Deck 5: Appendix B: Decreases in Ownership Interest

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/4

العب

ملء الشاشة (f)

Deck 5: Appendix B: Decreases in Ownership Interest

1

A parent company reduced its ownership in its subsidiary from 80% to 15%. How should this be reported on the parent's consolidated financial statements?

A)As a disposal of its interest in the subsidiary and a reacquisition of the retained interest at fair value

B)As a disposal of its interest in the subsidiary and a reacquisition of the retained interest at book value

C)As a write-down to the retained interest

D)As an adjustment to the shareholders' equity

A)As a disposal of its interest in the subsidiary and a reacquisition of the retained interest at fair value

B)As a disposal of its interest in the subsidiary and a reacquisition of the retained interest at book value

C)As a write-down to the retained interest

D)As an adjustment to the shareholders' equity

A

2

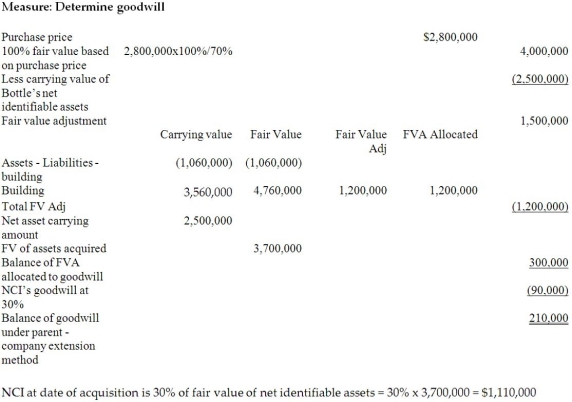

On January 1, 20X7, Water Limited purchased 700,000 shares of Bottle Inc. for $2.8 million. On January 1, 20X9, Water sold 150,000 shares of Bottle for $700,000. During the entire period Bottle had 1,000,000 shares outstanding. Water accounts for its investment in Bottle under the equity method. The following information was extracted from the financial records of Bottle:

All net identifiable assets had a fair value equal to their carrying value on the date of acquisition except the buildings. There is no goodwill reported on the separate entity financial statements of Water or Bottle. There have been no intercompany transactions between Water and Bottle.

Required:

Calculate the balances of the following accounts on the consolidated statement of financial position at December 31, 20X10, under the parent-company extension method:

a. Goodwill

b. NCI

Determine the adjustment to equity required.

All net identifiable assets had a fair value equal to their carrying value on the date of acquisition except the buildings. There is no goodwill reported on the separate entity financial statements of Water or Bottle. There have been no intercompany transactions between Water and Bottle.

Required:

Calculate the balances of the following accounts on the consolidated statement of financial position at December 31, 20X10, under the parent-company extension method:

a. Goodwill

b. NCI

Determine the adjustment to equity required.

Building Fair value increment Amortization per year:

Building Fair value increment Amortization per year:Fair value increment annually.

a.

Note-this balance will not change as percentage ownership is added as long as control is maintained. b)

Adjustment to equity:

3

Gumble Ltd. has owned 65% of the common shares of Lopez for several years. This year, Gumble reduced its interest in Lopez to 10%. Which of the following statements is true?

A)Gumble must change from reporting under consolidation to the equity method.

B)Gumble must change from reporting under consolidation to the cost method.

C)Gumble must change from reporting under the equity method to the cost method.

D)Gumble is not required to change its reporting method.

A)Gumble must change from reporting under consolidation to the equity method.

B)Gumble must change from reporting under consolidation to the cost method.

C)Gumble must change from reporting under the equity method to the cost method.

D)Gumble is not required to change its reporting method.

B

4

When a subsidiary issues shares, ________.

A)no gain or loss is recognized

B)a gain or loss is always recognized

C)this reduces the NCI

D)this may increase the NCI

A)no gain or loss is recognized

B)a gain or loss is always recognized

C)this reduces the NCI

D)this may increase the NCI

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 4 في هذه المجموعة.

فتح الحزمة

k this deck