Deck 16: Accounting for Health Care Organizations

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/46

العب

ملء الشاشة (f)

Deck 16: Accounting for Health Care Organizations

1

Nongovernmental (private)colleges and universities follow FASB standards; governmental (public)colleges and universities should follow GASB standards.

True

Explanation: Since its formation in 1984 GASB has been responsible for setting financial reporting standards for government colleges and universities. FASB has responsibility for all others.

Explanation: Since its formation in 1984 GASB has been responsible for setting financial reporting standards for government colleges and universities. FASB has responsibility for all others.

2

Public colleges and universities are considered general purpose governments and are expected to be engaged in governmental activities only for purposes of their stand-alone reports.

False

Explanation: Public colleges and universities are considered special purpose governments, and most are expected to be engaged in business-type activities only. These public colleges and universities rely on tuition and fees, state appropriations, gifts and grants, income from auxiliary activities, and investment income to fund operations. Community colleges, and other colleges with the power to tax, may be engaged in both business-type and governmental activities.

Explanation: Public colleges and universities are considered special purpose governments, and most are expected to be engaged in business-type activities only. These public colleges and universities rely on tuition and fees, state appropriations, gifts and grants, income from auxiliary activities, and investment income to fund operations. Community colleges, and other colleges with the power to tax, may be engaged in both business-type and governmental activities.

3

A receipt of a $500,000 gift by a private college which is stipulated by the donor to be used to endow a "chaired" professorship in accounting would be recorded as an increase in temporarily restricted net assets.

False

Explanation: The term endowment indicates that the corpus of the gift is to remain intact in perpetuity, so this gift would increase permanently restricted net assets in a private college.

Explanation: The term endowment indicates that the corpus of the gift is to remain intact in perpetuity, so this gift would increase permanently restricted net assets in a private college.

4

College summer school revenues of a public university engaged only in business-type activities should be recognized in the fiscal year in which the term is predominantly conducted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

5

The sale of bonds for construction of a college residence hall would always result in a credit to proceeds of bonds in the accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

6

Private colleges and universities must provide aggregated entity-wide financial statements prepared in conformity with FASB Statement No.117.Consequently,private colleges and universities no longer utilize fund accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

7

A statement of cash flows is required by GAAP for both private colleges and universities and public colleges and universities engaged in business-type activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

8

Public colleges and universities that use business-type reporting must present segment information in the notes to the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

9

Earnings on endowment investments may increase unrestricted or restricted net assets,or both.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

10

The cost of professors' salaries would normally be recorded in which functional area?

A)Student services.

B)Instruction.

C)Service.

D)Institutional support.

A)Student services.

B)Instruction.

C)Service.

D)Institutional support.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

11

Revenues and expenses of both public and private colleges and universities are accounted for on the accrual basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

12

An unrestricted gift that is subsequently designated by the board of regents of a public university for agricultural research would be recorded as an unrestricted contribution.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following receipts may properly be accounted for as an increase in unrestricted net assets?

A)Student tuition and fees.

B)Gift from an alumnus for a new college of business building.

C)Federal grant for genetic research.

D)Acceptance of assets,the income from which will be paid to the donor.

A)Student tuition and fees.

B)Gift from an alumnus for a new college of business building.

C)Federal grant for genetic research.

D)Acceptance of assets,the income from which will be paid to the donor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

14

An unrestricted endowment established by the governing board of a public college engaged only in business-type activities is considered a permanent fund and would be reported as unrestricted net assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

15

GASB accounting and reporting standards applicable to public colleges and universities

A)Are now the same as FASB standards to permit comparability between public and private colleges and universities.

B)Permit public colleges and universities to use the AICPA model which differs substantially from the reporting model used by private colleges and universities subject to FASB jurisdiction.

C)Permit public colleges and universities to optionally follow FASB standards.

D)Differ in some significant ways from FASB standards applicable to private colleges and universities.

A)Are now the same as FASB standards to permit comparability between public and private colleges and universities.

B)Permit public colleges and universities to use the AICPA model which differs substantially from the reporting model used by private colleges and universities subject to FASB jurisdiction.

C)Permit public colleges and universities to optionally follow FASB standards.

D)Differ in some significant ways from FASB standards applicable to private colleges and universities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

16

Contributions or grants restricted by an external donor for a particular operating purpose would be reported as increases to restricted fund balances by a public college or university engaged only in business-type activities and as an addition to temporarily restricted net assets by a private college or university.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

17

Depreciation of a residence hall should be reported as an expense in a private college's operating statement but might not be reported in the operating statement of a public college engaged only in business-type activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

18

Cactus College,a small private college,received a research grant from NACUBO to study whether service efforts and accomplishments measures improve institutional performance.Under the provisions of SFAS No.116 the grant would be reported as an increase in:

A)Unrestricted net assets.

B)Temporarily restricted net assets.

C)Permanently restricted net assets.

D)The fund balance of restricted current funds.

A)Unrestricted net assets.

B)Temporarily restricted net assets.

C)Permanently restricted net assets.

D)The fund balance of restricted current funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

19

What type of college or university must report expenses by functional classification?

A)Both private and public colleges and universities.

B)Private colleges and universities.

C)Public colleges and universities.

D)Neither private nor public colleges and universities.

A)Both private and public colleges and universities.

B)Private colleges and universities.

C)Public colleges and universities.

D)Neither private nor public colleges and universities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following statements is true regarding generally accepted accounting principles (GAAP)for colleges and universities?

A)The FASB has set standards for private and public colleges and universities from the time of its inception in 1974.

B)The National Association of Colleges and University Business Officers (NACUBO)only recently began to play a role in establishing accounting and reporting standards for colleges and universities.

C)Public and private colleges and universities must comply with the 1973 AICPA Audit and Accounting Guide Audits of Colleges and Universities for financial reporting.

D)The GASB is responsible for establishing GAAP for public colleges and universities.

A)The FASB has set standards for private and public colleges and universities from the time of its inception in 1974.

B)The National Association of Colleges and University Business Officers (NACUBO)only recently began to play a role in establishing accounting and reporting standards for colleges and universities.

C)Public and private colleges and universities must comply with the 1973 AICPA Audit and Accounting Guide Audits of Colleges and Universities for financial reporting.

D)The GASB is responsible for establishing GAAP for public colleges and universities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

21

An alumnus donates securities to St.Aloysius College,a private college,and stipulates that the principal be held in perpetuity and income from the securities be used for faculty travel.Dividends received from the securities should be recognized as increases in

A)Endowments.

B)Unrestricted net assets.

C)Permanently restricted net assets.

D)Temporarily restricted net assets.

A)Endowments.

B)Unrestricted net assets.

C)Permanently restricted net assets.

D)Temporarily restricted net assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

22

Assets that the governing board of a public university,rather than a donor or other outside agency,has determined are to be retained and invested for future scholarships would be reported as

A)An endowment.

B)Unrestricted net assets.

C)Deposits held in custody for others.

D)Restricted net assets.

A)An endowment.

B)Unrestricted net assets.

C)Deposits held in custody for others.

D)Restricted net assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following is not a classification of revenues for a college or university as recommended by the National Association of College and University Business Officers (NACUBO)?

A)Athletic ticket sales.

B)Federal appropriations.

C)Sales and services of educational activities.

D)Private gifts.

A)Athletic ticket sales.

B)Federal appropriations.

C)Sales and services of educational activities.

D)Private gifts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

24

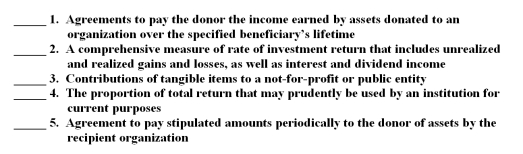

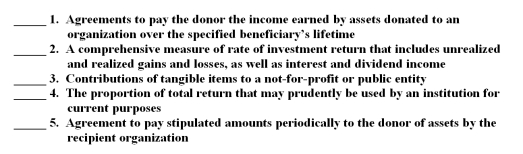

The following are key terms in Chapter 16 that relate to accounting for colleges and universities:

A.Term endowments

B.Gifts in kind

C.Annuity agreements

D.Collections

E.Pooled life income agreements

F.Spending rate

G.Total return

For each of the following definitions,indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition.

A.Term endowments

B.Gifts in kind

C.Annuity agreements

D.Collections

E.Pooled life income agreements

F.Spending rate

G.Total return

For each of the following definitions,indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

25

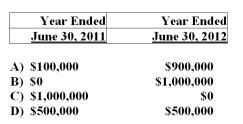

Culver City College,a public college,has a 10-week summer session that starts on June 25,2011,so that one week is held during FY 2011 and the other nine weeks meet during FY 2012.Tuition and fees in the amount of $1,000,000 were collected from students for classes to be conducted in this session.What amount should Culver City College recognize as unrestricted revenue in each of the years ended June 30,2011 and June 30,2012.

A)Choice A

B)Choice B

C)Choice C

D)Choice D

A)Choice A

B)Choice B

C)Choice C

D)Choice D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following items would not affect the amounts reported in Revenues and Gains section of the statement of activities for a private college or university?

A)Student tuition and fees.

B)Tuition and fees discounts and allowances.

C)Net assets released from restriction.

D)Deferred revenues.

A)Student tuition and fees.

B)Tuition and fees discounts and allowances.

C)Net assets released from restriction.

D)Deferred revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

27

State educational appropriations received by a public university are classified as which of the following on the statement of revenues,expenses,and changes in net assets?

A)Nonoperating revenue.

B)Operating revenue.

C)Other financing source.

D)Increase in unrestricted net assets.

A)Nonoperating revenue.

B)Operating revenue.

C)Other financing source.

D)Increase in unrestricted net assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

28

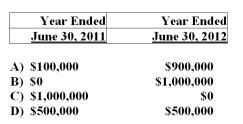

During the year ended June 30,2011,Hopkins College,a private college,received a federal government grant of $800,000 for research on the role of music in improving math skills for students.Expenses for this research amounted to $100,000 during the same year.Under applicable FASB standards,assuming this is a nonexchange transaction,Hopkins College would report what amount(s)as changes in net assets for the year ended June 30,2011?

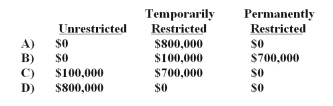

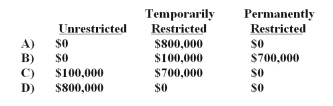

A)Choice A

B)Choice B

C)Choice C

D)Choice D

A)Choice A

B)Choice B

C)Choice C

D)Choice D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

29

Tuition scholarships for which there is no intention of collection from the student should be classified by a private university as

A)Reductions of gross revenue to arrive at net revenue.

B)Revenues and expenditures.

C)Revenues and expenses.

D)Reductions of gross revenue or as expenses,provided they are consistently classified in the same manner from year to year.

A)Reductions of gross revenue to arrive at net revenue.

B)Revenues and expenditures.

C)Revenues and expenses.

D)Reductions of gross revenue or as expenses,provided they are consistently classified in the same manner from year to year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following is a typical classification of a functional expense in a college or university?

A)Recreation and culture.

B)Public safety.

C)Institutional support.

D)Depreciation.

A)Recreation and culture.

B)Public safety.

C)Institutional support.

D)Depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

31

Are public and private colleges and universities required to report depreciation expense in their financial statements?

A)Public: No; Private: No

B)Public: Yes; Private: Yes

C)Public: Yes; Private: No

D)Public: No; Private: Yes

A)Public: No; Private: No

B)Public: Yes; Private: Yes

C)Public: Yes; Private: No

D)Public: No; Private: Yes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

32

FASB standards applicable to private colleges and universities require that their financial statements

A)Provide separate columns for each fund group.

B)Include a statement of changes in fund balances.

C)Provide aggregated financial information on an entity-wide basis.

D)Include a statement of cash flows prepared using the direct method.

A)Provide separate columns for each fund group.

B)Include a statement of changes in fund balances.

C)Provide aggregated financial information on an entity-wide basis.

D)Include a statement of cash flows prepared using the direct method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following statements usually will not be included in the annual financial report of a governmentally owned public university engaged only in business-type activities?

A)Statement of cash flows.

B)Statement of net assets.

C)Statement of activities.

D)Statement of revenues,expenses,and changes in net assets.

A)Statement of cash flows.

B)Statement of net assets.

C)Statement of activities.

D)Statement of revenues,expenses,and changes in net assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

34

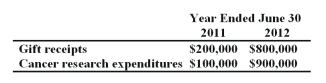

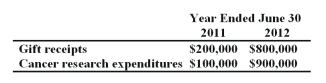

During the years ended June 30,2011 and 2012,Jackson University,a private university,conducted a cancer research project financed by a $1,000,000 gift from an alumnus.The entire amount was pledged by the donor on July 10,2010,although she paid only $200,000 at that date.The gift was restricted to the financing of this particular research project.During the two-year research period,Jasper's related gift receipts and research expenditures were as follows:  How much contribution revenue should Jasper University report for the year ended June 30,2012?

How much contribution revenue should Jasper University report for the year ended June 30,2012?

A)$0

B)$800,000

C)$900,000

D)$1,000,000

How much contribution revenue should Jasper University report for the year ended June 30,2012?

How much contribution revenue should Jasper University report for the year ended June 30,2012?A)$0

B)$800,000

C)$900,000

D)$1,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following is required as part of a complete set of financial statements for a private college or university?

A)Statement of changes in financial position.

B)Statement of revenues,expenses,and changes in net assets.

C)Statement of activities.

D)Statement of functional expenses.

A)Statement of changes in financial position.

B)Statement of revenues,expenses,and changes in net assets.

C)Statement of activities.

D)Statement of functional expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

36

Economic rationality would argue against a university accepting a split interest agreement in which a fixed annuity is payable to the donor if:

A)The donor has attached conditions to the gift.

B)The university has no immediate need for the assets.

C)The sum of future annuity payments plus interest thereon exceeds the fair market value of the assets.

D)The present value of the future annuity payments and other liabilities exceed the fair market value of the assets.

A)The donor has attached conditions to the gift.

B)The university has no immediate need for the assets.

C)The sum of future annuity payments plus interest thereon exceeds the fair market value of the assets.

D)The present value of the future annuity payments and other liabilities exceed the fair market value of the assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following is not a condition that would permit a public college or private college or university to avoid accounting recognition of the value of its collections of art,historical treasures,and similar assets?

A)Public colleges and universities are required by GASB standards to capitalize and report all collections.

B)The assets are held for public exhibition,education,or research in furtherance of public service rather than financial gain.

C)The assets are protected,kept unencumbered,cared for,and preserved.

D)The assets are subject to an organizational policy that ensures the proceeds of sales of collectible assets are used to acquire other items for collections.

A)Public colleges and universities are required by GASB standards to capitalize and report all collections.

B)The assets are held for public exhibition,education,or research in furtherance of public service rather than financial gain.

C)The assets are protected,kept unencumbered,cared for,and preserved.

D)The assets are subject to an organizational policy that ensures the proceeds of sales of collectible assets are used to acquire other items for collections.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following relationships indicates that River State University,a public university,would report an independent not-for-profit fund-raising foundation as a component unit?

A)The foundation raises and holds economic resources that are entirely or almost entirely for the direct benefit of River State University,but the university can only access the resources if and when the foundation's board of trustees approves a transfer.

B)The foundation raises and holds economic resources that are entirely or almost entirely for the direct benefit of River State University,the university has the ability to access the resources at its discretion,and the resources are significant to the university.

C)The foundation raises and holds economic resources that are entirely or almost entirely for direct benefit to River State University as well as a group of other universities in the state,but no individual university can access the resources until the foundation's board of trustees approves a transfer.

D)The foundation raises and holds economic resources that are entirely or almost entirely for the direct benefit of River State University and the university has the ability to access the resources at its discretion; however,the dollar amount of such resources are not significant to the university.

A)The foundation raises and holds economic resources that are entirely or almost entirely for the direct benefit of River State University,but the university can only access the resources if and when the foundation's board of trustees approves a transfer.

B)The foundation raises and holds economic resources that are entirely or almost entirely for the direct benefit of River State University,the university has the ability to access the resources at its discretion,and the resources are significant to the university.

C)The foundation raises and holds economic resources that are entirely or almost entirely for direct benefit to River State University as well as a group of other universities in the state,but no individual university can access the resources until the foundation's board of trustees approves a transfer.

D)The foundation raises and holds economic resources that are entirely or almost entirely for the direct benefit of River State University and the university has the ability to access the resources at its discretion; however,the dollar amount of such resources are not significant to the university.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

39

"Tuition and fees should be recorded as revenues of colleges and universities even though they must be reported net of fee remissions,scholarships,and fellowships." Do you agree or disagree with this statement? If you disagree,explain how fee remissions,scholarships,and fellowships should be recorded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following measures may be useful to decision makers evaluating the financial condition of a college or university?

A)Number of graduates.

B)Current ratio.

C)Faculty productivity.

D)Graduation rate.

A)Number of graduates.

B)Current ratio.

C)Faculty productivity.

D)Graduation rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

41

Describe the treatment of a not-for-profit,nongovernmental foundation that is related to a public university under GASB standards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

42

Describe why and how a public college or university reports on segments of its operations? Are private colleges and universities also required to do the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

43

Refunds of college or university tuition or fees should be recorded as expenses in the period in which they are made.Do you agree? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

44

Show entries in general journal form for the following transactions for a certain private university.

1)The university was awarded a federal grant in the amount of $1,800,000 to be used for a specified research project (determined to be a nonexchange transaction).During the year the entire $1,800,000 was received and expenses for the specified project totaled $1,000,000.

2)Ira Beaker,a renowned chemist and alumnus,donated $7,000,000 to be used for the construction of new chemistry building to be named Beaker Hall.The gift is to be paid to the university in equal installments over a two-year period; the sum for the current year was received in cash.

3)Cash outlays of $2,750,000 were made during the year for construction in progress on the new chemistry building.Other construction projects completed during the year,also financed by temporarily restricted resources,amounted to $1,500,000 for buildings and $500,000 for improvements other than buildings.There was no debt financing used for these projects.

4)During the year bonds with a face value of $180,000 were retired.

1)The university was awarded a federal grant in the amount of $1,800,000 to be used for a specified research project (determined to be a nonexchange transaction).During the year the entire $1,800,000 was received and expenses for the specified project totaled $1,000,000.

2)Ira Beaker,a renowned chemist and alumnus,donated $7,000,000 to be used for the construction of new chemistry building to be named Beaker Hall.The gift is to be paid to the university in equal installments over a two-year period; the sum for the current year was received in cash.

3)Cash outlays of $2,750,000 were made during the year for construction in progress on the new chemistry building.Other construction projects completed during the year,also financed by temporarily restricted resources,amounted to $1,500,000 for buildings and $500,000 for improvements other than buildings.There was no debt financing used for these projects.

4)During the year bonds with a face value of $180,000 were retired.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

45

If a public university receives $1,000,000 in fiscal year 2011 as a grant restricted for a specific research project and makes expenditures amounting to $400,000 during fiscal year 2011 properly chargeable to the grant,how much should be reported as revenues in fiscal year 2011? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

46

Prepare in general journal form the entries required for each of the following selected transactions of Northern University,a state-funded public institution engaged only in business-type activities.Some of these transactions are related and some are not.

1)A generous alumnus donated $300,000 that can only be used for research on diabetes.The full $300,000 was received in FY 2011.

2)During FY 2011,expenses of $150,000 were made in cash for diabetes research (see item 1 above).

3)$2,000,000 in long-term bonds was issued to construct a new parking garage on campus.

4)During FY 2011,the parking garage (see item 3 above)was partially completed at a total cash expenditure of $1,800,000.

5)During 2011,interest was paid in the amount of $120,000 on the long-term bonds issued for the parking garage project (see item 3 above).

1)A generous alumnus donated $300,000 that can only be used for research on diabetes.The full $300,000 was received in FY 2011.

2)During FY 2011,expenses of $150,000 were made in cash for diabetes research (see item 1 above).

3)$2,000,000 in long-term bonds was issued to construct a new parking garage on campus.

4)During FY 2011,the parking garage (see item 3 above)was partially completed at a total cash expenditure of $1,800,000.

5)During 2011,interest was paid in the amount of $120,000 on the long-term bonds issued for the parking garage project (see item 3 above).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck