Deck 9: Income Effects of Denominator Level on Inventory Valuation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

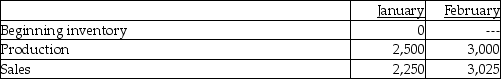

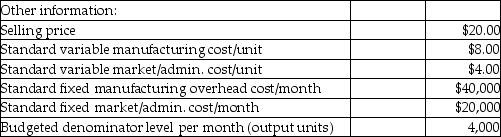

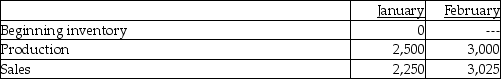

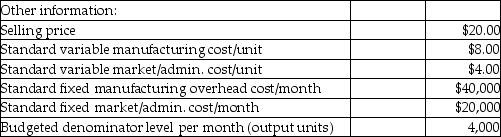

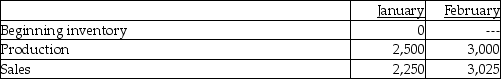

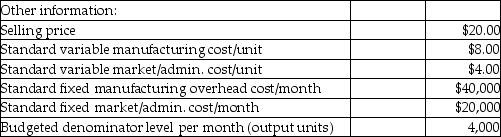

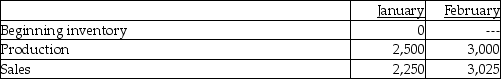

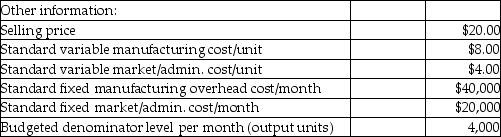

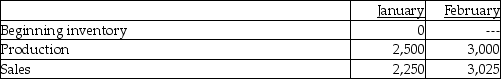

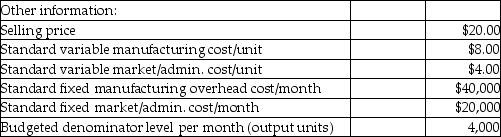

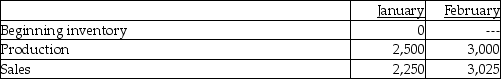

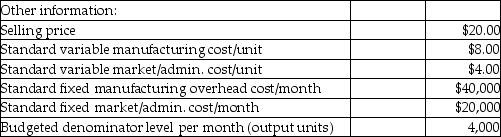

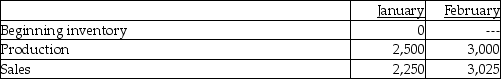

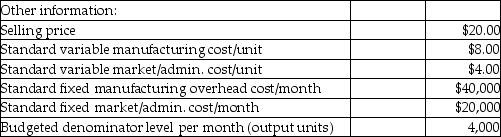

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

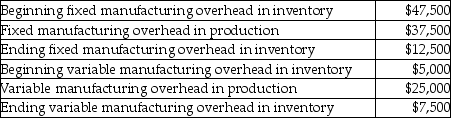

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/154

العب

ملء الشاشة (f)

Deck 9: Income Effects of Denominator Level on Inventory Valuation

1

A manufacturing firm is able to produce 2,000 pairs of shoes per hour, at maximum efficiency. There are three eight-hour shifts each day. Production is actually 1,600 pairs of shoes per hour due to unavoidable operating interruptions. The plant is only able to operate for 27 days per month due to scheduled maintenance. What is the practical capacity for the month of September?

A) 1,488,000 pairs of shoes

B) 1,440,000 pairs of shoes

C) 1,036,800 pairs of shoes

D) 1,296,000 pairs of shoes

E) 1,152,000 pairs of shoes

A) 1,488,000 pairs of shoes

B) 1,440,000 pairs of shoes

C) 1,036,800 pairs of shoes

D) 1,296,000 pairs of shoes

E) 1,152,000 pairs of shoes

C

2

Normal capacity utilization is the expected level of capacity utilization for the current budget period, which is typically one year.

False

3

________ provides the lowest estimate of denominator-level capacity.

A) Practical capacity

B) Theoretical capacity

C) Master-budget capacity utilization

D) Normal capacity utilization

E) Supply capacity

A) Practical capacity

B) Theoretical capacity

C) Master-budget capacity utilization

D) Normal capacity utilization

E) Supply capacity

C

4

Normal capacity utilization is not the same as master-budget capacity utilization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

5

Practical capacity is based on which of the following assumptions?

A) that absorption costing is used

B) that variable costing is used

C) Production will occur at peak efficiency all the time.

D) Production will occur at peak capacity where feasible (e.g., except for maintenance downtime, repairs, holidays, etc.).

E) Production can never occur at peak capacity.

A) that absorption costing is used

B) that variable costing is used

C) Production will occur at peak efficiency all the time.

D) Production will occur at peak capacity where feasible (e.g., except for maintenance downtime, repairs, holidays, etc.).

E) Production can never occur at peak capacity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

6

Betts Wrench Company manufactures socket wrenches. For next month the vice-president of production plans on producing 4,400 wrenches per day. The company can produce as many as 5,000 wrenches per day, but are more likely to produce 4,500 per day. The demand for wrenches for the next three years is expected to average 4,250 wrenches per day. Fixed manufacturing costs per month total $336,600. The company works 20 days a month due to local zoning restrictions. Fixed manufacturing overhead is charged on a per wrench basis. Required:

A) What is the theoretical fixed manufacturing overhead rate per wrench?

B) What is the practical fixed manufacturing overhead rate per wrench?

C) What is the normal fixed manufacturing overhead rate per wrench?

D) What is the master-budget fixed manufacturing overhead rate per wrench?

A) What is the theoretical fixed manufacturing overhead rate per wrench?

B) What is the practical fixed manufacturing overhead rate per wrench?

C) What is the normal fixed manufacturing overhead rate per wrench?

D) What is the master-budget fixed manufacturing overhead rate per wrench?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

7

A manufacturing firm is able to produce 2,000 pairs of shoes per hour, at maximum efficiency. There are three eight-hour shifts each day. Production is actually 1,600 pairs of shoes per hour due to unavoidable operating interruptions. The plant is expected to run every day but was only able to operate for 27 days in September. What is the theoretical capacity for the month of September?

A) 1,488,000 shoes

B) 1,440,000 shoes

C) 1,036,800 shoes

D) 1,296,000 shoes

E) 1,152,000 shoes

A) 1,488,000 shoes

B) 1,440,000 shoes

C) 1,036,800 shoes

D) 1,296,000 shoes

E) 1,152,000 shoes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

8

A major reason for choosing ________ utilization over ________, is the difficulty in forecasting.

A) theoretical capacity; master-budget

B) practical capacity; master-budget

C) normal capacity utilization; master-budget

D) master-budget; theoretical capacity

E) master-budget; normal capacity utilization

A) theoretical capacity; master-budget

B) practical capacity; master-budget

C) normal capacity utilization; master-budget

D) master-budget; theoretical capacity

E) master-budget; normal capacity utilization

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

9

What is the theoretical capacity for the month of April?

A) 600,000 units

B) 720,000 units

C) 744,400 units

D) 576,000 units

E) 480,000 units

A) 600,000 units

B) 720,000 units

C) 744,400 units

D) 576,000 units

E) 480,000 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

10

Determining the "right" level of capacity is one of the most strategic and difficult decisions managers face.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

11

The Canada Revenue Agency requires companies to use practical capacity as the denominator-level concept.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

12

Theoretical capacity is based on which of the following assumptions?

A) that absorption costing is used

B) that variable costing is used

C) production will occur at peak efficiency all the time

D) production will occur at peak capacity where feasible (e.g., except for maintenance downtime)

E) production can never occur at peak capacity

A) that absorption costing is used

B) that variable costing is used

C) production will occur at peak efficiency all the time

D) production will occur at peak capacity where feasible (e.g., except for maintenance downtime)

E) production can never occur at peak capacity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

13

The denominator-level concept based on capacity utilization that satisfies average customer demand that includes seasonal and cyclical factors is called

A) theoretical capacity.

B) practical capacity.

C) normal capacity.

D) master-budget capacity.

E) supply capacity.

A) theoretical capacity.

B) practical capacity.

C) normal capacity.

D) master-budget capacity.

E) supply capacity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

14

Both theoretical and practical capacity measure capacity in terms of demand for the output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

15

What is the practical capacity for the month of April?

A) 600,000 units

B) 720,000 units

C) 744,400 units

D) 576,000 units

E) 480,000 units

A) 600,000 units

B) 720,000 units

C) 744,400 units

D) 576,000 units

E) 480,000 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

16

Using either the theoretical capacity or practical capacity as the denominator-level concept will result in the same production-volume variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

17

________ is the level of capacity based on producing at full efficiency all the time.

A) Practical capacity

B) Theoretical capacity

C) Normal capacity

D) Demand capacity

E) Master-budget capacity

A) Practical capacity

B) Theoretical capacity

C) Normal capacity

D) Demand capacity

E) Master-budget capacity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

18

From the perspective of long-run product costing it is best to use

A) master-budget capacity utilization to highlight unused capacity.

B) normal capacity utilization for benchmarking purposes.

C) practical capacity for pricing decisions.

D) theoretical capacity for performance evaluation.

E) supply capacity to satisfy customer demand.

A) master-budget capacity utilization to highlight unused capacity.

B) normal capacity utilization for benchmarking purposes.

C) practical capacity for pricing decisions.

D) theoretical capacity for performance evaluation.

E) supply capacity to satisfy customer demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

19

The denominator-level concept based on capacity utilization for the anticipated level of output that will satisfy customer demand for a single operating cycle, and complies with the Canada Revenue Agency for tax purposes, is the

A) theoretical budget capacity.

B) practical budget capacity.

C) normal capacity.

D) master-budget capacity.

E) supply capacity.

A) theoretical budget capacity.

B) practical budget capacity.

C) normal capacity.

D) master-budget capacity.

E) supply capacity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

20

The budgeted fixed manufacturing cost rate is the lowest for

A) practical capacity.

B) supply capacity.

C) master-budget capacity utilization.

D) normal capacity utilization.

E) theoretical capacity.

A) practical capacity.

B) supply capacity.

C) master-budget capacity utilization.

D) normal capacity utilization.

E) theoretical capacity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

21

Using ________ capacity fixes the cost of capacity at the cost of supplying the capacity regardless of the demand for capacity.

A) practical

B) theoretical

C) supply

D) demand

E) master-budget

A) practical

B) theoretical

C) supply

D) demand

E) master-budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

22

Should a company with high fixed costs and unused capacity raise selling prices to try to fully recoup its costs?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

23

Variable costing includes all direct manufacturing costs and all manufacturing overhead costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

24

The downward demand spiral for a company is the continuing reduction in the demand for its products that occurs when prices of competitors' products are not met and higher unit costs result in more reluctance to meet competitors' prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

25

The distinction between variable costs and fixed costs is highlighted in variable costing via the contribution-margin format while the distinction between manufacturing and nonmanufacturing costs is central to absorption and is highlighted by the gross-margin format.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

26

________ utilization is an average that provides no meaningful feedback to the marketing manager for a particular year.

A) Normal capacity

B) Master-budget capacity

C) Practical capacity

D) Flexible budget capacity

E) Planned unused capacity

A) Normal capacity

B) Master-budget capacity

C) Practical capacity

D) Flexible budget capacity

E) Planned unused capacity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

27

How does the capacity level chosen to compute the budgeted fixed overhead cost rate affect the production-volume variance?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

28

Explain how using master-budget capacity utilization for setting prices can lead to a downward demand spiral.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

29

The Canada Revenue Agency effectively eliminates the use of certain denominator-level concepts through its income tax rulings. The accepted concept(s) for tax purpose is(are)

A) theoretical capacity and practical capacity.

B) master-budget capacity and theoretical capacity.

C) practical capacity.

D) master-budget capacity.

E) normal capacity or master-budget capacity.

A) theoretical capacity and practical capacity.

B) master-budget capacity and theoretical capacity.

C) practical capacity.

D) master-budget capacity.

E) normal capacity or master-budget capacity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

30

Another common term used by some companies for variable costing is direct costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

31

Full product costs under absorption costing include only inventoriable costs and upstream costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

32

The difference between variable costing and absorption costing centres on accounting for variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

33

Theoretical capacity is rarely used to calculate the budgeted fixed manufacturing cost per case because it departs significantly from the real capacity available to a company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

34

Many companies using absorption costing do not make any distinction between variable and fixed costs in their accounting system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

35

Unused capacity is considered wasted resources and the result of poor planning.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

36

Using practical capacity is best for evaluating the marketing manager's performance for a particular year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

37

The marketing manager's performance evaluation is most fair when based on a denominator level using

A) practical capacity.

B) theoretical capacity.

C) master-budget capacity.

D) normal capacity.

E) supply capacity.

A) practical capacity.

B) theoretical capacity.

C) master-budget capacity.

D) normal capacity.

E) supply capacity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

38

Master-budget capacity utilization

A) hides the amount of unused capacity.

B) represents the maximum units of production for current capacity.

C) provides the best cost estimate for benchmarking purposes.

D) when used for product costing results in the lowest cost estimate of the four capacity options.

E) represents the long-term utilization expected to meet customer demand.

A) hides the amount of unused capacity.

B) represents the maximum units of production for current capacity.

C) provides the best cost estimate for benchmarking purposes.

D) when used for product costing results in the lowest cost estimate of the four capacity options.

E) represents the long-term utilization expected to meet customer demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

39

Master-budget capacity utilization can be more reliably estimated than normal capacity utilization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which denominator-level concept results in the highest amount of fixed manufacturing overhead costs per unit of ending inventory?

A) theoretical capacity

B) practical capacity

C) normal capacity

D) master-budget capacity

E) supply capacity

A) theoretical capacity

B) practical capacity

C) normal capacity

D) master-budget capacity

E) supply capacity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

41

Direct costing is not truly synonymous with variable costing since variable costing does not include all direct costs as inventorial costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

42

Variable costs of value chain areas other than manufacturing are typically written off as period costs regardless of the costing method used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

43

Variable manufacturing costs are accounted for in the same manner on the income statement regardless of whether absorption or variable costing is used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

44

Absorption costing defers the fixed manufacturing costs in ending inventory to a future period, but variable costing expenses these costs in the current period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

45

In absorption costing, all nonmanufacturing costs are subtracted from gross margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

46

What is Honda Heaven's inventory cost per box using variable costing?

A) $9.50

B) $10.00

C) $12.50

D) $13.40

E) $15.40

A) $9.50

B) $10.00

C) $12.50

D) $13.40

E) $15.40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

47

The main difference between variable costing and absorption costing is the way in which fixed manufacturing costs are accounted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

48

Variable costing will generally report less operating income than absorption costing when the inventory level decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

49

The gross-margin format of the income statement highlights the lump sum of fixed manufacturing costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

50

The period-to-period change in operating income under variable costing is driven by unit level of sales, if the contribution margin is constant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

51

Direct costing is a perfect way to describe the variable-costing inventory method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

52

Variable costing does not include variable indirect manufacturing costs as inventorial costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

53

Absorption costing can be criticized as a method that encourages managers to make decisions that may be contrary to the long-term interest of the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

54

When all fixed manufacturing costs and variable manufacturing costs are included as inventorial costs, the method being used is

A) absorption costing.

B) fixed overhead costing.

C) manufacturing overhead costing.

D) variable costing.

E) direct costing.

A) absorption costing.

B) fixed overhead costing.

C) manufacturing overhead costing.

D) variable costing.

E) direct costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

55

Each unit in inventory under absorption costing absorbs fixed manufacturing costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

56

Changes in inventory levels do not affect income amounts between variable and absorption costing because the difference in accounting for fixed manufacturing overhead offsets the affect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

57

Absorption-costing income statements cannot easily differentiate between variable and fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

58

Absorption costing prevents managers from increasing production to levels above customer demand, as a means of inflating operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

59

The method of costing that excludes fixed manufacturing costs from inventorial costs is known as

A) absorption costing.

B) fixed overhead costing.

C) manufacturing overhead costing.

D) variable costing.

E) full manufacturing costing.

A) absorption costing.

B) fixed overhead costing.

C) manufacturing overhead costing.

D) variable costing.

E) full manufacturing costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

60

The distinction between absorption costing and variable costing is most important for which type of industry?

A) manufacturing

B) marketing

C) retail

D) service

E) educational

A) manufacturing

B) marketing

C) retail

D) service

E) educational

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

61

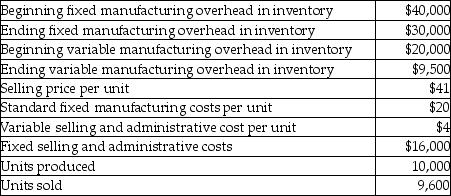

The following information pertains to ABC Corporation:  What is the difference between absorption costing operating income and variable costing operating income?

What is the difference between absorption costing operating income and variable costing operating income?

A) $500

B) $5,000

C) $10,000

D) $20,500

E) $21,000

What is the difference between absorption costing operating income and variable costing operating income?

What is the difference between absorption costing operating income and variable costing operating income?A) $500

B) $5,000

C) $10,000

D) $20,500

E) $21,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

62

One possible means of determining the difference between absorption and variable costing based operating incomes is

A) to add fixed manufacturing cost to the variable costing operating income.

B) by subtracting the variable overhead rate from the fixed overhead rate and then multiplying the difference by the number of units in inventory.

C) by subtracting fixed manufacturing overhead in beginning inventory from fixed manufacturing overhead in ending inventory.

D) by multiplying the number of units produced by the budgeted fixed manufacturing overhead rate.

E) by adding fixed manufacturing overhead in beginning inventory to income.

A) to add fixed manufacturing cost to the variable costing operating income.

B) by subtracting the variable overhead rate from the fixed overhead rate and then multiplying the difference by the number of units in inventory.

C) by subtracting fixed manufacturing overhead in beginning inventory from fixed manufacturing overhead in ending inventory.

D) by multiplying the number of units produced by the budgeted fixed manufacturing overhead rate.

E) by adding fixed manufacturing overhead in beginning inventory to income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following is correct concerning variable vs absorption costing?

A) Absorption costing income statement classifies fixed costs as period costs.

B) The absorption costing income statement combines costs by cost behaviour.

C) Absorption costing income statements need to differentiate between variable and fixed costs.

D) The difference in operating income between the two approaches is captured by the difference between fixed manufacturing costs in ending inventory minus fixed manufacturing costs in opening inventory.

E) The difference in operating income between the two approaches is captured by the difference between fixed manufacturing costs in ending inventory minus variable manufacturing costs in ending inventory.

A) Absorption costing income statement classifies fixed costs as period costs.

B) The absorption costing income statement combines costs by cost behaviour.

C) Absorption costing income statements need to differentiate between variable and fixed costs.

D) The difference in operating income between the two approaches is captured by the difference between fixed manufacturing costs in ending inventory minus fixed manufacturing costs in opening inventory.

E) The difference in operating income between the two approaches is captured by the difference between fixed manufacturing costs in ending inventory minus variable manufacturing costs in ending inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

64

Absorption costing is also known as

A) direct costing.

B) full absorption costing.

C) non-traditional costing.

D) manufacturing costing.

E) variable costing.

A) direct costing.

B) full absorption costing.

C) non-traditional costing.

D) manufacturing costing.

E) variable costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

65

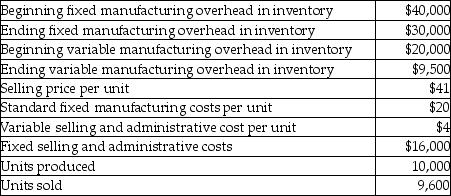

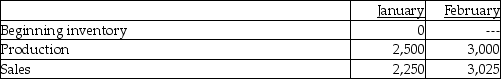

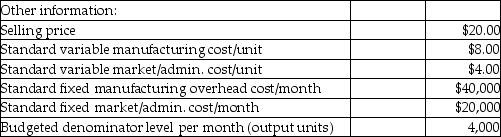

Use the information below to answer the following question(s).

Beauty Supply Company manufactures shampoo. The supervisor has provided the following information and stated that standard costing is used for manufacturing, marketing, and administrative costs.

There were no beginning or ending inventories of materials or work-in-process.

There were no beginning or ending inventories of materials or work-in-process.

What is the per unit manufacturing cost using absorption costing?

A) $23.00

B) $18.00

C) $27.00

D) $12.00

E) $10.00

Beauty Supply Company manufactures shampoo. The supervisor has provided the following information and stated that standard costing is used for manufacturing, marketing, and administrative costs.

There were no beginning or ending inventories of materials or work-in-process.

There were no beginning or ending inventories of materials or work-in-process.What is the per unit manufacturing cost using absorption costing?

A) $23.00

B) $18.00

C) $27.00

D) $12.00

E) $10.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

66

Under variable costing, which of the following expenses is inventoriable?

A) variable manufacturing overhead

B) direct manufacturing labour and fixed manufacturing overhead

C) marketing and direct manufacturing labour

D) variable manufacturing overhead and administrative

E) variable and fixed manufacturing overhead

A) variable manufacturing overhead

B) direct manufacturing labour and fixed manufacturing overhead

C) marketing and direct manufacturing labour

D) variable manufacturing overhead and administrative

E) variable and fixed manufacturing overhead

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

67

Variable costing regards fixed manufacturing overhead as

A) an unexpired cost.

B) an inventoriable cost.

C) a period expense.

D) a product cost.

E) a deferred asset.

A) an unexpired cost.

B) an inventoriable cost.

C) a period expense.

D) a product cost.

E) a deferred asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

68

Use the information below to answer the following question(s).

Beauty Supply Company manufactures shampoo. The supervisor has provided the following information and stated that standard costing is used for manufacturing, marketing, and administrative costs.

There were no beginning or ending inventories of materials or work-in-process.

There were no beginning or ending inventories of materials or work-in-process.

Advanced Lighting's total variable costs are $102 and total manufacturing costs are $98. Standard variable marketing/administrative costs constitute 20 percent of the total variable costs. Respectively, what are Advanced Lighting's standard variable manufacturing costs and standard fixed manufacturing costs?

A) $77.60 and $81.60

B) $78.40 and $98.00

C) $81.60 and $16.40

D) $81.60 and $77.60

E) $78.40 and $16.40

Beauty Supply Company manufactures shampoo. The supervisor has provided the following information and stated that standard costing is used for manufacturing, marketing, and administrative costs.

There were no beginning or ending inventories of materials or work-in-process.

There were no beginning or ending inventories of materials or work-in-process.Advanced Lighting's total variable costs are $102 and total manufacturing costs are $98. Standard variable marketing/administrative costs constitute 20 percent of the total variable costs. Respectively, what are Advanced Lighting's standard variable manufacturing costs and standard fixed manufacturing costs?

A) $77.60 and $81.60

B) $78.40 and $98.00

C) $81.60 and $16.40

D) $81.60 and $77.60

E) $78.40 and $16.40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

69

What are Car Tune's appropriate period costs for September if variable costing is used?

A) $330,000

B) $363,000

C) $550,000

D) $583,000

E) $630,000

A) $330,000

B) $363,000

C) $550,000

D) $583,000

E) $630,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

70

When the distinction between variable and fixed costs is one of the important elements in the preparation of the income statement, the method used should be the

A) capitalization method.

B) contribution margin method.

C) gross margin method.

D) inventorial method.

E) absorption method.

A) capitalization method.

B) contribution margin method.

C) gross margin method.

D) inventorial method.

E) absorption method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following variances exists only under absorption costing?

A) spending variance

B) efficiency variances

C) sales-volume variance

D) variable overhead flexible budget variance

E) production-volume variance

A) spending variance

B) efficiency variances

C) sales-volume variance

D) variable overhead flexible budget variance

E) production-volume variance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

72

Use the information below to answer the following question(s).

Beauty Supply Company manufactures shampoo. The supervisor has provided the following information and stated that standard costing is used for manufacturing, marketing, and administrative costs.

There were no beginning or ending inventories of materials or work-in-process.

There were no beginning or ending inventories of materials or work-in-process.

What would Beauty Supply Company's operating income (loss) be for January and February, respectively, using the variable costing approach?

A) $18,000 and $24,200

B) $(45,000) and $(35,500)

C) $(44,000) and $(33,809)

D) $(42,000) and $(35,800)

E) $18,000 and $(35,800)

Beauty Supply Company manufactures shampoo. The supervisor has provided the following information and stated that standard costing is used for manufacturing, marketing, and administrative costs.

There were no beginning or ending inventories of materials or work-in-process.

There were no beginning or ending inventories of materials or work-in-process.What would Beauty Supply Company's operating income (loss) be for January and February, respectively, using the variable costing approach?

A) $18,000 and $24,200

B) $(45,000) and $(35,500)

C) $(44,000) and $(33,809)

D) $(42,000) and $(35,800)

E) $18,000 and $(35,800)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following concepts is most compatible with absorption costing in a manufacturing environment?

A) "the whole world is the market and the whole world is the competitor"

B) niche marketing

C) flexible manufacturing

D) continuous improvement

E) matching revenue to expense for financial reporting

A) "the whole world is the market and the whole world is the competitor"

B) niche marketing

C) flexible manufacturing

D) continuous improvement

E) matching revenue to expense for financial reporting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

74

What is the Car Tune's September cost of goods sold amount if absorption costing is used?

A) $300,000

B) $266,000

C) $270,000

D) $258,600

E) $630,000

A) $300,000

B) $266,000

C) $270,000

D) $258,600

E) $630,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

75

There is not an output-level variance for variable costing, because

A) the inventory level decreased during the period.

B) the inventory level increased during the period.

C) fixed manufacturing overhead is allocated to work-in-process.

D) fixed manufacturing overhead is not allocated to work-in-process.

E) variable manufacturing overhead is not allocated to work-in-process.

A) the inventory level decreased during the period.

B) the inventory level increased during the period.

C) fixed manufacturing overhead is allocated to work-in-process.

D) fixed manufacturing overhead is not allocated to work-in-process.

E) variable manufacturing overhead is not allocated to work-in-process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

76

For Consumer Lumber what would be the total difference between operating incomes under absorption costing and variable costing?

A) $35,000

B) $25,000

C) $20,000

D) $2,500

E) $1,500

A) $35,000

B) $25,000

C) $20,000

D) $2,500

E) $1,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

77

The costing method that has been labelled as a "black hole" because fixed costs are inventoried is commonly known as

A) absorption costing.

B) direct costing.

C) break-even point costing.

D) variable costing.

E) standard costing.

A) absorption costing.

B) direct costing.

C) break-even point costing.

D) variable costing.

E) standard costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

78

Use the information below to answer the following question(s).

Beauty Supply Company manufactures shampoo. The supervisor has provided the following information and stated that standard costing is used for manufacturing, marketing, and administrative costs.

There were no beginning or ending inventories of materials or work-in-process.

There were no beginning or ending inventories of materials or work-in-process.

What is the per unit variable cost?

A) $22.00

B) $18.00

C) $14.00

D) $12.00

E) $11.00

Beauty Supply Company manufactures shampoo. The supervisor has provided the following information and stated that standard costing is used for manufacturing, marketing, and administrative costs.

There were no beginning or ending inventories of materials or work-in-process.

There were no beginning or ending inventories of materials or work-in-process.What is the per unit variable cost?

A) $22.00

B) $18.00

C) $14.00

D) $12.00

E) $11.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

79

When large differences exist between practical capacity and master-budget capacity utilization, companies can classify part of the large difference as

A) production-volume variance.

B) sales volume variance.

C) normal capacity utilization.

D) theoretical capacity utilization.

E) planned unused capacity.

A) production-volume variance.

B) sales volume variance.

C) normal capacity utilization.

D) theoretical capacity utilization.

E) planned unused capacity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

80

What is Honda Heaven's inventorial cost per box using absorption costing?

A) $9.50

B) $10.00

C) $12.50

D) $13.40

E) $15.40

A) $9.50

B) $10.00

C) $12.50

D) $13.40

E) $15.40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck