Deck 16: Cost Allocation: Joint Products and Byproducts

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

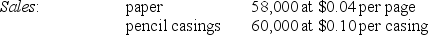

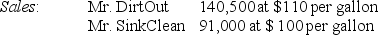

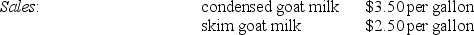

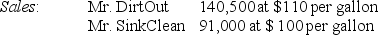

سؤال

سؤال

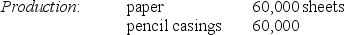

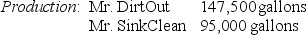

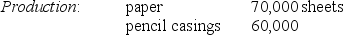

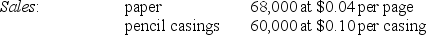

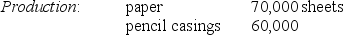

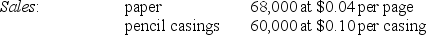

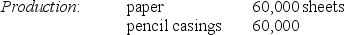

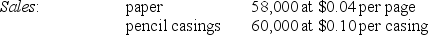

سؤال

سؤال

سؤال

سؤال

سؤال

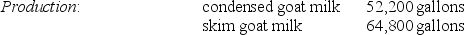

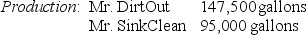

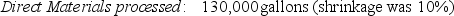

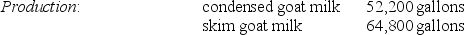

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

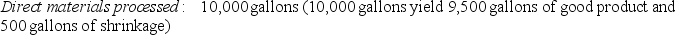

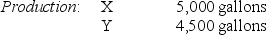

سؤال

سؤال

سؤال

سؤال

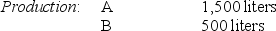

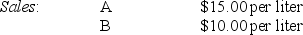

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/125

العب

ملء الشاشة (f)

Deck 16: Cost Allocation: Joint Products and Byproducts

1

Which of the following statements is true regarding main products and byproducts?

A)Product classifications do not change over the short run.

B)Product classifications do not change over the long run.

C)Product classifications may change over time.

D)The cause-and-effect criterion determines the classification.

A)Product classifications do not change over the short run.

B)Product classifications do not change over the long run.

C)Product classifications may change over time.

D)The cause-and-effect criterion determines the classification.

C

2

Byproducts and main products are differentiated by the:

A)number of units per processing period

B)weight or volume of outputs per period

C)amount of total sales value

D)None of these answers is correct.

A)number of units per processing period

B)weight or volume of outputs per period

C)amount of total sales value

D)None of these answers is correct.

C

3

In joint costing:

A)costs are assigned to individual products as assembly of the product occurs

B)costs are assigned to individual products as disassembly of the product occurs

C)a single production process yields two or more products

D)Both B and C are correct.

A)costs are assigned to individual products as assembly of the product occurs

B)costs are assigned to individual products as disassembly of the product occurs

C)a single production process yields two or more products

D)Both B and C are correct.

D

4

When a joint production process yields two or more products with high total sales values, these products are called:

A)main products

B)joint products

C)byproducts

D)scrap

A)main products

B)joint products

C)byproducts

D)scrap

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

5

Joint costs are the costs of a production process that yields multiple products simultaneously.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

6

Separable costs include manufacturing costs only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

7

The juncture in a joint production process when two products become separable is the byproduct point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

8

Joint costs are incurred beyond the splitoff point and are assignable to individual products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

9

The focus of joint costing is on allocating costs to individual products:

A)before the splitoff point

B)after the splitoff point

C)at the splitoff point

D)at the end of production

A)before the splitoff point

B)after the splitoff point

C)at the splitoff point

D)at the end of production

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

10

All of the following changes may indicate a change in product classification of a manufacturing process which has a splitoff point EXCEPT a:

A)byproduct increases in sales value due to a new application

B)main product becomes a joint product

C)main product becomes technologically obsolete

D)byproduct loses its market due to a new invention

A)byproduct increases in sales value due to a new application

B)main product becomes a joint product

C)main product becomes technologically obsolete

D)byproduct loses its market due to a new invention

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

11

Products with a relatively low sales value are known as:

A)scrap

B)main products

C)joint products

D)byproducts

A)scrap

B)main products

C)joint products

D)byproducts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

12

The focus of joint costing is assigning costs to individual products as assembly occurs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

13

The ________ point is the juncture in a joint production process when two or more products become separately identifiable.

A)splitoff

B)joint product

C)process

D)end

A)splitoff

B)joint product

C)process

D)end

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following methods of allocating costs use market-based data?

A)Sales value at splitoff method

B)Estimated net realizable value method

C)The constant gross-margin percentage method

D)All of these answers are correct.

A)Sales value at splitoff method

B)Estimated net realizable value method

C)The constant gross-margin percentage method

D)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

15

What type of cost is the result of an event that results in more than one product or service simultaneously?

A)byproduct cost

B)joint cost

C)main cost

D)separable cost

A)byproduct cost

B)joint cost

C)main cost

D)separable cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

16

Outputs with a negative sales value are:

A)added to cost of goods sold

B)added to joint production costs and allocated to joint or main products

C)added to joint production costs and allocated to byproducts and scrap

D)subtracted from product revenue

A)added to cost of goods sold

B)added to joint production costs and allocated to joint or main products

C)added to joint production costs and allocated to byproducts and scrap

D)subtracted from product revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

17

When a single manufacturing process yields two products, one of which has a relatively high sales value compared to the other, the two products are respectively known as:

A)joint products and byproducts

B)joint products and scrap

C)main products and byproducts

D)main products and joint products

A)joint products and byproducts

B)joint products and scrap

C)main products and byproducts

D)main products and joint products

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

18

Outputs with zero sales value are accounted for by:

A)listing these various outputs in a footnote to the financial statements

B)including the items as a relatively small portion of the value assigned to the products produced during the accounting period

C)making journal entries to reflect an estimate of possible values

D)None of these answers is correct.

A)listing these various outputs in a footnote to the financial statements

B)including the items as a relatively small portion of the value assigned to the products produced during the accounting period

C)making journal entries to reflect an estimate of possible values

D)None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

19

Separable costs are incurred beyond the splitoff point that are assignable to each of the specific products identified at the splitoff point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

20

All costs incurred beyond the splitoff point that are assignable to one or more individual products are called:

A)byproduct costs

B)joint costs

C)main costs

D)separable costs

A)byproduct costs

B)joint costs

C)main costs

D)separable costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

21

Silver Company uses one raw material, silver ore, for all of its products. It spends considerable time getting the silver from the ore before it starts the actual processing of the finished products, rings, lockets, etc. Traditionally, the company made one product at a time and charged the product with all costs of production, from ore to final inspection. However, in recent months, the cost accounting reports have been somewhat disturbing to management. It seems that some of the finished products are costing more than they should, even to the point of approaching their retail value. It has been noted by the accounting manager that this problem began when the company started buying ore from different parts of the world, some of which require difficult extraction methods.

Required:

Can you explain how the company might change its accounting system to reflect the reporting problems better? Are there other problems with the purchasing area?

Required:

Can you explain how the company might change its accounting system to reflect the reporting problems better? Are there other problems with the purchasing area?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

22

Litigation may be a reason that joint costs are allocated to individual products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

23

Joint costs are NOT allocated to individual products for the preparation of tax returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

24

An example of a market-based approach to allocating joint costs is (are)allocating joint costs based on:

A)sales value at splitoff method

B)physical volume

C)constant gross-margin percentage method

D)Both A and C are correct.

A)sales value at splitoff method

B)physical volume

C)constant gross-margin percentage method

D)Both A and C are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

25

At or beyond the splitoff point, decisions relating to the sale or further processing of each identifiable product can be made independently of decisions about the other products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

26

Explain the difference between a joint product and a byproduct. Can a byproduct ever become a joint product?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

27

A business which enters into a contract to purchase a product (or products)and will compensate the manufacturer under a cost reimbursement formula, should take an active part in the determination of how joint costs are allocated because:

A)the manufacturer will attempt to allocate as large a portion of its costs to these products

B)if the manufacturer successfully allocates a large portion of its costs to these products then it will be able to sell its other nonreimbursed products at lower prices

C)the FASB requires the business to participate in the cost allocation process

D)Both A and B are correct.

A)the manufacturer will attempt to allocate as large a portion of its costs to these products

B)if the manufacturer successfully allocates a large portion of its costs to these products then it will be able to sell its other nonreimbursed products at lower prices

C)the FASB requires the business to participate in the cost allocation process

D)Both A and B are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

28

If the value of a joint product drops significantly, it could also be viewed as a byproduct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

29

What are a joint cost and a splitoff point?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following is a reason to allocate joint costs?

A)rate regulation requirements, if applicable

B)cost of goods sold computations

C)insurance settlement cost information requirements

D)All of these answers are correct.

A)rate regulation requirements, if applicable

B)cost of goods sold computations

C)insurance settlement cost information requirements

D)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

31

In each of the following industries, identify possible joint (or severable)products at the splitoff point.

a. Coal

b. Petroleum

c. Dairy

d. Lamb

e. Lumber

f. Cocoa Beans

g. Christmas Trees

h. Salt

i. Cowhide

a. Coal

b. Petroleum

c. Dairy

d. Lamb

e. Lumber

f. Cocoa Beans

g. Christmas Trees

h. Salt

i. Cowhide

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

32

Proper costs allocation for inventory costing and cost-of-goods-sold computations are important because:

A)inventory costing is essential for proper balance sheet presentation

B)most states have laws requiring proper balance sheet presentation and recommended allocation methods

C)cost of goods sold is an important component in the determination of net income

D)Both A and C are correct.

A)inventory costing is essential for proper balance sheet presentation

B)most states have laws requiring proper balance sheet presentation and recommended allocation methods

C)cost of goods sold is an important component in the determination of net income

D)Both A and C are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

33

The products of a joint production process that have low total sales values compared with the total sales value of the main product or of joint products are called byproducts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

34

All products yielded from joint product processing have some positive value to the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

35

Define the terms main product, joint product, and byproduct. Give at least one example of each type of product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

36

The products of a joint production process that have low total sales values compared with the total sales value of the main product are called joint products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following is NOT a primary reason for allocating joint costs?

A)cost justification and insurance settlement cost information requirements

B)cost justification and asset measurement

C)income measurement and rate regulation requirements

D)to calculate the bonus of the chief executive officer

A)cost justification and insurance settlement cost information requirements

B)cost justification and asset measurement

C)income measurement and rate regulation requirements

D)to calculate the bonus of the chief executive officer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

38

All of the following methods may be used to allocate joint costs EXCEPT the:

A)constant gross-margin percentage method

B)estimated net realizable value method

C)present value allocation method

D)sales value at splitoff method

A)constant gross-margin percentage method

B)estimated net realizable value method

C)present value allocation method

D)sales value at splitoff method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

39

List three reasons why we allocate joint costs to individual products or services. Give an example of when the particular cost allocation reason would come into use.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

40

What are six reasons that joint costs should be allocated to individual products or services?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

41

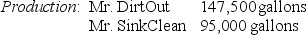

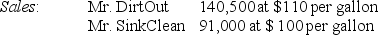

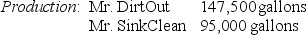

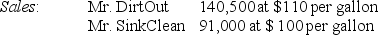

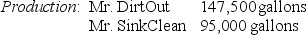

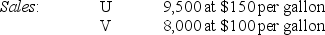

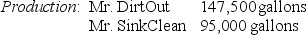

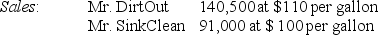

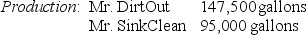

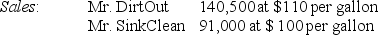

Answer the following questions using the information below:

The Oxnard Corporation processes a liquid component up to the splitoff point where two products, Mr. DirtOut and Mr. SinkClean, are produced and sold. There was no beginning inventory. The following material was collected for the month of January:

The cost of purchasing 250,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 242,500 gallons of good product was $760,000.

The cost of purchasing 250,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 242,500 gallons of good product was $760,000.

What are the physical-volume proportions to allocate joint costs for Mr. DirtOut and Mr. SinkClean, respectively?

A)59.00% and 41.00%

B)60.82% and 39.18%

C)39.18% and 60.82%

D)59.79% and 40.21%

The Oxnard Corporation processes a liquid component up to the splitoff point where two products, Mr. DirtOut and Mr. SinkClean, are produced and sold. There was no beginning inventory. The following material was collected for the month of January:

The cost of purchasing 250,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 242,500 gallons of good product was $760,000.

The cost of purchasing 250,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 242,500 gallons of good product was $760,000.What are the physical-volume proportions to allocate joint costs for Mr. DirtOut and Mr. SinkClean, respectively?

A)59.00% and 41.00%

B)60.82% and 39.18%

C)39.18% and 60.82%

D)59.79% and 40.21%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

42

Product X is sold for $32 a unit and Product Y is sold for $48 a unit. Each product can also be sold at the splitoff point. Product X can be sold for $10 and Product Y for $8. Joint costs for the two products totaled $2,000 for January for 300 units of X and 250 units of Y. What are the respective joint costs assigned each unit of products X and Y if the sales value at splitoff method is used?

A)$2.96 and $4.44

B)$4.00 and $4.55

C)$4.00 and $3.20

D)$4.55 and $4.55

A)$2.96 and $4.44

B)$4.00 and $4.55

C)$4.00 and $3.20

D)$4.55 and $4.55

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

43

Answer the following questions using the information below:

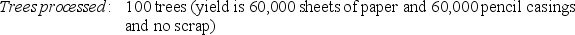

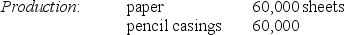

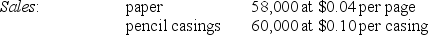

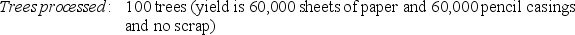

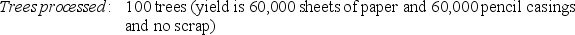

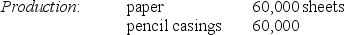

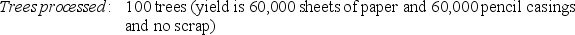

Yakima Manufacturing purchases trees from Cheney Lumber and processes them up to the splitoff point where two products (paper and pencil casings)are obtained. The products are then sold to an independent company that markets and distributes them to retail outlets. The following information was collected for the month of November:

The cost of purchasing 100 trees and processing them up to the splitoff point to yield 60,000 sheets of paper and 60,000 pencil casings is $3,000.

The cost of purchasing 100 trees and processing them up to the splitoff point to yield 60,000 sheets of paper and 60,000 pencil casings is $3,000.

Yakima's accounting department reported no beginning inventories and an ending inventory of 2,000 sheets of paper.

What is the sales value at the splitoff point of the pencil casings?

A)$600

B)$2,460

C)$6,000

D)$7,500

Yakima Manufacturing purchases trees from Cheney Lumber and processes them up to the splitoff point where two products (paper and pencil casings)are obtained. The products are then sold to an independent company that markets and distributes them to retail outlets. The following information was collected for the month of November:

The cost of purchasing 100 trees and processing them up to the splitoff point to yield 60,000 sheets of paper and 60,000 pencil casings is $3,000.

The cost of purchasing 100 trees and processing them up to the splitoff point to yield 60,000 sheets of paper and 60,000 pencil casings is $3,000.Yakima's accounting department reported no beginning inventories and an ending inventory of 2,000 sheets of paper.

What is the sales value at the splitoff point of the pencil casings?

A)$600

B)$2,460

C)$6,000

D)$7,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

44

Answer the following questions using the information below:

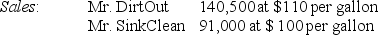

The Oxnard Corporation processes a liquid component up to the splitoff point where two products, Mr. DirtOut and Mr. SinkClean, are produced and sold. There was no beginning inventory. The following material was collected for the month of January:

The cost of purchasing 250,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 242,500 gallons of good product was $760,000.

The cost of purchasing 250,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 242,500 gallons of good product was $760,000.

When using a physical-volume measure, what is the approximate amount of joint costs that will be allocated to Mr. DirtOut and Mr. SinkClean?

A)$464,232 and $297,768

B)$448,400 and $311,600

C)$454,404 and $305,596

D)$461,252 and $298,748

The Oxnard Corporation processes a liquid component up to the splitoff point where two products, Mr. DirtOut and Mr. SinkClean, are produced and sold. There was no beginning inventory. The following material was collected for the month of January:

The cost of purchasing 250,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 242,500 gallons of good product was $760,000.

The cost of purchasing 250,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 242,500 gallons of good product was $760,000.When using a physical-volume measure, what is the approximate amount of joint costs that will be allocated to Mr. DirtOut and Mr. SinkClean?

A)$464,232 and $297,768

B)$448,400 and $311,600

C)$454,404 and $305,596

D)$461,252 and $298,748

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

45

If the sales value at splitoff method is used, what are the approximate joint costs assigned to ending inventory for paper?

A)$28.58

B)$100.00

C)$870.00

D)$1,500.00

A)$28.58

B)$100.00

C)$870.00

D)$1,500.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

46

Answer the following questions using the information below:

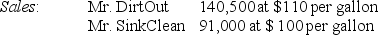

The Oxnard Corporation processes a liquid component up to the splitoff point where two products, Mr. DirtOut and Mr. SinkClean, are produced and sold. There was no beginning inventory. The following material was collected for the month of January:

The cost of purchasing 250,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 242,500 gallons of good product was $760,000.

The cost of purchasing 250,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 242,500 gallons of good product was $760,000.

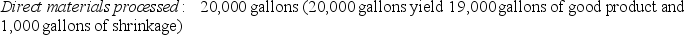

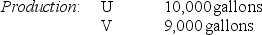

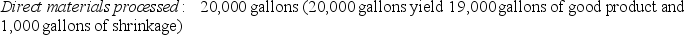

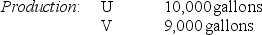

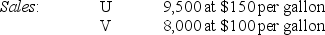

Argon Manufacturing Company processes direct materials up to the splitoff point where two products (U and V)are obtained and sold. The following information was collected for last quarter of the calendar year:

The cost of purchasing 20,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 19,000 gallons of good products was $1,950,000.

The cost of purchasing 20,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 19,000 gallons of good products was $1,950,000.

Beginning inventories totaled 100 gallons for U and 50 gallons for V. Ending inventory amounts reflected 600 gallons of Product U and 1,050 gallons of Product V. October costs per unit were the same as November.

What are the physical-volume proportions for products U and V, respectively?

A)47.37% and 53.63%

B)55.00% and 45.00%

C)52.63% and 47.37%

D)54.00% and 46.00%

The Oxnard Corporation processes a liquid component up to the splitoff point where two products, Mr. DirtOut and Mr. SinkClean, are produced and sold. There was no beginning inventory. The following material was collected for the month of January:

The cost of purchasing 250,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 242,500 gallons of good product was $760,000.

The cost of purchasing 250,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 242,500 gallons of good product was $760,000.Argon Manufacturing Company processes direct materials up to the splitoff point where two products (U and V)are obtained and sold. The following information was collected for last quarter of the calendar year:

The cost of purchasing 20,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 19,000 gallons of good products was $1,950,000.

The cost of purchasing 20,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 19,000 gallons of good products was $1,950,000.Beginning inventories totaled 100 gallons for U and 50 gallons for V. Ending inventory amounts reflected 600 gallons of Product U and 1,050 gallons of Product V. October costs per unit were the same as November.

What are the physical-volume proportions for products U and V, respectively?

A)47.37% and 53.63%

B)55.00% and 45.00%

C)52.63% and 47.37%

D)54.00% and 46.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

47

The benefits-received criteria for allocating joint costs indicate market-based measures are preferred because:

A)physical measures such as volume are a clearer basis for allocating cost than other measures

B)other measures are more difficult to calculate

C)revenues are usually the best indicator of the benefits received

D)None of these answers is correct.

A)physical measures such as volume are a clearer basis for allocating cost than other measures

B)other measures are more difficult to calculate

C)revenues are usually the best indicator of the benefits received

D)None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

48

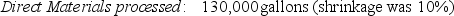

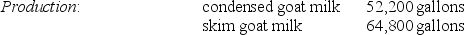

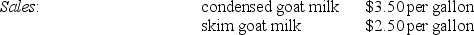

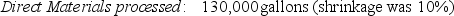

Answer the following questions using the information below:

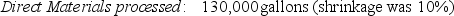

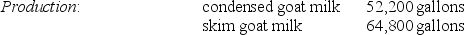

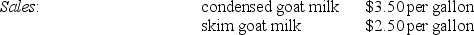

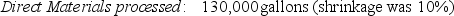

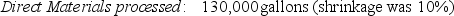

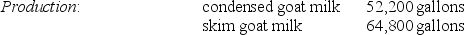

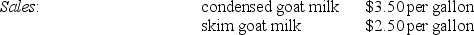

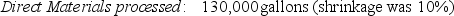

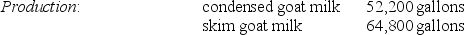

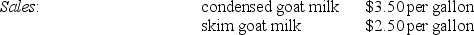

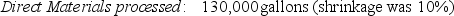

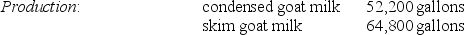

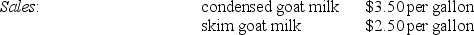

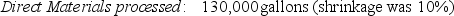

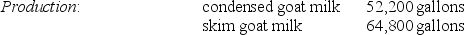

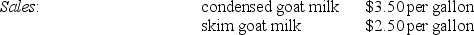

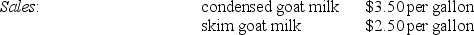

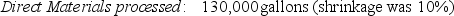

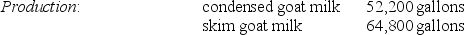

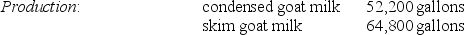

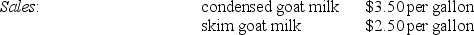

The Gows Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.

Condensed goat milk may be processed further to yield 39,000 gallons (the remainder is shrinkage)of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable gallon. Xyla can be sold for $18 per gallon.

Skim goat milk can be processed further to yield 56,200 gallons of skim goat ice cream, for an additional processing cost per usable gallon of $2.50. The product can be sold for $9 per gallon.

There are no beginning and ending inventory balances.

What is the estimated net realizable value of the skim goat ice cream at the splitoff point?

A)$365,300

B)$505,800

C)$220,400

D)$170,900

The Gows Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.Condensed goat milk may be processed further to yield 39,000 gallons (the remainder is shrinkage)of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable gallon. Xyla can be sold for $18 per gallon.

Skim goat milk can be processed further to yield 56,200 gallons of skim goat ice cream, for an additional processing cost per usable gallon of $2.50. The product can be sold for $9 per gallon.

There are no beginning and ending inventory balances.

What is the estimated net realizable value of the skim goat ice cream at the splitoff point?

A)$365,300

B)$505,800

C)$220,400

D)$170,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following statements is true in regard to the cause-and-effect relationship between allocated joint costs and individual products?

A)A high individual product value results in a high level of joint costs.

B)A low individual product value results in a low level of joint costs.

C)A high individual product value results in a low level of joint costs.

D)There is no cause-and-effect relationship.

A)A high individual product value results in a high level of joint costs.

B)A low individual product value results in a low level of joint costs.

C)A high individual product value results in a low level of joint costs.

D)There is no cause-and-effect relationship.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

50

Answer the following questions using the information below:

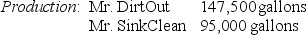

The Oxnard Corporation processes a liquid component up to the splitoff point where two products, Mr. DirtOut and Mr. SinkClean, are produced and sold. There was no beginning inventory. The following material was collected for the month of January:

The cost of purchasing 250,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 242,500 gallons of good product was $760,000.

The cost of purchasing 250,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 242,500 gallons of good product was $760,000.

When using the physical-volume method, what is Mr. DirtOut's approximate production cost per unit?

A)$3.02

B)$3.08

C)$3.14

D)$3.22

The Oxnard Corporation processes a liquid component up to the splitoff point where two products, Mr. DirtOut and Mr. SinkClean, are produced and sold. There was no beginning inventory. The following material was collected for the month of January:

The cost of purchasing 250,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 242,500 gallons of good product was $760,000.

The cost of purchasing 250,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 242,500 gallons of good product was $760,000.When using the physical-volume method, what is Mr. DirtOut's approximate production cost per unit?

A)$3.02

B)$3.08

C)$3.14

D)$3.22

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

51

The Arvid Corporation manufactures widgets, gizmos, and turnbols from a joint process. May production is 2,000 widgets; 3,500 gizmos; and 4,000 turnbols. Respective per unit selling prices at splitoff are $30, $20, and $10. Joint costs up to the splitoff point are $75,000. If joint costs are allocated based upon the sales value at splitoff, what amount of joint costs will be allocated to the widgets?

A)$30,882

B)$26,471

C)$17,647

D)$28,125

A)$30,882

B)$26,471

C)$17,647

D)$28,125

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following is NOT a market-based approach to allocating costs?

A)sales value at splitoff

B)constant gross-margin percentage NRV

C)physical measures

D)net realizable value

A)sales value at splitoff

B)constant gross-margin percentage NRV

C)physical measures

D)net realizable value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

53

A reason why a physical-measure to allocate joint costs is less preferred than the sales value at splitoff is:

A)a physical measure such as volume is difficult to estimate because of shrinkage

B)physical volume usually has little relationship to the revenue producing power of products

C)a physical measure usually results in the costs being allocated to the product that weighs the most

D)All of these answers are correct.

A)a physical measure such as volume is difficult to estimate because of shrinkage

B)physical volume usually has little relationship to the revenue producing power of products

C)a physical measure usually results in the costs being allocated to the product that weighs the most

D)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

54

The physical-measure method:

A)allocates joint costs to joint products in a way that each product has an identical gross-margin percentage

B)allocates joint costs to joint products on the basis of a comparable physical measure at the splitoff point

C)allocates joint costs to joint products on the basis of the relative sales value at the splitoff point

D)allocates joint costs to joint products on the basis of relative NRV

A)allocates joint costs to joint products in a way that each product has an identical gross-margin percentage

B)allocates joint costs to joint products on the basis of a comparable physical measure at the splitoff point

C)allocates joint costs to joint products on the basis of the relative sales value at the splitoff point

D)allocates joint costs to joint products on the basis of relative NRV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

55

If the sales value at splitoff method is used, what is the approximate production cost for each pencil casing?

A)$0.0250

B)$0.0255

C)$0.0335

D)$0.0357

A)$0.0250

B)$0.0255

C)$0.0335

D)$0.0357

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

56

The sales value at splitoff method:

A)allocates joint costs to joint products on the basis of the relative total sales value at the splitoff point

B)allocates joint costs to joint products on the basis of a comparable physical measure at the splitoff point

C)allocates joint costs to joint products on the basis of relative NRV

D)allocates joint costs to joint products in a way that each product has an identical gross-margin percentage

A)allocates joint costs to joint products on the basis of the relative total sales value at the splitoff point

B)allocates joint costs to joint products on the basis of a comparable physical measure at the splitoff point

C)allocates joint costs to joint products on the basis of relative NRV

D)allocates joint costs to joint products in a way that each product has an identical gross-margin percentage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

57

Answer the following questions using the information below:

The Gows Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.

Condensed goat milk may be processed further to yield 39,000 gallons (the remainder is shrinkage)of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable gallon. Xyla can be sold for $18 per gallon.

Skim goat milk can be processed further to yield 56,200 gallons of skim goat ice cream, for an additional processing cost per usable gallon of $2.50. The product can be sold for $9 per gallon.

There are no beginning and ending inventory balances.

What is the estimated net realizable value of Xyla at the splitoff point?

A)$365,300

B)$505,800

C)$585,000

D)$702,000

The Gows Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.Condensed goat milk may be processed further to yield 39,000 gallons (the remainder is shrinkage)of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable gallon. Xyla can be sold for $18 per gallon.

Skim goat milk can be processed further to yield 56,200 gallons of skim goat ice cream, for an additional processing cost per usable gallon of $2.50. The product can be sold for $9 per gallon.

There are no beginning and ending inventory balances.

What is the estimated net realizable value of Xyla at the splitoff point?

A)$365,300

B)$505,800

C)$585,000

D)$702,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

58

Yakima Manufacturing purchases trees from Cheney Lumber and processes them up to the splitoff point where two products (paper and pencil casings)are obtained. The products are then sold to an independent company that markets and distributes them to retail outlets. The following information was collected for the month of May:

The cost of purchasing 100 trees and processing them up to the splitoff point to yield 70,000 sheets of paper and 60,000 pencil casings is $3,000.

The cost of purchasing 100 trees and processing them up to the splitoff point to yield 70,000 sheets of paper and 60,000 pencil casings is $3,000.

Yakima's Manufacturing's accounting department reported no beginning inventories and an ending inventory of 2,000 sheets of paper.

What are the paper's and the pencils' approximate weighted cost proportions using the sales value at splitoff method, respectively?

A)50.00% and 50.00%

B)33.33% and 66.67%

C)31.82% and 68.18%

D)None of these answers is correct.

The cost of purchasing 100 trees and processing them up to the splitoff point to yield 70,000 sheets of paper and 60,000 pencil casings is $3,000.

The cost of purchasing 100 trees and processing them up to the splitoff point to yield 70,000 sheets of paper and 60,000 pencil casings is $3,000.Yakima's Manufacturing's accounting department reported no beginning inventories and an ending inventory of 2,000 sheets of paper.

What are the paper's and the pencils' approximate weighted cost proportions using the sales value at splitoff method, respectively?

A)50.00% and 50.00%

B)33.33% and 66.67%

C)31.82% and 68.18%

D)None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

59

Answer the following questions using the information below:

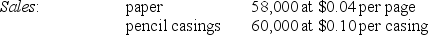

Yakima Manufacturing purchases trees from Cheney Lumber and processes them up to the splitoff point where two products (paper and pencil casings)are obtained. The products are then sold to an independent company that markets and distributes them to retail outlets. The following information was collected for the month of November:

The cost of purchasing 100 trees and processing them up to the splitoff point to yield 60,000 sheets of paper and 60,000 pencil casings is $3,000.

The cost of purchasing 100 trees and processing them up to the splitoff point to yield 60,000 sheets of paper and 60,000 pencil casings is $3,000.

Yakima's accounting department reported no beginning inventories and an ending inventory of 2,000 sheets of paper.

What is the sales value at the splitoff point for paper?

A)$240

B)$2,320

C)$2,400

D)$3,900

Yakima Manufacturing purchases trees from Cheney Lumber and processes them up to the splitoff point where two products (paper and pencil casings)are obtained. The products are then sold to an independent company that markets and distributes them to retail outlets. The following information was collected for the month of November:

The cost of purchasing 100 trees and processing them up to the splitoff point to yield 60,000 sheets of paper and 60,000 pencil casings is $3,000.

The cost of purchasing 100 trees and processing them up to the splitoff point to yield 60,000 sheets of paper and 60,000 pencil casings is $3,000.Yakima's accounting department reported no beginning inventories and an ending inventory of 2,000 sheets of paper.

What is the sales value at the splitoff point for paper?

A)$240

B)$2,320

C)$2,400

D)$3,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

60

The net realizable value method:

A)allocates joint costs to joint products on the basis of a comparable physical measure at the splitoff point

B)allocates joint costs to joint products on the basis of the relative sales value at the splitoff point

C)allocates joint costs to joint products in a way that each product has an identical gross-margin percentage

D)allocates joint costs to joint products on the basis of relative NRV

A)allocates joint costs to joint products on the basis of a comparable physical measure at the splitoff point

B)allocates joint costs to joint products on the basis of the relative sales value at the splitoff point

C)allocates joint costs to joint products in a way that each product has an identical gross-margin percentage

D)allocates joint costs to joint products on the basis of relative NRV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

61

How much (if any)extra income would Morton earn if it produced and sold all of the Xyla from the condensed goat milk? Allocate joint processing costs based upon relative sales value on the splitoff. (Extra income means income in excess of what Morton would have earned from selling condensed goat milk.)

A)$106,126

B)$508,426

C)$402,300

D)$193,574

A)$106,126

B)$508,426

C)$402,300

D)$193,574

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

62

The net realizable value method is generally used for products or services that are processed and after splitoff additional value is added to the product and a selling price can be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

63

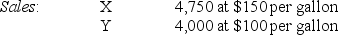

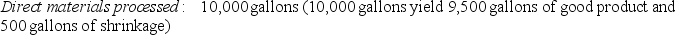

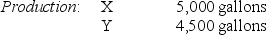

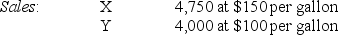

Chem Manufacturing Company processes direct materials up to the splitoff point where two products (X and Y)are obtained and sold. The following information was collected for the month of November:

The cost of purchasing 10,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 9,500 gallons of good products was $975,000.

The cost of purchasing 10,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 9,500 gallons of good products was $975,000.

The beginning inventories totaled 50 gallons for X and 25 gallons for Y. Ending inventory amounts reflected 300 gallons of Product X and 525 gallons of Product Y. October costs per unit were the same as November.

Using the physical-volume method, what is Product X's approximate gross-margin percentage?

A)32%

B)33%

C)35%

D)38%

The cost of purchasing 10,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 9,500 gallons of good products was $975,000.

The cost of purchasing 10,000 gallons of direct materials and processing it up to the splitoff point to yield a total of 9,500 gallons of good products was $975,000.The beginning inventories totaled 50 gallons for X and 25 gallons for Y. Ending inventory amounts reflected 300 gallons of Product X and 525 gallons of Product Y. October costs per unit were the same as November.

Using the physical-volume method, what is Product X's approximate gross-margin percentage?

A)32%

B)33%

C)35%

D)38%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

64

Why do accountants criticize the practice of carrying inventories at estimated net realizable values?

A)The costs of producing the products are usually estimates.

B)There is usually no clearly defined realizable value for these inventories.

C)The effect of this practice is to recognize income before sales are made.

D)All of these answers are correct.

A)The costs of producing the products are usually estimates.

B)There is usually no clearly defined realizable value for these inventories.

C)The effect of this practice is to recognize income before sales are made.

D)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

65

The sales value at splitoff method is an example of allocating costs using physical measures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

66

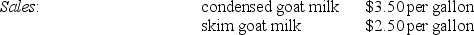

Answer the following questions using the information below:

The Gows Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.

Condensed goat milk may be processed further to yield 39,000 gallons (the remainder is shrinkage)of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable gallon. Xyla can be sold for $18 per gallon.

Skim goat milk can be processed further to yield 56,200 gallons of skim goat ice cream, for an additional processing cost per usable gallon of $2.50. The product can be sold for $9 per gallon.

There are no beginning and ending inventory balances.

Using the sales value at splitoff method, what is the gross-margin percentage for condensed goat milk at the splitoff point?

A)21.1%

B)55.1%

C)58.1%

D)38.2%

The Gows Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.Condensed goat milk may be processed further to yield 39,000 gallons (the remainder is shrinkage)of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable gallon. Xyla can be sold for $18 per gallon.

Skim goat milk can be processed further to yield 56,200 gallons of skim goat ice cream, for an additional processing cost per usable gallon of $2.50. The product can be sold for $9 per gallon.

There are no beginning and ending inventory balances.

Using the sales value at splitoff method, what is the gross-margin percentage for condensed goat milk at the splitoff point?

A)21.1%

B)55.1%

C)58.1%

D)38.2%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

67

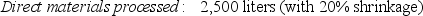

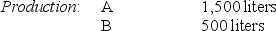

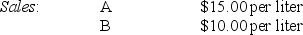

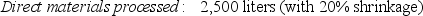

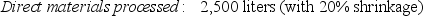

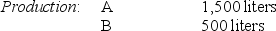

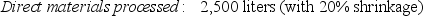

Beverage Drink Company processes direct materials up to the splitoff point where two products, A and B, are obtained. The following information was collected for the month of July:

The cost of purchasing 2,500 liters of direct materials and processing it up to the splitoff point to yield a total of 2,000 liters of good products was $4,500. There were no inventory balances of A and B.

The cost of purchasing 2,500 liters of direct materials and processing it up to the splitoff point to yield a total of 2,000 liters of good products was $4,500. There were no inventory balances of A and B.

Product A may be processed further to yield 1,375 liters of Product Z5 for an additional processing cost of $150. Product Z5 is sold for $25.00 per liter. There was no beginning inventory and ending inventory was 125 liters.

Product B may be processed further to yield 375 liters of Product W3 for an additional processing cost of $275. Product W3 is sold for $30.00 per liter. There was no beginning inventory and ending inventory was 25 liters.

If Product Z5 and Product W3 are produced, what are the expected sales values of production, respectively?

A)$11,250 and $34,375

B)$22,500 and $ 5,000

C)$31,250 and $10,500

D)$34,375 and $11,250

The cost of purchasing 2,500 liters of direct materials and processing it up to the splitoff point to yield a total of 2,000 liters of good products was $4,500. There were no inventory balances of A and B.

The cost of purchasing 2,500 liters of direct materials and processing it up to the splitoff point to yield a total of 2,000 liters of good products was $4,500. There were no inventory balances of A and B.Product A may be processed further to yield 1,375 liters of Product Z5 for an additional processing cost of $150. Product Z5 is sold for $25.00 per liter. There was no beginning inventory and ending inventory was 125 liters.

Product B may be processed further to yield 375 liters of Product W3 for an additional processing cost of $275. Product W3 is sold for $30.00 per liter. There was no beginning inventory and ending inventory was 25 liters.

If Product Z5 and Product W3 are produced, what are the expected sales values of production, respectively?

A)$11,250 and $34,375

B)$22,500 and $ 5,000

C)$31,250 and $10,500

D)$34,375 and $11,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

68

The net realizable value (NRV)method allocates joint costs to joint products produced during the accounting period on the basis of their relative NRV-final sales value plus separable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

69

The sales value at splitoff method allocates joint costs to joint products produced during the accounting period on the basis of the relative total sales value at the splitoff point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

70

An advantage of the physical-measure method is that obtaining physical measures for all products is an easy task.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

71

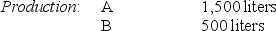

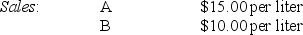

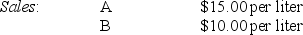

Cola Drink Company processes direct materials up to the splitoff point where two products, A and B, are obtained. The following information was collected for the month of July:

The cost of purchasing 2,500 liters of direct materials and processing it up to the splitoff point to yield a total of 2,000 liters of good products was $4,500. There were no inventory balances of A and B.

The cost of purchasing 2,500 liters of direct materials and processing it up to the splitoff point to yield a total of 2,000 liters of good products was $4,500. There were no inventory balances of A and B.

Product A may be processed further to yield 1,375 liters of Product Z5 for an additional processing cost of $150. Product Z5 is sold for $25.00 per liter. There was no beginning inventory and ending inventory was 125 liters.

Product B may be processed further to yield 375 liters of Product W3 for an additional processing cost of $275. Product W3 is sold for $30.00 per liter. There was no beginning inventory and ending inventory was 25 liters.

What is Product Z5's estimated net realizable value at the splitoff point?

A)$11,100

B)$22,350

C)$34,225

D)$34,375

The cost of purchasing 2,500 liters of direct materials and processing it up to the splitoff point to yield a total of 2,000 liters of good products was $4,500. There were no inventory balances of A and B.

The cost of purchasing 2,500 liters of direct materials and processing it up to the splitoff point to yield a total of 2,000 liters of good products was $4,500. There were no inventory balances of A and B.Product A may be processed further to yield 1,375 liters of Product Z5 for an additional processing cost of $150. Product Z5 is sold for $25.00 per liter. There was no beginning inventory and ending inventory was 125 liters.

Product B may be processed further to yield 375 liters of Product W3 for an additional processing cost of $275. Product W3 is sold for $30.00 per liter. There was no beginning inventory and ending inventory was 25 liters.

What is Product Z5's estimated net realizable value at the splitoff point?

A)$11,100

B)$22,350

C)$34,225

D)$34,375

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the methods of allocating joint costs usually is considered the simplest to implement?

A)estimated net realizable value

B)constant gross-margin percentage NRV

C)sales value at splitoff

D)All of these answers are correct.

A)estimated net realizable value

B)constant gross-margin percentage NRV

C)sales value at splitoff

D)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

73

The estimated net realizable value method is used when the market selling prices at the splitoff point are NOT available.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following is a DISADVANTAGE of the physical-measure method of allocating joint costs?

A)The measurement basis for each product may be different.

B)The need for a common denominator.

C)The physical measure may not reflect the product's ability to generate revenues.

D)All of these answers are correct.

A)The measurement basis for each product may be different.

B)The need for a common denominator.

C)The physical measure may not reflect the product's ability to generate revenues.

D)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

75

How much (if any)extra income would Morton earn if it produced and sold skim milk ice cream from goats rather than goat skim milk? Allocate joint processing costs based upon the relative sales value at the splitoff point.

A)$94,094

B)$234,594

C)$203,300

D)$140,500

A)$94,094

B)$234,594

C)$203,300

D)$140,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

76

The constant gross-margin percentage NRV method of joint cost allocation:

A)involves allocating costs in such a way that maintaining the same gross margin percentage for each product that was obtained in prior years

B)involves allocating costs in such a way that the overall gross margin percentage is identical for the individual products

C)is the same as the estimated NRV method

D)is the same as the sales-value at splitoff method

A)involves allocating costs in such a way that maintaining the same gross margin percentage for each product that was obtained in prior years

B)involves allocating costs in such a way that the overall gross margin percentage is identical for the individual products

C)is the same as the estimated NRV method

D)is the same as the sales-value at splitoff method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

77

Answer the following questions using the information below:

The Gows Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.

Condensed goat milk may be processed further to yield 39,000 gallons (the remainder is shrinkage)of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable gallon. Xyla can be sold for $18 per gallon.

Skim goat milk can be processed further to yield 56,200 gallons of skim goat ice cream, for an additional processing cost per usable gallon of $2.50. The product can be sold for $9 per gallon.

There are no beginning and ending inventory balances.

Using the sales value at splitoff method, what is the gross-margin percentage for skim goat milk at the splitoff point?

A)21.1%

B)55.1%

C)58.1%

D)38.2%

The Gows Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.Condensed goat milk may be processed further to yield 39,000 gallons (the remainder is shrinkage)of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable gallon. Xyla can be sold for $18 per gallon.

Skim goat milk can be processed further to yield 56,200 gallons of skim goat ice cream, for an additional processing cost per usable gallon of $2.50. The product can be sold for $9 per gallon.

There are no beginning and ending inventory balances.

Using the sales value at splitoff method, what is the gross-margin percentage for skim goat milk at the splitoff point?

A)21.1%

B)55.1%

C)58.1%

D)38.2%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

78

Industries that recognize income on each product when production is completed include:

A)mining

B)toy manufacturers

C)canning

D)Both A and C are correct.

A)mining

B)toy manufacturers

C)canning

D)Both A and C are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

79

The sales value at splitoff method enables the accountant to obtain individual product costs and gross margins.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

80

Answer the following questions using the information below:

The Gows Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.

Condensed goat milk may be processed further to yield 39,000 gallons (the remainder is shrinkage)of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable gallon. Xyla can be sold for $18 per gallon.

Skim goat milk can be processed further to yield 56,200 gallons of skim goat ice cream, for an additional processing cost per usable gallon of $2.50. The product can be sold for $9 per gallon.

There are no beginning and ending inventory balances.

Using estimated net realizable value, what amount of the $72,240 of joint costs would be allocated Xyla and the skim goat ice cream?

A)$83,942 and $60,538

B)$88,942 and $55,538

C)$65,592 and $78,888

D)$144,480 and $72,140

The Gows Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.Condensed goat milk may be processed further to yield 39,000 gallons (the remainder is shrinkage)of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable gallon. Xyla can be sold for $18 per gallon.

Skim goat milk can be processed further to yield 56,200 gallons of skim goat ice cream, for an additional processing cost per usable gallon of $2.50. The product can be sold for $9 per gallon.

There are no beginning and ending inventory balances.

Using estimated net realizable value, what amount of the $72,240 of joint costs would be allocated Xyla and the skim goat ice cream?

A)$83,942 and $60,538

B)$88,942 and $55,538

C)$65,592 and $78,888

D)$144,480 and $72,140

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck