Deck 20: Accounting for State and Local Governmental Units - Governmental Funds

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/34

العب

ملء الشاشة (f)

Deck 20: Accounting for State and Local Governmental Units - Governmental Funds

1

Use the following information to answer the question(s)below.

The town of Mayberry receives a gift of $500,000 in bonds.The contributor instructs that the principal should remain intact,but the annual interest income of $50,000 can be used for the maintenance of the zoo animals.

When the donation of bonds is received,what account should be debited?

A)Encumbrance

B)Other Financing Sources

C)Other Financing Uses

D)Investment

The town of Mayberry receives a gift of $500,000 in bonds.The contributor instructs that the principal should remain intact,but the annual interest income of $50,000 can be used for the maintenance of the zoo animals.

When the donation of bonds is received,what account should be debited?

A)Encumbrance

B)Other Financing Sources

C)Other Financing Uses

D)Investment

D

2

A Capital Projects Fund awards the construction of a building to a construction contractor at a contract cost of $1,000,000.What entry is prepared by the Capital Projects Fund?

A)Debit Expenditures $1,000,000,Credit Liability $1,000,000

B)Debit Building $1,000,000,Credit Expenditures $1,000,000

C)Debit Other Financing Uses $1,000,000,Credit Expenditures $1,000,000

D)Debit Encumbrances $1,000,000,Credit Reserve for Encumbrances $1,000,000

A)Debit Expenditures $1,000,000,Credit Liability $1,000,000

B)Debit Building $1,000,000,Credit Expenditures $1,000,000

C)Debit Other Financing Uses $1,000,000,Credit Expenditures $1,000,000

D)Debit Encumbrances $1,000,000,Credit Reserve for Encumbrances $1,000,000

D

3

At any point in time,a government will be able to spend an amount equal to

A)appropriations minus expenditures.

B)appropriations minus expenditures minus encumbrances.

C)appropriations minus encumbrances.

D)expenditures minus encumbrances.

A)appropriations minus expenditures.

B)appropriations minus expenditures minus encumbrances.

C)appropriations minus encumbrances.

D)expenditures minus encumbrances.

B

4

When a city enters into a capital lease for a fixed asset for the general government,

A)government-wide statements will report the asset and liability for the leased asset.

B)government-wide statements will report the liability,Capital Lease Obligation.

C)governmental fund statements will report a fixed asset.

D)governmental fund statements will report a liability,Capital Lease Obligation.

A)government-wide statements will report the asset and liability for the leased asset.

B)government-wide statements will report the liability,Capital Lease Obligation.

C)governmental fund statements will report a fixed asset.

D)governmental fund statements will report a liability,Capital Lease Obligation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

5

Assume you are preparing journal entries for the General Fund under the consumption method.What account should be debited when office supplies are ordered?

A)Appropriations

B)Encumbrances

C)Expenditures

D)Other financing use

A)Appropriations

B)Encumbrances

C)Expenditures

D)Other financing use

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

6

The General Fund transfers $50,000 cash to the Debt Service Fund to meet annual interest payments.What entry did the Debt Service Fund prepare?

A)Debit Cash $50,000,Credit Revenue $50,000

B)Debit Cash $50,000,Credit Other Financing Sources-Transfer from General Fund $50,000

C)Debit Encumbrance $50,000,Credit Due to General Fund $50,000

D)Debit Appropriation $50,000,Credit Reserve for Encumbrance $50,000

A)Debit Cash $50,000,Credit Revenue $50,000

B)Debit Cash $50,000,Credit Other Financing Sources-Transfer from General Fund $50,000

C)Debit Encumbrance $50,000,Credit Due to General Fund $50,000

D)Debit Appropriation $50,000,Credit Reserve for Encumbrance $50,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

7

Use the following information to answer the question(s)below.

The town of Mayberry receives a gift of $500,000 in bonds.The contributor instructs that the principal should remain intact,but the annual interest income of $50,000 can be used for the maintenance of the zoo animals.

Governments must record a liability for uncollected taxes instead of revenues for uncollected taxes if the taxes are going to be collected

A)30 days after the fiscal year end.

B)45 days after the fiscal year end.

C)60 days after the fiscal year end.

D)15 days after the fiscal year end.

The town of Mayberry receives a gift of $500,000 in bonds.The contributor instructs that the principal should remain intact,but the annual interest income of $50,000 can be used for the maintenance of the zoo animals.

Governments must record a liability for uncollected taxes instead of revenues for uncollected taxes if the taxes are going to be collected

A)30 days after the fiscal year end.

B)45 days after the fiscal year end.

C)60 days after the fiscal year end.

D)15 days after the fiscal year end.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

8

Use the following information to answer the question(s)below.

The town of Mayberry receives a gift of $500,000 in bonds.The contributor instructs that the principal should remain intact,but the annual interest income of $50,000 can be used for the maintenance of the zoo animals.

The proper sequence of events is

A)purchase order,appropriation,encumbrance,expenditure.

B)purchase order,encumbrance,expenditure,appropriation.

C)appropriation,encumbrance,purchase order,expenditure.

D)appropriation,purchase order,encumbrance,expenditure.

The town of Mayberry receives a gift of $500,000 in bonds.The contributor instructs that the principal should remain intact,but the annual interest income of $50,000 can be used for the maintenance of the zoo animals.

The proper sequence of events is

A)purchase order,appropriation,encumbrance,expenditure.

B)purchase order,encumbrance,expenditure,appropriation.

C)appropriation,encumbrance,purchase order,expenditure.

D)appropriation,purchase order,encumbrance,expenditure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

9

When recording an approved budget into the accounts of the general fund,which of the following accounts would be credited?

A)Appropriations

B)Encumbrances

C)Estimated revenues

D)Deferred revenues

A)Appropriations

B)Encumbrances

C)Estimated revenues

D)Deferred revenues

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

10

Use the following information to answer the question(s)below.

The town of Mayberry receives a gift of $500,000 in bonds.The contributor instructs that the principal should remain intact,but the annual interest income of $50,000 can be used for the maintenance of the zoo animals.

When the interest income of $50,000 is received,what account should be credited?

A)Other Financing Sources

B)Other Financing Uses

C)Deferred Revenue

D)Revenue

The town of Mayberry receives a gift of $500,000 in bonds.The contributor instructs that the principal should remain intact,but the annual interest income of $50,000 can be used for the maintenance of the zoo animals.

When the interest income of $50,000 is received,what account should be credited?

A)Other Financing Sources

B)Other Financing Uses

C)Deferred Revenue

D)Revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

11

When a capital lease is used to lease fixed assets for the general government,the governmental fund acquiring the fixed assets debits ________ at the ________.

A)expenditures;future value of the minimum lease payments

B)fixed assets;future value of the minimum lease payments

C)expenditures;present value of the minimum lease payments

D)fixed assets;present value of the minimum lease payments

A)expenditures;future value of the minimum lease payments

B)fixed assets;future value of the minimum lease payments

C)expenditures;present value of the minimum lease payments

D)fixed assets;present value of the minimum lease payments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

12

The proceeds from a bond issuance for the construction of a new public school should be recorded in the ________ fund at the time the bonds are sold.At the time of the bond issue,the debit is to cash and the credit is to ________.

A)capital projects;revenues

B)general;bonds payable

C)general;other financing sources

D)capital projects;other financing sources

A)capital projects;revenues

B)general;bonds payable

C)general;other financing sources

D)capital projects;other financing sources

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

13

Use the following information to answer the question(s)below.

The town of Mayberry receives a gift of $500,000 in bonds.The contributor instructs that the principal should remain intact,but the annual interest income of $50,000 can be used for the maintenance of the zoo animals.

What type of fund should be used to account for the gift of bonds and the interest income?

A)General Fund

B)Special Revenue Fund

C)Proprietary Fund

D)Permanent Fund

The town of Mayberry receives a gift of $500,000 in bonds.The contributor instructs that the principal should remain intact,but the annual interest income of $50,000 can be used for the maintenance of the zoo animals.

What type of fund should be used to account for the gift of bonds and the interest income?

A)General Fund

B)Special Revenue Fund

C)Proprietary Fund

D)Permanent Fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

14

What statements are required for Government-wide financial statements?

A)Statement of Cash Flows and Balance Sheet

B)Statement of Cash Flows and Statement of Net Assets

C)Statement of Net Position and Statement of Activities

D)Operating Statement and Balance Sheet

A)Statement of Cash Flows and Balance Sheet

B)Statement of Cash Flows and Statement of Net Assets

C)Statement of Net Position and Statement of Activities

D)Operating Statement and Balance Sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

15

Goodwill County had the following transactions for their General Fund in the first month of their fiscal 2014 year,which ends June 30,2014.

1.The budget was approved,with $1,200,000 expected from property taxes,and another $5,000,000 expected from sales taxes.The budget showed these funds were expected to be spent on Salaries and Wages,$3,100,000;Utilities,$1,800,000;Rent,$900,000;and Supplies,$200,000.

2.Supplies were ordered in the amount of $33,000.

3.The electric bill was paid upon receipt in the amount of $75,000.

4.Property taxes were billed in the amount of $1,200,000,due on December 31.Bad debts are estimated at 1% of receivables.

5.Supplies were received,but the invoice amount was $35,000 and will be paid in 35 days.Supplies are used quickly and are not inventoried.

6.Property tax payments were received amounting to $100,000.

7.Payment was received from merchants for sales tax collections amounting to $400,000.

Required:

Prepare the journal entries for the General Fund that would be required for these transactions.

1.The budget was approved,with $1,200,000 expected from property taxes,and another $5,000,000 expected from sales taxes.The budget showed these funds were expected to be spent on Salaries and Wages,$3,100,000;Utilities,$1,800,000;Rent,$900,000;and Supplies,$200,000.

2.Supplies were ordered in the amount of $33,000.

3.The electric bill was paid upon receipt in the amount of $75,000.

4.Property taxes were billed in the amount of $1,200,000,due on December 31.Bad debts are estimated at 1% of receivables.

5.Supplies were received,but the invoice amount was $35,000 and will be paid in 35 days.Supplies are used quickly and are not inventoried.

6.Property tax payments were received amounting to $100,000.

7.Payment was received from merchants for sales tax collections amounting to $400,000.

Required:

Prepare the journal entries for the General Fund that would be required for these transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

16

Use the following information to answer the question(s)below.

The town of Mayberry receives a gift of $500,000 in bonds.The contributor instructs that the principal should remain intact,but the annual interest income of $50,000 can be used for the maintenance of the zoo animals.

Which of the following represents the recording of a budget in the accounts of the General Fund?

A)Debit Appropriations,Credit Estimated Revenues and Credit Fund Balance - Unassigned

B)Debit Appropriations,Credit Estimated Revenues

C)Debit Estimated Revenues,Credit Appropriations,Credit Estimated Other Financing Uses,Credit Fund Balance - Unassigned

D)Debit Estimated Other Financing Uses,Credit Appropriations and Credit Fund Balance - Unassigned

The town of Mayberry receives a gift of $500,000 in bonds.The contributor instructs that the principal should remain intact,but the annual interest income of $50,000 can be used for the maintenance of the zoo animals.

Which of the following represents the recording of a budget in the accounts of the General Fund?

A)Debit Appropriations,Credit Estimated Revenues and Credit Fund Balance - Unassigned

B)Debit Appropriations,Credit Estimated Revenues

C)Debit Estimated Revenues,Credit Appropriations,Credit Estimated Other Financing Uses,Credit Fund Balance - Unassigned

D)Debit Estimated Other Financing Uses,Credit Appropriations and Credit Fund Balance - Unassigned

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following funds has similar accounting and reporting to the special revenue fund?

A)The proprietary fund

B)The trust fund

C)The general fund

D)The agency fund

A)The proprietary fund

B)The trust fund

C)The general fund

D)The agency fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

18

Taxes which were billed,but are not paid by the due date,require which of the following entries at the fiscal close?

A)Debit Taxes Receivable - Delinquent

B)Debit Allowance for Uncollectible Taxes - Delinquent

C)Credit Taxes Receivable - Delinquent

D)Credit Allowance for Uncollectible Taxes - Current

A)Debit Taxes Receivable - Delinquent

B)Debit Allowance for Uncollectible Taxes - Delinquent

C)Credit Taxes Receivable - Delinquent

D)Credit Allowance for Uncollectible Taxes - Current

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

19

Match the following fund balance descriptions for a General Fund with the proper classification for a fund balance.Each classification may be used more than once.

A.Nonspendable Fund Balance

B.Restricted Fund Balance

C.Committed Fund Balance

D.Assigned Fund Balance

E.Unassigned Fund Balance

________ 1.Amounts can only be spent for the specific purposes determined by a formal action of the government's highest level of decision-making authority.

________ 2.Amounts can only be spent for the specific purposes stipulated by constitution,external resource provider or enabling legislation.

________ 3.Residual classification of funds for the General Fund.

________ 4.Dollar amount of Ending Inventory.

________ 5.Amounts intended to be used by the government for specific purposes but do not meet the criteria of restricted or committed.

________ 6.Dollar amount of endowment principal.

A.Nonspendable Fund Balance

B.Restricted Fund Balance

C.Committed Fund Balance

D.Assigned Fund Balance

E.Unassigned Fund Balance

________ 1.Amounts can only be spent for the specific purposes determined by a formal action of the government's highest level of decision-making authority.

________ 2.Amounts can only be spent for the specific purposes stipulated by constitution,external resource provider or enabling legislation.

________ 3.Residual classification of funds for the General Fund.

________ 4.Dollar amount of Ending Inventory.

________ 5.Amounts intended to be used by the government for specific purposes but do not meet the criteria of restricted or committed.

________ 6.Dollar amount of endowment principal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which statement below is incorrect with respect to the Government-wide financial statements?

A)All governmental fund categories must convert to the modified accrual basis of accounting.

B)It is necessary to eliminate interfund balances within the governmental funds.

C)Capital lease liabilities associated with governmental funds must be included on the Government-wide financial statements.

D)All fixed assets and long-term debt for governmental funds must be included on the Government-wide financial statements.

A)All governmental fund categories must convert to the modified accrual basis of accounting.

B)It is necessary to eliminate interfund balances within the governmental funds.

C)Capital lease liabilities associated with governmental funds must be included on the Government-wide financial statements.

D)All fixed assets and long-term debt for governmental funds must be included on the Government-wide financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

21

Carson County had the following transactions for their General Fund relating to the levy and collection of property taxes.

1.Property tax bills for $1,000,000 are sent to property tax owners.Taxes are due in 45 days.History shows that Carson County should expect 1.5% of the property taxes to be uncollectible.

2.$850,000 in property taxes is collected.The remaining receivables are past due.

3.An additional $80,000 of the delinquent taxes is collected.

4.Wrote off $10,000 of delinquent taxes determined to be uncollectible.

Required:

Prepare the journal entries in the General Fund for the transactions.

1.Property tax bills for $1,000,000 are sent to property tax owners.Taxes are due in 45 days.History shows that Carson County should expect 1.5% of the property taxes to be uncollectible.

2.$850,000 in property taxes is collected.The remaining receivables are past due.

3.An additional $80,000 of the delinquent taxes is collected.

4.Wrote off $10,000 of delinquent taxes determined to be uncollectible.

Required:

Prepare the journal entries in the General Fund for the transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

22

Prepare journal entries to record the following grant-related transactions for a municipality special revenue fund.

1.Special Revenue Fund awarded an operating grant from the state,$2,500,000 (cash will be received after qualified expenditures are made).

2.Special Revenue Fund received funds of $1,600,000,temporarily transferred from the General Fund.

3.Incurred qualifying expenditures on the state grant program of $1,600,000 and paid them with funds temporarily transferred from the General Fund.

4.Received a federal grant to finance planting of trees in city,$4,500,000 (cash received in advance).

5.Incurred and paid cost of $3,000,000 for planting 10,000 trees in city.

1.Special Revenue Fund awarded an operating grant from the state,$2,500,000 (cash will be received after qualified expenditures are made).

2.Special Revenue Fund received funds of $1,600,000,temporarily transferred from the General Fund.

3.Incurred qualifying expenditures on the state grant program of $1,600,000 and paid them with funds temporarily transferred from the General Fund.

4.Received a federal grant to finance planting of trees in city,$4,500,000 (cash received in advance).

5.Incurred and paid cost of $3,000,000 for planting 10,000 trees in city.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

23

Peking County incurred the following transactions during 2014:

1.Marketable securities were donated to support the county's bike and nature trails.The donor acquired the securities for $35,000 ten years earlier;however,their current market value was $200,000.The donor specified that all income from the securities be used for the trails.The principal is to be held intact for an indefinite period of time.

2.Computer equipment was ordered for general fund departments.The estimated cost was $48,000.

3.The county received the computer equipment.The actual cost was $47,750,of which $42,000 was paid to the vendor before year-end.

4.The county sold a (general government)dump truck that originally cost $55,000.The county sold the truck at auction for $3,300.The book value of the truck at the time of sale was $0.

5.The government leased equipment for the general government under a capital lease agreement.The present value of the minimum lease payments was $120,000.The county made an initial down payment of $10,000.

Required:

Prepare journal entries for each of the above transactions.Identify the appropriate fund or funds used by Peking County.

1.Marketable securities were donated to support the county's bike and nature trails.The donor acquired the securities for $35,000 ten years earlier;however,their current market value was $200,000.The donor specified that all income from the securities be used for the trails.The principal is to be held intact for an indefinite period of time.

2.Computer equipment was ordered for general fund departments.The estimated cost was $48,000.

3.The county received the computer equipment.The actual cost was $47,750,of which $42,000 was paid to the vendor before year-end.

4.The county sold a (general government)dump truck that originally cost $55,000.The county sold the truck at auction for $3,300.The book value of the truck at the time of sale was $0.

5.The government leased equipment for the general government under a capital lease agreement.The present value of the minimum lease payments was $120,000.The county made an initial down payment of $10,000.

Required:

Prepare journal entries for each of the above transactions.Identify the appropriate fund or funds used by Peking County.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

24

For each of the following transactions relating to the startup of a community pool,determine the fund(s)being affected and prepare the appropriate journal entry for each.Be sure to note the fund type with each journal entry prepared.

1.General obligation bonds are issued at face value of $500,000 to construct a new community pool.

2.Cash of $100,000 is received from a state grant.Grant is set up to support the construction of the community pool.

3.A community fund-raiser by a citizens' group raises $50,000 which is donated to the pool fund,with the restriction placed on it that only earnings are to be used for lifeguard wages,and the principal may not be used until such time as the pool ceases to operate,at which time the principal will revert to the general fund.

4.Construction is completed and the contractors invoices received,totaling $578,000.The invoices are paid within 60 days.

5.The balance of funds from the general obligation bonds and state grant that was not used is transferred to the General Fund.

1.General obligation bonds are issued at face value of $500,000 to construct a new community pool.

2.Cash of $100,000 is received from a state grant.Grant is set up to support the construction of the community pool.

3.A community fund-raiser by a citizens' group raises $50,000 which is donated to the pool fund,with the restriction placed on it that only earnings are to be used for lifeguard wages,and the principal may not be used until such time as the pool ceases to operate,at which time the principal will revert to the general fund.

4.Construction is completed and the contractors invoices received,totaling $578,000.The invoices are paid within 60 days.

5.The balance of funds from the general obligation bonds and state grant that was not used is transferred to the General Fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

25

Bounty County had the following transactions in 2014.

1.The budget for the county was approved,showing estimated revenues of $320,000 from local income taxes,and total estimated expenditures of $316,000.

2.Tax bills were mailed amounting to $326,000,which are due in 60 days.All but 2% was expected to be collectible.

3.Taxes collected prior to the due date amounted to $260,800.The balance was delinquent.

4.$4,200 of taxes due were determined to be uncollectible and written off.

5.The year-end books were closed,with the expectation that the remaining taxes due would be collected evenly over the first two months after the fiscal year end.

Required:

Prepare the journal entries for the General Fund for the transactions.

1.The budget for the county was approved,showing estimated revenues of $320,000 from local income taxes,and total estimated expenditures of $316,000.

2.Tax bills were mailed amounting to $326,000,which are due in 60 days.All but 2% was expected to be collectible.

3.Taxes collected prior to the due date amounted to $260,800.The balance was delinquent.

4.$4,200 of taxes due were determined to be uncollectible and written off.

5.The year-end books were closed,with the expectation that the remaining taxes due would be collected evenly over the first two months after the fiscal year end.

Required:

Prepare the journal entries for the General Fund for the transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

26

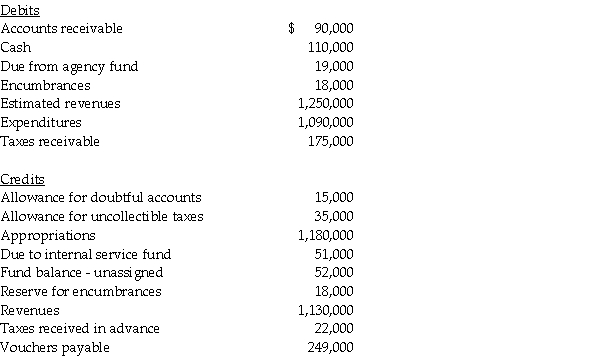

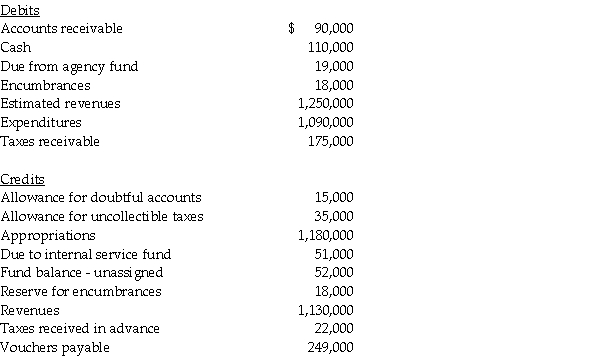

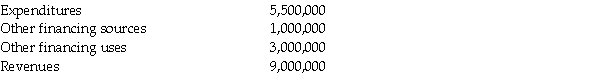

The unadjusted trial balance for the general fund of the City of Jordan at June 30,2014 is as follows:

Supplies on hand at June 30,2014 totaled $17,000.The $18,000 encumbrance relates to equipment ordered but not received by fiscal year-end.

Required:

Prepare a balance sheet for the general fund of the City of Jordan at June 30,2014.

Supplies on hand at June 30,2014 totaled $17,000.The $18,000 encumbrance relates to equipment ordered but not received by fiscal year-end.

Required:

Prepare a balance sheet for the general fund of the City of Jordan at June 30,2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

27

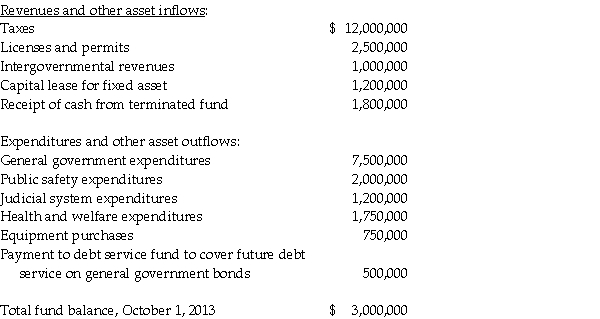

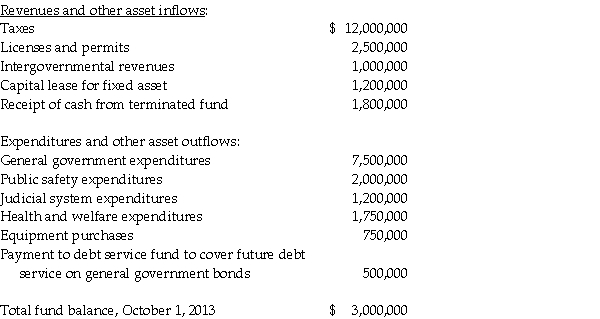

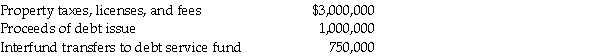

The following information regarding the fiscal year ended September 30,2014,was drawn from the accounts and records of the Mayberry County general fund:

Required:

Prepare a statement of revenues,expenditures,and changes in fund balance for the Mayberry County general fund for the year ended September 30,2014.

Required:

Prepare a statement of revenues,expenditures,and changes in fund balance for the Mayberry County general fund for the year ended September 30,2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

28

The City of Electri entered the following transactions during 2014:

1.Borrowed $120,000 for a six-month term,to be paid upon receipt of property tax payments which were previously billed.

2.Used the funds borrowed to purchase a new fire truck.The truck is expected to have a 15-year useful life,and a $5,000 residual value.

3.Received $90,000 cash from a state grant.Funds are restricted for the purchase of a second fire truck.

4.Used the grant funds received to purchase a second fire truck.The truck is expected to have a 15-year useful life,and a $5,000 residual value.

5.Nonreciprocal transfer of $50,000 to the Debt Service Fund to be used toward repayment of the note.

Required:

Prepare the journal entries in the General Fund for the transactions.

1.Borrowed $120,000 for a six-month term,to be paid upon receipt of property tax payments which were previously billed.

2.Used the funds borrowed to purchase a new fire truck.The truck is expected to have a 15-year useful life,and a $5,000 residual value.

3.Received $90,000 cash from a state grant.Funds are restricted for the purchase of a second fire truck.

4.Used the grant funds received to purchase a second fire truck.The truck is expected to have a 15-year useful life,and a $5,000 residual value.

5.Nonreciprocal transfer of $50,000 to the Debt Service Fund to be used toward repayment of the note.

Required:

Prepare the journal entries in the General Fund for the transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

29

Address the following situations separately.

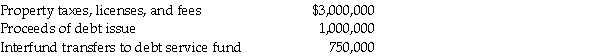

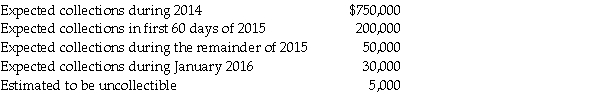

1.For the budgetary year beginning July 1,2014,Coastal City expected the following cash flow resources:

In the budgetary entry,what amount did Coastal City record for estimated revenues?

2.During the fiscal year ended June 30,2014,Western County issued purchase orders totaling $7,000,000.Western County received $6,500,000 of invoiced goods at the encumbered amounts and paid $6,100,000 toward them before year-end.

How much were Western County's encumbrances on July 1,2014?

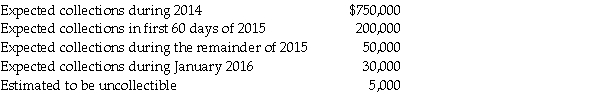

3.The following information pertains to property taxes levied ($1,035,000 total)by Southern Township for the calendar year 2014:

What amount did Southern Township report for property tax revenues in 2014?

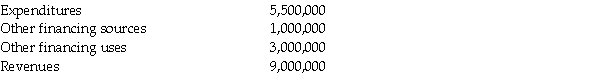

4.The following information pertains to Northern City's general fund for 2014:

At what amount will Northern City's total fund balance increase (decrease)in 2014?

1.For the budgetary year beginning July 1,2014,Coastal City expected the following cash flow resources:

In the budgetary entry,what amount did Coastal City record for estimated revenues?

2.During the fiscal year ended June 30,2014,Western County issued purchase orders totaling $7,000,000.Western County received $6,500,000 of invoiced goods at the encumbered amounts and paid $6,100,000 toward them before year-end.

How much were Western County's encumbrances on July 1,2014?

3.The following information pertains to property taxes levied ($1,035,000 total)by Southern Township for the calendar year 2014:

What amount did Southern Township report for property tax revenues in 2014?

4.The following information pertains to Northern City's general fund for 2014:

At what amount will Northern City's total fund balance increase (decrease)in 2014?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

30

1.Urban City issued $6 million of general obligation bonds at par to finance the construction of a city building.The bonds are 6%,10-year bonds,and interest is paid on June 30 and December 31.

2.The city transferred $3,600,000 from its General Fund to its Debt Service Fund to provide a portion of the resources needed to service the bonds.

3.The city paid the first interest payment to the bondholders.

Required:

Prepare journal entries for each of the above transactions.Identify the appropriate fund or funds used by the city of Urban.

2.The city transferred $3,600,000 from its General Fund to its Debt Service Fund to provide a portion of the resources needed to service the bonds.

3.The city paid the first interest payment to the bondholders.

Required:

Prepare journal entries for each of the above transactions.Identify the appropriate fund or funds used by the city of Urban.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

31

The City of Attross entered the following transactions during 2014:

1.The city authorized a bond issue of $2,500,000 par to finance construction of a fountain and pavilion in the city square.The bonds were issued for $2,560,000.The premium was transferred to the fund for which the debt will be serviced.(This was a nonreciprocal transfer . )

2.The city entered into a contract for construction of the fountain at an estimated cost of $2,425,000.

3.The city received and paid a bill for $2,445,000 from the contractor upon completion of and approval of the fountain.

4.The unused bond proceeds were set aside for debt service on the bonds.Accordingly,those resources were paid to the appropriate fund(nonreciprocal).

Required:

Prepare journal entries for each of the above transactions.Identify the appropriate fund or funds used by Attross.

1.The city authorized a bond issue of $2,500,000 par to finance construction of a fountain and pavilion in the city square.The bonds were issued for $2,560,000.The premium was transferred to the fund for which the debt will be serviced.(This was a nonreciprocal transfer . )

2.The city entered into a contract for construction of the fountain at an estimated cost of $2,425,000.

3.The city received and paid a bill for $2,445,000 from the contractor upon completion of and approval of the fountain.

4.The unused bond proceeds were set aside for debt service on the bonds.Accordingly,those resources were paid to the appropriate fund(nonreciprocal).

Required:

Prepare journal entries for each of the above transactions.Identify the appropriate fund or funds used by Attross.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

32

Middlefield County incurred the following transactions during 2014:

1.The county authorized a new general obligation bond issue of $5 million par to construct an office building with a contract price of $4,975,000.The bonds were issued for $4,980,000.

2.The county levied real property taxes of $10,000,000.Eighty-five percent of the net taxes were collected immediately.Two percent of the total levy was estimated to be uncollectible.

3.The office building was completed and the county paid the contract price to the contractor.

4.The General Fund transferred $500,000 to the Debt Service Fund.

5.The county paid $200,000 for interest on the bonds from the Debt Service Fund.

Required:

Prepare journal entries for each of the above transactions.Identify the appropriate fund or funds used by Middlefield County.

1.The county authorized a new general obligation bond issue of $5 million par to construct an office building with a contract price of $4,975,000.The bonds were issued for $4,980,000.

2.The county levied real property taxes of $10,000,000.Eighty-five percent of the net taxes were collected immediately.Two percent of the total levy was estimated to be uncollectible.

3.The office building was completed and the county paid the contract price to the contractor.

4.The General Fund transferred $500,000 to the Debt Service Fund.

5.The county paid $200,000 for interest on the bonds from the Debt Service Fund.

Required:

Prepare journal entries for each of the above transactions.Identify the appropriate fund or funds used by Middlefield County.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

33

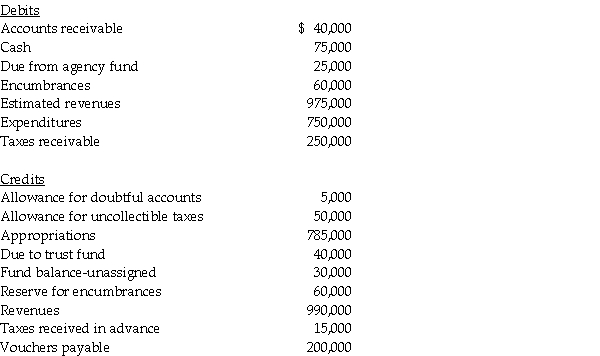

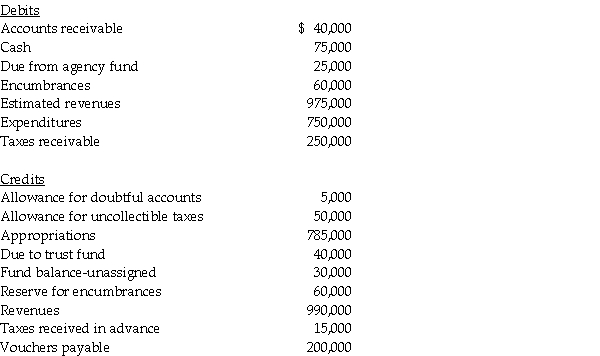

The unadjusted trial balance for the general fund of the City of Nineva at June 30,2014 is as follows:

Supplies on hand at June 30,2014 totaled $8,000.The $60,000 encumbrance relates to equipment ordered but not received by fiscal year-end.

Required:

Prepare a balance sheet for the general fund of the City of Nineva at June 30,2014.

Supplies on hand at June 30,2014 totaled $8,000.The $60,000 encumbrance relates to equipment ordered but not received by fiscal year-end.

Required:

Prepare a balance sheet for the general fund of the City of Nineva at June 30,2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

34

Old West City had the following transactions in fiscal 2014.Assume that all expenditures were properly appropriated in the fiscal 2014 budget.

1.A six-month loan was made to the special revenue fund from the general fund amounting to $28,000.

2.A purchase order for landscaping maintenance services was issued in the amount of $43,000.

3.A $10,000 nonreciprocal transfer was made to the debt service fund to pay interest amounts outstanding.

4.The final invoice for landscaping maintenance was received in the amount of $39,000,and it was scheduled to be paid in 30 days.

5.The city enters into a capital lease of fixed assets for the general government.The present value of the minimum lease payments equals $70,000.

Required:

Prepare the journal entries for the General Fund.

1.A six-month loan was made to the special revenue fund from the general fund amounting to $28,000.

2.A purchase order for landscaping maintenance services was issued in the amount of $43,000.

3.A $10,000 nonreciprocal transfer was made to the debt service fund to pay interest amounts outstanding.

4.The final invoice for landscaping maintenance was received in the amount of $39,000,and it was scheduled to be paid in 30 days.

5.The city enters into a capital lease of fixed assets for the general government.The present value of the minimum lease payments equals $70,000.

Required:

Prepare the journal entries for the General Fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck