Deck 11: Auditing of Governmental and Not-For-Profit Organizations

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/51

العب

ملء الشاشة (f)

Deck 11: Auditing of Governmental and Not-For-Profit Organizations

1

The "net position" of a federal agency may include all of the following components,except.

A)Unexpended appropriations.

B)Cumulative results of operations.

C)Appropriations represented by undelivered orders and unobligated balances.

D)Fund balance with U.S.Treasury.

A)Unexpended appropriations.

B)Cumulative results of operations.

C)Appropriations represented by undelivered orders and unobligated balances.

D)Fund balance with U.S.Treasury.

D

2

Fund balances of a federal agency's various funds are reported in the fund equity section of the agency's balance sheet.

False

Explanation: The fund balances (net assets) of the various funds are reported in the net position section of an agency's balance sheet.

Explanation: The fund balances (net assets) of the various funds are reported in the net position section of an agency's balance sheet.

3

Federal government agencies prepare a management's discussion and analysis (MD&A)to be included in their general purpose federal financial report.

True

Explanation: Statement of Federal Financial Accounting Concepts No. 3 requires an MD&A for federal agencies to be in compliance with federal GAAP.

Explanation: Statement of Federal Financial Accounting Concepts No. 3 requires an MD&A for federal agencies to be in compliance with federal GAAP.

4

FASAB has identified four major user groups of federal financial reports,they are

A)Congress,executives,program managers,and citizens.

B)Congress,executives,citizens,and bond rating agencies.

C)Congress,program managers,foreign governments,and citizens.

D)Congress,program managers,bond rating agencies,and political parties.

A)Congress,executives,program managers,and citizens.

B)Congress,executives,citizens,and bond rating agencies.

C)Congress,program managers,foreign governments,and citizens.

D)Congress,program managers,bond rating agencies,and political parties.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

5

Cumulative results of operations is the component of net position in a federal agency balance sheet that represents the amount of appropriations still available for obligation,or which has been obligated but not yet expended.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

6

Beneficial investments of the federal government in items such as nonfederal physical property,human capital,and research and development on the financial statements are called heritage assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

7

The federal budgetary term "commitment" is synonymous with "encumbrance" as used in state and local government terminology.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

8

Objectives that are identified by SFFAS No.1 for federal financial reporting include budgetary integrity,operating performance,transparency,but not stewardship.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

9

The three perspectives from which the federal government can be viewed are organizational,budget,and line-item.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

10

The financial statements of the U.S.government are prepared using generally accepted accounting principles promulgated by the Governmental Accounting Standards Board.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following federal officials is a "principal" of the Joint Financial Management Improvement Program who considers and approves or disapproves accounting and reporting standards recommended by the Federal Accounting Standards Advisory Board?

A)Chair of the Federal Accounting Standards Advisory Board.

B)Secretary of the Interior.

C)Comptroller General.

D)Director of the Congressional Budget Office.

A)Chair of the Federal Accounting Standards Advisory Board.

B)Secretary of the Interior.

C)Comptroller General.

D)Director of the Congressional Budget Office.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

12

The objectives of federal financial reporting are to assist report users in evaluating budgetary integrity,operating performance,stewardship,and adequacy of systems and controls.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

13

At the present time,the conceptual framework for the federal government and its agencies does not provide definitions of the basic elements of the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

14

Unexpended appropriations is the component of net position in a federal agency balance sheet that represents the amount of appropriations still available for obligation,or which has been obligated but not yet expended.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

15

Responsibility for setting accounting and reporting standards for federal agencies rests primarily with the Federal Accounting Standards Advisory Board.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

16

Federal government accounting standards require the measurement of expenses rather than expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

17

Federal departments and agencies should utilize the U.S.Government Standard General Ledger as the account structure for their accounting systems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following is not an objective identified in FASAB Statement of Accounting and Reporting Concepts No.1?

A)To assist report users in evaluating budgetary integrity.

B)To assist report users in evaluating the extent to which tax burdens have changed.

C)To assist report users in evaluating stewardship.

D)To assist report users in evaluating operating performance.

A)To assist report users in evaluating budgetary integrity.

B)To assist report users in evaluating the extent to which tax burdens have changed.

C)To assist report users in evaluating stewardship.

D)To assist report users in evaluating operating performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

19

The Chief Financial Officer Act of 1990 establishes an office of federal financial management within the OMB,headed by a controller appointed by the President,establishes a chief financial officer position within each major federal department and agency,requires the development of a 5-year financial plan by OMB,and requires some federal agencies to provide audited financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

20

Current FASAB standards distinguish intragovernmental assets from governmental assets and entity assets from nonentity assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

21

Explain the "dual-track" accounting system used by federal agencies and why it is needed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following statements is not true about the United States government-wide financial report?

A)Since 1997,the financial statements of the U.S.government as a whole have been audited by the GAO.

B)The majority of the 24 major federal agencies required to be audited have received unqualified audit opinions by the GAO.

C)The Comptroller General of the United States has rendered a disclaimer of opinion on the U.S.Government's consolidated financial statements for as long as that office has audited these statements.

D)The federal government received an unqualified opinion from the GAO on the most recent financial statements of the U.S.government as a whole.

A)Since 1997,the financial statements of the U.S.government as a whole have been audited by the GAO.

B)The majority of the 24 major federal agencies required to be audited have received unqualified audit opinions by the GAO.

C)The Comptroller General of the United States has rendered a disclaimer of opinion on the U.S.Government's consolidated financial statements for as long as that office has audited these statements.

D)The federal government received an unqualified opinion from the GAO on the most recent financial statements of the U.S.government as a whole.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

23

Explain the GAAP hierarchy used by federal government agencies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

24

The required report or statements in the general purpose federal financial report that addresses forward-looking information regarding the possible effects of currently known demands,risks,and uncertainties,and trends in the federal entity is (are):

A)Basic statements.

B)Required supplemental information.

C)Management discussion and analysis.

D)Related notes to the financial statements.

A)Basic statements.

B)Required supplemental information.

C)Management discussion and analysis.

D)Related notes to the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

25

The Comptroller General of the United States is the head of the:

A)Office of the Management and Budget.

B)Government Accountability Office.

C)Congressional Budget Office.

D)Federal Accounting Standards Advisory Board.

A)Office of the Management and Budget.

B)Government Accountability Office.

C)Congressional Budget Office.

D)Federal Accounting Standards Advisory Board.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following is an accurate list of the three perspectives from which the federal government can be viewed,as described in SFFAS No.2 "Entity and Display?"

A)Function,department,and program.

B)Organizational,budget,and program.

C)Budget,program,and line-item.

D)Fund,activity,and account.

A)Function,department,and program.

B)Organizational,budget,and program.

C)Budget,program,and line-item.

D)Fund,activity,and account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following statements most accurately describes the dual-track accounting system used in federal agency accounting?

A)Recording internal budgetary transactions along with financial transactions with external parties.

B)Use of double-entry accounting.

C)Maintaining self-balancing sets of proprietary and budgetary accounts and recording the effects of transactions on both available budgetary resources and proprietary accounts,the latter measured on the accrual basis to better promote agency management.

D)Keeping separate books,one on a tax basis and the other on a GAAP basis.

A)Recording internal budgetary transactions along with financial transactions with external parties.

B)Use of double-entry accounting.

C)Maintaining self-balancing sets of proprietary and budgetary accounts and recording the effects of transactions on both available budgetary resources and proprietary accounts,the latter measured on the accrual basis to better promote agency management.

D)Keeping separate books,one on a tax basis and the other on a GAAP basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following is required by OMB Circular A-136 in the basic financial statements?

A)Statement of changes in net position.

B)Statement of net assets.

C)Statement of revenues,expenditures,and changes in fund balances.

D)Statement of financing.

A)Statement of changes in net position.

B)Statement of net assets.

C)Statement of revenues,expenditures,and changes in fund balances.

D)Statement of financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

29

One of the purposes of the Federal Financial Management Improvement Act of 1996 was to

A)Establish a requirement that the financial statements of the federal government as a whole be audited.

B)Improve the effectiveness of programs receiving federal funds.

C)Establish generally accepted federal accounting principles.

D)Rebuild the credibility and restore public confidence in the federal government.

A)Establish a requirement that the financial statements of the federal government as a whole be audited.

B)Improve the effectiveness of programs receiving federal funds.

C)Establish generally accepted federal accounting principles.

D)Rebuild the credibility and restore public confidence in the federal government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

30

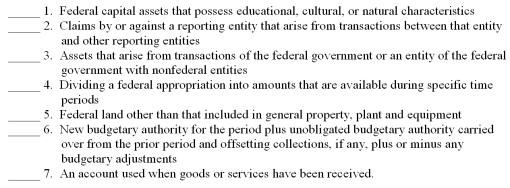

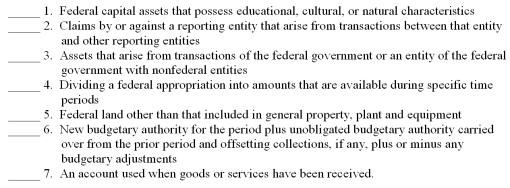

The following are key terms in Chapter 11 that relate to accounting and financial reporting for federal agencies and the federal government:

A.Apportionment

B.Budgetary resources

C.Expended appropriation

D.Governmental assets

E.Heritage assets

F.Intragovernmental assets

G.Stewardship investments

H.Stewardship land

For each of the following definitions,indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition.

A.Apportionment

B.Budgetary resources

C.Expended appropriation

D.Governmental assets

E.Heritage assets

F.Intragovernmental assets

G.Stewardship investments

H.Stewardship land

For each of the following definitions,indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

31

In federal government accounting,recording the estimated amount of equipment prior to actually placing an order or entering into a contract is called a(an)

A)Obligation.

B)Apportionment.

C)Commitment.

D)Allotment.

A)Obligation.

B)Apportionment.

C)Commitment.

D)Allotment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following financial statements is not required by OMB Circular A-136?

A)Statement of budgetary resources.

B)Statement of cash flows.

C)Balance sheet.

D)Statement of changes in net position.

A)Statement of budgetary resources.

B)Statement of cash flows.

C)Balance sheet.

D)Statement of changes in net position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

33

A certain federal agency placed an order for office supplies at an estimated cost of $14,400.Later in the same fiscal year these supplies were received at an actual cost of $14,800.Assume commitment accounting is not used by this agency.When the order is received the required journal entry (or entries)will affect the accounts shown in what net amounts?

A)Budgetary Accounts: $14,400; Proprietary Accounts: $14,400

B)Budgetary Accounts: $14,400; Proprietary Accounts: $14,800

C)Budgetary Accounts: $400; Proprietary Accounts: $14,800

D)Budgetary Accounts: $0; Proprietary Accounts: $14,800

A)Budgetary Accounts: $14,400; Proprietary Accounts: $14,400

B)Budgetary Accounts: $14,400; Proprietary Accounts: $14,800

C)Budgetary Accounts: $400; Proprietary Accounts: $14,800

D)Budgetary Accounts: $0; Proprietary Accounts: $14,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

34

Explain the components of net position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following describes the usual flow of budgetary authority through the budgetary accounts of a federal agency?

A)Apportionment,allotment,appropriation,commitment,obligation,expended appropriation.

B)Allotment,commitment,obligation,expended appropriation,apportionment.

C)Appropriation,apportionment,allotment,commitment,obligation,expended appropriation.

D)Commitment,obligation,appropriation,apportionment,allotment,expended appropriation.

A)Apportionment,allotment,appropriation,commitment,obligation,expended appropriation.

B)Allotment,commitment,obligation,expended appropriation,apportionment.

C)Appropriation,apportionment,allotment,commitment,obligation,expended appropriation.

D)Commitment,obligation,appropriation,apportionment,allotment,expended appropriation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

36

The management's discussion and analysis (MD&A)required in general purpose federal financial reporting is different than that required by GASB of state and local governments in that:

A)Federal agencies should address the reporting entity's performance goals and results in addition to financial activities.

B)It is outside the general purpose federal financial report and is optional,not required.

C)It is a part of the basic financial statements.

D)There are no significant differences.

A)Federal agencies should address the reporting entity's performance goals and results in addition to financial activities.

B)It is outside the general purpose federal financial report and is optional,not required.

C)It is a part of the basic financial statements.

D)There are no significant differences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

37

A certain federal agency placed an order for office supplies at an estimated cost of $14,400.Later in the same fiscal year these supplies were received at an actual cost of $14,800.Assume commitment accounting is not used by this agency.When the order is placed the required journal entry (or entries)will affect the accounts shown in what net amounts?

A)Budgetary accounts: $14,400; Proprietary accounts: $14,400

B)Budgetary accounts: $14,400; Proprietary accounts: $0

C)Budgetary accounts: $14,400; Proprietary accounts: $14,800

D)Budgetary accounts: $0; Proprietary accounts: $0

A)Budgetary accounts: $14,400; Proprietary accounts: $14,400

B)Budgetary accounts: $14,400; Proprietary accounts: $0

C)Budgetary accounts: $14,400; Proprietary accounts: $14,800

D)Budgetary accounts: $0; Proprietary accounts: $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following federal programs involve nonexchange transactions for which there is some accounting guidance on recording liabilities but for which much more research is needed?

A)National parks.

B)Social insurance.

C)Post offices.

D)Heritage assets.

A)National parks.

B)Social insurance.

C)Post offices.

D)Heritage assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following accounts used in state and local government accounting is most like the federal budgetary account "Undelivered Orders"?

A)Reserve for Encumbrance.

B)Expenditures.

C)Appropriations.

D)Encumbrances.

A)Reserve for Encumbrance.

B)Expenditures.

C)Appropriations.

D)Encumbrances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following officials has shared responsibility under federal law for establishing and maintaining a sound financial structure for the federal government?

A)Chief Financial Officer of the Congressional Budget Office.

B)Chair of the Governmental Accounting Standards Board.

C)Secretary of the Treasury.

D)Chair of the Federal Accounting Standards Advisory Board.

A)Chief Financial Officer of the Congressional Budget Office.

B)Chair of the Governmental Accounting Standards Board.

C)Secretary of the Treasury.

D)Chair of the Federal Accounting Standards Advisory Board.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

41

The Federal Monuments Commission began operations on October 1,2011.Show in general journal form all entries that should be made in budgetary and proprietary accounts of the agency to record the following events:

A.The Congress passed,and the President signed,a one-year appropriation for fiscal year 2012 for the Monuments Commission in the amount of $30,000,000.

B.The OMB notified the agency of the following apportionments of the 2012 appropriation: first quarter,$8,000,000; second quarter,$8,000,000; third quarter,$7,000,000; and fourth quarter,$7,000,000.

C.The Commission Director allotted $1,500,000 for the operations of October 2011.

D.Commitments for goods and services not yet ordered or received were recorded in the amount of $1,300,000.

E.Purchase orders and contracts for services were recorded for the month of October 2011 in the amount of $1,250,000.

A.The Congress passed,and the President signed,a one-year appropriation for fiscal year 2012 for the Monuments Commission in the amount of $30,000,000.

B.The OMB notified the agency of the following apportionments of the 2012 appropriation: first quarter,$8,000,000; second quarter,$8,000,000; third quarter,$7,000,000; and fourth quarter,$7,000,000.

C.The Commission Director allotted $1,500,000 for the operations of October 2011.

D.Commitments for goods and services not yet ordered or received were recorded in the amount of $1,300,000.

E.Purchase orders and contracts for services were recorded for the month of October 2011 in the amount of $1,250,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

42

Identify the office,officer,or department of the United States federal government that is responsible for each of the following:

A)Appropriations.

B)Apportionments.

C)Allotments.

D)Obligations.

A)Appropriations.

B)Apportionments.

C)Allotments.

D)Obligations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

43

"Each federal government agency should maintain a General Fund and as many other funds defined by the GASB as are appropriate." Do you agree? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

44

Describe the budgetary accounts used in federal agency accounting and the flow of budgetary authority through those accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

45

What is a Performance and Accountability Report (PAR)? Describe its purpose and contents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

46

What is the difference between entity assets and nonentity assets?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

47

Describe accounting for federal social insurance programs.Comment on the adequacy of current accounting standards in this area.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

48

Describe the purpose of a management's discussion and analysis (MD&A)in the general purpose federal financial report of a federal agency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

49

Explain the process of financial reporting of the U.S.Government as a whole.Does the federal government receive an unqualified audit opinion?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

50

The Desert Conservation Agency was authorized by the United States Congress to commence operations on October 1,2011.Record the following transactions in general journal form,as they should appear in the budgetary and proprietary accounts of the agency.For each entry indicate whether it affects the budgetary accounts or the proprietary accounts.

A.The agency received official notice that its one-year appropriation passed by the Congress and signed by the President amounted to $350 million for operating expenses for the fiscal year and $100 million for acquisition of capital assets during the year.

B.The Office of Management and Budget notified the agency that the entire appropriation had been apportioned.

C.The head of the agency allotted $75 million for the first quarter's operating expenses,and $25 million for equipment to be ordered during the first quarter.

D.Purchase orders and contracts for services recorded for the first quarter totaled $90 million (the agency does not record commitments prior to placing orders or entering into contracts).

E.Total expenditures for the first quarter amounted to $70 million for operating expenses and $18 million for equipment,for which an obligation in the amount of $84 million had been previously recorded (see item D above).The expenditures were all paid from fund balance with U.S.Treasury.

A.The agency received official notice that its one-year appropriation passed by the Congress and signed by the President amounted to $350 million for operating expenses for the fiscal year and $100 million for acquisition of capital assets during the year.

B.The Office of Management and Budget notified the agency that the entire appropriation had been apportioned.

C.The head of the agency allotted $75 million for the first quarter's operating expenses,and $25 million for equipment to be ordered during the first quarter.

D.Purchase orders and contracts for services recorded for the first quarter totaled $90 million (the agency does not record commitments prior to placing orders or entering into contracts).

E.Total expenditures for the first quarter amounted to $70 million for operating expenses and $18 million for equipment,for which an obligation in the amount of $84 million had been previously recorded (see item D above).The expenditures were all paid from fund balance with U.S.Treasury.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

51

Compute the missing amount in the following list of proprietary accounts of a federal government agency.Show all computations legibly with labels.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck