Deck 13: Financial Statement Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

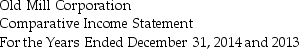

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

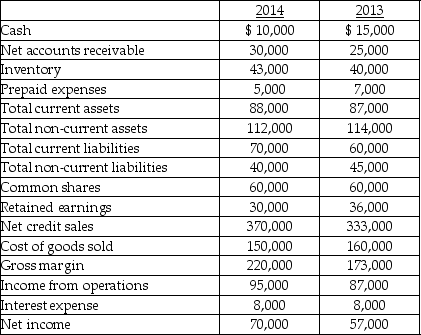

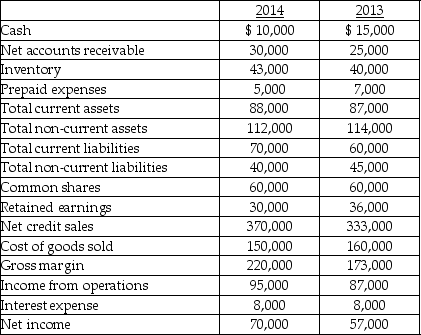

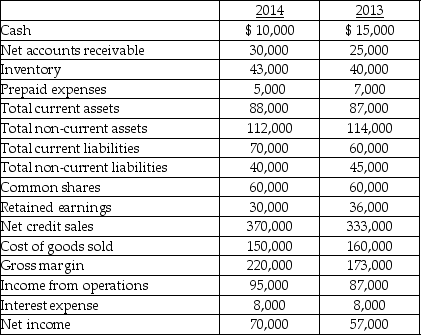

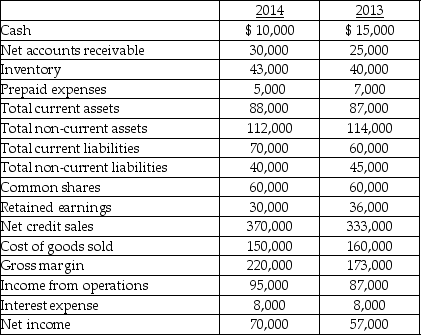

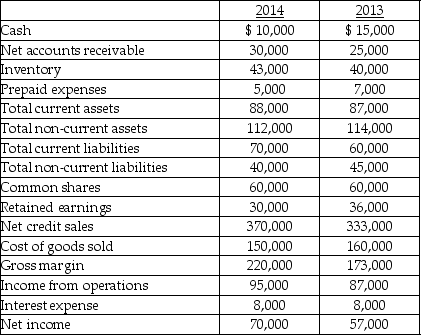

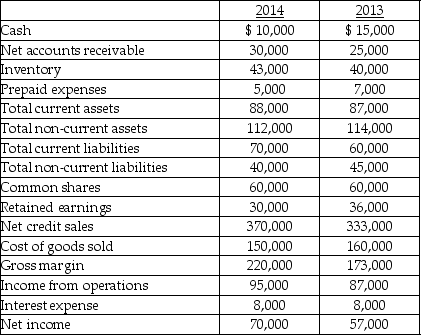

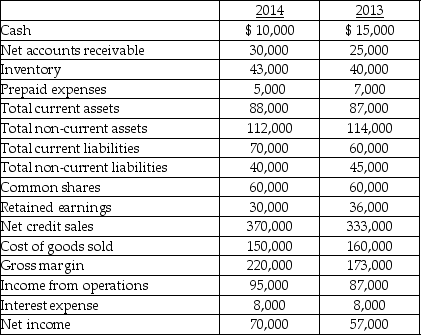

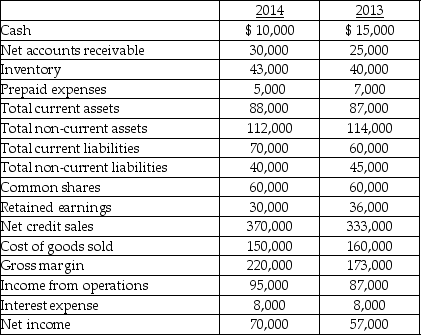

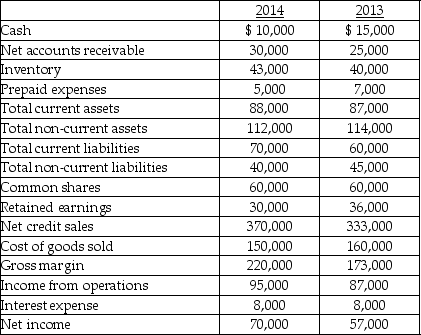

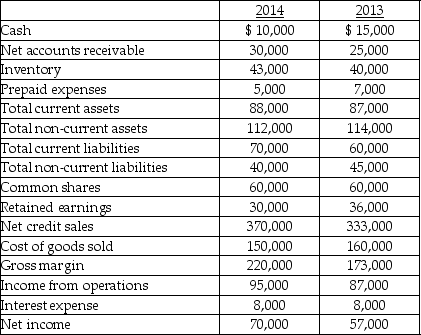

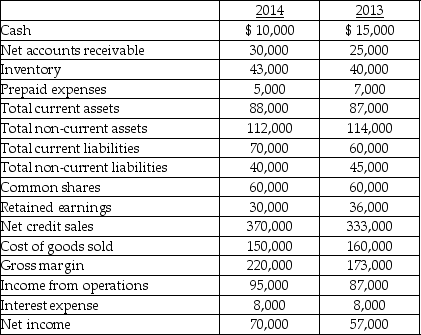

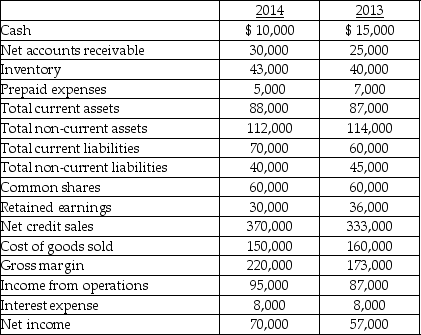

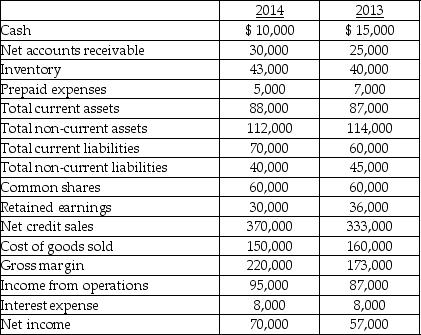

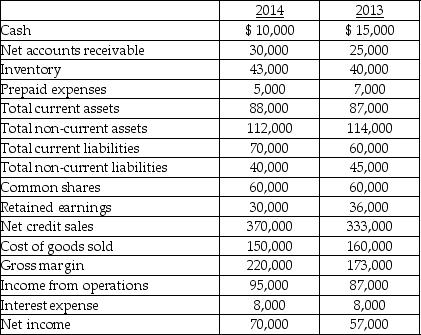

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/116

العب

ملء الشاشة (f)

Deck 13: Financial Statement Analysis

1

The analysis of trend percentages is a form of vertical analysis.

False

2

The form of analysis that looks at trend percentages over a representative period is known as:

A) trend analysis, which is considered a form of horizontal analysis

B) trend analysis, which is considered a form of vertical analysis

C) ratio analysis

D) economic value added analysis

A) trend analysis, which is considered a form of horizontal analysis

B) trend analysis, which is considered a form of vertical analysis

C) ratio analysis

D) economic value added analysis

A

3

The percentage change in financial statement balances is computed by dividing the dollar amount of the change from the base (earlier) period to the later period by the base-period amount.

True

4

Which of the following would be most likely to reveal that cost of goods sold increased by $75,000 from 2013 to 2014?

A) horizontal analysis

B) trend analysis

C) vertical analysis

D) ratio analysis

A) horizontal analysis

B) trend analysis

C) vertical analysis

D) ratio analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

5

Horizontal analysis involves the study of:

A) percentage changes in comparative financial statements

B) percentage and/or dollar amount changes in various financial statement amounts from year to year

C) the change in key financial statement ratios over a certain time frame or horizon

D) the changes in individual financial statement amounts as a percentage of some related total

A) percentage changes in comparative financial statements

B) percentage and/or dollar amount changes in various financial statement amounts from year to year

C) the change in key financial statement ratios over a certain time frame or horizon

D) the changes in individual financial statement amounts as a percentage of some related total

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

6

Given the following data for total sales:  A table showing trend percentages for 2011-2014, respectively, using 2011 as the base year, would show:

A table showing trend percentages for 2011-2014, respectively, using 2011 as the base year, would show:

A) 100%, 110%, and 95%

B) 100%, 110%, 112%, and 106%

C) 100%, 10%, 2%, and (5%)

D) 94%, 1.04%, 1.06%, and 100%

A table showing trend percentages for 2011-2014, respectively, using 2011 as the base year, would show:

A table showing trend percentages for 2011-2014, respectively, using 2011 as the base year, would show:A) 100%, 110%, and 95%

B) 100%, 110%, 112%, and 106%

C) 100%, 10%, 2%, and (5%)

D) 94%, 1.04%, 1.06%, and 100%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

7

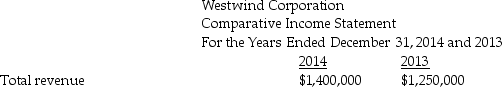

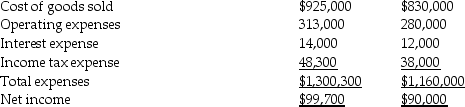

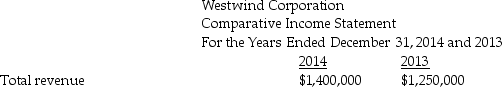

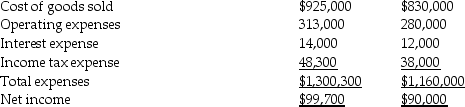

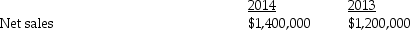

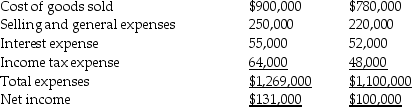

Prepare a horizontal analysis of the following comparative income statement for Westwind Corporation. Round percentage changes to the nearest one-tenth percent.

Expenses:

Expenses:

Expenses:

Expenses:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

8

The analysis of percentage changes in comparative statements is known as:

A) economic value added analysis

B) benchmarking analysis

C) horizontal analysis

D) vertical analysis

A) economic value added analysis

B) benchmarking analysis

C) horizontal analysis

D) vertical analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

9

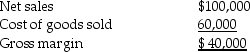

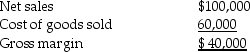

Given the following data:  If net sales decreases by 10%, and cost of goods sold increases by 15%, gross margin would:

If net sales decreases by 10%, and cost of goods sold increases by 15%, gross margin would:

A) increase by 40%

B) decrease by 40%

C) increase by 47.5%

D) decrease by 47.5%

If net sales decreases by 10%, and cost of goods sold increases by 15%, gross margin would:

If net sales decreases by 10%, and cost of goods sold increases by 15%, gross margin would:A) increase by 40%

B) decrease by 40%

C) increase by 47.5%

D) decrease by 47.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

10

Most investors only need one year's worth of financial information to evaluate an organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

11

The percentage change in any individual item shown on comparative financial statements is calculated by dividing the dollar amount of the change from the base period to the current period by:

A) 100

B) the amount shown for the current period

C) the average of the amounts shown for the base and the current periods

D) the base-period amount

A) 100

B) the amount shown for the current period

C) the average of the amounts shown for the base and the current periods

D) the base-period amount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

12

It is generally considered more useful to know the absolute dollar amount of change in financial statement amounts from year to year than to know the percentage change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

13

A company reported $75,000 of income for 2012, $80,000 for 2013, and $90,000 for 2014. The percentage change in net income from 2012 to 2013 was:

A) 6.7%

B) 6.25%

C) 5.9%

D) 10.7%

A) 6.7%

B) 6.25%

C) 5.9%

D) 10.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

14

Horizontal analysis is the study of percentage changes in financial statement balances from one year to the next.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following would be most likely to reveal that cost of goods sold is 125% of the amount shown for a base year?

A) trend analysis

B) ratio analysis

C) vertical analysis

D) horizontal analysis

A) trend analysis

B) ratio analysis

C) vertical analysis

D) horizontal analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

16

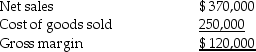

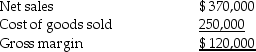

Hamilton Corporation reports the following data:  If net sales increases by 15%, and cost of goods sold increases by 20%, gross margin would:

If net sales increases by 15%, and cost of goods sold increases by 20%, gross margin would:

A) increase by 4.6%

B) decrease by 4.6%

C) decrease by 4.4%

D) increase by 4.4%

If net sales increases by 15%, and cost of goods sold increases by 20%, gross margin would:

If net sales increases by 15%, and cost of goods sold increases by 20%, gross margin would:A) increase by 4.6%

B) decrease by 4.6%

C) decrease by 4.4%

D) increase by 4.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

17

A company reported $75,000 of income for 2012, $80,000 for 2013, and $90,000 for 2014. The percentage change in net income from 2013 to 2014 was:

A) 9.1%

B) 11.1%

C) 12.5%

D) 16.7%

A) 9.1%

B) 11.1%

C) 12.5%

D) 16.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

18

When calculating trend percentages, all percentages shown are relative to:

A) the current year

B) the base year

C) the immediately preceding year

D) the average index calculated for all the years shown

A) the current year

B) the base year

C) the immediately preceding year

D) the average index calculated for all the years shown

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

19

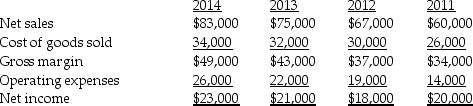

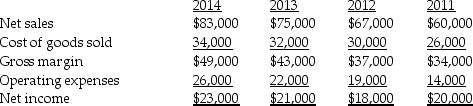

Data for the most recent four fiscal years of Burleigh Falls Corp. are given below:

Required:

Required:

a. Prepare an analysis showing the trend percentages for the four-year period using 2011 as the base year.

b. What do the trend percentages indicate regarding Burleigh Falls Corp.'s income statement data?

Required:

Required:a. Prepare an analysis showing the trend percentages for the four-year period using 2011 as the base year.

b. What do the trend percentages indicate regarding Burleigh Falls Corp.'s income statement data?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

20

Most financial analyses cover trends of three, five, or even 10 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

21

Vertical analysis could be used to determine what is happening to cost of goods sold from one year to the next.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

22

When performing vertical analysis of an income statement, which of the following is usually used as the base?

A) gross sales

B) net sales

C) net income

D) gross margin

A) gross sales

B) net sales

C) net income

D) gross margin

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

23

If a balance sheet is subjected to vertical analysis which shows that current assets (using total assets as the base) have decreased from 53% to 36%, this would always mean that:

A) the dollar amount of current assets has decreased

B) current assets have decreased as a percentage of total assets

C) the dollar amount of total assets has decreased

D) the dollar amount of total assets has increased

A) the dollar amount of current assets has decreased

B) current assets have decreased as a percentage of total assets

C) the dollar amount of total assets has decreased

D) the dollar amount of total assets has increased

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

24

When performing vertical analysis on a balance, cash is compared to the total current assets figure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

25

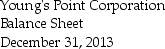

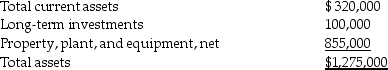

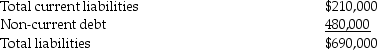

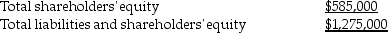

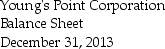

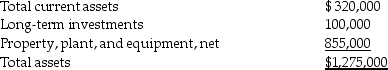

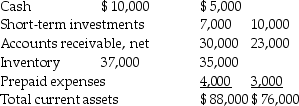

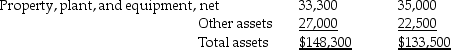

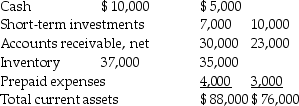

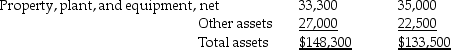

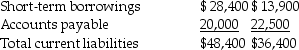

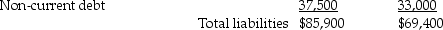

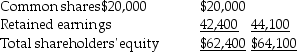

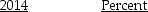

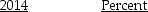

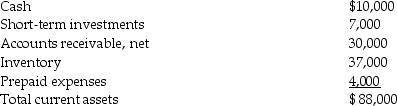

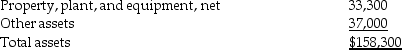

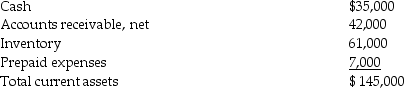

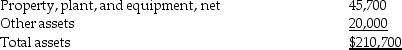

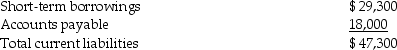

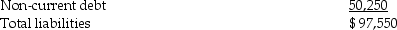

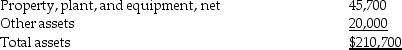

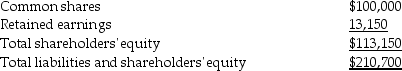

Prepare a vertical analysis for Young's Point Corporation's balance sheet to determine the component percentages of its assets, liabilities, and shareholders' equity. Round percentages to the nearest one-tenth percent.

Assets

Assets

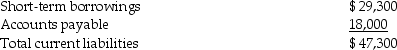

Liabilities

Liabilities

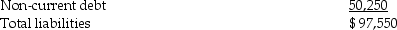

Shareholders' equity

Shareholders' equity

Assets

Assets Liabilities

Liabilities Shareholders' equity

Shareholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

26

When performing vertical analysis on a balance, the current liabilities are compared typically to total liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

27

When performing vertical analysis, each financial statement item is shown as a percentage of the base amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

28

Expressing gross margin for 2013 as a percentage of net sales in 2013 is an example of:

A) vertical analysis

B) horizontal analysis

C) ratio analysis

D) economic value added

A) vertical analysis

B) horizontal analysis

C) ratio analysis

D) economic value added

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

29

Vertical analysis looks at:

A) percentage changes in the balances shown in comparative financial statements

B) the change in key financial statement ratios over a specified period of time

C) the dollar amount of the change in various financial statement amounts from year to year

D) individual financial statement items expressed as a percentage of a base (which represents 100%)

A) percentage changes in the balances shown in comparative financial statements

B) the change in key financial statement ratios over a specified period of time

C) the dollar amount of the change in various financial statement amounts from year to year

D) individual financial statement items expressed as a percentage of a base (which represents 100%)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

30

Assume you are using net sales as the base in vertical analysis. Cost of goods sold in 2013 is 67%, and is 70% in 2014. This would always indicate that:

A) gross margin has declined

B) cost of goods sold as a percentage of net sales has increased

C) the dollar amount of cost of goods sold has increased

D) gross margin has declined, cost of goods sold as a percentage of net sales has increased, and the dollar amount of cost of goods sold has increased

A) gross margin has declined

B) cost of goods sold as a percentage of net sales has increased

C) the dollar amount of cost of goods sold has increased

D) gross margin has declined, cost of goods sold as a percentage of net sales has increased, and the dollar amount of cost of goods sold has increased

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

31

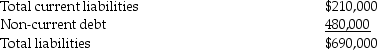

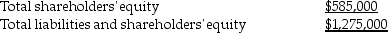

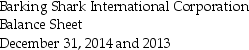

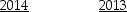

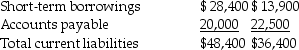

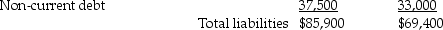

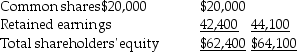

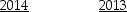

Following is a comparative balance sheet for Barking Shark International Corporation:

Current assets

Current assets

Current liabilities

Current liabilities

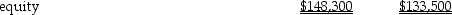

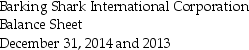

Shareholders' equity

Shareholders' equity

Total liabilities and shareholders'

Total liabilities and shareholders'

Required:

Required:

a. Calculate and show the percentages that would appear in a horizontal analysis for this balance sheet.

b. Indicate any positive or negative developments from one year to the next.

Current assets

Current assets

Current liabilities

Current liabilities

Shareholders' equity

Shareholders' equity Total liabilities and shareholders'

Total liabilities and shareholders' Required:

Required:a. Calculate and show the percentages that would appear in a horizontal analysis for this balance sheet.

b. Indicate any positive or negative developments from one year to the next.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

32

When performing vertical analysis on a balance, non-current debt is calculated as a percentage of total liabilities and shareholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

33

When performing vertical analysis on a balance, accounts receivable is calculated as a percentage of total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

34

When performing vertical analysis of an income statement, net income is usually used as the base.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

35

Vertical analysis highlights changes in an item on the financial statements over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

36

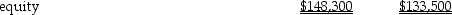

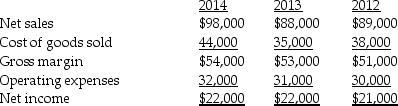

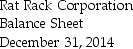

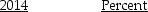

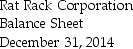

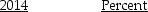

Prepare a horizontal analysis for 2014 using the information provided by Rat Rack Incorporated below. What do these numbers tell you about Rat Rack's 2014 year? Using 2012 as the base year for Rat Rack prepare the trend percentages for the three year period 2012-2013. What do these trend percentages indicate about Rat Rack?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

37

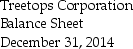

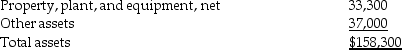

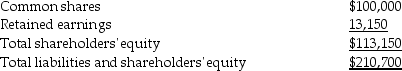

Prepare vertical analysis calculations by filling in the far right column of the following balance sheet with the appropriate percentages.

Current assets

Current assets

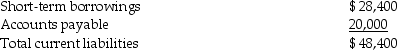

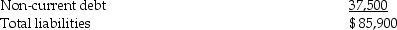

Current liabilities

Current liabilities

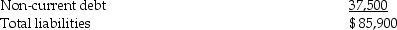

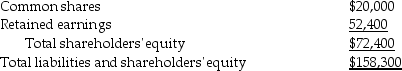

Shareholders' equity

Shareholders' equity

Current assets

Current assets

Current liabilities

Current liabilities

Shareholders' equity

Shareholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

38

When performing vertical analysis on a balance, share capital is calculated as a percentage of total shareholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

39

Assume you are using total assets as the base in vertical analysis. Current assets in 2013 are 42%, and are 36% in 2014. This would always indicate that:

A) the current ratio has decreased

B) the dollar amount of current assets has decreased

C) total non-current assets have increased as a percentage of total assets

D) the dollar amount of non-current assets has increased

A) the current ratio has decreased

B) the dollar amount of current assets has decreased

C) total non-current assets have increased as a percentage of total assets

D) the dollar amount of non-current assets has increased

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

40

If the assets shown on a balance sheet are subjected to vertical analysis (using total assets as the base), an increase in the figure for non-current assets from 40% to 55% would always mean that:

A) total non-current assets have increased as a percentage of total assets

B) the dollar amount of current assets has decreased

C) total current assets have decreased as a percentage of total assets

D) total non-current assets have increased as a percentage of total assets and total current assets have decreased as a percentage of total assets

A) total non-current assets have increased as a percentage of total assets

B) the dollar amount of current assets has decreased

C) total current assets have decreased as a percentage of total assets

D) total non-current assets have increased as a percentage of total assets and total current assets have decreased as a percentage of total assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

41

Working capital is defined as:

A) current liabilities - current assets

B) current assets - current liabilities

C) total assets - total liabilities

D) current assets + current liabilities

A) current liabilities - current assets

B) current assets - current liabilities

C) total assets - total liabilities

D) current assets + current liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

42

Benchmarking is the practice of comparing a company to a standard set by other companies with similar characteristics.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

43

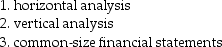

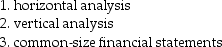

Horizontal analysis and vertical analysis, including the preparation of common-size financial statements, are important analytical techniques used to evaluate the strength of published financial statements.

Required:

a. Define:

b. How is each of these techniques helpful in the analysis of financial statements?

b. How is each of these techniques helpful in the analysis of financial statements?

Required:

a. Define:

b. How is each of these techniques helpful in the analysis of financial statements?

b. How is each of these techniques helpful in the analysis of financial statements?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following would be most likely to reveal that net income represented 7% of total net sales in 2014, but only 4% in 2013?

A) common-size financial statements

B) horizontal analysis

C) trend analysis

D) ratio analysis

A) common-size financial statements

B) horizontal analysis

C) trend analysis

D) ratio analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

45

Analyzing the cash flow statement may help analysts determine the financial health of a company. Which of the following signs below is not an indicator of a financially healthy company?

A) The company's operations are a major source (not a use) of cash.

B) The company's operations are a major use (not a source) of cash.

C) The company's investing activities include more purchases than sales of non-current assets.

D) The company's financing activities are not dominated by borrowing.

A) The company's operations are a major source (not a use) of cash.

B) The company's operations are a major use (not a source) of cash.

C) The company's investing activities include more purchases than sales of non-current assets.

D) The company's financing activities are not dominated by borrowing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

46

Bench marking involves comparing your company's results to a standard set by other.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

47

Common-size financial statements may identify the need for corrective action.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

48

Benchmarking is the process of comparing a company to a standard set by one or more other companies, with a view toward improvement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

49

A common-size statement eases the comparison of different companies because their amounts are stated in percentages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

50

Total revenues and net income for 2013 for Tiger-Cat Corporation is $3,000,000 and $200,000, respectively. Tiger-Cat Corporation has had 400,000 common shares of stock outstanding for all of 2013. The selling price of Tiger-Cat Corporation common shares on December 31, 2013, is $15. Earnings per share for 2013 is:

A) $30.00

B) $7.50

C) $7.00

D) $0.50

A) $30.00

B) $7.50

C) $7.00

D) $0.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

51

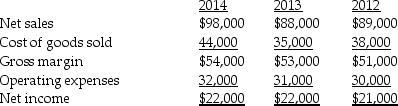

Use the following data to prepare a common-size comparative income statement for Old Mill Corporation on December 31, 2014. Round percentages to one-tenth percent.

Expenses:

Expenses:

Expenses:

Expenses:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

52

Following is the income statement for Lovesick Lake Group Inc., for the year ended December 31, 2014:

Expenses:

Expenses:

Required:

Required:

a. Prepare a vertical analysis of the income statement showing appropriate percentages for each item listed above. Round percentages to one-tenth percent.

b. What additional information would you need to determine whether these percentages are good or bad?

Expenses:

Expenses: Required:

Required:a. Prepare a vertical analysis of the income statement showing appropriate percentages for each item listed above. Round percentages to one-tenth percent.

b. What additional information would you need to determine whether these percentages are good or bad?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

53

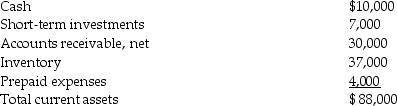

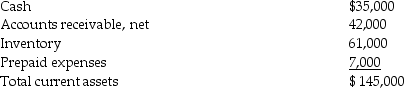

Prepare vertical analysis calculations by filling in the far right column of the following balance sheet with the appropriate percentages.

Current assets

Current assets

Current liabilities

Current liabilities

Shareholders' equity

Shareholders' equity

Current assets

Current assets

Current liabilities

Current liabilities

Shareholders' equity

Shareholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

54

Assume a company has a current ratio of 1.5 and working capital equal to $25,000. If the company's current liabilities are equal to $50,000, its total current assets are:

A) $7,500

B) $25,000

C) $75,000

D) $37,500

A) $7,500

B) $25,000

C) $75,000

D) $37,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

55

Common size statements include the relation of each item on the statement of earnings to net sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

56

Common-size financial statements represent a form of:

A) ratio analysis

B) vertical analysis

C) trend analysis

D) horizontal analysis

A) ratio analysis

B) vertical analysis

C) trend analysis

D) horizontal analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

57

The current ratio is calculated as:

A) total assets / total liabilities

B) current assets / total liabilities

C) current assets × current liabilities

D) current assets / current liabilities

A) total assets / total liabilities

B) current assets / total liabilities

C) current assets × current liabilities

D) current assets / current liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

58

Of the items listed below, the one most helpful in the comparison of different size companies is:

A) horizontal analysis

B) comparison of their net incomes

C) preparation of common-size financial statements

D) comparison of their working capital balances

A) horizontal analysis

B) comparison of their net incomes

C) preparation of common-size financial statements

D) comparison of their working capital balances

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

59

A common size statement reports each item as a percentage of the previous years figure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

60

A common size statement aids in comparing different companies as their amounts are stated in percentages of the total base rather than numbers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

61

If the ending inventory balance was overstated on the financial statements and the beginning inventory balance was understated, but all other items were properly reported, the calculated inventory turnover ratio would be:

A) too high

B) too low

C) indeterminable with the information given

D) unaffected by these errors

A) too high

B) too low

C) indeterminable with the information given

D) unaffected by these errors

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

62

The rate of return on net sales is calculated as:

A) gross margin / net sales

B) net income / net sales

C) operating income / net sales

D) dividends paid during the year / net sales

A) gross margin / net sales

B) net income / net sales

C) operating income / net sales

D) dividends paid during the year / net sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following statements about current ratios is most appropriate?

A) The determination of whether a current ratio is acceptable is best made by reference to industry norms.

B) A current ratio less than 1.5 is unacceptable.

C) A current ratio greater than 1.0 is excellent.

D) The determination of whether a current ratio is acceptable is best made by reference to industry norms, a current ratio less than 1.5 is unacceptable and a current ratio greater than 1.0 is excellent.

A) The determination of whether a current ratio is acceptable is best made by reference to industry norms.

B) A current ratio less than 1.5 is unacceptable.

C) A current ratio greater than 1.0 is excellent.

D) The determination of whether a current ratio is acceptable is best made by reference to industry norms, a current ratio less than 1.5 is unacceptable and a current ratio greater than 1.0 is excellent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

64

The times-interest-earned ratio is calculated as:

A) income from operations / interest expense

B) net income / interest expense

C) net income after taxes + interest expense/interest expense

D) income from operations - interest expense/interest expense

A) income from operations / interest expense

B) net income / interest expense

C) net income after taxes + interest expense/interest expense

D) income from operations - interest expense/interest expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

65

The dividend yield is calculated as:

A) dividends per share / market price per share of common shares

B) dividends per share / earnings per share of common shares

C) dividends per share / book value per share of common shares

D) dividends per share / number of shares of common shares

A) dividends per share / market price per share of common shares

B) dividends per share / earnings per share of common shares

C) dividends per share / book value per share of common shares

D) dividends per share / number of shares of common shares

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following ratios measures profitability?

A) rate of return on total assets

B) times-interest-earned ratio

C) inventory turnover

D) book value per share of common shares

A) rate of return on total assets

B) times-interest-earned ratio

C) inventory turnover

D) book value per share of common shares

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

67

The following data represent selected information from the comparative income statement and balance sheet for Hot Rolled Corporation for the years ended December 31, 2014 and 2013:  •10,000 shares of common shares have been issued and outstanding since the

•10,000 shares of common shares have been issued and outstanding since the

Company was established. They had a market value of $90 per share on December 31, 2013, and they were selling for $91.50 on December 31, 2014.

Refer to the table above. The accounts receivable turnover for Hot Rolled Corporation for the year ended December 31, 2014, was:

A) 13.45

B) 13.32

C) 12.33

D) 12.11

•10,000 shares of common shares have been issued and outstanding since the

•10,000 shares of common shares have been issued and outstanding since theCompany was established. They had a market value of $90 per share on December 31, 2013, and they were selling for $91.50 on December 31, 2014.

Refer to the table above. The accounts receivable turnover for Hot Rolled Corporation for the year ended December 31, 2014, was:

A) 13.45

B) 13.32

C) 12.33

D) 12.11

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

68

The debt ratio is an indicator of a company's:

A) relationship between current liabilities and current assets

B) relationship between debt and interest expense

C) relationship between interest expense and income

D) percentage of assets financed with debt

A) relationship between current liabilities and current assets

B) relationship between debt and interest expense

C) relationship between interest expense and income

D) percentage of assets financed with debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

69

The following data represent selected information from the comparative income statement and balance sheet for Hot Rolled Corporation for the years ended December 31, 2014 and 2013:  •10,000 shares of common shares have been issued and outstanding since the company was established. They had a market value of $90 per share on December 31, 2013, and they were selling for $91.50 on December 31, 2014.

•10,000 shares of common shares have been issued and outstanding since the company was established. They had a market value of $90 per share on December 31, 2013, and they were selling for $91.50 on December 31, 2014.

Refer to the table above. The inventory turnover for Hot Rolled Corporation for the year ended December 31, 2014, was:

A) 4.00

B) 3.86

C) 3.61

D) 3.49

•10,000 shares of common shares have been issued and outstanding since the company was established. They had a market value of $90 per share on December 31, 2013, and they were selling for $91.50 on December 31, 2014.

•10,000 shares of common shares have been issued and outstanding since the company was established. They had a market value of $90 per share on December 31, 2013, and they were selling for $91.50 on December 31, 2014.Refer to the table above. The inventory turnover for Hot Rolled Corporation for the year ended December 31, 2014, was:

A) 4.00

B) 3.86

C) 3.61

D) 3.49

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

70

Trent Corporation has total current assets equal to $50,000 and working capital of $20,000. Fleming Company has the same amount of working capital, but it has total current assets of $300,000. The company with the better working capital position is:

A) Fleming Company

B) Trent Corporation

C) They both have equally good working capital positions.

D) indeterminable with the information given

A) Fleming Company

B) Trent Corporation

C) They both have equally good working capital positions.

D) indeterminable with the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

71

Inventory turnover is calculated as:

A) average inventory for the period / cost of goods sold

B) cost of goods sold / average inventory for the period

C) gross margin for the period / average inventory for the period

D) average inventory for the period / gross margin for the period

A) average inventory for the period / cost of goods sold

B) cost of goods sold / average inventory for the period

C) gross margin for the period / average inventory for the period

D) average inventory for the period / gross margin for the period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

72

The following data represent selected information from the comparative income statement and balance sheet for Hot Rolled Corporation for the years ended December 31, 2014 and 2013:  •10,000 shares of common shares have been issued and outstanding since the company was established. They had a market value of $90 per share on December 31, 2013, and they were selling for $91.50 on December 31, 2014.

•10,000 shares of common shares have been issued and outstanding since the company was established. They had a market value of $90 per share on December 31, 2013, and they were selling for $91.50 on December 31, 2014.

Refer to the table above. For the year ending on December 31, 2013, Hot Rolled Corporation's rate of return on net sales was:

A) 0.19

B) 0.18

C) 0.17

D) 0.21

•10,000 shares of common shares have been issued and outstanding since the company was established. They had a market value of $90 per share on December 31, 2013, and they were selling for $91.50 on December 31, 2014.

•10,000 shares of common shares have been issued and outstanding since the company was established. They had a market value of $90 per share on December 31, 2013, and they were selling for $91.50 on December 31, 2014.Refer to the table above. For the year ending on December 31, 2013, Hot Rolled Corporation's rate of return on net sales was:

A) 0.19

B) 0.18

C) 0.17

D) 0.21

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

73

The following data represent selected information from the comparative income statement and balance sheet for Hot Rolled Corporation for the years ended December 31, 2014 and 2013:  •10,000 shares of common shares have been issued and outstanding since the

•10,000 shares of common shares have been issued and outstanding since the

Company was established. They had a market value of $90 per share on December 31, 2013, and they were selling for $91.50 on December 31, 2014.

Refer to the table above. The acid-test ratio for Hot Rolled Corporation on December 31, 2013, was:

A) 0.67

B) 0.57

C) 1.26

D) 1.45

•10,000 shares of common shares have been issued and outstanding since the

•10,000 shares of common shares have been issued and outstanding since theCompany was established. They had a market value of $90 per share on December 31, 2013, and they were selling for $91.50 on December 31, 2014.

Refer to the table above. The acid-test ratio for Hot Rolled Corporation on December 31, 2013, was:

A) 0.67

B) 0.57

C) 1.26

D) 1.45

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following is not included in the calculation of the numerator in the acid-test ratio?

A) prepaid expenses and inventory

B) cash and prepaid expenses

C) inventory and net current receivables

D) short-term investments and net current receivables

A) prepaid expenses and inventory

B) cash and prepaid expenses

C) inventory and net current receivables

D) short-term investments and net current receivables

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

75

All of the following ratios directly relate to the analysis of a given stock as an investment except the:

A) earnings per share

B) dividend yield

C) current ratio

D) book value per share of common shares

A) earnings per share

B) dividend yield

C) current ratio

D) book value per share of common shares

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

76

The following data represent selected information from the comparative income statement and balance sheet for Hot Rolled Corporation for the years ended December 31, 2014 and 2013:  •10,000 shares of common shares have been issued and outstanding since the company was established. They had a market value of $90 per share on December 31, 2013, and they were selling for $91.50 on December 31, 2014.

•10,000 shares of common shares have been issued and outstanding since the company was established. They had a market value of $90 per share on December 31, 2013, and they were selling for $91.50 on December 31, 2014.

Refer to the table above. The debt ratio for Hot Rolled Corporation on December 31, 2014, was:

A) 87

B) 1.82

C) 0.55

D) 0.54

•10,000 shares of common shares have been issued and outstanding since the company was established. They had a market value of $90 per share on December 31, 2013, and they were selling for $91.50 on December 31, 2014.

•10,000 shares of common shares have been issued and outstanding since the company was established. They had a market value of $90 per share on December 31, 2013, and they were selling for $91.50 on December 31, 2014.Refer to the table above. The debt ratio for Hot Rolled Corporation on December 31, 2014, was:

A) 87

B) 1.82

C) 0.55

D) 0.54

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

77

If all else is held equal, an increase in the current ratio of a company is generally considered to be:

A) an indication that current assets have decreased

B) an indication that current liabilities have increased

C) an indication that the company will have increased difficulty meeting short-term obligations

D) an indication that the company will be better able to meet short-term debt obligations

A) an indication that current assets have decreased

B) an indication that current liabilities have increased

C) an indication that the company will have increased difficulty meeting short-term obligations

D) an indication that the company will be better able to meet short-term debt obligations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

78

Accounts receivable turnover is calculated as:

A) total cost of goods sold / 365 days

B) total net credit sales / average net accounts receivable

C) average net accounts receivable / 365 days

D) total net credit sales / cost of goods sold

A) total cost of goods sold / 365 days

B) total net credit sales / average net accounts receivable

C) average net accounts receivable / 365 days

D) total net credit sales / cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

79

The following data represent selected information from the comparative income statement and balance sheet for Hot Rolled Corporation for the years ended December 31, 2014 and 2013:  • 10,000 shares of common shares have been issued and outstanding since the company was established. They had a market value of $90 per share on December 31, 2013, and they were selling for $91.50 on December 31, 2014.

• 10,000 shares of common shares have been issued and outstanding since the company was established. They had a market value of $90 per share on December 31, 2013, and they were selling for $91.50 on December 31, 2014.

Refer to the table above. The current ratio for Hot Rolled Corporation on December 31, 2014, was:

A) 0.80

B) 0.67

C) 1.45

D) 1.26

• 10,000 shares of common shares have been issued and outstanding since the company was established. They had a market value of $90 per share on December 31, 2013, and they were selling for $91.50 on December 31, 2014.

• 10,000 shares of common shares have been issued and outstanding since the company was established. They had a market value of $90 per share on December 31, 2013, and they were selling for $91.50 on December 31, 2014.Refer to the table above. The current ratio for Hot Rolled Corporation on December 31, 2014, was:

A) 0.80

B) 0.67

C) 1.45

D) 1.26

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

80

The following data represent selected information from the comparative income statement and balance sheet for Hot Rolled Corporation for the years ended December 31, 2014 and 2013:  •10,000 shares of common shares have been issued and outstanding since the company was established. They had a market value of $90 per share on December 31, 2013, and they were selling for $91.50 on December 31, 2014.

•10,000 shares of common shares have been issued and outstanding since the company was established. They had a market value of $90 per share on December 31, 2013, and they were selling for $91.50 on December 31, 2014.

Refer to the table above. Hot Rolled Corporation's times-interest-earned ratio for the year ended December 31, 2014, was:

A) 22.75

B) 11.88

C) 11.38

D) 10.88

•10,000 shares of common shares have been issued and outstanding since the company was established. They had a market value of $90 per share on December 31, 2013, and they were selling for $91.50 on December 31, 2014.

•10,000 shares of common shares have been issued and outstanding since the company was established. They had a market value of $90 per share on December 31, 2013, and they were selling for $91.50 on December 31, 2014.Refer to the table above. Hot Rolled Corporation's times-interest-earned ratio for the year ended December 31, 2014, was:

A) 22.75

B) 11.88

C) 11.38

D) 10.88

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck