Deck 18: Corporate Liquidations and Reorganizations

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

Match between columns

الفرضيات:

Claims for wages that are less than $11,725 per individual, earned within 90 days of filing petition for bankruptcy.

Claims for wages that are less than $11,725 per individual, earned within 90 days of filing petition for bankruptcy.

Claims for wages that are less than $11,725 per individual, earned within 90 days of filing petition for bankruptcy.

Claims for wages that are less than $11,725 per individual, earned within 90 days of filing petition for bankruptcy.

Claim by the accounting firm for the audit fee from the prior year-end audit completed two months prior to the bankruptcy filing.

Claim by the accounting firm for the audit fee from the prior year-end audit completed two months prior to the bankruptcy filing.

Claim by the accounting firm for the audit fee from the prior year-end audit completed two months prior to the bankruptcy filing.

Claim by the accounting firm for the audit fee from the prior year-end audit completed two months prior to the bankruptcy filing.

Claims with a valid lien against assets of the entity.

Claims with a valid lien against assets of the entity.

Claims with a valid lien against assets of the entity.

Claims with a valid lien against assets of the entity.

الردود:

Unsecured Priority Claims

Stockholders' Claims

Unsecured Nonpriority Claims

Secured Claims

Unsecured Priority Claims

Stockholders' Claims

Unsecured Nonpriority Claims

Secured Claims

Unsecured Priority Claims

Stockholders' Claims

Unsecured Nonpriority Claims

Secured Claims

Unsecured Priority Claims

Stockholders' Claims

Unsecured Nonpriority Claims

Secured Claims

Unsecured Priority Claims

Stockholders' Claims

Unsecured Nonpriority Claims

Secured Claims

Unsecured Priority Claims

Stockholders' Claims

Unsecured Nonpriority Claims

Secured Claims

Unsecured Priority Claims

Stockholders' Claims

Unsecured Nonpriority Claims

Secured Claims

Unsecured Priority Claims

Stockholders' Claims

Unsecured Nonpriority Claims

Secured Claims

Unsecured Priority Claims

Stockholders' Claims

Unsecured Nonpriority Claims

Secured Claims

Unsecured Priority Claims

Stockholders' Claims

Unsecured Nonpriority Claims

Secured Claims

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/50

العب

ملء الشاشة (f)

Deck 18: Corporate Liquidations and Reorganizations

1

Which condition must be met for fresh-start reporting for an emerging company from Chapter 11?

A)Holders of existing voting shares immediately before confirmation of the reorganization plan must receive more than fifty percent of the emerging entity.

B)The loss of control by voting shareholders must be temporary.

C)The reorganization value of the emerging entity's assets immediately before the date of the confirmation of the reorganization plan must be less than the total of all postpetition liabilities and allowed claims.

D)The fresh-start entity must have a deficit.

A)Holders of existing voting shares immediately before confirmation of the reorganization plan must receive more than fifty percent of the emerging entity.

B)The loss of control by voting shareholders must be temporary.

C)The reorganization value of the emerging entity's assets immediately before the date of the confirmation of the reorganization plan must be less than the total of all postpetition liabilities and allowed claims.

D)The fresh-start entity must have a deficit.

C

2

A primary difference between voluntary and involuntary bankruptcy petitions is that

A)creditors file the petition in an involuntary filing.

B)trustees are not used in a voluntary filing.

C)voluntary petitions are not subject to review by the bankruptcy court.

D)the debtor corporation files the petition in an involuntary filing.

A)creditors file the petition in an involuntary filing.

B)trustees are not used in a voluntary filing.

C)voluntary petitions are not subject to review by the bankruptcy court.

D)the debtor corporation files the petition in an involuntary filing.

A

3

In a Chapter 7 bankruptcy case,what is the first-to-last ranking order of priority for payment? (Use the following list of claim types.)

I.stockholder claims

II. unsecured priority claims

III. secured claims

IV. unsecured nonpriority claims

A)I,II,IV,and III

B)III,II,IV,and I

C)III,I,IV,and II

D)II,IV,III,and I

I.stockholder claims

II. unsecured priority claims

III. secured claims

IV. unsecured nonpriority claims

A)I,II,IV,and III

B)III,II,IV,and I

C)III,I,IV,and II

D)II,IV,III,and I

III,II,IV,and I

4

Chapter 7 bankruptcy cases differ from Chapter 11 bankruptcy cases because Chapter 7 bankruptcy

A)is involuntary.

B)requires a reorganization plan that is approved by the court.

C)requires the debtor corporation to file a list of creditors,schedule of assets and liabilities,and work with a trustee.

D)leads to full liquidation of the bankrupt company.

A)is involuntary.

B)requires a reorganization plan that is approved by the court.

C)requires the debtor corporation to file a list of creditors,schedule of assets and liabilities,and work with a trustee.

D)leads to full liquidation of the bankrupt company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

5

Creditor committees are elected

A)in all bankruptcy cases.

B)in Chapter 7 cases.

C)only in bankruptcy cases arising from involuntary petitions.

D)in Chapter 11 cases.

A)in all bankruptcy cases.

B)in Chapter 7 cases.

C)only in bankruptcy cases arising from involuntary petitions.

D)in Chapter 11 cases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

6

An entity which qualified for fresh-start accounting is not required to disclose which of the following items in their initial financial statements?

A)Adjustments from historical cost of assets and liabilities

B)Amount of debt of the prior entity forgiven

C)Amount of ending retained earnings/deficit of the prior entity

D)Changes to the management team from the prior entity

A)Adjustments from historical cost of assets and liabilities

B)Amount of debt of the prior entity forgiven

C)Amount of ending retained earnings/deficit of the prior entity

D)Changes to the management team from the prior entity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

7

The duties of a debtor in possession in a Chapter 11 bankruptcy case do not include

A)filing a list of creditors and schedules of assets and liabilities with the bankruptcy court.

B)operating the business during the reorganization period.

C)filing a reorganization plan.

D)issuing an order of relief.

A)filing a list of creditors and schedules of assets and liabilities with the bankruptcy court.

B)operating the business during the reorganization period.

C)filing a reorganization plan.

D)issuing an order of relief.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following does not occur for a trustee in a Chapter 7 bankruptcy case?

A)Gains and losses on the sale of assets are debited to the estate equity account.

B)Unrecorded liabilities discovered by the trustee are debited to the estate equity account and credited to the liability account.

C)Liquidation expenses are debited to the estate equity account.

D)An income statement is prepared showing gains and losses on sale of assets.

A)Gains and losses on the sale of assets are debited to the estate equity account.

B)Unrecorded liabilities discovered by the trustee are debited to the estate equity account and credited to the liability account.

C)Liquidation expenses are debited to the estate equity account.

D)An income statement is prepared showing gains and losses on sale of assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

9

A company emerging from bankruptcy will have a reorganization value that

A)approximates the book value of the entity's assets prior to bankruptcy.

B)approximates the book value of the entity prior to bankruptcy.

C)approximates the fair market value of the entity without considering liabilities.

D)approximates the fair market value of the entity's liabilities.

A)approximates the book value of the entity's assets prior to bankruptcy.

B)approximates the book value of the entity prior to bankruptcy.

C)approximates the fair market value of the entity without considering liabilities.

D)approximates the fair market value of the entity's liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

10

A bankruptcy petition filed by a firm's creditors is

A)a Chapter 2 petition.

B)a petition for liquidation.

C)an involuntary petition.

D)a voluntary petition.

A)a Chapter 2 petition.

B)a petition for liquidation.

C)an involuntary petition.

D)a voluntary petition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

11

In a Chapter 11 case,the debtor corporation filing the petition may continue in possession of the corporation's property,and is referred to as a(n)

A)examiner.

B)trustee.

C)liquidator.

D)debtor in possession.

A)examiner.

B)trustee.

C)liquidator.

D)debtor in possession.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

12

In a liquidation under Chapter 7,the trustee

A)may not be appointed,but may only be elected.

B)may not be elected,but may only be appointed.

C)is responsible for converting assets to cash and distributing payments to claimants.

D)is responsible for appointing a creditors' committee.

A)may not be appointed,but may only be elected.

B)may not be elected,but may only be appointed.

C)is responsible for converting assets to cash and distributing payments to claimants.

D)is responsible for appointing a creditors' committee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

13

When the bankruptcy court grants an order for relief under Chapter 7,

A)creditors may not seek payment for their claims directly from the debtor corporation.

B)the reorganization plan was accepted by creditors having at least one-half of the total number of claims and the claims represent at least two-thirds of the total amount owed.

C)the bankruptcy court confirms that the reorganization plan is fair and equitable to creditors.

D)the court discharges the debtor except for those claims provided for in the reorganization plan.

A)creditors may not seek payment for their claims directly from the debtor corporation.

B)the reorganization plan was accepted by creditors having at least one-half of the total number of claims and the claims represent at least two-thirds of the total amount owed.

C)the bankruptcy court confirms that the reorganization plan is fair and equitable to creditors.

D)the court discharges the debtor except for those claims provided for in the reorganization plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

14

A petition commencing a case against a corporate debtor

A)can be filed only under Chapter 7 of the bankruptcy act.

B)can be filed only under Chapter 11 of the bankruptcy act.

C)can be filed under either Chapter 7 or Chapter 11 of the bankruptcy act.

D)will be determined by the trustee whether it shall be Chapter 7 or Chapter 11 of the bankruptcy act.

A)can be filed only under Chapter 7 of the bankruptcy act.

B)can be filed only under Chapter 11 of the bankruptcy act.

C)can be filed under either Chapter 7 or Chapter 11 of the bankruptcy act.

D)will be determined by the trustee whether it shall be Chapter 7 or Chapter 11 of the bankruptcy act.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

15

A single creditor

A)can never file a petition for bankruptcy.

B)with a $15,775 or more secured claim may file a petition for bankruptcy.

C)with a $15,775 or more unsecured claim may file a petition for bankruptcy,if there are fewer than 12 unsecured creditors.

D)with a $14,425 or more unsecured claim may file a petition for bankruptcy if there are more than 12 unsecured creditors.

A)can never file a petition for bankruptcy.

B)with a $15,775 or more secured claim may file a petition for bankruptcy.

C)with a $15,775 or more unsecured claim may file a petition for bankruptcy,if there are fewer than 12 unsecured creditors.

D)with a $14,425 or more unsecured claim may file a petition for bankruptcy if there are more than 12 unsecured creditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following must approve a Chapter 11 plan?

A)The organization's management and the assigned trustee

B)The assigned trustee and creditors

C)The assigned trustee and entity's stockholders

D)The bankruptcy court and the creditors

A)The organization's management and the assigned trustee

B)The assigned trustee and creditors

C)The assigned trustee and entity's stockholders

D)The bankruptcy court and the creditors

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

17

What is an advantage of filing a Chapter 11 petition?

A)The continuation of interest accrual on liabilities

B)Restrictions imposed by the bankruptcy court on day-to-day transactions

C)It is less costly than filing Chapter 7.

D)The opportunity to cancel unfavorable contracts

A)The continuation of interest accrual on liabilities

B)Restrictions imposed by the bankruptcy court on day-to-day transactions

C)It is less costly than filing Chapter 7.

D)The opportunity to cancel unfavorable contracts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

18

When a corporation's total liabilities are greater than the fair value of total assets,the firm is

A)a distressed corporation.

B)a bankrupt corporation.

C)insolvent in the equity sense.

D)insolvent in the bankruptcy sense.

A)a distressed corporation.

B)a bankrupt corporation.

C)insolvent in the equity sense.

D)insolvent in the bankruptcy sense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

19

Fresh-start reporting results in

A)a new reporting entity with no retained earnings/deficit balance.

B)a new reporting entity with a retained earnings/deficit balance equal to the reorganization value.

C)a continuation of the reorganized organization with no retained earnings/deficit balance.

D)a continuation of the reorganized organization with a retained earnings/deficit balance equal to the reorganization value.

A)a new reporting entity with no retained earnings/deficit balance.

B)a new reporting entity with a retained earnings/deficit balance equal to the reorganization value.

C)a continuation of the reorganized organization with no retained earnings/deficit balance.

D)a continuation of the reorganized organization with a retained earnings/deficit balance equal to the reorganization value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following statements is correct concerning companies emerging from reorganization under Chapter 11 when they do not qualify for fresh start accounting? The forgiveness of debt is reported as

A)an operating gain.

B)a non-operating gain.

C)an extraordinary item.

D)an increase in contributed capital.

A)an operating gain.

B)a non-operating gain.

C)an extraordinary item.

D)an increase in contributed capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

21

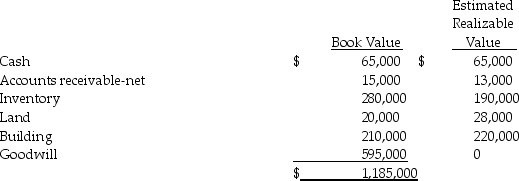

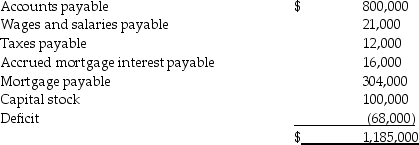

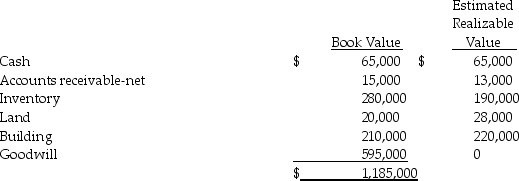

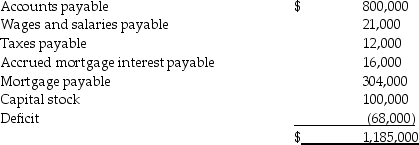

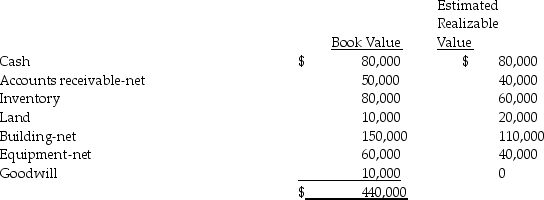

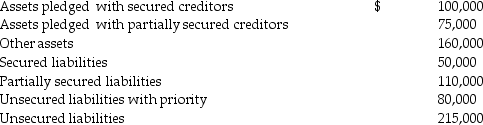

Pasten Corporation is liquidating under Chapter 7 of the Bankruptcy Act.The accounts of Pasten at the time of filing are summarized as follows:

The land and building are pledged as security for the mortgage payable as well as any accrued interest on the mortgage.Wages and salaries were earned within 90 days of filing the bankruptcy petition and do not exceed $10,000 per employee.Liquidation expenses are expected to be $35,000.

The land and building are pledged as security for the mortgage payable as well as any accrued interest on the mortgage.Wages and salaries were earned within 90 days of filing the bankruptcy petition and do not exceed $10,000 per employee.Liquidation expenses are expected to be $35,000.

Required:

1.Prepare a schedule showing the priority rankings of the creditors and the expected payouts.

2.Yuomi Corporation was a supplier to Pasten Corporation and at the time of Pasten's bankruptcy filing,Yuomi's account receivable from Pasten was $500,000.On the basis of the estimates,how much can Yuomi expect to receive?

The land and building are pledged as security for the mortgage payable as well as any accrued interest on the mortgage.Wages and salaries were earned within 90 days of filing the bankruptcy petition and do not exceed $10,000 per employee.Liquidation expenses are expected to be $35,000.

The land and building are pledged as security for the mortgage payable as well as any accrued interest on the mortgage.Wages and salaries were earned within 90 days of filing the bankruptcy petition and do not exceed $10,000 per employee.Liquidation expenses are expected to be $35,000.Required:

1.Prepare a schedule showing the priority rankings of the creditors and the expected payouts.

2.Yuomi Corporation was a supplier to Pasten Corporation and at the time of Pasten's bankruptcy filing,Yuomi's account receivable from Pasten was $500,000.On the basis of the estimates,how much can Yuomi expect to receive?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

22

Oceana Corporation is being liquidated under Chapter 7 of the Bankruptcy Act.The trustee has determined that the unsecured claims will receive $.35 on the dollar.Loans-R-Us holds a $1,000,000 mortgage note receivable from Oceana that is secured by building and equipment with a $1,200,000 book value and a $900,000 fair value.

Required:

How much of the mortgage receivable will Loans-R-Us recover?

Required:

How much of the mortgage receivable will Loans-R-Us recover?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

23

Ending Company is in bankruptcy and is being liquidated under the provisions of Chapter 7 of the bankruptcy code.The trustee has converted all assets into $80,000 cash (which includes the amounts shown below for assets sold)and has prepared the following list of approved claims:

Note payable to bank,secured by all accounts receivable of which $20,000

Note payable to bank,secured by all accounts receivable of which $20,000

Required:

Required:

How much will the bank receive on the note payable?

Note payable to bank,secured by all accounts receivable of which $20,000

Note payable to bank,secured by all accounts receivable of which $20,000 Required:

Required:How much will the bank receive on the note payable?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

24

Finale Company is in bankruptcy and is being liquidated under the provisions of Chapter 7 of the bankruptcy code.The trustee has converted all assets into $180,000 cash and has prepared the following list of approved claims:

Customer deposits ($1,000 from each of three customers

Note payable to bank,secured by all accounts receivable of which $45,000

Note payable to bank,secured by all accounts receivable of which $45,000

Required:

Required:

How much will the bank receive on the note payable?

Customer deposits ($1,000 from each of three customers

Note payable to bank,secured by all accounts receivable of which $45,000

Note payable to bank,secured by all accounts receivable of which $45,000 Required:

Required:How much will the bank receive on the note payable?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

25

Dip Corporation is in a Chapter 11 bankruptcy reorganization.For each of the following transactions relating to the reorganization,show the journal entry that would be required by Dip.Assume that all unsecured liabilities were not reclassified to Prepetition Claims Subject to Compromise.

1.Dip has $200,000 in bonds payable which mature at the end of the current year.The bondholders agree to accept $100,000 of new common stock and $75,000 cash,payable immediately.

2.Accrued interest on the bonds recorded at $20,000 will not be paid.

3.Recorded patents in the amount of $15,000 are determined to be worthless and are written off.

4.Equipment recorded net at $24,000 is appraised at $30,000.

5.A building recorded net at $78,000 is appraised for $87,000.

6.Creditors owed $120,000 recorded in accounts payable are paid $96,000 in full settlement.

7.Property taxes and payroll taxes withheld are paid in full at $12,000.

8.A capital lease recorded at $48,000 is re-negotiated,and the resulting operating lease will require monthly lease payments of $500.

9.An unsecured bank note amounting to $180,000 will be exchanged for $120,000 note secured by the building and equipment.

10.Current stockholders will exchange their stock which has a current book value of $300,000 for $100,000 common stock of the new entity.

1.Dip has $200,000 in bonds payable which mature at the end of the current year.The bondholders agree to accept $100,000 of new common stock and $75,000 cash,payable immediately.

2.Accrued interest on the bonds recorded at $20,000 will not be paid.

3.Recorded patents in the amount of $15,000 are determined to be worthless and are written off.

4.Equipment recorded net at $24,000 is appraised at $30,000.

5.A building recorded net at $78,000 is appraised for $87,000.

6.Creditors owed $120,000 recorded in accounts payable are paid $96,000 in full settlement.

7.Property taxes and payroll taxes withheld are paid in full at $12,000.

8.A capital lease recorded at $48,000 is re-negotiated,and the resulting operating lease will require monthly lease payments of $500.

9.An unsecured bank note amounting to $180,000 will be exchanged for $120,000 note secured by the building and equipment.

10.Current stockholders will exchange their stock which has a current book value of $300,000 for $100,000 common stock of the new entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

26

Trustin Corporation is in a Chapter 7 bankruptcy liquidation.For each of the following transactions,show the journal entry that would be required by the trustee of the estate.

1.An electric bill is received for $1,000 which had not yet been recorded by Trustin.

2.Inventory recorded net at $18,000 is sold for $16,000 cash.

3.Recorded patents in the amount of $7,000 are determined to be worthless and are written off.

4.Equipment recorded net at $24,000 is sold for $20,000 cash.

5.A building recorded net at $78,000 is sold for $87,000 cash.

6.Trustee fees of $2,500 are accrued.

7.The fully secured mortgage is paid in the amount of $70,000.

8.Wages payable that were recorded in the amount of $9,000 are paid.

9.An equipment lease,which was recorded as prepaid equipment lease,is cancelled and a $1,500 refund is received.

10.Accounts receivable amounting to $12,000 are collected,and an additional $3,000 is determined to be uncollectible.

1.An electric bill is received for $1,000 which had not yet been recorded by Trustin.

2.Inventory recorded net at $18,000 is sold for $16,000 cash.

3.Recorded patents in the amount of $7,000 are determined to be worthless and are written off.

4.Equipment recorded net at $24,000 is sold for $20,000 cash.

5.A building recorded net at $78,000 is sold for $87,000 cash.

6.Trustee fees of $2,500 are accrued.

7.The fully secured mortgage is paid in the amount of $70,000.

8.Wages payable that were recorded in the amount of $9,000 are paid.

9.An equipment lease,which was recorded as prepaid equipment lease,is cancelled and a $1,500 refund is received.

10.Accounts receivable amounting to $12,000 are collected,and an additional $3,000 is determined to be uncollectible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

27

Gonne Corporation is being liquidated under Chapter 7 of the Bankruptcy Act.The trustee has determined that the unsecured claims will receive $.35 on the dollar.Odemay Corporation holds a $100,000 mortgage note receivable from Gonne that is secured by equipment with a $120,000 book value and a $75,000 fair value.

Required:

How much of the mortgage receivable will be recovered by Odemay?

Required:

How much of the mortgage receivable will be recovered by Odemay?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

28

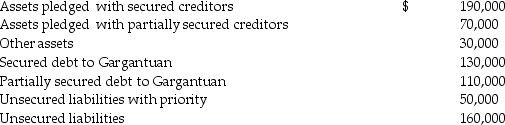

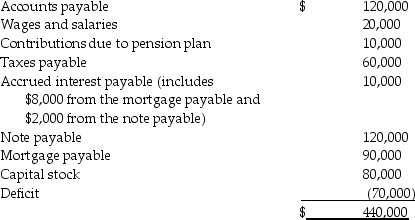

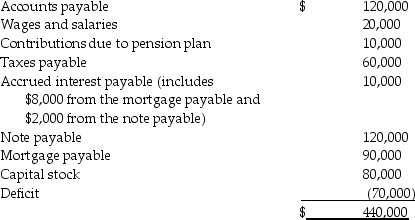

Gargantuan Bank has loaned money in two separate loans to Little Company,which is now in Chapter 7 bankruptcy.Little Company has the following assets and liabilities,stated at fair value in liquidation.

Required:

Required:

Determine the amount of cash that Gargantuan will collect from these two pieces of debt.

Required:

Required:Determine the amount of cash that Gargantuan will collect from these two pieces of debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

29

CommTex Corporation is liquidating under Chapter 7 of the Bankruptcy Act.The accounts of CommTex at the time of filing are summarized as follows:

The land and building are pledged as security for the mortgage payable as well as any accrued interest on the mortgage.The note payable is secured with the equipment,but the interest on the note is unsecured.Wages and salaries were earned within 90 days of filing the petition for bankruptcy and pension plan contributions relate to services rendered within 6 months of filing the petition for bankruptcy; neither exceeds $4,000 per employee.Liquidation expenses are expected to be $40,000.

The land and building are pledged as security for the mortgage payable as well as any accrued interest on the mortgage.The note payable is secured with the equipment,but the interest on the note is unsecured.Wages and salaries were earned within 90 days of filing the petition for bankruptcy and pension plan contributions relate to services rendered within 6 months of filing the petition for bankruptcy; neither exceeds $4,000 per employee.Liquidation expenses are expected to be $40,000.

Required:

1.Prepare a schedule showing the priority rankings of the creditors and the expected payouts.

2.Devendor Corporation was a supplier to CommTex Corporation and at the time of CommTex's bankruptcy filing,Devendor's account receivable from CommTex was $25,000.On the basis of the estimates,how much can Devendor expect to receive?

The land and building are pledged as security for the mortgage payable as well as any accrued interest on the mortgage.The note payable is secured with the equipment,but the interest on the note is unsecured.Wages and salaries were earned within 90 days of filing the petition for bankruptcy and pension plan contributions relate to services rendered within 6 months of filing the petition for bankruptcy; neither exceeds $4,000 per employee.Liquidation expenses are expected to be $40,000.

The land and building are pledged as security for the mortgage payable as well as any accrued interest on the mortgage.The note payable is secured with the equipment,but the interest on the note is unsecured.Wages and salaries were earned within 90 days of filing the petition for bankruptcy and pension plan contributions relate to services rendered within 6 months of filing the petition for bankruptcy; neither exceeds $4,000 per employee.Liquidation expenses are expected to be $40,000.Required:

1.Prepare a schedule showing the priority rankings of the creditors and the expected payouts.

2.Devendor Corporation was a supplier to CommTex Corporation and at the time of CommTex's bankruptcy filing,Devendor's account receivable from CommTex was $25,000.On the basis of the estimates,how much can Devendor expect to receive?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

30

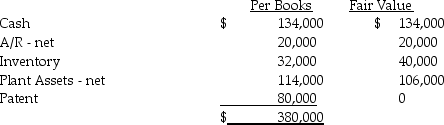

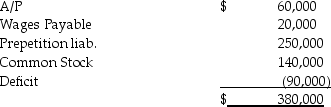

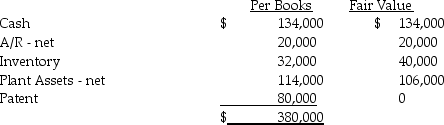

Hilfmir Corporation filed for Chapter 11 bankruptcy on January 1,2014.A summary of their financial status is shown below on June 30,2014,at the date of the approved reorganization,along with the fair value of their assets.

Under the reorganization plan,the reorganization value has been set at $320,000.Prepetition liabilities include $30,000 of trade Accounts Payable and a $220,000 Note Payable to Bigg Bank.The reorganization plan calls for the Prepetition accounts payable to be paid at 80% at a later date,and the Note Payable for $220,000 to be replaced by a Note Payable for $76,000 and the issuance of common stock of the new entity for $100,000.The former stockholders will receive $40,000 in common stock of the new entity,Hilfmir,in exchange for their shares.

Under the reorganization plan,the reorganization value has been set at $320,000.Prepetition liabilities include $30,000 of trade Accounts Payable and a $220,000 Note Payable to Bigg Bank.The reorganization plan calls for the Prepetition accounts payable to be paid at 80% at a later date,and the Note Payable for $220,000 to be replaced by a Note Payable for $76,000 and the issuance of common stock of the new entity for $100,000.The former stockholders will receive $40,000 in common stock of the new entity,Hilfmir,in exchange for their shares.

Required:

Show the calculations to determine if Hilfmir is eligible for fresh-start accounting,and prepare a fresh-start balance sheet for the new entity,Hilfmir,as of July 1,2014.

Under the reorganization plan,the reorganization value has been set at $320,000.Prepetition liabilities include $30,000 of trade Accounts Payable and a $220,000 Note Payable to Bigg Bank.The reorganization plan calls for the Prepetition accounts payable to be paid at 80% at a later date,and the Note Payable for $220,000 to be replaced by a Note Payable for $76,000 and the issuance of common stock of the new entity for $100,000.The former stockholders will receive $40,000 in common stock of the new entity,Hilfmir,in exchange for their shares.

Under the reorganization plan,the reorganization value has been set at $320,000.Prepetition liabilities include $30,000 of trade Accounts Payable and a $220,000 Note Payable to Bigg Bank.The reorganization plan calls for the Prepetition accounts payable to be paid at 80% at a later date,and the Note Payable for $220,000 to be replaced by a Note Payable for $76,000 and the issuance of common stock of the new entity for $100,000.The former stockholders will receive $40,000 in common stock of the new entity,Hilfmir,in exchange for their shares.Required:

Show the calculations to determine if Hilfmir is eligible for fresh-start accounting,and prepare a fresh-start balance sheet for the new entity,Hilfmir,as of July 1,2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

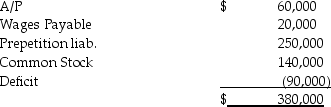

31

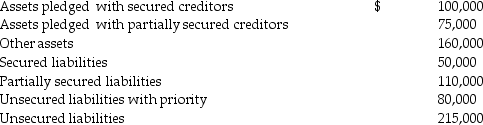

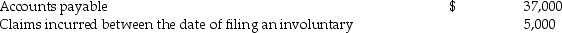

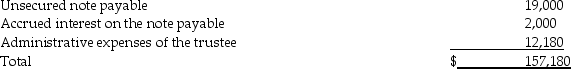

Lesher Corporation lost their primary contract and entered into voluntary Chapter 7 bankruptcy in the early part of 2014.By July 1,all assets were converted into cash,the secured creditors were paid,and $124,500 in cash was left to pay the remaining claims as follows:

Claims incurred between the date of filing an involuntary

Claims incurred between the date of filing an involuntary

Wages payable (all under $10,000 per employee; earned within

Wages payable (all under $10,000 per employee; earned within

Required:

Required:

Classify the claims by their Chapter 7 priority ranking,and analyze which amounts will be paid and which amounts will be written off.

Claims incurred between the date of filing an involuntary

Claims incurred between the date of filing an involuntary Wages payable (all under $10,000 per employee; earned within

Wages payable (all under $10,000 per employee; earned within Required:

Required:Classify the claims by their Chapter 7 priority ranking,and analyze which amounts will be paid and which amounts will be written off.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

32

Ohio Corporation is being liquidated under Chapter 7 of the Bankruptcy Act.The trustee has determined that the unsecured claims will receive $.05 on the dollar.Lender Bank holds a $100,000 mortgage note receivable from Ohio that is secured by equipment with a $120,000 book value and a $90,000 fair value,and a second mortgage on the same equipment amounting to $50,000.

Required:

How much of the mortgage receivable will be recovered by Lender?

Required:

How much of the mortgage receivable will be recovered by Lender?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

33

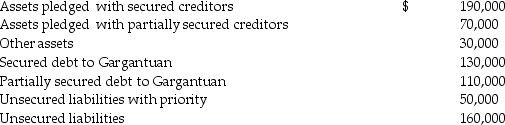

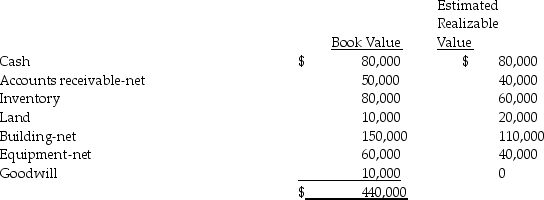

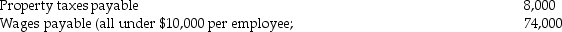

Alitech Corporation is liquidating under Chapter 7 of the Bankruptcy Act.The accounts of Alitech at the time of filing are summarized as follows:

The land and building are pledged as security for the mortgage payable as well as any accrued interest on the mortgage.Wages and salaries were earned within 90 days of filing the petition for bankruptcy and do not exceed $11,725 per employee.Liquidation expenses are expected to be $30,000.

The land and building are pledged as security for the mortgage payable as well as any accrued interest on the mortgage.Wages and salaries were earned within 90 days of filing the petition for bankruptcy and do not exceed $11,725 per employee.Liquidation expenses are expected to be $30,000.

Required:

1.Prepare a schedule showing the priority rankings of the creditors and the expected payouts.

2.Billing Corporation was a supplier to Alitech Corporation and at the time of Alitech's bankruptcy filing,Billing's account receivable from Alitech was $40,000.On the basis of the estimates,how much can Billing expect to receive?

The land and building are pledged as security for the mortgage payable as well as any accrued interest on the mortgage.Wages and salaries were earned within 90 days of filing the petition for bankruptcy and do not exceed $11,725 per employee.Liquidation expenses are expected to be $30,000.

The land and building are pledged as security for the mortgage payable as well as any accrued interest on the mortgage.Wages and salaries were earned within 90 days of filing the petition for bankruptcy and do not exceed $11,725 per employee.Liquidation expenses are expected to be $30,000.Required:

1.Prepare a schedule showing the priority rankings of the creditors and the expected payouts.

2.Billing Corporation was a supplier to Alitech Corporation and at the time of Alitech's bankruptcy filing,Billing's account receivable from Alitech was $40,000.On the basis of the estimates,how much can Billing expect to receive?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

34

Match between columns

الفرضيات:

Claims for wages that are less than $11,725 per individual, earned within 90 days of filing petition for bankruptcy.

Claims for wages that are less than $11,725 per individual, earned within 90 days of filing petition for bankruptcy.

Claims for wages that are less than $11,725 per individual, earned within 90 days of filing petition for bankruptcy.

Claims for wages that are less than $11,725 per individual, earned within 90 days of filing petition for bankruptcy.

Claim by the accounting firm for the audit fee from the prior year-end audit completed two months prior to the bankruptcy filing.

Claim by the accounting firm for the audit fee from the prior year-end audit completed two months prior to the bankruptcy filing.

Claim by the accounting firm for the audit fee from the prior year-end audit completed two months prior to the bankruptcy filing.

Claim by the accounting firm for the audit fee from the prior year-end audit completed two months prior to the bankruptcy filing.

Claims with a valid lien against assets of the entity.

Claims with a valid lien against assets of the entity.

Claims with a valid lien against assets of the entity.

Claims with a valid lien against assets of the entity.

الردود:

Unsecured Priority Claims

Stockholders' Claims

Unsecured Nonpriority Claims

Secured Claims

Unsecured Priority Claims

Stockholders' Claims

Unsecured Nonpriority Claims

Secured Claims

Unsecured Priority Claims

Stockholders' Claims

Unsecured Nonpriority Claims

Secured Claims

Unsecured Priority Claims

Stockholders' Claims

Unsecured Nonpriority Claims

Secured Claims

Unsecured Priority Claims

Stockholders' Claims

Unsecured Nonpriority Claims

Secured Claims

Unsecured Priority Claims

Stockholders' Claims

Unsecured Nonpriority Claims

Secured Claims

Unsecured Priority Claims

Stockholders' Claims

Unsecured Nonpriority Claims

Secured Claims

Unsecured Priority Claims

Stockholders' Claims

Unsecured Nonpriority Claims

Secured Claims

Unsecured Priority Claims

Stockholders' Claims

Unsecured Nonpriority Claims

Secured Claims

Unsecured Priority Claims

Stockholders' Claims

Unsecured Nonpriority Claims

Secured Claims

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

35

Rank the following claims 1 through 5,with 1 being the first priority claim,under Chapter 7 of the bankruptcy code.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

36

DeFunk Corporation is being liquidated under Chapter 7 of the Bankruptcy Act.The trustee has determined that the unsecured claims will receive $.18 on the dollar.Magma Corporation holds a $200,000 mortgage receivable from DeFunk that is secured by the land and buildings with a book value of $180,000 and a fair value of $190,000.Magma also holds an $80,000 unsecured note receivable from Defunk.Mortgage interest owed,which is secured with the mortgage note,is $4,000.Note interest owed,which is unsecured,is $2,000.

Required:

How much of the amounts owed will Magma recover?

Required:

How much of the amounts owed will Magma recover?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

37

Moddle Corporation is being liquidated under Chapter 7 of the Bankruptcy Act.The trustee has determined that the unsecured claims will receive $.20 on the dollar.National Corporation holds a $500,000 mortgage note receivable from Moddle that is secured by equipment with a $550,000 book value and a $430,000 fair value.

Required:

How much of the mortgage receivable will National recover?

Required:

How much of the mortgage receivable will National recover?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

38

Faled Company has the following assets and liabilities,stated at fair value in liquidation.

Required:

Required:

Determine the amount of cash that will be available to pay unsecured creditors,and the percentage of unsecured liabilities that will be paid.

Required:

Required:Determine the amount of cash that will be available to pay unsecured creditors,and the percentage of unsecured liabilities that will be paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

39

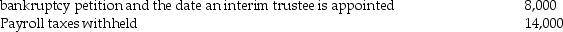

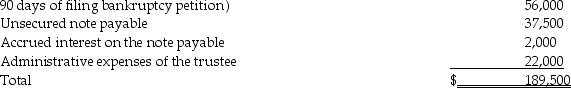

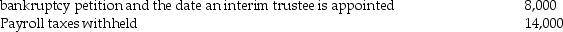

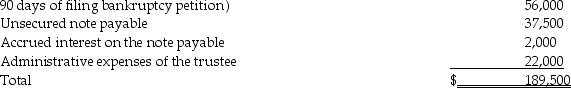

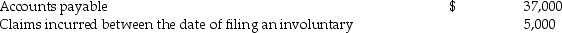

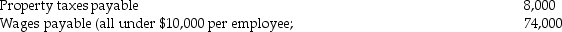

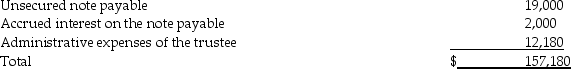

Kline Corporation incurred major losses in 2014 and entered into voluntary Chapter 7 bankruptcy in the early part of 2015.By July 1,all assets were converted into cash,the secured creditors were paid,and $122,700 in cash was left to pay the remaining claims as follows:

petition and the date an interim trustee is appointed

petition and the date an interim trustee is appointed

earned within 90 days of filing bankruptcy petition)

earned within 90 days of filing bankruptcy petition)

Required:

Required:

Classify the claims by their Chapter 7 priority ranking,and analyze which amounts will be paid and which amounts will be written off.

petition and the date an interim trustee is appointed

petition and the date an interim trustee is appointed earned within 90 days of filing bankruptcy petition)

earned within 90 days of filing bankruptcy petition) Required:

Required:Classify the claims by their Chapter 7 priority ranking,and analyze which amounts will be paid and which amounts will be written off.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

40

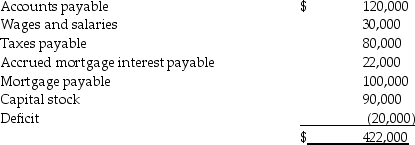

Aqua Corporation filed a petition under Chapter 7 of the bankruptcy act in January,2014.On February 28,the following information was presented regarding Aqua's financial status.

The Note Payable is secured by Accounts Receivable,and the Mortgage Payable is secured by the Fixed Assets.

Required:

Calculate the amount expected to be available for unsecured claims and the percentage recovery that the unsecured class should expect to receive.

The Note Payable is secured by Accounts Receivable,and the Mortgage Payable is secured by the Fixed Assets.

Required:

Calculate the amount expected to be available for unsecured claims and the percentage recovery that the unsecured class should expect to receive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

41

When total debts exceed the fair value of total assets it is referred to as equity insolvency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

42

The doctrine of equitable subordination allows judges to move unsecured creditors ahead of secured creditors in bankruptcy proceedings in the interest of "fairness".

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

43

The inability to make payments on time is equity insolvency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

44

In the case of Chapter 7 Liquidation,the stockholders are the first to have their claims satisfied.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

45

An executory contract is one that has been completely performed but not settled in terms of payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

46

In cases of Chapter 11,a private trustee or a debtor in possession can be appointed to oversee the reorganization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

47

Chapter 7 bankruptcy appoints a trustee to sell off the assets of the company and pay claims to its creditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

48

In the bankruptcy process a statement of affairs is prepared and filed by the trustee.The statement of affairs shows the income statement information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

49

A statement of realization and liquidation is an activity statement that shows progress toward the liquidation of a debtor's estate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

50

U.S.Trustees are appointed by the Attorney General to handle the administrative duties of bankruptcy cases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck