Deck 5: Activity-Based Costing and Activity-Based Management

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/175

العب

ملء الشاشة (f)

Deck 5: Activity-Based Costing and Activity-Based Management

1

As product diversity and indirect costs increase, it is usually best to switch away from an activity based cost system to a broad averaging system.

False

2

A company produces three products; if one product is overcosted then:

A)one product is undercosted

B)one or two products are undercosted

C)two products are undercosted

D)no products are undercosted

A)one product is undercosted

B)one or two products are undercosted

C)two products are undercosted

D)no products are undercosted

B

3

If companies increase market share in a given product line because their reported costs are less than their actual costs, they will become more profitable in the long run.

False

4

Misleading cost numbers are most likely the result of misallocating:

A)direct material costs

B)direct manufacturing labor costs

C)indirect costs

D)All of these answers are correct.

A)direct material costs

B)direct manufacturing labor costs

C)indirect costs

D)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

5

A top-selling product might actually result in losses for the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

6

Greater indirect costs are associated with:

A)specialized engineering drawings

B)quality specifications and testing

C)inventoried materials and material control systems

D)All of these answers are correct.

A)specialized engineering drawings

B)quality specifications and testing

C)inventoried materials and material control systems

D)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

7

An accelerated need for refined cost systems is due to:

A)global monopolies

B)rising prices

C)intense competition

D)a shift toward increased direct costs

A)global monopolies

B)rising prices

C)intense competition

D)a shift toward increased direct costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

8

Direct costs plus indirect costs equal total costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

9

If a company overcosts one of its products, then it will undercost at least one of its other products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

10

In a homogeneous cost pool, all costs have a similar cause-and-effect relationship with the cost-allocation base.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

11

When refining a costing system, a company should classify as many costs as possible as direct costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

12

Uniformly assigning the costs of resources to cost objects when those resources are actually used in a nonuniform way is called:

A)overcosting

B)undercosting

C)peanut-butter costing

D)department costing

A)overcosting

B)undercosting

C)peanut-butter costing

D)department costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

13

The use of a single indirect-cost rate is more likely to:

A)undercost high-volume simple products

B)undercost low-volume complex products

C)undercost lower-priced products

D)Both B and C are correct.

A)undercost high-volume simple products

B)undercost low-volume complex products

C)undercost lower-priced products

D)Both B and C are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

14

Companies that overcost products will most likely lose market share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

15

Refining a cost system includes:

A)classifying as many costs as indirect costs as is feasible

B)creating as many cost pools as possible

C)identifying the activities involved in a process

D)seeking a lesser level of detail

A)classifying as many costs as indirect costs as is feasible

B)creating as many cost pools as possible

C)identifying the activities involved in a process

D)seeking a lesser level of detail

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

16

Overcosting a particular product may result in:

A)loss of market share

B)pricing the product too low

C)operating efficiencies

D)understating total product costs

A)loss of market share

B)pricing the product too low

C)operating efficiencies

D)understating total product costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

17

Explain how a top-selling product may actually result in losses for the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

18

Undercosting of a product is most likely to result from:

A)misallocating direct labor costs

B)underpricing the product

C)overcosting another product

D)overstating total product costs

A)misallocating direct labor costs

B)underpricing the product

C)overcosting another product

D)overstating total product costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

19

Design of an ABC system requires:

A)that the job bid process be redesigned

B)that a cause-and-effect relationship exists between resource costs and individual activities

C)an adjustment to product mix

D)Both B and C are correct.

A)that the job bid process be redesigned

B)that a cause-and-effect relationship exists between resource costs and individual activities

C)an adjustment to product mix

D)Both B and C are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

20

If products are different, then for costing purposes:

A)an ABC costing system will yield more accurate cost numbers

B)a simple costing system should be used

C)a single indirect-cost rate should be used

D)none of the above

A)an ABC costing system will yield more accurate cost numbers

B)a simple costing system should be used

C)a single indirect-cost rate should be used

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

21

A cost-allocation base is a necessary element when using a strategy that will refine a costing system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

22

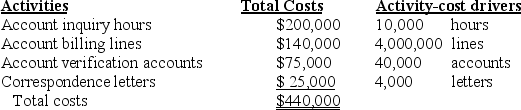

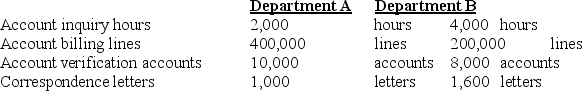

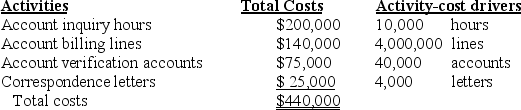

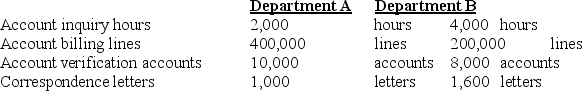

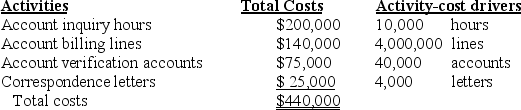

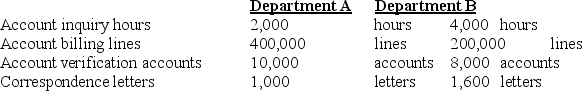

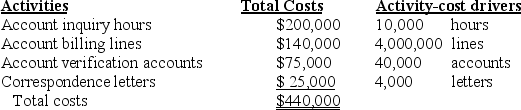

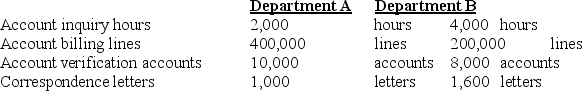

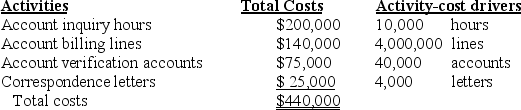

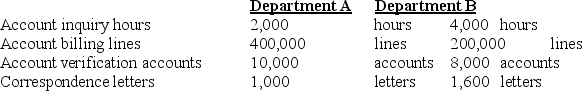

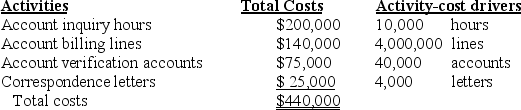

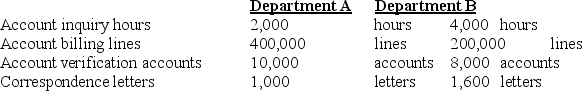

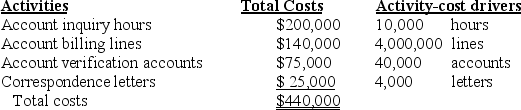

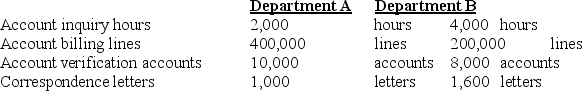

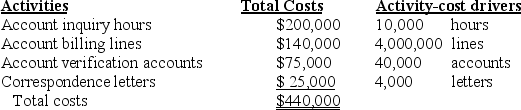

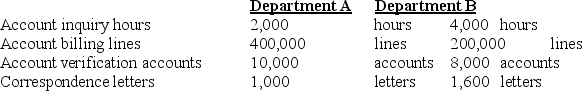

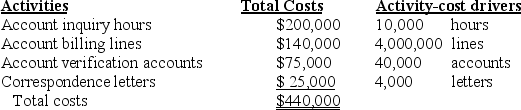

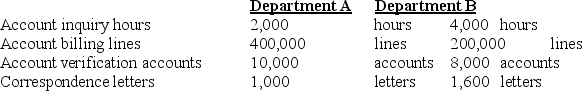

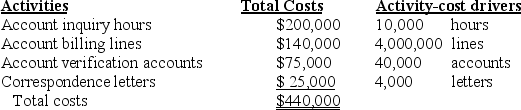

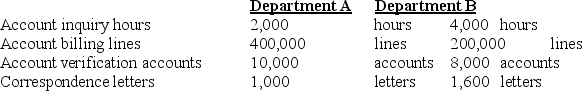

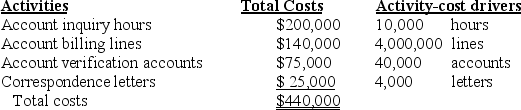

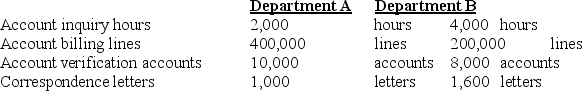

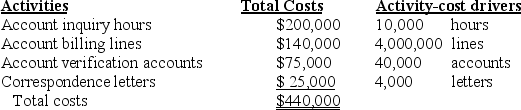

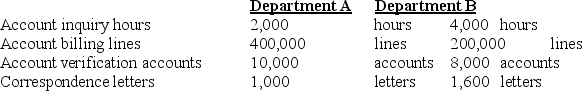

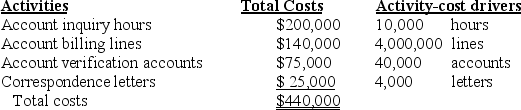

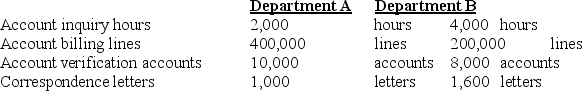

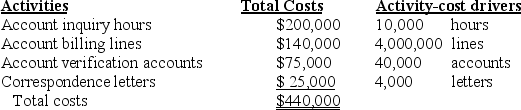

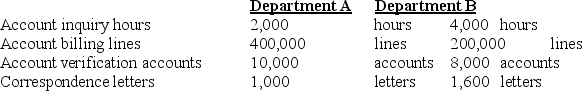

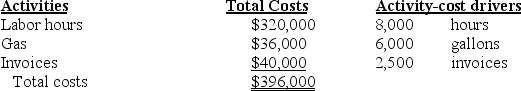

Answer the following questions using the information below:

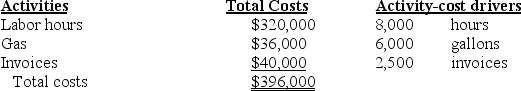

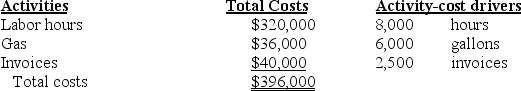

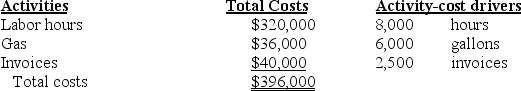

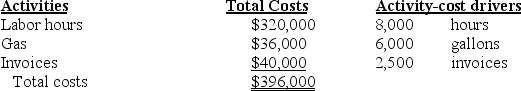

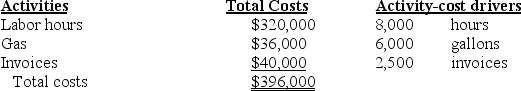

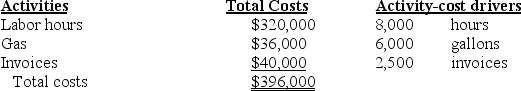

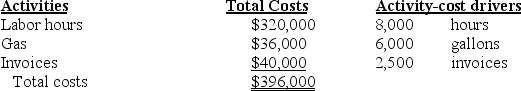

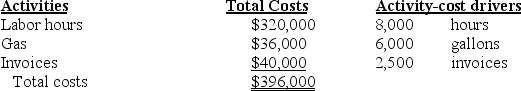

Mertens Company provides the following ABC costing information:

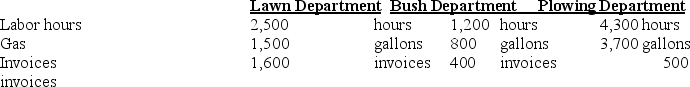

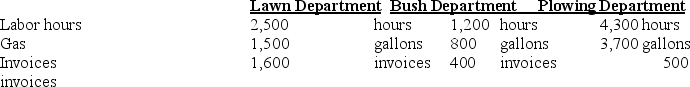

The above activities are used by Departments A and B as follows:

The above activities are used by Departments A and B as follows:

How much of the total costs will be assigned to Department B?

A)$79,000

B)$40,000

C)$112,000

D)$440,000

Mertens Company provides the following ABC costing information:

The above activities are used by Departments A and B as follows:

The above activities are used by Departments A and B as follows:

How much of the total costs will be assigned to Department B?

A)$79,000

B)$40,000

C)$112,000

D)$440,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

23

Activity-based costing is most likely to yield benefits for companies with all of the following characteristics EXCEPT:

A)numerous products that consume different amounts of resources

B)operations that remain fairly consistent

C)a highly competitive environment, where cost control is critical

D)accessible accounting and information systems expertise to maintain the system

A)numerous products that consume different amounts of resources

B)operations that remain fairly consistent

C)a highly competitive environment, where cost control is critical

D)accessible accounting and information systems expertise to maintain the system

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

24

Answer the following questions using the information below:

Mertens Company provides the following ABC costing information:

The above activities are used by Departments A and B as follows:

The above activities are used by Departments A and B as follows:

How much of the total costs will be assigned to Department A?

A)$79,000

B)$40,000

C)$112,000

D)$440,000

Mertens Company provides the following ABC costing information:

The above activities are used by Departments A and B as follows:

The above activities are used by Departments A and B as follows:

How much of the total costs will be assigned to Department A?

A)$79,000

B)$40,000

C)$112,000

D)$440,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

25

Product lines that produce different variations (models, styles, or colors)often require specialized manufacturing activities that translate into:

A)fewer indirect costs for each product line

B)decisions to drop product variations

C)a greater number of direct manufacturing labor cost allocation rates

D)greater overhead costs for each product line

A)fewer indirect costs for each product line

B)decisions to drop product variations

C)a greater number of direct manufacturing labor cost allocation rates

D)greater overhead costs for each product line

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

26

Indirect labor and distribution costs would most likely be in the same activity-cost pool.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

27

ABC systems:

A)highlight the different levels of activities

B)limit cost drivers to units of output

C)allocate costs based on the overall level of activity

D)generally undercost complex products

A)highlight the different levels of activities

B)limit cost drivers to units of output

C)allocate costs based on the overall level of activity

D)generally undercost complex products

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

28

A single indirect-cost rate may distort product costs because:

A)there is an assumption that all support activities affect all products

B)it recognizes specific activities that are required to produce a product

C)costs are not consistently recorded

D)it fails to measure the correct amount of total costs

A)there is an assumption that all support activities affect all products

B)it recognizes specific activities that are required to produce a product

C)costs are not consistently recorded

D)it fails to measure the correct amount of total costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

29

Answer the following questions using the information below:

Mertens Company provides the following ABC costing information:

The above activities are used by Departments A and B as follows:

The above activities are used by Departments A and B as follows:

How much of account verification costs will be assigned to Department A?

A)$15,000

B)$18,750

C)$75,000

D)$5,000

Mertens Company provides the following ABC costing information:

The above activities are used by Departments A and B as follows:

The above activities are used by Departments A and B as follows:

How much of account verification costs will be assigned to Department A?

A)$15,000

B)$18,750

C)$75,000

D)$5,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

30

What are the factors that are causing many companies to refine their costing systems to obtain more accurate measures of the costs of their products?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

31

Traditional cost systems distort product costs because:

A)they do not know how to identify the appropriate units

B)competitive pricing is ignored

C)they emphasize financial accounting requirements

D)they apply average support costs to each unit of product

A)they do not know how to identify the appropriate units

B)competitive pricing is ignored

C)they emphasize financial accounting requirements

D)they apply average support costs to each unit of product

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

32

Answer the following questions using the information below:

Mertens Company provides the following ABC costing information:

The above activities are used by Departments A and B as follows:

The above activities are used by Departments A and B as follows:

How much of correspondence costs will be assigned to Department B?

A)$800

B)$6,250

C)$25,000

D)$10,000

Mertens Company provides the following ABC costing information:

The above activities are used by Departments A and B as follows:

The above activities are used by Departments A and B as follows:

How much of correspondence costs will be assigned to Department B?

A)$800

B)$6,250

C)$25,000

D)$10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

33

Answer the following questions using the information below:

Mertens Company provides the following ABC costing information:

The above activities are used by Departments A and B as follows:

The above activities are used by Departments A and B as follows:

How much of the account billing cost will be assigned to Department B?

A)$14,000

B)$140,000

C)$7,000

D)None of these answers are correct.

Mertens Company provides the following ABC costing information:

The above activities are used by Departments A and B as follows:

The above activities are used by Departments A and B as follows:

How much of the account billing cost will be assigned to Department B?

A)$14,000

B)$140,000

C)$7,000

D)None of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following statements about activity-based costing is NOT true?

A)Activity-based costing is useful for allocating marketing and distribution costs.

B)Activity-based costing is more likely to result in major differences from traditional costing systems if the firm manufactures only one product rather than multiple products.

C)Activity-based costing seeks to distinguish batch-level, product-sustaining, and facility-sustaining costs, especially when they are not proportionate to one another.

D)Activity-based costing differs from traditional costing systems in that products are not cross-subsidized.

A)Activity-based costing is useful for allocating marketing and distribution costs.

B)Activity-based costing is more likely to result in major differences from traditional costing systems if the firm manufactures only one product rather than multiple products.

C)Activity-based costing seeks to distinguish batch-level, product-sustaining, and facility-sustaining costs, especially when they are not proportionate to one another.

D)Activity-based costing differs from traditional costing systems in that products are not cross-subsidized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

35

Logical cost allocation bases include:

A)cubic feet of packages moved to measure distribution activity

B)number of setups used to measure setup activity

C)number of design hours to measure designing activity

D)All of these answers are correct.

A)cubic feet of packages moved to measure distribution activity

B)number of setups used to measure setup activity

C)number of design hours to measure designing activity

D)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

36

Activity-based costing (ABC)can eliminate cost distortions because ABC:

A)develops cost drivers that have a cause-and-effect relationship with the activities performed

B)establishes multiple cost pools

C)eliminates product variations

D)recognizes interactions between different departments in assigning support costs

A)develops cost drivers that have a cause-and-effect relationship with the activities performed

B)establishes multiple cost pools

C)eliminates product variations

D)recognizes interactions between different departments in assigning support costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

37

ABC systems create:

A)one large cost pool

B)homogenous activity-related cost pools

C)activity-cost pools with a broad focus

D)activity-cost pools containing many direct costs

A)one large cost pool

B)homogenous activity-related cost pools

C)activity-cost pools with a broad focus

D)activity-cost pools containing many direct costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

38

Direct tracing of costs improves cost accuracy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

39

Answer the following questions using the information below:

Mertens Company provides the following ABC costing information:

The above activities are used by Departments A and B as follows:

The above activities are used by Departments A and B as follows:

Dalrymple Company produces a special spray nozzle. The budgeted indirect total cost of inserting the spray nozzle is $80,000. The budgeted number of nozzles to be inserted is 40,000. What is the budgeted indirect cost allocation rate for this activity?

A)$0.50

B)$1.00

C)$1.50

D)$2.00

Mertens Company provides the following ABC costing information:

The above activities are used by Departments A and B as follows:

The above activities are used by Departments A and B as follows:

Dalrymple Company produces a special spray nozzle. The budgeted indirect total cost of inserting the spray nozzle is $80,000. The budgeted number of nozzles to be inserted is 40,000. What is the budgeted indirect cost allocation rate for this activity?

A)$0.50

B)$1.00

C)$1.50

D)$2.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

40

Answer the following questions using the information below:

Mertens Company provides the following ABC costing information:

The above activities are used by Departments A and B as follows:

The above activities are used by Departments A and B as follows:

How much of the account inquiry cost will be assigned to Department A?

A)$40,000

B)$200,000

C)$80,000

D)None of these answers are correct.

Mertens Company provides the following ABC costing information:

The above activities are used by Departments A and B as follows:

The above activities are used by Departments A and B as follows:

How much of the account inquiry cost will be assigned to Department A?

A)$40,000

B)$200,000

C)$80,000

D)None of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

41

Answer the following questions using the information below:

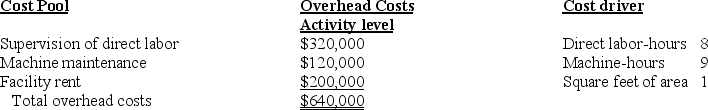

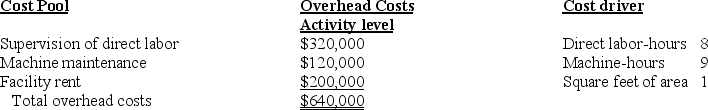

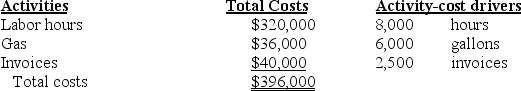

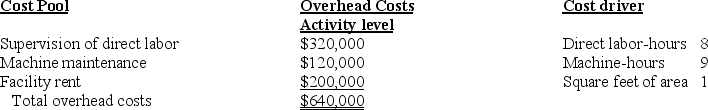

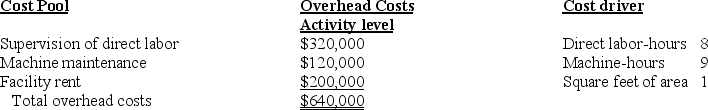

Gregory Enterprises has identified three cost pools to allocate overhead costs. The following estimates are provided for the coming year:

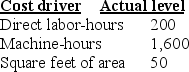

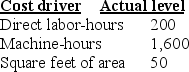

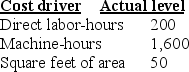

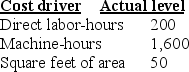

The accounting records show the Mossman Job consumed the following resources:

The accounting records show the Mossman Job consumed the following resources:

If direct labor-hours are considered the only overhead cost driver, what is the single cost driver rate for Gregory Enterprises?

A)$0.50 per direct labor-hour

B)$0.80 per direct labor-hour

C)$0.40 per direct labor-hour

D)$1.20 per direct labor-hour

Gregory Enterprises has identified three cost pools to allocate overhead costs. The following estimates are provided for the coming year:

The accounting records show the Mossman Job consumed the following resources:

The accounting records show the Mossman Job consumed the following resources:

If direct labor-hours are considered the only overhead cost driver, what is the single cost driver rate for Gregory Enterprises?

A)$0.50 per direct labor-hour

B)$0.80 per direct labor-hour

C)$0.40 per direct labor-hour

D)$1.20 per direct labor-hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

42

Answer the following questions using the information below:

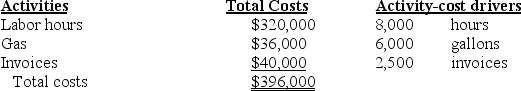

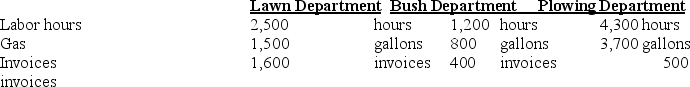

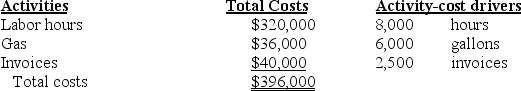

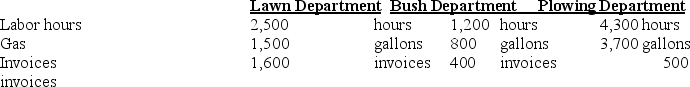

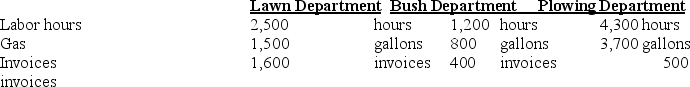

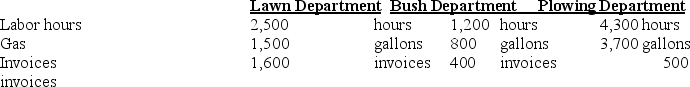

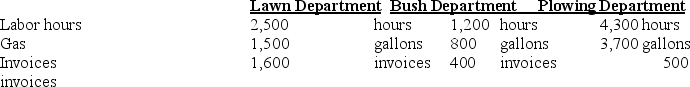

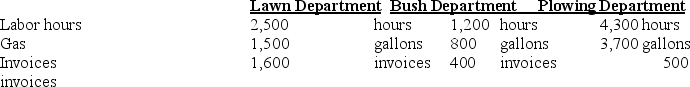

Happy Valley Land and Snow Company provides the following ABC costing information:

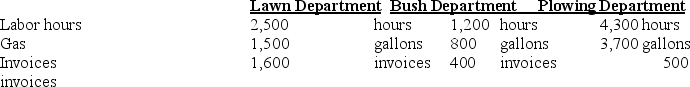

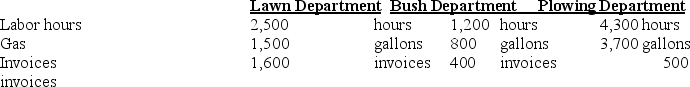

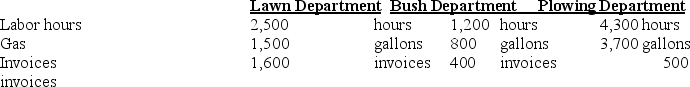

The above activities used by their three departments are:

The above activities used by their three departments are:

How much of invoice cost will be assigned to the Bush Department?

A)$6,400

B)$8,000

C)$25,600

D)$40,000

Happy Valley Land and Snow Company provides the following ABC costing information:

The above activities used by their three departments are:

The above activities used by their three departments are:

How much of invoice cost will be assigned to the Bush Department?

A)$6,400

B)$8,000

C)$25,600

D)$40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

43

An activity-based costing system is necessary for costing services that are similar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

44

Each of the following statements is true EXCEPT:

A)traditional product costing systems seek to assign all manufacturing costs to products

B)ABC product costing systems seek to assign all manufacturing costs to products

C)traditional product costing systems are more refined than an ABC system

D)cost distortions occur when a mismatch (incorrect association)occurs between the way indirect costs are incurred and the basis for their assignment to individual products

A)traditional product costing systems seek to assign all manufacturing costs to products

B)ABC product costing systems seek to assign all manufacturing costs to products

C)traditional product costing systems are more refined than an ABC system

D)cost distortions occur when a mismatch (incorrect association)occurs between the way indirect costs are incurred and the basis for their assignment to individual products

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

45

The most likely example of a batch-level cost is:

A)utility costs

B)machine repairs

C)product-designing costs

D)setup costs

A)utility costs

B)machine repairs

C)product-designing costs

D)setup costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

46

The most likely example of an output unit-level cost is:

A)general administrative costs

B)paying suppliers for orders received

C)engineering costs

D)machine depreciation

A)general administrative costs

B)paying suppliers for orders received

C)engineering costs

D)machine depreciation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

47

Answer the following questions using the information below:

Happy Valley Land and Snow Company provides the following ABC costing information:

The above activities used by their three departments are:

The above activities used by their three departments are:

How much of the total cost will be assigned to the Plowing Department?

A)$396,000

B)$202.200

C)$134,600

D)$172,000

Happy Valley Land and Snow Company provides the following ABC costing information:

The above activities used by their three departments are:

The above activities used by their three departments are:

How much of the total cost will be assigned to the Plowing Department?

A)$396,000

B)$202.200

C)$134,600

D)$172,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

48

Answer the following questions using the information below:

Happy Valley Land and Snow Company provides the following ABC costing information:

The above activities used by their three departments are:

The above activities used by their three departments are:

How much of the gas cost will be assigned to the Lawn Department?

A)$4,800

B)$20,000

C)$9,000

D)$22,200

Happy Valley Land and Snow Company provides the following ABC costing information:

The above activities used by their three departments are:

The above activities used by their three departments are:

How much of the gas cost will be assigned to the Lawn Department?

A)$4,800

B)$20,000

C)$9,000

D)$22,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

49

Answer the following questions using the information below:

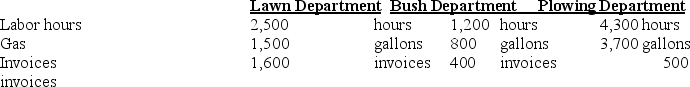

Whitman Printing has contracts to complete weekly supplements required by forty-six customers. For the year 20X5, manufacturing overhead cost estimates total $840,000 for an annual production capacity of 12 million pages.

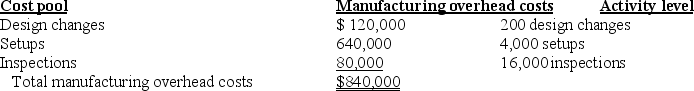

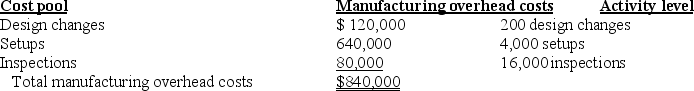

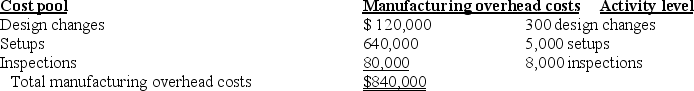

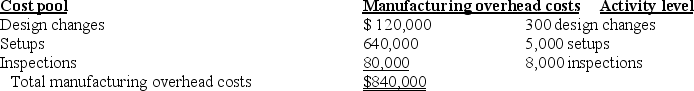

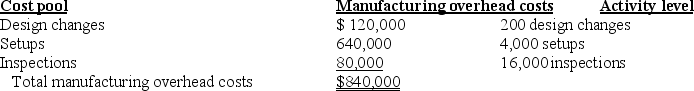

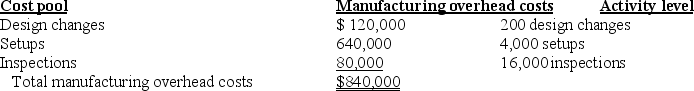

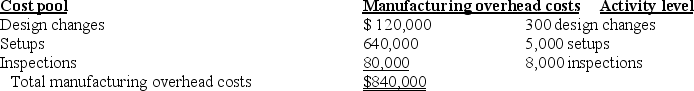

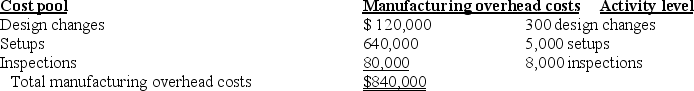

For 2010 Whitman Printing decided to evaluate the use of additional cost pools. After analyzing manufacturing overhead costs, it was determined that number of design changes, setups, and inspections are the primary manufacturing overhead cost drivers. The following information was gathered during the analysis:

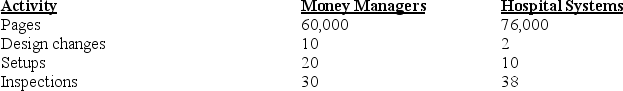

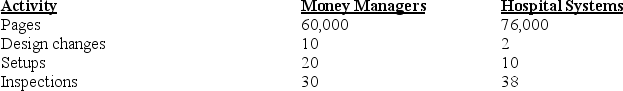

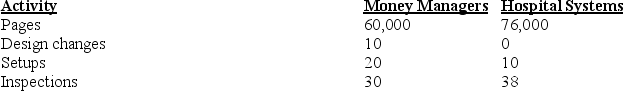

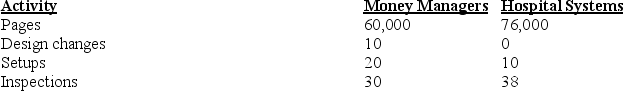

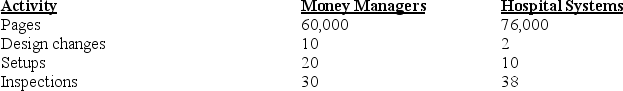

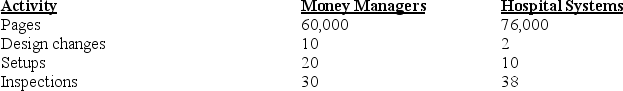

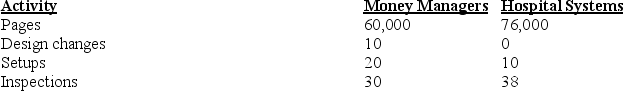

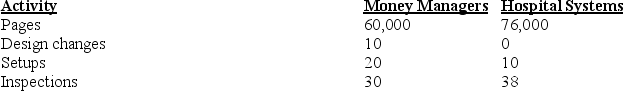

During 2010, two customers, Money Managers and Hospital Systems, are expected to use the following printing services:

During 2010, two customers, Money Managers and Hospital Systems, are expected to use the following printing services:

Using the cost driver rate determined in the previous question, what is the manufacturing overhead cost estimate for Hospital Systems during 2010?

A)Manufacturing overhead costs applied to Hospital Systems total $4,200.

B)Manufacturing overhead costs applied to Hospital Systems total $3,800.

C)Manufacturing overhead costs applied to Hospital Systems total $5,320.

D)Manufacturing overhead costs applied to Hospital Systems total $7,200.

Whitman Printing has contracts to complete weekly supplements required by forty-six customers. For the year 20X5, manufacturing overhead cost estimates total $840,000 for an annual production capacity of 12 million pages.

For 2010 Whitman Printing decided to evaluate the use of additional cost pools. After analyzing manufacturing overhead costs, it was determined that number of design changes, setups, and inspections are the primary manufacturing overhead cost drivers. The following information was gathered during the analysis:

During 2010, two customers, Money Managers and Hospital Systems, are expected to use the following printing services:

During 2010, two customers, Money Managers and Hospital Systems, are expected to use the following printing services:

Using the cost driver rate determined in the previous question, what is the manufacturing overhead cost estimate for Hospital Systems during 2010?

A)Manufacturing overhead costs applied to Hospital Systems total $4,200.

B)Manufacturing overhead costs applied to Hospital Systems total $3,800.

C)Manufacturing overhead costs applied to Hospital Systems total $5,320.

D)Manufacturing overhead costs applied to Hospital Systems total $7,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

50

Activity-based costing helps identify various activities that explain why costs are incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

51

Answer the following questions using the information below:

Velshi Printers has contracts to complete weekly supplements required by forty-six customers. For the year 2010, manufacturing overhead cost estimates total $840,000 for an annual production capacity of 12 million pages.

For 2010 Velshi Printers has decided to evaluate the use of additional cost pools. After analyzing manufacturing overhead costs, it was determined that number of design changes, setups, and inspections are the primary manufacturing overhead cost drivers. The following information was gathered during the analysis:

During 2010, two customers, Money Managers and Hospital Systems, are expected to use the following printing services:

During 2010, two customers, Money Managers and Hospital Systems, are expected to use the following printing services:

Using pages printed as the only overhead cost driver, what is the manufacturing overhead cost estimate for Money Managers during 2010?

A)$5,000

B)$3,500

C)$4,200

D)$6,000

Velshi Printers has contracts to complete weekly supplements required by forty-six customers. For the year 2010, manufacturing overhead cost estimates total $840,000 for an annual production capacity of 12 million pages.

For 2010 Velshi Printers has decided to evaluate the use of additional cost pools. After analyzing manufacturing overhead costs, it was determined that number of design changes, setups, and inspections are the primary manufacturing overhead cost drivers. The following information was gathered during the analysis:

During 2010, two customers, Money Managers and Hospital Systems, are expected to use the following printing services:

During 2010, two customers, Money Managers and Hospital Systems, are expected to use the following printing services:

Using pages printed as the only overhead cost driver, what is the manufacturing overhead cost estimate for Money Managers during 2010?

A)$5,000

B)$3,500

C)$4,200

D)$6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

52

Answer the following questions using the information below:

Happy Valley Land and Snow Company provides the following ABC costing information:

The above activities used by their three departments are:

The above activities used by their three departments are:

How much of the total costs will be assigned to the Lawn Department?

A)$100,000

B)$49,200

C)$200,000

D)$134,600

Happy Valley Land and Snow Company provides the following ABC costing information:

The above activities used by their three departments are:

The above activities used by their three departments are:

How much of the total costs will be assigned to the Lawn Department?

A)$100,000

B)$49,200

C)$200,000

D)$134,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

53

Answer the following questions using the information below:

Whitman Printing has contracts to complete weekly supplements required by forty-six customers. For the year 20X5, manufacturing overhead cost estimates total $840,000 for an annual production capacity of 12 million pages.

For 2010 Whitman Printing decided to evaluate the use of additional cost pools. After analyzing manufacturing overhead costs, it was determined that number of design changes, setups, and inspections are the primary manufacturing overhead cost drivers. The following information was gathered during the analysis:

During 2010, two customers, Money Managers and Hospital Systems, are expected to use the following printing services:

During 2010, two customers, Money Managers and Hospital Systems, are expected to use the following printing services:

If manufacturing overhead costs are considered one large cost pool and are assigned based on 12 million pages of production capacity, what is the cost driver rate?

A)$0.50 per page

B)$0.10 per page

C)$0.05 per page

D)$0.07 per page

Whitman Printing has contracts to complete weekly supplements required by forty-six customers. For the year 20X5, manufacturing overhead cost estimates total $840,000 for an annual production capacity of 12 million pages.

For 2010 Whitman Printing decided to evaluate the use of additional cost pools. After analyzing manufacturing overhead costs, it was determined that number of design changes, setups, and inspections are the primary manufacturing overhead cost drivers. The following information was gathered during the analysis:

During 2010, two customers, Money Managers and Hospital Systems, are expected to use the following printing services:

During 2010, two customers, Money Managers and Hospital Systems, are expected to use the following printing services:

If manufacturing overhead costs are considered one large cost pool and are assigned based on 12 million pages of production capacity, what is the cost driver rate?

A)$0.50 per page

B)$0.10 per page

C)$0.05 per page

D)$0.07 per page

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

54

Answer the following questions using the information below:

Happy Valley Land and Snow Company provides the following ABC costing information:

The above activities used by their three departments are:

The above activities used by their three departments are:

How much of the gas cost will be assigned to the Plowing Department?

A)$50,000

B)$22,200

C)$30,000

D)None of these answers are correct.

Happy Valley Land and Snow Company provides the following ABC costing information:

The above activities used by their three departments are:

The above activities used by their three departments are:

How much of the gas cost will be assigned to the Plowing Department?

A)$50,000

B)$22,200

C)$30,000

D)None of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

55

Answer the following questions using the information below:

Happy Valley Land and Snow Company provides the following ABC costing information:

The above activities used by their three departments are:

The above activities used by their three departments are:

How much of the labor cost will be assigned to the Lawn Department?

A)$100,000

B)$25,600

C)$40,000

D)None of these answers are correct.

Happy Valley Land and Snow Company provides the following ABC costing information:

The above activities used by their three departments are:

The above activities used by their three departments are:

How much of the labor cost will be assigned to the Lawn Department?

A)$100,000

B)$25,600

C)$40,000

D)None of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

56

Answer the following questions using the information below:

Gregory Enterprises has identified three cost pools to allocate overhead costs. The following estimates are provided for the coming year:

The accounting records show the Mossman Job consumed the following resources:

The accounting records show the Mossman Job consumed the following resources:

Using direct labor-hours as the only overhead cost driver, what is the amount of overhead costs allocated to the Mossman Job?

A)$160

B)$120

C)$240

D)$125

Gregory Enterprises has identified three cost pools to allocate overhead costs. The following estimates are provided for the coming year:

The accounting records show the Mossman Job consumed the following resources:

The accounting records show the Mossman Job consumed the following resources:

Using direct labor-hours as the only overhead cost driver, what is the amount of overhead costs allocated to the Mossman Job?

A)$160

B)$120

C)$240

D)$125

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

57

Answer the following questions using the information below:

Velshi Printers has contracts to complete weekly supplements required by forty-six customers. For the year 2010, manufacturing overhead cost estimates total $840,000 for an annual production capacity of 12 million pages.

For 2010 Velshi Printers has decided to evaluate the use of additional cost pools. After analyzing manufacturing overhead costs, it was determined that number of design changes, setups, and inspections are the primary manufacturing overhead cost drivers. The following information was gathered during the analysis:

During 2010, two customers, Money Managers and Hospital Systems, are expected to use the following printing services:

During 2010, two customers, Money Managers and Hospital Systems, are expected to use the following printing services:

What is the cost driver rate if manufacturing overhead costs are considered one large cost pool and are assigned based on 12 million pages of production capacity?

A)$0.10 per page

B)$0.07 per page

C)$0.70 per page

D)$0.05 per page

Velshi Printers has contracts to complete weekly supplements required by forty-six customers. For the year 2010, manufacturing overhead cost estimates total $840,000 for an annual production capacity of 12 million pages.

For 2010 Velshi Printers has decided to evaluate the use of additional cost pools. After analyzing manufacturing overhead costs, it was determined that number of design changes, setups, and inspections are the primary manufacturing overhead cost drivers. The following information was gathered during the analysis:

During 2010, two customers, Money Managers and Hospital Systems, are expected to use the following printing services:

During 2010, two customers, Money Managers and Hospital Systems, are expected to use the following printing services:

What is the cost driver rate if manufacturing overhead costs are considered one large cost pool and are assigned based on 12 million pages of production capacity?

A)$0.10 per page

B)$0.07 per page

C)$0.70 per page

D)$0.05 per page

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

58

For activity-based cost systems, activity costs are assigned to products in the proportion of the demand they place on activity resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

59

Traditional systems are likely to overcost complex products with lower production volume.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

60

Explain how activity-based costing systems can provide more accurate product costs than traditional cost systems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

61

To set realistic selling prices:

A)all costs should be allocated to products

B)costs should only be allocated when there is a strong cause-and-effect relationship

C)only unit-level costs and batch-level costs should be allocated

D)only unit-level costs should be allocated

A)all costs should be allocated to products

B)costs should only be allocated when there is a strong cause-and-effect relationship

C)only unit-level costs and batch-level costs should be allocated

D)only unit-level costs should be allocated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

62

ABC systems identify ________ costs used by products.

A)all

B)short-term fixed

C)short-term variable

D)long-term fixed

A)all

B)short-term fixed

C)short-term variable

D)long-term fixed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

63

Unit-level measures can distort product costing because the demand for overhead resources may be driven by batch-level or product-sustaining activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

64

Misleading cost numbers are larger when unit-level assignments and the alternative activity-cost-driver assignments are proportionately dissimilar to each other.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

65

What are the four parts of the cost hierarchy. Briefly explain each part, and contrast this cost hierarchy to the fixed-variable dichotomy?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

66

ABC assumes all costs are ________ because over the long run management can adjust the amount of resources employed.

A)fixed

B)variable

C)committed

D)nondiscretionary

A)fixed

B)variable

C)committed

D)nondiscretionary

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

67

________ costs support the organization as a whole.

A)Unit-level

B)Batch-level

C)Product-sustaining

D)Facility-sustaining

A)Unit-level

B)Batch-level

C)Product-sustaining

D)Facility-sustaining

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

68

Put the following ABC implementation steps in order:

A)DACB

B)DBCA

C)BADC

D)CDAB

A)DACB

B)DBCA

C)BADC

D)CDAB

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

69

Explain how traditional cost systems, using a single unit-level cost rate, may distort product costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

70

Different products consume different proportions of manufacturing overhead costs because of differences in all of the following EXCEPT:

A)selling prices

B)customers' customization specifications

C)setup times

D)product design

A)selling prices

B)customers' customization specifications

C)setup times

D)product design

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

71

Output unit-level costs CANNOT be determined unless you know how many units are in a given batch.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

72

The focus of ABC systems is on:

A)long-term decisions

B)short-term decisions

C)make-or-buy decisions

D)special-pricing decisions

A)long-term decisions

B)short-term decisions

C)make-or-buy decisions

D)special-pricing decisions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

73

When designing a costing system, it is easiest to:

A)calculate total costs first and then per-unit cost

B)calculate per-unit costs first and then total costs

C)calculate long-term costs first and then short-term costs

D)calculate short-term costs first and then long-term costs

A)calculate total costs first and then per-unit cost

B)calculate per-unit costs first and then total costs

C)calculate long-term costs first and then short-term costs

D)calculate short-term costs first and then long-term costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

74

With traditional costing systems, products manufactured in small batches and in small annual volumes may be ________ because batch-related and product-sustaining costs are assigned using unit-related drivers.

A)overcosted

B)fairly costed

C)undercosted

D)ignored

A)overcosted

B)fairly costed

C)undercosted

D)ignored

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

75

Using multiple unit-level cost drivers generally constitutes an effective activity-based cost system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

76

Unit-level cost drivers are most appropriate as an overhead assignment base when:

A)several complex products are manufactured

B)only one product is manufactured

C)direct labor costs are low

D)factories produce a varied mix of products

A)several complex products are manufactured

B)only one product is manufactured

C)direct labor costs are low

D)factories produce a varied mix of products

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

77

Answer the following questions using the information below:

Products S5 and CP8 each are assigned $100.00 in indirect costs by a traditional costing system. An activity analysis revealed that although production requirements are identical, S5 requires 45 minutes less setup time than CP8.

According to an ABC system, S5 uses a disproportionately:

A)smaller amount of unit-level costs

B)larger amount of unit-level costs

C)smaller amount of batch-level costs

D)larger amount of batch-level costs

Products S5 and CP8 each are assigned $100.00 in indirect costs by a traditional costing system. An activity analysis revealed that although production requirements are identical, S5 requires 45 minutes less setup time than CP8.

According to an ABC system, S5 uses a disproportionately:

A)smaller amount of unit-level costs

B)larger amount of unit-level costs

C)smaller amount of batch-level costs

D)larger amount of batch-level costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

78

Design costs are an example of:

A)unit-level costs

B)batch-level costs

C)product-sustaining costs

D)facility-sustaining costs

A)unit-level costs

B)batch-level costs

C)product-sustaining costs

D)facility-sustaining costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

79

Answer the following questions using the information below:

Products S5 and CP8 each are assigned $100.00 in indirect costs by a traditional costing system. An activity analysis revealed that although production requirements are identical, S5 requires 45 minutes less setup time than CP8.

According to an ABC system, CP8 is ________ under the traditional system.

A)undercosted

B)overcosted

C)fairly costed

D)accurately costed

Products S5 and CP8 each are assigned $100.00 in indirect costs by a traditional costing system. An activity analysis revealed that although production requirements are identical, S5 requires 45 minutes less setup time than CP8.

According to an ABC system, CP8 is ________ under the traditional system.

A)undercosted

B)overcosted

C)fairly costed

D)accurately costed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck

80

It is usually difficult to find good cause-and-effect relationships between ________ and a cost allocation base.

A)unit-level costs

B)batch-level costs

C)product-sustaining costs

D)facility-sustaining costs

A)unit-level costs

B)batch-level costs

C)product-sustaining costs

D)facility-sustaining costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 175 في هذه المجموعة.

فتح الحزمة

k this deck