Deck 3: Cost-Volume-Profit Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/139

العب

ملء الشاشة (f)

Deck 3: Cost-Volume-Profit Analysis

1

Cost-Volume-Profit analysis is useful for

A) helping managers to answer "what-if" questions.

B) implementing a differentiation strategy.

C) eliminating uncertainty about external factors, such as interest rates.

D) for long-range planning.

E) assigning costs to products.

A) helping managers to answer "what-if" questions.

B) implementing a differentiation strategy.

C) eliminating uncertainty about external factors, such as interest rates.

D) for long-range planning.

E) assigning costs to products.

A

2

The contribution margin method can be used to verify a break-even calculation.

True

3

CVP analysis requires the time value of money to be factored into formula when comparing revenues and costs.

False

4

Which of the following are necessary assumptions when using the contribution margin method of determining the break-even point?

A) Average unit costs must be known.

B) There must be an input-related cost driver.

C) Fixed costs are irrelevant.

D) Total variable cost must be known.

E) Unit selling price and unit variable cost must be known.

A) Average unit costs must be known.

B) There must be an input-related cost driver.

C) Fixed costs are irrelevant.

D) Total variable cost must be known.

E) Unit selling price and unit variable cost must be known.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

5

The contribution margin method of CVP analysis uses the equation: break-even units = unit contribution margin/fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

6

Sales total $200,000 when variable costs total $150,000 and fixed costs total $30,000. The break-even point in sales dollars is

A) $200,000.

B) $120,000.

C) $40,000.

D) $30,000.

E) $180,000.

A) $200,000.

B) $120,000.

C) $40,000.

D) $30,000.

E) $180,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

7

Total revenues less total fixed costs equal the contribution margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

8

In the graph method of CVP analysis, the break-even point is the (X-axis) quantity of units sold for which the total revenues line crosses the total costs line.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

9

At the break-even point of 200 units, variable costs total $400 and fixed costs total $600. The 201st unit sold will contribute ________ to profits.

A) $1

B) $2

C) $3

D) $5

E) $6

A) $1

B) $2

C) $3

D) $5

E) $6

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

10

CVP analysis assumes that the behaviour of total costs is non-linear.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

11

The contribution margin is computed by deducting all costs which vary on the basis of an output-related cost driver from revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

12

In CVP analysis, total costs can be separated into a fixed component that does not vary with output and a component that is variable with output level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

13

A profit-volume graph shows the impact on operating income from changes in the output level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

14

The total costs line includes all variable costs and all fixed costs when using the graph method of CVP analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

15

In CVP analysis, an assumption is made that the total revenues are linear with respect to output units, but that total costs are non-linear with respect to output units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

16

Schuppener Company sells its only product for $18 per unit; variable production costs are $6 per unit, and variable selling and administrative costs are $3 per unit; fixed costs for 10,000 units are $10,000. The contribution margin is

A) $12 per unit.

B) $9 per unit.

C) $11 per unit.

D) $8 per unit.

E) $18 per unit.

A) $12 per unit.

B) $9 per unit.

C) $11 per unit.

D) $8 per unit.

E) $18 per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

17

CVP analysis assumes that total costs can be separated into the fixed component and variable component with respect to the level of output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

18

Cost-volume profit is used to analyze

A) the behaviour of some costs and revenues as changes occur in the output level.

B) the behaviour of total costs, total revenues, and operating income as changes occur in the output level.

C) a single revenue driver and multiple cost drivers in special case CVP.

D) multiple revenue drivers and a single cost driver in special case CVP.

E) the behaviour of variable costs at all levels of output.

A) the behaviour of some costs and revenues as changes occur in the output level.

B) the behaviour of total costs, total revenues, and operating income as changes occur in the output level.

C) a single revenue driver and multiple cost drivers in special case CVP.

D) multiple revenue drivers and a single cost driver in special case CVP.

E) the behaviour of variable costs at all levels of output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

19

Variable operating costs and fixed operating costs constitute total operating costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

20

To perform cost-volume-profit analysis, a company must be able to separate costs into fixed and variable components.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

21

Break-even point in units is

A) 2,000 units.

B) 3,000 units.

C) 5,000 units.

D) 7,000 units.

E) 2,797 units.

A) 2,000 units.

B) 3,000 units.

C) 5,000 units.

D) 7,000 units.

E) 2,797 units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

22

Revenues less all costs that vary with respect to an output level is the gross margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

23

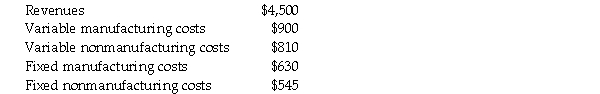

Arthur's Plumbing reported the following:

Required:

Required:

a. Compute contribution margin.

b. Compute contribution margin percentage.

c. Compute gross margin.

d. Compute gross margin percentage.

e. Compute operating income.

Required:

Required:a. Compute contribution margin.

b. Compute contribution margin percentage.

c. Compute gross margin.

d. Compute gross margin percentage.

e. Compute operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

24

The contribution income statement highlights

A) gross margin.

B) products costs and period costs.

C) different product lines.

D) variable and fixed costs.

E) gross margin and net operating income.

A) gross margin.

B) products costs and period costs.

C) different product lines.

D) variable and fixed costs.

E) gross margin and net operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

25

The break-even point in CVP analysis is defined as the point

A) where output units equal input units.

B) where total revenue equals fixed costs.

C) where revenues less variable costs equal operating income.

D) where the unit contribution margin equals the selling price less the unit variable cost.

E) where total revenue equals total costs.

A) where output units equal input units.

B) where total revenue equals fixed costs.

C) where revenues less variable costs equal operating income.

D) where the unit contribution margin equals the selling price less the unit variable cost.

E) where total revenue equals total costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

26

Operating margin is the same as operating revenues in CVP analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following statements about net income (NI) is true?

A) NI = operating income - income taxes

B) NI = operating income + operating costs

C) NI = operating income + non-operating revenues less non-operating costs

D) NI = operating income less Cost of Goods Sold

E) NI = operating revenue less Cost of Goods Sold

A) NI = operating income - income taxes

B) NI = operating income + operating costs

C) NI = operating income + non-operating revenues less non-operating costs

D) NI = operating income less Cost of Goods Sold

E) NI = operating revenue less Cost of Goods Sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

28

If unit sales exceed the break-even point when using the graph method,

A) there is a loss because the total cost line exceeds the total revenue line.

B) total sales exceed total costs.

C) there is a profit because the total cost line exceeds the total revenue line.

D) expenses are extremely high relative to revenues.

E) operating income is negative (an operating loss).

A) there is a loss because the total cost line exceeds the total revenue line.

B) total sales exceed total costs.

C) there is a profit because the total cost line exceeds the total revenue line.

D) expenses are extremely high relative to revenues.

E) operating income is negative (an operating loss).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

29

What is meant by the term break-even point? Why should a manager be concerned about the break-even point?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following is an assumption of CVP analysis?

A) Costs must be separated into separate fixed and variable components.

B) Total revenues and total costs are curvilinear in relation to output units.

C) Given revenue mixed of products is dynamic.

D) There will be a change between beginning and ending levels of inventory.

E) The time value of money must be taken into account.

A) Costs must be separated into separate fixed and variable components.

B) Total revenues and total costs are curvilinear in relation to output units.

C) Given revenue mixed of products is dynamic.

D) There will be a change between beginning and ending levels of inventory.

E) The time value of money must be taken into account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

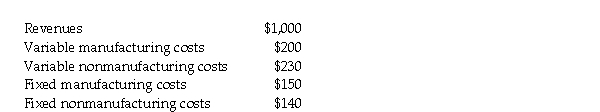

31

Stephanie's Stuffed Animals reported the following:

Required:

Required:

a. Compute contribution margin.

b. Compute gross margin.

c. Compute operating income.

Required:

Required:a. Compute contribution margin.

b. Compute gross margin.

c. Compute operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

32

Gross margin in a merchandising organization is considered to be

A) the same as the contribution margin.

B) all revenues less costs which do not change with respect to an output-related driver.

C) all revenues less cost of goods sold.

D) all revenues plus costs which change with respect to an output-related driver.

E) all revenues.

A) the same as the contribution margin.

B) all revenues less costs which do not change with respect to an output-related driver.

C) all revenues less cost of goods sold.

D) all revenues plus costs which change with respect to an output-related driver.

E) all revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

33

Comparing contribution margin [CM] to gross margin [GM], which of the following is true?

A) If Cost of goods sold includes fixed costs, then CM will exceed GM.

B) If Cost of goods sold does not include any fixed costs, then CM will equal GM.

C) In the merchandising sector, CM and GM are equivalent terms.

D) If CM and GM remain constant from one period to the next, operating income has to remain constant as well.

E) CM is computed after all variable costs are deducted, but GM is computed by deducting only cost of goods sold from revenues.

A) If Cost of goods sold includes fixed costs, then CM will exceed GM.

B) If Cost of goods sold does not include any fixed costs, then CM will equal GM.

C) In the merchandising sector, CM and GM are equivalent terms.

D) If CM and GM remain constant from one period to the next, operating income has to remain constant as well.

E) CM is computed after all variable costs are deducted, but GM is computed by deducting only cost of goods sold from revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

34

Operating income is equal to net income plus income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

35

Operating costs include

A) interest costs.

B) income taxes.

C) only operating expenses.

D) operating expenses but not cost of goods sold.

E) operating expenses and cost of goods sold.

A) interest costs.

B) income taxes.

C) only operating expenses.

D) operating expenses but not cost of goods sold.

E) operating expenses and cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

36

Explain when a manager would use cost-volume-profit analysis and sensitivity analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following statements about contribution margin and gross margin in CVP analysis is true?

A) Contribution margin equals total revenue minus cost of goods sold.

B) Contribution margin equals total revenue minus non-variable costs.

C) Gross margin equals total revenue minus cost of goods sold.

D) Service companies can compute a gross margin but not a contribution margin.

E) Gross margin equals total revenue minus non-variable costs.

A) Contribution margin equals total revenue minus cost of goods sold.

B) Contribution margin equals total revenue minus non-variable costs.

C) Gross margin equals total revenue minus cost of goods sold.

D) Service companies can compute a gross margin but not a contribution margin.

E) Gross margin equals total revenue minus non-variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

38

The number of units that must be sold to achieve $60,000 of operating income is

A) 10,000 units.

B) 11,666 units.

C) 15,000 units.

D) 18,000 units.

E) 12,000 units.

A) 10,000 units.

B) 11,666 units.

C) 15,000 units.

D) 18,000 units.

E) 12,000 units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

39

Contribution margin per unit is

A) $4.00

B) $4.29

C) $6.00

D) $10.00

E) $5.71

A) $4.00

B) $4.29

C) $6.00

D) $10.00

E) $5.71

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

40

If sales increase by $25,000, operating income will increase by

A) $10,000.

B) $15,000.

C) $22,200.

D) $12,500.

E) $8,000.

A) $10,000.

B) $15,000.

C) $22,200.

D) $12,500.

E) $8,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

41

What would his break-even point be assuming Brian incurred $31,200 in fixed expenses?

A) 312 packages

B) 232 packages

C) 125 packages

D) 110 packages

E) 100 packages

A) 312 packages

B) 232 packages

C) 125 packages

D) 110 packages

E) 100 packages

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following statements about using the equation method to determine the break-even point is true?

A) Operating income in the equation is set equal to the target income for the year.

B) Operating income in the equation assumes that fixed costs are nil.

C) Revenue in the equation includes only operating revenues plus fixed costs.

D) The number of units required to reach the break-even point tends to be higher (as it incorporates total costs) using this method than when using the Contribution Margin method.

E) Operating income in the equation is set equal to nil.

A) Operating income in the equation is set equal to the target income for the year.

B) Operating income in the equation assumes that fixed costs are nil.

C) Revenue in the equation includes only operating revenues plus fixed costs.

D) The number of units required to reach the break-even point tends to be higher (as it incorporates total costs) using this method than when using the Contribution Margin method.

E) Operating income in the equation is set equal to nil.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

43

What is the contribution margin per case?

A) $100.00

B) $60.00

C) $40.00

D) $15.00

E) $10.00

A) $100.00

B) $60.00

C) $40.00

D) $15.00

E) $10.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

44

What is the Bridal Shoppe's operating income when 200 dresses are sold?

A) $120,000

B) $80,000

C) $200,000

D) $100,000

E) $30,000

A) $120,000

B) $80,000

C) $200,000

D) $100,000

E) $30,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

45

How many units would have to be sold to yield a target operating income of $22,000, assuming variable costs are $15 per unit, total fixed costs are $2,000, and the unit selling price is $20?

A) 4,800 units

B) 4,400 units

C) 4,000 units

D) 3,600 units

E) 1,600 units

A) 4,800 units

B) 4,400 units

C) 4,000 units

D) 3,600 units

E) 1,600 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

46

What is the break-even point in units for a product line, assuming a unit selling price of $200, total fixed costs are $4,000, unit variable costs are $40, and target operating income is $16,000,000?

A) 25 units

B) 75 units

C) 100 units

D) 125 units

E) 100,000 units

A) 25 units

B) 75 units

C) 100 units

D) 125 units

E) 100,000 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

47

When making net income evaluations, CVP calculations for target income must be stated in terms of target operating income instead of target net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

48

An increase in the tax rate will increase the break-even point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

49

Berhannan's Cellular sells phones for $100. The unit variable cost per phone is $50 plus a selling commission of 10%. Fixed manufacturing costs total $1,250 per month, while fixed selling and administrative costs total $2,500.

Required:

a. What is the contribution margin per phone?

b. What is the break-even point in phones?

c. How many phones must be sold to earn pretax income of $7,500?

Required:

a. What is the contribution margin per phone?

b. What is the break-even point in phones?

c. How many phones must be sold to earn pretax income of $7,500?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

50

How many dresses must the Bridal Shoppe sell to yield after-tax net income of $18,000, assuming the tax rate is 40%?

A) 180 dresses

B) 170 dresses

C) 150 dresses

D) 200 dresses

E) 270 dresses

A) 180 dresses

B) 170 dresses

C) 150 dresses

D) 200 dresses

E) 270 dresses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following formulae is correct when using the contribution margin method to determine the break-even point?

A) Revenues less operating income equal variable costs plus fixed costs.

B) Unit contribution margin times unit variable cost equals the break-even number of units.

C) Unit contribution margin times the break-even number of units equals total variable costs.

D) Selling price less unit contribution margin equals unit fixed cost for all values below or at the break-even number of units.

E) Unit contribution margin times the break-even number of units equals fixed costs.

A) Revenues less operating income equal variable costs plus fixed costs.

B) Unit contribution margin times unit variable cost equals the break-even number of units.

C) Unit contribution margin times the break-even number of units equals total variable costs.

D) Selling price less unit contribution margin equals unit fixed cost for all values below or at the break-even number of units.

E) Unit contribution margin times the break-even number of units equals fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

52

How many units will he need to sell in order to break-even assuming Brian incurred $10,000 in expenses to advertise the sale, and there are no other expenses?

A) 20 packages

B) 25 packages

C) 75 packages

D) 100 packages

E) 125 packages

A) 20 packages

B) 25 packages

C) 75 packages

D) 100 packages

E) 125 packages

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

53

Target net income is computed by multiplying operating income by one minus the entity's tax rate, or by multiplying operating income by the tax rate, and subtracting that amount from operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

54

Determining the number of units that must be produced in order to generate enough profit to cover total fixed costs is one reason for using a break-even analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

55

What is the break-even point in units, assuming a product's selling price is $100, fixed costs are $8,000, unit variable costs are $20, and operating income is $32,000?

A) 100 units

B) 300 units

C) 400 units

D) 500 units

E) 600 units

A) 100 units

B) 300 units

C) 400 units

D) 500 units

E) 600 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

56

How many units would have to be sold to yield a target income of $11,000 assuming variable costs are $30 per unit, total fixed costs are $1,000, and the unit selling price is $40?

A) 1,200 units

B) 1,100 units

C) 1,000 units

D) 900 units

E) 300 units

A) 1,200 units

B) 1,100 units

C) 1,000 units

D) 900 units

E) 300 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

57

What is the break-even point in cases?

A) 6 cases

B) 10 cases

C) 15 cases

D) 20 cases

E) 100 cases

A) 6 cases

B) 10 cases

C) 15 cases

D) 20 cases

E) 100 cases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

58

What would target operating income be when fixed costs equal $6,000, unit contribution margin equals $40.00, and the number of units equals 400?

A) $6,000

B) $10,000

C) $16,000

D) $20,000

E) $60,000

A) $6,000

B) $10,000

C) $16,000

D) $20,000

E) $60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

59

If planned net income is $21,000 and the tax rate is 30%, then planned operating income would be $27,300.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

60

How many dresses are sold when operating income is zero?

A) 225 dresses

B) 150 dresses

C) 100 dresses

D) 90 dresses

E) 60 dresses

A) 225 dresses

B) 150 dresses

C) 100 dresses

D) 90 dresses

E) 60 dresses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

61

An expected value is the weighted-average of the outcomes based on the percentage combinations of the incomes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

62

Heady Company sells headbands to retailers for $5. The variable cost of goods sold per headband is $1, with a selling commission of 10 percent of sales. Fixed manufacturing costs total $25,000 per month, while fixed selling and administrative costs total $10,500. The income tax rate for Heady Company is 30 percent.

Required:

a. What is the break-even point in headbands?

b. What are target sales in headbands to generate a before tax income of $3,000?

c. What are target sales in headbands to generate an after tax income of $3,080?

d. What is net income assuming Heady sells total 15,000 headbands?

Required:

a. What is the break-even point in headbands?

b. What are target sales in headbands to generate a before tax income of $3,000?

c. What are target sales in headbands to generate an after tax income of $3,080?

d. What is net income assuming Heady sells total 15,000 headbands?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following statements about sensitivity analysis is true?

A) It is a technique which is used to examine past results.

B) It can be used in CVP to show changes in operating income if variable costs per unit change.

C) It examines the relationship between production and service departments.

D) It shows the impact of a manager's behaviour.

E) It is relevant for isolating conversion costs.

A) It is a technique which is used to examine past results.

B) It can be used in CVP to show changes in operating income if variable costs per unit change.

C) It examines the relationship between production and service departments.

D) It shows the impact of a manager's behaviour.

E) It is relevant for isolating conversion costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

64

Sensitivity analysis is a "what-if" technique that managers use to examine how a result will change if the originally predicted data are not achieved or if an underlying assumption changes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

65

Widget Company sells widgets for $20.00 each. The manufacturing costs, all variable, are $6 each. The company is planning on renting an exhibition booth ,for both display and selling purposes, at the annual candy convention. The company's sales manager will earn a vacation bonus if she can earn a target net income of $150,000, for the sales operation at the convention. The convention organizers provide the advertising and guarantee a certain level of traffic, in exchange for 15% of the net income. The 15% surcharge operates like a tax on net income. The company absorbs all of the fixed costs of production for the sales made at the convention.

How many widgets does the sales manager have to sell to earn the vacation bonus?

How many widgets does the sales manager have to sell to earn the vacation bonus?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

66

Companies with a greater proportion of fixed costs have a greater risk of loss from changes in demand than companies with a greater proportion of variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

67

Margin of safety measures the difference between budgeted revenues and break-even revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

68

The Holiday Card Company, a producer of specialty cards, has asked you to complete several

calculations based upon the following information:

Required:

Required:

a. What is the break-even point in cards?

b. What sales volume is needed to earn an after-tax net income of $13,028.40?

c. How many cards must be sold to earn an after-tax net income of $18,480?

calculations based upon the following information:

Required:

Required:a. What is the break-even point in cards?

b. What sales volume is needed to earn an after-tax net income of $13,028.40?

c. How many cards must be sold to earn an after-tax net income of $18,480?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

69

The degree of operating leverage at a specific level of sales helps the managers calculate the effect that potential changes in sales will have on operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

70

Better Battery has been in the battery renewal business for four years. It rents a building but owns all of its equipment. All employees are paid a fixed salary except for the busy season (April - June), when temporary help is hired by the hour. Utilities and other operating charges remain fairly constant during each month, except those in the busy season.

Selling prices per battery average $100, except during the busy season. Because a large number of customers buy batteries prior to winter, discounts run above average during the busy season. A 15 percent discount is given when two batteries are purchased at one time. During the busy months selling prices per battery average $90.

The president of Better Battery is somewhat displeased with the company's management accounting system because the cost behaviour pattern displayed by the monthly break-even charts are inconsistent; the busy months' charts are different from the other months of the year. The president is never sure if the company has a satisfactory margin of safety or if it is just above the break-even point.

Required:

a. What is wrong with the accountant's computations?

b. How can the information be presented in a better format for the president?

Selling prices per battery average $100, except during the busy season. Because a large number of customers buy batteries prior to winter, discounts run above average during the busy season. A 15 percent discount is given when two batteries are purchased at one time. During the busy months selling prices per battery average $90.

The president of Better Battery is somewhat displeased with the company's management accounting system because the cost behaviour pattern displayed by the monthly break-even charts are inconsistent; the busy months' charts are different from the other months of the year. The president is never sure if the company has a satisfactory margin of safety or if it is just above the break-even point.

Required:

a. What is wrong with the accountant's computations?

b. How can the information be presented in a better format for the president?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

71

"Uncertainty" may be defined as

A) the possibility that an actual amount will be the same as an expected amount.

B) the possibility that an actual amount will be either higher or lower than the expected amount.

C) the possibility that a budgeted amount will be the same as an estimated amount.

D) the possibility that the budgeted amount will be lower than the estimated amount.

E) the possibility that the budgeted amount will be either higher or lower than the expected amount.

A) the possibility that an actual amount will be the same as an expected amount.

B) the possibility that an actual amount will be either higher or lower than the expected amount.

C) the possibility that a budgeted amount will be the same as an estimated amount.

D) the possibility that the budgeted amount will be lower than the estimated amount.

E) the possibility that the budgeted amount will be either higher or lower than the expected amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

72

Information Inc., sells accounting software. Each unit's cost may be separated as follows: selling price of $100 and variable costs of $30. Fixed costs are $10,000. What is Information Inc.'s operating income assuming 1,000 units are sold?

A) $100,000

B) $90,000

C) $60,000

D) $40,000

E) $20,000

A) $100,000

B) $90,000

C) $60,000

D) $40,000

E) $20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

73

If the tax rate is t, it is possible to calculate planned operating income by

A) dividing net operating income by t.

B) dividing net operating income by 1 - t.

C) multiplying net operating income by t.

D) multiplying net operating income by 1 - t.

E) dividing net operating income by t - 1.

A) dividing net operating income by t.

B) dividing net operating income by 1 - t.

C) multiplying net operating income by t.

D) multiplying net operating income by 1 - t.

E) dividing net operating income by t - 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

74

Gates Rubber Company sells cases of hydraulic hoses for $80. The unit variable costs per case are $40 plus a selling commission of 10 percent of sales. Fixed manufacturing costs total $1,000 per month, while fixed selling and administrative costs total $2,000.

Required:

a. What is the contribution margin per case?

b. What is the break-even point in cases?

c. How many cases must be sold to earn pretax income of $6,000?

Required:

a. What is the contribution margin per case?

b. What is the break-even point in cases?

c. How many cases must be sold to earn pretax income of $6,000?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

75

Ben's Custom Golf sells special clubs. Ben is able to purchase equipment from a manufacturing company for $100 each. The equipment is sold for $150 each.

Required:

a. What is the break-even in units assuming Ben incurred $2,500 in selling expenses, and there were no other expenses?

b. What would be the break-even in units assuming Ben incurred $2,500 in selling expenses and had $10,000 in other fixed expenses?

Required:

a. What is the break-even in units assuming Ben incurred $2,500 in selling expenses, and there were no other expenses?

b. What would be the break-even in units assuming Ben incurred $2,500 in selling expenses and had $10,000 in other fixed expenses?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

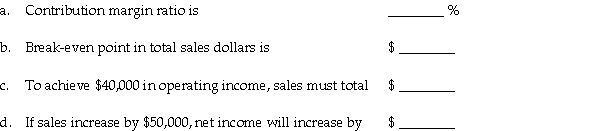

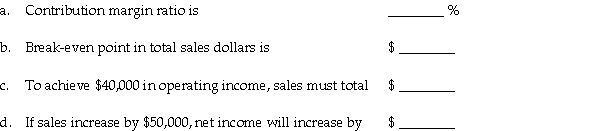

k this deck

76

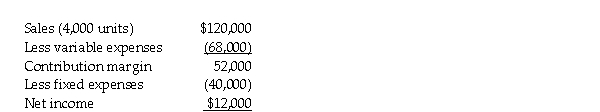

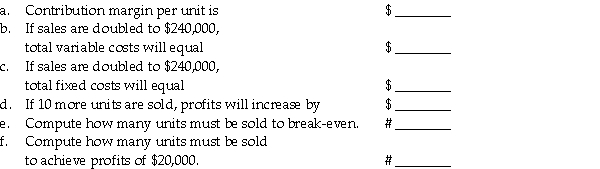

Blankinship, Inc., sells a single product. The company's most recent income statement is given below.

Required:

Required:

Required:

Required:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

77

A probability distribution describes the likelihood of each of the mutually exclusive and collectively exhaustive set of events.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

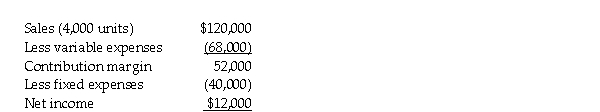

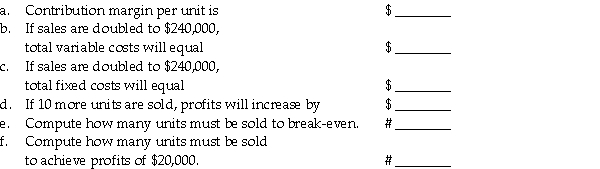

78

Gilley Inc., sells a single product. The company's most recent income statement is given below.

Required:

Required:

Required:

Required:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

79

Sensitivity analysis may be used to determine how a result will change if the original data are changed or if the original results are not achieved.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

80

To determine the effect of income tax on a decision, managers should evaluate

A) target operating income.

B) contribution margin.

C) tax as a variable expense in determining contribution margin.

D) selling price.

E) target net income.

A) target operating income.

B) contribution margin.

C) tax as a variable expense in determining contribution margin.

D) selling price.

E) target net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck