Deck 12: Full Costing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/67

العب

ملء الشاشة (f)

Deck 12: Full Costing

1

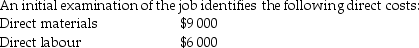

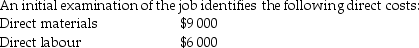

Use the information below to answer the following questions.

Scott's Fencing constructs paling fences. During last month, the fencing division erected 4 000 metres of fencing. The costs incurred by the division were as follows:

-Refer to the table above. The cost per metre of fencing is:

A)$2.25

B)$2.75

C)$2.50

D)$3.00

Scott's Fencing constructs paling fences. During last month, the fencing division erected 4 000 metres of fencing. The costs incurred by the division were as follows:

-Refer to the table above. The cost per metre of fencing is:

A)$2.25

B)$2.75

C)$2.50

D)$3.00

$3.00

2

Use the information below to answer the following questions.

Jan runs a successful hairdressing salon in the CBD. The type of costs incurred in providing services to clients are:

i)Hairdressers' salaries

ii) Shampoo and Conditioner

(noindividual records kept of usage)

iii) Colour and Perm Solutions

(individual records kept of usage per client )

iv) Electricity and Gas v)Depreciation of equipment

-Refer to the information above. The indirect costs incurred in providing a haircut only to a client would be:

A)all costs mentioned above.

B)shampoo and conditioner, electricity and gas.

C)electricity and gas and depreciation of equipment.

D)shampoo and conditioner, electricity and gas, and depreciation of equipment.

Jan runs a successful hairdressing salon in the CBD. The type of costs incurred in providing services to clients are:

i)Hairdressers' salaries

ii) Shampoo and Conditioner

(noindividual records kept of usage)

iii) Colour and Perm Solutions

(individual records kept of usage per client )

iv) Electricity and Gas v)Depreciation of equipment

-Refer to the information above. The indirect costs incurred in providing a haircut only to a client would be:

A)all costs mentioned above.

B)shampoo and conditioner, electricity and gas.

C)electricity and gas and depreciation of equipment.

D)shampoo and conditioner, electricity and gas, and depreciation of equipment.

shampoo and conditioner, electricity and gas, and depreciation of equipment.

3

The approach to deriving full costs in an operation where only identical products are produced is:

A)(total cost times percentage allocated to each unit)divided by total units.

B)total cost divided by total units.

C)(total units times percentage allocated to each unit)times total cost.

D)total units times total cost.

A)(total cost times percentage allocated to each unit)divided by total units.

B)total cost divided by total units.

C)(total units times percentage allocated to each unit)times total cost.

D)total units times total cost.

B

4

In full costing overhead, costs are:

A)economically identifiable with the cost object.

B)always fixed costs.

C)not economically identifiable with the cost object.

D)Both B and C

A)economically identifiable with the cost object.

B)always fixed costs.

C)not economically identifiable with the cost object.

D)Both B and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

5

Use the information below to answer the following questions.

Jan runs a successful hairdressing salon in the CBD. The type of costs incurred in providing services to clients are:

i)Hairdressers' salaries

ii) Shampoo and Conditioner

(noindividual records kept of usage)

iii) Colour and Perm Solutions

(individual records kept of usage per client )

iv) Electricity and Gas v)Depreciation of equipment

-Refer to the information above. The indirect costs incurred in providing a perm to a client would be:

A)all costs mentioned above.

B)shampoo and conditioner, electricity and gas, depreciation on equipment.

C)shampoo and conditioner, electricity and gas, colour and perm solution.

D)shampoo and conditioner, electricity and gas.

Jan runs a successful hairdressing salon in the CBD. The type of costs incurred in providing services to clients are:

i)Hairdressers' salaries

ii) Shampoo and Conditioner

(noindividual records kept of usage)

iii) Colour and Perm Solutions

(individual records kept of usage per client )

iv) Electricity and Gas v)Depreciation of equipment

-Refer to the information above. The indirect costs incurred in providing a perm to a client would be:

A)all costs mentioned above.

B)shampoo and conditioner, electricity and gas, depreciation on equipment.

C)shampoo and conditioner, electricity and gas, colour and perm solution.

D)shampoo and conditioner, electricity and gas.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

6

Use the information below to answer the following questions.

Jan runs a successful hairdressing salon in the CBD. The type of costs incurred in providing services to clients are:

i)Hairdressers' salaries

ii) Shampoo and Conditioner

(noindividual records kept of usage)

iii) Colour and Perm Solutions

(individual records kept of usage per client )

iv) Electricity and Gas v)Depreciation of equipment

-Refer to the information above. The direct costs incurred in providing a haircut only to a client would be:

A)all costs mentioned above.

B)hairdresser salary, shampoo and conditioner.

C)hairdresser salary, shampoo and conditioner and electricity and gas.

D)hairdresser salary.

Jan runs a successful hairdressing salon in the CBD. The type of costs incurred in providing services to clients are:

i)Hairdressers' salaries

ii) Shampoo and Conditioner

(noindividual records kept of usage)

iii) Colour and Perm Solutions

(individual records kept of usage per client )

iv) Electricity and Gas v)Depreciation of equipment

-Refer to the information above. The direct costs incurred in providing a haircut only to a client would be:

A)all costs mentioned above.

B)hairdresser salary, shampoo and conditioner.

C)hairdresser salary, shampoo and conditioner and electricity and gas.

D)hairdresser salary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

7

What does full cost represent?

A)Only semi-variable costs

B)Variable costs

C)Both fixed and variable costs

D)Fixed costs

A)Only semi-variable costs

B)Variable costs

C)Both fixed and variable costs

D)Fixed costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

8

A printing firm that produces newsletters, advertising brochures and other small documents for individual clients is operating what type of costing system?

A)Process costing

B)Job costing

C)Periodic costing

D)None of the above

A)Process costing

B)Job costing

C)Periodic costing

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

9

Use the information below to answer the following questions.

Scott's Fencing constructs paling fences. During last month, the fencing division erected 4 000 metres of fencing. The costs incurred by the division were as follows:

-Refer to the table above. The total direct costs incurred in erecting the 4 000 metres of fencing is:

A)$11 000

B)$9 000

C)$9 500

D)$10 000

Scott's Fencing constructs paling fences. During last month, the fencing division erected 4 000 metres of fencing. The costs incurred by the division were as follows:

-Refer to the table above. The total direct costs incurred in erecting the 4 000 metres of fencing is:

A)$11 000

B)$9 000

C)$9 500

D)$10 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

10

Full product costs comprise:

A)non-production costs only.

B)production costs only.

C)both production and non-production costs.

D)all costs except warrantee costs.

A)non-production costs only.

B)production costs only.

C)both production and non-production costs.

D)all costs except warrantee costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

11

What is the difference between selling price and profit?

A)Direct cost

B)Full cost

C)Variable cost

D)Fixed cost

A)Direct cost

B)Full cost

C)Variable cost

D)Fixed cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following statements is correct?

A)Full costing takes into account all resources sacrificed to achieve a specific objective.

B)Full costing only takes into account manufacturing costs.

C)Only variable costs are required to determine the selling price for a product.

D)Full costing cannot be used in the service industries.

A)Full costing takes into account all resources sacrificed to achieve a specific objective.

B)Full costing only takes into account manufacturing costs.

C)Only variable costs are required to determine the selling price for a product.

D)Full costing cannot be used in the service industries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

13

What costing system is used to assign costs to a distinct, identifiable job or service?

A)Job costing system

B)Material control system

C)Process costing system

D)Average costing system

A)Job costing system

B)Material control system

C)Process costing system

D)Average costing system

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

14

The classification of a cost as either direct or indirect depends primarily on:

A)the computer tracing system within the organisation.

B)the definition of the cost object.

C)the knowledge of the accountant.

D)the type of business.

A)the computer tracing system within the organisation.

B)the definition of the cost object.

C)the knowledge of the accountant.

D)the type of business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

15

Although ________ costs are important in management decision-making, they cannot be directly related to individual cost units.

A)overhead

B)direct

C)material

D)fixed

A)overhead

B)direct

C)material

D)fixed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

16

Use the information below to answer the following questions.

Jan runs a successful hairdressing salon in the CBD. The type of costs incurred in providing services to clients are:

i)Hairdressers' salaries

ii) Shampoo and Conditioner

(noindividual records kept of usage)

iii) Colour and Perm Solutions

(individual records kept of usage per client )

iv) Electricity and Gas v)Depreciation of equipment

-Refer to the information above. The direct costs incurred in providing a perm to a client would be:

A)all costs mentioned above.

B)hairdresser salary, shampoo, and conditioner.

C)hairdresser salary, colour and perm solution.

D)hairdresser salary.

Jan runs a successful hairdressing salon in the CBD. The type of costs incurred in providing services to clients are:

i)Hairdressers' salaries

ii) Shampoo and Conditioner

(noindividual records kept of usage)

iii) Colour and Perm Solutions

(individual records kept of usage per client )

iv) Electricity and Gas v)Depreciation of equipment

-Refer to the information above. The direct costs incurred in providing a perm to a client would be:

A)all costs mentioned above.

B)hairdresser salary, shampoo, and conditioner.

C)hairdresser salary, colour and perm solution.

D)hairdresser salary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

17

What does an overhead recovery rate represent?

A)A rate at which jobs will be charged with overheads

B)A rate at which jobs are charged labour costs

C)A rate at which jobs are charged to clients

D)A rate at which jobs use overhead

A)A rate at which jobs will be charged with overheads

B)A rate at which jobs are charged labour costs

C)A rate at which jobs are charged to clients

D)A rate at which jobs use overhead

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

18

Anything for which a separate measurement of cost is desired is called a:

A)cost unit.

B)job.

C)article.

D)fixed cost object.

A)cost unit.

B)job.

C)article.

D)fixed cost object.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

19

Use the information below to answer the following questions.

Scott's Fencing constructs paling fences. During last month, the fencing division erected 4 000 metres of fencing. The costs incurred by the division were as follows:

-Refer to the table above. The full cost associated with constructing the 4 000 metres of fencing is:

A)$12 000

B)$9 500

C)$9 000

D)$10 000

Scott's Fencing constructs paling fences. During last month, the fencing division erected 4 000 metres of fencing. The costs incurred by the division were as follows:

-Refer to the table above. The full cost associated with constructing the 4 000 metres of fencing is:

A)$12 000

B)$9 500

C)$9 000

D)$10 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

20

A cost unit can be:

A)a product.

B)a department.

C)a job.

D)All of the above

A)a product.

B)a department.

C)a job.

D)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following is an example of a product cost centre?

A)Corporate headquarters

B)Payroll department

C)Accounts payable department

D)Machining department

A)Corporate headquarters

B)Payroll department

C)Accounts payable department

D)Machining department

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

22

To what are service cost centre costs assigned?

A)Individual customers

B)Corporate headquarters

C)Production cost centres

D)Units of output directly

A)Individual customers

B)Corporate headquarters

C)Production cost centres

D)Units of output directly

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

23

Use the information below to answer the following questions.

Whack Ltd, a tennis racquet manufacturer, has broken the production process into three lines, each in a different department: framing, stringing, and finishing. The following information relates to each department for the month of April:

Production for April is 10 000 racquets

-Refer to the table above. What is the total overhead for the organisation?

A)$30 000

B)$10 000

C)$20 000

D)$60 000

Whack Ltd, a tennis racquet manufacturer, has broken the production process into three lines, each in a different department: framing, stringing, and finishing. The following information relates to each department for the month of April:

Production for April is 10 000 racquets

-Refer to the table above. What is the total overhead for the organisation?

A)$30 000

B)$10 000

C)$20 000

D)$60 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

24

Nugyen Pty Ltd estimates its overhead costs will be $300 000 for the coming year and it will use 20 000 direct labour hours over the same period. How much overhead will be charged to a job that uses 25 direct labour hours?

A)$375

B)$15

C)$23

D)$120

A)$375

B)$15

C)$23

D)$120

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

25

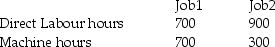

Use the information below to answer the following questions.

Fingers Ltd, a graphic design service, has received an inquiry from a potential customer for a quotation for a web-page design. The pricing policy of the business is based on the budgeted financial data for the coming financial year. The data for the coming year is shown below:

Other relevant information: Management has budgeted for 20 000 direct labour hours. Overhead is applied based on direct labour hours. An estimate for the direct costs of the job to be quoted on is shown below:

-Refer to the table above. The budgeted overhead recovery rate based on direct labour hours is:

A)$3.85 per DLH.

B)$5.60 per DLH.

C)$2.85 per DLH.

D)$5.85 per DLH.

Fingers Ltd, a graphic design service, has received an inquiry from a potential customer for a quotation for a web-page design. The pricing policy of the business is based on the budgeted financial data for the coming financial year. The data for the coming year is shown below:

Other relevant information: Management has budgeted for 20 000 direct labour hours. Overhead is applied based on direct labour hours. An estimate for the direct costs of the job to be quoted on is shown below:

-Refer to the table above. The budgeted overhead recovery rate based on direct labour hours is:

A)$3.85 per DLH.

B)$5.60 per DLH.

C)$2.85 per DLH.

D)$5.85 per DLH.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

26

Use the information below to answer the following questions.

Fingers Ltd, a graphic design service, has received an inquiry from a potential customer for a quotation for a web-page design. The pricing policy of the business is based on the budgeted financial data for the coming financial year. The data for the coming year is shown below:

Other relevant information: Management has budgeted for 20 000 direct labour hours. Overhead is applied based on direct labour hours. An estimate for the direct costs of the job to be quoted on is shown below:

-Refer to the table above. Total budgeted indirect costs for the year are:

A)$117 000

B)$77 000

C)$72 000

D)$57 000

Fingers Ltd, a graphic design service, has received an inquiry from a potential customer for a quotation for a web-page design. The pricing policy of the business is based on the budgeted financial data for the coming financial year. The data for the coming year is shown below:

Other relevant information: Management has budgeted for 20 000 direct labour hours. Overhead is applied based on direct labour hours. An estimate for the direct costs of the job to be quoted on is shown below:

-Refer to the table above. Total budgeted indirect costs for the year are:

A)$117 000

B)$77 000

C)$72 000

D)$57 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

27

Ace Ltd makes trailers for boats. Management have decided they would like to implement a full cost recovery system as detailed below. Direct materials and direct labour are the only costs that can be traced directly to jobs. All other costs will be recovered using an overhead recovery rate based on direct labour cost. Profit (mark-up)will be 12% of full costs.

REQUIRED:

REQUIRED:

A)Calculate the overhead recovery rate to apply overhead to jobs.

B)Provide a quotation (full cost estimate plus mark-up)for the following job.

REQUIRED:

REQUIRED:A)Calculate the overhead recovery rate to apply overhead to jobs.

B)Provide a quotation (full cost estimate plus mark-up)for the following job.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

28

If the overhead applied to a job is $800 and the overhead recovery rate is $20 per direct labour hour, how many direct labour hours were used for the job?

A)900 hours

B)25 hours

C)30 hours

D)40 hours

A)900 hours

B)25 hours

C)30 hours

D)40 hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

29

When revenues and costs are dealt with on a departmental basis, each department is known as a:

A)cost centre.

B)overhead centre.

C)job centre.

D)collection centre.

A)cost centre.

B)overhead centre.

C)job centre.

D)collection centre.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

30

Use information below to answer the following questions.

Oswald Ltd manufactures a wide range of leather suitcases. The following costs are expected to be incurred by the company during June:

-Refer to the table above. The overhead recovery rate (rounded), using direct labour hours as the allocation base, is:

A)$3.90 per DLH.

B)$7.20 per DLH.

C)$5.90 per DLH.

D)$7.00 per DLH.

Oswald Ltd manufactures a wide range of leather suitcases. The following costs are expected to be incurred by the company during June:

-Refer to the table above. The overhead recovery rate (rounded), using direct labour hours as the allocation base, is:

A)$3.90 per DLH.

B)$7.20 per DLH.

C)$5.90 per DLH.

D)$7.00 per DLH.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

31

Use the information below to answer the following questions.

Fingers Ltd, a graphic design service, has received an inquiry from a potential customer for a quotation for a web-page design. The pricing policy of the business is based on the budgeted financial data for the coming financial year. The data for the coming year is shown below:

Other relevant information: Management has budgeted for 20 000 direct labour hours. Overhead is applied based on direct labour hours. An estimate for the direct costs of the job to be quoted on is shown below:

-Refer to the table above. If the budgeted direct labour hours change to 25 000 hours, what will be the revised quote?

A)$2 128

B)$2 348

C)$2 208

D)$2 368

Fingers Ltd, a graphic design service, has received an inquiry from a potential customer for a quotation for a web-page design. The pricing policy of the business is based on the budgeted financial data for the coming financial year. The data for the coming year is shown below:

Other relevant information: Management has budgeted for 20 000 direct labour hours. Overhead is applied based on direct labour hours. An estimate for the direct costs of the job to be quoted on is shown below:

-Refer to the table above. If the budgeted direct labour hours change to 25 000 hours, what will be the revised quote?

A)$2 128

B)$2 348

C)$2 208

D)$2 368

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

32

Use information below to answer the following questions.

Oswald Ltd manufactures a wide range of leather suitcases. The following costs are expected to be incurred by the company during June:

-Refer to the table above. The management accountant at Oswald Ltd, wants to revise his estimates and use machine hours as the allocation base to determine the overhead recovery rate. The revised overhead recovery rate (rounded)per machine hour will be:

A)$4.88 per MH.

B)$9.00 per MH.

C)$7.38 per MH.

D)$8.75 per MH.

Oswald Ltd manufactures a wide range of leather suitcases. The following costs are expected to be incurred by the company during June:

-Refer to the table above. The management accountant at Oswald Ltd, wants to revise his estimates and use machine hours as the allocation base to determine the overhead recovery rate. The revised overhead recovery rate (rounded)per machine hour will be:

A)$4.88 per MH.

B)$9.00 per MH.

C)$7.38 per MH.

D)$8.75 per MH.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

33

Use information below to answer the following questions.

Oswald Ltd manufactures a wide range of leather suitcases. The following costs are expected to be incurred by the company during June:

-Refer to the table above. Total indirect costs are:

A)$72 000

B)$39 000

C)$59 000

D)$70 000

Oswald Ltd manufactures a wide range of leather suitcases. The following costs are expected to be incurred by the company during June:

-Refer to the table above. Total indirect costs are:

A)$72 000

B)$39 000

C)$59 000

D)$70 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

34

Use information below to answer the following questions.

Oswald Ltd manufactures a wide range of leather suitcases. The following costs are expected to be incurred by the company during June:

-Refer to the table above. The full cost of producing the suitcases for May is:

A)$220 000

B)$218 000

C)$207 000

D)$187 000

Oswald Ltd manufactures a wide range of leather suitcases. The following costs are expected to be incurred by the company during June:

-Refer to the table above. The full cost of producing the suitcases for May is:

A)$220 000

B)$218 000

C)$207 000

D)$187 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

35

An example of a service cost centre is:

A)finished goods department.

B)machining department.

C)payroll department.

D)assembly department.

A)finished goods department.

B)machining department.

C)payroll department.

D)assembly department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

36

The base for allocating overhead costs most commonly used in practice is:

A)direct labour cost.

B)direct labour hours.

C)machine hours.

D)units produced.

A)direct labour cost.

B)direct labour hours.

C)machine hours.

D)units produced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

37

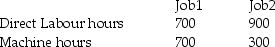

A service business expects to incur overheads totalling $20 000 next month. The total direct labour time worked is 1 600 hours and total machine hours are 1 000. During next month, the business expects to do just two large jobs. Information concerning each job is as follows:  REQUIRED:

REQUIRED:

A)Calculate the overhead recovery rate for the month using direct labour hours.

B)Compute how much of the month's overhead will be charged to each job.

REQUIRED:

REQUIRED:A)Calculate the overhead recovery rate for the month using direct labour hours.

B)Compute how much of the month's overhead will be charged to each job.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of these is not another name for overhead costs?

A)Indirect costs

B)Common costs

C)Fixed costs

D)None of the above, i.e., all are other names for overhead costs

A)Indirect costs

B)Common costs

C)Fixed costs

D)None of the above, i.e., all are other names for overhead costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

39

Use the information below to answer the following questions.

Fingers Ltd, a graphic design service, has received an inquiry from a potential customer for a quotation for a web-page design. The pricing policy of the business is based on the budgeted financial data for the coming financial year. The data for the coming year is shown below:

Other relevant information: Management has budgeted for 20 000 direct labour hours. Overhead is applied based on direct labour hours. An estimate for the direct costs of the job to be quoted on is shown below:

-Refer to the table above. Total budgeted direct costs for the year are:

A)$350 000

B)$340 000

C)$375 000

D)$300 000

Fingers Ltd, a graphic design service, has received an inquiry from a potential customer for a quotation for a web-page design. The pricing policy of the business is based on the budgeted financial data for the coming financial year. The data for the coming year is shown below:

Other relevant information: Management has budgeted for 20 000 direct labour hours. Overhead is applied based on direct labour hours. An estimate for the direct costs of the job to be quoted on is shown below:

-Refer to the table above. Total budgeted direct costs for the year are:

A)$350 000

B)$340 000

C)$375 000

D)$300 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

40

Use the information below to answer the following questions.

Fingers Ltd, a graphic design service, has received an inquiry from a potential customer for a quotation for a web-page design. The pricing policy of the business is based on the budgeted financial data for the coming financial year. The data for the coming year is shown below:

Other relevant information: Management has budgeted for 20 000 direct labour hours. Overhead is applied based on direct labour hours. An estimate for the direct costs of the job to be quoted on is shown below:

-Refer to the table above. The recommended quote for the job is:

A)$2 285

B)$2 460

C)$2 195

D)$2 485

Fingers Ltd, a graphic design service, has received an inquiry from a potential customer for a quotation for a web-page design. The pricing policy of the business is based on the budgeted financial data for the coming financial year. The data for the coming year is shown below:

Other relevant information: Management has budgeted for 20 000 direct labour hours. Overhead is applied based on direct labour hours. An estimate for the direct costs of the job to be quoted on is shown below:

-Refer to the table above. The recommended quote for the job is:

A)$2 285

B)$2 460

C)$2 195

D)$2 485

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

41

What is the formula for the overhead recovery rate using an activity-based costing system?

A)Overhead cost divided into relevant cost driver

B)Overhead cost divided by the number of products

C)Overhead cost divided into labour hours

D)Overhead cost divided by relevant cost driver

A)Overhead cost divided into relevant cost driver

B)Overhead cost divided by the number of products

C)Overhead cost divided into labour hours

D)Overhead cost divided by relevant cost driver

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

42

Use the information below to answer the following questions.

Whack Ltd, a tennis racquet manufacturer, has broken the production process into three lines, each in a different department: framing, stringing, and finishing. The following information relates to each department for the month of April:

Production for April is 10 000 racquets

-Refer to the table above. The overhead recovery rate for stringing and finishing based on direct labour hours is:

A)$6; $11

B)$4; $10

C)$10; $22

D)$5; $ 3

Whack Ltd, a tennis racquet manufacturer, has broken the production process into three lines, each in a different department: framing, stringing, and finishing. The following information relates to each department for the month of April:

Production for April is 10 000 racquets

-Refer to the table above. The overhead recovery rate for stringing and finishing based on direct labour hours is:

A)$6; $11

B)$4; $10

C)$10; $22

D)$5; $ 3

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

43

Under both the traditional approach to full costing and activity-based costing, there is no difference in the:

A)total costs.

B)assignment of overhead costs.

C)unit cost.

D)Both A and B

A)total costs.

B)assignment of overhead costs.

C)unit cost.

D)Both A and B

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

44

In general, in recent times compared to the past, overhead as a percentage of a firm's total costs:

A)has decreased.

B)has remained the same.

C)has increased.

D)Cannot tell

A)has decreased.

B)has remained the same.

C)has increased.

D)Cannot tell

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

45

By the end of the 20th Century, the manufacturing sector had fundamentally altered from the sector in the 1920s. The sector is now characterised by the following features, except for:

A)low levels of depreciation.

B)a highly competitive international market.

C)capital-intensive and machine-paced production.

D)a high level of overheads relative to direct costs.

A)low levels of depreciation.

B)a highly competitive international market.

C)capital-intensive and machine-paced production.

D)a high level of overheads relative to direct costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

46

Use the information below to answer the following questions.

Whack Ltd, a tennis racquet manufacturer, has broken the production process into three lines, each in a different department: framing, stringing, and finishing. The following information relates to each department for the month of April:

Production for April is 10 000 racquets

-Refer to the table above. The overhead recovery rate for framing based on machine hours is:

A)$4

B)$5

C)$2

D)$20

Whack Ltd, a tennis racquet manufacturer, has broken the production process into three lines, each in a different department: framing, stringing, and finishing. The following information relates to each department for the month of April:

Production for April is 10 000 racquets

-Refer to the table above. The overhead recovery rate for framing based on machine hours is:

A)$4

B)$5

C)$2

D)$20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

47

At the time of the industrial revolution in Britain, the manufacturing sector was characterised by the following features, except for:

A)high use of technology.

B)a relatively uncompetitive market.

C)direct labour-intensive and direct labour-paced production.

D)a low level of overheads relative to direct costs.

A)high use of technology.

B)a relatively uncompetitive market.

C)direct labour-intensive and direct labour-paced production.

D)a low level of overheads relative to direct costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

48

How does activity-based costing view overhead costs?

A)As the responsibility of each department

B)As unimportant in the development of full costs

C)As rendering service to cost units

D)As caused by activities which 'drive' the costs

A)As the responsibility of each department

B)As unimportant in the development of full costs

C)As rendering service to cost units

D)As caused by activities which 'drive' the costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which statement concerning overhead costs is not true?

A)If overhead is segmented, say on a departmental basis, different bases can be used by the different departments to charge overhead to jobs.

B)There is no 'correct' basis for charging overhead to jobs.

C)It is possible to charge the overhead of one department to different jobs using different allocation bases.

D)None of the above, i.e., all are true statements

A)If overhead is segmented, say on a departmental basis, different bases can be used by the different departments to charge overhead to jobs.

B)There is no 'correct' basis for charging overhead to jobs.

C)It is possible to charge the overhead of one department to different jobs using different allocation bases.

D)None of the above, i.e., all are true statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

50

What does the break-even price represent?

A)Variable costs + mark-up

B)Direct costs + mark-up

C)Direct costs

D)Full costs

A)Variable costs + mark-up

B)Direct costs + mark-up

C)Direct costs

D)Full costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

51

Activity-based costing is likely to be most beneficial to firms with which characteristics?

A)Has a multi-product range that use resources differently

B)Manufactures a single product

C)Has a multi-product range that use similar processes

D)Is set-up as a public company

A)Has a multi-product range that use resources differently

B)Manufactures a single product

C)Has a multi-product range that use similar processes

D)Is set-up as a public company

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

52

Activity-based costing can be used in:

A)a non-profit organisation.

B)a service organisation.

C)a manufacturing organisation.

D)Any of the above

A)a non-profit organisation.

B)a service organisation.

C)a manufacturing organisation.

D)Any of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

53

When determining full costs the treatment of direct costs under activity-based costing:

A)is the same as under traditional costing.

B)relies upon identifying appropriate cost drivers.

C)must be related to activities.

D)Both B and C

A)is the same as under traditional costing.

B)relies upon identifying appropriate cost drivers.

C)must be related to activities.

D)Both B and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

54

The focus in activity-based costing is on:

A)products.

B)direct costs.

C)services.

D)activities.

A)products.

B)direct costs.

C)services.

D)activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

55

An example of a product cost centre for a furniture manufacturer is:

A)human resources.

B)assembly.

C)accounting.

D)canteen.

A)human resources.

B)assembly.

C)accounting.

D)canteen.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

56

The following information is available on departmental overhead recovery rates for Major Manufacturing: Machining Department per machine hou1

Assembling Department per direct labour How much overhead will be applied to job X 123 if it uses 13 machine hours and 20 direct labour hours?

A)$955.50

B)$33

C)$64.40

D)$1169.70

Assembling Department per direct labour How much overhead will be applied to job X 123 if it uses 13 machine hours and 20 direct labour hours?

A)$955.50

B)$33

C)$64.40

D)$1169.70

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

57

Use the information below to answer the following questions.

Whack Ltd, a tennis racquet manufacturer, has broken the production process into three lines, each in a different department: framing, stringing, and finishing. The following information relates to each department for the month of April:

Production for April is 10 000 racquets

-Refer to the table above. The direct unit cost per racquet for April is:

A)$17.00

B)$9.60

C)$16.70

D)$11.60

Whack Ltd, a tennis racquet manufacturer, has broken the production process into three lines, each in a different department: framing, stringing, and finishing. The following information relates to each department for the month of April:

Production for April is 10 000 racquets

-Refer to the table above. The direct unit cost per racquet for April is:

A)$17.00

B)$9.60

C)$16.70

D)$11.60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of these are possible cost drivers under activity-based costing?

A)Number of deliveries

B)Hours of storage of raw materials

C)Number of set ups of machinery

D)All of the above

A)Number of deliveries

B)Hours of storage of raw materials

C)Number of set ups of machinery

D)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

59

All of the statements regarding activity-based costing are correct except:

A)it provides better information for decision-making.

B)it provides more accurate product costs.

C)it is used by the majority of businesses in Australia.

D)it is costlier than alternative systems.

A)it provides better information for decision-making.

B)it provides more accurate product costs.

C)it is used by the majority of businesses in Australia.

D)it is costlier than alternative systems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

60

A cost centre through which jobs do not pass is known as a:

A)product cost centre.

B)service cost centre.

C)non-job cost centre.

D)administrative cost centre.

A)product cost centre.

B)service cost centre.

C)non-job cost centre.

D)administrative cost centre.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

61

How do both Australian and International standards require inventory to be valued?

A)At full cost

B)At variable cost

C)At manufacturing full cost

D)At direct cost

A)At full cost

B)At variable cost

C)At manufacturing full cost

D)At direct cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

62

What is an advantage of activity-based costing compared to traditional costing?

A)It is cheaper to implement.

B)Overhead allocation is objective rather than arbitrary.

C)Linking overheads to cost drivers results in a fairer and more accurate costing.

D)All of the above are advantages.

A)It is cheaper to implement.

B)Overhead allocation is objective rather than arbitrary.

C)Linking overheads to cost drivers results in a fairer and more accurate costing.

D)All of the above are advantages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of these is not a use of full cost information?

A)Pricing

B)Income measurement

C)Short-term decision-making

D)None of the above, i.e., all are a use of full cost information

A)Pricing

B)Income measurement

C)Short-term decision-making

D)None of the above, i.e., all are a use of full cost information

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following statements is incorrect?

A)Full costs are useful in decision-making, because this approach focuses on future costs.

B)The use of full costs is criticised, because it focuses on past costs.

C)Full costing can lead to incorrect decision-making, because it can distort figures.

D)Actual costs do not always follow the direction that the recovery rate may suggest.

A)Full costs are useful in decision-making, because this approach focuses on future costs.

B)The use of full costs is criticised, because it focuses on past costs.

C)Full costing can lead to incorrect decision-making, because it can distort figures.

D)Actual costs do not always follow the direction that the recovery rate may suggest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which type of pricing approach with a supplier use in a competitive market?

A)Cost plus

B)Target pricing

C)Target costing

D)Market price

A)Cost plus

B)Target pricing

C)Target costing

D)Market price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

66

Full costs are calculated in advance to assist management in:

A)determining profit during the year.

B)setting prices.

C)saving time at the end of the year.

D)Both A and B

A)determining profit during the year.

B)setting prices.

C)saving time at the end of the year.

D)Both A and B

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

67

The approach to overhead costs under activity-based costing is that:

A)overheads provide service to cost objects.

B)overheads are caused by activities.

C)overheads happen.

D)overheads can be traced to cost objects.

A)overheads provide service to cost objects.

B)overheads are caused by activities.

C)overheads happen.

D)overheads can be traced to cost objects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck