Deck 3: The Double-Entry Framework

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

Match between columns

الفرضيات:

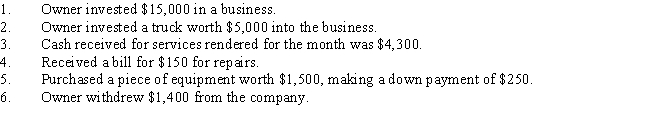

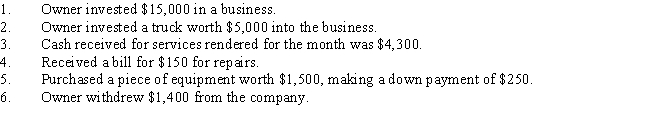

Owner's equity is increased with a ------

Owner's equity is increased with a ------

An asset account is increased with a ------

An asset account is increased with a ------

الردود:

debit

credit

debit

credit

debit

credit

debit

credit

debit

credit

debit

credit

debit

credit

debit

credit

debit

credit

debit

credit

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/94

العب

ملء الشاشة (f)

Deck 3: The Double-Entry Framework

1

Equity accounts normally have debit balances.

False

2

Prepaid insurance and supplies are assets because they will provide benefits for more than one month.

True

3

Revenues decrease owner's equity.

False

4

When services are performed for which payment will be received later,accounts receivable increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

5

Payment of rent on account decreases the Cash account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

6

A T account has three parts: the title,the debit side,and the credit side.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

7

Withdrawals of cash and other assets by the owner for personal reasons decrease owner's equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

8

The trial balance is used in preparing financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

9

At least two accounts are affected by every transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

10

When debits equal credits for a transaction,the accounting equation is in balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

11

The difference between the footings of an account is called the balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

12

The sum of the debits must equal the sum of the credits on the trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

13

To debit an account is to enter an amount on the left side of the account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

14

Prepaid Insurance is an asset account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

15

The fact that each transaction has a dual effect on the accounting elements provides the basis for what is called complex-entry accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

16

A credit increases liabilities and owner's equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

17

Liability accounts normally have debit balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

18

Expense accounts normally have debit balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

19

If services for the month total $7,000 in cash and $1,500 on account,the revenue account increases $5,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

20

An increase or decrease in any asset,liability,owner's equity,revenue,or expense is always accompanied by an offsetting change within the basic accounting elements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

21

John received $350 for delivery services; this transaction increased Cash and revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

22

The owner's capital account normally has a credit balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

23

The balance of a T account is on the side with the larger footing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

24

Owner's equity includes four types of accounts: Owner's Capital,Revenues,Expenses,and Owner's Drawing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

25

If services for the month total $3,300 in cash and $700 on account,the cash account increases $700.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

26

Increases in owner's equity are entered as credits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

27

A trial balance is a list of all accounts showing the title and balance of each account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

28

The accounting equation must remain in balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

29

Kate made a $475 payment on her company van.She should credit Accounts Payable and debit the automobile account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

30

If services for the month total $3,300 in cash and $700 on account,Accounts Receivable increases $700.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

31

Connie made a purchase on account of printer paper to last for about three months; this transaction increased Supplies and decreased Accounts Payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

32

Craig deposits $6,000 in an account to start a new business.He should debit Cash and credit his capital account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

33

A trial balance is taken periodically to check the equality of the debits and credits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

34

The purchase of a supply of markers for three months should be recorded as an increase in revenue and a decrease in cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

35

A trial balance is a formal business report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

36

Mandy withdraws $600 from her business.This transaction increases cash but decreases owner's equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

37

Services on account increase a revenue account and increase the cash account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

38

Elysa paid $135 for utilities for her office; this transaction increased Cash and the expense account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

39

The standard T account includes all of the following EXCEPT

A) a credit side.

B) a debit side.

C) a title.

D) the current date.

A) a credit side.

B) a debit side.

C) a title.

D) the current date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

40

An account is a form or record used to keep track of the increases or decreases in the individual assets,liabilities,owner's equity,revenues,and expenses of a business entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

41

Examples of revenue accounts include all of the following EXCEPT

A) Wages.

B) Sales.

C) Delivery Fees.

D) Professional Fees.

A) Wages.

B) Sales.

C) Delivery Fees.

D) Professional Fees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

42

Liability,owner's capital,and revenue accounts normally have

A) debit balances.

B) large balances.

C) negative balances.

D) credit balances.

A) debit balances.

B) large balances.

C) negative balances.

D) credit balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

43

The capital account

A) decreases with increased revenue.

B) increases with increased expenses.

C) has a normal balance of a debit.

D) increases when the owner invests money in the business.

A) decreases with increased revenue.

B) increases with increased expenses.

C) has a normal balance of a debit.

D) increases when the owner invests money in the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

44

Accounts that affect owner's equity are

A) assets,capital,and revenue.

B) capital,liabilities,and expenses.

C) expenses,capital,and revenue.

D) drawing,assets,and liabilities.

A) assets,capital,and revenue.

B) capital,liabilities,and expenses.

C) expenses,capital,and revenue.

D) drawing,assets,and liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

45

The drawing account should be used to show

A) the amount the owner has invested in the business.

B) the amount the owner has taken out of the business.

C) the amount the business has earned.

D) the amount the business has spent.

A) the amount the owner has invested in the business.

B) the amount the owner has taken out of the business.

C) the amount the business has earned.

D) the amount the business has spent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

46

The normal balance of a capital account

A) can be either a debit or a credit balance.

B) is a debit balance.

C) is a credit balance.

D) is called a footing.

A) can be either a debit or a credit balance.

B) is a debit balance.

C) is a credit balance.

D) is called a footing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

47

A T account has which of the following three major parts?

A) a title,a debit side,and a credit side

B) a title,a current date,and a balance

C) a debit side,a credit side,and a total column

D) a debit side,a credit side,and a balance

A) a title,a debit side,and a credit side

B) a title,a current date,and a balance

C) a debit side,a credit side,and a total column

D) a debit side,a credit side,and a balance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

48

An increase in an asset account may be offset by a(n)

A) decrease in a liability account.

B) increase in an expense account.

C) increase in owner's equity.

D) decrease in owner's equity.

A) decrease in a liability account.

B) increase in an expense account.

C) increase in owner's equity.

D) decrease in owner's equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

49

Increases are entered on the credit side of a(n)

A) asset account.

B) liability account.

C) expense account.

D) drawing account.

A) asset account.

B) liability account.

C) expense account.

D) drawing account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

50

The difference between the total debits and credits to an account is called a

A) balance.

B) ruling.

C) footing.

D) trial balance.

A) balance.

B) ruling.

C) footing.

D) trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

51

A credit

A) increases assets.

B) is on the right side.

C) decreases liabilities.

D) decreases owner's equity.

A) increases assets.

B) is on the right side.

C) decreases liabilities.

D) decreases owner's equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

52

A cash payment on a loan affects which of the following accounts?

A) Cash and Accounts Receivable

B) Cash and Notes Payable

C) Cash and an expense account

D) Cash and a revenue account

A) Cash and Accounts Receivable

B) Cash and Notes Payable

C) Cash and an expense account

D) Cash and a revenue account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

53

A debit

A) is on the left side.

B) decreases assets.

C) increases liabilities.

D) increases owner's equity.

A) is on the left side.

B) decreases assets.

C) increases liabilities.

D) increases owner's equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

54

Totals on the debit and credit sides to determine the balance of an account are known as

A) rulings.

B) credits.

C) debits.

D) footings.

A) rulings.

B) credits.

C) debits.

D) footings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

55

An example of an expense is

A) prepaid insurance.

B) advertising.

C) accounts payable.

D) cash.

A) prepaid insurance.

B) advertising.

C) accounts payable.

D) cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

56

An investment of cash in a business by the owner

A) increases cash.

B) decreases owner's equity.

C) appears in a liability account.

D) represents an obligation of the business.

A) increases cash.

B) decreases owner's equity.

C) appears in a liability account.

D) represents an obligation of the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

57

Revenues

A) decrease liabilities.

B) decrease cash.

C) increase expenses.

D) increase owner's equity.

A) decrease liabilities.

B) decrease cash.

C) increase expenses.

D) increase owner's equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

58

Asset and expense accounts normally have

A) credit balances.

B) large balances.

C) debit balances.

D) negative balances.

A) credit balances.

B) large balances.

C) debit balances.

D) negative balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

59

A debit represents an increase in

A) an asset.

B) a liability.

C) owner's equity.

D) revenues.

A) an asset.

B) a liability.

C) owner's equity.

D) revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

60

The fact that each transaction has a dual effect on the accounting elements provides the basis for what is called

A) single-entry accounting.

B) compound-entry accounting.

C) multiple-entry accounting.

D) double-entry accounting.

A) single-entry accounting.

B) compound-entry accounting.

C) multiple-entry accounting.

D) double-entry accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

61

Falana receives payment for services performed in the amount of $3,147.This transaction

A) decreases Wage Expense.

B) increases Cash.

C) increases owner's equity.

D) decreases Cash.

A) decreases Wage Expense.

B) increases Cash.

C) increases owner's equity.

D) decreases Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

62

Match between columns

الفرضيات:

Owner's equity is increased with a ------

Owner's equity is increased with a ------

An asset account is increased with a ------

An asset account is increased with a ------

الردود:

debit

credit

debit

credit

debit

credit

debit

credit

debit

credit

debit

credit

debit

credit

debit

credit

debit

credit

debit

credit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

63

A list of all accounts showing the account title and the balance of each account is called a(n)____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

64

The balance sheet

A) is a list of all accounts showing the title and balance of each account.

B) is used as an aid in preparing the trial balance and income statement.

C) is for a period of time.

D) shows that assets equal liabilities plus owner's equity.

A) is a list of all accounts showing the title and balance of each account.

B) is used as an aid in preparing the trial balance and income statement.

C) is for a period of time.

D) shows that assets equal liabilities plus owner's equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

65

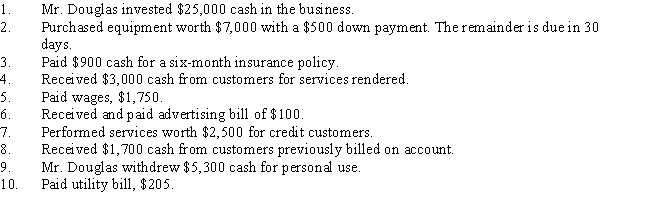

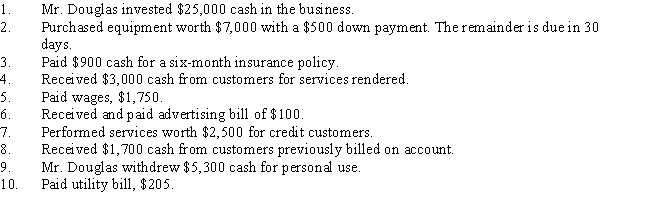

Analyze the following transactions using the T account approach.Place the dollar amount on the debit and credit sides.After all transactions have been recorded,foot the accounts where necessary and enter the balance in the proper place.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

66

Payment of a telephone bill represents an increase in a(n)

A) asset.

B) liability.

C) revenue.

D) expense.

A) asset.

B) liability.

C) revenue.

D) expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

67

Payment of office rent represents a decrease in

A) a liability account.

B) expenses.

C) cash.

D) a revenue account.

A) a liability account.

B) expenses.

C) cash.

D) a revenue account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

68

Record the following transactions in the T accounts below.Indicate next to each entry the number for that transaction.After all transactions have been recorded,foot the accounts where necessary and enter the balances in the proper places.Prepare a trial balance for Douglas Distinctive Services as of December 31,20--.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

69

A debit to either the ____________________ account or a(n)____________________ account will cause a decrease in the owner's equity of a business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

70

The trial balance

A) shows the current date.

B) shows only debit balances.

C) shows only credit balances.

D) lists only accounts that are used to prepare the balance sheet.

A) shows the current date.

B) shows only debit balances.

C) shows only credit balances.

D) lists only accounts that are used to prepare the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

71

A purchase of an asset on account

A) increases cash.

B) decreases owner's equity.

C) increases assets.

D) decreases expenses.

A) increases cash.

B) decreases owner's equity.

C) increases assets.

D) decreases expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

72

Footings in T accounts

A) appear after each entry.

B) always appear on the right side.

C) are unnecessary when there is only one entry.

D) appear only in accounts carried over from the previous accounting period.

A) appear after each entry.

B) always appear on the right side.

C) are unnecessary when there is only one entry.

D) appear only in accounts carried over from the previous accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

73

The accounts below all have normal balances.Prepare a trial balance for Alana's Florist Shop as of September 30,20--.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

74

An amount entered on the left side of an account is called a(n)____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

75

Analyze the following transactions using the T account approach.Place the dollar amounts on the debit and credit sides.Indicate next to each entry the number for that transaction.After all transactions have been recorded,foot the accounts where necessary and enter the balance in the proper place for each account.

1.Nick Bowman invested cash of $12,000 in the business.

2.Received and paid utility bill of $125.

3.Bought $300 of supplies on account.

4.Sold services worth $2,500 to customers on account.

5.Received cash payment of $800 from credit customers.

1.Nick Bowman invested cash of $12,000 in the business.

2.Received and paid utility bill of $125.

3.Bought $300 of supplies on account.

4.Sold services worth $2,500 to customers on account.

5.Received cash payment of $800 from credit customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

76

Footings in T accounts

A) appear to the left of the amount columns.

B) are used for accounts with more than one debit or credit.

C) are only used in asset accounts.

D) are used for accounts with only one entry.

A) appear to the left of the amount columns.

B) are used for accounts with more than one debit or credit.

C) are only used in asset accounts.

D) are used for accounts with only one entry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

77

The ____________________ is shown on the third line of the trial balance heading.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

78

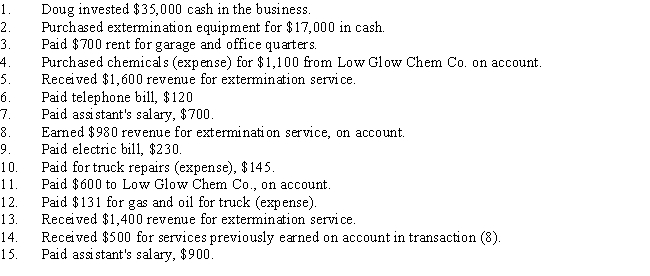

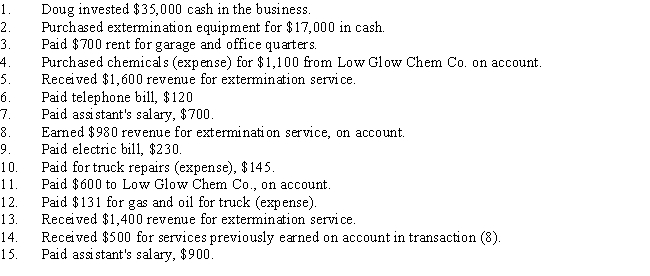

Doug Allen has decided to go into the insect extermination business and to operate as Doug's Extermination Service.The following transactions were completed during the first month of operations,May,20--.

Enter the transactions in the T accounts,then enter the total of each column.If an account has entries on both sides,determine the balance and enter it on the side with the larger total.

Enter the transactions in the T accounts,then enter the total of each column.If an account has entries on both sides,determine the balance and enter it on the side with the larger total.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

79

The purchase of an asset on account and making a partial payment results in all of the following EXCEPT

A) an increase in an asset account.

B) a decrease in the Cash account.

C) a balanced accounting equation.

D) an increase in owner's equity.

A) an increase in an asset account.

B) a decrease in the Cash account.

C) a balanced accounting equation.

D) an increase in owner's equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

80

The normal balance for an expense account would be on the ____________________ side.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck