Deck 12: Pricing Decisions, Product Profitability Decisions, and Cost Management

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

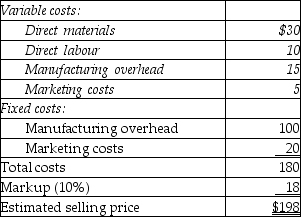

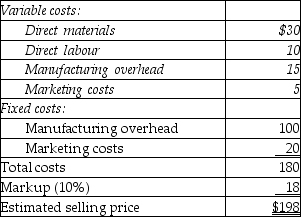

سؤال

سؤال

سؤال

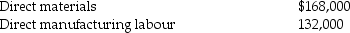

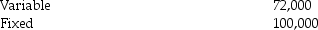

سؤال

سؤال

سؤال

سؤال

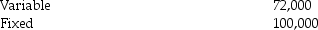

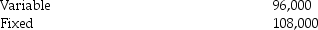

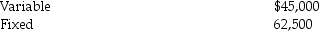

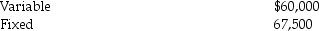

سؤال

سؤال

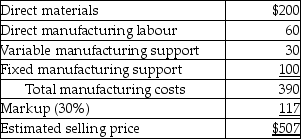

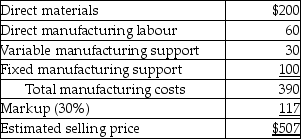

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

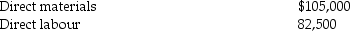

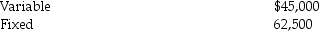

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/135

العب

ملء الشاشة (f)

Deck 12: Pricing Decisions, Product Profitability Decisions, and Cost Management

1

Your company produces 700,000 widgets per year but has the capacity to produce 950,000 units. Company records show the following; full product costs = $85 per unit, which includes fixed manufacturing overhead of $11, and variable overhead of $4 per unit, and direct variable costs of $22, all based on the current 700,000 production run. If the company wanted to bid on a special one-time order, based on the above information only, what would be its minimum bid?

A) $59

B) $81

C) $63

D) $74

E) $85

A) $59

B) $81

C) $63

D) $74

E) $85

D

2

Pricing for one-time-only special orders is, typically,

A) a pricing decision using the time horizon.

B) a short-run decision.

C) a long-run decision.

D) higher in variable costs than usual.

E) based on fixed costs alone.

A) a pricing decision using the time horizon.

B) a short-run decision.

C) a long-run decision.

D) higher in variable costs than usual.

E) based on fixed costs alone.

B

3

For long-run pricing decisions, using stable prices has the advantage of

A) helping build buyer-seller relationships.

B) reducing the need to change cost structures frequently.

C) reducing competition.

D) minimizing the need to monitor competitors prices frequently.

E) increasing margins.

A) helping build buyer-seller relationships.

B) reducing the need to change cost structures frequently.

C) reducing competition.

D) minimizing the need to monitor competitors prices frequently.

E) increasing margins.

A

4

In deciding whether to accept a special sales order, any fixed costs that would remain unchanged are considered irrelevant data.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

5

Relevant costs for pricing decisions include manufacturing costs, but not costs from other value-chain functions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

6

In less competitive markets where products can be differentiated by their features the pricing decision depends on the pricing strategies of competitors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

7

Explain the differences between short-run pricing decisions and long-run pricing decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

8

Decisions on the price to bid on a one-time-only special order should include

A) only cost data.

B) only the potential bids of competitors.

C) existing fixed manufacturing overhead.

D) cost data, and the use of variable costing income statements.

E) cost data and potential bids of competitors.

A) only cost data.

B) only the potential bids of competitors.

C) existing fixed manufacturing overhead.

D) cost data, and the use of variable costing income statements.

E) cost data and potential bids of competitors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following are examples of downstream costs?

A) R&D, distribution, marketing, design

B) production, distribution, marketing, design

C) R&D, design, production

D) production, R&D, distribution, marketing, design

E) after-sales service, distribution, marketing

A) R&D, distribution, marketing, design

B) production, distribution, marketing, design

C) R&D, design, production

D) production, R&D, distribution, marketing, design

E) after-sales service, distribution, marketing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

10

Pricing decisions that are long-run based should focus on more than short-run costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

11

A price-bidding decision for a one-time-only special order includes an analysis of

A) only marketing costs.

B) all cost drivers.

C) all costs of each function in the value chain.

D) only fixed manufacturing costs.

E) indirect costs of each category in the value chain.

A) only marketing costs.

B) all cost drivers.

C) all costs of each function in the value chain.

D) only fixed manufacturing costs.

E) indirect costs of each category in the value chain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

12

Target pricing is based on

A) engineered cost.

B) variable manufacturing and nonmanufacturing costs.

C) full product cost.

D) what customers are willing to pay.

E) full manufacturing cost.

A) engineered cost.

B) variable manufacturing and nonmanufacturing costs.

C) full product cost.

D) what customers are willing to pay.

E) full manufacturing cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

13

Knowledge of long-run product costs helps guide decisions about entering or remaining in the market for a given product when in a highly competitive price-setting situation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

14

The three major influences on pricing decisions are

A) competition, costs, and customers.

B) competition, demand, and production efficiency.

C) continuous improvement, customer satisfaction, and a dual internal/external focus.

D) variable costs, fixed costs, and mixed costs.

E) economic, qualitative, and costs.

A) competition, costs, and customers.

B) competition, demand, and production efficiency.

C) continuous improvement, customer satisfaction, and a dual internal/external focus.

D) variable costs, fixed costs, and mixed costs.

E) economic, qualitative, and costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

15

Short-run pricing decisions include adjusting product mix and output volume in a competitive market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

16

Special orders increase income if the revenue from the order exceeds the incremental variable and fixed costs incurred to fill the order.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

17

Managers have little discretion in setting prices in market situations which are not competitive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

18

The controller and sales manager are at odds over the pricing of a new product. What major influences should be considered in pricing the new product? Discuss each briefly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

19

Upstream costs refer to post-production costs such as after-sales service.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

20

The three major influences on pricing decisions are: costs, competitors, and customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

21

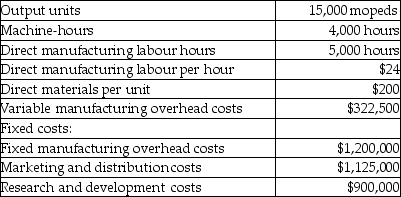

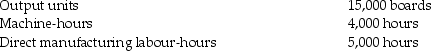

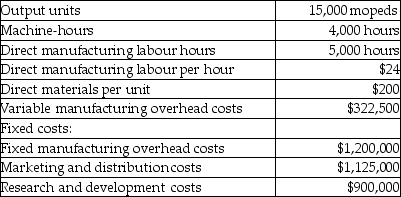

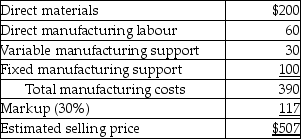

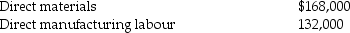

Use the information below to answer the following question(s).

Action Mopeds manufactures mopeds. The following information pertains to the company's normal operations per month:

What is the unit cost when establishing a long-run price for mopeds?

A) $309.50

B) $325.48

C) $444.50

D) $460.50

E) $470.00

Action Mopeds manufactures mopeds. The following information pertains to the company's normal operations per month:

What is the unit cost when establishing a long-run price for mopeds?

A) $309.50

B) $325.48

C) $444.50

D) $460.50

E) $470.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

22

Profit margins are often set to earn a reasonable return on investment for short-term pricing decisions, but not long-term pricing decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

23

Companies that produce high quality products do not have to pay attention to the actions of their competitors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

24

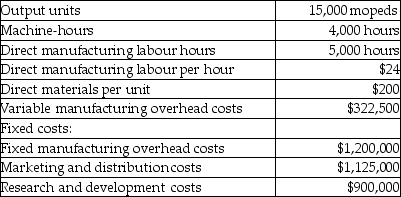

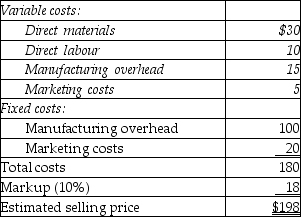

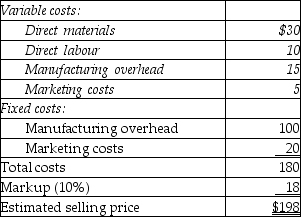

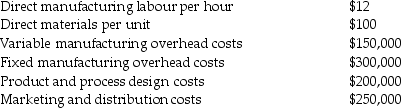

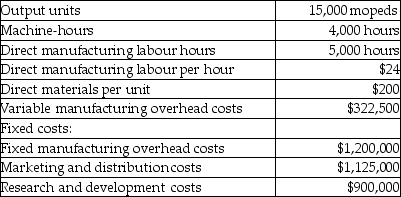

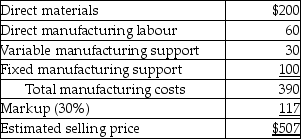

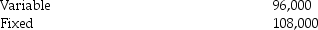

Answer the following question(s) using the information below.

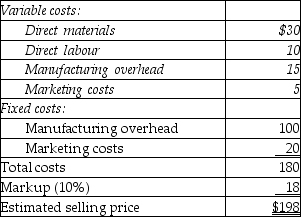

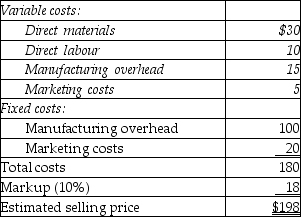

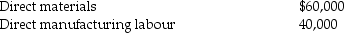

Welch Manufacturing is approached by a European customer to fulfill a one-time-only special order for a product similar to one offered to domestic customers. Welch Manufacturing has a policy of adding a 10% markup to full costs and currently has excess capacity. The following per unit data apply for sales to regular customers:

What is the full cost of the product per unit?

A) $60

B) $180

C) $198

D) $66

E) $155

Welch Manufacturing is approached by a European customer to fulfill a one-time-only special order for a product similar to one offered to domestic customers. Welch Manufacturing has a policy of adding a 10% markup to full costs and currently has excess capacity. The following per unit data apply for sales to regular customers:

What is the full cost of the product per unit?

A) $60

B) $180

C) $198

D) $66

E) $155

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

25

When prices are set in a competitive marketplace, product costs are the most important influence on pricing decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

26

At a management meeting, you just finished presenting your cost analysis report, showing unit costs last year for 60,000 widgets produced were $435.00. The sales manager then complained that she was going to lose a special overseas sale because the customer had indicated they could only pay $425.00. She knew from sources that no competitor would be bidding below $440, and she complained that if the company had better cost control, there would be more profit for everyone. The production manager also would like to take the extra job, since even with the extra production, the plant would be under-capacity.

Required:

What type of information would you need in order to be able to determine if the extra order could be profitably produced if the selling price was held to $425 per unit?

Required:

What type of information would you need in order to be able to determine if the extra order could be profitably produced if the selling price was held to $425 per unit?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

27

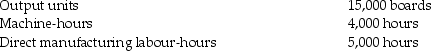

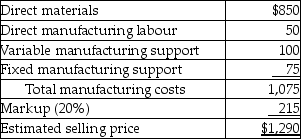

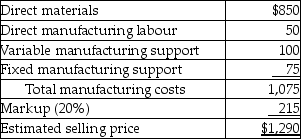

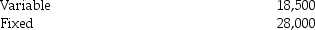

Schlickau Company manufactures basketball backboards. The following information pertains to the

company's normal operations per month:

Required:

Required:

a. For long-run pricing, what is the full-cost base per unit?

b. Schlickau Company is approached by an overseas city to fulfill a one-time-only special order for 1,000 units. All cost relationships remain the same except for an additional one-time setup charge of $40,000. No additional design, marketing, or distribution costs will be incurred. What is the minimum acceptable bid per unit on this one-time-only special order?

company's normal operations per month:

Required:

Required:a. For long-run pricing, what is the full-cost base per unit?

b. Schlickau Company is approached by an overseas city to fulfill a one-time-only special order for 1,000 units. All cost relationships remain the same except for an additional one-time setup charge of $40,000. No additional design, marketing, or distribution costs will be incurred. What is the minimum acceptable bid per unit on this one-time-only special order?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

28

Including unit fixed costs for pricing is often used because of its simplicity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

29

Answer the following question(s) using the information below.

Welch Manufacturing is approached by a European customer to fulfill a one-time-only special order for a product similar to one offered to domestic customers. Welch Manufacturing has a policy of adding a 10% markup to full costs and currently has excess capacity. The following per unit data apply for sales to regular customers:

If the European customer wanted a long-term commitment for supplying this product, what price would most likely be quoted?

A) $66

B) $180

C) $155

D) $217

E) $198

Welch Manufacturing is approached by a European customer to fulfill a one-time-only special order for a product similar to one offered to domestic customers. Welch Manufacturing has a policy of adding a 10% markup to full costs and currently has excess capacity. The following per unit data apply for sales to regular customers:

If the European customer wanted a long-term commitment for supplying this product, what price would most likely be quoted?

A) $66

B) $180

C) $155

D) $217

E) $198

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

30

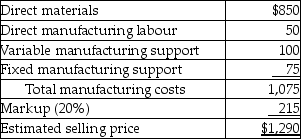

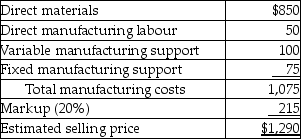

Answer the following question(s) using the information below.

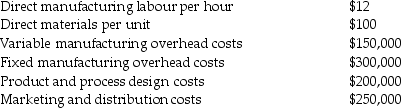

Gerry's Generator Supply is approached by Mr. Gladstone, a new customer, to fulfill a large one-time-only special order for a product similar to one offered to regular customers. Gerry's Generator Supply has excess capacity. The following per unit data apply for sales to regular customers:

If Mr. Gladstone wanted a long-term commitment for supplying this product, what price would most likely be quoted to him?

A) $1,000

B) $1,200

C) $1,290

D) $1,400

E) $1,075

Gerry's Generator Supply is approached by Mr. Gladstone, a new customer, to fulfill a large one-time-only special order for a product similar to one offered to regular customers. Gerry's Generator Supply has excess capacity. The following per unit data apply for sales to regular customers:

If Mr. Gladstone wanted a long-term commitment for supplying this product, what price would most likely be quoted to him?

A) $1,000

B) $1,200

C) $1,290

D) $1,400

E) $1,075

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

31

Muskoka Travel offers guided tours through the lake system. Muskoka Travel provides a guide, necessary equipment, and food for a fee of $75 per person per day. Currently the company is providing an average of 600 guide-days per month. Based on available equipment and guides the maximum capacity is 950 guide-days (customers taken on the equivalent of an all day tour) per month.

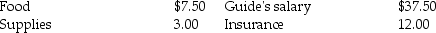

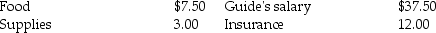

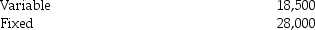

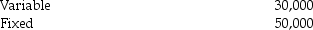

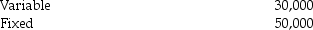

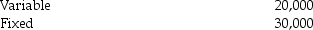

Variable costs per guide-day for the year were as follows:

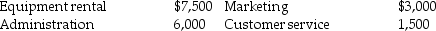

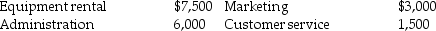

Fixed costs per month during the year were as follows:

Fixed costs per month during the year were as follows:

Required:

Required:

A group of foreign tourists has offered Muskoka Travel a proposal of 300 guide-days in July if they will cut the fee to $67.50 per guide-day. They have their own food and do not want to use the Muskoka Travel menus. Muskoka Travel will incur $300 in additional costs for busing the tourists back and forth to the camp site. If fixed costs would not increase, should Muskoka Travel accept the special offer?

Variable costs per guide-day for the year were as follows:

Fixed costs per month during the year were as follows:

Fixed costs per month during the year were as follows: Required:

Required:A group of foreign tourists has offered Muskoka Travel a proposal of 300 guide-days in July if they will cut the fee to $67.50 per guide-day. They have their own food and do not want to use the Muskoka Travel menus. Muskoka Travel will incur $300 in additional costs for busing the tourists back and forth to the camp site. If fixed costs would not increase, should Muskoka Travel accept the special offer?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

32

Relevant costs for pricing decisions include manufacturing costs, but not costs from other value-chain functions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

33

Answer the following question(s) using the information below.

Rogers' Heaters is approached by Ms. Yukki, a new customer, to fulfill a large one-time-only special order for a product similar to one offered to regular customers. Rogers' Heaters has excess capacity. The following per unit data apply for sales to regular customers:

For Rogers' Heaters, what is the minimum acceptable price of this one-time-only special order?

A) $290

B) $390

C) $260

D) $507

E) $377

Rogers' Heaters is approached by Ms. Yukki, a new customer, to fulfill a large one-time-only special order for a product similar to one offered to regular customers. Rogers' Heaters has excess capacity. The following per unit data apply for sales to regular customers:

For Rogers' Heaters, what is the minimum acceptable price of this one-time-only special order?

A) $290

B) $390

C) $260

D) $507

E) $377

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

34

Answer the following question(s) using the information below.

Welch Manufacturing is approached by a European customer to fulfill a one-time-only special order for a product similar to one offered to domestic customers. Welch Manufacturing has a policy of adding a 10% markup to full costs and currently has excess capacity. The following per unit data apply for sales to regular customers:

For Welch Manufacturing, what is the minimum acceptable price of this one-time-only special order?

A) $40

B) $55

C) $60

D) $66

E) $86

Welch Manufacturing is approached by a European customer to fulfill a one-time-only special order for a product similar to one offered to domestic customers. Welch Manufacturing has a policy of adding a 10% markup to full costs and currently has excess capacity. The following per unit data apply for sales to regular customers:

For Welch Manufacturing, what is the minimum acceptable price of this one-time-only special order?

A) $40

B) $55

C) $60

D) $66

E) $86

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

35

Use the information below to answer the following question(s).

Action Mopeds manufactures mopeds. The following information pertains to the company's normal operations per month:

What is the unit cost for establishing a minimum bid on a one-time-only special order of 1,000 mopeds from an overseas city if all cost relationships remain the same except for a one-time setup charge of $40,000?

A) $269.50

B) $309.50

C) $444.50

D) $260.50

E) $209.50

Action Mopeds manufactures mopeds. The following information pertains to the company's normal operations per month:

What is the unit cost for establishing a minimum bid on a one-time-only special order of 1,000 mopeds from an overseas city if all cost relationships remain the same except for a one-time setup charge of $40,000?

A) $269.50

B) $309.50

C) $444.50

D) $260.50

E) $209.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

36

Answer the following question(s) using the information below.

Gerry's Generator Supply is approached by Mr. Gladstone, a new customer, to fulfill a large one-time-only special order for a product similar to one offered to regular customers. Gerry's Generator Supply has excess capacity. The following per unit data apply for sales to regular customers:

For Gerry's Generators, what is the minimum acceptable price of this one-time-only special order?

A) $900

B) $1,000

C) $1,075

D) $1,290

E) $1,200

Gerry's Generator Supply is approached by Mr. Gladstone, a new customer, to fulfill a large one-time-only special order for a product similar to one offered to regular customers. Gerry's Generator Supply has excess capacity. The following per unit data apply for sales to regular customers:

For Gerry's Generators, what is the minimum acceptable price of this one-time-only special order?

A) $900

B) $1,000

C) $1,075

D) $1,290

E) $1,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

37

Backwoods Incorporated manufactures rustic furniture. The cost accounting system estimates manufacturing costs to be $80 per table, consisting of 70% variable costs and 30% fixed costs. The company has surplus capacity available. It is Backwoods' policy to add a 50% markup to full costs.

Required:

a. Backwoods Incorporated is invited to bid on an order to supply 100 rustic tables. What is the lowest price Backwoods should bid on this one-time-only special order?

b. A large hotel chain is currently expanding and has decided to decorate all new hotels using the rustic style. Backwoods Incorporated is invited to submit a bid to the hotel chain. What is the lowest price per unit Backwoods should bid on this long-term order?

Required:

a. Backwoods Incorporated is invited to bid on an order to supply 100 rustic tables. What is the lowest price Backwoods should bid on this one-time-only special order?

b. A large hotel chain is currently expanding and has decided to decorate all new hotels using the rustic style. Backwoods Incorporated is invited to submit a bid to the hotel chain. What is the lowest price per unit Backwoods should bid on this long-term order?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

38

Brady Lumber Company, a producer of oak lumber for furniture companies has an offer to supply a special load of lumber for an exporter. It will take three months to fill the order of 1,000,000 board metres. During the three months half of its production capacity will be utilized for the special order. The total fixed costs for the three months will be $6,000,000. Variable costs per 1,000 board metres will be $2,500.

The marketing manager believes that half of the capacity taken up by the special order can be utilized with regular business which will generate income of $240,000.

Required:

Determine the minimum price that needs to be charged for the special order.

The marketing manager believes that half of the capacity taken up by the special order can be utilized with regular business which will generate income of $240,000.

Required:

Determine the minimum price that needs to be charged for the special order.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

39

Answer the following question(s) using the information below.

Rogers' Heaters is approached by Ms. Yukki, a new customer, to fulfill a large one-time-only special order for a product similar to one offered to regular customers. Rogers' Heaters has excess capacity. The following per unit data apply for sales to regular customers:

If Ms. Yukki wanted a long-term commitment for supplying this product, what price would most likely be quoted to her?

A) $290

B) $390

C) $260

D) $377

E) $507

Rogers' Heaters is approached by Ms. Yukki, a new customer, to fulfill a large one-time-only special order for a product similar to one offered to regular customers. Rogers' Heaters has excess capacity. The following per unit data apply for sales to regular customers:

If Ms. Yukki wanted a long-term commitment for supplying this product, what price would most likely be quoted to her?

A) $290

B) $390

C) $260

D) $377

E) $507

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

40

Target pricing includes: (1) developing a needed product, (2) choosing a target price, (3) deriving a target cost per unit, and (4) performing value engineering.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

41

Use the information below to answer the following question(s).

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.

The target pricing approach is easier when

A) products highly differentiated and the consumer life cycle is shorter.

B) products highly differentiated and the consumer life cycle is longer.

C) products are not well differentiated and the consumer life cycle is shorter.

D) products are not well differentiated and the consumer life cycle is longer.

E) little is known about market factors.

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.The target pricing approach is easier when

A) products highly differentiated and the consumer life cycle is shorter.

B) products highly differentiated and the consumer life cycle is longer.

C) products are not well differentiated and the consumer life cycle is shorter.

D) products are not well differentiated and the consumer life cycle is longer.

E) little is known about market factors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

42

Use the information below to answer the following question(s).

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.

The current selling price for the Pluto, a mid-sized car, is $19,000. For next year it is anticipated that Pluto will have a $12,000 cost base. What is its prospective selling price, using cost-plus pricing, if the company desires a markup component of 15 percent?

A) $10,200

B) $13,800

C) $19,000

D) $30,000

E) $31,000

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.The current selling price for the Pluto, a mid-sized car, is $19,000. For next year it is anticipated that Pluto will have a $12,000 cost base. What is its prospective selling price, using cost-plus pricing, if the company desires a markup component of 15 percent?

A) $10,200

B) $13,800

C) $19,000

D) $30,000

E) $31,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

43

Use the information below to answer the following question(s).

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.

What is Acorn's target cost if the company wants to maintain its same income level, and marketing is correct?

A) $280.00

B) $270.00

C) $252.00

D) $236.27

E) $227.27

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.What is Acorn's target cost if the company wants to maintain its same income level, and marketing is correct?

A) $280.00

B) $270.00

C) $252.00

D) $236.27

E) $227.27

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

44

Use the information below to answer the following question(s).

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.

What is the target cost?

A) $800,000

B) $960,000

C) $1,440,000

D) $1,600,000

E) $768,000

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.What is the target cost?

A) $800,000

B) $960,000

C) $1,440,000

D) $1,600,000

E) $768,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

45

Use the information below to answer the following question(s).

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.

What are target sales revenues?

A) $960,000

B) $2,000,000

C) $1,800,000

D) $1,000,000

E) $1,200,000

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.What are target sales revenues?

A) $960,000

B) $2,000,000

C) $1,800,000

D) $1,000,000

E) $1,200,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

46

Use the information below to answer the following question(s).

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.

What is Acorn's target selling price if costs cannot be reduced and target profit is changed cost plus 20 percent?

A) $280.00

B) $336.00

C) $350.00

D) $353.33

E) $360.00

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.What is Acorn's target selling price if costs cannot be reduced and target profit is changed cost plus 20 percent?

A) $280.00

B) $336.00

C) $350.00

D) $353.33

E) $360.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

47

Use the information below to answer the following question(s).

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.

Johnson Petroleum Company is considering pricing its 5,000 litre petroleum tanks using either variable manufacturing or full product costs as the base. The variable cost base provides a prospective price of $2,800 and the full cost base provides a prospective price of $2,850. The difference between the two prices is

A) the amount of profit to be included.

B) due to the fact that the variable cost base must estimate all fixed costs, other variable costs, and desired profit while the full cost base must estimate only desired profit.

C) known as price discrimination.

D) caused by the inability of most companies to estimate fixed cost per unit with any degree of reliability.

E) known as peak pricing.

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.Johnson Petroleum Company is considering pricing its 5,000 litre petroleum tanks using either variable manufacturing or full product costs as the base. The variable cost base provides a prospective price of $2,800 and the full cost base provides a prospective price of $2,850. The difference between the two prices is

A) the amount of profit to be included.

B) due to the fact that the variable cost base must estimate all fixed costs, other variable costs, and desired profit while the full cost base must estimate only desired profit.

C) known as price discrimination.

D) caused by the inability of most companies to estimate fixed cost per unit with any degree of reliability.

E) known as peak pricing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

48

Use the information below to answer the following question(s).

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.

Seneca Company has invested $1,000,000 in a plant to make gas pumps for service stations. The average long-run income desired from the plant is $150,000 annually. The annual cost base for each pump is $1,000. What should be the prospective selling price for each pump if the company uses a target return on investment as the markup base?

A) $1,150

B) $2,500

C) $16,000

D) $17,000

E) $17,500

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.Seneca Company has invested $1,000,000 in a plant to make gas pumps for service stations. The average long-run income desired from the plant is $150,000 annually. The annual cost base for each pump is $1,000. What should be the prospective selling price for each pump if the company uses a target return on investment as the markup base?

A) $1,150

B) $2,500

C) $16,000

D) $17,000

E) $17,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

49

Use the information below to answer the following question(s).

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.

Which of the following best describes the cost-plus pricing approach?

A) Cost base + Markup component = Prospective selling price

B) Prospective selling price + Cost base = Markup component

C) Cost base + Gross margin = Prospective selling price

D) Variable cost + Fixed cost + Contribution margin = Prospective selling price

E) Cost base plus markup ÷ 100% = selling profit percentage

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.Which of the following best describes the cost-plus pricing approach?

A) Cost base + Markup component = Prospective selling price

B) Prospective selling price + Cost base = Markup component

C) Cost base + Gross margin = Prospective selling price

D) Variable cost + Fixed cost + Contribution margin = Prospective selling price

E) Cost base plus markup ÷ 100% = selling profit percentage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

50

Use the information below to answer the following question(s).

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.

What are the target sales revenues?

A) $1,380,000

B) $13,800,000

C) $11,316,000

D) $12,000,000

E) $16,284,000

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.What are the target sales revenues?

A) $1,380,000

B) $13,800,000

C) $11,316,000

D) $12,000,000

E) $16,284,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

51

Use the information below to answer the following question(s).

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.

The target profit percentage for setting prices as a percentage of total costs would be

A) 61%.

B) 21%.

C) 47%.

D) 27%.

E) 35%.

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.The target profit percentage for setting prices as a percentage of total costs would be

A) 61%.

B) 21%.

C) 47%.

D) 27%.

E) 35%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

52

Use the information below to answer the following question(s).

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.

The target profit percentage for setting prices as a percentage of total variable costs would be

A) 47%.

B) 33%.

C) 29%.

D) 38%.

E) 61%.

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.The target profit percentage for setting prices as a percentage of total variable costs would be

A) 47%.

B) 33%.

C) 29%.

D) 38%.

E) 61%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

53

Use the information below to answer the following question(s).

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.

What is the target profit percentage as a percentage of total manufacturing costs?

A) 61%

B) 21%

C) 47%

D) 27%

E) 35%

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.What is the target profit percentage as a percentage of total manufacturing costs?

A) 61%

B) 21%

C) 47%

D) 27%

E) 35%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

54

Use the information below to answer the following question(s).

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.

What is the target cost if target profit is 25 percent of the competitor's selling price?

A) $75

B) $90

C) $225

D) $270

E) $280

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.What is the target cost if target profit is 25 percent of the competitor's selling price?

A) $75

B) $90

C) $225

D) $270

E) $280

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

55

Use the information below to answer the following question(s).

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.

What is the target operating income?

A) $240,000

B) $360,000

C) $200,000

D) $192,000

E) $400,000

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.What is the target operating income?

A) $240,000

B) $360,000

C) $200,000

D) $192,000

E) $400,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

56

Use the information below to answer the following question(s).

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.

Under cost-plus pricing, what is the required selling price to achieve a 15% markup?

A) $285

B) $6300

C) $310

D) $315

E) $322

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.Under cost-plus pricing, what is the required selling price to achieve a 15% markup?

A) $285

B) $6300

C) $310

D) $315

E) $322

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

57

Use the information below to answer the following question(s).

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.

When target costing and target pricing are used together,

A) the target cost is established first, then the target price.

B) the target cost per unit is the estimated long-run price per unit that enables a product or service to achieve the target profit per unit.

C) the target price is set to undercut the competition.

D) target costs are higher than current costs because of inflation over time.

E) target price is the estimated price for a product or service that a potential customer will be willing to pay.

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.When target costing and target pricing are used together,

A) the target cost is established first, then the target price.

B) the target cost per unit is the estimated long-run price per unit that enables a product or service to achieve the target profit per unit.

C) the target price is set to undercut the competition.

D) target costs are higher than current costs because of inflation over time.

E) target price is the estimated price for a product or service that a potential customer will be willing to pay.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

58

Use the information below to answer the following question(s).

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.

A product's markup percentage would need to cover fixed manufacturing costs if

A) the company has only fixed manufacturing costs.

B) the company wants to break-even during the fiscal period.

C) the company wants to make a profit.

D) the cost base does not include fixed manufacturing costs.

E) the cost base includes fixed manufacturing costs as well as variable costs.

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.A product's markup percentage would need to cover fixed manufacturing costs if

A) the company has only fixed manufacturing costs.

B) the company wants to break-even during the fiscal period.

C) the company wants to make a profit.

D) the cost base does not include fixed manufacturing costs.

E) the cost base includes fixed manufacturing costs as well as variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

59

Use the information below to answer the following question(s).

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.

If total invested capital is $1,000,000, what is the company's target rate of return on investment?

A) 15 %

B) 20 %

C) 25 %

D) 30 %

E) 35 %

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.If total invested capital is $1,000,000, what is the company's target rate of return on investment?

A) 15 %

B) 20 %

C) 25 %

D) 30 %

E) 35 %

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

60

Use the information below to answer the following question(s).

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.

What is the target cost for each interior door?

A) $48

B) $72

C) $80

D) $38

E) $40

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.What is the target cost for each interior door?

A) $48

B) $72

C) $80

D) $38

E) $40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

61

Use the information below to answer the following question(s).

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.

What is the target cost if operating income is 25% of sales?

A) $189.00

B) $41.25

C) $210.00

D) $202.50

E) $168.75

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.What is the target cost if operating income is 25% of sales?

A) $189.00

B) $41.25

C) $210.00

D) $202.50

E) $168.75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

62

Use the information below to answer the following question(s).

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.

What is the target cost if target operating income is 25% of sales?

A) $105.00

B) $145.00

C) $140.00

D) $135.00

E) $112.50

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.What is the target cost if target operating income is 25% of sales?

A) $105.00

B) $145.00

C) $140.00

D) $135.00

E) $112.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

63

Bridget, a college student, plans to operate a hot dog stand at the beach during the summer for three months. Her fixed costs for the booth, which include utilities, will be $2,600. Variable costs per hot dog will be $1.50 for materials and $0.40 for a franchise fee from the hot dog supplier. This year's sales are expected to be 20,000 units based upon the operation of the same booth the prior year. Bridget needs to earn $10,000 so that she can pay part of her college expenses for the coming academic year. Based on competitor's prices, her target price is $2.40

Required:

Determine whether she can expect to earn the $10,000 at the target price.

Required:

Determine whether she can expect to earn the $10,000 at the target price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

64

Use the information below to answer the following question(s).

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.

What is the target cost for each coffee pot?

A) $32.80

B) $44.51

C) $30.93

D) $3.77

E) $37.72

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.What is the target cost for each coffee pot?

A) $32.80

B) $44.51

C) $30.93

D) $3.77

E) $37.72

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

65

Use the information below to answer the following question(s).

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.

What is the change in operating income if marketing is correct and only the sales price is changed?

A) $1,421,250

B) $(204,000)

C) $(352,500)

D) $(435,000)

E) $18,750

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.What is the change in operating income if marketing is correct and only the sales price is changed?

A) $1,421,250

B) $(204,000)

C) $(352,500)

D) $(435,000)

E) $18,750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

66

Use the information below to answer the following question(s).

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.

What is the target operating income?

A) $2,931,120

B) $2,160,000

C) $2,036,880

D) $2,484,000

E) $248,400

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.What is the target operating income?

A) $2,931,120

B) $2,160,000

C) $2,036,880

D) $2,484,000

E) $248,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

67

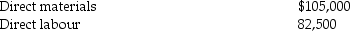

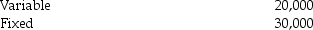

Timothy Company has budgeted sales of $780,000 with the following budgeted costs:

Factory overhead:

Factory overhead:

Selling and administrative expenses:

Selling and administrative expenses:

Compute the average markup percentage for setting prices as a percentage of:

Compute the average markup percentage for setting prices as a percentage of:

a. Total manufacturing costs

b. The variable cost of the product

c. The full cost of the product

d. Variable manufacturing costs

Factory overhead:

Factory overhead: Selling and administrative expenses:

Selling and administrative expenses: Compute the average markup percentage for setting prices as a percentage of:

Compute the average markup percentage for setting prices as a percentage of:a. Total manufacturing costs

b. The variable cost of the product

c. The full cost of the product

d. Variable manufacturing costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

68

Reuter Avionics currently sells radios for $1,800. It has costs of $1,400. A competitor is bringing a new

radio to market that will sell for $1,600. Management believes it must lower the price to $1,600 to

compete in the market for radios. Marketing believes that the new price will cause sales to increase by

10%, even with a new competitor in the market. Reuter's sales are currently 1,000 radios per year.

Required:

a. What is the target cost if target operating income is 25% of sales?

b. What is the change in operating income if marketing is correct and only the sales price is changed?

c. What is the target cost if the company wants to maintain its same income level, and marketing is correct?

radio to market that will sell for $1,600. Management believes it must lower the price to $1,600 to

compete in the market for radios. Marketing believes that the new price will cause sales to increase by

10%, even with a new competitor in the market. Reuter's sales are currently 1,000 radios per year.

Required:

a. What is the target cost if target operating income is 25% of sales?

b. What is the change in operating income if marketing is correct and only the sales price is changed?

c. What is the target cost if the company wants to maintain its same income level, and marketing is correct?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

69

Use the information below to answer the following question(s).

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.

What is the change in operating income if marketing is correct and only the sales price is changed?

A) $125,000

B) $950,000

C) $(3,450,000)

D) $(2,900,000)

E) $2,350,000)

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.What is the change in operating income if marketing is correct and only the sales price is changed?

A) $125,000

B) $950,000

C) $(3,450,000)

D) $(2,900,000)

E) $2,350,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

70

Robert's Medical Equipment Company manufactures hospital beds. Its' most popular model, Deluxe, sells for $5,000. It has variable costs of $2,800 and fixed costs of $1,000 per unit, base on an average production run of 5,000 units. It normally has four production runs a year, with $400,000 in setup costs each time. Plant capacity can handle up to six runs a year for a total of 30,000 beds.

A competitor is introducing a new hospital bed similar to Deluxe that will sell for $4,000.

Management believes it must lower the price to compete. Marketing believes that the new price will

increase sales by 25% a year. The plant manager thinks that production can increase by 25% with the

same level of fixed costs. The company currently sells all the Deluxe beds it can produce.

Required:

a. What is the annual operating income from Deluxe at the current price of $5,000 and normal production?

b. What is the annual operating income from Deluxe if the price is reduced to $4,000 and sales in units increase by 25%?

c. What is the target cost per unit for the new price if target operating income is 20% of sales?

A competitor is introducing a new hospital bed similar to Deluxe that will sell for $4,000.

Management believes it must lower the price to compete. Marketing believes that the new price will

increase sales by 25% a year. The plant manager thinks that production can increase by 25% with the

same level of fixed costs. The company currently sells all the Deluxe beds it can produce.

Required:

a. What is the annual operating income from Deluxe at the current price of $5,000 and normal production?

b. What is the annual operating income from Deluxe if the price is reduced to $4,000 and sales in units increase by 25%?

c. What is the target cost per unit for the new price if target operating income is 20% of sales?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

71

Frost Inc. has budgeted sales of $150,000 with the following budgeted costs:

Factory overhead:

Factory overhead:

Selling and administrative expenses:

Selling and administrative expenses:

Compute the target profit percentage for setting prices as a percentage of:

Compute the target profit percentage for setting prices as a percentage of:

a. Total costs

b. Total variable costs

c. Variable manufacturing costs

d. Total manufacturing costs

Factory overhead:

Factory overhead: Selling and administrative expenses:

Selling and administrative expenses: Compute the target profit percentage for setting prices as a percentage of:

Compute the target profit percentage for setting prices as a percentage of:a. Total costs

b. Total variable costs

c. Variable manufacturing costs

d. Total manufacturing costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

72

Use the information below to answer the following question(s).

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.

What is the target cost if the company wants to maintain its same income level, and marketing is correct (rounded to the nearest cent)?

A) $112.50

B) $113.64

C) $123.34

D) $140.00

E) $135.00

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.What is the target cost if the company wants to maintain its same income level, and marketing is correct (rounded to the nearest cent)?

A) $112.50

B) $113.64

C) $123.34

D) $140.00

E) $135.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

73

Use the information below to answer the following question(s).

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.

What is the target cost if the company wants to maintain its same income level, and marketing is correct (rounded to the nearest cent)?

A) $168.75

B) $170.46

C) $185.00

D) $210.00

E) $202.50

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.What is the target cost if the company wants to maintain its same income level, and marketing is correct (rounded to the nearest cent)?

A) $168.75

B) $170.46

C) $185.00

D) $210.00

E) $202.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

74

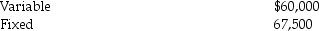

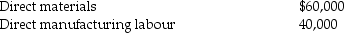

Ellingson Company has budgeted sales of $487,500 with the following budgeted costs:

Factory overhead:

Factory overhead:

Selling and administrative expenses:

Selling and administrative expenses:

Compute the target profit percentage for setting prices as a percentage of:

Compute the target profit percentage for setting prices as a percentage of:

a. Total manufacturing costs

b. Total variable costs

c. Total costs

d. Variable manufacturing costs

Factory overhead:

Factory overhead: Selling and administrative expenses:

Selling and administrative expenses: Compute the target profit percentage for setting prices as a percentage of:

Compute the target profit percentage for setting prices as a percentage of:a. Total manufacturing costs

b. Total variable costs

c. Total costs

d. Variable manufacturing costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

75

Kezer Crafts currently sells motor boats for $6,000. It has costs of $4,650. A competitor is bringing a new motor boat to the market that will sell for $5,500. Management believes it must lower the price to $5,500 to compete in the market for motor boats. Marketing believes that the new price will cause sales to increase by 12.5%, even with a new competitor in the market. Kezer Crafts' sales are currently 2,000 motor boats per year.

Required:

a. What is the target cost if target operating income is 25% of sales?

b. What is the change in operating income if marketing is correct and only the sales price is changed?

c. What is the target cost if the company wants to maintain its same income level, and marketing is correct?

Required:

a. What is the target cost if target operating income is 25% of sales?

b. What is the change in operating income if marketing is correct and only the sales price is changed?

c. What is the target cost if the company wants to maintain its same income level, and marketing is correct?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

76

Steven Corporation manufactures fishing poles that have a price of $21.00. It has costs of $16.32. A competitor is introducing a new fishing pole that will sell for $18.00. Management believes it must lower the price to $18.00 to compete in the highly cost-conscious fishing pole market. Marketing believes that the new price will maintain the current sales level. Steven Corporation's sales are currently 200,000 poles per year.

Required:

a. What is the target cost for the new price if target operating income is 20% of sales?

b. What is the change in operating income for the year if $18.00 is the new price and costs remain the same?

c. What is the target cost per unit if the selling price is reduced to $18.00 and the company wants to maintain its same income level?

Required:

a. What is the target cost for the new price if target operating income is 20% of sales?

b. What is the change in operating income for the year if $18.00 is the new price and costs remain the same?

c. What is the target cost per unit if the selling price is reduced to $18.00 and the company wants to maintain its same income level?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

77

Do-It Company manufactures sinker molds for fishing. A sinker mold has a price of $7.00, and costs currently assigned to it of $5.44. A competitor is introducing a new sinker mold that will sell for $6.00. Management believes it must lower the price to $6.00 in order to compete in the highly cost-conscious sinker mold market. Marketing believes that the new price will maintain the current sales level. Do-It Company's sales are currently 200,000 molds per year.

Required:

a. What is the target cost for the new price if target profit is 20 percent of sales?

b. What is the target selling price if costs cannot be reduced and target profit is changed to 15 percent of sales?

c. What is the change in operating income for the year if $6.00 is the new price and costs remain the same?

d. What is the target cost per unit if the selling price is reduced to $6.00 and the company wants to maintain its same income level?

Required:

a. What is the target cost for the new price if target profit is 20 percent of sales?

b. What is the target selling price if costs cannot be reduced and target profit is changed to 15 percent of sales?

c. What is the change in operating income for the year if $6.00 is the new price and costs remain the same?

d. What is the target cost per unit if the selling price is reduced to $6.00 and the company wants to maintain its same income level?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

78

Use the information below to answer the following question(s).

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.

What is the total target cost?

A) $9,840,000

B) $11,316,000

C) $13,352,000

D) $9,279,120

E) $1,131,600

Pershing Company budgeted the following costs for the production of its one and only product, blades, for the next fiscal year:

Pershing has a target profit of $150,000.

Pershing has a target profit of $150,000.What is the total target cost?

A) $9,840,000

B) $11,316,000

C) $13,352,000

D) $9,279,120

E) $1,131,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

79

Central Dental Company manufactures dental chairs. Its most popular model, Deluxe, sells for $2,500. It has variable costs totaling $1,400 and fixed costs of $500 per unit based on an average production run of 5,000 units. It normally has four production runs a year with $200,000 setup costs each time. Plant capacity can handle up to six runs a year for a total of 30,000 chairs.

A competitor is introducing a new dental chair similar to Deluxe that will sell for $2,000. Management believes it must lower the price in order to compete. Marketing believes that the new price will increase sales by 25 percent a year. The plant manager thinks that production can increase by 25 percent with the same level of fixed costs. The company currently sells all the Deluxe chairs it can produce.

Required:

What is the target cost per unit for the new price if target profit is 20 percent of sales?

A competitor is introducing a new dental chair similar to Deluxe that will sell for $2,000. Management believes it must lower the price in order to compete. Marketing believes that the new price will increase sales by 25 percent a year. The plant manager thinks that production can increase by 25 percent with the same level of fixed costs. The company currently sells all the Deluxe chairs it can produce.

Required:

What is the target cost per unit for the new price if target profit is 20 percent of sales?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

80

Nancy Company has budgeted sales of $300,000 with the following budgeted costs:

Factory overhead:

Factory overhead:

Selling and administrative expenses:

Selling and administrative expenses:

Compute the average markup percentage for setting prices as a percentage of:

Compute the average markup percentage for setting prices as a percentage of:

a. The full cost of the product

b. The variable cost of the product

c. Variable manufacturing costs

d. Total manufacturing costs

Factory overhead:

Factory overhead: Selling and administrative expenses:

Selling and administrative expenses: Compute the average markup percentage for setting prices as a percentage of:

Compute the average markup percentage for setting prices as a percentage of:a. The full cost of the product

b. The variable cost of the product

c. Variable manufacturing costs

d. Total manufacturing costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck