Deck 12: Corporations: Paid-In Capital and the Balance Sheet

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

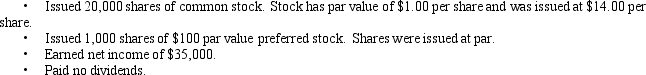

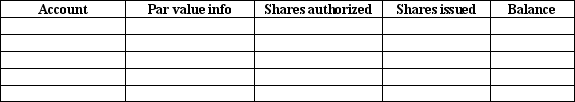

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

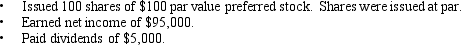

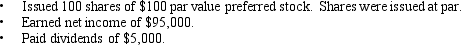

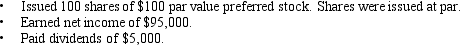

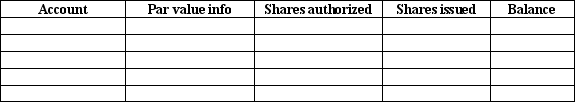

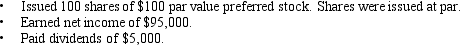

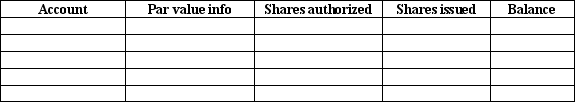

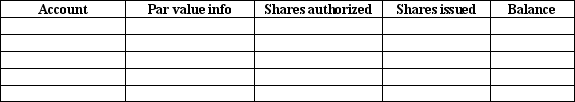

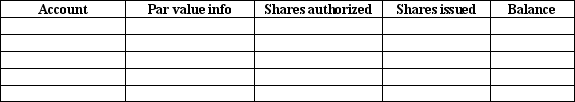

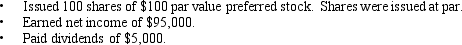

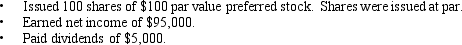

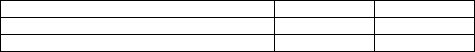

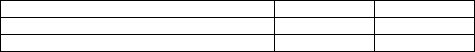

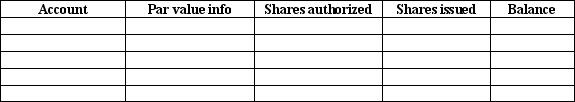

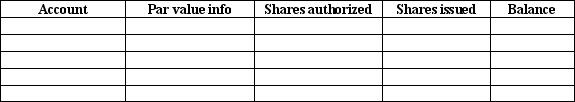

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/167

العب

ملء الشاشة (f)

Deck 12: Corporations: Paid-In Capital and the Balance Sheet

1

Which of the following corporate characteristics is a disadvantage of the corporate form of business?

A)Limited liability

B)Double taxation

C)No mutual agency

D)Transferability of ownership

A)Limited liability

B)Double taxation

C)No mutual agency

D)Transferability of ownership

B

2

Which of the following is a disadvantage of the corporate form of business?

A)Separation of ownership and management

B)Continuous life

C)The potential to raise large amounts of capital

D)No mutual agency

A)Separation of ownership and management

B)Continuous life

C)The potential to raise large amounts of capital

D)No mutual agency

A

3

Which of the following characteristics of a corporation limits a stockholder's loss to the amount of his or her investment in the stock of the corporation?

A)Transferability of ownership

B)Limited liability

C)Separate legal entity

D)Separation of ownership and management

A)Transferability of ownership

B)Limited liability

C)Separate legal entity

D)Separation of ownership and management

B

4

Paid-in capital is equity that is generated internally by corporate business transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

5

Stockholders of a corporation have unlimited liability for the corporation's debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

6

All forms and classes of stock carry voting rights.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following statements describes the corporate characteristic termed double taxation?

A)The liabilities of the corporation cannot be extended to the personal assets of the shareholder.

B)Shares of stock can be readily bought and sold by investors on the open market.

C)Shareholders are not authorized to sign contracts or make business commitments on behalf of the corporation.

D)Corporations pay income tax on corporate earnings, and shareholders pay personal income tax on corporate dividends and gains from sale of stock.

A)The liabilities of the corporation cannot be extended to the personal assets of the shareholder.

B)Shares of stock can be readily bought and sold by investors on the open market.

C)Shareholders are not authorized to sign contracts or make business commitments on behalf of the corporation.

D)Corporations pay income tax on corporate earnings, and shareholders pay personal income tax on corporate dividends and gains from sale of stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following describes the term outstanding stock?

A)The shares of stock that are held by the stockholders

B)The shares of stock that have been sold for the highest price

C)The total amount of stock that has been authorized by state law

D)The total amount of stock that has not been sold yet

A)The shares of stock that are held by the stockholders

B)The shares of stock that have been sold for the highest price

C)The total amount of stock that has been authorized by state law

D)The total amount of stock that has not been sold yet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following is a TRUE statement about a corporation?

A)The owners of a corporation have co-ownership of the property of the corporation.

B)A corporation is not taxed on the corporation's business income.

C)A corporation has a limited life.

D)The owners of a corporation have limited liability for the corporation's debts.

A)The owners of a corporation have co-ownership of the property of the corporation.

B)A corporation is not taxed on the corporation's business income.

C)A corporation has a limited life.

D)The owners of a corporation have limited liability for the corporation's debts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

10

A corporation is a separate legal entity formed under the laws of a particular state.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

11

Corporations must issue common stock, but may or may not decide to issue preferred stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following statements describes the corporate characteristic of easy transfer of corporate ownership?

A)The liabilities of the corporation cannot be extended to the personal assets of the shareholder.

B)Shares of stock can be readily bought and sold by investors on the open market.

C)Shareholders are not authorized to sign contracts or make business commitments on behalf of the corporation.

D)Corporations pay income tax on corporate earnings, and shareholders pay personal income tax on corporate dividends and gains from sale of stock.

A)The liabilities of the corporation cannot be extended to the personal assets of the shareholder.

B)Shares of stock can be readily bought and sold by investors on the open market.

C)Shareholders are not authorized to sign contracts or make business commitments on behalf of the corporation.

D)Corporations pay income tax on corporate earnings, and shareholders pay personal income tax on corporate dividends and gains from sale of stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

13

The formation of a corporation is generally less complicated than the formation of a partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

14

What authority determines how many shares of stock a corporation may issue?

A)A vote by the board of directors

B)The rules of GAAP

C)Regulations of the Securities and Exchange Commission

D)The government laws in the state where the business is incorporated

A)A vote by the board of directors

B)The rules of GAAP

C)Regulations of the Securities and Exchange Commission

D)The government laws in the state where the business is incorporated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

15

A disadvantage of the corporation is the separation between the owners of the corporation (the stockholders)and the managers of the corporation, which can sometimes result in a conflict of interests.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

16

Every corporation issues preferred stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following statements describes the corporate characteristic termed no mutual agency?

A)The liabilities of the corporation cannot be extended to the personal assets of the shareholder.

B)Shares of stock can be readily bought and sold by investors on the open market.

C)Shareholders are not authorized to sign contracts or make business commitments on behalf of the corporation.

D)Corporations pay income tax on corporate earnings, and shareholders pay personal income tax on corporate dividends and gains from sale of stock.

A)The liabilities of the corporation cannot be extended to the personal assets of the shareholder.

B)Shares of stock can be readily bought and sold by investors on the open market.

C)Shareholders are not authorized to sign contracts or make business commitments on behalf of the corporation.

D)Corporations pay income tax on corporate earnings, and shareholders pay personal income tax on corporate dividends and gains from sale of stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following characteristics is an advantage of the corporate form of business?

A)Higher degree of government regulation

B)The potential to raise large amounts of capital

C)Separation of ownership and management

D)Double taxation

A)Higher degree of government regulation

B)The potential to raise large amounts of capital

C)Separation of ownership and management

D)Double taxation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

19

Different classes and types of stock carry different degrees of risk for the shareholder.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following statements describes the corporate characteristic termed limited liability?

A)The liabilities of the corporation cannot be extended to the personal assets of the shareholder.

B)Shares of stock can be readily bought and sold by investors on the open market.

C)Shareholders are not authorized to sign contracts or make business commitments on behalf of the corporation.

D)Corporations pay income tax on corporate earnings, and shareholders pay personal income tax on corporate dividends and gains from sale of stock.

A)The liabilities of the corporation cannot be extended to the personal assets of the shareholder.

B)Shares of stock can be readily bought and sold by investors on the open market.

C)Shareholders are not authorized to sign contracts or make business commitments on behalf of the corporation.

D)Corporations pay income tax on corporate earnings, and shareholders pay personal income tax on corporate dividends and gains from sale of stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following represents one of the basic rights of stockholders?

A)Stockholders can maintain their proportionate ownership if the corporation issues new stock.

B)Stockholders may sell their stock back to the company if they wish.

C)Stockholders may authorize a business contract on behalf of the corporation.

D)Stockholders may determine at what price the company issues stock.

A)Stockholders can maintain their proportionate ownership if the corporation issues new stock.

B)Stockholders may sell their stock back to the company if they wish.

C)Stockholders may authorize a business contract on behalf of the corporation.

D)Stockholders may determine at what price the company issues stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following is an advantage of preferred stock?

A)Preferred shareholders generally receive a fixed amount of dividends before common stockholders do.

B)Preferred shareholders are guaranteed that they will not take a loss on their investment.

C)Preferred shareholders have higher voting rights than common shareholders.

D)Preferred shareholders may sell their shares for a price higher than that of common stock.

A)Preferred shareholders generally receive a fixed amount of dividends before common stockholders do.

B)Preferred shareholders are guaranteed that they will not take a loss on their investment.

C)Preferred shareholders have higher voting rights than common shareholders.

D)Preferred shareholders may sell their shares for a price higher than that of common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following represents one of the basic rights of stockholders?

A)Stockholders may sell their stock back to the company if they wish.

B)Stockholders may authorize a business contract on behalf of the corporation.

C)Stockholders may participate in management by voting on corporate matters.

D)Stockholders may determine at what price the company issues stock.

A)Stockholders may sell their stock back to the company if they wish.

B)Stockholders may authorize a business contract on behalf of the corporation.

C)Stockholders may participate in management by voting on corporate matters.

D)Stockholders may determine at what price the company issues stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

24

When a company sells stock for more than the par value, it will record a gain on sale for the amount in excess of par.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

25

When a corporation sells 10,000 shares of $10 par value common stock for $120,000, the Common stock account is credited for $100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following represents one of the basic rights of stockholders?

A)Stockholders may sell their stock back to the company if they wish.

B)Stockholders may authorize a business contract on behalf of the corporation.

C)Stockholders may determine at what price the company issues stock.

D)Stockholders may receive dividends from corporate earnings.

A)Stockholders may sell their stock back to the company if they wish.

B)Stockholders may authorize a business contract on behalf of the corporation.

C)Stockholders may determine at what price the company issues stock.

D)Stockholders may receive dividends from corporate earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

27

Stock sold for amounts in excess of par value results in a gain reported on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following represents one of the basic rights of stockholders?

A)Stockholders may sell their stock back to the company if they wish.

B)Stockholders can claim a portion of the corporate assets in the event the company is liquidated.

C)Stockholders may authorize a business contract on behalf of the corporation.

D)Stockholders may determine at what price the company issues stock.

A)Stockholders may sell their stock back to the company if they wish.

B)Stockholders can claim a portion of the corporate assets in the event the company is liquidated.

C)Stockholders may authorize a business contract on behalf of the corporation.

D)Stockholders may determine at what price the company issues stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following is a TRUE statement about no-par stock?

A)No-par stock has zero value.

B)No-par stock has been purchased by the corporation for investment purposes.

C)No-par stock is a form of common stock that does not carry par value.

D)No-par stock is a form of preferred stock without voting rights.

A)No-par stock has zero value.

B)No-par stock has been purchased by the corporation for investment purposes.

C)No-par stock is a form of common stock that does not carry par value.

D)No-par stock is a form of preferred stock without voting rights.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following types of stock are considered to be LEAST risky for investors?

A)Common stock

B)Par value stock

C)No-par stock

D)Preferred stock

A)Common stock

B)Par value stock

C)No-par stock

D)Preferred stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

31

All corporations must issue both common and preferred shares of stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

32

Paid-in capital consists of:

A)amounts paid by customers.

B)capital raised by issuing bonds.

C)earnings generated by the corporation.

D)amounts received from stockholders.

A)amounts paid by customers.

B)capital raised by issuing bonds.

C)earnings generated by the corporation.

D)amounts received from stockholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

33

The stock of publicly owned corporations is bought and sold on stock exchanges, such as the New York Stock Exchange.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following describes retained earnings?

A)Internally generated capital that results from profitable business transactions

B)Externally generated capital that is contributed by shareholders

C)Externally generated capital that is raised from banks and other creditors

D)Internally generated capital that results from employees' contributions

A)Internally generated capital that results from profitable business transactions

B)Externally generated capital that is contributed by shareholders

C)Externally generated capital that is raised from banks and other creditors

D)Internally generated capital that results from employees' contributions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

35

Retained earnings is equity that is generated internally by corporate business transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following is an advantage of preferred stock?

A)Preferred shareholders are guaranteed that they will not take a loss on their investment.

B)Preferred shareholders have higher voting rights than common shareholders.

C)Preferred shareholders may sell their shares for a price higher than that of common stock.

D)Preferred shareholders have the first claim on dividend funds.

A)Preferred shareholders are guaranteed that they will not take a loss on their investment.

B)Preferred shareholders have higher voting rights than common shareholders.

C)Preferred shareholders may sell their shares for a price higher than that of common stock.

D)Preferred shareholders have the first claim on dividend funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following describes preferred stock?

A)Stock that sells for a very high price

B)Stock that is sold to employees of the company as a performance incentive

C)Stock that is purchased by the corporation for investment purposes

D)Stock which gives shareholders certain preferences and advantages over common stock

A)Stock that sells for a very high price

B)Stock that is sold to employees of the company as a performance incentive

C)Stock that is purchased by the corporation for investment purposes

D)Stock which gives shareholders certain preferences and advantages over common stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following is an advantage of preferred stock?

A)In the event of liquidation, preferred shareholders are guaranteed to get their investment back in full.

B)In the event of liquidation, preferred shareholders have first claim on remaining corporate assets.

C)In the event of liquidation, preferred shareholders may sell their shares for higher amounts than common stock.

D)In the event of liquidation, preferred shareholders may retain their proportionate share of voting rights.

A)In the event of liquidation, preferred shareholders are guaranteed to get their investment back in full.

B)In the event of liquidation, preferred shareholders have first claim on remaining corporate assets.

C)In the event of liquidation, preferred shareholders may sell their shares for higher amounts than common stock.

D)In the event of liquidation, preferred shareholders may retain their proportionate share of voting rights.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following describes the par value of stock?

A)Par value is the current selling price of stock.

B)Par value is the highest price for which a share can sell.

C)Par value is the price paid if the corporation purchases its own stock back.

D)Par value is a nominal, or minimal, amount assigned to shares of stock by the corporation.

A)Par value is the current selling price of stock.

B)Par value is the highest price for which a share can sell.

C)Par value is the price paid if the corporation purchases its own stock back.

D)Par value is a nominal, or minimal, amount assigned to shares of stock by the corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

40

The two basic sources of equity are:

A)common stock and bonds.

B)common stock and preferred stock.

C)paid-in capital and retained earnings.

D)loans from banks and gifts from donors.

A)common stock and bonds.

B)common stock and preferred stock.

C)paid-in capital and retained earnings.

D)loans from banks and gifts from donors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

41

Bradley Corporation issued 10,000 shares of common stock on January 1, 2013. The stock has par value of $0.01 per share and was sold for cash at par. The journal entry to record this transaction would:

A)debit Cash $100 and credit Common stock $100.

B)credit Cash $10,000 and debit Common stock $10,000.

C)debit Paid-in capital $9,900,and credit Common stock $9,900.

D)debit Cash $10,000, credit Common stock $100, and credit Paid-in capital $9,900.

A)debit Cash $100 and credit Common stock $100.

B)credit Cash $10,000 and debit Common stock $10,000.

C)debit Paid-in capital $9,900,and credit Common stock $9,900.

D)debit Cash $10,000, credit Common stock $100, and credit Paid-in capital $9,900.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

42

Bradley Corporation issued 10,000 shares of common stock on January 1, 2013. The stock has par value of $0.01 per share and was sold at $25 per share. The journal entry for this transaction would:

A)debit Cash $250,000, credit Paid-in capital $100, and credit Common stock $249,900.

B)credit Cash $250,000 and debit Paid-in capital $250,000.

C)credit Cash $250,000, debit Common stock $100, and debit Paid-in capital $249,900.

D)debit Cash $250,000, credit Common stock $100, and credit Paid-in capital $249,900.

A)debit Cash $250,000, credit Paid-in capital $100, and credit Common stock $249,900.

B)credit Cash $250,000 and debit Paid-in capital $250,000.

C)credit Cash $250,000, debit Common stock $100, and debit Paid-in capital $249,900.

D)debit Cash $250,000, credit Common stock $100, and credit Paid-in capital $249,900.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

43

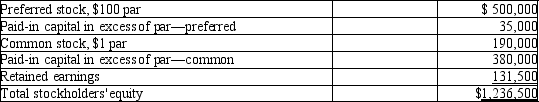

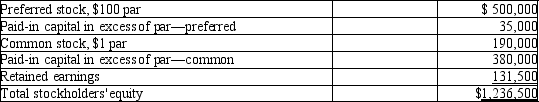

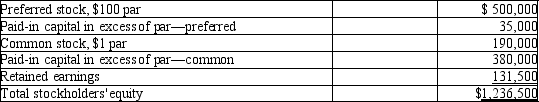

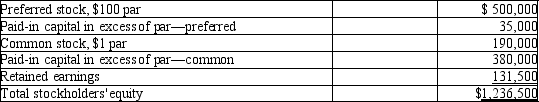

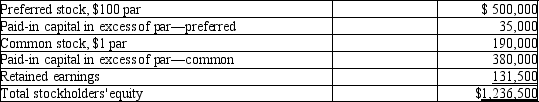

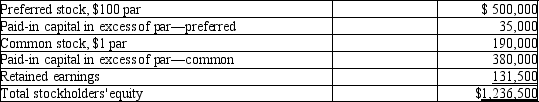

The following information is from the balance sheet of Tudor Corporation as of December 31, 2014.  What was the total paid-in capital as of December 31, 2014?

What was the total paid-in capital as of December 31, 2014?

A)$1,236,600

B)$1,105,000

C)$956,000

D)$131,500

What was the total paid-in capital as of December 31, 2014?

What was the total paid-in capital as of December 31, 2014?A)$1,236,600

B)$1,105,000

C)$956,000

D)$131,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

44

Most preferred stock is sold at a price higher than its par value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

45

On December 2, 2014, Ewell Company purchases a piece of land from the original owner. In payment for the land, Ewell Company issues 8,000 shares of common stock with $1.00 par value. The land has been appraised at a market value of $400,000. The journal entry to record this transaction would include which of the following items?

A)Debit Common stock $8,000 and debit Paid-in capital $392,000.

B)Credit Common stock $8,000 and credit Paid-in capital $392,000.

C)Credit Common stock $400,000.

D)Debit Cash $400,000.

A)Debit Common stock $8,000 and debit Paid-in capital $392,000.

B)Credit Common stock $8,000 and credit Paid-in capital $392,000.

C)Credit Common stock $400,000.

D)Debit Cash $400,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

46

No gains or losses are ever recorded by a company when they sell or issue shares of their own stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

47

Osbourne Company issued 50,000 shares of common stock in exchange for manufacturing equipment. The equipment was valued at $1,000,000. The stock has par value of $0.01 per share. The entry to record this transaction would include which of the following line items?

A)Debit Cash $5,000.

B)Credit Gain on sale of common stock $1,050,000.

C)Credit Paid-in capital $999,500.

D)Credit Common stock $1,000,000.

A)Debit Cash $5,000.

B)Credit Gain on sale of common stock $1,050,000.

C)Credit Paid-in capital $999,500.

D)Credit Common stock $1,000,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

48

Osbourne Company issued 50,000 shares of common stock in exchange for manufacturing equipment. The equipment was valued at $1,000,000. The stock has par value of $0.01 per share. Osbourne should record a gain on the sale of stock for the difference between the equipment's market value and the stock's current market value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

49

Retained earnings represents:

A)the assets of the corporation less the liabilities.

B)capital contributed by the stockholders of a corporation.

C)the accumulated profits of the corporation less dividends paid out.

D)a liability on the corporate balance sheet.

A)the assets of the corporation less the liabilities.

B)capital contributed by the stockholders of a corporation.

C)the accumulated profits of the corporation less dividends paid out.

D)a liability on the corporate balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following would be included in the entry to record the issuance of 5,000 shares of $10 par value common stock at $13 per share cash?

A)Cash would be debited for $65,000.

B)Common stock would be debited for $50,000.

C)Common stock would be credited for $65,000.

D)Paid-in capital in excess of par-common would be debited for $5,000.

A)Cash would be debited for $65,000.

B)Common stock would be debited for $50,000.

C)Common stock would be credited for $65,000.

D)Paid-in capital in excess of par-common would be debited for $5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

51

Dallkin Corporation issued 5,000 shares of common stock on January 1, 2013. The stock has no par value and was sold at $18 per share. The journal entry for this transaction would:

A)debit Cash $90,000 and credit Common stock $90,000.

B)debit Cash $90,000 and credit Paid-in capital $600,000.

C)credit Cash $90,000 and debit Common stock $90,000.

D)credit Cash $90,000, debit Paid-in capital $5,000, and debit Common stock $85,000.

A)debit Cash $90,000 and credit Common stock $90,000.

B)debit Cash $90,000 and credit Paid-in capital $600,000.

C)credit Cash $90,000 and debit Common stock $90,000.

D)credit Cash $90,000, debit Paid-in capital $5,000, and debit Common stock $85,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

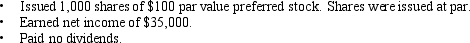

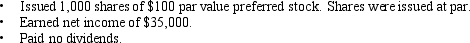

52

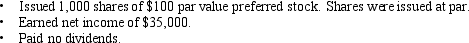

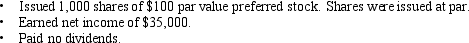

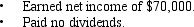

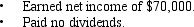

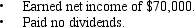

Lerner Company had the following transactions in 2013, its first year of operations.  per share.

per share.

At the end of 2013, what is the total amount of Paid-in capital?

At the end of 2013, what is the total amount of Paid-in capital?

A)$415,000

B)$120,000

C)$280,000

D)$380,000

per share.

per share. At the end of 2013, what is the total amount of Paid-in capital?

At the end of 2013, what is the total amount of Paid-in capital?A)$415,000

B)$120,000

C)$280,000

D)$380,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

53

The following information is from the balance sheet of Tudor Corporation as of December 31, 2014.  What was the average issue price of the common stock shares?

What was the average issue price of the common stock shares?

A)$1.90

B)$1.00

C)$3.00

D)$13.15

What was the average issue price of the common stock shares?

What was the average issue price of the common stock shares?A)$1.90

B)$1.00

C)$3.00

D)$13.15

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following occurs when a shareholder invests cash in a corporation in exchange for stock?

A)Both liabilities and stockholders' equity are increased.

B)Both assets and stockholders' equity are increased.

C)One asset is increased and another asset is decreased.

D)Both assets and liabilities are increased.

A)Both liabilities and stockholders' equity are increased.

B)Both assets and stockholders' equity are increased.

C)One asset is increased and another asset is decreased.

D)Both assets and liabilities are increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

55

Moretown Company had the following transactions in 2014, its first year of operations.  per share.

per share.

At the end of 2014, what is the total amount of Stockholders' equity?

At the end of 2014, what is the total amount of Stockholders' equity?

A)$30,000

B)$610,000

C)$540,000

D)$70,000

per share.

per share. At the end of 2014, what is the total amount of Stockholders' equity?

At the end of 2014, what is the total amount of Stockholders' equity?A)$30,000

B)$610,000

C)$540,000

D)$70,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

56

Peterson Company issued 4,000 shares of preferred stock for $240,000. The stock has a par value of $60 per share. The journal entry to record this transaction would:

A)credit Cash $240,000, debit Common stock $4,000, and debit Paid-in capital $236,000.

B)debit Cash $240,000, credit Common stock $4,000, and credit Paid-in capital $236,000.

C)credit Cash $240,000 and debit Preferred stock $240,000.

D)debit Cash $240,000 and credit Preferred stock $240,000.

A)credit Cash $240,000, debit Common stock $4,000, and debit Paid-in capital $236,000.

B)debit Cash $240,000, credit Common stock $4,000, and credit Paid-in capital $236,000.

C)credit Cash $240,000 and debit Preferred stock $240,000.

D)debit Cash $240,000 and credit Preferred stock $240,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

57

The following information is from the balance sheet of Tudor Corporation as of December 31, 2014.

What is the average issue price of the preferred stock shares?

What is the average issue price of the preferred stock shares?

A)$107

B)$100

C)$176

D)$5,000

What is the average issue price of the preferred stock shares?

What is the average issue price of the preferred stock shares? A)$107

B)$100

C)$176

D)$5,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

58

If a company's share prices go up from the original issue price, the company will record income for the amount of the gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

59

Lerner Company had the following transactions in 2013, its first year of operations.  per share.

per share.

At the end of 2013, what is the total amount of Stockholders' equity?

At the end of 2013, what is the total amount of Stockholders' equity?

A)$415,000

B)$120,000

C)$260,000

D)$380,000

per share.

per share. At the end of 2013, what is the total amount of Stockholders' equity?

At the end of 2013, what is the total amount of Stockholders' equity?A)$415,000

B)$120,000

C)$260,000

D)$380,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

60

Chaney Corporation issued 20,000 shares of common stock on January 1, 2014. The stock has par value of $1.00 per share and was sold at $30 per share. The journal entry for this transaction would:

A)credit Cash $600,000, debit Common stock $20,000, and debit Paid-in capital $580,000.

B)debit Cash $600,000 and credit Paid-in capital $600,000.

C)debit Cash $600,000, credit Common stock $20,000, and credit Paid-in capital $580,000.

D)debit Cash $600,000 and credit Common stock $600,000.

A)credit Cash $600,000, debit Common stock $20,000, and debit Paid-in capital $580,000.

B)debit Cash $600,000 and credit Paid-in capital $600,000.

C)debit Cash $600,000, credit Common stock $20,000, and credit Paid-in capital $580,000.

D)debit Cash $600,000 and credit Common stock $600,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

61

Notebook Company had the following transactions in 2013, its first year of operations.  per share.

per share.

At the end of 2013, how much was the total Stockholders' equity?

At the end of 2013, how much was the total Stockholders' equity?

A)$200,000

B)$110,000

C)$90,000

D)$100,000

per share.

per share. At the end of 2013, how much was the total Stockholders' equity?

At the end of 2013, how much was the total Stockholders' equity?A)$200,000

B)$110,000

C)$90,000

D)$100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

62

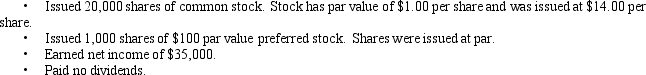

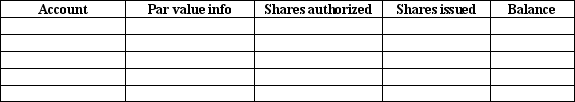

Notebook Company had the following transactions in 2014, its first year of operations.

per share.

per share.

The company charter authorizes 1,000,000 shares of common stock and 100,000 shares of preferred stock.

The company charter authorizes 1,000,000 shares of common stock and 100,000 shares of preferred stock.

Please provide the stockholders' equity section of the balance sheet at December 31, 2014. Include information on par values, and the number of shares authorized and issued, where necessary. No subtotals are needed for total paid-in capital, but please show total stockholders' equity on the bottom line.

per share.

per share. The company charter authorizes 1,000,000 shares of common stock and 100,000 shares of preferred stock.

The company charter authorizes 1,000,000 shares of common stock and 100,000 shares of preferred stock.Please provide the stockholders' equity section of the balance sheet at December 31, 2014. Include information on par values, and the number of shares authorized and issued, where necessary. No subtotals are needed for total paid-in capital, but please show total stockholders' equity on the bottom line.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

63

Dallkin Corporation issued 5,000 shares of common stock on January 1, 2015. The stock has no par value and was sold at $18 per share. Please provide the journal entry for this transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

64

A net loss for the year increases the balance in Retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

65

When a company records the year-end closing entries, the Income summary balance, before it is closed to Retained earnings, should be equal to the Net income or Net loss for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

66

Peterson Company issued 4,000 shares of preferred stock for $240,000. The stock has a par value of $60 per share. Please provide the journal entry for this transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

67

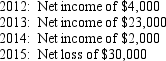

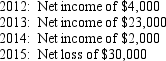

Ajax Company was founded in 2009. Its yearly earnings are shown here:

No dividends were paid. At the end of the year 2015, Ajax would have a Retained earnings deficit of $1,000.

No dividends were paid. At the end of the year 2015, Ajax would have a Retained earnings deficit of $1,000.

No dividends were paid. At the end of the year 2015, Ajax would have a Retained earnings deficit of $1,000.

No dividends were paid. At the end of the year 2015, Ajax would have a Retained earnings deficit of $1,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

68

Overton Company had the following transactions in 2013, its first year of operations.

per share.

per share.

The company charter authorizes 1,000,000 shares of common stock and 100,000 shares of preferred stock.

The company charter authorizes 1,000,000 shares of common stock and 100,000 shares of preferred stock.

Please provide the stockholders' equity section of the balance sheet at December 31, 2013. Include information on par values, and the number of shares authorized and issued, where necessary. No subtotals are needed for total paid-in capital, but please show total stockholders' equity on the bottom line.

per share.

per share. The company charter authorizes 1,000,000 shares of common stock and 100,000 shares of preferred stock.

The company charter authorizes 1,000,000 shares of common stock and 100,000 shares of preferred stock.Please provide the stockholders' equity section of the balance sheet at December 31, 2013. Include information on par values, and the number of shares authorized and issued, where necessary. No subtotals are needed for total paid-in capital, but please show total stockholders' equity on the bottom line.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

69

On December 2, 2014, Ewell Company purchases a piece of land from the original owner. In payment for the land, Ewell Company issues 8,000 shares of common stock with $1.00 par value. The land has been appraised at a market value of $400,000. Please provide the journal entry for this transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

70

Bradley Corporation issued 10,000 shares of common stock on January 1, 2013. The stock has par value of $0.01 per share and was sold at par. Please provide the journal entry for this transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

71

Notebook Company had the following transactions in 2013, its first year of operations.  per share.

per share.

At the end of 2013, how much was the total Paid-in capital?

At the end of 2013, how much was the total Paid-in capital?

A)$190,000

B)$110,000

C)$90,000

D)$200,000

per share.

per share. At the end of 2013, how much was the total Paid-in capital?

At the end of 2013, how much was the total Paid-in capital?A)$190,000

B)$110,000

C)$90,000

D)$200,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

72

Chaney Corporation issued 20,000 shares of common stock on January 1, 2014. The stock has par value of $1.00 per share and was sold at $30 per share. Please provide the journal entry for this transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

73

Bradley Corporation issued 10,000 shares of common stock on January 1, 2013. The stock has par value of $0.01 per share and was sold at $25 per share. Please provide the journal entry for this transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

74

Moretown Company had the following transactions in 2013, its first year of operations.

per share.

per share.

The company charter authorizes 1,000,000 shares of common stock and 100,000 shares of preferred stock.

The company charter authorizes 1,000,000 shares of common stock and 100,000 shares of preferred stock.

Please provide the stockholders' equity section of the balance sheet at December 31, 2013. Include information on par values, and the number of shares authorized and issued, where necessary. No subtotals are needed for total paid-in capital, but please show total stockholders' equity on the bottom line.

per share.

per share. The company charter authorizes 1,000,000 shares of common stock and 100,000 shares of preferred stock.

The company charter authorizes 1,000,000 shares of common stock and 100,000 shares of preferred stock.Please provide the stockholders' equity section of the balance sheet at December 31, 2013. Include information on par values, and the number of shares authorized and issued, where necessary. No subtotals are needed for total paid-in capital, but please show total stockholders' equity on the bottom line.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

75

Overton Company had the following transactions in 2012, its first year of operations.  per share.

per share.

At the end of 2012, how much is the total Stockholders' equity?

At the end of 2012, how much is the total Stockholders' equity?

A)$150,000

B)$325,000

C)$175,000

D)$200,000

per share.

per share. At the end of 2012, how much is the total Stockholders' equity?

At the end of 2012, how much is the total Stockholders' equity?A)$150,000

B)$325,000

C)$175,000

D)$200,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

76

Overton Company had the following transactions in 2012, its first year of operations.  per share.

per share.

At the end of 2012, how much is the total Paid-in capital?

At the end of 2012, how much is the total Paid-in capital?

A)$150,000

B)$325,000

C)$175,000

D)$200,000

per share.

per share. At the end of 2012, how much is the total Paid-in capital?

At the end of 2012, how much is the total Paid-in capital?A)$150,000

B)$325,000

C)$175,000

D)$200,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

77

Moretown Company had the following transactions in 2014, its first year of operations.  per share.

per share.

At the end of 2014, what is the total amount of Paid-in capital?

At the end of 2014, what is the total amount of Paid-in capital?

A)$30,000

B)$610,000

C)$540,000

D)$70,000

per share.

per share. At the end of 2014, what is the total amount of Paid-in capital?

At the end of 2014, what is the total amount of Paid-in capital?A)$30,000

B)$610,000

C)$540,000

D)$70,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

78

Lerner Company had the following transactions in 2013, its first year of operations.

The company charter authorizes 1,000,000 shares of common stock and 100,000 shares of preferred stock.

The company charter authorizes 1,000,000 shares of common stock and 100,000 shares of preferred stock.

Please provide the stockholders' equity section of the balance sheet at December 31, 2013. Include information on par values, and the number of shares authorized and issued, where necessary. No subtotals are needed for total paid-in capital, but please show total stockholders' equity on the bottom line.

The company charter authorizes 1,000,000 shares of common stock and 100,000 shares of preferred stock.

The company charter authorizes 1,000,000 shares of common stock and 100,000 shares of preferred stock.Please provide the stockholders' equity section of the balance sheet at December 31, 2013. Include information on par values, and the number of shares authorized and issued, where necessary. No subtotals are needed for total paid-in capital, but please show total stockholders' equity on the bottom line.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

79

When a company records the year-end closing entries, the first step is to close the Revenues to Retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following is the correct order of accounts in the stockholders' equity section of the balance sheet? (Assume preferred stock is issued at par.)

A)Common stock, Preferred stock, Paid-in capital in excess of par, Retained earnings.

B)Common stock, Paid-in capital in excess of par, Preferred stock, Retained earnings

C)Preferred stock, Paid-in capital in excess of par, Common stock, Retained earnings

D)Preferred stock, Common stock, Paid-in capital in excess of par, Retained earnings

A)Common stock, Preferred stock, Paid-in capital in excess of par, Retained earnings.

B)Common stock, Paid-in capital in excess of par, Preferred stock, Retained earnings

C)Preferred stock, Paid-in capital in excess of par, Common stock, Retained earnings

D)Preferred stock, Common stock, Paid-in capital in excess of par, Retained earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 167 في هذه المجموعة.

فتح الحزمة

k this deck