Deck 11: The Income Statement, the Statement of Comprehensive Income, and the Statement of Shareholders Equity

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/71

العب

ملء الشاشة (f)

Deck 11: The Income Statement, the Statement of Comprehensive Income, and the Statement of Shareholders Equity

1

Under ASPE, when pretax accounting income exceeds taxable income:

A) Prepaid Income Tax is debited

B) Prepaid Income Tax is credited

C) Future Tax Liability is credited

D) Future Tax Asset is debited

A) Prepaid Income Tax is debited

B) Prepaid Income Tax is credited

C) Future Tax Liability is credited

D) Future Tax Asset is debited

C

2

Challenger 605 Corporation, whose income tax rate is 35%, has pretax accounting income of $4,850,000 and taxable income of $4,075,000. Under ASPE, the entry to record the income tax includes a:

A) debit to Future Tax Asset for $271,250

B) debit to Future Tax Asset for $775,000

C) credit to Future Tax Liability for $271,250

D) credit to Future Tax Liability for $775,000

A) debit to Future Tax Asset for $271,250

B) debit to Future Tax Asset for $775,000

C) credit to Future Tax Liability for $271,250

D) credit to Future Tax Liability for $775,000

C

3

Mitrac Corporation, whose income tax rate is 35%, has pretax accounting income of $636,000 and taxable income of $748,000. Under IFRS, the entry to record the income tax includes a:

A) debit to Income Tax Expense for $261,800

B) credit to Income Tax Payable for $222,600

C) debit to Deferred Tax Asset for $39,200

D) credit to Deferred Tax Liability for $39,200

A) debit to Income Tax Expense for $261,800

B) credit to Income Tax Payable for $222,600

C) debit to Deferred Tax Asset for $39,200

D) credit to Deferred Tax Liability for $39,200

C

4

Over the past two decades, research has shown half of financial statement fraud has involved improper revenue recognition. What are the more common revenue recognition schemes?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

5

Mechatronic Bogie Ltd., whose income tax rate is 35%, has taxable income of $482,000 and pretax accounting income of $566,000. The entry to record the income tax includes a:

A) credit to Income Tax Expense for $198,100

B) credit to Income Tax Payable for $168,700

C) credit to Income Tax Payable for $198,100

D) debit to Income Tax Payable for $168,700

A) credit to Income Tax Expense for $198,100

B) credit to Income Tax Payable for $168,700

C) credit to Income Tax Payable for $198,100

D) debit to Income Tax Payable for $168,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

6

Taxable income is found on the:

A) income statement

B) balance sheet

C) tax return

D) retained earnings statement

A) income statement

B) balance sheet

C) tax return

D) retained earnings statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

7

Pretax accounting income is found on the:

A) income statement

B) balance sheet

C) tax return

D) retained earnings statement

A) income statement

B) balance sheet

C) tax return

D) retained earnings statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

8

Channel stuffing is a common fraud technique used to increase revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

9

Under IFRS, when income tax payable exceeds income tax expense:

A) Accumulated Income Tax is debited

B) Prepaid Income Tax is credited

C) Deferred Tax Liability is credited

D) Deferred Tax Asset is debited

A) Accumulated Income Tax is debited

B) Prepaid Income Tax is credited

C) Deferred Tax Liability is credited

D) Deferred Tax Asset is debited

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

10

Flexity Corporation, whose income tax rate is 35%, has taxable income of $592,600 and pretax accounting income of $494,000. The entry to record the income tax includes a:

A) debit to Income Tax Expense for $207,410

B) credit to Income Tax Payable for $207,410

C) credit to Income Tax Payable for $172,900

D) debit to Income Tax Payable for $172,900

A) debit to Income Tax Expense for $207,410

B) credit to Income Tax Payable for $207,410

C) credit to Income Tax Payable for $172,900

D) debit to Income Tax Payable for $172,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following is not an indicator of a high earnings quality?

A) Gain on the disposition of a discontinued operation

B) Proper revenue and expense recognition

C) Improving earnings from operations as a percentage of sales

D) Low operating expenses as a percentage of sales

A) Gain on the disposition of a discontinued operation

B) Proper revenue and expense recognition

C) Improving earnings from operations as a percentage of sales

D) Low operating expenses as a percentage of sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

12

Income tax expense is based on ________ from the income statement while income tax payable is based on ________ from the income tax return.

A) net income, taxable income

B) taxable income, net income

C) pretax accounting income, taxable income

D) taxable income, pretax accounting income

A) net income, taxable income

B) taxable income, net income

C) pretax accounting income, taxable income

D) taxable income, pretax accounting income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

13

Net income is considered by many users to be a more reliable indicator of future earnings than earnings from continuing operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

14

A company that switches from straight-line amortization to double-declining-balance amortization during an accounting period must report this change on the financial statements as:

A) an extraordinary item

B) income from continuing operations

C) a prior-period adjustment

D) a cumulative effect of a change in accounting principle

A) an extraordinary item

B) income from continuing operations

C) a prior-period adjustment

D) a cumulative effect of a change in accounting principle

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

15

Under IFRS a deferred tax liability is classified as a ________ and income tax payable is classified as a ________ on the balance sheet.

A) current liability; current liability

B) current liability; non-current liability

C) non-current liability; current liability

D) non-current liability; non-current liability

A) current liability; current liability

B) current liability; non-current liability

C) non-current liability; current liability

D) non-current liability; non-current liability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

16

Outline the criteria required for revenue recognition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

17

Automatic Train Company, whose income tax rate is 40%, has taxable income of $856,000 and pretax accounting income of $813,000. Under IFRS the entry to record the income tax includes a:

A) credit to Deferred Tax Liability for $17,200

B) debit to Deferred Tax Asset for $17,200

C) credit to Income Tax Payable for $325,200

D) debit to Income Tax Expense for $342,400

A) credit to Deferred Tax Liability for $17,200

B) debit to Deferred Tax Asset for $17,200

C) credit to Income Tax Payable for $325,200

D) debit to Income Tax Expense for $342,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

18

Explain what is meant by the phrase "the quality of earnings."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

19

When a company sells a segment of its business, the gain or loss on the disposal of the segment is shown as:

A) other gains or losses on the income statement

B) part of the discontinued operations section on the income statement

C) an extraordinary item appearing on the income statement

D) an adjustment to the beginning balance of retained earnings

A) other gains or losses on the income statement

B) part of the discontinued operations section on the income statement

C) an extraordinary item appearing on the income statement

D) an adjustment to the beginning balance of retained earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

20

Under the accrual method of accounting, revenues and gains are recorded when they occur, regardless of when the company receives or pays cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

21

JetNew has a tax rate of 35%. The controller has just calculated JetNew's accounting income (pre-tax) to be $560,000 for 2013. Taking into account the differences in calculation, JetNew's taxable income is $440,000. Prepare the journal entry to record JetNew's taxes for 2013 under IFRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

22

For 2014 Zip has accounting income (pre-tax) of $880,000. Their taxable income for 2014 has been calculated at $950,000. Prepare the journal entry under IFRS to record Zip's taxes for 2014 given a tax rate of 38%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

23

Preferred share dividends must be accounted for in the earnings-per-share calculation. Preferred dividends are:

A) added to net income in the numerator of the EPS calculation

B) subtracted from common shares in the denominator of the EPS calculation

C) added to common shares in the denominator of the EPS calculation

D) subtracted from net income in the numerator of the EPS calculation

A) added to net income in the numerator of the EPS calculation

B) subtracted from common shares in the denominator of the EPS calculation

C) added to common shares in the denominator of the EPS calculation

D) subtracted from net income in the numerator of the EPS calculation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

24

In what situation would a company have to calculate and report diluted EPS on the financial statements?

A) a company that has both convertible preferred and common shares issued and outstanding

B) a company whose common shares' fair market value has dropped 20% from the prior financial statement reporting period

C) a company that has both nonconvertible preferred and common shares issued and outstanding

D) a company that has only common shares issued and outstanding

A) a company that has both convertible preferred and common shares issued and outstanding

B) a company whose common shares' fair market value has dropped 20% from the prior financial statement reporting period

C) a company that has both nonconvertible preferred and common shares issued and outstanding

D) a company that has only common shares issued and outstanding

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

25

JetNew has a tax rate of 30%. The controller has just calculated JetNew's accounting income (pre-tax) to be $660,000 for 2013. Taking into account the differences in calculation, JetNew's taxable income is $530,000. Prepare the journal entry to record JetNew's taxes for 2013 under IFRS.

Outline for each account used where it would appear on JetNew's financial statements.

Outline for each account used where it would appear on JetNew's financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

26

Earnings per share (EPS) is calculated by:

A) dividing the average number of common shares outstanding throughout the year by net income

B) dividing net income by the average number of common shares outstanding throughout the year

C) dividing net income by the number of common shares outstanding at the end of the year

D) dividing the number of common shares outstanding at the end of the year by net income

A) dividing the average number of common shares outstanding throughout the year by net income

B) dividing net income by the average number of common shares outstanding throughout the year

C) dividing net income by the number of common shares outstanding at the end of the year

D) dividing the number of common shares outstanding at the end of the year by net income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

27

Operating income excludes income from discontinued operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

28

If a corporation has issued either nonconvertible preferred shares or nonconvertible bonds, it must present:

A) only basic earnings per share

B) only diluted earnings per share

C) either basic or diluted earnings per share

D) both basic and diluted earnings per share

A) only basic earnings per share

B) only diluted earnings per share

C) either basic or diluted earnings per share

D) both basic and diluted earnings per share

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

29

Describe the process of income tax accrual. What is the goal of income tax accrual? When is income tax expense recorded? How is income tax expense calculated? Is this the same amount that will be paid to the government when the income tax return is filed? Discuss a common difference between pretax accounting income and taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

30

The dollar amount of a company's net income for each common share outstanding is referred to as:

A) the price-to-earnings ratio

B) income as a percentage of equity

C) earnings per share

D) cumulative retained earnings ratio

A) the price-to-earnings ratio

B) income as a percentage of equity

C) earnings per share

D) cumulative retained earnings ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

31

EPS (Earnings Per Share) is a key measure of a business's success. Which statement below is true regarding EPS and a company's financial statements?

A) The EPS calculation never takes into consideration preferred shares or preferred shares dividends.

B) EPS is based on the number of common shares outstanding at the end of an accounting period.

C) An EPS figure should be calculated and presented for each significant element of net income on the income statement.

D) EPS based on the actual outstanding number of common shares of stock is called diluted EPS.

A) The EPS calculation never takes into consideration preferred shares or preferred shares dividends.

B) EPS is based on the number of common shares outstanding at the end of an accounting period.

C) An EPS figure should be calculated and presented for each significant element of net income on the income statement.

D) EPS based on the actual outstanding number of common shares of stock is called diluted EPS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

32

Traxx Corporation reports net income for 2014 of $460,000. Traxx Corporation had 10,000 shares of $10 preferred shares outstanding for all of 2014. Traxx Corporation also had 50,000 common shares issued at $10 outstanding for all of 2014. Earnings per share is:

A) $6.00

B) $6.67

C) $7.20

D) $8.00

A) $6.00

B) $6.67

C) $7.20

D) $8.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

33

The deprecation method used by a company for income tax purposes will not normally be the same as the method used for financial reporting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

34

Corporations generally credit Income Tax Payable based on the amount of pretax accounting income multiplied by the income tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

35

A change in accounting estimate must be accounted for is accounted for retrospectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

36

European Rail Corporation, whose income tax rate is 40%, has taxable income of $815,000 and pretax accounting income of $846,000. Under IFRS the entry to record the income tax includes a:

A) credit to Deferred Tax Liability for $12,400

B) debit to Deferred Tax Asset for $12,400

C) debit to Income Tax Expense for $326,000

D) credit to Income Tax Payable for $338,400

A) credit to Deferred Tax Liability for $12,400

B) debit to Deferred Tax Asset for $12,400

C) debit to Income Tax Expense for $326,000

D) credit to Income Tax Payable for $338,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

37

Equipment was purchased at a cost of $20,000 at the beginning of 2009. It has been depreciated at $2,000 per year over its ten-year estimated useful life. The company is preparing its 2013 financial statements (the net book value of the equipment is $12,000); management now estimates that the remaining useful life is three years and at the end of that time the residual value will be $3,000. Assuming that the company continues to use the straight-line method of depreciation, how much will be charged to depreciation expense in 2013?

A) $2,000

B) $3,000

C) $4,000

D) $5,667

A) $2,000

B) $3,000

C) $4,000

D) $5,667

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

38

Under IFRS for a given year if income taxes payable is less than income tax expenses, a deferred tax liability is recorded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

39

C-series Corporation's net income for the year ending on December 31, 2013, was $365,000. At the end of 2013, the corporation had outstanding 4,000 shares of $10 nonconvertible preferred shares and 10,000 common shares issued at $20. No shares were issued or retired during 2013. The numerator to be used in the earnings-per-share calculation is:

A) $365,000

B) $350,000

C) $325,000

D) $750,000

A) $365,000

B) $350,000

C) $325,000

D) $750,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

40

Under IFRS if in one year Zip's income taxes payable exceeds its income tax expense then there is a deferred tax liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

41

Repurchased share transactions are reported on the:

A) statement of shareholders' equity

B) statement of retained earnings

C) income statement as an extraordinary item

D) income statement as a part of continuing operations

A) statement of shareholders' equity

B) statement of retained earnings

C) income statement as an extraordinary item

D) income statement as a part of continuing operations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

42

On January 1, 2013, Assembly System Corporation's Retained Earnings account had a balance of $675,000. During 2013, cash dividends of $25,000 and stock dividends with a market value of $55,000 were declared and distributed. Assembly System Corporation had a net loss of $5,000 in 2013. What is the balance in Retained Earnings that would appear on Assembly System Corporation's statement of shareholders' equity on December 31, 2013?

A) $670,000

B) $595,000

C) $615,000

D) $590,000

A) $670,000

B) $595,000

C) $615,000

D) $590,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

43

Gail. Inc. has 100,000 common shares outstanding at the beginning of 2013. The company issued an additional 50,000 common shares on July 1, 2013. Gail Inc.'s net income for the year ended December 31, 2013 was $300,000; its comprehensive income was $450,000. Gail Inc. paid dividends of $50,000 during the year. What was Gail Inc.'s basic EPS for 2013?

A) $2.00

B) $2.40

C) $3.00

D) $3.60

A) $2.00

B) $2.40

C) $3.00

D) $3.60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

44

On January 1, 2014, Guided Light Corporation's Retained Earnings account had a balance of $275,000. During 2014, cash dividends of $50,000 were declared and stock dividends with a market value of $40,000 were declared. Net income for 2014 amounted to $120,000. What is the balance in Retained Earnings appearing on the statement of shareholders' equity on December 31, 2014?

A) $305,000

B) $185,000

C) $395,000

D) $345,000

A) $305,000

B) $185,000

C) $395,000

D) $345,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

45

All of the following might be found on a statement of shareholders' equity except:

A) earnings-per-share information

B) cash dividends

C) repurchased share purchases

D) net income

A) earnings-per-share information

B) cash dividends

C) repurchased share purchases

D) net income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

46

On January 1, 2013, Proven Technology Corporation's common shares account had a balance of $250,000, representing 25,000 shares issued at $10 per share. On May 15, 2013, 12,000 shares were issued for $150,000 cash. On August 31, 2013, a 10% stock dividend was declared and distributed. What is the balance in Common Shares appearing on the statement of shareholders' equity on December 31, 2013?

A) $440,000

B) $300,000

C) $400,000

D) $415,000

A) $440,000

B) $300,000

C) $400,000

D) $415,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

47

The statement of retained earnings reports the changes in all categories of equity during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

48

Prior-period adjustments are:

A) added to beginning balance of retained earnings

B) added to or deducted from the beginning balance of retained earnings

C) deducted from ending balance of retained earnings

D) added to or deducted from net income

A) added to beginning balance of retained earnings

B) added to or deducted from the beginning balance of retained earnings

C) deducted from ending balance of retained earnings

D) added to or deducted from net income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

49

The amount of cash dividends declared during the period and the amount of cash dividends paid during the period are reflected in the:

A) income statement and cash flow statement, respectively

B) statement of shareholders' equity and income statement, respectively

C) statement of shareholders' equity and the cash flow statement, respectively

D) cash flow statement and statement of shareholders' equity, respectively

A) income statement and cash flow statement, respectively

B) statement of shareholders' equity and income statement, respectively

C) statement of shareholders' equity and the cash flow statement, respectively

D) cash flow statement and statement of shareholders' equity, respectively

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

50

On January 1, 2013, Automatic Train Corporation had 30,000 common shares outstanding issued at $10 each. On June 1, 2013, Automatic Train Corporation issued 12,000 shares of its common shares at $15 per share. On November 30, 2013, Automatic Train Corporation repurchased 3,000 shares of its common shares for $17 per share. The balance in Common shares on December 31, 2013, as shown on the statement of shareholders' equity, is:

A) $429,000

B) $445,200

C) $445,714

D) $480,000

A) $429,000

B) $445,200

C) $445,714

D) $480,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following would not be reported on the statement of shareholders' equity?

A) interest expense

B) net income

C) repurchased share transactions

D) cash dividends declared but not paid

A) interest expense

B) net income

C) repurchased share transactions

D) cash dividends declared but not paid

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

52

A statement of shareholder's equity does not include details about a company's issuance of stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

53

A statement of shareholders' equity would not include which type of transaction?

A) repurchased shares reacquired by the corporation

B) land exchanged for machinery and equipment

C) cumulative translation adjustment

D) cash dividends declared by the board of directors

A) repurchased shares reacquired by the corporation

B) land exchanged for machinery and equipment

C) cumulative translation adjustment

D) cash dividends declared by the board of directors

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

54

Gail. Inc. has 100,000 common shares outstanding and 10,000 $5.00 preferred shares at the beginning of 2013. The company issued an additional 50,000 common shares on July 1, 2013. Gail Inc.'s net income for the year ended December 31, 2013 was $300,000; its comprehensive income was $450,000. Gail Inc. paid dividends of $50,000 during the year. What was Gail Inc.'s basic EPS for 2013?

A) $2.00

B) $2.40

C) $2.50

D) $3.20

A) $2.00

B) $2.40

C) $2.50

D) $3.20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

55

Corrections to the beginning balance of retained earnings for errors of an earlier period are called:

A) cumulative error adjustments

B) prior-period adjustments

C) extraordinary items

D) discontinued items

A) cumulative error adjustments

B) prior-period adjustments

C) extraordinary items

D) discontinued items

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

56

On January 1, 2013, Bogie Corporation had 40,000 common shares outstanding issued at $16 each during 2012. On June 1, 2013, Bogie Corporation issued 5,000 shares of its common shares at $15 per share. On September 30, 2013, Bogie Corporation repurchased 3,000 shares of its common shares for $17 per share. On November 30, 2013, Bogie Corporation reissued 2,000 shares of repurchased shares at $18 per share. The balance in Share Capital on December 31, 2013, as shown on the statement of shareholders' equity, is:

A) $640,000

B) $700,000

C) $703,333

D) $756,000

A) $640,000

B) $700,000

C) $703,333

D) $756,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

57

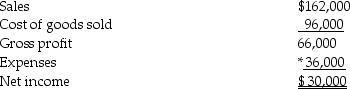

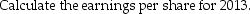

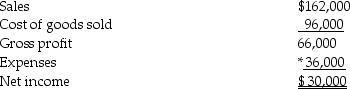

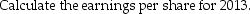

The statement of earnings for Bancroft Company for the year ended December 31, 2013 appears below.

*Includes $6,000 of interest expense and $3,200 of income tax expense.

*Includes $6,000 of interest expense and $3,200 of income tax expense.

Additional information:

1. Average number of common shares outstanding in 2013 was 15,000 shares.

2. The market price of Bancroft's shares was $36 per share at the end of 2013

3. Cash dividends of $6,000 were paid; $1,200 of which were paid to preferred shareholders.

*Includes $6,000 of interest expense and $3,200 of income tax expense.

*Includes $6,000 of interest expense and $3,200 of income tax expense.Additional information:

1. Average number of common shares outstanding in 2013 was 15,000 shares.

2. The market price of Bancroft's shares was $36 per share at the end of 2013

3. Cash dividends of $6,000 were paid; $1,200 of which were paid to preferred shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

58

The financial statement that reports the changes in all categories of equity during the period is called the:

A) statement of income

B) statement of shareholders' equity

C) statement of retained earnings

D) statement of changes in financial position

A) statement of income

B) statement of shareholders' equity

C) statement of retained earnings

D) statement of changes in financial position

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

59

On January 1, 2014, Balises Corporation's Retained Earnings account has a balance of $300,000. During 2014, cash dividends of $20,000 were declared and stock dividends with a market value of $40,000 were declared. Net income for 2014 amounted to $90,000. On June 30, 2014, Balises Corporation issued 5,000 shares of common shares at $10 per share. What is the balance in Retained Earnings appearing on the statement of shareholders' equity on December 31, 2014?

A) $420,000

B) $380,000

C) $330,000

D) $440,000

A) $420,000

B) $380,000

C) $330,000

D) $440,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

60

A statement of shareholders' equity would not include which type of transaction?

A) inventory acquired for cash

B) land exchanged for common shares

C) repurchased shares reissued by the corporation

D) stock dividends declared by the board of directors

A) inventory acquired for cash

B) land exchanged for common shares

C) repurchased shares reissued by the corporation

D) stock dividends declared by the board of directors

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

61

The responsibility for a company's financial statements rests with:

A) the treasurer of the company

B) top management of the company

C) the controller of the company

D) the external accountants that perform the independent audit

A) the treasurer of the company

B) top management of the company

C) the controller of the company

D) the external accountants that perform the independent audit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

62

The primary responsibility of the independent auditor is to decide whether the company's:

A) internal controls are effective

B) financial statements are free from errors

C) management has complied with all applicable laws and regulations during the fiscal year under audit

D) financial statements comply with generally accepted accounting principles (GAAP)

A) internal controls are effective

B) financial statements are free from errors

C) management has complied with all applicable laws and regulations during the fiscal year under audit

D) financial statements comply with generally accepted accounting principles (GAAP)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

63

Prior-period adjustments are made when an error occurs in one period and it is corrected in a later period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

64

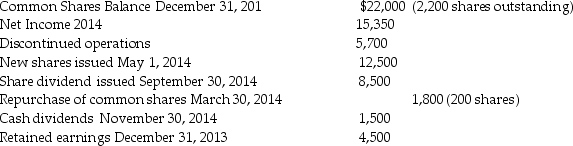

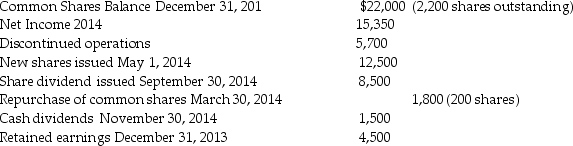

Given the following information prepare a Statement of Shareholders' Equity for Q8 Inc for 2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

65

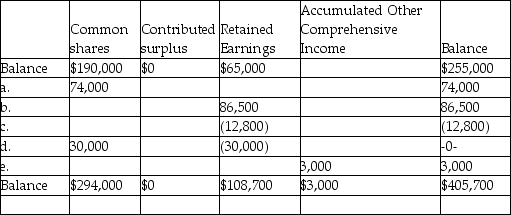

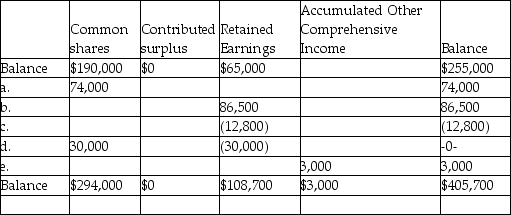

The following statement of shareholders' equity for the Q8 Corporation is missing explanations of the events that led to the changes in the shareholders' equity accounts. Write a brief explanation for each change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

66

In a standard Statement of Management Responsibility for the Financial Statements, management indicates:

A) that it has audited the financial statements found in the annual report

B) it is responsible for the financial statements and all related financial information contained in the annual report

C) that no amounts found in the financial statements are based either on estimates or judgments

D) that the company is fiscally sound

A) that it has audited the financial statements found in the annual report

B) it is responsible for the financial statements and all related financial information contained in the annual report

C) that no amounts found in the financial statements are based either on estimates or judgments

D) that the company is fiscally sound

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

67

An audit report is addressed to the board of directors and shareholders of a company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

68

Corrections to the beginning balance of Retained Earnings for errors found within the current period are called prior-period adjustments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

69

An unqualified (or clean) opinion issued by an external auditor means:

A) the financial statements are reliable, except for one or more items stated in the third paragraph

B) the financial statements are unreliable

C) the auditor was unable to reach a professional opinion

D) the statements are reliable

A) the financial statements are reliable, except for one or more items stated in the third paragraph

B) the financial statements are unreliable

C) the auditor was unable to reach a professional opinion

D) the statements are reliable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

70

The amount of cash dividends declared during the period and the amount of cash dividends paid during the period are reflected in the statement of shareholders' equity and the cash flow statement, respectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

71

Companies issuing publicly-traded stock are required to have their financial statements audited by an external auditor. This requirement is placed on corporations by the:

A) Canada Revenue Agency

B) Provincial Securities Commissions

C) Various federal and provincial incorporating acts

D) the Prime Minister of Canada

A) Canada Revenue Agency

B) Provincial Securities Commissions

C) Various federal and provincial incorporating acts

D) the Prime Minister of Canada

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck