Deck 14: Foreign Currency Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/39

العب

ملء الشاشة (f)

Deck 14: Foreign Currency Financial Statements

1

All of the following factors would be used to define a foreign entity's functional currency,except

A)high volume of intercompany transactions.

B)expenses for foreign entity primarily driven by local factors.

C)financing for foreign entity denominated in local currency.

D)foreign entity's status as a local tax haven for transfer pricing purposes.

A)high volume of intercompany transactions.

B)expenses for foreign entity primarily driven by local factors.

C)financing for foreign entity denominated in local currency.

D)foreign entity's status as a local tax haven for transfer pricing purposes.

D

2

At the time of a business acquisition,

A)identifiable assets and liabilities are allocated the portion of the translation or remeasurement adjustment that existed on the date of acquisition.

B)a foreign entity's assets and liabilities are translated into U.S.dollars using the current exchange rate in effect on that date.

C)the difference between investment fair value and translated net assets acquired is treated as a remeasurement gain or loss on the income statement.

D)the difference between investment fair value and translated net assets acquired is recorded as a cumulative translation adjustment on the balance sheet.

A)identifiable assets and liabilities are allocated the portion of the translation or remeasurement adjustment that existed on the date of acquisition.

B)a foreign entity's assets and liabilities are translated into U.S.dollars using the current exchange rate in effect on that date.

C)the difference between investment fair value and translated net assets acquired is treated as a remeasurement gain or loss on the income statement.

D)the difference between investment fair value and translated net assets acquired is recorded as a cumulative translation adjustment on the balance sheet.

B

3

When translating foreign subsidiary income statements using the current rate method,why are some accounts translated at an average rate?

A)This approach improves matching.

B)This approach accentuates the conservatism principle.

C)This approach smoothes out highly volatile exchange rate fluctuations.

D)This approach approximates the effect of transactions which occur continuously during the period.

A)This approach improves matching.

B)This approach accentuates the conservatism principle.

C)This approach smoothes out highly volatile exchange rate fluctuations.

D)This approach approximates the effect of transactions which occur continuously during the period.

D

4

Accounts representing an allowance for uncollectible accounts are converted into U.S.dollars at

A)historical rates when the U.S.dollar is the functional currency.

B)current rates only when the U.S.dollar is the functional currency.

C)historical rates regardless of the functional currency.

D)current rates regardless of the functional currency.

A)historical rates when the U.S.dollar is the functional currency.

B)current rates only when the U.S.dollar is the functional currency.

C)historical rates regardless of the functional currency.

D)current rates regardless of the functional currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

5

The primary goal behind consolidating financial statements of a controlled subsidiary is

A)assuring that the subsidiary financial statements are the same under the temporal method or the current rate method.

B)assuring that the individual nature of the subsidiary entity is not lost in the consolidation.

C)representing the conversion of statements at the historical exchange rate.

D)representing the company's underlying economic condition.

A)assuring that the subsidiary financial statements are the same under the temporal method or the current rate method.

B)assuring that the individual nature of the subsidiary entity is not lost in the consolidation.

C)representing the conversion of statements at the historical exchange rate.

D)representing the company's underlying economic condition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following statements about the Current Rate method is false?

A)Translation involves restating the functional currency amounts into the reporting currency.

B)All assets and liabilities are translated at the current rate.

C)If the subsidiary maintains their books in their functional currency,the current rate method is used.

D)The effect of exchange rate changes are reported on the income statement as a foreign exchange gain or loss.

A)Translation involves restating the functional currency amounts into the reporting currency.

B)All assets and liabilities are translated at the current rate.

C)If the subsidiary maintains their books in their functional currency,the current rate method is used.

D)The effect of exchange rate changes are reported on the income statement as a foreign exchange gain or loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

7

A U.S.parent corporation loans funds to a foreign subsidiary to be used to purchase equipment.The loan is denominated in U.S.dollars and the functional currency of the subsidiary is the euro.This intercompany transaction is a foreign currency transaction of

A)neither the subsidiary nor the parent,as it is eliminated as part of the consolidation procedure.

B)the subsidiary but not the parent.

C)both the subsidiary and the parent.

D)the parent but not the subsidiary.

A)neither the subsidiary nor the parent,as it is eliminated as part of the consolidation procedure.

B)the subsidiary but not the parent.

C)both the subsidiary and the parent.

D)the parent but not the subsidiary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

8

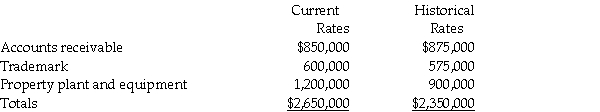

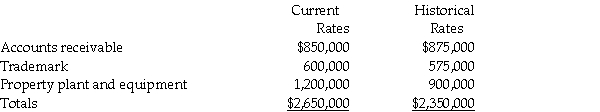

The following assets of Poole Corporation's Romanian subsidiary have been converted into U.S.dollars at the following exchange rates:

Assume the functional currency of the subsidiary is the U.S.dollar and the books are kept in a different currency.The assets should be reported in the consolidated financial statements of Poole Corporation and Subsidiary in the total amount of

A)$2,325,000.

B)$2,350,000.

C)$2,375,000.

D)$2,650,000.

Assume the functional currency of the subsidiary is the U.S.dollar and the books are kept in a different currency.The assets should be reported in the consolidated financial statements of Poole Corporation and Subsidiary in the total amount of

A)$2,325,000.

B)$2,350,000.

C)$2,375,000.

D)$2,650,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

9

If a U.S.company wants to hedge a prospective loss on its investment in a foreign entity that may result from a foreign currency fluctuation,the U.S.company should

A)purchase a forward to swap currency of the foreign entity's local country for U.S.currency.

B)purchase a call option to buy currency of the foreign entity's local country.

C)issue a loan in the foreign entity's local country.

D)borrow money in the foreign entity's local country.

A)purchase a forward to swap currency of the foreign entity's local country for U.S.currency.

B)purchase a call option to buy currency of the foreign entity's local country.

C)issue a loan in the foreign entity's local country.

D)borrow money in the foreign entity's local country.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

10

Exchange gains or losses from remeasurement appear

A)in the continuing operations section of the consolidated income statement.

B)as an extraordinary item on the consolidated income statement.

C)as other comprehensive income typically reported in a statement of stockholders' equity.

D)as an adjustment to the beginning balance of retained earnings on the consolidated Statement of retained earnings.

A)in the continuing operations section of the consolidated income statement.

B)as an extraordinary item on the consolidated income statement.

C)as other comprehensive income typically reported in a statement of stockholders' equity.

D)as an adjustment to the beginning balance of retained earnings on the consolidated Statement of retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

11

A foreign subsidiary's accounts receivable balance should be translated for the consolidated financial statements at

A)the appropriate historical rate.

B)the prior year's forecast rate.

C)the future rate for the next year.

D)the spot rate at year-end.

A)the appropriate historical rate.

B)the prior year's forecast rate.

C)the future rate for the next year.

D)the spot rate at year-end.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following assets and/or liabilities are considered monetary?

A)Intangible Assets and Plant,Property,and Equipment

B)Bonds Payable and Common Stock

C)Cash and Accounts Payable

D)Notes Receivable and Inventories carried at cost

A)Intangible Assets and Plant,Property,and Equipment

B)Bonds Payable and Common Stock

C)Cash and Accounts Payable

D)Notes Receivable and Inventories carried at cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

13

Paskin Corporation's wholly-owned Canadian subsidiary has a Canadian dollar functional currency.In translating the subsidiary's account balances into U.S.dollars for reporting purposes,which one of the following accounts would be translated at historical exchange rates?

A)Accounts Receivable

B)Notes Payable

C)Capital Stock

D)Retained Earnings

A)Accounts Receivable

B)Notes Payable

C)Capital Stock

D)Retained Earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

14

Pelmer has a foreign subsidiary,Sapp Corporation of Germany,whose functional currency is the euro.Sapp's books are maintained in euros.On December 31,2014,Sapp has an account receivable denominated in British pounds.Which one of the following statements is true?

A)Because all accounts of the subsidiary are translated into U.S.dollars at the current rate,the Account Receivable is not adjusted on the subsidiary's books before translation.

B)The Account Receivable is remeasured into the functional currency,thus eliminating the need for translation.

C)The Account Receivable is first adjusted to reflect the current exchange rate in euros and then translated at the current exchange rate into dollars.

D)The Account Receivable is adjusted to euros at the current exchange rate,and any resulting gain or loss is included as a translation adjustment in the stockholders' equity section of the subsidiary's separate balance sheet.

A)Because all accounts of the subsidiary are translated into U.S.dollars at the current rate,the Account Receivable is not adjusted on the subsidiary's books before translation.

B)The Account Receivable is remeasured into the functional currency,thus eliminating the need for translation.

C)The Account Receivable is first adjusted to reflect the current exchange rate in euros and then translated at the current exchange rate into dollars.

D)The Account Receivable is adjusted to euros at the current exchange rate,and any resulting gain or loss is included as a translation adjustment in the stockholders' equity section of the subsidiary's separate balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

15

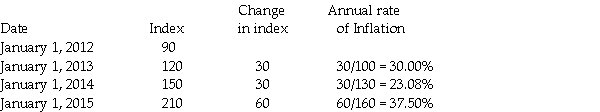

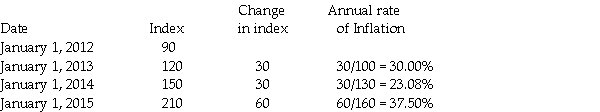

Palk Corporation has a foreign subsidiary located in a country experiencing high rates of inflation.Information concerning this country's inflation rate experience is given below.

The inflation rate that is used in determining if the subsidiary is operating in a highly inflationary economy is

A)37.50%.

B)90.58%.

C)133.33%.

D)350.00%.

The inflation rate that is used in determining if the subsidiary is operating in a highly inflationary economy is

A)37.50%.

B)90.58%.

C)133.33%.

D)350.00%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

16

A U.S.firm has a Belgian subsidiary that uses the British pound as its functional currency.According to GAAP,the U.S.dollar from Belgian unit's point of view will be

A)its only foreign currency.

B)its local currency.

C)its current rate method currency.

D)its reporting currency.

A)its only foreign currency.

B)its local currency.

C)its current rate method currency.

D)its reporting currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

17

Assume the functional currency of a foreign entity is the U.S.dollar,but the books are kept in euros.The objective of remeasurement of a foreign entity's accounts is to

A)produce the same results as if the foreign entity's books were maintained in the currency of the largest customer.

B)produce the same results as if the foreign entity's books were maintained solely in the local currency.

C)produce the same results as if the foreign entity's books were maintained solely in the U.S.dollar.

D)produce the results reflective of the foreign entity's economics in the local currency.

A)produce the same results as if the foreign entity's books were maintained in the currency of the largest customer.

B)produce the same results as if the foreign entity's books were maintained solely in the local currency.

C)produce the same results as if the foreign entity's books were maintained solely in the U.S.dollar.

D)produce the results reflective of the foreign entity's economics in the local currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

18

Selvey Inc.is a wholly-owned subsidiary of Parsfield Incorporated,a U.S.firm.The country where Selvey operates is determined to have a highly inflationary economy according to GAAP definitions.Therefore,for purposes of preparing consolidated financial statements,the functional currency is

A)its reporting currency.

B)its current rate method currency.

C)the US dollar.

D)its local currency.

A)its reporting currency.

B)its current rate method currency.

C)the US dollar.

D)its local currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

19

A foreign entity is a subsidiary of a U.S.parent company and has always used the current rate method to translate its foreign financial statements on behalf of its parent company.Which one of the following statements is false?

A)The U.S.dollar is the functional currency of this company.

B)Changes in exchange rates between the subsidiary's country and the parent's country are not expected to affect the foreign entity's cash flows.

C)Translation adjustments are shown in stockholders' equity as increases or decreases in other comprehensive income.

D)Translation adjustments are not shown on the income statement.

A)The U.S.dollar is the functional currency of this company.

B)Changes in exchange rates between the subsidiary's country and the parent's country are not expected to affect the foreign entity's cash flows.

C)Translation adjustments are shown in stockholders' equity as increases or decreases in other comprehensive income.

D)Translation adjustments are not shown on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following foreign subsidiary accounts will have the same value on consolidated financial statements,regardless of whether the statements are remeasured or translated?

A)Trademark

B)Deferred Income

C)Accounts Receivable

D)Goodwill

A)Trademark

B)Deferred Income

C)Accounts Receivable

D)Goodwill

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

21

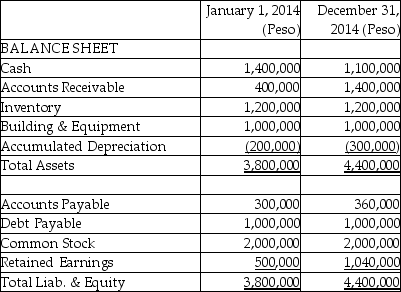

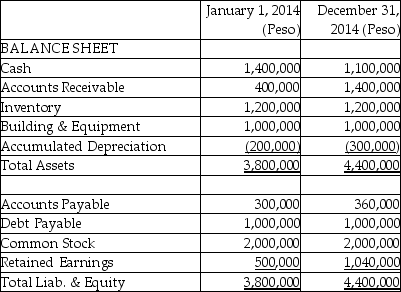

Pritt Company purchased all the outstanding stock of Standy Company (a manufacturing company in Argentina)when the book value of Standy's net assets equaled their fair value.Standy's summarized balance sheet is shown below on January 1,2014,the date of acquisition,and on December 31,2014,when the exchange rates were $.25 and $.20,respectively.The average exchange rate for 2014 was $.23,and Standy paid dividends in 2014 amounting to 300,000 pesos when the exchange rate was $.21.

Required:

If Standy's functional currency and reporting currency are the Argentine peso,compute the change to other comprehensive income that would result from the translation of these financial statements at December 31,2014.

Required:

If Standy's functional currency and reporting currency are the Argentine peso,compute the change to other comprehensive income that would result from the translation of these financial statements at December 31,2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

22

Pew Corporation (a U.S.corporation)acquired all of the stock of Skunk Company (a Brazilian company)on January 1,2014 for $9,300,000 when Skunk had 10,000,000 Brazilian real (BR)capital stock and 5,000,000 BR retained earnings.The book value of Skunk's net assets equaled the fair value on this date,and any cost/book value differential is due to a patent with a 5-year remaining useful life.Skunk's functional currency is the BR.Skunk's books are maintained in the functional currency.The exchange rates for BR's for 2014 are shown below:

Required:

1.Calculate the patent value from the business combination on January 1,2014 in U.S.dollars.

2.Calculate the patent amortization in U.S.dollars for 2014.

3.Prepare the journal entry (in U.S.dollars)required on Pew's books to record the patent amortization for 2014,assuming that Pew accounts for Skunk using the equity method.

Required:

1.Calculate the patent value from the business combination on January 1,2014 in U.S.dollars.

2.Calculate the patent amortization in U.S.dollars for 2014.

3.Prepare the journal entry (in U.S.dollars)required on Pew's books to record the patent amortization for 2014,assuming that Pew accounts for Skunk using the equity method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

23

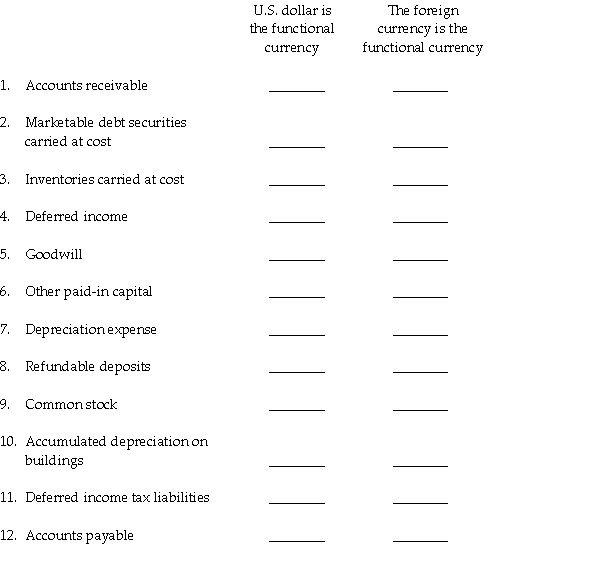

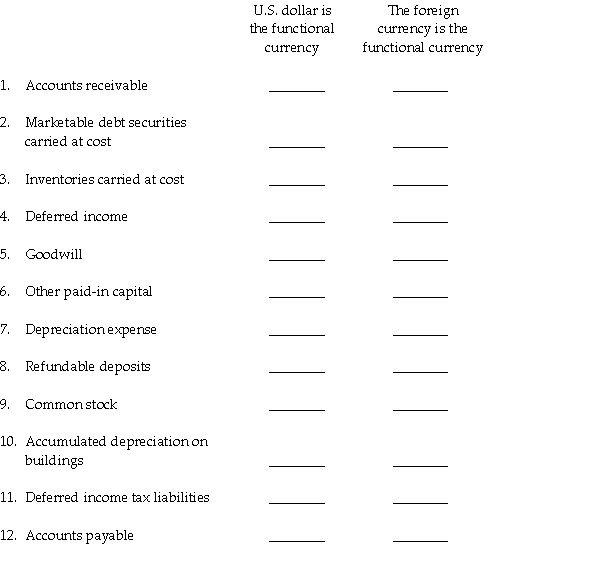

For each of the 12 accounts listed in the table below,select the correct exchange rate to use when either remeasuring or translating a foreign subsidiary for its U.S.parent company.

Codes

C = Current exchange rate

H = Historical exchange rate

A = Average exchange rate

Codes

C = Current exchange rate

H = Historical exchange rate

A = Average exchange rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

24

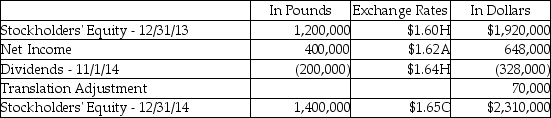

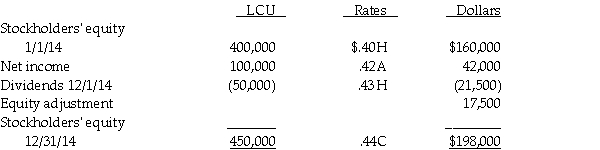

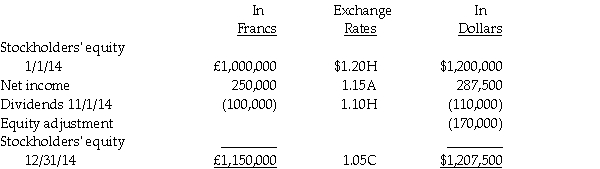

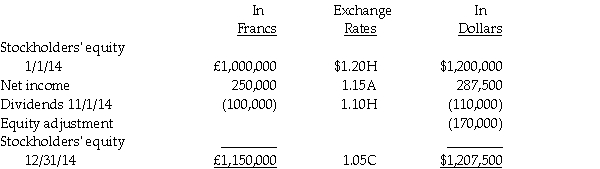

Puddle Incorporated purchased an 80% interest in Soake Company,located in England.Puddle paid $1,560,000 on January 1,2014,at a time when the book values of Soake equaled the fair values.Any excess cost/book value differential was attributed to a patent with a five-year remaining useful life.Soake's books are kept in the functional currency,pounds.A summary of Soake's equity is shown below for the first year that Puddle had ownership interest.

Required:

Determine Puddle's income from Soake for 2014,and the balance of Puddle's Investment in Soake account at December 31,2014.

Required:

Determine Puddle's income from Soake for 2014,and the balance of Puddle's Investment in Soake account at December 31,2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

25

On January 1,2014,Paste Unlimited,a U.S.company,acquired 100% of Sticky Corporation of Italy,paying an excess of 112,500 euros over the book value of Sticky's net assets.The excess was allocated to undervalued equipment with a five year remaining useful life.Sticky's functional currency is the euro,and the books are kept in euros.Exchange rates for the euro for 2014 are:

Required:

1.Determine the depreciation expense on the excess allocated to equipment for 2014 in U.S.dollars.

2.Determine the unamortized excess allocated to equipment on December 31,2014 in U.S.dollars.

3.If Sticky's functional currency was the U.S.dollar,what would be the depreciation expense on the excess allocated to the equipment for 2014?

Required:

1.Determine the depreciation expense on the excess allocated to equipment for 2014 in U.S.dollars.

2.Determine the unamortized excess allocated to equipment on December 31,2014 in U.S.dollars.

3.If Sticky's functional currency was the U.S.dollar,what would be the depreciation expense on the excess allocated to the equipment for 2014?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

26

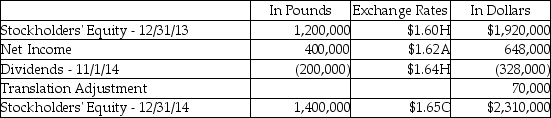

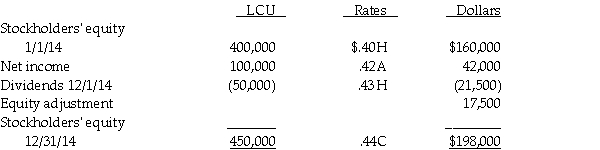

On January 1,2014,Pilgrim Corporation,a U.S.firm,acquired ownership of Settlement Corporation,a foreign company,for $168,000,when Settlement's stockholders' equity consisted of 300,000 local currency units (LCU)and retained earnings of 100,000 LCU.At the time of the acquisition,Settlement's assets and liabilities were fairly valued except for a patent that did not have any recorded book value.All excess purchase cost was attributed to the patent,which had an estimated economic life of 10 years at the date of acquisition.The exchange rate for LCUs on January 1,2014 was $.40.The functional currency for Settlement is LCU.Settlement's books are maintained in LCU.

A summary of changes in Settlement's stockholders' equity during 2014 and the exchange rates for LCUs is as follows:

Required:

Determine the following:

1.Fair value of the patent from Pilgrim's investment in Settlement on January 1,2014 in U.S.dollars.

2.Patent amortization for 2014 in U.S.dollars.

3.Unamortized patent at December 31,2014 in U.S.dollars.

4.Equity adjustment from the patent in U.S.dollars.

5.Income from Settlement for 2014 in U.S.dollars.

6.Investment in Settlement balance at December 31,2014 in U.S.dollars.

A summary of changes in Settlement's stockholders' equity during 2014 and the exchange rates for LCUs is as follows:

Required:

Determine the following:

1.Fair value of the patent from Pilgrim's investment in Settlement on January 1,2014 in U.S.dollars.

2.Patent amortization for 2014 in U.S.dollars.

3.Unamortized patent at December 31,2014 in U.S.dollars.

4.Equity adjustment from the patent in U.S.dollars.

5.Income from Settlement for 2014 in U.S.dollars.

6.Investment in Settlement balance at December 31,2014 in U.S.dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

27

Note to Instructor: This exam item is a continuation of Exercise 3 and proceeds forward with Skillet's second year of operations.

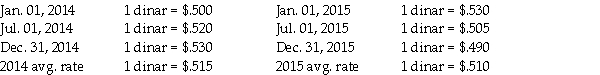

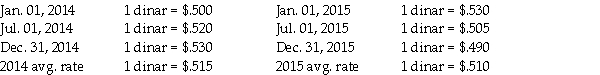

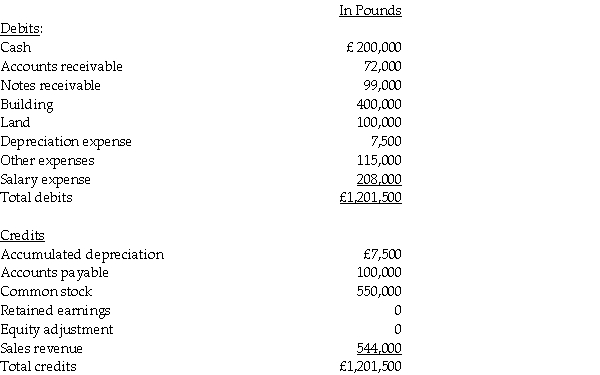

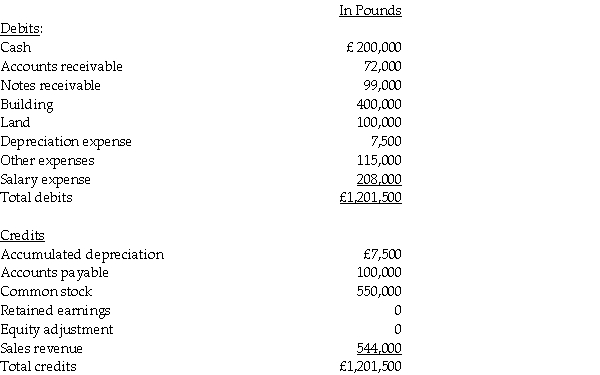

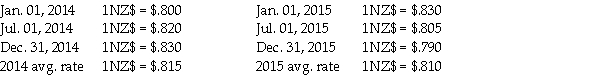

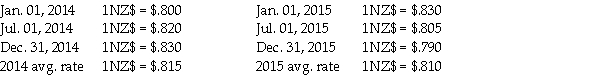

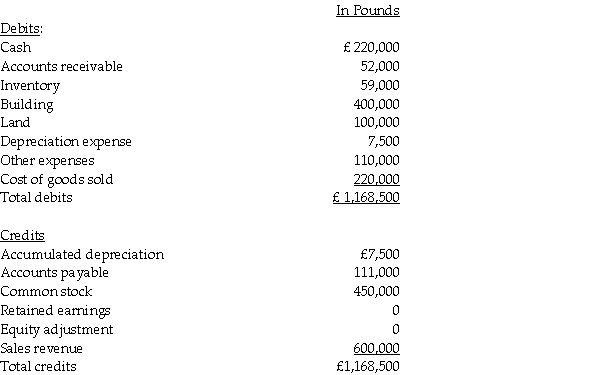

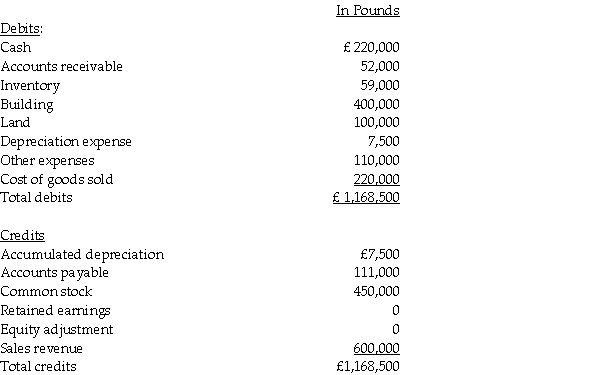

Skillet Corporation,a British subsidiary of Pan Corporation (a U.S.company)was formed by Pan on January 1,2014 in exchange for all of the subsidiary's common stock.Skillet has now ended its second year of operations on December 31,2015.Relevant exchange rates are:

Skillet's adjusted trial balance is presented below for the calendar year 2015.The amount of equity adjustment carried over from 2014 is a credit balance of $41,250 (in dollars).

Required:

For Skillet's second year of operations,prepare the:

1.Translation working papers;

2.Translated income statement;and

3.Translated balance sheet.

Skillet Corporation,a British subsidiary of Pan Corporation (a U.S.company)was formed by Pan on January 1,2014 in exchange for all of the subsidiary's common stock.Skillet has now ended its second year of operations on December 31,2015.Relevant exchange rates are:

Skillet's adjusted trial balance is presented below for the calendar year 2015.The amount of equity adjustment carried over from 2014 is a credit balance of $41,250 (in dollars).

Required:

For Skillet's second year of operations,prepare the:

1.Translation working papers;

2.Translated income statement;and

3.Translated balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

28

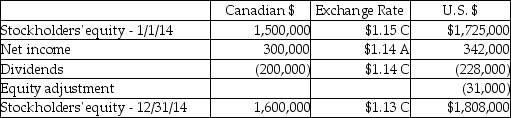

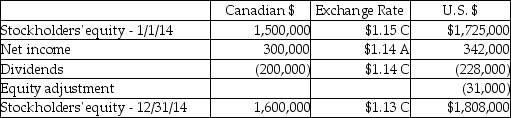

On January 1,2014,Placid Corporation acquired a 40% interest in Superior Industries,a Canadian Corporation,for $811,900 when Superior's stockholders' equity consisted of 1,000,000 Canadian dollars (C$)capital stock and C$500,000 retained earnings.Superior's functional currency is the Canadian dollar and the books are kept in the same currency.The exchange rate at the time of the purchase was $1.15 per Canadian dollar.Any excess allocated to patents is to be amortized over 10 years.A summary of changes in the stockholders' equity of Superior during 2014 and related exchange rates follows:

Required:

Determine the following:

1.Fair value of the patent from Placid's investment in Superior on January 1,2014 in U.S.dollars

2.Patent amortization for 2014 in U.S.dollars

3.Unamortized patent at December 31,2014 in U.S.dollars

4.Equity adjustment from the patent in U.S.dollars

5.Income from Superior for 2014 in U.S.dollars

6.Investment in Superior balance at December 31,2014 in U.S.dollars

Required:

Determine the following:

1.Fair value of the patent from Placid's investment in Superior on January 1,2014 in U.S.dollars

2.Patent amortization for 2014 in U.S.dollars

3.Unamortized patent at December 31,2014 in U.S.dollars

4.Equity adjustment from the patent in U.S.dollars

5.Income from Superior for 2014 in U.S.dollars

6.Investment in Superior balance at December 31,2014 in U.S.dollars

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

29

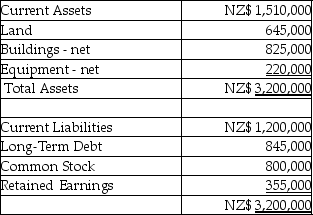

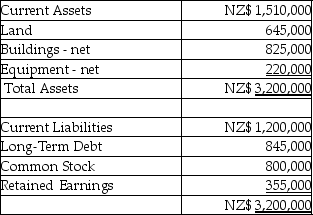

Par Industries,a U.S.Corporation,purchased Slice Company of New Zealand for $1,411,800 on January 1,2014.Slice's functional currency is the New Zealand dollar (NZ$).Slice's books are kept in NZ$.The book values of Slice's assets and liabilities were equal to fair values,with the exception of land which was valued at NZ$1,300,000.Slice's balance sheet appears below:

Relevant exchange rates are shown below:

January 1,2014 1 NZ$ = $0.78

Average rate 2014 1 NZ$ = $0.79

December 31,2014 1 NZ$ = $0.80

Required:

Determine the unrealized translation gain or loss at December 31,2014 relating to the excess allocated to the undervalued land.

Relevant exchange rates are shown below:

January 1,2014 1 NZ$ = $0.78

Average rate 2014 1 NZ$ = $0.79

December 31,2014 1 NZ$ = $0.80

Required:

Determine the unrealized translation gain or loss at December 31,2014 relating to the excess allocated to the undervalued land.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

30

Plate Corporation,a US company,acquired ownership of Saucer Corporation of Switzerland on January 1,2014 for $1,500,000 when Saucer's stockholders' equity in Swiss francs (SF)consisted of 700,000 SF Capital Stock and 300,000 SF Retained Earnings.The exchange rate for Swiss francs was $1.20 on January 1.All excess purchase cost was attributed to a Trademark that did not have a recorded book value.The trademark is to be amortized over 20 years.

Saucer's functional currency is Swiss francs and the records are kept in the same currency.A summary of changes in Saucer's stockholders' equity during 2014 and relevant exchange rates are as follows:

Required:

Determine the following:

1.Fair value of the Trademark from Plate's investment in Saucer on January 1,2014 in U.S.dollars.

2.Trademark amortization for 2014 in U.S.dollars.

3.Unamortized Trademark at December 31,2014 in U.S.dollars.

4.Equity adjustment from the Trademark in U.S.dollars.

5.Income from Saucer for 2014 in U.S.dollars.

6.Investment in Saucer balance at December 31,2014 in U.S.dollars.

Saucer's functional currency is Swiss francs and the records are kept in the same currency.A summary of changes in Saucer's stockholders' equity during 2014 and relevant exchange rates are as follows:

Required:

Determine the following:

1.Fair value of the Trademark from Plate's investment in Saucer on January 1,2014 in U.S.dollars.

2.Trademark amortization for 2014 in U.S.dollars.

3.Unamortized Trademark at December 31,2014 in U.S.dollars.

4.Equity adjustment from the Trademark in U.S.dollars.

5.Income from Saucer for 2014 in U.S.dollars.

6.Investment in Saucer balance at December 31,2014 in U.S.dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

31

On January 1,2014,Psalm Corporation purchased all the stock of Solomon Corporation for $481,400 when Solomon had capital stock of 180,000 pounds (£)and retained earnings of 90,000£.The book value of Solomon's assets and liabilities represented the fair value,except for equipment with a 5-year life that was undervalued by 15,000£.Any remaining excess is due to a patent with a useful life of 6 years.Solomon's functional currency is the pound.Solomon's books are kept in pounds.Relevant exchange rates for a pound follow:

Required:

1.Determine the equity adjustment on translation of the excess differential assigned to equipment at December 31,2014.

2.Determine the equity adjustment on translation of the excess differential assigned to patent at December 31,2014.

Required:

1.Determine the equity adjustment on translation of the excess differential assigned to equipment at December 31,2014.

2.Determine the equity adjustment on translation of the excess differential assigned to patent at December 31,2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

32

Plane Corporation,a U.S.company,owns 100% of Shipp Corporation,a Libyan company.Shipp's equipment was acquired on the following dates (amounts are stated in Libyan dinars):

Jan.01,2014 Purchased equipment for 40,000 dinars

Jul.01,2014 Purchased equipment for 80,000 dinars

Jan.01,2015 Purchased equipment for 50,000 dinars

Jul.01,2015 Sold equipment purchased on Jan.01,2014 for 35,000 dinars

Exchange rates for the Libyan dinars on various dates are:

Shipp's equipment has an estimated 5-year life with no salvage value and is depreciated using the straight-line method,calculating depreciation expense on a monthly basis.Shipp's functional currency is the U.S.dollar,but the company uses the Libyan dinar as its reporting currency.

Required:

1.Determine the value of Shipp's equipment account on December 31,2015 in U.S.dollars.

2.Determine Shipp's depreciation expense for 2015 in U.S.dollars.

3.Determine the gain or loss from the sale of equipment on July 1,2015 in U.S.dollars.

Jan.01,2014 Purchased equipment for 40,000 dinars

Jul.01,2014 Purchased equipment for 80,000 dinars

Jan.01,2015 Purchased equipment for 50,000 dinars

Jul.01,2015 Sold equipment purchased on Jan.01,2014 for 35,000 dinars

Exchange rates for the Libyan dinars on various dates are:

Shipp's equipment has an estimated 5-year life with no salvage value and is depreciated using the straight-line method,calculating depreciation expense on a monthly basis.Shipp's functional currency is the U.S.dollar,but the company uses the Libyan dinar as its reporting currency.

Required:

1.Determine the value of Shipp's equipment account on December 31,2015 in U.S.dollars.

2.Determine Shipp's depreciation expense for 2015 in U.S.dollars.

3.Determine the gain or loss from the sale of equipment on July 1,2015 in U.S.dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

33

Note to Instructor: This exam item is similar to Exercise 3 except that the exchange rates have been changed and the temporal method is used instead of the current rate method.

The Polka Corporation,a U.S.corporation,formed a British subsidiary on January 1,2014 by investing 550,000 British pounds (£)in exchange for all of the subsidiary's no-par common stock.The British subsidiary,Stripe Corporation,purchased real property on April 1,2014 at a cost of £500,000,with £100,000 allocated to land and £400,000 allocated to the building.The building is depreciated over a 40-year estimated useful life on a straight-line basis with no salvage value.The U.S.dollar is Stripe's functional currency,but it keeps its records in pounds.The British economy does not experience high rates of inflation.Exchange rates for the pound on various dates are:

Stripe's adjusted trial balance is presented below for the year ended December 31,2014.

Required:

Prepare Stripe's:

1.Remeasurement working papers;

2.Remeasured income statement;and

3.Remeasured balance sheet.

The Polka Corporation,a U.S.corporation,formed a British subsidiary on January 1,2014 by investing 550,000 British pounds (£)in exchange for all of the subsidiary's no-par common stock.The British subsidiary,Stripe Corporation,purchased real property on April 1,2014 at a cost of £500,000,with £100,000 allocated to land and £400,000 allocated to the building.The building is depreciated over a 40-year estimated useful life on a straight-line basis with no salvage value.The U.S.dollar is Stripe's functional currency,but it keeps its records in pounds.The British economy does not experience high rates of inflation.Exchange rates for the pound on various dates are:

Stripe's adjusted trial balance is presented below for the year ended December 31,2014.

Required:

Prepare Stripe's:

1.Remeasurement working papers;

2.Remeasured income statement;and

3.Remeasured balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

34

Phim Inc. ,a U.S.company,owns 100% of Sera Corporation,a New Zealand company.Sera's equipment was acquired on the following dates (amounts are stated in New Zealand dollars as NZ$):

Jan.01,2014 Purchased equipment for NZ$40,000

Jul.01,2014 Purchased equipment for NZ$80,000

Jan.01,2015 Purchased equipment for NZ$50,000

Jul.01,2015 Sold equipment purchased on Jan.01,2014 for NZ$35,000

Exchange rates for the New Zealand dollar on various dates are:

Sera's equipment has an estimated 5-year life with no salvage value and is depreciated using the straight-line method.Sera's functional currency and reporting currency are the New Zealand dollar.

Required:

1.Determine the value of Sera's equipment account on December 31,2015 in U.S.dollars.

2.Determine Sera's depreciation expense for 2015 in U.S.dollars.

3.Determine the gain or loss from the sale of equipment on July 1,2015 in U.S.dollars.

Jan.01,2014 Purchased equipment for NZ$40,000

Jul.01,2014 Purchased equipment for NZ$80,000

Jan.01,2015 Purchased equipment for NZ$50,000

Jul.01,2015 Sold equipment purchased on Jan.01,2014 for NZ$35,000

Exchange rates for the New Zealand dollar on various dates are:

Sera's equipment has an estimated 5-year life with no salvage value and is depreciated using the straight-line method.Sera's functional currency and reporting currency are the New Zealand dollar.

Required:

1.Determine the value of Sera's equipment account on December 31,2015 in U.S.dollars.

2.Determine Sera's depreciation expense for 2015 in U.S.dollars.

3.Determine the gain or loss from the sale of equipment on July 1,2015 in U.S.dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

35

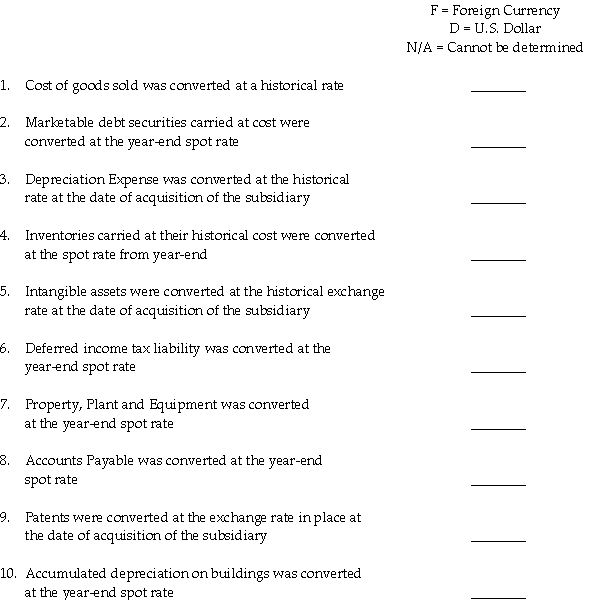

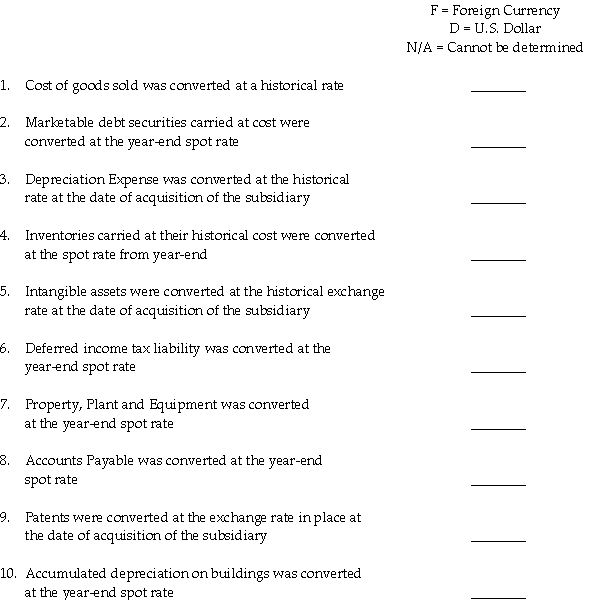

Each of the following accounts has been converted to U.S.dollars from a foreign subsidiary's financial statements.Based on the information given,determine if the U.S.dollar or a foreign currency is the functional currency of the subsidiary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

36

Note to Instructor: This exam item is a continuation of Exercise 5 and proceeds forward with Stripe's second year of operations.

Stripe Corporation,a British subsidiary of Polka Corporation (a U.S.company)was formed by Polka on January 1,2014 in exchange for all of the subsidiary's common stock.Stripe has now ended its second year of operations on December 31,2015.Relevant exchange rates are:

January 01,2014 = 1£ = $1.60

April 01,2014 = 1£ = $1.62

December 31,2015 = 1£ = $1.57

2015 average rate = 1£ = $1.56

Stripe's adjusted trial balance is presented below for the calendar year 2015.

Required: Prepare Stripe's:

1.Remeasurement working papers;

2.Remeasured income statement;and

3.Remeasured balance sheet.

Stripe Corporation,a British subsidiary of Polka Corporation (a U.S.company)was formed by Polka on January 1,2014 in exchange for all of the subsidiary's common stock.Stripe has now ended its second year of operations on December 31,2015.Relevant exchange rates are:

January 01,2014 = 1£ = $1.60

April 01,2014 = 1£ = $1.62

December 31,2015 = 1£ = $1.57

2015 average rate = 1£ = $1.56

Stripe's adjusted trial balance is presented below for the calendar year 2015.

Required: Prepare Stripe's:

1.Remeasurement working papers;

2.Remeasured income statement;and

3.Remeasured balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

37

Pan Corporation,a U.S.company,formed a British subsidiary on January 1,2014 by investing 450,000 British pounds (£)in exchange for all of the subsidiary's no-par common stock.The British subsidiary,Skillet Corporation,purchased real property on April 1,2014 at a cost of £500,000,with £100,000 allocated to land and £400,000 allocated to a building.The building is depreciated over a 40-year estimated useful life on a straight-line basis with no salvage value.The British pound is Skillet's functional currency and its reporting currency.The British economy does not have high rates of inflation.Exchange rates for the pound on various dates were:

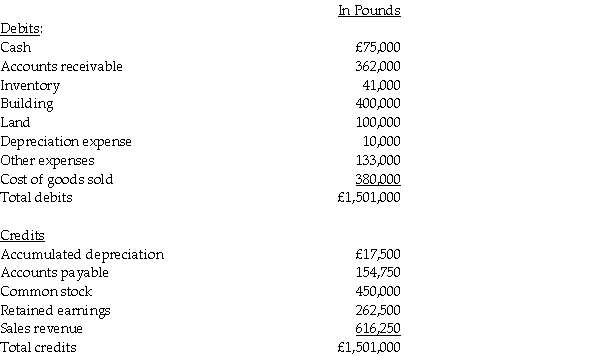

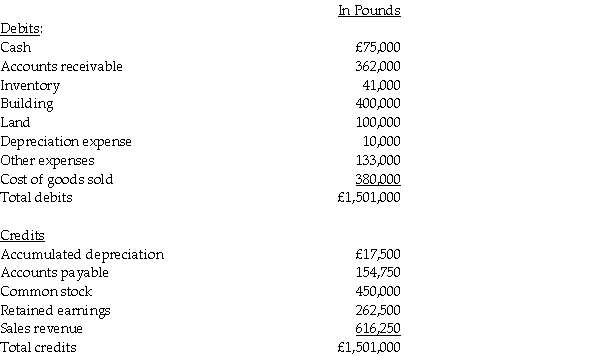

Skillet's adjusted trial balance is presented below for the year ended December 31,2014.

Required:

Prepare Skillet's:

1.Translation working papers;

2.Translated income statement;and

3.Translated balance sheet.

Skillet's adjusted trial balance is presented below for the year ended December 31,2014.

Required:

Prepare Skillet's:

1.Translation working papers;

2.Translated income statement;and

3.Translated balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

38

On January 1,2014,Planet Corporation,a U.S.company,acquired 100% of Star Corporation of Bulgaria,paying an excess of 90,000 Bulgarian lev over the book value of Star's net assets.The excess was allocated to undervalued equipment with a three-year remaining useful life.Star's functional currency is the Bulgarian lev.Star's books are maintained in the functional currency.Exchange rates for Bulgarian lev for 2014 are:

Required:

1.Determine the depreciation expense stated in U.S.dollars on the excess allocated to equipment for 2014.

2.Determine the unamortized excess allocated to equipment on December 31,2014 in U.S.dollars.

3.If Star's functional currency was the U.S.dollar,what would be the depreciation expense on the excess allocated to the equipment for 2014?

Required:

1.Determine the depreciation expense stated in U.S.dollars on the excess allocated to equipment for 2014.

2.Determine the unamortized excess allocated to equipment on December 31,2014 in U.S.dollars.

3.If Star's functional currency was the U.S.dollar,what would be the depreciation expense on the excess allocated to the equipment for 2014?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

39

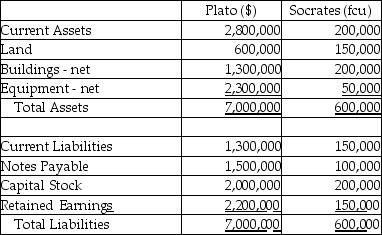

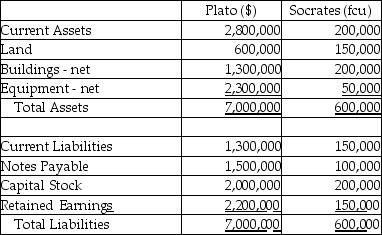

Plato Corporation,a U.S.company,purchases all of the outstanding stock of Socrates Company,which operates outside the U.S.on January 1,2014.Socrates' net assets have fair values that equal their book values with the exception of land that has a fair value of 200,000 foreign currency units and equipment with a fair value of 100,000 foreign currency units.Plato paid $180,000 for this acquisition.The balance sheets for Plato and Socrates are shown below just before the business combination.Socrates' functional currency is the foreign currency unit (fcu)and the exchange rate at the date of acquisition was $.40 per fcu.Socrates uses the fcu for record-keeping purposes.

Required:

Prepare a consolidated balance sheet for Plato and subsidiary at January 1,2014 immediately following the business combination.

Required:

Prepare a consolidated balance sheet for Plato and subsidiary at January 1,2014 immediately following the business combination.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck