Deck 3: Appendix A: AIncome Tax Allocation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/6

العب

ملء الشاشة (f)

Deck 3: Appendix A: AIncome Tax Allocation

1

Foster Ltd. acquired 100% of Benson Ltd. The carrying values of Benson's capital assets differed from their fair values and their fair values differed from their tax bases. Which of the following statements is true?

A)The difference between Benson's carrying values and its fair values created a deferred tax asset or liability that is part of the allocation of the acquisition cost.

B)The difference between Benson's fair values and its adjusted cost bases for tax purposes creates a deferred tax asset or liability that is part of the allocation of the acquisition cost.

C)The difference between Benson's carrying values and its adjusted cost bases for tax purposes created a deferred tax asset or liability that is part of the allocation of the acquisition cost.

D)No deferred tax asset or liability arises from the above situation.

A)The difference between Benson's carrying values and its fair values created a deferred tax asset or liability that is part of the allocation of the acquisition cost.

B)The difference between Benson's fair values and its adjusted cost bases for tax purposes creates a deferred tax asset or liability that is part of the allocation of the acquisition cost.

C)The difference between Benson's carrying values and its adjusted cost bases for tax purposes created a deferred tax asset or liability that is part of the allocation of the acquisition cost.

D)No deferred tax asset or liability arises from the above situation.

B

2

O'Ball Ltd. wants to acquire Kiro Ltd. to take advantage of its tax losses and credit carryforwards. In what way can O'Ball accomplish this?

A)O'Ball can purchase Kiro's net assets.

B)O'Ball can do a share exchange with Kiro.

C)O'Ball can either purchase Kiro's net assets or purchase Kiro's shares.

D)O'Ball can either purchase Kiro's net assets or do a share exchange with Kiro.

A)O'Ball can purchase Kiro's net assets.

B)O'Ball can do a share exchange with Kiro.

C)O'Ball can either purchase Kiro's net assets or purchase Kiro's shares.

D)O'Ball can either purchase Kiro's net assets or do a share exchange with Kiro.

B

3

Castle Ltd. acquired 100% of Bello Ltd. At the time of acquisition, Bello had assets with a tax value of $700,000, carrying value of $800,000, and fair value of $950,000. Both Castle and Bello are subject to a tax rate of 40%. What is the amount of the deferred tax liability on Castle's consolidated SFP?

A)$40,000

B)$60,000

C)$100,000

D)$280,000

A)$40,000

B)$60,000

C)$100,000

D)$280,000

C

4

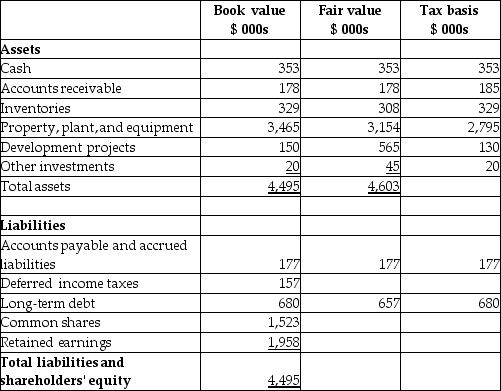

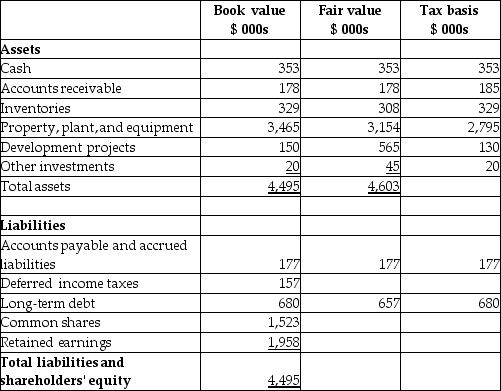

On January 1, 20X7, Falcon acquired 100% of the outstanding shares of Intra for $3,600,000. Both are mining companies involved in nickel and copper production. The balance sheet for Intra at the date of acquisition is shown below, together with estimates of the fair values and tax values of Intra's recorded assets and liabilities.

Intra Corp

Statement of Financial Position

December 31, 20X 6 The tax rate for Intra and for Falcon is 30%.

The tax rate for Intra and for Falcon is 30%.

Required:

What is the amount of goodwill to be recorded for this business combination?

Intra Corp

Statement of Financial Position

December 31, 20X 6

The tax rate for Intra and for Falcon is 30%.

The tax rate for Intra and for Falcon is 30%.Required:

What is the amount of goodwill to be recorded for this business combination?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 6 في هذه المجموعة.

فتح الحزمة

k this deck

5

Castle Ltd. acquired 100% of Bello Ltd. At the time of acquisition, Bello had assets with a tax value of $700,000, carrying value of $800,000, and fair value of $950,000. Both Castle and Bello are subject to a tax rate of 40%. What is the effect of recognizing the deferred tax in accounting for the acquisition?

A)Increase in liabilities and goodwill

B)Decrease in liabilities and goodwill

C)Decrease in liabilities and increase in goodwill

D)Increase in liabilities and decrease in goodwill

A)Increase in liabilities and goodwill

B)Decrease in liabilities and goodwill

C)Decrease in liabilities and increase in goodwill

D)Increase in liabilities and decrease in goodwill

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 6 في هذه المجموعة.

فتح الحزمة

k this deck

6

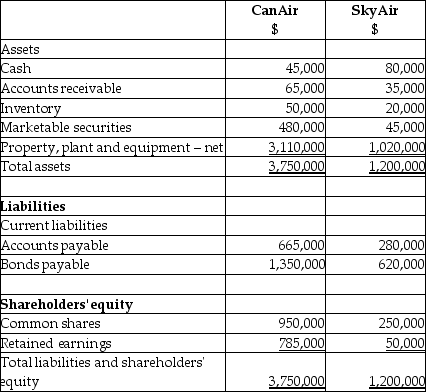

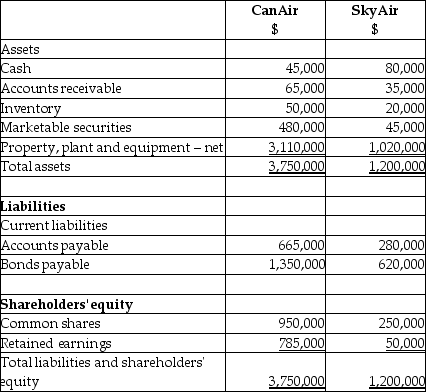

On September 1, 20X7, CanAir Limited decided to buy 100% of the shares outstanding of SkyAir Inc. for $1,215,000. CanAir will pay for this acquisition by cashing in all of its marketable securities and issuing share capital for the remaining amount. The balances showing on the statement of financial position for the two companies at August 31, 20X7, are as follows:

After a review of the financial assets and liabilities, CanAir determines that some of the assets of SkyAir have fair values different from their carrying values. These items are listed below:

After a review of the financial assets and liabilities, CanAir determines that some of the assets of SkyAir have fair values different from their carrying values. These items are listed below:

Property, plant, and equipment: Fair value is $1,350,000

Internet domain name: Fair value is $55,000

Customer lists: Fair value is $35,000

In addition, SkyAir has tax losses available for carryforward that have a fair value of $225,000 and it is probable that they will be realized in the future.

Required:

Determine the amount of goodwill that will be recorded on the business combination.

Prepare the consolidated statement of financial position as at September 1, 20X7.

After a review of the financial assets and liabilities, CanAir determines that some of the assets of SkyAir have fair values different from their carrying values. These items are listed below:

After a review of the financial assets and liabilities, CanAir determines that some of the assets of SkyAir have fair values different from their carrying values. These items are listed below:Property, plant, and equipment: Fair value is $1,350,000

Internet domain name: Fair value is $55,000

Customer lists: Fair value is $35,000

In addition, SkyAir has tax losses available for carryforward that have a fair value of $225,000 and it is probable that they will be realized in the future.

Required:

Determine the amount of goodwill that will be recorded on the business combination.

Prepare the consolidated statement of financial position as at September 1, 20X7.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 6 في هذه المجموعة.

فتح الحزمة

k this deck