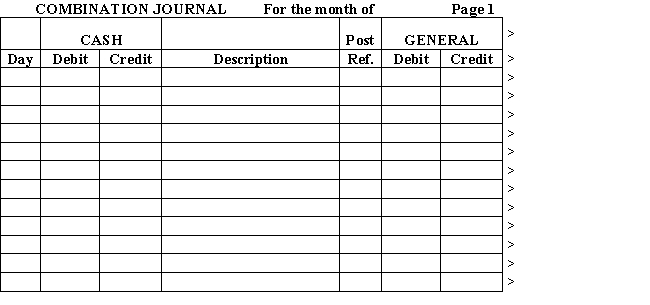

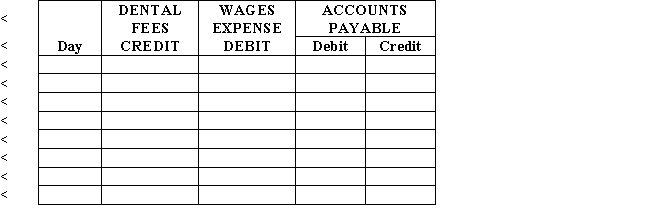

Deck 10: Module Accounting For A Professional Service Business The Combination Journal

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

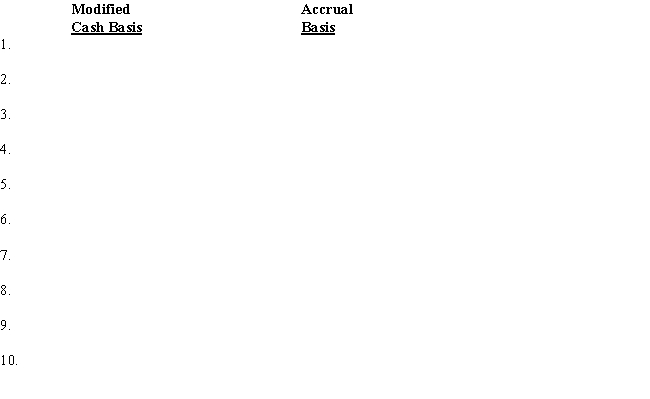

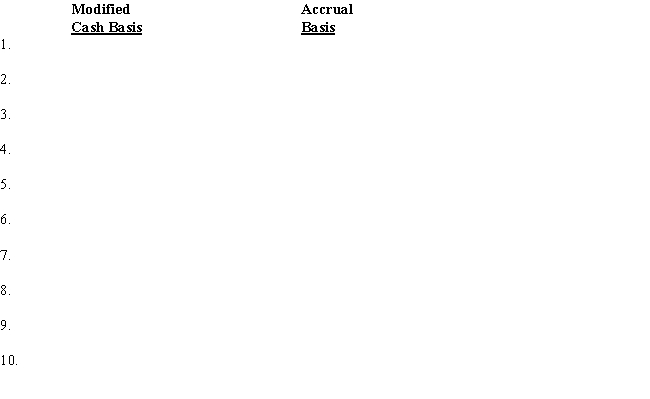

سؤال

سؤال

سؤال

سؤال

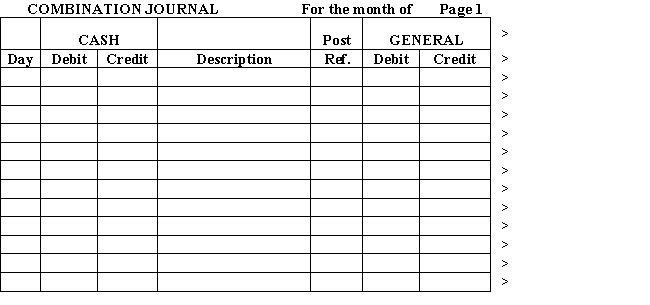

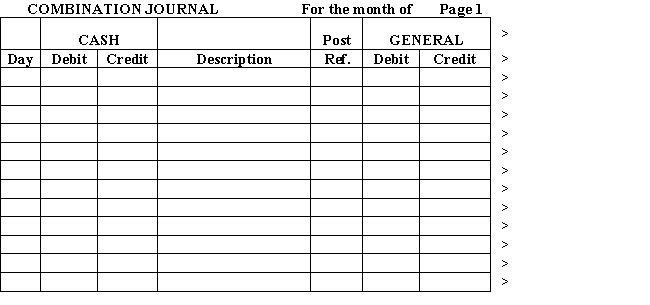

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

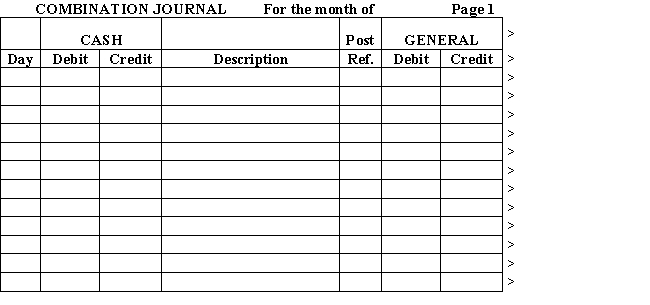

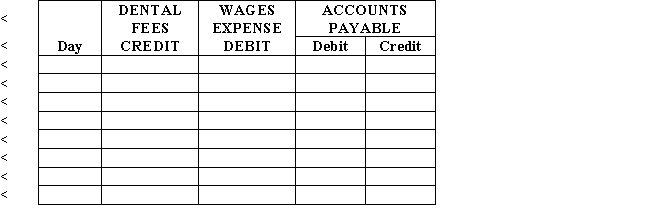

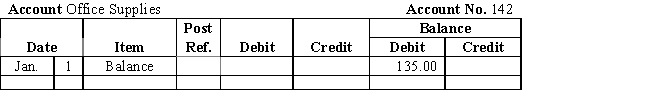

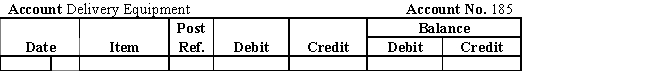

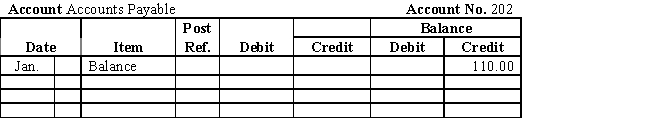

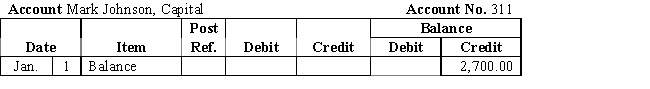

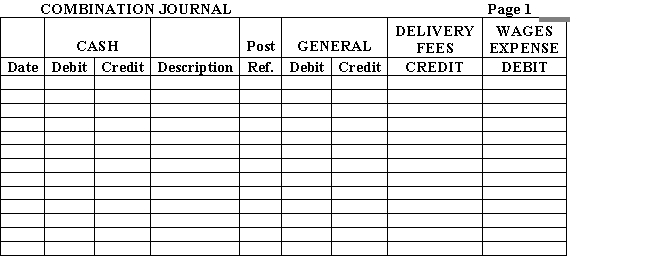

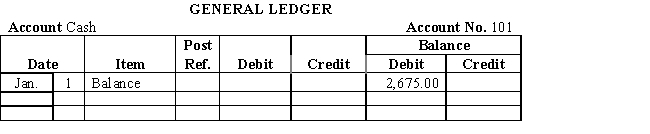

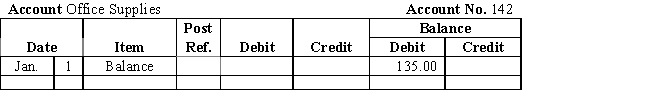

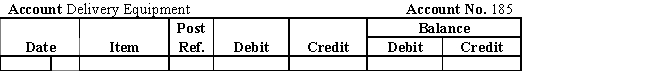

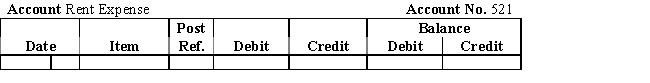

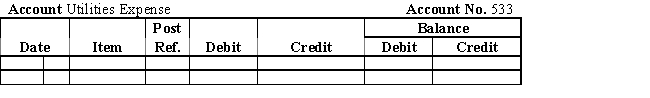

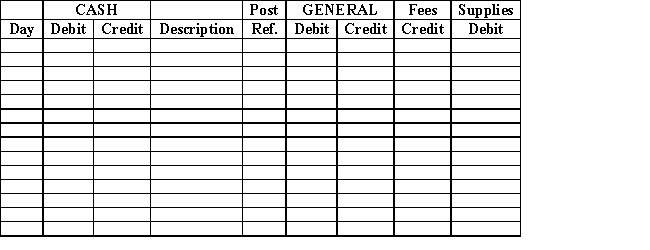

سؤال

سؤال

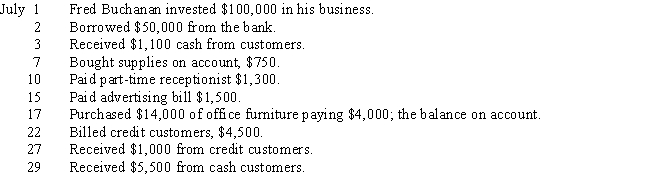

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/69

العب

ملء الشاشة (f)

Deck 10: Module Accounting For A Professional Service Business The Combination Journal

1

Each entry is posted individually from the Cash Credit column of the combination journal to the proper general ledger account.

False

2

Professional service enterprises include real estate,insurance,advertising,transportation,and various other firms.

False

3

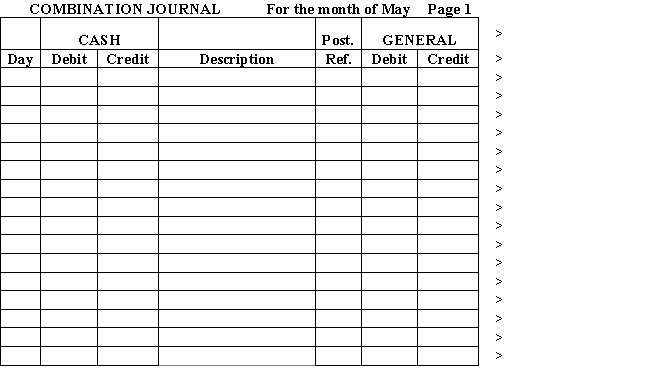

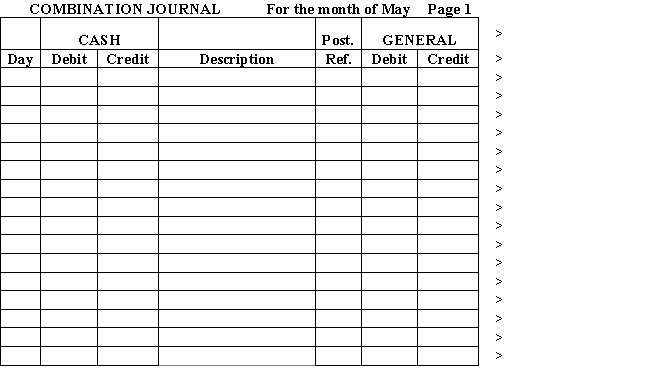

A journal with special and general columns is called a combination journal.

True

4

Under the modified cash basis of accounting,adjustments are made only for prepaid items and depreciation on plant and equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

5

Financial statements are normally prepared at the end of the fiscal year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

6

Seldom used accounts are entered in the General Debit column and the General Credit column of a special journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

7

Each entry is posted individually from the General Debit column of the combination journal to the proper general ledger account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

8

Businesses might set up special journal columns for different accounts depending on the frequency of their use.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

9

Adjusting and closing entries are made differently in the combination journal and in the general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

10

More time is required if a journal contains special columns for cash debits and cash credits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

11

Many small professional service businesses use the modified cash basis of accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

12

It will take additional work and time if a journal contains a special column for cash debits and one for cash credits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

13

If the owner has not made any additional investments during the period,the financial statements can be prepared directly from the work sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

14

In using a combination journal,posting requires less time; however,the danger of making a posting error is increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

15

A journal with Debit and Credit columns for Cash,as well as General Debit and General Credit columns,is called a general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

16

Posting from the combination journal to the general ledger must be done at the end of the month only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

17

To be sure that the debits entered in the journal are equal to the credits,the journal must be posted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

18

Amounts in the general columns of the combination journal are posted individually.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

19

Amounts in the special columns of the combination journal are posted individually.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

20

Professional service business enterprises include attorneys,physicians,dentists,public accountants,artists,and educators.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

21

The column totals of the combination journal for Davis Manufacturing are: Cash Debit,$1,500; Cash Credit,$1,328.50; General Debit,$868.20; General Credit,$1,300.If the totals are correct,and the Wages Expense is the only other column,what must be the total of the Wages Expense Debit column?

A) $171.50

B) $260.30

C) $431.80

D) $1,039.70

A) $171.50

B) $260.30

C) $431.80

D) $1,039.70

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

22

The debits and credits to Cash are not posted until the end of the accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

23

The debits and credits to Cash in the combination journal are posted

A) daily.

B) weekly.

C) at the end of the accounting period.

D) after each cash transaction.

A) daily.

B) weekly.

C) at the end of the accounting period.

D) after each cash transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

24

Professional service business enterprises include the following businesses EXCEPT

A) accounting.

B) real estate.

C) dentistry.

D) medicine.

A) accounting.

B) real estate.

C) dentistry.

D) medicine.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

25

To record wages earned but not paid under the modified cash accounting method,

A) debit Wages Payable and credit Wages Expense.

B) debit Cash and credit Wages Expense.

C) debit Wages Expense and credit Wages Payable.

D) no entry is required.

A) debit Wages Payable and credit Wages Expense.

B) debit Cash and credit Wages Expense.

C) debit Wages Expense and credit Wages Payable.

D) no entry is required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following is the proper sequence for end-of-the-month work with the combination journal?

A) complete the individual postings,total and rule the columns,prove the journal,complete the summary postings

B) prove the journal,total and rule the columns,complete the individual posting,complete the summary postings

C) total and rule the columns,complete the individual postings,complete the summary postings,prove the journal

D) total and rule the columns,complete the summary postings,complete the individual postings,prove the journal

A) complete the individual postings,total and rule the columns,prove the journal,complete the summary postings

B) prove the journal,total and rule the columns,complete the individual posting,complete the summary postings

C) total and rule the columns,complete the individual postings,complete the summary postings,prove the journal

D) total and rule the columns,complete the summary postings,complete the individual postings,prove the journal

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

27

To record the purchase of assets on account under the modified cash accounting method,

A) no entry is required.

B) debit the asset and credit Accounts Payable.

C) debit the asset and credit Cash.

D) debit Accounts Receivable and credit Accounts Payable.

A) no entry is required.

B) debit the asset and credit Accounts Payable.

C) debit the asset and credit Cash.

D) debit Accounts Receivable and credit Accounts Payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

28

Under the modified cash basis of accounting,no accounts receivable are entered in the accounting system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

29

If a business records revenues when earned,regardless of whether cash has been received,and records expenses when they are incurred,the accounting system is a(n)

A) accrual basis of accounting.

B) cash basis of accounting.

C) modified cash basis of accounting.

D) revenue basis of accounting.

A) accrual basis of accounting.

B) cash basis of accounting.

C) modified cash basis of accounting.

D) revenue basis of accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

30

A journal with special and general columns is called a

A) general journal.

B) combination journal.

C) two-column journal.

D) business journal.

A) general journal.

B) combination journal.

C) two-column journal.

D) business journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following would be placed in the "Post.Ref." column to indicate that the amount is not posted individually?

A) the abbreviation "CJ"

B) an "x"

C) a dash

D) a check mark

A) the abbreviation "CJ"

B) an "x"

C) a dash

D) a check mark

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

32

Accounting for revenue when no entry of revenue is made in the accounts until cash is received for the services performed is called

A) matching basis revenue.

B) cash basis expense.

C) service basis accounting.

D) modified cash basis.

A) matching basis revenue.

B) cash basis expense.

C) service basis accounting.

D) modified cash basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

33

A type of business in which the principal source of revenue is compensation for services rendered to a business firm or to a person is a

A) mercantile enterprise.

B) manufacturing enterprise.

C) professional service enterprise.

D) retail enterprise.

A) mercantile enterprise.

B) manufacturing enterprise.

C) professional service enterprise.

D) retail enterprise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

34

When an individual entry is posted from the combination journal to a ledger account,what information is entered in the "Post.Ref." column of the combination journal?

A) the letters "CJ"

B) the letters "CJ" and the page number

C) the letters "CJ" and the invoice number

D) the account number

A) the letters "CJ"

B) the letters "CJ" and the page number

C) the letters "CJ" and the invoice number

D) the account number

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

35

When an individual entry is posted from the combination journal to a ledger account,what information is entered in the "Post.Ref." column of the ledger account?

A) the letters "CJ"

B) the letters "CJ" and the page number

C) the letters "CJ" and the invoice number

D) the letters "CJ" and the year

A) the letters "CJ"

B) the letters "CJ" and the page number

C) the letters "CJ" and the invoice number

D) the letters "CJ" and the year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

36

It is NOT necessary to post the total of which of the following columns to the related ledger accounts?

A) the Cash Debit and Credit columns totals

B) the Wages Expense Debit column total

C) the General Debit and Credit column totals

D) the Medical Supplies Debit column total

A) the Cash Debit and Credit columns totals

B) the Wages Expense Debit column total

C) the General Debit and Credit column totals

D) the Medical Supplies Debit column total

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

37

From the combination journal,the total of the Cash Debit column is posted as one amount to the credit side of the Cash account and the total of the Cash Credit column is posted as one amount to the debit side of the Cash account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

38

The cash balance may be computed at any time during the accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

39

Individual entries are posted from which of the following columns in the combination journal to the proper general ledger account?

A) Post.Ref.column

B) Date column

C) Cash Credit column

D) General Debit column

A) Post.Ref.column

B) Date column

C) Cash Credit column

D) General Debit column

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following amounts should NOT be posted to any ledger account?

A) the total of the Cash Credit column

B) the total of the Professional Fees column

C) the total of the Supplies Expense column

D) the total of the General Debit and Credit column

A) the total of the Cash Credit column

B) the total of the Professional Fees column

C) the total of the Supplies Expense column

D) the total of the General Debit and Credit column

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

41

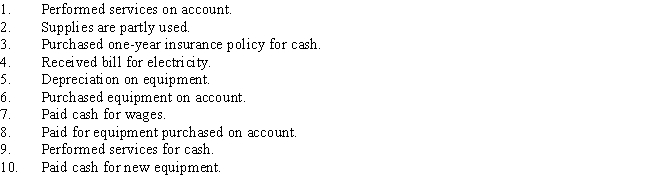

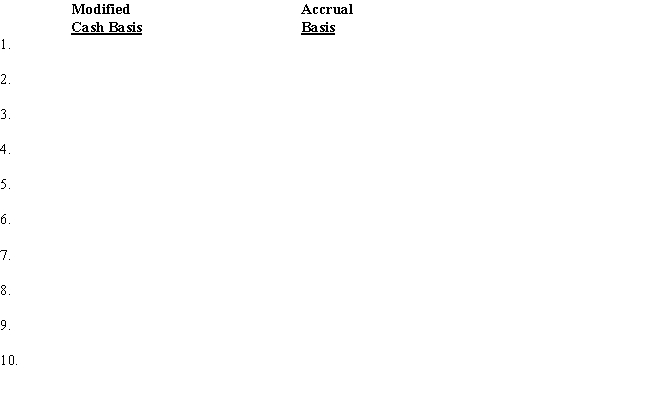

In the columns below,insert the entry that would be made for each transaction under each accounting basis,using appropriate debit and credit account titles.

1. Purchased equipment on account.

2. Paid cash for new equipment.

3. Purchased one-year insurance policy for cash.

4. Received bill for electricity.

5. Performed services for cash.

6. Performed services on account.

7. Paid cash for wages.

8. Paid for equipment purchased on account.

9. Depreciation on equipment.

10. Supplies are partly used.

1. Purchased equipment on account.

2. Paid cash for new equipment.

3. Purchased one-year insurance policy for cash.

4. Received bill for electricity.

5. Performed services for cash.

6. Performed services on account.

7. Paid cash for wages.

8. Paid for equipment purchased on account.

9. Depreciation on equipment.

10. Supplies are partly used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

42

The ____________________ is a method of accounting under which revenues are recorded when cash is received and expenses are recorded when cash is paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

43

The ____________________ is a method of accounting that combines aspects of the cash and accrual methods.It uses the cash basis for recording revenues and most expenses.Exceptions are made when cash is paid for assets with useful lives greater than one accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

44

Once an amount has been posted to the general ledger account from the combination journal,what is entered in the "Post.Ref." column of the combination journal?

A) the abbreviation "CJ"

B) your initials

C) a check mark

D) the account number

A) the abbreviation "CJ"

B) your initials

C) a check mark

D) the account number

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

45

Joe Maxwell is opening a new accounting practice.Journalize the following transactions in a combination journal.Use the modified cash basis.Total,rule,and prove the journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

46

The ____________________ column in the combination journal is used to enter the account titles for the General Debit and General Credit columns,identify specific creditors when assets are purchased on account,and identify amounts forwarded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

47

Ryan Honeycutt is opening a new dental practice.Journalize the following transactions in a combination journal.Use the modified cash basis.Total,rule,and prove the journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

48

A(n)____________________ is a journal with special and general columns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

49

End-of-period activities include all of the following EXCEPT

A) adjusting entries.

B) closing entries.

C) a work sheet.

D) appointment records.

A) adjusting entries.

B) closing entries.

C) a work sheet.

D) appointment records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

50

The column in the combination journal where the account number is entered after posting is the ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

51

The ____________________ column in the combination journal is used to credit accounts that are used infrequently.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

52

The amounts in the general columns of the combination journal should be posted

A) daily.

B) weekly.

C) at the end of the accounting period.

D) whenever there is time.

A) daily.

B) weekly.

C) at the end of the accounting period.

D) whenever there is time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

53

Record the following transactions for K-9 Kennel and Grooming Salon in a combination journal using the modified cash basis of accounting.Total,rule,and prove the combination journal.

?

?

?

?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

54

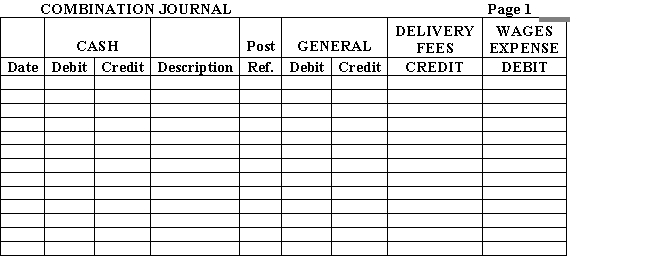

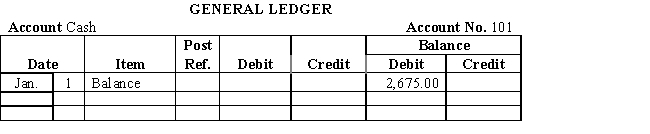

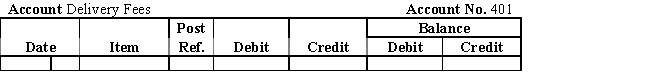

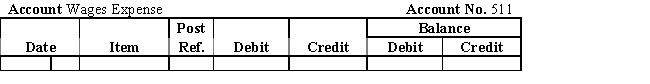

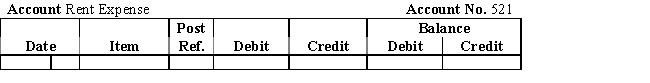

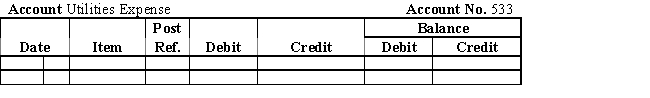

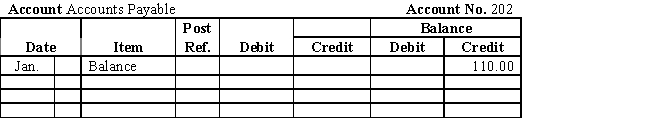

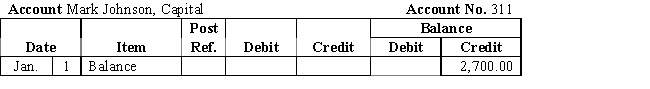

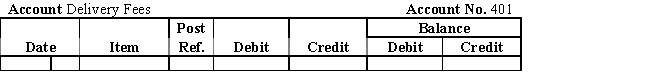

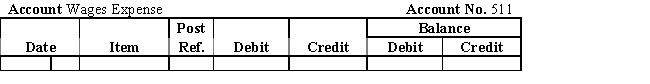

Mark Johnson opened a delivery service.His chart of accounts is shown below.

Required:

1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided.

2.Prove the combination journal.

3.Post to the general ledger.

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" > Proving the Combination Journal

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" > Proving the Combination Journal

___________________________________________________

___________________________________________________

___________________________________________________

___________________________________________________

___________________________________________________

___________________________________________________

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >

Required:

1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided.

2.Prove the combination journal.

3.Post to the general ledger.

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" > Proving the Combination Journal

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" > Proving the Combination Journal___________________________________________________

___________________________________________________

___________________________________________________

___________________________________________________

___________________________________________________

___________________________________________________

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >  . }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >  . }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >  . }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >  . }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >  . }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >  . }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >  . }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >  . }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >

. }\\ &5\quad\text { Purchased office supplies for cash, }\\ &6\quad\text {Paid the tel ephone bill (utilities), . }\\ &7\quad\text { Paid part-time employee, . }\\ &8\quad\text { Received cash for delivery services, . }\\ &11\quad\text { Paid electricity bill (utilities), .}\\ &13\quad\text { Made payment on account for delivery car previously purchased, .}\\ &14\quad\text {Paid part-time employee, . }\\ \end{array} Required: 1.Journalize the above transactions that occurred in January,20--.Use the modified cash basis and the combination journal provided. 2.Prove the combination journal. 3.Post to the general ledger. Proving the Combination Journal ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ ___________________________________________________ " class="answers-bank-image d-block" loading="lazy" >

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

55

____________________ are meant for frequently used accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

56

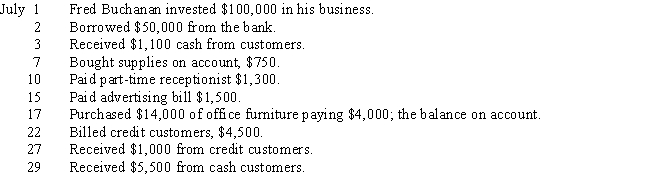

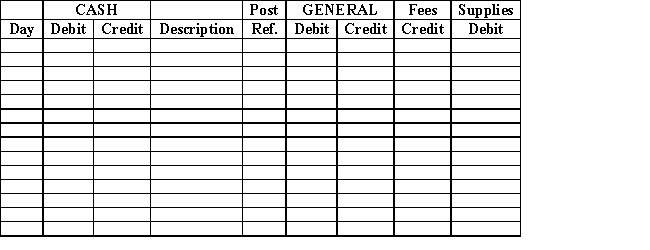

Journalize Fred Buchanan's July transactions using the combination journal provided.Prove the journal.Fred uses the modified cash basis for his accounting records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

57

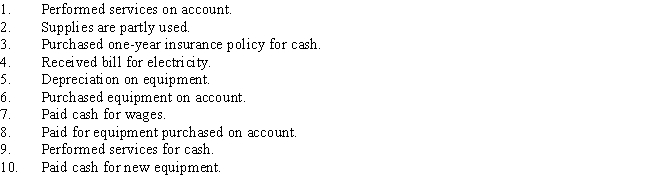

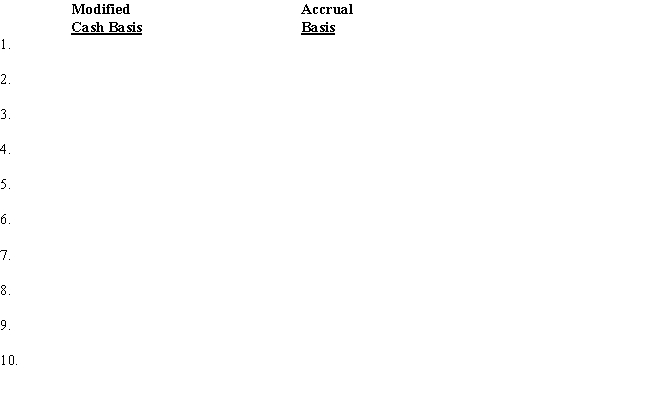

In the columns below,insert the entry that would be made for each transaction under each accounting basis,using appropriate debit and credit account titles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

58

A cash balance may be computed

A) daily.

B) weekly.

C) at the end of the accounting period.

D) whenever desired.

A) daily.

B) weekly.

C) at the end of the accounting period.

D) whenever desired.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

59

Once the total of a special column has been posted,what is written under the total of the column in the journal?

A) a check mark

B) the account number

C) the abbreviation "CJ"

D) the date

A) a check mark

B) the account number

C) the abbreviation "CJ"

D) the date

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

60

The end-of-period work sheet is used to facilitate

A) preparing financial statements.

B) posting the special journal.

C) updating appointment records.

D) recording transactions in the general ledger.

A) preparing financial statements.

B) posting the special journal.

C) updating appointment records.

D) recording transactions in the general ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

61

Match the terms with the definitions.

-The column in the combination journal used to credit accounts that are used infrequently.

A)accrual basis of accounting

B)combination journal

C)Description column

D)General Credit column

E)General Debit column

F)modified cash basis

G)Posting Reference column

H)special columns

-The column in the combination journal used to credit accounts that are used infrequently.

A)accrual basis of accounting

B)combination journal

C)Description column

D)General Credit column

E)General Debit column

F)modified cash basis

G)Posting Reference column

H)special columns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

62

Match the terms with the definitions.

-A journal with special and general columns.

A)accrual basis of accounting

B)combination journal

C)Description column

D)General Credit column

E)General Debit column

F)modified cash basis

G)Posting Reference column

H)special columns

-A journal with special and general columns.

A)accrual basis of accounting

B)combination journal

C)Description column

D)General Credit column

E)General Debit column

F)modified cash basis

G)Posting Reference column

H)special columns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

63

Match the terms with the definitions.

-The column in the combination journal used to enter the account titles for the General Debit and General Credit columns,to identify specific creditors when assets are purchased on account,and to identify amounts forwarded.

A)accrual basis of accounting

B)combination journal

C)Description column

D)General Credit column

E)General Debit column

F)modified cash basis

G)Posting Reference column

H)special columns

-The column in the combination journal used to enter the account titles for the General Debit and General Credit columns,to identify specific creditors when assets are purchased on account,and to identify amounts forwarded.

A)accrual basis of accounting

B)combination journal

C)Description column

D)General Credit column

E)General Debit column

F)modified cash basis

G)Posting Reference column

H)special columns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

64

Match the terms with the definitions.

-The column in the combination journal used to debit accounts that are used infrequently.

A)accrual basis of accounting

B)combination journal

C)Description column

D)General Credit column

E)General Debit column

F)modified cash basis

G)Posting Reference column

H)special columns

-The column in the combination journal used to debit accounts that are used infrequently.

A)accrual basis of accounting

B)combination journal

C)Description column

D)General Credit column

E)General Debit column

F)modified cash basis

G)Posting Reference column

H)special columns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

65

Match the terms with the definitions.

-A method of accounting under which revenues are recorded when earned and expenses are recorded when incurred.

A)accrual basis of accounting

B)combination journal

C)Description column

D)General Credit column

E)General Debit column

F)modified cash basis

G)Posting Reference column

H)special columns

-A method of accounting under which revenues are recorded when earned and expenses are recorded when incurred.

A)accrual basis of accounting

B)combination journal

C)Description column

D)General Credit column

E)General Debit column

F)modified cash basis

G)Posting Reference column

H)special columns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

66

The ____________________ column in the combination journal is used to debit accounts that are used infrequently.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

67

Match the terms with the definitions.

-A method of accounting that combines aspects of the cash and accrual methods.It uses the cash basis for recording revenues and most expenses.Exceptions are made when cash is paid for assets with useful lives greater than one accounting period.

A)accrual basis of accounting

B)combination journal

C)Description column

D)General Credit column

E)General Debit column

F)modified cash basis

G)Posting Reference column

H)special columns

-A method of accounting that combines aspects of the cash and accrual methods.It uses the cash basis for recording revenues and most expenses.Exceptions are made when cash is paid for assets with useful lives greater than one accounting period.

A)accrual basis of accounting

B)combination journal

C)Description column

D)General Credit column

E)General Debit column

F)modified cash basis

G)Posting Reference column

H)special columns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

68

Match the terms with the definitions.

-The column in the combination journal where the account number is entered after posting.

A)accrual basis of accounting

B)combination journal

C)Description column

D)General Credit column

E)General Debit column

F)modified cash basis

G)Posting Reference column

H)special columns

-The column in the combination journal where the account number is entered after posting.

A)accrual basis of accounting

B)combination journal

C)Description column

D)General Credit column

E)General Debit column

F)modified cash basis

G)Posting Reference column

H)special columns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

69

Match the terms with the definitions.

-Columns in journals for frequently used accounts.

A)accrual basis of accounting

B)combination journal

C)Description column

D)General Credit column

E)General Debit column

F)modified cash basis

G)Posting Reference column

H)special columns

-Columns in journals for frequently used accounts.

A)accrual basis of accounting

B)combination journal

C)Description column

D)General Credit column

E)General Debit column

F)modified cash basis

G)Posting Reference column

H)special columns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck