Deck 8: Consolidations - Changes in Ownership Interests

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/50

العب

ملء الشاشة (f)

Deck 8: Consolidations - Changes in Ownership Interests

1

On April 1,2014,Paramount Company acquires 100% of the outstanding stock of Yester Company on the open market.Paramount and Yester have December 31 fiscal year ends.Under GAAP,a consolidated income statement for the year ending December 31,2014,will include

A)100 percent of the revenues and expenses in 2014 of Yester Company after January 1,2014.

B)no revenues and expenses in 2014 of Yester Company.

C)80 percent of the revenues and expenses in 2014 of Yester Company.

D)100 percent of the revenues and expenses in 2014 of Yester Company after April 1,2014.

A)100 percent of the revenues and expenses in 2014 of Yester Company after January 1,2014.

B)no revenues and expenses in 2014 of Yester Company.

C)80 percent of the revenues and expenses in 2014 of Yester Company.

D)100 percent of the revenues and expenses in 2014 of Yester Company after April 1,2014.

D

2

Use the following information to answer the question(s) below.

Bird Corporation purchased an 80% interest in Brush Corporation on July 1, 2013 at its book value, and on January 1, 2014 its Investment in Brush account was $300,000, equal to its book value. Brush's net income for 2014 was $99,000 (earned uniformly); no dividends were declared. On March 1, 2014, Bird reduced its interest in Brush by selling a 20% interest, one-fourth of its investment, for $84,000.

-If Bird uses the "actual-sale-date" sales assumption,its gain on the sale and income from Brush for 2014 will be

A)

B)

C)

D)

Bird Corporation purchased an 80% interest in Brush Corporation on July 1, 2013 at its book value, and on January 1, 2014 its Investment in Brush account was $300,000, equal to its book value. Brush's net income for 2014 was $99,000 (earned uniformly); no dividends were declared. On March 1, 2014, Bird reduced its interest in Brush by selling a 20% interest, one-fourth of its investment, for $84,000.

-If Bird uses the "actual-sale-date" sales assumption,its gain on the sale and income from Brush for 2014 will be

A)

B)

C)

D)

3

Use the following information to answer the question(s) below.

Goldberg Corporation owned a 70% interest in Savannah Corporation on December 31, 2013, and Goldberg's Investment in Savannah account had a balance of $3,900,000. Savannah's stockholders' equity on this date was as follows:

-What is Goldberg's percentage ownership in Savannah after Savannah issues its stock to Goldberg?

A)76.32%

B)80.43%

C)82.57%

D)83.43%

Goldberg Corporation owned a 70% interest in Savannah Corporation on December 31, 2013, and Goldberg's Investment in Savannah account had a balance of $3,900,000. Savannah's stockholders' equity on this date was as follows:

-What is Goldberg's percentage ownership in Savannah after Savannah issues its stock to Goldberg?

A)76.32%

B)80.43%

C)82.57%

D)83.43%

76.32%

4

The acquisition of treasury stock by a subsidiary from noncontrolling shareholders at a price above book value

A)decreases the parent's share of subsidiary book value and decreases the parent's ownership percentage.

B)decreases the parent's share of subsidiary book value and increases the parent's ownership percentage.

C)increases the parent's share of subsidiary book value and decreases the parent's ownership percentage.

D)increases the parent's share of subsidiary book value and increases the parent's ownership percentage.

A)decreases the parent's share of subsidiary book value and decreases the parent's ownership percentage.

B)decreases the parent's share of subsidiary book value and increases the parent's ownership percentage.

C)increases the parent's share of subsidiary book value and decreases the parent's ownership percentage.

D)increases the parent's share of subsidiary book value and increases the parent's ownership percentage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following is correct? The direct sale of additional shares of stock at book value per share to only the parent company from a subsidiary

A)decreases the parent's interest and decreases the noncontrolling shareholders' interest.

B)decreases the parent's interest and increases the noncontrolling shareholders' interest.

C)increases the parent's interest and increases the noncontrolling shareholders' interest.

D)increases the parent's interest and decreases the noncontrolling shareholders' interest.

A)decreases the parent's interest and decreases the noncontrolling shareholders' interest.

B)decreases the parent's interest and increases the noncontrolling shareholders' interest.

C)increases the parent's interest and increases the noncontrolling shareholders' interest.

D)increases the parent's interest and decreases the noncontrolling shareholders' interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

6

Utah Company holds 80% of the stock of a subsidiary company.The subsidiary issues 100 additional shares of stock to Utah Company at a price above book value per share.The subsidiary does not issue any additional shares at the same time.How will Utah Company record the purchase?

A)Utah Company records a gain on sale of stock.

B)Utah Company increases additional paid-in capital.

C)Utah Company decreases additional paid-in capital.

D)Utah Company assigns any excess cost over book value acquired to increase undervalued identifiable assets or goodwill as appropriate.

A)Utah Company records a gain on sale of stock.

B)Utah Company increases additional paid-in capital.

C)Utah Company decreases additional paid-in capital.

D)Utah Company assigns any excess cost over book value acquired to increase undervalued identifiable assets or goodwill as appropriate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

7

Use the following information to answer the question(s) below.

Great Corporation acquired a 90% interest in SOS Corporation at its $810,000 book value on December 31, 2013. A summary of the stockholders' equity for SOS at the end of 2013 and 2014 is as follows:

-If SOS sold the additional shares to the general public,Great's Investment in SOS account after the sale would be ________.(Use four decimal places.)

A)$945,000

B)$1,157,100

C)$1,225,000

D)$1,245,000

Great Corporation acquired a 90% interest in SOS Corporation at its $810,000 book value on December 31, 2013. A summary of the stockholders' equity for SOS at the end of 2013 and 2014 is as follows:

-If SOS sold the additional shares to the general public,Great's Investment in SOS account after the sale would be ________.(Use four decimal places.)

A)$945,000

B)$1,157,100

C)$1,225,000

D)$1,245,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

8

Use the following information to answer the question(s) below.

Bird Corporation purchased an 80% interest in Brush Corporation on July 1, 2013 at its book value, and on January 1, 2014 its Investment in Brush account was $300,000, equal to its book value. Brush's net income for 2014 was $99,000 (earned uniformly); no dividends were declared. On March 1, 2014, Bird reduced its interest in Brush by selling a 20% interest, one-fourth of its investment, for $84,000.

-If Bird uses a "beginning-of-the-year" sale assumption,its gain on sale and income from Brush for 2014 will be

A)

B)

C)

D)

Bird Corporation purchased an 80% interest in Brush Corporation on July 1, 2013 at its book value, and on January 1, 2014 its Investment in Brush account was $300,000, equal to its book value. Brush's net income for 2014 was $99,000 (earned uniformly); no dividends were declared. On March 1, 2014, Bird reduced its interest in Brush by selling a 20% interest, one-fourth of its investment, for $84,000.

-If Bird uses a "beginning-of-the-year" sale assumption,its gain on sale and income from Brush for 2014 will be

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

9

Jersey Company acquired 90% of York Company on April 1,2014.Both Jersey Company and York Company have December 31 fiscal year ends.Under current GAAP,which of the following statements is false?

A)The consolidated income statement in 2014 should not include York's revenues and expenses prior to April 1,2014.

B)When preparing consolidating work papers in 2014,York's revenues prior to April 1,2014 are eliminated.

C)York's earnings prior to April 1,2014 should appear as a deduction on the consolidated income statement in 2014.

D)The consolidated income statement in 2014 should include York's revenues and expenses after April 1,2014.

A)The consolidated income statement in 2014 should not include York's revenues and expenses prior to April 1,2014.

B)When preparing consolidating work papers in 2014,York's revenues prior to April 1,2014 are eliminated.

C)York's earnings prior to April 1,2014 should appear as a deduction on the consolidated income statement in 2014.

D)The consolidated income statement in 2014 should include York's revenues and expenses after April 1,2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

10

Anthony Company declared and paid $20,000 of dividends during 2014.The schedule of dividends follows: Anthony Company was acquired on June 1,2014 by Google Company.Google acquired 100 percent of Anthony Company.Both companies have a December 31 fiscal year end.What is the amount of preacquisition dividends in 2014?

A)0

B)$5,000

C)$10,000

D)$15,000

A)0

B)$5,000

C)$10,000

D)$15,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

11

A stock dividend by a subsidiary causes

A)the parent company investment account to decrease.

B)the parent company investment account to remain the same.

C)the parent company investment account to increase.

D)the noncontrolling interest equity to increase.

A)the parent company investment account to decrease.

B)the parent company investment account to remain the same.

C)the parent company investment account to increase.

D)the noncontrolling interest equity to increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

12

Use the following information to answer the question(s) below.

On December 31, 2013, Giant Corporation's Investment in Penguin Corporation account had a balance of $500,000. The balance consisted of 80% of Penguin's $625,000 stockholders' equity on that date. Giant owns 80% of Penguin. On January 2, 2014, Penguin increased its outstanding common stock from 15,000 to 18,000 shares.

-Assume that Penguin sold the additional 3,000 shares directly to Giant for $150,000 on January 2,2014.Giant's percentage ownership in Penguin immediately after the purchase of the additional stock is

A)66-2/3%.

B)80%.

C)83-1/3%.

D)86-2/3%

On December 31, 2013, Giant Corporation's Investment in Penguin Corporation account had a balance of $500,000. The balance consisted of 80% of Penguin's $625,000 stockholders' equity on that date. Giant owns 80% of Penguin. On January 2, 2014, Penguin increased its outstanding common stock from 15,000 to 18,000 shares.

-Assume that Penguin sold the additional 3,000 shares directly to Giant for $150,000 on January 2,2014.Giant's percentage ownership in Penguin immediately after the purchase of the additional stock is

A)66-2/3%.

B)80%.

C)83-1/3%.

D)86-2/3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

13

Use the following information to answer the question(s) below.

Goldberg Corporation owned a 70% interest in Savannah Corporation on December 31, 2013, and Goldberg's Investment in Savannah account had a balance of $3,900,000. Savannah's stockholders' equity on this date was as follows:

-On January 1,2014,assume the fair values of Savannah's identifiable assets and liabilities equal book values.What is the change in the amount of goodwill associated with the issuance of 80,000 additional shares to Goldberg? (Use four decimal places.)

A)Increase goodwill $38,176.

B)Decrease goodwill $38,176.

C)Increase goodwill $384,000.

D)Decrease goodwill $384,000.

Goldberg Corporation owned a 70% interest in Savannah Corporation on December 31, 2013, and Goldberg's Investment in Savannah account had a balance of $3,900,000. Savannah's stockholders' equity on this date was as follows:

-On January 1,2014,assume the fair values of Savannah's identifiable assets and liabilities equal book values.What is the change in the amount of goodwill associated with the issuance of 80,000 additional shares to Goldberg? (Use four decimal places.)

A)Increase goodwill $38,176.

B)Decrease goodwill $38,176.

C)Increase goodwill $384,000.

D)Decrease goodwill $384,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

14

Consider a sale of stock by a subsidiary to parties outside the consolidated entity.This transaction requires an adjustment of the parent's investment and additional paid-in capital accounts except when

A)the shares are sold below book value per share.

B)the shares are sold above book value per share.

C)the shares are sold at book value per share.

D)the shares are sold at market value.

A)the shares are sold below book value per share.

B)the shares are sold above book value per share.

C)the shares are sold at book value per share.

D)the shares are sold at market value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

15

If a parent company and outside investors purchase shares of a subsidiary in relation to existing stock ownership (ratably),then

A)there will be an adjustment to additional paid-in capital if the stock is sold above book value.

B)there will be no adjustment to additional paid-in capital regardless whether the stock is sold above or below book value.

C)there will be an adjustment to additional paid-in capital if the stock is sold below book value.

D)there will be the elimination of a gain.

A)there will be an adjustment to additional paid-in capital if the stock is sold above book value.

B)there will be no adjustment to additional paid-in capital regardless whether the stock is sold above or below book value.

C)there will be an adjustment to additional paid-in capital if the stock is sold below book value.

D)there will be the elimination of a gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

16

Use the following information to answer the question(s) below.

Great Corporation acquired a 90% interest in SOS Corporation at its $810,000 book value on December 31, 2013. A summary of the stockholders' equity for SOS at the end of 2013 and 2014 is as follows:

-If SOS sold the additional shares directly to Great,Great's Investment in SOS account after the sale would be

A)$1,350,000.

B)$1,395,000.

C)$1,425,000.

D)$1,500,000.

Great Corporation acquired a 90% interest in SOS Corporation at its $810,000 book value on December 31, 2013. A summary of the stockholders' equity for SOS at the end of 2013 and 2014 is as follows:

-If SOS sold the additional shares directly to Great,Great's Investment in SOS account after the sale would be

A)$1,350,000.

B)$1,395,000.

C)$1,425,000.

D)$1,500,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

17

Use the following information to answer the question(s) below.

Bower Corporation purchased a 70% interest in Stage Corporation on June 1, 2013 at a purchase price of $350,000. On June 1, 2013, the book values of Stage's assets and liabilities were equal to fair values. On June 1, 2013, Stage's stockholders' equity consisted of $290,000 of Common Stock and $210,000 of Retained Earnings. All cost-book differentials were attributed to goodwill.

During 2013, Stage earned $120,000 of net income, earned uniformly throughout the year and paid $6,000 of dividends on March 1 and another $6,000 on September 1.

-Noncontrolling interest share for 2013 is

A)$21,000.

B)$32,400.

C)$36,000.

D)$50,000.

Bower Corporation purchased a 70% interest in Stage Corporation on June 1, 2013 at a purchase price of $350,000. On June 1, 2013, the book values of Stage's assets and liabilities were equal to fair values. On June 1, 2013, Stage's stockholders' equity consisted of $290,000 of Common Stock and $210,000 of Retained Earnings. All cost-book differentials were attributed to goodwill.

During 2013, Stage earned $120,000 of net income, earned uniformly throughout the year and paid $6,000 of dividends on March 1 and another $6,000 on September 1.

-Noncontrolling interest share for 2013 is

A)$21,000.

B)$32,400.

C)$36,000.

D)$50,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

18

A subsidiary split its stock 2 for 1.Which of the following statements is false?

A)A stock split does not affect the amount of net assets of the subsidiary.

B)A stock split does not affect parent and noncontrolling interest ownership percentages.

C)A stock split does not affect consolidation procedures.

D)A 2 for 1 stock split decreases the number of shares outstanding.

A)A stock split does not affect the amount of net assets of the subsidiary.

B)A stock split does not affect parent and noncontrolling interest ownership percentages.

C)A stock split does not affect consolidation procedures.

D)A 2 for 1 stock split decreases the number of shares outstanding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

19

Use the following information to answer the question(s) below.

Bower Corporation purchased a 70% interest in Stage Corporation on June 1, 2013 at a purchase price of $350,000. On June 1, 2013, the book values of Stage's assets and liabilities were equal to fair values. On June 1, 2013, Stage's stockholders' equity consisted of $290,000 of Common Stock and $210,000 of Retained Earnings. All cost-book differentials were attributed to goodwill.

During 2013, Stage earned $120,000 of net income, earned uniformly throughout the year and paid $6,000 of dividends on March 1 and another $6,000 on September 1.

-Preacquisition income for 2013 is

A)$50,000.

B)$35,000.

C)$44,000.

D)$36,000.

Bower Corporation purchased a 70% interest in Stage Corporation on June 1, 2013 at a purchase price of $350,000. On June 1, 2013, the book values of Stage's assets and liabilities were equal to fair values. On June 1, 2013, Stage's stockholders' equity consisted of $290,000 of Common Stock and $210,000 of Retained Earnings. All cost-book differentials were attributed to goodwill.

During 2013, Stage earned $120,000 of net income, earned uniformly throughout the year and paid $6,000 of dividends on March 1 and another $6,000 on September 1.

-Preacquisition income for 2013 is

A)$50,000.

B)$35,000.

C)$44,000.

D)$36,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

20

Use the following information to answer the question(s) below.

On December 31, 2013, Giant Corporation's Investment in Penguin Corporation account had a balance of $500,000. The balance consisted of 80% of Penguin's $625,000 stockholders' equity on that date. Giant owns 80% of Penguin. On January 2, 2014, Penguin increased its outstanding common stock from 15,000 to 18,000 shares.

-Assume that Penguin sold the additional 3,000 shares to outside interests for $150,000 on January 2,2014.Giant's percentage ownership immediately after the sale of additional stock would be

A)66-2/3%.

B)75%.

C)80%.

D)83-1/3%.

On December 31, 2013, Giant Corporation's Investment in Penguin Corporation account had a balance of $500,000. The balance consisted of 80% of Penguin's $625,000 stockholders' equity on that date. Giant owns 80% of Penguin. On January 2, 2014, Penguin increased its outstanding common stock from 15,000 to 18,000 shares.

-Assume that Penguin sold the additional 3,000 shares to outside interests for $150,000 on January 2,2014.Giant's percentage ownership immediately after the sale of additional stock would be

A)66-2/3%.

B)75%.

C)80%.

D)83-1/3%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

21

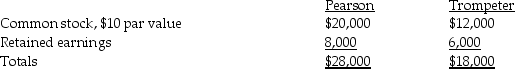

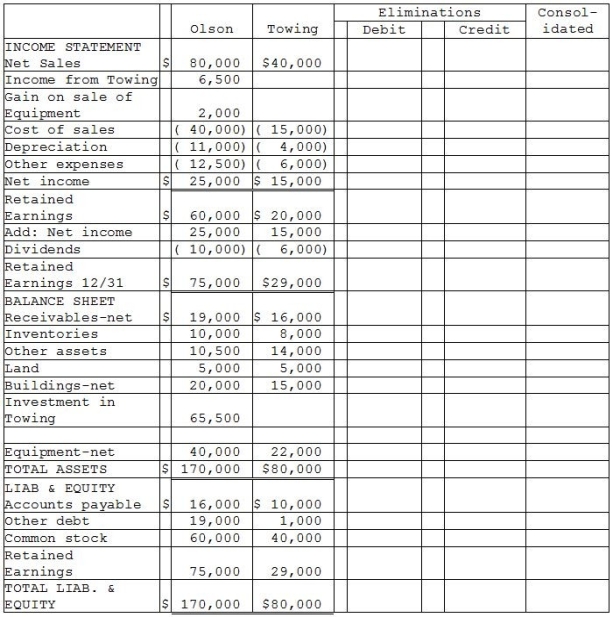

At December 31,2013,the stockholders' equity of Pearson Corporation and its 80%-owned subsidiary,Trompeter Corporation,are as follows:

Pearson's Investment in Trompeter is equal to 80 percent of Trompeter's book value.Trompeter Corporation issued 400 additional shares of common stock directly to Pearson on January 1,2014 at $10 per share.

Pearson's Investment in Trompeter is equal to 80 percent of Trompeter's book value.Trompeter Corporation issued 400 additional shares of common stock directly to Pearson on January 1,2014 at $10 per share.

Required:

1.Compute the balance in Pearson's Investment in Trompeter account on January 1,2014 after the new investment is recorded.

2.Determine the increase or decrease in goodwill from Pearson's new investment in the 400 Trompeter shares.Use four decimal places for the ownership percentage.Assume the fair value and book value of Trompeter's assets and liabilities are equal.

Pearson's Investment in Trompeter is equal to 80 percent of Trompeter's book value.Trompeter Corporation issued 400 additional shares of common stock directly to Pearson on January 1,2014 at $10 per share.

Pearson's Investment in Trompeter is equal to 80 percent of Trompeter's book value.Trompeter Corporation issued 400 additional shares of common stock directly to Pearson on January 1,2014 at $10 per share.Required:

1.Compute the balance in Pearson's Investment in Trompeter account on January 1,2014 after the new investment is recorded.

2.Determine the increase or decrease in goodwill from Pearson's new investment in the 400 Trompeter shares.Use four decimal places for the ownership percentage.Assume the fair value and book value of Trompeter's assets and liabilities are equal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

22

On September 1,2013,Nelson Corporation acquired a 90% interest in Corbin Corporation for $900,000.Corbin's stockholders' equity at January 1,2013 consisted of $200,000 of Common Stock and $600,000 of Retained Earnings.The book values of its assets and liabilities were equal to their respective fair values on this date.All excess purchase cost was attributed to goodwill.

During 2013,Corbin uniformly earned $98,000 and paid dividends of $19,000 on each of four dates: February 1,June 1,August 1,and December 1.

Required: Compute the following:

1.Implied goodwill associated with Corbin Corporation based on Nelson's purchase price on September 1,2013.

2.Nelson's income from Corbin for 2013.

3.Preacquisition income for Nelson Corporation and Subsidiary for 2013.

4.Noncontrolling interest share for 2013.

5.What is the balance in Nelson's Investment in Corbin account at December 31,2013?

During 2013,Corbin uniformly earned $98,000 and paid dividends of $19,000 on each of four dates: February 1,June 1,August 1,and December 1.

Required: Compute the following:

1.Implied goodwill associated with Corbin Corporation based on Nelson's purchase price on September 1,2013.

2.Nelson's income from Corbin for 2013.

3.Preacquisition income for Nelson Corporation and Subsidiary for 2013.

4.Noncontrolling interest share for 2013.

5.What is the balance in Nelson's Investment in Corbin account at December 31,2013?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

23

At December 31,2014 year-end,Arnold Corporation's investment in Oakes Inc.was $200,000 consisting of 80% of Oakes's $250,000 stockholders' equity on that date.On April 1,2015,Arnold sold 20% interest (one-fourth of its holdings)in Oakes for $65,000.During 2015,Oakes had net income of $75,000 (earned uniformly)and on July 1,2015,Oakes paid dividends of $40,000.Arnold uses the equity method to account for the investment.

Required:

1.What is the gain or loss on sale of the 20% interest?

2.Record the journal entries for Arnold for the year ending December 31,2015.Use the beginning-of-the-year-sale-date assumption.

Required:

1.What is the gain or loss on sale of the 20% interest?

2.Record the journal entries for Arnold for the year ending December 31,2015.Use the beginning-of-the-year-sale-date assumption.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

24

If an acquisition by a parent of a subsidiary occurs during the accounting period,adjustments must be made for the income earned by a subsidiary prior to the acquisition date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

25

On September 1,2013,Beck Corporation acquired an 80% interest in Johnsen Corporation for $700,000.Johnsen's stockholders' equity at January 1,2013 consisted of $200,000 of Common Stock and $600,000 of Retained Earnings.The book values of its assets and liabilities were equal to their respective fair values on this date.All excess purchase cost was attributed to goodwill.

During 2013,Johnsen uniformly earned $78,000 and paid dividends of $9,000 on each of four dates: February 1,June 1,August 1,and December 1.

Required: Compute the following:

1.Implied goodwill associated with Johnsen Corporation based on Beck's purchase price on September 1,2013.

2.Beck's income from Johnsen for 2013.

3.Preacquisition income for Beck Corporation and Subsidiary for 2013.

4.Noncontrolling interest share for 2013.

5.What is the balance in Beck's Investment in Johnsen account at December 31,2013?

During 2013,Johnsen uniformly earned $78,000 and paid dividends of $9,000 on each of four dates: February 1,June 1,August 1,and December 1.

Required: Compute the following:

1.Implied goodwill associated with Johnsen Corporation based on Beck's purchase price on September 1,2013.

2.Beck's income from Johnsen for 2013.

3.Preacquisition income for Beck Corporation and Subsidiary for 2013.

4.Noncontrolling interest share for 2013.

5.What is the balance in Beck's Investment in Johnsen account at December 31,2013?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

26

On December 31,2013,Pat Corporation has the following information available:

On December 31,2013,Anne Corporation buys an 80% interest in Pat Corporation for $160,000.On December 31,2013,the fair value of Pat's assets and liabilities are equal to the respective book values.Use four decimal places for the ownership percentage.

Required:

1.On January 1,2014,Pat Corporation sells 2,000 additional shares of common stock to noncontrolling stockholders at $20 per share.Prepare the journal entry for Anne Corporation on January 1,2014.

2.On January 1,2014 Pat Corporation sells 2,000 additional shares of common stock to noncontrolling stockholders at $35 per share.Prepare the journal entry for Anne Corporation on January 1,2014.

3.On January 1,2014,Pat Corporation sells 2,000 additional shares of common stock to noncontrolling stockholders at $15 per share.Prepare the journal entry for Anne Corporation on January 1,2014.

On December 31,2013,Anne Corporation buys an 80% interest in Pat Corporation for $160,000.On December 31,2013,the fair value of Pat's assets and liabilities are equal to the respective book values.Use four decimal places for the ownership percentage.

Required:

1.On January 1,2014,Pat Corporation sells 2,000 additional shares of common stock to noncontrolling stockholders at $20 per share.Prepare the journal entry for Anne Corporation on January 1,2014.

2.On January 1,2014 Pat Corporation sells 2,000 additional shares of common stock to noncontrolling stockholders at $35 per share.Prepare the journal entry for Anne Corporation on January 1,2014.

3.On January 1,2014,Pat Corporation sells 2,000 additional shares of common stock to noncontrolling stockholders at $15 per share.Prepare the journal entry for Anne Corporation on January 1,2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

27

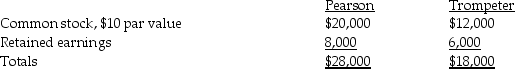

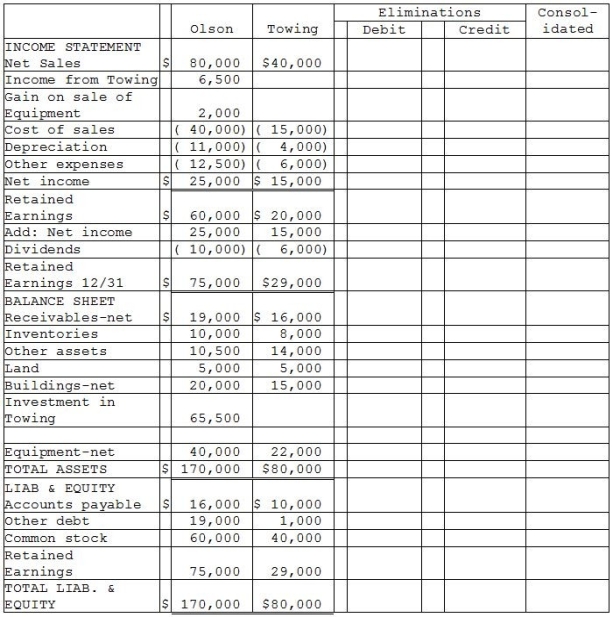

Olson Corporation paid $62,000 to acquire 100% of Towing Corporation's outstanding voting common stock at book value on May 1,2013.The stockholders' equity of Towing on January 1,2013 consisted of $40,000 Capital Stock and $20,000 Retained Earnings.Towing's total dividends for 2013 were $6,000,paid equally on April 1 and October 1.Towing's net income was earned uniformly throughout 2013.In 2013,preacquisition sales were $10,000 and preacquisition expenses were cost of sales for $5,000.(There were no other preacquisition expenses in 2013.)

During 2013,Olson made sales of $10,000 to Towing at a gross profit of $3,000.One-half of this merchandise was inventoried by Towing at year-end,and one-half of the 2011 intercompany sales were unpaid at year-end 2013.

Olson sold equipment with a ten-year remaining useful life to Towing at a $2,000 gain on December 31,2013.The straight-line depreciation method is used by both companies.The equipment has no salvage value.

Financial statements of Olson and Towing Corporations for 2013 appear in the first two columns of the partially completed consolidation working papers.

Required:

Complete the consolidating working papers for Olson Corporation and Subsidiary for the year ending December 31,2013.

During 2013,Olson made sales of $10,000 to Towing at a gross profit of $3,000.One-half of this merchandise was inventoried by Towing at year-end,and one-half of the 2011 intercompany sales were unpaid at year-end 2013.

Olson sold equipment with a ten-year remaining useful life to Towing at a $2,000 gain on December 31,2013.The straight-line depreciation method is used by both companies.The equipment has no salvage value.

Financial statements of Olson and Towing Corporations for 2013 appear in the first two columns of the partially completed consolidation working papers.

Required:

Complete the consolidating working papers for Olson Corporation and Subsidiary for the year ending December 31,2013.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

28

At December 31,2015 year-end,Lapwing Corporation's investment in Ground Inc.was $200,000 consisting of 80% of Ground's $250,000 stockholders' equity on that date.On April 1,2016,Lapwing sold 20% interest (one-fourth of its holdings)in Ground for $65,000.During 2016,Ground had net income of $75,000 (earned uniformly)and on July 1,2016,Ground paid dividends of $40,000.Lapwing uses the equity method to account for the investment.

Required:

1.What is the gain or loss on sale of the 20% interest?

2.Record the journal entries for Lapwing for the year ending December 31,2016.Use the actual-sale-date assumption.

Required:

1.What is the gain or loss on sale of the 20% interest?

2.Record the journal entries for Lapwing for the year ending December 31,2016.Use the actual-sale-date assumption.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

29

On December 31,2013,Lorna Corporation has the following information available:

On December 31,2013,Gerald Corporation buys an 80% interest in Lorna Corporation for $240,000.On December 31,2013,the fair values of Lorna's assets and liabilities are equal to the respective book values.

Required:

1.On January 1,2014,Lorna Corporation buys 500 shares of common stock from noncontrolling stockholders at $20 per share.Prepare the journal entry for Gerald Corporation on January 1,2014.Use four decimal places for the ownership percentage.

2.On January 1,2014,Lorna Corporation buys 500 shares of common stock from noncontrolling stockholders at $30 per share.Prepare the journal entry for Gerald Corporation on January 1,2014.Use four decimal places for the ownership percentage.

3.On January 1,2014,Lorna Corporation buys 500 shares of common stock from noncontrolling stockholders at $10 per share.Prepare the journal entry for Gerald Corporation on January 1,2014.Use four decimal places for the ownership percentage.

On December 31,2013,Gerald Corporation buys an 80% interest in Lorna Corporation for $240,000.On December 31,2013,the fair values of Lorna's assets and liabilities are equal to the respective book values.

Required:

1.On January 1,2014,Lorna Corporation buys 500 shares of common stock from noncontrolling stockholders at $20 per share.Prepare the journal entry for Gerald Corporation on January 1,2014.Use four decimal places for the ownership percentage.

2.On January 1,2014,Lorna Corporation buys 500 shares of common stock from noncontrolling stockholders at $30 per share.Prepare the journal entry for Gerald Corporation on January 1,2014.Use four decimal places for the ownership percentage.

3.On January 1,2014,Lorna Corporation buys 500 shares of common stock from noncontrolling stockholders at $10 per share.Prepare the journal entry for Gerald Corporation on January 1,2014.Use four decimal places for the ownership percentage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

30

On January 1,2014,Fly Corporation held a 60% interest in Liptin Corporation.The investment account balance was $2,100,000,consisting of 60% of Liptin's $3,500,000 of net assets.

During 2014,Liptin earned $300,000 uniformly and paid dividends of $110,000 on November 1.On October 1,2014,Fly sold 10% of its investment in Liptin for $364,000,thereby reducing its interest in Liptin to 54%.

Required: Compute the following using the actual sales date assumption:

1.Gain or loss on sale.

2.Income from Liptin for 2014.

3.Noncontrolling interest share for 2014.

During 2014,Liptin earned $300,000 uniformly and paid dividends of $110,000 on November 1.On October 1,2014,Fly sold 10% of its investment in Liptin for $364,000,thereby reducing its interest in Liptin to 54%.

Required: Compute the following using the actual sales date assumption:

1.Gain or loss on sale.

2.Income from Liptin for 2014.

3.Noncontrolling interest share for 2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

31

At December 31,2013,the stockholders' equity of Gost Corporation and its 80%-owned subsidiary,Tree Corporation,are as follows:

Gost's Investment in Tree is equal to 80 percent of Tree's book value.Tree Corporation issued 225 additional shares of common stock directly to Gost on January 1,2014 at $18 per share.

Required:

1.Compute the balance in Gost's Investment in Tree account on January 1,2014 after the new investment is recorded.

2.Determine the increase or decrease in goodwill from Gost's new investment in the 225 Tree shares.Use four decimal places for the ownership percentage.Assume the fair values of Tree's assets and liabilities are equal to book values.

Gost's Investment in Tree is equal to 80 percent of Tree's book value.Tree Corporation issued 225 additional shares of common stock directly to Gost on January 1,2014 at $18 per share.

Required:

1.Compute the balance in Gost's Investment in Tree account on January 1,2014 after the new investment is recorded.

2.Determine the increase or decrease in goodwill from Gost's new investment in the 225 Tree shares.Use four decimal places for the ownership percentage.Assume the fair values of Tree's assets and liabilities are equal to book values.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

32

On December 31,2013,Dixie Corporation has the following information available:

On December 31,2013,Grimsled Corporation buys an 80% interest in Dixie Corporation for $240,000.On December 31,2013,the fair values of Dixie's assets and liabilities are equal to the respective book values.

Required:

1.On January 1,2014,Dixie Corporation sells 5,000 additional shares of common stock to noncontrolling stockholders at $20 per share.Prepare the journal entry for Grimsled Corporation on January 1,2014.

2.On January 1,2014,Dixie Corporation sells 5,000 additional shares of common stock to noncontrolling stockholders at $35 per share.Prepare the journal entry for Grimsled Corporation on January 1,2014.

3.On January 1,2014,Dixie Corporation sells 5,000 additional shares of common stock to noncontrolling stockholders at $10 per share.Prepare the journal entry for Grimsled Corporation on January 1,2014.

On December 31,2013,Grimsled Corporation buys an 80% interest in Dixie Corporation for $240,000.On December 31,2013,the fair values of Dixie's assets and liabilities are equal to the respective book values.

Required:

1.On January 1,2014,Dixie Corporation sells 5,000 additional shares of common stock to noncontrolling stockholders at $20 per share.Prepare the journal entry for Grimsled Corporation on January 1,2014.

2.On January 1,2014,Dixie Corporation sells 5,000 additional shares of common stock to noncontrolling stockholders at $35 per share.Prepare the journal entry for Grimsled Corporation on January 1,2014.

3.On January 1,2014,Dixie Corporation sells 5,000 additional shares of common stock to noncontrolling stockholders at $10 per share.Prepare the journal entry for Grimsled Corporation on January 1,2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

33

On January 1,2013,Starling Corporation held an 80% interest in Twig Corporation and the investment account balance was $900,000.On January 1,2013,Twig's total stockholders' equity was $1,125,000.

During 2013,Twig uniformly earned $234,000 and paid dividends of $37,500 on April 1 and again on October 1.On August 1,2013,Starling sold 30% of its investment in Twig for $262,500,thereby reducing its interest in Twig to 56%.

Required: Compute the following using the actual sales date assumption:

1.Gain or loss on sale.

2.Income from Twig for 2013.

3.Noncontrolling interest share for 2013.

During 2013,Twig uniformly earned $234,000 and paid dividends of $37,500 on April 1 and again on October 1.On August 1,2013,Starling sold 30% of its investment in Twig for $262,500,thereby reducing its interest in Twig to 56%.

Required: Compute the following using the actual sales date assumption:

1.Gain or loss on sale.

2.Income from Twig for 2013.

3.Noncontrolling interest share for 2013.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

34

On December 31,2013,Potter Corporation has the following stockholders' equity:

On January 1,2014,Potter Corporation declared and issued a 10% stock dividend when the market price per share was $50.

On January 2,2014,Corrao Corporation purchased an 80% interest in Potter Corporation for $250,000 on the open market.On January 2,2014,the fair value of Potter's individual assets and liabilities was equal to book value.Any excess cost over book value is attributed to goodwill.

Required:

1.Prepare the journal entry(ies)for Potter Corporation on January 1,2014.

2.Prepare the journal entry(ies)for Corrao Corporation on January 2,2014.

3.Prepare the elimination entry(ies)for consolidating work papers on January 2,2014.

4.Prepare the elimination entry(ies)for consolidating work papers on January 2,2014 if the 10% stock dividend is not declared and issued on January 1,2014.

On January 1,2014,Potter Corporation declared and issued a 10% stock dividend when the market price per share was $50.

On January 2,2014,Corrao Corporation purchased an 80% interest in Potter Corporation for $250,000 on the open market.On January 2,2014,the fair value of Potter's individual assets and liabilities was equal to book value.Any excess cost over book value is attributed to goodwill.

Required:

1.Prepare the journal entry(ies)for Potter Corporation on January 1,2014.

2.Prepare the journal entry(ies)for Corrao Corporation on January 2,2014.

3.Prepare the elimination entry(ies)for consolidating work papers on January 2,2014.

4.Prepare the elimination entry(ies)for consolidating work papers on January 2,2014 if the 10% stock dividend is not declared and issued on January 1,2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

35

Preacquisition dividends are dividends paid on stock by the subsidiary before the date of acquisition by the parent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

36

At December 31,2013,the stockholders' equity of Godwin Corporation and its 80%-owned subsidiary,Goldberg Corporation,are as follows:

Godwin's Investment in Goldberg is equal to 80 percent of Goldberg's book value.Goldberg Corporation issued 225 additional shares of common stock directly to Godwin on January 1,2014 at $28 per share.

Required:

1.Compute the balance in Godwin's Investment in Goldberg account on January 1,2014 after the new investment is recorded.

2.Determine the increase or decrease in goodwill from Godwin's new investment in the 225 Goldberg shares.Use four decimal places for the ownership percentage.Assume the fair value and book value of Goldberg's assets and liabilities are equal.

Godwin's Investment in Goldberg is equal to 80 percent of Goldberg's book value.Goldberg Corporation issued 225 additional shares of common stock directly to Godwin on January 1,2014 at $28 per share.

Required:

1.Compute the balance in Godwin's Investment in Goldberg account on January 1,2014 after the new investment is recorded.

2.Determine the increase or decrease in goodwill from Godwin's new investment in the 225 Goldberg shares.Use four decimal places for the ownership percentage.Assume the fair value and book value of Goldberg's assets and liabilities are equal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

37

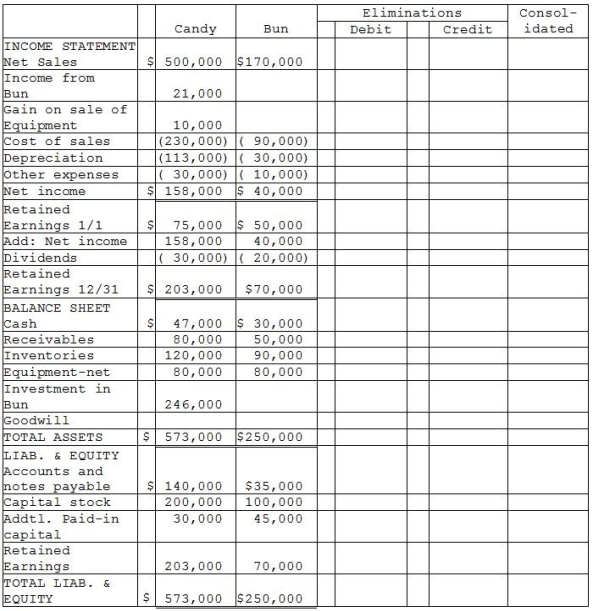

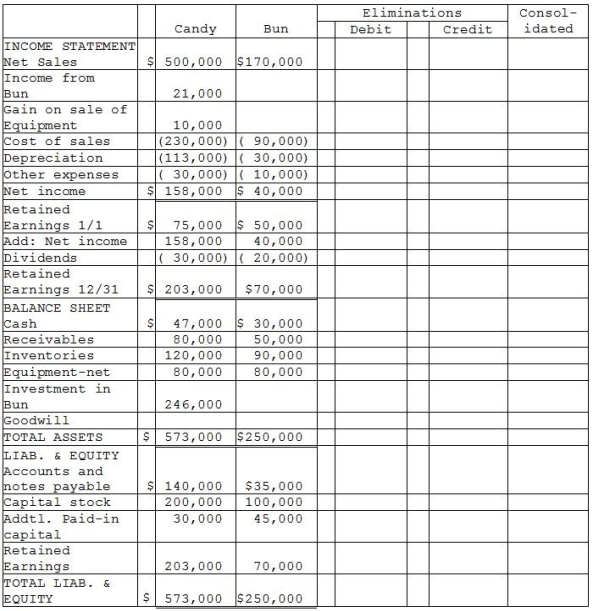

Candy Corporation paid $240,000 on April 1,2013 for all of the common stock of Bun Corporation in a business acquisition.On January 1,2013,Bun's stockholders' equity was equal to $195,000.Bun's first quarter 2013 net income was $10,000 and first quarter 2013 dividends were $5,000.In 2013,preacquisition sales were $32,500 and preacquisition cost of sales was $22,500.(There were no other preacquisition expenses in 2013.)Dividends are paid quarterly on March 31,June 30,September 30 and December 31.Any excess cost over book value acquired is allocated to goodwill.

Additional information:

1.Candy sold equipment with a 5-year remaining useful life to Bun on July 1,2013 for a gain of $10,000.Salvage value of the equipment is zero and both companies use the straight-line depreciation method.

2.Bun's accounts payable balance at December 31 includes $5,000 due to Candy from the sale of equipment.

3.Candy accounts for its investment in Bun using the equity method.

Required:

Complete the working papers to consolidate the financial statements of Candy and Bun Corporations for the year ending December 31,2013.

Additional information:

1.Candy sold equipment with a 5-year remaining useful life to Bun on July 1,2013 for a gain of $10,000.Salvage value of the equipment is zero and both companies use the straight-line depreciation method.

2.Bun's accounts payable balance at December 31 includes $5,000 due to Candy from the sale of equipment.

3.Candy accounts for its investment in Bun using the equity method.

Required:

Complete the working papers to consolidate the financial statements of Candy and Bun Corporations for the year ending December 31,2013.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

38

At January 1,2013,the stockholders' equity of Raven Corporation and its 60%-owned subsidiary,Trunk Corporation,are as follows:

Trunk's net income for 2013 was $40,000.No dividends were declared or paid in 2013.Raven's Investment in Trunk account balance on December 31,2013 was equal to its underlying equity on December 31,2013.Trunk Corporation issued 10,000 additional shares of common stock directly to Raven on January 1,2014 at $22 per share.

Required:

1.Compute the balance in Raven's Investment in Trunk account on January 1,2014 after its purchase of the additional Trunk shares.

2.Determine the increase or decrease in goodwill stemming from Raven's investment in the 10,000 Trunk shares.Assume the fair value and book value of Trunk's assets and liabilities are equal.

Trunk's net income for 2013 was $40,000.No dividends were declared or paid in 2013.Raven's Investment in Trunk account balance on December 31,2013 was equal to its underlying equity on December 31,2013.Trunk Corporation issued 10,000 additional shares of common stock directly to Raven on January 1,2014 at $22 per share.

Required:

1.Compute the balance in Raven's Investment in Trunk account on January 1,2014 after its purchase of the additional Trunk shares.

2.Determine the increase or decrease in goodwill stemming from Raven's investment in the 10,000 Trunk shares.Assume the fair value and book value of Trunk's assets and liabilities are equal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

39

On December 31,2013,Maria Corporation has the following stockholders' equity:

On January 1,2014,Maria Corporation declared and issued a 10% stock dividend when the market price per share was $50.

On January 2,2014,James Corporation purchased an 80% interest in Maria Corporation for $160,000 from the open market.On January 2,2014,the fair value of Maria's individual assets and liabilities was equal to book value.

Required:

1.Prepare the journal entry(ies)for Maria Corporation on January 1,2014.

2.Prepare the journal entry(ies)for James Corporation on January 2,2014.

3.Prepare the elimination entry(ies)for consolidating work papers on January 2,2014.

4.Prepare the elimination entry(ies)for consolidating work papers on January 2,2014 if the 10% stock dividend is not declared and issued on January 1,2014.

On January 1,2014,Maria Corporation declared and issued a 10% stock dividend when the market price per share was $50.

On January 2,2014,James Corporation purchased an 80% interest in Maria Corporation for $160,000 from the open market.On January 2,2014,the fair value of Maria's individual assets and liabilities was equal to book value.

Required:

1.Prepare the journal entry(ies)for Maria Corporation on January 1,2014.

2.Prepare the journal entry(ies)for James Corporation on January 2,2014.

3.Prepare the elimination entry(ies)for consolidating work papers on January 2,2014.

4.Prepare the elimination entry(ies)for consolidating work papers on January 2,2014 if the 10% stock dividend is not declared and issued on January 1,2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

40

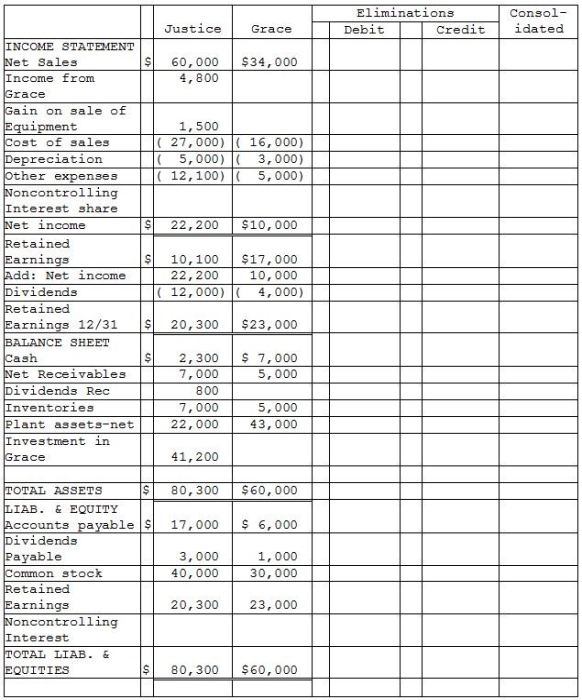

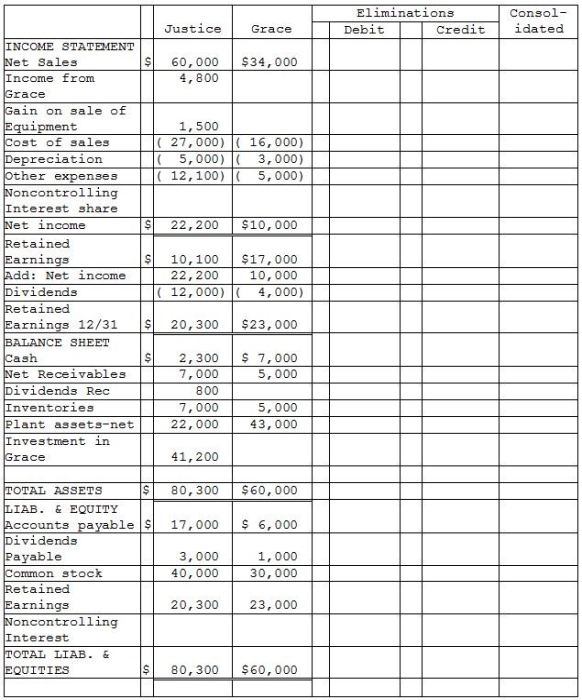

Justice Corporation paid $40,000 cash for an 80% interest in the voting common stock of Grace Corporation on July 1,2014,when Grace's stockholders' equity consisted of $30,000 of $10 par common stock and $15,000 retained earnings.The excess cost over the book value of the investment was assigned $2,000 to undervalued inventory items that were sold in 2014,with the remaining excess being assigned to goodwill.During the last half of 2014,Grace reported $4,000 net income and declared dividends of $2,000,and Justice reported income from Grace of $1,200.

There were no intercompany sales during the last half of 2014,but during 2015 Justice sold inventory items that cost $8,000 to Grace for $12,000.Half of these inventory items were included in Grace Corporation's Inventory at December 31,2015,with $1,000 unpaid by Grace at December 31,2015.

On January 5,2015,Justice sold a plant asset with a book value of $2,500 and a remaining useful life of 5 years to Grace for $4,000.Grace Corporation owned the plant asset at year-end.The plant asset has no salvage value and both companies use the straight-line depreciation method.

Justice Corporation uses the equity method to account for its investment in Grace,and the changes in Justice's Investment in Grace account from acquisition until year-end 2015 are as follows:

Required:

Complete the working papers for the year ending December 31,2015 that are given below.

There were no intercompany sales during the last half of 2014,but during 2015 Justice sold inventory items that cost $8,000 to Grace for $12,000.Half of these inventory items were included in Grace Corporation's Inventory at December 31,2015,with $1,000 unpaid by Grace at December 31,2015.

On January 5,2015,Justice sold a plant asset with a book value of $2,500 and a remaining useful life of 5 years to Grace for $4,000.Grace Corporation owned the plant asset at year-end.The plant asset has no salvage value and both companies use the straight-line depreciation method.

Justice Corporation uses the equity method to account for its investment in Grace,and the changes in Justice's Investment in Grace account from acquisition until year-end 2015 are as follows:

Required:

Complete the working papers for the year ending December 31,2015 that are given below.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

41

The GAAP requires that the parent corporation account for the effect of decreased ownership percentage as an equity transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

42

The GAAP stipulates that transactions of an investee of a capital nature that affect the investor's share of stockholders' equity of the investee should be accounted for as if the investee were a consolidated subsidiary if accounting for an equity investment under a one-line consolidation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

43

Whenever a parent ceases to have a controlling interest,the subsidiary should be deconsolidated and recorded as either an equity method or cost method investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

44

GAAP (ASC 810-10-65)states that an acquirer purchases control of the assets and assumes the liabilities of a subsidiary at a price that reflects fair values at the combination date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

45

A stock split by a subsidiary increases the number of shares outstanding,but it does not affect the net assets of the subsidiary or the individual equity accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

46

Piecemeal acquisitions occurs when a corporation acquires an interest in another corporation in a series of separate stock purchases over a period of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

47

When a parent/investor sells an ownership interest,a gain or loss is recorded where the interest sold leads to deconsolidation of a former subsidiary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

48

When a parent/investor sells an ownership interest,a gain or loss is recorded where the interest sold does not impact control by the parent company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

49

The acquisition of treasury stock by a subsidiary increases subsidiary equity and share outstanding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

50

Piecemeal acquisitions require the previously held investment to be measured at book value at the date control of the subsidiary is obtained.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck