Deck 15: Allocation of Support-Department Costs, Common Costs, and Revenues

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/144

العب

ملء الشاشة (f)

Deck 15: Allocation of Support-Department Costs, Common Costs, and Revenues

1

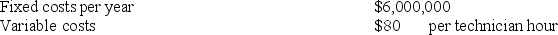

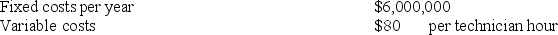

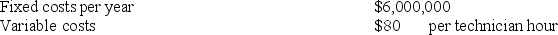

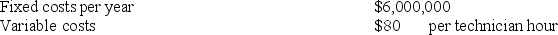

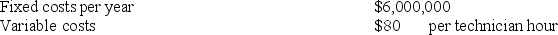

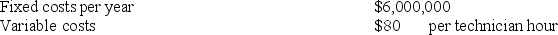

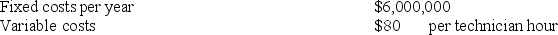

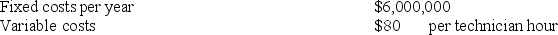

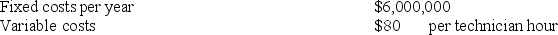

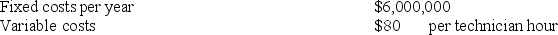

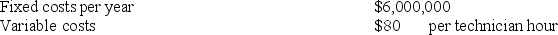

Answer the following questions using the information below:

The Quickjet Aircraft Corporation has a central materials laboratory. The laboratory has only two users, the Large Plane Department and the Small Plane Department. The following data apply to the coming budget year:

Budgeted costs of operating the materials laboratory

for 100,000 to 200,000 technician hours per year:

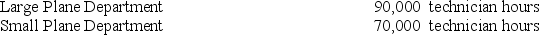

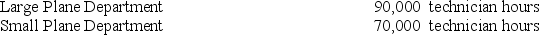

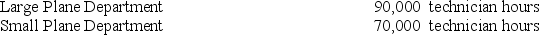

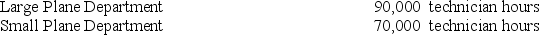

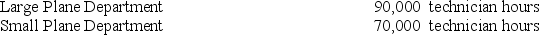

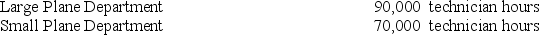

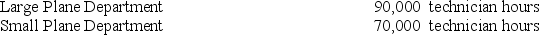

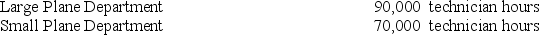

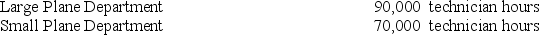

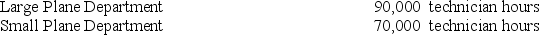

Budgeted long-run usage in hours per year:

Budgeted long-run usage in hours per year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.

Actual usage for the year by the Large Plane Department was 60,000 technician hours and by the Small Plane Department was 65,000 technician hours.

If a single-rate cost-allocation method is used, what amount of materials laboratory costs will be allocated to the Large Plane Department? Assume actual usage is used to allocate copying costs.

A)$10,575,000

B)$8,225,000

C)$7,637,500

D)$7,050,000

The Quickjet Aircraft Corporation has a central materials laboratory. The laboratory has only two users, the Large Plane Department and the Small Plane Department. The following data apply to the coming budget year:

Budgeted costs of operating the materials laboratory

for 100,000 to 200,000 technician hours per year:

Budgeted long-run usage in hours per year:

Budgeted long-run usage in hours per year: Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.Actual usage for the year by the Large Plane Department was 60,000 technician hours and by the Small Plane Department was 65,000 technician hours.

If a single-rate cost-allocation method is used, what amount of materials laboratory costs will be allocated to the Large Plane Department? Assume actual usage is used to allocate copying costs.

A)$10,575,000

B)$8,225,000

C)$7,637,500

D)$7,050,000

D

2

The method that allocates costs in each cost pool using the same rate per unit is known as the:

A)incremental cost-allocation method

B)reciprocal cost-allocation method

C)single-rate cost allocation method

D)dual-rate cost-allocation method

A)incremental cost-allocation method

B)reciprocal cost-allocation method

C)single-rate cost allocation method

D)dual-rate cost-allocation method

C

3

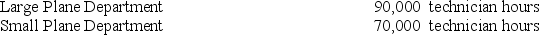

Answer the following questions using the information below:

The Quickjet Aircraft Corporation has a central materials laboratory. The laboratory has only two users, the Large Plane Department and the Small Plane Department. The following data apply to the coming budget year:

Budgeted costs of operating the materials laboratory

for 100,000 to 200,000 technician hours per year:

Budgeted long-run usage in hours per year:

Budgeted long-run usage in hours per year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.

Actual usage for the year by the Large Plane Department was 60,000 technician hours and by the Small Plane Department was 65,000 technician hours.

If a dual-rate cost-allocation method is used, what amount of materials laboratory costs will be budgeted for the Small Plane Department?

A)$10,575,000

B)$7,637,500

C)$7,050,000

D)$8,225,000

The Quickjet Aircraft Corporation has a central materials laboratory. The laboratory has only two users, the Large Plane Department and the Small Plane Department. The following data apply to the coming budget year:

Budgeted costs of operating the materials laboratory

for 100,000 to 200,000 technician hours per year:

Budgeted long-run usage in hours per year:

Budgeted long-run usage in hours per year: Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.Actual usage for the year by the Large Plane Department was 60,000 technician hours and by the Small Plane Department was 65,000 technician hours.

If a dual-rate cost-allocation method is used, what amount of materials laboratory costs will be budgeted for the Small Plane Department?

A)$10,575,000

B)$7,637,500

C)$7,050,000

D)$8,225,000

D

4

When using the single-rate method, fixed cost allocation may be based on:

A)actual usage

B)budgeted usage

C)incremental cost allocation

D)Either A or B are correct.

A)actual usage

B)budgeted usage

C)incremental cost allocation

D)Either A or B are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

5

The dual-rate cost-allocation method classifies costs in each cost pool into a:

A)budgeted-cost pool and an actual-cost pool

B)variable-cost pool and a fixed-cost pool

C)used-capacity-cost pool and a practical-capacity-cost pool

D)direct-cost pool and a reciprocal-cost pool

A)budgeted-cost pool and an actual-cost pool

B)variable-cost pool and a fixed-cost pool

C)used-capacity-cost pool and a practical-capacity-cost pool

D)direct-cost pool and a reciprocal-cost pool

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

6

Answer the following questions using the information below:

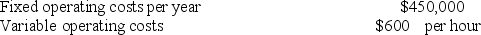

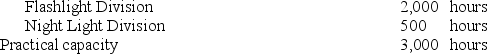

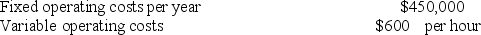

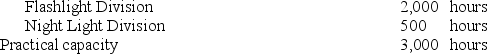

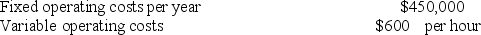

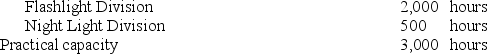

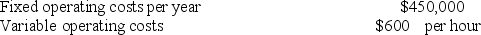

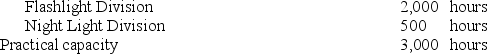

The Laserlight Corporation operates one central plant that has two divisions, the Flashlight Division and the Night Light Division. The following data apply to the coming budget year:

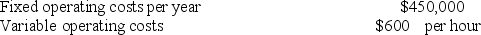

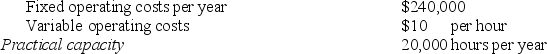

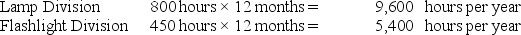

Budgeted costs of operating the plant for 2,000 to 3,000 hours:

Budgeted long-run usage per year:

Budgeted long-run usage per year:

Assume that practical capacity is used to calculate the allocation rates.

Assume that practical capacity is used to calculate the allocation rates.

Actual usage for the year by the Flashlight Division was 1,400 hours and by the Night Light Division was 600 hours.

If a dual-rate cost-allocation method is used, what amount of operating costs will be budgeted for the Night Light Division?

A)$390,000

B)$450,000

C)$375,000

D)$435,000

The Laserlight Corporation operates one central plant that has two divisions, the Flashlight Division and the Night Light Division. The following data apply to the coming budget year:

Budgeted costs of operating the plant for 2,000 to 3,000 hours:

Budgeted long-run usage per year:

Budgeted long-run usage per year: Assume that practical capacity is used to calculate the allocation rates.

Assume that practical capacity is used to calculate the allocation rates.Actual usage for the year by the Flashlight Division was 1,400 hours and by the Night Light Division was 600 hours.

If a dual-rate cost-allocation method is used, what amount of operating costs will be budgeted for the Night Light Division?

A)$390,000

B)$450,000

C)$375,000

D)$435,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

7

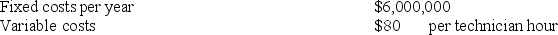

Answer the following questions using the information below:

The Quickjet Aircraft Corporation has a central materials laboratory. The laboratory has only two users, the Large Plane Department and the Small Plane Department. The following data apply to the coming budget year:

Budgeted costs of operating the materials laboratory

for 100,000 to 200,000 technician hours per year:

Budgeted long-run usage in hours per year:

Budgeted long-run usage in hours per year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.

Actual usage for the year by the Large Plane Department was 60,000 technician hours and by the Small Plane Department was 65,000 technician hours.

If a single-rate cost-allocation method is used, what is the allocation rate per hour used?

A)$80.00

B)$117.50

C)$146.67

D)$100.00

The Quickjet Aircraft Corporation has a central materials laboratory. The laboratory has only two users, the Large Plane Department and the Small Plane Department. The following data apply to the coming budget year:

Budgeted costs of operating the materials laboratory

for 100,000 to 200,000 technician hours per year:

Budgeted long-run usage in hours per year:

Budgeted long-run usage in hours per year: Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.Actual usage for the year by the Large Plane Department was 60,000 technician hours and by the Small Plane Department was 65,000 technician hours.

If a single-rate cost-allocation method is used, what is the allocation rate per hour used?

A)$80.00

B)$117.50

C)$146.67

D)$100.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

8

Benefits of the single-rate method include:

A)it is easier to calculate

B)fixed costs that are transformed into variable costs for user decision making

C)signals regarding how variable and fixed costs behave differently

D)information that leads to outsourcing decisions that benefit the organization as a whole

A)it is easier to calculate

B)fixed costs that are transformed into variable costs for user decision making

C)signals regarding how variable and fixed costs behave differently

D)information that leads to outsourcing decisions that benefit the organization as a whole

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

9

Answer the following questions using the information below:

The Quickjet Aircraft Corporation has a central materials laboratory. The laboratory has only two users, the Large Plane Department and the Small Plane Department. The following data apply to the coming budget year:

Budgeted costs of operating the materials laboratory

for 100,000 to 200,000 technician hours per year:

Budgeted long-run usage in hours per year:

Budgeted long-run usage in hours per year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.

Actual usage for the year by the Large Plane Department was 60,000 technician hours and by the Small Plane Department was 65,000 technician hours.

If a dual-rate cost-allocation method is used, what amount of materials laboratory costs will be allocated to the Small Plane Department? Assume budgeted usage is used to allocate materials laboratory costs and actual usage is used to allocate variable materials laboratory costs.

A)$8,225,000

B)$7,825,000

C)$8,175,000

D)$7,637,500

The Quickjet Aircraft Corporation has a central materials laboratory. The laboratory has only two users, the Large Plane Department and the Small Plane Department. The following data apply to the coming budget year:

Budgeted costs of operating the materials laboratory

for 100,000 to 200,000 technician hours per year:

Budgeted long-run usage in hours per year:

Budgeted long-run usage in hours per year: Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.Actual usage for the year by the Large Plane Department was 60,000 technician hours and by the Small Plane Department was 65,000 technician hours.

If a dual-rate cost-allocation method is used, what amount of materials laboratory costs will be allocated to the Small Plane Department? Assume budgeted usage is used to allocate materials laboratory costs and actual usage is used to allocate variable materials laboratory costs.

A)$8,225,000

B)$7,825,000

C)$8,175,000

D)$7,637,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

10

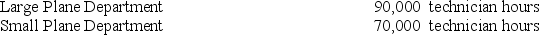

Answer the following questions using the information below:

The Quickjet Aircraft Corporation has a central materials laboratory. The laboratory has only two users, the Large Plane Department and the Small Plane Department. The following data apply to the coming budget year:

Budgeted costs of operating the materials laboratory

for 100,000 to 200,000 technician hours per year:

Budgeted long-run usage in hours per year:

Budgeted long-run usage in hours per year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.

Actual usage for the year by the Large Plane Department was 60,000 technician hours and by the Small Plane Department was 65,000 technician hours.

If a dual-rate cost-allocation method is used, what amount of materials laboratory costs will be budgeted for the Large Plane Department?

A)$10,575,000

B)$8,225,000

C)$18,800,000

D)$16,000,000

The Quickjet Aircraft Corporation has a central materials laboratory. The laboratory has only two users, the Large Plane Department and the Small Plane Department. The following data apply to the coming budget year:

Budgeted costs of operating the materials laboratory

for 100,000 to 200,000 technician hours per year:

Budgeted long-run usage in hours per year:

Budgeted long-run usage in hours per year: Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.Actual usage for the year by the Large Plane Department was 60,000 technician hours and by the Small Plane Department was 65,000 technician hours.

If a dual-rate cost-allocation method is used, what amount of materials laboratory costs will be budgeted for the Large Plane Department?

A)$10,575,000

B)$8,225,000

C)$18,800,000

D)$16,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

11

Answer the following questions using the information below:

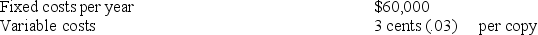

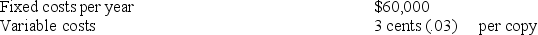

The Charmatz Corporation has a central copying facility. The copying facility has only two users, the Marketing Department and the Operations Department. The following data apply to the coming budget year:

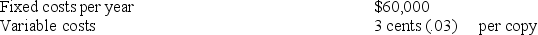

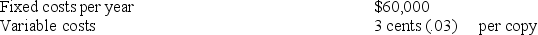

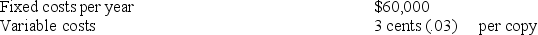

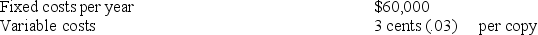

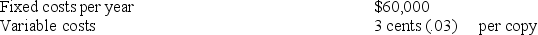

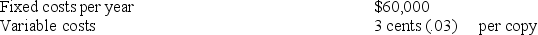

Budgeted costs of operating the copying facility

for 400,000 to 600,000 copies:

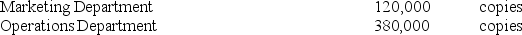

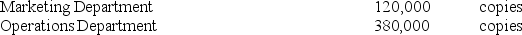

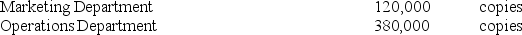

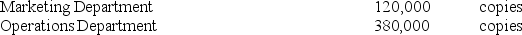

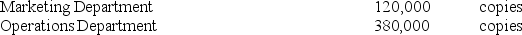

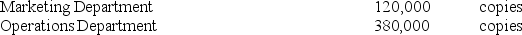

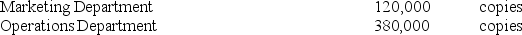

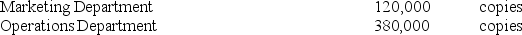

Budgeted long-run usage in copies per year:

Budgeted long-run usage in copies per year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.

Actual usage for the year by the Marketing Department was 80,000 copies and by the Operations Department was 360,000 copies.

If a dual-rate cost-allocation method is used, what amount of copying facility costs will be allocated to the Operations Department? Assume budgeted usage is used to allocate fixed copying costs and actual usage is used to allocate variable copying costs.

A)$60,490

B)$59,890

C)$57,000

D)$56,400

The Charmatz Corporation has a central copying facility. The copying facility has only two users, the Marketing Department and the Operations Department. The following data apply to the coming budget year:

Budgeted costs of operating the copying facility

for 400,000 to 600,000 copies:

Budgeted long-run usage in copies per year:

Budgeted long-run usage in copies per year: Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.Actual usage for the year by the Marketing Department was 80,000 copies and by the Operations Department was 360,000 copies.

If a dual-rate cost-allocation method is used, what amount of copying facility costs will be allocated to the Operations Department? Assume budgeted usage is used to allocate fixed copying costs and actual usage is used to allocate variable copying costs.

A)$60,490

B)$59,890

C)$57,000

D)$56,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

12

Answer the following questions using the information below:

The Quickjet Aircraft Corporation has a central materials laboratory. The laboratory has only two users, the Large Plane Department and the Small Plane Department. The following data apply to the coming budget year:

Budgeted costs of operating the materials laboratory

for 100,000 to 200,000 technician hours per year:

Budgeted long-run usage in hours per year:

Budgeted long-run usage in hours per year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.

Actual usage for the year by the Large Plane Department was 60,000 technician hours and by the Small Plane Department was 65,000 technician hours.

If a dual-rate cost-allocation method is used, what amount of materials laboratory costs will be allocated to the Large Plane Department? Assume budgeted usage is used to allocate fixed materials laboratory costs and actual usage is used to allocate variable materials laboratory costs.

A)$7,825,000

B)$8,175,000

C)$8,225,000

D)$7,050,000

The Quickjet Aircraft Corporation has a central materials laboratory. The laboratory has only two users, the Large Plane Department and the Small Plane Department. The following data apply to the coming budget year:

Budgeted costs of operating the materials laboratory

for 100,000 to 200,000 technician hours per year:

Budgeted long-run usage in hours per year:

Budgeted long-run usage in hours per year: Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.Actual usage for the year by the Large Plane Department was 60,000 technician hours and by the Small Plane Department was 65,000 technician hours.

If a dual-rate cost-allocation method is used, what amount of materials laboratory costs will be allocated to the Large Plane Department? Assume budgeted usage is used to allocate fixed materials laboratory costs and actual usage is used to allocate variable materials laboratory costs.

A)$7,825,000

B)$8,175,000

C)$8,225,000

D)$7,050,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

13

Answer the following questions using the information below:

The Charmatz Corporation has a central copying facility. The copying facility has only two users, the Marketing Department and the Operations Department. The following data apply to the coming budget year:

Budgeted costs of operating the copying facility

for 400,000 to 600,000 copies:

Budgeted long-run usage in copies per year:

Budgeted long-run usage in copies per year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.

Actual usage for the year by the Marketing Department was 80,000 copies and by the Operations Department was 360,000 copies.

If a single-rate cost-allocation method is used, what amount of copying facility costs will be budgeted for the Marketing Department?

A)$18,000

B)$3,600

C)$14,400

D)$16,800

The Charmatz Corporation has a central copying facility. The copying facility has only two users, the Marketing Department and the Operations Department. The following data apply to the coming budget year:

Budgeted costs of operating the copying facility

for 400,000 to 600,000 copies:

Budgeted long-run usage in copies per year:

Budgeted long-run usage in copies per year: Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.Actual usage for the year by the Marketing Department was 80,000 copies and by the Operations Department was 360,000 copies.

If a single-rate cost-allocation method is used, what amount of copying facility costs will be budgeted for the Marketing Department?

A)$18,000

B)$3,600

C)$14,400

D)$16,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

14

Answer the following questions using the information below:

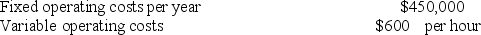

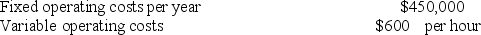

The Laserlight Corporation operates one central plant that has two divisions, the Flashlight Division and the Night Light Division. The following data apply to the coming budget year:

Budgeted costs of operating the plant for 2,000 to 3,000 hours:

Budgeted long-run usage per year:

Budgeted long-run usage per year:

Assume that practical capacity is used to calculate the allocation rates.

Assume that practical capacity is used to calculate the allocation rates.

Actual usage for the year by the Flashlight Division was 1,400 hours and by the Night Light Division was 600 hours.

If a single-rate cost-allocation method is used, what amount of operating costs will be budgeted for the Flashlight Division?

A)$1,500,000

B)$1,560,000

C)$1,140,000

D)$1,410,000

The Laserlight Corporation operates one central plant that has two divisions, the Flashlight Division and the Night Light Division. The following data apply to the coming budget year:

Budgeted costs of operating the plant for 2,000 to 3,000 hours:

Budgeted long-run usage per year:

Budgeted long-run usage per year: Assume that practical capacity is used to calculate the allocation rates.

Assume that practical capacity is used to calculate the allocation rates.Actual usage for the year by the Flashlight Division was 1,400 hours and by the Night Light Division was 600 hours.

If a single-rate cost-allocation method is used, what amount of operating costs will be budgeted for the Flashlight Division?

A)$1,500,000

B)$1,560,000

C)$1,140,000

D)$1,410,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

15

Answer the following questions using the information below:

The Charmatz Corporation has a central copying facility. The copying facility has only two users, the Marketing Department and the Operations Department. The following data apply to the coming budget year:

Budgeted costs of operating the copying facility

for 400,000 to 600,000 copies:

Budgeted long-run usage in copies per year:

Budgeted long-run usage in copies per year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.

Actual usage for the year by the Marketing Department was 80,000 copies and by the Operations Department was 360,000 copies.

If a dual-rate cost-allocation method is used, what amount of copying facility costs will be budgeted for the Operations Department?

A)$57,000

B)$56,400

C)$60,490

D)$59,890

The Charmatz Corporation has a central copying facility. The copying facility has only two users, the Marketing Department and the Operations Department. The following data apply to the coming budget year:

Budgeted costs of operating the copying facility

for 400,000 to 600,000 copies:

Budgeted long-run usage in copies per year:

Budgeted long-run usage in copies per year: Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.Actual usage for the year by the Marketing Department was 80,000 copies and by the Operations Department was 360,000 copies.

If a dual-rate cost-allocation method is used, what amount of copying facility costs will be budgeted for the Operations Department?

A)$57,000

B)$56,400

C)$60,490

D)$59,890

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

16

Answer the following questions using the information below:

The Charmatz Corporation has a central copying facility. The copying facility has only two users, the Marketing Department and the Operations Department. The following data apply to the coming budget year:

Budgeted costs of operating the copying facility

for 400,000 to 600,000 copies:

Budgeted long-run usage in copies per year:

Budgeted long-run usage in copies per year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.

Actual usage for the year by the Marketing Department was 80,000 copies and by the Operations Department was 360,000 copies.

If a single-rate cost-allocation method is used, what amount of copying facility costs will be allocated to the Marketing Department? Assume actual usage is used to allocate copying costs.

A)$16,800

B)$18,000

C)$12,000

D)$9,600

The Charmatz Corporation has a central copying facility. The copying facility has only two users, the Marketing Department and the Operations Department. The following data apply to the coming budget year:

Budgeted costs of operating the copying facility

for 400,000 to 600,000 copies:

Budgeted long-run usage in copies per year:

Budgeted long-run usage in copies per year: Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.Actual usage for the year by the Marketing Department was 80,000 copies and by the Operations Department was 360,000 copies.

If a single-rate cost-allocation method is used, what amount of copying facility costs will be allocated to the Marketing Department? Assume actual usage is used to allocate copying costs.

A)$16,800

B)$18,000

C)$12,000

D)$9,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

17

The advantage of using practical capacity to allocate costs:

A)is that it allows a downward demand spiral to develop

B)is that it focuses management's attention on managing unused capacity

C)is that budgets are much easier to develop

D)Either A or B are correct.

A)is that it allows a downward demand spiral to develop

B)is that it focuses management's attention on managing unused capacity

C)is that budgets are much easier to develop

D)Either A or B are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

18

The single-rate cost-allocation method may base the denominator choice on:

A)master-budget capacity utilization

B)normal capacity utilization

C)practical capacity

D)All of these answers are correct.

A)master-budget capacity utilization

B)normal capacity utilization

C)practical capacity

D)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

19

Benefits of the dual-rate method include:

A)variable costs that are transformed into fixed costs for user decision making

B)the low cost of implementation

C)avoidance of expensive analysis for categorizing costs as either fixed or variable

D)information that leads to outsourcing decisions that benefit the organization as a whole

A)variable costs that are transformed into fixed costs for user decision making

B)the low cost of implementation

C)avoidance of expensive analysis for categorizing costs as either fixed or variable

D)information that leads to outsourcing decisions that benefit the organization as a whole

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

20

Answer the following questions using the information below:

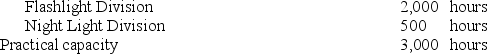

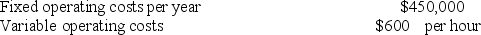

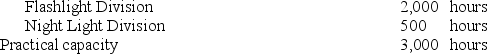

The Laserlight Corporation operates one central plant that has two divisions, the Flashlight Division and the Night Light Division. The following data apply to the coming budget year:

Budgeted costs of operating the plant for 2,000 to 3,000 hours:

Budgeted long-run usage per year:

Budgeted long-run usage per year:

Assume that practical capacity is used to calculate the allocation rates.

Assume that practical capacity is used to calculate the allocation rates.

Actual usage for the year by the Flashlight Division was 1,400 hours and by the Night Light Division was 600 hours.

If a single-rate cost-allocation method is used, what amount of cost will be allocated to the Flashlight Division? Assume actual usage is used to allocate operating costs.

A)$1,140,000

B)$1,200,000

C)$1,500,000

D)$1,050,000

The Laserlight Corporation operates one central plant that has two divisions, the Flashlight Division and the Night Light Division. The following data apply to the coming budget year:

Budgeted costs of operating the plant for 2,000 to 3,000 hours:

Budgeted long-run usage per year:

Budgeted long-run usage per year: Assume that practical capacity is used to calculate the allocation rates.

Assume that practical capacity is used to calculate the allocation rates.Actual usage for the year by the Flashlight Division was 1,400 hours and by the Night Light Division was 600 hours.

If a single-rate cost-allocation method is used, what amount of cost will be allocated to the Flashlight Division? Assume actual usage is used to allocate operating costs.

A)$1,140,000

B)$1,200,000

C)$1,500,000

D)$1,050,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

21

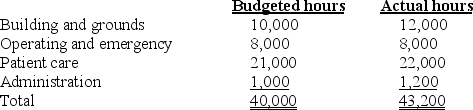

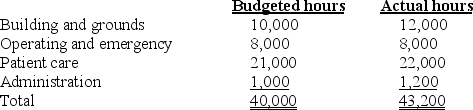

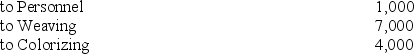

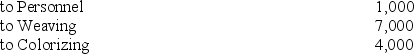

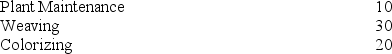

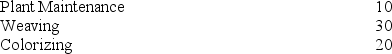

The fixed costs of operating the maintenance facility of General Hospital are $4,500,000 annually. Variable costs are incurred at the rate of $30 per maintenance-hour. The facility averages 40,000 maintenance-hours a year. Budgeted and actual hours per user for 20X3 are as follows:

Assume that budgeted maintenance-hours are used to calculate the allocation rates.

Assume that budgeted maintenance-hours are used to calculate the allocation rates.

Required:

a. If a single-rate cost-allocation method is used, what amount of maintenance cost will be budgeted for each department?

b. If a single-rate cost-allocation method is used, what amount of maintenance cost will be allocated to each department based on actual usage?

c. If a dual-rate cost-allocation method is used, what amount of maintenance cost will be budgeted for each department?

d. If a dual-rate cost-allocation method is used, what amount of maintenance cost will be allocated to each department based on actual usage? Based on budgeted usage for fixed operating costs and actual usage for variable operating costs?

Assume that budgeted maintenance-hours are used to calculate the allocation rates.

Assume that budgeted maintenance-hours are used to calculate the allocation rates.Required:

a. If a single-rate cost-allocation method is used, what amount of maintenance cost will be budgeted for each department?

b. If a single-rate cost-allocation method is used, what amount of maintenance cost will be allocated to each department based on actual usage?

c. If a dual-rate cost-allocation method is used, what amount of maintenance cost will be budgeted for each department?

d. If a dual-rate cost-allocation method is used, what amount of maintenance cost will be allocated to each department based on actual usage? Based on budgeted usage for fixed operating costs and actual usage for variable operating costs?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

22

The Pitt Corporation has been outsourcing data processing in the belief that such outsourcing would reduce costs and increase corporate profitability. In spite of this, there has been no meaningful increase in corporate profitability.

Previously, Pitt used a single-rate method to allocate data processing costs. A per unit cost for data processing was computed and compared to the price of the outside supplier. The price of the outside supplier was lower, so the outside bid was accepted.

Required:

Formulate a possible reason why Pitt's profitability has not shown improvement in terms of the cost allocation method used.

Previously, Pitt used a single-rate method to allocate data processing costs. A per unit cost for data processing was computed and compared to the price of the outside supplier. The price of the outside supplier was lower, so the outside bid was accepted.

Required:

Formulate a possible reason why Pitt's profitability has not shown improvement in terms of the cost allocation method used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

23

Under the dual-rate cost-allocation method, when fixed costs are allocated based on actual usage then:

A)user-division managers are motivated to make accurate long-run usage forecasts

B)user-division managers can better plan for the short-run and for the long-run

C)the costs of unused capacity are highlighted

D)variations in one division's usage affect another division's allocation

A)user-division managers are motivated to make accurate long-run usage forecasts

B)user-division managers can better plan for the short-run and for the long-run

C)the costs of unused capacity are highlighted

D)variations in one division's usage affect another division's allocation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

24

When actual cost-allocations rates are used:

A)user divisions pay for costs that exceed budgeted amounts

B)managers of the supplier division are motivated to improve efficiency

C)user divisions do not know allocated amounts until the end of the accounting period

D)managers of the user divisions may be tempted to underestimate planned usage

A)user divisions pay for costs that exceed budgeted amounts

B)managers of the supplier division are motivated to improve efficiency

C)user divisions do not know allocated amounts until the end of the accounting period

D)managers of the user divisions may be tempted to underestimate planned usage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

25

Answer the following questions using the information below:

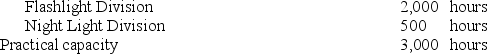

The Laserlight Corporation operates one central plant that has two divisions, the Flashlight Division and the Night Light Division. The following data apply to the coming budget year:

Budgeted costs of operating the plant for 2,000 to 3,000 hours:

Budgeted long-run usage per year:

Budgeted long-run usage per year:

Assume that practical capacity is used to calculate the allocation rates.

Assume that practical capacity is used to calculate the allocation rates.

Actual usage for the year by the Flashlight Division was 1,400 hours and by the Night Light Division was 600 hours.

If a dual-rate cost-allocation method is used, what amount of cost will be allocated to the Night Light Division? Assume budgeted usage is used to allocate fixed operating costs and actual usage is used to allocate variable operating costs.

A)$375,000

B)$435,000

C)$390,000

D)$450,000

The Laserlight Corporation operates one central plant that has two divisions, the Flashlight Division and the Night Light Division. The following data apply to the coming budget year:

Budgeted costs of operating the plant for 2,000 to 3,000 hours:

Budgeted long-run usage per year:

Budgeted long-run usage per year: Assume that practical capacity is used to calculate the allocation rates.

Assume that practical capacity is used to calculate the allocation rates.Actual usage for the year by the Flashlight Division was 1,400 hours and by the Night Light Division was 600 hours.

If a dual-rate cost-allocation method is used, what amount of cost will be allocated to the Night Light Division? Assume budgeted usage is used to allocate fixed operating costs and actual usage is used to allocate variable operating costs.

A)$375,000

B)$435,000

C)$390,000

D)$450,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

26

The biggest advantage of using practical capacity to allocate costs is that it:

A)is a value that is readily available

B)never causes over or under-allocated overhead

C)burdens the user divisions with the costs of unused capacity

D)focuses management's attention on unused capacity

A)is a value that is readily available

B)never causes over or under-allocated overhead

C)burdens the user divisions with the costs of unused capacity

D)focuses management's attention on unused capacity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

27

When actual cost-allocation rates are used, managers of the supplier division are motivated to improve efficiency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

28

Van Meter Fig Company has substantial fluctuations in its production costs because of the seasonality of figs.

Would you recommend an actual or budgeted allocation base? Why? Would you recommend calculating monthly, seasonal, or annual allocation rates? Why?

Would you recommend an actual or budgeted allocation base? Why? Would you recommend calculating monthly, seasonal, or annual allocation rates? Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

29

The dual-rate method makes no distinction between fixed and variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

30

To discourage unnecessary use of a support department, management might:

A)not allocate any support department costs to user departments

B)allocate support department costs based upon user department usage

C)allocate a fixed amount of support department costs to each department regardless of use

D)issue memos on useful services provided by the support department

A)not allocate any support department costs to user departments

B)allocate support department costs based upon user department usage

C)allocate a fixed amount of support department costs to each department regardless of use

D)issue memos on useful services provided by the support department

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

31

The costs of unused capacity are highlighted when:

A)actual usage based allocations are used

B)budgeted usage allocations are used

C)practical capacity-based allocations are used

D)the dual-rate cost-allocation method allocates fixed costs based on actual usage

A)actual usage based allocations are used

B)budgeted usage allocations are used

C)practical capacity-based allocations are used

D)the dual-rate cost-allocation method allocates fixed costs based on actual usage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

32

When budgeted cost-allocation rates are used, user-division managers face uncertainty about the allocation rates for that budget period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

33

The Alex Miller Corporation operates one central plant that has two divisions, the Flashlight Division and the Night Light Division. The following data apply to the coming budget year:

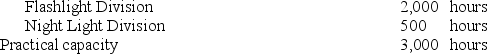

Budgeted costs of the operating the plant

for 10,000 to 20,000 hours:

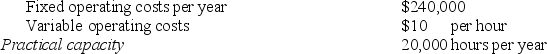

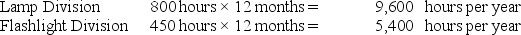

Budgeted long-run usage per year:

Budgeted long-run usage per year:

Assume that practical capacity is used to calculate the allocation rates. Further assume that actual usage of the Lamp Division was 700 hours and the Flashlight Division was 400 hours for the month of June.

Assume that practical capacity is used to calculate the allocation rates. Further assume that actual usage of the Lamp Division was 700 hours and the Flashlight Division was 400 hours for the month of June.

Required:

a. If a single-rate cost-allocation method is used, what amount of operating costs will be budgeted for the Lamp Division each month? For the Flashlight Division each month?

b. For the month of June, if a single-rate cost-allocation method is used, what amount of cost will be allocated to the Lamp Division? To the Flashlight Division? Assume actual usage is used to allocate operating costs.

c. If a dual-rate cost-allocation method is used, what amount of operating costs will be budgeted for the Lamp Division each month? For the Flashlight Division each month?

d. For the month of June, if a dual-rate cost-allocation method is used, what amount of cost will be allocated to the Lamp Division? To the Flashlight Division? Assume budgeted usage is used to allocate fixed operating costs and actual usage is used to allocate variable operating costs.

Budgeted costs of the operating the plant

for 10,000 to 20,000 hours:

Budgeted long-run usage per year:

Budgeted long-run usage per year: Assume that practical capacity is used to calculate the allocation rates. Further assume that actual usage of the Lamp Division was 700 hours and the Flashlight Division was 400 hours for the month of June.

Assume that practical capacity is used to calculate the allocation rates. Further assume that actual usage of the Lamp Division was 700 hours and the Flashlight Division was 400 hours for the month of June.Required:

a. If a single-rate cost-allocation method is used, what amount of operating costs will be budgeted for the Lamp Division each month? For the Flashlight Division each month?

b. For the month of June, if a single-rate cost-allocation method is used, what amount of cost will be allocated to the Lamp Division? To the Flashlight Division? Assume actual usage is used to allocate operating costs.

c. If a dual-rate cost-allocation method is used, what amount of operating costs will be budgeted for the Lamp Division each month? For the Flashlight Division each month?

d. For the month of June, if a dual-rate cost-allocation method is used, what amount of cost will be allocated to the Lamp Division? To the Flashlight Division? Assume budgeted usage is used to allocate fixed operating costs and actual usage is used to allocate variable operating costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

34

When budgeted cost-allocations rates are used:

A)variations in actual usage by one division affect the costs allocated to other divisions

B)the manager of the supplier division bears the risk of unfavorable cost variances

C)user divisions pay for costs that exceed budgeted amounts

D)user divisions pay for inefficiencies of the supplier department

A)variations in actual usage by one division affect the costs allocated to other divisions

B)the manager of the supplier division bears the risk of unfavorable cost variances

C)user divisions pay for costs that exceed budgeted amounts

D)user divisions pay for inefficiencies of the supplier department

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

35

When budgeted cost-allocation rates are used, variations in actual usage by one division affect the costs allocated to other divisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

36

An advantage of the single-rate method is that it is easier and always the most accurate cost-allocation choice.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

37

Using the single-rate method transforms the fixed costs per hour into a variable cost to users of that facility.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

38

The dual cost-allocation method classifies costs into two pools, a budgeted cost pool and an actual cost pool.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

39

The practical capacity method of allocating costs is:

A)based on the budgeted capacity demanded.

B)based on actual capacity used.

C)based on the practical capacity supplied.

D)based on the using departments negotiating the charges they will accept.

A)based on the budgeted capacity demanded.

B)based on actual capacity used.

C)based on the practical capacity supplied.

D)based on the using departments negotiating the charges they will accept.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

40

The dual-rate cost-allocation method provides better information for decision making than the single-rate method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

41

Jonathan has managed a downtown store in a major metropolitan city for several years. The firm has ten stores in varying locations. In the past, senior management noticed Jonathan's work and he has received very good annual evaluations for his management of the store.

This year his store has generated steady growth in sales, but earnings have been deteriorating. After examining the monthly performance report generated by the company budgeting department, he noticed that increasing fixed costs is causing the decrease in earnings.

Administrative corporate costs, primarily fixed costs, are allocated to individual stores each month based on actual sales for that month. Two of these stores are currently growing at a rapid pace, while four other stores are having operating difficulties.

Required:

From the information presented, what do you think is the cause of Jonathan's reported decrease in earnings? How can this be corrected?

This year his store has generated steady growth in sales, but earnings have been deteriorating. After examining the monthly performance report generated by the company budgeting department, he noticed that increasing fixed costs is causing the decrease in earnings.

Administrative corporate costs, primarily fixed costs, are allocated to individual stores each month based on actual sales for that month. Two of these stores are currently growing at a rapid pace, while four other stores are having operating difficulties.

Required:

From the information presented, what do you think is the cause of Jonathan's reported decrease in earnings? How can this be corrected?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

42

Answer the following questions using the information below:

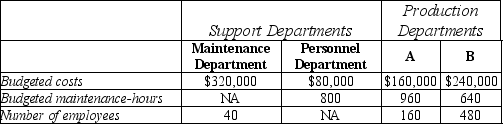

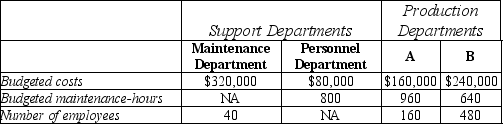

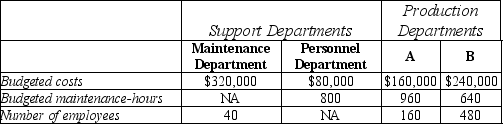

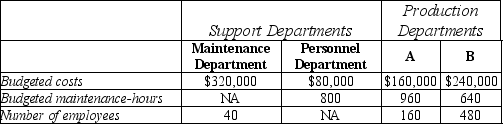

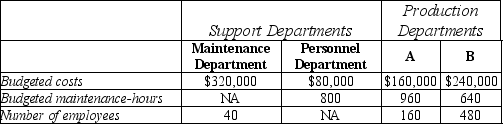

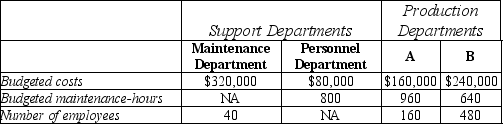

Jake's Battery Company has two service departments, Maintenance and Personnel. Maintenance Department costs of $320,000 are allocated on the basis of budgeted maintenance-hours. Personnel Department costs of $80,000 are allocated based on the number of employees. The costs of operating departments A and B are $160,000 and $240,000, respectively. Data on budgeted maintenance-hours and number of employees are as follows:

Using the step-down method, what amount of Maintenance Department cost will be allocated to Department B if the service department with the highest percentage of interdepartmental support service is allocated first? (Round up)

A)$64,000

B)$85,333

C)$114,667

D)$128,000

Jake's Battery Company has two service departments, Maintenance and Personnel. Maintenance Department costs of $320,000 are allocated on the basis of budgeted maintenance-hours. Personnel Department costs of $80,000 are allocated based on the number of employees. The costs of operating departments A and B are $160,000 and $240,000, respectively. Data on budgeted maintenance-hours and number of employees are as follows:

Using the step-down method, what amount of Maintenance Department cost will be allocated to Department B if the service department with the highest percentage of interdepartmental support service is allocated first? (Round up)

A)$64,000

B)$85,333

C)$114,667

D)$128,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

43

The step-down allocation method:

A)typically begins with the support department that provides the highest percentage of its total services to other support departments

B)recognizes the total amount of services that support departments provide to each other

C)allocates complete reciprocated costs

D)offers key input for outsourcing decisions

A)typically begins with the support department that provides the highest percentage of its total services to other support departments

B)recognizes the total amount of services that support departments provide to each other

C)allocates complete reciprocated costs

D)offers key input for outsourcing decisions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

44

The most common method to allocate support department costs is to employ actual rates based on the costs realized during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following departments is NOT a support department for a boat manufacturing company?

A)Personnel

B)Molding and assembly

C)Data processing

D)Accounting

A)Personnel

B)Molding and assembly

C)Data processing

D)Accounting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

46

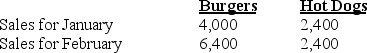

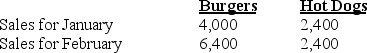

Blaster Drive-In is a fast-food restaurant that sells burgers and hot dogs in a 1950s environment. The fixed operating costs of the company are $5,000 per month. The controlling shareholder, interested in product profitability and pricing, wants all costs allocated to either the burgers or the hot dogs. The following information is provided for the operations of the company:

Required:

Required:

a. What amount of fixed operating costs is assigned to the burgers and hot dogs when actual sales are used as the allocation base for January? For February?

b. Hot dog sales for January and February remained constant. Did the amount of fixed operating costs allocated to hot dogs also remain constant for January and February? Explain why or why not. Comment on any other observations.

Required:

Required:a. What amount of fixed operating costs is assigned to the burgers and hot dogs when actual sales are used as the allocation base for January? For February?

b. Hot dog sales for January and February remained constant. Did the amount of fixed operating costs allocated to hot dogs also remain constant for January and February? Explain why or why not. Comment on any other observations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

47

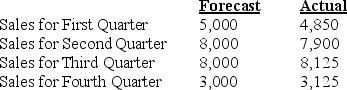

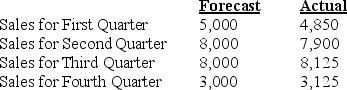

Marvelous Motors is a small motor supply outlet that sells motors to companies that make various small motorized appliances. The fixed operating costs of the company are $300,000 per year. The controlling shareholder, interested in product profitability and pricing, wants all costs allocated to the motors and wants to review the company status on a quarterly basis. The shareholder is trying to determine whether the costs should be allocated each quarter based on the 25% of the annual fixed operating costs ($75,000)or by using an annual forecast budget to allocate the costs. The following information is provided for the operations of the company:

Required:

Required:

a. What amount of fixed operating costs are assigned to each motor by quarter when actual sales are used as the allocation base and $75,000 is allocated?

b. How much fixed cost is recovered each quarter under requirement a.?

c. What amount of fixed operating costs are assigned to each motor by quarter when forecast sales are used as the allocation base and the rate is calculated annually as part of the budgetary process?

d. How much fixed cost is recovered each quarter under requirement c.?

e. Which method seems more appropriate in this case? Explain.

Required:

Required:a. What amount of fixed operating costs are assigned to each motor by quarter when actual sales are used as the allocation base and $75,000 is allocated?

b. How much fixed cost is recovered each quarter under requirement a.?

c. What amount of fixed operating costs are assigned to each motor by quarter when forecast sales are used as the allocation base and the rate is calculated annually as part of the budgetary process?

d. How much fixed cost is recovered each quarter under requirement c.?

e. Which method seems more appropriate in this case? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

48

Complete reciprocated costs:

A)are less than the support department's own costs

B)include the support department's costs plus any interdepartmental cost allocations

C)are used for step-down allocations

D)are also referred to as budgeted costs

A)are less than the support department's own costs

B)include the support department's costs plus any interdepartmental cost allocations

C)are used for step-down allocations

D)are also referred to as budgeted costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

49

The method that allocates costs by explicitly including all the services rendered among all support departments is the:

A)direct method

B)step-down method

C)reciprocal method

D)sequential method

A)direct method

B)step-down method

C)reciprocal method

D)sequential method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

50

Special cost-allocation problems arise when:

A)support department costs exceed budgetary estimates

B)practical capacity is used as the allocation base

C)support departments provide reciprocal services to other support departments

D)there is more than one operating department

A)support department costs exceed budgetary estimates

B)practical capacity is used as the allocation base

C)support departments provide reciprocal services to other support departments

D)there is more than one operating department

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

51

The support department allocation method that is the most widely used because of its simplicity is the:

A)step-down method

B)reciprocal allocation method

C)direct allocation method

D)sequential allocation method

A)step-down method

B)reciprocal allocation method

C)direct allocation method

D)sequential allocation method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

52

The reciprocal allocation method:

A)is the most widely used because of its simplicity

B)requires the ranking of support departments in the order that the allocation is to proceed

C)is conceptually the most precise

D)results in allocating more support costs to operating departments than actually incurred

A)is the most widely used because of its simplicity

B)requires the ranking of support departments in the order that the allocation is to proceed

C)is conceptually the most precise

D)results in allocating more support costs to operating departments than actually incurred

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

53

Answer the following questions using the information below:

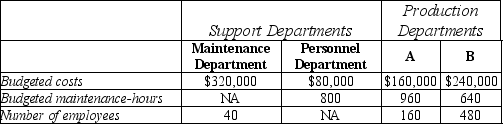

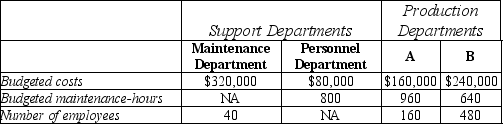

Jake's Battery Company has two service departments, Maintenance and Personnel. Maintenance Department costs of $320,000 are allocated on the basis of budgeted maintenance-hours. Personnel Department costs of $80,000 are allocated based on the number of employees. The costs of operating departments A and B are $160,000 and $240,000, respectively. Data on budgeted maintenance-hours and number of employees are as follows:

Using the direct method, what amount of Maintenance Department costs will be allocated to Department A?

A)$96,000

B)$128,000

C)$166,000

D)$192,000

Jake's Battery Company has two service departments, Maintenance and Personnel. Maintenance Department costs of $320,000 are allocated on the basis of budgeted maintenance-hours. Personnel Department costs of $80,000 are allocated based on the number of employees. The costs of operating departments A and B are $160,000 and $240,000, respectively. Data on budgeted maintenance-hours and number of employees are as follows:

Using the direct method, what amount of Maintenance Department costs will be allocated to Department A?

A)$96,000

B)$128,000

C)$166,000

D)$192,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

54

Under which allocation method are one-way reciprocal support services recognized?

A)direct method

B)artificial cost method

C)reciprocal method

D)step-down method

A)direct method

B)artificial cost method

C)reciprocal method

D)step-down method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

55

Answer the following questions using the information below:

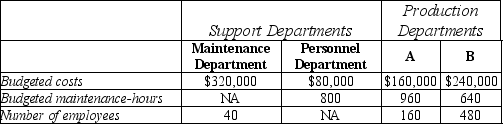

Jake's Battery Company has two service departments, Maintenance and Personnel. Maintenance Department costs of $320,000 are allocated on the basis of budgeted maintenance-hours. Personnel Department costs of $80,000 are allocated based on the number of employees. The costs of operating departments A and B are $160,000 and $240,000, respectively. Data on budgeted maintenance-hours and number of employees are as follows:

Using the direct method, what amount of Maintenance Department costs will be allocated to Department B?

A)$96,000

B)$128,000

C)$156,000

D)$192,000

Jake's Battery Company has two service departments, Maintenance and Personnel. Maintenance Department costs of $320,000 are allocated on the basis of budgeted maintenance-hours. Personnel Department costs of $80,000 are allocated based on the number of employees. The costs of operating departments A and B are $160,000 and $240,000, respectively. Data on budgeted maintenance-hours and number of employees are as follows:

Using the direct method, what amount of Maintenance Department costs will be allocated to Department B?

A)$96,000

B)$128,000

C)$156,000

D)$192,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

56

The only choices that a firm has for support department cost allocation rates are to use either a budgeted rate or an actual rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

57

Why do organizations use budgeted rates instead of actual rates to allocate the costs of support departments to each other and to user departments and divisions? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

58

The direct allocation method:

A)partially recognizes the services provided among support departments

B)is also referred to as the sequential method

C)is conceptually the most precise method

D)results in allocating only the support costs used by operating departments

A)partially recognizes the services provided among support departments

B)is also referred to as the sequential method

C)is conceptually the most precise method

D)results in allocating only the support costs used by operating departments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

59

Answer the following questions using the information below:

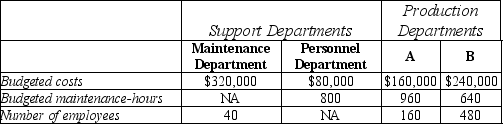

Jake's Battery Company has two service departments, Maintenance and Personnel. Maintenance Department costs of $320,000 are allocated on the basis of budgeted maintenance-hours. Personnel Department costs of $80,000 are allocated based on the number of employees. The costs of operating departments A and B are $160,000 and $240,000, respectively. Data on budgeted maintenance-hours and number of employees are as follows:

Using the direct method, what amount of Personnel Department costs will be allocated to Department B?

A)$20,000

B)$32,000

C)$48,000

D)$60,000

Jake's Battery Company has two service departments, Maintenance and Personnel. Maintenance Department costs of $320,000 are allocated on the basis of budgeted maintenance-hours. Personnel Department costs of $80,000 are allocated based on the number of employees. The costs of operating departments A and B are $160,000 and $240,000, respectively. Data on budgeted maintenance-hours and number of employees are as follows:

Using the direct method, what amount of Personnel Department costs will be allocated to Department B?

A)$20,000

B)$32,000

C)$48,000

D)$60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

60

Answer the following questions using the information below:

Jake's Battery Company has two service departments, Maintenance and Personnel. Maintenance Department costs of $320,000 are allocated on the basis of budgeted maintenance-hours. Personnel Department costs of $80,000 are allocated based on the number of employees. The costs of operating departments A and B are $160,000 and $240,000, respectively. Data on budgeted maintenance-hours and number of employees are as follows:

Using the direct method, what amount of Personnel Department costs will be allocated to Department A?

A)$20,000

B)$32,000

C)$48,000

D)$60,000

Jake's Battery Company has two service departments, Maintenance and Personnel. Maintenance Department costs of $320,000 are allocated on the basis of budgeted maintenance-hours. Personnel Department costs of $80,000 are allocated based on the number of employees. The costs of operating departments A and B are $160,000 and $240,000, respectively. Data on budgeted maintenance-hours and number of employees are as follows:

Using the direct method, what amount of Personnel Department costs will be allocated to Department A?

A)$20,000

B)$32,000

C)$48,000

D)$60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

61

Answer the following questions using the information below:

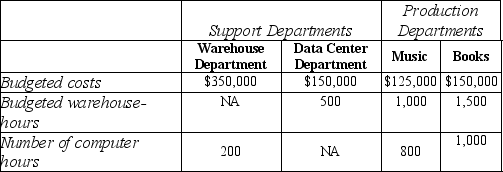

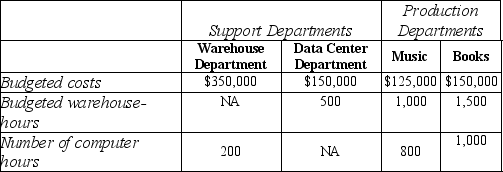

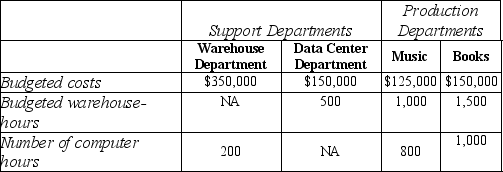

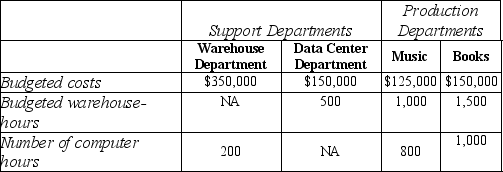

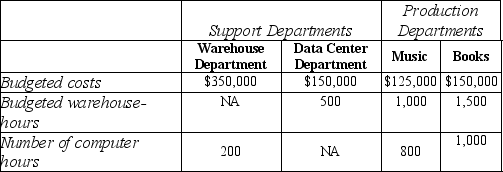

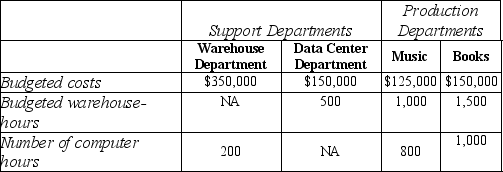

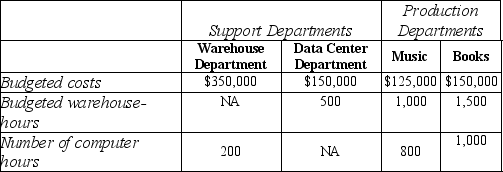

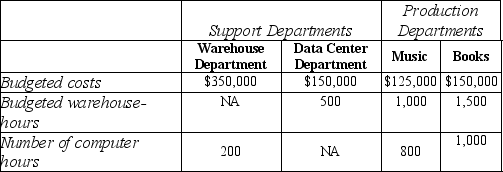

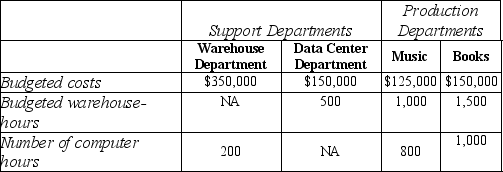

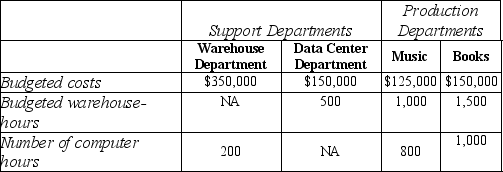

Goldfarb's Book and Music Store has two service departments, Warehouse and Data Center. Warehouse Department costs of $350,000 are allocated on the basis of budgeted warehouse-hours. Data Center Department costs of $150,000 are allocated based on the number of computer log-on hours. The costs of operating departments Music and Books are $250,000 and $300,000, respectively. Data on budgeted warehouse-hours and number of computer log-on hours are as follows:

Using the direct method, what amount of Warehouse Department costs will be allocated to Department Books?

A)$140,000

B)$210,000

C)$150,000

D)$175,000

Goldfarb's Book and Music Store has two service departments, Warehouse and Data Center. Warehouse Department costs of $350,000 are allocated on the basis of budgeted warehouse-hours. Data Center Department costs of $150,000 are allocated based on the number of computer log-on hours. The costs of operating departments Music and Books are $250,000 and $300,000, respectively. Data on budgeted warehouse-hours and number of computer log-on hours are as follows:

Using the direct method, what amount of Warehouse Department costs will be allocated to Department Books?

A)$140,000

B)$210,000

C)$150,000

D)$175,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

62

Answer the following questions using the information below:

Goldfarb's Book and Music Store has two service departments, Warehouse and Data Center. Warehouse Department costs of $350,000 are allocated on the basis of budgeted warehouse-hours. Data Center Department costs of $150,000 are allocated based on the number of computer log-on hours. The costs of operating departments Music and Books are $250,000 and $300,000, respectively. Data on budgeted warehouse-hours and number of computer log-on hours are as follows:

Using the step-down method, what amount of Data Center Department cost will be allocated to Department Music if the service department with the highest percentage of interdepartmental support service is allocated first? (Round up)

A)$117,342

B)$66,667

C)$92,592

D)$83,333

Goldfarb's Book and Music Store has two service departments, Warehouse and Data Center. Warehouse Department costs of $350,000 are allocated on the basis of budgeted warehouse-hours. Data Center Department costs of $150,000 are allocated based on the number of computer log-on hours. The costs of operating departments Music and Books are $250,000 and $300,000, respectively. Data on budgeted warehouse-hours and number of computer log-on hours are as follows:

Using the step-down method, what amount of Data Center Department cost will be allocated to Department Music if the service department with the highest percentage of interdepartmental support service is allocated first? (Round up)

A)$117,342

B)$66,667

C)$92,592

D)$83,333

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

63

Answer the following questions using the information below:

Goldfarb's Book and Music Store has two service departments, Warehouse and Data Center. Warehouse Department costs of $350,000 are allocated on the basis of budgeted warehouse-hours. Data Center Department costs of $150,000 are allocated based on the number of computer log-on hours. The costs of operating departments Music and Books are $250,000 and $300,000, respectively. Data on budgeted warehouse-hours and number of computer log-on hours are as follows:

Using the step-down method, what amount of Data Center Department cost will be allocated to the Warehouse Department if the service department with the highest percentage of interdepartmental support service is allocated first? (Round up)

A)$50,000

B)$150,000

C)$15,000

D)$0

Goldfarb's Book and Music Store has two service departments, Warehouse and Data Center. Warehouse Department costs of $350,000 are allocated on the basis of budgeted warehouse-hours. Data Center Department costs of $150,000 are allocated based on the number of computer log-on hours. The costs of operating departments Music and Books are $250,000 and $300,000, respectively. Data on budgeted warehouse-hours and number of computer log-on hours are as follows:

Using the step-down method, what amount of Data Center Department cost will be allocated to the Warehouse Department if the service department with the highest percentage of interdepartmental support service is allocated first? (Round up)

A)$50,000

B)$150,000

C)$15,000

D)$0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

64

Answer the following questions using the information below:

Goldfarb's Book and Music Store has two service departments, Warehouse and Data Center. Warehouse Department costs of $350,000 are allocated on the basis of budgeted warehouse-hours. Data Center Department costs of $150,000 are allocated based on the number of computer log-on hours. The costs of operating departments Music and Books are $250,000 and $300,000, respectively. Data on budgeted warehouse-hours and number of computer log-on hours are as follows:

Using the direct method, what amount of Data Center Department costs will be allocated to Department Music?

A)$150,000

B)$66,667

C)$83,333

D)$60,000

Goldfarb's Book and Music Store has two service departments, Warehouse and Data Center. Warehouse Department costs of $350,000 are allocated on the basis of budgeted warehouse-hours. Data Center Department costs of $150,000 are allocated based on the number of computer log-on hours. The costs of operating departments Music and Books are $250,000 and $300,000, respectively. Data on budgeted warehouse-hours and number of computer log-on hours are as follows:

Using the direct method, what amount of Data Center Department costs will be allocated to Department Music?

A)$150,000

B)$66,667

C)$83,333

D)$60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

65

Answer the following questions using the information below:

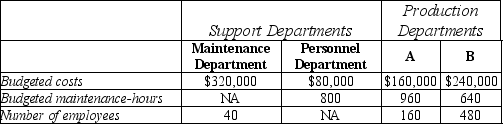

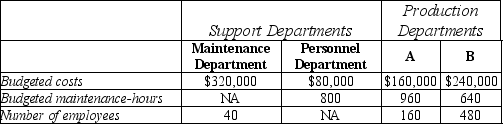

Jake's Battery Company has two service departments, Maintenance and Personnel. Maintenance Department costs of $320,000 are allocated on the basis of budgeted maintenance-hours. Personnel Department costs of $80,000 are allocated based on the number of employees. The costs of operating departments A and B are $160,000 and $240,000, respectively. Data on budgeted maintenance-hours and number of employees are as follows:

Using the step-down method, what amount of Maintenance Department cost will be allocated to Department A if the service department with the highest percentage of interdepartmental support service is allocated first? (Round up)

A)$64,000

B)$85,333

C)$114,667

D)$128,000

Jake's Battery Company has two service departments, Maintenance and Personnel. Maintenance Department costs of $320,000 are allocated on the basis of budgeted maintenance-hours. Personnel Department costs of $80,000 are allocated based on the number of employees. The costs of operating departments A and B are $160,000 and $240,000, respectively. Data on budgeted maintenance-hours and number of employees are as follows:

Using the step-down method, what amount of Maintenance Department cost will be allocated to Department A if the service department with the highest percentage of interdepartmental support service is allocated first? (Round up)

A)$64,000

B)$85,333

C)$114,667

D)$128,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

66

Answer the following questions using the information below:

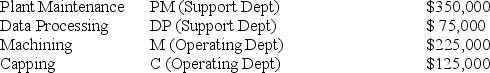

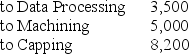

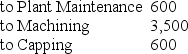

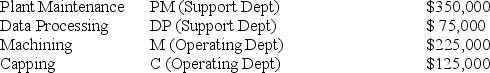

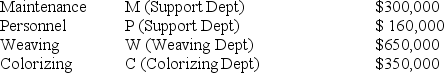

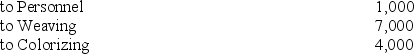

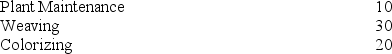

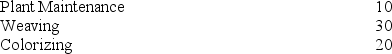

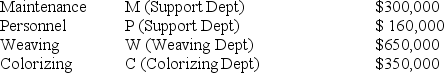

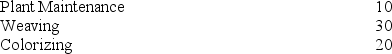

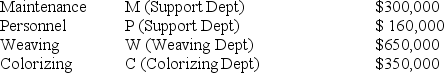

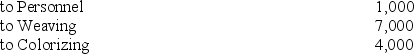

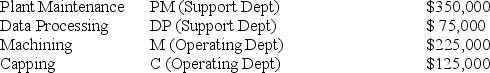

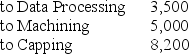

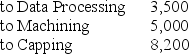

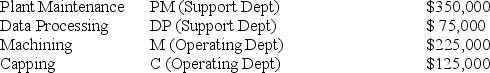

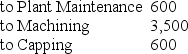

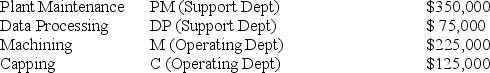

Alfred, owner of Hi-Tech Fiberglass Fabricators, Inc., is interested in using the reciprocal allocation method. The following data from operations were collected for analysis:

Budgeted manufacturing overhead costs:

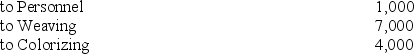

Services furnished:

Services furnished:

By Plant Maintenance (budgeted labor-hours):

By Data Processing (budgeted computer time):

By Data Processing (budgeted computer time):

What is the complete reciprocated cost of the Plant Maintenance Department?

A)$393,750

B)$369,459

C)$365,000

D)$375,773

Alfred, owner of Hi-Tech Fiberglass Fabricators, Inc., is interested in using the reciprocal allocation method. The following data from operations were collected for analysis:

Budgeted manufacturing overhead costs:

Services furnished:

Services furnished:By Plant Maintenance (budgeted labor-hours):

By Data Processing (budgeted computer time):

By Data Processing (budgeted computer time):

What is the complete reciprocated cost of the Plant Maintenance Department?

A)$393,750

B)$369,459

C)$365,000

D)$375,773

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

67

The cost-allocation method that allocates support department costs only to production departments is the:

A)direct method

B)sequential method

C)step-down method

D)reciprocal method

A)direct method

B)sequential method

C)step-down method

D)reciprocal method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

68

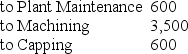

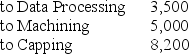

Answer the following questions using the information below:

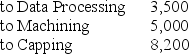

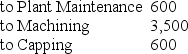

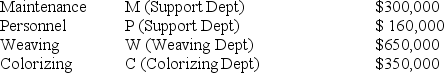

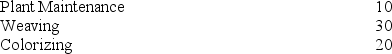

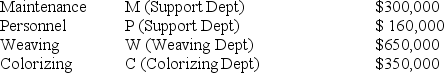

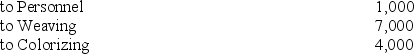

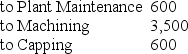

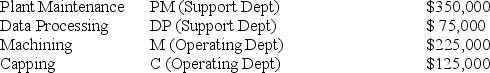

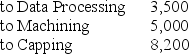

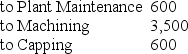

Hugo, owner of Automated Fabric, Inc., is interested in using the reciprocal allocation method. The following data from operations were collected for analysis:

Budgeted manufacturing overhead costs:

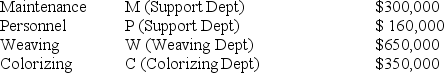

Services furnished:

Services furnished:

By Maintenance (budgeted labor-hours):

By Personnel (Number of employees serviced):

By Personnel (Number of employees serviced):

What is the complete reciprocated cost of the Maintenance Department?

A)$331,267

B)$326,667

C)$300,000

D)$0

Hugo, owner of Automated Fabric, Inc., is interested in using the reciprocal allocation method. The following data from operations were collected for analysis:

Budgeted manufacturing overhead costs:

Services furnished:

Services furnished:By Maintenance (budgeted labor-hours):

By Personnel (Number of employees serviced):

By Personnel (Number of employees serviced):

What is the complete reciprocated cost of the Maintenance Department?

A)$331,267

B)$326,667

C)$300,000

D)$0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck

69

Answer the following questions using the information below:

Goldfarb's Book and Music Store has two service departments, Warehouse and Data Center. Warehouse Department costs of $350,000 are allocated on the basis of budgeted warehouse-hours. Data Center Department costs of $150,000 are allocated based on the number of computer log-on hours. The costs of operating departments Music and Books are $250,000 and $300,000, respectively. Data on budgeted warehouse-hours and number of computer log-on hours are as follows:

Using the step-down method, what amount of Warehouse Department cost will be allocated to Department Music if the service department with the highest percentage of interdepartmental support service is allocated first? (Round up)

A)$233,333

B)$116,667

C)$243,333

D)$121,667

Goldfarb's Book and Music Store has two service departments, Warehouse and Data Center. Warehouse Department costs of $350,000 are allocated on the basis of budgeted warehouse-hours. Data Center Department costs of $150,000 are allocated based on the number of computer log-on hours. The costs of operating departments Music and Books are $250,000 and $300,000, respectively. Data on budgeted warehouse-hours and number of computer log-on hours are as follows:

Using the step-down method, what amount of Warehouse Department cost will be allocated to Department Music if the service department with the highest percentage of interdepartmental support service is allocated first? (Round up)

A)$233,333

B)$116,667

C)$243,333

D)$121,667

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 144 في هذه المجموعة.

فتح الحزمة

k this deck