Deck 4: Consolidated Techniques and Procedures

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/50

العب

ملء الشاشة (f)

Deck 4: Consolidated Techniques and Procedures

1

Which of the following will be debited to the Investment account when the equity method is used?

A)Investee net losses

B)Investee net profits

C)Investee declaration of dividends

D)Depreciation of excess purchase cost attributable to investee equipment

A)Investee net losses

B)Investee net profits

C)Investee declaration of dividends

D)Depreciation of excess purchase cost attributable to investee equipment

B

2

In contrast with single entity organizations,consolidated financial statements include which of the following in the calculation of cash flows from operating activities under the indirect method?

A)Cash paid to employees

B)Noncontrolling interest dividends paid

C)Noncontrolling interest share

D)Proceeds from the sale of land

A)Cash paid to employees

B)Noncontrolling interest dividends paid

C)Noncontrolling interest share

D)Proceeds from the sale of land

C

3

Use the following information to answer question(s) below.

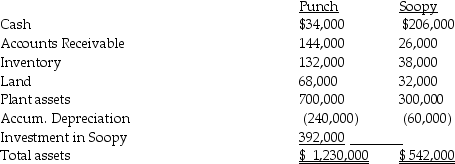

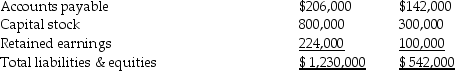

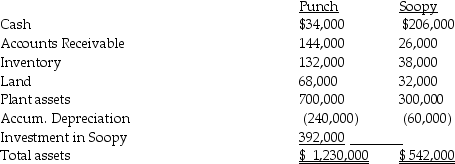

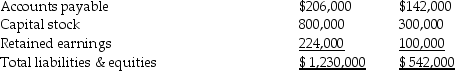

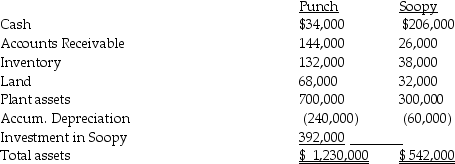

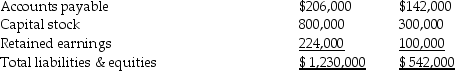

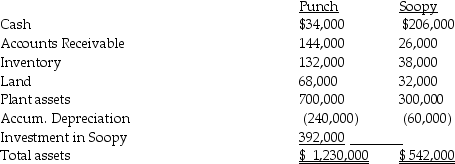

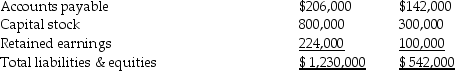

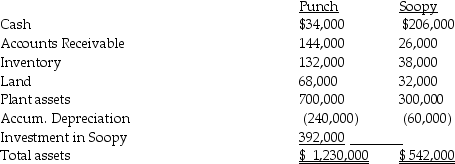

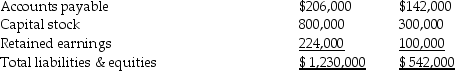

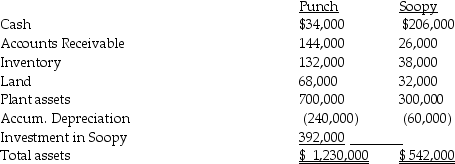

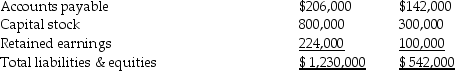

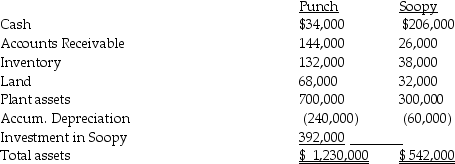

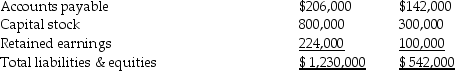

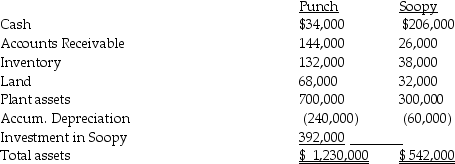

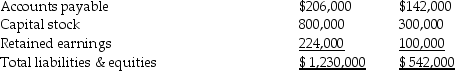

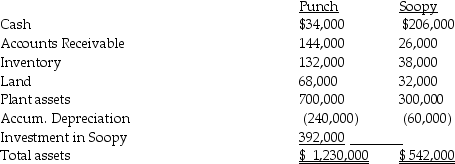

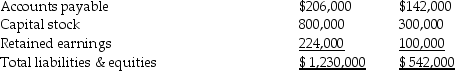

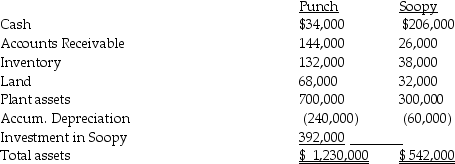

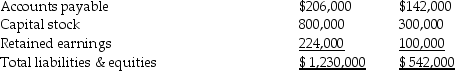

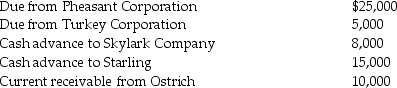

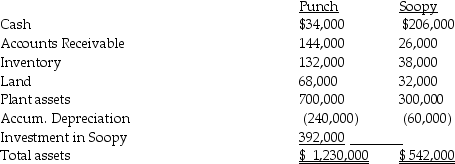

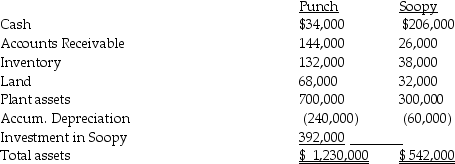

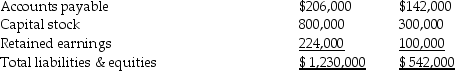

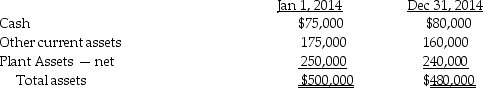

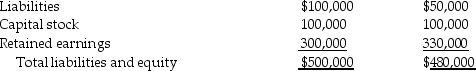

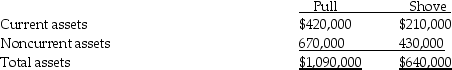

On January 1, 2014, Punch Corporation purchased 80% of the common stock of Soopy Co. Separate balance sheet data for the companies at the acquisition date (after the acquisition) are given below:

-What amount of Goodwill will be reported?

A)$54,400

B)$68,000

C)$72,000

D)$90,000

On January 1, 2014, Punch Corporation purchased 80% of the common stock of Soopy Co. Separate balance sheet data for the companies at the acquisition date (after the acquisition) are given below:

-What amount of Goodwill will be reported?

A)$54,400

B)$68,000

C)$72,000

D)$90,000

$68,000

4

Pigeon Corporation acquired an 80% interest in Statue Company on January 1,2014,for $90,000 cash when Statue had Capital Stock of $60,000 and Retained Earnings of $40,000.The fair value/book value differential of $12,500 was attributable to equipment with a 10-year (straight-line)life.Statue suffered a $10,000 net loss in 2014 and paid no dividends.At year-end 2014,Statue owed Pigeon $18,000 on account.Pigeon's separate income for 2011 was $150,000.Controlling interest share of consolidated net income for 2014 was

A)$140,000.

B)$141,000.

C)$142,000.

D)$150,000.

A)$140,000.

B)$141,000.

C)$142,000.

D)$150,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

5

Use the following information to answer question(s) below.

On January 1, 2014, Punch Corporation purchased 80% of the common stock of Soopy Co. Separate balance sheet data for the companies at the acquisition date (after the acquisition) are given below:

-What amount of total liabilities will be reported?

A)$206,000

B)$278,400

C)$319,600

D)$348,000

On January 1, 2014, Punch Corporation purchased 80% of the common stock of Soopy Co. Separate balance sheet data for the companies at the acquisition date (after the acquisition) are given below:

-What amount of total liabilities will be reported?

A)$206,000

B)$278,400

C)$319,600

D)$348,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

6

A parent company uses the equity method to account for its wholly-owned subsidiary,but has applied it incorrectly.In each of the past four full years,the company adjusted the Investment account when it received dividends from the subsidiary but did not adjust the account for any of the subsidiary's profits.The subsidiary had four years of profits and paid yearly dividends in amounts that were less than reported net incomes.Which one of the following statements is correct if the parent company discovered its mistake at the end of the fourth year,and is now preparing consolidation working papers?

A)The parent company's Retained Earnings will be increased by the cumulative total of four years of subsidiary profits.

B)The parent company's Retained Earnings will be increased by the cumulative total of the first three years of subsidiary profit,and the Subsidiary Income account will be increased by the profit for the current year.

C)The parent company's Subsidiary Income account will be increased by the cumulative total of four years of subsidiary profits.

D)A prior period adjustment must be recorded for the cumulative effect of four years of accounting errors.

A)The parent company's Retained Earnings will be increased by the cumulative total of four years of subsidiary profits.

B)The parent company's Retained Earnings will be increased by the cumulative total of the first three years of subsidiary profit,and the Subsidiary Income account will be increased by the profit for the current year.

C)The parent company's Subsidiary Income account will be increased by the cumulative total of four years of subsidiary profits.

D)A prior period adjustment must be recorded for the cumulative effect of four years of accounting errors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

7

At the beginning of 2014,Parling Food Services acquired a 90% interest in Simmons' Orchards when Simmons' book values of identifiable net assets equaled their fair values.On December 26,2014,Simmons declared dividends of $50,000,and the dividends were unpaid at year-end.Parling had not recorded the dividend receivable at December 31.A consolidated working paper entry is necessary to

A)enter $50,000 dividends receivable in the consolidated balance sheet.

B)enter $45,000 dividends receivable in the consolidated balance sheet.

C)reduce the dividends payable account by $45,000 in the consolidated balance sheet.

D)eliminate the dividend payable account from the consolidated balance sheet.

A)enter $50,000 dividends receivable in the consolidated balance sheet.

B)enter $45,000 dividends receivable in the consolidated balance sheet.

C)reduce the dividends payable account by $45,000 in the consolidated balance sheet.

D)eliminate the dividend payable account from the consolidated balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following statements is not true with respect to the statement of cash flows for a consolidated entity?

A)The statement may be prepared using either the direct or the indirect method.

B)Noncontrolling interest share will be added back to cash flows from operating activities under the indirect method.

C)Payment of dividends from the subsidiary to the parent will appear on the statement of cash flows as a financing activity.

D)If the subsidiary does not use the same method (direct or indirect)as the parent,it must convert their separate statement of cash flows first to the same method that the parent uses,and then the two statements are consolidated.

A)The statement may be prepared using either the direct or the indirect method.

B)Noncontrolling interest share will be added back to cash flows from operating activities under the indirect method.

C)Payment of dividends from the subsidiary to the parent will appear on the statement of cash flows as a financing activity.

D)If the subsidiary does not use the same method (direct or indirect)as the parent,it must convert their separate statement of cash flows first to the same method that the parent uses,and then the two statements are consolidated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

9

Use the following information to answer question(s) below.

On January 1, 2014, Punch Corporation purchased 80% of the common stock of Soopy Co. Separate balance sheet data for the companies at the acquisition date (after the acquisition) are given below:

-What amount of Inventory will be reported?

A)$170,000

B)$169,000

C)$186,500

D)$192,000

On January 1, 2014, Punch Corporation purchased 80% of the common stock of Soopy Co. Separate balance sheet data for the companies at the acquisition date (after the acquisition) are given below:

-What amount of Inventory will be reported?

A)$170,000

B)$169,000

C)$186,500

D)$192,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

10

When preparing consolidated financial statements,which of the following is a subtraction in the calculation of cash flows from operating activities under the indirect method?

A)The change in the balance sheet of the common stock account

B)Noncontrolling interest dividends paid

C)Noncontrolling interest share

D)Undistributed income of equity investees

A)The change in the balance sheet of the common stock account

B)Noncontrolling interest dividends paid

C)Noncontrolling interest share

D)Undistributed income of equity investees

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

11

When performing a consolidation,if the balance sheet does not balance,

A)that indicates that the Investment in Subsidiary account on the parent's books should not be adjusted to -0-,because there is excess value represented in the investment.

B)it is frequently because of the noncontrolling interest,as these amounts do not appear on the separate companies' general ledgers.

C)the debit and credit totals of the adjusting/eliminating columns of the consolidation working paper should be checked to confirm that they balance,and if so,then there is no need to check the individual line items.

D)the amount that it is "off" will always equal the noncontrolling interest in the current year net income of the subsidiary.

A)that indicates that the Investment in Subsidiary account on the parent's books should not be adjusted to -0-,because there is excess value represented in the investment.

B)it is frequently because of the noncontrolling interest,as these amounts do not appear on the separate companies' general ledgers.

C)the debit and credit totals of the adjusting/eliminating columns of the consolidation working paper should be checked to confirm that they balance,and if so,then there is no need to check the individual line items.

D)the amount that it is "off" will always equal the noncontrolling interest in the current year net income of the subsidiary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

12

Use the following information to answer question(s) below.

On January 1, 2014, Punch Corporation purchased 80% of the common stock of Soopy Co. Separate balance sheet data for the companies at the acquisition date (after the acquisition) are given below:

-What is the amount of consolidated Retained Earnings?

A)$224,000

B)$259,200

C)$304,000

D)$324,000

On January 1, 2014, Punch Corporation purchased 80% of the common stock of Soopy Co. Separate balance sheet data for the companies at the acquisition date (after the acquisition) are given below:

-What is the amount of consolidated Retained Earnings?

A)$224,000

B)$259,200

C)$304,000

D)$324,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

13

Use the following information to answer question(s) below.

On January 1, 2014, Punch Corporation purchased 80% of the common stock of Soopy Co. Separate balance sheet data for the companies at the acquisition date (after the acquisition) are given below:

-What is the amount of total assets?

A)$1,380,000

B)$1,402,000

C)$1,470,000

D)$1,875,000

On January 1, 2014, Punch Corporation purchased 80% of the common stock of Soopy Co. Separate balance sheet data for the companies at the acquisition date (after the acquisition) are given below:

-What is the amount of total assets?

A)$1,380,000

B)$1,402,000

C)$1,470,000

D)$1,875,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

14

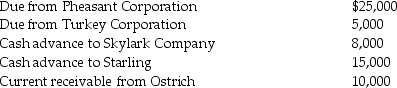

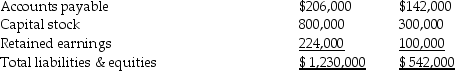

Bird Corporation has several subsidiaries that are included in its consolidated financial statements and several other investments in corporations that are not consolidated.In its year-end trial balance,the following intercompany balances appear.Ostrich Corporation is the unconsolidated company; the rest are consolidated.  What amount should Bird report as intercompany receivables on its consolidated balance sheet?

What amount should Bird report as intercompany receivables on its consolidated balance sheet?

A)$0

B)$10,000

C)$30,000

D)$63,000

What amount should Bird report as intercompany receivables on its consolidated balance sheet?

What amount should Bird report as intercompany receivables on its consolidated balance sheet?A)$0

B)$10,000

C)$30,000

D)$63,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

15

On consolidated working papers,a subsidiary's net income is

A)deducted from beginning consolidated retained earnings.

B)deducted from ending consolidated retained earnings.

C)allocated between the noncontrolling interest share and the parent's share.

D)only an entry in the parent company's general ledger.

A)deducted from beginning consolidated retained earnings.

B)deducted from ending consolidated retained earnings.

C)allocated between the noncontrolling interest share and the parent's share.

D)only an entry in the parent company's general ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

16

A parent corporation owns 55% of the outstanding voting common stock of one domestic subsidiary.The parent has control over the subsidiary.Which of the following statements is correct?

A)The parent corporation must prepare consolidated financial statements for the economic entity.

B)The parent corporation must use the fair value method.

C)The parent company may use the equity method but the subsidiary cannot be consolidated.

D)The parent company can use the equity method or the fair value/cost method.

A)The parent corporation must prepare consolidated financial statements for the economic entity.

B)The parent corporation must use the fair value method.

C)The parent company may use the equity method but the subsidiary cannot be consolidated.

D)The parent company can use the equity method or the fair value/cost method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

17

When preparing the consolidation workpaper for a company and its controlled subsidiary,which of the following would be used for the entities being consolidated?

A)Post-closing trial balances

B)Adjusted trial balances

C)Unadjusted trial balances

D)The adjusted trial balance for the parent and the unadjusted trial balance for all controlled subsidiaries

A)Post-closing trial balances

B)Adjusted trial balances

C)Unadjusted trial balances

D)The adjusted trial balance for the parent and the unadjusted trial balance for all controlled subsidiaries

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

18

Use the following information to answer question(s) below.

On January 1, 2014, Punch Corporation purchased 80% of the common stock of Soopy Co. Separate balance sheet data for the companies at the acquisition date (after the acquisition) are given below:

-What is the reported amount for the noncontrolling interest?

A)$80,000

B)$84,400

C)$98,000

D)$122,500

On January 1, 2014, Punch Corporation purchased 80% of the common stock of Soopy Co. Separate balance sheet data for the companies at the acquisition date (after the acquisition) are given below:

-What is the reported amount for the noncontrolling interest?

A)$80,000

B)$84,400

C)$98,000

D)$122,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

19

A parent company uses the equity method to account for its wholly-owned subsidiary.Which of the following will be a correct procedure for the Investment account?

A)A debit for a subsidiary loss and a credit for dividends received

B)A credit for subsidiary income and a debit for dividends received

C)A debit for subsidiary dividends received and a credit for a subsidiary loss

D)A credit for a subsidiary loss and a credit for dividends received

A)A debit for a subsidiary loss and a credit for dividends received

B)A credit for subsidiary income and a debit for dividends received

C)A debit for subsidiary dividends received and a credit for a subsidiary loss

D)A credit for a subsidiary loss and a credit for dividends received

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which one of the following will increase consolidated retained earnings?

A)An increase in the value of goodwill associated with a subsidiary subsequent to the parent's date of acquisition

B)The amortization of a $10,000 excess in the fair value of a note payable over its recorded book value

C)The depreciation of a $10,000 excess in the fair value of equipment over its recorded book value

D)The sale of inventory by a subsidiary that had a $10,000 excess in fair value over recorded book value on the parent's date of acquisition

A)An increase in the value of goodwill associated with a subsidiary subsequent to the parent's date of acquisition

B)The amortization of a $10,000 excess in the fair value of a note payable over its recorded book value

C)The depreciation of a $10,000 excess in the fair value of equipment over its recorded book value

D)The sale of inventory by a subsidiary that had a $10,000 excess in fair value over recorded book value on the parent's date of acquisition

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

21

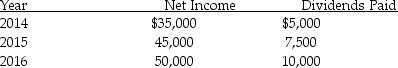

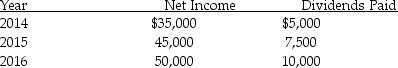

On January 1,2014,Persona Company acquired 80% of Sule Tooling for $332,000.At that time,Sule reported their Common stock at $150,000,Additional paid in capital at $45,000,and Retained earnings at $105,000.Sule also had equipment on their books that had a remaining life of 10 years and were undervalued on the books by $40,000,but any additional fair value/book value differential is assumed to be goodwill.During the next three years,Sule reported the following:

Required: Calculate the following.

Required: Calculate the following.

a.How much excess depreciation or amortization would be recognized in the consolidated financial statements in each of these three years?

b.How much goodwill would be recognized on the balance sheet at the date of acquisition,and at the end of each year listed?

c.How much investment income would be reported by Persona under the equity method for each of the three years?

d.What would be the balance in the Investment in Sule account at January 1,2014,and at the end of each of the three years listed?

Required: Calculate the following.

Required: Calculate the following.a.How much excess depreciation or amortization would be recognized in the consolidated financial statements in each of these three years?

b.How much goodwill would be recognized on the balance sheet at the date of acquisition,and at the end of each year listed?

c.How much investment income would be reported by Persona under the equity method for each of the three years?

d.What would be the balance in the Investment in Sule account at January 1,2014,and at the end of each of the three years listed?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

22

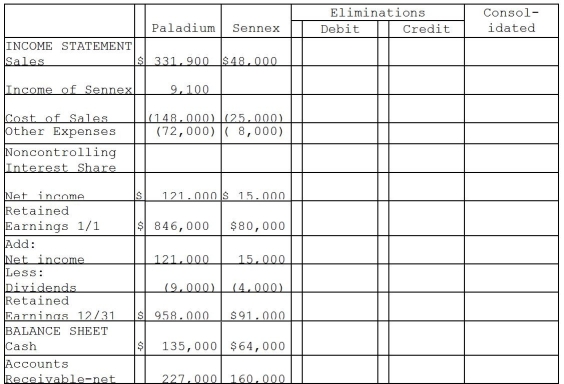

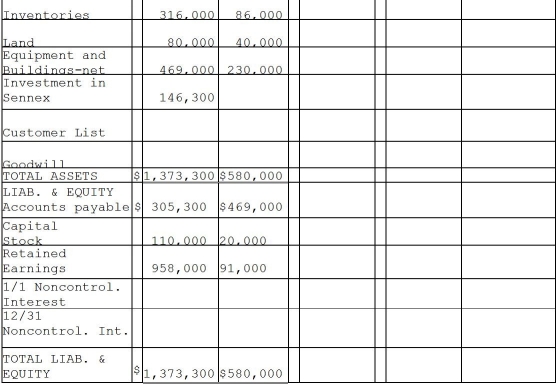

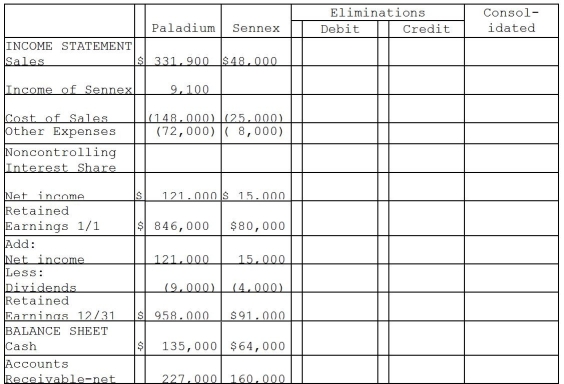

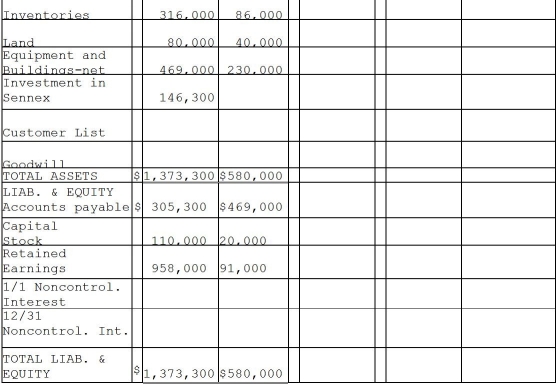

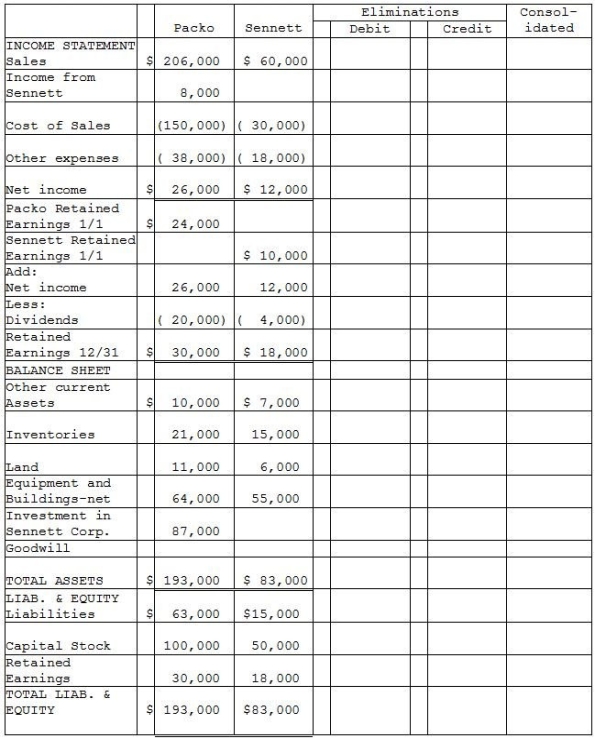

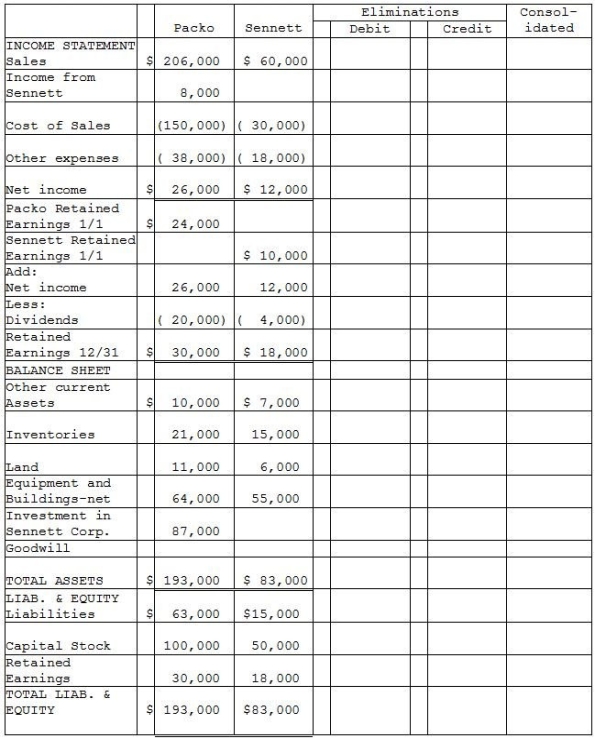

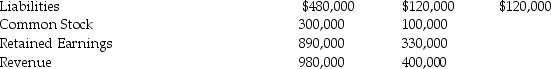

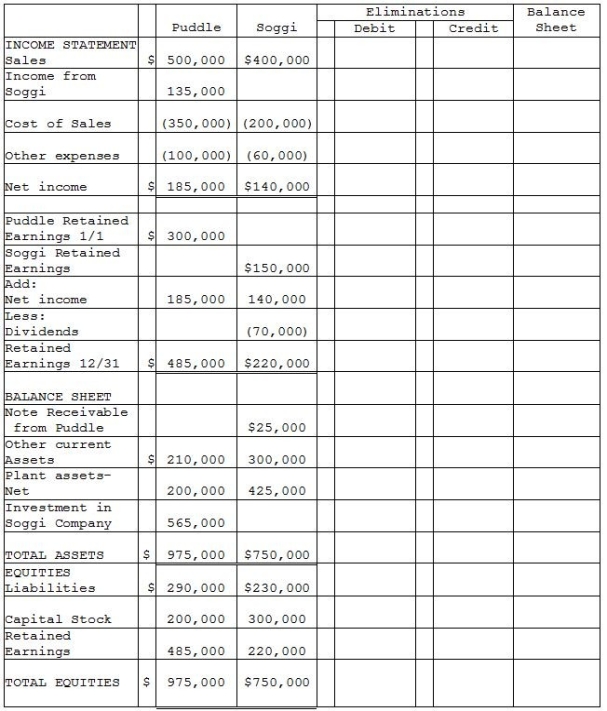

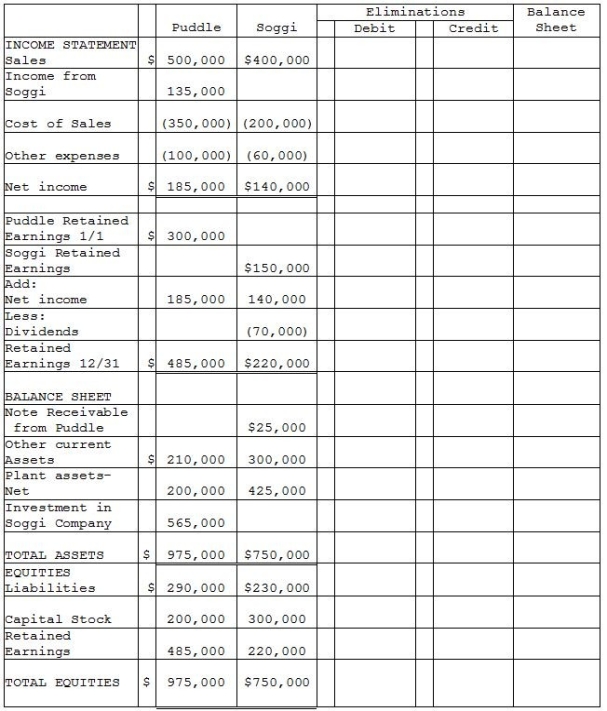

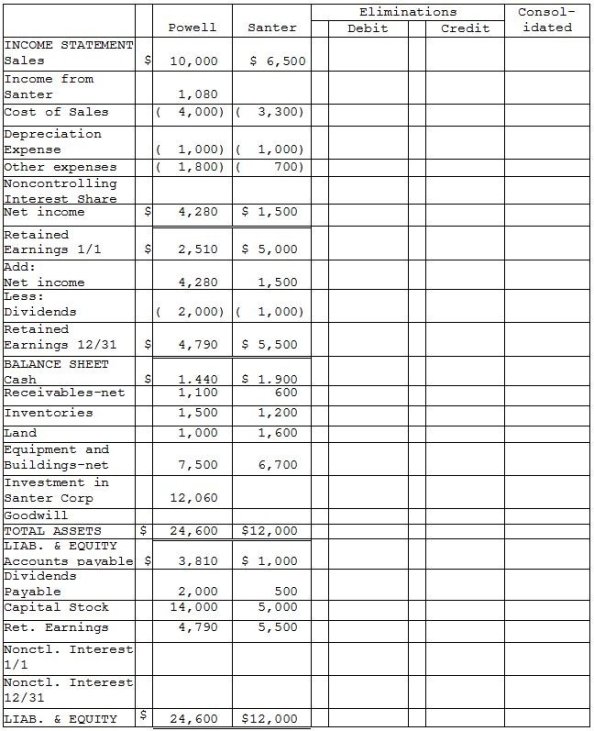

On December 31,2014,Paladium International purchased 70% of the outstanding common stock of Sennex Chemical.Paladium paid $140,000 for the shares and determined that the fair value of all recorded Sennex assets and liabilities approximated their book values,with the exception of a customer list that was not recorded and had a fair value of $10,000,and an expected remaining useful life of 5 years.At the time of purchase,Sennex had stockholders' equity consisting of capital stock amounting to $20,000 and retained earnings amounting to $80,000.Any remaining excess fair value was attributed to goodwill.The separate financial statements at December 31,2015 appear in the first two columns of the consolidation workpapers shown below.

Required:

Complete the consolidation working papers for Paladium and Sennex for the year 2015.

Required:

Complete the consolidation working papers for Paladium and Sennex for the year 2015.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

23

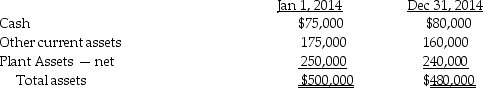

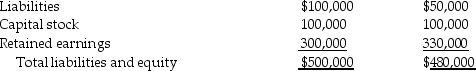

Pennack Corporation purchased 75% of the outstanding stock of Shing Corporation on January 1,2014 for $300,000 cash.At the time of the purchase,the book value and fair value of Shing's assets and liabilities were equal.Shing's balance sheet at the time of acquisition and December 31,2014 are shown below.

Shing earned $60,000 in income during the year,and paid out $30,000 in dividends.Pennack uses the equity method to account for its investment in Shing.

Shing earned $60,000 in income during the year,and paid out $30,000 in dividends.Pennack uses the equity method to account for its investment in Shing.

Requirement 1: Calculate Pennack's net income from Shing in 2014.

Requirement 2: Calculate the noncontrolling interest share in Shing's income for 2014.

Requirement 3: Calculate the balance in the Investment in Shing account reported on Pennack's separate general ledger at December 31,2014.

Requirement 4: Calculate the noncontrolling interest that will be reported on the consolidated balance sheet at December 31,2014.

Shing earned $60,000 in income during the year,and paid out $30,000 in dividends.Pennack uses the equity method to account for its investment in Shing.

Shing earned $60,000 in income during the year,and paid out $30,000 in dividends.Pennack uses the equity method to account for its investment in Shing.Requirement 1: Calculate Pennack's net income from Shing in 2014.

Requirement 2: Calculate the noncontrolling interest share in Shing's income for 2014.

Requirement 3: Calculate the balance in the Investment in Shing account reported on Pennack's separate general ledger at December 31,2014.

Requirement 4: Calculate the noncontrolling interest that will be reported on the consolidated balance sheet at December 31,2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

24

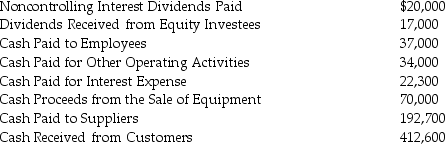

Parakeet Company has the following information collected in order to prepare a cash flow statement and uses the direct method for Cash Flow from Operations.The annual report year end is December 31,2014.

Required:

Required:

1.Prepare the Cash Flow for Operations part of the cash flow statement for Parakeet for the year ended December 31,2014.

Required:

Required:1.Prepare the Cash Flow for Operations part of the cash flow statement for Parakeet for the year ended December 31,2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

25

Under the equity method of accounting parent-retained earnings and the consolidated-retained earnings are equal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

26

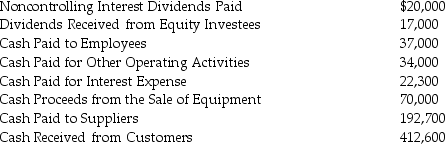

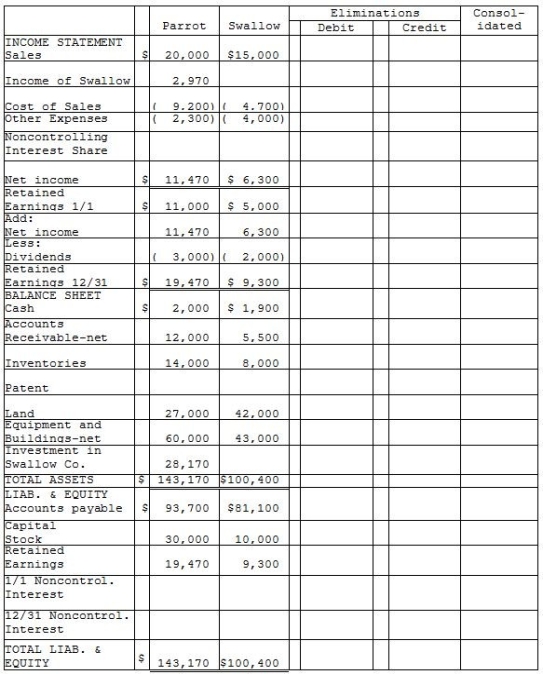

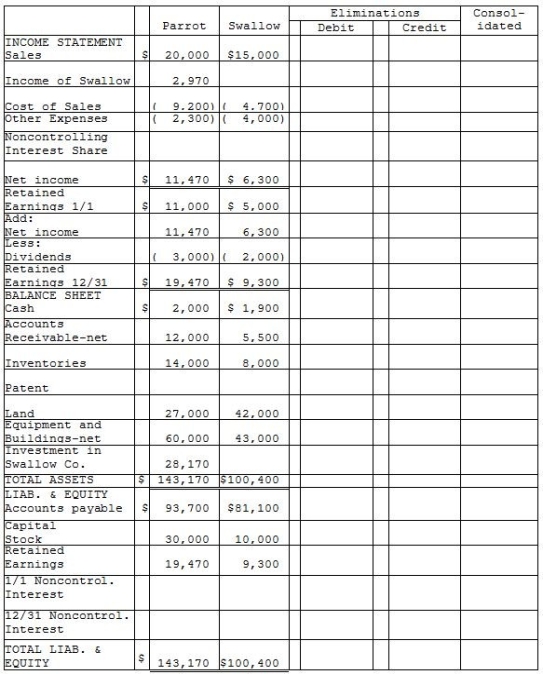

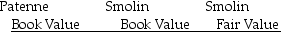

Parrot Corporation acquired 90% of Swallow Co.on January 1,2014 for $27,000 cash when Swallow's stockholders' equity consisted of $10,000 of Capital Stock and $5,000 of Retained Earnings.The difference between the fair value and book value of Swallow's net assets was allocated solely to a patent amortized over 5 years.The separate company statements for Parrot and Swallow appear in the first two columns of the partially completed consolidation working papers.

Required:

Complete the consolidation working papers for Parrot and Swallow for the year 2014.

Required:

Complete the consolidation working papers for Parrot and Swallow for the year 2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

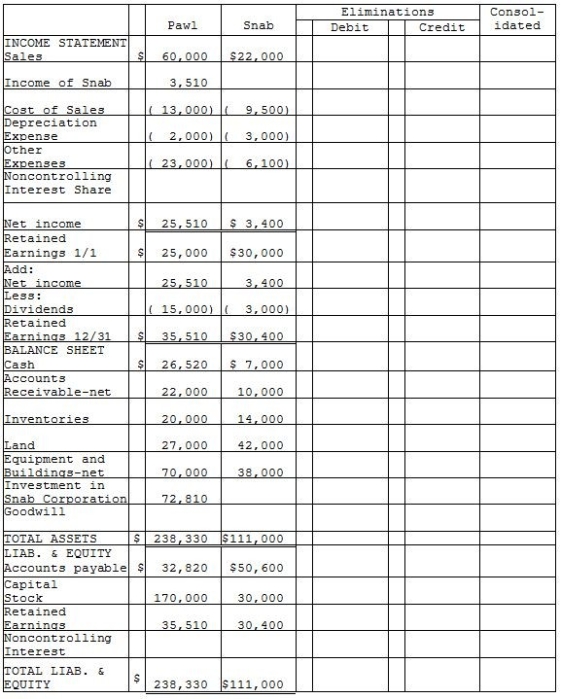

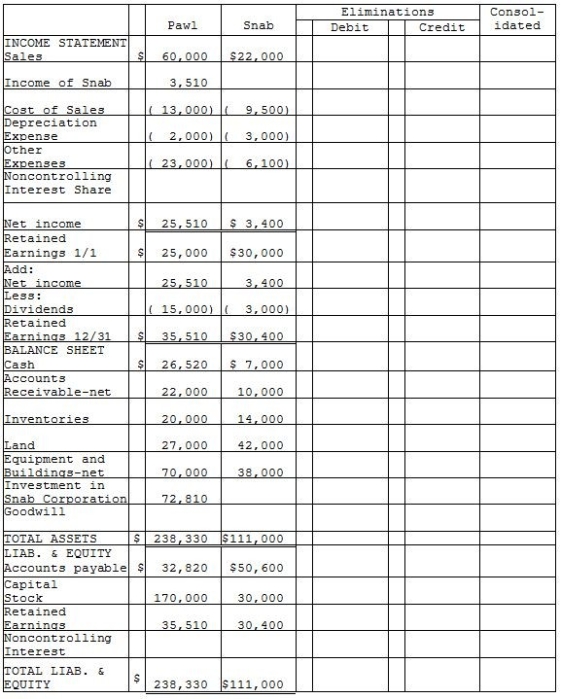

27

Pawl Corporation acquired 90% of Snab Corporation on January 1,2014 for $72,000 cash when Snab's stockholders' equity consisted of $30,000 of Capital Stock and $30,000 of Retained Earnings.The difference between the fair value of Pawl's assets and liabilities and the book value was allocated to a plant asset with a remaining 10-year straight-line life that was overvalued on the books by $5,000.The remainder was attributable to goodwill.The separate company statements for Pawl and Snab appear in the first two columns of the partially completed consolidation working papers.

Required:

Complete the consolidation working papers for Pawl and Snab for the year 2014.

Required:

Complete the consolidation working papers for Pawl and Snab for the year 2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

28

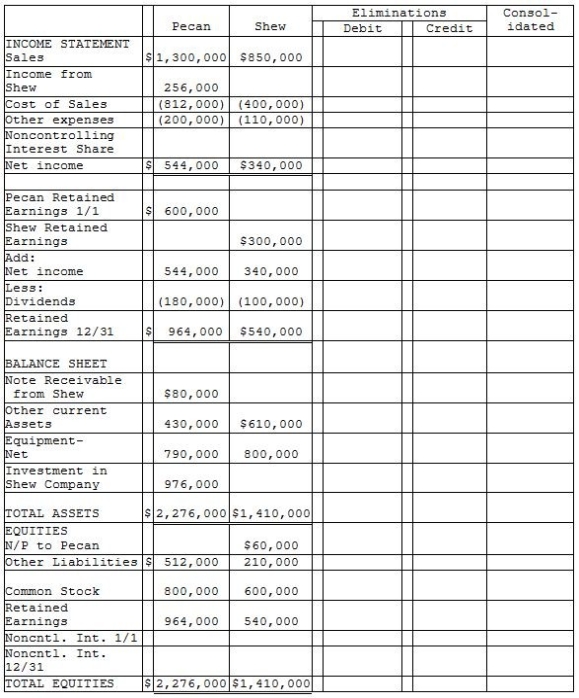

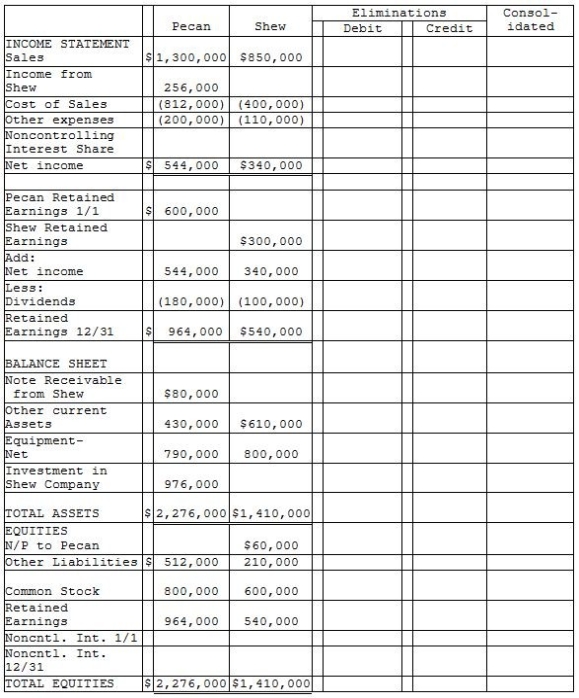

Pecan Incorporated acquired 80% of the voting stock of Shew Manufacturing for $800,000 on January 2,2014 when Shew had outstanding common stock of $600,000 and Retained Earnings of $300,000.The book value and fair value of Shew's assets and liabilities were equal except for equipment.The entire fair value/book value differential is allocated to equipment and is fully depreciated on a straight-line basis over a 5-year period.

During 2014,Shew borrowed $80,000 on a short-term non-interest-bearing note from Pecan,and on December 31,2014,Shew mailed a check for $20,000 to Pecan in partial payment of the note.Pecan deposited the check on January 4,2015,and recorded the entry to reduce the note balance at that time.

Required:

Complete the consolidation working papers for the year ended December 31,2014.

During 2014,Shew borrowed $80,000 on a short-term non-interest-bearing note from Pecan,and on December 31,2014,Shew mailed a check for $20,000 to Pecan in partial payment of the note.Pecan deposited the check on January 4,2015,and recorded the entry to reduce the note balance at that time.

Required:

Complete the consolidation working papers for the year ended December 31,2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

29

Packo Company acquired all the voting stock of Sennett Corporation on January 1,2014 for $90,000 when Sennett had Capital Stock of $50,000 and Retained Earnings of $8,000.The excess of fair value over book value was allocated as follows: (1)$5,000 to inventories (sold in 2014),(2)$16,000 to equipment with a 4-year remaining useful life (straight-line method of depreciation)and (3)the remainder to goodwill.

Financial statements for Packo and Sennett at the end of the fiscal year ended December 31,2015 (two years after acquisition),appear in the first two columns of the partially completed consolidation working papers.Packo has accounted for its investment in Sennett using the equity method of accounting.

Required:

Complete the consolidation working papers for Packo Company and Subsidiary for the year ending December 31,2015.

Financial statements for Packo and Sennett at the end of the fiscal year ended December 31,2015 (two years after acquisition),appear in the first two columns of the partially completed consolidation working papers.Packo has accounted for its investment in Sennett using the equity method of accounting.

Required:

Complete the consolidation working papers for Packo Company and Subsidiary for the year ending December 31,2015.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

30

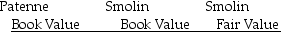

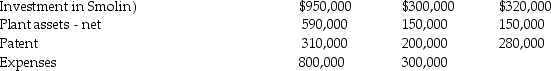

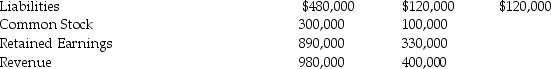

On December 31,2014,Patenne Incorporated purchased 60% of Smolin Manufacturing for $300,000.The book value and fair value of Smolin's assets and liabilities were equal with the exception of plant assets which were undervalued by $60,000 and had a remaining life of 10 years,and a patent which was undervalued by $40,000 and had a remaining life of 5 years.At December 31,2016,the companies showed the following balances on their respective adjusted trial balances:

Assets (includes

Assets (includes

Requirement 1: Calculate the balance in the Plant assets - net and the Patent accounts on the consolidated balance sheet as of December 31,2016.

Requirement 1: Calculate the balance in the Plant assets - net and the Patent accounts on the consolidated balance sheet as of December 31,2016.

Requirement 2: Calculate consolidated net income for 2016,and the amount allocated to the controlling and noncontrolling interests.

Requirement 3: Calculate the balance of the noncontrolling interest in Smolin to be reported on the consolidated balance sheet at December 31,2016.

Assets (includes

Assets (includes

Requirement 1: Calculate the balance in the Plant assets - net and the Patent accounts on the consolidated balance sheet as of December 31,2016.

Requirement 1: Calculate the balance in the Plant assets - net and the Patent accounts on the consolidated balance sheet as of December 31,2016.Requirement 2: Calculate consolidated net income for 2016,and the amount allocated to the controlling and noncontrolling interests.

Requirement 3: Calculate the balance of the noncontrolling interest in Smolin to be reported on the consolidated balance sheet at December 31,2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

31

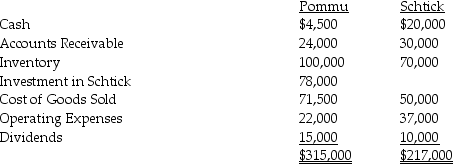

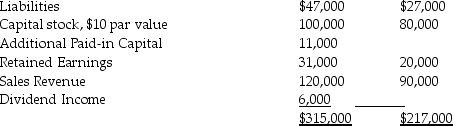

Pommu Corporation paid $78,000 for a 60% interest in Schtick Inc.on January 1,2014,when Schtick's Capital Stock was $80,000 and its Retained Earnings $20,000.The fair values of Schtick's identifiable assets and liabilities were the same as the recorded book values on the acquisition date.Trial balances at the end of the year on December 31,2014 are given below:

During 2014,Pommu made only two journal entries with respect to its investment in Schtick.On January 1,2014,it debited the Investment in Schtick account for $78,000 and on November 1,2014,it credited Dividend Income for $6,000.

During 2014,Pommu made only two journal entries with respect to its investment in Schtick.On January 1,2014,it debited the Investment in Schtick account for $78,000 and on November 1,2014,it credited Dividend Income for $6,000.

Required:

1.Prepare a consolidated income statement and a statement of retained earnings for Pommu and Subsidiary for the year ended December 31,2014.

2.Prepare a consolidated balance sheet for Pommu and Subsidiary as of December 31,2014.

During 2014,Pommu made only two journal entries with respect to its investment in Schtick.On January 1,2014,it debited the Investment in Schtick account for $78,000 and on November 1,2014,it credited Dividend Income for $6,000.

During 2014,Pommu made only two journal entries with respect to its investment in Schtick.On January 1,2014,it debited the Investment in Schtick account for $78,000 and on November 1,2014,it credited Dividend Income for $6,000.Required:

1.Prepare a consolidated income statement and a statement of retained earnings for Pommu and Subsidiary for the year ended December 31,2014.

2.Prepare a consolidated balance sheet for Pommu and Subsidiary as of December 31,2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

32

Adjustments made for consolidation statements impact both the parent and subsidiary general ledger accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

33

Puddle Corporation acquired all the voting stock of Soggi Company for $500,000 on January 1,2014 when Soggi had Capital Stock of $300,000 and Retained Earnings of $150,000.The book value of Soggi's assets and liabilities were equal to the fair value except for the plant assets.The entire cost-book value differential is allocated to plant assets and is fully depreciated on a straight-line basis over a 10-year period.

During 2014,Puddle borrowed $25,000 on a short-term non-interest-bearing note from Soggi,and on December 31,2014,Puddle mailed a check to Soggi to settle the note.Soggi deposited the check on January 5,2015,but receipt of payment of the note was not reflected in Soggi's December 31,2014 balance sheet.

Required:

Complete the consolidation working papers for the year ended December 31,2014.

During 2014,Puddle borrowed $25,000 on a short-term non-interest-bearing note from Soggi,and on December 31,2014,Puddle mailed a check to Soggi to settle the note.Soggi deposited the check on January 5,2015,but receipt of payment of the note was not reflected in Soggi's December 31,2014 balance sheet.

Required:

Complete the consolidation working papers for the year ended December 31,2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

34

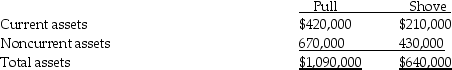

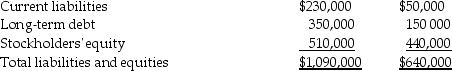

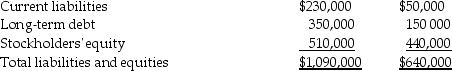

Pull Incorporated and Shove Company reported summarized balance sheets as shown below,on December 31,2014.

On January 1,2015,Pull purchased 70% of the outstanding capital stock of Shove for $392,000,of which $92,000 was paid in cash,and $300,000 was borrowed from their bank.The debt is to be repaid in 10 annual installments beginning on December 31,2015,with each payment consisting of $30,000 principal,plus accrued interest.

On January 1,2015,Pull purchased 70% of the outstanding capital stock of Shove for $392,000,of which $92,000 was paid in cash,and $300,000 was borrowed from their bank.The debt is to be repaid in 10 annual installments beginning on December 31,2015,with each payment consisting of $30,000 principal,plus accrued interest.

The excess fair value of Shove Company over the underlying book value is allocated to inventory (60 percent)and to goodwill (40 percent).

Required: Calculate the balance in each of the following accounts,on the consolidated balance sheet,immediately following the acquisition.

a.Current assets

b.Noncurrent assets

c.Current liabilities

d.Long-term debt

e.Stockholders' equity

On January 1,2015,Pull purchased 70% of the outstanding capital stock of Shove for $392,000,of which $92,000 was paid in cash,and $300,000 was borrowed from their bank.The debt is to be repaid in 10 annual installments beginning on December 31,2015,with each payment consisting of $30,000 principal,plus accrued interest.

On January 1,2015,Pull purchased 70% of the outstanding capital stock of Shove for $392,000,of which $92,000 was paid in cash,and $300,000 was borrowed from their bank.The debt is to be repaid in 10 annual installments beginning on December 31,2015,with each payment consisting of $30,000 principal,plus accrued interest.The excess fair value of Shove Company over the underlying book value is allocated to inventory (60 percent)and to goodwill (40 percent).

Required: Calculate the balance in each of the following accounts,on the consolidated balance sheet,immediately following the acquisition.

a.Current assets

b.Noncurrent assets

c.Current liabilities

d.Long-term debt

e.Stockholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

35

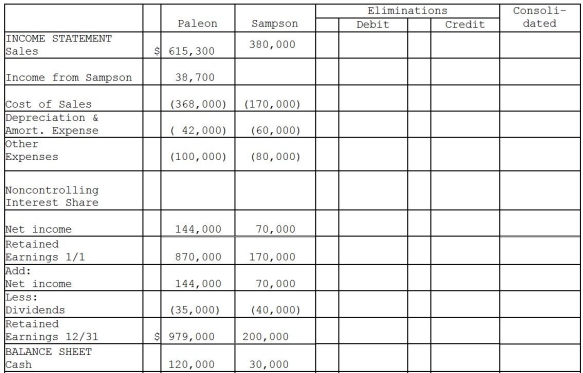

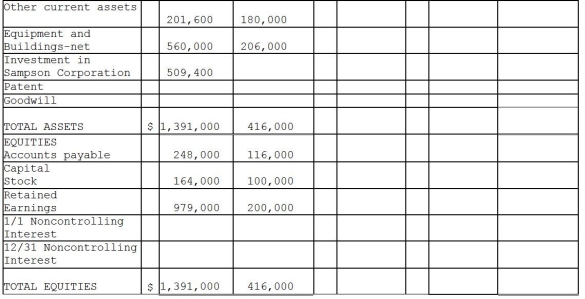

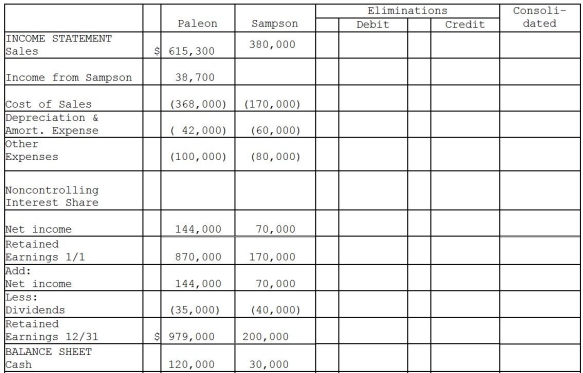

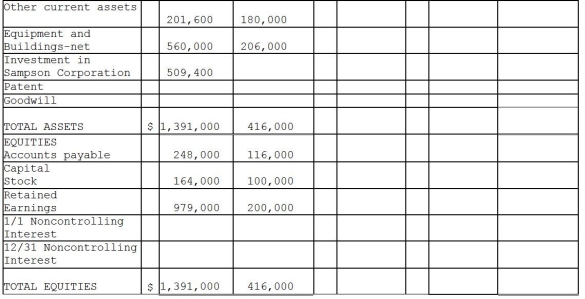

On January 2,2014,Paleon Packaging purchased 90% of the outstanding common stock of Sampson Shipping and Supplies for $513,000.Sampson's book values represented the fair values of all recorded assets and liabilities at that date,however Sampson had rights to a patent that was not recorded on their books,with an approximate fair value of $270,000,and a 10-year remaining useful life.Sampson's shareholders' equity reported on that date consisted of $100,000 in capital stock and $150,000 in retained earnings.Any remaining fair value/book value differential is assumed to be goodwill.The December 31,2015 financial statements for each of the companies are provided in the worksheet below.

Required: Complete the consolidation worksheet provided below to determine consolidated balances to be reported at December 31,2015.

Required: Complete the consolidation worksheet provided below to determine consolidated balances to be reported at December 31,2015.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

36

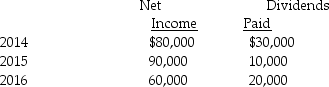

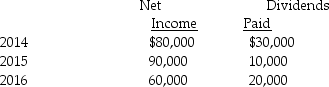

On January 1,2014,Paisley Incorporated paid $300,000 for 60% of Smarnia Company's outstanding capital stock.Smarnia reported common stock on that date of $250,000 and retained earnings of $100,000.Plant assets,which had a five-year remaining life,were undervalued in Smarnia's financial records by $10,000.Smarnia also had a patent that was not on the books,but had a market value of $60,000.The patent has a remaining useful life of 10 years.Any remaining fair value/book value differential is allocated to goodwill.Smarnia's net income and dividends paid the first three years that Paisley owned them are shown below.

Requirement 1: Calculate the noncontrolling interest share in Smarnia's income for each of the three years.

Requirement 1: Calculate the noncontrolling interest share in Smarnia's income for each of the three years.

Requirement 2: Calculate the noncontrolling interest that should be reported on the consolidated balance sheet at the end of each of the three years.

Requirement 3: Assuming that Paisley uses the equity method to record their investment in Smarnia,calculate the ending balance in the Investment in Smarnia account for each of the three years.

Requirement 1: Calculate the noncontrolling interest share in Smarnia's income for each of the three years.

Requirement 1: Calculate the noncontrolling interest share in Smarnia's income for each of the three years.Requirement 2: Calculate the noncontrolling interest that should be reported on the consolidated balance sheet at the end of each of the three years.

Requirement 3: Assuming that Paisley uses the equity method to record their investment in Smarnia,calculate the ending balance in the Investment in Smarnia account for each of the three years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

37

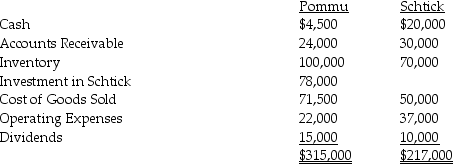

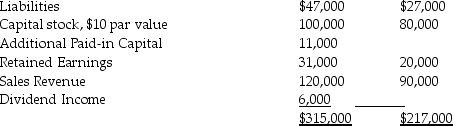

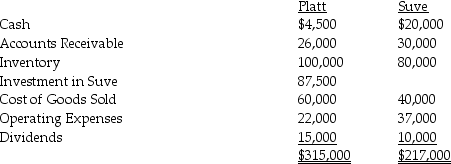

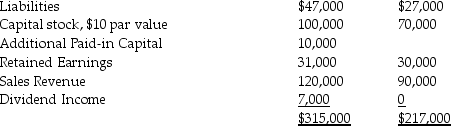

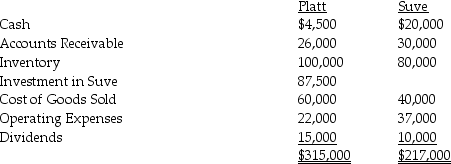

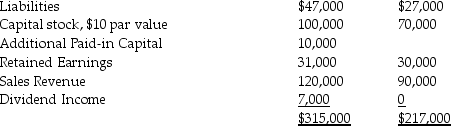

Platt Corporation paid $87,500 for a 70% interest in Suve Corporation on January 1,2014,when Suve's Capital Stock was $70,000 and its Retained Earnings $30,000.The fair values of Suve's identifiable assets and liabilities were the same as the recorded book values on the acquisition date.Trial balances at the end of the year on December 31,2014 are given below:

During 2014,Platt made only two journal entries with respect to its investment in Suve.On January 1,2014,it debited the Investment in Suve account for $87,500 and on November 1,2014,it credited Dividend Income for $7,000.

During 2014,Platt made only two journal entries with respect to its investment in Suve.On January 1,2014,it debited the Investment in Suve account for $87,500 and on November 1,2014,it credited Dividend Income for $7,000.

Required:

1.Prepare a consolidated income statement and a statement of retained earnings for Platt and Subsidiary for the year ended December 31,2014.

2.Prepare a consolidated balance sheet for Platt and Subsidiary as of December 31,2014.

During 2014,Platt made only two journal entries with respect to its investment in Suve.On January 1,2014,it debited the Investment in Suve account for $87,500 and on November 1,2014,it credited Dividend Income for $7,000.

During 2014,Platt made only two journal entries with respect to its investment in Suve.On January 1,2014,it debited the Investment in Suve account for $87,500 and on November 1,2014,it credited Dividend Income for $7,000.Required:

1.Prepare a consolidated income statement and a statement of retained earnings for Platt and Subsidiary for the year ended December 31,2014.

2.Prepare a consolidated balance sheet for Platt and Subsidiary as of December 31,2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

38

On January 2,2014,PBL Enterprises purchased 90% of Santos Incorporated outstanding common stock for $1,687,500 cash.Santos' net assets had a book value of $1,300,000 at the time.A building with a 15-year remaining life and a book value of $100,000 had a fair value of $175,000.Any other excess amount was attributed to goodwill.PBL reported net income for the first year of $350,000 (without regard for its ownership in Santos),while Santos had $175,000 in earnings.

Required:

1.Calculate the amount of goodwill related to this acquisition as reported on the consolidated balance sheet at January 2,2014.

2.Calculate the amount of consolidated net income for the year ended December 31,2014.

3.What is the amount that will be assigned to the building on the consolidated balance sheet at the date of acquisition?

Required:

1.Calculate the amount of goodwill related to this acquisition as reported on the consolidated balance sheet at January 2,2014.

2.Calculate the amount of consolidated net income for the year ended December 31,2014.

3.What is the amount that will be assigned to the building on the consolidated balance sheet at the date of acquisition?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

39

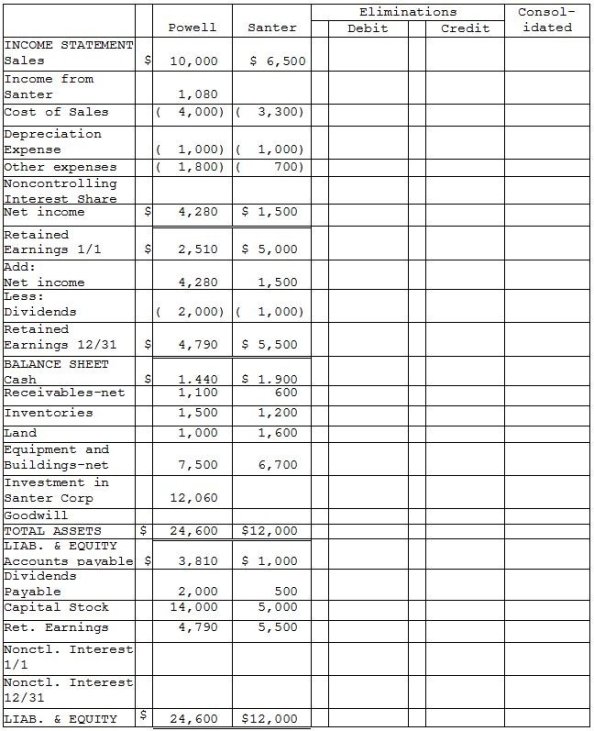

Powell Corporation acquired 90% of the voting stock of Santer Corporation on January 1,2014 for $11,700 when Santer had Capital Stock of $5,000 and Retained Earnings of $4,000.The amounts reported on the financial statements approximated fair value,with the exception of inventories,which were understated on the books by $500 and were sold in 2014,land which was undervalued by $1,000,and equipment with a remaining useful life of 5 years under the straight-line method which was undervalued by $1,500.Any remainder was assigned to goodwill.

Financial statements for Powell and Santer Corporations at the end of the fiscal year ended December 31,2015 appear in the first two columns of the partially completed consolidation working papers.Powell has accounted for its investment in Santer using the equity method of accounting.Powell Corporation owed Santer Corporation $100 on open account at the end of the year.Dividends receivable in the amount of $450 payable from Santer to Powell is included in Powell's net receivables.

Required:

Complete the consolidation working papers for Powell Corporation and Subsidiary for the year ended December 31,2015.

Financial statements for Powell and Santer Corporations at the end of the fiscal year ended December 31,2015 appear in the first two columns of the partially completed consolidation working papers.Powell has accounted for its investment in Santer using the equity method of accounting.Powell Corporation owed Santer Corporation $100 on open account at the end of the year.Dividends receivable in the amount of $450 payable from Santer to Powell is included in Powell's net receivables.

Required:

Complete the consolidation working papers for Powell Corporation and Subsidiary for the year ended December 31,2015.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

40

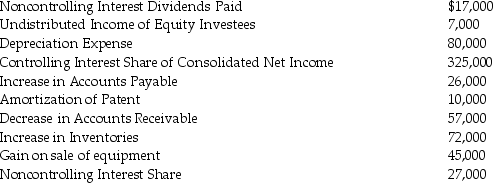

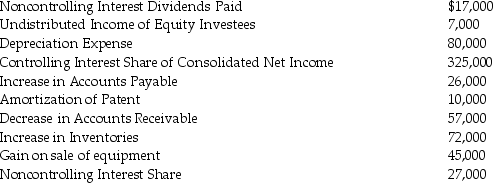

Flagship Company has the following information collected in order to prepare a cash flow statement and uses the indirect method for Cash Flow from Operations.The annual report year end is December 31,2014.

Required:

Required:

1.Prepare the Cash Flow for Operations part of the cash flow statement for Flagship for the year ended December 31,2014.

Required:

Required:1.Prepare the Cash Flow for Operations part of the cash flow statement for Flagship for the year ended December 31,2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

41

Proceeds from the sale of land are presented in the operating activities on the consolidated cash flow statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

42

The GAAP only authorizes the use of the indirect method for preparation of the consolidated cash flow statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

43

The portion of a subsidiary's net income not accruing to the parent can be referred to as noncontrolling interest share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

44

The entry to record the receipt of intercompany note receivable includes a credit to Note Receivable - Subsidiary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

45

The trial balance approach to consolidation workpapers brings together the adjusted trial balances for affiliated companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

46

In the cost method of acquisition income is recognized only when the subsidiary declares dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

47

The depreciation on buildings is presented under investing activities on the consolidated cash flow statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

48

In the consolidated balance sheet,the GAAP requires that the amount of goodwill be shown as a separate balance sheet item even if it is immaterial.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

49

The consolidated cash flow statement is prepared from the consolidated income statement and consolidated balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

50

The direct method of the consolidated cash flow statement begins with the controlling share of consolidated net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck