Deck 17: Accounting and Reporting for the Federal Government

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/52

العب

ملء الشاشة (f)

Deck 17: Accounting and Reporting for the Federal Government

1

Long-term debt related to a construction project in a public hospital that follows business-type accounting should be reported as other financing sources.

False

Explanation: Public health care organizations would report long-term debt as a liability of the entity as a whole in the statement of net assets.

Explanation: Public health care organizations would report long-term debt as a liability of the entity as a whole in the statement of net assets.

2

A gift to a hospital with the restriction that the principal be maintained intact for ten years and then it may be expended would be an example of a term endowment.

True

Explanation: This is an example of a term endowment not a permanent or pure endowment in which the principal is to be maintained intact in perpetuity.

Explanation: This is an example of a term endowment not a permanent or pure endowment in which the principal is to be maintained intact in perpetuity.

3

Health care is provided by organizations that may be for-profit,not-for-profit,or governmental; although roughly half of all health care is provided by not-for-profit entities.

True

Explanation: Illustration 17-1 in the text outlines the sponsorship or legal structure of health care organizations as well as the types of services provided.

Explanation: Illustration 17-1 in the text outlines the sponsorship or legal structure of health care organizations as well as the types of services provided.

4

When a governmental hospital purchases capital assets from resources restricted by donors for that purpose,the net assets account Net Assets-Invested in Capital Assets,Net of Related Debt is increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

5

Equipment purchased from the restricted resources of a private hospital should be depreciated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

6

All health care entities recognize all revenues and expenses on the accrual basis of accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

7

Contingencies that are unique to health care providers arise from malpractice claims,risk contracting,and payor payment programs,obligations to provide uncompensated care,and contractual agreements with physicians.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

8

The net assets or equity section of a health care organization's balance sheet or statement of net assets will indicate whether the health care organization is for-profit,not-for-profit,or governmental.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

9

Assets set aside by the governing board for the eventual construction of a hospital addition should be recorded as "assets limited as to use".

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

10

In accounting for health care entities,the provision for bad debt should always be recorded as a revenue deduction,rather than as an expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

11

The goal of financial and operational analysis of a health care organization is to determine if the entity is profitable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

12

Health care organizations often collaborate and combine with related entities in providing health care services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

13

An expense for diabetes research that was financed by temporarily restricted contributions would be recorded as a decrease of unrestricted net assets by a not-for-profit health care organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

14

Patient service revenues and related receivables include charges for charity care services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

15

Financial reporting standards for all government owned and operated hospitals are established by the GASB.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

16

The required financial statements for a not-for-profit hospital are a balance sheet,statement of revenues and expenses of the General Fund,a statement of changes in fund balances,and a statement of cash flows of the General Fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

17

The purpose of a performance indicator is to provide an operating measure for not-for-profit health care organizations that is equivalent to income from continuing operations of for-profit health care organizations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

18

All health care organizations report investments at fair value and report unrealized gains or losses on the statement of operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

19

Endowment income expended by a not-for-profit health care organization for purposes specified by the donor should be recorded as a decrease in temporarily restricted net assets using the account Net Assets Released from Restrictions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

20

Continuing care retirement communities (CCRC)provide residential care in a facility,along with some level of long-term medical care that is less intensive that hospital care.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

21

An annual contributor to a not-for-profit hospital made an unrestricted pledge in October 2010 that will be paid in March 2011.Assuming the hospital's fiscal year-end is December 31,2010,the pledge in October 2010 should be credited to:

A)Contributions-Temporarily Restricted in 2010.

B)Contributions-Unrestricted in 2010.

C)Contributions-Temporarily Restricted in 2011.

D)Contributions-Unrestricted in equal amounts in 2010 and 2011.

A)Contributions-Temporarily Restricted in 2010.

B)Contributions-Unrestricted in 2010.

C)Contributions-Temporarily Restricted in 2011.

D)Contributions-Unrestricted in equal amounts in 2010 and 2011.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

22

Contractual Adjustments is properly characterized as

A)An expense.

B)An other financing use.

C)A liability.

D)A deduction from revenues.

A)An expense.

B)An other financing use.

C)A liability.

D)A deduction from revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

23

SFAS No.117 requires that interest received on endowment funds be reported in the statement of cash flows as a(n)

A)Reconciliation of change in net assets to cash.

B)Operating activity.

C)Investing activity.

D)Financing activity.

A)Reconciliation of change in net assets to cash.

B)Operating activity.

C)Investing activity.

D)Financing activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

24

Independent health care organizations that associate for the specific purpose of obtaining financing are called a(an)

A)Consolidation.

B)Obligated group.

C)Affiliation.

D)Joint venture.

A)Consolidation.

B)Obligated group.

C)Affiliation.

D)Joint venture.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

25

The statement of activities required by SFAS No.117 for not-for-profit health care entities must display changes for the period in which of the following categories of net assets?

A)Unrestricted,temporarily restricted,and invested in capital assets.

B)Unrestricted,temporarily restricted,and permanently restricted.

C)Unrestricted,restricted,and invested in capital assets.

D)Unreserved fund balance and reserved fund balance.

A)Unrestricted,temporarily restricted,and invested in capital assets.

B)Unrestricted,temporarily restricted,and permanently restricted.

C)Unrestricted,restricted,and invested in capital assets.

D)Unreserved fund balance and reserved fund balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following statements is true about diagnosis-related groups (DRGs)?

A)DRGs are the basis for a cost accounting method that groups costs together by departments performing the services.

B)A DRG is a case-mix classification scheme that is used to determine the payment provided to the hospital for inpatient services,regardless of how much the hospital spends to treat a patient.

C)The federal Medicare system of retroactive payment for services depends on DRGs.

D)The diagnostic-related groups method is the prevailing practice of billing third-party payors for a health care organization's average cost for providing care for locally defined similar medical conditions.

A)DRGs are the basis for a cost accounting method that groups costs together by departments performing the services.

B)A DRG is a case-mix classification scheme that is used to determine the payment provided to the hospital for inpatient services,regardless of how much the hospital spends to treat a patient.

C)The federal Medicare system of retroactive payment for services depends on DRGs.

D)The diagnostic-related groups method is the prevailing practice of billing third-party payors for a health care organization's average cost for providing care for locally defined similar medical conditions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following would usually be considered as temporarily restricted net assets in a nongovernmental not-for-profit hospital?

A)Investment income.

B)Donated services by senior citizens.

C)A permanent endowment received from the city's leading citizen.

D)A research grant from the federal government to study high blood pressure.

A)Investment income.

B)Donated services by senior citizens.

C)A permanent endowment received from the city's leading citizen.

D)A research grant from the federal government to study high blood pressure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following kinds of volunteer service is most likely to be reported by a private hospital as contribution revenue and an expense?

A)Community members who plant flowers on the grounds once a year in the spring.

B)Volunteers in the gift shop who work a few hours a day serving customers.

C)Nurses from a religious organization who volunteer to assist in the care of critically ill children.

D)An accountant who is a member of the board of directors.

A)Community members who plant flowers on the grounds once a year in the spring.

B)Volunteers in the gift shop who work a few hours a day serving customers.

C)Nurses from a religious organization who volunteer to assist in the care of critically ill children.

D)An accountant who is a member of the board of directors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

29

Assets whose use is limited by contracts or agreements with outside parties other than donors or grantors are labeled

A)Temporarily restricted net assets.

B)Designated net assets.

C)Assets limited as to use.

D)Restricted assets.

A)Temporarily restricted net assets.

B)Designated net assets.

C)Assets limited as to use.

D)Restricted assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

30

Donated medicines that normally would be purchased by a hospital should be recorded at fair market value and should be credited to

A)Net Patient Service Revenue.

B)Other Revenue.

C)Nonoperating Gains.

D)Deferred Revenues.

A)Net Patient Service Revenue.

B)Other Revenue.

C)Nonoperating Gains.

D)Deferred Revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

31

The primary source of revenue for most hospitals is

A)Nonexchange transactions,such as contributions.

B)Exchange transactions,such as fees for services.

C)Investment income.

D)Capitation fees from health maintenance organizations.

A)Nonexchange transactions,such as contributions.

B)Exchange transactions,such as fees for services.

C)Investment income.

D)Capitation fees from health maintenance organizations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

32

Under SFAS No.116,pledges received by a nongovernment not-for-profit hospital during its building construction fund drive,and restricted for that purpose,would be recognized as an increase in temporarily restricted net assets (support)

A)When the building is constructed.

B)When the pledge is made.

C)When the pledge is collected.

D)During each period of construction using the percentage-of-completion method.

A)When the building is constructed.

B)When the pledge is made.

C)When the pledge is collected.

D)During each period of construction using the percentage-of-completion method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

33

If the equity/net assets section of the balance sheet (or statement of net assets)is comprised of unrestricted net assets,temporarily restricted net assets,and permanently restricted net assets,then the health care organization is

A)Public,governmental.

B)Private,nongovernmental.

C)Commercial or proprietary.

D)Cannot be determined.

A)Public,governmental.

B)Private,nongovernmental.

C)Commercial or proprietary.

D)Cannot be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following statements is true regarding hospitals?

A)Hospital accounting and financial reporting is identical to that used by for-profit businesses.

B)Hospitals use modified accrual accounting.

C)Hospitals record revenues based upon full charges and report contractual adjustments as a deduction from revenues.

D)Hospitals report charity care in the same manner as contractual adjustments.

A)Hospital accounting and financial reporting is identical to that used by for-profit businesses.

B)Hospitals use modified accrual accounting.

C)Hospitals record revenues based upon full charges and report contractual adjustments as a deduction from revenues.

D)Hospitals report charity care in the same manner as contractual adjustments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

35

A contribution that is restricted by the donor to be held in perpetuity and for which the investment income can be spent at the discretion of a nongovernmental,not-for-profit hospital's governing board,will be reported as an increase to

A)Permanent funds.

B)Current restricted funds.

C)Permanently restricted net assets.

D)Specific purpose assets.

A)Permanent funds.

B)Current restricted funds.

C)Permanently restricted net assets.

D)Specific purpose assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following statements is not true regarding generally accepted accounting principles (GAAP)applicable to health care organizations?

A)Private hospitals follow guidance from the GASB.

B)Public health care organizations follow guidance from the GASB.

C)The AICPA Audit and Accounting Guide Health Care Organizations provides guidance for public,private,and for-profit health care entities.

D)Both for-profit and not-for-profit health care organizations follow guidance from the FASB.

A)Private hospitals follow guidance from the GASB.

B)Public health care organizations follow guidance from the GASB.

C)The AICPA Audit and Accounting Guide Health Care Organizations provides guidance for public,private,and for-profit health care entities.

D)Both for-profit and not-for-profit health care organizations follow guidance from the FASB.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

37

The AICPA Audit and Accounting Guide Health Care Organizations requires that health care organizations prepare a balance sheet (or statement of net assets)and the following additional statements:

A)Statement of changes in fund balances,statement of changes in equity,and statement of cash flows.

B)Statement of revenues and expenditures,statement of changes in equity,and statement of cash flows.

C)Statement of operations,statement of changes in equity,and statement of cash flows.

D)Statement of operations,statement of changes in equity,statement of cash flows,and statement of functional expenses.

A)Statement of changes in fund balances,statement of changes in equity,and statement of cash flows.

B)Statement of revenues and expenditures,statement of changes in equity,and statement of cash flows.

C)Statement of operations,statement of changes in equity,and statement of cash flows.

D)Statement of operations,statement of changes in equity,statement of cash flows,and statement of functional expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

38

Contractual adjustments that arise from differences between the gross charge for patient services and the amount paid by a third party payor are reported as

A)Deductions from gross patient revenue in arriving at net patient revenue.

B)Disclosures in the notes to the financial statements.

C)Either deductions from gross patient revenue or disclosure in the notes,depending on the dollar amount of the adjustments relative to billings.

D)Bad debt expense.

A)Deductions from gross patient revenue in arriving at net patient revenue.

B)Disclosures in the notes to the financial statements.

C)Either deductions from gross patient revenue or disclosure in the notes,depending on the dollar amount of the adjustments relative to billings.

D)Bad debt expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following would not be considered a health care organization required to follow the guidance of the AICPA Audit and Accounting Guide Health Care Organizations?

A)A heart research and education foundation.

B)A home health agency.

C)A public health clinic.

D)A health maintenance organization.

A)A heart research and education foundation.

B)A home health agency.

C)A public health clinic.

D)A health maintenance organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

40

Charity service and bad debts in a public hospital that follows business-type accounting are reported

A)The same; reported as deductions from gross patient revenue in arriving at net patient revenue.

B)The same; reported as expenses.

C)Differently; charity service is disclosed in the notes to the financial statements,and bad debts are reported as a deduction from revenue.

D)Differently; charity service is reported as a deduction from gross patient revenue and bad debts are reported as an expense.

A)The same; reported as deductions from gross patient revenue in arriving at net patient revenue.

B)The same; reported as expenses.

C)Differently; charity service is disclosed in the notes to the financial statements,and bad debts are reported as a deduction from revenue.

D)Differently; charity service is reported as a deduction from gross patient revenue and bad debts are reported as an expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following would be an appropriate performance indicator for a not-for-profit health care organization?

A)Revenues.

B)Excess of revenues and gains over expenses and losses.

C)Expenses and losses.

D)Contributions to long-lived assets.

A)Revenues.

B)Excess of revenues and gains over expenses and losses.

C)Expenses and losses.

D)Contributions to long-lived assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

42

Contrast and compare the statement of cash flows that nongovernmental not-for-profit hospitals prepare to those that governmental hospitals prepare.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

43

Show entries in general journal form for the following transactions of Bothwell Regional Hospital,a not-for-profit hospital.

1)For the month just ended the hospital received in cash $8,000 from the hospital's gift shop sales,and received donated medicines with a fair value of $47,000.These medicines are of the type the hospital normally would purchase.

2)The hospital's finance officer,in compliance with the directive of the governing board,invested $600,000 of operating cash in certificates of deposit to be held for future purchases of equipment.

3)New fixed equipment costing $750,000 was purchased from money given the hospital in a prior year to be held until needed for equipment purchases.

4)A federal grant was received in cash in the amount of $400,000 to be used for heart research.During the current year only $50,000 was spent for this research program.

1)For the month just ended the hospital received in cash $8,000 from the hospital's gift shop sales,and received donated medicines with a fair value of $47,000.These medicines are of the type the hospital normally would purchase.

2)The hospital's finance officer,in compliance with the directive of the governing board,invested $600,000 of operating cash in certificates of deposit to be held for future purchases of equipment.

3)New fixed equipment costing $750,000 was purchased from money given the hospital in a prior year to be held until needed for equipment purchases.

4)A federal grant was received in cash in the amount of $400,000 to be used for heart research.During the current year only $50,000 was spent for this research program.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

44

There are three main reasons why a hospital does not receive the full amount that they normally charge for a room: 1)contractual adjustments arising from transactions with third-party payors,2)charity service provided to indigent patients,and 3)bad debts.Compare the accounting treatment for the three reasons listed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

45

Do you agree with the following statement? Why or why not? "The goal of financial and operational analysis for the manager is to determine the creditworthiness of the health care organization."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

46

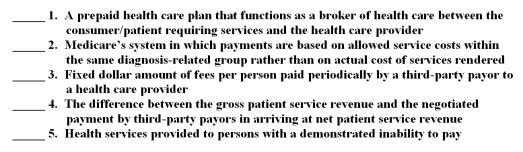

The following are key terms in Chapter 17 that relate to accounting for health care organizations:

A.Contractual adjustments

B.Capitation fees

C.Charity care

D.Diagnosis-related groups

E.Prospective payment system

F.Health maintenance organizations

G.Performance indicator

H.Third-party payor

For each of the following definitions,indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition.

A.Contractual adjustments

B.Capitation fees

C.Charity care

D.Diagnosis-related groups

E.Prospective payment system

F.Health maintenance organizations

G.Performance indicator

H.Third-party payor

For each of the following definitions,indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

47

Record in general journal form the following selected transactions for Avalon General Hospital,a nongovernmental,not-for-profit institution.

1)Gross charges for patient services rendered during the period amounted to $7,870,000,of which $350,000 represented charity care for indigent patients.

2)During the year the provision for bad debts was set at $190,000 and contractual adjustments amounted to $435,000.

3)A wealthy donor donated $2,000,000 to construct a new cardiology wing on the hospital.

4)During the year,the new cardiology wing (see item 3)was one-half completed at a cost of $1,000,000.

1)Gross charges for patient services rendered during the period amounted to $7,870,000,of which $350,000 represented charity care for indigent patients.

2)During the year the provision for bad debts was set at $190,000 and contractual adjustments amounted to $435,000.

3)A wealthy donor donated $2,000,000 to construct a new cardiology wing on the hospital.

4)During the year,the new cardiology wing (see item 3)was one-half completed at a cost of $1,000,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

48

What auditing issues are of particular significance to the health care industry?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

49

Explain how one can evaluate both the financial performance of a hospital and the quality of health care the hospital provides.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

50

Congress mandated diagnosis-related groups (DRG)as a method for recording costs in health care organizations in the early 1980s,in part to facilitate Medicare's prospective payment system.Explain what the DRG system is and describe the impact this change may have had on the cost accounting systems of health care organizations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

51

Georgetown Hospital,a governmental hospital,recorded during its fiscal year ended September 30,gross patient services valued at $15,000,000,excluding charity care services of $1,600,000.However,contractual adjustments by third-party payors amounted to $1,200,000.In May of that year St.John received donated medical supplies worth $2,000; supplies they had planned to purchase had it not been for the gift.At year-end,the governing board set aside investments in the amount of $500,000 for future plant expansion and $250,000 to be invested with the related earnings used for a special prenatal care program.

1)In its operating statement for the year ended September 30,how much should St.John report as net patient services revenue?

2)For the year ended September 30,how should the donation of medical supplies should be reported?

3)What amount of unrestricted net assets should St.John report in its balance sheet as board designated,assuming it had no board designated net assets at the beginning of the year?

1)In its operating statement for the year ended September 30,how much should St.John report as net patient services revenue?

2)For the year ended September 30,how should the donation of medical supplies should be reported?

3)What amount of unrestricted net assets should St.John report in its balance sheet as board designated,assuming it had no board designated net assets at the beginning of the year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

52

Describe what prepaid health care plans are and some of the related accounting issues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck