Deck 7: Property, Plant, and Equipment, and Intangible Assets

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/129

العب

ملء الشاشة (f)

Deck 7: Property, Plant, and Equipment, and Intangible Assets

1

A major expenditure made to equipment that extends its useful life beyond the original estimate is journalized by:

A) crediting Depreciation Expense

B) debiting Equipment

C) debiting Depreciation Expense

D) debiting Repair Expense

A) crediting Depreciation Expense

B) debiting Equipment

C) debiting Depreciation Expense

D) debiting Repair Expense

B

2

Bavarian Purity Corporation purchased equipment for $32,000. Bavarian Purity also paid $400 for freight and insurance while the equipment was in transit. Sales tax amounted to $240. Insurance, taxes, and maintenance the first year of use cost $1,000. How much should Bavarian Purity Corporation capitalize as the cost of the equipment?

A) $32,000

B) $32,400

C) $32,640

D) $31,640

A) $32,000

B) $32,400

C) $32,640

D) $31,640

C

3

Which of the following is not a long-lived asset?

A) supplies

B) furniture

C) buildings

D) land

A) supplies

B) furniture

C) buildings

D) land

A

4

All amounts paid to acquire a long lived-asset and to get it ready for its intended use are referred to as:

A) immediate expenses

B) net book value

C) salvage value

D) the cost of an asset

A) immediate expenses

B) net book value

C) salvage value

D) the cost of an asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

5

The removal of an old building to make land suitable for its intended use is charged to:

A) land

B) land improvements

C) land improvements expense

D) renovation and restoration expense

A) land

B) land improvements

C) land improvements expense

D) renovation and restoration expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following would not be included in the Land account?

A) brokerage commissions connected with the purchase of the land

B) survey fees connected with the purchase of the land

C) paving costs for a driveway

D) back property taxes paid

A) brokerage commissions connected with the purchase of the land

B) survey fees connected with the purchase of the land

C) paving costs for a driveway

D) back property taxes paid

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which expense below would not be considered part of the cost of a tangible long-lived asset?

A) the price paid for the property, plant, and equipment when purchased from the manufacturer

B) taxes paid on the purchase price of property, plant, and equipment

C) commissions paid to the salesperson that sold the property, plant, and equipment

D) repaving a driveway to the building where the property, plant, and equipment is housed

A) the price paid for the property, plant, and equipment when purchased from the manufacturer

B) taxes paid on the purchase price of property, plant, and equipment

C) commissions paid to the salesperson that sold the property, plant, and equipment

D) repaving a driveway to the building where the property, plant, and equipment is housed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

8

The Loft Corporation purchased land and a building for $700,000. An appraisal indicates that the land's value is $400,000 and the building's value is $350,000. The amount that The Loft Corporation should debit to the Building account is:

A) $326,667

B) $350,000

C) $373,333

D) $375,000

A) $326,667

B) $350,000

C) $373,333

D) $375,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

9

Land, buildings, and equipment are acquired for a lump sum of $950,000. The fair values of the three assets are respectively, $200,000, $500,000, and $300,000. What is the cost assigned to the building?

A) $190,000

B) $475,000

C) $500,000

D) $555,556

A) $190,000

B) $475,000

C) $500,000

D) $555,556

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following is not an intangible asset?

A) Copyright

B) Patent

C) Leasehold improvement

D) Trademark

A) Copyright

B) Patent

C) Leasehold improvement

D) Trademark

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

11

Grasshopper Room Company acquired land and buildings for $1,500,000. The land is appraised at $475,000 and the buildings are appraised at $775,000. The debit to the Buildings account will be:

A) $930,000

B) $775,000

C) $1,025,000

D) $570,000

A) $930,000

B) $775,000

C) $1,025,000

D) $570,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following is not an intangible asset?

A) accounts receivable

B) patent

C) copyright

D) goodwill

A) accounts receivable

B) patent

C) copyright

D) goodwill

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

13

Expenditures of a periodic, routine nature incurred to maintain the asset in its existing condition are referred to as:

A) capital expenditures

B) equity expenditures

C) matching expenditures

D) immediate expenses

A) capital expenditures

B) equity expenditures

C) matching expenditures

D) immediate expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

14

Expenditures that increase the efficiency of an asset or extend its useful life are referred to as:

A) immediate expenses

B) capital expenditures

C) equity expenditures

D) matching expenditures

A) immediate expenses

B) capital expenditures

C) equity expenditures

D) matching expenditures

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following would not be included in the Machinery account?

A) cost of transporting the machinery to its setup location

B) cost of a maintenance insurance plan after the machinery is up and running

C) cost of installing the machinery

D) cost of insurance while the machinery is in transit

A) cost of transporting the machinery to its setup location

B) cost of a maintenance insurance plan after the machinery is up and running

C) cost of installing the machinery

D) cost of insurance while the machinery is in transit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

16

The Warthog Company purchased land, buildings, and equipment for $2,400,000. The land has been appraised at $865,000, the buildings at $1,175,000, and the equipment at $510,000. The equipment account will be debited for:

A) $525,000

B) $500,000

C) $480,000

D) $410,156

A) $525,000

B) $500,000

C) $480,000

D) $410,156

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following expenses is most closely associated with tangible long-lived assets?

A) accumulation

B) depreciation

C) interest

D) depletion

A) accumulation

B) depreciation

C) interest

D) depletion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

18

The cost of paving a parking lot should be charged to:

A) land

B) land improvements

C) immediate expense

D) repairs and maintenance expense

A) land

B) land improvements

C) immediate expense

D) repairs and maintenance expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

19

Land is purchased for $60,000. Back taxes paid by the purchaser were $2,400, clearing and grading costs were $3,000, fencing costs were $2,500, and lighting costs were $500. What is the cost of the land?

A) $60,000

B) $65,400

C) $66,400

D) $68,400

A) $60,000

B) $65,400

C) $66,400

D) $68,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

20

The cost of land would include all of the following except:

A) purchase price

B) back property taxes

C) clearing the land

D) sidewalks and curbs

A) purchase price

B) back property taxes

C) clearing the land

D) sidewalks and curbs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

21

Treating a capital expenditure as an immediate expense:

A) understates expenses and overstates owners' equity

B) understates expenses and understates assets

C) overstates assets and overstates owner's equity

D) overstates expenses and understates net income

A) understates expenses and overstates owners' equity

B) understates expenses and understates assets

C) overstates assets and overstates owner's equity

D) overstates expenses and understates net income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

22

Immediate expenses are those that maintain the existing condition of an asset or restore an asset to good working order.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

23

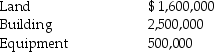

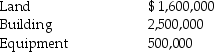

Glenmore Reservoir Corporation paid $4,000,000 in a lump-sum purchase of land, a building, and equipment. The payment consisted of $1,500,000 cash and a note payable for the balance. An appraisal indicated the following fair values at the time of the purchase:

Prepare the journal entry to record this lump-sum purchase (round all percentage calculations to two decimal places).

Prepare the journal entry to record this lump-sum purchase (round all percentage calculations to two decimal places).

Prepare the journal entry to record this lump-sum purchase (round all percentage calculations to two decimal places).

Prepare the journal entry to record this lump-sum purchase (round all percentage calculations to two decimal places).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

24

Land improvements are subject to depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following depreciation methods best fits those assets that tend to wear out before they become obsolete?

A) depletion method

B) straight-line method

C) double-declining-balance method

D) units-of-production method

A) depletion method

B) straight-line method

C) double-declining-balance method

D) units-of-production method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

26

Rocky Mountain Water Corporation paid $270,000 to purchase equipment for use in its manufacturing operations. In addition, Rocky Mountain Water Corporation incurred the following expenditures relating to the equipment:

∙ $1,500 freight to have the equipment shipped to its manufacturing facility

∙ $750 insurance while the equipment was in transit

∙ $3,200 for special steel and concrete reinforcements used to house the equipment in the factory

∙ $1,200 for a one-year insurance policy on the equipment after it has been installed

∙ $300 to test the equipment before it is placed in service

∙ $400 for maintenance costs during the first year of service

Calculate the cost of the equipment.

∙ $1,500 freight to have the equipment shipped to its manufacturing facility

∙ $750 insurance while the equipment was in transit

∙ $3,200 for special steel and concrete reinforcements used to house the equipment in the factory

∙ $1,200 for a one-year insurance policy on the equipment after it has been installed

∙ $300 to test the equipment before it is placed in service

∙ $400 for maintenance costs during the first year of service

Calculate the cost of the equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

27

Of the tangible long-lived assets, buildings are unique because they are not amortized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

28

Discuss the type of tangible long-lived assets Canadian Tire owns and controls, and how they are typically recorded on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which accounting principle directs the depreciation process?

A) historical cost

B) going concern

C) full disclosure

D) matching

A) historical cost

B) going concern

C) full disclosure

D) matching

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

30

The cost of land does not include the cost of paving to construct a parking lot.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

31

Thompson Glacier Limited purchased a tract of land and contracted with a commercial developer to build an office building. Thompson Glacier Limited also engaged other contractors for fencing, paving, lighting, and landscaping.

Based on the following data, determine the cost of the land, the building, and the land improvements.

∙ Purchased land for $100,000.

∙ Paid $2,000 for seller's back property taxes.

∙ Paid a builder $225,000 to design and build the office building.

∙ Paid an excavation company $6,000 to grade and clear the land to make it suitable for building purposes.

∙ Paid a landscaping company $6,500 for trees and shrubs.

∙ Paid a lighting contractor $10,000 for outside lighting around the parking area and sidewalks.

∙ Paid $15,000 to have the parking lot paved.

∙ Paid a fence builder $12,000 to construct a security fence around the property.

Based on the following data, determine the cost of the land, the building, and the land improvements.

∙ Purchased land for $100,000.

∙ Paid $2,000 for seller's back property taxes.

∙ Paid a builder $225,000 to design and build the office building.

∙ Paid an excavation company $6,000 to grade and clear the land to make it suitable for building purposes.

∙ Paid a landscaping company $6,500 for trees and shrubs.

∙ Paid a lighting contractor $10,000 for outside lighting around the parking area and sidewalks.

∙ Paid $15,000 to have the parking lot paved.

∙ Paid a fence builder $12,000 to construct a security fence around the property.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

32

Repairs made to equipment as part of a yearly maintenance project would be recorded in the journal by:

A) debiting Equipment

B) debiting Repair Expense

C) debiting Depreciation Expense

D) debiting Accumulated Depreciation

A) debiting Equipment

B) debiting Repair Expense

C) debiting Depreciation Expense

D) debiting Accumulated Depreciation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

33

The cost of a tangible long-lived asset includes the purchase price, applicable taxes, purchase commissions, and all other amounts paid to acquire the asset and get it ready for its intended use.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

34

The process of allocating property, plant, and equipment's cost to expense over the period the asset is used is called:

A) accumulation

B) depreciation

C) interest

D) repairs expense

A) accumulation

B) depreciation

C) interest

D) repairs expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

35

Except for goodwill, the accounting for intangibles is similar to accounting for tangible long-lived assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

36

On October 15, 2013, Out West Enterprises purchased new factory equipment for its manufacturing facilities. The new equipment had an invoice price of $16,000, plus a 6% sales tax. In addition, the purchaser was responsible for $950 of freight charges. The sale was subject to 2/10, n/45 credit terms. Upon receipt of the new equipment Out West Enterprises paid $1,200 to have the equipment installed. To finance the purchase, Out West Enterprises borrowed $17,000 from the First Street Bank for 60 days at 12% interest. Out West Enterprises paid the invoice within 9 days.

Calculate the cost of the factory equipment to be capitalized on the books.

Calculate the cost of the factory equipment to be capitalized on the books.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

37

The cost of land would include all of the following except:

A) survey and legal fees incurred

B) costs of removing any unwanted building on the land

C) paving and fencing

D) costs to grade and clear the land

A) survey and legal fees incurred

B) costs of removing any unwanted building on the land

C) paving and fencing

D) costs to grade and clear the land

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

38

Improvements to land are considered part of the cost of land since they are tied directly to the use of the land itself.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following statements is true?

A) Depreciation is a process of objective valuation.

B) Depreciation means that a business sets aside cash to replace assets as they become fully amortized.

C) Accumulated depreciation represents a growing amount of cash to be used to replace the existing asset.

D) Accumulated depreciation is that portion of property, plant, and equipment's cost that has already been recorded as an expense.

A) Depreciation is a process of objective valuation.

B) Depreciation means that a business sets aside cash to replace assets as they become fully amortized.

C) Accumulated depreciation represents a growing amount of cash to be used to replace the existing asset.

D) Accumulated depreciation is that portion of property, plant, and equipment's cost that has already been recorded as an expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

40

Costs of land improvements are not included in the Land account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

41

On January 2, 2012, McNally's Extra Corporation acquired equipment for $120,000. The estimated life of the equipment is 5 years or 20,000 hours. The estimated residual value is $20,000. What is the balance in Accumulated Depreciation on December 31, 2013, if McNally's Extra Corporation uses the double-declining-balance method of depreciation?

A) $23,200

B) $36,000

C) $43,200

D) $76,800

A) $23,200

B) $36,000

C) $43,200

D) $76,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

42

One of several terms can be used to identify the expected cash value of a tangible long-lived asset at the end of its useful life. Which term below is not used in this sense?

A) residual value

B) scrap value

C) current carrying amount

D) salvage value

A) residual value

B) scrap value

C) current carrying amount

D) salvage value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

43

Depreciation computed under double-declining-balance will decrease each year because:

A) the book value used in the computation each year increases

B) the rate used in the computation each year increases

C) the rate used in the computation each year decreases

D) the book value used in the computation each year decreases

A) the book value used in the computation each year increases

B) the rate used in the computation each year increases

C) the rate used in the computation each year decreases

D) the book value used in the computation each year decreases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

44

The terms residual value and carrying value are synonymous.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following depreciation methods best applies to those assets that generate greater revenue earlier in their useful lives?

A) depletion method

B) double-declining-balance method

C) units-of-production method

D) straight-line method

A) depletion method

B) double-declining-balance method

C) units-of-production method

D) straight-line method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

46

Regardless of the method of depreciation used, accumulated depreciation will be the same when the asset is fully amortized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

47

To measure depreciation for a tangible long-lived asset, all of the following must be known except:

A) estimated useful life

B) current market value

C) estimated residual value

D) historical cost

A) estimated useful life

B) current market value

C) estimated residual value

D) historical cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

48

In order to calculate depreciation, the cost of the asset, the estimated useful life, and the estimated residual value of the asset must be known.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

49

Book value is determined by subtracting the salvage value from the cost of an asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

50

Carrying amount is defined as:

A) cost less salvage value

B) cost less accumulated depreciation

C) current market value less salvage value

D) current market value less accumulated depreciation

A) cost less salvage value

B) cost less accumulated depreciation

C) current market value less salvage value

D) current market value less accumulated depreciation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

51

Double-declining-balance depreciation computes annual depreciation by multiplying the asset's carrying value by two times the straight-line rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

52

On January 2, 2012 McNally's Extra Corporation acquired equipment for $120,000. The estimated life of the equipment is 5 years or 20,000 hours. The estimated residual value is $20,000. What is the amount of depreciation expense for 2014, if McNally's Extra Corporation uses the asset 4,000 hours and uses the units-of-production method of depreciation?

A) $20,000

B) $24,000

C) $25,000

D) $30,000

A) $20,000

B) $24,000

C) $25,000

D) $30,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

53

The double-declining-balance method of depreciation causes:

A) less depreciation in early years of an asset's use as compared to other depreciation methods

B) more depreciation in early years of an asset's use as compared to other depreciation methods

C) the same amount of depreciation in early years of an asset's use as compared to other depreciation methods

D) is not an acceptable depreciation method according to GAAP

A) less depreciation in early years of an asset's use as compared to other depreciation methods

B) more depreciation in early years of an asset's use as compared to other depreciation methods

C) the same amount of depreciation in early years of an asset's use as compared to other depreciation methods

D) is not an acceptable depreciation method according to GAAP

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

54

At the end of an asset's useful life, the balance in Accumulated Depreciation will:

A) be greater under units-of-production depreciation than under straight-line depreciation

B) be the same amount under all the depreciation methods

C) be a greater amount under straight-line depreciation than under double-declining-balance depreciation

D) be a lesser amount under double-declining-balance depreciation than under units-of-production depreciation

A) be greater under units-of-production depreciation than under straight-line depreciation

B) be the same amount under all the depreciation methods

C) be a greater amount under straight-line depreciation than under double-declining-balance depreciation

D) be a lesser amount under double-declining-balance depreciation than under units-of-production depreciation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

55

To measure depreciation, all of the following must be known except:

A) the asset's useful life in terms of years, hours, or units

B) the estimated residual value of the asset

C) the cost of the asset

D) the current market value of the asset

A) the asset's useful life in terms of years, hours, or units

B) the estimated residual value of the asset

C) the cost of the asset

D) the current market value of the asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

56

In which of the following depreciation methods is annual depreciation calculated as the difference between the asset's historical cost and its residual value, divided by the asset's useful life in years?

A) double-declining-balance

B) straight-line

C) units-of-production

D) depletion

A) double-declining-balance

B) straight-line

C) units-of-production

D) depletion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

57

Amortizable cost is defined as:

A) book value

B) salvage value

C) cost minus accumulated depreciation

D) cost minus salvage value

A) book value

B) salvage value

C) cost minus accumulated depreciation

D) cost minus salvage value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

58

On January 2, 2012 McNally's Extra Corporation acquired equipment for $120,000. The estimated life of the equipment is 5 years or 20,000 hours. The estimated residual value is $20,000. If McNally's Extra Corporation uses the straight-line method of depreciation, what will be the debit to Depreciation Expense for the year ended December 31, 2013, during which period the asset was used 4,500 hours?

A) $20,000

B) $22,500

C) $24,000

D) $27,000

A) $20,000

B) $22,500

C) $24,000

D) $27,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

59

When using the double-declining-balance depreciation method, the asset's residual value is used in computing the first year of depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

60

The Accumulated Depreciation account represents a source of cash to be used to replace the asset in the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

61

Lauter Tun Corporation acquired equipment on January 1, 2012, for $300,000. The equipment had an estimated useful life of 10 years and an estimated salvage value of $25,000. On January 1, 2015, Lauter Tun Corporation revised the total useful life of the equipment to 8 years and the estimated salvage value to be $10,000. Compute depreciation expense for the year ending December 31, 2015, if Lauter Tun Corporation uses straight-line depreciation.

A) $25,938

B) $38,500

C) $41,500

D) $43,500

A) $25,938

B) $38,500

C) $41,500

D) $43,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

62

The Mash Tun Corp. purchased equipment on September 1, 2013 for $200,000. The residual value is $20,000 and the estimated life is 5 years or 60,000 hours. Compute depreciation expense for the year ending December 31, 2014, if the Mash Tun Corp. uses the double-declining-balance method of depreciation.

A) $69,333

B) $48,000

C) $43,200

D) $62,400

A) $69,333

B) $48,000

C) $43,200

D) $62,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

63

Explain how a company should decide which depreciation method to use for financial reporting purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

64

For each of the independent situations below, determine the age of the asset in question. All assets were acquired at the beginning of the year.

a. The balance in the Buildings account is $400,000 while the balance sheet shows the book value of the buildings at $217,600. The notes to the financial statements indicate that straight-line depreciation is used for all property, plant, and equipment and that residual values are estimated at 5% of cost. The estimated life of the buildings is 25 years.

b. The book value of the delivery equipment is $51,520. The cost of the delivery equipment was $80,500. The company uses the straight-line method of depreciation for delivery equipment and estimates life at 5 years or 50,000 units. So far, 27,000 units have been produced. Residual value is 10% of cost.

c. The balance in the Accumulated Depreciation account for furniture is $21,875. The furniture has been amortized a total of 43.75% of its original cost. The company's notes to the financial statements indicate that double-declining-balance depreciation is used for all furniture. The company estimates useful life at 8 years and residual value at 20% of cost.

a. The balance in the Buildings account is $400,000 while the balance sheet shows the book value of the buildings at $217,600. The notes to the financial statements indicate that straight-line depreciation is used for all property, plant, and equipment and that residual values are estimated at 5% of cost. The estimated life of the buildings is 25 years.

b. The book value of the delivery equipment is $51,520. The cost of the delivery equipment was $80,500. The company uses the straight-line method of depreciation for delivery equipment and estimates life at 5 years or 50,000 units. So far, 27,000 units have been produced. Residual value is 10% of cost.

c. The balance in the Accumulated Depreciation account for furniture is $21,875. The furniture has been amortized a total of 43.75% of its original cost. The company's notes to the financial statements indicate that double-declining-balance depreciation is used for all furniture. The company estimates useful life at 8 years and residual value at 20% of cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

65

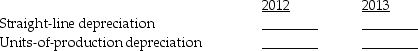

Big Valley Ltd. purchased machinery on January 2, 2012, at a total cost of $85,000. The machinery's estimated useful life is 8 years or 60,000 hours, and its residual value is $5,000. During 2012 and 2013, the machinery was used 7,000 and 7,500 hours, respectively.

Compute depreciation under straight-line, units-of-production, and double-declining-balance methods for 2012 and 2013.

Double-declining-balance

Double-declining-balance

Compute depreciation under straight-line, units-of-production, and double-declining-balance methods for 2012 and 2013.

Double-declining-balance

Double-declining-balance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

66

Victory Stables purchased new equipment for their barn on July 1, 2013. The new equipment had a cost of $100,000, estimated salvage of $20,000 and an expected useful life of 10 years. Prepare the journal entry for the December 31, 2013 and 2014 amortization. Note: Victory Stables uses the straight-line method of depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

67

A fully amortized asset is an asset:

A) whose book value has reached zero, and therefore has no market value

B) whose amortizable cost has reached its salvage value, and therefore is of no further use to the company

C) that has reached the end of its estimated useful life

D) that has reached the end of its actual useful life

A) whose book value has reached zero, and therefore has no market value

B) whose amortizable cost has reached its salvage value, and therefore is of no further use to the company

C) that has reached the end of its estimated useful life

D) that has reached the end of its actual useful life

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

68

Big Rock Times Corporation (BRT) acquired equipment on January 1, 2012, for $300,000. The equipment had an estimated useful life of 10 years and an estimated salvage value of $25,000. On January 1, 2015, BRT Corporation revised the total useful life of the equipment to 6 years and the estimated salvage value to be $10,000. Compute the book value of the equipment as of December 31, 2015, if BRT Corporation uses straight-line depreciation.

A) $148,333

B) $151,667

C) $155,000

D) $190,000

A) $148,333

B) $151,667

C) $155,000

D) $190,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

69

Victory Stables purchased new equipment for their barn on January 1, 2012. The new equipment had a cost of $100,000, estimated salvage of $20,000 and an expected useful life of 10 years. On January 1, 2013 the equipment is not working out to be as durable as first thought so management has now revised its useful life down to 5 years. Prepare the journal entry for the December 31, 2013 amortization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

70

Rainier Corporation purchased five automobiles at the beginning of 2012 for a total cost of $125,000. Rainier Corporation estimates the total residual value of the five automobiles to be $25,000 and their estimated useful life at 5 years. Use the double declining balance method to calculate the depreciation expense for 2012 and 2013.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

71

Barlow Trail Corporation purchased office equipment on September 30, 2013, for a total cost of $50,500. Management estimated useful life at 15 years and residual value at $5,500. Straight-line depreciation is used and computed to the nearest whole month. Barlow Trail Corporation's year end is December 31.

Required:

a. Prepare the adjusting entry for depreciation on December 31, 2013.

b. Early in 2015, management revised its estimates of useful life and residual value for the office equipment. Useful life was reduced to a total of 10 years, and residual value was reduced to $2,000. Prepare the adjusting entry for depreciation on December 31, 2015, using the revised estimate.

Required:

a. Prepare the adjusting entry for depreciation on December 31, 2013.

b. Early in 2015, management revised its estimates of useful life and residual value for the office equipment. Useful life was reduced to a total of 10 years, and residual value was reduced to $2,000. Prepare the adjusting entry for depreciation on December 31, 2015, using the revised estimate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

72

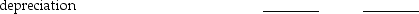

Carleton Corporation purchased machinery on October 1, 2013, at a total cost of $98,000. Estimated residual value is $8,000, estimated life of the machinery is 6 years or 50,000 hours. During 2013 and 2014, the machinery was used 1,400 and 8,760 hours, respectively.

Compute depreciation under straight-line, units-of-production, and double-declining-balance methods for 2013 and 2014.

Double-declining-balance

Double-declining-balance

Compute depreciation under straight-line, units-of-production, and double-declining-balance methods for 2013 and 2014.

Double-declining-balance

Double-declining-balance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

73

When an organization has determined that a piece of equipment is impaired the journal entry to record an impair of $1000 would require:

A) a cr to the equipment account

B) a dr to accumulated depreciation

C) a cr to accumulated depreciation

D) a cr to impairment loss

A) a cr to the equipment account

B) a dr to accumulated depreciation

C) a cr to accumulated depreciation

D) a cr to impairment loss

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

74

Rhoundakona Corporation bought property, plant, and equipment on January 1, 2012, at a cost of $35,000. Estimated residual value is $5,000 and the estimated useful life is 8 years. The company uses straight-line depreciation. On January 1, 2015, Rhoundakona's management sells the asset for $25,000. The balance in Accumulated Depreciation on January 1, 2015, is:

A) $3,750

B) $4,375

C) $11,250

D) $13,125

A) $3,750

B) $4,375

C) $11,250

D) $13,125

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

75

Hot Wort Ltd. purchased equipment on April 1, 2014, for $140,000. The residual value is $20,000 and the estimated life is 6 years or 55,000 hours. Compute depreciation expense for the year ending December 31, 2014 if Hot Wort Ltd. uses the straight-line method of depreciation.

A) $15,000

B) $20,000

C) $14,988

D) $19,983

A) $15,000

B) $20,000

C) $14,988

D) $19,983

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

76

Kegging & Canning Inc. acquired equipment on June 30, 2013, for $175,000. The residual value is $35,000 and the estimated life is 5 years or 40,000 hours. Compute the balance in Accumulated Depreciation as of December 31, 2015, if Kegging & Canning Inc. uses the double-declining-balance method of depreciation.

A) $99,680

B) $105,840

C) $124,600

D) $117,600

A) $99,680

B) $105,840

C) $124,600

D) $117,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

77

Seasons Limited paid $135,000 to purchase equipment at the beginning of 2012. Seasons Limited estimated the useful life of the equipment to be 4 years or 200,000 units. The equipment will be considered fully amortized when the balance in the Accumulated Depreciation account reaches $120,000. The equipment produced 52,000 units in 2015.

Required:

a. Determine the estimated residual value of the equipment.

b. What is the amortizable cost of the equipment?

c. Calculate depreciation expense for 2015 under each of the following methods:

Required:

a. Determine the estimated residual value of the equipment.

b. What is the amortizable cost of the equipment?

c. Calculate depreciation expense for 2015 under each of the following methods:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

78

Blockware Corporation has selected to use the revaluation model for its assets. Recently it had its building appraised. The appraiser placed a $5.0 M value on the building. Back in 2012 this building was purchased for $4.0M. This increases in value over cost requires a:

A) Dr. to accumulated depreciation

B) Cr. to the building account

C) Cr. to revaluation surplus

D) Dr. to revaluation surplus

A) Dr. to accumulated depreciation

B) Cr. to the building account

C) Cr. to revaluation surplus

D) Dr. to revaluation surplus

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

79

A revision of an estimate which extends the asset's useful life:

A) is ignored until the last year of the asset's life

B) requires restatement of prior years' financial statements

C) increases depreciation expense and decreases owners' equity

D) decreases depreciation expense and increases owners' equity

A) is ignored until the last year of the asset's life

B) requires restatement of prior years' financial statements

C) increases depreciation expense and decreases owners' equity

D) decreases depreciation expense and increases owners' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

80

Explain the concept of depreciation. Include in your discussion one common misconception regarding depreciation and its impact on the finances of a business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck