Deck 4: Revenue and Recognition

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/105

العب

ملء الشاشة (f)

Deck 4: Revenue and Recognition

1

Discuss when it is acceptable to use the residual approach to allocate the transaction price to performance obligations.

The residual approach may only be used if either (i)the good or service in question have a highly variable selling price, or (ii)the entity has not yet established a price for that good or service.

2

Explain how the timing of revenue recognition is affected by multiple performance obligations in the arrangement. Explain how revenue is ultimately recognized in a multiple performance obligations sales arrangements.

Clearly, it is inappropriate to record all the revenue upon delivery of simply one product or service if some products or services are delivered at different points in time.

All products or services in such a sales transaction are taken into account.

To record revenue in a manner that reflects the timing of delivery for each product or service in the sales arrangement, the sales price of the total arrangement is allocated to the individual components. Then the normal revenue recognition criteria are applied to each component to determine when the revenue from that element can be recorded by the company.

All products or services in such a sales transaction are taken into account.

To record revenue in a manner that reflects the timing of delivery for each product or service in the sales arrangement, the sales price of the total arrangement is allocated to the individual components. Then the normal revenue recognition criteria are applied to each component to determine when the revenue from that element can be recorded by the company.

3

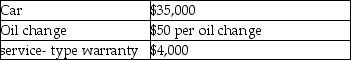

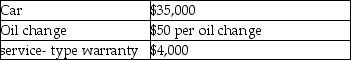

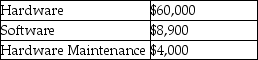

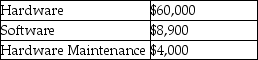

Fancy Cars sold a used car for $35,000 cash. The company will also provide 4 oil changes per year for 5 years and an extended service-type warranty for 5 years. This is the first time that Fancy has offered an extended warranty. They intend to offer it to customers on a stand-alone basis but have not yet established a sales price. The observable selling prices of the car and oil changes follow:

a. Determine how revenue should be allocated to the various components in this transaction.

a. Determine how revenue should be allocated to the various components in this transaction.

b. Apply the appropriate revenue recognition criteria to determine when revenue should be recognized for the various components of this transaction.

a. Determine how revenue should be allocated to the various components in this transaction.

a. Determine how revenue should be allocated to the various components in this transaction.b. Apply the appropriate revenue recognition criteria to determine when revenue should be recognized for the various components of this transaction.

a. The residual method is appropriate since the fair value of the warranty is not determinable as a stand-alone price has not yet been established for the service-type warranty.

b. Revenue for the car should be recognized upon delivery. Revenue for the oil changes will recorded as each of the 20 oil changes is performed (1,000/ (4/yr × 5 yrs)). The revenue for the warranty would be recognized over the 5 years.

b. Revenue for the car should be recognized upon delivery. Revenue for the oil changes will recorded as each of the 20 oil changes is performed (1,000/ (4/yr × 5 yrs)). The revenue for the warranty would be recognized over the 5 years.

b. Revenue for the car should be recognized upon delivery. Revenue for the oil changes will recorded as each of the 20 oil changes is performed (1,000/ (4/yr × 5 yrs)). The revenue for the warranty would be recognized over the 5 years.

b. Revenue for the car should be recognized upon delivery. Revenue for the oil changes will recorded as each of the 20 oil changes is performed (1,000/ (4/yr × 5 yrs)). The revenue for the warranty would be recognized over the 5 years. 4

Explain how the transaction price should be allocated to the performance obligations in a multiple performance obligation sales arrangement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following best explains what recognition means in financial reporting?

A)Recognition is the process of reporting an item that is due within 12 months in the current section of the balance sheet.

B)Recognition is the process of reporting an item in the notes to the financial statements.

C)Recognition is the process of presenting an item in the financial statements.

D)Recognition refers to the choice between using fair value and historical cost in the financial statements.

A)Recognition is the process of reporting an item that is due within 12 months in the current section of the balance sheet.

B)Recognition is the process of reporting an item in the notes to the financial statements.

C)Recognition is the process of presenting an item in the financial statements.

D)Recognition refers to the choice between using fair value and historical cost in the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

6

You are an accountant working at Phantastic Pharmaceutical Inc. and have been asked to explain to your controller the possible points at which revenue could be recognized by your organization. Identify two alternatives that are in accordance with IFRS 15 for recognizing revenue at Phantastic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

7

On March 1, Pendant Textbook Publications delivered 100 copies of one of its accounting textbooks to the First University bookstore. The bookstore can return all unsold copies to Pendant. The retail price of each copy is $110, while the price charged to the bookstore is $80. Each book costs Pendant $40 to produce. On April 15, the distributor returns 30 unsold copies to Pendant. Based on these facts, how much revenue would Pendant recognize on April 15?

A)$2,800

B)$5,600

C)$7,700

D)$2,400

A)$2,800

B)$5,600

C)$7,700

D)$2,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

8

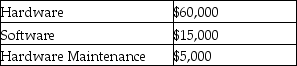

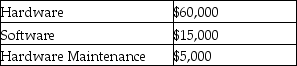

Superior Cars sold a car for $35,000 cash. In addition, the company will provide 4 oil changes per year for 5 years and an extended warranty for 5 years. The normal observable stand-alone selling prices are as follows:

a. Determine how revenue should be allocated to the various performance obligations in this transaction.

a. Determine how revenue should be allocated to the various performance obligations in this transaction.

b. Apply the appropriate revenue recognition criteria to determine when revenue should be recognized to the components in this transaction.

a. Determine how revenue should be allocated to the various performance obligations in this transaction.

a. Determine how revenue should be allocated to the various performance obligations in this transaction.b. Apply the appropriate revenue recognition criteria to determine when revenue should be recognized to the components in this transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

9

A city transit authority issues 200,000 monthly passes at $80 each for sale at various retailers. Retailers act as consignees for these passes. Identify why the transit authority cannot recognize revenue at time of distribution.

A)The retailers have not taken physical possession of the asset.

B)A contract has not been entered into.

C)The transaction price is not known.

D)The retailers do not bear the significant risks and rewards of ownership.

A)The retailers have not taken physical possession of the asset.

B)A contract has not been entered into.

C)The transaction price is not known.

D)The retailers do not bear the significant risks and rewards of ownership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

10

Hedley Corporation sold hardware and software for $70,000 cash. In addition, the company will provide support on the software for 1 year and maintenance on the hardware for 3 years. The observable stand-alone selling prices are as follows:

a. Determine how revenue should be allocated to the various components in this transaction.

a. Determine how revenue should be allocated to the various components in this transaction.

b. Apply the appropriate revenue recognition criteria to determine when revenue should be recognized for the various components of this transaction.

a. Determine how revenue should be allocated to the various components in this transaction.

a. Determine how revenue should be allocated to the various components in this transaction.b. Apply the appropriate revenue recognition criteria to determine when revenue should be recognized for the various components of this transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

11

Explain why accounting standards generally prescribe a smaller set of alternatives for revenue recognition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following is correct about the value creation process?

A)The value creation process is the same for all entities.

B)The value creation process is the same for all industries.

C)Any point on the value creation process is acceptable for revenue recognition.

D)The value creation process is specific to each entity.

A)The value creation process is the same for all entities.

B)The value creation process is the same for all industries.

C)Any point on the value creation process is acceptable for revenue recognition.

D)The value creation process is specific to each entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

13

Simply Manufacturers has signed an order to supply 10,000 chairs at a price to be determined sixty days after delivery. Payment is due at that time. The price per chair may range from $0 to $100 depending on a series of events, the outcome of which cannot be accurately predicted. Which of the following factors is most likely to precludes Simply from recognizing revenue at time of delivery.

A)The purchaser bears the significant risks and rewards of ownership.

B)The revenue is variable in nature.

C)The purchaser is not obligated to pay for the goods at time of delivery.

D)Simply had not paid its suppliers for the materials used to manufacture the chairs.

A)The purchaser bears the significant risks and rewards of ownership.

B)The revenue is variable in nature.

C)The purchaser is not obligated to pay for the goods at time of delivery.

D)Simply had not paid its suppliers for the materials used to manufacture the chairs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

14

An insurance company receives annual premiums for fire insurance on June 25 for coverage beginning July 1. Identify why the insurance company cannot recognize revenue when the premium is received.

A)The insurance company has not transferred to the buyer the significant risks and rewards of ownership of the service.

B)The customer has not taken possession of the asset.

C)The insurance company earns the revenue over time, rather than at a point of time (time of sale).

D)The customer does not control the asset.

A)The insurance company has not transferred to the buyer the significant risks and rewards of ownership of the service.

B)The customer has not taken possession of the asset.

C)The insurance company earns the revenue over time, rather than at a point of time (time of sale).

D)The customer does not control the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following statements about the value creation process is not correct?

A)The value creation process reflects the wide range of possible points at which revenue could be recognized.

B)Recognizing revenue early in the value creation process is more conservative than waiting until cash is received.

C)Recognizing revenue early in the value creation process involves more uncertainties and lower reliability about cash flows.

D)Permitting too much choice in accounting policies impairs comparability of financial statements.

A)The value creation process reflects the wide range of possible points at which revenue could be recognized.

B)Recognizing revenue early in the value creation process is more conservative than waiting until cash is received.

C)Recognizing revenue early in the value creation process involves more uncertainties and lower reliability about cash flows.

D)Permitting too much choice in accounting policies impairs comparability of financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

16

Discuss advantages and disadvantages of using the cash basis to recognize revenues. Provide three valid reasons in your discussion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which statement is correct about multiple performance obligation arrangements?

A)The revenue recognition criteria no longer apply to these transactions.

B)The revenue must be allocated to the components of the sale evenly over the life of the contract.

C)The revenue must be recognized evenly over the life of the contract.

D)Identifying the different sources of revenue increases the representational faithfulness.

A)The revenue recognition criteria no longer apply to these transactions.

B)The revenue must be allocated to the components of the sale evenly over the life of the contract.

C)The revenue must be recognized evenly over the life of the contract.

D)Identifying the different sources of revenue increases the representational faithfulness.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which statement is correct about multiple performance obligation arrangements?

A)The residual method must normally be used.

B)The relative stand-alone selling price method must normally be used.

C)There is no specific method that must be used.

D)The adjusted market assessment approach is an acceptable residual approach that may be used.

A)The residual method must normally be used.

B)The relative stand-alone selling price method must normally be used.

C)There is no specific method that must be used.

D)The adjusted market assessment approach is an acceptable residual approach that may be used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

19

Explain why a company should allocate revenue to multiple performance obligations in a sales transaction even if the company delivers all of the products or services in the same accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

20

List the five key steps in the revenue recognition process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

21

Shear Company sells computer equipment with a 2-year warranty. Prior experience indicates that costs associated with this warranty average 1% in the first year and 2% in the second year. In 2021, Shear had sales of $1,800,000. It paid $250,000 for materials and labour to make warranty-related repairs in 2021. What amount should the warranty expense for 2021 be?

A)$18,000

B)$36,000

C)$54,000

D)$250,000

A)$18,000

B)$36,000

C)$54,000

D)$250,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following is TRUE when goods are sold on consignment?

A)The customer has taken physical possession of the asset.

B)The selling entity has the present right to payment for the asset.

C)The significant risks and rewards of ownership have been transferred.

D)The customer has accepted the asset.

A)The customer has taken physical possession of the asset.

B)The selling entity has the present right to payment for the asset.

C)The significant risks and rewards of ownership have been transferred.

D)The customer has accepted the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following is TRUE when goods are sold on on an installment basis?

A)Revenue is recognized at time of the initial sale.

B)Cost of goods sold is debited for the cost of the merchandise sold.

C)Revenue is not recognized until all monies due under the contract have been collected.

D)The deferred gross profit liability is debited as cash is collected.

A)Revenue is recognized at time of the initial sale.

B)Cost of goods sold is debited for the cost of the merchandise sold.

C)Revenue is not recognized until all monies due under the contract have been collected.

D)The deferred gross profit liability is debited as cash is collected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which statement best describes a franchise arrangement?

A)An arrangement in which one party licenses its business practices to another party.

B)An arrangement in which one party exchanges goods or services with another party with little or no consideration.

C)An arrangement in which one party provides goods to another party to sell on its behalf and will accept all goods that are not sold.

D)An arrangement in which one party allows the purchaser to make payments over an extended period of time.

A)An arrangement in which one party licenses its business practices to another party.

B)An arrangement in which one party exchanges goods or services with another party with little or no consideration.

C)An arrangement in which one party provides goods to another party to sell on its behalf and will accept all goods that are not sold.

D)An arrangement in which one party allows the purchaser to make payments over an extended period of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

25

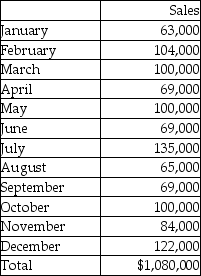

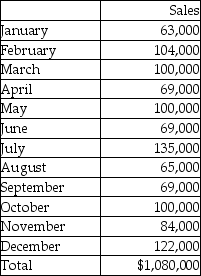

The publisher of Accounting Digest received the following 12-month subscriptions during 2021. Each subscription is $100. The company has a December 31 year end. Each subscription becomes effective in the calendar month after the company receives the subscription. What amount of revenue will the company record in 2021 for the subscriptions received between January-March? (Round your response to the nearest dollar).

A)$315,000

B)$779,167

C)$1,051,667

D)$1,260,000

A)$315,000

B)$779,167

C)$1,051,667

D)$1,260,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

26

In July, Telly-Rental sells a home theatre for $1,000 on an installment basis. The cost of goods sold is $400. How much deferred gross profit is recorded by Telly-Rental in July?

A)$0

B)$400

C)$600

D)$1,000

A)$0

B)$400

C)$600

D)$1,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

27

Simple Inc. had sales of $1,500,000, including: •$30,000 of goods sold that were on consignment from an unrelated company on December 28, 2021

•$10,000 of goods shipped F.O.B shipping point on December 28, 2021.

•$20,000 of goods shipped F.O.B. destination point on December 31, 2021.

On its income statement, what amount of net sales should Simple Inc. record for 2021?

A)$1,440,000

B)$1,470,000

C)$1,480,000

D)$1,490,000

•$10,000 of goods shipped F.O.B shipping point on December 28, 2021.

•$20,000 of goods shipped F.O.B. destination point on December 31, 2021.

On its income statement, what amount of net sales should Simple Inc. record for 2021?

A)$1,440,000

B)$1,470,000

C)$1,480,000

D)$1,490,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

28

Philips Corp. is unsure how to record the following transactions: •$60,000 of goods shipped F.O.B shipping point on December 28, 2021.

•$50,000 of goods shipped F.O.B. destination point on December 31, 2021.

What amount of sales related to these two transactions should Philips Corp. record in fiscal 2021?

A)$0

B)$50,000

C)$60,000

D)$110,000

•$50,000 of goods shipped F.O.B. destination point on December 31, 2021.

What amount of sales related to these two transactions should Philips Corp. record in fiscal 2021?

A)$0

B)$50,000

C)$60,000

D)$110,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

29

On June 1, Electronics Distribution ships 100 TVs to TV World on consignment. The cost of each unit is $600 and the unit selling price is $750. At the end of June, TV World sold 50 units. How much cost of sales should be recorded by Electronics Distribution for the month of June?

A)$37,500

B)$30,000

C)$60,000

D)$75,000

A)$37,500

B)$30,000

C)$60,000

D)$75,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following is an acceptable revenue-recognition method?

A)At time of shipment, if warranty uncertainty is not reliably measurable.

B)At time of shipment to the consignee, for consignment sales.

C)Installment method, if credit risk is high.

D)At the point of sale, if credit risk is very high.

A)At time of shipment, if warranty uncertainty is not reliably measurable.

B)At time of shipment to the consignee, for consignment sales.

C)Installment method, if credit risk is high.

D)At the point of sale, if credit risk is very high.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

31

In July, Telly-Rental sells a home theatre for $1,000 on an installment basis. The system costs Telly-Rental $400. Telly-Rental generally earns a gross profit of 15%. How much revenue is recorded by Telly-Rental in July?

A)$0

B)$150

C)$400

D)$1,000

A)$0

B)$150

C)$400

D)$1,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

32

The publisher of TV Weekly received the following 52-week subscriptions during the first quarter of fiscal 2021. Each subscription is $110, which is a 47% discount off the newsstand price of $4 per issue. Each subscription becomes effective in the calendar month after the company receives the subscription. The company has a December 31 fiscal year. What amount of revenue will the company record in 2021 for the subscriptions received in January? (Round your response to the nearest dollar).

A)$247,142

B)$250,690

C)$433,583

D)$1,279,500

A)$247,142

B)$250,690

C)$433,583

D)$1,279,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

33

In September, Fast-Foods Inc. (FF)sells a franchise for an initial fee of $150,000 and ongoing fees based on 3% of gross profit. FF estimates that 20% of the initial fee relates to initial training, store design and opening activities; the remaining 80% relate to activities to be performed over 3 years. How much revenue should be recorded in September?

A)$4,500

B)$30,000

C)$120,000

D)$150,000

A)$4,500

B)$30,000

C)$120,000

D)$150,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

34

YMN had sales of $1,500,000, including: •$25,000 of goods shipped on consignment to an unrelated company on December 28, 2021 and received by that company on December 31, 2021

•$20,000 of goods shipped F.O.B. shipping point to a different unrelated party on December 31, 2021 and received on January 2, 2022.

On its income statement, what amount of net sales should YMN record for 2021?

A)$1,455,000

B)$1,475,000

C)$1,525,000

D)$1,545,000

•$20,000 of goods shipped F.O.B. shipping point to a different unrelated party on December 31, 2021 and received on January 2, 2022.

On its income statement, what amount of net sales should YMN record for 2021?

A)$1,455,000

B)$1,475,000

C)$1,525,000

D)$1,545,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

35

On September 1, 2021, Electric Depot sold 100 laptop computers at $750 each with a 120-day unconditional right of return. Customers have 90 days to pay. Based on past experience, Electric Depot estimates that approximately 1% will be returned. Which of the following is TRUE regarding Electric Depot's December 31, 2021 financial statements?

A)Sales of $75,000 should only be recognized after 120 days when the return privilege expires.

B)Sales of $74,250 should be recognized and a provision for refund liability of $750 established in September.

C)Sales of $75,000 should be recognized in September 2021.

D)Sales should only be recognized as the related cash is collected.

A)Sales of $75,000 should only be recognized after 120 days when the return privilege expires.

B)Sales of $74,250 should be recognized and a provision for refund liability of $750 established in September.

C)Sales of $75,000 should be recognized in September 2021.

D)Sales should only be recognized as the related cash is collected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

36

Harris Corporation sold hardware and software for $70,000 cash. In addition, the company will provide support on the software for 1 year and maintenance on the hardware for 3 years. The observable stand-alone selling prices are as follows:

a. Determine how revenue should be allocated to the various components in this transaction.

a. Determine how revenue should be allocated to the various components in this transaction.

b. Apply the appropriate revenue recognition criteria to determine when revenue should be recognized for the various components of this transaction.

a. Determine how revenue should be allocated to the various components in this transaction.

a. Determine how revenue should be allocated to the various components in this transaction.b. Apply the appropriate revenue recognition criteria to determine when revenue should be recognized for the various components of this transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

37

RU FIT Centre opened for business on April 5, 2021. For revenue recognition purposes, all memberships are assumed to be issued at the beginning of the month, with 1-year memberships costing $600 and 2-year memberships costing $960. During April, 32 1-year memberships and 25 2-year memberships were sold. RU FIT Centre prepares monthly financial statements. Which of the following statements is correct?

A)Revenue to be recognized as earned for the month of April is $2,600.

B)Revenue to be recognized as earned for the month of April is $3,600.

C)Revenue to be recognized as earned for the month of April is $43,200.

D)Deferred revenue at April 30 would be $43,200.

A)Revenue to be recognized as earned for the month of April is $2,600.

B)Revenue to be recognized as earned for the month of April is $3,600.

C)Revenue to be recognized as earned for the month of April is $43,200.

D)Deferred revenue at April 30 would be $43,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

38

On June 1, Electronics Distribution ships 100 TVs to TV World on consignment. Electronic Distribution's pays its wholesaler $500 for each TV. It then sells each TV for $800 to its retail customers including TV World. At the end of June, TV World sold 50 units. How much revenue should be recorded by Electronics Distribution for the month of June?

A)$80,000

B)$50,000

C)$40,000

D)$25,000

A)$80,000

B)$50,000

C)$40,000

D)$25,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

39

In July, Telly-Rental sells a home theatre for $1,000 on an installment basis. Telly-Rental generally earns a gross margin of 25%. The customer pays $500 in December. How much revenue is recorded by Telly-Rental in December?

A)$125

B)$250

C)$500

D)$1,000

A)$125

B)$250

C)$500

D)$1,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

40

On December 1, 2021, SuperTech sold 100 locks for laptop computers at $50 each with a 90-day unconditional right of return. Since this is a new product for SuperTech, it has no past history regarding estimated returns. Which of the following is TRUE regarding SuperTech's December 31, 2021 financial statements?

A)Sales of $5,000 should only be recognized in 2022 when the return privilege expires.

B)Sales of $5,000 should be recognized in 2021 as long as there is a reserve for returns.

C)Sales of $5,000 should be recognized in 2021, with future costs accrued as an estimated liability.

D)Sales should only be recognized as the related cash is collected.

A)Sales of $5,000 should only be recognized in 2022 when the return privilege expires.

B)Sales of $5,000 should be recognized in 2021 as long as there is a reserve for returns.

C)Sales of $5,000 should be recognized in 2021, with future costs accrued as an estimated liability.

D)Sales should only be recognized as the related cash is collected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following methods of revenue recognition would be selected when a vendor has another firm acting as its selling agent?

A)Cost recovery method.

B)Returned goods method.

C)Installment sales method.

D)Consignment sales method.

A)Cost recovery method.

B)Returned goods method.

C)Installment sales method.

D)Consignment sales method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

42

Here are some financial records for Accounting Plus Magazine which started operations in October 2021. Sales for its first month were as follows: What would be the subscription revenue to be recognized for the month of Oct 2021? (Round to the nearest dollar).

A)$68,333

B)$107,667

C)$774,333

D)$882,000

A)$68,333

B)$107,667

C)$774,333

D)$882,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

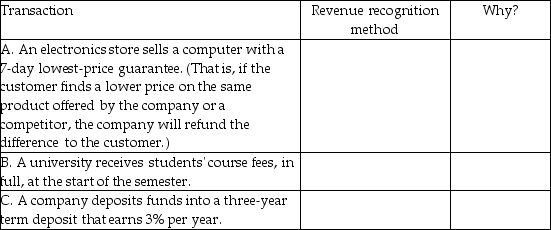

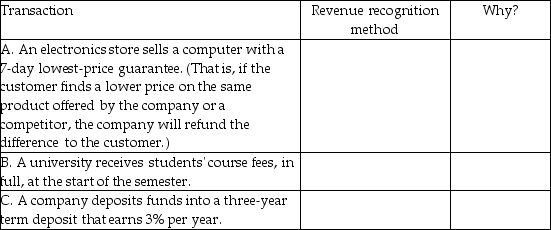

43

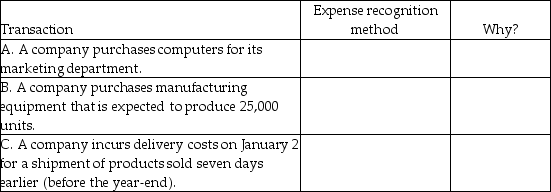

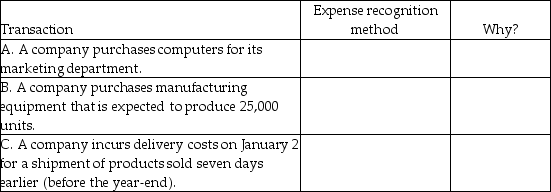

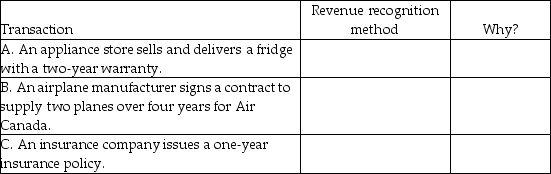

In the chart below, identify the revenue recognition method that you feel is most appropriate and also explain why.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

44

On January 1, 2021 Sukhi's Cycles Inc. sells a motorcycle for $24,000. Terms offered are $10,000 cash; $7,000 due on January 1, 2022, and $7,000 due on January 1, 2023. The market interest rate for transactions of this type is 4.0% per annum. What is the amount of revenue that Sukhi should record at time of sale?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

45

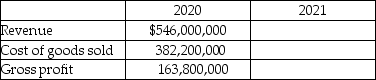

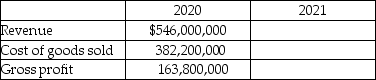

Aurora Gold Company produced 650,000 ounces of gold in 2021. Average sales price was $870/oz. The price was $870/oz at the start of the year and $870/oz at the end of the year. Production cost averaged $588/oz, which has been stable for several years. The company had 50,000 ounces in inventory at the beginning of the year, and 20,000 ounces at the end of the year.

Required:

a)Calculate Aurora Gold's revenue, cost of goods sold, and gross profit, assuming the company recognizes revenue at the point of sale/delivery.

b)Determine the amount that should be shown as ending inventory on Aurora's 2021 balance sheet.

b)Determine the amount that should be shown as ending inventory on Aurora's 2021 balance sheet.

Required:

a)Calculate Aurora Gold's revenue, cost of goods sold, and gross profit, assuming the company recognizes revenue at the point of sale/delivery.

b)Determine the amount that should be shown as ending inventory on Aurora's 2021 balance sheet.

b)Determine the amount that should be shown as ending inventory on Aurora's 2021 balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

46

Jennifer Furnishings frequently has sales involving "no down payment and no payments for three months." Three months after the purchase date, customers make four equal monthly payments (i.e., they make equal payments 3, 4, 5, and 6 months after purchase). Each payment is one-quarter of the purchase price. The company has a December 31 year-end. During 2021, the company made the following sales on installment plans. Jennifer makes 15% gross profit on these sales.

Required: Using the installment sales method and ignoring the time value of money

Required: Using the installment sales method and ignoring the time value of money

a)Determine the balance of installment accounts receivable at December 31, 2021.

b)Determine the amount of deferred gross profit as at December 31, 2021. (Round to the nearest whole dollar.)

c)Determine the sales revenue to recognize in 2021 for installment sales made in the year.

Required: Using the installment sales method and ignoring the time value of money

Required: Using the installment sales method and ignoring the time value of moneya)Determine the balance of installment accounts receivable at December 31, 2021.

b)Determine the amount of deferred gross profit as at December 31, 2021. (Round to the nearest whole dollar.)

c)Determine the sales revenue to recognize in 2021 for installment sales made in the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

47

Compare and contrast the revenue recognition criteria for a transaction involving the sale of goods with a transaction involving the provision of services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

48

Based on the note disclosure provided below for XYZ Group, when would the following types of revenue be recognized?

a)Consignment sales of vehicles (Sales with repurchase commitments).

b)Financial services.

c)Lease rentals.

d)Post-sale services (Multiple-component contracts).

e)Sale of products.

Revenues from the sale of products are recognized when the risks and rewards of ownership of the goods are transferred to the customer, the sales price is agreed or determinable and receipt of payment can be assumed. Revenues are stated net of discounts, allowances, settlement discount and rebates. In the case of long-term contracts, revenues are generally recognized in accordance with IFRS 15 (Revenue)on the basis of the stage of completion of work performed using the percentage of completion method. Revenues also include lease rentals and interest income from financial services. Revenues for the Financial Operations sub-group also include the interest income earned by Group financing companies.

If the sale of products includes a determinable amount for subsequent services ("multiple performance obligation contracts")the related revenues are deferred and recognized as income over the period of the contract. Amounts are normally recognized as income by reference to the expected pattern of related expenditure.

Profits arising on the sale of vehicles for which a Group company retains a repurchase commitment (buy-back contracts)are not recognized until such profits have been realized. The vehicles are included in inventories and stated at cost.

a)Consignment sales of vehicles (Sales with repurchase commitments).

b)Financial services.

c)Lease rentals.

d)Post-sale services (Multiple-component contracts).

e)Sale of products.

Revenues from the sale of products are recognized when the risks and rewards of ownership of the goods are transferred to the customer, the sales price is agreed or determinable and receipt of payment can be assumed. Revenues are stated net of discounts, allowances, settlement discount and rebates. In the case of long-term contracts, revenues are generally recognized in accordance with IFRS 15 (Revenue)on the basis of the stage of completion of work performed using the percentage of completion method. Revenues also include lease rentals and interest income from financial services. Revenues for the Financial Operations sub-group also include the interest income earned by Group financing companies.

If the sale of products includes a determinable amount for subsequent services ("multiple performance obligation contracts")the related revenues are deferred and recognized as income over the period of the contract. Amounts are normally recognized as income by reference to the expected pattern of related expenditure.

Profits arising on the sale of vehicles for which a Group company retains a repurchase commitment (buy-back contracts)are not recognized until such profits have been realized. The vehicles are included in inventories and stated at cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

49

Soorya Manufacturing makes educational toys that are sold to retailers on the following contractual terms: Each type of toy has a fixed wholesale price, is shipped F.O.B. shipping point, and payment is due 45 days after the shipment. The retailer may return a maximum of 45% of an order at the retailer's expense up to 6 months after delivery. Sales are made only to retailers that have a good credit rating.

Required:

a)Identify at least four different revenue recognition points that Soorya could use for its sales.

b)What revenue recognition criteria should Soorya use to determine when revenue should be recorded?

Required:

a)Identify at least four different revenue recognition points that Soorya could use for its sales.

b)What revenue recognition criteria should Soorya use to determine when revenue should be recorded?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

50

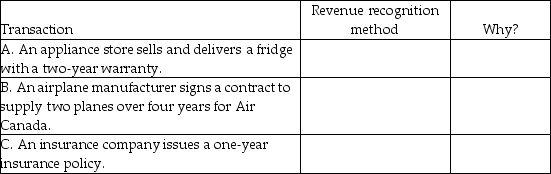

In the chart below, identify the expense recognition method that you feel is most appropriate and also explain why.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

51

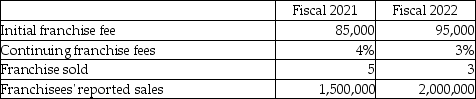

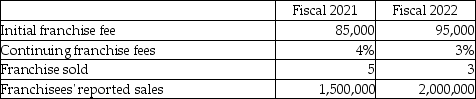

McNicols started selling franchise locations in April 2021. The franchisee pays continuing fees based on annual sales. The initial fee relates to finding a store location and training the franchisee at McNicols' training facility over a 2-year period.

Required:

Required:

a)Explain how McNicols should account for the initial fee. Ignore the time value of money.

b)Assume that management estimates that 40% of the value of services related to the initial fee is fulfilled in the first year of signing the franchise agreement. Provide the journal entries to record this revenue in fiscal 2021 and in 2022.

c)Explain how McNicols should account for the ongoing fees.

d)Provide the journal entries to record the ongoing fees in fiscal 2021 and 2022.

Required:

Required:a)Explain how McNicols should account for the initial fee. Ignore the time value of money.

b)Assume that management estimates that 40% of the value of services related to the initial fee is fulfilled in the first year of signing the franchise agreement. Provide the journal entries to record this revenue in fiscal 2021 and in 2022.

c)Explain how McNicols should account for the ongoing fees.

d)Provide the journal entries to record the ongoing fees in fiscal 2021 and 2022.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

52

In the chart below, identify the revenue recognition method that you feel is most appropriate and also explain why.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

53

On January 1, 2021 Sukhi's Cycles Inc. sells a motorcycle for $24,000. Terms offered are $10,000 cash with the balance of $14,000 due on January 1, 2023. The market interest rate for transactions of this type is 5% per annum. What is the amount of revenue that Sukhi should record at time of sale?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following statements is correct about the revenue recognition criteria for a performance obligation satisfied over time?

A)The outcome of the performance obligation must be reasonably estimable before the percentage of completion method can be used to record revenue.

B)The selling entity creates an asset that the selling asset controls..

C)The selling entity creates an asset with an alternative use to the selling entity

D)The selling entity does not have an enforceable right to payment for the performance completed to date.

A)The outcome of the performance obligation must be reasonably estimable before the percentage of completion method can be used to record revenue.

B)The selling entity creates an asset that the selling asset controls..

C)The selling entity creates an asset with an alternative use to the selling entity

D)The selling entity does not have an enforceable right to payment for the performance completed to date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

55

Soorya Manufacturing makes educational toys that are sold to retailers on the following terms: Each type of toy has a fixed wholesale price, is shipped F.O.B. shipping point, and payment is due 45 days after the shipment. The retailer may return a maximum of 45% of an order at the retailer's expense up to 6 months after delivery. Sales are made only to retailers that have a good credit rating. In Soorya's 11 years of existence, the company has experienced a return rate of approximately 15%, a bad debt expense of 5% of sales and an average collection period of 90 days. Soorya provides a bonus to its senior managers based on annual revenues, net of returns.

Required:

a. Identify at least three different revenue recognition points that Soorya could use to record revenue.

b. What revenue recognition criteria should Soorya use to determine when revenue should be recorded?

c. Discuss the pros and cons for 2 alternative recognition points mentioned in point (a). Remember to support your reasoning with case facts.

d. Recommend the recognition point that Soorya should use in its financial statements.

Required:

a. Identify at least three different revenue recognition points that Soorya could use to record revenue.

b. What revenue recognition criteria should Soorya use to determine when revenue should be recorded?

c. Discuss the pros and cons for 2 alternative recognition points mentioned in point (a). Remember to support your reasoning with case facts.

d. Recommend the recognition point that Soorya should use in its financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

56

Larimar Computers provides customers the option to purchase products with three installment payments made over 12 months (equal payments at the end of the 4th, 8th, and 12th months). In January 2021, Larimar sold $39,000 of computers to one customer on this installment plan. The cost of these computers is $30,420.

Required:

Using the installment sales method, record the journal entries for Larimar's installment sales made in January 2021 and the subsequent payments received on each installment date. Assume all installment payments are received, and ignore the time value of money.

Required:

Using the installment sales method, record the journal entries for Larimar's installment sales made in January 2021 and the subsequent payments received on each installment date. Assume all installment payments are received, and ignore the time value of money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

57

Through non-subscription sales, TV Weekly provides retailers with a 50% margin (or 100% mark up)on its magazines. The newsstand price is $8 per issue. During 2021, the company distributed 1,654,000 copies to retailers, not all of which were sold. Retailers sent a total of 390,000 unsold copies back to the publisher, of which 30,000 copies were for last two issues published in 2020. In January 2022, the company received 27,000 unsold copies for magazines published in the last weeks of December 2021.

Required:

Determine the amount of revenue from non-subscriptions TV Weekly should recognize in 2021.

Required:

Determine the amount of revenue from non-subscriptions TV Weekly should recognize in 2021.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

58

On January 1, 2021 Sukhi's Cycles Inc. sells a motorcycle for $24,000. Terms offered are $1,000 per month first due February 1, 2021. The market interest rate for transactions of this type is 0.25% per month. What is the amount of revenue that Sukhi should record at time of sale?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

59

Lagory Co. started a contract in June 2020 to build a bridge at a fixed price of $14 million. The bridge was to be completed by October 2022. Total cumulative costs incurred by the end of December 2020 and 2021 were $2 million and $6 million, respectively. Lagory Co. is unable to estimate the total costs of the project prior to completion. Final costs at the end of the project totalled $11 million. How much revenue will Lagory Co. report in 2021?

A)$2,000,000

B)$3,000,000

C)$4,000,000

D)$14,000,000

A)$2,000,000

B)$3,000,000

C)$4,000,000

D)$14,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

60

Here are some financial records for Accounting Plus Magazine which started operations in October 2021. Sales for its first month were as follows: What would be the deferred revenue at Oct 31, 2021? (Round to the nearest dollar).

A)$107,667

B)$341,667

C)$774,333

D)$882,000

A)$107,667

B)$341,667

C)$774,333

D)$882,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

61

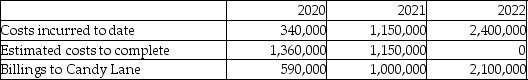

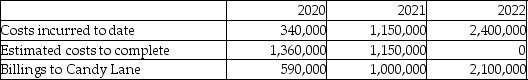

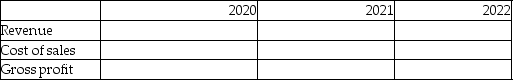

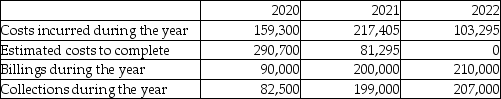

On July 1, 2020, Cusak Construction Company Inc. contracted to build an office building for Candy Lane Corp. for a total contract price of $2,150,000. On July 1, Cusak estimated that it would take between two and three years to complete the building. In October 2022, the building was deemed substantially completed. Following are accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to Candy Lane in 2020, 2021, and 2022.

Required:

Required:

Using the percentage of completion method, calculate the revenue and profit or loss to be recognized as a result of this contract for the years ended December 31, 2020, 2021, and 2022. The company used the cost-to-cost method to estimate the percentage complete.

Required:

Required:Using the percentage of completion method, calculate the revenue and profit or loss to be recognized as a result of this contract for the years ended December 31, 2020, 2021, and 2022. The company used the cost-to-cost method to estimate the percentage complete.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

62

Nova Construction Company (NCC)entered into a contract to build a school for $1,800,000. Construction commenced on May 1, 2020, with a planned completion date of December 31, 2022. A summary of the related accounting information is provided below: How much gross profit would be recognized in fiscal 2020 if NCC uses the percentage of completion method?

A)$50,000

B)$100,000

C)$130,000

D)$180,000

A)$50,000

B)$100,000

C)$130,000

D)$180,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which statement best explains the completed contract method?

A)An accounting method that defers revenue and expense recognition until the date when the contractor completes the project.

B)An accounting method that recognizes revenue and expenses on a contract in proportion to the degree of progress.

C)An accounting method that recognizes an amount of revenue equal to the costs that are expected to be recovered on the contract.

D)An accounting method that recognizes revenue and expenses based on the fair value of the contract.

A)An accounting method that defers revenue and expense recognition until the date when the contractor completes the project.

B)An accounting method that recognizes revenue and expenses on a contract in proportion to the degree of progress.

C)An accounting method that recognizes an amount of revenue equal to the costs that are expected to be recovered on the contract.

D)An accounting method that recognizes revenue and expenses based on the fair value of the contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

64

Ying Construction Company entered into a contract to build a new airport terminal for $2,500,000. Construction commenced on August 1, 2020, with a planned completion date of December 31, 2022. A summary of the costs, billings, and collections is provided below: Ying uses the percentage of completion method. What amount would appear as accounts receivable on Ying's December 31, 2021 balance sheet?

A)$100,000

B)$140,000

C)$1,000,000

D)$1,400,000

A)$100,000

B)$140,000

C)$1,000,000

D)$1,400,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

65

Pool Contractors (PC)entered into a contract to build a solar heated swimming complex for $1,800,000. Construction commenced on July 1, 2020, with a planned completion date of December 31, 2022. A summary of the related accounting information is provided below: How much gross profit would be recognized in fiscal 2021 if PC uses the percentage of completion method?

A)$50,000

B)$100,000

C)$130,000

D)$180,000

A)$50,000

B)$100,000

C)$130,000

D)$180,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

66

Queensbridge Corp. started a contract in June 2020 to build a bridge at a fixed price of $45 million. The bridge was to be completed by October 2022 at a total estimated cost of $35 million. Total cumulative costs incurred by the end of December 2020 and 2021 were $7 million and $24 million, respectively. Because of cost overruns in 2021, it is now expected that the project will cost $5,000,000 more than originally estimated. Final costs at the end of the project totaled $36 million. Queensbridge Corp. follows the guidance in IFRS.

Required:

Determine the amount of gross profit to be recognized for the years ended December 31, 2020 and December 31, 2021.

Required:

Determine the amount of gross profit to be recognized for the years ended December 31, 2020 and December 31, 2021.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

67

Early in 2021, Forest Ltd. signed a contract to construct a warehouse. Forest's management estimated the gross profit on the contract to be $740,000, as indicated by the following: At the end of 2021, the status of the work on the contract was as follows:

How much revenue can be recognized on this contract for 2021, assuming that Forest uses the

Percentage of completion basis for long-term construction contracts (round to nearest dollar)?

A)$333,000

B)$863,333

C)$1,575,000

D)$1,711,957

How much revenue can be recognized on this contract for 2021, assuming that Forest uses the

Percentage of completion basis for long-term construction contracts (round to nearest dollar)?

A)$333,000

B)$863,333

C)$1,575,000

D)$1,711,957

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

68

Tyco Ltd entered into a contract to build a sports arena for $1,800,000. Construction commenced on August 1, 2020, with a planned completion date of December 31, 2022. A summary of the related accounting information is provided below: How much would the balance in accounts receivable be on the balance sheet of Tyco at the end of 2020 if Tyco uses the percentage of completion method?

A)$110,000

B)$60,000

C)$500,000

D)$660,000

A)$110,000

B)$60,000

C)$500,000

D)$660,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

69

How is revenue recognized on a cost plus 7% contract?

A)Revenue is recognized only after the contract is completed.

B)Revenue and expenses are recognized in proportion to the degree of progress.

C)Record an amount of revenue equal to the costs that are expected to be recovered on the contract.

D)Revenue equal to the cost plus 7% profit will be recorded each year.

A)Revenue is recognized only after the contract is completed.

B)Revenue and expenses are recognized in proportion to the degree of progress.

C)Record an amount of revenue equal to the costs that are expected to be recovered on the contract.

D)Revenue equal to the cost plus 7% profit will be recorded each year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

70

Yang Construction Company entered into a contract to build a new airport terminal for $2,500,000. Construction commenced on August 1, 2020, with a planned completion date of December 31, 2022. A summary of the costs, billings, and collections is provided below: Yang uses the percentage of completion method. How much gross profit would Yang recognize in 2021?

A)$100,000 loss

B)$75,000 loss

C)$50,000 profit

D)$100,000 profit

A)$100,000 loss

B)$75,000 loss

C)$50,000 profit

D)$100,000 profit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

71

Nichols Construction Company (NCC)entered into a contract to build a shopping complex for $1,900,000. Construction commenced on July 1, 2020, with a planned completion date of December 31, 2022. A summary of the related accounting information is provided below: How much would the balance in accounts receivable be on the balance sheet of NCC at the end of 2021 if NCC uses the percentage of completion method?

A)$130,000

B)$390,000

C)$790,000

D)$1,100,000

A)$130,000

B)$390,000

C)$790,000

D)$1,100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

72

WestCoast Co. started a contract in June 2020 to build a bridge at a fixed price of $14 million. The bridge was to be completed by October 2022. Total cumulative costs incurred by the end of December 2020 and 2021 were $2 million and $6 million, respectively. WestCoast Co. is unable to estimate the total costs of the project prior to completion. Final costs at the end of the project totaled $11 million.

Required:

Determine the amount of revenue, cost of sales, and gross profit WestCoast Co. would report in 2020, 2021, and 2022.

Required:

Determine the amount of revenue, cost of sales, and gross profit WestCoast Co. would report in 2020, 2021, and 2022.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which statement about the percentage of completion method is correct?

A)This method recognizes revenue on a straight-line basis.

B)This method can only be used if there are no uncertainties about how much the contract will cost or how long it will take to complete.

C)This method allocates revenue, not construction costs.

D)This method allocates construction costs, not revenue.

A)This method recognizes revenue on a straight-line basis.

B)This method can only be used if there are no uncertainties about how much the contract will cost or how long it will take to complete.

C)This method allocates revenue, not construction costs.

D)This method allocates construction costs, not revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which statement best explains the percentage of completion method?

A)An accounting method that recognizes revenue and expenses on a contract only after it is completed.

B)An accounting method that recognizes revenue and expenses on a contract in proportion to the degree of progress.

C)An accounting method that recognizes an amount of revenue equal to the costs that are expected to be recovered on the contract.

D)An accounting method that recognizes revenue and expenses based on the fair value of the contract.

A)An accounting method that recognizes revenue and expenses on a contract only after it is completed.

B)An accounting method that recognizes revenue and expenses on a contract in proportion to the degree of progress.

C)An accounting method that recognizes an amount of revenue equal to the costs that are expected to be recovered on the contract.

D)An accounting method that recognizes revenue and expenses based on the fair value of the contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

75

Explain how a company records revenue and expenses for a long-term contract under IFRS. Include an explanation of how changes in estimates are accounted for under this method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

76

Algae builds large ships and uses the percentage of completion method of revenue recognition. The following information pertains to the construction contracts it had in place as of its December 31, 2021 year-end. How much revenue will Algae recognize in 2020?

A)$260 million

B)$325 million

C)$433 million

D)$1,300 million

A)$260 million

B)$325 million

C)$433 million

D)$1,300 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

77

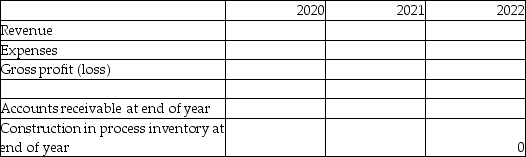

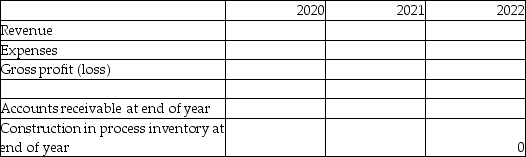

Jones Contractors Inc. agreed to construct a building for $500,000. Construction commenced in 2020 and was completed in 2022.

Required:

Required:

For each of the three years, determine the following amounts relating to the above contract: revenue, expenses, gross profit, accounts receivable balance, and construction-in-process inventory balance.

Required:

Required:For each of the three years, determine the following amounts relating to the above contract: revenue, expenses, gross profit, accounts receivable balance, and construction-in-process inventory balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

78

Sunshine Contractors started a contract in January 2020 to build a bridge at a fixed price of $14 million. The bridge was to be completed by October 2022 Total cumulative costs incurred by the end of December 2020 and 2021 were $2 million and $6 million, respectively. Sunshine is unable to estimate the total costs of the project prior to completion. Final costs at the end of the project totaled $11 million. How much cost of sales will Sunshine report in 2022?

A)$3,000,000

B)$5,000,000

C)$8,000,000

D)$11,000,000

A)$3,000,000

B)$5,000,000

C)$8,000,000

D)$11,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which statement best explains the cost recovery method?

A)An accounting method that recognizes revenue and expenses on a contract only after it is completed.

B)An accounting method that recognizes revenue and expenses on a contract in proportion to the degree of progress.

C)An accounting method that recognizes contract costs as incurred and an amount of revenue equal to the costs that are expected to be recovered on the contract.

D)An accounting method that recognizes revenue and expenses based on the fair value of the contract.

A)An accounting method that recognizes revenue and expenses on a contract only after it is completed.

B)An accounting method that recognizes revenue and expenses on a contract in proportion to the degree of progress.

C)An accounting method that recognizes contract costs as incurred and an amount of revenue equal to the costs that are expected to be recovered on the contract.

D)An accounting method that recognizes revenue and expenses based on the fair value of the contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

80

Nichols Construction Company (NCC)entered into a contract to build a shopping complex for $1,900,000. Construction commenced on July 1, 2020, with a planned completion date of December 31, 2022. A summary of the related accounting information is provided below: How much would the balance in accounts receivable be on the balance sheet of NCC at the end of 2022 if NCC uses the percentage of completion method?

A)$0

B)$250,000

C)$290,000

D)$800,000

A)$0

B)$250,000

C)$290,000

D)$800,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck