Deck 10: The Share Market

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/84

العب

ملء الشاشة (f)

Deck 10: The Share Market

1

In the Australian share market, a relatively small number of very large companies dominate the market.

True

2

Since the share market operates on a trading-day basis, it has processes for matching orders entered before the trading day starts.

True

3

CHESS settles share trades on a T + 3 basis.

True

4

In the Australian market, large cap companies are those in the ASX200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

5

Companies no longer have to maintain their share registry because CHESS holds this information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

6

The ASX's continuous disclosure policy requires companies to advise the ASX of any new price-sensitive information in a timely fashion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

7

The share market is a market for corporate control.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

8

The ASX is the Australian Stock Exchange Limited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

9

The central limit order book is the list of limit and market orders that have not yet resulted in a transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

10

The ASX has a second board for those companies that do not meet its listing requirements but for which there is substantial investor interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

11

The share market is both the primary and secondary market for shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

12

The ASX was formed from the amalgamation of the state-based exchanges.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

13

The settlement of share trades is cumbersome because sellers must supply share certificates to the clearinghouse before receiving payment from the buyer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

14

All else the same, trading on the ASX is cheaper under an ATS than under open outcry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

15

Market capitalisation is the market value of a company's assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

16

Market integrity on the ASX is monitored by ASX Markets Supervision Pty Ltd.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

17

The ASX is listed on the ASX.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

18

Good corporate governance ensures that members of a company's top management are held accountable for their actions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

19

The share market performs price discovery, for example by determining entry and exit values for investors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

20

The ASX uses an automatic trading system that matches buy and sell orders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

21

The turnover of shares in the market is much greater for large-cap firms than for smaller firms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

22

Narrow bid-offer spreads are an indicator of an illiquid market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

23

The All Ordinaries Index (AOI)comprises all the ordinary shares listed on the ASX.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

24

As a monopoly, the ASX does not have to contend with competition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

25

A share price index aims to measure the overall movement in the value of the shares included in the index.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

26

The firms in the ASX 20 are not included in the ASX 200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

27

Traders with loss-making positions in CFDs are required to make margin payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

28

A retail sized trade cannot be conducted in a 'dark pool'.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

29

The liquidity of listed shares is rather variable, depending generally on the size of the listed firms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

30

Chi-X provides Australian retail and wholesale investors with an alternative trading venue to the ASX.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

31

A buy-and-hold investment strategy is more prevalent in the bond market than in the share market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

32

High frequency trading relies on computer programs to identify arbitrage opportunities and automatically trade to take advantage of those opportunities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

33

A share price index level considered in isolation conveys no useful information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

34

High-frequency trading usually involves large-value parcels of shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

35

There is evidence that the entry of Chi-X to Australia has increased efficiency by lowering transaction costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

36

All else the same, an accumulation index is a better benchmark for a broad equity portfolio's return than is an otherwise identical price (non-accumulation)index.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

37

A short position in a CFD contract profits from increases in the share-price without the expense of buying the share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

38

The main investors in Australian shares are foreign investors, fund managers and retail investors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

39

The advantage of crossings through 'dark pools' is they facilitate large trades with the least possible market price impact.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

40

Free float is the estimated proportion of a company's shares that are available for trade.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

41

The ASX's share price indices are:

A)the sum of the share prices of the constituent companies

B)weighted by share turnover

C)weighted by market capitalisation

D)the sum of the share prices of the constituent companies divided by the number of shares

E)all accumulation indices.

A)the sum of the share prices of the constituent companies

B)weighted by share turnover

C)weighted by market capitalisation

D)the sum of the share prices of the constituent companies divided by the number of shares

E)all accumulation indices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

42

A company requires a record of its shareholders for:

A)facilitating communication between management and shareholders

B)authorising voting at general shareholder meetings

C)paying dividends

D)monitoring significant changes in share ownership.

E)All of these.

A)facilitating communication between management and shareholders

B)authorising voting at general shareholder meetings

C)paying dividends

D)monitoring significant changes in share ownership.

E)All of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

43

Chi-X:

A)is an organisation that has established a second exchange in Australia

B)specialises in servicing the retail share trading market

C)is the new trading system that has replaced CLICK XT

D)trades all listed shares.

E)None of these.

A)is an organisation that has established a second exchange in Australia

B)specialises in servicing the retail share trading market

C)is the new trading system that has replaced CLICK XT

D)trades all listed shares.

E)None of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

44

The approximate percentage of total ASX market capitalisation accounted for by all of the shares in the ASX 100 as at September 2013 is:

A)46 per cent

B)63 per cent

C)74 per cent

D)80 per cent

E)81 per cent

A)46 per cent

B)63 per cent

C)74 per cent

D)80 per cent

E)81 per cent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

45

'Small-cap companies' are those:

A)not in the ASX 100

B)not in the ASX 200

C)the 200 companies in the ASX 300 but not in the ASX 100

D)the 100 companies in the ASX 200 but not in the ASX 100

E)the 200 smallest listed companies.

A)not in the ASX 100

B)not in the ASX 200

C)the 200 companies in the ASX 300 but not in the ASX 100

D)the 100 companies in the ASX 200 but not in the ASX 100

E)the 200 smallest listed companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

46

CFDs are both OTC and exchange-traded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

47

The main benchmark index for Australia's share market is the:

A)All Ordinaries Index (AOI)

B)ASX 200

C)ASX 100

D)S&P 500

E)SPI.

A)All Ordinaries Index (AOI)

B)ASX 200

C)ASX 100

D)S&P 500

E)SPI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

48

In order to conduct a secondary market for shares, the ASX:

A)sets the rules for the admission of companies to the market

B)establishes trading and settlement arrangements

C)discloses trading information, such as individual share prices

D)promotes itself as a market for securities.

E)All of these.

A)sets the rules for the admission of companies to the market

B)establishes trading and settlement arrangements

C)discloses trading information, such as individual share prices

D)promotes itself as a market for securities.

E)All of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

49

The settlement of share market trades:

A)requires the exchange of share certificates

B)is performed electronically by CHESS

C)occurs on a T + 1 basis

D)is carried out by Computershare.

E)None of these.

A)requires the exchange of share certificates

B)is performed electronically by CHESS

C)occurs on a T + 1 basis

D)is carried out by Computershare.

E)None of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

50

The criteria used by the S&P Australian Index Committee to determine the constituents of an index are:

A)market capitalisation, 'free-float', liquidity, shares from a range of sectors and being institutionally tradeable

B)market capitalisation, 'free-float', liquidity and shares from a range of sectors

C)market capitalisation, 'free-float' and liquidity

D)market capitalisation and 'free-float'

E)market capitalisation.

A)market capitalisation, 'free-float', liquidity, shares from a range of sectors and being institutionally tradeable

B)market capitalisation, 'free-float', liquidity and shares from a range of sectors

C)market capitalisation, 'free-float' and liquidity

D)market capitalisation and 'free-float'

E)market capitalisation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

51

Large-cap shares have much greater liquidity than the shares of smaller companies.This is reflected in their:

A)greater daily turnover

B)greater daily turnover and wider bid-ask spreads

C)greater daily turnover, wider bid-ask spreads and lower price resilience

D)greater daily turnover, narrower bid-ask spreads and lower price resilience

E)greater daily turnover, narrower bid-ask spread and greater price resilience.

A)greater daily turnover

B)greater daily turnover and wider bid-ask spreads

C)greater daily turnover, wider bid-ask spreads and lower price resilience

D)greater daily turnover, narrower bid-ask spreads and lower price resilience

E)greater daily turnover, narrower bid-ask spread and greater price resilience.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

52

The functions of the share market do NOT include:

A)performing price discovery by revealing the value of shares

B)endowing listed securities with liquidity

C)setting the price for IPOs

D)disciplining the behaviour of a company's top management.

E)developing a pool of investors.

A)performing price discovery by revealing the value of shares

B)endowing listed securities with liquidity

C)setting the price for IPOs

D)disciplining the behaviour of a company's top management.

E)developing a pool of investors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

53

Market discipline refers to:

A)the role of ASIC in administering securities law

B)the influence of share price movements on a company's senior management

C)the ASX's company listing and disclosure requirements

D)the decision making processes used by a company's top management and how management is made accountable for its decisions.

E)None of these.

A)the role of ASIC in administering securities law

B)the influence of share price movements on a company's senior management

C)the ASX's company listing and disclosure requirements

D)the decision making processes used by a company's top management and how management is made accountable for its decisions.

E)None of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

54

The ASX is facing competition from:

A)Chi-X and CFDs

B)high frequency trading and CFDs

C)high frequency trading and Chi-X

D)Chi-X and 'dark pools'

E)'dark pools" and CFDs.

A)Chi-X and CFDs

B)high frequency trading and CFDs

C)high frequency trading and Chi-X

D)Chi-X and 'dark pools'

E)'dark pools" and CFDs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

55

The automated trading system used by the ASX:

A)can be accessed by individual retail investors

B)stores unmatched at-market orders

C)ranks unmatched orders in terms of time

D)matches the highest priced buy orders and the lowest priced sell orders first

E)is called SEATS.

A)can be accessed by individual retail investors

B)stores unmatched at-market orders

C)ranks unmatched orders in terms of time

D)matches the highest priced buy orders and the lowest priced sell orders first

E)is called SEATS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

56

Identify the INCORRECT statement regarding 'dark pools'.

A)'Crossings' are arranged by brokers.

B)'Crossings' are a new development in share trading in Australia.

C)'Dark pools' facilitate large trades with the least possible market price impact.

D)Trading in 'dark pools' has grown because of advances in technology.

E)Traders can avoid the exchanges trading fees when trading through 'dark pools'.

A)'Crossings' are arranged by brokers.

B)'Crossings' are a new development in share trading in Australia.

C)'Dark pools' facilitate large trades with the least possible market price impact.

D)Trading in 'dark pools' has grown because of advances in technology.

E)Traders can avoid the exchanges trading fees when trading through 'dark pools'.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

57

The average value of a trade in shares listed on the ASX has fallen since 2008 because of:

A)the emergence of high-frequency trading

B)the prevalence of a 'buy-and-hold' attitude in the share market

C)share prices being generally lower

D)greater participation in the market by retail investors

E)reduced investor interest in shares since the GFC.

A)the emergence of high-frequency trading

B)the prevalence of a 'buy-and-hold' attitude in the share market

C)share prices being generally lower

D)greater participation in the market by retail investors

E)reduced investor interest in shares since the GFC.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following is NOT an admission requirement or rule of listing on the ASX?

A)Securities must be issued in circumstances that are fair to existing security holders.

B)The listed entity must have a minimum number of shareholders.

C)Firms must immediately advise the ASX of any new price-sensitive information.

D)The entity be making a substantial profit.

E)None of these.

A)Securities must be issued in circumstances that are fair to existing security holders.

B)The listed entity must have a minimum number of shareholders.

C)Firms must immediately advise the ASX of any new price-sensitive information.

D)The entity be making a substantial profit.

E)None of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

59

ASX Trade:

A)is the ATS currently used by the ASX

B)consists of three automated trading sub-systems

C)was introduced by the ASX to improve its ability to compete with alternative trading arrangements

D)operates on the principle of priority trading.

E)All of these.

A)is the ATS currently used by the ASX

B)consists of three automated trading sub-systems

C)was introduced by the ASX to improve its ability to compete with alternative trading arrangements

D)operates on the principle of priority trading.

E)All of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

60

The ASX automated trading system does NOT:

A)facilitate trading on a 24/7 basis

B)conduct auctions to determine a single opening and closing price

C)close (except for enquiries)between 7 p.m.and 7 a.m.

D)allow brokers and online investors to enter orders during the 7 a.m.to 10 a.m.pre-opening phase

E)permit brokers to amend or cancel orders during the after-hours adjust phase.

A)facilitate trading on a 24/7 basis

B)conduct auctions to determine a single opening and closing price

C)close (except for enquiries)between 7 p.m.and 7 a.m.

D)allow brokers and online investors to enter orders during the 7 a.m.to 10 a.m.pre-opening phase

E)permit brokers to amend or cancel orders during the after-hours adjust phase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

61

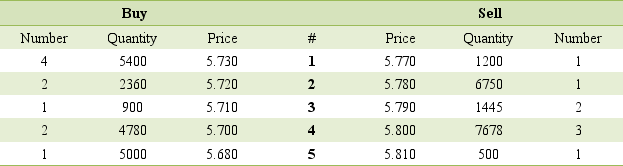

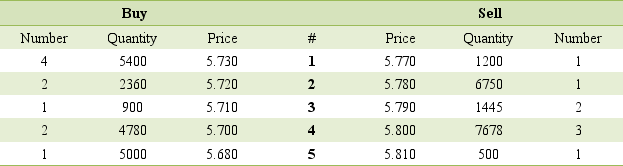

Consider the following market depth information for Fosters Group Ltd:  (a)What would be the outcome if you placed an at-market order to sell 3000 Fosters shares?

(a)What would be the outcome if you placed an at-market order to sell 3000 Fosters shares?

(b)How much would you pay to buy 5000 Fosters shares 'at-market'?

(c)Explain what would happen to the order queue after the transactions in (a)and (b), assuming no other changes.(d)Explain what would happen to your order if you placed an order to sell 1500 Fosters shares at $5.78 (assuming the transactions in (a)and (b)do not take place).

(a)What would be the outcome if you placed an at-market order to sell 3000 Fosters shares?

(a)What would be the outcome if you placed an at-market order to sell 3000 Fosters shares?(b)How much would you pay to buy 5000 Fosters shares 'at-market'?

(c)Explain what would happen to the order queue after the transactions in (a)and (b), assuming no other changes.(d)Explain what would happen to your order if you placed an order to sell 1500 Fosters shares at $5.78 (assuming the transactions in (a)and (b)do not take place).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

62

Give an overview of the ASX's admission and listing rules.Refer to the ASX website for additional information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

63

List some of the factors for which a company share registry is necessary.How do most companies now maintain their share registries?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

64

Discuss the trading and settlement arrangements used by the Australian Securities Exchange.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

65

Discuss the role of the share market and how it influences the corporate governance of listed companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

66

An investment in a CFD contract finishes when:

A)the contract expires

B)the contract is sold in the secondary market

C)the trader closes-out the position with a reversing trade

D)90 days after issue.

E)None of these.

A)the contract expires

B)the contract is sold in the secondary market

C)the trader closes-out the position with a reversing trade

D)90 days after issue.

E)None of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

67

The index level yesterday was 6000 points.At that time, the combined market capitalisation of the shares in the index was $800 billion.The next day the market capitalisation of the shares in the index was $825 billion.Given this information, calculate the new index level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

68

Provide a brief overview of the ASX's admission and listing rules.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

69

Explain how share markets contribute to good corporate governance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

70

If the index level today is 6188 points and the index level yesterday was 6000 points, what was the weighted average of the changes in the share prices between day one and day two?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

71

High-frequency trading refers to computerised trading that:

A)identifies profitable opportunities that are then executed by a trader

B)profits from positions held for very short periods

C)executes many high-value transactions

D)responds to events in a manner described as 'high latency'.

E)All of these.

A)identifies profitable opportunities that are then executed by a trader

B)profits from positions held for very short periods

C)executes many high-value transactions

D)responds to events in a manner described as 'high latency'.

E)All of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

72

What is a share price index? Explain the calculation of ASX share price indices.What advantage does an accumulation index have over a share price index?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

73

Identify and briefly explain the competitive pressures faced by the ASX.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

74

Describe the structure of Australia's share market in terms of the number of listed companies, their relative size and their liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

75

Describe the trading and settlement arrangements used in the Australian share market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

76

What is the role of the ASX 200? Describe how the S&P Australian Index Committee determine the shares in this index.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

77

Contracts for difference:

A)are only available to institutional investors

B)are a low risk product that allows an investment in shares without the cost of buying the shares

C)are exchange traded only

D)enable investors to trade shares on a geared (or leveraged)basis

E)have no risk of default

A)are only available to institutional investors

B)are a low risk product that allows an investment in shares without the cost of buying the shares

C)are exchange traded only

D)enable investors to trade shares on a geared (or leveraged)basis

E)have no risk of default

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

78

Briefly explain the contributions made by the share market to the financial system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

79

Hamish is a day trader who forms the opinion that JB Hi Fi will fall from its current price of $18.50 to $18.He has $5000 to risk.The initial margin payment is 10%, ignoring brokerage costs.(a)What CFD order should Hamish place and what exposure does this achieve?

(b)Later that day, JB Hi Fi shares are trading at $18.Explain how Hamish can close-out his position and the profit or loss achieved.(c)Say instead the price increased to $19.Again explain how Hamish can close-out his position and the profit or loss achieved.

(b)Later that day, JB Hi Fi shares are trading at $18.Explain how Hamish can close-out his position and the profit or loss achieved.(c)Say instead the price increased to $19.Again explain how Hamish can close-out his position and the profit or loss achieved.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

80

Explain high-frequency trading.Why is a retail trader unable to use the same trading strategy?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck