Deck 5: Cash and Receivables

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/119

العب

ملء الشاشة (f)

Deck 5: Cash and Receivables

1

Which statement is correct about the bank reconciliation?

A)It compares cash in the company's records with those of the bank.

B)It does not identify accounting errors made by the bank.

C)It interferes with other internal controls over cash.

D)It compares cash in the general ledger with the monthly budgets.

A)It compares cash in the company's records with those of the bank.

B)It does not identify accounting errors made by the bank.

C)It interferes with other internal controls over cash.

D)It compares cash in the general ledger with the monthly budgets.

A

2

What amount will be included in "cash and cash equivalents"?

A)$30,000

B)$36,000

C)$40,000

D)$42,000

A)$30,000

B)$36,000

C)$40,000

D)$42,000

$42,000

3

Explain why the definition of cash and cash equivalents is important for the financial statements. How would a transfer from one bank account to another be reported in the cash flow statement?

The definition impacts the cash flow statement. Only changes in cash and cash equivalents result in cash flows; changes in the composition of cash and cash equivalents does not constitute a cash flow.

4

Define "cash" and explain how funds that are subject tor restrictions should be accounted for in the accounting records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

5

What amount will be included in "cash and cash equivalents"?

A)$0

B)$12,000

C)$36,000

D)$64,000

A)$0

B)$12,000

C)$36,000

D)$64,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

6

What amount will be included in "cash and cash equivalents"?

A)$12,000

B)$18,000

C)$24,000

D)$54,000

A)$12,000

B)$18,000

C)$24,000

D)$54,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

7

What is included in "cash and cash equivalents"?

A)Guaranteed Investment Certificate maturing in 181 days.

B)Four-month term deposits.

C)U)S. cash on hand.

D)Guaranteed Investment Certificate maturing in 125 days.

A)Guaranteed Investment Certificate maturing in 181 days.

B)Four-month term deposits.

C)U)S. cash on hand.

D)Guaranteed Investment Certificate maturing in 125 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

8

What amount will be included in "cash and cash equivalents"?

A)$18,000

B)$22,000

C)$30,000

D)$42,000

A)$18,000

B)$22,000

C)$30,000

D)$42,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

9

What is included in "cash and cash equivalents"?

A)Short term, liquid investments convertible into known amounts of cash.

B)Short term, highly liquid investment convertible into known amounts of cash.

C)Cash restricted for plant expansion.

D)Sinking funds.

A)Short term, liquid investments convertible into known amounts of cash.

B)Short term, highly liquid investment convertible into known amounts of cash.

C)Cash restricted for plant expansion.

D)Sinking funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

10

What is included in "cash and cash equivalents"?

A)Petty cash.

B)Six-month term deposits in Canadian dollars.

C)Guaranteed Investment Certificate maturing in 100 days.

D)Four-month term deposit in U.S. dollars.

A)Petty cash.

B)Six-month term deposits in Canadian dollars.

C)Guaranteed Investment Certificate maturing in 100 days.

D)Four-month term deposit in U.S. dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

11

What is not included in "cash and cash equivalents"?

A)Canadian cash on hand.

B)Demand deposits.

C)Six-month term deposits.

D)Three-month Treasury bills.

A)Canadian cash on hand.

B)Demand deposits.

C)Six-month term deposits.

D)Three-month Treasury bills.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

12

What dollar amount will be included in "cash and cash equivalents"?

A)$9,000

B)$12,000

C)$21,000

D)$22,000

A)$9,000

B)$12,000

C)$21,000

D)$22,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

13

What criterion is not required for a "cash equivalent"?

A)Convertibility into cash.

B)Long term investment.

C)Insignificant risk of change in value.

D)Highly liquid investment.

A)Convertibility into cash.

B)Long term investment.

C)Insignificant risk of change in value.

D)Highly liquid investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

14

What amount will be included in "cash and cash equivalents"?

A)$36,000

B)$42,000

C)$52,000

D)$64,000

A)$36,000

B)$42,000

C)$52,000

D)$64,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

15

What amount will be included in "cash and cash equivalents"?

A)$36,000

B)$42,000

C)$54,000

D)$64,000

A)$36,000

B)$42,000

C)$54,000

D)$64,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following is not a reason for preparing a bank reconciliation?

A)It explains differences between cash in the general ledger and cash on the bank statement.

B)It is necessary in order to prevent fraud committed by employees.

C)It is helpful in identifying any errors made by the bank.

D)It is helpful in identifying any bookkeeping errors made in the general ledger.

A)It explains differences between cash in the general ledger and cash on the bank statement.

B)It is necessary in order to prevent fraud committed by employees.

C)It is helpful in identifying any errors made by the bank.

D)It is helpful in identifying any bookkeeping errors made in the general ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

17

What dollar amount will be included in "cash and cash equivalents"?

A)$8,000

B)$10,000

C)$19,000

D)$21,000

A)$8,000

B)$10,000

C)$19,000

D)$21,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

18

What amount will be included in "cash and cash equivalents"?

A)$36,000

B)$42,000

C)$54,000

D)$64,000

A)$36,000

B)$42,000

C)$54,000

D)$64,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which statement about "cash and cash equivalents" is correct?

A)The definition for "cash and cash equivalents" used on the balance sheet differs from the definition for "cash and cash equivalents" used on the cash flow statement.

B)A change in the composition of "cash and cash equivalents" is considered an operating activity on the cash flow statement.

C)A change in the composition of "cash and cash equivalents" is not considered a cash flow for purposes of the cash flow statement.

D)"Cash and cash equivalents" are short term liquid investments that can be converted to cash within a short time frame.

A)The definition for "cash and cash equivalents" used on the balance sheet differs from the definition for "cash and cash equivalents" used on the cash flow statement.

B)A change in the composition of "cash and cash equivalents" is considered an operating activity on the cash flow statement.

C)A change in the composition of "cash and cash equivalents" is not considered a cash flow for purposes of the cash flow statement.

D)"Cash and cash equivalents" are short term liquid investments that can be converted to cash within a short time frame.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

20

What dollar amount will be included in "cash and cash equivalents"?

A)$9,000

B)$11,000

C)$21,000

D)$22,000

A)$9,000

B)$11,000

C)$21,000

D)$22,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which statement about "cash and cash equivalents" is correct?

A)The definition for "cash and cash equivalents" used on the balance sheet differs from the definition for "cash and cash equivalents" used on the cash flow statement.

B)A change in the composition of "cash and cash equivalents" is considered a financing activity on the cash flow statement.

C)A change in the composition of "cash and cash equivalents" is considered a cash flow for purposes of the cash flow statement.

D)The definition for "cash and cash equivalents" used on the balance sheet is the same as the definition for "cash and cash equivalents" used on the cash flow statement.

A)The definition for "cash and cash equivalents" used on the balance sheet differs from the definition for "cash and cash equivalents" used on the cash flow statement.

B)A change in the composition of "cash and cash equivalents" is considered a financing activity on the cash flow statement.

C)A change in the composition of "cash and cash equivalents" is considered a cash flow for purposes of the cash flow statement.

D)The definition for "cash and cash equivalents" used on the balance sheet is the same as the definition for "cash and cash equivalents" used on the cash flow statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

22

What amount will be included in "cash and cash equivalents"?

A)$0

B)$12,000

C)$36,000

D)$64,000

A)$0

B)$12,000

C)$36,000

D)$64,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

23

Explain some controls that can be used in an organization to safeguard cash and other assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

24

What are the general recognition criteria for non-cash assets under GAAP?

A)If the item meets the definition of an asset, it must have an indefinite life.

B)If the item meets the definition of an expense, it must be measurable.

C)In order for the item to be an asset, it will have future economic benefits, be under the entity's control, and result form past transactions.

D)Future transactions can be recorded under GAAP.

A)If the item meets the definition of an asset, it must have an indefinite life.

B)If the item meets the definition of an expense, it must be measurable.

C)In order for the item to be an asset, it will have future economic benefits, be under the entity's control, and result form past transactions.

D)Future transactions can be recorded under GAAP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

25

During May 2021, ABC Company wrote a cheque (#345)to a supplier as a payment on its account. The cheque was written for the correct amount of $16,900. The May bank statement listed the cheque at $61,900 and an ending account balance of $(50,500)in overdraft.

Required:

a. Given the above information, prepare the portion of the May cash reconciliation that reconciles the bank balance to the cash balance to be used in the financial statements.

b. Where on the balance sheet should the cash (or overdraft)balance be shown?

Required:

a. Given the above information, prepare the portion of the May cash reconciliation that reconciles the bank balance to the cash balance to be used in the financial statements.

b. Where on the balance sheet should the cash (or overdraft)balance be shown?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

26

Pomegranate Company's bank balance on its October 31, 2021 bank statement is $11,500. Pomegranate's accountant is preparing a bank reconciliation and determined that three cheques issued by Pomegranate to its suppliers for a total of $6,500 had not yet cleared the bank. Also, a deposit for $700 made by Pomegranate on October 31 did not appear on the bank statement. Bank service charges of $240 appear on the bank statement, but have not yet been recorded in the general ledger.

Given the above information, prepare a bank reconciliation to determine the correct cash balance that should be reflected in Pomegranate's general ledger at October 31, 2021.

Given the above information, prepare a bank reconciliation to determine the correct cash balance that should be reflected in Pomegranate's general ledger at October 31, 2021.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

27

The following accounts were abstracted from Almond Co.'s unadjusted trial balance at December 31, 2019:

The company estimates that 5 percent of the gross accounts receivable will become uncollectible. After adjustment at December 31, 2019, the allowance for doubtful accounts should have a credit balance of

A)192,500

B)243,500

C)246,500

D)297,500

The company estimates that 5 percent of the gross accounts receivable will become uncollectible. After adjustment at December 31, 2019, the allowance for doubtful accounts should have a credit balance of

A)192,500

B)243,500

C)246,500

D)297,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

28

Small Company (SC)is in its fourth year of retail operations. The owner/manager previously employed a part-time bookkeeper to sign cheques, as well as to prepare journal entries, bank reconciliations, and monthly financial statements. SC has just hired you as the first full-time accountant to replace the bookkeeper, and you are preparing the December 31, 2021 financial statements.

Required:

a. Briefly explain the concept of "segregation of duties."

b. Identify an internal control issue relating to SC's cash-handling procedures, and provide your recommendation(s)to improve SC's internal controls over cash.

Required:

a. Briefly explain the concept of "segregation of duties."

b. Identify an internal control issue relating to SC's cash-handling procedures, and provide your recommendation(s)to improve SC's internal controls over cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which statement about internal controls over cash is correct?

A)Internal controls should not be designed to be preventative.

B)A bank reconciliation is designed for prevention of problems before the fact.

C)Controls should restrict sales staff ability to modify or delete accounts receivable.

D)Credit notes should not be issued for customer refunds.

A)Internal controls should not be designed to be preventative.

B)A bank reconciliation is designed for prevention of problems before the fact.

C)Controls should restrict sales staff ability to modify or delete accounts receivable.

D)Credit notes should not be issued for customer refunds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

30

Explain why it is important to segregate duties of employees dealing with cash in an organization. Provide at least three examples of ways which this segregation could be made on the receivables side.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

31

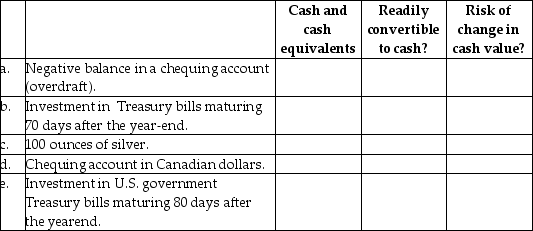

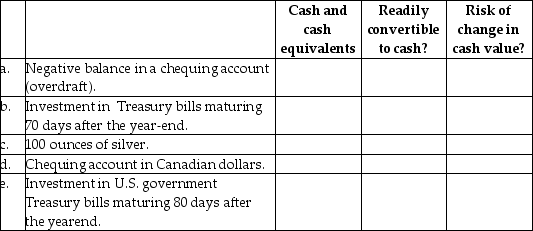

Identify whether each of the following items should be classified in "cash and cash equivalents" on the balance sheet. Assume that the reporting entity has operations in Canada.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

32

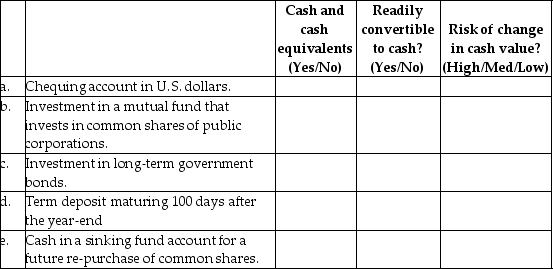

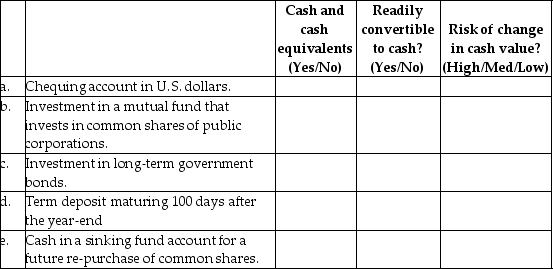

Identify if the following investments meet the requirements to be classified as cash and cash equivalents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

33

The following accounts were abstracted from Almond Co.'s unadjusted trial balance at December 31, 2019:

The company estimates that 1.5 percent of the net credit sales will become uncollectible. After adjustment at December 31, 2019, the allowance for doubtful accounts should have a credit balance of

A)11,000

B)12,000

C)44,250

D)55,250

The company estimates that 1.5 percent of the net credit sales will become uncollectible. After adjustment at December 31, 2019, the allowance for doubtful accounts should have a credit balance of

A)11,000

B)12,000

C)44,250

D)55,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following would not be an example of segregation of duties?

A)Sales employees have restricted ability to delete or modify accounts receivables.

B)Employees make sales to customers and record the credit sales in the accounts receivables.

C)Customer refunds are recorded on a written credit note.

D)Employees depositing funds to the bank do not prepare the bank reconciliation.

A)Sales employees have restricted ability to delete or modify accounts receivables.

B)Employees make sales to customers and record the credit sales in the accounts receivables.

C)Customer refunds are recorded on a written credit note.

D)Employees depositing funds to the bank do not prepare the bank reconciliation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which statement about internal controls over cash is correct?

A)A bank reconciliation is the only control required for cash.

B)A bank reconciliation is designed for detection of problems after the fact.

C)A bank reconciliation is a tool to investigate employee fraud.

D)A bank reconciliation is designed to prevent problems from happening.

A)A bank reconciliation is the only control required for cash.

B)A bank reconciliation is designed for detection of problems after the fact.

C)A bank reconciliation is a tool to investigate employee fraud.

D)A bank reconciliation is designed to prevent problems from happening.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

36

Identify the two criteria for classifying an investment as a cash equivalent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following would be an example of segregation of duties?

A)Sales employees have the ability to delete or modify accounts receivables.

B)Employees who make sales to customers record the credit sales in the accounts receivables.

C)Customer refunds are not recorded on a credit note.

D)Employees depositing funds to the bank do not prepare the bank reconciliation.

A)Sales employees have the ability to delete or modify accounts receivables.

B)Employees who make sales to customers record the credit sales in the accounts receivables.

C)Customer refunds are not recorded on a credit note.

D)Employees depositing funds to the bank do not prepare the bank reconciliation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

38

What is one way to segregate duties to improve controls over cash?

A)Request all customers to pay in cash.

B)Separate sales employees from employees who book the accounting entries.

C)Request all customers to pay by cheques made payable to "CASH."

D)Have the employee who is responsible for making cash deposits to the bank also do the bank reconciliations.

A)Request all customers to pay in cash.

B)Separate sales employees from employees who book the accounting entries.

C)Request all customers to pay by cheques made payable to "CASH."

D)Have the employee who is responsible for making cash deposits to the bank also do the bank reconciliations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

39

Explain why a bank reconciliation is necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

40

Explain why it is important to segregate duties of employees dealing with cash in an organization. Provide an example of ways which this segregation could be made on the payable side

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

41

A $50,000 sale transaction is made with terms of 2/10, net 30. Assuming that the customer takes the discount, what amount is booked to the "cash discount" account under the gross method of accounting for cash discounts?

A)$0

B)$1,000 debit

C)$1,000 credit

D)$49,000 debit

A)$0

B)$1,000 debit

C)$1,000 credit

D)$49,000 debit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

42

A $100,000 sale transaction is made with terms of 5/10, net 30. What amount is debited to the accounts receivable account when the sale is made under the gross method of recording a discount?

A)$95,000 credit

B)$95,000 debit

C)$100,000 credit

D)$100,000 debit

A)$95,000 credit

B)$95,000 debit

C)$100,000 credit

D)$100,000 debit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

43

A $50,000 sale transaction is made with terms of 2/10, net 30. What amount is debited to the accounts receivable account when the sale is made under the gross method of accounting for cash discounts?

A)$49,000 credit

B)$49,000 debit

C)$50,000 credit

D)$50,000 debit

A)$49,000 credit

B)$49,000 debit

C)$50,000 credit

D)$50,000 debit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

44

A $50,000 sale transaction is made with terms of 2/10, net 30. Assuming that the customer takes the discount, what amount is booked to the "cash discount" account under the net method of recording a discount?

A)$0

B)$1,000 debit

C)$1,000 credit

D)$49,000 debit

A)$0

B)$1,000 debit

C)$1,000 credit

D)$49,000 debit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which statement about receivables is correct?

A)Receivables are non-monetary items.

B)Monetary items are measured at their present value.

C)Trade receivables generally have payments terms extending beyond 3 months.

D)Trade receivables should generally be recorded at their discounted present value.

A)Receivables are non-monetary items.

B)Monetary items are measured at their present value.

C)Trade receivables generally have payments terms extending beyond 3 months.

D)Trade receivables should generally be recorded at their discounted present value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following is one of the general criteria for recognizing an asset?

A)The item must have future economic benefits.

B)The item must have an indefinite life.

C)The item must be tangible.

D)The item must be material.

A)The item must have future economic benefits.

B)The item must have an indefinite life.

C)The item must be tangible.

D)The item must be material.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which statement is not correct?

A)Factoring with recourse creates a liability on the balance sheet.

B)Factoring with recourse reduces a current ratio that is >1.

C)Factoring with recourse negatively impacts working capital.

D)Factoring without recourse reduces a current ratio that is >1.

A)Factoring with recourse creates a liability on the balance sheet.

B)Factoring with recourse reduces a current ratio that is >1.

C)Factoring with recourse negatively impacts working capital.

D)Factoring without recourse reduces a current ratio that is >1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which statement is not correct?

A)Factoring with recourse creates a liability on the balance sheet.

B)Factoring with recourse creates a receivable on the balance sheet.

C)Factoring without recourse negatively impacts working capital.

D)Factoring without recourse means that the seller takes the collection risk.

A)Factoring with recourse creates a liability on the balance sheet.

B)Factoring with recourse creates a receivable on the balance sheet.

C)Factoring without recourse negatively impacts working capital.

D)Factoring without recourse means that the seller takes the collection risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which statement is correct?

A)The "net" method for recording cash discounts is conceptually inferior to the "gross" method.

B)Under the "net" method, an entry is needed if the discount is not taken.

C)The "gross" method for recording cash discounts is conceptually superior to the "net" method.

D)The gross method overstates revenue.

A)The "net" method for recording cash discounts is conceptually inferior to the "gross" method.

B)Under the "net" method, an entry is needed if the discount is not taken.

C)The "gross" method for recording cash discounts is conceptually superior to the "net" method.

D)The gross method overstates revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

50

EasyCredit Inc. reported cash sales of $45,000, credit sales of $280,000 and write-offs of bad debts of $7,000 for last year. Accounts receivable had a balance of $327,000 at the beginning of the year and $381,000 at the end of the year. How much cash was collected from customers during the year?

A)$54,000

B)$219,000

C)$264,000

D)$334,000

A)$54,000

B)$219,000

C)$264,000

D)$334,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

51

Jackie Co.'s allowance for doubtful accounts was $15,000 at the end of 2022 and $205,000 at the end of 2021. For the year ended December 31, 2022, Jackie reported bad debt expense of $48,000 in its income statement. What amount did Jackie debit to the appropriate account in 2022 to write off actual bad debts?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which statement is correct?

A)A transfer with recourse means that the purchaser of the receivables takes the collection risk.

B)A transfer without recourse means that the seller of the receivables takes the collection risk.

C)Factoring with recourse reduces a current ratio that is >1.

D)Factoring without recourse creates a liability on the balance sheet.

A)A transfer with recourse means that the purchaser of the receivables takes the collection risk.

B)A transfer without recourse means that the seller of the receivables takes the collection risk.

C)Factoring with recourse reduces a current ratio that is >1.

D)Factoring without recourse creates a liability on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which statement best describes the net method of accounting for cash discounts?

A)Records receivables at their face value.

B)Records any discounts forfeited as income.

C)Records any discounts taken as an expense.

D)Records any discounts taken as a reduction in revenue.

A)Records receivables at their face value.

B)Records any discounts forfeited as income.

C)Records any discounts taken as an expense.

D)Records any discounts taken as a reduction in revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which statement is correct?

A)A transfer with recourse means that the purchaser cannot go back to the company for compensation of bad debts.

B)A transfer with recourse means that the purchaser of the receivables takes the collection risk.

C)A transfer with recourse means that the seller of the receivables takes the collection risk.

D)A transfer without recourse means that the seller of the receivables takes the collection risk.

A)A transfer with recourse means that the purchaser cannot go back to the company for compensation of bad debts.

B)A transfer with recourse means that the purchaser of the receivables takes the collection risk.

C)A transfer with recourse means that the seller of the receivables takes the collection risk.

D)A transfer without recourse means that the seller of the receivables takes the collection risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which statement is correct?

A)The "gross" method for recording cash discounts is conceptually better than the "net" method.

B)The net method understates expenses.

C)The gross method overstates revenue.

D)Under the "gross" method, an entry is needed if the discount is taken.

A)The "gross" method for recording cash discounts is conceptually better than the "net" method.

B)The net method understates expenses.

C)The gross method overstates revenue.

D)Under the "gross" method, an entry is needed if the discount is taken.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which statement best describes the gross method of accounting for cash discounts?

A)Records receivables at their present value amount.

B)Records any discounts forfeited as income.

C)Records any discounts taken as a reduction in revenue.

D)Records any discounts taken as an expense.

A)Records receivables at their present value amount.

B)Records any discounts forfeited as income.

C)Records any discounts taken as a reduction in revenue.

D)Records any discounts taken as an expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which statement is correct?

A)A transfer without recourse means that the purchaser can go back to the company for compensation of bad debts.

B)A transfer without recourse means that the purchaser of the receivables takes the collection risk.

C)A transfer without recourse means that the seller of the receivables takes the collection risk.

D)A transfer with recourse means that the purchaser of the receivables takes the collection risk.

A)A transfer without recourse means that the purchaser can go back to the company for compensation of bad debts.

B)A transfer without recourse means that the purchaser of the receivables takes the collection risk.

C)A transfer without recourse means that the seller of the receivables takes the collection risk.

D)A transfer with recourse means that the purchaser of the receivables takes the collection risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which statement is correct?

A)Factoring without recourse creates a receivable on the balance sheet.

B)Factoring without recourse reduces a current ratio that is >1.

C)Factoring with recourse negatively impacts working capital.

D)Factoring without recourse creates a liability on the balance sheet.

A)Factoring without recourse creates a receivable on the balance sheet.

B)Factoring without recourse reduces a current ratio that is >1.

C)Factoring with recourse negatively impacts working capital.

D)Factoring without recourse creates a liability on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

59

Maximum Inc. reported credit sales of $880,000, bad debt write-offs of $297,000 and bad debt expense of $257,000 for last year. Accounts receivable had a balance of $1,367,000 at the beginning of the year and $1,381,000 at the end of the year. How much cash was collected from customers during the year?

A)$457,000

B)$569,000

C)$714,000

D)$866,000

A)$457,000

B)$569,000

C)$714,000

D)$866,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

60

Philip Corp reported credit sales of $240,000 and write-offs of bad debts of $57,000 for last year. Accounts receivable had a balance of $1,127,000 at the beginning of the year and $881,000 at the end of the year. How much cash was collected from customers during the year?

A)$246,000

B)$429,000

C)$486,000

D)$669,000

A)$246,000

B)$429,000

C)$486,000

D)$669,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

61

Micelle Inc. reported credit sales of $600,000, cash collections of $450,000 and bad debt expense of $15,000 for last year. Accounts receivable had a balance of $1,000,000 at the end of the year. Assuming there are no write-offs made during the year, what was the balance in the accounts receivable account at the beginning of the year?

A)$400,000

B)$850,000

C)$865,000

D)$1,150,000

A)$400,000

B)$850,000

C)$865,000

D)$1,150,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

62

Fruit Valley Inc. reported cash sales of $250,000, credit sales of $850,000, cash collections from receivables of $500,000, bad debt write-offs of $25,000 and bad debt expense of $35,000 for last year. Accounts receivable had a balance of $1,000,000 at the end of the year. What was the balance in the accounts receivable account at the beginning of the year?

A)$425,000

B)$460,000

C)$650,000

D)$675,000

A)$425,000

B)$460,000

C)$650,000

D)$675,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

63

Micelle Inc. reported credit sales of $600,000 and cash collections of $450,000 for last year. The ending balance in accounts receivable was $800,000. Bad debt expense is estimated at 1% of credit sales. The allowance for doubtful accounts had a balance of $80,000 at the beginning of the year. Assuming there are no write-offs made during the year, what was the balance in the allowance for doubtful accounts at the end of the year?

A)$6,000

B)$8,000

C)$81,500

D)$86,000

A)$6,000

B)$8,000

C)$81,500

D)$86,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

64

Micelle Inc. reported credit sales of $700,000 and cash sales of $100,000 for last year. The ending balance in accounts receivable was $1,500,000. Bad debt expense is estimated at 1% of credit sales. The allowance for doubtful accounts had a balance of $40,000 at the beginning of the year. Assuming there are no write-offs made during the year, what was the balance in the allowance for doubtful accounts at the end of the year?

A)$7,000

B)$8,000

C)$47,000

D)$150,000

A)$7,000

B)$8,000

C)$47,000

D)$150,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

65

Fitness Machines reported cash sales of $50,000, credit sales of $800,000 and bad debt expense of $150,000 for last year. Accounts receivable had a balance of $1,000,000 at the beginning of the year and $1,250,000 at the end of the year. Assuming there are no write-offs during the year, how much cash was collected from customers during the year?

A)$400,000

B)$450,000

C)$550,000

D)$600,000

A)$400,000

B)$450,000

C)$550,000

D)$600,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

66

Pauline Company estimates the allowance for doubtful accounts by aging its accounts receivable. At the end of 2021, the balance in the allowance account was $50,000. During 2022, the company wrote off $5,000 and collected a $3,000 receivable that had been previously written off as uncollectable. At the end of 2022, the aging schedule indicated that the balance of the allowance for doubtful accounts should be $64,000. What is the bad debt expense for 2022?

A)$16,000

B)$19,000

C)$66,000

D)$69,000

A)$16,000

B)$19,000

C)$66,000

D)$69,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

67

Fitness Machines reported credit sales of $880,000 and bad debt expense of $250,000 for last year. Accounts receivable had a balance of $1,400,000 at the beginning of the year and $1,350,000 at the end of the year. Assuming there are no write-offs made during the year, how much cash was collected from customers during the year?

A)$630,000

B)$680,000

C)$930,000

D)$1,180,000

A)$630,000

B)$680,000

C)$930,000

D)$1,180,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

68

Lenient Corp. reported cash sales of $1,145,000, credit sales of $1,880,000, cash returns of $50,000, bad debt write-offs of $300,000 and bad debt expense of $250,000 for last year. Accounts receivable had a balance of $3,400,000 at the beginning of the year and $2,350,000 at the end of the year. How much cash was collected from customers during the year?

A)$2,630,000

B)$2,975,000

C)$3,725,000

D)$3,775,000

A)$2,630,000

B)$2,975,000

C)$3,725,000

D)$3,775,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which statement is correct about estimating the allowance for doubtful accounts?

A)Under the income statement approach, bad debt expense is based on the accounts receivable amount.

B)Under the income statement approach, bad debt expense is based on the percentage of credit sales.

C)Under the income statement approach, bad debt expense is based on an aging of the accounts receivable amount.

D)Under the income statement approach, bad debt expense is based on the volume of sales transactions.

A)Under the income statement approach, bad debt expense is based on the accounts receivable amount.

B)Under the income statement approach, bad debt expense is based on the percentage of credit sales.

C)Under the income statement approach, bad debt expense is based on an aging of the accounts receivable amount.

D)Under the income statement approach, bad debt expense is based on the volume of sales transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which statement is not correct about estimating the allowance for doubtful accounts under the balance sheet approach?

A)Accounts receivable are stated at their net realizable value.

B)Accounts receivable are stated at their fair value.

C)Bad debt expense is based on the accounts receivable balance.

D)Bad debt expense is based on an aging of the accounts receivable.

A)Accounts receivable are stated at their net realizable value.

B)Accounts receivable are stated at their fair value.

C)Bad debt expense is based on the accounts receivable balance.

D)Bad debt expense is based on an aging of the accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

71

Family Fun reported cash sales of $250,000, credit sales of $750,000, cash collections from receivables of $500,000, bad debt write-offs of $25,000 and bad debt expense of $35,000 for last year. Accounts receivable had a balance of $1,000,000 at the beginning of the year. What was the ending balance in the accounts receivable account?

A)$1,190,000

B)$1,225,000

C)$1,440,000

D)$1,475,000

A)$1,190,000

B)$1,225,000

C)$1,440,000

D)$1,475,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

72

Medical Machines reported credit sales of $800,000, cash returns of $25,000 and bad debt expense of $150,000 for last year. Accounts receivable had a balance of $1,000,000 at the beginning of the year and $1,250,000 at the end of the year. Assuming there are no write-offs during the year, how much cash was collected from customers during the year?

A)$375,000

B)$525,000

C)$550,000

D)$650,000

A)$375,000

B)$525,000

C)$550,000

D)$650,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

73

Medical Machines reported credit sales of $800,000, cash collections of $550,000 and bad debt write-offs of $15,000 for last year. Accounts receivable had a balance of $1,000,000 at the beginning of the year. What was the ending balance in the accounts receivable account?

A)$450,000

B)$1,235,000

C)$1,250,000

D)$1,800,000

A)$450,000

B)$1,235,000

C)$1,250,000

D)$1,800,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

74

Sahil Inc. reported credit sales of $600,000 and cash collections of $450,000 for last year. The ending balance in accounts receivable was $800,000. Bad debt expense is estimated at 1% of credit sales. The allowance for doubtful accounts had a balance of $80,000 at the beginning of the year. What was the bad debt expense for the year?

A)$1,500

B)$6,000

C)$8,000

D)$86,000

A)$1,500

B)$6,000

C)$8,000

D)$86,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

75

Karin-Jones Ltd. reported an opening balance of $1,712,000 in accounts receivable and of $147,000 in allowance for doubtful accounts for last year. During the year, sales on account were $2,500,000, collections of accounts receivable were $1,300,000, and bad debt expense was $89,000. At the end of the year, the company had a credit balance of $172,000 in the allowance for doubtful accounts. What amount of accounts receivable was written off during the year?

A)$25,000

B)$64,000

C)$83,000

D)$2,912,000

A)$25,000

B)$64,000

C)$83,000

D)$2,912,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

76

A $100,000 sale transaction is made with terms of 5/10, net 30. What entry is made to the accounts receivable account when the sale is made under the net method of recording a discount?

A)$95,000 credit

B)$95,000 debit

C)$100,000 credit

D)$100,000 debit

A)$95,000 credit

B)$95,000 debit

C)$100,000 credit

D)$100,000 debit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which statement is correct about recording an allowance for doubtful accounts?

A)Accounts receivable are not adjusted for known uncollectable amounts.

B)Net accounts receivable is recalculated when there are changes recorded in the Allowance for Doubtful Accounts contra account.

C)Comparability is the reason an allowance for doubtful accounts is needed.

D)An allowance for doubtful accounts does not require estimates or judgments.

A)Accounts receivable are not adjusted for known uncollectable amounts.

B)Net accounts receivable is recalculated when there are changes recorded in the Allowance for Doubtful Accounts contra account.

C)Comparability is the reason an allowance for doubtful accounts is needed.

D)An allowance for doubtful accounts does not require estimates or judgments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

78

Marvelos Inc. reported credit sales of $1,000,000 and cash sales of $100,000 for last year. The ending balance in accounts receivable was $1,500,000. Bad debt expense is estimated at 1% of ending accounts receivable. The allowance for doubtful accounts had a balance of $40,000 at the beginning of the year. Assuming there are no write-offs made during the year, what was the balance in the allowance for doubtful accounts at the end of the year?

A)$11,000

B)$15,000

C)$51,000

D)$55,000

A)$11,000

B)$15,000

C)$51,000

D)$55,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

79

Family Fun reported credit sales of $800,000, cash collections of $550,000 and bad debt expense of $15,000 for last year. Accounts receivable had a balance of $1,000,000 at the beginning of the year. Assuming there are no write-offs made during the year, what was the ending balance in the accounts receivable account?

A)$450,000

B)$1,235,000

C)$1,250,000

D)$1,800,000

A)$450,000

B)$1,235,000

C)$1,250,000

D)$1,800,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

80

Sabrina Inc. reported credit sales of $700,000 and cash sales of $100,000. The ending balance in accounts receivable was $1,500,000. Bad debt expense is estimated at 1% of credit sales. The allowance for doubtful accounts had a balance of $40,000 at the beginning of the year. What was the bad debt expense for the year?

A)$7,000

B)$8,000

C)$15,000

D)$47,000

A)$7,000

B)$8,000

C)$15,000

D)$47,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck