Deck 15: Segment and Interim Financial Reporting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/38

العب

ملء الشاشة (f)

Deck 15: Segment and Interim Financial Reporting

1

In general,GAAP encourages the identification of reportable segments based on the following:

A)Reported segments must account for at least 75% of all external and inter-segment sales.

B)Reported segments must ideally account for at least 75% of all sales,unless there are many smaller divisions and separate reporting would create less clarity in reporting.

C)If there are more than 10 reportable segments,the company should consider additional aggregation of their segments.

D)Reported segments must account for 100% of the external sales,but only 75% of external and inter-segment sales.

A)Reported segments must account for at least 75% of all external and inter-segment sales.

B)Reported segments must ideally account for at least 75% of all sales,unless there are many smaller divisions and separate reporting would create less clarity in reporting.

C)If there are more than 10 reportable segments,the company should consider additional aggregation of their segments.

D)Reported segments must account for 100% of the external sales,but only 75% of external and inter-segment sales.

C

2

Sandpiper Corporation paid $120,000 for annual property taxes on January 15,2014,and $20,000 for building repair costs on March 10,2014.Total repair expenses for the year were estimated to be $200,000,and are normally accrued during the year until incurred.What total amount of expense for these items was reported in Sandpiper's first quarter 2014 interim income statement?

A)$ 50,000

B)$ 80,000

C)$100,000

D)$140,000

A)$ 50,000

B)$ 80,000

C)$100,000

D)$140,000

B

3

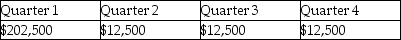

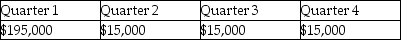

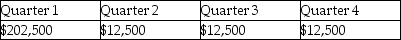

On January 5,2014,Eagle Corporation paid $50,000 in real estate taxes for the calendar year.In March of 2014,Eagle paid $180,000 for an annual machinery overhaul and $10,000 for the annual CPA audit fee.What amount was expensed for these items on Eagle's quarterly interim financial statements?

A)

B)

C)

D)

A)

B)

C)

D)

D

4

Similar operating segments may be combined if the segments have similar economic characteristics.Which one of the following is a similar economic characteristic under GAAP?

A)The segments' management teams

B)The tax reporting law sections

C)The distribution method for products or services

D)The expected rates of return and risk for the segments' productive assets

A)The segments' management teams

B)The tax reporting law sections

C)The distribution method for products or services

D)The expected rates of return and risk for the segments' productive assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which one of the following operating segment information items is not directly named by GAAP to be reconciled to consolidated totals?

A)Assets

B)Liabilities

C)Revenues

D)Profit or loss

A)Assets

B)Liabilities

C)Revenues

D)Profit or loss

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

6

For an operating segment to be considered a reporting segment under the revenue threshold,its reported revenue must be 10% or more of

A)the combined enterprise revenues,eliminating all relevant intracompany transfers and balances.

B)the combined revenues,excluding intersegment revenues,of all operating segments.

C)the combined revenues,including intersegment revenues,of all operating segments.

D)the consolidated revenue of all operating segments.

A)the combined enterprise revenues,eliminating all relevant intracompany transfers and balances.

B)the combined revenues,excluding intersegment revenues,of all operating segments.

C)the combined revenues,including intersegment revenues,of all operating segments.

D)the consolidated revenue of all operating segments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

7

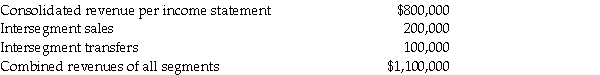

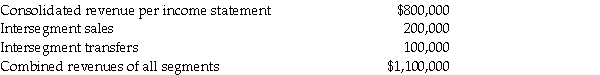

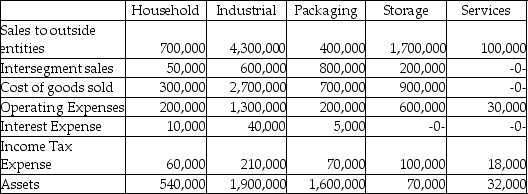

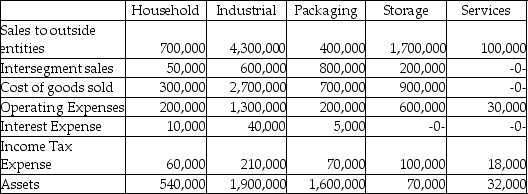

Cole Company has the following 2014 financial data:

Cole Company should add segments if

A)the sum of its segments' external revenue does not exceed $600,000.

B)the sum of its segments' external revenue does not exceed $825,000.

C)the sum of its segments' revenue including intersegment revenue does not exceed $600,000.

D)the sum of its segments' revenue including intersegment revenue does not exceed $825,000.

Cole Company should add segments if

A)the sum of its segments' external revenue does not exceed $600,000.

B)the sum of its segments' external revenue does not exceed $825,000.

C)the sum of its segments' revenue including intersegment revenue does not exceed $600,000.

D)the sum of its segments' revenue including intersegment revenue does not exceed $825,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

8

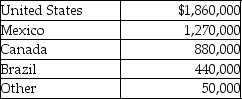

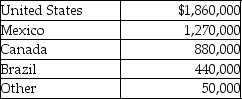

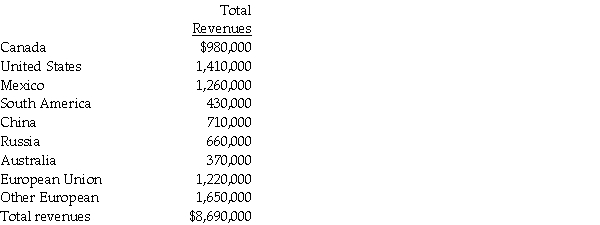

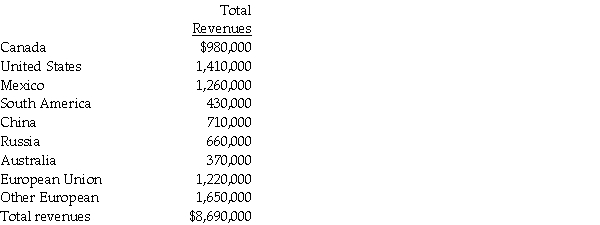

The following table is provided in the disclosures for interim reporting by Bigg Company,regarding the location of their assets.

Based on the table,which of the following statements is true?

A)Only the U.S.and Mexico divisions would be reportable geographic divisions.

B)The U.S. ,Mexico and Canada divisions would be reportable geographic divisions.

C)All geographic divisions would be reportable,except for "other."

D)All geographic divisions would be reportable.

Based on the table,which of the following statements is true?

A)Only the U.S.and Mexico divisions would be reportable geographic divisions.

B)The U.S. ,Mexico and Canada divisions would be reportable geographic divisions.

C)All geographic divisions would be reportable,except for "other."

D)All geographic divisions would be reportable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

9

What is the threshold for reporting a major customer?

A)5 percent of revenues

B)5 percent of profits

C)10 percent of revenues

D)10 percent of profits

A)5 percent of revenues

B)5 percent of profits

C)10 percent of revenues

D)10 percent of profits

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

10

GAAP requires disclosures for each reportable operating segment for each of the following,except for

A)Revenues.

B)Depreciation expense.

C)R&D expenditures.

D)Extraordinary items.

A)Revenues.

B)Depreciation expense.

C)R&D expenditures.

D)Extraordinary items.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

11

How does GAAP view interim accounting periods?

A)As discrete units for which net income may be separately determined

B)As integral units of the entire year for which each interim period is an essential part of an annual period

C)As integral units of the entire year with each interim period as an independent accounting period

D)As discrete units of the entire year using the same principles that are applied to the annual period

A)As discrete units for which net income may be separately determined

B)As integral units of the entire year for which each interim period is an essential part of an annual period

C)As integral units of the entire year with each interim period as an independent accounting period

D)As discrete units of the entire year using the same principles that are applied to the annual period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which one of the following operating segment disclosures is not required by GAAP?

A)Total Assets

B)Equity

C)Intersegment sales

D)Extraordinary items

A)Total Assets

B)Equity

C)Intersegment sales

D)Extraordinary items

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

13

GAAP requires that segment information be reported

A)by geographics,without regard to size of the segment.

B)by geographics,without regard to industry or product-line.

C)however management organizes the enterprise into units for internal decision-making and performance-evaluation purposes.

D)by industry or product-line,without regard to geographics.

A)by geographics,without regard to size of the segment.

B)by geographics,without regard to industry or product-line.

C)however management organizes the enterprise into units for internal decision-making and performance-evaluation purposes.

D)by industry or product-line,without regard to geographics.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

14

What is the purpose of interim reporting?

A)Provide shareholders with more timely information

B)Provide shareholders with more accurate information

C)Provide shareholders with more extensive detail about specific accounts and transactions

D)Provide shareholders with more current audited information

A)Provide shareholders with more timely information

B)Provide shareholders with more accurate information

C)Provide shareholders with more extensive detail about specific accounts and transactions

D)Provide shareholders with more current audited information

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following is not a quantitative threshold for determining a reportable segment?

A)Segment assets are 10% or more of the combined assets of all operating segments.

B)The absolute value of a segment's profit or loss is 10% or more of the greater of (1)the combined reported profit of all operating segments that reported a profit or (2)the absolute value of the combined reported loss of all operating segments that reported a loss.

C)Segment reported revenue,including intersegment revenues,is 10% or more of the combined revenue (both internal and external)of all operating segments.

D)Segment residual profit after the cost of equity is 10% or more of the combined residual profit of all operating segments.

A)Segment assets are 10% or more of the combined assets of all operating segments.

B)The absolute value of a segment's profit or loss is 10% or more of the greater of (1)the combined reported profit of all operating segments that reported a profit or (2)the absolute value of the combined reported loss of all operating segments that reported a loss.

C)Segment reported revenue,including intersegment revenues,is 10% or more of the combined revenue (both internal and external)of all operating segments.

D)Segment residual profit after the cost of equity is 10% or more of the combined residual profit of all operating segments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

16

Jacana Company uses the LIFO inventory method.During the second quarter,Jacana experienced a 100-unit liquidation in its LIFO inventory at a LIFO cost of $430 per unit.Jacana considered the liquidation temporary and expects to replace the units in the third quarter at an estimated replacement cost of $460 a unit.The cost of goods sold computation in the interim report for the second quarter will

A)include the 100 liquidated units at the $460 estimated replacement unit cost.

B)include the 100 liquidated units at the $430 LIFO unit cost.

C)be understated by $3,000.

D)be overstated by $3,000.

A)include the 100 liquidated units at the $460 estimated replacement unit cost.

B)include the 100 liquidated units at the $430 LIFO unit cost.

C)be understated by $3,000.

D)be overstated by $3,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

17

An enterprise has eight reporting segments.Five segments show an operating profit and three segments show an operating loss.In determining which segments are classified as reporting segments under the operating profits test,which of the following statements is correct?

A)The test value for all segments is 10% of consolidated net profit.

B)The test value for profitable segments is 10% or more of those segments reporting a profit,and the test value for loss segments is 10% or more of those segments reporting a loss.

C)The test value for loss segments is 10% of the greater of (a)the absolute value of the sum of those segments reporting losses,or (b)10% of consolidated net profit.

D)The test value for all segments is 10% of the greater of (a)the absolute value of the sum of those segments reporting profits,or (b)the absolute value of the sum of those segments reporting losses.

A)The test value for all segments is 10% of consolidated net profit.

B)The test value for profitable segments is 10% or more of those segments reporting a profit,and the test value for loss segments is 10% or more of those segments reporting a loss.

C)The test value for loss segments is 10% of the greater of (a)the absolute value of the sum of those segments reporting losses,or (b)10% of consolidated net profit.

D)The test value for all segments is 10% of the greater of (a)the absolute value of the sum of those segments reporting profits,or (b)the absolute value of the sum of those segments reporting losses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

18

The estimated taxable income for Shebill Corporation on January 1,2014,was $80,000,$100,000,$100,000,and $120,000,respectively,for each of the four quarters of 2014.Shebill's estimated annual effective tax rate was 30%.During the second quarter of 2014,the estimated annual effective tax rate was increased to 34%.Given only this information,Shebill's second quarter income tax expense was

A)$30,000.

B)$34,000.

C)$37,200.

D)$61,200.

A)$30,000.

B)$34,000.

C)$37,200.

D)$61,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

19

Dott Corporation experienced a $100,000 extraordinary loss in the second quarter of 2014 in their East Coast operating segment.The loss should be recognized

A)only at the consolidated report level at the end of the year.

B)entirely in the second quarter of 2014 in the East Coast operating segment.

C)in equal amounts allocated to the remaining three quarters of 2014 at the corporate level.

D)in equal amounts allocated to the remaining three quarters of 2014 of the East Coast segment.

A)only at the consolidated report level at the end of the year.

B)entirely in the second quarter of 2014 in the East Coast operating segment.

C)in equal amounts allocated to the remaining three quarters of 2014 at the corporate level.

D)in equal amounts allocated to the remaining three quarters of 2014 of the East Coast segment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following conditions would not indicate that two business segments should be classified as a single operating segment?

A)They have similar amounts of intersegment revenues or expenses.

B)They have a similar distribution method for products.

C)They have similar production processes.

D)They have similar products or services.

A)They have similar amounts of intersegment revenues or expenses.

B)They have a similar distribution method for products.

C)They have similar production processes.

D)They have similar products or services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

21

The following information was collected together for the Lawson Company relating to the preparation of their annual financial statements for 2011.For each item,indicate "yes" or "no" as to whether the item must be disclosed in the annual report.

________ 1.Names of major customers for all reportable segments

________ 2.Interest revenue and expense for all reportable segments

________ 3.Cost of Goods Sold for all reportable segments

________ 4.Depreciation expense and amortization expense for all reportable segments

________ 5.Revenue from external customers for all reportable segments

________ 6.The basis for aggregating any operating segments to arrive at reporting segments

________ 7.Income tax expense (or benefit)for all reportable segments

________ 8.Total assets for all reportable segments

________ 9.Type of product or service for all reportable segments

________ 10.Extraordinary items for all reportable segments

________ 1.Names of major customers for all reportable segments

________ 2.Interest revenue and expense for all reportable segments

________ 3.Cost of Goods Sold for all reportable segments

________ 4.Depreciation expense and amortization expense for all reportable segments

________ 5.Revenue from external customers for all reportable segments

________ 6.The basis for aggregating any operating segments to arrive at reporting segments

________ 7.Income tax expense (or benefit)for all reportable segments

________ 8.Total assets for all reportable segments

________ 9.Type of product or service for all reportable segments

________ 10.Extraordinary items for all reportable segments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

22

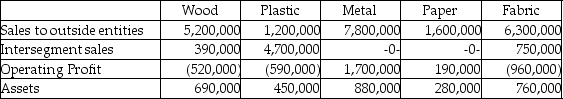

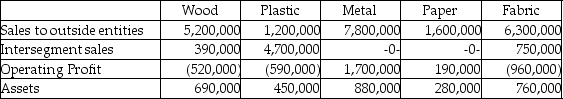

Tillman Fabrications has five operating segments,as summarized below:

Required:

Determine which of the operating segments of Tillman Fabrications are reportable segments for the period shown.

Required:

Determine which of the operating segments of Tillman Fabrications are reportable segments for the period shown.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

23

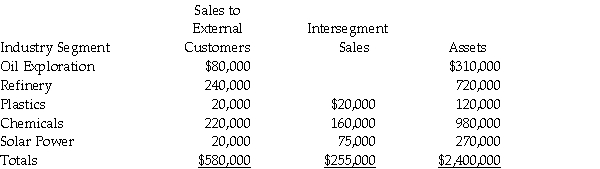

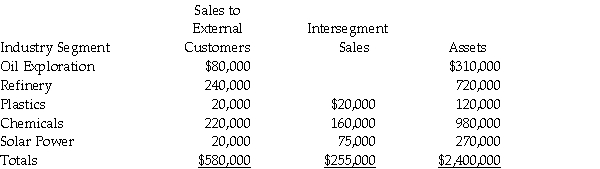

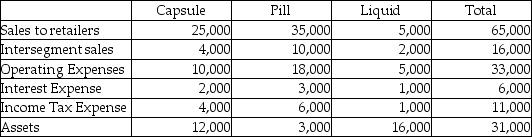

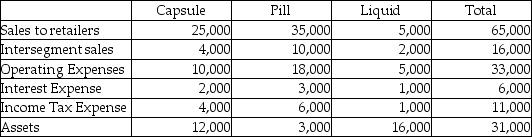

The following data relate to Falcon Corporation's industry segments:

Required:

1.Which of Falcon's operating segments would be considered reporting segments under the "revenue" test?

2.Which of Falcon's operating segments would be considered reporting segments under the "asset" test?

Required:

1.Which of Falcon's operating segments would be considered reporting segments under the "revenue" test?

2.Which of Falcon's operating segments would be considered reporting segments under the "asset" test?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

24

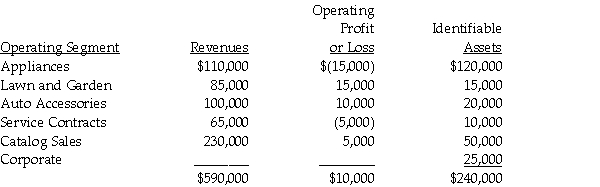

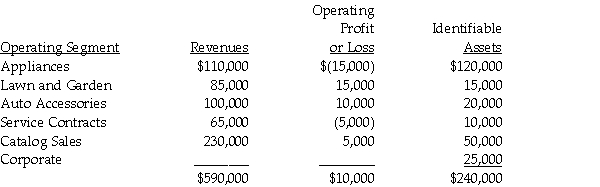

For internal decision-making purposes,Calam Corporation's operating segments have been identified as follows:

Required:

1.In applying the "operating profit or loss" test to identify reporting segments,what is the test value for Calam Corporation?

2.Using the "reported profit or loss" test,which of Calam's operating segments will also be reporting segments?

Required:

1.In applying the "operating profit or loss" test to identify reporting segments,what is the test value for Calam Corporation?

2.Using the "reported profit or loss" test,which of Calam's operating segments will also be reporting segments?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

25

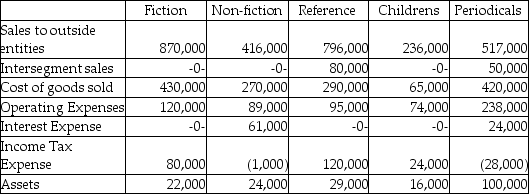

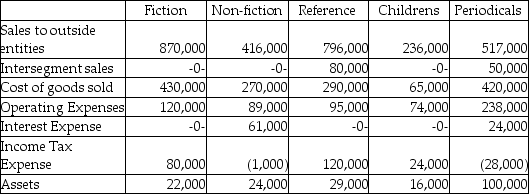

Rollins Publishing has five operating segments,as summarized below:

Required:

Determine which of the operating segments of Rollins Publishing are reportable segments for the period shown.

Required:

Determine which of the operating segments of Rollins Publishing are reportable segments for the period shown.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

26

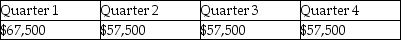

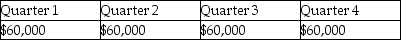

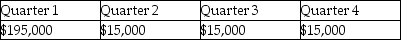

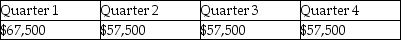

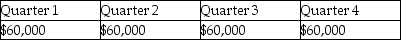

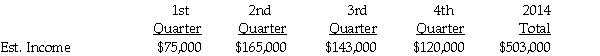

Nettle Corporation is preparing its first quarterly interim report.It is subject to a corporate income tax rate of 20% on the first $50,000 of taxable income and 35% on taxable income above $50,000.Its estimated pretax accounting income for 2014,by quarter,is:

Nettle expects to earn and receive operating income for the year and does not contemplate any changes in accounting procedures or principles that would affect its pretax accounting income.

Required:

1.Determine Nettle's estimated effective tax rate for 2014.

2.Prepare a schedule to show Nettle's estimated net income for each quarter of 2014.

Nettle expects to earn and receive operating income for the year and does not contemplate any changes in accounting procedures or principles that would affect its pretax accounting income.

Required:

1.Determine Nettle's estimated effective tax rate for 2014.

2.Prepare a schedule to show Nettle's estimated net income for each quarter of 2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

27

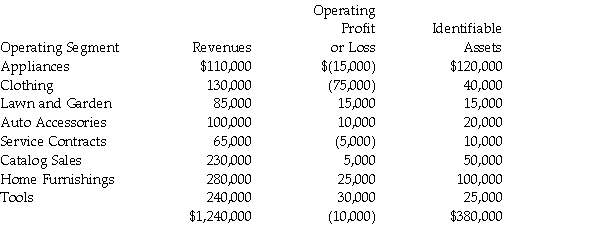

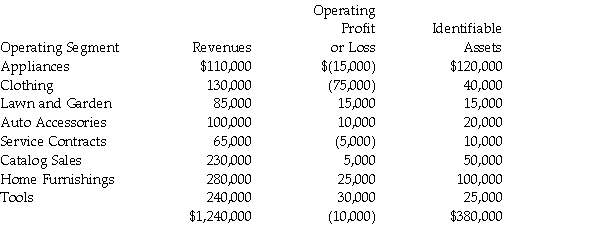

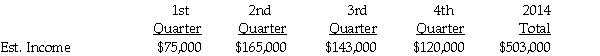

For internal decision-making purposes,Dashwood Corporation's operating segments have been identified as follows:

Revenues of the segments are external,with the exception of tools,which sold $400,000 to other segments,and Appliances,which sold $200,000 to other segments.

Required:

1.In applying the "revenue" test to identify reporting segments,what is the test value for Dashwood Corporation?

2.Using the "revenue" test,which of Dashwood's operating segments will also be reportable segments?

Revenues of the segments are external,with the exception of tools,which sold $400,000 to other segments,and Appliances,which sold $200,000 to other segments.

Required:

1.In applying the "revenue" test to identify reporting segments,what is the test value for Dashwood Corporation?

2.Using the "revenue" test,which of Dashwood's operating segments will also be reportable segments?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

28

Quantex Corporation has five operating segments,as summarized below:

Required:

Determine which of the operating segments of Quantex Corporation are reportable segments for the period shown.

Required:

Determine which of the operating segments of Quantex Corporation are reportable segments for the period shown.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

29

The accountant for Baxter Corporation has assigned most of the company's assets to its three segments as follows:

The unassigned assets consist of $430,000 of unallocated goodwill and $270,000 of assets attached to the corporate headquarters.For internal decision-making purposes,goodwill is not assigned to the segments and the assets assigned to the corporate headquarters are allocated equally to the operating segments.

Required:

1.What is the proper threshold value to use in determining which of the operating segments shown above are reporting segments?

2.Which of the operating segments are considered reporting segments?

The unassigned assets consist of $430,000 of unallocated goodwill and $270,000 of assets attached to the corporate headquarters.For internal decision-making purposes,goodwill is not assigned to the segments and the assets assigned to the corporate headquarters are allocated equally to the operating segments.

Required:

1.What is the proper threshold value to use in determining which of the operating segments shown above are reporting segments?

2.Which of the operating segments are considered reporting segments?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

30

For internal decision-making purposes,Geogh Corporation identifies its industry segments by geographical area.For 2014,the total revenues of each segment are provided below.There are no intersegment revenues.

Required:

1.Which operating segments will be considered reporting segments based on the revenue test?

2.What is the test value for determining whether a sufficient number of segments are reported?

3.What will be the minimum number of segments that must be reported?

Required:

1.Which operating segments will be considered reporting segments based on the revenue test?

2.What is the test value for determining whether a sufficient number of segments are reported?

3.What will be the minimum number of segments that must be reported?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

31

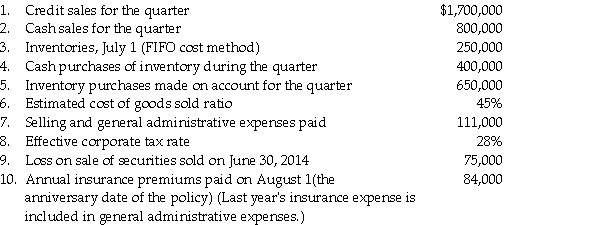

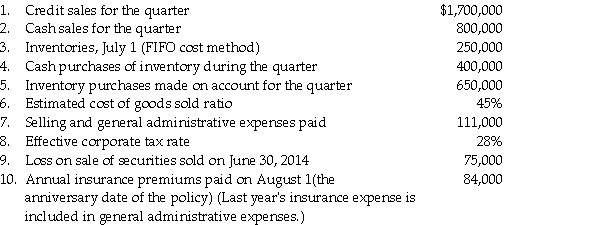

Jeale Corporation is preparing its interim financial statements for the third quarter of calendar 2014.The following information was provided for the preparation of the statements:

Additional information:

At the end of the year,Jeale accrues its annual pension and depreciation expenses which amount to $60,000 and $42,000,respectively.

Required:

Prepare Jeale's interim income statement for the third quarter of calendar 2014.

Additional information:

At the end of the year,Jeale accrues its annual pension and depreciation expenses which amount to $60,000 and $42,000,respectively.

Required:

Prepare Jeale's interim income statement for the third quarter of calendar 2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

32

For internal decision-making purposes,Elom Corporation's operating segments have been identified as follows:

Corporate assets are typically allocated back evenly to the segments for internal analysis purposes.

Required:

1.In applying the "asset" test to identify reporting segments,what is the test value for Elom Corporation?

2.Using the "asset" test,which of Elom's operating segments will also be reporting segments?

Corporate assets are typically allocated back evenly to the segments for internal analysis purposes.

Required:

1.In applying the "asset" test to identify reporting segments,what is the test value for Elom Corporation?

2.Using the "asset" test,which of Elom's operating segments will also be reporting segments?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

33

Illiana Corporation has several accounting issues with respect to its interim financial statements for the first quarter of calendar 2014.

Required:

For each of the independent situations given below,state whether or not the method proposed by Illiana is acceptable.Justify each answer with appropriate reasoning.

1.Illiana will not perform a physical inventory at the end of the calendar quarter.It intends to estimate the cost of sales by using the gross profit inventory method.

2.Illiana grants volume discounts to its customers based upon their total annual purchases.The discounts are calculated on a sliding scale ranging from 1% to 8%.The amount of discount applied will progressively increase for a customer as the cumulative purchase total for the customer increases during the year.Illiana will use the average rate of discounts earned for each customer in the prior year as the expected discount rate for the current year.

3.At the beginning of the current quarter,Illiana incurred a large loss on the sale of some of its marketable securities.It intends to distribute the loss evenly to each of the four calendar quarters.

4.Illiana incurs maintenance costs during its year-end holiday shut down,but has minimal maintenance costs during the rest of the year.It intends to deduct one-fourth of the yearly estimated cost on its interim income statement.

Required:

For each of the independent situations given below,state whether or not the method proposed by Illiana is acceptable.Justify each answer with appropriate reasoning.

1.Illiana will not perform a physical inventory at the end of the calendar quarter.It intends to estimate the cost of sales by using the gross profit inventory method.

2.Illiana grants volume discounts to its customers based upon their total annual purchases.The discounts are calculated on a sliding scale ranging from 1% to 8%.The amount of discount applied will progressively increase for a customer as the cumulative purchase total for the customer increases during the year.Illiana will use the average rate of discounts earned for each customer in the prior year as the expected discount rate for the current year.

3.At the beginning of the current quarter,Illiana incurred a large loss on the sale of some of its marketable securities.It intends to distribute the loss evenly to each of the four calendar quarters.

4.Illiana incurs maintenance costs during its year-end holiday shut down,but has minimal maintenance costs during the rest of the year.It intends to deduct one-fourth of the yearly estimated cost on its interim income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

34

Osprin Corporation has three operating segments,as summarized below:

Required:

1.Using the revenue test,what is the minimum amount of revenue of a reportable segment?

2.Using the operating profit or loss test,what is the minimum amount of operating profit or loss of a reportable segment?

3.Using the asset test,what is the minimum amount of assets of a reportable segment?

4.Based on the three tests,which segments will be separately reported?

Required:

1.Using the revenue test,what is the minimum amount of revenue of a reportable segment?

2.Using the operating profit or loss test,what is the minimum amount of operating profit or loss of a reportable segment?

3.Using the asset test,what is the minimum amount of assets of a reportable segment?

4.Based on the three tests,which segments will be separately reported?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

35

The following data relate to Elle Corporation's industry segments.(Elle HQ represents the corporate headquarters).All other segments are geographical sales segments.

Required:

1.Prepare a report which reconciles the reportable segment profits to total consolidated profits assuming that corporate expenses are not allocated to the operating segments.

2.Prepare a report which reconciles the reportable segment profits to total consolidated profits assuming that corporate expenses are allocated evenly among the operating segments.

Required:

1.Prepare a report which reconciles the reportable segment profits to total consolidated profits assuming that corporate expenses are not allocated to the operating segments.

2.Prepare a report which reconciles the reportable segment profits to total consolidated profits assuming that corporate expenses are allocated evenly among the operating segments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

36

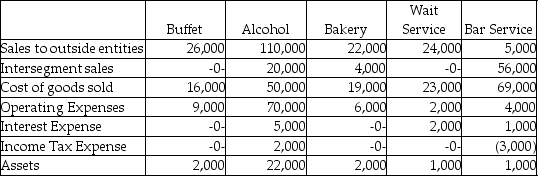

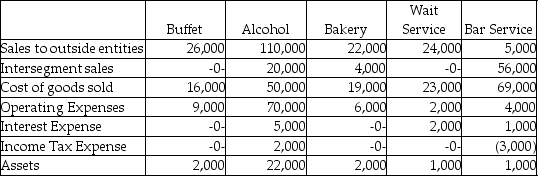

Snodberry Catering has five operating segments,as summarized below:

Required:

Determine which of the operating segments of Snodberry Catering are reportable segments for the period shown.

Required:

Determine which of the operating segments of Snodberry Catering are reportable segments for the period shown.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

37

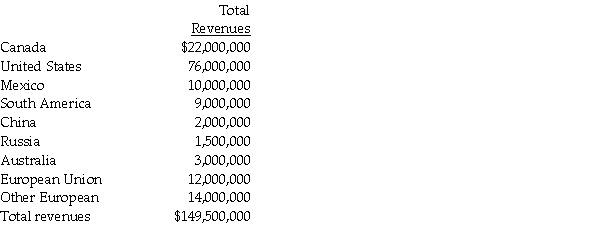

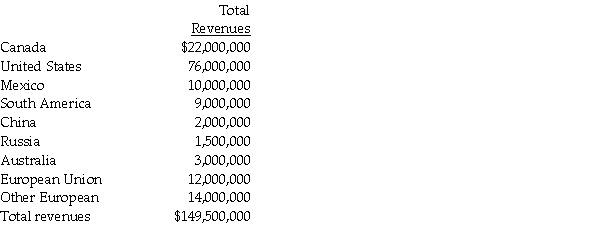

For internal decision-making purposes,Falcon Corporation identifies its industry segments by geographical area.For 2014,the total revenues of each segment are provided below.There are no intersegment revenues.

Required:

1.Which operating segments will be considered reporting segments based on the revenue test?

2.What is the test value for determining whether a sufficient number of segments are reported?

3.What will be the minimum number of segments that must be reported?

Required:

1.Which operating segments will be considered reporting segments based on the revenue test?

2.What is the test value for determining whether a sufficient number of segments are reported?

3.What will be the minimum number of segments that must be reported?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

38

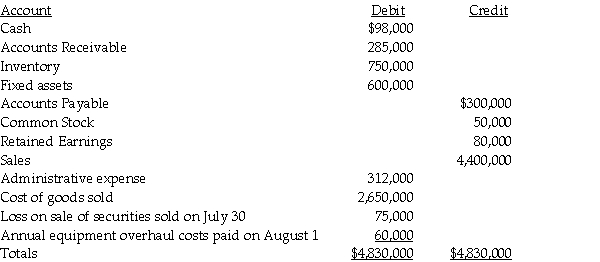

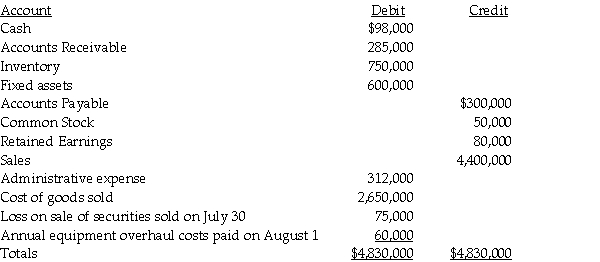

Krull Corporation is preparing its interim financial statements for the third quarter of calendar 2014.

The following trial balance information is available for third quarter:

Additional information

At the end of the year,Krull distributes annual employee bonuses and charitable donations that are estimated at $40,000,and $12,000,respectively.The cost of goods sold includes the liquidation of a $45,000 base layer in inventory that Krull will restore in the fourth quarter at a cost of $75,000.Effective corporate tax rate for 2014 is 32%.

Required:

Prepare Krull's interim income statement for the third quarter of calendar 2014.

The following trial balance information is available for third quarter:

Additional information

At the end of the year,Krull distributes annual employee bonuses and charitable donations that are estimated at $40,000,and $12,000,respectively.The cost of goods sold includes the liquidation of a $45,000 base layer in inventory that Krull will restore in the fourth quarter at a cost of $75,000.Effective corporate tax rate for 2014 is 32%.

Required:

Prepare Krull's interim income statement for the third quarter of calendar 2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck