Deck 10: Reporting and Analyzing Long-Term Liabilities

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/194

العب

ملء الشاشة (f)

Deck 10: Reporting and Analyzing Long-Term Liabilities

1

An advantage of bond financing is that issuing bonds does not affect owner control.

True

2

A basic present value concept is that cash in the future is worth less than the same amount of cash today.

True

3

The type of bond that provides the greatest security from theft of loss is the debenture.

False

4

If a bond's interest period does not coincide with the issuing company's accounting period,an adjusting entry is necessary to recognize bond interest expense accruing since the most recent interest payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

5

Interest payments on bonds are determined by multiplying the par value of the bond by the stated contract rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

6

Operating leases are long-term or noncancelable leases in which the lessor transfers all the risks and rewards of ownership to the lessee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

7

A lease is a contractual agreement between a lessor and a lessee that grants the lessee the right to use the asset for a period of time in return for cash payment(s) to the lessor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

8

If the borrower fails to pay a mortgage,most mortgage contracts grant the lender the right to foreclose on the property that is identified as security in the contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

9

A common payment pattern for installment notes is to pay the accrued interest periodically and to pay the principle amount on the maturity date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

10

An annuity is a series of equal payments made at equal time intervals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

11

The carrying value of a long-term note is computed as the present value of all remaining future payments,discounted using the market rate at the time of issuance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

12

An advantage of bonds is that interest does not have to be paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

13

Bonds and long-term notes are similar in that they are typically transacted with multiple lenders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

14

Bonds may only be issued on an interest payment date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

15

The present value of an annuity can be computed as the sum of the individual future values for each payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

16

A pension plan is a contractual agreement between an employer and its employees in which the employer provides benefits to employees after they retire.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

17

An installment note is an obligation to the issuing company that requires a series of periodic payments to the holder.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

18

Return on equity increases when the expected rate of return from the acquired assets is higher than the interest rate on the debt issued to finance the acquired assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

19

The present value of an annuity factor for six years at 10% is 4.3553.This means that the present value of an annuity of six annual $2,000 payments at 10% would equal $8,711.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

20

A basic present value concept is that cash received in the future is worth more value than the same amount of cash received today.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

21

Premium on Bonds Payable increases a company's liabilities..

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

22

A company borrowed $50,000 cash from the bank and signed a six-year note at 7%.The present value factor for an annuity for six years at 7% is 4.7665.The annual annuity payments equal $10,490.The present value of the loan is:

A)$10,490

B)$11,004

C)$50,000

D)$52,450

E)$238,325

A)$10,490

B)$11,004

C)$50,000

D)$52,450

E)$238,325

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

23

The debt to equity ratio helps assess the risks of a company's financing structure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

24

Installment notes payable that require periodic payments of accrued interest plus equal amounts of principal result in:

A)Periodic total payments that gradually decrease in amount.

B)Periodic total payments that are equal.

C)Periodic total payments that gradually increase in amount.

D)Increasing amounts of interest each period.

E)Increasing amounts of principal each period.

A)Periodic total payments that gradually decrease in amount.

B)Periodic total payments that are equal.

C)Periodic total payments that gradually increase in amount.

D)Increasing amounts of interest each period.

E)Increasing amounts of principal each period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

25

A bond listed at 103 on a stock exchange is selling at 103% of its par value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

26

The carrying value of a long-term note payable:

A)Is computed as the future value of all remaining future payments,using the market rate as interest.

B)Is the face value of the long-term note less the total of all future interest payments.

C)Is computed as the present value of all remaining future payments,discounted using the market rate of interest at the time of issuance.

D)Is computed as the present value of all remaining interest payments,discounted using the note's rate of interest.

E)Decreases each time period the discount on the note is amortized.

A)Is computed as the future value of all remaining future payments,using the market rate as interest.

B)Is the face value of the long-term note less the total of all future interest payments.

C)Is computed as the present value of all remaining future payments,discounted using the market rate of interest at the time of issuance.

D)Is computed as the present value of all remaining interest payments,discounted using the note's rate of interest.

E)Decreases each time period the discount on the note is amortized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

27

A company must repay the bank $10,000 cash in three years for a loan.The loan agreement specifies 8% interest compounded annually.The present value factor for three years at 8% is 0.7938.How much cash did the company receive from the bank on the day they borrowed this money?

A)$10,000

B)$12,400

C)$7,938

D)$9,200

E)$7,600

A)$10,000

B)$12,400

C)$7,938

D)$9,200

E)$7,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

28

Callable bonds have an option exercisable by the issuer to retire them at a stated dollar amount prior to maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

29

A discount on bonds payable occurs when a company issues bonds at a price less than par value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

30

The effective interest method yields increasing amounts of bond interest expense and decreasing amount of premium amortization over the life of the bond .

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

31

To provide security to creditors and to reduce interest costs,bonds and notes payable can be secured by:

A)Safe deposit boxes

B)Mortgages

C)Equity

D)The FASB

E)Debentures

A)Safe deposit boxes

B)Mortgages

C)Equity

D)The FASB

E)Debentures

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

32

The debt to equity ratio is calculated by dividing total liabilities by total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

33

GAAP criteria for identifying a lease as a capital lease are more general than the criteria under IFRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

34

Two common ways of retiring bonds before maturity are to (1) exercise a call option or (2) purchase them on the open market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

35

Promissory notes that require the issuer to make a series of payments consisting of both interest and principal are:

A)Debentures

B)Discounted notes

C)Installment notes

D)Indentures

E)Investment notes

A)Debentures

B)Discounted notes

C)Installment notes

D)Indentures

E)Investment notes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

36

A company with liabilities of $2,816,000 and equity of $826,000 has a debt to equity ratio equal to 29.33%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

37

A premium on bonds payable occurs when bonds have a contract rate greater than the market rate at issuance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

38

A company borrowed $300,000 cash from the bank by signing a five-year,8% installment note.The present value factor for an annuity at 8% for five years is 3.9927.Each annuity payment equals $75,137.How much cash did the company receive from the bank on the day they borrowed this money?

A)$75,137

B)$94,013

C)$300,000

D)$375,685

E)$1,197,810

A)$75,137

B)$94,013

C)$300,000

D)$375,685

E)$1,197,810

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

39

A company purchased equipment and signed a seven-year installment loan at 9% annual interest.The annual payments equal $9,000.The present value factor for an annuity for seven years at 9% is 5.0330.What value for this equipment should be recorded on the company's books on the day the contract is signed?

A)$9,000

B)$5,033

C)$63,000

D)$57,330

E)$45,297

A)$9,000

B)$5,033

C)$63,000

D)$57,330

E)$45,297

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

40

A bond's par value is not necessarily the same as its market value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

41

Bonds that have interest coupons attached to their certificates,which the bondholders detach during each interest period and present to a bank for collection,are called:

A)Coupon bonds.

B)Callable bonds.

C)Serial bonds.

D)Convertible bonds.

E)Clip and Carry bonds.

A)Coupon bonds.

B)Callable bonds.

C)Serial bonds.

D)Convertible bonds.

E)Clip and Carry bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following statements is true? For the issuer:

A)Interest paid on bonds is tax deductible.

B)Interest paid on bonds is not tax deductible.

C)Dividends paid to stockholders are tax deductible.

D)Bonds are assets.

E)Bonds always decrease return on equity.

A)Interest paid on bonds is tax deductible.

B)Interest paid on bonds is not tax deductible.

C)Dividends paid to stockholders are tax deductible.

D)Bonds are assets.

E)Bonds always decrease return on equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

43

Bonds owned by investors whose names and addresses are recorded by the issuing company and for which interest payments are made with checks to the bondholders,are called:

A)Callable bonds

B)Serial bonds

C)Registered bonds

D)Coupon bonds

E)Bearer bonds

A)Callable bonds

B)Serial bonds

C)Registered bonds

D)Coupon bonds

E)Bearer bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

44

A company issues 9%,20-year bonds with a par value of $750,000.The current market rate is 9%.The amount of interest owed to the bondholders for each semiannual interest payment is.

A)$0

B)$33,750

C)$67,500

D)$750,000

E)$1,550,000

A)$0

B)$33,750

C)$67,500

D)$750,000

E)$1,550,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

45

Operating leases differ from capital leases in that

A)For a capital lease,the lessee records the lease payments as rent expense,but for an operating lease,the lessee reports the lease payments as depreciation expense.

B)For an operating lease,the lessee depreciates the asset acquired under lease,but for the capital lease,the lessee does not.

C)Operating leases create a long-term liability on the balance sheet,but capital leases do not.

D)Operating leases do not transfer ownership of the asset under the lease,but capital leases often do.

E)Operating lease payments are generally greater than capital lease payments.

A)For a capital lease,the lessee records the lease payments as rent expense,but for an operating lease,the lessee reports the lease payments as depreciation expense.

B)For an operating lease,the lessee depreciates the asset acquired under lease,but for the capital lease,the lessee does not.

C)Operating leases create a long-term liability on the balance sheet,but capital leases do not.

D)Operating leases do not transfer ownership of the asset under the lease,but capital leases often do.

E)Operating lease payments are generally greater than capital lease payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

46

A bond traded at 102½ means that:

A)The bond pays 2.5% interest.

B)The bond traded at $1,025 per $1,000 bond.

C)The market rate of interest is 2.5%.

D)The bonds were retired at $1,025 each.

E)The market rate of interest is 2½% above the contract rate.

A)The bond pays 2.5% interest.

B)The bond traded at $1,025 per $1,000 bond.

C)The market rate of interest is 2.5%.

D)The bonds were retired at $1,025 each.

E)The market rate of interest is 2½% above the contract rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

47

What is the debt to equity ratio for a company that has $700,000 in total liabilities and $3,500,000 in total equity?

A)20%

B)5

C)$2,100,000

D)2%

E).5

A)20%

B)5

C)$2,100,000

D)2%

E).5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

48

Bonds that mature at different dates and end up with the total principal repaid gradually over a number of periods are referred to as:

A)Registered bonds

B)Bearer bonds

C)Callable bonds

D)Sinking fund bonds

E)Serial bonds

A)Registered bonds

B)Bearer bonds

C)Callable bonds

D)Sinking fund bonds

E)Serial bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

49

Secured bonds:

A)Are also referred to as debentures.

B)Have specific assets of the issuing company pledged as collateral.

C)Are backed by the issuer's bank.

D)Are subordinated to those of other unsecured liabilities.

E)Are the same as sinking fund bonds.

A)Are also referred to as debentures.

B)Have specific assets of the issuing company pledged as collateral.

C)Are backed by the issuer's bank.

D)Are subordinated to those of other unsecured liabilities.

E)Are the same as sinking fund bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

50

A bondholder that owns a $1,000,10%,10-year bond has:

A)Ownership rights in the company who issued the bond.

B)The right to receive $10 per year until maturity.

C)The right to receive $1,000 at maturity.

D)The right to receive $10,000 at maturity.

E)The right to receive dividends of $1,000 per year.

A)Ownership rights in the company who issued the bond.

B)The right to receive $10 per year until maturity.

C)The right to receive $1,000 at maturity.

D)The right to receive $10,000 at maturity.

E)The right to receive dividends of $1,000 per year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

51

Sinking fund bonds:

A)Require the issuer to set aside assets in order to retire the bonds at maturity.

B)Require equal payments of both principal and interest over the life of the bond issue.

C)Decline in value over time.

D)Are registered bonds.

E)Are bearer bonds.

A)Require the issuer to set aside assets in order to retire the bonds at maturity.

B)Require equal payments of both principal and interest over the life of the bond issue.

C)Decline in value over time.

D)Are registered bonds.

E)Are bearer bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

52

A company issues bonds at par on April 1.These 9% bonds have a par value of $100,000 and pay interest annually.April 1 is four months after the most recent interest payment date.How much total cash interest is received on April 1 by the bond issuer?

A)$750

B)$5,250

C)$1,500

D)$3,000

E)$6,000

A)$750

B)$5,250

C)$1,500

D)$3,000

E)$6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

53

The contract between the bond issuer and the bondholders,which identifies the rights and obligations of the parties,is called a(n):

A)Debenture

B)Bond indenture

C)Mortgage

D)Installment note

E)Mortgage contract

A)Debenture

B)Bond indenture

C)Mortgage

D)Installment note

E)Mortgage contract

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

54

If an issuer sells a bond at any other date than the interest payment date:

A)This means the bond sells at a premium.

B)This means the bond sells at a discount.

C)The issuing company will report a loss on the sale of the bond.

D)The issuing company will report a gain on the sale of the bond.

E)The buyer normally pays the issuer the purchase price plus any interest accrued since the last interest payment date.

A)This means the bond sells at a premium.

B)This means the bond sells at a discount.

C)The issuing company will report a loss on the sale of the bond.

D)The issuing company will report a gain on the sale of the bond.

E)The buyer normally pays the issuer the purchase price plus any interest accrued since the last interest payment date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

55

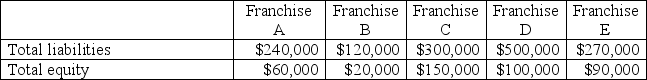

Using the debt to equity ratio,which of the following franchises would be assessed as having the riskiest financing structure?

A)Franchise A

B)Franchise B

C)Franchise C

D)Franchise D

E)Franchise E

A)Franchise A

B)Franchise B

C)Franchise C

D)Franchise D

E)Franchise E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

56

When a bond sells at a premium:

A)The contract rate is above the market rate.

B)The contract rate is equal to the market rate.

C)The contract rate is below the market rate.

D)It means that the bond is a zero coupon bond.

E)The bond pays no interest.

A)The contract rate is above the market rate.

B)The contract rate is equal to the market rate.

C)The contract rate is below the market rate.

D)It means that the bond is a zero coupon bond.

E)The bond pays no interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

57

A bond sells at a discount when the:

A)Contract rate is above the market rate.

B)Contract rate is equal to the market rate.

C)Contract rate is below the market rate.

D)Bond has a short-term life.

E)Bond pays interest only once a year.

A)Contract rate is above the market rate.

B)Contract rate is equal to the market rate.

C)Contract rate is below the market rate.

D)Bond has a short-term life.

E)Bond pays interest only once a year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

58

A company issues bonds at par on June 1.These 7% bonds have a par value of $500,000 and pay interest annually.June 1 is five months after the most recent interest payment date.How much total cash interest is received on June 1 by the bond issuer?

A)$0

B)$2,916.66

C)$100,000.00

D)$14,583.33

E)$35,000.00

A)$0

B)$2,916.66

C)$100,000.00

D)$14,583.33

E)$35,000.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

59

Bonds with a par value of less than $1,000 are known as:

A)Junk bonds

B)Baby bonds

C)Callable bonds

D)Unsecured bonds

E)Convertible bonds

A)Junk bonds

B)Baby bonds

C)Callable bonds

D)Unsecured bonds

E)Convertible bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

60

Bonds that have an option exercisable by the issuer to retire them at a stated dollar amount prior to maturity are known as:

A)Convertible bonds

B)Sinking fund bonds

C)Callable bonds

D)Serial bonds

E)Junk bonds

A)Convertible bonds

B)Sinking fund bonds

C)Callable bonds

D)Serial bonds

E)Junk bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

61

Amortizing a bond discount:

A)Allocates a part of the total discount to each interest period.

B)Increases the market value of the Bonds Payable.

C)Decreases the Bonds Payable account.

D)Decreases interest expense each period.

E)Increases cash flows from the bond.

A)Allocates a part of the total discount to each interest period.

B)Increases the market value of the Bonds Payable.

C)Decreases the Bonds Payable account.

D)Decreases interest expense each period.

E)Increases cash flows from the bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

62

A company issued 7%,five-year bonds with a par value of $100,000.The market rate when the bonds were issued was 7.5%.The company received $97,947 cash for the bonds.Using the effective interest method,the amount of interest expense for the first semiannual interest period is:

A)$3,750.00

B)$3,673.01

C)$3,705.30

D)$3,428.15

E)$7,346.03

A)$3,750.00

B)$3,673.01

C)$3,705.30

D)$3,428.15

E)$7,346.03

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

63

A company issued five-year,7% bonds with a par value of $100,000.The company received $97,947 for the bonds.Using the straight-line method,the amount of interest expense for the first semiannual interest period is:

A)$3,294.70

B)$3,500.00

C)$3,705.30

D)$7,000.00

E)$7,410.60

A)$3,294.70

B)$3,500.00

C)$3,705.30

D)$7,000.00

E)$7,410.60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

64

A company issued 10-year,8% bonds with a par value of $200,000.The company received $190,000 for the bonds.Using the straight-line method,the amount of interest expense for the first semiannual interest period is:

A)$8,000.00

B)$8,500.00

C)$16,000.00

D)$7,500.00

E)$18,000.00

A)$8,000.00

B)$8,500.00

C)$16,000.00

D)$7,500.00

E)$18,000.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

65

Adidas issued 10-year,8% bonds with a par value of $200,000,where interest is paid semiannually.The market rate on the issue date was 7.5%.Adidas received $206,948 in cash proceeds.Which of the following statements is true?

A)Adidas must pay $200,000 at maturity and no interest payments.

B)Adidas must pay $206,948 at maturity and no interest payments.

C)Adidas must pay $200,000 at maturity plus 20 interest payments of $8,000 each.

D)Adidas must pay $206,948 at maturity plus 20 interest payments of $8,000 each.

E)Adidas must pay $200,000 at maturity plus 20 interest payments of $7,500 each.

A)Adidas must pay $200,000 at maturity and no interest payments.

B)Adidas must pay $206,948 at maturity and no interest payments.

C)Adidas must pay $200,000 at maturity plus 20 interest payments of $8,000 each.

D)Adidas must pay $206,948 at maturity plus 20 interest payments of $8,000 each.

E)Adidas must pay $200,000 at maturity plus 20 interest payments of $7,500 each.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

66

A company issued 18-year,6% bonds with a par value of $750,000.The company received $761,736 cash for the bonds.Using the straight-line method,the amount of interest expense for the first semiannual interest period is:

A)$22,174

B)$22,826

C)$22,500

D)$23,152

E)$21,848

A)$22,174

B)$22,826

C)$22,500

D)$23,152

E)$21,848

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following is true regarding the effective interest amortization method?

A)Allocates bond interest expense using a changing interest rate.

B)Allocates bond interest expense using a constant interest rate.

C)Allocates a decreasing amount of interest over the life of a discounted bond.

D)Allocates bond interest expense using the current market rate for each period.

E)Is not allowed by the FASB.

A)Allocates bond interest expense using a changing interest rate.

B)Allocates bond interest expense using a constant interest rate.

C)Allocates a decreasing amount of interest over the life of a discounted bond.

D)Allocates bond interest expense using the current market rate for each period.

E)Is not allowed by the FASB.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

68

The Discount on Bonds Payable account is:

A)A liability

B)A contra liability

C)An expense

D)A contra expense

E)A contra equity

A)A liability

B)A contra liability

C)An expense

D)A contra expense

E)A contra equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

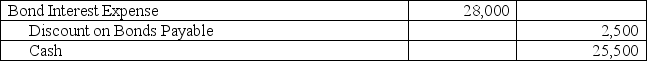

69

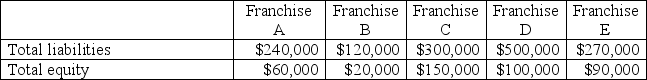

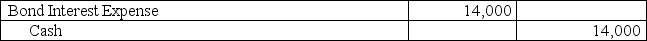

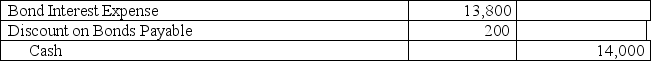

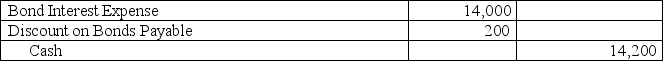

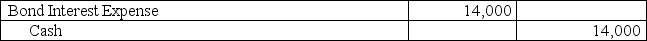

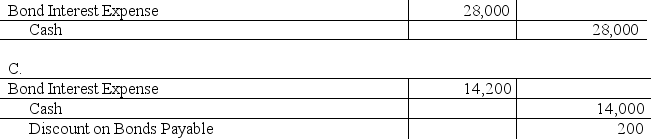

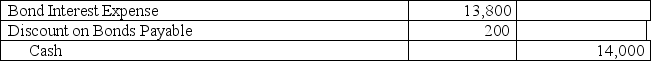

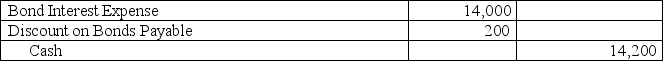

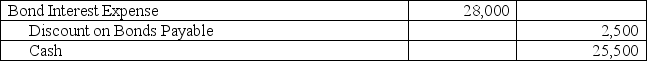

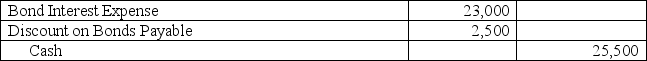

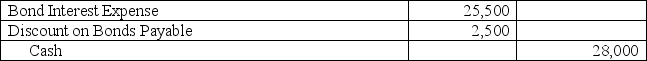

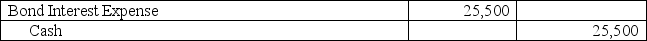

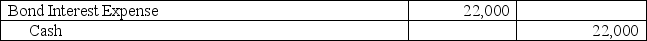

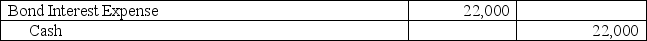

On January 1,2013,a company issued and sold a $400,000,7%,10-year bond payable and received proceeds of $396,000.Interest is payable each June 30 and December 31.The company uses the straight-line method to amortize the discount.The journal entry to record the first interest payment is:

A)

B)

D)

E)

A)

B)

D)

E)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

70

A company issued five-year,7% bonds with a par value of $100,000.The market rate when the bonds were issued was 6.5%.The company received $101,137 cash for the bonds.Using the effective interest method,the amount of recorded interest expense for the first semiannual interest period is:

A)$3,500.00

B)$7,000.00

C)$3,286.95

D)$6,573.90

E)$1,750.00

A)$3,500.00

B)$7,000.00

C)$3,286.95

D)$6,573.90

E)$1,750.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

71

The market value of a bond is equal to:

A)The present value of all future cash payments provided by a bond.

B)The present value of all future interest payments provided by a bond.

C)The present value of the principal for an interest-bearing bond.

D)The future value of all future cash payments provided by a bond.

E)The future value of all future interest payments provided by a bond.

A)The present value of all future cash payments provided by a bond.

B)The present value of all future interest payments provided by a bond.

C)The present value of the principal for an interest-bearing bond.

D)The future value of all future cash payments provided by a bond.

E)The future value of all future interest payments provided by a bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

72

A discount on bonds payable:

A)Occurs when a company issues bonds with a contract rate less than the market rate.

B)Occurs when a company issues bonds with a contract rate more than the market rate.

C)Increases the Bond Payable account.

D)Decreases the total bond interest expense.

E)Is not allowed in many states to protect creditors.

A)Occurs when a company issues bonds with a contract rate less than the market rate.

B)Occurs when a company issues bonds with a contract rate more than the market rate.

C)Increases the Bond Payable account.

D)Decreases the total bond interest expense.

E)Is not allowed in many states to protect creditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

73

A company received cash proceeds of $206,948 on a bond issue with a par value of $200,000.The difference between par value and issue price for this bond is recorded as a:

A)Credit to Interest Income.

B)Credit to Premium on Bonds Payable.

C)Credit to Discount on Bonds Payable.

D)Debit to Premium on Bonds Payable.

E)Debit to Discount on Bonds Payable.

A)Credit to Interest Income.

B)Credit to Premium on Bonds Payable.

C)Credit to Discount on Bonds Payable.

D)Debit to Premium on Bonds Payable.

E)Debit to Discount on Bonds Payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

74

A company issued 10%,five-year bonds with a par value of $400,000.The market rate when the bonds were issued was 8%.The company received $432,458 cash for the bonds.Using the effective interest method,the amount of interest expense for the first semiannual interest period is:

A)$16,000.00

B)$20,000.00

C)$4,324.58

D)$17,298.32

E)$16,754.20

A)$16,000.00

B)$20,000.00

C)$4,324.58

D)$17,298.32

E)$16,754.20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

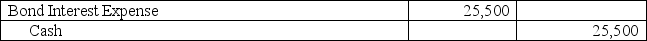

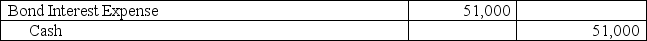

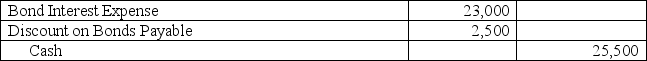

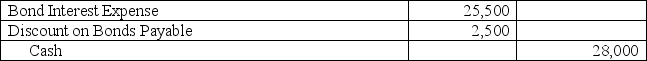

75

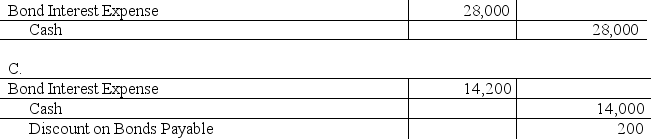

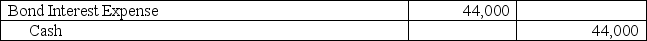

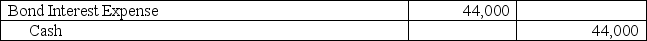

On January 1,2013,a company issued and sold an $850,000,6%,five-year bond payable and received proceeds of $825,000.Interest is payable each June 30 and December 31.The company uses the straight-line method to amortize the discount.The journal entry to record the first interest payment is:

A)

B)

C)

D)

E)

A)

B)

C)

D)

E)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

76

A company issued five-year,7% bonds with a par value of $100,000.The market rate when the bonds were issued was 6.5%.The company received $101,137 cash for the bonds.Using the straight-line method,the amount of recorded interest expense for the first semiannual interest period is:

A)$3,386.30

B)$3,500.00

C)$3,613.70

D)$6,633.70

E)$7,000.00

A)$3,386.30

B)$3,500.00

C)$3,613.70

D)$6,633.70

E)$7,000.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

77

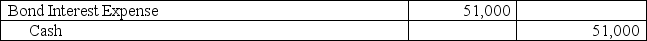

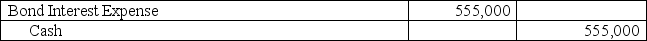

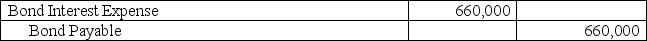

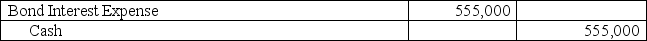

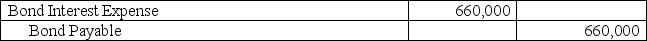

A company issued 8%,15-year bonds with a par value of $550,000.The current market rate is 8%.The journal entry to record each semiannual interest payment is:

A)

B)

C)

D)

E)No entry is needed,since no interest is paid until the bond is due

A)

B)

C)

D)

E)No entry is needed,since no interest is paid until the bond is due

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

78

A company issued 25-year,8% bonds with a par value of $900,000.The company received $1,000,000 cash for the bonds.Using the straight-line method,the amount of interest expense for the first semiannual interest period is:

A)$36,000

B)$34,000

C)$38,000

D)$40,000

E)$32,000

A)$36,000

B)$34,000

C)$38,000

D)$40,000

E)$32,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

79

A company issued seven-year,8% bonds with a par value of $200,000.The market rate when the bonds were issued was 5.5%.The company received $203,010 cash for the bonds.Using the straight-line method,the amount of recorded interest expense for the first semiannual interest period is:

A)$8,000

B)$8,215

C)$7,785

D)$16,000

E)$4,990

A)$8,000

B)$8,215

C)$7,785

D)$16,000

E)$4,990

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

80

The Premium on Bonds Payable account is a(n):

A)Revenue account.

B)Adjunct or accretion liability account.

C)Contra revenue account.

D)Asset account.

E)Contra expense account.

A)Revenue account.

B)Adjunct or accretion liability account.

C)Contra revenue account.

D)Asset account.

E)Contra expense account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck