Deck 2: An Introduction to Cost Terms and Purposes

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/224

العب

ملء الشاشة (f)

Deck 2: An Introduction to Cost Terms and Purposes

1

A customer could be considered a cost object.

True

2

Cost objects include:

A)products

B)customers

C)departments

D)All of these answers are correct.

A)products

B)customers

C)departments

D)All of these answers are correct.

D

3

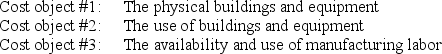

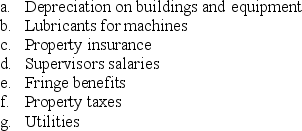

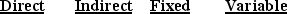

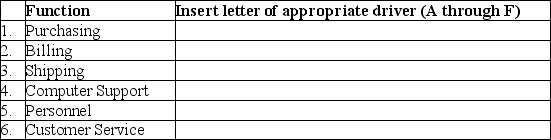

Lucas Manufacturing has three cost objects that it uses to accumulate costs for its manufacturing plants. They are:

The following manufacturing overhead cost categories are found in the accounting records:

The following manufacturing overhead cost categories are found in the accounting records:

Required:

Required:

Assign each of the above costs to the most appropriate cost object.

The following manufacturing overhead cost categories are found in the accounting records:

The following manufacturing overhead cost categories are found in the accounting records: Required:

Required:Assign each of the above costs to the most appropriate cost object.

Cost object # 1 includes categories a, c, and f.

Cost object # 2 includes categories b and g.

Cost object # 3 includes categories d and e.

Cost object # 2 includes categories b and g.

Cost object # 3 includes categories d and e.

4

A cost object is always either a product or a service.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following does NOT affect the direct/indirect classification of a cost?

A)the level of budgeted profit for the next year

B)the materiality of the cost in question

C)available technology to gather information about the cost

D)the design of the operation

A)the level of budgeted profit for the next year

B)the materiality of the cost in question

C)available technology to gather information about the cost

D)the design of the operation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

6

A cost system determines the cost of a cost object by:

A)accumulating and then assigning costs

B)accumulating costs

C)assigning and then accumulating costs

D)assigning costs

A)accumulating and then assigning costs

B)accumulating costs

C)assigning and then accumulating costs

D)assigning costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

7

Actual costs and historical costs are two different terms referring to the same thing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

8

Budgeted costs are:

A)the costs incurred this year

B)the costs incurred last year

C)planned or forecasted costs

D)competitor's costs

A)the costs incurred this year

B)the costs incurred last year

C)planned or forecasted costs

D)competitor's costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

9

Cost tracing is:

A)the assignment of direct costs to the chosen cost object

B)a function of cost allocation

C)the process of tracking both direct and indirect costs associated with a cost object

D)the process of determining the actual cost of the cost object

A)the assignment of direct costs to the chosen cost object

B)a function of cost allocation

C)the process of tracking both direct and indirect costs associated with a cost object

D)the process of determining the actual cost of the cost object

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

10

The general term used to identify both the tracing and the allocation of accumulated costs to a cost object is:

A)cost accumulation

B)cost assignment

C)cost tracing

D)conversion costing

A)cost accumulation

B)cost assignment

C)cost tracing

D)conversion costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

11

Cost assignment :

A)is always arbitrary

B)is includes tracing and allocating

C)is the same as cost accumulation

D)is finding the difference between budgeted and actual costs

A)is always arbitrary

B)is includes tracing and allocating

C)is the same as cost accumulation

D)is finding the difference between budgeted and actual costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

12

Accountants define a cost as a resource to be sacrificed to achieve a specific objective.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

13

Products, services, departments, and customers may be cost objects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

14

Actual costs are:

A)the costs incurred

B)budgeted costs

C)estimated costs

D)forecasted costs

A)the costs incurred

B)budgeted costs

C)estimated costs

D)forecasted costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

15

In order to make decisions, managers need to know:

A)actual costs

B)budgeted costs

C)both costs

D)neither cost

A)actual costs

B)budgeted costs

C)both costs

D)neither cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following statements about the direct/indirect cost classification is NOT true?

A)Indirect costs are always traced.

B)Indirect costs are always allocated.

C)The design of operations affects the direct/indirect classification.

D)The direct/indirect classification depends on the choice of cost object.

A)Indirect costs are always traced.

B)Indirect costs are always allocated.

C)The design of operations affects the direct/indirect classification.

D)The direct/indirect classification depends on the choice of cost object.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

17

Costs are accounted for in two basic stages: assignment followed by accumulation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

18

The determination of a cost as either direct or indirect depends upon the:

A)accounting system

B)allocation system

C)cost tracing system

D)cost object chosen

A)accounting system

B)allocation system

C)cost tracing system

D)cost object chosen

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

19

Cost allocation is:

A)the process of tracking both direct and indirect costs associated with a cost object

B)the process of determining the actual cost of the cost object

C)the assignment of indirect costs to the chosen cost object

D)a function of cost tracing

A)the process of tracking both direct and indirect costs associated with a cost object

B)the process of determining the actual cost of the cost object

C)the assignment of indirect costs to the chosen cost object

D)a function of cost tracing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

20

The collection of accounting data in some organized way is:

A)cost accumulation

B)cost assignment

C)cost tracing

D)conversion costing

A)cost accumulation

B)cost assignment

C)cost tracing

D)conversion costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

21

Improvements in information-gathering technologies are making it possible to trace more costs as direct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

22

Indirect manufacturing costs:

A)can be traced to the product that created the costs

B)can be easily identified with the cost object

C)generally include the cost of material and the cost of labor

D)may include both variable and fixed costs

A)can be traced to the product that created the costs

B)can be easily identified with the cost object

C)generally include the cost of material and the cost of labor

D)may include both variable and fixed costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

23

The same cost may be direct for one cost object and indirect for another cost object.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

24

A manufacturing plant produces two product lines: golf equipment and soccer equipment. An example of direct costs for the golf equipment line are:

A)beverages provided daily in the plant break room

B)monthly lease payments for a specialized piece of equipment needed to manufacture the golf driver

C)salaries of the clerical staff that work in the company administrative offices

D)utilities paid for the manufacturing plant

A)beverages provided daily in the plant break room

B)monthly lease payments for a specialized piece of equipment needed to manufacture the golf driver

C)salaries of the clerical staff that work in the company administrative offices

D)utilities paid for the manufacturing plant

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

25

Assigning direct costs poses more problems than assigning indirect costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

26

Classifying a cost as either direct or indirect depends upon:

A)the behavior of the cost in response to volume changes

B)whether the cost is expensed in the period in which it is incurred

C)whether the cost can be easily identified with the cost object

D)whether an expenditure is avoidable or not in the future

A)the behavior of the cost in response to volume changes

B)whether the cost is expensed in the period in which it is incurred

C)whether the cost can be easily identified with the cost object

D)whether an expenditure is avoidable or not in the future

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

27

Why is it possible that a raw material such as glue might be considered as an indirect material for one furniture manufacturer and as a direct material for another furniture manufacture?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

28

All of the following are true EXCEPT that indirect costs:

A)may be included in prime costs

B)are not easily traced to products or services

C)vary with the selection of the cost object

D)may be included in manufacturing overhead

A)may be included in prime costs

B)are not easily traced to products or services

C)vary with the selection of the cost object

D)may be included in manufacturing overhead

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

29

Some fixed costs may be classified as direct manufacturing costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

30

The materiality of the cost is a factor in classifying the cost as a direct or indirect cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

31

A manufacturing plant produces two product lines: golf equipment and soccer equipment. An example of indirect cost for the soccer equipment line is:

A)material used to make the soccer balls

B)labor to shape the leather used to make the soccer ball

C)shift supervisor for the soccer line

D)plant supervisor

A)material used to make the soccer balls

B)labor to shape the leather used to make the soccer ball

C)shift supervisor for the soccer line

D)plant supervisor

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which one of the following items is a direct cost?

A)Customer-service costs of a multiproduct firm; Product A is the cost object.

B)Printing costs incurred for payroll check processing; payroll check processing is the cost object.

C)The salary of a maintenance supervisor in a multiproduct manufacturing plant; Product B is the cost object.

D)Utility costs of the administrative offices; the accounting department is the cost object.

A)Customer-service costs of a multiproduct firm; Product A is the cost object.

B)Printing costs incurred for payroll check processing; payroll check processing is the cost object.

C)The salary of a maintenance supervisor in a multiproduct manufacturing plant; Product B is the cost object.

D)Utility costs of the administrative offices; the accounting department is the cost object.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which statement is true?

A)A direct cost of one cost object cannot be an indirect cost of another cost object.

B)All variable costs are direct costs.

C)A direct cost of one cost object can be an indirect cost of another cost object.

D)All fixed costs are direct costs.

A)A direct cost of one cost object cannot be an indirect cost of another cost object.

B)All variable costs are direct costs.

C)A direct cost of one cost object can be an indirect cost of another cost object.

D)All fixed costs are direct costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

34

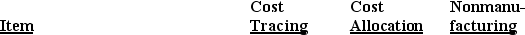

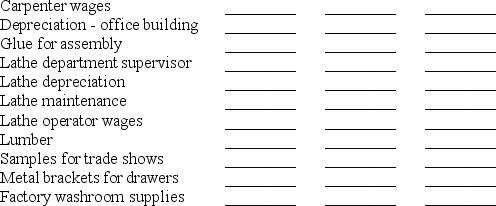

Archambeau Products Company manufactures office furniture. Recently, the company decided to develop a formal cost accounting system and classify all costs into three categories. Categorize each of the following items as being appropriate for (1)cost tracing to the finished furniture, (2)cost allocation of an indirect manufacturing cost to the finished furniture, or (3)as a nonmanufacturing item.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

35

The cost of electricity used in the production of multiple products would be classified as a indirect cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

36

What are the differences between direct costs and indirect costs? Give an example of each.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

37

The distinction between direct and indirect costs is clearly set forth in Generally Accepted Accounting Principles (GAAP).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

38

Misallocated indirect costs may lead to NOT promoting profitability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which statement is true?

A)All variable costs are direct costs.

B)Because of a cost-benefit tradeoff, some direct costs may be treated as indirect costs.

C)All fixed costs are indirect costs.

D)All direct costs are variable costs.

A)All variable costs are direct costs.

B)Because of a cost-benefit tradeoff, some direct costs may be treated as indirect costs.

C)All fixed costs are indirect costs.

D)All direct costs are variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

40

A mixed cost is:

A)a fixed cost

B)a cost with fixed and variable elements

C)a variable cost

D)always an indirect cost

A)a fixed cost

B)a cost with fixed and variable elements

C)a variable cost

D)always an indirect cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

41

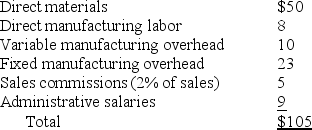

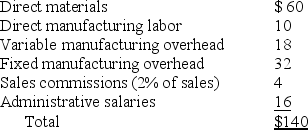

Answer the following questions using the information below:

The East Company manufactures several different products. Unit costs associated with Product ORD203 are as follows:

What are the variable costs per unit associated with Product ORD203?

A)$60

B)$82

C)$73

D)$105

The East Company manufactures several different products. Unit costs associated with Product ORD203 are as follows:

What are the variable costs per unit associated with Product ORD203?

A)$60

B)$82

C)$73

D)$105

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

42

A band of normal activity or volume in which specific cost-volume relationships are maintained is referred to as the:

A)average range

B)cost-allocation range

C)cost driver range

D)relevant range

A)average range

B)cost-allocation range

C)cost driver range

D)relevant range

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following is a mixed cost?

A)monthly rent payment

B)manager's salary

C)monthly electric bill

D)direct materials

A)monthly rent payment

B)manager's salary

C)monthly electric bill

D)direct materials

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

44

Fixed costs depend on the:

A)amount of resources used

B)amount of resources acquired

C)volume of production

D)volume of sales

A)amount of resources used

B)amount of resources acquired

C)volume of production

D)volume of sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

45

An understanding of the underlying behavior of costs helps in all of the following EXCEPT:

A)costs can be better estimated as volume expands and contracts

B)true costs can be better evaluated

C)process inefficiencies can be better identified and as a result improved

D)sales volume can be better estimated

A)costs can be better estimated as volume expands and contracts

B)true costs can be better evaluated

C)process inefficiencies can be better identified and as a result improved

D)sales volume can be better estimated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

46

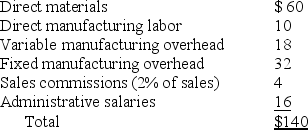

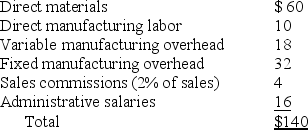

Answer the following questions using the information below:

The Singer Company manufactures several different products. Unit costs associated with Product ICT101 are as follows:

What are the variable costs per unit associated with Product ICT101?

A)$18

B)$22

C)$88

D)$92

The Singer Company manufactures several different products. Unit costs associated with Product ICT101 are as follows:

What are the variable costs per unit associated with Product ICT101?

A)$18

B)$22

C)$88

D)$92

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which one of the following is a variable cost for an insurance company?

A)rent

B)president's salary

C)sales commissions

D)property taxes

A)rent

B)president's salary

C)sales commissions

D)property taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

48

Within the relevant range, if there is a change in the level of the cost driver, then:

A)fixed and variable costs per unit will change

B)fixed and variable costs per unit will remain the same

C)fixed costs per unit will remain the same and variable costs per unit will change

D)fixed costs per unit will change and variable costs per unit will remain the same

A)fixed and variable costs per unit will change

B)fixed and variable costs per unit will remain the same

C)fixed costs per unit will remain the same and variable costs per unit will change

D)fixed costs per unit will change and variable costs per unit will remain the same

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

49

The most likely cost driver of direct labor costs is the:

A)number of machine setups for the product

B)number of miles driven

C)number of production hours

D)number of machine hours

A)number of machine setups for the product

B)number of miles driven

C)number of production hours

D)number of machine hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

50

If each motorcycle requires a belt that costs $20 and 2,000 motorcycles are produced for the month, the total cost for belts is:

A)considered to be a direct fixed cost

B)considered to be a direct variable cost

C)considered to be an indirect fixed cost

D)considered to be an indirect variable cost

A)considered to be a direct fixed cost

B)considered to be a direct variable cost

C)considered to be an indirect fixed cost

D)considered to be an indirect variable cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

51

The most likely cost driver of distribution costs is the:

A)number of parts within the product

B)number of miles driven

C)number of products manufactured

D)number of production hours

A)number of parts within the product

B)number of miles driven

C)number of products manufactured

D)number of production hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following statements is FALSE?

A)There is a cause-and-effect relationship between the cost driver and the amount of cost.

B)Fixed costs have cost drivers over the short run.

C)Over the long run all costs have cost drivers.

D)Volume of production is a cost driver of direct manufacturing costs.

A)There is a cause-and-effect relationship between the cost driver and the amount of cost.

B)Fixed costs have cost drivers over the short run.

C)Over the long run all costs have cost drivers.

D)Volume of production is a cost driver of direct manufacturing costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

53

Cost behavior refers to:

A)how costs react to a change in the level of activity

B)whether a cost is incurred in a manufacturing, merchandising, or service company

C)classifying costs as either inventoriable or period costs

D)whether a particular expense has been ethically incurred

A)how costs react to a change in the level of activity

B)whether a cost is incurred in a manufacturing, merchandising, or service company

C)classifying costs as either inventoriable or period costs

D)whether a particular expense has been ethically incurred

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

54

At a plant where a union agreement sets annual salaries and conditions, annual labor costs usually:

A)are considered a variable cost

B)are considered a fixed cost

C)depend on the scheduling of floor workers

D)depend on the scheduling of production runs

A)are considered a variable cost

B)are considered a fixed cost

C)depend on the scheduling of floor workers

D)depend on the scheduling of production runs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following is a fixed cost for an automobile manufacturing plant?

A)administrative salaries

B)electricity used by assembly-line machines

C)sales commissions

D)windows for each car produced

A)administrative salaries

B)electricity used by assembly-line machines

C)sales commissions

D)windows for each car produced

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

56

Within the relevant range, if there is a change in the level of the cost driver, then:

A)total fixed costs and total variable costs will change

B)total fixed costs and total variable costs will remain the same

C)total fixed costs will remain the same and total variable costs will change

D)total fixed costs will change and total variable costs will remain the same

A)total fixed costs and total variable costs will change

B)total fixed costs and total variable costs will remain the same

C)total fixed costs will remain the same and total variable costs will change

D)total fixed costs will change and total variable costs will remain the same

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

57

Answer the following questions using the information below:

The Singer Company manufactures several different products. Unit costs associated with Product ICT101 are as follows:

What are the fixed costs per unit associated with Product ICT101?

A)$102

B)$48

C)$52

D)$32

The Singer Company manufactures several different products. Unit costs associated with Product ICT101 are as follows:

What are the fixed costs per unit associated with Product ICT101?

A)$102

B)$48

C)$52

D)$32

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

58

Variable costs:

A)are always indirect costs

B)increase in total when the actual level of activity increases

C)include most personnel costs and depreciation on machinery

D)can always be traced directly to the cost object

A)are always indirect costs

B)increase in total when the actual level of activity increases

C)include most personnel costs and depreciation on machinery

D)can always be traced directly to the cost object

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following would be LEAST likely to be a cost driver for a company's human resource costs?

A)the number of employees in the human resource department

B)the number of job applications processed

C)the number of units sold

D)the square footage of the office space used by the human resource department

A)the number of employees in the human resource department

B)the number of job applications processed

C)the number of units sold

D)the square footage of the office space used by the human resource department

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

60

Fixed costs:

A)may include either direct or indirect costs

B)vary with production or sales volumes

C)include parts and materials used to manufacture a product

D)can be adjusted in the short run to meet actual demands

A)may include either direct or indirect costs

B)vary with production or sales volumes

C)include parts and materials used to manufacture a product

D)can be adjusted in the short run to meet actual demands

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

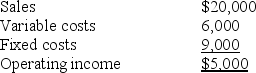

61

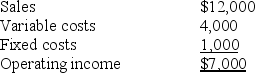

Amber Manufacturing provided the following information for last month:  If sales double next month, what is the projected operating income?

If sales double next month, what is the projected operating income?

A)$10,000

B)$25,000

C)$19,000

D)$12,000

If sales double next month, what is the projected operating income?

If sales double next month, what is the projected operating income?A)$10,000

B)$25,000

C)$19,000

D)$12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

62

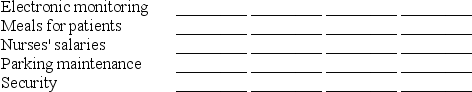

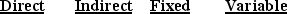

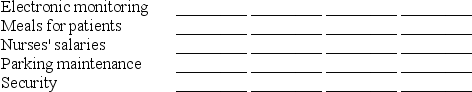

Butler Hospital wants to estimate the cost for each patient stay. It is a general health care facility offering only basic services and not specialized services such as organ transplants.

Required:

a. Classify each of the following costs as either direct or indirect with respect to each patient.

b. Classify each of the following costs as either fixed or variable with respect to hospital costs per day.

Required:

a. Classify each of the following costs as either direct or indirect with respect to each patient.

b. Classify each of the following costs as either fixed or variable with respect to hospital costs per day.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

63

Fixed costs in total will NOT change in the short run, but may change in the long run.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

64

Fixed costs depend on the resources used, not the resources acquired.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

65

Describe a variable cost. Describe a fixed cost. Explain why the distinction between variable and fixed costs is important in cost accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

66

A decision maker CANNOT adjust capacity over the short run.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

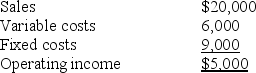

67

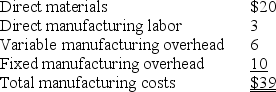

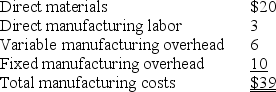

Wheel and Tire Manufacturing currently produces 1,000 tires per month. The following per unit data apply for sales to regular customers:  The plant has capacity for 3,000 tires and is considering expanding production to 2,000 tires. What is the total cost of producing 2,000 tires?

The plant has capacity for 3,000 tires and is considering expanding production to 2,000 tires. What is the total cost of producing 2,000 tires?

A)$39,000

B)$78,000

C)$68,000

D)$62,000

The plant has capacity for 3,000 tires and is considering expanding production to 2,000 tires. What is the total cost of producing 2,000 tires?

The plant has capacity for 3,000 tires and is considering expanding production to 2,000 tires. What is the total cost of producing 2,000 tires?A)$39,000

B)$78,000

C)$68,000

D)$62,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

68

Currently, most administrative personnel costs would be classified as fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

69

XIAN Manufacturing produces a unique valve, and has the capacity to produce 50,000 valves annually. Currently XIAN produces 40,000 valves and is thinking about increasing production to 45,000 valves next year. What is the most likely behavior of total manufacturing costs and unit manufacturing costs given this change?

A)Total manufacturing costs will increase and unit manufacturing costs will stay the same.

B)Total manufacturing costs will increase and unit manufacturing costs will decrease.

C)Total manufacturing costs will stay the same and unit manufacturing costs will stay the same.

D)Total manufacturing costs will stay the same and unit manufacturing costs will decrease.

A)Total manufacturing costs will increase and unit manufacturing costs will stay the same.

B)Total manufacturing costs will increase and unit manufacturing costs will decrease.

C)Total manufacturing costs will stay the same and unit manufacturing costs will stay the same.

D)Total manufacturing costs will stay the same and unit manufacturing costs will decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

70

An appropriate cost driver for shipping costs might be the number of units shipped.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

71

In making product mix and pricing decisions, managers should focus on:

A)total costs

B)unit costs

C)variable costs

D)fixed costs

A)total costs

B)unit costs

C)variable costs

D)fixed costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

72

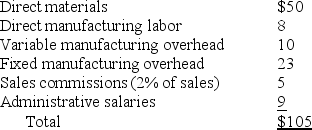

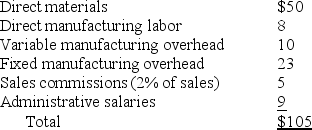

Answer the following questions using the information below:

The East Company manufactures several different products. Unit costs associated with Product ORD203 are as follows:

What are the fixed costs per unit associated with Product ORD203?

A)$23

B)$32

C)$35

D)$44

The East Company manufactures several different products. Unit costs associated with Product ORD203 are as follows:

What are the fixed costs per unit associated with Product ORD203?

A)$23

B)$32

C)$35

D)$44

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

73

When 10,000 units are produced, variable costs are $6 per unit. Therefore, when 20,000 units are produced:

A)variable costs will total $120,000

B)variable costs will total $60,000

C)variable unit costs will increase to $12 per unit

D)variable unit costs will decrease to $3 per unit

A)variable costs will total $120,000

B)variable costs will total $60,000

C)variable unit costs will increase to $12 per unit

D)variable unit costs will decrease to $3 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

74

A unit cost is computed by:

A)multiplying total cost by the number of units

B)dividing total cost by the number of units

C)dividing variable cost by the number of units

D)adding variable cost to fixed cost

A)multiplying total cost by the number of units

B)dividing total cost by the number of units

C)dividing variable cost by the number of units

D)adding variable cost to fixed cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

75

Costs that are difficult to change over the short run are always variable over the long run.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

76

The variable cost per unit of a product should stay the same throughout the relevant range of production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

77

Variable costs per unit vary with the level of production or sales volume.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

78

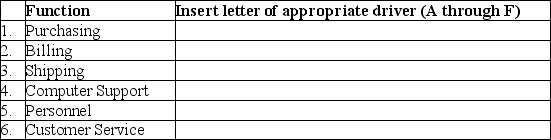

The list of representative cost drivers in the right column below are randomized with respect to the list of functions in the left column. That is, they do not match.

Required:

Required:

Match each business function with its representative cost driver.

Required:

Required:Match each business function with its representative cost driver.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

79

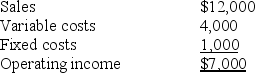

Kym Manufacturing provided the following information for last month:  If sales double next month, what is the projected operating income?

If sales double next month, what is the projected operating income?

A)$14,000

B)$15,000

C)$18,000

D)$19,000

If sales double next month, what is the projected operating income?

If sales double next month, what is the projected operating income?A)$14,000

B)$15,000

C)$18,000

D)$19,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck

80

When 20,000 units are produced, fixed costs are $16 per unit. Therefore, when 40,000 units are produced fixed costs will:

A)increase to $32 per unit

B)remain at $16 per unit

C)decrease to $8 per unit

D)total $640,000

A)increase to $32 per unit

B)remain at $16 per unit

C)decrease to $8 per unit

D)total $640,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 224 في هذه المجموعة.

فتح الحزمة

k this deck