Deck 1: Business Combinations

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/46

العب

ملء الشاشة (f)

Deck 1: Business Combinations

1

In a business combination,which of the following will occur?

A)All identifiable assets and liabilities are recorded at fair value at the date of acquisition.

B)All identifiable assets and liabilities are recorded at book value at the date of acquisition.

C)Goodwill is recorded if the fair value of the net assets acquired exceeds the book value of the net assets acquired.

D)The Sarbanes-Oxley Act requires firms to report material aggregate amounts of goodwill as a separate balance sheet line item.

A)All identifiable assets and liabilities are recorded at fair value at the date of acquisition.

B)All identifiable assets and liabilities are recorded at book value at the date of acquisition.

C)Goodwill is recorded if the fair value of the net assets acquired exceeds the book value of the net assets acquired.

D)The Sarbanes-Oxley Act requires firms to report material aggregate amounts of goodwill as a separate balance sheet line item.

A

2

Pepper Company paid $2,500,000 for the net assets of Salt Corporation and Salt was then dissolved.Salt had no liabilities.The fair values of Salt's assets were $3,750,000.Salt's only non-current assets were land and buildings with book values of $100,000 and $520,000,respectively,and fair values of $180,000 and $730,000,respectively.At what value will the buildings be recorded by Pepper?

A)$730,000

B)$520,000

C)$210,000

D)$0

A)$730,000

B)$520,000

C)$210,000

D)$0

A

3

A business merger differs from a business consolidation because

A)a merger dissolves all but one of the prior entities,but a consolidation dissolves all of the prior entities and forms a new corporation.

B)a consolidation dissolves all but one of the prior entities,but a merger dissolves all of the prior entities.

C)a merger is created when two entities join,but a consolidation is created when more than two entities join.

D)a consolidation is created when two entities join,but a merger is created when more than two entities join.

A)a merger dissolves all but one of the prior entities,but a consolidation dissolves all of the prior entities and forms a new corporation.

B)a consolidation dissolves all but one of the prior entities,but a merger dissolves all of the prior entities.

C)a merger is created when two entities join,but a consolidation is created when more than two entities join.

D)a consolidation is created when two entities join,but a merger is created when more than two entities join.

A

4

Which of the following methods does the FASB consider the best indicator of fair values in the evaluation of goodwill impairment?

A)Senior executive's estimates

B)Financial analyst forecasts

C)Fair value

D)The present value of future cash flows discounted at the firm's cost of capital

A)Senior executive's estimates

B)Financial analyst forecasts

C)Fair value

D)The present value of future cash flows discounted at the firm's cost of capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following is not a reason for a company to expand through a combination,rather than by building new facilities?

A)A combination might provide cost advantages.

B)A combination might provide fewer operating delays.

C)A combination might provide easier access to intangible assets.

D)A combination might provide an opportunity to invest in a company without having to take responsibility for its financial results.

A)A combination might provide cost advantages.

B)A combination might provide fewer operating delays.

C)A combination might provide easier access to intangible assets.

D)A combination might provide an opportunity to invest in a company without having to take responsibility for its financial results.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

6

Use the following information to answer the question(s) below.

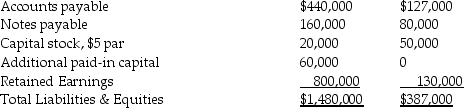

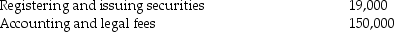

Polka Corporation exchanges 100,000 shares of newly issued $1 par value common stock with a fair market value of $20 per share for all of the outstanding $5 par value common stock of Spot Inc. and Spot is then dissolved. Polka paid the following costs and expenses related to the business combination:

-In the business combination of Polka and Spot

A)the costs of registering and issuing the securities are included as part of the purchase price for Spot.

B)the salaries of Polka's employees assigned to the merger are treated as expenses.

C)all of the costs except those of registering and issuing the securities are included in the purchase price of Spot.

D)only the accounting and legal fees are included in the purchase price of Spot.

Polka Corporation exchanges 100,000 shares of newly issued $1 par value common stock with a fair market value of $20 per share for all of the outstanding $5 par value common stock of Spot Inc. and Spot is then dissolved. Polka paid the following costs and expenses related to the business combination:

-In the business combination of Polka and Spot

A)the costs of registering and issuing the securities are included as part of the purchase price for Spot.

B)the salaries of Polka's employees assigned to the merger are treated as expenses.

C)all of the costs except those of registering and issuing the securities are included in the purchase price of Spot.

D)only the accounting and legal fees are included in the purchase price of Spot.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

7

Pitch Co.paid $50,000 in fees to its accountants and lawyers in acquiring Slope Company.Pitch will treat the $50,000 as

A)an expense for the current year.

B)a prior period adjustment to retained earnings.

C)additional cost to investment of Slope on the consolidated balance sheet.

D)a reduction in additional paid-in capital.

A)an expense for the current year.

B)a prior period adjustment to retained earnings.

C)additional cost to investment of Slope on the consolidated balance sheet.

D)a reduction in additional paid-in capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

8

Under the current GAAP,Goodwill arising from a business combination is

A)charged to Retained Earnings after the acquisition is completed.

B)amortized over 40 years or its useful life,whichever is longer.

C)amortized over 40 years or its useful life,whichever is shorter.

D)never amortized.

A)charged to Retained Earnings after the acquisition is completed.

B)amortized over 40 years or its useful life,whichever is longer.

C)amortized over 40 years or its useful life,whichever is shorter.

D)never amortized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

9

Historically,much of the controversy concerning accounting requirements for business combinations involved the ________ method.

A)purchase

B)pooling of interests

C)equity

D)acquisition

A)purchase

B)pooling of interests

C)equity

D)acquisition

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

10

Picasso Co.issued 5,000 shares of its $1 par common stock,valued at $100,000,to acquire shares of Seurat Company in an all-stock transaction.Picasso paid the investment bankers $35,000 and will treat the investment banker fee as

A)an expense for the current year.

B)a prior period adjustment to Retained Earnings.

C)additional goodwill on the consolidated balance sheet.

D)a reduction to additional paid-in capital.

A)an expense for the current year.

B)a prior period adjustment to Retained Earnings.

C)additional goodwill on the consolidated balance sheet.

D)a reduction to additional paid-in capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

11

In reference to the FASB disclosure requirements about a business combination in the period in which the combination occurs,which of the following is correct?

A)Firms are not required to disclose the name of the acquired company.

B)Firms are not required to disclose the business purpose for a combination.

C)Firms are required to disclose the nature,terms and fair value of consideration transferred in a business combination.

D)Firms are not required to disclose the details about step acquisitions.

A)Firms are not required to disclose the name of the acquired company.

B)Firms are not required to disclose the business purpose for a combination.

C)Firms are required to disclose the nature,terms and fair value of consideration transferred in a business combination.

D)Firms are not required to disclose the details about step acquisitions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

12

Following the accounting concept of a business combination,a business combination occurs when a company acquires an equity interest in another entity and has

A)at least 20% ownership in the entity.

B)more than 50% ownership in the entity.

C)100% ownership in the entity.

D)control over the entity,irrespective of the percentage owned.

A)at least 20% ownership in the entity.

B)more than 50% ownership in the entity.

C)100% ownership in the entity.

D)control over the entity,irrespective of the percentage owned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

13

According to ASC 810-10,liabilities assumed in an acquisition will be valued at the ________.

A)fair value

B)historical book value

C)current replacement cost

D)present value using market interest rates

A)fair value

B)historical book value

C)current replacement cost

D)present value using market interest rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

14

When considering an acquisition,which of the following is NOT a method by which one company may gain control of another company?

A)Purchase of the majority of outstanding voting stock of the acquired company.

B)Purchase of all assets and liabilities of another company.

C)Purchase of all the outstanding voting stock of the acquired company.

D)Purchase of 25% of outstanding voting stock of the acquired company.

A)Purchase of the majority of outstanding voting stock of the acquired company.

B)Purchase of all assets and liabilities of another company.

C)Purchase of all the outstanding voting stock of the acquired company.

D)Purchase of 25% of outstanding voting stock of the acquired company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

15

Use the following information to answer the question(s) below.

Polka Corporation exchanges 100,000 shares of newly issued $1 par value common stock with a fair market value of $20 per share for all of the outstanding $5 par value common stock of Spot Inc. and Spot is then dissolved. Polka paid the following costs and expenses related to the business combination:

-In the business combination of Polka and Spot,

A)all of the items listed above are treated as expenses.

B)all of the items listed above except the cost of registering and issuing the securities are included in the purchase price.

C)the costs of registering and issuing the securities are deducted from the fair market value of the common stock used to acquire Spot.

D)only the costs of closing duplicate facilities,the salaries of Polka's employees assigned to the merger,and the costs of the shareholders' meeting would be treated as expenses.

Polka Corporation exchanges 100,000 shares of newly issued $1 par value common stock with a fair market value of $20 per share for all of the outstanding $5 par value common stock of Spot Inc. and Spot is then dissolved. Polka paid the following costs and expenses related to the business combination:

-In the business combination of Polka and Spot,

A)all of the items listed above are treated as expenses.

B)all of the items listed above except the cost of registering and issuing the securities are included in the purchase price.

C)the costs of registering and issuing the securities are deducted from the fair market value of the common stock used to acquire Spot.

D)only the costs of closing duplicate facilities,the salaries of Polka's employees assigned to the merger,and the costs of the shareholders' meeting would be treated as expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

16

In reference to international accounting for goodwill,U.S.companies have complained that past U.S.accounting rules for goodwill placed them at a disadvantage in competing against foreign companies for merger partners.Why?

A)Previous rules required immediate write off of goodwill which resulted in a one-time expense that was not required under international rules.

B)Previous rules required amortization of goodwill which resulted in an ongoing expense that was not required under international rules.

C)Previous rules did not permit the recording of goodwill,thus resulting in a lower asset base than international counterparts would recognize.

D)Previous rules required the immediate write of goodwill to stockholder's equity.

A)Previous rules required immediate write off of goodwill which resulted in a one-time expense that was not required under international rules.

B)Previous rules required amortization of goodwill which resulted in an ongoing expense that was not required under international rules.

C)Previous rules did not permit the recording of goodwill,thus resulting in a lower asset base than international counterparts would recognize.

D)Previous rules required the immediate write of goodwill to stockholder's equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

17

According to ASC 805-30,which one of the following items may not be accounted for as an intangible asset apart from goodwill?

A)A production backlog

B)A valuable employee workforce

C)Noncontractual customer relationships

D)Employment contracts

A)A production backlog

B)A valuable employee workforce

C)Noncontractual customer relationships

D)Employment contracts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

18

With respect to goodwill,an impairment

A)will be amortized over the remaining useful life.

B)is a two-step process which first compares book value to fair value at the business reporting unit level.

C)is a one-step process considering the entire firm.

D)occurs when asset values are adjusted to fair value in a purchase.

A)will be amortized over the remaining useful life.

B)is a two-step process which first compares book value to fair value at the business reporting unit level.

C)is a one-step process considering the entire firm.

D)occurs when asset values are adjusted to fair value in a purchase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

19

Durer Inc.acquired Sea Corporation in a business combination and Sea Corp.went out of existence.Sea Corp.developed a patent listed as an asset on Sea Corp.'s books at the patent office filing cost.In recording the combination,

A)fair value is not assigned to the patent because the research and development costs have been expensed by Sea Corp.

B)Sea Corp.'s prior expenses to develop the patent are recorded as an asset by Durer at purchase.

C)the patent is recorded as an asset at fair market value.

D)the patent's market value increases goodwill.

A)fair value is not assigned to the patent because the research and development costs have been expensed by Sea Corp.

B)Sea Corp.'s prior expenses to develop the patent are recorded as an asset by Durer at purchase.

C)the patent is recorded as an asset at fair market value.

D)the patent's market value increases goodwill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

20

Under the provisions of ASC 805-30,in a business combination,when the investment cost exceeds the total fair value of identifiable net assets acquired,which of the following statements is correct?

A)The excess is first assigned to identifiable net assets according to their fair values; then the rest is assigned to goodwill.

B)The difference is allocated first to reduce proportionately (according to market value)non-current assets,then to non-monetary current assets,and any negative remainder is classified as a deferred credit.

C)The difference is allocated first to reduce proportionately (according to market value)non-current assets,and any negative remainder is classified as an extraordinary gain.

D)The difference is allocated first to reduce proportionately (according to market value)non-current,depreciable assets to zero,and any negative remainder is classified as a deferred credit.

A)The excess is first assigned to identifiable net assets according to their fair values; then the rest is assigned to goodwill.

B)The difference is allocated first to reduce proportionately (according to market value)non-current assets,then to non-monetary current assets,and any negative remainder is classified as a deferred credit.

C)The difference is allocated first to reduce proportionately (according to market value)non-current assets,and any negative remainder is classified as an extraordinary gain.

D)The difference is allocated first to reduce proportionately (according to market value)non-current,depreciable assets to zero,and any negative remainder is classified as a deferred credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

21

It is frequently more expensive for a firm to obtain needed facilities through combination than through development.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

22

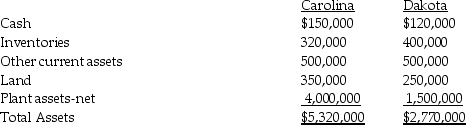

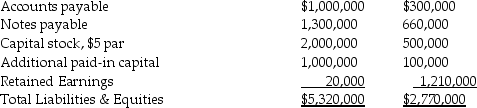

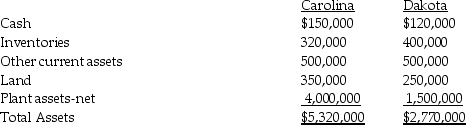

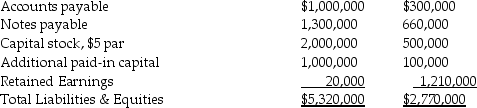

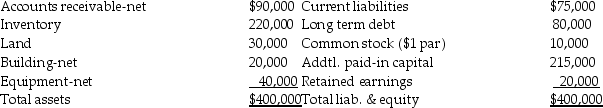

On January 2,2013 Carolina Clothing issued 100,000 new shares of its $5 par value common stock valued at $19 a share for all of Dakota Dressing Company's outstanding common shares in an acquisition.Carolina paid $15,000 for registering and issuing securities and $10,000 for other direct costs of the business combination.The fair value and book value of Dakota's identifiable assets and liabilities were the same.Assume Dakota Company is dissolved on the date of the acquisition.Summarized balance sheet information for both companies just before the acquisition on January 2,2013 is as follows:

Required:

Required:

Prepare a balance sheet for Carolina Clothing immediately after the business combination.

Required:

Required:Prepare a balance sheet for Carolina Clothing immediately after the business combination.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

23

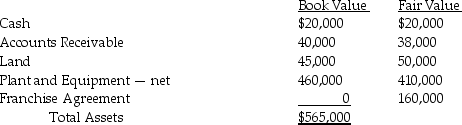

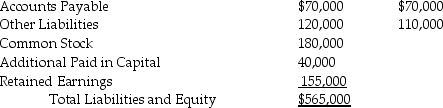

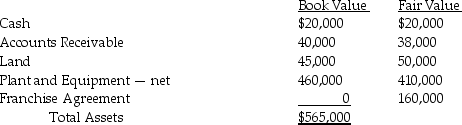

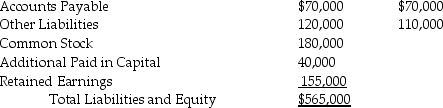

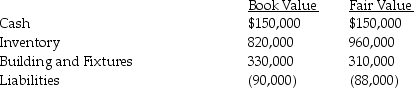

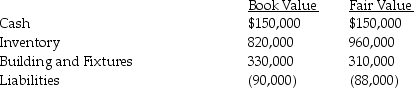

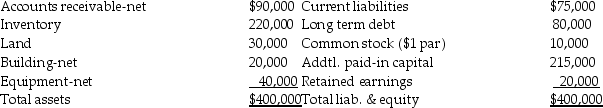

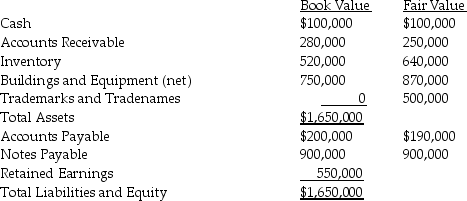

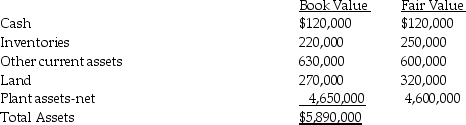

Pony acquired Spur Corporation's assets and liabilities for $500,000 cash on December 31,2013.Spur dissolved on the date of the acquisition.Spur's balance sheet and related fair values are shown as of that date,below.

Required: Prepare the journal entry recorded by Pony as a result of this transaction.

Required: Prepare the journal entry recorded by Pony as a result of this transaction.

Required: Prepare the journal entry recorded by Pony as a result of this transaction.

Required: Prepare the journal entry recorded by Pony as a result of this transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

24

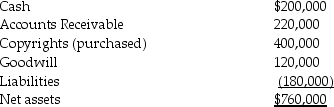

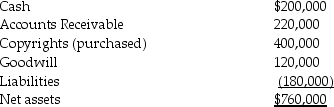

Samantha's Sporting Goods had net assets consisting of the following:

Pedic Incorporated purchased Samantha's Sporting Goods,and immediately dissolved Samantha's as a separate legal entity.

Pedic Incorporated purchased Samantha's Sporting Goods,and immediately dissolved Samantha's as a separate legal entity.

Requirement 1: If Samantha's was purchased for $1,000,000 cash,prepare the entry recorded by Pedic.

Requirement 2: If Samantha's was purchased for $1,500,000 cash,prepare the entry recorded by Pedic.

Pedic Incorporated purchased Samantha's Sporting Goods,and immediately dissolved Samantha's as a separate legal entity.

Pedic Incorporated purchased Samantha's Sporting Goods,and immediately dissolved Samantha's as a separate legal entity.Requirement 1: If Samantha's was purchased for $1,000,000 cash,prepare the entry recorded by Pedic.

Requirement 2: If Samantha's was purchased for $1,500,000 cash,prepare the entry recorded by Pedic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

25

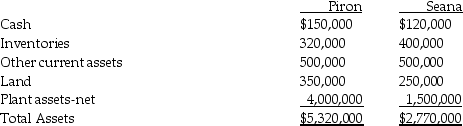

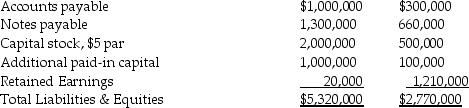

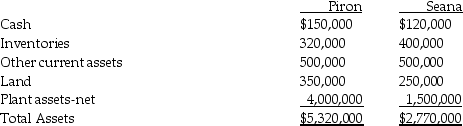

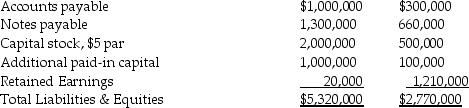

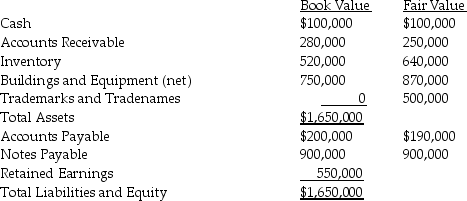

On January 2,2013 Piron Corporation issued 100,000 new shares of its $5 par value common stock valued at $19 a share for all of Seana Corporation's outstanding common shares.Piron paid $15,000 to register and issue shares.Piron also paid $20,000 for the direct combination costs of the accountants.The fair value and book value of Seana's identifiable assets and liabilities were the same.Summarized balance sheet information for both companies just before the acquisition on January 2,2013 is as follows:

Required:

Required:

1.Prepare Piron's general journal entry for the acquisition of Seana,assuming that Seana survives as a separate legal entity.

2.Prepare Piron's general journal entry for the acquisition of Seana,assuming that Seana will dissolve as a separate legal entity.

Required:

Required:1.Prepare Piron's general journal entry for the acquisition of Seana,assuming that Seana survives as a separate legal entity.

2.Prepare Piron's general journal entry for the acquisition of Seana,assuming that Seana will dissolve as a separate legal entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

26

The U.S.Department of Justice and the Federal Trade Commission have primary responsibility for enforcing federal antitrust laws.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

27

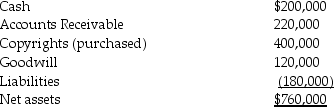

On January 2,2013,Pilates Inc.paid $700,000 for all of the outstanding common stock of Spinning Company,and dissolved Spinning Company.The carrying values for Spinning Company's assets and liabilities are recorded below.

On January 2,2013,Spinning anticipated collecting $185,000 of the recorded Accounts Receivable.Pilates entered into the acquisition because Spinning had Copyrights that Pilates wished to own,and also unrecorded patents with a fair value of $100,000.

On January 2,2013,Spinning anticipated collecting $185,000 of the recorded Accounts Receivable.Pilates entered into the acquisition because Spinning had Copyrights that Pilates wished to own,and also unrecorded patents with a fair value of $100,000.

Required:

Calculate the amount of goodwill that will be recorded on Pilate's balance sheet as of the date of acquisition.Then record the journal entry Pilates would record on their books to record the acquisition.

On January 2,2013,Spinning anticipated collecting $185,000 of the recorded Accounts Receivable.Pilates entered into the acquisition because Spinning had Copyrights that Pilates wished to own,and also unrecorded patents with a fair value of $100,000.

On January 2,2013,Spinning anticipated collecting $185,000 of the recorded Accounts Receivable.Pilates entered into the acquisition because Spinning had Copyrights that Pilates wished to own,and also unrecorded patents with a fair value of $100,000.Required:

Calculate the amount of goodwill that will be recorded on Pilate's balance sheet as of the date of acquisition.Then record the journal entry Pilates would record on their books to record the acquisition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

28

Bigga Corporation purchased the net assets of Petit,Inc.on January 2,2013 for $380,000 cash and also paid $15,000 in direct acquisition costs.Petit,Inc.was dissolved on the date of the acquisition.Petit's balance sheet on January 2,2013 was as follows:

Fair values agree with book values except for inventory,land,and equipment,which have fair values of $260,000,$35,000 and $35,000,respectively.Petit has patent rights with a fair value of $20,000.

Fair values agree with book values except for inventory,land,and equipment,which have fair values of $260,000,$35,000 and $35,000,respectively.Petit has patent rights with a fair value of $20,000.

Required:

Prepare Bigga's general journal entry for the cash purchase of Petit's net assets.

Fair values agree with book values except for inventory,land,and equipment,which have fair values of $260,000,$35,000 and $35,000,respectively.Petit has patent rights with a fair value of $20,000.

Fair values agree with book values except for inventory,land,and equipment,which have fair values of $260,000,$35,000 and $35,000,respectively.Petit has patent rights with a fair value of $20,000.Required:

Prepare Bigga's general journal entry for the cash purchase of Petit's net assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

29

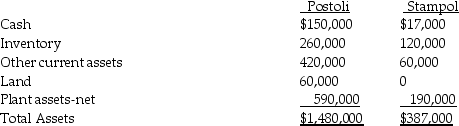

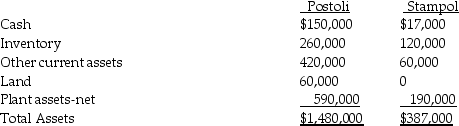

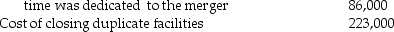

On June 30,2013,Stampol Company ceased operations and all of their assets and liabilities were purchased by Postoli Incorporated.Postoli paid $40,000 in cash to the owner of Stampol,and signed a five-year note payable to the owners of Stampol in the amount of $200,000.Their closing balance sheets as of June 30,2013 are shown below.In the purchase agreement,both parties noted that Inventory was undervalued on the books by $10,000,and Pistoli would also take possession of a customer list with a fair value of $18,000.Pistoli paid all legal costs of the acquisition,which amounted to $7,000.

Required:

Required:

1.Prepare the journal entry Postoli would record at the date of acquisition.

2.Prepare the journal entry Stampol would record at the date of acquisition.

Required:

Required:1.Prepare the journal entry Postoli would record at the date of acquisition.

2.Prepare the journal entry Stampol would record at the date of acquisition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

30

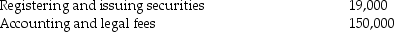

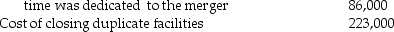

Pali Corporation exchanges 200,000 shares of newly issued $10 par value common stock with a fair market value of $40 per share for all the outstanding $5 par value common stock of Shingle Incorporated,which continues on as a legal entity.Fair value approximated book value for all assets and liabilities of Shingle.Pali paid the following costs and expenses related to the business combination:

Salaries of Pali's employees whose

Salaries of Pali's employees whose

Required: Prepare the journal entries relating to the above acquisition and payments incurred by Pali,assuming all costs were paid in cash.

Required: Prepare the journal entries relating to the above acquisition and payments incurred by Pali,assuming all costs were paid in cash.

Salaries of Pali's employees whose

Salaries of Pali's employees whose Required: Prepare the journal entries relating to the above acquisition and payments incurred by Pali,assuming all costs were paid in cash.

Required: Prepare the journal entries relating to the above acquisition and payments incurred by Pali,assuming all costs were paid in cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

31

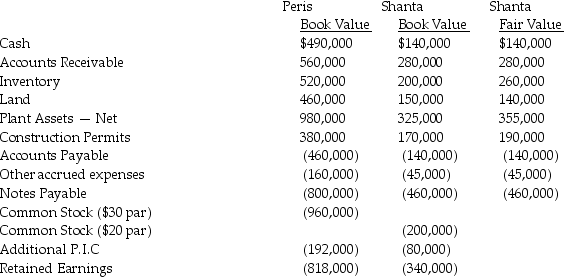

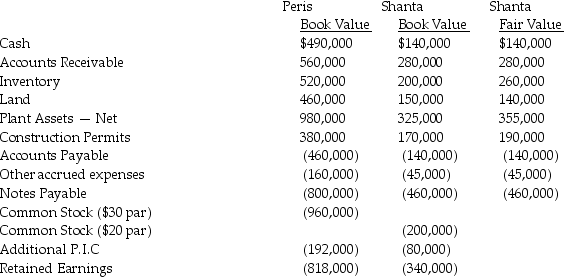

On December 31,2013,Peris Company acquired Shanta Company's outstanding stock by paying $400,000 cash and issuing 10,000 shares of its own $30 par value common stock,when the market price was $32 per share.Peris paid legal and accounting fees amounting to $35,000 in addition to stock issuance costs of $8,000.Shanta is dissolved on the date of the acquisition.Balance sheet information for Peris and Shanta immediately preceding the acquisition is shown below,including fair values for Shanta's assets and liabilities.

Required: Determine the consolidated balances which Peris would present on their consolidated balance sheet for the following accounts.

Required: Determine the consolidated balances which Peris would present on their consolidated balance sheet for the following accounts.

Cash

Inventory

Construction Permits

Goodwill

Notes Payable

Common Stock

Additional Paid in Capital

Retained Earnings

Required: Determine the consolidated balances which Peris would present on their consolidated balance sheet for the following accounts.

Required: Determine the consolidated balances which Peris would present on their consolidated balance sheet for the following accounts.Cash

Inventory

Construction Permits

Goodwill

Notes Payable

Common Stock

Additional Paid in Capital

Retained Earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

32

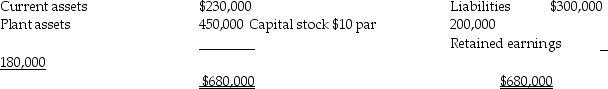

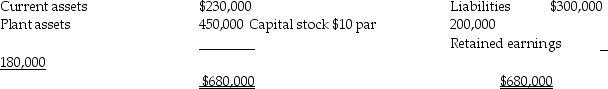

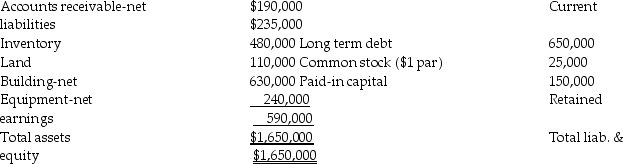

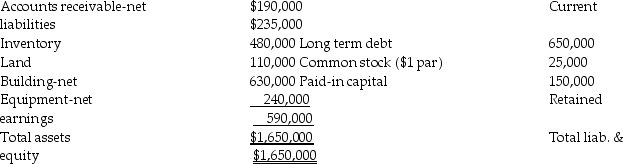

Balance sheet information for Sphinx Company at January 1,2013,is summarized as follows:

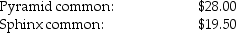

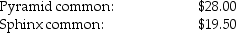

Sphinx's assets and liabilities are fairly valued except for plant assets that are undervalued by $50,000.On January 2,2013,Pyramid Corporation issues 20,000 shares of its $10 par value common stock for all of Sphinx's net assets and Sphinx is dissolved.Market quotations for the two stocks on this date are:

Sphinx's assets and liabilities are fairly valued except for plant assets that are undervalued by $50,000.On January 2,2013,Pyramid Corporation issues 20,000 shares of its $10 par value common stock for all of Sphinx's net assets and Sphinx is dissolved.Market quotations for the two stocks on this date are:

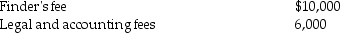

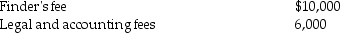

Pyramid pays the following fees and costs in connection with the combination:

Pyramid pays the following fees and costs in connection with the combination:

Required:

Required:

1.Calculate Pyramid's investment cost of Sphinx Corporation.

2.Calculate any goodwill from the business combination.

Sphinx's assets and liabilities are fairly valued except for plant assets that are undervalued by $50,000.On January 2,2013,Pyramid Corporation issues 20,000 shares of its $10 par value common stock for all of Sphinx's net assets and Sphinx is dissolved.Market quotations for the two stocks on this date are:

Sphinx's assets and liabilities are fairly valued except for plant assets that are undervalued by $50,000.On January 2,2013,Pyramid Corporation issues 20,000 shares of its $10 par value common stock for all of Sphinx's net assets and Sphinx is dissolved.Market quotations for the two stocks on this date are: Pyramid pays the following fees and costs in connection with the combination:

Pyramid pays the following fees and costs in connection with the combination: Required:

Required:1.Calculate Pyramid's investment cost of Sphinx Corporation.

2.Calculate any goodwill from the business combination.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

33

Saveed Corporation purchased the net assets of Penny Inc.on January 2,2013 for $1,690,000 cash and also paid $15,000 in direct acquisition costs.Penny dissolved as of the date of the acquisition.Penny's balance sheet on January 2,2013 was as follows:

Fair values agree with book values except for inventory,land,and equipment,which have fair values of $640,000,$140,000 and $230,000,respectively.Penny has customer contracts valued at $20,000.

Fair values agree with book values except for inventory,land,and equipment,which have fair values of $640,000,$140,000 and $230,000,respectively.Penny has customer contracts valued at $20,000.

Required:

Prepare Saveed's general journal entry for the cash purchase of Penny's net assets.

Fair values agree with book values except for inventory,land,and equipment,which have fair values of $640,000,$140,000 and $230,000,respectively.Penny has customer contracts valued at $20,000.

Fair values agree with book values except for inventory,land,and equipment,which have fair values of $640,000,$140,000 and $230,000,respectively.Penny has customer contracts valued at $20,000.Required:

Prepare Saveed's general journal entry for the cash purchase of Penny's net assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

34

On December 31,2013,Pandora Incorporated issued 40,000 shares of its $20 par common stock for all the outstanding shares of the Sophocles Company.In addition,Pandora agreed to pay the owners of Sophocles an additional $200,000 if a specific contract achieved the profit levels that were targeted by the owners of Sophocles in their sale agreement.The fair value of this amount,with an agreed likelihood of occurrence and discounted to present value,is $160,000.In addition,Pandora paid $10,000 in stock issue costs,$40,000 in legal fees,and $48,000 to employees who were dedicated to this acquisition for the last three months of the year.Summarized balance sheet and fair value information for Sophocles immediately prior to the acquisition follows.

Required:

Required:

1.Prepare Pandora's general journal entry for the acquisition of Sophocles assuming that Pandora's stock was trading at $35 at the date of acquisition and Sophocles dissolves as a separate legal entity.

2.Prepare Pandora's general journal entry for the acquisition of Sophocles assuming that Pandora's stock was trading at $35 at the date of acquisition and Sophocles continues as a separate legal entity.

3.Prepare Pandora's general journal entry for the acquisition of Sophocles assuming that Pandora's stock was trading at $25 at the date of acquisition and Sophocles dissolves as a separate legal entity.

4.Prepare Pandora's general journal entry for the acquisition of Sophocles assuming that Pandora's stock was trading at $25 at the date of acquisition and Sophocles survives as a separate legal entity.

Required:

Required:1.Prepare Pandora's general journal entry for the acquisition of Sophocles assuming that Pandora's stock was trading at $35 at the date of acquisition and Sophocles dissolves as a separate legal entity.

2.Prepare Pandora's general journal entry for the acquisition of Sophocles assuming that Pandora's stock was trading at $35 at the date of acquisition and Sophocles continues as a separate legal entity.

3.Prepare Pandora's general journal entry for the acquisition of Sophocles assuming that Pandora's stock was trading at $25 at the date of acquisition and Sophocles dissolves as a separate legal entity.

4.Prepare Pandora's general journal entry for the acquisition of Sophocles assuming that Pandora's stock was trading at $25 at the date of acquisition and Sophocles survives as a separate legal entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

35

Parrot Incorporated purchased the assets and liabilities of Sparrow Company at the close of business on December 31,2013.Parrot borrowed $2,000,000 to complete this transaction,in addition to the $640,000 cash that they paid directly.The fair value and book value of Sparrow's recorded assets and liabilities as of the date of acquisition are listed below.In addition,Sparrow had a patent that had a fair value of $50,000.

Required:

Required:

1.Prepare Parrot's general journal entry for the acquisition of Sparrow,assuming that Sparrow survives as a separate legal entity.

2.Prepare Parrot's general journal entry for the acquisition of Sparrow,assuming that Sparrow will dissolve as a separate legal entity.

Required:

Required:1.Prepare Parrot's general journal entry for the acquisition of Sparrow,assuming that Sparrow survives as a separate legal entity.

2.Prepare Parrot's general journal entry for the acquisition of Sparrow,assuming that Sparrow will dissolve as a separate legal entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

36

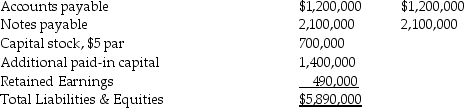

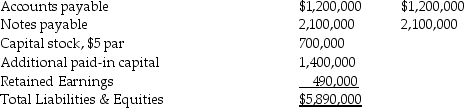

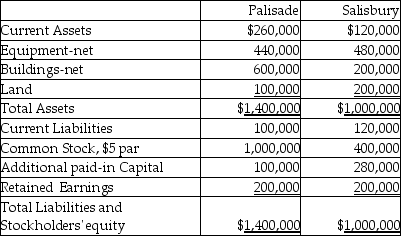

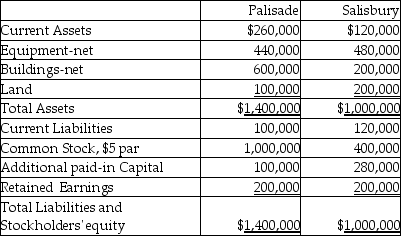

The balance sheets of Palisade Company and Salisbury Corporation were as follows on December 31,2013:

On January 1,2014 Palisade issued 30,000 of its shares with a market value of $40 per share in exchange for all of Salisbury's shares,and Salisbury was dissolved.Palisade paid $20,000 to register and issue the new common shares.It cost Palisade $50,000 in direct combination costs.Book values equal market values except that Salisbury's land is worth $250,000.

On January 1,2014 Palisade issued 30,000 of its shares with a market value of $40 per share in exchange for all of Salisbury's shares,and Salisbury was dissolved.Palisade paid $20,000 to register and issue the new common shares.It cost Palisade $50,000 in direct combination costs.Book values equal market values except that Salisbury's land is worth $250,000.

Required:

Prepare a Palisade balance sheet after the business combination on January 1,2014.

On January 1,2014 Palisade issued 30,000 of its shares with a market value of $40 per share in exchange for all of Salisbury's shares,and Salisbury was dissolved.Palisade paid $20,000 to register and issue the new common shares.It cost Palisade $50,000 in direct combination costs.Book values equal market values except that Salisbury's land is worth $250,000.

On January 1,2014 Palisade issued 30,000 of its shares with a market value of $40 per share in exchange for all of Salisbury's shares,and Salisbury was dissolved.Palisade paid $20,000 to register and issue the new common shares.It cost Palisade $50,000 in direct combination costs.Book values equal market values except that Salisbury's land is worth $250,000.Required:

Prepare a Palisade balance sheet after the business combination on January 1,2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

37

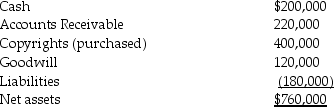

On January 2,2013,Pilates Inc.paid $900,000 for all of the outstanding common stock of Spinning Company,and dissolved Spinning Company.The carrying values for Spinning Company's assets and liabilities are recorded below.

On January 2,2013,Spinning anticipated collecting $185,000 of the recorded Accounts Receivable.Pilates entered into the acquisition because Spinning had Copyrights that Pilates wished to own,and also unrecorded patents with a fair value of $100,000.

On January 2,2013,Spinning anticipated collecting $185,000 of the recorded Accounts Receivable.Pilates entered into the acquisition because Spinning had Copyrights that Pilates wished to own,and also unrecorded patents with a fair value of $100,000.

Required:

Calculate the amount of goodwill that will be reported on Pilate's balance sheet as of the date of acquisition.

On January 2,2013,Spinning anticipated collecting $185,000 of the recorded Accounts Receivable.Pilates entered into the acquisition because Spinning had Copyrights that Pilates wished to own,and also unrecorded patents with a fair value of $100,000.

On January 2,2013,Spinning anticipated collecting $185,000 of the recorded Accounts Receivable.Pilates entered into the acquisition because Spinning had Copyrights that Pilates wished to own,and also unrecorded patents with a fair value of $100,000.Required:

Calculate the amount of goodwill that will be reported on Pilate's balance sheet as of the date of acquisition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

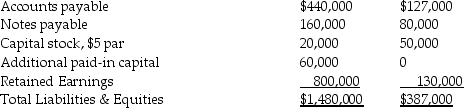

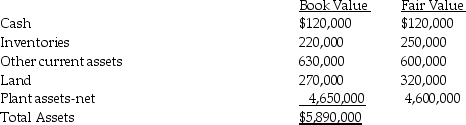

38

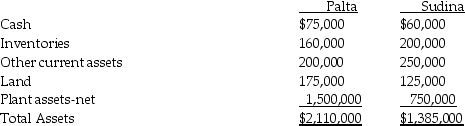

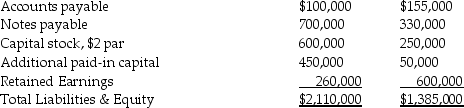

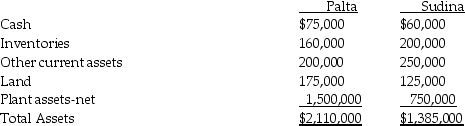

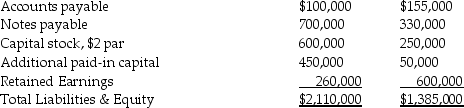

On January 2,2013 Palta Company issued 80,000 new shares of its $5 par value common stock valued at $12 a share for all of Sudina Corporation's outstanding common shares.Palta paid $5,000 for the direct combination costs of the accountants.Palta paid $18,000 to register and issue shares.The fair value and book value of Sudina's identifiable assets and liabilities were the same.Summarized balance sheet information for both companies just before the acquisition on January 2,2013 is as follows:

Required:

Required:

1.Prepare Palta's general journal entry for the acquisition of Sudina assuming that Sudina survives as a separate legal entity.

2.Prepare Palta's general journal entry for the acquisition of Sudina assuming that Sudina will dissolve as a separate legal entity.

Required:

Required:1.Prepare Palta's general journal entry for the acquisition of Sudina assuming that Sudina survives as a separate legal entity.

2.Prepare Palta's general journal entry for the acquisition of Sudina assuming that Sudina will dissolve as a separate legal entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

39

A merger occurs when one corporation takes over all the operations of another business entity,and that entity is dissolved.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

40

In August 1999,the Financial Accounting Standards Board issued a report supporting its proposed decision to eliminate the pooling of interests method to account for business combinations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

41

Firms should conduct an impairment test for goodwill at least quarterly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

42

For intangibles to be recognizable they must meet both a separability criterion and a contractual-legal criterion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

43

In an acquisition,if the fair value of identifiable assets acquired over liabilities assumed exceed the cost of the acquired company the gain is recognized as an extraordinary gain by the acquiror.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

44

The first step in recording an acquisition is to determine the fair values of all identifiable tangible and intangible assets acquired and actual value of liabilities assumed in the combination.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

45

The GAAP defines the accounting concept of a business combination as a transaction or other event in which an acquirer obtains control of one or more businesses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

46

Under the acquisition method a combination is recorded using the fair-value principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck