Deck 13: The Estate Tax

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/107

العب

ملء الشاشة (f)

Deck 13: The Estate Tax

1

The probate estate includes property that passes by will or an intestacy statute and does not include property that passes due to a beneficiary designation.

True

2

Martin transfers stock to an irrevocable trust and names himself to receive the trust income for life with the remainder interest gifted to his son.When Martin dies,

A) none of the stock will be included in Martin's estate.

B) the stock's value at the time of transfer to the trust will be included in Martin's estate.

C) the value of the stock less the present value of the income receivable by Martin will be included in Martin's estate.

D) the value of the stock at death will be included in Martin's estate.

A) none of the stock will be included in Martin's estate.

B) the stock's value at the time of transfer to the trust will be included in Martin's estate.

C) the value of the stock less the present value of the income receivable by Martin will be included in Martin's estate.

D) the value of the stock at death will be included in Martin's estate.

D

3

Taxpayers can avoid the estate tax by making gifts at least a year prior to death.

False

4

Listed stocks are valued at their closing price on the date of death.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

5

A special power of appointment exists if the holder can exercise the power in favor of himself or herself, his or her creditors, or the creditors of his or her estate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

6

An executor may elect to postpone payment of the estate tax attributable to a remainder or reversionary interest until 6 months after the interests of the other person(s)terminate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

7

The estate tax return is due, ignoring extensions, 3-1/2 months after the decedent's date of death.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

8

A terminable interest is one that ceases upon the passage of time or the occurrence of some event.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

9

Administrative expenses are not deductible on the estate's income tax return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

10

For 2013, the unified credit is equivalent to a statutory exemption of

A) $1,000,000.

B) $1,500,000.

C) $780,800.

D) $5,250,000.

A) $1,000,000.

B) $1,500,000.

C) $780,800.

D) $5,250,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

11

An executor can value each asset in an estate at the lower of its FMV at death or the alternate valuation date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

12

Brent, who died on January 10, owned 10 shares of Potts Corporation stock.The closest trading dates to January 10 are January 8 (two working days before the date of death)and January 11 (one working day after the date of death).On January 8, the stock traded at a high of 101 and a low of 97, while on January 11, the high was 90 and the low was 86.The date-of-death per-share value is

A) $99.00.

B) $95.33.

C) $93.50.

D) $91.67.

A) $99.00.

B) $95.33.

C) $93.50.

D) $91.67.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following is deductible in arriving at the amount of the taxable estate?

A) expenses incurred in administering the estate

B) casualty losses that occurred while administering the estate

C) charitable contributions

D) All of the above are deductible.

A) expenses incurred in administering the estate

B) casualty losses that occurred while administering the estate

C) charitable contributions

D) All of the above are deductible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

14

Identify which of the following statements is true.

A) The tax base for the federal estate tax is the total of the decedent's taxable estate and post-1976 taxable gifts.

B) Property included in a decedent's gross estate consists of only that property to which the decedent held title.

C) Funeral expenses are not deductible from the gross estate.

D) All of the above are false.

A) The tax base for the federal estate tax is the total of the decedent's taxable estate and post-1976 taxable gifts.

B) Property included in a decedent's gross estate consists of only that property to which the decedent held title.

C) Funeral expenses are not deductible from the gross estate.

D) All of the above are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

15

The FMV of an asset for gift or estate tax purposes is the same except for

A) marketable securities.

B) land.

C) life insurance policies.

D) patents.

A) marketable securities.

B) land.

C) life insurance policies.

D) patents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

16

The estate tax is a wealth transfer tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

17

The value of stock that is not publicly traded may be determined by considering

A) the nature and history of the business.

B) earning capacity.

C) dividend-paying capacity.

D) all of the above

A) the nature and history of the business.

B) earning capacity.

C) dividend-paying capacity.

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

18

Identify which of the following statements is true.

A) The unified credit is the only credit common to both the gift and estate tax computation.

B) For estate tax purposes, publicly traded stocks are valued at their closing price on the date of death.

C) Stocks traded on a stock exchange are valued at the closing price for the date of death unless the alternate valuation date is elected.

D) All of the above are false.

A) The unified credit is the only credit common to both the gift and estate tax computation.

B) For estate tax purposes, publicly traded stocks are valued at their closing price on the date of death.

C) Stocks traded on a stock exchange are valued at the closing price for the date of death unless the alternate valuation date is elected.

D) All of the above are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

19

The tax base for the federal estate tax is the total of the decedent's taxable estate and post-1986 taxable gifts if the decedent made gifts in 1981.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

20

In 2013, the unified credit enables an estate valued at $5.25 million or less to not be subject to the estate tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

21

Dan transfers an apartment building to Grace but retains the right to the rental income for 10 years.Dan dies nine years after the transfer when the building is worth $600,000.The applicable federal rate is 10% and the reversionary actuarial factor is 0.30.How much would be included in Dan's estate?

A) $0

B) $150,000

C) $350,000

D) $600,000

A) $0

B) $150,000

C) $350,000

D) $600,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

22

Identify which of the following statements is false.

A) The "blockage" regulations allow the IRS to prevent the estate's executor from electing the alternate valuation date.

B) If the alternate valuation date is elected, changes in value that occur solely because of a "mere lapse of time" usually are to be ignored.

C) The alternate valuation date can be elected for estate tax purposes only if the election decreases the value of the gross estate and estate tax liability (after reduction for credits).

D) If property is sold within 6 months of the date of death, the alternative valuation date is the date of sale.

A) The "blockage" regulations allow the IRS to prevent the estate's executor from electing the alternate valuation date.

B) If the alternate valuation date is elected, changes in value that occur solely because of a "mere lapse of time" usually are to be ignored.

C) The alternate valuation date can be elected for estate tax purposes only if the election decreases the value of the gross estate and estate tax liability (after reduction for credits).

D) If property is sold within 6 months of the date of death, the alternative valuation date is the date of sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

23

Identify which of the following statements is false.

A) Annuities not related to employment are valued in the gross estate at the cost of a comparable contract multiplied by a fraction that represents the portion of the purchase price that the decedent has contributed.

B) If an annuity ceases payments with the death of the decedent and nothing is to be received by any other party, the annuity is included in the gross estate.

C) When persons other than spouses own property jointly, the amount included in the joint owner's gross estate is measured in accordance with the consideration the decedent furnished to purchase the property.

D) Statements A and C are true.

A) Annuities not related to employment are valued in the gross estate at the cost of a comparable contract multiplied by a fraction that represents the portion of the purchase price that the decedent has contributed.

B) If an annuity ceases payments with the death of the decedent and nothing is to be received by any other party, the annuity is included in the gross estate.

C) When persons other than spouses own property jointly, the amount included in the joint owner's gross estate is measured in accordance with the consideration the decedent furnished to purchase the property.

D) Statements A and C are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

24

Reversionary interests in publicly traded stocks included in a gross estate must be valued

A) by an independent actuary.

B) by an appraiser.

C) by considering the fact that the transferor has died.

D) using actuarial tables.

A) by an independent actuary.

B) by an appraiser.

C) by considering the fact that the transferor has died.

D) using actuarial tables.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

25

The alternate valuation date can be elected for estate tax purposes only if the election

A) increases the value of the gross estate.

B) decreases the value of the gross estate.

C) decreases the estate tax liability (after reduction for tax credits).

D) Both B and C are required.

A) increases the value of the gross estate.

B) decreases the value of the gross estate.

C) decreases the estate tax liability (after reduction for tax credits).

D) Both B and C are required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

26

Identify which of the following statements is true.

A) A courtesy interest is a widower's interest in his deceased wife's property.

B) All gifts made within three years of the date of death must be included in the gross estate.

C) Dower rights are not the same as courtesy rights.

D) All of the above are false.

A) A courtesy interest is a widower's interest in his deceased wife's property.

B) All gifts made within three years of the date of death must be included in the gross estate.

C) Dower rights are not the same as courtesy rights.

D) All of the above are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

27

In February of the current year, Tom dies.Two years and nine months before the date of death, Tom made a gift of stock valued at $2 million.Gift taxes paid on the transfer by Tom were $435,000 after reduction for a $345,800 unified credit ($780,800 - $345,800).At the time of his death, the gifted stock was valued at $2.3 million.The amount included in Tom's gross estate from this transfer is

A) $2,000,000.

B) $2,300,000.

C) $435,000.

D) none of the above

A) $2,000,000.

B) $2,300,000.

C) $435,000.

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

28

The gross-up rule requires

A) all beneficial interests be included in the decedent's estate.

B) post-1976 gifts by the decedent be included in the decedent's estate.

C) certain gifts made by the decedent within three years of the date of death are included in the decedent's gross estate.

D) gift taxes on gifts made by the decedent or the decedent's spouse that are paid by the decedent or his estate during the three-year period ending with the decedent's date of death must be included in the decedent's gross estate.

A) all beneficial interests be included in the decedent's estate.

B) post-1976 gifts by the decedent be included in the decedent's estate.

C) certain gifts made by the decedent within three years of the date of death are included in the decedent's gross estate.

D) gift taxes on gifts made by the decedent or the decedent's spouse that are paid by the decedent or his estate during the three-year period ending with the decedent's date of death must be included in the decedent's gross estate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

29

On March 1, Bart transfers ownership of a $700,000 life insurance policy on his life that he purchased in 2011.How long must Bart live to avoid inclusion of the $700,000 death benefit in his estate?

A) six months

B) one year

C) three years

D) No minimum time period exists.

A) six months

B) one year

C) three years

D) No minimum time period exists.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

30

Appraisal methods used to value real estate for estate tax purposes may include

A) comparable sales.

B) reproduction cost.

C) capitalization of earnings.

D) all of the above

A) comparable sales.

B) reproduction cost.

C) capitalization of earnings.

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

31

In 2001, Alejandro buys an annuity for $100,000 that will pay Alejandro an annual amount for life with survivor benefits to his wife.When Alejandro dies in the current year, a comparable contract would have cost $81,000.What amount is included in Alejandro's gross estate?

A) $0

B) $81,000

C) $100,000

D) $181,000

A) $0

B) $81,000

C) $100,000

D) $181,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

32

Identify which of the following statements is true.

A) Reversionary interests of less than 5% are includible in the gross estate.

B) A reversionary interest means a chance exists that the property may pass back to the transferor under the terms of the transfer.

C) If a reversionary interest exceeds 3% of the property's value, the amount that is included in the estate is not the value of the reversionary interest, but rather the date-of-death value of the gifted property less the value of intervening life estates.

D) All of the above are false.

A) Reversionary interests of less than 5% are includible in the gross estate.

B) A reversionary interest means a chance exists that the property may pass back to the transferor under the terms of the transfer.

C) If a reversionary interest exceeds 3% of the property's value, the amount that is included in the estate is not the value of the reversionary interest, but rather the date-of-death value of the gifted property less the value of intervening life estates.

D) All of the above are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

33

Yoyo Corporation maintains a retirement plan for its employees to which it makes 70% of the contributions and the employees make 30%.Gary dies this year and is employed at the time of his death.Gary's spouse will receive an annuity valued at $600,000 from the retirement plan.How much of the annuity will be included in Gary's gross estate?

A) $600,000

B) $420,000

C) $180,000

D) $0

A) $600,000

B) $420,000

C) $180,000

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

34

Identify which of the following statements is true.

A) The gross-up rule applies to the gift tax triggered by a gift during a three-year look-forward period.

B) All gift taxes paid by the decedent on gifts made within five years of the date of death must be included in the gross estate.

C) If a transferor retains voting rights in stock of a controlled corporation for the transferor's lifetime, the stock is included in the transferor's gross estate.

D) All of the above are false.

A) The gross-up rule applies to the gift tax triggered by a gift during a three-year look-forward period.

B) All gift taxes paid by the decedent on gifts made within five years of the date of death must be included in the gross estate.

C) If a transferor retains voting rights in stock of a controlled corporation for the transferor's lifetime, the stock is included in the transferor's gross estate.

D) All of the above are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

35

In 2012, Paul transfers $1,000,000 to a trust benefiting his three children.As trustee, he has the power to determine the amount of distributions each year.Paul dies in the current year when the trust has a value of $1,200,000.How much of the trust's value is included in Paul's estate?

A) $0

B) $400,000

C) $1,000,000

D) $1,200,000

A) $0

B) $400,000

C) $1,000,000

D) $1,200,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

36

Denise died April 1 and owned several bonds that paid interest March 31 and September 30.Also, she owned stock that paid dividends quarterly on March 31, June 30, September 30, and December 31.Denise's estate received the interest and dividends on the payment dates.What should be included in Denise's gross estate?

A) all interest and dividends received in the year of death

B) only interest and dividends received prior to the date of death

C) only interest and dividends received after the date of death

D) none of the interest and dividends received

A) all interest and dividends received in the year of death

B) only interest and dividends received prior to the date of death

C) only interest and dividends received after the date of death

D) none of the interest and dividends received

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

37

Identify which of the following statements is true.

A) The alternate valuation date can be used for estate tax purposes only if the election increases the value of the gross estate.

B) If the alternative valuation date is elected, changes in value that occur solely because of "mere lapse of time" usually are to be ignored.

C) The gross estate, a federal law concept, is generally smaller than the probate estate, a state law concept.

D) All of the above are false.

A) The alternate valuation date can be used for estate tax purposes only if the election increases the value of the gross estate.

B) If the alternative valuation date is elected, changes in value that occur solely because of "mere lapse of time" usually are to be ignored.

C) The gross estate, a federal law concept, is generally smaller than the probate estate, a state law concept.

D) All of the above are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

38

Four years ago, Roper transferred to his son ownership of a $100,000 life insurance policy that Roper purchased on his own life in 2000.The cash value of the policy on the transfer date was $25,000.Roper died on March 1st of this year.The amount included in Roper's gross estate due to the life insurance policy is

A) $0.

B) $25,000.

C) $35,000.

D) $100,000.

A) $0.

B) $25,000.

C) $35,000.

D) $100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

39

On March 1, Sue transfers stock worth $20,000 to Frank.How long must Sue live to avoid inclusion of the $20,000 of stock in her gross estate?

A) six months

B) one year

C) three years

D) No minimum time period exists, but she must be alive at transfer of ownership.

A) six months

B) one year

C) three years

D) No minimum time period exists, but she must be alive at transfer of ownership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

40

The alternate valuation date is generally

A) 3 months after the date of death.

B) 6 months after the date of death.

C) 9 months after the date of death.

D) 12 months after the date of death.

A) 3 months after the date of death.

B) 6 months after the date of death.

C) 9 months after the date of death.

D) 12 months after the date of death.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

41

In 2006, Roger gives stock valued at $100,000 to Martha.Roger and Martha are not related.In 2008, Martha uses the stock then valued at $110,000 as partial consideration to acquire realty costing $220,000.Pat (her brother)furnishes the remaining $110,000 of consideration.The realty is titled in the names of Martha and Pat as joint tenants with right of survivorship.This year, Martha dies and Pat survives.The realty is valued at $300,000 at Martha's death.How much, if any, of the realty's value will be included in Martha's estate?

A) $0

B) $110,000

C) $150,000

D) $300,000

A) $0

B) $110,000

C) $150,000

D) $300,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

42

Identify which of the following statements is false.

A) To qualify for the marital deduction, property must be includible in the decedent's gross estate.

B) Property is not eligible for the marital deduction if it passes to the spouse under the individual's dower rights.

C) A terminable interest is one that ceases upon the passage of time or the occurrence of some event.

D) Some, but not all, terminal interests qualify for the marital deduction.

A) To qualify for the marital deduction, property must be includible in the decedent's gross estate.

B) Property is not eligible for the marital deduction if it passes to the spouse under the individual's dower rights.

C) A terminable interest is one that ceases upon the passage of time or the occurrence of some event.

D) Some, but not all, terminal interests qualify for the marital deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

43

In 2001, Polly and Fred, brother and sister, purchased a condominium at a golf resort.Polly contributed 60% of the $200,000 cost; Fred contributed 40%.Polly dies in the current year when the condominium has a $300,000 value.How much is included in Polly's estate?

A) $120,000

B) $180,000

C) $200,000

D) $300,000

A) $120,000

B) $180,000

C) $200,000

D) $300,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

44

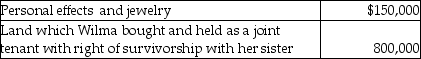

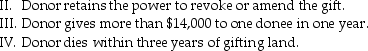

Following are the fair market values of Wilma's assets at her date of death:  The executor of Wilma's estate did not elect the alternate valuation date.The amount includible in Wilma's gross estate is

The executor of Wilma's estate did not elect the alternate valuation date.The amount includible in Wilma's gross estate is

A) $150,000.

B) $550,000.

C) $800,000.

D) $950,000.

The executor of Wilma's estate did not elect the alternate valuation date.The amount includible in Wilma's gross estate is

The executor of Wilma's estate did not elect the alternate valuation date.The amount includible in Wilma's gross estate isA) $150,000.

B) $550,000.

C) $800,000.

D) $950,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

45

Identify which of the following statements is true.

A) Administrative expenses are not deductible on the estate's income tax return.

B) Casualty or theft losses incurred during the administration of the estate are not deductible on the estate tax return.

C) There is a limitation of $100,000 on the charitable contribution deduction for estate tax purposes.

D) All of the above are false.

A) Administrative expenses are not deductible on the estate's income tax return.

B) Casualty or theft losses incurred during the administration of the estate are not deductible on the estate tax return.

C) There is a limitation of $100,000 on the charitable contribution deduction for estate tax purposes.

D) All of the above are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

46

Lou dies on April 12, 2011.All of Lou's property passed to Paula, his daughter.Paula dies on January 15, 2013.Both Lou's and Paula's estates pay federal estate taxes.Lou's estate tax was $350,000.How much can Paula's estate claim for a credit for tax on prior transfers?

A) $350,000

B) $280,000

C) $210,000

D) $140,000

A) $350,000

B) $280,000

C) $210,000

D) $140,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following credits is available for estate tax purposes?

A) investment tax credit

B) credit for income taxes paid on decedent's final return

C) credit for estate taxes paid on certain prior transfers

D) All of the above are available.

A) investment tax credit

B) credit for income taxes paid on decedent's final return

C) credit for estate taxes paid on certain prior transfers

D) All of the above are available.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following is not a credit for purposes of computing the federal estate tax liability?

A) credit for gift tax paid on pre-1977 gifts

B) credit for estate taxes paid on certain prior transfers

C) a credit for foreign death taxes

D) All of the above are credits for the federal estate tax.

A) credit for gift tax paid on pre-1977 gifts

B) credit for estate taxes paid on certain prior transfers

C) a credit for foreign death taxes

D) All of the above are credits for the federal estate tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

49

Ernie died this year.His will creates a $2,000,000 QTIP trust for his widow.Ernie's executor elects to claim the marital deduction for the QTIP transfer.At the time of the surviving spouse's death, the value of the QTIP trust is $3.6 million.The amount of the QTIP trust included in the surviving spouse's gross estate is

A) $3,600,000.

B) $2,000,000.

C) $1,800,000.

D) $0.

A) $3,600,000.

B) $2,000,000.

C) $1,800,000.

D) $0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

50

Ted died on May 3.At the time of his death, he owned a beach house valued at $250,000.On June 10, the beach house was completely destroyed by a hurricane and there was no insurance coverage.If the executor elects to use the alternate valuation date, the executor will

A) include the beach house in the gross estate at $250,000.

B) take a casualty loss of $250,000 on the estate tax return.

C) take a casualty loss of $250,000 on the estate's income tax return.

D) include the beach house in the gross estate at $0.

A) include the beach house in the gross estate at $250,000.

B) take a casualty loss of $250,000 on the estate tax return.

C) take a casualty loss of $250,000 on the estate's income tax return.

D) include the beach house in the gross estate at $0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

51

Two years ago, Nils transfers a $200,000 life insurance policy on his life to his daughter, Gail.The policy is worth $60,000 at the time of transfer and Gail pays Nils $50,000.When Nils dies this year, the $50,000 cash is still in a savings account.The consideration offset when computing Nils's gross estate is

A) $0.

B) $50,000.

C) $150,000.

D) $166,667.

A) $0.

B) $50,000.

C) $150,000.

D) $166,667.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

52

Proceeds of a life insurance policy payable to the estate's executor, as the estate's representative, are

A) includible in the decedent's gross estate only if the premiums had been paid by the insured.

B) includible in the decedent's gross estate only if the policy was taken out within three years of the insured's death.

C) never includible in the decedent's gross estate.

D) always includible in the decedent's gross estate.

A) includible in the decedent's gross estate only if the premiums had been paid by the insured.

B) includible in the decedent's gross estate only if the policy was taken out within three years of the insured's death.

C) never includible in the decedent's gross estate.

D) always includible in the decedent's gross estate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

53

Identify which of the following statements is true.

A) If spouses are the only joint owners, only one-half of the value of the jointly owned property is included in the gross estate, regardless of the relative amount of consideration provided by either spouse.

B) Special powers of appointment give the power holder less restricted powers than a general power of appointment.

C) The gross estate does not include the value of life insurance policies on the decedent if the proceeds are receivable by the executor or for the benefit of the estate.

D) All of the above are false.

A) If spouses are the only joint owners, only one-half of the value of the jointly owned property is included in the gross estate, regardless of the relative amount of consideration provided by either spouse.

B) Special powers of appointment give the power holder less restricted powers than a general power of appointment.

C) The gross estate does not include the value of life insurance policies on the decedent if the proceeds are receivable by the executor or for the benefit of the estate.

D) All of the above are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

54

Four years ago, David gave land to Mike that he purchased for $70,000, which is presently worth $100,000.Three years ago, Mike exchanged the land (then worth $150,000)along with a $100,000 cash contribution made by David for a new piece of land worth $250,000.The new land is titled with David and Mike as joint tenants with the right of survivorship.When Mike dies this year, the land is worth $300,000.Mike's estate will include

A) $0.

B) $150,000.

C) $180,000.

D) $300,000.

A) $0.

B) $150,000.

C) $180,000.

D) $300,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

55

When computing the federal estate tax liability in 2013, the maximum amount for a taxable estate (not tentative tax)that the unified credit for the current year will eliminate all of the tax is

A) $555,800.

B) $780,800.

C) $5,250,000.

D) $2,000,000.

A) $555,800.

B) $780,800.

C) $5,250,000.

D) $2,000,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following is not a test for an interest to qualify for the marital deduction?

A) The property must be included in the decedent's gross estate.

B) If a QTIP transfer is made, the spouse must be entitled to all of the income at least annually for life.

C) The interest conveyed must not be a nondeductible terminable interest.

D) All of the above are required.

A) The property must be included in the decedent's gross estate.

B) If a QTIP transfer is made, the spouse must be entitled to all of the income at least annually for life.

C) The interest conveyed must not be a nondeductible terminable interest.

D) All of the above are required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

57

Identify which of the following statements is true.

A) Regardless of how large the gross estate is, the estate tax liability can be completely eliminated if the estate is willed to a charitable organization.

B) There is a ceiling on the marital deduction.

C) All transfers to the surviving spouse are eligible for the marital deduction.

D) All of the above are false.

A) Regardless of how large the gross estate is, the estate tax liability can be completely eliminated if the estate is willed to a charitable organization.

B) There is a ceiling on the marital deduction.

C) All transfers to the surviving spouse are eligible for the marital deduction.

D) All of the above are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

58

Identify which of the following statements is true.

A) If a marital deduction is elected on a QTIP trust transfer, property remaining in the QTIP trust is not included in the estate of the surviving spouse.

B) The credit for state death taxes has been replaced with a deduction for state estate taxes.

C) The unified credit is the only credit allowed against the estate tax.

D) All of the above are false.

A) If a marital deduction is elected on a QTIP trust transfer, property remaining in the QTIP trust is not included in the estate of the surviving spouse.

B) The credit for state death taxes has been replaced with a deduction for state estate taxes.

C) The unified credit is the only credit allowed against the estate tax.

D) All of the above are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

59

Identify which of the following statements is true.

A) The credit for taxes paid on prior transfers does not reduce the impact of property being taxed in more than one estate in quick succession.

B) The deduction for state death taxes is not limited.

C) An estate is not entitled to a credit for foreign death taxes paid on property located in a foreign country and included in the gross estate.

D) All of the above are false.

A) The credit for taxes paid on prior transfers does not reduce the impact of property being taxed in more than one estate in quick succession.

B) The deduction for state death taxes is not limited.

C) An estate is not entitled to a credit for foreign death taxes paid on property located in a foreign country and included in the gross estate.

D) All of the above are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

60

Joe dies late in 2011 and his estate is subject to an estate tax of $2 million.He leaves all of his assets to his daughter, Claudia.Claudia dies in early 2013.Which of the following statements is correct?

A) Claudia's estate receives no credit or deduction for the tax paid by Joe's estate.

B) Claudia's estate receives a credit for $1,000,000 of Joe's estate tax.

C) Claudia's estate receives a credit for $2,000,000 of Joe's estate tax.

D) Claudia's estate receives a deduction for $2,000,000 of Joe's estate tax.

A) Claudia's estate receives no credit or deduction for the tax paid by Joe's estate.

B) Claudia's estate receives a credit for $1,000,000 of Joe's estate tax.

C) Claudia's estate receives a credit for $2,000,000 of Joe's estate tax.

D) Claudia's estate receives a deduction for $2,000,000 of Joe's estate tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

61

The payment date for estate taxes may be extended by the IRS for all of the following reasons except

A) the estate includes a 40% interest in a closely held business.

B) the estate includes a relatively large remainder or reversionary interest.

C) the executor of the estate shows reasonable cause.

D) All are valid reasons.

A) the estate includes a 40% interest in a closely held business.

B) the estate includes a relatively large remainder or reversionary interest.

C) the executor of the estate shows reasonable cause.

D) All are valid reasons.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

62

Melissa transferred $650,000 in trust in 2006: income for life to herself, the remainder to her son.What part, if any, of the value of the trust's assets will be included in Melissa's estate?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

63

The maximum amount of the stock redemption proceeds under Sec.303 is determined by summing all of the following except

A) the estate's death taxes.

B) the estate's funeral expenses.

C) the estate's administrative expenses.

D) All are allowable.

A) the estate's death taxes.

B) the estate's funeral expenses.

C) the estate's administrative expenses.

D) All are allowable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

64

Identify which of the following statements is true.

A) The transferee is liable for the generation-skipping transfer tax (GSTT) in the case of a direct skip.

B) Special use valuation is available for farmland to help alleviate liquidity problems.

C) Qualified disclaimers are not available for estate planning purposes.

D) All of the above are false.

A) The transferee is liable for the generation-skipping transfer tax (GSTT) in the case of a direct skip.

B) Special use valuation is available for farmland to help alleviate liquidity problems.

C) Qualified disclaimers are not available for estate planning purposes.

D) All of the above are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

65

One of the major problems facing executors in managing the estate is

A) identifying deductions.

B) liquidity.

C) the unified credit computation.

D) determining the method to value assets.

A) identifying deductions.

B) liquidity.

C) the unified credit computation.

D) determining the method to value assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

66

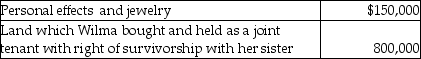

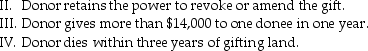

Which of the following circumstances would cause the gifted property to be included in the donor's gross estate? I.Donor retains a life estate in the gift property.

A) I, II and III

B) I, II

C) II, IV

D) III, IV

A) I, II and III

B) I, II

C) II, IV

D) III, IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

67

In 2002, Gert made a $5,000,000 taxable gift.The 2002 gift tax on $5,000,000 was $2,275.800.Gert was entitled to a unified credit of $345,800, resulting in a gift tax of $1,193,000.The marginal tax rate in 2002 is 50%.Assume Gert dies in 2013 when the credit is $2,045.800 and the marginal rate is 40%, the tax on $5,000,000 would equal $1,945,800 before subtracting any credit.In arriving at Gert's estate tax liability, what is the amount subtracted for 1992 gift taxes paid?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

68

The GSTT's (generation-skipping transfer tax)purpose is

A) to impose a graduated transfer tax one time a generation.

B) to impose some form of transfer tax one time a generation.

C) to impose a graduated transfer tax every other generation.

D) to impose some form of transfer tax every other generation.

A) to impose a graduated transfer tax one time a generation.

B) to impose some form of transfer tax one time a generation.

C) to impose a graduated transfer tax every other generation.

D) to impose some form of transfer tax every other generation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

69

Yee made $3 million of taxable gifts in 1993 and paid gift taxes (less the unified credit)of $1,098,000.Yee died in 2013 with a taxable estate of $10,000,000.At current rates, the gift taxes payable on $3 million would be $1,145,800.Yee died in a year when the unified credit was $2,045,800.Determine her estate tax liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

70

Sasha gives $1,000,000 to her granddaughter.Sasha has used all of her unified credit and is in the 40% marginal gift tax bracket; ignore the annual exclusion and exemption.What is the amount of her tax on this transfer?

A) $450,000

B) $400,000

C) $1,450,000

D) $652,500

A) $450,000

B) $400,000

C) $1,450,000

D) $652,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

71

A qualified disclaimer is a valuable estate planning tool because

A) it establishes the value of the disclaimed assets.

B) it qualifies the assets for the alternative valuation date.

C) it is not treated as a gift made by the person who disclaims.

D) it allows the person making the disclaimer to determine the recipient.

A) it establishes the value of the disclaimed assets.

B) it qualifies the assets for the alternative valuation date.

C) it is not treated as a gift made by the person who disclaims.

D) it allows the person making the disclaimer to determine the recipient.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

72

Identify which of the following statements is false.

A) Life insurance can help provide liquidity for paying estate taxes.

B) Life insurance has the potential for large appreciation.

C) The insured does not have to be the owner of the policy.

D) Life insurance is always part of the estate of the insured.

A) Life insurance can help provide liquidity for paying estate taxes.

B) Life insurance has the potential for large appreciation.

C) The insured does not have to be the owner of the policy.

D) Life insurance is always part of the estate of the insured.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

73

A stock redemption to pay death taxes under Sec.303 is generally treated as

A) a sale or exchange of property.

B) a dividend.

C) a return of capital.

D) ordinary income.

A) a sale or exchange of property.

B) a dividend.

C) a return of capital.

D) ordinary income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

74

Identify which of the following statements is true.

A) In general, an estate tax return is not required to be filed unless the value of the gross estate and adjusted taxable gifts exceeds the exemption equivalent.

B) Estate taxes must be paid when the return is filed, including any extensions.

C) The estate tax return is due, ignoring extensions, 12 months after the decedent's date of death.

D) All of the above are false.

A) In general, an estate tax return is not required to be filed unless the value of the gross estate and adjusted taxable gifts exceeds the exemption equivalent.

B) Estate taxes must be paid when the return is filed, including any extensions.

C) The estate tax return is due, ignoring extensions, 12 months after the decedent's date of death.

D) All of the above are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

75

Identify which of the following statements is false.

A) Special use valuation is available for farmland to help alleviate liquidity problems.

B) The transferee is liable for the generation-skipping transfer tax (GSTT) in the case of a direct skip.

C) The generation-skipping transfer tax (GSTT) is imposed to assure that some form of transfer taxation is imposed once a generation.

D) A direct skip skips one or more generations.

A) Special use valuation is available for farmland to help alleviate liquidity problems.

B) The transferee is liable for the generation-skipping transfer tax (GSTT) in the case of a direct skip.

C) The generation-skipping transfer tax (GSTT) is imposed to assure that some form of transfer taxation is imposed once a generation.

D) A direct skip skips one or more generations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

76

Identify which of the following statements is true.

A) The estate tax on interests in certain closely held businesses may be paid in installments over a 15-year period if elected.

B) An executor may elect to postpone payment of the estate tax attributable to a remainder or reversionary interest until six months after the interests of the other person(s) terminate.

C) A corporation with 25 owners can be classified as a closely held business if the decedent's gross estate holds 10% of the stock.

D) All of the above are false.

A) The estate tax on interests in certain closely held businesses may be paid in installments over a 15-year period if elected.

B) An executor may elect to postpone payment of the estate tax attributable to a remainder or reversionary interest until six months after the interests of the other person(s) terminate.

C) A corporation with 25 owners can be classified as a closely held business if the decedent's gross estate holds 10% of the stock.

D) All of the above are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

77

Identify which of the following statements is false.

A) Every grantor is entitled to a $5.25 million exemption from the GSTT in 2011.

B) If Greg transfers assets directly to his grandson, this transaction would be an example of a direct skip.

C) If Shaad transfers property in trust to his son, with the remainder to his grandson, at the death of the son a taxable termination will result.

D) The GSTT is levied at a flat rate, which is higher than the top rate under the estate tax rate schedule.

A) Every grantor is entitled to a $5.25 million exemption from the GSTT in 2011.

B) If Greg transfers assets directly to his grandson, this transaction would be an example of a direct skip.

C) If Shaad transfers property in trust to his son, with the remainder to his grandson, at the death of the son a taxable termination will result.

D) The GSTT is levied at a flat rate, which is higher than the top rate under the estate tax rate schedule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

78

Identify which of the following statements is true.

A) The period for payment of estate taxes may be extended if the executor shows "reasonable cause" for not being able to pay some, or all, of the estate tax liability on the regular due date.

B) The estate tax on interests in certain closely held businesses may be paid in installments over a 15-year period if elected.

C) An executor may elect to postpone payment of the estate tax attributable to a remainder or reversionary interest until eight months after the interests of the other person(s) terminate.

D) All of the above are false.

A) The period for payment of estate taxes may be extended if the executor shows "reasonable cause" for not being able to pay some, or all, of the estate tax liability on the regular due date.

B) The estate tax on interests in certain closely held businesses may be paid in installments over a 15-year period if elected.

C) An executor may elect to postpone payment of the estate tax attributable to a remainder or reversionary interest until eight months after the interests of the other person(s) terminate.

D) All of the above are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

79

In 2001, Clara made taxable gifts of $2 million.This year, Clara dies with a taxable estate of $4 million.At the time of her death, the FMV of the property Clara gifted in 2001 is $8 million.What is the amount of the estate tax base?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

80

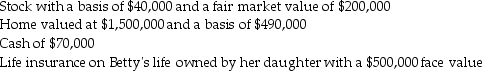

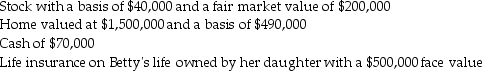

Betty dies on February 20, 2013.Her estate consisted of the following assets, all valued as of her date of death:  What is Betty's gross estate?

What is Betty's gross estate?

A) $600,000

B) $1,100,000

C) $1,770,000

D) $2,270,000

What is Betty's gross estate?

What is Betty's gross estate?A) $600,000

B) $1,100,000

C) $1,770,000

D) $2,270,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck