Deck 11: Decision Making and Relevant Information

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

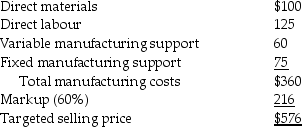

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

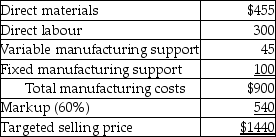

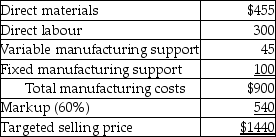

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

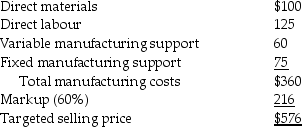

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

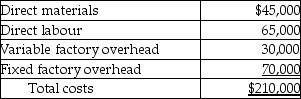

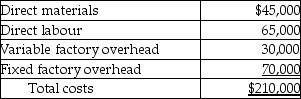

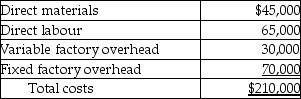

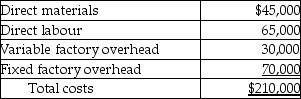

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/146

العب

ملء الشاشة (f)

Deck 11: Decision Making and Relevant Information

1

An expected value is the weighted average of the outcomes, with the probability of each outcome serving as the weight.

True

2

When choosing between two alternatives, costs that do not differ between the two alternatives can be considered to be irrelevant to that decision.

True

3

The last step in the decision process is normally to

A) evaluate and explain outcomes.

B) make assumptions and predictions.

C) choose alternatives.

D) perform quantitative analysis.

E) gather information.

A) evaluate and explain outcomes.

B) make assumptions and predictions.

C) choose alternatives.

D) perform quantitative analysis.

E) gather information.

A

4

If a manufacturer chooses to continue purchasing direct materials from a supplier because of the on-going relationship that has developed over the years, the decision is based on qualitative factors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

5

The feedback obtained in the decision process cannot affect

A) future predictions.

B) the prediction method.

C) the decision model.

D) implementation.

E) past performance.

A) future predictions.

B) the prediction method.

C) the decision model.

D) implementation.

E) past performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

6

Each item included in the relevant-cost analysis should differ according to the alternative being considered and be an expected future revenue or cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

7

Quantitative factors are always expressed in financial terms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following is False concerning relevant costs and relevant revenues?

A) Every decision deals with the future.

B) Nothing can be done to alter past costs or revenues.

C) Historical costs may be useful for predicting future costs.

D) Historical costs in themselves are irrelevant to a decision on future costs.

E) Total differential costs include both relevant and irrelevant costs.

A) Every decision deals with the future.

B) Nothing can be done to alter past costs or revenues.

C) Historical costs may be useful for predicting future costs.

D) Historical costs in themselves are irrelevant to a decision on future costs.

E) Total differential costs include both relevant and irrelevant costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

9

Divisional revenues which remain at the same level from year to year are known as relevant revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

10

The total cost difference between two separate alternatives in a decision making process is considered to be its net relevant cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

11

Relevant information analysis is a key aspect of making decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

12

Management accountants help managers identify what information is relevant and what information can be ignored.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

13

Ted owns a small body shop. His major costs include labour, parts, and rent. In the decision making process, these costs are always considered to be

A) fixed.

B) qualitative factors.

C) quantitative factors.

D) variable.

E) relevant costs.

A) fixed.

B) qualitative factors.

C) quantitative factors.

D) variable.

E) relevant costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

14

Anticipated future costs that differ with alternative courses of action are known as relevant costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

15

Cost items that do not change between the alternative choices involved in the decision are not relevant to the decision to be made as they will be incurred no matter which alternative is chosen.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

16

The Gameshop manufactures specialized board games. Management is attempting to search for ways to reduce costs and is considering two alternatives for an upcoming project of special games that must be delivered to the customer in 12 months' time. Management agreed to the special project job as they have an idle plant that is scheduled for demolition 18 months from now, and either alternative will easily meet the delivery deadline. Alternative 1 requires 10 machine operators and 2.5 individuals to handle direct materials. Employee pay averages $17.50 per hour and will increase to $18.50 at the mid-point (July 1) of next year. Each employee currently works 2,500 hours but will decrease to 2,400 hours if Alternative 2 is implemented. The second proposal only requires 8.5 workers.

Which of the following items of information are relevant to this decision?

A) property taxes for the idle plant

B) hourly wage rates

C) the timing of the wage increase

D) the number of employees required in each alternative

E) the delivery deadline

Which of the following items of information are relevant to this decision?

A) property taxes for the idle plant

B) hourly wage rates

C) the timing of the wage increase

D) the number of employees required in each alternative

E) the delivery deadline

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

17

The purpose of evaluating performance in the decision process is to provide feedback.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

18

The variation in total costs between two alternatives is known as

A) differential cost.

B) analyzed cost.

C) irrelevant cost.

D) predictable cost.

E) expected cost.

A) differential cost.

B) analyzed cost.

C) irrelevant cost.

D) predictable cost.

E) expected cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

19

Employee morale at Bedland Inc. is very high. This type of information is known as

A) a qualitative factor.

B) a quantitative factor.

C) a nonmeasurable factor.

D) a financial factor.

E) a numerical factor.

A) a qualitative factor.

B) a quantitative factor.

C) a nonmeasurable factor.

D) a financial factor.

E) a numerical factor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following anticipated future costs always differ among alternative courses of actions?

A) direct labour costs

B) historical costs

C) relevant costs

D) direct materials costs

E) indirect costs

A) direct labour costs

B) historical costs

C) relevant costs

D) direct materials costs

E) indirect costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

21

A restaurant is deciding whether it wants to update its image or not. It currently has a cozy appeal with loyal customers. The outdated décor that is still in good condition; menus and carpet need to be replaced.

Required:

Identify for the restaurant management

a. those costs that are relevant to this decision;

b. those costs that are not differential;

c. and qualitative considerations.

Required:

Identify for the restaurant management

a. those costs that are relevant to this decision;

b. those costs that are not differential;

c. and qualitative considerations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

22

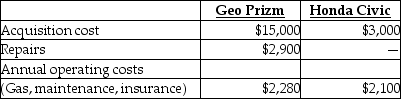

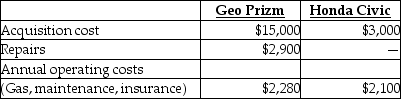

Answer the following question(s) using the information below.

Jim's 5-year-old Geo Prizm requires repairs estimated at $3,000 to make it road worthy again. His friend, Julie, suggested that he should buy a 5-year-old used Honda Civic instead for $3,000 cash. Julie estimated the following costs for the two cars:

The cost NOT relevant for this decision is the

A) acquisition cost of the Geo Prizm.

B) acquisition cost of the Honda Civic.

C) repairs to the Geo Prizm.

D) annual operating costs of the Honda Civic.

E) annual operating costs of the Geo Prizm.

Jim's 5-year-old Geo Prizm requires repairs estimated at $3,000 to make it road worthy again. His friend, Julie, suggested that he should buy a 5-year-old used Honda Civic instead for $3,000 cash. Julie estimated the following costs for the two cars:

The cost NOT relevant for this decision is the

A) acquisition cost of the Geo Prizm.

B) acquisition cost of the Honda Civic.

C) repairs to the Geo Prizm.

D) annual operating costs of the Honda Civic.

E) annual operating costs of the Geo Prizm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

23

Lobster Liquidators will make $500,000 if the fishing season weather is good, $200,000 if the weather is fair, and would actually lose $50,000 if the weather is poor during the season. If the weather service gives a 40% probability of good weather, a 25% probability of fair weather, and a 35% probability of poor weather, what is the expected value of the profit for Lobster Liquidators?

A) $500,000

B) $232,500

C) $267,500

D) $200,000

E) $217,000

A) $500,000

B) $232,500

C) $267,500

D) $200,000

E) $217,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following represents a qualitative factor?

A) any nonfinancial factor

B) historical costs

C) relevant costs

D) the timing of variable costs

E) an outcome that cannot be measured in numerical terms

A) any nonfinancial factor

B) historical costs

C) relevant costs

D) the timing of variable costs

E) an outcome that cannot be measured in numerical terms

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

25

All fixed costs are irrelevant in relevant-cost analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

26

Chalet Ski & Patio manufactures a product that has two parts, X and Y. It is currently considering two alternative proposals related to parts X and Y.

The first proposal is for buying part Y. This would free up some of the plant space for the manufacture of more of part X and assembly of the final product. The product vice-president believes the additional production of the final product can be sold at the current market price. No other changes in manufacturing would be needed.

The second proposal is for buying new equipment for the production of part Y. The new equipment requires fewer workers and uses less power to operate. The old equipment has a net disposal value of zero.

Required:

Tell whether the following items are relevant or irrelevant for each proposal. Treat each proposal independently.

a. Sales revenue of the product.

b. Variable costs of assembling final products.

c. Direct manufacturing materials, part X.

d. Direct manufacturing materials, part Y.

e. Direct manufacturing labour, part X.

f. Direct manufacturing labour, part Y.

g. Variable manufacturing overhead, part X.

h. Variable manufacturing overhead, part Y.

i. Cost of old equipment for manufacturing Y.

j. Cost of new equipment for manufacturing Y.

k. Variable selling and administrative costs.

The first proposal is for buying part Y. This would free up some of the plant space for the manufacture of more of part X and assembly of the final product. The product vice-president believes the additional production of the final product can be sold at the current market price. No other changes in manufacturing would be needed.

The second proposal is for buying new equipment for the production of part Y. The new equipment requires fewer workers and uses less power to operate. The old equipment has a net disposal value of zero.

Required:

Tell whether the following items are relevant or irrelevant for each proposal. Treat each proposal independently.

a. Sales revenue of the product.

b. Variable costs of assembling final products.

c. Direct manufacturing materials, part X.

d. Direct manufacturing materials, part Y.

e. Direct manufacturing labour, part X.

f. Direct manufacturing labour, part Y.

g. Variable manufacturing overhead, part X.

h. Variable manufacturing overhead, part Y.

i. Cost of old equipment for manufacturing Y.

j. Cost of new equipment for manufacturing Y.

k. Variable selling and administrative costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

27

Sunk costs

A) are relevant.

B) are differential.

C) have future implications.

D) are ignored when evaluating alternatives.

E) are evaluated to determine if they are relevant or not evaluating alternatives.

A) are relevant.

B) are differential.

C) have future implications.

D) are ignored when evaluating alternatives.

E) are evaluated to determine if they are relevant or not evaluating alternatives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

28

What should Jim do? What are his savings in the first year?

A) Buy the Honda Civic; $15,080

B) Fix the Geo Prizm; $2,820

C) Buy the Honda Civic; $180

D) Fix the Geo Prizm; $5,280

E) Buy the Honda Civic; $80

A) Buy the Honda Civic; $15,080

B) Fix the Geo Prizm; $2,820

C) Buy the Honda Civic; $180

D) Fix the Geo Prizm; $5,280

E) Buy the Honda Civic; $80

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which option should Patrick choose to maximize income assuming there is a 40% probability that 70 units will be sold and a 60% probability that 40 units will be sold?

A) Options two and three are equivalent.

B) All options maximize income equally.

C) Option one

D) Option two

E) Option three

A) Options two and three are equivalent.

B) All options maximize income equally.

C) Option one

D) Option two

E) Option three

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

30

Explain what revenues and costs are relevant when choosing among alternatives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

31

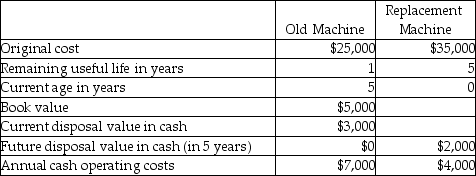

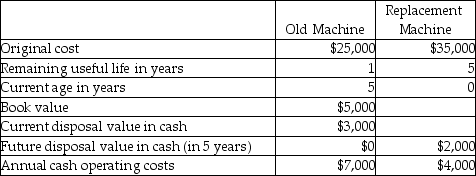

Jansen Industries is considering replacing a machine that is presently used in its production process. The following information is available:  Which of the information provided in the table is irrelevant to the replacement decision?

Which of the information provided in the table is irrelevant to the replacement decision?

A) the annual operating cost of the old machine

B) the original cost of the old machine

C) the current disposal value of the old machine

D) the future disposal value of the replacement machine

E) the remaining useful life of the old machine

Which of the information provided in the table is irrelevant to the replacement decision?

Which of the information provided in the table is irrelevant to the replacement decision?A) the annual operating cost of the old machine

B) the original cost of the old machine

C) the current disposal value of the old machine

D) the future disposal value of the replacement machine

E) the remaining useful life of the old machine

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

32

When making decisions, it is best to use

A) average costs.

B) fixed costs that would be incurred.

C) unit cost, rather than total cost.

D) variable costs that would be incurred.

E) relevant costs.

A) average costs.

B) fixed costs that would be incurred.

C) unit cost, rather than total cost.

D) variable costs that would be incurred.

E) relevant costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

33

All variable costs are relevant in relevant-cost analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

34

Expected value may be defined as

A) the probability that each outcome will occur.

B) the probability that each outcome will not occur.

C) the expected future benefit of selecting one alternative over another.

D) the average of all possible outcomes.

E) the weighted average of the outcomes with the probability of each outcome serving as the weight.

A) the probability that each outcome will occur.

B) the probability that each outcome will not occur.

C) the expected future benefit of selecting one alternative over another.

D) the average of all possible outcomes.

E) the weighted average of the outcomes with the probability of each outcome serving as the weight.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

35

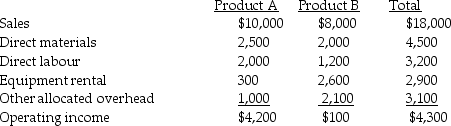

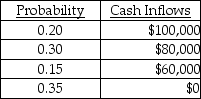

Clinton Company sells two items, product A and product B. The company is considering dropping product B. It is expected that sales of product A will increase by 40% as a result. Dropping product B will allow the company to cancel its monthly equipment rental costing $100 per month. The other existing equipment will be used for additional production of product A. One employee earning $200 per month can be terminated if product B production is dropped. Clinton's other fixed costs are allocated and will continue regardless of the decision made. A condensed, budgeted monthly income statement with both products follows:

Required:

Required:

Prepare an incremental analysis to determine the financial effect of dropping product B.

Required:

Required:Prepare an incremental analysis to determine the financial effect of dropping product B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

36

A computer system installed last year is an example of a(n)

A) sunk cost.

B) relevant cost.

C) differential cost.

D) avoidable cost.

E) opportunity cost.

A) sunk cost.

B) relevant cost.

C) differential cost.

D) avoidable cost.

E) opportunity cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

37

Scott is the new manager of the credit card department of a large bank. One of his first changes, directed by the president, was to reorganize the activities of the department. He is reluctant to start the reorganization without including a comprehensive report from accounting about the current costs of operations and possible costs of changes.

Required:

Explain how the decision process model can assist the manager and discuss the steps in the decision process model that might be taken to ensure an orderly decision process.

Required:

Explain how the decision process model can assist the manager and discuss the steps in the decision process model that might be taken to ensure an orderly decision process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

38

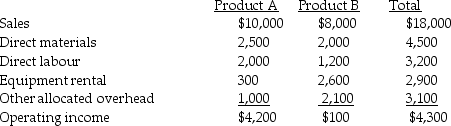

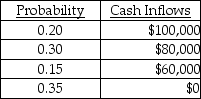

What would be the expected monetary value for the following data using the probability method?

A) $20,000

B) $94,000

C) $80,000

D) $53,000

E) $30,000

A) $20,000

B) $94,000

C) $80,000

D) $53,000

E) $30,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following costs are never relevant in the decision-making process?

A) fixed costs

B) historical costs

C) relevant costs

D) variable costs

E) opportunity costs

A) fixed costs

B) historical costs

C) relevant costs

D) variable costs

E) opportunity costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

40

A student is considering whether to finish their university program in four consecutive years, or take a year off and work for some extra cash.

Required:

a. Identify at least two revenues or costs that are relevant to making this decision. Explain why each is relevant.

b. Identify at least two costs that would be considered sunk costs for this decision.

c. Comment on at least one qualitative consideration for this decision.

Required:

a. Identify at least two revenues or costs that are relevant to making this decision. Explain why each is relevant.

b. Identify at least two costs that would be considered sunk costs for this decision.

c. Comment on at least one qualitative consideration for this decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

41

Insourcing is the process of producing goods and services within the firm rather than purchasing them from an outside supplier.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

42

For one-time-only special orders, variable costs may be relevant but not fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

43

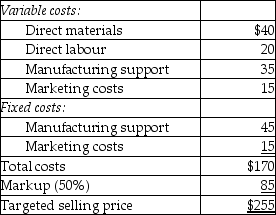

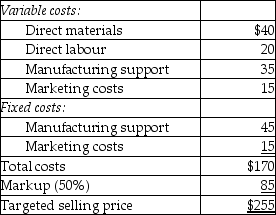

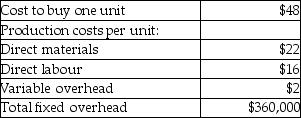

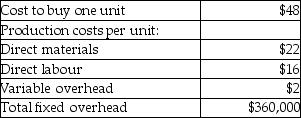

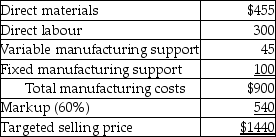

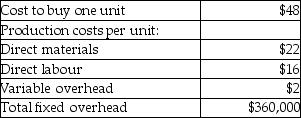

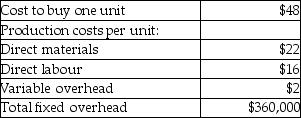

Answer the following question(s) using the information below.

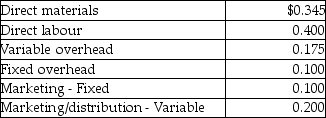

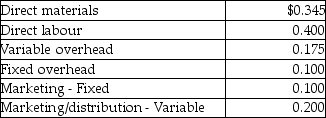

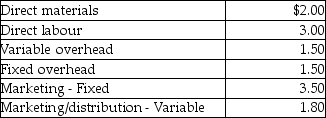

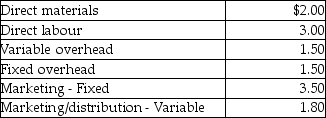

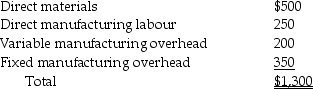

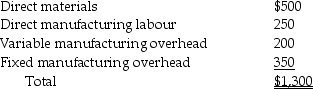

Welch Manufacturing is approached by a European customer to fulfill a one-time-only special order for a product similar to one offered to domestic customers. Welch Manufacturing has excess capacity. The following per unit data apply for sales to regular customers:

For Welch Manufacturing, what is the minimum acceptable price of this special order?

A) $110

B) $140

C) $170

D) $240

E) $255

Welch Manufacturing is approached by a European customer to fulfill a one-time-only special order for a product similar to one offered to domestic customers. Welch Manufacturing has excess capacity. The following per unit data apply for sales to regular customers:

For Welch Manufacturing, what is the minimum acceptable price of this special order?

A) $110

B) $140

C) $170

D) $240

E) $255

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

44

Answer the following question(s) using the information below.

Welch Manufacturing is approached by a European customer to fulfill a one-time-only special order for a product similar to one offered to domestic customers. Welch Manufacturing has excess capacity. The following per unit data apply for sales to regular customers:

What is the full cost of the product per unit?

A) $110

B) $170

C) $255

D) $95

E) $140

Welch Manufacturing is approached by a European customer to fulfill a one-time-only special order for a product similar to one offered to domestic customers. Welch Manufacturing has excess capacity. The following per unit data apply for sales to regular customers:

What is the full cost of the product per unit?

A) $110

B) $170

C) $255

D) $95

E) $140

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

45

Anchor Sign Company manufactures signs from direct materials to the finished product. This is an example of which of the following?

A) insourcing

B) outsourcing

C) product needs analysis

D) product specialization

E) utilization of idle facilities

A) insourcing

B) outsourcing

C) product needs analysis

D) product specialization

E) utilization of idle facilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

46

Omark Corporation currently manufactures a subassembly for its main product. The variable costs per unit are $48, in addition to a $6 charge based on estimated selling expenses. R-Corp has contacted Omark with an offer to sell them 5,000 of the subassemblies for $44.00 each. Omark will eliminate $50,000 of fixed overhead if it accepts the proposal.

What is increase or decrease in profit from accepting the offer?

A) $50,000 increase

B) $100,000 increase

C) $170,000 increase

D) $50,000 decrease

E) $70,000 increase

What is increase or decrease in profit from accepting the offer?

A) $50,000 increase

B) $100,000 increase

C) $170,000 increase

D) $50,000 decrease

E) $70,000 increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

47

Precision Sewing Company incorporates the services of Rosie's Sewing. Precision purchases pre-cut dresses from Rosie's. This is primarily known as

A) insourcing.

B) outsourcing.

C) product needs analysis.

D) product specialization.

E) qualitative analysis.

A) insourcing.

B) outsourcing.

C) product needs analysis.

D) product specialization.

E) qualitative analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

48

When considering a project that will require production using otherwise idle resources, which of the following are true?

A) Avoidable fixed costs are irrelevant.

B) Only the variable costs of the project are relevant.

C) Only financial factors should be considered.

D) The project should not be undertaken if total revenue from the project is less than the total costs of production.

E) In the short run, even if revenue is less than the total costs of production, the project could help the company's overall operating income.

A) Avoidable fixed costs are irrelevant.

B) Only the variable costs of the project are relevant.

C) Only financial factors should be considered.

D) The project should not be undertaken if total revenue from the project is less than the total costs of production.

E) In the short run, even if revenue is less than the total costs of production, the project could help the company's overall operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

49

Answer the following question(s) using the information below.

Welch Manufacturing is approached by a European customer to fulfill a one-time-only special order for a product similar to one offered to domestic customers. Welch Manufacturing has excess capacity. The following per unit data apply for sales to regular customers:

What is the contribution margin per unit?

A) $85

B) $110

C) $145

D) $160

E) $195

Welch Manufacturing is approached by a European customer to fulfill a one-time-only special order for a product similar to one offered to domestic customers. Welch Manufacturing has excess capacity. The following per unit data apply for sales to regular customers:

What is the contribution margin per unit?

A) $85

B) $110

C) $145

D) $160

E) $195

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

50

A one-time-only special order decision

A) should consider only long-term costs and benefits.

B) must still consider short-term and long-term costs and benefits.

C) allows a company to sell products at prices which only cover fixed costs.

D) should consider only short-term costs and benefits.

E) should only be undertaken if there is idle capacity.

A) should consider only long-term costs and benefits.

B) must still consider short-term and long-term costs and benefits.

C) allows a company to sell products at prices which only cover fixed costs.

D) should consider only short-term costs and benefits.

E) should only be undertaken if there is idle capacity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

51

Answer the following question(s) using the information below.

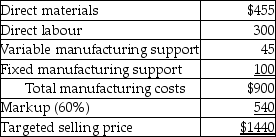

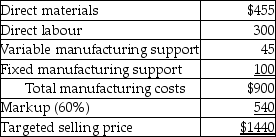

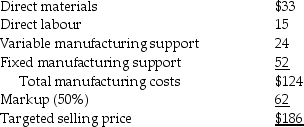

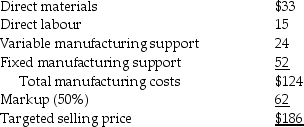

Grant's Kitchens is approached by Ms. Tammy Wang, a new customer, to fulfill a large one-time-only special order for a product similar to one offered to regular customers. The following per unit data apply for sales to regular customers:

Grant's Kitchens has excess capacity. Ms. Wang wants the cabinets in cherry rather than oak, so direct material costs will increase by $30 per unit.

Grant's Kitchens has excess capacity. Ms. Wang wants the cabinets in cherry rather than oak, so direct material costs will increase by $30 per unit.

For Grant's Kitchens, what is the minimum acceptable price of this one-time-only special order?

A) $830

B) $900

C) $930

D) $1,440

E) $800

Grant's Kitchens is approached by Ms. Tammy Wang, a new customer, to fulfill a large one-time-only special order for a product similar to one offered to regular customers. The following per unit data apply for sales to regular customers:

Grant's Kitchens has excess capacity. Ms. Wang wants the cabinets in cherry rather than oak, so direct material costs will increase by $30 per unit.

Grant's Kitchens has excess capacity. Ms. Wang wants the cabinets in cherry rather than oak, so direct material costs will increase by $30 per unit.For Grant's Kitchens, what is the minimum acceptable price of this one-time-only special order?

A) $830

B) $900

C) $930

D) $1,440

E) $800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

52

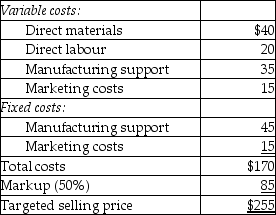

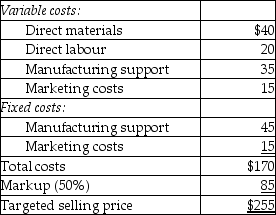

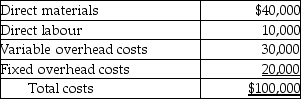

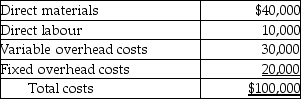

Northern Glass Manufacturing has a current production level of 200,000 glass jars per month. Unit costs at this level are:  Current monthly sales are 180,000 units. Canadian Hardware Ltd. has contacted Northern Glass Manufacturing about purchasing 15,000 units at $1.00 each. Current sales would not be affected by the special order, and variable marketing/ distributing costs would not be incurred on the special order.

Current monthly sales are 180,000 units. Canadian Hardware Ltd. has contacted Northern Glass Manufacturing about purchasing 15,000 units at $1.00 each. Current sales would not be affected by the special order, and variable marketing/ distributing costs would not be incurred on the special order.

What is Comics Plus' change in profits if the order is accepted?

A) $4,800 increase

B) $4,800 decrease

C) $1,800 decrease

D) $300 decrease

E) $1,200 increase

Current monthly sales are 180,000 units. Canadian Hardware Ltd. has contacted Northern Glass Manufacturing about purchasing 15,000 units at $1.00 each. Current sales would not be affected by the special order, and variable marketing/ distributing costs would not be incurred on the special order.

Current monthly sales are 180,000 units. Canadian Hardware Ltd. has contacted Northern Glass Manufacturing about purchasing 15,000 units at $1.00 each. Current sales would not be affected by the special order, and variable marketing/ distributing costs would not be incurred on the special order.What is Comics Plus' change in profits if the order is accepted?

A) $4,800 increase

B) $4,800 decrease

C) $1,800 decrease

D) $300 decrease

E) $1,200 increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

53

Outsourcing is risk free to the manufacturer because the supplier now has the responsibility of producing the part.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

54

Boyd Tool Company is a tool manufacturer. Production capacity is 3,000 units per month; however, they are considering alternative ways to increase capacity to 3,500 units. One of the alternatives involves purchasing new equipment. In this alternative, there are two choices: machine A will provide increased capacity of 4,000 units per month, with unit costs of $14 at capacity; and, machine B will increase capacity to 3,600 units per month with unit costs of $15 at capacity. Both machines are adequate since Boyd's does not intend to go beyond the 3,500 units per month level for the foreseeable future. Relevant information for this decision includes

A) whether other costs will change solely due to a capacity increase.

B) the different unit cost of production between the two machine at their capacity levels.

C) Boyd's planned capacity utilization.

D) excess capacity of either machine.

E) the different unit cost of production between the two machines at Boyd's planned capacity levels.

A) whether other costs will change solely due to a capacity increase.

B) the different unit cost of production between the two machine at their capacity levels.

C) Boyd's planned capacity utilization.

D) excess capacity of either machine.

E) the different unit cost of production between the two machines at Boyd's planned capacity levels.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following terms represents additional costs required to obtain an additional quantity, over and above existing or planned quantities of a cost object?

A) contract increase costs

B) contract pocket costs

C) contract expense

D) outlay costs

E) super variable costs

A) contract increase costs

B) contract pocket costs

C) contract expense

D) outlay costs

E) super variable costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

56

An example of an outsourcing process is when a computer company purchases keyboards from another company instead of producing the components internally.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

57

Northwoods is invited to bid on a one-time-only special order to supply 100 rustic tables. What is the lowest price Northwoods should bid on this special order?

A) $6,300

B) $7,200

C) $10,800

D) $13,500

E) $9,000

A) $6,300

B) $7,200

C) $10,800

D) $13,500

E) $9,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

58

Answer the following question(s) using the information below.

Welch Manufacturing is approached by a European customer to fulfill a one-time-only special order for a product similar to one offered to domestic customers. Welch Manufacturing has excess capacity. The following per unit data apply for sales to regular customers:

What is the change in operating profits if the one-time-only special order for 1,000 units is accepted for $180 a unit by Welch?

A) $70,000 increase in operating profits

B) $10,000 increase in operating profits

C) $10,000 decrease in operating profits

D) $75,000 decrease in operating profits

E) $40,000 increase in operating profits

Welch Manufacturing is approached by a European customer to fulfill a one-time-only special order for a product similar to one offered to domestic customers. Welch Manufacturing has excess capacity. The following per unit data apply for sales to regular customers:

What is the change in operating profits if the one-time-only special order for 1,000 units is accepted for $180 a unit by Welch?

A) $70,000 increase in operating profits

B) $10,000 increase in operating profits

C) $10,000 decrease in operating profits

D) $75,000 decrease in operating profits

E) $40,000 increase in operating profits

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

59

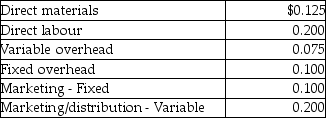

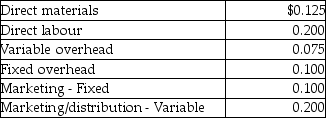

First Image has a plant capacity of 80,000 units per month. Unit costs at capacity are:  Current monthly sales are 78,000 units at $12.60 each. Computer Output Management has contacted First Image about purchasing 2,000 units at $12.00 each. Current sales would not be affected by the special order. What is First Image's change in profits if the order is accepted?

Current monthly sales are 78,000 units at $12.60 each. Computer Output Management has contacted First Image about purchasing 2,000 units at $12.00 each. Current sales would not be affected by the special order. What is First Image's change in profits if the order is accepted?

A) $7,400 increase

B) $8,600 increase

C) $4,400 increase

D) $2,600 decrease

E) $3,600 decrease

Current monthly sales are 78,000 units at $12.60 each. Computer Output Management has contacted First Image about purchasing 2,000 units at $12.00 each. Current sales would not be affected by the special order. What is First Image's change in profits if the order is accepted?

Current monthly sales are 78,000 units at $12.60 each. Computer Output Management has contacted First Image about purchasing 2,000 units at $12.00 each. Current sales would not be affected by the special order. What is First Image's change in profits if the order is accepted?A) $7,400 increase

B) $8,600 increase

C) $4,400 increase

D) $2,600 decrease

E) $3,600 decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

60

Comics Plus has a current production level of 200,000 comics per month. Unit costs at this level are:  Current monthly sales are 180,000 units. Printers Ltd. has contacted Comics Plus about purchasing 15,000 units at $1.00 each. Current sales would not be affected by the special order, and variable marketing/ distributing costs would not be incurred on the special order.

Current monthly sales are 180,000 units. Printers Ltd. has contacted Comics Plus about purchasing 15,000 units at $1.00 each. Current sales would not be affected by the special order, and variable marketing/ distributing costs would not be incurred on the special order.

What is Comics Plus' change in profits if the order is accepted?

A) $6,000 increase

B) $6,000 decrease

C) $7,500 increase

D) $9,000 increase

E) $3,000 increase

Current monthly sales are 180,000 units. Printers Ltd. has contacted Comics Plus about purchasing 15,000 units at $1.00 each. Current sales would not be affected by the special order, and variable marketing/ distributing costs would not be incurred on the special order.

Current monthly sales are 180,000 units. Printers Ltd. has contacted Comics Plus about purchasing 15,000 units at $1.00 each. Current sales would not be affected by the special order, and variable marketing/ distributing costs would not be incurred on the special order.What is Comics Plus' change in profits if the order is accepted?

A) $6,000 increase

B) $6,000 decrease

C) $7,500 increase

D) $9,000 increase

E) $3,000 increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

61

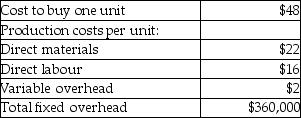

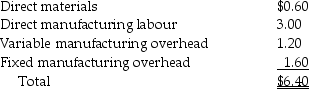

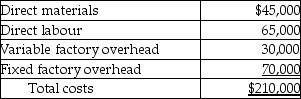

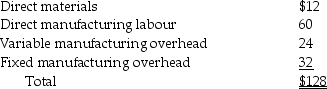

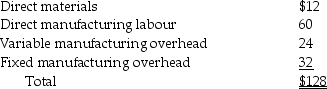

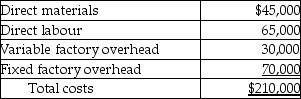

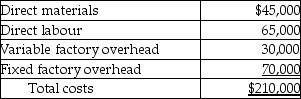

Southwestern Company needs 1,000 motors in its manufacture of automobiles. It can buy the motors from Jinx Motors for $1,250 each. Southwestern's plant can manufacture the motors for the following costs per unit:

If Southwestern buys the motors from Jinx, 30% of the fixed manufacturing overhead applied will be avoided.

If Southwestern buys the motors from Jinx, 30% of the fixed manufacturing overhead applied will be avoided.

Required:

a. Should the company make or buy the motors?

b. What additional factors should Southwestern consider in deciding whether or not to make or buy the motors?

If Southwestern buys the motors from Jinx, 30% of the fixed manufacturing overhead applied will be avoided.

If Southwestern buys the motors from Jinx, 30% of the fixed manufacturing overhead applied will be avoided.Required:

a. Should the company make or buy the motors?

b. What additional factors should Southwestern consider in deciding whether or not to make or buy the motors?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

62

Answer the following question(s) using the information below.

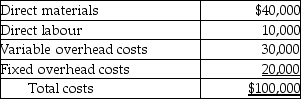

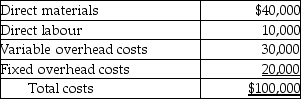

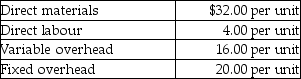

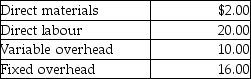

Konrade's Engine Company manufactures part TE456 used in several of its engine models. Monthly production costs for 1,000 units are as follows:

It is estimated that 10% of the fixed overhead costs assigned to TE456 will no longer be incurred if the company purchases TE456 from the outside supplier. Konrade's Engine Company has the option of purchasing the part from an outside supplier at $85 per unit.

It is estimated that 10% of the fixed overhead costs assigned to TE456 will no longer be incurred if the company purchases TE456 from the outside supplier. Konrade's Engine Company has the option of purchasing the part from an outside supplier at $85 per unit.

The maximum price that Konrade's Engine Company should be willing to pay the outside supplier is

A) $80 per TE456 part.

B) $82 per TE456 part.

C) $98 per TE456 part.

D) $100 per TE456 part.

E) $50 per TE456 part.

Konrade's Engine Company manufactures part TE456 used in several of its engine models. Monthly production costs for 1,000 units are as follows:

It is estimated that 10% of the fixed overhead costs assigned to TE456 will no longer be incurred if the company purchases TE456 from the outside supplier. Konrade's Engine Company has the option of purchasing the part from an outside supplier at $85 per unit.

It is estimated that 10% of the fixed overhead costs assigned to TE456 will no longer be incurred if the company purchases TE456 from the outside supplier. Konrade's Engine Company has the option of purchasing the part from an outside supplier at $85 per unit.The maximum price that Konrade's Engine Company should be willing to pay the outside supplier is

A) $80 per TE456 part.

B) $82 per TE456 part.

C) $98 per TE456 part.

D) $100 per TE456 part.

E) $50 per TE456 part.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

63

Answer the following question(s) using the information below.

Day Star collected the following information:

Day Star can sell 25,000 units per year, at $80 each. The company also has an offer from a subsidiary to rent its plant facilities for $2,000,000. The fixed overhead will be incurred in each alternative, but there will be a savings of $150,000 in the fixed costs under the renting alternative.

Day Star can sell 25,000 units per year, at $80 each. The company also has an offer from a subsidiary to rent its plant facilities for $2,000,000. The fixed overhead will be incurred in each alternative, but there will be a savings of $150,000 in the fixed costs under the renting alternative.

Based on the above information only, should Day Star make or buy the product or rent its facilities out?

A) buy

B) make

C) either make or buy - indifferent

D) rent the facilities to the subsidiary

E) either make or rent - indifferent

Day Star collected the following information:

Day Star can sell 25,000 units per year, at $80 each. The company also has an offer from a subsidiary to rent its plant facilities for $2,000,000. The fixed overhead will be incurred in each alternative, but there will be a savings of $150,000 in the fixed costs under the renting alternative.

Day Star can sell 25,000 units per year, at $80 each. The company also has an offer from a subsidiary to rent its plant facilities for $2,000,000. The fixed overhead will be incurred in each alternative, but there will be a savings of $150,000 in the fixed costs under the renting alternative.Based on the above information only, should Day Star make or buy the product or rent its facilities out?

A) buy

B) make

C) either make or buy - indifferent

D) rent the facilities to the subsidiary

E) either make or rent - indifferent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

64

Answer the following question(s) using the information below.

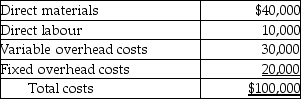

Day Star collected the following information:

Day Star can sell 25,000 units per year, at $80 each. The company also has an offer from a subsidiary to rent its plant facilities for $2,000,000. The fixed overhead will be incurred in each alternative, but there will be a savings of $150,000 in the fixed costs under the renting alternative.

Day Star can sell 25,000 units per year, at $80 each. The company also has an offer from a subsidiary to rent its plant facilities for $2,000,000. The fixed overhead will be incurred in each alternative, but there will be a savings of $150,000 in the fixed costs under the renting alternative.

Audio Labs collected the following information on the cost of producing 20,000 speaker units: Cartunes has offered to sell Audio 10,000 speakers for $56.00 each.

Cartunes has offered to sell Audio 10,000 speakers for $56.00 each.

Should Audio Labs make or buy the parts if the facilities remain idle when speakers are purchased?

A) buy, save $16.00 per unit

B) buy, save $4.00 per unit

C) make, save $2.00 per unit

D) make, save $4.00 per unit

E) make, save $6.00 per unit

Day Star collected the following information:

Day Star can sell 25,000 units per year, at $80 each. The company also has an offer from a subsidiary to rent its plant facilities for $2,000,000. The fixed overhead will be incurred in each alternative, but there will be a savings of $150,000 in the fixed costs under the renting alternative.

Day Star can sell 25,000 units per year, at $80 each. The company also has an offer from a subsidiary to rent its plant facilities for $2,000,000. The fixed overhead will be incurred in each alternative, but there will be a savings of $150,000 in the fixed costs under the renting alternative.Audio Labs collected the following information on the cost of producing 20,000 speaker units:

Cartunes has offered to sell Audio 10,000 speakers for $56.00 each.

Cartunes has offered to sell Audio 10,000 speakers for $56.00 each.Should Audio Labs make or buy the parts if the facilities remain idle when speakers are purchased?

A) buy, save $16.00 per unit

B) buy, save $4.00 per unit

C) make, save $2.00 per unit

D) make, save $4.00 per unit

E) make, save $6.00 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

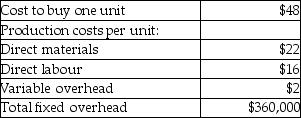

65

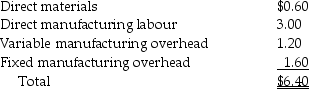

Kirkland Company manufactures a part for use in its production of hats. When 10,000 items are produced, the costs per unit are:

Mike Company has offered to sell to Kirkland Company 10,000 units of the part for $6.00 per unit. The plant facilities could be used to manufacture another item at a savings of $9,000 if Kirkland accepts the offer. In addition, $1.00 per unit of fixed manufacturing overhead on the original item would be eliminated.

Mike Company has offered to sell to Kirkland Company 10,000 units of the part for $6.00 per unit. The plant facilities could be used to manufacture another item at a savings of $9,000 if Kirkland accepts the offer. In addition, $1.00 per unit of fixed manufacturing overhead on the original item would be eliminated.

Required:

a. What is the relevant per unit cost for the original part?

b. Which alternative is best for Kirkland Company? By how much?

Mike Company has offered to sell to Kirkland Company 10,000 units of the part for $6.00 per unit. The plant facilities could be used to manufacture another item at a savings of $9,000 if Kirkland accepts the offer. In addition, $1.00 per unit of fixed manufacturing overhead on the original item would be eliminated.

Mike Company has offered to sell to Kirkland Company 10,000 units of the part for $6.00 per unit. The plant facilities could be used to manufacture another item at a savings of $9,000 if Kirkland accepts the offer. In addition, $1.00 per unit of fixed manufacturing overhead on the original item would be eliminated.Required:

a. What is the relevant per unit cost for the original part?

b. Which alternative is best for Kirkland Company? By how much?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

66

Answer the following question(s) using the information below.

Grant's Kitchens is approached by Ms. Tammy Wang, a new customer, to fulfill a large one-time-only special order for a product similar to one offered to regular customers. The following per unit data apply for sales to regular customers:

Grant's Kitchens has excess capacity. Ms. Wang wants the cabinets in cherry rather than oak, so direct material costs will increase by $30 per unit.

Grant's Kitchens has excess capacity. Ms. Wang wants the cabinets in cherry rather than oak, so direct material costs will increase by $30 per unit.

Other than price, what other item should Grant's Kitchens consider before accepting this one-time-only special order?

A) reaction of shareholders

B) management stock options

C) demand for cherry cabinets

D) price is the only consideration

E) reaction of existing customers to the lower price offered to Ms. Wang

Grant's Kitchens is approached by Ms. Tammy Wang, a new customer, to fulfill a large one-time-only special order for a product similar to one offered to regular customers. The following per unit data apply for sales to regular customers:

Grant's Kitchens has excess capacity. Ms. Wang wants the cabinets in cherry rather than oak, so direct material costs will increase by $30 per unit.

Grant's Kitchens has excess capacity. Ms. Wang wants the cabinets in cherry rather than oak, so direct material costs will increase by $30 per unit.Other than price, what other item should Grant's Kitchens consider before accepting this one-time-only special order?

A) reaction of shareholders

B) management stock options

C) demand for cherry cabinets

D) price is the only consideration

E) reaction of existing customers to the lower price offered to Ms. Wang

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

67

Answer the following question(s) using the information below.

Konrade's Engine Company manufactures part TE456 used in several of its engine models. Monthly production costs for 1,000 units are as follows:

It is estimated that 10% of the fixed overhead costs assigned to TE456 will no longer be incurred if the company purchases TE456 from the outside supplier. Konrade's Engine Company has the option of purchasing the part from an outside supplier at $85 per unit.

It is estimated that 10% of the fixed overhead costs assigned to TE456 will no longer be incurred if the company purchases TE456 from the outside supplier. Konrade's Engine Company has the option of purchasing the part from an outside supplier at $85 per unit.

If Konrade's Engine Company purchases 1,000 TE456 parts from the outside supplier per month, then its monthly operating income will

A) increase by $13,000.

B) increase by $15,000.

C) decrease by $5,000.

D) decrease by $3,000.

E) decrease by $35,000.

Konrade's Engine Company manufactures part TE456 used in several of its engine models. Monthly production costs for 1,000 units are as follows:

It is estimated that 10% of the fixed overhead costs assigned to TE456 will no longer be incurred if the company purchases TE456 from the outside supplier. Konrade's Engine Company has the option of purchasing the part from an outside supplier at $85 per unit.

It is estimated that 10% of the fixed overhead costs assigned to TE456 will no longer be incurred if the company purchases TE456 from the outside supplier. Konrade's Engine Company has the option of purchasing the part from an outside supplier at $85 per unit.If Konrade's Engine Company purchases 1,000 TE456 parts from the outside supplier per month, then its monthly operating income will

A) increase by $13,000.

B) increase by $15,000.

C) decrease by $5,000.

D) decrease by $3,000.

E) decrease by $35,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

68

Answer the following question(s) using the information below.

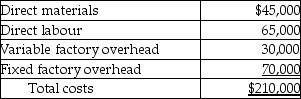

Schmidt Corporation produces a part that is used in the manufacture of one of its products. The costs associated with the production of 10,000 units of this part are as follows:

Of the fixed factory overhead costs, $30,000 is avoidable.

Of the fixed factory overhead costs, $30,000 is avoidable.

Lynn Valley Corporation currently manufactures a subassembly for its main product. The costs per unit are as follows: Reliance Corp has contacted Lynn Valley with an offer to sell them 5,000 of the subassemblies for $44.00 each. Lynn Valley will eliminate $50,000 of fixed overhead if it accepts the proposal.

Reliance Corp has contacted Lynn Valley with an offer to sell them 5,000 of the subassemblies for $44.00 each. Lynn Valley will eliminate $50,000 of fixed overhead if it accepts the proposal.

Should Omark make or buy the subassemblies? What is the difference between the two alternatives?

A) buy; savings = $20,000

B) buy; savings = $50,000

C) make; savings = $60,000

D) make; savings = $10,000

E) buy; savings = $10,000

Schmidt Corporation produces a part that is used in the manufacture of one of its products. The costs associated with the production of 10,000 units of this part are as follows:

Of the fixed factory overhead costs, $30,000 is avoidable.

Of the fixed factory overhead costs, $30,000 is avoidable.Lynn Valley Corporation currently manufactures a subassembly for its main product. The costs per unit are as follows:

Reliance Corp has contacted Lynn Valley with an offer to sell them 5,000 of the subassemblies for $44.00 each. Lynn Valley will eliminate $50,000 of fixed overhead if it accepts the proposal.

Reliance Corp has contacted Lynn Valley with an offer to sell them 5,000 of the subassemblies for $44.00 each. Lynn Valley will eliminate $50,000 of fixed overhead if it accepts the proposal.Should Omark make or buy the subassemblies? What is the difference between the two alternatives?

A) buy; savings = $20,000

B) buy; savings = $50,000

C) make; savings = $60,000

D) make; savings = $10,000

E) buy; savings = $10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

69

Answer the following question(s) using the information below.

Day Star collected the following information:

Day Star can sell 25,000 units per year, at $80 each. The company also has an offer from a subsidiary to rent its plant facilities for $2,000,000. The fixed overhead will be incurred in each alternative, but there will be a savings of $150,000 in the fixed costs under the renting alternative.

Day Star can sell 25,000 units per year, at $80 each. The company also has an offer from a subsidiary to rent its plant facilities for $2,000,000. The fixed overhead will be incurred in each alternative, but there will be a savings of $150,000 in the fixed costs under the renting alternative.

What production level is required for Day Star to be indifferent between making or buying the part if $260,000 of fixed costs can be eliminated by buying?

A) 32,500 units

B) 26,500 units

C) 12,500 units

D) 1,000 units

E) 0 units

Day Star collected the following information:

Day Star can sell 25,000 units per year, at $80 each. The company also has an offer from a subsidiary to rent its plant facilities for $2,000,000. The fixed overhead will be incurred in each alternative, but there will be a savings of $150,000 in the fixed costs under the renting alternative.

Day Star can sell 25,000 units per year, at $80 each. The company also has an offer from a subsidiary to rent its plant facilities for $2,000,000. The fixed overhead will be incurred in each alternative, but there will be a savings of $150,000 in the fixed costs under the renting alternative.What production level is required for Day Star to be indifferent between making or buying the part if $260,000 of fixed costs can be eliminated by buying?

A) 32,500 units

B) 26,500 units

C) 12,500 units

D) 1,000 units

E) 0 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

70

Axle and Wheel Manufacturing is approached by a European customer to fill a one-time-only special order for a product similar to one offered to domestic customers. The following per unit data apply for sales to regular customers:

Axle and Wheel Manufacturing has excess capacity.

Axle and Wheel Manufacturing has excess capacity.

Required:

a. What is the full cost of the product per unit?

b. What is the contribution margin per unit?

c. Which costs are relevant for making the decision regarding this one-time-only special order? Why?

d. For Axle and Wheel Manufacturing, what is the minimum acceptable price of this one-time-only special order?

e. For this one-time-only special order, should Axle and Wheel Manufacturing consider a price of $100 per unit? Why or why not?

Axle and Wheel Manufacturing has excess capacity.

Axle and Wheel Manufacturing has excess capacity.Required:

a. What is the full cost of the product per unit?

b. What is the contribution margin per unit?

c. Which costs are relevant for making the decision regarding this one-time-only special order? Why?

d. For Axle and Wheel Manufacturing, what is the minimum acceptable price of this one-time-only special order?

e. For this one-time-only special order, should Axle and Wheel Manufacturing consider a price of $100 per unit? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

71

Clearwater Company operates a wine outlet in a tourist area. One litre bottles sell for $12. Daily fixed costs are $3,000, and variable costs are $6 per litre. An average of 750 litres are sold each day. Clearwater has a capacity of 800 litres per day.

Required:

a. Determine the average cost per bottle.

b. A bus loaded with 40 senior citizens stops by at closing time and the tour director offers Clearwater $300 for 40 litres. Clearwater refuses, saying they would lose $2.50 on each litre. Is Clearwater correct about the $2.50? Why or why not?

c. A fund-raising organization has offered Clearwater a one-year contract to buy 300 litres a day for $7.50 each. Should they accept the offer? Why or why not?

Required:

a. Determine the average cost per bottle.

b. A bus loaded with 40 senior citizens stops by at closing time and the tour director offers Clearwater $300 for 40 litres. Clearwater refuses, saying they would lose $2.50 on each litre. Is Clearwater correct about the $2.50? Why or why not?

c. A fund-raising organization has offered Clearwater a one-year contract to buy 300 litres a day for $7.50 each. Should they accept the offer? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

72

Answer the following question(s) using the information below.

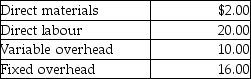

Konrade's Engine Company manufactures part TE456 used in several of its engine models. Monthly production costs for 1,000 units are as follows:

It is estimated that 10% of the fixed overhead costs assigned to TE456 will no longer be incurred if the company purchases TE456 from the outside supplier. Konrade's Engine Company has the option of purchasing the part from an outside supplier at $85 per unit.

It is estimated that 10% of the fixed overhead costs assigned to TE456 will no longer be incurred if the company purchases TE456 from the outside supplier. Konrade's Engine Company has the option of purchasing the part from an outside supplier at $85 per unit.

If Konrade's Engine Company accepts the offer from the outside supplier, the monthly avoidable costs (costs that will no longer be incurred) total

A) $80,000.

B) $98,000.

C) $50,000.

D) $100,000.

E) $82,000.

Konrade's Engine Company manufactures part TE456 used in several of its engine models. Monthly production costs for 1,000 units are as follows:

It is estimated that 10% of the fixed overhead costs assigned to TE456 will no longer be incurred if the company purchases TE456 from the outside supplier. Konrade's Engine Company has the option of purchasing the part from an outside supplier at $85 per unit.

It is estimated that 10% of the fixed overhead costs assigned to TE456 will no longer be incurred if the company purchases TE456 from the outside supplier. Konrade's Engine Company has the option of purchasing the part from an outside supplier at $85 per unit.If Konrade's Engine Company accepts the offer from the outside supplier, the monthly avoidable costs (costs that will no longer be incurred) total

A) $80,000.

B) $98,000.

C) $50,000.

D) $100,000.

E) $82,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

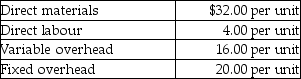

73

Lewis Auto Company manufactures a part for use in its production of automobiles. When 10,000 items are produced, the costs per unit are:

Monty Company has offered to sell Lewis Auto Company 10,000 units of the part for $120 per unit. The plant facilities could be used to manufacture another part at a savings of $180,000 if Lewis Auto accepts the supplier's offer. In addition, $20 per unit of fixed manufacturing overhead on the original part would be eliminated.

Monty Company has offered to sell Lewis Auto Company 10,000 units of the part for $120 per unit. The plant facilities could be used to manufacture another part at a savings of $180,000 if Lewis Auto accepts the supplier's offer. In addition, $20 per unit of fixed manufacturing overhead on the original part would be eliminated.

Required:

a. What is the relevant per unit cost for the original part?

b. Which alternative is best for Lewis Auto Company? By how much?

Monty Company has offered to sell Lewis Auto Company 10,000 units of the part for $120 per unit. The plant facilities could be used to manufacture another part at a savings of $180,000 if Lewis Auto accepts the supplier's offer. In addition, $20 per unit of fixed manufacturing overhead on the original part would be eliminated.

Monty Company has offered to sell Lewis Auto Company 10,000 units of the part for $120 per unit. The plant facilities could be used to manufacture another part at a savings of $180,000 if Lewis Auto accepts the supplier's offer. In addition, $20 per unit of fixed manufacturing overhead on the original part would be eliminated.Required:

a. What is the relevant per unit cost for the original part?

b. Which alternative is best for Lewis Auto Company? By how much?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

74

Collier Bicycles has been manufacturing its own wheels for its bikes. The company is currently operating at 100% capacity, and variable manufacturing overhead is charged to production at the rate of 30% of direct labour cost. The direct materials and direct labour cost per unit to make the wheels are $1.50 and $1.80, respectively. Normal production is 200,000 wheels per year.

A supplier offers to make the wheels at a price of $4 each. If the bicycle company accepts this offer, all variable manufacturing costs will be eliminated, but the $42,000 of fixed manufacturing overhead currently being charged to the wheels will have to be absorbed by other products.

Required:

a. Prepare an incremental analysis for the decision to make or buy the wheels.

b. Should Collier Bicycles buy the wheels from the outside supplier? Justify your answer.

A supplier offers to make the wheels at a price of $4 each. If the bicycle company accepts this offer, all variable manufacturing costs will be eliminated, but the $42,000 of fixed manufacturing overhead currently being charged to the wheels will have to be absorbed by other products.

Required:

a. Prepare an incremental analysis for the decision to make or buy the wheels.

b. Should Collier Bicycles buy the wheels from the outside supplier? Justify your answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

75

Answer the following question(s) using the information below.

Schmidt Corporation produces a part that is used in the manufacture of one of its products. The costs associated with the production of 10,000 units of this part are as follows:

Of the fixed factory overhead costs, $30,000 is avoidable.

Of the fixed factory overhead costs, $30,000 is avoidable.

Assuming no other use of their facilities, the highest price that Schmidt should be willing to pay for 10,000 units of the part is

A) $210,000.

B) $170,000.

C) $110,000.

D) $180,000.

E) $140,000.

Schmidt Corporation produces a part that is used in the manufacture of one of its products. The costs associated with the production of 10,000 units of this part are as follows:

Of the fixed factory overhead costs, $30,000 is avoidable.

Of the fixed factory overhead costs, $30,000 is avoidable.Assuming no other use of their facilities, the highest price that Schmidt should be willing to pay for 10,000 units of the part is

A) $210,000.

B) $170,000.

C) $110,000.

D) $180,000.

E) $140,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

76

A cafe specializes in short order meals and morning and afternoon snack breaks. It is open from 9:00 am until 4:00 pm. An office manager in a nearby high rise office building offers the owner a contract to provide her 50 employees with afternoon snack breaks for$2.00 each. Each employee would receive a drink and a snack item. The shop has an hourly capacity of 50 customers. The owner estimates that the variable costs of the afternoon breaks would be $1.20 each. Currently the afternoon service, starting at 2:00, is running at only 50 percent capacity, although the morning and noon activities are near capacity. At the present level of operations each meal/snack served is allocated a fixed cost of $0.25.

Required:

a. What nonfinancial factors should be considered by the owner?

b. Given your concerns listed in part a., should the offer be accepted? Why or why not?

Required:

a. What nonfinancial factors should be considered by the owner?

b. Given your concerns listed in part a., should the offer be accepted? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

77

Answer the following question(s) using the information below.

Grant's Kitchens is approached by Ms. Tammy Wang, a new customer, to fulfill a large one-time-only special order for a product similar to one offered to regular customers. The following per unit data apply for sales to regular customers:

Grant's Kitchens has excess capacity. Ms. Wang wants the cabinets in cherry rather than oak, so direct material costs will increase by $30 per unit.

Grant's Kitchens has excess capacity. Ms. Wang wants the cabinets in cherry rather than oak, so direct material costs will increase by $30 per unit.

For make-or-buy decisions, a supplier's ability to deliver the item on a timely basis is considered a(n)

A) qualitative factor.

B) relevant cost.

C) differential factor.

D) opportunity cost.

E) quantitative factor.

Grant's Kitchens is approached by Ms. Tammy Wang, a new customer, to fulfill a large one-time-only special order for a product similar to one offered to regular customers. The following per unit data apply for sales to regular customers:

Grant's Kitchens has excess capacity. Ms. Wang wants the cabinets in cherry rather than oak, so direct material costs will increase by $30 per unit.

Grant's Kitchens has excess capacity. Ms. Wang wants the cabinets in cherry rather than oak, so direct material costs will increase by $30 per unit.For make-or-buy decisions, a supplier's ability to deliver the item on a timely basis is considered a(n)

A) qualitative factor.

B) relevant cost.

C) differential factor.

D) opportunity cost.

E) quantitative factor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

78

Answer the following question(s) using the information below.

Schmidt Corporation produces a part that is used in the manufacture of one of its products. The costs associated with the production of 10,000 units of this part are as follows:

Of the fixed factory overhead costs, $30,000 is avoidable.

Of the fixed factory overhead costs, $30,000 is avoidable.

Phil Company has offered to sell 10,000 units of the same part to Schmidt Corporation for $18 per unit. Assuming there is no other use for the facilities, Schmidt should

A) make the part, as this would save $3 per unit.

B) buy the part, as this would save $3 per unit.

C) make the part, as this would save $4 per unit.

D) make the part, as this would save $1 per unit.

E) buy the part, as this would save $4 per unit.

Schmidt Corporation produces a part that is used in the manufacture of one of its products. The costs associated with the production of 10,000 units of this part are as follows:

Of the fixed factory overhead costs, $30,000 is avoidable.

Of the fixed factory overhead costs, $30,000 is avoidable.Phil Company has offered to sell 10,000 units of the same part to Schmidt Corporation for $18 per unit. Assuming there is no other use for the facilities, Schmidt should

A) make the part, as this would save $3 per unit.

B) buy the part, as this would save $3 per unit.

C) make the part, as this would save $4 per unit.

D) make the part, as this would save $1 per unit.

E) buy the part, as this would save $4 per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

79

Silver Lake Cabinets is approached by Ms. Jenny Zhang, a new customer, to fulfill a large one-time-only special order for a product similar to one offered to regular customers. The following per unit data apply for sales to regular customers:

Silver Lake Cabinets has excess capacity. Ms. Zhang wants the cabinets in cherry rather than oak, so direct material costs will increase by $30 per unit.

Silver Lake Cabinets has excess capacity. Ms. Zhang wants the cabinets in cherry rather than oak, so direct material costs will increase by $30 per unit.

Required:

a. For Silver Lake Cabinets, what is the minimum acceptable price of this one-time-only special order?

b. Other than price, what other items should Silver Lake Cabinets consider before accepting this one-time-only special order?

c. How would the analysis differ if there was limited capacity?

Silver Lake Cabinets has excess capacity. Ms. Zhang wants the cabinets in cherry rather than oak, so direct material costs will increase by $30 per unit.

Silver Lake Cabinets has excess capacity. Ms. Zhang wants the cabinets in cherry rather than oak, so direct material costs will increase by $30 per unit.Required:

a. For Silver Lake Cabinets, what is the minimum acceptable price of this one-time-only special order?

b. Other than price, what other items should Silver Lake Cabinets consider before accepting this one-time-only special order?

c. How would the analysis differ if there was limited capacity?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

80

Answer the following question(s) using the information below.

Schmidt Corporation produces a part that is used in the manufacture of one of its products. The costs associated with the production of 10,000 units of this part are as follows:

Of the fixed factory overhead costs, $30,000 is avoidable.

Of the fixed factory overhead costs, $30,000 is avoidable.

Assuming accepting the offer creates excess facility capacity that can be used to produce 2,000 units of another product that has a unit selling price of $24, variable costs of $12, and fixed cost allocation of $3. What is the highest price that Schmidt should be willing to pay Phil Company for 10,000 units of the part?

A) $146,000

B) $164,000

C) $116,000

D) $134,000

E) $186,000

Schmidt Corporation produces a part that is used in the manufacture of one of its products. The costs associated with the production of 10,000 units of this part are as follows:

Of the fixed factory overhead costs, $30,000 is avoidable.

Of the fixed factory overhead costs, $30,000 is avoidable.Assuming accepting the offer creates excess facility capacity that can be used to produce 2,000 units of another product that has a unit selling price of $24, variable costs of $12, and fixed cost allocation of $3. What is the highest price that Schmidt should be willing to pay Phil Company for 10,000 units of the part?

A) $146,000

B) $164,000

C) $116,000

D) $134,000

E) $186,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck