Deck 4: Payment for Goods and Services: Cash and Accounts Receivable

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

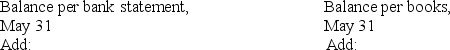

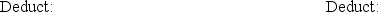

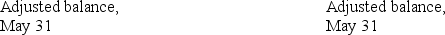

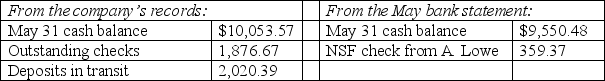

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

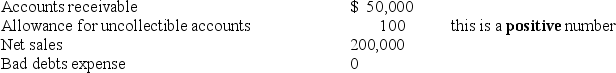

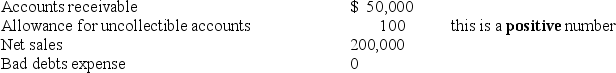

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

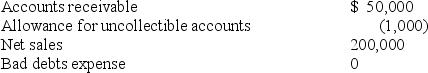

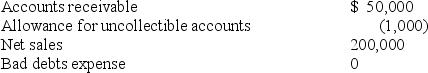

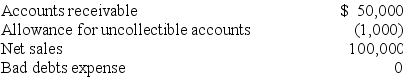

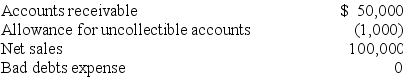

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

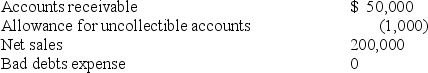

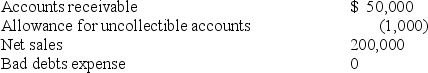

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/195

العب

ملء الشاشة (f)

Deck 4: Payment for Goods and Services: Cash and Accounts Receivable

1

Which of the following items from Kash Kow's bank reconciliation requires an adjusting entry on Kash Kow's books?

A)deposits in transit

B)outstanding checks

C)bank service charges

D)an error made by the bank on the bank statement

A)deposits in transit

B)outstanding checks

C)bank service charges

D)an error made by the bank on the bank statement

C

2

The accountant found that four outstanding checks worth a total of $990 were not on the bank statement.On the bank reconciliation,this amount should be ________.

A)added to the balance per books

B)deducted from the balance per books

C)added to the balance per bank statement

D)deducted from the balance per bank statement

A)added to the balance per books

B)deducted from the balance per books

C)added to the balance per bank statement

D)deducted from the balance per bank statement

D

3

Making a comparison between the cash balance in the accounting records and on the bank statement is called a bank reconciliation.

True

4

Which of the following is NOT correct when preparing a bank reconciliation?

A)Outstanding checks are added to the balance per books.

B)Deposits in transit are added to the balance per bank statement.

C)Bank service charges are deducted from the balance per books.

D)NSF checks are deducted from the balance per books.

A)Outstanding checks are added to the balance per books.

B)Deposits in transit are added to the balance per bank statement.

C)Bank service charges are deducted from the balance per books.

D)NSF checks are deducted from the balance per books.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

5

According to its August 31 bank statement,X Co's bank account held $10,000.Deposits in transit were $3,000; outstanding checks were $1,000; bank service charges were $10; and a customer's check for $50 was returned NSF.How much cash should X Co report on its August 31 balance sheet?

A)$10,000

B)$12,000

C)$9,940

D)$8,000

A)$10,000

B)$12,000

C)$9,940

D)$8,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

6

First Bank charged Team Shirts $100 in services charges for September.On the bank reconciliation,the $100 should be ________.

A)added to the balance per books

B)deducted from the balance per books

C)added to the balance per bank statement

D)deducted from the balance per bank statement

A)added to the balance per books

B)deducted from the balance per books

C)added to the balance per bank statement

D)deducted from the balance per bank statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

7

X Company used the following items to complete its bank reconciliation for the month of October: ∙ Deposits in transit were $2,500.

∙ Outstanding checks totaled $1,100.

∙ Bank service charges were $10.

∙ The company correctly wrote a check for $192,but mistakenly recorded the check as $129 on its books.The bank cashed the check correctly for $192.

∙ A customer's check for $50 was returned by the bank,NSF.

The $1,100 of outstanding checks should be ________.

A)added to the balance per bank statement

B)deducted from the balance per bank statement

C)added to the balance per books

D)deducted from the balance per books

∙ Outstanding checks totaled $1,100.

∙ Bank service charges were $10.

∙ The company correctly wrote a check for $192,but mistakenly recorded the check as $129 on its books.The bank cashed the check correctly for $192.

∙ A customer's check for $50 was returned by the bank,NSF.

The $1,100 of outstanding checks should be ________.

A)added to the balance per bank statement

B)deducted from the balance per bank statement

C)added to the balance per books

D)deducted from the balance per books

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

8

Preparing a bank reconciliation enables a company to ________.

A)locate any errors,whether made by the bank or by the company

B)make adjustments for transactions that have already been recorded in the accounting records

C)make adjustments in the cash accounts

D)update the bank statements

A)locate any errors,whether made by the bank or by the company

B)make adjustments for transactions that have already been recorded in the accounting records

C)make adjustments in the cash accounts

D)update the bank statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

9

X Company used the following items to complete its bank reconciliation for the month of October: ∙ Deposits in transit were $2,500.

∙ Outstanding checks totaled $1,100.

∙ Bank service charges were $10.

∙ The company correctly wrote a check for $192,but mistakenly recorded the check as $129 on its books.The bank cashed the check correctly for $192.

∙ A customer's check for $50 was returned by the bank,NSF.

How should the check for $192 that was recorded as $129 be treated?

A)added to the balance per bank statement

B)deducted from the balance per bank statement

C)added to the balance per books

D)deducted from the balance per books

∙ Outstanding checks totaled $1,100.

∙ Bank service charges were $10.

∙ The company correctly wrote a check for $192,but mistakenly recorded the check as $129 on its books.The bank cashed the check correctly for $192.

∙ A customer's check for $50 was returned by the bank,NSF.

How should the check for $192 that was recorded as $129 be treated?

A)added to the balance per bank statement

B)deducted from the balance per bank statement

C)added to the balance per books

D)deducted from the balance per books

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

10

The March bank statement for Jem's Jewelers showed an NSF check for $125.On the bank reconciliation,the amount of the check should be ________.

A)added to the balance per books

B)deducted from the balance per books

C)added to the balance per bank statement

D)deducted from the balance per bank statement

A)added to the balance per books

B)deducted from the balance per books

C)added to the balance per bank statement

D)deducted from the balance per bank statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

11

Team Shirts deposited a check written for $325.However,the accountant entered the amount as $235 into the books.On the bank statement the amount deposited was correctly entered as $325.On the bank reconciliation,the $90 should be ________.

A)added to the balance per books

B)deducted from the balance per books

C)added to the balance per bank statement

D)deducted from the balance per bank statement

A)added to the balance per books

B)deducted from the balance per books

C)added to the balance per bank statement

D)deducted from the balance per bank statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

12

Team Shirts made a deposit of $150 on March 31 to its account at First Bank.The deposit did not appear on the March bank statement.On its bank reconciliation,Team Shirts should ________.

A)add $150 to the Team Shirts' balance per books

B)subtract $150 from the Team Shirts' balance per books

C)add $150 to the balance per bank statement

D)subtract $150 from the balance per bank statement

A)add $150 to the Team Shirts' balance per books

B)subtract $150 from the Team Shirts' balance per books

C)add $150 to the balance per bank statement

D)subtract $150 from the balance per bank statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

13

The August bank statement for Midway Company showed that the bank had collected a $5,000 note receivable for the company.Midway Company has not recorded the collection.On the bank reconciliation,the $5,000 should be ________.

A)added to the balance per books

B)deducted from the balance per books

C)added to the balance per bank statement

D)deducted from the balance per bank statement

A)added to the balance per books

B)deducted from the balance per books

C)added to the balance per bank statement

D)deducted from the balance per bank statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

14

A common item on the bank reconciliation is ________.

A)outstanding checks,which are added to the balance per bank statement

B)outstanding checks,which are added to the balance per books

C)deposits in transit,which are added to the balance per bank statement

D)deposits in transit,which are added to the balance per books

A)outstanding checks,which are added to the balance per bank statement

B)outstanding checks,which are added to the balance per books

C)deposits in transit,which are added to the balance per bank statement

D)deposits in transit,which are added to the balance per books

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

15

In preparing a bank reconciliation,outstanding checks are added to the balance per books.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

16

Goldilocks is the bookkeeper for Three Bears Company.She prepared the company's bank reconciliation at the end of the year and found only two reconciling items: deposits in transit of $2,850 and outstanding checks of $3,500.She then made an adjusting entry to decrease the company's cash balance for the deposits in transit and increase the company's cash balance for the outstanding checks.Now the company's cash balance is exactly the same as the bank statement balance.As a result of the adjusting entry,the cash shown on Three Bears Company's year-end balance sheet will be ________.

A)too high

B)too low

C)just right

D)The answer cannot be determined from the information given.

A)too high

B)too low

C)just right

D)The answer cannot be determined from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

17

X Company used the following items to complete its bank reconciliation for the month of October: ∙ Deposits in transit were $2,500.

∙ Outstanding checks totaled $1,100.

∙ Bank service charges were $10.

∙ The company correctly wrote a check for $192,but mistakenly recorded the check as $129 on its books.The bank cashed the check correctly for $192.

∙ A customer's check for $50 was returned by the bank,NSF.

The $2,500 deposit in transit should be ________.

A)added to the balance per bank statement

B)deducted from the balance per bank statement

C)added to the balance per books

D)deducted from the balance per books

∙ Outstanding checks totaled $1,100.

∙ Bank service charges were $10.

∙ The company correctly wrote a check for $192,but mistakenly recorded the check as $129 on its books.The bank cashed the check correctly for $192.

∙ A customer's check for $50 was returned by the bank,NSF.

The $2,500 deposit in transit should be ________.

A)added to the balance per bank statement

B)deducted from the balance per bank statement

C)added to the balance per books

D)deducted from the balance per books

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

18

Comparing a company's cash balance in its accounting records with the bank statement is called ________.

A)a bank reconciliation

B)an external audit

C)an internal audit

D)adjusting the books

A)a bank reconciliation

B)an external audit

C)an internal audit

D)adjusting the books

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

19

X Company used the following items to complete its bank reconciliation for the month of October: ∙ Deposits in transit were $2,500.

∙ Outstanding checks totaled $1,100.

∙ Bank service charges were $10.

∙ The company correctly wrote a check for $192,but mistakenly recorded the check as $129 on its books.The bank cashed the check correctly for $192.

∙ A customer's check for $50 was returned by the bank,NSF.

How should the customer's check for $50 that was returned by the bank,NSF,be treated?

A)added to the balance per bank statement

B)deducted from the balance per bank statement

C)added to the balance per books

D)deducted from the balance per books

∙ Outstanding checks totaled $1,100.

∙ Bank service charges were $10.

∙ The company correctly wrote a check for $192,but mistakenly recorded the check as $129 on its books.The bank cashed the check correctly for $192.

∙ A customer's check for $50 was returned by the bank,NSF.

How should the customer's check for $50 that was returned by the bank,NSF,be treated?

A)added to the balance per bank statement

B)deducted from the balance per bank statement

C)added to the balance per books

D)deducted from the balance per books

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

20

X Company used the following items to complete its bank reconciliation for the month of October: ∙ Deposits in transit were $2,500

∙ Outstanding checks totaled $1,100

∙ Bank service charges were $10

∙ The company correctly wrote a check for $192,but mistakenly recorded the check as $129 on its books.The bank cashed the check correctly for $192.

∙ A customer's check for $50 was returned by the bank,NSF

According to the bank statement,the cash balance was $10,000.How much cash should X Company show on its October 31 balance sheet?

A)$10,000

B)$11,350

C)$11,400

D)$12,500

∙ Outstanding checks totaled $1,100

∙ Bank service charges were $10

∙ The company correctly wrote a check for $192,but mistakenly recorded the check as $129 on its books.The bank cashed the check correctly for $192.

∙ A customer's check for $50 was returned by the bank,NSF

According to the bank statement,the cash balance was $10,000.How much cash should X Company show on its October 31 balance sheet?

A)$10,000

B)$11,350

C)$11,400

D)$12,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

21

Alpha Company's bookkeeper decided to save time by accepting the cash balance shown on the bank statement as the company's correct ending cash balance each month.Explain to the bookkeeper why a monthly bank reconciliation should be prepared.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

22

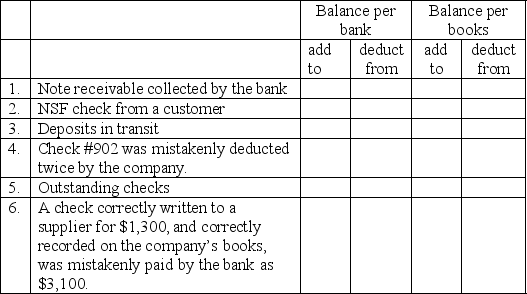

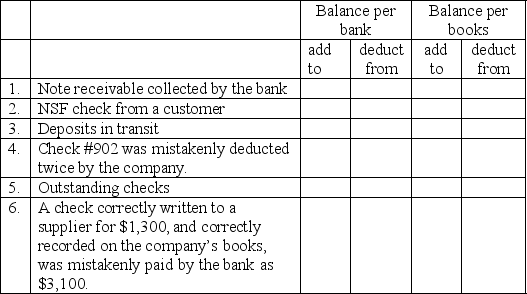

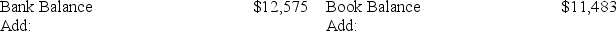

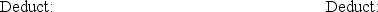

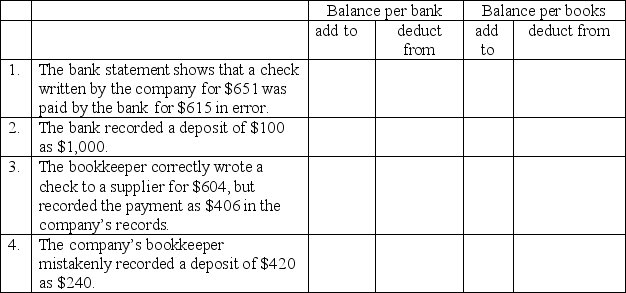

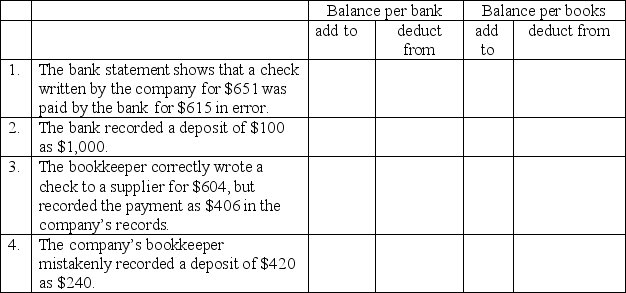

Put an X in the appropriate box to show how each of these items would appear on a company's bank reconciliation.Put an asterisk (*)next to the items for which the company must record an adjusting entry:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

23

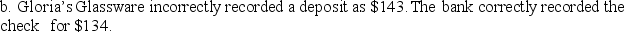

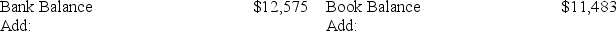

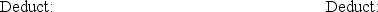

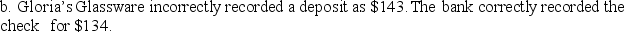

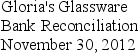

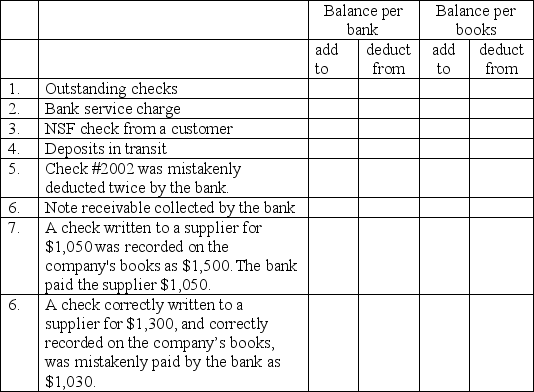

Prepare Gloria's Glassware's November bank reconciliation.Below is a list of items that will be included in the reconciliation.The balance on the bank statement was $12,575.The cash balance for Gloria's Glassware was $11,483.

a.Gloria's Glassware correctly deposited a check for $87.The bank recorded the check for $78.

c.Bank service charges for the month were $45.

c.Bank service charges for the month were $45.

d.$1,555 worth of checks was outstanding.

e.A deposit of $400 was mailed to the bank,but has not been recorded by the bank.

a.Gloria's Glassware correctly deposited a check for $87.The bank recorded the check for $78.

c.Bank service charges for the month were $45.

c.Bank service charges for the month were $45.d.$1,555 worth of checks was outstanding.

e.A deposit of $400 was mailed to the bank,but has not been recorded by the bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

24

On a bank reconciliation,outstanding checks and NSF checks are deductions from the bank balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

25

Identify each of the following reconciling items in the bank reconciliation process as being a reconciling item either on the bank's side (Bank)or on the company's side (Book)of the bank reconciliation.

_____ 1.A bank fee for printing new checks

_____ 2.Team Shirts correctly deposited a check for $882.The bank recorded the check as $828.

_____ 3.Outstanding checks

_____ 4.Deposits in transit

_____ 5.Team Shirts deposited a check that it had recorded as $89.00.The bank correctly recorded the check as $98.

_____ 1.A bank fee for printing new checks

_____ 2.Team Shirts correctly deposited a check for $882.The bank recorded the check as $828.

_____ 3.Outstanding checks

_____ 4.Deposits in transit

_____ 5.Team Shirts deposited a check that it had recorded as $89.00.The bank correctly recorded the check as $98.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

26

Put an X in the appropriate box to show how each of these items would appear on a company's bank reconciliation.Put an asterisk (*)next to the items for which the company must record an adjusting entry:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

27

If you bank on-line,you can view your bank balance at any time and see exactly how much cash you have available to pay bills.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

28

Cash is found on the ________.

A)Income statement

B)Balance sheet

C)Statement of changes in shareholders' equity

D)Statement of operations

A)Income statement

B)Balance sheet

C)Statement of changes in shareholders' equity

D)Statement of operations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

29

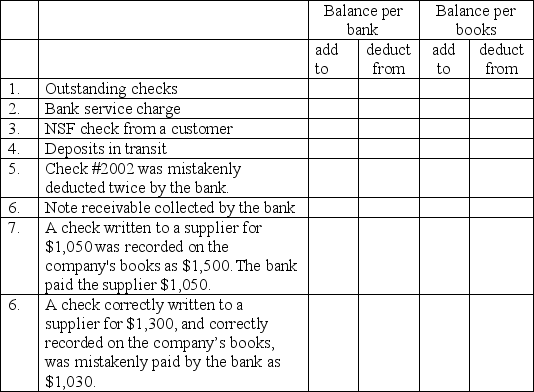

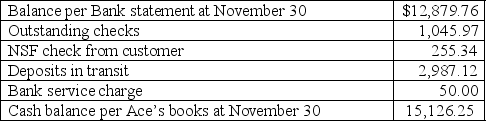

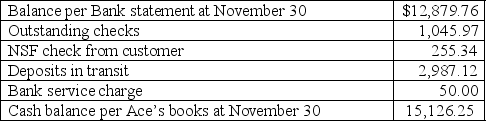

The following information is available for Ace Electronics for November:

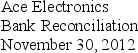

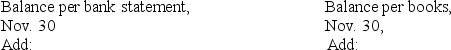

Part A: Prepare a bank reconciliation:

Part A: Prepare a bank reconciliation:

Part B: What amount will Ace Electronics show for cash on its November 30 balance sheet?

Part B: What amount will Ace Electronics show for cash on its November 30 balance sheet?

Part C: For which item(s)must Ace Electronics prepare an adjusting entry?

Part A: Prepare a bank reconciliation:

Part A: Prepare a bank reconciliation:

Part B: What amount will Ace Electronics show for cash on its November 30 balance sheet?

Part B: What amount will Ace Electronics show for cash on its November 30 balance sheet?Part C: For which item(s)must Ace Electronics prepare an adjusting entry?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

30

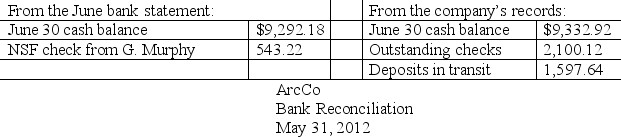

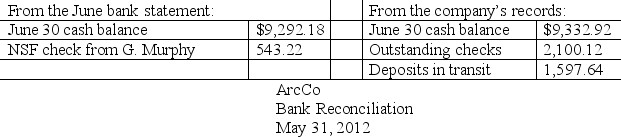

Part A: Use the following information to complete the June bank reconciliation for ArcCo:

Part B: What amount will ArcCo show for cash on its June 30 balance sheet?

Part B: What amount will ArcCo show for cash on its June 30 balance sheet?

Part C: For which item(s)must ArcCo prepare an adjusting entry?

Part B: What amount will ArcCo show for cash on its June 30 balance sheet?

Part B: What amount will ArcCo show for cash on its June 30 balance sheet?Part C: For which item(s)must ArcCo prepare an adjusting entry?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

31

Identify each of the following reconciling items in the bank reconciliation process as being a reconciling item either on the bank's side (Bank)or on the company's side (Book)of the bank reconciliation.

_____ 1.NSF check

_____ 2.Bank service charges

_____ 3.Interest earned on the checking account

_____ 4.Outstanding checks

_____ 5.Deposits in transit

_____ 1.NSF check

_____ 2.Bank service charges

_____ 3.Interest earned on the checking account

_____ 4.Outstanding checks

_____ 5.Deposits in transit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

32

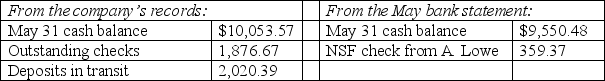

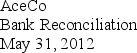

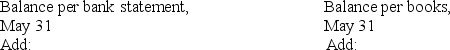

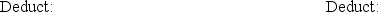

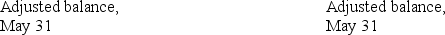

Part A: Use the following information to complete the May bank reconciliation for AceCo:

Part B: What amount will AceCo show for cash on its May 31 balance sheet?

Part B: What amount will AceCo show for cash on its May 31 balance sheet?

Part C: For which item(s)must AceCo prepare an adjusting entry?

Part B: What amount will AceCo show for cash on its May 31 balance sheet?

Part B: What amount will AceCo show for cash on its May 31 balance sheet?Part C: For which item(s)must AceCo prepare an adjusting entry?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

33

Put an X in the appropriate box to show how each of these items would appear on a company's bank reconciliation.Put an asterisk (*)next to the items for which the company must record an adjusting entry:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of these is a cash equivalent?

A)U)S.treasury bills that mature in three months or less

B)a note receivable that matures in six months

C)a note payable due in three months or less

D)accounts receivable due in three months or less

A)U)S.treasury bills that mature in three months or less

B)a note receivable that matures in six months

C)a note payable due in three months or less

D)accounts receivable due in three months or less

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

35

What is the purpose of a bank reconciliation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

36

D.Lee was preparing the monthly bank reconciliation for WhackCo when he noticed the bank made an error in the company's favor.How should the error appear on the bank reconciliation? Discuss the ethical issue of not reporting this error to the bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

37

Cash equivalents are ________.

A)the amounts paid to acquire assets

B)highly liquid investments with maturities of three months or less

C)the total market value of a corporation's stock

D)current assets minus current liabilities

A)the amounts paid to acquire assets

B)highly liquid investments with maturities of three months or less

C)the total market value of a corporation's stock

D)current assets minus current liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

38

"NSF" checks are checks that have been deposited in the bank,but "bounced".

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

39

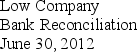

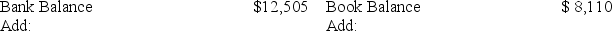

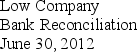

Prepare the June bank reconciliation for Low Company using the reconciling items below.The cash balance for Low Company was $8,110.The balance on the bank statement was $12,505.

a.$50 bank service charge

b.$4,889 worth of outstanding checks

c.$118 check for insufficient funds returned by the bank

d.Low Company deposited $576 worth of checks that are not on the bank statement.

e.The bank collected a note receivable for Low Company worth $275.

f.The bank charged Low Company $25 to collect the note receivable.

a.$50 bank service charge

b.$4,889 worth of outstanding checks

c.$118 check for insufficient funds returned by the bank

d.Low Company deposited $576 worth of checks that are not on the bank statement.

e.The bank collected a note receivable for Low Company worth $275.

f.The bank charged Low Company $25 to collect the note receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following methods of accounting for uncollectible accounts matches sales with bad debts expense?

A)direct write-off method

B)allowance method

C)contra-asset method

D)reconciliation method

A)direct write-off method

B)allowance method

C)contra-asset method

D)reconciliation method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

41

Accounts receivable are ________.

A)current assets

B)current liabilities

C)long-term assets

D)long-term liabilities

A)current assets

B)current liabilities

C)long-term assets

D)long-term liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

42

Cash and cash equivalents are found on both the balance sheet and the statement of cash flows

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

43

When reporting accounts receivable,the amount reported should be ________.

A)the accounts receivable collected during the period

B)the amount of accounts receivable that a company expects to collect

C)the accounts receivable charged for the current month

D)the amount of accounts receivable minus credit card expense

A)the accounts receivable collected during the period

B)the amount of accounts receivable that a company expects to collect

C)the accounts receivable charged for the current month

D)the amount of accounts receivable minus credit card expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

44

The balance sheet account used to report the amount of accounts receivable that a company does not expect to collect is called ________.

A)net accounts receivable

B)allowance for uncollectible accounts

C)uncollectible accounts expense

D)bad debts expense

A)net accounts receivable

B)allowance for uncollectible accounts

C)uncollectible accounts expense

D)bad debts expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

45

In the allowance method,the adjustment used to write off an uncollectible account ________.

A)decreases net income

B)has no effect on net income

C)reduces total assets

D)decreases liabilities

A)decreases net income

B)has no effect on net income

C)reduces total assets

D)decreases liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

46

Net accounts receivable are ________.

A)accounts receivable plus the allowance for uncollectible accounts

B)accounts receivable minus the allowance for uncollectible accounts

C)accounts receivable minus bad debts expense

D)sales minus bad debts expense

A)accounts receivable plus the allowance for uncollectible accounts

B)accounts receivable minus the allowance for uncollectible accounts

C)accounts receivable minus bad debts expense

D)sales minus bad debts expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

47

In preparing the financial statements for January,the accountant for Team Shirts has compiled the following information: accounts receivable are $5,000; the amount estimated to be uncollectible is 3% of sales for the month; sales for the month were $43,000; and the balance in the allowance for uncollectible accounts is a positive $1,000.Using the sales method,the amount of bad debts expense for January is ________.

A)$290

B)$1,000

C)$1,290

D)$2,290

A)$290

B)$1,000

C)$1,290

D)$2,290

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

48

What is the effect on the accounting equation when a company collects an account receivable?

A)Total assets increase,total liabilities increase,and total shareholders' equity stays the same.

B)Total assets stay the same,total liabilities stay the same,and total shareholders' equity stays the same.

C)Total assets decrease,total liabilities stay the same,and total shareholders' equity decreases.

D)Total assets stay the same,total liabilities increases,and total shareholders' equity decreases.

A)Total assets increase,total liabilities increase,and total shareholders' equity stays the same.

B)Total assets stay the same,total liabilities stay the same,and total shareholders' equity stays the same.

C)Total assets decrease,total liabilities stay the same,and total shareholders' equity decreases.

D)Total assets stay the same,total liabilities increases,and total shareholders' equity decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

49

Team Shirts had an unadjusted balance in its Allowance for uncollectible accounts of $(875)on August 31.This amount was "left over" at the end of August because not as many accounts were written off as previously anticipated.An aging of accounts receivable at August 31 revealed an estimate of $1,000 for uncollectible accounts.Using the accounts receivable allowance method,bad debts expense for August should be:

A)$125.

B)$275

C)$1,000.

D)$1,875.

A)$125.

B)$275

C)$1,000.

D)$1,875.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following is the contra account that accompanies Accounts receivable?

A)Allowance for uncollectible accounts

B)Sales returns and allowances

C)Bad debts expense

D)Net accounts receivable

A)Allowance for uncollectible accounts

B)Sales returns and allowances

C)Bad debts expense

D)Net accounts receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

51

After the write-off and adjustment,the balance in the allowance for uncollectible accounts should be ________.

A)$450

B)$365

C)$465

D)$550

A)$450

B)$365

C)$465

D)$550

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

52

What is the effect on the accounting equation of writing off an uncollectible account of $75?

A)increase assets $75 and decrease liabilities $75

B)decrease assets $75 and decrease liabilities $75

C)decrease assets $75 and increase expense $75

D)no net effect on total assets

A)increase assets $75 and decrease liabilities $75

B)decrease assets $75 and decrease liabilities $75

C)decrease assets $75 and increase expense $75

D)no net effect on total assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following statements is FALSE about the allowance method for uncollectible accounts?

A)Bad debt expense is estimated and matched with sales.

B)Expense is recorded during end of the period adjustments.

C)This method is not acceptable under GAAP.

D)The method is acceptable under GAAP.

A)Bad debt expense is estimated and matched with sales.

B)Expense is recorded during end of the period adjustments.

C)This method is not acceptable under GAAP.

D)The method is acceptable under GAAP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following statements is FALSE?

A)The allowance method is a GAAP method.

B)The direct write-off method violates the matching principle.

C)Under the direct write-off method,accounts are expensed when they are identified as uncollectible.

D)Under the allowance method,amounts written off are recorded as bad debts expense.

A)The allowance method is a GAAP method.

B)The direct write-off method violates the matching principle.

C)Under the direct write-off method,accounts are expensed when they are identified as uncollectible.

D)Under the allowance method,amounts written off are recorded as bad debts expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

55

In preparing the financial statements for January,the accountant for Team Shirts has compiled the following information: accounts receivable are $5,000; the amount estimated to be uncollectible is 10% of receivables; sales for the month were $43,000; and the balance in the allowance for uncollectible accounts is a positive $100.Using the accounts receivable allowance method,the amount of bad debts expense for January is ________.

A)$100

B)$500

C)$600

D)$4,300

A)$100

B)$500

C)$600

D)$4,300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

56

Cash equivalents are found on the ________.

A)Income statement

B)Statement of financial position

C)Statement of changes in shareholders' equity

D)Statement of operations

A)Income statement

B)Statement of financial position

C)Statement of changes in shareholders' equity

D)Statement of operations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

57

The allowance for uncollectible accounts is a(n)________.

A)contra-expense account

B)contra-revenue account

C)contra-asset account

D)expense account

A)contra-expense account

B)contra-revenue account

C)contra-asset account

D)expense account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

58

In 2011,Seven Seas sold $20,000 worth of merchandise on account.Its accountant estimated that $400 of that amount would be uncollectible.In 2011,Saki,a Japanese customer,purchased $500 of merchandise on account from Seven Seas.In 2012,Saki declared bankruptcy while still owing the $500.What is the amount of bad debts expense Seven Seas should report on December 31,2011?

A)$100

B)$400

C)$500

D)$900

A)$100

B)$400

C)$500

D)$900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

59

Cash and cash equivalents is a line item found on the balance sheet that represents the amounts customers owe the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

60

When Y Company later records the write-off of a specific customer's account receivable,its total assets will ________.

A)increase

B)decrease

C)remain the same

D)The answer cannot be determined from the information given.

A)increase

B)decrease

C)remain the same

D)The answer cannot be determined from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

61

KayCo began business January 1,2012.During 2012,sales were $650,000.The year-end accounts receivable balance was $104,000.The company estimates that 10% of accounts receivable will be uncollectible.The financial statements for the year ended December 31,2012 will show ________.

A)bad debts expense of $10,400 on the income statement

B)bad debts expense of $9,750 on the income statement

C)net accounts receivable of $94,250 on the balance sheet

D)bad debts expense of $10,400 on the balance sheet

A)bad debts expense of $10,400 on the income statement

B)bad debts expense of $9,750 on the income statement

C)net accounts receivable of $94,250 on the balance sheet

D)bad debts expense of $10,400 on the balance sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

62

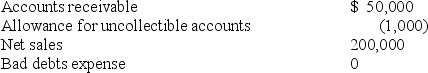

Rusk,Inc.had the following balances at December 31,2012,before recording any adjustments:  Rusk estimated that $3,000 of the receivables would be uncollectible.The financial statements for the year ended December 31,2012 will show:

Rusk estimated that $3,000 of the receivables would be uncollectible.The financial statements for the year ended December 31,2012 will show:

A)Bad debts expense of $2,500 on the income statement.

B)Allowance for uncollectible accounts of $(3,000)on the balance sheet.

C)Net accounts receivable of $27,000 on the balance sheet.

D)more than one of the above is correct.

Rusk estimated that $3,000 of the receivables would be uncollectible.The financial statements for the year ended December 31,2012 will show:

Rusk estimated that $3,000 of the receivables would be uncollectible.The financial statements for the year ended December 31,2012 will show:A)Bad debts expense of $2,500 on the income statement.

B)Allowance for uncollectible accounts of $(3,000)on the balance sheet.

C)Net accounts receivable of $27,000 on the balance sheet.

D)more than one of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

63

Midway Company had a balance of $(500)in its allowance for uncollectible accounts.Aging of its accounts receivable revealed that the allowance should be $(1,400).The amount of bad debts expense for the period should be ________.

A)$500

B)$900

C)$1,400

D)$1,900

A)$500

B)$900

C)$1,400

D)$1,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

64

Lee's Lions had a balance of a positive $200 in its Allowance for uncollectible accounts.Based on an aging of accounts receivable,management estimates that the Allowance for uncollectible accounts balance should be $(2,000).Bad debts expense should be ________.

A)$1,600

B)$1,800

C)$2,000

D)$2,200

A)$1,600

B)$1,800

C)$2,000

D)$2,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

65

KayCo began business January 1,2012.During 2012,sales were $650,000.The year-end accounts receivable balance was $104,000.The company estimates that 1.5% of sales will become bad debts.The financial statements for the year ended December 31,2012 will show ________.

A)bad debts expense of $1,560 on the income statement

B)bad debts expense of $9,750 on the income statement

C)net accounts receivable of $94,250 on the income statement

D)bad debts expense of $1,560 on the balance sheet

A)bad debts expense of $1,560 on the income statement

B)bad debts expense of $9,750 on the income statement

C)net accounts receivable of $94,250 on the income statement

D)bad debts expense of $1,560 on the balance sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which accounting principle requires that bad debts expense be recognized in the same period as the sale?

A)entity

B)matching

C)revenue recognition

D)cost

A)entity

B)matching

C)revenue recognition

D)cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

67

The Allowance for uncollectible accounts ________.

A)is subtracted from Sales to calculate Net sales on the income statement

B)is always equal to Bad debts expense for the year

C)is subtracted from Accounts receivable to calculate Net realizable value of accounts receivable

D)is subtracted from Cash on the balance sheet

A)is subtracted from Sales to calculate Net sales on the income statement

B)is always equal to Bad debts expense for the year

C)is subtracted from Accounts receivable to calculate Net realizable value of accounts receivable

D)is subtracted from Cash on the balance sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

68

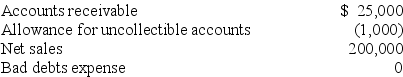

Z Company obtained the following balances from its computerized accounting information system at the end of the year before adjustments:  The company estimates that 2% of net sales will be uncollectible.After the correct adjusting entry has been made,bad debts expense for the year will be:

The company estimates that 2% of net sales will be uncollectible.After the correct adjusting entry has been made,bad debts expense for the year will be:

A)$4,000.

B)$1,000.

C)$3,000.

D)$5,000.

The company estimates that 2% of net sales will be uncollectible.After the correct adjusting entry has been made,bad debts expense for the year will be:

The company estimates that 2% of net sales will be uncollectible.After the correct adjusting entry has been made,bad debts expense for the year will be:A)$4,000.

B)$1,000.

C)$3,000.

D)$5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

69

Z Company obtained the following balances from its computerized accounting information system at the end of the year before adjustments:  The company estimates that 2% of net sales will be uncollectible.After the correct adjusting entry has been made,what is the net accounts receivable on the year-end balance sheet?

The company estimates that 2% of net sales will be uncollectible.After the correct adjusting entry has been made,what is the net accounts receivable on the year-end balance sheet?

A)This is a trick question.Accounts receivable appear on the income statement,not the balance sheet.

B)$46,000

C)$45,000

D)$44,000

The company estimates that 2% of net sales will be uncollectible.After the correct adjusting entry has been made,what is the net accounts receivable on the year-end balance sheet?

The company estimates that 2% of net sales will be uncollectible.After the correct adjusting entry has been made,what is the net accounts receivable on the year-end balance sheet?A)This is a trick question.Accounts receivable appear on the income statement,not the balance sheet.

B)$46,000

C)$45,000

D)$44,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

70

XYZ Company's accounting records on January 1 showed:  On January 2,XYZ wrote off an account receivable of $1,000 from Bounder,Inc.As a result of this write-off,the net realizable value of XYZ's accounts receivable will ________.

On January 2,XYZ wrote off an account receivable of $1,000 from Bounder,Inc.As a result of this write-off,the net realizable value of XYZ's accounts receivable will ________.

A)increase

B)decrease

C)remain the same

D)The answer cannot be determined from the information given.

On January 2,XYZ wrote off an account receivable of $1,000 from Bounder,Inc.As a result of this write-off,the net realizable value of XYZ's accounts receivable will ________.

On January 2,XYZ wrote off an account receivable of $1,000 from Bounder,Inc.As a result of this write-off,the net realizable value of XYZ's accounts receivable will ________.A)increase

B)decrease

C)remain the same

D)The answer cannot be determined from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

71

The bookkeeper was unable to reconcile the company's checking account,so she changed the company's books to agree with the cash balance on the bank statement.This is an internal control ________.

A)strength

B)weakness

C)principle

D)suggestion

A)strength

B)weakness

C)principle

D)suggestion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

72

The sales method for estimating bad debts is calculated using ________.

A)aging of accounts receivable

B)a percentage of credit sales

C)a percentage of net accounts receivable

D)the current balance in accounts receivable

A)aging of accounts receivable

B)a percentage of credit sales

C)a percentage of net accounts receivable

D)the current balance in accounts receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

73

A company has an allowance for uncollectible accounts of $1,000,a positive number,at the end of the year,before the adjusting entry is made to record this year's bad debts expense.The allowance account has a positive balance because ________.

A)the allowance always has a positive balance

B)the allowance created at the end of last year was too small to cover all of the accounts written off this year

C)the allowance created at the end of last year was larger than the total of all of the accounts written off this year

D)the balance in the allowance must always equal bad debts expense for the year.

A)the allowance always has a positive balance

B)the allowance created at the end of last year was too small to cover all of the accounts written off this year

C)the allowance created at the end of last year was larger than the total of all of the accounts written off this year

D)the balance in the allowance must always equal bad debts expense for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

74

Team Shirts had a balance in its allowance for uncollectible accounts of $(200).Aging the accounts receivable showed that the allowance should be $(1,800).Bad debts expense should be ________.

A)$1,400

B)$1,600

C)$1,800

D)$2,000

A)$1,400

B)$1,600

C)$1,800

D)$2,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

75

Team Shirts had a balance of $(700)in its Allowance for uncollectible accounts.Aging of its accounts receivable revealed that the allowance should be $(1,250).The amount of bad debts expense for the period should be ________.

A)$550

B)$700

C)$1,250

D)$1,950

A)$550

B)$700

C)$1,250

D)$1,950

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

76

Z Company obtained the following balances from its computerized accounting information system at the end of the year before adjustments:  The company estimates that 2% of net sales will be uncollectible.After the correct adjusting entry has been made,the allowance for uncollectible accounts will be:

The company estimates that 2% of net sales will be uncollectible.After the correct adjusting entry has been made,the allowance for uncollectible accounts will be:

A)$(1,000).

B)$(3,000).

C)$(4,000).

D)$(5,000).

The company estimates that 2% of net sales will be uncollectible.After the correct adjusting entry has been made,the allowance for uncollectible accounts will be:

The company estimates that 2% of net sales will be uncollectible.After the correct adjusting entry has been made,the allowance for uncollectible accounts will be:A)$(1,000).

B)$(3,000).

C)$(4,000).

D)$(5,000).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

77

Y Company has the following accounting balances at the end of the year before adjustments:  The company estimates that 20% of accounts receivable will be uncollectible.After the correct adjusting entry has been made,which of the following is correct about Bad debts expense for the year and Allowance for uncollectible accounts at the end of the year?

The company estimates that 20% of accounts receivable will be uncollectible.After the correct adjusting entry has been made,which of the following is correct about Bad debts expense for the year and Allowance for uncollectible accounts at the end of the year?

A)Bad debts expense will be $4,000 on the income statement and Allowance for uncollectible accounts will be $(5,000)on the balance sheet.

B)Bad debts expense will be $4,000 on the income statement and Allowance for uncollectible accounts will be $(4,000)on the balance sheet.

C)Bad debts expense will be $5,000 on the balance sheet and Allowance for uncollectible accounts will be $(5,000)on the income statement.

D)Bad debts expense will be $5,000 on the income statement and Allowance for uncollectible accounts will be $(5,000)on the balance sheet.

The company estimates that 20% of accounts receivable will be uncollectible.After the correct adjusting entry has been made,which of the following is correct about Bad debts expense for the year and Allowance for uncollectible accounts at the end of the year?

The company estimates that 20% of accounts receivable will be uncollectible.After the correct adjusting entry has been made,which of the following is correct about Bad debts expense for the year and Allowance for uncollectible accounts at the end of the year?A)Bad debts expense will be $4,000 on the income statement and Allowance for uncollectible accounts will be $(5,000)on the balance sheet.

B)Bad debts expense will be $4,000 on the income statement and Allowance for uncollectible accounts will be $(4,000)on the balance sheet.

C)Bad debts expense will be $5,000 on the balance sheet and Allowance for uncollectible accounts will be $(5,000)on the income statement.

D)Bad debts expense will be $5,000 on the income statement and Allowance for uncollectible accounts will be $(5,000)on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

78

X Company has the following accounting balances at the end of the year before adjustments:  The company estimates that 2% of net sales will be uncollectible.After the correct adjusting entry has been made,which of the following is correct about Bad debts expense for the year and Allowance for uncollectible accounts at the end of the year?

The company estimates that 2% of net sales will be uncollectible.After the correct adjusting entry has been made,which of the following is correct about Bad debts expense for the year and Allowance for uncollectible accounts at the end of the year?

A)Bad debts expense will be $2,000 on the income statement and Allowance for uncollectible accounts will be $(3,000)on the balance sheet.

B)Bad debts expense will be $3,000 on the income statement and Allowance for uncollectible accounts will be $(2,000)on the balance sheet.

C)Bad debts expense will be $3,000 on the balance sheet and Allowance for uncollectible accounts will be $(3,000)on the income statement.

D)Bad debts expense will be $1,000 on the income statement and Allowance for uncollectible accounts will be $(2,000)on the balance sheet.

The company estimates that 2% of net sales will be uncollectible.After the correct adjusting entry has been made,which of the following is correct about Bad debts expense for the year and Allowance for uncollectible accounts at the end of the year?

The company estimates that 2% of net sales will be uncollectible.After the correct adjusting entry has been made,which of the following is correct about Bad debts expense for the year and Allowance for uncollectible accounts at the end of the year?A)Bad debts expense will be $2,000 on the income statement and Allowance for uncollectible accounts will be $(3,000)on the balance sheet.

B)Bad debts expense will be $3,000 on the income statement and Allowance for uncollectible accounts will be $(2,000)on the balance sheet.

C)Bad debts expense will be $3,000 on the balance sheet and Allowance for uncollectible accounts will be $(3,000)on the income statement.

D)Bad debts expense will be $1,000 on the income statement and Allowance for uncollectible accounts will be $(2,000)on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

79

Z Company obtained the following balances from its computerized accounting information system at the end of the year before adjustments:  The company estimates that 2% of net sales will be uncollectible.After the correct adjusting entry has been made,bad debts expense for the year will be:

The company estimates that 2% of net sales will be uncollectible.After the correct adjusting entry has been made,bad debts expense for the year will be:

A)$4,000.

B)$1,000.

C)$3,000.

D)$5,000.

The company estimates that 2% of net sales will be uncollectible.After the correct adjusting entry has been made,bad debts expense for the year will be:

The company estimates that 2% of net sales will be uncollectible.After the correct adjusting entry has been made,bad debts expense for the year will be:A)$4,000.

B)$1,000.

C)$3,000.

D)$5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

80

The direct write-off method and the allowance method are methods used to adjust the balance in accounts receivable to reflect uncollectible accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck