Deck 8: Payroll Accounting: Employee Earnings and Deductions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

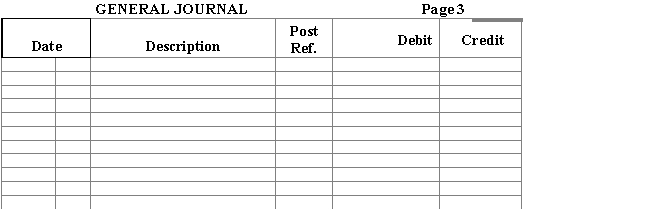

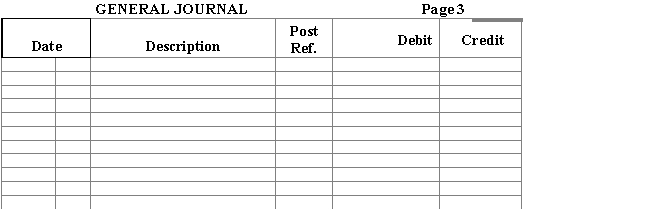

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

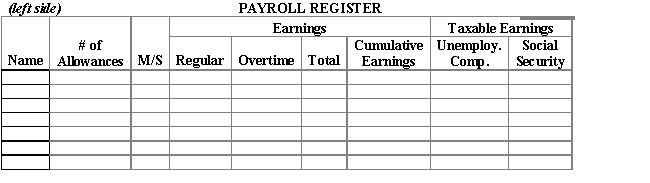

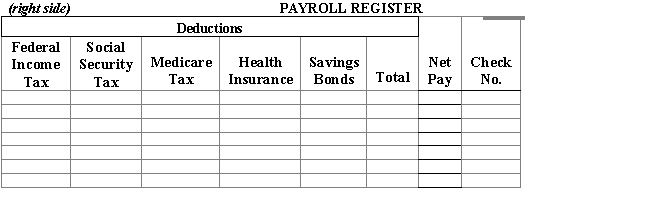

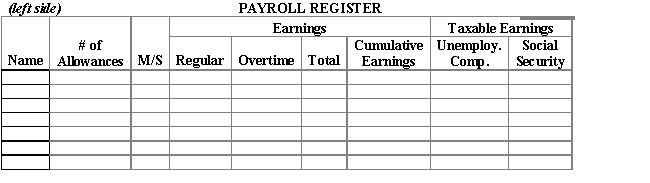

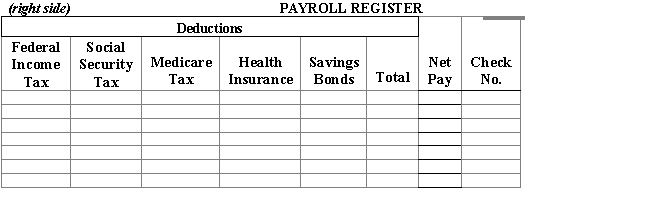

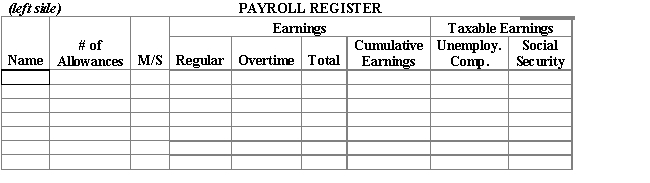

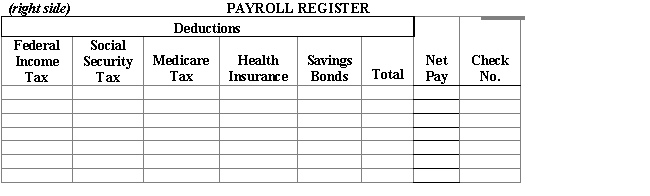

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/105

العب

ملء الشاشة (f)

Deck 8: Payroll Accounting: Employee Earnings and Deductions

1

Every individual who performs services for a business is considered to be an employee.

False

2

The payroll register replaces the general journal in most businesses.

False

3

Under federal law,employers are required to withhold a percentage of the employees' wages for pensions.

False

4

The payroll register is a summary of the annual earnings of each employee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

5

Compensation expressed in terms of hours,weeks,or units produced for skilled or unskilled labor is usually referred to as salary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

6

The Fair Labor Standards Act provides that all employees covered by the act must be paid one and one-half times the regular rate for all hours worked over 40 per week.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

7

The Fair Labor Standards Act requires employees to pay double the regular hourly rate for the time worked on Saturday.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

8

Companies must accumulate payroll data both for the business as a whole and for each employee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

9

The difference between an independent contractor and an employee is an important legal distinction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

10

An independent contractor performs a service for a fee and works under the control and direction of the company paying for the service.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

11

FICA taxes include amounts for both Social Security but not Medicare programs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

12

Compensation for managerial or administrative services usually is expressed in biweekly,monthly,or annual terms and is called wages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

13

Separate accounts are kept for each type of earnings deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

14

Payroll expenditures represent a relatively small part of the total expenditures of most companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

15

The Medicare tax rate is subject to a maximum amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

16

Plastic cards or badges encoded with basic employee data are now being used in computer-based time keeping systems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

17

Government laws and regulations regarding payroll are much more complex for employees than for independent contractors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

18

Employers primarily use the wage-bracket method to determine the amount of tax to be withheld from an employee's pay.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

19

The various government laws and regulations regarding employee deductions,employer payroll taxes,payroll records,and payroll reports apply only to employees and not to independent contractors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

20

The earnings base,against which the FICA tax is applied,and the tax rate have been changed several times since the law was first enacted and can be changed by Congress at any time in the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

21

The employee's earnings record is a summary of the earnings of all employees for each pay period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

22

Under federal law,employers are required to withhold certain amounts from the total earnings of each employee to be applied toward the payment of the employee's federal income tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

23

In an electronic system,only the employee number and hours worked need to be entered into a computer each pay period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

24

An employee's total earnings is referred to as gross pay.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

25

The Social Security Tax Payable account is debited for Social Security taxes withheld and Social Security taxes imposed on the employer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

26

Tracing the employee's gross pay for a specific time period into the appropriate wage-bracket table provided by the Internal Revenue Service is called using the wage-bracket method to determine the amount of tax to be withheld from an employee's pay.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

27

An electronic payroll system is one in which data is processed using computers equipped with payroll software.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

28

Both manual and electronic payroll systems require the same payroll input and output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

29

Deductions for U.S.savings bond purchases,pension plan payments,and Social Security taxes are considered voluntary deductions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

30

The Federal Insurance Contributions Act requires employers to withhold FICA taxes from employees' earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

31

A purely manual system of record keeping is one in which all records,journals,and ledgers are prepared by hand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

32

The journal entry to record payroll transactions for the accounting period is to debit Wages and Salaries Expense for the gross pay and credit the appropriate liability and cash accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

33

A withholding allowance exempts a specific dollar amount of an employee's gross pay from federal income tax withholding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

34

Joel Trump is paid one and one-half times the regular hourly rate for all hours worked in excess of 40 hours per week and double time for work on Sunday.Trump's regular rate is $8 per hour.During the week ended October 10,he worked 9 hours each day from Monday through Friday,6 hours on Saturday,and 4 hours on Sunday.Trump's total earnings for the week ended October 10 are

A) $110.

B) $320.

C) $430.

D) $516.

A) $110.

B) $320.

C) $430.

D) $516.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

35

Base and rate changes in payroll taxes such as FICA affect the accounting principles and procedures for payroll.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

36

Employees Income Tax Payable is a liability account that is credited for the FICA tax withheld from an employee's earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

37

Pension payments are required deductions from an employee's gross earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

38

Unless an employer has only a few employees,manual systems can be inefficient.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

39

Whether the wage-bracket method or some other method is used in computing the amount of tax to be withheld,the sum of the taxes withheld from an employee's wages is only an approximation of what the employee's actual taxes will be for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

40

Employers may use the wage-bracket method to determine the amount of tax to be withheld from an employee's pay.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

41

Jillian Diaz receives a regular salary of $1,500 a month and is entitled to overtime pay at the rate of one and one-half times the regular hourly rate for any time worked in excess of 40 hours per week.Diaz's overtime pay rate is

A) $6.92.

B) $12.98.

C) $276.92.

D) $1,800.

A) $6.92.

B) $12.98.

C) $276.92.

D) $1,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

42

Examples of employees include all of the following EXCEPT

A) secretaries.

B) attorneys.

C) accounting clerks.

D) plant supervisors.

A) secretaries.

B) attorneys.

C) accounting clerks.

D) plant supervisors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

43

The act that requires most employers to withhold certain amounts from employees' earnings for contributions to the Social Security and Medicare programs is called the

A) Federal Unemployment Tax Act.

B) Federal Withholding Tax Act.

C) State Unemployment Tax Act.

D) Federal Insurance Contributions Act.

A) Federal Unemployment Tax Act.

B) Federal Withholding Tax Act.

C) State Unemployment Tax Act.

D) Federal Insurance Contributions Act.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

44

The Fair Labor Standards Act provides which of the following minimum rates to be paid to employees for all hours worked over 40 hours per week?

A) one and one-half times the regular rate

B) same rate as the regular rate

C) two and one-half times the regular rate

D) two times the regular rate

A) one and one-half times the regular rate

B) same rate as the regular rate

C) two and one-half times the regular rate

D) two times the regular rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

45

Each employee is required to furnish the employer with which of the following forms?

A) W-2

B) 941

C) W-4

D) 1040

A) W-2

B) 941

C) W-4

D) 1040

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

46

Form W-4 is a(n)

A) Social Security application form.

B) Employer's Quarterly Federal Tax Return.

C) Employee's Withholding Allowance Certificate.

D) Wage and Tax Statement.

A) Social Security application form.

B) Employer's Quarterly Federal Tax Return.

C) Employee's Withholding Allowance Certificate.

D) Wage and Tax Statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

47

Sandra Wilson is paid one and one-half times the regular hourly rate for all hours worked in excess of 40 hours per week and double time for work on Sunday.Wilson's regular rate is $12 per hour.During the week ended July 3,she worked 9 hours each day from Monday through Friday,6 hours on Saturday,and 4 hours on Sunday.Wilson's overtime earnings for the week ended July 3 are

A) $180.

B) $294.

C) $360.

D) $430.

A) $180.

B) $294.

C) $360.

D) $430.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

48

For this text,it is assumed that the maximum amount of earnings subject to FICA taxes is

A) $100,000.

B) $110,500.

C) $105,900.

D) $110,100

A) $100,000.

B) $110,500.

C) $105,900.

D) $110,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

49

Denise Cruz receives a regular salary of $900 a month and is entitled to overtime pay at the rate of one and one-half times the regular hourly rate for any time worked in excess of 40 hours per week.Cruz's overtime rate of pay is

A) $5.63.

B) $7.79.

C) $8.44.

D) $22.50.

A) $5.63.

B) $7.79.

C) $8.44.

D) $22.50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

50

Cameron Tiller is paid one and one-half times the regular hourly rate for all hours worked in excess of 40 hours per week and double time for work on Sunday.Tiller's regular rate is $12 per hour.During the week ended March 15,he worked 9 hours each day from Monday through Friday,6 hours on Saturday,and 4 hours on Sunday.Tiller's total regular earnings for the week ended March 15 are

A) $110.

B) $216.

C) $480.

D) $430.

A) $110.

B) $216.

C) $480.

D) $430.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

51

An amount of an employee's gross pay which is exempt from federal income tax withholding is a(n)

A) additional withholding allowance.

B) withholding allowance.

C) zero bracket amount.

D) special withholding allowance.

A) additional withholding allowance.

B) withholding allowance.

C) zero bracket amount.

D) special withholding allowance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

52

Federal income tax that is withheld each pay period from the employee's earnings is NOT based on the

A) total earnings of the employee.

B) marital status of the employee.

C) number of withholding allowances claimed by the employee.

D) number of sick days.

A) total earnings of the employee.

B) marital status of the employee.

C) number of withholding allowances claimed by the employee.

D) number of sick days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

53

Any person who agrees to perform a service for a fee and is not subject to the control of those for whom the service is performed is called a(n)

A) manager.

B) employee.

C) independent contractor.

D) executive.

A) manager.

B) employee.

C) independent contractor.

D) executive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

54

The account that should be credited for the total income tax withheld from employee's earnings is

A) FICA Tax Payable.

B) FICA Tax Expense.

C) Employee Income Tax Payable.

D) Employee Income Tax Expense.

A) FICA Tax Payable.

B) FICA Tax Expense.

C) Employee Income Tax Payable.

D) Employee Income Tax Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

55

Compensation normally expressed in biweekly,monthly,or annual terms for managerial or administrative services is called

A) supplements.

B) commission.

C) salary.

D) wages.

A) supplements.

B) commission.

C) salary.

D) wages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

56

Employers usually prepare which of the following types of payroll records?

A) payroll register,employee earnings record,and payroll check

B) payroll register,payroll ledger,and employee earnings record

C) payroll journal,employee earning record,and payroll ledger

D) employee earning record,payroll check,and payroll ledger

A) payroll register,employee earnings record,and payroll check

B) payroll register,payroll ledger,and employee earnings record

C) payroll journal,employee earning record,and payroll ledger

D) employee earning record,payroll check,and payroll ledger

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

57

The needs of management and the requirements of various federal and state laws make it necessary for employers to keep records that will provide all of the following information for each employee EXCEPT

A) name,address,and Social Security number.

B) gross amount of earnings,date of payment,and period of employment covered by each payroll.

C) gross amount of earnings accumulated since the first of the year.

D) number of hours the employee works as a volunteer for the community.

A) name,address,and Social Security number.

B) gross amount of earnings,date of payment,and period of employment covered by each payroll.

C) gross amount of earnings accumulated since the first of the year.

D) number of hours the employee works as a volunteer for the community.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

58

The payroll register for the week ended April 15 for Ultimate Tanning Spa indicates gross earnings of $4,000 and total deductions of $1,200.The journal entry for the payroll for this week would include which of the following credit amounts to Cash?

A) $1,200

B) $2,800

C) $4,000

D) $5,200

A) $1,200

B) $2,800

C) $4,000

D) $5,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

59

The account that is credited with amounts withheld from an employee's earnings for any pension plan contribution is

A) Pension Plan Expense.

B) Pension Plan Taxes Payable.

C) Miscellaneous Expense.

D) Pension Plan Deductions Payable.

A) Pension Plan Expense.

B) Pension Plan Taxes Payable.

C) Miscellaneous Expense.

D) Pension Plan Deductions Payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

60

The payroll register for the week ended February 14 for Luxury Homes Construction Company indicates gross earnings of $4,000 and total deductions of $1,200.The entry for the Wages and Salaries Expense ending February 14 would be a

A) $1,200 debit.

B) $2,800 credit.

C) $4,000 debit.

D) $5,200 debit.

A) $1,200 debit.

B) $2,800 credit.

C) $4,000 debit.

D) $5,200 debit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

61

Vince Lupino works for Best Supplies Company,which pays its employees time and a half for all hours worked in excess of 40 hours per week.Lupino's rate of pay is $12.00 per hour paid weekly.Federal income tax withheld was $54.00.His wages are subject to Social Security tax withheld at the rate of 6.2% and Medicare tax at the rate of 1.45%.He worked 8 hours of overtime last week (week ended July 16).

Required:

1. Compute the following:

a. Regular pay for the week

b. Overtime pay for the week

c. Total gross wages

d. Social Security withheld

e. Medicare tax withheld

f. Total withholding

g. Net pay

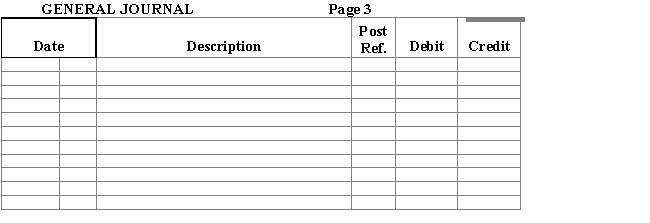

2. Journalize the payroll entry.

Required:

1. Compute the following:

a. Regular pay for the week

b. Overtime pay for the week

c. Total gross wages

d. Social Security withheld

e. Medicare tax withheld

f. Total withholding

g. Net pay

2. Journalize the payroll entry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

62

An employee's total earnings are also known as ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

63

Compensation for managerial or administrative services is called ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

64

According to the assumption used in this text,employers are required to withhold Social Security taxes on the first ____ of each employee's earnings.

A) $120,000

B) $105,900

C) $120,000

D) $110,100

A) $120,000

B) $105,900

C) $120,000

D) $110,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

65

The outputs from a manual or an electronic payroll accounting system include all of the following EXCEPT

A) payroll checks.

B) a payroll register.

C) an employee earnings record.

D) time cards.

A) payroll checks.

B) a payroll register.

C) an employee earnings record.

D) time cards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

66

The ____________________ requires employers to pay overtime at 1 1/2 times the regular rate to any hourly employee who works over 40 hours in a week.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

67

Someone who performs a service for a fee and does not work under the control and direction of the company paying for the service is known as a(n)____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

68

A multi-column form used to assemble,compute,and summarize data for all employees at the end of the payroll period is a(n)

A) payroll register.

B) employee earnings record.

C) payroll ledger.

D) payroll check.

A) payroll register.

B) employee earnings record.

C) payroll ledger.

D) payroll check.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

69

A separate record of each employee's earnings is called a(n)

A) payroll register.

B) employee earning record.

C) payroll ledger.

D) payroll check.

A) payroll register.

B) employee earning record.

C) payroll ledger.

D) payroll check.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

70

Gross pay less mandatory and voluntary deductions is called ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

71

The account that is debited for the total amount of the gross earnings of all employees for each pay period is

A) Wages and Salaries Expense.

B) Payroll Taxes Expense.

C) Miscellaneous Expense.

D) Withdrawal Expense.

A) Wages and Salaries Expense.

B) Payroll Taxes Expense.

C) Miscellaneous Expense.

D) Withdrawal Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

72

When a single-check for payroll is prepared and deposited into a special payroll bank account,which of the following entries is made to record the deposit?

A) debit Wages and Salaries Expense; credit Cash

B) debit Payroll Cash; credit Cash

C) debit Cash; credit Payroll Expense

D) debit Cash; credit Wages and Salaries Expense

A) debit Wages and Salaries Expense; credit Cash

B) debit Payroll Cash; credit Cash

C) debit Cash; credit Payroll Expense

D) debit Cash; credit Wages and Salaries Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

73

____________________ are compensation for skilled or unskilled labor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

74

The payroll register for the week ended May 28 for J & D United indicates gross earnings of $4,000 and total deductions of $1,200.The total of all the credit entries for the payroll for the week ending May 28 would be

A) $1,200.

B) $2,800.

C) $4,000.

D) $5,200.

A) $1,200.

B) $2,800.

C) $4,000.

D) $5,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

75

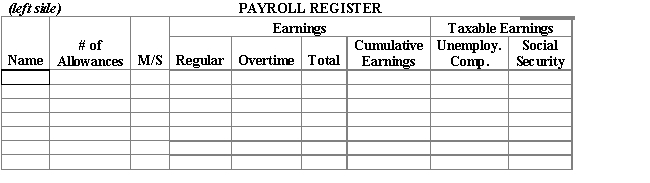

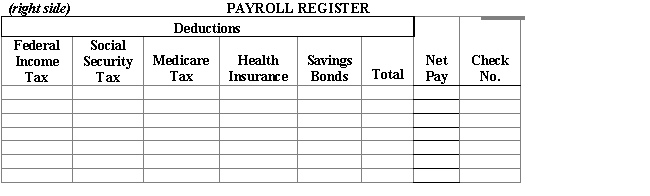

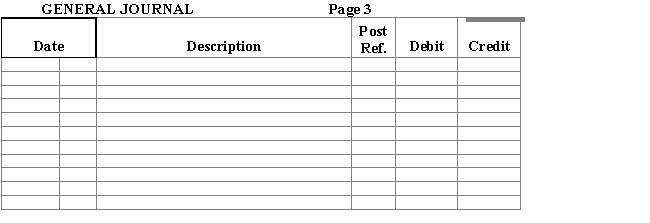

F.Fuentes operates a business known as Variety Unlimited.Listed below are the name,number of allowances claimed,marital status,total hours worked,and hourly rate of each employee.All hours worked in excess of 40 hours per week are paid at the rate of time and a half.

The employer uses the weekly federal income tax withholding table.Social Security tax is withheld at the rate of 6.2%,Medicare tax is withheld at the rate of 1.45%.All employees have Health Insurance Premiums withheld in the amount of $55.00.Hertz,Jordan,and Pollo each will have $25.00 withheld this payday under a savings bond purchase plan.

Fuentes follows the practice of drawing a single check for the net amount of the payroll and depositing the check in a special payroll account at the bank.Individual paychecks are then drawn for the amount due each employee.The checks issued this payday were numbered consecutively beginning with No.786.

Required:

1.Prepare a payroll register for Variety Unlimited for the pay period ended December 15,20--.

2.Assuming that the wages for the week ended December 15 were paid on December 17,enter the payment in the general journal.

The employer uses the weekly federal income tax withholding table.Social Security tax is withheld at the rate of 6.2%,Medicare tax is withheld at the rate of 1.45%.All employees have Health Insurance Premiums withheld in the amount of $55.00.Hertz,Jordan,and Pollo each will have $25.00 withheld this payday under a savings bond purchase plan.

Fuentes follows the practice of drawing a single check for the net amount of the payroll and depositing the check in a special payroll account at the bank.Individual paychecks are then drawn for the amount due each employee.The checks issued this payday were numbered consecutively beginning with No.786.

Required:

1.Prepare a payroll register for Variety Unlimited for the pay period ended December 15,20--.

2.Assuming that the wages for the week ended December 15 were paid on December 17,enter the payment in the general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

76

Ian McCarthy works for Willow Tree Homes.His rate of pay is $16.00 per hour and he is paid 1 1/2 times the regular rate for all hours worked in excess of 40 per week.During the last week of March of the current year he worked 45 hours.Ian is single and claims 2 withholding allowances on his W-4 form.His weekly wages are subject to the following deductions:

a. Employee (Federal)income tax (use withhol ding table provided in text).

b. Social Security tax at .

c. Medicare tax at .

d. Heal th insurance premium, .

e. Credit union deposit, .

f. United Way contribution, .

Required:

1.Compute McCarthy's regular,overtime,gross,and net pay.

2.Journalize the payment of his wages for the week ended March 26,crediting Cash for the net amount.

a. Employee (Federal)income tax (use withhol ding table provided in text).

b. Social Security tax at .

c. Medicare tax at .

d. Heal th insurance premium, .

e. Credit union deposit, .

f. United Way contribution, .

Required:

1.Compute McCarthy's regular,overtime,gross,and net pay.

2.Journalize the payment of his wages for the week ended March 26,crediting Cash for the net amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

77

Journalize the entry for Hot Rod Service using the following data from the payroll register:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

78

Jerri's Mason Supply Company has four employees who are paid on a weekly basis receiving time and a half for working more than 40 hours in any one week.The payroll data for the week ended December 10 is as follows:

?

Social Security tax is withheld at 6.2% and Medicare tax at 1.45%.Each employee that is single has $40 withheld for health insurance and each that is married has $70 withheld.Higgins has $25 withheld for United Way.Number the checks beginning with 803.

Required:

1.Complete the payroll register.

2.Journalize the payroll entry.

?

?

?

?

?

?

?

Social Security tax is withheld at 6.2% and Medicare tax at 1.45%.Each employee that is single has $40 withheld for health insurance and each that is married has $70 withheld.Higgins has $25 withheld for United Way.Number the checks beginning with 803.

Required:

1.Complete the payroll register.

2.Journalize the payroll entry.

?

?

?

? ?

?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

79

A(n)____________________ is a computerized system based on a software package that performs all payroll record keeping and prepares payroll checks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

80

The account that is credited for the Medicare tax withheld from employee's earnings and the Medicare tax imposed on the employer is

A) Medicare Tax Expense.

B) Medicare Tax Payable.

C) Payroll Taxes Expense.

D) Payroll Expense.

A) Medicare Tax Expense.

B) Medicare Tax Payable.

C) Payroll Taxes Expense.

D) Payroll Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck