Deck 12: Budgeting and Performance Measurement

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/58

العب

ملء الشاشة (f)

Deck 12: Budgeting and Performance Measurement

1

The introductory paragraph of an audit report introduces the auditor and his/her background and qualifications to perform the auditor.

False

Explanation: This item might seem to make sense. However, as explained in Chapter 12 the introductory paragraph identifies the financial statements being audited and indicates that the financial statements are the responsibility of management, not the auditor.

Explanation: This item might seem to make sense. However, as explained in Chapter 12 the introductory paragraph identifies the financial statements being audited and indicates that the financial statements are the responsibility of management, not the auditor.

2

In auditing compliance with laws and regulations as part of a single audit,the auditor must render an opinion on the specific requirements applicable to each program for which the entity receives federal financial assistance.

False

Explanation: The auditor is required to render an opinion on specific compliance requirements for major programs (as defined in Illustration 12-9 of the text) that are selected using a risk-based approach. Not all programs are audited.

Explanation: The auditor is required to render an opinion on specific compliance requirements for major programs (as defined in Illustration 12-9 of the text) that are selected using a risk-based approach. Not all programs are audited.

3

Only state and local governments and their component units must have single audits; colleges and universities and other not-for-profit organizations that expend federal financial awards are not required to have single audits.

False

Explanation: The Single Audit Act Amendments of 1996 and OMB Circular A-133 require single audits of all colleges and universities and other not-for-profit organizations that expend $500,000 or more in federal financial awards, in addition to state and local governments. OMB Circular A-133 extended the single audit requirement to colleges and universities and not-for-profit organizations beyond the Single Audit Act of 1984 which covered only state and local governments.

Explanation: The Single Audit Act Amendments of 1996 and OMB Circular A-133 require single audits of all colleges and universities and other not-for-profit organizations that expend $500,000 or more in federal financial awards, in addition to state and local governments. OMB Circular A-133 extended the single audit requirement to colleges and universities and not-for-profit organizations beyond the Single Audit Act of 1984 which covered only state and local governments.

4

The yellow book (i.e.,GAGAS)independence standard prescribes two overarching principles-Auditors should not perform management functions or make management decisions and auditors should not audit their own work or provide nonaudit services in situations where the nonaudit services are significant to audit subject matter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

5

An audit of a government's financial statements,conducted in accordance with generally accepted government auditing standards (GAGAS),includes

A)A determination of efficiency and effectiveness.

B)An examination of the financial statements and underlying records for conformance with generally accepted accounting principles (GAAP).

C)Tests for compliance with laws and regulations.

D)An examination of the financial statements and underlying records for conformance with GAAP and tests for compliance with laws and regulations.

A)A determination of efficiency and effectiveness.

B)An examination of the financial statements and underlying records for conformance with generally accepted accounting principles (GAAP).

C)Tests for compliance with laws and regulations.

D)An examination of the financial statements and underlying records for conformance with GAAP and tests for compliance with laws and regulations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

6

Performance audits provide an auditor's independent assessment of the performance and the management of an entity,program,service,or activity against objective criteria.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

7

The AICPA's suite of risk assessment audit standards requires that auditors conduct a more rigorous assessment of the risk of material misstatement of the client's financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

8

In the auditor's report the financial statements on which the opinion is being expressed are specified in the

A)Introductory paragraph.

B)Opinion paragraph.

C)Scope paragraph.

D)Explanatory paragraph.

A)Introductory paragraph.

B)Opinion paragraph.

C)Scope paragraph.

D)Explanatory paragraph.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

9

Audits of governments' financial statements are performed to determine if the financial statements are fair and in accordance with generally accepted accounting principles,but not to determine if there is compliance with laws and regulations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

10

The scope paragraph of an independent auditor's report on a financial audit of a local government

A)Identifies the statutes the auditor determined to be relevant to the financial activities of the government.

B)Identifies the financial statements that the auditor has examined.

C)Identifies all applicable accounting records that were located and examined.

D)Identifies the standards used in performing the audit.

A)Identifies the statutes the auditor determined to be relevant to the financial activities of the government.

B)Identifies the financial statements that the auditor has examined.

C)Identifies all applicable accounting records that were located and examined.

D)Identifies the standards used in performing the audit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

11

Generally accepted government auditing standards (GAGAS)apply to audits of state and local governments only if they expend $500,000 or more in federal financial assistance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

12

Governments often engage one auditor to audit the primary government and other auditors to audit certain component units.In such cases the auditor of the primary government is permitted under generally accepted auditing standards (GAAS)to rely on the work of the other auditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

13

The scope paragraph of an audit report identifies the audit standards used in performing the audit and describes any limitations imposed on the audit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

14

In evaluating an entity's system of internal controls a significant deficiency is a deficiency in the design or operation of internal controls of such magnitude that the internal control components do not reduce the risk of detection or prevention of material misstatement to an acceptably low level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

15

Audits of state and local governments may be performed by all of the following except

A)Independent CPAs.

B)State audit agencies.

C)Federal grantor agencies.

D)Client management.

A)Independent CPAs.

B)State audit agencies.

C)Federal grantor agencies.

D)Client management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

16

The opinion paragraph of the independent auditor's standard report states the auditor's opinion that the financial statements are free of errors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

17

The single audit requirement applies to

A)All audits of state and local government reporting entities.

B)Audits to determine efficiency and economy.

C)Audits following the Single Audit Act of 1984 (with 1996 Amendments)and the revised OMB Circular A-133.

D)Financial and performance audits,and attestation engagements.

A)All audits of state and local government reporting entities.

B)Audits to determine efficiency and economy.

C)Audits following the Single Audit Act of 1984 (with 1996 Amendments)and the revised OMB Circular A-133.

D)Financial and performance audits,and attestation engagements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

18

In audits of state and local government units which of the following paragraphs may not be required in the auditor's report for every audit?

A)Introductory paragraph.

B)Scope paragraph.

C)Explanatory paragraph.

D)Opinion paragraph.

A)Introductory paragraph.

B)Scope paragraph.

C)Explanatory paragraph.

D)Opinion paragraph.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

19

Government Auditing Standards (GAS)issued by the U.S.Comptroller General,also referred to as generally accepted government auditing standards (GAGAS)apply to all of the following audits,except

A)Financial statement audits of federal organizations made by the Government Accountability Office.

B)Financial audits of not-for-profit organizations that do not receive or expend federal financial awards.

C)Financial audits of federal grants made by independent CPAs.

D)Financial statement audits of federal programs made by state auditors.

A)Financial statement audits of federal organizations made by the Government Accountability Office.

B)Financial audits of not-for-profit organizations that do not receive or expend federal financial awards.

C)Financial audits of federal grants made by independent CPAs.

D)Financial statement audits of federal programs made by state auditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

20

Though used historically by corporate boards of directors,audit committees have great potential in a government setting to improve the quality of financial reporting through the audit process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

21

Performance audits,as defined in the GAO's Governmental Auditing Standards

A)Provide a basis for an auditor's opinion as to whether the entity is acquiring,protecting,and using its resources economically and efficiently.

B)Provide assurance that operations are in compliance with all applicable laws and regulations that may have a material effect on the financial statements.

C)Provide assurance or conclusions based on an evaluation of evidence regarding program effectiveness,economy,and efficiency; internal control compliance,and prospective analyses.D)Are always performed by the internal audit staff to assist the entity's independent auditor.

A)Provide a basis for an auditor's opinion as to whether the entity is acquiring,protecting,and using its resources economically and efficiently.

B)Provide assurance that operations are in compliance with all applicable laws and regulations that may have a material effect on the financial statements.

C)Provide assurance or conclusions based on an evaluation of evidence regarding program effectiveness,economy,and efficiency; internal control compliance,and prospective analyses.D)Are always performed by the internal audit staff to assist the entity's independent auditor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following would be considered Category (b)GAAP for state and local government auditees?

A)AICPA Practice Bulletins if specifically made applicable to state and local governments by the AICPA and cleared by the GASB.

B)GASB Technical Bulletins.

C)GASB Statements and Interpretations.

D)GASB Implementation Guides.

A)AICPA Practice Bulletins if specifically made applicable to state and local governments by the AICPA and cleared by the GASB.

B)GASB Technical Bulletins.

C)GASB Statements and Interpretations.

D)GASB Implementation Guides.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following kinds of information is not included within the scope of a financial statement audit of a state or local government?

A)Governmental activities financial information.

B)Management's discussion and analysis (MD&A).

C)Major funds financial information.

D)Business-type activities financial information.

A)Governmental activities financial information.

B)Management's discussion and analysis (MD&A).

C)Major funds financial information.

D)Business-type activities financial information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

24

Typical objectives of a performance audit include

A)Determining whether financial statements fairly present the entity's operational results.

B)Judging the appropriateness of an entity's program goals.

C)Determining whether financial statements fairly present in conformity with GAAP.

D)Assessing effectiveness and results,economy and efficiency,and internal controls and compliance with laws and regulations.

A)Determining whether financial statements fairly present the entity's operational results.

B)Judging the appropriateness of an entity's program goals.

C)Determining whether financial statements fairly present in conformity with GAAP.

D)Assessing effectiveness and results,economy and efficiency,and internal controls and compliance with laws and regulations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

25

An auditor would not render an opinion on a(an)

A)Financial audit of financial statements.

B)Performance audit.

C)Audit to determine whether the entity has adhered to specific compliance requirements applicable to a major program.

D)Audit to determine whether a governmental department's financial information complies with specific state regulatory requirements.

A)Financial audit of financial statements.

B)Performance audit.

C)Audit to determine whether the entity has adhered to specific compliance requirements applicable to a major program.

D)Audit to determine whether a governmental department's financial information complies with specific state regulatory requirements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

26

A significant deficiency of such magnitude that internal control components do not reduce the risk of detection or prevention of material misstatement to an acceptably low level is called a(an)

A)Material weakness and significant deficiency.

B)System design deficiency.

C)Unacceptable reportable condition.

D)Audit alert item.

A)Material weakness and significant deficiency.

B)System design deficiency.

C)Unacceptable reportable condition.

D)Audit alert item.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

27

All of the following reports are included in the reporting package resulting from the single audit except

A)Financial statements and schedule of expenditures of federal awards.

B)Summary schedule of prior audit findings.

C)Report on efficiency and effectiveness.

D)Corrective action plan.

A)Financial statements and schedule of expenditures of federal awards.

B)Summary schedule of prior audit findings.

C)Report on efficiency and effectiveness.

D)Corrective action plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

28

An unqualified audit opinion rendered on a governmental unit's general purpose external financial statements means those statements

A)Contain departures from GAAP that may make them misleading.

B)Have been audited by an auditor with limited qualifications.

C)Present fairly in conformity with GAAP.

D)Have been certified as free from error.

A)Contain departures from GAAP that may make them misleading.

B)Have been audited by an auditor with limited qualifications.

C)Present fairly in conformity with GAAP.

D)Have been certified as free from error.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

29

In which paragraph of the standard audit report does the auditor communicate to the user that certain combining fund information in the financial statements is not part of the basic financial statements,but that such information has been subjected to auditing procedures and,in his or her opinion,is fairly presented in all material respects in relation to the basic financial statements?

A)Explanatory paragraph.

B)Scope paragraph.

C)Opening paragraph.

D)Opinion paragraph.

A)Explanatory paragraph.

B)Scope paragraph.

C)Opening paragraph.

D)Opinion paragraph.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

30

A common reason why a government might receive a "qualified opinion" from the external auditors is

A)A violation of generally accepted accounting principles that does not cause material misstatement of the financial statements.

B)A fund balance deficit in the General Fund.

C)Poor internal controls such that the accounting records could not be audited.

D)Liabilities exceed assets in the General Fund.

A)A violation of generally accepted accounting principles that does not cause material misstatement of the financial statements.

B)A fund balance deficit in the General Fund.

C)Poor internal controls such that the accounting records could not be audited.

D)Liabilities exceed assets in the General Fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following is the highest in the hierarchy of generally accepted accounting principles according to AICPA Statement of Auditing Standard No.69,as amended by SAS No.91,for the federal government entities?

A)AICPA Audit and Accounting Guide.

B)FASB emerging issues task force reports.

C)GASB statements.

D)FASAB statements.

A)AICPA Audit and Accounting Guide.

B)FASB emerging issues task force reports.

C)GASB statements.

D)FASAB statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following is not a requirement imposed on auditors by the AICPA risk assessment standards to enhance auditors' application of the audit risk model?

A)Obtain a more in-depth understanding of the entity and its environment,including its internal control.

B)Where possible,utilize the same audit program used for the prior year's audit of a given client.

C)Conduct a more rigorous assessment of risk of material misstatement.

D)Improve the link between the assessment of risk and the nature,timing,and extent of any further procedures performed.

A)Obtain a more in-depth understanding of the entity and its environment,including its internal control.

B)Where possible,utilize the same audit program used for the prior year's audit of a given client.

C)Conduct a more rigorous assessment of risk of material misstatement.

D)Improve the link between the assessment of risk and the nature,timing,and extent of any further procedures performed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following is not a required audit report for a single audit?

A)A report on the entity's compliance with laws and regulations.

B)A report on internal controls related to the financial statements and major programs.

C)A report on the entity's financial statements and conformity with GAAP.

D)A report from the cognizant agency on auditee compliance.

A)A report on the entity's compliance with laws and regulations.

B)A report on internal controls related to the financial statements and major programs.

C)A report on the entity's financial statements and conformity with GAAP.

D)A report from the cognizant agency on auditee compliance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following best describes the relationship between generally accepted auditing standards (GAAS)and generally accepted government auditing standards (GAGAS)?

A)GAAS apply to independent CPA auditors; GAGAS apply to governmental auditors.

B)Audits conducted in conformity with GAGAS may also require the auditor to conform to GAAS.

C)Audits done in accordance with GAGAS must also be done in accordance with GAAS.

D)Audits of state and local governments always required that the audit be conducted in accordance with both GAAS and GAGAS.

A)GAAS apply to independent CPA auditors; GAGAS apply to governmental auditors.

B)Audits conducted in conformity with GAGAS may also require the auditor to conform to GAAS.

C)Audits done in accordance with GAGAS must also be done in accordance with GAAS.

D)Audits of state and local governments always required that the audit be conducted in accordance with both GAAS and GAGAS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following is not one of the types of opinions an auditor may render in accordance with generally accepted auditing standards?

A)Satisfactory.

B)Qualified.

C)Unqualified.

D)Adverse.

A)Satisfactory.

B)Qualified.

C)Unqualified.

D)Adverse.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following statements concerning the Single Audit Act of 1984 (with 1996 Amendments)is correct?

A)Only those entities receiving over $500,000 a year in federal financial assistance are required to have a single audit.

B)Those entities expending under $500,000 a year in federal awards are exempt from single audit requirements.

C)The Single Audit Act only applies if an entity has high risk programs.

D)The single audit is optional for all entities receiving federal awards.

A)Only those entities receiving over $500,000 a year in federal financial assistance are required to have a single audit.

B)Those entities expending under $500,000 a year in federal awards are exempt from single audit requirements.

C)The Single Audit Act only applies if an entity has high risk programs.

D)The single audit is optional for all entities receiving federal awards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

37

A single audit conducted pursuant to the Single Audit Act Amendments of 1996 requires which of the following types of audits?

A)Financial Audit: Yes; Performance Audit: No

B)Financial Audit: No; Performance Audit: No

C)Financial Audit: No; Performance Audit: Yes

D)Financial Audit: Yes; Performance Audit: Yes

A)Financial Audit: Yes; Performance Audit: No

B)Financial Audit: No; Performance Audit: No

C)Financial Audit: No; Performance Audit: Yes

D)Financial Audit: Yes; Performance Audit: Yes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

38

Attestation engagements include

A)Assessment of the extent to which entity programs met their objectives.

B)Reviews of interim financial information.

C)Services that provide various levels of assurance on such matters as internal control,compliance,MD&A presentation,and reliability of performance measures.

D)Examining whether the entity's financial statements fairly present in conformity with GAAP.

A)Assessment of the extent to which entity programs met their objectives.

B)Reviews of interim financial information.

C)Services that provide various levels of assurance on such matters as internal control,compliance,MD&A presentation,and reliability of performance measures.

D)Examining whether the entity's financial statements fairly present in conformity with GAAP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

39

Generally accepted government auditing standards (GAGAS)

A)Establish the same scope as GAAS,but use wording appropriate to governmental entities instead of business organizations.

B)Are set forth in the "Federal Government Red Book."

C)Establish more standards that are broader in scope than those found in GAAS.

D)Establish standard wording of auditor's reports on governmental financial statements.

A)Establish the same scope as GAAS,but use wording appropriate to governmental entities instead of business organizations.

B)Are set forth in the "Federal Government Red Book."

C)Establish more standards that are broader in scope than those found in GAAS.

D)Establish standard wording of auditor's reports on governmental financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

40

One of the primary purposes of the Single Audit Act of 1984 (amended in 1996)is to

A)Detect fraud,waste and abuse in government entities.

B)To promote the efficient and effective use of audit resources by consolidating audit activity into one organization-wide audit.

C)Make audit activity legal at the federal level.

D)Allow federal auditors greater access to government entities receiving federal funds.

A)Detect fraud,waste and abuse in government entities.

B)To promote the efficient and effective use of audit resources by consolidating audit activity into one organization-wide audit.

C)Make audit activity legal at the federal level.

D)Allow federal auditors greater access to government entities receiving federal funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

41

Audit objectives set forth by the United States Comptroller General in Government Auditing Standards (GAS)differ from the AICPA view (GAAS)as discussed in Chapter 12.Explain briefly how GAS audits might meet the information needs of taxpayers better than GAAS audits.Make clear what the two sets of objectives cover.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

42

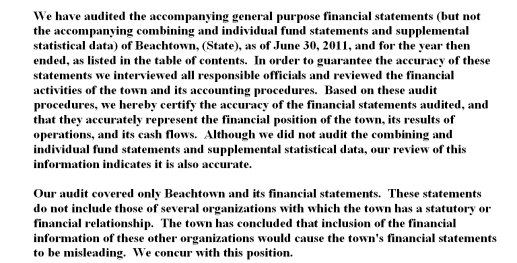

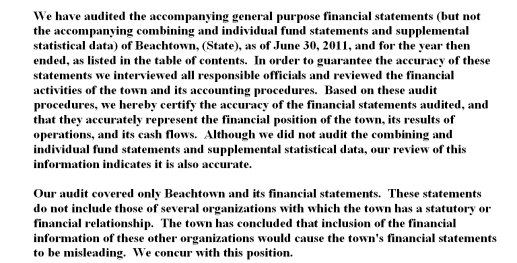

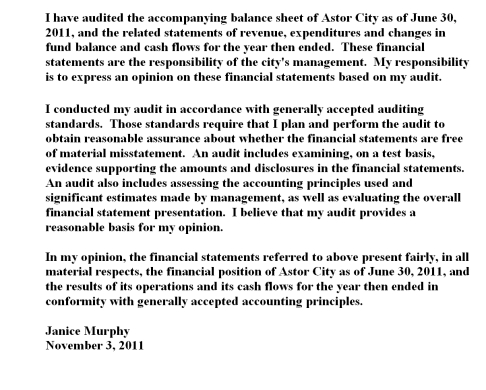

The following audit report was rendered on the financial statements of Beachtown:  Required:

Required:

Evaluate the extent to which this audit report conforms to that required by generally accepted auditing standards (GAAS).Identify areas of noncompliance with GAAS requirements that have been omitted.

Required:

Required:Evaluate the extent to which this audit report conforms to that required by generally accepted auditing standards (GAAS).Identify areas of noncompliance with GAAS requirements that have been omitted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

43

Contrast and compare a financial audit to a performance audit,as defined in the GAO's Government Auditing Standards (yellow book).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

44

In the standard auditor's report for a state or local government,the introductory paragraph identifies the opinion units on which the auditor is expressing an opinion and refers to the accompanying financial statements of those units.Name or describe the financial statements that are usually accompanying the standard report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

45

What are the objectives of the Single Audit Act Amendments of 1996 (and original Single Audit Act of 1984),and to whom is it applicable?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

46

Describe the importance of materiality for auditors and explain how materiality is determined in audits of state and local governments that follow GASB standards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

47

An auditor performing nonaudit work for a client may be in danger of violating the independence rules in Government Auditing Standards when he or she

A)Conducts a search and recommends a particular person for a management position for the client.

B)Provides advice on establishing or improving internal controls.

C)Provides the client with benchmarking information.

D)Answers technical questions for the client.

A)Conducts a search and recommends a particular person for a management position for the client.

B)Provides advice on establishing or improving internal controls.

C)Provides the client with benchmarking information.

D)Answers technical questions for the client.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following is one of the overarching principles in Government Auditing Standards related to auditors performing nonaudit work for clients?

A)Auditors should not provide training to clients.

B)Auditors should not provide routine advice to clients or serve on advisory committees.

C)Auditors should not audit their own work or provide nonaudit services in situations when the nonaudit services are significant to the audit subject matter.

D)Auditors should not propose adjusting and correction entries.

A)Auditors should not provide training to clients.

B)Auditors should not provide routine advice to clients or serve on advisory committees.

C)Auditors should not audit their own work or provide nonaudit services in situations when the nonaudit services are significant to the audit subject matter.

D)Auditors should not propose adjusting and correction entries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

49

"An unqualified opinion on the financial statements of a local government means that all statements in the comprehensive annual financial report (CAFR)have been audited and conform with GAAP." Do you agree or disagree? Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

50

What are the benefits to a state or local government of establishing an audit committee?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

51

What are the essential elements of an "unqualified opinion" expressed in the AICPA standard auditor's report? Your answer should be brief,but complete.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

52

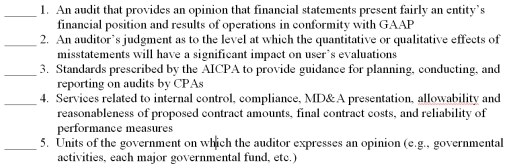

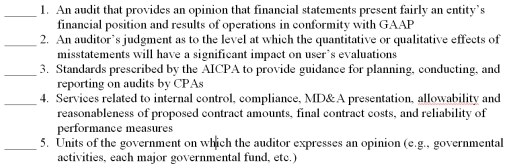

The following are key terms in Chapter 12 that relate to auditing of governmental and not-for-profit organizations:

A.Attestation engagement

B.Generally accepted auditing standards (GAAS)

C.Opinion units

D.Materiality

E.Financial audit

F.Generally accepted government auditing standards (GAGAS)

G.Nonaudit work

H.Performance audits

For each of the following definitions,indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition.

A.Attestation engagement

B.Generally accepted auditing standards (GAAS)

C.Opinion units

D.Materiality

E.Financial audit

F.Generally accepted government auditing standards (GAGAS)

G.Nonaudit work

H.Performance audits

For each of the following definitions,indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

53

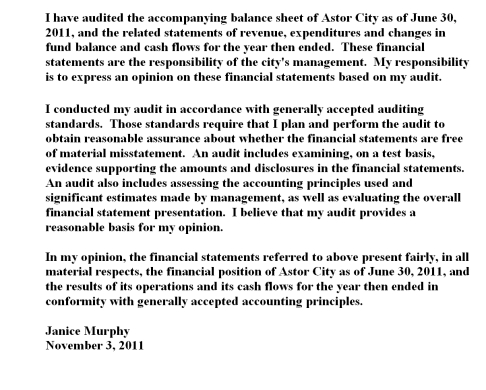

Astor City,a small city that is not required to have independent audit,voluntarily decided to have an audit of its financial records.Currently,the city generates $900,000 in revenues.Of the revenue generated,10% is from state sources and 2% is from federal sources.Janice Murphy,a CPA who serves on the city council has orally agreed to conduct the audit for a small gratuitous fee.Murphy decided not to accept a full fee since in the last three years she has gotten away from doing audit work and has concentrated her time on tax preparation and small business consulting.Murphy conducts the audit and presents the city with the following audit report:  Required

Required

(a)At a minimum what audit standards apply to Astor City (GAAS,GAS or Single Audit Act)? Why?

(b)Discuss any potential violations of the applicable audit standards.

Required

Required(a)At a minimum what audit standards apply to Astor City (GAAS,GAS or Single Audit Act)? Why?

(b)Discuss any potential violations of the applicable audit standards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

54

Explain what an "attestation engagement" is and contrast that to financial audits and performance audits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

55

"The guidance provided by OMB Circular A-133,the OMB Compliance Supplement,and AICPA publications has resulted in an extraordinarily high level of single audit quality." Do you agree or disagree? Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

56

Why should persons interested in public administration and persons interested in working as accountants for governments have an understanding of audit objectives and standards?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

57

Answer the following questions relating to the provisions of the Single Audit Act of 1984 and 1996 Amendments.

(a)What is a single audit?

(b)How do you determine if your government must have a single audit?

(c)Where would you find authoritative guidance on conducting a single audit?

(a)What is a single audit?

(b)How do you determine if your government must have a single audit?

(c)Where would you find authoritative guidance on conducting a single audit?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

58

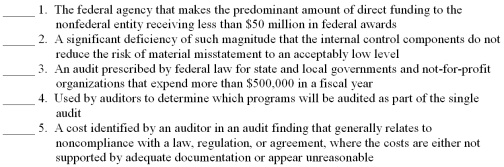

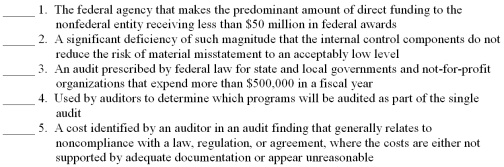

The following are key terms in Chapter 12 that relate to single audits:

A.Risk-based approach

B.Single audit

C.Questioned cost

D.Material weakness

E.Oversight agency

F.Major programs

G.Cognizant agency

H.Significant deficiency

For each of the following definitions,indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition.

A.Risk-based approach

B.Single audit

C.Questioned cost

D.Material weakness

E.Oversight agency

F.Major programs

G.Cognizant agency

H.Significant deficiency

For each of the following definitions,indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck