Deck 6: Accounting for General Long-Term Liabilities and Debt Service

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/82

العب

ملء الشاشة (f)

Deck 6: Accounting for General Long-Term Liabilities and Debt Service

1

Taxes for debt service are always levied by the General Fund and transferred to a debt service fund.

False

Explanation: Taxes may be levied for a debt service fund directly, or debt service activity may be recorded in the General Fund.

Explanation: Taxes may be levied for a debt service fund directly, or debt service activity may be recorded in the General Fund.

2

Installments of special assessments to be collected within one year are recorded as Assessments Receivable-Current; installments due in periods after one year are recorded as Assessments Receivable-Deferred.

True

Explanation: This describes the proper accounting for assessment receivables as illustrated in Chapter 6.

Explanation: This describes the proper accounting for assessment receivables as illustrated in Chapter 6.

3

Notes to the financial statements of a state or local government should include a schedule,or summary,of annual debt service requirements (principal and interest payments)for the year following the balance sheet date and for all subsequent years until the final maturity of debt outstanding on the balance sheet date.

True

Explanation: This provision of GASB standards is described in Chapter 6.

Explanation: This provision of GASB standards is described in Chapter 6.

4

Debt limit is a term used to denote the total amount of indebtedness of specified kinds that is allowed by law to be outstanding at any one time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

5

Both general capital assets acquired or constructed from the proceeds of special assessment debt,and the related long-term liability are recorded in the governmental fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

6

In a particular debt service fund journal entry the offsetting credit to debits for Assessments Receivable-Current could be to Assessments Receivable-Deferred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

7

Debt margin is the difference between the debt limit and the amount of outstanding debt subject to the debt limitation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

8

Since the debt of a government is subject to a legal debt limit,there cannot be any legal overlapping debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

9

Disclosures about long-term liabilities should be included in the notes to the financial statements to provide users with information about authorization of new debt issues,sale of previously authorized issues,and retirement and refunding of debt during the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

10

Debt backed by both special assessments and the full faith and credit of a government should be reported in the government-wide statement of net assets in the Business-type Activities column.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

11

All long-term debt,including bonds,notes or warrants,and various other long-term obligations,intended to be repaid from tax levies or special assessments are accounted for in debt service funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

12

When a capital lease payment of $20,000 is legally due,an entry is made in the debt service fund to record the expenditure of $20,000,and an entry is made in the governmental activities accounts to reduce Capital Lease Obligations Payable by $20,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

13

At year-end,budgetary and operating statement accounts of a debt service fund are closed in the same manner as are those of a General Fund or special revenue funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

14

Expenditures for interest on tax supported long-term debt are accrued in debt service funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

15

The debt service activity of a government may be properly accounted for within the General Fund unless law mandates the use of a debt service fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

16

Debt service funds exist to accumulate resources to pay tax supported bond issues at maturity.Interest on such bonds is paid from General Fund appropriations rather than from debt service fund appropriations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

17

Debt service funds use the same budgetary procedures as the General Fund and special revenue funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

18

If all financial resource inflows have been collected,and all debt interest and principal legally due has been paid,a regular serial bond debt service fund could have no assets,no liabilities,and no fund balance at year-end.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

19

The liability for matured bonds payable should be recorded by a debt service fund only if a legal appropriation for that purpose exists in the proper amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

20

Issuance of tax supported debt having a maturity of more than one year from date of issue results in a journal entry in only the governmental activities general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

21

Interest expenditures on bonds payable should be recorded in a debt service fund

A)At the end of the fiscal period if the interest due date does not coincide with the end of the fiscal period.

B)When bonds are issued.

C)When the interest is paid.

D)When the interest is legally payable.

A)At the end of the fiscal period if the interest due date does not coincide with the end of the fiscal period.

B)When bonds are issued.

C)When the interest is paid.

D)When the interest is legally payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following would result in the amortization of a bond discount or premium?

A)Bonds are issued: No; Bonds are held as investments: No

B)Bonds are issued: No; Bonds are held as investments: Yes

C)Bonds are issued: Yes; Bonds are held as investments: No

D)Bonds are issued: Yes; Bonds are held as investments: Yes

A)Bonds are issued: No; Bonds are held as investments: No

B)Bonds are issued: No; Bonds are held as investments: Yes

C)Bonds are issued: Yes; Bonds are held as investments: No

D)Bonds are issued: Yes; Bonds are held as investments: Yes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

23

Term bond debt service funds should always be accounted for on the assumption that they are operated on an actuarial basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

24

Expenditures for capital lease payments consist of two elements: payment of interest on the lease obligation,and payment on the obligation itself.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

25

General obligation bonds issued for the benefit of enterprise funds,with the intent of paying bond principal and interest from revenues of the enterprise fund,should be reported as a liability in the balance sheet of the

A)Enterprise fund.

B)Governmental activities.

C)Both the enterprise fund and the governmental activities accounts.

D)Enterprise fund and a note to the financial statements explaining the contingent liability of the general government if enterprise funds are insufficient to pay principal and interest.

A)Enterprise fund.

B)Governmental activities.

C)Both the enterprise fund and the governmental activities accounts.

D)Enterprise fund and a note to the financial statements explaining the contingent liability of the general government if enterprise funds are insufficient to pay principal and interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

26

The issuance of general long-term bonds requires recognition by the fund receiving the proceeds and by the business-type activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

27

Debt service funds for term bonds would generally include sinking fund investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following is not properly recorded in the governmental activities accounts?

A)Tax-supported general obligation bonds.

B)Obligations under capital leases used to finance general capital assets.

C)The long-term portion of judgments and claims.

D)Revenue bonds issued by an enterprise fund.

A)Tax-supported general obligation bonds.

B)Obligations under capital leases used to finance general capital assets.

C)The long-term portion of judgments and claims.

D)Revenue bonds issued by an enterprise fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following resource inflows would be recorded as a revenue of a debt service fund?

A)Property taxes levied by the debt service fund for debt service purposes.

B)Receipt of the premium on a new bond issue.

C)Taxes collected by the General Fund and transferred to the debt service fund.

D)Transfer of the residual equity of a capital project from a capital projects fund to the debt service fund.

A)Property taxes levied by the debt service fund for debt service purposes.

B)Receipt of the premium on a new bond issue.

C)Taxes collected by the General Fund and transferred to the debt service fund.

D)Transfer of the residual equity of a capital project from a capital projects fund to the debt service fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following statements is always true concerning the reporting of debt service funds?

A)Debt service funds are reported in a separate column in the governmental fund financial statements.

B)Debt service funds are reported in a separate column in the government-wide financial statements.

C)Debt service funds are reported in the Other Governmental Funds column in the governmental fund financial statements.

D)Debt service funds are reported in the Governmental Activities column in the government-wide financial statements.

A)Debt service funds are reported in a separate column in the governmental fund financial statements.

B)Debt service funds are reported in a separate column in the government-wide financial statements.

C)Debt service funds are reported in the Other Governmental Funds column in the governmental fund financial statements.

D)Debt service funds are reported in the Governmental Activities column in the government-wide financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

31

Basic financial statements are often supplemented by schedules of securities held at the balance sheet date,and other schedules detailing securities transactions during the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

32

Capital lease payments should be recorded by a debt service fund rather than the fund using the leased asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

33

If all financial resources recognized as assets and as revenues of a debt service fund have not been collected in cash and/or have not been disbursed for payment of debt service as of the end of a fiscal year it is necessary that a debt service fund balance sheet be prepared for inclusion in a government's annual report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

34

Immediately after making its annual $20,000 lease payment on June 30,2011,the last day of its fiscal year,a certain city had an unpaid capital lease obligation of $95,000.The interest rate applicable to the lease is 10 percent.When the $20,000 lease payment due on June 30,2012 is made,the journal entry for the governmental activities accounts will include

A)A debit to Capital Lease Obligation Payable in the amount of $10,500.

B)A debit to Capital Lease Obligation Payable in the amount of $20,000.

C)A debit to Cash in the amount of $20,000.

D)A debit to Capital Lease Obligation Payable in the amount of $12,500.

A)A debit to Capital Lease Obligation Payable in the amount of $10,500.

B)A debit to Capital Lease Obligation Payable in the amount of $20,000.

C)A debit to Cash in the amount of $20,000.

D)A debit to Capital Lease Obligation Payable in the amount of $12,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

35

A debt service fund is a

A)Nonexpendable fund.

B)Governmental fund.

C)Fiduciary fund.

D)Proprietary fund.

A)Nonexpendable fund.

B)Governmental fund.

C)Fiduciary fund.

D)Proprietary fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

36

On the due date for bond interest,the debt service fund journal entry (or entries)will include

A)A debit to Bonds Payable.

B)A debit to Interfund Transfers Out.

C)A debit to Expenditures-Bond Interest.

D)A debit to Interest Expense.

A)A debit to Bonds Payable.

B)A debit to Interfund Transfers Out.

C)A debit to Expenditures-Bond Interest.

D)A debit to Interest Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

37

The premium or discount on bonds purchased as investments is accounted for in the same manner as a premium or discount on bonds sold (i.e.,bond payable).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following budgetary accounts is typically used by a debt service fund?

A)Encumbrances.

B)Appropriations.

C)Estimated Uncollectible Accounts.

D)Reserve for Encumbrances.

A)Encumbrances.

B)Appropriations.

C)Estimated Uncollectible Accounts.

D)Reserve for Encumbrances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

39

Ordinarily,the statement of changes in fund balance for a debt service fund is combined with the statement of revenues and expenditures for the debt service fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

40

The liability for special assessment bonds that carry a secondary pledge of a city's general credit,if reported in conformity with GAAP,should be reported in the balance sheet(s)of

A)A debt service fund.

B)An agency fund.

C)The governmental activities accounts.

D)An agency fund and disclosed in the notes to the financial statements.

A)A debt service fund.

B)An agency fund.

C)The governmental activities accounts.

D)An agency fund and disclosed in the notes to the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

41

Special assessments levied for debt service of bonds issued for a special assessment capital project will be accounted for by a debt service fund under which of the following situations?

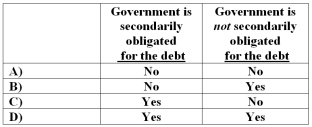

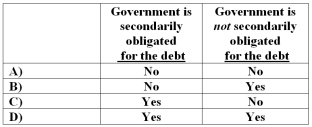

A)Choice A

B)Choice B

C)Choice C

D)Choice D

A)Choice A

B)Choice B

C)Choice C

D)Choice D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

42

Typically,proceeds from general obligation bonds will be recorded in the

A)Debt service fund.

B)General obligation bond fund.

C)Permanent fund.

D)Capital projects fund.

A)Debt service fund.

B)General obligation bond fund.

C)Permanent fund.

D)Capital projects fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following debt service funds would normally have the largest balance in its Fund Balance account?

A)Serial bond debt service fund.

B)Deferred serial bond debt service fund.

C)Irregular serial bond debt service fund.

D)Term bond debt service fund.

A)Serial bond debt service fund.

B)Deferred serial bond debt service fund.

C)Irregular serial bond debt service fund.

D)Term bond debt service fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

44

When bonds are sold at a premium for a capital project,the premium amount generally

A)Increases the cash available to the capital projects fund.

B)Is transferred to the debt service fund.

C)Is transferred to the General Fund.

D)Is ignored by both the capital projects fund and any other fund.

A)Increases the cash available to the capital projects fund.

B)Is transferred to the debt service fund.

C)Is transferred to the General Fund.

D)Is ignored by both the capital projects fund and any other fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

45

Debt service funds are used to account for which of the following?

A)Payment of only interest on general long-term debt.

B)Payment of only principal on general long-term debt.

C)Payment of principal and interest on general long-term debt.

D)Payment of principal and interest on all debt of the government.

A)Payment of only interest on general long-term debt.

B)Payment of only principal on general long-term debt.

C)Payment of principal and interest on general long-term debt.

D)Payment of principal and interest on all debt of the government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

46

If a city has an unpaid capital lease obligation at the beginning of its fiscal year,the journal entry in the debt service fund to record the lease payment at the end of that fiscal year will include

A)A debit to Capital Lease Obligations Payable.

B)A credit to Expenditures-Principal of Capital Lease Obligation.

C)A debit to Expenditures-Principal of Capital Lease Obligation.

D)A debit to Interest Expense on Capital Leases.

A)A debit to Capital Lease Obligations Payable.

B)A credit to Expenditures-Principal of Capital Lease Obligation.

C)A debit to Expenditures-Principal of Capital Lease Obligation.

D)A debit to Interest Expense on Capital Leases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

47

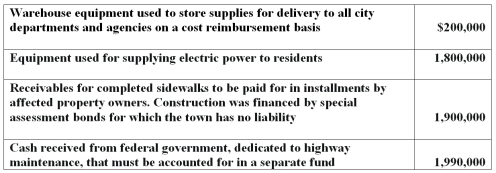

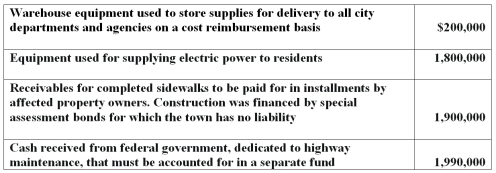

Based on the information below,what amount should be accounted for in a debt service fund?

A)$200,000.

B)$1,800,000.

C)$1,900,000.

D)$0.

A)$200,000.

B)$1,800,000.

C)$1,900,000.

D)$0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

48

The city of Sparr's fiscal year ends on December 31.On July 1,2011,the city issued $1,000,000 of 6%,10-year term bonds with semi-annual interest payments due on July 1 and January 1 each year,beginning on January 1,2012.What amount of expenditures should the city recognize in its debt service fund for the years 2011 and 2012?

A)$30,000 in 2011; $60,000 in 2012.

B)$60,000 in 2011; $60,000 in 2012.

C)$3,000 in 2011; $6,000 in 2012.

D)$0 in 2011; $60,000 in 2012.

A)$30,000 in 2011; $60,000 in 2012.

B)$60,000 in 2011; $60,000 in 2012.

C)$3,000 in 2011; $6,000 in 2012.

D)$0 in 2011; $60,000 in 2012.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following statements is not true for debt service funds?

A)Special assessment debt for which the government has some obligation is paid through the debt service fund.

B)Matured interest payable is reported as a liability of the debt service fund.

C)Bond principal is shown as a liability of the debt service fund only when that principal is due and payable.

D)All tax-supported bond principal is shown as a liability of the debt service fund.

A)Special assessment debt for which the government has some obligation is paid through the debt service fund.

B)Matured interest payable is reported as a liability of the debt service fund.

C)Bond principal is shown as a liability of the debt service fund only when that principal is due and payable.

D)All tax-supported bond principal is shown as a liability of the debt service fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following assets would not be found in the balance sheet of a debt service fund?

A)Cash with fiscal agent.

B)Investments.

C)Equipment.

D)Interest Receivable.

A)Cash with fiscal agent.

B)Investments.

C)Equipment.

D)Interest Receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

51

Valencia Village issued the following during the year ended June 30,2011: (1)$600,000 in bonds for the installation of street lights,to be assessed against properties benefited,but secondarily backed by the village; (2)$800,000 in bonds for construction of a Parks and Recreation Department public golf course to be paid from pledged fees collected from golf course users.How much should be accounted for through debt service funds for payments of principal over the life of the bonds?

A)$0.

B)$600,000.

C)$800,000.

D)$1,400,000.

A)$0.

B)$600,000.

C)$800,000.

D)$1,400,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

52

If a government issues debt to finance capital acquisition by another government and the proceeds of the debt are a short time later delivered to the intended beneficiary government,how is the related long-term debt reflected in a governmental fund of the issuing government?

A)Other financing source and other financing use.

B)Other financing source and expenditure.

C)Revenue and expenditure.

D)It is not displayed on the face of the financial statements; however,it is disclosed in the notes to the financial statements.

A)Other financing source and other financing use.

B)Other financing source and expenditure.

C)Revenue and expenditure.

D)It is not displayed on the face of the financial statements; however,it is disclosed in the notes to the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

53

The liability for general obligation bonds should be recorded in the

A)General Fund.

B)Capital projects fund.

C)Governmental activities journal.

D)Debt service fund.

A)General Fund.

B)Capital projects fund.

C)Governmental activities journal.

D)Debt service fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following debt service fund accounts would not be closed at the end of each fiscal year?

A)Estimated Revenues.

B)Fund Balance.

C)Revenues.

D)Expenditures-Bond Interest.

A)Estimated Revenues.

B)Fund Balance.

C)Revenues.

D)Expenditures-Bond Interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following is a true statement regarding in-substance defeasance of bonds?

A)The government must place cash or other assets in an irrevocable trust sufficient to pay all future interest and principal payments for the debt being defeased.

B)The government must agree to maintain sufficient cash and investment balances in its debt service fund to cover all interest and principal payments for the debt being defeased.

C)The government must pledge to transfer amounts to an escrow agent prior to the due date for each interest and principal payment for the debt being defeased.

D)The government must agree to maintain sufficient unrestricted cash and investments in its governmental funds to cover all interest and principal payments for the debt being defeased.

A)The government must place cash or other assets in an irrevocable trust sufficient to pay all future interest and principal payments for the debt being defeased.

B)The government must agree to maintain sufficient cash and investment balances in its debt service fund to cover all interest and principal payments for the debt being defeased.

C)The government must pledge to transfer amounts to an escrow agent prior to the due date for each interest and principal payment for the debt being defeased.

D)The government must agree to maintain sufficient unrestricted cash and investments in its governmental funds to cover all interest and principal payments for the debt being defeased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

56

On June 1,2012,Brooktown levied special assessments in the amount of $500,000,payable in 10 equal annual installments beginning on June 30,2012.The assessment installments are intended to pay principal and interest on special assessment bonds for which the town has pledged its full faith and credit should assessments be insufficient.Assuming no allowance for uncollectible receivables,the journal entry in the debt service fund on June 1,2012 would include:

A)A debit to Assessments Receivable-Current for $500,000.

B)A debit to Assessments Receivable-Current for $50,000.

C)A credit to Revenues for $500,000.

D)No journal entry is made in the debt service fund because special assessments are used.

A)A debit to Assessments Receivable-Current for $500,000.

B)A debit to Assessments Receivable-Current for $50,000.

C)A credit to Revenues for $500,000.

D)No journal entry is made in the debt service fund because special assessments are used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following financing sources used to redeem (or refund)bonds would not result in a debit to an expenditure account in the debt service fund when the liability for the redeemed (or refunded)bonds is removed from the governmental activities accounts?

A)Proceeds of Refunding Bonds.

B)Assets previously accumulated in the debt service fund.

C)Interfund Transfer from the General Fund.

D)A grant received from the federal government.

A)Proceeds of Refunding Bonds.

B)Assets previously accumulated in the debt service fund.

C)Interfund Transfer from the General Fund.

D)A grant received from the federal government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

58

On the due date for bond interest,the debt service fund journal entry (or entries)will include a debit to

A)Expenditures-Bond Interest.

B)Interfund Transfers In.

C)Appropriations.

D)Interest Expense.

A)Expenditures-Bond Interest.

B)Interfund Transfers In.

C)Appropriations.

D)Interest Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following is true for debt service funds?

A)A legally required budget should be recorded in the accounts.

B)A combining balance sheet may not be prepared for a comprehensive annual financial report (CAFR)when more than one debt service fund exists.

C)Encumbrance accounting is often used.

D)GAAP requires that a separate debt service fund be established for each bond issue.

A)A legally required budget should be recorded in the accounts.

B)A combining balance sheet may not be prepared for a comprehensive annual financial report (CAFR)when more than one debt service fund exists.

C)Encumbrance accounting is often used.

D)GAAP requires that a separate debt service fund be established for each bond issue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

60

Premiums received on tax-supported bonds are generally transferred to what fund?

A)Capital projects.

B)Debt service.

C)General.

D)Special revenue.

A)Capital projects.

B)Debt service.

C)General.

D)Special revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following basic financial statements contains a column for the total of all debt service funds?

A)Statement of cash flows.

B)Statement of revenues,expenditures,and changes in governmental fund balances.

C)Statement of revenues,expenses,and changes in proprietary net assets.

D)No basic financial statement contains a column for the total of all debt service funds.

A)Statement of cash flows.

B)Statement of revenues,expenditures,and changes in governmental fund balances.

C)Statement of revenues,expenses,and changes in proprietary net assets.

D)No basic financial statement contains a column for the total of all debt service funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

62

"Bonds to be retired by a debt service fund are recorded in that fund throughout their life." Do you agree or disagree? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

63

The sale of revenue bonds by a water utility fund would be recorded

A)In the governmental activities accounts as a liability.

B)In an enterprise fund as "Proceeds of Bonds."

C)In an enterprise fund as a liability.

D)In an enterprise fund as a revenue.

A)In the governmental activities accounts as a liability.

B)In an enterprise fund as "Proceeds of Bonds."

C)In an enterprise fund as a liability.

D)In an enterprise fund as a revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

64

Budgetary accounting for regular serial bond debt service funds differs somewhat from that for deferred serial bond or term bond debt service funds.Explain these differences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

65

"All taxes raised for payment of interest and principal on general long-term debt are recognized as other financing sources of the debt service fund." Do you agree? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

66

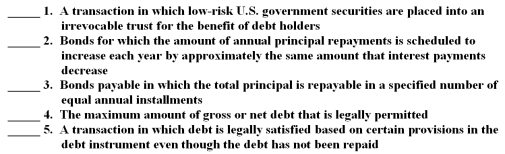

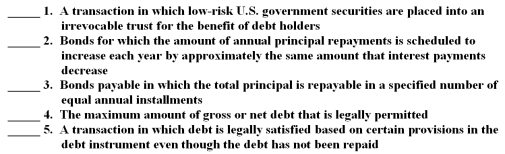

The following key terms from Chapter 6 relate to accounting for general long-term liabilities and debt service:

A.Legal defeasance

B.Regular serial bonds

C.In-substance defeasance

D.Irregular serial bonds

E.Debt limit

F.Annuity serial bonds

G.Debt margin

For each of the following definitions,indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition.

A.Legal defeasance

B.Regular serial bonds

C.In-substance defeasance

D.Irregular serial bonds

E.Debt limit

F.Annuity serial bonds

G.Debt margin

For each of the following definitions,indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following is not true?

A)The debt service activity of a government may be properly accounted for within the General Fund unless law mandates the use of a debt service fund.

B)Debt service funds,unlike the General Fund and special revenue funds,do not use budgetary accounting procedures.

C)Expenditures for interest on tax supported long-term debt are not accrued,even though debt service funds are accounted for on the modified accrual basis.

D)At year-end,budgetary and operating statement accounts of a debt service fund are closed in the same manner as is true for a General Fund or special revenue funds.

A)The debt service activity of a government may be properly accounted for within the General Fund unless law mandates the use of a debt service fund.

B)Debt service funds,unlike the General Fund and special revenue funds,do not use budgetary accounting procedures.

C)Expenditures for interest on tax supported long-term debt are not accrued,even though debt service funds are accounted for on the modified accrual basis.

D)At year-end,budgetary and operating statement accounts of a debt service fund are closed in the same manner as is true for a General Fund or special revenue funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

68

If general capital assets are being acquired by a government under a capital lease agreement,describe the entries that should be recorded in a governmental fund (logically,a debt service fund)for each lease payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

69

Debt service funds are used to record

A)Both principal and interest payments of debt issues.

B)Only interest payments on debt issues.

C)Only principal payments of debt issues.

D)Neither principal nor interest payments of debt issues.

A)Both principal and interest payments of debt issues.

B)Only interest payments on debt issues.

C)Only principal payments of debt issues.

D)Neither principal nor interest payments of debt issues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

70

Bonds and other debt of enterprise funds may legally,at least contingently,have the status of tax-supported debt.In the event that enterprise fund resources are insufficient for debt service on such debt,why might the government as a whole find it necessary or desirable to assume responsibility for debt service? How would assumption of responsibility for such debt by the government as a whole be accounted for in the governmental activities accounts in the enterprise fund?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

71

On July 1,the first day of its fiscal year,the city of Morgan sold bonds with a face value of $10,000,000 at 102 percent of par.The bonds bear annual interest at 6 percent; interest is payable semiannually.The bonds will mature in equal installments over 20 years.(The bond premium must be used for eventual bond redemption and is deposited directly in the debt service fund.)Assuming the bonds are tax-supported bonds sold to finance the construction of a sports complex,the operations of which will be financed by a special revenue fund when the complex is completed:

1)Name the type of fund and/or activity in which each of the following should be recorded.(If any of the following should not be recorded at all,enter "none" on the appropriate line.)

(a)The cash received for the sale of the bonds.

(b)The liability of $10,000,000 for bonds payable.

(c)The cost of the sports complex.

(d)Capitalization of bond interest paid or accrued during the period of construction.

(e)Amortization of premium on bonds sold.

2)Show in general journal form all entries that should be made to record the sale of the bonds.For each entry,indicate the fund or group in which the entry is made.

1)Name the type of fund and/or activity in which each of the following should be recorded.(If any of the following should not be recorded at all,enter "none" on the appropriate line.)

(a)The cash received for the sale of the bonds.

(b)The liability of $10,000,000 for bonds payable.

(c)The cost of the sports complex.

(d)Capitalization of bond interest paid or accrued during the period of construction.

(e)Amortization of premium on bonds sold.

2)Show in general journal form all entries that should be made to record the sale of the bonds.For each entry,indicate the fund or group in which the entry is made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

72

A government is planning a sinking fund to retire $10,000,000 of term bonds that mature in 20 years.Semiannual additions will be made to the sinking fund for the next 20 years at the end of each period.It is estimated that a net return of 6 percent per annum,compounded semiannually,can be realized on the average.

a)Compute the necessary periodic additions for debt repayment (the amount of an annuity of $1 compounded at 3 percent (the semiannual rate)for 40 periods is 75.4012597).

b)What information would you need,in addition to the results of your computation in part a,in order to be able to prepare the revenue budget for debt service for the term bond issue?

a)Compute the necessary periodic additions for debt repayment (the amount of an annuity of $1 compounded at 3 percent (the semiannual rate)for 40 periods is 75.4012597).

b)What information would you need,in addition to the results of your computation in part a,in order to be able to prepare the revenue budget for debt service for the term bond issue?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

73

One argument advanced in favor of financing with term bonds secured by some sort of a sinking fund is that earnings on investments held by the debt service fund will reduce the amount of support required from other sources.What is your opinion of the validity of this argument?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

74

In many jurisdictions,the statutory debt limit is relatively low,but overlapping debt is not prohibited.From the standpoint of the property owner and taxpayer,how does that situation compare with a relatively high total statutory debt limit?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

75

When the debt service fund makes a payment of principal and interest on an outstanding long-term debt,the governmental activities accounts

A)Reflect the principal payment only.

B)Reflect the interest payment only.

C)Has no record of the transaction.

D)Reflects both principal and interest payments.

A)Reflect the principal payment only.

B)Reflect the interest payment only.

C)Has no record of the transaction.

D)Reflects both principal and interest payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

76

The city of Superior's fiscal year ends on December 31.On July 1,2011 Superior issues $1,000,000 of 8%,10-year term bonds with semi-annual interest payments due on July 1 and January 1 each year.The General Fund transferred $100,000 to the debt service fund on July 1,2011 to pay for interest to bondholders for the year.The debt service fund invests the money at an annual rate of 10%.What is the amount of total assets in the debt service fund at the end of 2011?

A)$65,000

B)$105,000

C)$965,000

D)$1,005,000

A)$65,000

B)$105,000

C)$965,000

D)$1,005,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

77

Compute the legal debt margin for Mountain City given the following information regarding its bonded debt.

1)The legal debt limit is 10 percent of total assessed valuation.

2)Bonds outstanding and bonds authorized are:

1)The legal debt limit is 10 percent of total assessed valuation.

2)Bonds outstanding and bonds authorized are:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

78

"The entire debt arising from the acquisition of general capital assets under a capital lease agreement should be reported as debt of the fund that accounts for the activities of the department or function using the leased asset.Only debt arising from the lease of equipment used by a number of departments should be reported in the governmental activities accounts,rather than a fund." Do you agree? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

79

What provision in a bond indenture or bond ordinance is necessary for long-term debt to be classified as a general obligation? Are all obligations properly reported as general long-term debt evidenced by bonds or notes? If not,give several examples of general long-term debt not evidenced by bonds or notes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck

80

Modified accrual accounting is used for debt service funds in which of the following ways?

A)It is used without exception.

B)It is not used in any transaction.

C)It is used to account for interest,with the exception that interest is paid when legally due.

D)It is used for revenue transactions.

A)It is used without exception.

B)It is not used in any transaction.

C)It is used to account for interest,with the exception that interest is paid when legally due.

D)It is used for revenue transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 82 في هذه المجموعة.

فتح الحزمة

k this deck