Deck 5: Activity-Based Costing and Management

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/133

العب

ملء الشاشة (f)

Deck 5: Activity-Based Costing and Management

1

Activity-based costing relies heavily on broad averages to assign costs to jobs, products, and services.

False

2

A product that consumes a relatively low level of resources but is reported to have a relatively high cost, may result in

A) increased market share.

B) product marketing.

C) product undercosting.

D) product overcosting.

E) product sub-optimization.

A) increased market share.

B) product marketing.

C) product undercosting.

D) product overcosting.

E) product sub-optimization.

D

3

Which of the following statements is true concerning product costing systems?

A) Companies that undercost products always sell products at a loss.

B) Companies that overcost run the risk of losing customers.

C) Undercosting or overcosting does not relate to product cost cross-subsidization.

D) Peanut butter costing is another term for direct costing.

E) Companies that overcost will make more profit by passing along higher prices to customers.

A) Companies that undercost products always sell products at a loss.

B) Companies that overcost run the risk of losing customers.

C) Undercosting or overcosting does not relate to product cost cross-subsidization.

D) Peanut butter costing is another term for direct costing.

E) Companies that overcost will make more profit by passing along higher prices to customers.

B

4

If a company undercosts one of its products from indirect cost smoothing, then it will overcost at least one of its other products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

5

A critical distinction in activity-based costing is the difference between an activity and an event.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

6

The term used to describe a situation when at least one miscosted product causes other products to be miscosted in the organization is known as

A) cross-subsidization.

B) product marketing.

C) product overcosting.

D) product undercosting.

E) product sub-optimization.

A) cross-subsidization.

B) product marketing.

C) product overcosting.

D) product undercosting.

E) product sub-optimization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

7

A top-selling product might actually result in losses for the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

8

A busy law office has a central administration set up, with the administration work for all lawyers shared by the clerical staff. Clients are billed at the firm's hourly rate by the firm. The arrangement is that whenever there is administration work to be done, it is assigned to whoever is available at the time. One of the lawyers has complained that she hardly ever uses the administration services, and so her year end bonus should be larger than those who require the administration services. Therefore they are considering tracking the administration work done for each lawyer separately so that they know how many hours of administration services is being used by each lawyer. At the end of the year, the bonus of each lawyer would be reduced by a charge reflecting the administration services she/he used in the year. If the firm institutes this new approach, this will mean that

A) there will be no more cross subsidization.

B) there will still be cross-subsidization between lawyers but not between their clients.

C) the new information gathered will enable the firm to be able to reduce its costs.

D) there will still be cross-subsidization between clients but not between lawyers.

E) they will be using a departmental costing system.

A) there will be no more cross subsidization.

B) there will still be cross-subsidization between lawyers but not between their clients.

C) the new information gathered will enable the firm to be able to reduce its costs.

D) there will still be cross-subsidization between clients but not between lawyers.

E) they will be using a departmental costing system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following does not characterize an ABC system, as compared to a traditional costing system?

A) smaller cost pools

B) more cost drivers

C) more homogeneous cost pools

D) focus on activities

E) less expensive to set up and maintain

A) smaller cost pools

B) more cost drivers

C) more homogeneous cost pools

D) focus on activities

E) less expensive to set up and maintain

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

10

Provided a single allocation base is used, jobs are typically overcosted if

A) jobs consume proportionately less of the indirect activity but is reported to have higher cost.

B) jobs require more employees.

C) jobs consume proportionately more of the indirect activity and is reported to have higher cost.

D) jobs consume proportionately more of the indirect activity but is reported to have lower cost.

E) jobs cannot be overcosted; only products or service can be overcosted.

A) jobs consume proportionately less of the indirect activity but is reported to have higher cost.

B) jobs require more employees.

C) jobs consume proportionately more of the indirect activity and is reported to have higher cost.

D) jobs consume proportionately more of the indirect activity but is reported to have lower cost.

E) jobs cannot be overcosted; only products or service can be overcosted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

11

Cost smoothing involves assigning costs in a non uniform manner to reflect the different utilization of resources by different products or services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

12

Using a broad average to allocate costs to products is called

A) activity-based costing.

B) refined costing.

C) cost smoothing.

D) product undercoating.

E) job costing.

A) activity-based costing.

B) refined costing.

C) cost smoothing.

D) product undercoating.

E) job costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

13

Using a broad average to assign costs to products or services may lead to undercosting or overcosting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

14

Activity-based costing is a technique to improve the reliability of cost assignment

A) to work-in-process inventory.

B) from direct cost pools to distinct types of outputs.

C) from both direct and indirect cost pools to distinct types of outputs.

D) to all types of inventory.

E) from indirect cost pools to distinct types of outputs.

A) to work-in-process inventory.

B) from direct cost pools to distinct types of outputs.

C) from both direct and indirect cost pools to distinct types of outputs.

D) to all types of inventory.

E) from indirect cost pools to distinct types of outputs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following is true concerning selecting a cost-allocation base in an ABC system?

A) Cost-allocation bases are not relevant in defining the number of activity pools.

B) All costs can be directly identified with a specific activity.

C) The allocation base chosen may be constrained by the availability of reliable data.

D) Costs may need to be allocated to services first, before the costs of services can be allocated to activities.

E) Output unit-level costs cannot be related to a cost-allocation base.

A) Cost-allocation bases are not relevant in defining the number of activity pools.

B) All costs can be directly identified with a specific activity.

C) The allocation base chosen may be constrained by the availability of reliable data.

D) Costs may need to be allocated to services first, before the costs of services can be allocated to activities.

E) Output unit-level costs cannot be related to a cost-allocation base.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following is a sign that a "smoothing out" costing system exists?

A) Managers rely on data originated by the cost system.

B) The company wins bids they thought had low margins.

C) A batch consumes a relatively high level of input materials and conversion activities and is reported to have a relatively high cost.

D) A batch consumes a relatively low level of input materials and conversion activities and is reported to have a relatively low cost.

E) The company loses bids they thought had low margins.

A) Managers rely on data originated by the cost system.

B) The company wins bids they thought had low margins.

C) A batch consumes a relatively high level of input materials and conversion activities and is reported to have a relatively high cost.

D) A batch consumes a relatively low level of input materials and conversion activities and is reported to have a relatively low cost.

E) The company loses bids they thought had low margins.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

17

Explain how a top-selling product may actually result in losses for the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

18

Traditional cost systems distort product costs because

A) they do not know how to identify the appropriate units.

B) competitive pricing is ignored.

C) they emphasize financial accounting requirements.

D) they apply average support costs to each unit of product.

E) they assign direct costs using direct cost tracing.

A) they do not know how to identify the appropriate units.

B) competitive pricing is ignored.

C) they emphasize financial accounting requirements.

D) they apply average support costs to each unit of product.

E) they assign direct costs using direct cost tracing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

19

The use of a single indirect cost rate is more likely to

A) undercost high volume simple products.

B) undercost low volume complex products.

C) undercost lower priced products.

D) overcost higher priced products.

E) overcost low volume complex products.

A) undercost high volume simple products.

B) undercost low volume complex products.

C) undercost lower priced products.

D) overcost higher priced products.

E) overcost low volume complex products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

20

Uniformly assigning the costs of resources to cost objects when those resources are actually used in a non-uniform way is called

A) activity-based costing.

B) menu-based costing.

C) full product-cost allocation.

D) variable product-cost allocation.

E) cost smoothing or peanut butter costing.

A) activity-based costing.

B) menu-based costing.

C) full product-cost allocation.

D) variable product-cost allocation.

E) cost smoothing or peanut butter costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following is not an activity under an ABC system?

A) designing products

B) engineering

C) setting up equipment

D) distributing products

E) customers

A) designing products

B) engineering

C) setting up equipment

D) distributing products

E) customers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

22

Understanding the hierarchy of costs is critical when allocating costs to products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

23

Batch-level costs are resources sacrificed on activities undertaken to support specific products or services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

24

A costing system which focuses on individual event or tasks as the cost pool to be allocated is called

A) activity-based costing.

B) direct costing.

C) job costing.

D) process costing.

E) normal costing.

A) activity-based costing.

B) direct costing.

C) job costing.

D) process costing.

E) normal costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

25

Using multiple unit-level cost drivers generally constitutes an effective activity-based cost system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

26

Product-sustaining (service-sustaining),and facility-sustaining costs are equivalent terms in ABC systems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following is relevant concerning cost hierarchies?

A) activity levels

B) determining whether costs are variable or fixed

C) costing on the value chain

D) separating inventoriable costs from period costs

E) minimum cost required for a particular process

A) activity levels

B) determining whether costs are variable or fixed

C) costing on the value chain

D) separating inventoriable costs from period costs

E) minimum cost required for a particular process

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

28

Explain how activity-based costing systems can provide more accurate product costs than traditional cost systems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

29

Output unit-level cost is identical to batch-level cost in a system that costs based on activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

30

One of the benefits of an ABC system is that by highlighting different activities, you can ignore the different levels of activities, such as individual units of output versus batches of output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

31

Product-sustaining (service-sustaining) costs are the costs of resources sacrificed on activities undertaken to support specific services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

32

If the cost of an activity increases with each hour of machine time, it is which of the following?

A) market-sustaining cost

B) output unit-level cost

C) batch-level cost

D) product-sustaining (service-sustaining) costs

E) facility-sustaining cost

A) market-sustaining cost

B) output unit-level cost

C) batch-level cost

D) product-sustaining (service-sustaining) costs

E) facility-sustaining cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

33

A cost hierarchy is a categorization of costs into different cost pools on the basis of different classes of cost drivers or different degrees of difficulty in determining cause-and-effect relationships.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

34

Output unit-level costs cannot be determined unless you know how many units are in a given batch.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following is not an activity under an ABC system?

A) an event

B) a task

C) a unit of work

D) a process

E) indirect cost

A) an event

B) a task

C) a unit of work

D) a process

E) indirect cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

36

A four-part cost hierarchy includes

A) market-sustaining costs.

B) research and development costs.

C) manufacturing-level costs.

D) output unit-level costs.

E) period costs.

A) market-sustaining costs.

B) research and development costs.

C) manufacturing-level costs.

D) output unit-level costs.

E) period costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

37

ABC provides a straightforward cost-benefit analysis of the unequally shared benefits of a support activity. The technique also clearly discloses the scope of business functions where cost control will have a positive effect.

Required:

Provide three benefits that the identification of the scope of cost control focused on different activity levels should lead to.

Required:

Provide three benefits that the identification of the scope of cost control focused on different activity levels should lead to.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

38

Unit-level measures can distort product costing because the demand for overhead resources may be driven by batch-level or product-sustaining activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

39

If the cost of an activity increases with the number of purchase orders placed, rather than to the quantity of items purchased, it is which of the following?

A) market-sustaining cost

B) output unit-level cost

C) facility-sustaining cost

D) product-sustaining (service-sustaining) costs

E) batch-level cost

A) market-sustaining cost

B) output unit-level cost

C) facility-sustaining cost

D) product-sustaining (service-sustaining) costs

E) batch-level cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

40

If the cost of an activity increases with the quantity of items purchased, it is which of the following?

A) market-sustaining cost

B) output unit-level cost

C) batch-level cost

D) product-sustaining (service-sustaining) costs

E) facility-sustaining cost

A) market-sustaining cost

B) output unit-level cost

C) batch-level cost

D) product-sustaining (service-sustaining) costs

E) facility-sustaining cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

41

Engineering costs incurred to change product designs are which of the following?

A) market-sustaining costs

B) output unit-level costs

C) batch-level costs

D) product-sustaining (service-sustaining) costs

E) facility-sustaining costs

A) market-sustaining costs

B) output unit-level costs

C) batch-level costs

D) product-sustaining (service-sustaining) costs

E) facility-sustaining costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

42

According to an ABC system, S5 uses a disproportionately

A) smaller amount of unit-level costs.

B) larger amount of unit-level costs.

C) smaller amount of product-sustaining costs.

D) larger amount of batch-level costs.

E) smaller amount of batch-level costs.

A) smaller amount of unit-level costs.

B) larger amount of unit-level costs.

C) smaller amount of product-sustaining costs.

D) larger amount of batch-level costs.

E) smaller amount of batch-level costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

43

Resources sacrificed on activities undertaken to support product lines are which of the following?

A) market-sustaining costs

B) output unit-level costs

C) batch-level costs

D) facility-sustaining costs

E) product-sustaining (service-sustaining) costs

A) market-sustaining costs

B) output unit-level costs

C) batch-level costs

D) facility-sustaining costs

E) product-sustaining (service-sustaining) costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

44

Activity-based cost systems create

A) one large cost pool.

B) homogeneous activity-related cost pools.

C) activity-cost pools with a broad focus.

D) activity-cost pools containing many direct costs.

E) heterogenous activity-related cost pools.

A) one large cost pool.

B) homogeneous activity-related cost pools.

C) activity-cost pools with a broad focus.

D) activity-cost pools containing many direct costs.

E) heterogenous activity-related cost pools.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

45

A refined costing system results in a better measure of the nonuniformity of a company's resources by jobs, products, or services than by using broad averages to assign costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

46

Resources sacrificed on activities that cannot be traced to individual products or services, but which support the organization as a whole are which of the following?

A) output unit-level costs

B) service-sustaining costs

C) batch-level costs

D) product-sustaining costs

E) facility-sustaining costs

A) output unit-level costs

B) service-sustaining costs

C) batch-level costs

D) product-sustaining costs

E) facility-sustaining costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following is not a characterization of activity-based costing?

A) identification of only variable costs

B) a focus on both operating and strategic decisions

C) identifying all resources used by activities regardless of how individual costs behave in the short run

D) using the cost hierarchy to allocate costs to products

E) identification of all costs used by activities

A) identification of only variable costs

B) a focus on both operating and strategic decisions

C) identifying all resources used by activities regardless of how individual costs behave in the short run

D) using the cost hierarchy to allocate costs to products

E) identification of all costs used by activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

48

Explain how traditional cost systems, using a single unit-level cost rate, may distort product costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

49

Brewery Company operates many bottling plants around the globe. At its Montreal plant, where six different brands are bottled, the following costs were incurred in 2012 to produce 10,000,000 bottles of beer:

1. Development costs of adding the new product "Light Beer Plus" amounted to $307,000.

2. Material handling costs of inspecting and handling concentrate, bottles, packages, and so forth amounted to $216,750.These costs are allocated to each production run.

3. Incoming materials purchase costs that can be directly traced to individual products being bottled and packaged. These costs are purely variable with output level and amounted to $1,106,500.

4. Executive salaries and other central administration overhead amounted to $396,000.

5. Plant overhead including costs related to: supervision, safety , energy and plant insurance amounted to $311,500.

6. The cost of cleaning and calibrating equipment for each production run amounted to $85,750.

Required:

a. Classify each of the preceding costs as output unit-level, batch-level, product-sustaining, or facility-sustaining.

b. Compute the cost per unit for the total manufacturing cost.

1. Development costs of adding the new product "Light Beer Plus" amounted to $307,000.

2. Material handling costs of inspecting and handling concentrate, bottles, packages, and so forth amounted to $216,750.These costs are allocated to each production run.

3. Incoming materials purchase costs that can be directly traced to individual products being bottled and packaged. These costs are purely variable with output level and amounted to $1,106,500.

4. Executive salaries and other central administration overhead amounted to $396,000.

5. Plant overhead including costs related to: supervision, safety , energy and plant insurance amounted to $311,500.

6. The cost of cleaning and calibrating equipment for each production run amounted to $85,750.

Required:

a. Classify each of the preceding costs as output unit-level, batch-level, product-sustaining, or facility-sustaining.

b. Compute the cost per unit for the total manufacturing cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

50

With traditional costing systems, products manufactured in small batches and in small annual volumes may be ________ because batch-related and product-sustaining costs are assigned using unit-related drivers.

A) overcosted

B) fairly costed

C) costed the same as in activity-based costing

D) undercosted

E) ignored

A) overcosted

B) fairly costed

C) costed the same as in activity-based costing

D) undercosted

E) ignored

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

51

A refined costing system accounts for indirect cost allocation bases as non-financial variables.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

52

A cost hierarchy describes

A) a technique for direct cost tracing.

B) the process of arranging costs by importance.

C) the logic of segregating costs by value-chain classification.

D) the logic of separating one indirect cost pool into multiple pools according to activity level.

E) a technique of differentiating fixed and variable costs.

A) a technique for direct cost tracing.

B) the process of arranging costs by importance.

C) the logic of segregating costs by value-chain classification.

D) the logic of separating one indirect cost pool into multiple pools according to activity level.

E) a technique of differentiating fixed and variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

53

Do activity-based costing systems always provide more accurate product costs than conventional cost systems? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

54

For each of the following activities identify an appropriate activity-cost driver.

a. machine maintenance

b. machine setup

c. quality control

d. material ordering

e. production scheduling

f. warehouse expense

g. engineering design

a. machine maintenance

b. machine setup

c. quality control

d. material ordering

e. production scheduling

f. warehouse expense

g. engineering design

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

55

The costs of hiring building security would be which of the following?

A) output unit-level costs

B) batch-level costs

C) general-level costs

D) product-sustaining costs

E) facility-sustaining costs

A) output unit-level costs

B) batch-level costs

C) general-level costs

D) product-sustaining costs

E) facility-sustaining costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

56

Describe each of the four cost hierarchies used to define levels for activities in activity-based costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

57

A division of a company manufactures two products, which are in high demand in the defence industry. Product A is stamped out in a machine press, at the rate of 10,000 per hour. Product B is identical to product A, with the exception that it is made from thicker steel, and requires the machine press to be recalibrated. Product A is produced on the day shift and product B is produced on the afternoon shift, allowing set up changes to be done between shifts. In this case, set up hours are related to which of the following?

A) units of output

B) batches of output

C) the number of customers

D) machine hours

E) labour hours

A) units of output

B) batches of output

C) the number of customers

D) machine hours

E) labour hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

58

Bottle Company operates many bottling plants around the globe. At its Toronto plant, where nine different brands are bottled, the following costs were incurred in 2012 to produce 15,000,000 cans of soft drink:

1. Development costs of adding the new product "Soda Plus" amounted to $614,000.

2. Material handling costs of inspecting and handling concentrate, bottles, packages, and so forth amounted to $433,500.These costs are allocated to each production run.

3. Incoming materials purchase costs that can be directly traced to individual products being canned and packaged. These costs are purely variable with output level and amounted to $2,213,000.

4. Executive salaries and other central administration overhead amounted to $423,000.

5. Plant overhead including costs related to: supervision, safety , energy and plant insurance amounted to $623,000.

6. The cost of cleaning and calibrating equipment for each production run amounted to $171,500.

Required:

a. Classify each of the preceding costs as output unit-level, batch-level, product-sustaining, or facility-sustaining.

b. Compute the cost per unit for the total manufacturing cost.

1. Development costs of adding the new product "Soda Plus" amounted to $614,000.

2. Material handling costs of inspecting and handling concentrate, bottles, packages, and so forth amounted to $433,500.These costs are allocated to each production run.

3. Incoming materials purchase costs that can be directly traced to individual products being canned and packaged. These costs are purely variable with output level and amounted to $2,213,000.

4. Executive salaries and other central administration overhead amounted to $423,000.

5. Plant overhead including costs related to: supervision, safety , energy and plant insurance amounted to $623,000.

6. The cost of cleaning and calibrating equipment for each production run amounted to $171,500.

Required:

a. Classify each of the preceding costs as output unit-level, batch-level, product-sustaining, or facility-sustaining.

b. Compute the cost per unit for the total manufacturing cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

59

Activity-based cost systems

A) apply average support costs to each unit of product.

B) limit cost drivers to units of output.

C) allocate costs based on the overall level of activity.

D) generally undercost complex products.

E) highlight the different levels of activities.

A) apply average support costs to each unit of product.

B) limit cost drivers to units of output.

C) allocate costs based on the overall level of activity.

D) generally undercost complex products.

E) highlight the different levels of activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

60

Compared to an activity-based cost system, CP8 is ________ under the traditional system.

A) undercosted

B) overcosted

C) fairly costed

D) accurately costed

E) costed the same

A) undercosted

B) overcosted

C) fairly costed

D) accurately costed

E) costed the same

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

61

How are cost drivers selected in activity-based costing systems?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

62

The new manager of the insurance division does not understand how the company can have so many overhead rates for assigning costs to the activities of the company's life insurance underwriters. There is one rate schedule for average assignable costs when agents write standard policies. There is another rate schedule which the agents must complete when they write special policies, and these policies are costed out differently from those that are categorized as standard policies.

Required:

a. Why might the company have different costing systems with different overhead rates for the standard and specialized policies?

Required:

a. Why might the company have different costing systems with different overhead rates for the standard and specialized policies?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

63

How does direct cost tracing improve cost accuracy?

A) It identifies the cause-and-effect relationship between direct costs and indirect costs.

B) It identifies the cause-and-effect relationship between activities and non-activities.

C) It reclassifies costs or costs pools that vary with the quantity of a single activity cost driver as direct.

D) It makes no assumptions about the cause-and-effect relationship between direct costs and activities.

E) Because with a greater number of cost pools, it does not have to be concerned with the overhead costs used by different products.

A) It identifies the cause-and-effect relationship between direct costs and indirect costs.

B) It identifies the cause-and-effect relationship between activities and non-activities.

C) It reclassifies costs or costs pools that vary with the quantity of a single activity cost driver as direct.

D) It makes no assumptions about the cause-and-effect relationship between direct costs and activities.

E) Because with a greater number of cost pools, it does not have to be concerned with the overhead costs used by different products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

64

The plant manager has come to you, as the new management accountant, for assistance. The plant manufactures sailboards, operating two shifts per day. During March through July, a third shift is added. The company has to train new machine operators each summer as the demands for its products is very seasonal. Training always occurs on the day shift, and the plant allocates the costs of training (e.g., extra supervision required), based on machine hours. This year, the three shift managers cannot agree on who should be charged for the training. The day shift manager is angry because she has discovered that machine hours are highest on the day shift. The other two managers argue that the hours are higher due to the training, so the day shift should be charged for those costs.

Required:

Provide a recommendation to the plant manager? Include in your recommendation two options as an allocation base for training costs.

Required:

Provide a recommendation to the plant manager? Include in your recommendation two options as an allocation base for training costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

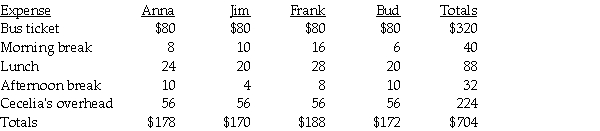

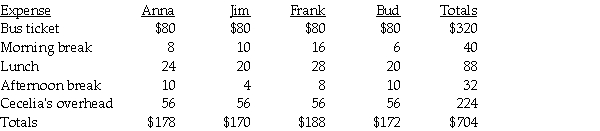

k this deck

65

Cecelia Schell is taking four clients (who are not related) on a tour of her retirement development. The clients incurred the following expenses while on the tour. All tour expenses are paid by Cecelia because she has business discounts for most of her business dealings. These expenses will be billed to the clients by Cecelia.

Required:

Required:

Compute the total average cost per client showing average indirect (overhead) and average direct (other) charges separately.

Required:

Required:Compute the total average cost per client showing average indirect (overhead) and average direct (other) charges separately.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

66

Direct cost tracing will accomplish which of the following?

A) identify homogeneous costs

B) classify more costs as indirect

C) focus on the cause-and-effect criterion when choosing allocation bases

D) expand the number of indirect cost pools

E) classify as many of the costs as direct costs, as is economically feasible

A) identify homogeneous costs

B) classify more costs as indirect

C) focus on the cause-and-effect criterion when choosing allocation bases

D) expand the number of indirect cost pools

E) classify as many of the costs as direct costs, as is economically feasible

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

67

By defining activities and identifying the costs of performing each activity, ABC systems provide detailed information regarding how an organization utilizes its available resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

68

When using activity-based costing in a manufacturing setting, its distinctive feature is the focus on

A) activities as the fundamental cost objects.

B) minimizing the number of journal entries related to the manufacturing process.

C) minimizing manufacturing costs.

D) materials handling.

E) materials sorting.

A) activities as the fundamental cost objects.

B) minimizing the number of journal entries related to the manufacturing process.

C) minimizing manufacturing costs.

D) materials handling.

E) materials sorting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

69

A cost accounting system should be revised when

A) the existing cost accounting system provides information that is representative of operations.

B) the existing cost accounting system could be updated, just to keep ahead.

C) the existing cost accounting system does not produce information that reflects the way various products use scarce resources.

D) management wants to change the system, even though the information is relevant and correct.

E) a new system would be easier to understand but would not be reliable.

A) the existing cost accounting system provides information that is representative of operations.

B) the existing cost accounting system could be updated, just to keep ahead.

C) the existing cost accounting system does not produce information that reflects the way various products use scarce resources.

D) management wants to change the system, even though the information is relevant and correct.

E) a new system would be easier to understand but would not be reliable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following statements is true regarding activity-based costing systems?

A) ABC systems accumulate overhead costs by departments.

B) ABC costing systems are less complex and, therefore, less costly than traditional systems.

C) ABC costing systems can be used in manufacturing firms only.

D) ABC costing systems have multiple indirect cost allocation rates for each activity.

E) ABC systems provide a greater level of detail to understand how an organization uses its common inputs differently for distinct products.

A) ABC systems accumulate overhead costs by departments.

B) ABC costing systems are less complex and, therefore, less costly than traditional systems.

C) ABC costing systems can be used in manufacturing firms only.

D) ABC costing systems have multiple indirect cost allocation rates for each activity.

E) ABC systems provide a greater level of detail to understand how an organization uses its common inputs differently for distinct products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

71

Hans Sorensen, controller of Franklin Production, has the choice of allocating indirect manufacturing cost using either direct manufacturing labour hours or manufacturing machine hours. If he uses labour hours for the month of January, Product A receives $312,000 in manufacturing overhead charges and Product B receives $448,000. When machine hours are used Product A receives $352,000 in manufacturing overhead charges while Product B receives only $408,000.

Required:

You are the department manager in charge of Product A and are strongly in favour of using labour hours. Of course, your co-manager, who is in charge of Product B, is strongly in favour of machine hours. What are some arguments you may be able to give for the allocation base that favours your department's product?

Required:

You are the department manager in charge of Product A and are strongly in favour of using labour hours. Of course, your co-manager, who is in charge of Product B, is strongly in favour of machine hours. What are some arguments you may be able to give for the allocation base that favours your department's product?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following can be described as a fiduciary duty of cost assignment?

A) ABC should be implemented to ensure adequate cost control regardless of cost.

B) Department managers should select activity cost drivers that increase their chance for success.

C) Effective delegation requires management to maintain close control over processes that incur costs.

D) Managers must avoid expanding their scope beyond the functions they control.

E) Cost assignment should begin with a limited scope of activities that managers believe are critical to the success of the company.

A) ABC should be implemented to ensure adequate cost control regardless of cost.

B) Department managers should select activity cost drivers that increase their chance for success.

C) Effective delegation requires management to maintain close control over processes that incur costs.

D) Managers must avoid expanding their scope beyond the functions they control.

E) Cost assignment should begin with a limited scope of activities that managers believe are critical to the success of the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following statements does not represent the logic of an ABC system?

A) Activity cost allocation bases are the activity cost drivers of costs in the activity cost pools.

B) A strong cause-and-effect relationship between overhead costs and the cost allocation base is essential.

C) The requirement to measure cost allocation bases of different activities used by different products is essential.

D) The overhead used by different products is not important, as it is a fixed cost.

E) A greater level of detailed information concerning costs will help organizations be more efficient.

A) Activity cost allocation bases are the activity cost drivers of costs in the activity cost pools.

B) A strong cause-and-effect relationship between overhead costs and the cost allocation base is essential.

C) The requirement to measure cost allocation bases of different activities used by different products is essential.

D) The overhead used by different products is not important, as it is a fixed cost.

E) A greater level of detailed information concerning costs will help organizations be more efficient.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

74

Indications that a product cost system needs revision include

A) the product line consists of a products which are produced at different locations.

B) the product costing computer system does not use the latest technology.

C) the company uses a single allocation base system developed long ago.

D) prime cost represent the vast majority of product cost.

E) managers lose bids they expected to win and win bids they expected to lose.

A) the product line consists of a products which are produced at different locations.

B) the product costing computer system does not use the latest technology.

C) the company uses a single allocation base system developed long ago.

D) prime cost represent the vast majority of product cost.

E) managers lose bids they expected to win and win bids they expected to lose.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

75

In an activity-cost pool,

A) a measure of the activity performed serves as the cost allocation base.

B) the costs have a cause-and-effect relationship with the cost-allocation base for that activity.

C) the cost pools are homogeneous over time.

D) costs in a cost pool can always be traced directly to products.

E) each pool pertains to a narrow and focused set of costs.

A) a measure of the activity performed serves as the cost allocation base.

B) the costs have a cause-and-effect relationship with the cost-allocation base for that activity.

C) the cost pools are homogeneous over time.

D) costs in a cost pool can always be traced directly to products.

E) each pool pertains to a narrow and focused set of costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

76

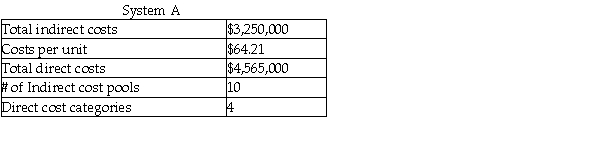

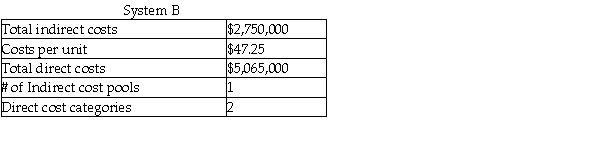

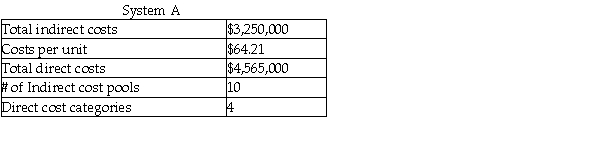

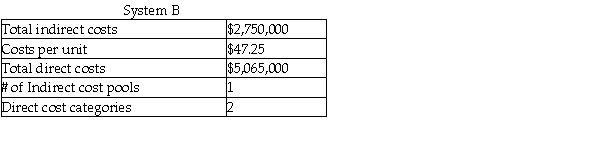

Analyze the two costing systems below and determine which one is an ABC system, stating the reasons for your choice.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

77

Improved direct cost tracing is a benefit of activity-based costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which of the following statements about activity-based costing is true?

A) It does not affect cost control.

B) Indirect cost allocation bases are unlikely to be cost drivers.

C) It provides less information than traditional cost systems.

D) It provides similar results to traditional costing when one activity creates a substantial amount of total cost.

E) It provides similar results to traditional costing when different products use resources from different activities in different proportions.

A) It does not affect cost control.

B) Indirect cost allocation bases are unlikely to be cost drivers.

C) It provides less information than traditional cost systems.

D) It provides similar results to traditional costing when one activity creates a substantial amount of total cost.

E) It provides similar results to traditional costing when different products use resources from different activities in different proportions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following is not a feature of costing system refinement?

A) budget costing allocation

B) cost allocation bases

C) direct cost tracing

D) indirect cost pools

E) activity cost drivers

A) budget costing allocation

B) cost allocation bases

C) direct cost tracing

D) indirect cost pools

E) activity cost drivers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck

80

Activity-based costing can "unlock" savings, not apparent when traditional costing is used, because the system requires a closer examination of operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 133 في هذه المجموعة.

فتح الحزمة

k this deck