Deck 8: Inventory

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/168

العب

ملء الشاشة (f)

Deck 8: Inventory

1

The following information is available for Plymouth Ltd. for last year: The cost of goods sold is equal to 200% of selling expenses. What is the cost of goods available for sale?

A) Cannot be determined from information given.

B) $447,000

C) $990,000

D) $927,000

A) Cannot be determined from information given.

B) $447,000

C) $990,000

D) $927,000

$990,000

2

Companies that carry inventories must carefully monitor inventory in order to

A) have the greatest selection available so customers can always find what they want.

B) minimize carrying costs and keep inventory levels high so stockouts never occur.

C) keep inventory levels high to maximize profits.

D) minimize carrying costs and meet customer demands.

A) have the greatest selection available so customers can always find what they want.

B) minimize carrying costs and keep inventory levels high so stockouts never occur.

C) keep inventory levels high to maximize profits.

D) minimize carrying costs and meet customer demands.

minimize carrying costs and meet customer demands.

3

For last month, Mingi Corp.'s cost of goods sold and ending inventory were $200,000 and $300,000 respectively. Assuming Mingi had neither purchases nor returns during the month, what was the cost of its beginning inventory?

A) $100,000

B) $300,000

C) $500,000

D) Cannot be determined from the information given.

A) $100,000

B) $300,000

C) $500,000

D) Cannot be determined from the information given.

$500,000

4

Under IFRs, liabilities related to non-cancellable purchase commitments are typically recognized

A) on the date the contract takes effect.

B) at the time of payment.

C) when the purchase is recorded in the accounting system.

D) in the period a decline in market price occurs.

A) on the date the contract takes effect.

B) at the time of payment.

C) when the purchase is recorded in the accounting system.

D) in the period a decline in market price occurs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

5

For calendar 2020, the gross profit of Seymour Corp. was $135,000; the cost of goods manufactured was $360,000; the beginning inventories of goods in process and finished goods were $33,500 and $57,000, respectively; and the ending inventories of goods in process and finished goods were $44,000 and $71,000, respectively. Allan Corp.'s sales for 2020 must have been

A) $346,000.

B) $552,000.

C) $445,000.

D) $481,000.

A) $346,000.

B) $552,000.

C) $445,000.

D) $481,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

6

When substantially all risks and rewards of ownership have passed to the purchaser, the purchaser then recognizes an asset. For this recognition, which of the following statements is correct?

A) The purchaser must have both legal title and possession of the goods.

B) Legal title and possession do not always pass to the purchaser at the same time.

C) In practice, recording inventory purchases often takes place when they leave the seller's place of business.

D) The purchaser must have possession of goods before it has legal title.

A) The purchaser must have both legal title and possession of the goods.

B) Legal title and possession do not always pass to the purchaser at the same time.

C) In practice, recording inventory purchases often takes place when they leave the seller's place of business.

D) The purchaser must have possession of goods before it has legal title.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

7

Delaware Corp.'s accounts payable at December 31, 2020, totalled $450,000 before any necessary year-end adjustments relating to the following:

1) On December 27, 2020, Delaware wrote and recorded cheques to creditors totalling $175,000 causing an overdraft of $100,000 in Delaware's bank account at December 31, 2020. The cheques were mailed out on January 10, 2021.

2) On December 28, 2020, Delaware purchased and received goods for $100,000, terms 2/10, n/30. Delaware records purchases and accounts payable at net amounts. The invoice was recorded and paid on January 3, 2021.

3) Goods shipped FOB destination on December 20, 2020 from a vendor were received on January 2, 2021. The invoice cost was $65,000.

At December 31, 2020, what amount should Delaware report as total accounts payable?

A) $550,000

B) $575,000

C) $723,000

D) $755,500

1) On December 27, 2020, Delaware wrote and recorded cheques to creditors totalling $175,000 causing an overdraft of $100,000 in Delaware's bank account at December 31, 2020. The cheques were mailed out on January 10, 2021.

2) On December 28, 2020, Delaware purchased and received goods for $100,000, terms 2/10, n/30. Delaware records purchases and accounts payable at net amounts. The invoice was recorded and paid on January 3, 2021.

3) Goods shipped FOB destination on December 20, 2020 from a vendor were received on January 2, 2021. The invoice cost was $65,000.

At December 31, 2020, what amount should Delaware report as total accounts payable?

A) $550,000

B) $575,000

C) $723,000

D) $755,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

8

The following information was derived from the 2020 accounting records of Jersey Co.:

Jersey's 2020 cost of sales was

A) $563,000.

B) $558,000.

C) $488,000.

D) $460,000.

Jersey's 2020 cost of sales was

A) $563,000.

B) $558,000.

C) $488,000.

D) $460,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

9

A manufacturer that carries very little inventory likely follows the

A) allowance method.

B) just-in-time method.

C) indirect method.

D) replacement method.

A) allowance method.

B) just-in-time method.

C) indirect method.

D) replacement method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

10

Goods in transit that are shipped FOB destination should be included

A) in the inventory of the buyer.

B) in the inventory of the seller.

C) in the inventory of the shipping company.

D) in no one's inventory until they arrive at their destination.

A) in the inventory of the buyer.

B) in the inventory of the seller.

C) in the inventory of the shipping company.

D) in no one's inventory until they arrive at their destination.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

11

An estimated loss on purchase commitments is reported

A) under other expenses and losses.

B) as a deduction from purchases.

C) as a current liability.

D) as an extraordinary item.

A) under other expenses and losses.

B) as a deduction from purchases.

C) as a current liability.

D) as an extraordinary item.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

12

The balance in Georgia Corp.'s accounts payable account at December 31, 2020, was $900,000 before any necessary year-end adjustments relating to the following:

1) Goods were in transit to Georgia from a vendor on December 31, 2020. The invoice cost was $75,000. The goods were shipped FOB shipping point on December 29, 2020 and were received on January 4, 2021.

2) Goods shipped FOB destination on December 21, 2020 from a vendor were received on January 6, 2021. The invoice cost was $37,500.

3) On December 27, 2020, Georgia wrote and recorded cheques to creditors totalling $45,000 that were mailed on January 10, 2021.

At December 31, 2020, what amount should Georgia report as total accounts payable?

A) $1,020,000

B) $1,012,500

C) $975,000

D) $945,000

1) Goods were in transit to Georgia from a vendor on December 31, 2020. The invoice cost was $75,000. The goods were shipped FOB shipping point on December 29, 2020 and were received on January 4, 2021.

2) Goods shipped FOB destination on December 21, 2020 from a vendor were received on January 6, 2021. The invoice cost was $37,500.

3) On December 27, 2020, Georgia wrote and recorded cheques to creditors totalling $45,000 that were mailed on January 10, 2021.

At December 31, 2020, what amount should Georgia report as total accounts payable?

A) $1,020,000

B) $1,012,500

C) $975,000

D) $945,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

13

Goods in transit that are shipped FOB shipping point should be included

A) in the inventory of the buyer.

B) in the inventory of the seller.

C) in the inventory of the shipping company.

D) in no one's inventory until they arrive at their destination.

A) in the inventory of the buyer.

B) in the inventory of the seller.

C) in the inventory of the shipping company.

D) in no one's inventory until they arrive at their destination.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

14

Finkler Inc.'s net sales and gross profit were $335,250 and $117,750 respectively. Assuming the cost of goods available for sale were $271,000, what was the cost value of the ending inventory?

A) $217,500

B) $117,750

C) $61,750

D) $53,500

A) $217,500

B) $117,750

C) $61,750

D) $53,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

15

A manufacturing company typically maintains the following inventory account(s):

A) Merchandise Inventory.

B) Raw Materials and Work in Process only.

C) Raw Materials, Work in Process, and Finished Goods.

D) Work in Process and Merchandise Inventory.

A) Merchandise Inventory.

B) Raw Materials and Work in Process only.

C) Raw Materials, Work in Process, and Finished Goods.

D) Work in Process and Merchandise Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

16

A hardware retailer typically maintains the following inventory account(s):

A) Merchandise Inventory.

B) Raw Materials and Work in Process only.

C) Raw Materials, Work in Process, and Finished Goods.

D) Work in Process and Merchandise Inventory.

A) Merchandise Inventory.

B) Raw Materials and Work in Process only.

C) Raw Materials, Work in Process, and Finished Goods.

D) Work in Process and Merchandise Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

17

Florida Ltd.'s accounts payable balance at December 31, 2020, was $300,000 before any necessary year-end adjustments relating to the following:

1) Goods were in transit from a vendor to Florida on December 31, 2020. The invoice price was $20,000, and the goods were shipped FOB shipping point on December 29, 2020. The goods were received on January 4, 2021.

2) Goods shipped to Florida, FOB shipping point on December 20, 2020, from a vendor were lost in transit. The invoice price was $12,500. On January 5, 2021, Florida filed a $12,500 claim against the common carrier.

At December 31, 2020, what amount should Florida report as total accounts payable?

A) $300,000

B) $312,500

C) $320,000

D) $332,500

1) Goods were in transit from a vendor to Florida on December 31, 2020. The invoice price was $20,000, and the goods were shipped FOB shipping point on December 29, 2020. The goods were received on January 4, 2021.

2) Goods shipped to Florida, FOB shipping point on December 20, 2020, from a vendor were lost in transit. The invoice price was $12,500. On January 5, 2021, Florida filed a $12,500 claim against the common carrier.

At December 31, 2020, what amount should Florida report as total accounts payable?

A) $300,000

B) $312,500

C) $320,000

D) $332,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

18

In its first year of operations as a retailer, Riley Ltd. reported a gross profit of $181,500, total purchases of $225,000, and an ending inventory of $90,000. Therefore, Riley's sales in its first year must have been

A) $91,500.

B) $135,000.

C) $315,000.

D) $316,500.

A) $91,500.

B) $135,000.

C) $315,000.

D) $316,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

19

The cost of goods available for sale is calculated as

A) beginning inventory plus ending inventory.

B) beginning inventory minus ending inventory.

C) beginning inventory plus the cost of goods acquired during the period.

D) cost of goods acquired during the period minus ending inventory.

A) beginning inventory plus ending inventory.

B) beginning inventory minus ending inventory.

C) beginning inventory plus the cost of goods acquired during the period.

D) cost of goods acquired during the period minus ending inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following items would be inventory for a company like Marriott Hotel Corporation?

A) hotel rooms

B) food and beverage stock

C) cleaning supplies

D) all of the above

A) hotel rooms

B) food and beverage stock

C) cleaning supplies

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

21

Wilma received merchandise on consignment from Betty. As at March 31, Wilma had recorded the transaction as a purchase and included the goods in inventory. The effect of this on Wilma's financial statements for March 31 would be

A) net income was correct and current assets and current liabilities were overstated.

B) net income, current assets, and current liabilities were overstated.

C) net income and current liabilities were overstated.

D) no effect.

A) net income was correct and current assets and current liabilities were overstated.

B) net income, current assets, and current liabilities were overstated.

C) net income and current liabilities were overstated.

D) no effect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

22

Use the following information for the following questions:

Giselle Ltd. is a calendar-year corporation. Its financial statements for the years 2020 and 2019 contained errors as follows:

-Assume that no correcting entries were made at December 31, 2019, or December 31, 2020 and that no additional errors occurred in 2021. Ignoring income taxes, by how much will working capital, at December 31, 2021 be overstated or understated?

A) $0

B) $4,000 overstated

C) $4,000 understated

D) $6,000 understated

Giselle Ltd. is a calendar-year corporation. Its financial statements for the years 2020 and 2019 contained errors as follows:

-Assume that no correcting entries were made at December 31, 2019, or December 31, 2020 and that no additional errors occurred in 2021. Ignoring income taxes, by how much will working capital, at December 31, 2021 be overstated or understated?

A) $0

B) $4,000 overstated

C) $4,000 understated

D) $6,000 understated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

23

In a periodic inventory system, if the beginning inventory is overstated

A) net income is understated.

B) working capital is understated.

C) the current ratio is overstated.

D) cost of goods sold is understated.

A) net income is understated.

B) working capital is understated.

C) the current ratio is overstated.

D) cost of goods sold is understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following items should be included in inventory at the statement of financial position date?

A) goods in transit that were purchased FOB destination

B) goods received from another company for sale on consignment

C) goods sold to a customer that are being held for the customer to call for at his or her convenience

D) goods in transit that were purchased FOB shipping point

A) goods in transit that were purchased FOB destination

B) goods received from another company for sale on consignment

C) goods sold to a customer that are being held for the customer to call for at his or her convenience

D) goods in transit that were purchased FOB shipping point

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following does NOT correctly describe the implications of an executory contract on the accounting entries and/or disclosures to be made by the purchaser and/or seller?

A) Assets and liabilities are usually recorded at inception of the contract.

B) Assets and liabilities are usually not recorded at inception of the contract.

C) Contract details should be disclosed if the amounts are abnormal in relation to the entity's normal business operations.

D) Assets and liabilities are recognized as performance has occurred.

A) Assets and liabilities are usually recorded at inception of the contract.

B) Assets and liabilities are usually not recorded at inception of the contract.

C) Contract details should be disclosed if the amounts are abnormal in relation to the entity's normal business operations.

D) Assets and liabilities are recognized as performance has occurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following is correct?

A) Goods on consignment are included in the consignee's inventory.

B) Goods on consignment are included in the consignor's inventory.

C) The consignee essentially has the risks and rewards of ownership.

D) Inventory on consignment is always shown in a separate account.

A) Goods on consignment are included in the consignee's inventory.

B) Goods on consignment are included in the consignor's inventory.

C) The consignee essentially has the risks and rewards of ownership.

D) Inventory on consignment is always shown in a separate account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

27

All else being equal, which of the following statements with respect to the impact of inventory errors is NOT correct?

A) An overstatement of ending inventory will result in an understatement of income.

B) An overstatement of ending inventory will result in an overstatement of income.

C) An overstatement of beginning inventory will result in an understatement of income.

D) An understatement of beginning inventory will cause cost of goods sold to be understated.

A) An overstatement of ending inventory will result in an understatement of income.

B) An overstatement of ending inventory will result in an overstatement of income.

C) An overstatement of beginning inventory will result in an understatement of income.

D) An understatement of beginning inventory will cause cost of goods sold to be understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

28

For calendar 2020, Redfern Corporation reported pre-tax income of $270,000. You have been made aware that the company's beginning inventory was overstated by $14,000 and ending inventory was understated by $9,000. What is Redfern's corrected pre-tax income for 2020?

A) $270,000

B) $275,000

C) $265,000

D) $293,000

A) $270,000

B) $275,000

C) $265,000

D) $293,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

29

Fred received merchandise on consignment from Dino. As at January 31, Fred included the goods in inventory, but did NOT record the transaction. The effect of this on Fred's financial statements for January 31 would be

A) net income, current assets, and retained earnings were understated.

B) net income was correct and current assets were understated.

C) net income, current assets, and retained earnings were overstated.

D) net income and current assets were overstated and current liabilities were understated.

A) net income, current assets, and retained earnings were understated.

B) net income was correct and current assets were understated.

C) net income, current assets, and retained earnings were overstated.

D) net income and current assets were overstated and current liabilities were understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

30

For calendar 2020, Gomez Corporation reported pre-tax income of $70,000. A recount of the company's inventory revealed that 2020 ending inventory was overstated by $10,000. What is Gomez's corrected pre-tax income for 2020?

A) $60,000

B) $80,000

C) $70,000

D) $75,000

A) $60,000

B) $80,000

C) $70,000

D) $75,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

31

Use the following information for the following questions:

Giselle Ltd. is a calendar-year corporation. Its financial statements for the years 2020 and 2019 contained errors as follows:

-Assume that the proper correcting entries were made at December 31, 2019. By how much will 2020 pre-tax income be overstated or understated?

A) $2,000 understated

B) $2,000 overstated

C) $6,000 overstated

D) $8,000 overstated

Giselle Ltd. is a calendar-year corporation. Its financial statements for the years 2020 and 2019 contained errors as follows:

-Assume that the proper correcting entries were made at December 31, 2019. By how much will 2020 pre-tax income be overstated or understated?

A) $2,000 understated

B) $2,000 overstated

C) $6,000 overstated

D) $8,000 overstated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

32

On December 27, Cloud Corp. accepted delivery of merchandise that it purchased on account. As at December 31, Cloud had recorded the transaction, but did not include the merchandise in its year-end inventory. The effect of this on its December 31 financial statements would be

A) net income, current assets, and retained earnings were understated.

B) net income was correct and current assets were understated.

C) net income was understated and current liabilities were overstated.

D) net income was overstated and current assets were understated.

A) net income, current assets, and retained earnings were understated.

B) net income was correct and current assets were understated.

C) net income was understated and current liabilities were overstated.

D) net income was overstated and current assets were understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

33

If a material amount of inventory has been ordered through a formal purchase contract at the statement of financial position date, for future delivery, at firm prices,

A) this fact must be disclosed.

B) disclosure is required only if prices have declined since the date of the order.

C) disclosure is required only if prices have since risen substantially.

D) an appropriation of retained earnings is necessary.

A) this fact must be disclosed.

B) disclosure is required only if prices have declined since the date of the order.

C) disclosure is required only if prices have since risen substantially.

D) an appropriation of retained earnings is necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

34

Use the following information for questions.

During 2020 Ebert Corp. transferred inventory to Siskel Corp. and agreed to repurchase the merchandise early in 2021. Siskel then used the inventory as collateral to borrow from Southern Bank, remitting the proceeds to Ebert. In 2021 when Ebert repurchased the inventory, Siskel used the proceeds to repay its bank loan.

On whose books should the cost of the inventory appear at the December 31, 2020, statement of financial position date?

A) Siskel Corp.

B) Ebert Corp.

C) Southern Bank

D) Siskel Corp., with Ebert Corp. making appropriate note disclosure of the transaction

During 2020 Ebert Corp. transferred inventory to Siskel Corp. and agreed to repurchase the merchandise early in 2021. Siskel then used the inventory as collateral to borrow from Southern Bank, remitting the proceeds to Ebert. In 2021 when Ebert repurchased the inventory, Siskel used the proceeds to repay its bank loan.

On whose books should the cost of the inventory appear at the December 31, 2020, statement of financial position date?

A) Siskel Corp.

B) Ebert Corp.

C) Southern Bank

D) Siskel Corp., with Ebert Corp. making appropriate note disclosure of the transaction

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

35

Use the following information to solve the following questions:

Shanti Inc. is a calendar-year corporation. Its financial statements for the years 2020 and 2019 contained errors as follows:

-Assume that the proper correcting entries were made at December 31, 2019. By how much will 2020 income before taxes be overstated or understated?

A) $2,000 understated

B) $2,000 overstated

C) $4,000 overstated

D) $10,000 overstated

Shanti Inc. is a calendar-year corporation. Its financial statements for the years 2020 and 2019 contained errors as follows:

-Assume that the proper correcting entries were made at December 31, 2019. By how much will 2020 income before taxes be overstated or understated?

A) $2,000 understated

B) $2,000 overstated

C) $4,000 overstated

D) $10,000 overstated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

36

If the unavoidable costs of completing a purchase commitment are higher than the expected benefits from receiving the contracted goods or services, IFRS requires a loss provision to be recognized. This is known as a(n)

A) executory contract.

B) purchase commitment.

C) onerous contract.

D) impaired contract.

A) executory contract.

B) purchase commitment.

C) onerous contract.

D) impaired contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

37

Use the following information for the following questions:

Giselle Ltd. is a calendar-year corporation. Its financial statements for the years 2020 and 2019 contained errors as follows:

-Assume that no correcting entries were made at December 31, 2019. Ignoring income taxes, by how much will retained earnings at December 31, 2020 be overstated or understated?

A) $4,000 understated

B) $6,000 overstated

C) $6,000 understated

D) $15,000 understated

Giselle Ltd. is a calendar-year corporation. Its financial statements for the years 2020 and 2019 contained errors as follows:

-Assume that no correcting entries were made at December 31, 2019. Ignoring income taxes, by how much will retained earnings at December 31, 2020 be overstated or understated?

A) $4,000 understated

B) $6,000 overstated

C) $6,000 understated

D) $15,000 understated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

38

Use the following information to solve the following questions:

Shanti Inc. is a calendar-year corporation. Its financial statements for the years 2020 and 2019 contained errors as follows:

-Assume that no correcting entries were made at December 31, 2019. Ignoring income taxes, by how much will retained earnings at December 31, 2020 be overstated or understated?

A) $2,000 understated

B) $18,000 understated

C) $10,000 overstated

D) $18,000 overstated

Shanti Inc. is a calendar-year corporation. Its financial statements for the years 2020 and 2019 contained errors as follows:

-Assume that no correcting entries were made at December 31, 2019. Ignoring income taxes, by how much will retained earnings at December 31, 2020 be overstated or understated?

A) $2,000 understated

B) $18,000 understated

C) $10,000 overstated

D) $18,000 overstated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

39

Use the following information for questions.

During 2020 Ebert Corp. transferred inventory to Siskel Corp. and agreed to repurchase the merchandise early in 2021. Siskel then used the inventory as collateral to borrow from Southern Bank, remitting the proceeds to Ebert. In 2021 when Ebert repurchased the inventory, Siskel used the proceeds to repay its bank loan.

This transaction is known as a(n)

A) consignment.

B) instalment sale.

C) product financing arrangement.

D) sale with delayed payment terms.

During 2020 Ebert Corp. transferred inventory to Siskel Corp. and agreed to repurchase the merchandise early in 2021. Siskel then used the inventory as collateral to borrow from Southern Bank, remitting the proceeds to Ebert. In 2021 when Ebert repurchased the inventory, Siskel used the proceeds to repay its bank loan.

This transaction is known as a(n)

A) consignment.

B) instalment sale.

C) product financing arrangement.

D) sale with delayed payment terms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

40

On June 25, Veranda Corp. accepted delivery of merchandise that it purchased on account. As at June 30, Veranda had NOT recorded the transaction nor included the merchandise in its inventory. The effect of this on Veranda's June 30 statement of financial position would be

A) assets and shareholders' equity were overstated but liabilities were not affected.

B) shareholders' equity was the only item affected by the omission.

C) assets, liabilities, and shareholders' equity were understated.

D) assets and liabilities were understated but shareholders' equity was not affected.

A) assets and shareholders' equity were overstated but liabilities were not affected.

B) shareholders' equity was the only item affected by the omission.

C) assets, liabilities, and shareholders' equity were understated.

D) assets and liabilities were understated but shareholders' equity was not affected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

41

At the end of its accounting year, Colin Corp.'s physical inventory count indicated that 180,000 units of inventory, costing $1.75 each, were on hand. The company's perpetual inventory system reported a balance of $357,600. The year-end adjusting entry is

A) debit Inventory and credit Loss on Inventory Due to Count, $42,600.

B) debit Loss on Inventory Due to Count and credit Inventory, $42,600.

C) debit Inventory and credit Loss on Inventory Due to Count, $92,400.

D) debit Loss on Inventory Due to Count and credit Inventory, $92,400.

A) debit Inventory and credit Loss on Inventory Due to Count, $42,600.

B) debit Loss on Inventory Due to Count and credit Inventory, $42,600.

C) debit Inventory and credit Loss on Inventory Due to Count, $92,400.

D) debit Loss on Inventory Due to Count and credit Inventory, $92,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following best describes the concept of standard costs?

A) They are the costs that should be incurred per unit of finished goods inventory.

B) They are the costs that are actually incurred per unit of finished goods inventory.

C) When using standard costs, unallocated overhead is capitalized.

D) Standard costs are always acceptable for reporting purposes.

A) They are the costs that should be incurred per unit of finished goods inventory.

B) They are the costs that are actually incurred per unit of finished goods inventory.

C) When using standard costs, unallocated overhead is capitalized.

D) Standard costs are always acceptable for reporting purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following best describes the concept of product costs?

A) They are costs that are "attached" to inventory.

B) They are costs that are usually expenses.

C) They usually don't include freight charges.

D) They usually don't include conversion costs.

A) They are costs that are "attached" to inventory.

B) They are costs that are usually expenses.

C) They usually don't include freight charges.

D) They usually don't include conversion costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

44

All of the following costs should be charged to expense in the period in which they are incurred EXCEPT for

A) manufacturing overhead costs for a product manufactured and sold in the same accounting period.

B) costs that will not benefit any future period.

C) costs from idle manufacturing capacity resulting from an unexpected plant shutdown.

D) costs of normal shrinkage and scrap incurred for the manufacture of a product in ending inventory.

A) manufacturing overhead costs for a product manufactured and sold in the same accounting period.

B) costs that will not benefit any future period.

C) costs from idle manufacturing capacity resulting from an unexpected plant shutdown.

D) costs of normal shrinkage and scrap incurred for the manufacture of a product in ending inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

45

If two factories produce the exact same product having the same costs, and factory costs are completely allocated to the individual products, the factory operating at 80% capacity (while the other operates at 100% capacity)

A) would have a lower rate of cost allocation to each unit of production.

B) would have a higher rate of cost allocation to each unit of production.

C) would have the same rate of cost allocation to each unit of production as the 100% capacity operation.

D) would be operating at a loss, because of unused capacity.

A) would have a lower rate of cost allocation to each unit of production.

B) would have a higher rate of cost allocation to each unit of production.

C) would have the same rate of cost allocation to each unit of production as the 100% capacity operation.

D) would be operating at a loss, because of unused capacity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

46

Conversion costs include

A) all materials plus direct labour.

B) all materials plus variable overhead allocated.

C) direct labour plus variable and fixed overhead allocated.

D) direct labour plus fixed overhead allocated.

A) all materials plus direct labour.

B) all materials plus variable overhead allocated.

C) direct labour plus variable and fixed overhead allocated.

D) direct labour plus fixed overhead allocated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

47

Borrowing costs

A) are never included in the costs of inventories.

B) must only be included in inventory cost if they relate to inventories produced in large quantities and on a repetitive basis.

C) are capitalized if incurred to finance activities that help bring inventories to a condition available for sale.

D) none of the above

A) are never included in the costs of inventories.

B) must only be included in inventory cost if they relate to inventories produced in large quantities and on a repetitive basis.

C) are capitalized if incurred to finance activities that help bring inventories to a condition available for sale.

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

48

The following information was reported by Belleville Inc. for 2020:

Based on this data, Belleville's 2020 inventoriable cost was

A) $28,250.

B) $27,750.

C) $26,250.

D) $25,000.

Based on this data, Belleville's 2020 inventoriable cost was

A) $28,250.

B) $27,750.

C) $26,250.

D) $25,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following types of interest cost incurred in connection with the purchase or manufacture of inventory should be capitalized as a product cost?

A) purchase discounts lost

B) interest incurred during the production of discrete projects such as ships or real estate projects

C) interest incurred on notes payable to vendors for routine purchases made on a repetitive basis

D) interest on a building mortgage

A) purchase discounts lost

B) interest incurred during the production of discrete projects such as ships or real estate projects

C) interest incurred on notes payable to vendors for routine purchases made on a repetitive basis

D) interest on a building mortgage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following statements regarding borrowing costs is correct?

A) Neither ASPE nor IFRS usually require disclosure of these items.

B) They are usually amortized until the majority of the underlying products have been sold.

C) They are usually treated as period costs if they are incurred to bring inventories to a condition ready for sale.

D) If interest is capitalized, ASPE requires this policy and the amount capitalized to be disclosed.

A) Neither ASPE nor IFRS usually require disclosure of these items.

B) They are usually amortized until the majority of the underlying products have been sold.

C) They are usually treated as period costs if they are incurred to bring inventories to a condition ready for sale.

D) If interest is capitalized, ASPE requires this policy and the amount capitalized to be disclosed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

51

Use the following information for the following questions:

Windsor Ltd. uses FIFO to cost its inventory. The following information is available for Windsor's inventory of product # 205:

Beginning inventory: units per unit

March 1: Purchase of 500 units per unit

April 10: Sale of 200 units per unit

-Assuming Windsor uses the perpetual inventory system, the entry to account for the March 1 purchase is

A) debit Inventory and credit Accounts Payable, $3,500.

B) debit Purchases and credit Accounts Payable, $3,500.

C) debit Accounts Payable and credit Purchases, $3,500.

D) debit Accounts Payable and credit Inventory, $3,500.

Windsor Ltd. uses FIFO to cost its inventory. The following information is available for Windsor's inventory of product # 205:

Beginning inventory: units per unit

March 1: Purchase of 500 units per unit

April 10: Sale of 200 units per unit

-Assuming Windsor uses the perpetual inventory system, the entry to account for the March 1 purchase is

A) debit Inventory and credit Accounts Payable, $3,500.

B) debit Purchases and credit Accounts Payable, $3,500.

C) debit Accounts Payable and credit Purchases, $3,500.

D) debit Accounts Payable and credit Inventory, $3,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

52

A "basket purchase" is a purchase of

A) a group of units with similar characteristics at a single lump-sum price.

B) individual units with similar characteristics priced individually.

C) a group of units with different characteristics at a single lump-sum price.

D) individual units with different characteristics priced individually.

A) a group of units with similar characteristics at a single lump-sum price.

B) individual units with similar characteristics priced individually.

C) a group of units with different characteristics at a single lump-sum price.

D) individual units with different characteristics priced individually.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

53

An EXCEPTION to the general rule that costs should be charged to expense in the period incurred is

A) factory overhead costs incurred on a product manufactured but not sold during the current accounting period.

B) interest costs for financing of inventories that are routinely manufactured in large quantities on a repetitive basis.

C) general and administrative fixed costs incurred in connection with the purchase of inventory.

D) sales commission and salary costs incurred in connection with the sale of inventory.

A) factory overhead costs incurred on a product manufactured but not sold during the current accounting period.

B) interest costs for financing of inventories that are routinely manufactured in large quantities on a repetitive basis.

C) general and administrative fixed costs incurred in connection with the purchase of inventory.

D) sales commission and salary costs incurred in connection with the sale of inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following is correct regarding vendor rebates?

A) Vendor rebates are generally recorded as a reduction from sales.

B) The rebate is never recognized until it is actually received.

C) If the rebate meets asset recognition criteria, the receivable is allocated to goods sold.

D) Vendor rebates are generally recorded as a reduction in the purchase cost of inventory.

A) Vendor rebates are generally recorded as a reduction from sales.

B) The rebate is never recognized until it is actually received.

C) If the rebate meets asset recognition criteria, the receivable is allocated to goods sold.

D) Vendor rebates are generally recorded as a reduction in the purchase cost of inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following is correct?

A) Selling costs are product costs.

B) Manufacturing overhead costs are product costs.

C) Interest costs for routine inventories are product costs.

D) Direct labour costs are usually period costs.

A) Selling costs are product costs.

B) Manufacturing overhead costs are product costs.

C) Interest costs for routine inventories are product costs.

D) Direct labour costs are usually period costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

56

In a periodic inventory system, if ending inventory is understated,

A) net income is understated.

B) working capital is overstated.

C) the current ratio is overstated.

D) cost of goods sold is understated.

A) net income is understated.

B) working capital is overstated.

C) the current ratio is overstated.

D) cost of goods sold is understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following does NOT correctly describe a perpetual inventory system?

A) Cost of goods sold is calculated every time a sale is made.

B) Assuming shrinkage of zero, inventory and cost of goods sold do not have to be updated at the end of the period.

C) The use of this system eliminates the requirement for an annual physical inventory count.

D) Assuming a FIFO cost flow, cost of goods sold would equal that calculated by the periodic system.

A) Cost of goods sold is calculated every time a sale is made.

B) Assuming shrinkage of zero, inventory and cost of goods sold do not have to be updated at the end of the period.

C) The use of this system eliminates the requirement for an annual physical inventory count.

D) Assuming a FIFO cost flow, cost of goods sold would equal that calculated by the periodic system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

58

Use the following information for the following questions:

Windsor Ltd. uses FIFO to cost its inventory. The following information is available for Windsor's inventory of product # 205:

Beginning inventory: units per unit

March 1: Purchase of 500 units per unit

April 10: Sale of 200 units per unit

-Assuming Windsor uses the periodic inventory system, the entry to account for the March 1 purchase is

A) debit Inventory and credit Accounts Payable, $3,500.

B) debit Purchases and credit Accounts Payable, $3,500.

C) debit Accounts Payable and credit Purchases, $3,500.

D) debit Accounts Payable and credit Inventory, $3,500.

Windsor Ltd. uses FIFO to cost its inventory. The following information is available for Windsor's inventory of product # 205:

Beginning inventory: units per unit

March 1: Purchase of 500 units per unit

April 10: Sale of 200 units per unit

-Assuming Windsor uses the periodic inventory system, the entry to account for the March 1 purchase is

A) debit Inventory and credit Accounts Payable, $3,500.

B) debit Purchases and credit Accounts Payable, $3,500.

C) debit Accounts Payable and credit Purchases, $3,500.

D) debit Accounts Payable and credit Inventory, $3,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

59

To record a "basket purchase" or to allocate a joint product cost, which method is the most rational?

A) average cost

B) relative sales value

C) fair value

D) amortized cost

A) average cost

B) relative sales value

C) fair value

D) amortized cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

60

Arizona Inc. uses the perpetual inventory system, and recorded the following data pertaining to raw material X during January 2020: The moving-average unit cost of raw material X inventory at January 31, 2020 is

A) $4.70.

B) $4.50.

C) $4.43.

D) $4.35.

A) $4.70.

B) $4.50.

C) $4.43.

D) $4.35.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following does NOT correctly describe a periodic inventory system?

A) Cost of goods sold is calculated every time a sale is made.

B) Cost of goods sold is a residual amount.

C) Assuming a FIFO cost flow, cost of goods sold would equal that calculated by the perpetual system.

D) Inventory and cost of goods sold must be updated at the end of the period.

A) Cost of goods sold is calculated every time a sale is made.

B) Cost of goods sold is a residual amount.

C) Assuming a FIFO cost flow, cost of goods sold would equal that calculated by the perpetual system.

D) Inventory and cost of goods sold must be updated at the end of the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

62

When using the moving-average cost formula with a perpetual system,

A) a weighted-average cost is calculated at year end.

B) a new unit cost is calculated each time a sale is made.

C) a new unit cost is calculated each time a purchase is made.

D) a new unit cost is calculated both when a sale is made and when a purchase is made.

A) a weighted-average cost is calculated at year end.

B) a new unit cost is calculated each time a sale is made.

C) a new unit cost is calculated each time a purchase is made.

D) a new unit cost is calculated both when a sale is made and when a purchase is made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

63

An inventory cost formula in which the oldest costs incurred rarely have an effect on the ending inventory valuation is

A) FIFO.

B) moving-average cost.

C) LIFO.

D) weighted average.

A) FIFO.

B) moving-average cost.

C) LIFO.

D) weighted average.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following does NOT correctly describe the FIFO cost formula?

A) This method assumes that the oldest inventory costs are the first costs recorded for cost of goods sold.

B) This method assumes that most current inventory costs are the first costs recorded for cost of goods sold.

C) This method approximates the physical flow of most types of goods.

D) This method is permitted under both ASPE and IFRS.

A) This method assumes that the oldest inventory costs are the first costs recorded for cost of goods sold.

B) This method assumes that most current inventory costs are the first costs recorded for cost of goods sold.

C) This method approximates the physical flow of most types of goods.

D) This method is permitted under both ASPE and IFRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the following statements is INCORRECT regarding the overriding objectives underlying inventory standards?

A) Report an inventory cost on the statement of financial position that is representative of the inventory's recent cost.

B) Choose an approach that corresponds as closely as possible to the physical flow of goods.

C) Use the same method for all inventory assets that have similar economic characteristics.

D) It is permissible under ASPE to use any inventory method, including LIFO.

A) Report an inventory cost on the statement of financial position that is representative of the inventory's recent cost.

B) Choose an approach that corresponds as closely as possible to the physical flow of goods.

C) Use the same method for all inventory assets that have similar economic characteristics.

D) It is permissible under ASPE to use any inventory method, including LIFO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

66

Tehran Ltd. uses FIFO to cost its inventory. The following information is available for Tehran's inventory of product # 101: Beginning inventory: units per unit

March 1: Purchase of 250 units @ per unit

April 10: Sale of 100 units @ per unit Assuming Tehran uses the perpetual inventory system, the second entry to account for the April 10 sale is

A) debit Cost of Goods Sold and credit Inventory, $350.

B) debit Cost of Goods Sold and credit Purchases, $350.

C) debit Cost of Goods Sold and credit Inventory, $314.

D) debit Cost of Goods Sold and credit Purchases, $314.

March 1: Purchase of 250 units @ per unit

April 10: Sale of 100 units @ per unit Assuming Tehran uses the perpetual inventory system, the second entry to account for the April 10 sale is

A) debit Cost of Goods Sold and credit Inventory, $350.

B) debit Cost of Goods Sold and credit Purchases, $350.

C) debit Cost of Goods Sold and credit Inventory, $314.

D) debit Cost of Goods Sold and credit Purchases, $314.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

67

All else being equal, which of the following statements is correct for a company that uses the FIFO costing formula with a perpetual inventory system (compared to a periodic system)?

A) The value of the ending inventory would be higher under a periodic system.

B) The value of the ending inventory would be lower under a periodic system.

C) The value of the ending inventory would be the same under both systems.

D) The periodic system would not require any additional entries at the end of the period.

A) The value of the ending inventory would be higher under a periodic system.

B) The value of the ending inventory would be lower under a periodic system.

C) The value of the ending inventory would be the same under both systems.

D) The periodic system would not require any additional entries at the end of the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

68

Use the following information for the following questions:

The following information was available from the inventory records of Key Company for January:

-Assuming that Key uses the periodic inventory system, what should the inventory be at January 31, using the weighted-average inventory method, rounded to the nearest dollar?

A) $10,237

B) $10,260

C) $10,360

D) $10,505

The following information was available from the inventory records of Key Company for January:

-Assuming that Key uses the periodic inventory system, what should the inventory be at January 31, using the weighted-average inventory method, rounded to the nearest dollar?

A) $10,237

B) $10,260

C) $10,360

D) $10,505

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

69

The inventory costing method that can be used only for goods that are NOT ordinarily interchangeable is the

A) LIFO method.

B) specific identification method.

C) weighted average cost method.

D) FIFO method.

A) LIFO method.

B) specific identification method.

C) weighted average cost method.

D) FIFO method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following does NOT correctly describe the specific identification cost formula?

A) This method is most appropriate when goods are not interchangeable.

B) This method is most appropriate when goods are interchangeable.

C) This method is generally used for expensive, one-of-a-kind merchandise.

D) This method is often used for merchandise with serial numbers such as automobiles.

A) This method is most appropriate when goods are not interchangeable.

B) This method is most appropriate when goods are interchangeable.

C) This method is generally used for expensive, one-of-a-kind merchandise.

D) This method is often used for merchandise with serial numbers such as automobiles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

71

data related to an item of inventory: If Ritz Ltd. uses FIFO, the value assigned to cost of goods sold is

A) $3,105.

B) $3,187.

C) $2,295.

D) $1,369.

A) $3,105.

B) $3,187.

C) $2,295.

D) $1,369.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following does NOT correctly describe the weighted average cost formula?

A) It prices inventory on the basis of the average cost of beginning inventory.

B) It prices inventory on the basis of the average cost of goods available for sale during the period.

C) It takes into account that the volume of goods acquired at each price is different.

D) It includes the cost of beginning inventory in the calculations.

A) It prices inventory on the basis of the average cost of beginning inventory.

B) It prices inventory on the basis of the average cost of goods available for sale during the period.

C) It takes into account that the volume of goods acquired at each price is different.

D) It includes the cost of beginning inventory in the calculations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

73

Use the following information for questions.

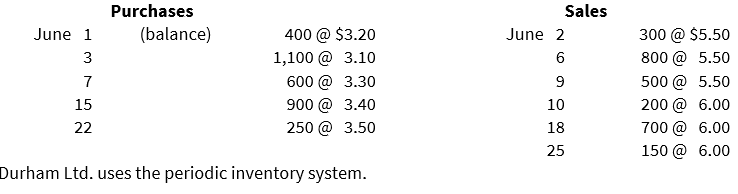

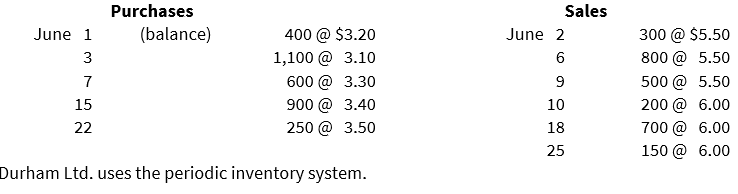

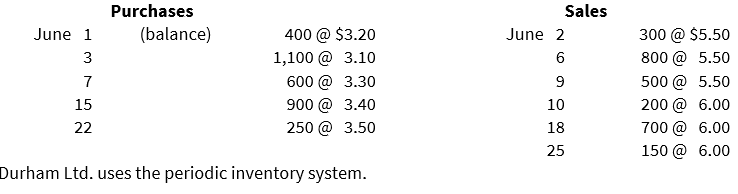

Transactions for Durham Ltd. for the month of June were:

The ending inventory on a FIFO basis is

A) $2,100.

B) $2,065.

C) $1,920.

D) $1,900.

Transactions for Durham Ltd. for the month of June were:

The ending inventory on a FIFO basis is

A) $2,100.

B) $2,065.

C) $1,920.

D) $1,900.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

74

Use the following information for questions.

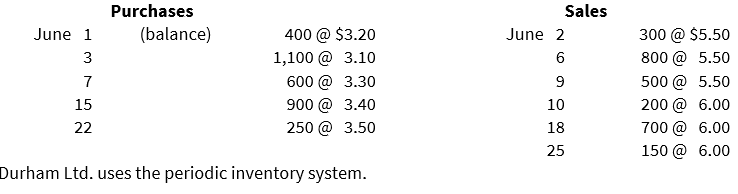

Transactions for Durham Ltd. for the month of June were:

The ending inventory on a weighted average cost basis, rounded to the nearest dollar, is

A) $1,956.

B) $1,970.

C) $1,980.

D) $1,995.

Transactions for Durham Ltd. for the month of June were:

The ending inventory on a weighted average cost basis, rounded to the nearest dollar, is

A) $1,956.

B) $1,970.

C) $1,980.

D) $1,995.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

75

The following inventory transactions took place for NPR Corporation for the month of May:

The ending inventory balance for NPR Corporation, assuming the company uses a perpetual inventory system, and a first-in, first-out (FIFO) cost formula is

A) $15,000.

B) $14,400.

C) $12,850.

D) $13,800.

The ending inventory balance for NPR Corporation, assuming the company uses a perpetual inventory system, and a first-in, first-out (FIFO) cost formula is

A) $15,000.

B) $14,400.

C) $12,850.

D) $13,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

76

Use the following information for the following questions:

The following information was available from the inventory records of Key Company for January:

-Assuming that Key uses the perpetual inventory system, what should the inventory be at January 31, using the moving-average inventory method, rounded to the nearest dollar?

A) $10,237

B) $10,260

C) $10,360

D) $10,505

The following information was available from the inventory records of Key Company for January:

-Assuming that Key uses the perpetual inventory system, what should the inventory be at January 31, using the moving-average inventory method, rounded to the nearest dollar?

A) $10,237

B) $10,260

C) $10,360

D) $10,505

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

77

When using a periodic inventory system,

A) a Purchases account is not used.

B) a Cost of Goods Sold account is used.

C) two entries are required to record a sale.

D) a Cost of Goods Sold account is not used.

A) a Purchases account is not used.

B) a Cost of Goods Sold account is used.

C) two entries are required to record a sale.

D) a Cost of Goods Sold account is not used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

78

At January 1, 2020, Nevada Ltd. had 150 units of product A on hand, costing $32 each. Purchases of product A during January were as follows: A physical count on January 31, 2020 shows 200 units of product A on hand. The cost of the inventory at January 31, 2020 under the FIFO cost formula is

A) $6,150.

B) $6,375.

C) $6,600.

D) $7,050.

A) $6,150.

B) $6,375.

C) $6,600.

D) $7,050.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following is a characteristic of a perpetual inventory system?

A) Inventory purchases are debited to a Purchases account.

B) Inventory records are not kept for every item.

C) Cost of goods sold is recorded with each sale.

D) Cost of goods sold is determined as the amount of purchases less the change in inventory.

A) Inventory purchases are debited to a Purchases account.

B) Inventory records are not kept for every item.

C) Cost of goods sold is recorded with each sale.

D) Cost of goods sold is determined as the amount of purchases less the change in inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

80

Why are inventories included in the computation of net income?

A) to determine cost of goods sold

B) to determine sales revenue

C) to determine merchandise returns

D) Inventories are not included in the computation of net income.

A) to determine cost of goods sold

B) to determine sales revenue

C) to determine merchandise returns

D) Inventories are not included in the computation of net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck