Deck 14: Period Cost Allocation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

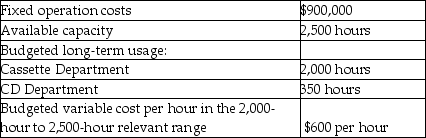

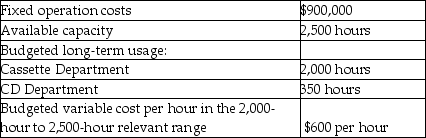

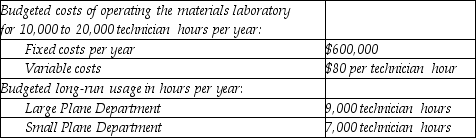

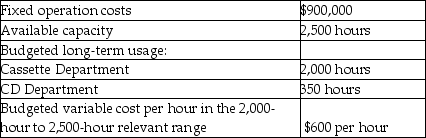

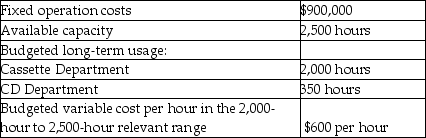

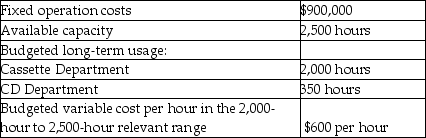

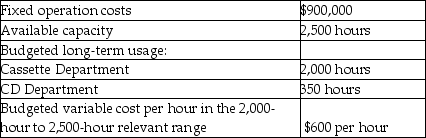

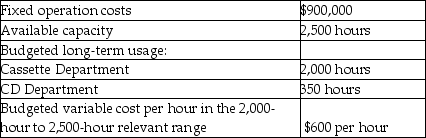

سؤال

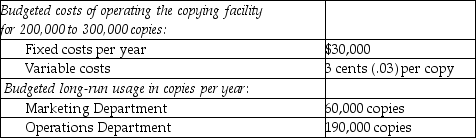

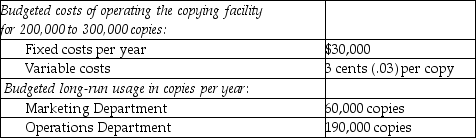

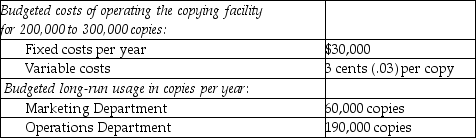

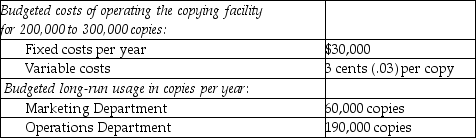

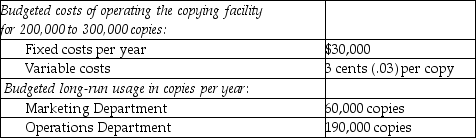

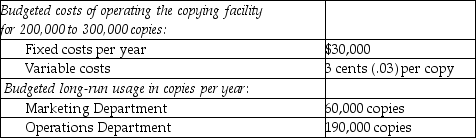

سؤال

سؤال

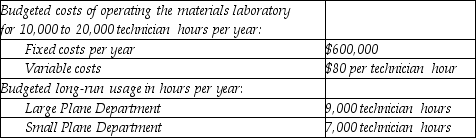

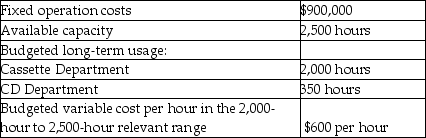

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/153

العب

ملء الشاشة (f)

Deck 14: Period Cost Allocation

1

Which of the following illustrates a purpose for allocating costs to cost objects?

A) to provide information for economic decisions

B) to reduce competition

C) to determine employee benefit costs

D) to defer income and reduce taxes payable

E) to motivate employees

A) to provide information for economic decisions

B) to reduce competition

C) to determine employee benefit costs

D) to defer income and reduce taxes payable

E) to motivate employees

A

2

If one is willing to put in the time and expense, it is always possible to identify the specific cause-and-effect relationship needed for a cost allocation base.

False

3

For the economic decision purpose

A) the costs in all six business functions should be included.

B) costs for only one function is included.

C) period costs are not allocated.

D) costing is only related to product pricing.

E) only inventoriable costs under GAAP/IFRS should be included.

A) the costs in all six business functions should be included.

B) costs for only one function is included.

C) period costs are not allocated.

D) costing is only related to product pricing.

E) only inventoriable costs under GAAP/IFRS should be included.

A

4

When using the causality criterion, cost drivers are selected as the cost allocation bases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following is the first step in the cost-allocation decision process?

A) Calculate the cost-allocation rate for each indirect cost pool.

B) Identify the purpose of the cost allocation.

C) Identify the direct inputs that are already measured.

D) Identify the relevant indirect costs included in the cost pool(s) or numerator(s).

E) Analyze the alternatives and select the best one for the denominator.

A) Calculate the cost-allocation rate for each indirect cost pool.

B) Identify the purpose of the cost allocation.

C) Identify the direct inputs that are already measured.

D) Identify the relevant indirect costs included in the cost pool(s) or numerator(s).

E) Analyze the alternatives and select the best one for the denominator.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

6

For the economic decision purpose of cost allocation, the costs in all six functions of the value chain should be included.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

7

Benefits from using a well-designed cost allocation system are highly visible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

8

To encourage the design of products that are simpler to manufacture or less costly to service, would be an example of which cost allocation purpose?

A) to provide information for economic decisions

B) to motivate managers and employees

C) to determine employees' wages

D) to measure income and assets for reporting to external parties

E) to justify costs or compute reimbursements

A) to provide information for economic decisions

B) to motivate managers and employees

C) to determine employees' wages

D) to measure income and assets for reporting to external parties

E) to justify costs or compute reimbursements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

9

Indirect costs typically constitute a large percentage of the costs assigned to cost objects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which purpose of cost allocation is used to encourage sales representatives to push high-margin products or services?

A) to provide information for economic decisions

B) to motivate managers and other employees

C) to justify costs

D) to measure income and assets for reporting to external parties

E) to compute reimbursement

A) to provide information for economic decisions

B) to motivate managers and other employees

C) to justify costs

D) to measure income and assets for reporting to external parties

E) to compute reimbursement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following is true concerning cost allocation in a multi-product company?

A) Where the indirect costs are variable and each product is assembled sequentially, the causality criterion can guide the choice of a cost allocation base.

B) Where the indirect costs are fixed and each product is assembled sequentially, the causality criterion can guide the choice of a cost allocation base.

C) Where the indirect costs are variable and each product is not assembled sequentially, the causality criterion can guide the choice of a cost allocation base.

D) Where the indirect costs are fixed and each product is not assembled sequentially, the causality criterion can guide the choice of a cost allocation base.

E) Where the indirect costs are variable and the products are produced jointly, it is not possible to identify specific cause-and-effect relationships between work on an individual product and total costs incurred.

A) Where the indirect costs are variable and each product is assembled sequentially, the causality criterion can guide the choice of a cost allocation base.

B) Where the indirect costs are fixed and each product is assembled sequentially, the causality criterion can guide the choice of a cost allocation base.

C) Where the indirect costs are variable and each product is not assembled sequentially, the causality criterion can guide the choice of a cost allocation base.

D) Where the indirect costs are fixed and each product is not assembled sequentially, the causality criterion can guide the choice of a cost allocation base.

E) Where the indirect costs are variable and the products are produced jointly, it is not possible to identify specific cause-and-effect relationships between work on an individual product and total costs incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following is not a common criteria used to guide decisions related to cost allocations?

A) ability to bear

B) benefit received

C) causality

D) fairness and equity

E) stable market prices

A) ability to bear

B) benefit received

C) causality

D) fairness and equity

E) stable market prices

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

13

The belief that a corporate division with higher sales ought to be allocated more of the company's advertising costs because it must have derived more benefit from the expenditures than a division with lower sales, is an example of which criteria for cost allocation decisions?

A) ability to bear

B) benefits expended

C) causality

D) fairness and equity

E) benefit received

A) ability to bear

B) benefits expended

C) causality

D) fairness and equity

E) benefit received

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

14

The ability-to-bear criterion is considered superior when the purpose of cost allocation is motivation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which purpose of cost allocation is used to decide on the selling price for a customized product or service?

A) to provide information for economic decisions

B) to motivate managers and other employees

C) to justify costs

D) to measure income and assets for reporting to external parties

E) to compute reimbursement

A) to provide information for economic decisions

B) to motivate managers and other employees

C) to justify costs

D) to measure income and assets for reporting to external parties

E) to compute reimbursement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

16

Deciding whether to make a component part or to purchase it, would be an example of which cost allocation purpose?

A) to provide information for economic decisions

B) to motivate managers

C) to determine employee's wages

D) to measure income and assets for reporting to external parties

E) to motivate employees

A) to provide information for economic decisions

B) to motivate managers

C) to determine employee's wages

D) to measure income and assets for reporting to external parties

E) to motivate employees

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

17

One of the purposes of allocating indirect costs is to justify costs or compute reimbursement amounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

18

The allocation of one particular cost must satisfy all four justifications of cost allocation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following criteria subsidizes poor performers at the expense of the best performers?

A) ability to bear

B) benefit received

C) causality

D) fairness and equity

E) benefits expended

A) ability to bear

B) benefit received

C) causality

D) fairness and equity

E) benefits expended

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

20

The costs of designing and implementing sophisticated cost allocation systems are usually not very visible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

21

The single-rate method is when all indirect costs are combined in one cost pool and allocated to cost objects via a single rate per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

22

The cost pool is homogeneous if all included activities have the same or similar cause-and-effects or benefits received relationships between the cost driver and the costs of the activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

23

An advantage of the single-rate method is that it is easier and always the most accurate cost-allocation choice.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

24

One of the important aspects about the dual-rate method is that it allows managers to see how variable and fixed costs behave differently.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

25

An organization determines its allocation base depending upon which of the following factors?

A) the purpose served by the cost allocation base

B) the size of the base

C) the number of different items in the base

D) the performance of the denominator activity

E) benchmarking competitor processes

A) the purpose served by the cost allocation base

B) the size of the base

C) the number of different items in the base

D) the performance of the denominator activity

E) benchmarking competitor processes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

26

A cost pool is a grouping of individual cost items.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

27

A company might choose to allocate corporate costs to various divisions within the company for what four purposes? Give an example of each.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

28

A grouping of individual cost items is known as

A) a cost pool.

B) an allocation base.

C) grouped direct costs.

D) grouped indirect costs.

E) a homogenous cost group.

A) a cost pool.

B) an allocation base.

C) grouped direct costs.

D) grouped indirect costs.

E) a homogenous cost group.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

29

There are multiple cost objects in most costing systems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

30

The single-rate method makes a distinction between fixed and variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

31

The single-rate cost-allocation method provides better information for decision making than the dual-rate method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

32

When all of a cost pool's individual activities have the same or similar relationships between the cost driver and the costs of the activity, it is considered

A) a beneficial cost pool.

B) a heterogeneous cost pool.

C) a homogeneous cost pool.

D) a similar cost pool.

E) an assigned cost pool.

A) a beneficial cost pool.

B) a heterogeneous cost pool.

C) a homogeneous cost pool.

D) a similar cost pool.

E) an assigned cost pool.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

33

Scarborough Sales, a real estate company specializing in apartment rentals and home sales, is having difficulty in gathering appropriate cost information for evaluating its operations. It owns several large apartment complexes and sells homes owned by builders or existing homeowners. As the company's new accountant you define cost by major activity. You use this information for allocating costs to cost objects. Also, cost pools are created for appropriate cost allocations. The owner of the company is interested in exactly what you have done, and why it appears to be working so smoothly.

Required:

Briefly state the four purposes for allocating costs to cost objects and give two examples of how each can be used for the real estate company.

Required:

Briefly state the four purposes for allocating costs to cost objects and give two examples of how each can be used for the real estate company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

34

The dual cost-allocation method classifies costs into two pools, a budgeted cost pool and an actual cost pool.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

35

Once a cost pool has been established, it should not need to be revisited or revised.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

36

Using the single-rate method transforms the fixed costs per hour into a variable cost to users of that facility.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

37

When there is a lesser degree of homogeneity, fewer cost pools are required to accurately explain the use of company resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

38

An electronics manufacturer is trying to encourage its engineers to design simpler products so that overall costs are reduced.

Required:

Which of the value-chain function costs (R&D, design, production, marketing, distribution, customer service) should be included in product-cost estimates to achieve the above purpose? Why?

Required:

Which of the value-chain function costs (R&D, design, production, marketing, distribution, customer service) should be included in product-cost estimates to achieve the above purpose? Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

39

If a cost pool is homogeneous, the cost allocations using that pool will be the same as they would be if costs of each individual activity in that pool were allocated separately.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

40

For each item listed, select the appropriate purpose of cost allocation from the list below. A purpose may be used more than once.

1. To cost a product at a fair price for government contracts

2. To encourage simpler product design

3. To decide on an approprite selling price for a special-order product

4. To cost inventories for reporting on a company's tax return

5. To encourage the sales department to focus on high-margin products

6. To evaluate a make or buy decision

7. To cost inventories for the balance sheet

8. To decide whether to add or delete a product line

Purposes of cost allocation:

a. To provide information for economic decisions

b. To motivate managers and other employees

c. To justify costs or compute reimbursement amounts

d. To measure income and assets for reports to external parties

1. To cost a product at a fair price for government contracts

2. To encourage simpler product design

3. To decide on an approprite selling price for a special-order product

4. To cost inventories for reporting on a company's tax return

5. To encourage the sales department to focus on high-margin products

6. To evaluate a make or buy decision

7. To cost inventories for the balance sheet

8. To decide whether to add or delete a product line

Purposes of cost allocation:

a. To provide information for economic decisions

b. To motivate managers and other employees

c. To justify costs or compute reimbursement amounts

d. To measure income and assets for reports to external parties

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

41

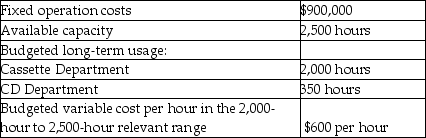

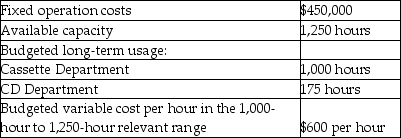

Use the information below to answer the following question(s).

Data Source Media manufactures cassettes and CDs. Management is attempting to set the budget for the coming year. Two divisions (Cassette and CD) of the company utilize one plant location. The following data have been prepared for review.

What is the cost per hour of use for the Cassette department and the CD Department assuming budgeted usage is the allocation base and a single-rate method is used?

A) $960.00

B) $600.00

C) $982.98

D) $1,021.28

E) $1,582.98

Data Source Media manufactures cassettes and CDs. Management is attempting to set the budget for the coming year. Two divisions (Cassette and CD) of the company utilize one plant location. The following data have been prepared for review.

What is the cost per hour of use for the Cassette department and the CD Department assuming budgeted usage is the allocation base and a single-rate method is used?

A) $960.00

B) $600.00

C) $982.98

D) $1,021.28

E) $1,582.98

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

42

Answer the following questions using the information below:

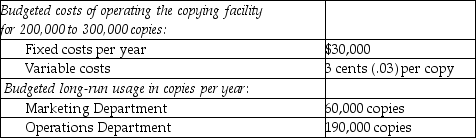

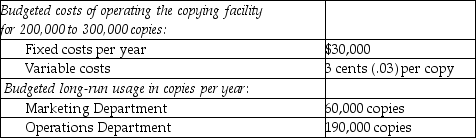

The Bonawitz Corporation has a central copying facility. The copying facility has only two users, the Marketing Department and the Operations Department. The following data apply to the coming budget year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.

Actual usage for the year by the Marketing Department was 40,000 copies and by the Operations Department was 180,000 copies.

If a dual-rate cost-allocation method is used, what amount of copying facility costs will be budgeted for the Operations Department?

A) $28,500

B) $28,200

C) $30,245

D) $29,945

E) $24,600

The Bonawitz Corporation has a central copying facility. The copying facility has only two users, the Marketing Department and the Operations Department. The following data apply to the coming budget year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.Actual usage for the year by the Marketing Department was 40,000 copies and by the Operations Department was 180,000 copies.

If a dual-rate cost-allocation method is used, what amount of copying facility costs will be budgeted for the Operations Department?

A) $28,500

B) $28,200

C) $30,245

D) $29,945

E) $24,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following is False concerning homogeneous cost pools?

A) They enable more accurate product, service and customer costs to be obtained.

B) The cost allocations using the pool will be the same as would be made if each individual activity in the pool were allocated separately.

C) The greater the degree of homogeneity, the fewer cost pools are required to accurately explain differences in how products use resources.

D) All activities in the pool have the same or similar cause-and-effect relationship between the cost allocator and the costs of the activity.

E) All activities in the pool have a unique and different benefits-received relationship between the cost allocator and the costs of the activity.

A) They enable more accurate product, service and customer costs to be obtained.

B) The cost allocations using the pool will be the same as would be made if each individual activity in the pool were allocated separately.

C) The greater the degree of homogeneity, the fewer cost pools are required to accurately explain differences in how products use resources.

D) All activities in the pool have the same or similar cause-and-effect relationship between the cost allocator and the costs of the activity.

E) All activities in the pool have a unique and different benefits-received relationship between the cost allocator and the costs of the activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

44

Answer the following questions using the information below:

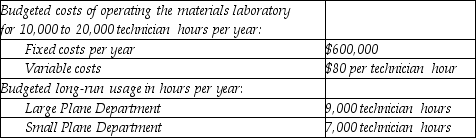

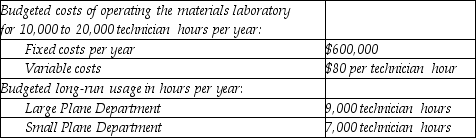

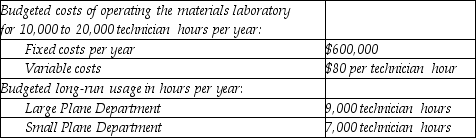

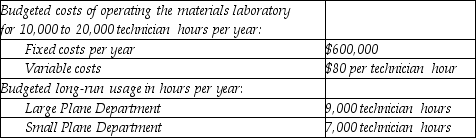

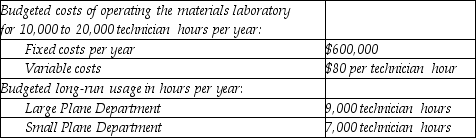

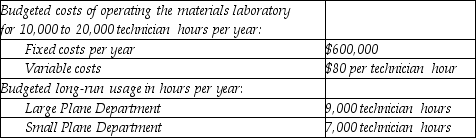

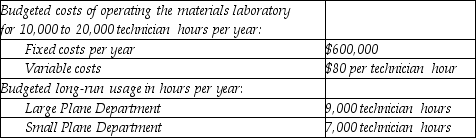

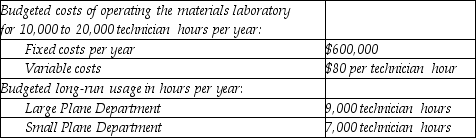

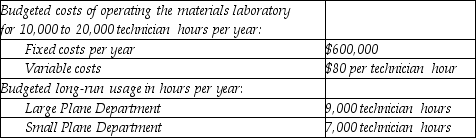

The Fancy Flier Airplane Corporation has a central materials laboratory. The laboratory has only two users, the Large Plane Department and the Small Plane Department. The following data apply to the coming budget year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.

Actual usage for the year by the Large Plane Department was 6,000 technician hours and by the Small Plane Department was 6,500 technician hours.

If a single-rate cost-allocation method is used, what is the allocation rate per hour used?

A) $80.00

B) $117.50

C) $146.67

D) $100.00

E) $128.00

The Fancy Flier Airplane Corporation has a central materials laboratory. The laboratory has only two users, the Large Plane Department and the Small Plane Department. The following data apply to the coming budget year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.Actual usage for the year by the Large Plane Department was 6,000 technician hours and by the Small Plane Department was 6,500 technician hours.

If a single-rate cost-allocation method is used, what is the allocation rate per hour used?

A) $80.00

B) $117.50

C) $146.67

D) $100.00

E) $128.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

45

Benefits of the single-rate method include

A) the low cost of implementation.

B) fixed costs that are transformed into variable costs for user decision making.

C) signals regarding how variable and fixed costs behave differently.

D) information that leads to outsourcing decisions that benefit the organization as a whole.

E) there is a stronger cause and effect relationship.

A) the low cost of implementation.

B) fixed costs that are transformed into variable costs for user decision making.

C) signals regarding how variable and fixed costs behave differently.

D) information that leads to outsourcing decisions that benefit the organization as a whole.

E) there is a stronger cause and effect relationship.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

46

Under which of the following methods of cost allocation is there no distinction between fixed and variable costs?

A) fixed method

B) dual-rate method

C) homogeneous method

D) standard cost method

E) single-rate method

A) fixed method

B) dual-rate method

C) homogeneous method

D) standard cost method

E) single-rate method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

47

Use the information below to answer the following question(s).

Data Source Media manufactures cassettes and CDs. Management is attempting to set the budget for the coming year. Two divisions (Cassette and CD) of the company utilize one plant location. The following data have been prepared for review.

What is the allocated cost to the two departments, respectively, if the single rate is $1,000? Assume that the Cassette and CD Departments used 1,750 and 200 hours, respectively.

A) $807,692 rounded and $92,308 rounded

B) $900,000 and $200,000

C) $1,750,000 and $200,000

D) $2,800,000 and $320,000

E) $900,000 and $320,000

Data Source Media manufactures cassettes and CDs. Management is attempting to set the budget for the coming year. Two divisions (Cassette and CD) of the company utilize one plant location. The following data have been prepared for review.

What is the allocated cost to the two departments, respectively, if the single rate is $1,000? Assume that the Cassette and CD Departments used 1,750 and 200 hours, respectively.

A) $807,692 rounded and $92,308 rounded

B) $900,000 and $200,000

C) $1,750,000 and $200,000

D) $2,800,000 and $320,000

E) $900,000 and $320,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

48

Use the information below to answer the following question(s).

Data Source Media manufactures cassettes and CDs. Management is attempting to set the budget for the coming year. Two divisions (Cassette and CD) of the company utilize one plant location. The following data have been prepared for review.

What is the fixed cost per year and the variable cost per hour, respectively, for the Cassette Department using the dual-rate method, assuming that the allocation bases are capacity for fixed costs and actual usage for variable costs?

A) $720,000 and $480

B) $720,000 and $600

C) $765,958 rounded and $480

D) $765,958 rounded and $600

E) $900,000 and $600

Data Source Media manufactures cassettes and CDs. Management is attempting to set the budget for the coming year. Two divisions (Cassette and CD) of the company utilize one plant location. The following data have been prepared for review.

What is the fixed cost per year and the variable cost per hour, respectively, for the Cassette Department using the dual-rate method, assuming that the allocation bases are capacity for fixed costs and actual usage for variable costs?

A) $720,000 and $480

B) $720,000 and $600

C) $765,958 rounded and $480

D) $765,958 rounded and $600

E) $900,000 and $600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

49

Data Source Media manufactures cassettes and CDs. Management is attempting to set the budget for the coming year. Two divisions (Cassette and CD) of the company utilize one plant location. The following data have been prepared for review.  What is the cost per hour of use for the Cassette department and the CD Department assuming budgeted usage is the allocation base and a single-rate method is used?

What is the cost per hour of use for the Cassette department and the CD Department assuming budgeted usage is the allocation base and a single-rate method is used?

A) $960.00

B) $600.00

C) $982.98

D) $1,021.28

E) $1,582.98

What is the cost per hour of use for the Cassette department and the CD Department assuming budgeted usage is the allocation base and a single-rate method is used?

What is the cost per hour of use for the Cassette department and the CD Department assuming budgeted usage is the allocation base and a single-rate method is used?A) $960.00

B) $600.00

C) $982.98

D) $1,021.28

E) $1,582.98

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

50

Answer the following questions using the information below:

The Fancy Flier Airplane Corporation has a central materials laboratory. The laboratory has only two users, the Large Plane Department and the Small Plane Department. The following data apply to the coming budget year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.

Actual usage for the year by the Large Plane Department was 6,000 technician hours and by the Small Plane Department was 6,500 technician hours.

If a dual-rate cost-allocation method is used, what amount of materials laboratory costs will be allocated to the Large Plane Department? Assume budgeted usage is used to allocate fixed materials laboratory costs and actual usage is used to allocate variable materials laboratory costs.

A) $782,500

B) $817,500

C) $822,500

D) $705,000

E) $996,923

The Fancy Flier Airplane Corporation has a central materials laboratory. The laboratory has only two users, the Large Plane Department and the Small Plane Department. The following data apply to the coming budget year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.Actual usage for the year by the Large Plane Department was 6,000 technician hours and by the Small Plane Department was 6,500 technician hours.

If a dual-rate cost-allocation method is used, what amount of materials laboratory costs will be allocated to the Large Plane Department? Assume budgeted usage is used to allocate fixed materials laboratory costs and actual usage is used to allocate variable materials laboratory costs.

A) $782,500

B) $817,500

C) $822,500

D) $705,000

E) $996,923

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

51

Answer the following questions using the information below:

The Bonawitz Corporation has a central copying facility. The copying facility has only two users, the Marketing Department and the Operations Department. The following data apply to the coming budget year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.

Actual usage for the year by the Marketing Department was 40,000 copies and by the Operations Department was 180,000 copies.

If a single-rate cost-allocation method is used, what amount of copying facility costs will be budgeted for the Marketing Department?

A) $9,000

B) $1,800

C) $7,200

D) $28,500

E) $24,600

The Bonawitz Corporation has a central copying facility. The copying facility has only two users, the Marketing Department and the Operations Department. The following data apply to the coming budget year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.Actual usage for the year by the Marketing Department was 40,000 copies and by the Operations Department was 180,000 copies.

If a single-rate cost-allocation method is used, what amount of copying facility costs will be budgeted for the Marketing Department?

A) $9,000

B) $1,800

C) $7,200

D) $28,500

E) $24,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

52

Answer the following questions using the information below:

The Fancy Flier Airplane Corporation has a central materials laboratory. The laboratory has only two users, the Large Plane Department and the Small Plane Department. The following data apply to the coming budget year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.

Actual usage for the year by the Large Plane Department was 6,000 technician hours and by the Small Plane Department was 6,500 technician hours.

If a dual-rate cost-allocation method is used, what amount of materials laboratory costs will be budgeted for the Large Plane Department?

A) $1,057,500

B) $822,500

C) $1,880,000

D) $1,600,000

E) $982,500

The Fancy Flier Airplane Corporation has a central materials laboratory. The laboratory has only two users, the Large Plane Department and the Small Plane Department. The following data apply to the coming budget year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.Actual usage for the year by the Large Plane Department was 6,000 technician hours and by the Small Plane Department was 6,500 technician hours.

If a dual-rate cost-allocation method is used, what amount of materials laboratory costs will be budgeted for the Large Plane Department?

A) $1,057,500

B) $822,500

C) $1,880,000

D) $1,600,000

E) $982,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

53

Answer the following questions using the information below:

The Fancy Flier Airplane Corporation has a central materials laboratory. The laboratory has only two users, the Large Plane Department and the Small Plane Department. The following data apply to the coming budget year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.

Actual usage for the year by the Large Plane Department was 6,000 technician hours and by the Small Plane Department was 6,500 technician hours.

If a single-rate cost-allocation method is used, what amount of materials laboratory costs will be allocated to the Large Plane Department? Assume budgeted usage is used to allocate fixed materials laboratory costs and actual usage is used to allocate variable materials laboratory costs.

A) $1,057,500

B) $822,500

C) $763,750

D) $705,000

E) $1,476,923

The Fancy Flier Airplane Corporation has a central materials laboratory. The laboratory has only two users, the Large Plane Department and the Small Plane Department. The following data apply to the coming budget year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.Actual usage for the year by the Large Plane Department was 6,000 technician hours and by the Small Plane Department was 6,500 technician hours.

If a single-rate cost-allocation method is used, what amount of materials laboratory costs will be allocated to the Large Plane Department? Assume budgeted usage is used to allocate fixed materials laboratory costs and actual usage is used to allocate variable materials laboratory costs.

A) $1,057,500

B) $822,500

C) $763,750

D) $705,000

E) $1,476,923

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

54

Answer the following questions using the information below:

The Bonawitz Corporation has a central copying facility. The copying facility has only two users, the Marketing Department and the Operations Department. The following data apply to the coming budget year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.

Actual usage for the year by the Marketing Department was 40,000 copies and by the Operations Department was 180,000 copies.

If a single-rate cost-allocation method is used, what amount of copying facility costs will be allocated to the Marketing Department? Assume budgeted usage is used to allocate fixed copying costs and actual usage is used to allocate variable copying costs.

A) $8,400

B) $9,000

C) $6,000

D) $4,800

E) $6,655

The Bonawitz Corporation has a central copying facility. The copying facility has only two users, the Marketing Department and the Operations Department. The following data apply to the coming budget year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.Actual usage for the year by the Marketing Department was 40,000 copies and by the Operations Department was 180,000 copies.

If a single-rate cost-allocation method is used, what amount of copying facility costs will be allocated to the Marketing Department? Assume budgeted usage is used to allocate fixed copying costs and actual usage is used to allocate variable copying costs.

A) $8,400

B) $9,000

C) $6,000

D) $4,800

E) $6,655

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

55

Use the information below to answer the following question(s).

Data Source Media manufactures cassettes and CDs. Management is attempting to set the budget for the coming year. Two divisions (Cassette and CD) of the company utilize one plant location. The following data have been prepared for review.

What are the fixed cost per year and the variable cost per hour for the CD Department if the dual-rate method is used? Assume that the allocation bases are budgeted usage for fixed costs and actual usage for variable costs.

A) $100,270 and $600

B) $126,000 and $600

C) $134,043 rounded and $89.36

D) $134,043 rounded and $600

E) $900,000 and $600

Data Source Media manufactures cassettes and CDs. Management is attempting to set the budget for the coming year. Two divisions (Cassette and CD) of the company utilize one plant location. The following data have been prepared for review.

What are the fixed cost per year and the variable cost per hour for the CD Department if the dual-rate method is used? Assume that the allocation bases are budgeted usage for fixed costs and actual usage for variable costs.

A) $100,270 and $600

B) $126,000 and $600

C) $134,043 rounded and $89.36

D) $134,043 rounded and $600

E) $900,000 and $600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

56

The method that allocates costs in each cost pool using the same rate per unit is known as the

A) incremental cost allocation method.

B) reciprocal cost allocation method.

C) single-rate cost allocation method.

D) dual-rate cost allocation method.

E) homogeneous cost allocation method.

A) incremental cost allocation method.

B) reciprocal cost allocation method.

C) single-rate cost allocation method.

D) dual-rate cost allocation method.

E) homogeneous cost allocation method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

57

Benefits of the dual-rate method include

A) variable costs that are transformed into fixed costs for user decision making.

B) the low cost of implementation.

C) avoidance of expensive analysis for categorizing costs as either fixed or variable.

D) information that leads to outsourcing decisions that benefit the organization as a whole.

E) increased costs of implementation.

A) variable costs that are transformed into fixed costs for user decision making.

B) the low cost of implementation.

C) avoidance of expensive analysis for categorizing costs as either fixed or variable.

D) information that leads to outsourcing decisions that benefit the organization as a whole.

E) increased costs of implementation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

58

Answer the following questions using the information below:

The Bonawitz Corporation has a central copying facility. The copying facility has only two users, the Marketing Department and the Operations Department. The following data apply to the coming budget year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.

Actual usage for the year by the Marketing Department was 40,000 copies and by the Operations Department was 180,000 copies.

If a dual-rate cost-allocation method is used, what amount of copying facility costs will be allocated to the Operations Department? Assume budgeted usage is used to allocate fixed copying costs and actual usage is used to allocate variable copying costs.

A) $30,245

B) $29,945

C) $28,500

D) $28,200

E) $24,600

The Bonawitz Corporation has a central copying facility. The copying facility has only two users, the Marketing Department and the Operations Department. The following data apply to the coming budget year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.Actual usage for the year by the Marketing Department was 40,000 copies and by the Operations Department was 180,000 copies.

If a dual-rate cost-allocation method is used, what amount of copying facility costs will be allocated to the Operations Department? Assume budgeted usage is used to allocate fixed copying costs and actual usage is used to allocate variable copying costs.

A) $30,245

B) $29,945

C) $28,500

D) $28,200

E) $24,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

59

Use the information below to answer the following question(s).

Data Source Media manufactures cassettes and CDs. Management is attempting to set the budget for the coming year. Two divisions (Cassette and CD) of the company utilize one plant location. The following data have been prepared for review.

What is the allocated cost to the two departments, respectively, if budgeted usage is the base for fixed costs and actual usage is the base for variable costs? (Use dual-rate method.) Assume that the Cassette and CD Departments used 1,750 and 200 hours, respectively.

A) $1,050,000; $120,000

B) $1,787,240; $204,256

C) $1,815,957; $254,043

D) $2,000,126; $294,112

E) $1,787,240; $254,043

Data Source Media manufactures cassettes and CDs. Management is attempting to set the budget for the coming year. Two divisions (Cassette and CD) of the company utilize one plant location. The following data have been prepared for review.

What is the allocated cost to the two departments, respectively, if budgeted usage is the base for fixed costs and actual usage is the base for variable costs? (Use dual-rate method.) Assume that the Cassette and CD Departments used 1,750 and 200 hours, respectively.

A) $1,050,000; $120,000

B) $1,787,240; $204,256

C) $1,815,957; $254,043

D) $2,000,126; $294,112

E) $1,787,240; $254,043

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which cost allocation method differentiates between variable and fixed costs?

A) dual-rate method

B) heterogeneous method

C) single-rate method

D) variable method

E) fixed rate method

A) dual-rate method

B) heterogeneous method

C) single-rate method

D) variable method

E) fixed rate method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

61

Answer the following questions using the information below:

The Fancy Flier Airplane Corporation has a central materials laboratory. The laboratory has only two users, the Large Plane Department and the Small Plane Department. The following data apply to the coming budget year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.

Actual usage for the year by the Large Plane Department was 6,000 technician hours and by the Small Plane Department was 6,500 technician hours.

If a dual-rate cost-allocation method is used, what amount of materials laboratory costs will be allocated to the Small Plane Department? Assume budgeted usage is used to allocate materials laboratory costs and actual usage is used to allocate variable materials laboratory costs.

A) $822,500

B) $782,500

C) $817,500

D) $763,750

E) $832,000

The Fancy Flier Airplane Corporation has a central materials laboratory. The laboratory has only two users, the Large Plane Department and the Small Plane Department. The following data apply to the coming budget year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.Actual usage for the year by the Large Plane Department was 6,000 technician hours and by the Small Plane Department was 6,500 technician hours.

If a dual-rate cost-allocation method is used, what amount of materials laboratory costs will be allocated to the Small Plane Department? Assume budgeted usage is used to allocate materials laboratory costs and actual usage is used to allocate variable materials laboratory costs.

A) $822,500

B) $782,500

C) $817,500

D) $763,750

E) $832,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

62

A budgeted rate helps to motivate the manager of a support department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

63

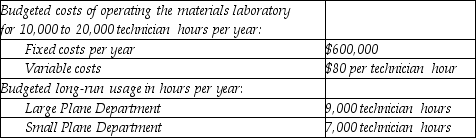

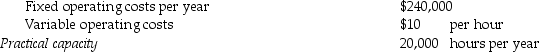

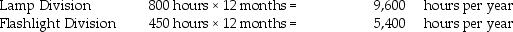

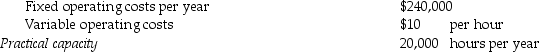

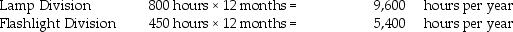

The Alex Miller Corporation operates one central plant that has two divisions, the Flashlight Division and the Lamp Division. The following data apply to the coming budget year:

Budgeted costs of the operating the plant

for 10,000 to 20,000 hours:

Budgeted long-run usage per year:

Budgeted long-run usage per year:

Assume that practical capacity is used to calculate the allocation rates. Further assume that actual usage of the Lamp Division was 700 hours and the Flashlight Division was 400 hours for the month of June.

Assume that practical capacity is used to calculate the allocation rates. Further assume that actual usage of the Lamp Division was 700 hours and the Flashlight Division was 400 hours for the month of June.

Required:

a. If a single-rate cost-allocation method is used, what amount of operating costs will be budgeted for the Lamp Division each month? For the Flashlight Division each month?

b. For the month of June, if a single-rate cost-allocation method is used, what amount of cost will be allocated to the Lamp Division? To the Flashlight Division? Assume actual usage is used to allocate operating costs.

c. If a dual-rate cost-allocation method is used, what amount of operating costs will be budgeted for the Lamp Division each month? For the Flashlight Division each month?

d. For the month of June, if a dual-rate cost-allocation method is used, what amount of cost will be allocated to the Lamp Division? To the Flashlight Division? Assume budgeted usage is used to allocate fixed operating costs and actual usage is used to allocate variable operating costs.

Budgeted costs of the operating the plant

for 10,000 to 20,000 hours:

Budgeted long-run usage per year:

Budgeted long-run usage per year: Assume that practical capacity is used to calculate the allocation rates. Further assume that actual usage of the Lamp Division was 700 hours and the Flashlight Division was 400 hours for the month of June.

Assume that practical capacity is used to calculate the allocation rates. Further assume that actual usage of the Lamp Division was 700 hours and the Flashlight Division was 400 hours for the month of June.Required:

a. If a single-rate cost-allocation method is used, what amount of operating costs will be budgeted for the Lamp Division each month? For the Flashlight Division each month?

b. For the month of June, if a single-rate cost-allocation method is used, what amount of cost will be allocated to the Lamp Division? To the Flashlight Division? Assume actual usage is used to allocate operating costs.

c. If a dual-rate cost-allocation method is used, what amount of operating costs will be budgeted for the Lamp Division each month? For the Flashlight Division each month?

d. For the month of June, if a dual-rate cost-allocation method is used, what amount of cost will be allocated to the Lamp Division? To the Flashlight Division? Assume budgeted usage is used to allocate fixed operating costs and actual usage is used to allocate variable operating costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

64

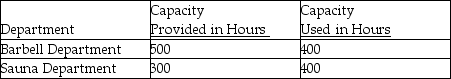

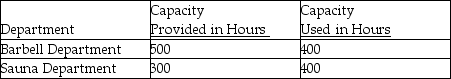

Use the information below to answer the following question(s).

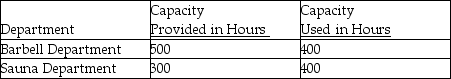

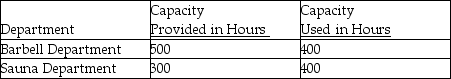

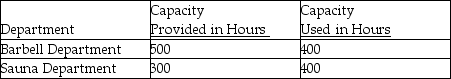

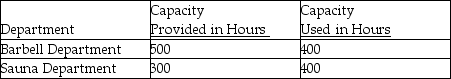

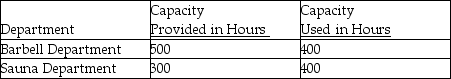

We Be Warehouse Fitness Equipment incurred $80,000 of common fixed costs and $120,000 of common variable costs. Data are provided below for the capacity allowed and the capacity used.

For both departments, common fixed costs are to be allocated on the basis of capacity provided and common variable costs are to be allocated on the basis of capacity used.

For both departments, common fixed costs are to be allocated on the basis of capacity provided and common variable costs are to be allocated on the basis of capacity used.

Both fixed and variable costs are allocated according to capacity used. The fixed and variable costs allocated to the Barbell Department are

A) $30,000 and $50,000, respectively.

B) $30,000 and $60,000, respectively.

C) $30,000 and $75,000 respectively.

D) $40,000 and $60,000, respectively.

E) $60,000 and $40,000, respectively.

We Be Warehouse Fitness Equipment incurred $80,000 of common fixed costs and $120,000 of common variable costs. Data are provided below for the capacity allowed and the capacity used.

For both departments, common fixed costs are to be allocated on the basis of capacity provided and common variable costs are to be allocated on the basis of capacity used.

For both departments, common fixed costs are to be allocated on the basis of capacity provided and common variable costs are to be allocated on the basis of capacity used.Both fixed and variable costs are allocated according to capacity used. The fixed and variable costs allocated to the Barbell Department are

A) $30,000 and $50,000, respectively.

B) $30,000 and $60,000, respectively.

C) $30,000 and $75,000 respectively.

D) $40,000 and $60,000, respectively.

E) $60,000 and $40,000, respectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

65

When choosing between budgeted usage and actual usage as allocation bases, which of the following is true?

A) Actual rates let users know in advance what their costs are.

B) When budgeted rates are used, users must wait till the end of the budget period to know what their costs are.

C) With actual rates, a support department, rather than a user department, bears the risk of unfavourable cost variances.

D) Budgeted rates may lead to user departments outsourcing needed work, rather than relying on an internal support department.

E) Budgeted rates may help the manager of a support department to improve efficiency.

A) Actual rates let users know in advance what their costs are.

B) When budgeted rates are used, users must wait till the end of the budget period to know what their costs are.

C) With actual rates, a support department, rather than a user department, bears the risk of unfavourable cost variances.

D) Budgeted rates may lead to user departments outsourcing needed work, rather than relying on an internal support department.

E) Budgeted rates may help the manager of a support department to improve efficiency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

66

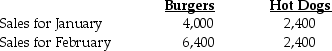

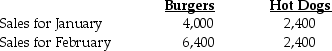

Blaster Drive-In is a fast-food restaurant that sells burgers and hot dogs in a 1950s environment. The fixed operating costs of the company are $5,000 per month. The controlling shareholder, interested in product profitability and pricing, wants all costs allocated to either the burgers or the hot dogs. The following information is provided for the operations of the company:

Required:

Required:

a. What amount of fixed operating costs is assigned to the burgers and hot dogs when actual sales are used as the allocation base for January? For February?

b. Hot dog sales for January and February remained constant. Did the amount of fixed operating costs allocated to hot dogs also remain constant for January and February? Explain why or why not. Comment on any other observations.

Required:

Required:a. What amount of fixed operating costs is assigned to the burgers and hot dogs when actual sales are used as the allocation base for January? For February?

b. Hot dog sales for January and February remained constant. Did the amount of fixed operating costs allocated to hot dogs also remain constant for January and February? Explain why or why not. Comment on any other observations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

67

For each of the following cost pools select an appropriate allocation base from the list below if the overall cost object is to assign costs to production departments. Each base can be used only once. Assume a manufacturing company.

Cost pools:

a. Vice-president of finance's office expenses.

b. Computer operations used in conjunction with manufacturing.

c. Personnel department.

d. Manufacturing machinery cost.

e. Energy costs.

Allocation bases for which the information system can provide data:

1. Number of employees per department.

2. Employee wages and salaries per department.

3. Production facility square metreage.

4. Hours of operation by production department.

5. Machine hours by department.

6. Machines per department.

7. Operations costs of each department.

8. Hours of computer use per month per department.

9. Indirect labour hours per department.

Cost pools:

a. Vice-president of finance's office expenses.

b. Computer operations used in conjunction with manufacturing.

c. Personnel department.

d. Manufacturing machinery cost.

e. Energy costs.

Allocation bases for which the information system can provide data:

1. Number of employees per department.

2. Employee wages and salaries per department.

3. Production facility square metreage.

4. Hours of operation by production department.

5. Machine hours by department.

6. Machines per department.

7. Operations costs of each department.

8. Hours of computer use per month per department.

9. Indirect labour hours per department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

68

An advantage to using budgeted usage, rather than actual usage, for the allocation base is that

A) GAAP/IFRS requires it for comparability to previous years.

B) variable costs are lower.

C) management does not have to be accountable for actual costs since the system only deals with budgeted costs.

D) it is consistent with a short-run time horizon.

E) user divisions will know their allocated costs in advance.

A) GAAP/IFRS requires it for comparability to previous years.

B) variable costs are lower.

C) management does not have to be accountable for actual costs since the system only deals with budgeted costs.

D) it is consistent with a short-run time horizon.

E) user divisions will know their allocated costs in advance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

69

Use the information below to answer the following question(s).

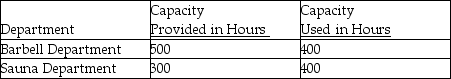

We Be Warehouse Fitness Equipment incurred $80,000 of common fixed costs and $120,000 of common variable costs. Data are provided below for the capacity allowed and the capacity used.

For both departments, common fixed costs are to be allocated on the basis of capacity provided and common variable costs are to be allocated on the basis of capacity used.

For both departments, common fixed costs are to be allocated on the basis of capacity provided and common variable costs are to be allocated on the basis of capacity used.

Both fixed and variable costs are allocated according to capacity used. The fixed and variable costs allocated to the Sauna Department are

A) $30,000 and $50,000, respectively.

B) $30,000 and $60,000, respectively.

C) $30,000 and $75,000 respectively.

D) $40,000 and $60,000, respectively.

E) $60,000 and $40,000, respectively.

We Be Warehouse Fitness Equipment incurred $80,000 of common fixed costs and $120,000 of common variable costs. Data are provided below for the capacity allowed and the capacity used.

For both departments, common fixed costs are to be allocated on the basis of capacity provided and common variable costs are to be allocated on the basis of capacity used.

For both departments, common fixed costs are to be allocated on the basis of capacity provided and common variable costs are to be allocated on the basis of capacity used.Both fixed and variable costs are allocated according to capacity used. The fixed and variable costs allocated to the Sauna Department are

A) $30,000 and $50,000, respectively.

B) $30,000 and $60,000, respectively.

C) $30,000 and $75,000 respectively.

D) $40,000 and $60,000, respectively.

E) $60,000 and $40,000, respectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

70

A support department adds value directly to a product or service, which is observable by the customer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

71

When budgeted cost-allocation rates are used, variations in actual usage by one division affect the costs allocated to other divisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

72

Answer the following questions using the information below:

The Fancy Flier Airplane Corporation has a central materials laboratory. The laboratory has only two users, the Large Plane Department and the Small Plane Department. The following data apply to the coming budget year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.

Actual usage for the year by the Large Plane Department was 6,000 technician hours and by the Small Plane Department was 6,500 technician hours.

If a dual-rate cost-allocation method is used, what amount of materials laboratory costs will be budgeted for the Small Plane Department?

A) $1,057,500

B) $763,750

C) $705,000

D) $822,500

E) $897,500

The Fancy Flier Airplane Corporation has a central materials laboratory. The laboratory has only two users, the Large Plane Department and the Small Plane Department. The following data apply to the coming budget year:

Budgeted amounts are used to calculate the allocation rates.

Budgeted amounts are used to calculate the allocation rates.Actual usage for the year by the Large Plane Department was 6,000 technician hours and by the Small Plane Department was 6,500 technician hours.

If a dual-rate cost-allocation method is used, what amount of materials laboratory costs will be budgeted for the Small Plane Department?

A) $1,057,500

B) $763,750

C) $705,000

D) $822,500

E) $897,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

73

Fixed costs

A) should be allocated according to past production capacity.

B) should be allocated according to current usage.

C) should be allocated according to short-term expected usage.

D) should be allocated according to long-term expected usage.

E) should be allocated using actual usage as the allocation base.

A) should be allocated according to past production capacity.

B) should be allocated according to current usage.

C) should be allocated according to short-term expected usage.

D) should be allocated according to long-term expected usage.

E) should be allocated using actual usage as the allocation base.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

74

The user department is responsible for any unfavourable cost variances during the budgeting period if budgeted prices and quantities are used for cost allocation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

75

Use the information below to answer the following question(s).

We Be Warehouse Fitness Equipment incurred $80,000 of common fixed costs and $120,000 of common variable costs. Data are provided below for the capacity allowed and the capacity used.

For both departments, common fixed costs are to be allocated on the basis of capacity provided and common variable costs are to be allocated on the basis of capacity used.

For both departments, common fixed costs are to be allocated on the basis of capacity provided and common variable costs are to be allocated on the basis of capacity used.

The fixed and variable costs allocated to the Barbell Department are

A) $50,000 and $75,000, respectively.

B) $50,000 and $60,000, respectively.

C) $30,000 and $75,000, respectively.

D) $30,000 and $60,000, respectively.

E) $30,000 and $50,000 respectively.

We Be Warehouse Fitness Equipment incurred $80,000 of common fixed costs and $120,000 of common variable costs. Data are provided below for the capacity allowed and the capacity used.

For both departments, common fixed costs are to be allocated on the basis of capacity provided and common variable costs are to be allocated on the basis of capacity used.

For both departments, common fixed costs are to be allocated on the basis of capacity provided and common variable costs are to be allocated on the basis of capacity used.The fixed and variable costs allocated to the Barbell Department are

A) $50,000 and $75,000, respectively.

B) $50,000 and $60,000, respectively.

C) $30,000 and $75,000, respectively.

D) $30,000 and $60,000, respectively.

E) $30,000 and $50,000 respectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

76

When budgeted cost-allocation rates are used, managers of the supplier division are motivated to improve efficiency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

77

Use the information below to answer the following question(s).

We Be Warehouse Fitness Equipment incurred $80,000 of common fixed costs and $120,000 of common variable costs. Data are provided below for the capacity allowed and the capacity used.

For both departments, common fixed costs are to be allocated on the basis of capacity provided and common variable costs are to be allocated on the basis of capacity used.

For both departments, common fixed costs are to be allocated on the basis of capacity provided and common variable costs are to be allocated on the basis of capacity used.

The fixed and variable costs allocated to the Sauna Department are

A) $50,000 and $75,000, respectively.

B) $50,000 and $60,000, respectively.

C) $30,000 and $75,000, respectively.

D) $30,000 and $50,000, respectively.

E) $30,000 and $60,000 respectively

We Be Warehouse Fitness Equipment incurred $80,000 of common fixed costs and $120,000 of common variable costs. Data are provided below for the capacity allowed and the capacity used.

For both departments, common fixed costs are to be allocated on the basis of capacity provided and common variable costs are to be allocated on the basis of capacity used.

For both departments, common fixed costs are to be allocated on the basis of capacity provided and common variable costs are to be allocated on the basis of capacity used.The fixed and variable costs allocated to the Sauna Department are

A) $50,000 and $75,000, respectively.

B) $50,000 and $60,000, respectively.

C) $30,000 and $75,000, respectively.

D) $30,000 and $50,000, respectively.

E) $30,000 and $60,000 respectively

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

78

User departments will be able to determine their allocated costs for each category in advance if budgeted usage is the allocation base.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

79

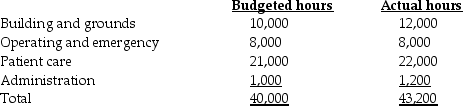

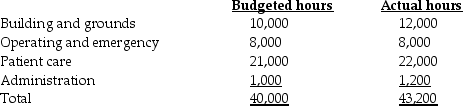

The fixed costs of operating the maintenance facility of General Hospital are $4,500,000 annually. Variable costs are incurred at the rate of $30 per maintenance-hour. The facility averages 40,000 maintenance-hours a year. Budgeted and actual hours per user for the year are as follows:

Assume that budgeted maintenance-hours are used to calculate the allocation rates.

Assume that budgeted maintenance-hours are used to calculate the allocation rates.

Required:

a. If a single-rate cost-allocation method is used, what amount of maintenance cost will be budgeted for each department?

b. If a single-rate cost-allocation method is used, what amount of maintenance cost will be allocated to each department based on actual usage?

c. If a dual-rate cost-allocation method is used, what amount of maintenance cost will be budgeted for each department?

d. If a dual-rate cost-allocation method is used, what amount of maintenance cost will be allocated to each department based on budgeted usage for fixed operating costs and actual usage for variable operating costs?

Assume that budgeted maintenance-hours are used to calculate the allocation rates.

Assume that budgeted maintenance-hours are used to calculate the allocation rates.Required:

a. If a single-rate cost-allocation method is used, what amount of maintenance cost will be budgeted for each department?

b. If a single-rate cost-allocation method is used, what amount of maintenance cost will be allocated to each department based on actual usage?

c. If a dual-rate cost-allocation method is used, what amount of maintenance cost will be budgeted for each department?

d. If a dual-rate cost-allocation method is used, what amount of maintenance cost will be allocated to each department based on budgeted usage for fixed operating costs and actual usage for variable operating costs?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck

80

AAA Fence Company manufactures wireless and aluminum fences in a common manufacturing facility. The company has become aware of unusual discrepancies in the costs of its products which management cannot explain. It seems that the sales and related production of wireless fences are in a very consistent growth market and are easily predicted. However, the sales and related production of aluminum fences are very erratic. Management does not understand why the costs per unit of wireless fences change when the production level seldom changes.

Required:

a. After some investigation you determine that for the last two quarters, the common fixed cost of the manufacturing operation has been $800,000. For the first quarter 12,000 wireless and 13,000 aluminum units were produced, respectively. For the second quarter, 12,000 wireless and 8,000 aluminum units were produced, respectively. What were the total cost per product and the cost per unit of each product in each quarter when production units is the allocation basis?

b. After studying the results of the above computations you decide to use the company's average quarterly production of 12,000 wireless and 10,500 aluminium units as the allocation base, respectively. What are the total cost per product and the cost per unit per quarter for each product when average production is used?

c. Which allocation base do you recommend, and why?

Required:

a. After some investigation you determine that for the last two quarters, the common fixed cost of the manufacturing operation has been $800,000. For the first quarter 12,000 wireless and 13,000 aluminum units were produced, respectively. For the second quarter, 12,000 wireless and 8,000 aluminum units were produced, respectively. What were the total cost per product and the cost per unit of each product in each quarter when production units is the allocation basis?

b. After studying the results of the above computations you decide to use the company's average quarterly production of 12,000 wireless and 10,500 aluminium units as the allocation base, respectively. What are the total cost per product and the cost per unit per quarter for each product when average production is used?

c. Which allocation base do you recommend, and why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 153 في هذه المجموعة.

فتح الحزمة

k this deck