Deck 20: Process Costing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

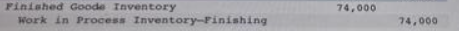

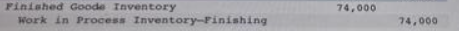

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/229

العب

ملء الشاشة (f)

Deck 20: Process Costing

1

A process cost summary usually does not include the number of equivalent units of production for the period.

False

2

Equivalent units of production is an engineering term used to describe the process by which one company attempts to manufacture units of a product that are equivalent to the product manufactured by a competitor.

False

3

Equivalent units of production for direct materials and direct labor are always the same.

False

4

A process cost summary is an accounting report that describes the costs charged to each department, the equivalent units of production by each department, and determining the costs assigned to each department's output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

5

If a department that uses process costing starts the reporting period with 100,000 physical units that were 20% complete with respect to direct labor, the equivalent units of direct labor in beginning Work in Process are 20,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

6

The FIFO method of computing equivalent units includes the beginning inventory costs in computing the cost per equivalent unit for the current period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

7

Equivalent units of production refer to the number of units that could have been started and completed given the costs incurred during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

8

Conversion cost per equivalent unit is the combined costs of direct labor and factory overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

9

The managers of process operations focus on the series of repetitive processes, or steps, resulting in a noncustomized product or service.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

10

The cost object in a process costing system is the specific job.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

11

The FIFO method of computing equivalent units excludes the beginning inventory costs in computing the cost per equivalent unit for the current period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

12

Conversion cost per equivalent unit is the combined costs of direct materials and factory overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

13

Equivalent units of production are always the same as the total number of physical units finished during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

14

In a process costing system, companies typically end each period with only Finished Goods Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

15

A process cost summary shows the cost of a particular job manufactured in the reporting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

16

Process and job order manufacturing operations both combine materials, labor, and overhead items in the process of producing products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

17

In a process costing system costs are measured upon completion of each job.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

18

Manufacturers that utilize process operations produce large quantities of identical products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

19

The process cost summary is an important managerial accounting report produced by a process costing system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

20

The FIFO method of computing equivalent units focuses on production activity in the current period only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

21

In process costing, indirect materials are always classified as factory overhead, even if they are linked with a specific production process or department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

22

Conversion cost per equivalent unit is the combined cost of direct materials, direct labor, and factory overhead per equivalent unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

23

Process costing typically uses only one Work in Process Inventory account, while job order costing typically uses a separate Work in Process Inventory account for each department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

24

When direct labor and overhead enter the production process at different rates, it is appropriate to use a conversion cost per equivalent unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

25

In a process operation, all labor that is used exclusively by a single production department is considered to be direct labor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

26

In process costing, the classification of materials as direct or indirect depends on whether or not they are clearly linked with a specific process or department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

27

Process costing systems are commonly used by companies that manufacture standardized products by passing them through a series of manufacturing steps.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

28

Process costing is applied to operations with repetitive production and noncustomized products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

29

Process costing systems consider overhead costs to include those costs that cannot be traced to a specific process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

30

In process costing, the cost object is the process and in job costing, the cost object is a job.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

31

Conversion cost per equivalent unit is the combined cost of direct labor and factory overhead per equivalent unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

32

Process costing systems are commonly used by companies that produce a large volume of standardized units on a continuous basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

33

The term "process costing system" is used in reference to the number of trained individuals and computers required to process the collected cost information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

34

A production department is an organizational unit that has the responsibility for the complete processing of one particular product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

35

When direct labor and overhead enter the production process at the same rates, it is appropriate to use a conversion cost per equivalent unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

36

Process costing is applied to operations with repetitive production and customized products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

37

In a process costing system, with the exception of the first department, each department receives output from the prior department as a partially processed product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

38

The use of process costing is of little benefit to a service type of operation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

39

Process costing systems are used only by companies that manufacture physical products; companies that provide services do not use process costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

40

Companies that use a series of repetitive manufacturing processes to produce standardized products should use a process costing system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

41

If indirect materials costing $37,500 that were not clearly linked with any specific production process or department were used during a reporting period, the following journal entry would be recorded in the process costing system:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

42

In a process costing system, the purchase of raw materials is credited to the Raw Materials Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

43

The following journal entry would be made to record the use of $6,100 of direct labor in a production department during the reporting period:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

44

In process costing there is never a balance remaining in Factory Overhead that needs to be closed at period end.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

45

In a process costing system, the entry to record cost of materials assigned to a production department requires a debit to the Work in Process Inventory account for that department and a credit to the Raw Materials Inventory account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

46

If Department C uses $10,000 of direct materials and Department D uses $15,000 of direct materials, the following journal entry would be recorded by the process costing system:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

47

In a process costing system, the purchase of raw materials is debited to the Raw Materials Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

48

In some circumstances, a process costing system can classify wages paid to maintenance workers as direct labor costs instead of factory overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

49

If the indirect labor cost in August for clerical and maintenance that help production in all departments was $123,000, the following journal entry would be recorded in a process costing system:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

50

Hybrid costing systems can only be applied to manufacturing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

51

In process costing, direct labor includes only the labor that is applied directly to individual units of product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

52

A materials consumption report is used instead of materials requisitions in companies where materials move continuously through the manufacturing process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

53

If Grayson Manufacturing incurred $17,400 for direct labor in the assembly department and $10,300 for direct labor in the painting department, the journal entry to record the labor used is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

54

In a process costing system, the entry to record cost of materials assigned to a production department requires a debit to the Raw Materials Inventory account and a credit to the Work in Process Inventory account for that department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

55

A unique feature of process costing systems is the use of a single Work in Process Inventory account regardless of the number of production departments that exist.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

56

Hybrid systems contain features of both process and job order operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

57

In a process costing system, factory overhead costs are allocated to production departments by using a predetermined overhead allocation rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

58

If Department R uses $60,000 of direct materials and Department S uses $15,000 of direct materials, the following journal entry would be recorded by the process costing system:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

59

If Department L uses $53,000 of direct labor and Department M uses $21,000 of direct labor, the following journal entry would be recorded using a process costing system:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

60

In a process costing system, factory labor costs incurred in a reporting period are presented on the income statement as Factory Labor Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

61

In process costing, all indirect materials are charged directly to Work in Process Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

62

The cost of units transferred from Work in Process Inventory to Finished Goods Inventory is called the cost of goods manufactured.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

63

The number of equivalent units of production assigned to ending Work in Process inventory should be equal to or less than the number of physical units in ending Work in Process inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

64

A process costing system records all factory overhead costs directly in the Work in Process Inventory accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the following characteristics does not usually apply to process operations systems?

A) Different managers are responsible for different processes.

B) The output of all processes except the final process is an input to the next process.

C) Each unit of product is separately identifiable.

D) Costs are computed using equivalent units.

E) Partially completed products are transferred between processes.

A) Different managers are responsible for different processes.

B) The output of all processes except the final process is an input to the next process.

C) Each unit of product is separately identifiable.

D) Costs are computed using equivalent units.

E) Partially completed products are transferred between processes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

66

If the predetermined overhead allocation rate is 250% of direct labor cost and the Finishing Department's direct labor cost for the reporting period is $20,000, the following entry would record the allocation of overhead to the products processed in this department:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

67

Once equivalent units are calculated for materials, this number will also be used for direct labor and factory overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

68

In the same time period, it is possible that a production department can produce 1,000 equivalent finished units with respect to direct materials and 1,200 equivalent finished units with respect to direct labor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

69

The process cost summary presents calculations of the cost of units completed during the reporting period, but does not present any information about the ending Work in Process inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following products is least likely to be produced in a process operations system?

A) Slacks for casual wear

B) Custom cabinets

C) Compact disks

D) Calculators

E) Baseball hats

A) Slacks for casual wear

B) Custom cabinets

C) Compact disks

D) Calculators

E) Baseball hats

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

71

If a production department has 100 equivalent units of production with respect to direct materials in a given reporting period, the equivalent units of production with respect to direct labor must also be 100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

72

One section of the process cost summary describes the equivalent units of production for the department during the reporting period and presents the calculations of the direct materials and conversion costs per equivalent unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

73

If a department that applies process costing starts the reporting period with 40,000 physical units that were 80% complete with respect to direct materials and 50% complete with respect to direct labor, it must add 8,000 equivalent units of direct materials and 20,000 equivalent units of direct labor to complete them.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

74

If a department that applies process costing starts the reporting period with 50,000 physical units that were 25% complete with respect to direct materials and 40% complete with respect to direct labor, it must add 12,500 equivalent units of direct materials and 20,000 equivalent units of direct labor to complete them.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

75

If the predetermined overhead allocation rate is 75% of direct labor cost, and the Assembly Department's direct labor cost for the reporting period is $20,000, the following entry would be made to record the allocation of overhead to the products processed in this department:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

76

If the predetermined overhead allocation rate is 245% of direct labor cost, and the Baking Department's direct labor cost for the reporting period is $10,000, the following entry would be made to record the allocation of overhead to the products processed in this department:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

77

A process cost summary for a production department accounts for all costs assigned to that department during the period plus costs that were in the department's Work in Process Inventory account at the beginning of the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which of the following products is most likely to be produced in a process operations system?

A) Custom cabinets

B) Bridges

C) Designer bridal gowns

D) Airplanes

E) Cereal

A) Custom cabinets

B) Bridges

C) Designer bridal gowns

D) Airplanes

E) Cereal

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

79

Since the process cost summary describes the activities of a production department for a specified reporting period, it does not present information about any costs incurred in prior periods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck

80

The Finishing Department transferred out completed units with a cost of $74,000. This transfer should be recorded with the following entry:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 229 في هذه المجموعة.

فتح الحزمة

k this deck