Deck 19: Acquisition Method Application After Control Date

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/28

العب

ملء الشاشة (f)

Deck 19: Acquisition Method Application After Control Date

1

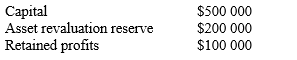

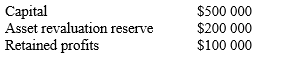

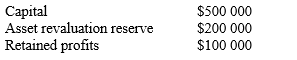

Rose Ltd acquired all the equity of Jeannie Ltd on 1 July 20X3.At that time the fair value/financial position of Jeannie was as follows:

Rose paid $850 000 for the shares in Jeannie.

In the 20X3-4 financial year, Jeannie made $75 000 in profits and recorded a goodwill impairment of $10 000.

Which of the following is the correct set of consolidation entries for June 30 20X4?

A)

Dr Impairment expense

- Goodwill

Cr. Accumulated goodwill impairment

B)

Dr Impairment expense

- Goodwill

C)

D)

Rose paid $850 000 for the shares in Jeannie.

In the 20X3-4 financial year, Jeannie made $75 000 in profits and recorded a goodwill impairment of $10 000.

Which of the following is the correct set of consolidation entries for June 30 20X4?

A)

Dr Impairment expense

- Goodwill

Cr. Accumulated goodwill impairment

B)

Dr Impairment expense

- Goodwill

C)

D)

Dr Impairment expense

- Goodwill

Cr. Accumulated goodwill impairment

2

Judith Ltd.took control of Athol Ltd on 1 January 20X5.Athol does not depreciate buildings but Judith group does.The building is shown by Athol at cost at $500 000.The Judith group depreciation rate for buildings is 10% p.a.The tax rate is 30%.

What would be the consolidation data adjustment entry for 31 December 20X5?

A)

B)Dr. Deferred tax liability

Cr. Deferred tax expense

C)

D)No entry required

What would be the consolidation data adjustment entry for 31 December 20X5?

A)

B)Dr. Deferred tax liability

Cr. Deferred tax expense

C)

D)No entry required

3

Assets of Argus Ltd include a plot of land purchased for $40 000.On 1 January 20X0 Argus became a subsidiary of Cyclops Ltd.The land was sold on 30 March 20X9 for $350 000.The land's fair value at the following dates was:

1 January 20X0 $100 000

31 December 20X3 $270 000

31 December 20X6 $240 000

31 December 20X8 $360 000

The subsidiary applies the cost model and the group applies the revaluation model.The carrying amount of the land immediately before control date is $40 000.

What is the correct consolidation data adjustment entry for 31 December 20X3?

A)

B)

C)

.

D)None of the above

1 January 20X0 $100 000

31 December 20X3 $270 000

31 December 20X6 $240 000

31 December 20X8 $360 000

The subsidiary applies the cost model and the group applies the revaluation model.The carrying amount of the land immediately before control date is $40 000.

What is the correct consolidation data adjustment entry for 31 December 20X3?

A)

B)

C)

.

D)None of the above

4

April Ltd owns 100% of the issued share capital of Sun Ltd.During the year ended 31 December 20X1 Sun Ltd declared and paid a dividend of $850 000 out of post acquisition profits.Which combination of amounts correctly shows the total amount of dividend revenue, if any, in April Ltd's financial statements and in its consolidated financial statements?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

5

Subsidiary has internally generated an intangible asset that it does not recognise in its own account balances and financial statements.Parent assesses the value of the intangible at $500 000.The correct consolidation data adjustment for the intangible is:

Dr.Intangible $500 000

Cr.Asset revaluation reserve $500 000

Dr.Intangible $500 000

Cr.Asset revaluation reserve $500 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

6

Assets of Argus Ltd include a plot of land purchased for $40 000.On 1 January 20X0 Argus became a subsidiary of Cyclops Ltd.The land was sold on 30 March 20X9 for $350 000.The land's fair value at the following dates was:

1 January 20X0 $100 000

31 December 20X3 $270 000

31 December 20X6 $240 000

31 December 20X8 $360 000

The group applies the cost model.The carrying amount of the land immediately before control date is $40 000.

What is the correct consolidation data adjustment entry for 31 December 20X6?

A)

B)

C)

D)

1 January 20X0 $100 000

31 December 20X3 $270 000

31 December 20X6 $240 000

31 December 20X8 $360 000

The group applies the cost model.The carrying amount of the land immediately before control date is $40 000.

What is the correct consolidation data adjustment entry for 31 December 20X6?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

7

Assets of Argus Ltd include a plot of land purchased for $40 000.On 1 January 20X0 Argus became a subsidiary of Cyclops Ltd.The land was sold on 30 March 20X9 for $350 000.The land's fair value at the following dates was:

1 January 20X0 $100 000

31 December 20X3 $270 000

31 December 20X6 $240 000

31 December 20X8 $360 000

The group applies the cost model.The carrying amount of the land immediately before control date is $40 000.

What is the correct consolidation data adjustment entry for 31 December 20X9?

A)

B)

C)

D)

1 January 20X0 $100 000

31 December 20X3 $270 000

31 December 20X6 $240 000

31 December 20X8 $360 000

The group applies the cost model.The carrying amount of the land immediately before control date is $40 000.

What is the correct consolidation data adjustment entry for 31 December 20X9?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

8

Rose Ltd acquired all the equity of Jeannie Ltd on 1 July 20X3.At that time the fair value/financial position of Jeannie was as follows:

Rose paid $850 000 for the shares in Jeannie.

In the 20X3-4 financial year, Jeannie made $75 000 in profits.

Which of the following correctly describes the accounting procedures that will arise as a result of the business combination?

A)The Rose Group will record a goodwill asset of $100 000 on its consolidation worksheet if prepared as at 30 June 20X4

B)Rose Ltd will record a goodwill asset of $100 000 in its ledger as of 1 July 20X3.

C)The Rose Group will record a goodwill asset of $25 000 on its consolidation worksheet if prepared as at 30 June 20X4

D)None of the above are appropriate

Rose paid $850 000 for the shares in Jeannie.

In the 20X3-4 financial year, Jeannie made $75 000 in profits.

Which of the following correctly describes the accounting procedures that will arise as a result of the business combination?

A)The Rose Group will record a goodwill asset of $100 000 on its consolidation worksheet if prepared as at 30 June 20X4

B)Rose Ltd will record a goodwill asset of $100 000 in its ledger as of 1 July 20X3.

C)The Rose Group will record a goodwill asset of $25 000 on its consolidation worksheet if prepared as at 30 June 20X4

D)None of the above are appropriate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

9

Angels Ltd acquired 100% of ACDC Ltd on 1 July 20X0 for $2 000 000, when the equity of ACDC Ltd comprised paid up capital of $1 400 000 and retained profits of $300 000.All ACDC Ltd's balance sheet was reported at fair value at acquisition date.During the year ended 30 June 20X1 ACDC Ltd declared and paid a total dividend of $100 000 out of pre-acquisition profits.What is the elimination entry for these transactions for the year ended 30 June 20X1? Assume AASB 127.38A was operational during this period.

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

10

Assets of Argus Ltd include a plot of land purchased for $40 000.On 1 January 20X0 Argus became a subsidiary of Cyclops Ltd.The land was sold on 30 March 20X9 for $350 000.The land's fair value at the following dates was:

1 January 20X0 $100 000

31 December 20X3 $270 000

31 December 20X6 $240 000

31 December 20X8 $360 000

The group applies the cost model.The carrying amount of the land immediately before control date is $40 000.

What is the profit on sale of land attributable to the group in 20X9?

A)$60 000

B)$310 000

C)$250 000

D)None of the above

1 January 20X0 $100 000

31 December 20X3 $270 000

31 December 20X6 $240 000

31 December 20X8 $360 000

The group applies the cost model.The carrying amount of the land immediately before control date is $40 000.

What is the profit on sale of land attributable to the group in 20X9?

A)$60 000

B)$310 000

C)$250 000

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

11

Rose Ltd acquired all the equity of Jeannie Ltd on 1 July 20X3.At that time the fair value/financial position of Jeannie was as follows:

Rose paid $850 000 for the shares in Jeannie.

In the 20X3-4 financial year, Jeannie made $75 000 in profits.

Which of the following is the correct substitution elimination entry as at 30 June 20X4?

A)

B)

C)

D)

Rose paid $850 000 for the shares in Jeannie.

In the 20X3-4 financial year, Jeannie made $75 000 in profits.

Which of the following is the correct substitution elimination entry as at 30 June 20X4?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

12

Led Ltd acquired 100% of Zeppelin Ltd on 30 June 20X0 by paying $7 million cash.At that date the net assets of Zeppelin Ltd was as follows:

Total assets comprise buildings of $6 million, equipment of $3 million and accounts receivable of $1 million.All these figures are fair values.What is the recorded amount of buildings in Led Ltd's consolidated financial statements for the year ended 30 June 20X0? Assume no asset revaluations.

A)$6 million

B)$3 million

C)$2 million

D)$4.66 million

Total assets comprise buildings of $6 million, equipment of $3 million and accounts receivable of $1 million.All these figures are fair values.What is the recorded amount of buildings in Led Ltd's consolidated financial statements for the year ended 30 June 20X0? Assume no asset revaluations.

A)$6 million

B)$3 million

C)$2 million

D)$4.66 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

13

Honky Ltd acquired all the issued share capital of Cat Ltd on 1 July 20X0.Goodwill acquired was $1 000 000 and Honky Ltd tests this goodwill for impairment every year.As at July 1 20X5 $500 000 or the original goodwill had been recorded as impaired.For the year ended June 30 20X6 a further $100 000 was regarded as being impaired.What is the elimination journal entry accounting for the impairment of this goodwill in Honky Ltd's consolidated financial statements for the year ended 30 June 20X6?

A)

B)

C)

D) .

A)

B)

C)

D) .

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

14

The substitution elimination entry may stay unchanged for several or more years after control date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

15

Angels Ltd acquired 100% of ACDC Ltd on 1 July 20X0 for $2 000 000, when the equity of ACDC Ltd comprised paid up capital of $1 400 000 and retained profits of $300 000.All ACDC Ltd's balance sheet was reported at fair value at acquisition date.During the year ended 30 June 20X1 ACDC Ltd declared and paid a total dividend of $100 000 out of pre-acquisition profits.What is the elimination entry for these transactions for the year ended 30 June 20X1? Assume AASB 127.38A was not operational during this period.

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

16

Rose Ltd acquired all the equity of Jeannie Ltd on 1 July 20X3.At that time the fair value/financial position of Jeannie was as follows:

Rose paid $500 000 for the shares in Jeannie.

In the 20X3-4 financial year, Jeannie made $75 000 in profits.

Which of the following correctly describes the accounting procedures that will arise as a result of the business combination?

A)The Rose Group will record a bargain purchase of $250 000 on its consolidation worksheet if prepared as at 30 June 20X4

B)Rose Ltd will record a bargain purchase gain of $250 000 in its ledger as of 1 July 20X3.

C)The Rose Group will record a goodwill asset of $325 000 on its consolidation worksheet if prepared as at 30 June 20X4

D)None of the above are appropriate

Rose paid $500 000 for the shares in Jeannie.

In the 20X3-4 financial year, Jeannie made $75 000 in profits.

Which of the following correctly describes the accounting procedures that will arise as a result of the business combination?

A)The Rose Group will record a bargain purchase of $250 000 on its consolidation worksheet if prepared as at 30 June 20X4

B)Rose Ltd will record a bargain purchase gain of $250 000 in its ledger as of 1 July 20X3.

C)The Rose Group will record a goodwill asset of $325 000 on its consolidation worksheet if prepared as at 30 June 20X4

D)None of the above are appropriate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

17

Rose Ltd acquired all the equity of Jeannie Ltd on 1 July 20X3.At that time the fair value/financial position of Jeannie was as follows:

Rose paid $500 000 for the shares in Jeannie.

In the 20X3-4 financial year, Jeannie made $75 000 in profits.

Which of the following is the correct substitution elimination entry as at 30 June 20X4?

A)

B)

C)

D)None of the above are appropriate because the bargain purchase is recognised in Rose's separate financial statements.

Rose paid $500 000 for the shares in Jeannie.

In the 20X3-4 financial year, Jeannie made $75 000 in profits.

Which of the following is the correct substitution elimination entry as at 30 June 20X4?

A)

B)

C)

D)None of the above are appropriate because the bargain purchase is recognised in Rose's separate financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

18

Reith Ltd owns all of the 10 million issued ordinary shares of Beasley Ltd.Beasley Ltd declared and paid a dividend of $0.80 per share during the 20X1 financial year out of profits it earned during 1999.Reith Ltd acquired Beasley Ltd in 20X0.What is the journal entry recorded by Reith Ltd in its own accounts for the 20X1 financial year?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

19

Angels Ltd acquired 100% of ACDC Ltd on 1 July 20X0 for $2 000 000, when the equity of ACDC Ltd comprised paid up capital of $1 400 000 and retained profits of $300 000.All ACDC Ltd's balance sheet was reported at fair value at acquisition date.During the year ended 30 June 20X1 ACDC Ltd declared and paid a total dividend of $100 000 out of pre-acquisition profits.What is the elimination entry for these transactions for the year ended 30 June 20X5? (assume no other transactions).Assume AASB 127.38A was operational during this period.

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

20

Judith Ltd took control of Athol Ltd on 1 January 20X5.Athol inventory is overstated by $5000 but is shown at the correct amount in the Judith group consolidation.The tax rate is 30%.

What would be the consolidation data adjustment entry for 1 January 20X5?

A)

Dr. Cost of sales

Cr. Inventory

Dr. Deferred tax asset

Cr. Deferred tax revenue

B)Dr. Deferred tax liability

Cr. Deferred tax expense

C)

D)No entry required

What would be the consolidation data adjustment entry for 1 January 20X5?

A)

Dr. Cost of sales

Cr. Inventory

Dr. Deferred tax asset

Cr. Deferred tax revenue

B)Dr. Deferred tax liability

Cr. Deferred tax expense

C)

D)No entry required

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

21

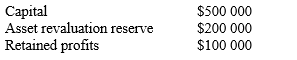

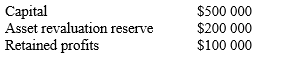

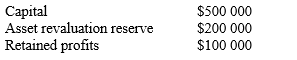

Wholly owned Subsidiary has the following balances at control date 20X1:

During 20X2 Subsidiary generates $100 000 profits and revalues plant downwards by $375 000.The 20X2 profit is before any impact of the downward asset revaluation.The asset revaluation reserve all relates to previous revaluation of plant.

During 20X3 Subsidiary incurs $50 000 of losses.

The amount of accumulated losses included in the consolidation for 20X3 (that is, not eliminated) is $125 000.

During 20X2 Subsidiary generates $100 000 profits and revalues plant downwards by $375 000.The 20X2 profit is before any impact of the downward asset revaluation.The asset revaluation reserve all relates to previous revaluation of plant.

During 20X3 Subsidiary incurs $50 000 of losses.

The amount of accumulated losses included in the consolidation for 20X3 (that is, not eliminated) is $125 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

22

The elimination of intra-group debts does not have any tax effects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

23

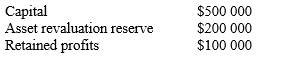

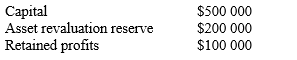

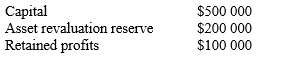

Wholly owned Subsidiary has the following balances at control date 20X1:

Parent paid $900 000 for the shares of Subsidiary.The tax rate is 30%.

Subsidiary assets are at fair value except for land, which the Subsidiary measures at cost and group policy is for revaluation.The land at cost is $60 000 and the fair value is $150 000.

In the consolidation there will be a deferred tax liability of $27 000.

Parent paid $900 000 for the shares of Subsidiary.The tax rate is 30%.

Subsidiary assets are at fair value except for land, which the Subsidiary measures at cost and group policy is for revaluation.The land at cost is $60 000 and the fair value is $150 000.

In the consolidation there will be a deferred tax liability of $27 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

24

Wholly owned Subsidiary has the following balances at control date 20X1:

During 20X2 Subsidiary generates $100 000 profits and revalues plant downwards by $375 000.The asset revaluation reserve all relates to previous revaluation of plant.

During 20X3 Subsidiary incurs $50 000 of losses.

The substitution elimination in 20X3 for asset revaluation reserve would be Cr.$200 000.

During 20X2 Subsidiary generates $100 000 profits and revalues plant downwards by $375 000.The asset revaluation reserve all relates to previous revaluation of plant.

During 20X3 Subsidiary incurs $50 000 of losses.

The substitution elimination in 20X3 for asset revaluation reserve would be Cr.$200 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

25

Subsidiary has property recorded at $60 000 using the cost method.Parent assesses the fair value of the property at $130 000.Group policy is to use the cost method.The correct consolidation data adjustment for the property is:

Dr.Property $70 000

Cr.Asset revaluation reserve $70 000

Dr.Property $70 000

Cr.Asset revaluation reserve $70 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

26

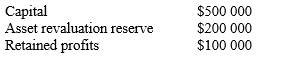

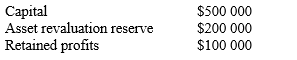

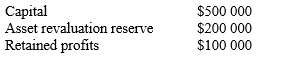

Wholly-owned Subsidiary has the following balances at control date 20X1:

During 20X2 Subsidiary generates $100 000 profits and revalues plant downwards by $375 000.The asset revaluation reserve all relates to previous revaluation of plant.

During 20X3 Subsidiary incurs $50 000 of losses.

The substitution elimination in 20X3 for retained profits would be Cr.$25 000.

During 20X2 Subsidiary generates $100 000 profits and revalues plant downwards by $375 000.The asset revaluation reserve all relates to previous revaluation of plant.

During 20X3 Subsidiary incurs $50 000 of losses.

The substitution elimination in 20X3 for retained profits would be Cr.$25 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

27

Wholly owned Subsidiary has the following balances at control date 20X1:

Parent paid $900 000 for the shares of Subsidiary.The tax rate is 30%.

In the consolidation for 20X1, recognition of goodwill generates a deferred tax asset of

$30 000.

Parent paid $900 000 for the shares of Subsidiary.The tax rate is 30%.

In the consolidation for 20X1, recognition of goodwill generates a deferred tax asset of

$30 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

28

Wholly owned Subsidiary has the following balances at control date 20X1:

Parent paid $900 000 for the shares of Subsidiary.The tax rate is 30%.

Subsidiary assets are at fair value except for inventory, which the Subsidiary measures at $20 000.Under group policy the amount would be $10 000.

In the consolidation there will be a deferred tax liability of $3000.

Parent paid $900 000 for the shares of Subsidiary.The tax rate is 30%.

Subsidiary assets are at fair value except for inventory, which the Subsidiary measures at $20 000.Under group policy the amount would be $10 000.

In the consolidation there will be a deferred tax liability of $3000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck