, the following transactions took place:June 2: Issue $2,400 of direct materials and $200 of indirect materials to production.

June 13: Pay $7,500 of direct factory labor cost, and $14,100 of indirect factory labor cost.

Following these transactions, what was the balance in the Work in process inventory account?

A)$29,900

B)$9,900

C)$44,200

D)$22,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

33

When manufacturing overhead is allocated, the amount is recorded as a debit to Finished goods and a credit to Work in process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

34

On June 1, 2012, Dalton Production Company had beginning balances as shown in the T-accounts below.  During June, the following transactions took place:

During June, the following transactions took place:

June 2: Issue $2,400 of direct materials and $200 of indirect materials to production.

Following this transaction, what was the balance in the Work in process inventory account?

A)$20,000

B)$22,400

C)$22,600

D)$20,200

During June, the following transactions took place:

During June, the following transactions took place:June 2: Issue $2,400 of direct materials and $200 of indirect materials to production.

Following this transaction, what was the balance in the Work in process inventory account?

A)$20,000

B)$22,400

C)$22,600

D)$20,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

35

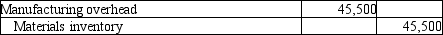

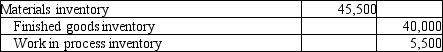

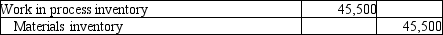

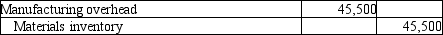

Broxsie Fabrication Company issued $40,000 of direct materials to production and $5,500 of indirect materials to production. Which of the following transactions would correctly record the transaction?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

36

The journal entry to record the incurrence of $1,500 of direct labor and $200 of indirect labor includes which of the following?

A)Debit to Manufacturing overhead for $1,700

B)Debit to Work in process inventory for $1,500 and debit to Finished goods for $200

C)Debit to Work in process inventory for $1,700

D)Debit to Work in process for $1,500, debit to Manufacturing overhead for $200

A)Debit to Manufacturing overhead for $1,700

B)Debit to Work in process inventory for $1,500 and debit to Finished goods for $200

C)Debit to Work in process inventory for $1,700

D)Debit to Work in process for $1,500, debit to Manufacturing overhead for $200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

37

On June 1, 2012, Dalton Production Company had beginning balances as shown in the T-accounts below.  During June, the following transactions took place:

During June, the following transactions took place:

June 2: Issue $2,400 of direct materials and $200 of indirect materials to production.

Following this transaction, what was the balance in the Manufacturing overhead account?

A)$43,600

B)$43,400

C)$41,200

D)$41,000

During June, the following transactions took place:

During June, the following transactions took place:June 2: Issue $2,400 of direct materials and $200 of indirect materials to production.

Following this transaction, what was the balance in the Manufacturing overhead account?

A)$43,600

B)$43,400

C)$41,200

D)$41,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

38

When manufacturing overhead is allocated, the amount is recorded as a debit to Work in process and a credit to Manufacturing overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

39

Specialty Wood Products company had the following manufacturing labor costs last month:  What is the journal entry to record the incurrence of these wages?

What is the journal entry to record the incurrence of these wages?

A)

B)

C)

D)

What is the journal entry to record the incurrence of these wages?

What is the journal entry to record the incurrence of these wages?A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

40

In a manufacturing operation, taxes and insurance for the plant should be debited to Manufacturing overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

41

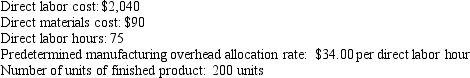

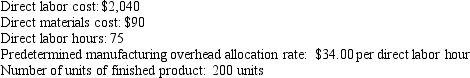

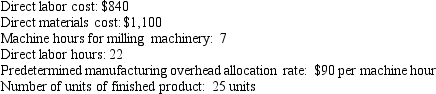

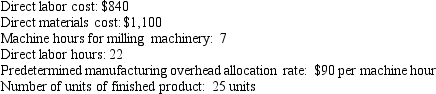

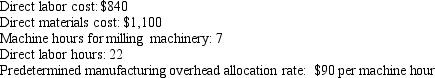

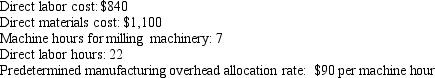

Halcyon Company just completed job number 10-B. See details below.  What was cost per unit of finished product? (Please round to nearest cent.)

What was cost per unit of finished product? (Please round to nearest cent.)

A)$26.40

B)$46.80

C)$25.50

D)$23.40

What was cost per unit of finished product? (Please round to nearest cent.)

What was cost per unit of finished product? (Please round to nearest cent.)A)$26.40

B)$46.80

C)$25.50

D)$23.40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

42

Gardner Machine Shop estimates manufacturing overhead costs for the coming year at $316,000. They will allocate based on direct labor hours. Gardner estimates 5,000 direct labor hours for the coming year. In January, Gardener completed job number A33, which included 15 direct labor hours. How much overhead was allocated to the job?

A)$948

B)$632

C)$1,204

D)$990

A)$948

B)$632

C)$1,204

D)$990

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

43

Arabica Manufacturing Company uses a predetermined manufacturing overhead rate based on a percentage of direct labor cost. At the beginning of 2012, they estimated total manufacturing overhead costs at $1,050,000, and they estimated total direct labor costs at $840,000. What was the predetermined manufacturing overhead rate?

A)80% of direct labor cost

B)$1.25 per direct labor hour

C)125% of direct labor cost

D)$35.00 per direct labor hour

A)80% of direct labor cost

B)$1.25 per direct labor hour

C)125% of direct labor cost

D)$35.00 per direct labor hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following describes the allocation base for allocating manufacturing overhead costs?

A)The factor that reflects the relationship between goods produced and the amount of overhead costs incurred

B)The estimated base amount of manufacturing overhead costs in a year

C)The percentage used to allocate direct labor to work in process

D)The formula for allocating depreciation expense over the life on an asset

A)The factor that reflects the relationship between goods produced and the amount of overhead costs incurred

B)The estimated base amount of manufacturing overhead costs in a year

C)The percentage used to allocate direct labor to work in process

D)The formula for allocating depreciation expense over the life on an asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

45

Halcyon Company just completed job number 10B. See details below.  What was the total job cost?

What was the total job cost?

A)$2,640

B)$4,680

C)$2,550

D)$4,590

What was the total job cost?

What was the total job cost?A)$2,640

B)$4,680

C)$2,550

D)$4,590

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

46

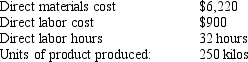

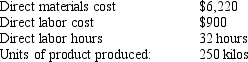

Arabica Manufacturing Company uses a predetermined manufacturing overhead rate based on a percentage of direct labor cost. At the beginning of 2012, they estimated total manufacturing overhead costs at $1,050,000, and they estimated total direct labor costs at $840,000. In June, 2012, Arabica completed job number 511. Job stats are as follows:  How much manufacturing overhead was allocated to the job?

How much manufacturing overhead was allocated to the job?

A)$16,250

B)$10,400

C)$5,000

D)$34,375

How much manufacturing overhead was allocated to the job?

How much manufacturing overhead was allocated to the job?A)$16,250

B)$10,400

C)$5,000

D)$34,375

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

47

Falstaff Products estimates manufacturing overhead costs for the coming year at $500,000. Falstaff will allocate based on machine hours. Falstaff estimates 8,000 machine hours for the coming year. What is the predetermined manufacturing overhead rate?

A)$62.50 per machine hour

B)$0.016 per machine hour

C)$32.00 per machine hour

D)$6.25 per machine hour

A)$62.50 per machine hour

B)$0.016 per machine hour

C)$32.00 per machine hour

D)$6.25 per machine hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following correctly describes the term cost driver?

A)The inflation rate which causes costs to rise

B)The initial purchase price of direct materials

C)The primary factor which is correlated with the amount of cost incurred to produce a product

D)The total material, labor, and overhead cost of a completed job

A)The inflation rate which causes costs to rise

B)The initial purchase price of direct materials

C)The primary factor which is correlated with the amount of cost incurred to produce a product

D)The total material, labor, and overhead cost of a completed job

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

49

When calculating the predetermined manufacturing overhead rate, what is the correct basis of calculation?

A)Estimated overhead costs divided by the number of days in a year

B)Estimated amount of the cost driver divided by the estimated total overhead costs

C)Actual overhead costs of the prior year divided by the actual amount of the cost driver or allocation base

D)Estimated overhead costs divided by the estimated amount of the cost driver or allocation base

A)Estimated overhead costs divided by the number of days in a year

B)Estimated amount of the cost driver divided by the estimated total overhead costs

C)Actual overhead costs of the prior year divided by the actual amount of the cost driver or allocation base

D)Estimated overhead costs divided by the estimated amount of the cost driver or allocation base

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

50

Inglesias Company just completed job number 12. See details below.  What was cost per unit of finished product? (Please round to nearest cent.)

What was cost per unit of finished product? (Please round to nearest cent.)

A)$77.88

B)$102.80

C)$12.40

D)$156.80

What was cost per unit of finished product? (Please round to nearest cent.)

What was cost per unit of finished product? (Please round to nearest cent.)A)$77.88

B)$102.80

C)$12.40

D)$156.80

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

51

Gardner Machine Shop estimates manufacturing overhead costs for the coming year at $316,000. They will allocate based on direct labor hours. Gardner estimates 5,000 direct labor hours for the coming year. What is the predetermined manufacturing overhead rate?

A)$6.32 per direct labor hour

B)$0.016 per direct labor hour

C)$63.20 per direct labor hour

D)$16.00 per direct labor hour

A)$6.32 per direct labor hour

B)$0.016 per direct labor hour

C)$63.20 per direct labor hour

D)$16.00 per direct labor hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following would NOT be considered a manufacturing overhead cost?

A)Depreciation of plant equipment

B)Direct labor cost

C)Plant utilities costs

D)Indirect labor

A)Depreciation of plant equipment

B)Direct labor cost

C)Plant utilities costs

D)Indirect labor

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

53

Falstaff Products allocates manufacturing overhead with a rate of $62.50 per machine hour. Job number 300 was just completed. It used 12 machine hours. How much overhead was allocated to the job?

A)$625

B)$75

C)$750

D)$7,500

A)$625

B)$75

C)$750

D)$7,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

54

Gardner Machine Shop uses a predetermined manufacturing overhead rate of $63.20 per direct labor hour. In January, Gardener completed job number A33, which included 15 direct labor hours. Which of the following correctly describes the journal entry needed to allocate overhead to the job?

A)Debit Finished goods for $948, credit Manufacturing overhead for $948

B)Debit Manufacturing overhead for $948, credit Work in process for $948

C)Debit Work in process for $948, credit Manufacturing overhead for $948

D)Debit Cost of goods sold for $948, credit Finished goods for $948

A)Debit Finished goods for $948, credit Manufacturing overhead for $948

B)Debit Manufacturing overhead for $948, credit Work in process for $948

C)Debit Work in process for $948, credit Manufacturing overhead for $948

D)Debit Cost of goods sold for $948, credit Finished goods for $948

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following correctly describes the predetermined manufacturing overhead rate?

A)The rate for factory utilities costs

B)The rate of actual overhead costs per day

C)The rate used to allocate overhead to production

D)The rate of increase in factory costs

A)The rate for factory utilities costs

B)The rate of actual overhead costs per day

C)The rate used to allocate overhead to production

D)The rate of increase in factory costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

56

When is the predetermined manufacturing overhead rate for a given production year calculated?

A)At the end of the production year

B)Before the production year begins

C)After each job is completed

D)At the mid-point of the production year

A)At the end of the production year

B)Before the production year begins

C)After each job is completed

D)At the mid-point of the production year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following would NOT be considered a manufacturing overhead cost?

A)Insurance for the factory

B)Indirect labor cost

C)Property tax for the plant

D)Direct labor

A)Insurance for the factory

B)Indirect labor cost

C)Property tax for the plant

D)Direct labor

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

58

Haverhill Products just completed job number 440. In addition to direct labor and direct materials cost, Haverhill allocated $450 of manufacturing overhead to the job. Which of the following describes the correct journal entry to record the allocation of overhead to the job?

A)Debit Finished goods, credit Manufacturing overhead

B)Debit Work in process, credit Cash

C)Debit Manufacturing overhead, credit Work in process

D)Debit Work in process, credit Manufacturing overhead

A)Debit Finished goods, credit Manufacturing overhead

B)Debit Work in process, credit Cash

C)Debit Manufacturing overhead, credit Work in process

D)Debit Work in process, credit Manufacturing overhead

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

59

Falstaff Products estimated manufacturing overhead costs for the year at $500,000. Falstaff also estimated 8,000 machine hours for the year. Falstaff bases their predetermined manufacturing overhead rate on machine hours. On January 31, job 300 was completed. It required 12 machine hours to produce. How much manufacturing overhead was allocated to the job?

A)$62.50

B)$19.20

C)$750.00

D)$42.00

A)$62.50

B)$19.20

C)$750.00

D)$42.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

60

Inglesias Company just completed job number 12. See details below.  What was the total job cost?

What was the total job cost?

A)$2,570

B)$1,940

C)$1,947

D)$3.920

What was the total job cost?

What was the total job cost?A)$2,570

B)$1,940

C)$1,947

D)$3.920

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

61

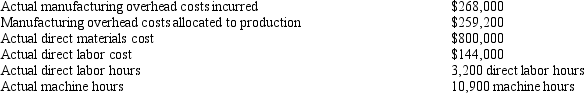

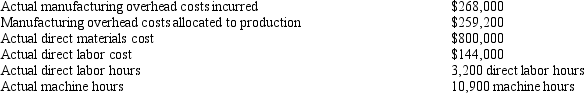

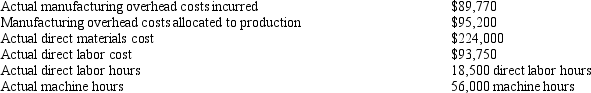

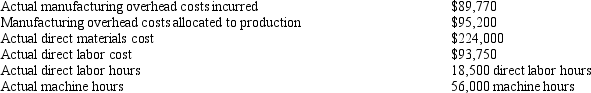

Petraeus Fabrication Company has provided the following information for the year 2012:  Based on the above information, what was Petraeus's allocation rate? (Hint: for this type of problem, the "trial and error" method may be used.)

Based on the above information, what was Petraeus's allocation rate? (Hint: for this type of problem, the "trial and error" method may be used.)

A)$95 per direct labor hour

B)180% of direct labor cost

C)$8.50 per machine hour

D)12% of direct materials cost

Based on the above information, what was Petraeus's allocation rate? (Hint: for this type of problem, the "trial and error" method may be used.)

Based on the above information, what was Petraeus's allocation rate? (Hint: for this type of problem, the "trial and error" method may be used.)A)$95 per direct labor hour

B)180% of direct labor cost

C)$8.50 per machine hour

D)12% of direct materials cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

62

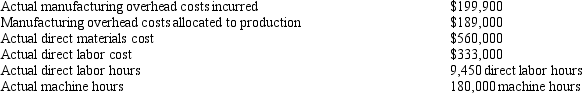

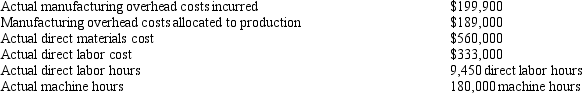

Q-dot Manufacturing Company has provided the following information for the year 2012:  Based on the above information, what was Q-dot's allocation rate? (Hint: for this type of problem, the "trial and error" method may be used.)

Based on the above information, what was Q-dot's allocation rate? (Hint: for this type of problem, the "trial and error" method may be used.)

A)$7.60 per machine hour

B)132% of direct labor cost

C)80% of direct materials cost

D)$20 per direct labor hour

Based on the above information, what was Q-dot's allocation rate? (Hint: for this type of problem, the "trial and error" method may be used.)

Based on the above information, what was Q-dot's allocation rate? (Hint: for this type of problem, the "trial and error" method may be used.)A)$7.60 per machine hour

B)132% of direct labor cost

C)80% of direct materials cost

D)$20 per direct labor hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

63

The Quadrangle Fabrication Plant had a fire at the beginning of 2013 and most of the records for the year 2012 were lost. Some data for the year 2012 were located by the accountants and are shown below.  The company bases its manufacturing overhead allocation on direct labor hours. What was the predetermined manufacturing overhead allocation rate for 2012? (Please round to the nearest cent.)

The company bases its manufacturing overhead allocation on direct labor hours. What was the predetermined manufacturing overhead allocation rate for 2012? (Please round to the nearest cent.)

A)$35.87

B)$33.82

C)$29.40

D)$27.71

The company bases its manufacturing overhead allocation on direct labor hours. What was the predetermined manufacturing overhead allocation rate for 2012? (Please round to the nearest cent.)

The company bases its manufacturing overhead allocation on direct labor hours. What was the predetermined manufacturing overhead allocation rate for 2012? (Please round to the nearest cent.)A)$35.87

B)$33.82

C)$29.40

D)$27.71

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

64

Gardner Machine Shop estimates manufacturing overhead costs for the coming year at $316,000. They will allocate based on direct labor hours. Gardner estimates 5,000 direct labor hours for the coming year. In January, Gardener completed job number A33, which included 15 direct labor hours. Please provide the journal entry to allocate overhead to the job.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

65

Felton Quality Productions Company has provided the following information for the year 2012:  Based on the above information, what was Felton's allocation rate? (Hint: for this type of problem, the "trial and error" method may be used.)

Based on the above information, what was Felton's allocation rate? (Hint: for this type of problem, the "trial and error" method may be used.)

A)$1.70 per machine hour

B)52% of direct labor cost

C)180% of direct materials cost

D)$24.80 per direct labor hour

Based on the above information, what was Felton's allocation rate? (Hint: for this type of problem, the "trial and error" method may be used.)

Based on the above information, what was Felton's allocation rate? (Hint: for this type of problem, the "trial and error" method may be used.)A)$1.70 per machine hour

B)52% of direct labor cost

C)180% of direct materials cost

D)$24.80 per direct labor hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

66

The records at Smith and Jones Company show Job. No. 110 charged with $11,000 of direct materials and $12,500 of direct labor. Smith and Jones Company allocates manufacturing overhead at 85% of direct labor cost. What is the total cost of Job No. 110?

A)$20,625

B)$34,125

C)$22,500

D)$21,625

A)$20,625

B)$34,125

C)$22,500

D)$21,625

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

67

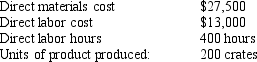

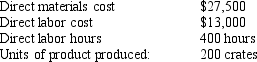

Arabica Manufacturing Company uses a predetermined manufacturing overhead rate based on a percentage of direct labor cost. At the beginning of 2012, they estimated total manufacturing overhead costs at $1,050,000, and they estimated total direct labor costs at $840,000. In June, 2012, Arabica completed job number 511. Job stats are as follows:  How much was the cost per unit (cost per crate)of finished product? (Please round to the nearest cent.)

How much was the cost per unit (cost per crate)of finished product? (Please round to the nearest cent.)

A)$374.38

B)$202.50

C)$254.50

D)$283.75

How much was the cost per unit (cost per crate)of finished product? (Please round to the nearest cent.)

How much was the cost per unit (cost per crate)of finished product? (Please round to the nearest cent.)A)$374.38

B)$202.50

C)$254.50

D)$283.75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

68

Arabica Manufacturing Company uses a predetermined manufacturing overhead rate based on a percentage of direct labor cost. At the beginning of 2012, they estimated total manufacturing overhead costs at $1,050,000, and they estimated total direct labor costs at $840,000. In June, 2012, Arabica completed job number 511. Job stats are as follows:  How much was the total job cost?

How much was the total job cost?

A)$40,500

B)$56,750

C)$50,900

D)$74,875

How much was the total job cost?

How much was the total job cost?A)$40,500

B)$56,750

C)$50,900

D)$74,875

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

69

Barbicon Manufacturing Company uses a predetermined manufacturing overhead rate based on a percentage of direct labor cost. At the beginning of 2012, they formulated a rate of 20% times the direct labor cost. In June, 2012, Barbicon completed job number 13C. Job stats are as follows:  How much was the total job cost?

How much was the total job cost?

A)$8,364

B)$180

C)$7,120

D)$7,300

How much was the total job cost?

How much was the total job cost?A)$8,364

B)$180

C)$7,120

D)$7,300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

70

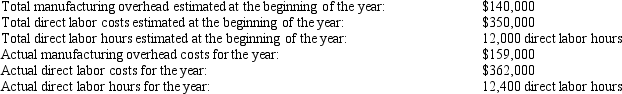

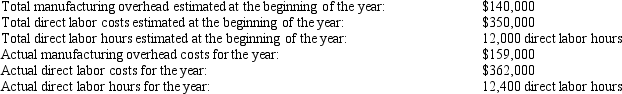

Archangel Manufacturing has just finished the year 2012. They created a predetermined manufacturing overhead allocation rate at the beginning of the year based on a percentage of direct labor costs. Below are various data:  Based on the data above, what was the allocation rate for 2012? (Please round to nearest whole percent.)

Based on the data above, what was the allocation rate for 2012? (Please round to nearest whole percent.)

A)40%

B)44%

C)250%

D)228%

Based on the data above, what was the allocation rate for 2012? (Please round to nearest whole percent.)

Based on the data above, what was the allocation rate for 2012? (Please round to nearest whole percent.)A)40%

B)44%

C)250%

D)228%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

71

Barbicon Manufacturing Company uses a predetermined manufacturing overhead rate based on a percentage of direct labor cost. At the beginning of 2012, they formulated a rate of 20% times the direct labor cost. In June, 2012, Barbicon completed job number 13C. Job stats are as follows:  How much was the cost per unit (cost per kilo)of finished product? (Please round to the nearest cent.)

How much was the cost per unit (cost per kilo)of finished product? (Please round to the nearest cent.)

A)$29.20

B)$33.46

C)$28.48

D)$36.70

How much was the cost per unit (cost per kilo)of finished product? (Please round to the nearest cent.)

How much was the cost per unit (cost per kilo)of finished product? (Please round to the nearest cent.)A)$29.20

B)$33.46

C)$28.48

D)$36.70

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

72

In 2012, the Doric Agricultural Products Company used a predetermined manufacturing overhead rate of 150% times direct labor cost. Information for the year is as follows:  What was the preliminary ending balance in the manufacturing overhead account, before the year-end adjustment to clear the balance to zero?

What was the preliminary ending balance in the manufacturing overhead account, before the year-end adjustment to clear the balance to zero?

A)Credit of $6,000

B)Debit of $6,000

C)Credit of $5,900

D)Debit of $4,300

What was the preliminary ending balance in the manufacturing overhead account, before the year-end adjustment to clear the balance to zero?

What was the preliminary ending balance in the manufacturing overhead account, before the year-end adjustment to clear the balance to zero?A)Credit of $6,000

B)Debit of $6,000

C)Credit of $5,900

D)Debit of $4,300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

73

Archangel Manufacturing has just finished the year 2012. They created a predetermined manufacturing overhead allocation rate at the beginning of the year based on a percentage of direct labor costs. Below are various data:  Based on the data above, what was the preliminary ending balance in the manufacturing overhead account, prior to the year-end adjustment to clear the balance to zero? (Please round to nearest whole dollar.)

Based on the data above, what was the preliminary ending balance in the manufacturing overhead account, prior to the year-end adjustment to clear the balance to zero? (Please round to nearest whole dollar.)

A)$19,000 credit balance

B)$19,000 debit balance

C)$14,200 credit balance

D)$14,200 debit balance

Based on the data above, what was the preliminary ending balance in the manufacturing overhead account, prior to the year-end adjustment to clear the balance to zero? (Please round to nearest whole dollar.)

Based on the data above, what was the preliminary ending balance in the manufacturing overhead account, prior to the year-end adjustment to clear the balance to zero? (Please round to nearest whole dollar.)A)$19,000 credit balance

B)$19,000 debit balance

C)$14,200 credit balance

D)$14,200 debit balance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

74

In 2012, the Cameratta Company used a predetermined manufacturing overhead rate of $4.75 per machine hour. Information for the year is as follows:  What was the preliminary ending balance in the manufacturing overhead account before the year-end adjustment to clear the balance to zero?

What was the preliminary ending balance in the manufacturing overhead account before the year-end adjustment to clear the balance to zero?

A)Credit of $260

B)Debit of $550

C)Credit of $330

D)Debit of $260

What was the preliminary ending balance in the manufacturing overhead account before the year-end adjustment to clear the balance to zero?

What was the preliminary ending balance in the manufacturing overhead account before the year-end adjustment to clear the balance to zero?A)Credit of $260

B)Debit of $550

C)Credit of $330

D)Debit of $260

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

75

Haverhill Products just completed job number 440. In addition to direct labor and direct materials cost, Haverhill allocated $450 of manufacturing overhead to the job. Please provide the journal entry for the allocation of overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

76

Forsyth Company uses estimated direct labor hours of 150,000 and estimated manufacturing overhead costs of $337,500 in establishing its 2012 predetermined manufacturing overhead rate. Actual results showed:  The number of direct labor hours worked during the period was:

The number of direct labor hours worked during the period was:

A)154,000.

B)152,800.

C)150,000.

D)146,000.

The number of direct labor hours worked during the period was:

The number of direct labor hours worked during the period was:A)154,000.

B)152,800.

C)150,000.

D)146,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

77

Archangel Manufacturing has just finished the year 2012. They created a predetermined manufacturing overhead allocation rate at the beginning of the year based on a percentage of direct labor costs. Below are various data:  Based on the data above, how much manufacturing overhead was allocated to production? (Please round to nearest whole dollar.)

Based on the data above, how much manufacturing overhead was allocated to production? (Please round to nearest whole dollar.)

A)$825,360

B)$905,000

C)$144,800

D)$159,280

Based on the data above, how much manufacturing overhead was allocated to production? (Please round to nearest whole dollar.)

Based on the data above, how much manufacturing overhead was allocated to production? (Please round to nearest whole dollar.)A)$825,360

B)$905,000

C)$144,800

D)$159,280

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

78

The Quadrangle Fabrication Plant had a fire at the beginning of 2013 and most of the records for the year 2012 were lost. Some data for the year 2012 were located by the accountants and are shown below.  The company bases its manufacturing overhead allocation on direct labor hours. How much manufacturing overhead was allocated to production in 2012? (Please round to the nearest whole dollar.)

The company bases its manufacturing overhead allocation on direct labor hours. How much manufacturing overhead was allocated to production in 2012? (Please round to the nearest whole dollar.)

A)$105,816

B)$86,730

C)$99,769

D)$81,745

The company bases its manufacturing overhead allocation on direct labor hours. How much manufacturing overhead was allocated to production in 2012? (Please round to the nearest whole dollar.)

The company bases its manufacturing overhead allocation on direct labor hours. How much manufacturing overhead was allocated to production in 2012? (Please round to the nearest whole dollar.)A)$105,816

B)$86,730

C)$99,769

D)$81,745

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

79

Davie Company used estimated direct labor hours of 180,000 and estimated manufacturing overhead costs of $990,000 in establishing its 2012 predetermined manufacturing overhead rate. Actual results showed:  What was the number of direct labor hours worked during 2009?

What was the number of direct labor hours worked during 2009?

A)180,000

B)186,000

C)192,000

D)175,000

What was the number of direct labor hours worked during 2009?

What was the number of direct labor hours worked during 2009?A)180,000

B)186,000

C)192,000

D)175,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck

80

The Quadrangle Fabrication Plant had a fire at the beginning of 2013 and most of the records for the year 2012 were lost. Some data for the year 2012 were located by the accountants and are shown below.  The company bases its manufacturing overhead allocation on direct labor hours. What was the preliminary ending balance in the manufacturing overhead account prior to the year-end adjustment to clear the balance to zero? (Please round to the nearest whole dollar.)

The company bases its manufacturing overhead allocation on direct labor hours. What was the preliminary ending balance in the manufacturing overhead account prior to the year-end adjustment to clear the balance to zero? (Please round to the nearest whole dollar.)

A)$6,080 credit balance

B)$4,982 debit balance

C)$13,030 credit balance

D)$13,030 debit balance

The company bases its manufacturing overhead allocation on direct labor hours. What was the preliminary ending balance in the manufacturing overhead account prior to the year-end adjustment to clear the balance to zero? (Please round to the nearest whole dollar.)

The company bases its manufacturing overhead allocation on direct labor hours. What was the preliminary ending balance in the manufacturing overhead account prior to the year-end adjustment to clear the balance to zero? (Please round to the nearest whole dollar.)A)$6,080 credit balance

B)$4,982 debit balance

C)$13,030 credit balance

D)$13,030 debit balance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 172 في هذه المجموعة.

فتح الحزمة

k this deck