Deck 4: Security Analysis and Portfolio Theory

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/125

العب

ملء الشاشة (f)

Deck 4: Security Analysis and Portfolio Theory

1

A significant portion of the small-firm premium is earned in the first two weeks of the calendar year.

True

2

Which of the following statements is true?

A) An increase in coupons increases the duration of the bond.

B) The longer the maturity of a bond, the greater will be its duration.

C) An increase in the interest rate decreases the duration of the bond.

D) Duration is a measure of the sensitivity of the equities.

A) An increase in coupons increases the duration of the bond.

B) The longer the maturity of a bond, the greater will be its duration.

C) An increase in the interest rate decreases the duration of the bond.

D) Duration is a measure of the sensitivity of the equities.

C

3

Which of the following investment strategies is inconsistent with a "contrarian" philosophy?

A) buying low, selling high

B) buying when odd-lot buying is lower than normal

C) buying when mutual fund cash positions are low

D) buying when most investment advisory services are bearish

E) selling after a market crash or decline

A) buying low, selling high

B) buying when odd-lot buying is lower than normal

C) buying when mutual fund cash positions are low

D) buying when most investment advisory services are bearish

E) selling after a market crash or decline

E

4

Studies of stock splits indicate that one could make excess returns by investing in stocks after splits occur.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

5

A common stock is expected to generate an end-of-period dividend of $5 and an end-of-period price of $62.If this security has a beta coefficient of 1.3,the risk-free interest rate is 10%,and the expected return on the market portfolio is 19%,then what is the value of this security today?

A) $55.50

B) $59.98

C) $55.05

D) $56.30

A) $55.50

B) $59.98

C) $55.05

D) $56.30

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

6

Studies show that stocks with high dividend yields and low P/E ratios earn excess returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

7

A high positive serial correlation in prices would imply market inefficiency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following statements is true of warrants?

A) A warrant is almost identical to a put option.

B) When warrants are exercised the number of warrants still outstanding increases.

C) A warrant is a combination of call and put options.

D) A warrant is issued by the corporation rather than another investor.

A) A warrant is almost identical to a put option.

B) When warrants are exercised the number of warrants still outstanding increases.

C) A warrant is a combination of call and put options.

D) A warrant is issued by the corporation rather than another investor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following statement is correct with regard to bond valuation?

A) All else equal, the longer the time to maturity, the smaller the interest rate risk.

B) All else equal, the higher the coupon rate, the greater the interest rate risk

C) Spot interest rates are yields to maturity on loan or bonds that pay multiple cash flows to the investor.

D) Bond price will fall as the market interest rate rise, as the present value of the bond's future cash flows is obtained by discounting at a higher interest rate.

A) All else equal, the longer the time to maturity, the smaller the interest rate risk.

B) All else equal, the higher the coupon rate, the greater the interest rate risk

C) Spot interest rates are yields to maturity on loan or bonds that pay multiple cash flows to the investor.

D) Bond price will fall as the market interest rate rise, as the present value of the bond's future cash flows is obtained by discounting at a higher interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

10

Tests of market efficiency tend to

A) look for statistical dependencies that exist in price changes over time.

B) measure the nature of the impact of new information on security prices as that new information becomes available.

C) search for trading systems that might be able to generate supernormal profits.

D) all of the above

A) look for statistical dependencies that exist in price changes over time.

B) measure the nature of the impact of new information on security prices as that new information becomes available.

C) search for trading systems that might be able to generate supernormal profits.

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following statements is (or are)true of the efficient markets hypothesis?

A) It implies perfect forecasting ability.

B) It implies that prices reflect all available information.

C) It results from keen competition among investors.

D) It implies that market is irrational.

E) It implies that prices do not fluctuate.

A) It implies perfect forecasting ability.

B) It implies that prices reflect all available information.

C) It results from keen competition among investors.

D) It implies that market is irrational.

E) It implies that prices do not fluctuate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

12

In a strongly efficient market,the price of a firm's stock should not change if no new information comes out about the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

13

If expectation theory holds then:

A) a flat yield curve is an indication that long-run rates are expected to increase.

B) investors must be offered a higher expected return to hold a bond longer

C) the yield curve cannot be downward sloping

D) then an upward sloping yield curve is an indication that short-term rates are expected to increase.

A) a flat yield curve is an indication that long-run rates are expected to increase.

B) investors must be offered a higher expected return to hold a bond longer

C) the yield curve cannot be downward sloping

D) then an upward sloping yield curve is an indication that short-term rates are expected to increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

14

In a strongly efficient market,no mutual fund manager will beat the market in any period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

15

Studies of firms classified on the basis of P/E ratios come to the conclusion that low-P/E-ratio stocks earn much higher returns,after adjusting for risk,than high-P/E-ratio stocks.This is because

A) low-P/E-ratio stocks are riskier than high-P/E-ratio stocks.

B) investors like low-P/E-ratio stocks.

C) low-P/E-ratio stocks are more likely to be undervalued.

A) low-P/E-ratio stocks are riskier than high-P/E-ratio stocks.

B) investors like low-P/E-ratio stocks.

C) low-P/E-ratio stocks are more likely to be undervalued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following is not a general conclusion of studies of stock prices?

A) The serial correlation in daily returns in U.S. stocks is positive.

B) The serial correlation in longer period returns (monthly, annual) in U.S. stocks is negative.

C) Filter rules greater than 1% generally do not make money.

D) Stocks that have done well in the past are also likely to do well in the future.

E) There are more runs in daily stock prices than we would expect to find under a random walk.

A) The serial correlation in daily returns in U.S. stocks is positive.

B) The serial correlation in longer period returns (monthly, annual) in U.S. stocks is negative.

C) Filter rules greater than 1% generally do not make money.

D) Stocks that have done well in the past are also likely to do well in the future.

E) There are more runs in daily stock prices than we would expect to find under a random walk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

17

All other things equal,which of the following bond price is more sensitive to interest rate changes?

A) a 10 year bond with a 10% coupon

B) a 20 year bond with a 7% coupon

C) a 20 year bond with a 10% coupon

D) a 30 year bond with 7% coupon

A) a 10 year bond with a 10% coupon

B) a 20 year bond with a 7% coupon

C) a 20 year bond with a 10% coupon

D) a 30 year bond with 7% coupon

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following is an attribute of futures contract?

A) There are no limits on the size of the position that any investor can take in financial futures markets.

B) Futures contracts are marked to the market on a daily basis

C) Margins for futures are more relative to other types of markets.

D) Almost all futures positions are settled by delivery.

A) There are no limits on the size of the position that any investor can take in financial futures markets.

B) Futures contracts are marked to the market on a daily basis

C) Margins for futures are more relative to other types of markets.

D) Almost all futures positions are settled by delivery.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following is an implication of market efficiency?

A) Resources are allocated among firms that put them to the best use.

B) No investor will do better than the S&P 500 in any time period.

C) No investor will do better than the S&P 500 consistently after adjusting for risk.

D) No investor will do better than the S&P 500 consistently after adjusting for risk and transactions costs.

A) Resources are allocated among firms that put them to the best use.

B) No investor will do better than the S&P 500 in any time period.

C) No investor will do better than the S&P 500 consistently after adjusting for risk.

D) No investor will do better than the S&P 500 consistently after adjusting for risk and transactions costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

20

The fact that superior returns can not be made by selling stocks that cut dividends is evidence of:

A) weak-form efficiency.

B) semi-strong-form efficiency.

C) strong-form efficiency.

A) weak-form efficiency.

B) semi-strong-form efficiency.

C) strong-form efficiency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

21

You have just completed a study of small and large stocks and have obtained the following results:

s

Given the difference in transactions costs,how long would your investment horizon have to be for small stocks to be a better investment than large stocks?

s

Given the difference in transactions costs,how long would your investment horizon have to be for small stocks to be a better investment than large stocks?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

22

Discuss whether the following statement is true or false:

Buying a call option on a portfolio of common stocks is the same as buying a futures contract on the same portfolio.

Buying a call option on a portfolio of common stocks is the same as buying a futures contract on the same portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

23

Your friend claims that,since the market went up seven days in a row recently,there is no way that the market could follow a random walk.Discuss whether your friend's claim is true or false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

24

Stocks that have high P/E ratios are much more likely to be found to be undervalued using the dividend-discount model.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

25

Discuss whether the following statement is true or false:

A certain retailing firm has a strong seasonal pattern to its sales.Therefore,we would expect to find a seasonal pattern to its stock price as well.

A certain retailing firm has a strong seasonal pattern to its sales.Therefore,we would expect to find a seasonal pattern to its stock price as well.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

26

Discuss whether the following statement is true or false:

The random walk model implies that the best estimate of tomorrow's price is today's price.

The random walk model implies that the best estimate of tomorrow's price is today's price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

27

The Fed announces a tightening of monetary policy,leading to an increase in interest rates.Other things remaining equal,P/E ratios for stocks will decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

28

Discuss whether the following statement is true or false:

If markets are semi-strong-form efficient,one should not observe excess returns after the announcement of a dividend increase.

If markets are semi-strong-form efficient,one should not observe excess returns after the announcement of a dividend increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

29

Discuss whether the following statement is true or false:

An investor is considering purchasing either a zero-coupon bond with 5 years to maturity or a 10% coupon bond with 5 years to maturity,but if both bonds have identical yields to maturity and the investor expects to hold the bond for the full 5 years,then it does not matter which bond is purchased.

An investor is considering purchasing either a zero-coupon bond with 5 years to maturity or a 10% coupon bond with 5 years to maturity,but if both bonds have identical yields to maturity and the investor expects to hold the bond for the full 5 years,then it does not matter which bond is purchased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

30

The duration of a bond decreases as the coupon rate on the bond increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

31

Spot interest rates are yields to maturity on loans or bonds that pay only one cash flow to the investor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

32

Everything else remaining equal,the duration of a coupon bond increases with maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

33

Discuss whether the following statement is true or false:

Two portfolios with matching cash flows are always immunized.

Two portfolios with matching cash flows are always immunized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

34

Discuss whether the following statement is true or false:

The existence of a downward-sloping yield curve is inconsistent with the liquidity preference theory.

The existence of a downward-sloping yield curve is inconsistent with the liquidity preference theory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

35

Discuss whether the following statement is true or false:

If semi-strong efficiency holds,then weak-form efficiency must hold.

If semi-strong efficiency holds,then weak-form efficiency must hold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

36

Discuss whether the following statement is true or false:

A GNMA (mortgage pool)security with a 20-year maturity should sell at a lower yield to maturity than a 20-year corporate bond,because the interest and principal of the GNMA security are government insured.

A GNMA (mortgage pool)security with a 20-year maturity should sell at a lower yield to maturity than a 20-year corporate bond,because the interest and principal of the GNMA security are government insured.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

37

The duration of a five year maturity 10% coupon bond will be higher than the duration of a five year maturity zero coupon bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

38

The duration of a perpetual bond is infinite.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

39

Discuss whether the following statement is true or false:

The promised yield on corporate bonds will in general be higher than the expected yield.

The promised yield on corporate bonds will in general be higher than the expected yield.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

40

Discuss whether the following statement is true or false:

The use of a dividend-discount model to value common stocks is inconsistent with strong-form efficiency but is consistent with weak-form efficiency.

The use of a dividend-discount model to value common stocks is inconsistent with strong-form efficiency but is consistent with weak-form efficiency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

41

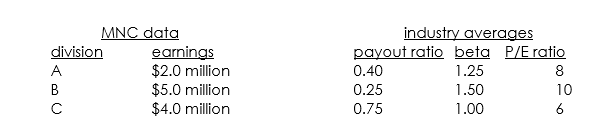

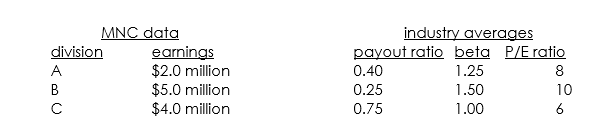

You are attempting to value MNC Inc.,a conglomerate firm with three divisions.Each division is in a different industry,and you are provided with the following information:

The corporate tax rate is 40% and all the industries are in their stable growth phases.MNC Inc.pays out 50% of its earnings as dividends and has no debt.The current annualized 6-month T-bill rate is 8%.What is your best estimate of earnings growth for MNC? Assume a market rate of return of 15%.

The corporate tax rate is 40% and all the industries are in their stable growth phases.MNC Inc.pays out 50% of its earnings as dividends and has no debt.The current annualized 6-month T-bill rate is 8%.What is your best estimate of earnings growth for MNC? Assume a market rate of return of 15%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

42

UV Company has just been formed with $100 million in equity capital to invest in five projects,all with infinite lives,with the following characteristics:

If all five projects have a beta of 1 and the riskless rate is 7%,what is the estimated price-to-book-value ratio of this firm assuming that all five projects are taken? (Assume market rate of return of 15% and the growth rate for the company is 20%)

If all five projects have a beta of 1 and the riskless rate is 7%,what is the estimated price-to-book-value ratio of this firm assuming that all five projects are taken? (Assume market rate of return of 15% and the growth rate for the company is 20%)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

43

Assume that you have been asked to evaluate the P/E ratios of five prospective acquisition candidates.You have the following information:

a. If the riskless rate is 7% and the above statistics will hold through infinity, which of the companies are overvalued and which are undervalued?

b. Now assume that you are using a regression methodology to estimate the relationship between P/E ratios and these variables. Using a cross-sectional sample, you obtain the following equation: P/E = 2 + 0.3 x growth rate + 5 x payout ratio - 1 x beta. Using this equation, which of the companies are overvalued and which are undervalued?

a. If the riskless rate is 7% and the above statistics will hold through infinity, which of the companies are overvalued and which are undervalued?

b. Now assume that you are using a regression methodology to estimate the relationship between P/E ratios and these variables. Using a cross-sectional sample, you obtain the following equation: P/E = 2 + 0.3 x growth rate + 5 x payout ratio - 1 x beta. Using this equation, which of the companies are overvalued and which are undervalued?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

44

The government has just issued two bonds.The first bond pays $1,000 at the end of year 1 and is now selling for $909.29.The second bond pays $100 at the end of year 1 and $1,100 at the end of year 2 and is now selling for $976.15.

a. What are the spot and forward rates for 1-year and 2-year bonds?

b. Using the spot rates determined in part a, what is the duration of each of these bonds?

c. If a new bond is offered that pays $60 at the end of year 1 and $60 at the end of year 2, what must it sell for now?

a. What are the spot and forward rates for 1-year and 2-year bonds?

b. Using the spot rates determined in part a, what is the duration of each of these bonds?

c. If a new bond is offered that pays $60 at the end of year 1 and $60 at the end of year 2, what must it sell for now?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

45

You are a research analyst for a major investment bank and have been asked to evaluate three candidates for a takeover and recommend one.You estimate the risk-free rate to be 5% and the market risk premium to be 8%.You also have the following data:

Which firm is the best candidate for a takeover?

Which firm is the best candidate for a takeover?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

46

You have been hired as an analyst by a noted security analysis firm and asked to value two stocks.You have been given the following data on the two firms:

You estimate that firm 1 will become a stable firm after five years have passed,after which it will have a constant growth rate of 6%,and that firm 1's return on investment will remain unchanged.Value each firm.

You estimate that firm 1 will become a stable firm after five years have passed,after which it will have a constant growth rate of 6%,and that firm 1's return on investment will remain unchanged.Value each firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

47

You have been given the following historical data on XYZ Corporation:

a. Estimate the beta for XYZ.

b. The price of XYZ stock was $50 a year ago, and today it is $55. The dividends paid by XYZ over the last twelve months amount to $3. The T-bill rate a year ago was 6%, and the NYSE index has risen 10% over the past year. Assume that the average dividend yield on all stocks is 3% and evaluate the performance of XYZ stock over the past year.

c. If the T-bill rate today is 5.5%, what would you project the price of XYZ stock to be a year from today? (Assume that XYZ will continue to pay an annual dividend of $1.)

a. Estimate the beta for XYZ.

b. The price of XYZ stock was $50 a year ago, and today it is $55. The dividends paid by XYZ over the last twelve months amount to $3. The T-bill rate a year ago was 6%, and the NYSE index has risen 10% over the past year. Assume that the average dividend yield on all stocks is 3% and evaluate the performance of XYZ stock over the past year.

c. If the T-bill rate today is 5.5%, what would you project the price of XYZ stock to be a year from today? (Assume that XYZ will continue to pay an annual dividend of $1.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

48

You are a financial analyst for General Motors and have been asked to evaluate the effect on risk of taking over RandomTech,an electronics firm.You have collected the following data for both firms:

You estimate the correlation of returns between GM and RandomTech to be 0.3.

a. How will taking over RandomTech affect GM's beta?

b. What will the variance of the combined firm be if the takeover is carried through?

You estimate the correlation of returns between GM and RandomTech to be 0.3.

a. How will taking over RandomTech affect GM's beta?

b. What will the variance of the combined firm be if the takeover is carried through?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

49

You have been asked to evaluate the performance of a firm over the last year and to make some predictions for performance over the next year.The following data are provided to you:

a. Evaluate the firm's performance over the last year. (Estimate the excess returns, either positive or negative, made by this firm.)

b. What would you expect the stock price to be one year from today?

c. You estimate that the standard deviation of this stock next year will be 50% and the standard deviation of the market will be 20%. What proportion of the firm's total risk is non-diversifiable?

a. Evaluate the firm's performance over the last year. (Estimate the excess returns, either positive or negative, made by this firm.)

b. What would you expect the stock price to be one year from today?

c. You estimate that the standard deviation of this stock next year will be 50% and the standard deviation of the market will be 20%. What proportion of the firm's total risk is non-diversifiable?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

50

You are considering investing your money with Value Max,a professional money management firm.Value Max's portfolio maintains constant percentages in computer stocks (40%),bio-technology stocks (20%),and health service stocks (40%).Value Max has sent you the following information on past performance and investment details: Value Max returns = 40% per annum over the last 5 years; returns on NYSE index = 20% per annum over last 5 years; average annualized 6-month T-bill rate = 7% over last 5 years.Your research indicates that the average betas for the three sectors Value Max invests in are 1.2 for computer stocks,1.5 for bio-technology stocks,and 0.8 for health service stocks.

a. What is the appropriate beta to use to evaluate Value Max's portfolio?

b. Evaluate Value Max's performance over the last five years.

a. What is the appropriate beta to use to evaluate Value Max's portfolio?

b. Evaluate Value Max's performance over the last five years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

51

Last year,ABC Corp.earned $10 per share and its retention rate was 40%.You require a 12% rate of return on the stock and believe that ABC can realize a rate of return of 15% on its retained earnings.

a. If ABC has just paid its annual dividend, and you are planning to buy and hold forever, what is a share of ABC worth to you now?

b. Assuming that your expectations and the market's expectations are the same, and that these expectations are met over the next thirty years, what will the market price of a share of ABC stock be at the end of thirty years from now?

a. If ABC has just paid its annual dividend, and you are planning to buy and hold forever, what is a share of ABC worth to you now?

b. Assuming that your expectations and the market's expectations are the same, and that these expectations are met over the next thirty years, what will the market price of a share of ABC stock be at the end of thirty years from now?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

52

ABC Corp.has just paid an annual dividend of $0.50 per share.Dividends are expected to grow at 15% for each of the next 8 years,at 10% for the 2 years after that,and at 3% thereafter.If the appropriate discount rate is 10%,what is the intrinsic value of the stock?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

53

Firm A has a stock price of $10 per share,an expected dividend for next year of $1 per share,an expected constant growth rate of 8% per year,and a beta of 0.8 on its stock.Firm B has a stock price of $50 per share,an expected dividend for next year of $5.50 per share,a retention rate of 40%,a historical rate of return on investment of 20%,and a beta of 1.3 on its stock.If the riskless rate is 10% and the expected return on the market portfolio is 18%,is either of these stocks underpriced or overpriced? What is your buy/sell recommendation for each stock?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

54

You are trying to value Godzilla,Inc.You are provided with the following data for the company: the current earnings per share is $2.50; the expected return on assets is 15%; the current dividend payout ratio is 40%,and this rate is expected to stay constant over the next five years,during which time the firm expects high growth; the firm has a debt-equity ratio of 0.5; the firm pays an interest rate of 10% on its debt; after the fifth year,the firm is expected to grow at a constant rate of 8%,and the return on assets will remain unchanged at 15%; the firm's beta is 0.8; the riskless rate is 7%; the expected return on the market is 15%.

a. Value the firm.

b. Mr. Poone Bickens is attempting to take over Godzilla, Inc. He claims that the managers are not managing the firm optimally. In particular, he feels that the firm should prune some of its losing assets and should borrow more money, so that the return on assets will be 20% and the debt-equity ratio will be 1.5. He agrees with the constant growth estimate for the stable phase (after the fifth year and on). Assuming Mr. Bickens is right, how much will he be willing to pay for the firm?

a. Value the firm.

b. Mr. Poone Bickens is attempting to take over Godzilla, Inc. He claims that the managers are not managing the firm optimally. In particular, he feels that the firm should prune some of its losing assets and should borrow more money, so that the return on assets will be 20% and the debt-equity ratio will be 1.5. He agrees with the constant growth estimate for the stable phase (after the fifth year and on). Assuming Mr. Bickens is right, how much will he be willing to pay for the firm?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

55

Silicon Valley Electronics (SVE)is expected to pay out 40% of its earnings and to earn an average return of 15% per year forever on its reinvested earnings.Stocks with similar characteristics are priced to return 12% to investors.By what percentage can SVE's earnings per share be expected to grow each year? What is the appropriate P/E ratio for the stock? What portion of SVE's total yield is likely to come from capital gains? What portion will come from dividend yield?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

56

You have been given the following information on AD Corporation,and you expect this information to hold for the next five years: ROA = 20%; debt/equity ratio = 0.5; interest rate on debt = 10%; dividend payout ratio = 20%.After five years have passed,you expect AD's growth rate to be 10%.The annualized six-month T-bill rate is 7%,current EPS is $4.00,and the stock's beta is 1.25.Assume a market rate of return of 15%.

a. Using the dividend-discount model, estimate the intrinsic value of the stock.

b. The company's CFO is considering increasing his payout ratio to 40% for the first five years. Advise him by estimating the value of the stock with the new payout ratio.

c. The CFO is also considering increasing the debt/equity ratio to one. Estimate the value of the stock with the new ratio.

a. Using the dividend-discount model, estimate the intrinsic value of the stock.

b. The company's CFO is considering increasing his payout ratio to 40% for the first five years. Advise him by estimating the value of the stock with the new payout ratio.

c. The CFO is also considering increasing the debt/equity ratio to one. Estimate the value of the stock with the new ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

57

On January 1,1991,you are considering buying stock in Genetic Biology Systems (GBS),which has just announced a new type of corn that will provide nitrogen to the soil and thus eliminate the need for additional fertilizer.GBS had an EPS of $1.20 in 1990.The firm's expected annual growth rate is 50% for 1991 and 1992,25% for the following two years,and 10% thereafter.Its dividend payout ratio is expected to be zero in 1990 and 1991,to rise to 20% for the following two years,and then to stabilize at 50% thereafter.The risk-free rate is 15%,and GBS has a beta of 1.2.The market rate of return is 16%.

a. What is the value of GBS stock?

b. Now assume that you are in the 40% tax bracket but that capital gains are taxed at 16%. Assume that you can buy GBS stock for $22.26. You can also buy the stock of ISD, Inc., which is of equal risk to GBS and sells for $42.86. ISD has just paid a dividend of $6, and has an expected constant growth rate of 2%. If you plan to hold either investment for four years and then sell it, which stock is a better investment for you?

a. What is the value of GBS stock?

b. Now assume that you are in the 40% tax bracket but that capital gains are taxed at 16%. Assume that you can buy GBS stock for $22.26. You can also buy the stock of ISD, Inc., which is of equal risk to GBS and sells for $42.86. ISD has just paid a dividend of $6, and has an expected constant growth rate of 2%. If you plan to hold either investment for four years and then sell it, which stock is a better investment for you?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

58

You are responsible for valuing QXR Corporation,given the following data: current EPS = $4.00; current payout ratio = 40%,ROA = 20%; beta = 1.2; debt/equity ratio = 0.75; interest rate on debt = 12%; annualized 6-month T-bill rate = 8%; number of shares outstanding = 100,000.You expect the firm to grow at 8% after the first five years,with the ROA declining to 15%.You also know that QXR has substantial real estate holdings that are currently unutilized and can be sold for $1,000,000.What is your estimate of QXR's intrinsic value? Assume a market rate of return of 15%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

59

You are trying to value a stable firm that has the following characteristics: current EPS = $5.00; dividend payout ratio = 60%; ROA = 16%; debt/equity ratio = 0.8; interest rate on debt = 11%; required rate of return = 15%; number of shares outstanding = 100,000.What is your best estimate of the firm's value?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

60

You are an analyst looking at the risk-return characteristics of XYZ Corporation.You decide to use the CAPM as your model for estimating risk.Using a regression of stock returns on market returns,you come up with the following regression equation: Rjt = 0.02 + 1.2 Rmt.

a. If the current riskless rate is 7% and the stock is currently selling for $50, what is your best estimate of the stock price a year from today? (Assume that the expected dividend per share next year is $2 and the market of return is 15%.)

b. The stock was selling for $54 a year ago. You have been asked to judge the performance of the stock over the last year. (Assume that the NYSE index declined from 150 to 145.5 over the same period, that the T-bill rate was 7% a year ago, and that the dividend per share last year was also $2.)

c. XYZ Corp. is considering the acquisition of ABC Co. for $25 million. You have estimated the beta for ABC Co. to be 2.0, and the correlation between XYZ and ABC stock returns to be 0.4. If XYZ goes through with the acquisition, what will its beta be afterwards? (There are one million shares of outstanding XYZ stock.)

a. If the current riskless rate is 7% and the stock is currently selling for $50, what is your best estimate of the stock price a year from today? (Assume that the expected dividend per share next year is $2 and the market of return is 15%.)

b. The stock was selling for $54 a year ago. You have been asked to judge the performance of the stock over the last year. (Assume that the NYSE index declined from 150 to 145.5 over the same period, that the T-bill rate was 7% a year ago, and that the dividend per share last year was also $2.)

c. XYZ Corp. is considering the acquisition of ABC Co. for $25 million. You have estimated the beta for ABC Co. to be 2.0, and the correlation between XYZ and ABC stock returns to be 0.4. If XYZ goes through with the acquisition, what will its beta be afterwards? (There are one million shares of outstanding XYZ stock.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

61

You are evaluating the riskiness of a government bond with a coupon rate of 8% and a maturity of 5 years.If the current yield to maturity is 10%,what is the duration of this bond?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

62

Consider the following data for bonds A,B,and C:

a. Calculate the forward and spot rates for each period.

b. What is the value of the discount function for the first period?

c. What is the yield to maturity for bond C assuming annual payment periods?

a. Calculate the forward and spot rates for each period.

b. What is the value of the discount function for the first period?

c. What is the yield to maturity for bond C assuming annual payment periods?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

63

At the end of years 1 through10,an investor deposits $450 per year in a bank account paying 9% per year.At the end of years 11 through 20,she withdraws $450 per year.At the end of years 21 through 30,she deposits $450 per year.What is the account balance at the end of year 30?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

64

Consider the following data for bonds A and B:

a. Assuming a flat yield curve of 10%, the expectations theory of the term structure, and semi-annual compounding, which bond is a superior investment?

b. If you kept everything the same in part a, except for replacing the assumption of the expectations theory with the assumption of a liquidity premium theory, would your answer to part a be affected and, if so, how?

a. Assuming a flat yield curve of 10%, the expectations theory of the term structure, and semi-annual compounding, which bond is a superior investment?

b. If you kept everything the same in part a, except for replacing the assumption of the expectations theory with the assumption of a liquidity premium theory, would your answer to part a be affected and, if so, how?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

65

Bond A pays $10 at the end of year 1 and $110 at the end of year 2,bond B pays $5 at the end of year 1 and $105 at the end of year 2,and bond C pays $20 at the end of year 1 and $120 at the end of year 2.If bond A is selling for $100,bond B for $95,and bond C for $105,does the law of one price hold? If not,describe the arbitrage that would restore the law of one price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

66

Assume that the annual interest rate on 2-period loans is 10% and the annual interest rate on 3-period loans is 12%.

a. What is the forward rate on loans made in period 2 and repaid in period 3?

b. What is the present value of a security with a cash flow of $300 at the end of period 1 and a cash flow of $400 at the end of period 3?

c. What is the future value (at the end of period 3) of the security in part b?

a. What is the forward rate on loans made in period 2 and repaid in period 3?

b. What is the present value of a security with a cash flow of $300 at the end of period 1 and a cash flow of $400 at the end of period 3?

c. What is the future value (at the end of period 3) of the security in part b?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

67

Assume that the yield curve is flat at 10% and that the expectations theory of the term structure holds.For a bond with 5 years to maturity,an annual coupon rate of 20%,and semi-annual coupon payments occurring at the middle and end of each year,what is the duration as of the beginning of year 3 just after a coupon payment?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

68

You are the CFO of a small corporation and you anticipate that you will have a significant liability of $10 million coming due in five years.You are considering investing enough money in one or both of the following two bonds to protect yourself against interest rate risk: a five-year bond with a coupon rate of 16%,and a ten-year bond with a coupon rate of 12%.Each bond has a yield to maturity of 12%.Assuming duration is a perfect measure of interest rate risk,what combination of the two bonds would provide you with complete protection against interest rate risk?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

69

Assume that the yield curve is currently flat at 12.5% and that you are considering the following four investments,all of which are currently selling for $100,for a holding period of four years: a series of one-year securities with coupon rate = yield to maturity; a four-year zero-coupon bond; a five-year bond that pays coupons of $12.50 per year; a perpetuity.

a. What is the duration of each investment?

b. Which investment would you choose for complete immunization?

c. Calculate the rate of return on each investment if interest rates go up to 20%; do the same if interest rates go down to 5%. How does this relate to the duration measure in part a?

a. What is the duration of each investment?

b. Which investment would you choose for complete immunization?

c. Calculate the rate of return on each investment if interest rates go up to 20%; do the same if interest rates go down to 5%. How does this relate to the duration measure in part a?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

70

An annual-coupon corporate bond has a 20-year maturity,an 11.5% coupon rate,and a par value of $1,000.The yield to maturity on the bond is 11%.An investor plans to buy the bond today and hold it to maturity,reinvesting the coupon payments at a 9% reinvestment rate.

a. What is the purchase price of the bond?

b. How much will the investor have at maturity?

a. What is the purchase price of the bond?

b. How much will the investor have at maturity?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

71

A $1,000 par bond has an annual coupon rate of 12% with semi-annual coupon payments and has a 5-year maturity.Assuming a flat yield curve of 10%,what is the bond's duration?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

72

It is now time 0.You are a bond portfolio manager using a barbell strategy to immunize.Your portfolio will consist of two bonds: bond A,which is a $100 par zero coupon bond maturing in five years; bond B,which is a $100 par zero-coupon bond maturing in ten years.You are trying to immunize a $1 million liability that is due in six years.The yield curve is flat at 10%,so you need a present value of $1 million/(1.10)6 = $564,474.

a. Of the $564,474, how much will you put in bond A and how much will you put in bond B? How many of the A and B bonds will you buy?

b. One minute after you set up the portfolio, the yield curve shifts up to 15% (staying flat). How much is your portfolio worth?

c. After the shift in part b, is your liability immunized? If not, what should you do to immunize it? Be specific, and give numbers if you can.

d. Now assume that the shift in part b never happened. You leave the firm and nobody bothers to look at the portfolio again until the end of year 4. Interest rates are still at 10%; there have been no further changes. At the end of year 4, a new bond portfolio manager takes over, goes through the files, and finds the records of the portfolio. What, if anything, will she have to do to keep the liability immunized? Be specific, and give numbers if you can.

a. Of the $564,474, how much will you put in bond A and how much will you put in bond B? How many of the A and B bonds will you buy?

b. One minute after you set up the portfolio, the yield curve shifts up to 15% (staying flat). How much is your portfolio worth?

c. After the shift in part b, is your liability immunized? If not, what should you do to immunize it? Be specific, and give numbers if you can.

d. Now assume that the shift in part b never happened. You leave the firm and nobody bothers to look at the portfolio again until the end of year 4. Interest rates are still at 10%; there have been no further changes. At the end of year 4, a new bond portfolio manager takes over, goes through the files, and finds the records of the portfolio. What, if anything, will she have to do to keep the liability immunized? Be specific, and give numbers if you can.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

73

Consider the following securities: a fully taxable coupon bond paying 12 in one year,112 in two years,selling at 103; a fully taxable coupon bond paying 5 in one year,105 in two years,selling at 92; a municipal bond paying 8 in one year,108 in two years,selling at 98; a bank account paying 10%.

a. Which of the above securities is most attractive to an investor in the 40% effective tax bracket? (Ignore capital gains tax)

b. Which one is most attractive to a tax-exempt investor?

a. Which of the above securities is most attractive to an investor in the 40% effective tax bracket? (Ignore capital gains tax)

b. Which one is most attractive to a tax-exempt investor?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

74

You have the opportunity to invest at the following rates.Rank them from best to worst.

a. 10% compounded continuously

b. 10.3% compounded monthly

c. 10.7% simple interest (compounded annually)

a. 10% compounded continuously

b. 10.3% compounded monthly

c. 10.7% simple interest (compounded annually)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

75

Consider the following interest rates: r01 = 10%,r12 = 11%,r03 = 12%,r34 = 13%,and r05 = 14%,where r0t is the annual spot rate for period t and rt t+1 is the annual forward rate from period t to t + 1.What is the price of a $1,000 par bond with 5 years to maturity that has an annual coupon rate of 10% and annual coupon payments?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

76

Assume you want to get a 5-year mortgage on your house and that the yield curve is flat at 10%.

a. If you want to pay back the mortgage in 5 equal annual installments of $1,000, how much can you borrow?

b. What would be the duration of the above mortgage?

a. If you want to pay back the mortgage in 5 equal annual installments of $1,000, how much can you borrow?

b. What would be the duration of the above mortgage?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

77

Consider the following two bonds: a discount bond paying 100 in one year,selling at 93; a coupon bond paying 10 in one year,110 in two years,selling at 95.

a. What is the one-year spot rate? What is the forward rate for the second year?

b. Suppose there is a liquidity premium of 50 basis points on two-year lending. What is the market's expectation of what the one-year spot rate will be in the second year? What does the market expect the second bond's price to be at the beginning of the second year?

c. Suppose you are in the 40% effective marginal tax bracket. What is the total amount you expect to have after taxes at the end of year 2 if you buy the second bond? (Don't forget to reinvest the first-year coupon.)

d. Suppose you buy the second bond and then the market's expectation of the spot rate in the second year changes to 10%. What would be the immediate price change on the bond? If you sold the bond right away, what would be your after-tax profit or loss?

a. What is the one-year spot rate? What is the forward rate for the second year?

b. Suppose there is a liquidity premium of 50 basis points on two-year lending. What is the market's expectation of what the one-year spot rate will be in the second year? What does the market expect the second bond's price to be at the beginning of the second year?

c. Suppose you are in the 40% effective marginal tax bracket. What is the total amount you expect to have after taxes at the end of year 2 if you buy the second bond? (Don't forget to reinvest the first-year coupon.)

d. Suppose you buy the second bond and then the market's expectation of the spot rate in the second year changes to 10%. What would be the immediate price change on the bond? If you sold the bond right away, what would be your after-tax profit or loss?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

78

You have been asked to estimate the duration of a ten-year,8% coupon bond with a yield to maturity of 10%.It has a sinking fund provision where 10% of the outstanding bonds will be retired each year.What is the duration of this bond?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

79

Assume bond returns are given by a single-index model where the index is the percentage change in 1 plus the interest rate.

a. What is the appropriate measure of how bond returns are affected by the index?

b. If the above model is used as a return-generating process, what is the corresponding APT model?

a. What is the appropriate measure of how bond returns are affected by the index?

b. If the above model is used as a return-generating process, what is the corresponding APT model?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

80

Consider the following spot rates: i01 = 6%,i02 = 7%,i03 = 7.5%,i04 = 8%,i05 = 9%.

a. Based on the pure expectations theory, what does the market expect the one-year spot rate to be at the end of year 3?

b. Based on the liquidity premium hypothesis, would you expect the actual one-year spot rate at the end of year 3 to be below the number you computed in part a? Why or why not?

c. Based on the pure expectations hypothesis, what does the market expect the two-year (annualized) spot rate to be at the end of year 3?

d. Can we say whether the yield to maturity on a four-year coupon bond will be above or below 8%? Explain.

a. Based on the pure expectations theory, what does the market expect the one-year spot rate to be at the end of year 3?

b. Based on the liquidity premium hypothesis, would you expect the actual one-year spot rate at the end of year 3 to be below the number you computed in part a? Why or why not?

c. Based on the pure expectations hypothesis, what does the market expect the two-year (annualized) spot rate to be at the end of year 3?

d. Can we say whether the yield to maturity on a four-year coupon bond will be above or below 8%? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck