Deck 24: Multinational Performance Measurement and Compensation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

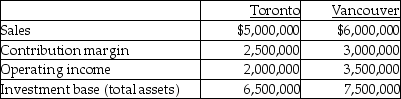

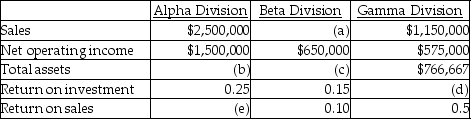

سؤال

سؤال

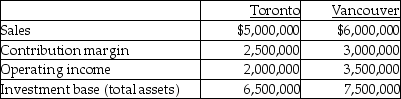

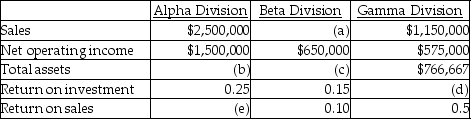

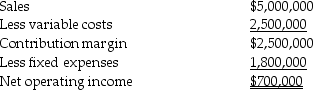

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

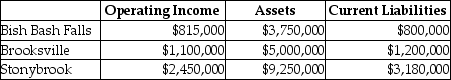

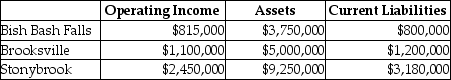

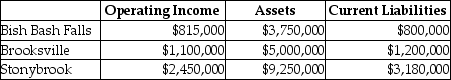

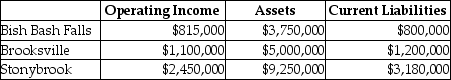

سؤال

سؤال

سؤال

سؤال

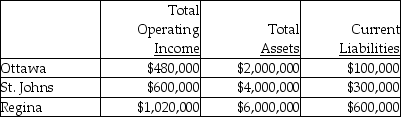

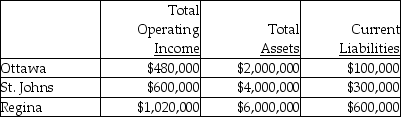

سؤال

سؤال

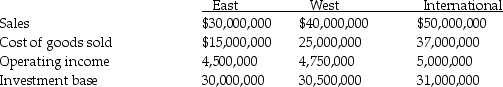

سؤال

سؤال

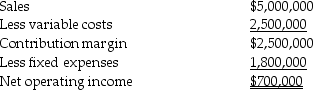

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

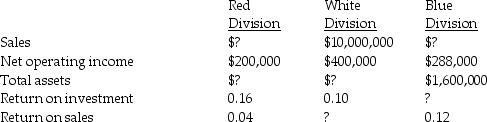

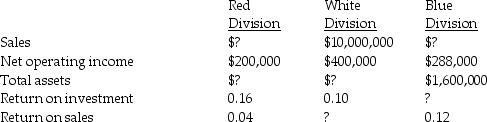

سؤال

سؤال

سؤال

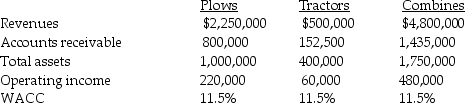

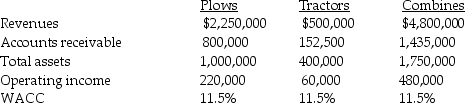

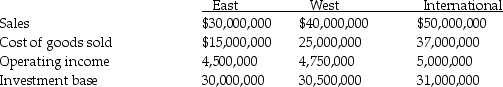

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

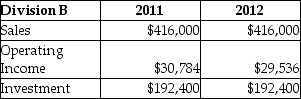

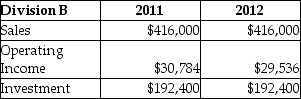

سؤال

سؤال

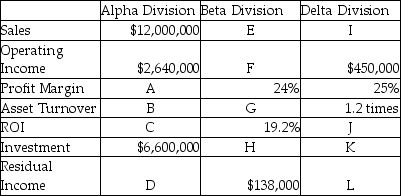

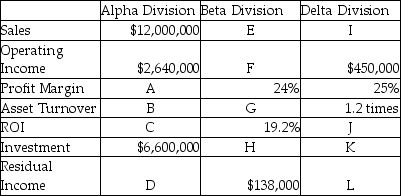

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/139

العب

ملء الشاشة (f)

Deck 24: Multinational Performance Measurement and Compensation

1

What the first step in selecting appropriate performance measures?

A) Decide on the level of relevance and urgency of feedback.

B) Decide on measurement alternatives for each performance measure.

C) Decide on components n each performance measure.

D) Decide on criteria targets against which to measure performance.

E) Identify and align accounting performance measures with financial goals.

A) Decide on the level of relevance and urgency of feedback.

B) Decide on measurement alternatives for each performance measure.

C) Decide on components n each performance measure.

D) Decide on criteria targets against which to measure performance.

E) Identify and align accounting performance measures with financial goals.

E

2

Return on sales is calculated by dividing net income by revenues.

True

3

Some companies present financial and non-financial performance measures for various organization units in a single report called the financial performance scorecard.

False

4

The imputed cost of an investment is the required rate of return times the investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

5

Investment turnover is calculated by dividing investments by revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

6

Return on investment highlights the benefits that managers can obtain by reducing their investments in current or fixed assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

7

The three alternatives for increasing return on investment include increasing assets such as receivables, increasing revenues, and decreasing costs. (In all cases assume that all other items stay the same.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following approaches include investment in a performance measure?

A) ROI and RI

B) ROI and ROS

C) ROS and RI

D) EVA and ROI

E) ROI, EVA, and RI

A) ROI and RI

B) ROI and ROS

C) ROS and RI

D) EVA and ROI

E) ROI, EVA, and RI

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

9

Residual income is income plus an imputed interest charge for the investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

10

The first step in designing accounting based performance measures is to choose performance measures that align with top management's financial goals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

11

Deciding if all subunits should have the same required rate of return is an example of

A) deciding on the level of relevance and urgency of feedback.

B) deciding on measurement alternatives for each performance measure.

C) deciding on components n each performance measure.

D) deciding on criteria targets against which to measure performance.

E) identifying and aligning accounting performance measures with financial goals.

A) deciding on the level of relevance and urgency of feedback.

B) deciding on measurement alternatives for each performance measure.

C) deciding on components n each performance measure.

D) deciding on criteria targets against which to measure performance.

E) identifying and aligning accounting performance measures with financial goals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

12

A report that measures financial and nonfinancial performance measures for various organization units in a single report is called a (n)

A) balanced scorecard.

B) financial report scorecard.

C) imbalanced scorecard.

D) unbalanced scorecard.

E) non-financial scorecard.

A) balanced scorecard.

B) financial report scorecard.

C) imbalanced scorecard.

D) unbalanced scorecard.

E) non-financial scorecard.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

13

There are three basic ingredients in profitability: investment, revenues, and debts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

14

Imputed costs are costs recognized in particular situations that are not regularly recognized by accrual accounting procedures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

15

Many common performance measures rely on internal financial and accounting information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

16

Return on investment is also called the accrual accounting rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

17

ROI, residual income, and economic value-added, can be used as performance measures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

18

In establishing performance measures and compensation policy, the issues are interdependent and the decision maker may proceed through a series of decisions several times before selecting the performance measure(s).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following is the least typical balanced scorecard measure?

A) customer satisfaction measures.

B) direct materials measures.

C) innovation measures.

D) time measures.

E) profitability measures.

A) customer satisfaction measures.

B) direct materials measures.

C) innovation measures.

D) time measures.

E) profitability measures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

20

Economic value-added is after-tax operating income minus (required rate of return times total assets).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

21

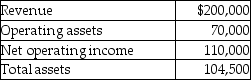

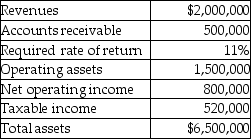

Paymaster Company provided the following information for the year just ended.  What is the return on investment?

What is the return on investment?

A) 2.25

B) 1.57

C) 1.05

D) 0.59

E) 0.55

What is the return on investment?

What is the return on investment?A) 2.25

B) 1.57

C) 1.05

D) 0.59

E) 0.55

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

22

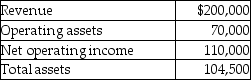

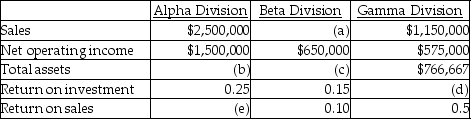

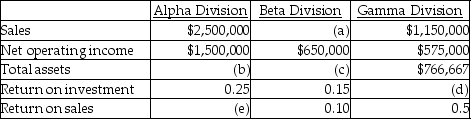

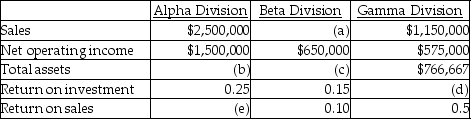

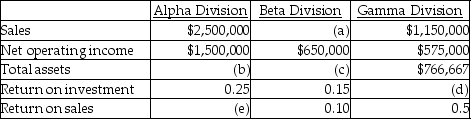

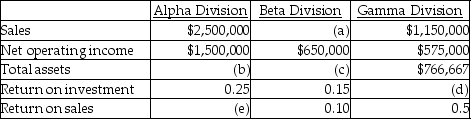

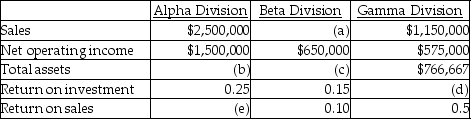

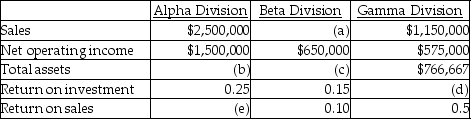

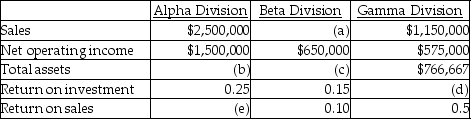

Use the information below to answer the following question(s).

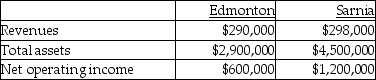

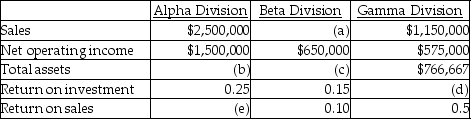

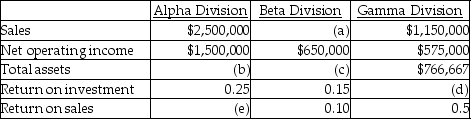

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the value of the total assets belonging to the Beta Division?

A) $4,333,333

B) $5,952,380

C) $6,500,000

D) $7,151,800

E) $4,654,252

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the value of the total assets belonging to the Beta Division?

A) $4,333,333

B) $5,952,380

C) $6,500,000

D) $7,151,800

E) $4,654,252

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

23

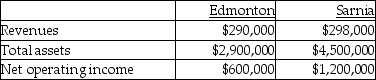

Use the information below to answer the following question(s).

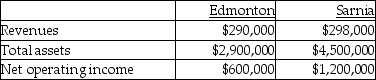

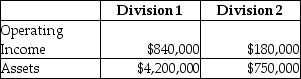

Thacker Company has two regional offices. The information for each is as follows:

What is the return on investment for the Sarnia division?

A) 0.21

B) 0.27

C) 0.48

D) 2.06

E) 0.25

Thacker Company has two regional offices. The information for each is as follows:

What is the return on investment for the Sarnia division?

A) 0.21

B) 0.27

C) 0.48

D) 2.06

E) 0.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

24

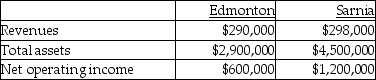

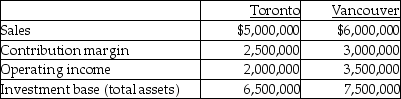

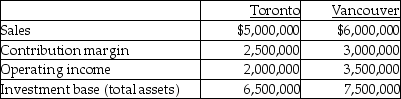

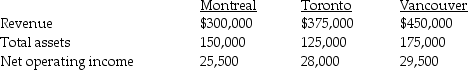

Use the information below to answer the following question(s).

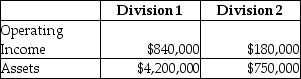

Berger Publishing has two divisions which operate autonomously. Their results for the past year were as follows:

The company's desired rate of return is 15%.

The company's desired rate of return is 15%.

What are the respective residual incomes for the Toronto and Vancouver divisions?

A) $975,000; $1,125,000

B) $1,025,000; $1,125,000

C) $1,025,000; $2,375,000

D) $2,375,000; $1,025,000

E) $1,075,000; $1,125,000

Berger Publishing has two divisions which operate autonomously. Their results for the past year were as follows:

The company's desired rate of return is 15%.

The company's desired rate of return is 15%.What are the respective residual incomes for the Toronto and Vancouver divisions?

A) $975,000; $1,125,000

B) $1,025,000; $1,125,000

C) $1,025,000; $2,375,000

D) $2,375,000; $1,025,000

E) $1,075,000; $1,125,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

25

During the past year Badger Company had a net income of $175,000. What is the ROI if the investment is $25,000?

A) 0.142

B) 2.500

C) 5.140

D) 7.000

E) 5.450

A) 0.142

B) 2.500

C) 5.140

D) 7.000

E) 5.450

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

26

The Dupont method of profitability analysis is

A) TA - CL / operating income

B) ROI × WACC

C) [revenue / investment] × [income / revenue]

D) ROI / WACC

E) ROI × RI

A) TA - CL / operating income

B) ROI × WACC

C) [revenue / investment] × [income / revenue]

D) ROI / WACC

E) ROI × RI

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

27

What disadvantage is there in using ROI and/or RI as performance measures?

A) A manager's bonus will decrease when ROI decreases.

B) ROI may decrease when business expands if income does not increase in line with the new investment.

C) RI and ROI are both single-period measures.

D) RI is measured in absolute dollars but ROI is in percentages.

E) Imputed costs that are deducted in the RI calculation, are not recognized in accrual accounting, and are therefore not included in the operating figure used in calculating ROI.

A) A manager's bonus will decrease when ROI decreases.

B) ROI may decrease when business expands if income does not increase in line with the new investment.

C) RI and ROI are both single-period measures.

D) RI is measured in absolute dollars but ROI is in percentages.

E) Imputed costs that are deducted in the RI calculation, are not recognized in accrual accounting, and are therefore not included in the operating figure used in calculating ROI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

28

Use the information below to answer the following question(s).

Berger Publishing has two divisions which operate autonomously. Their results for the past year were as follows:

The company's desired rate of return is 15%.

The company's desired rate of return is 15%.

What are the respective return-on-investment ratios for the Toronto and Vancouver divisions?

A) 0.04; 0.58

B) 0.31; 0.47

C) 0.38; 0.40

D) 0.77; 1.25

E) 0.38; 0.45

Berger Publishing has two divisions which operate autonomously. Their results for the past year were as follows:

The company's desired rate of return is 15%.

The company's desired rate of return is 15%.What are the respective return-on-investment ratios for the Toronto and Vancouver divisions?

A) 0.04; 0.58

B) 0.31; 0.47

C) 0.38; 0.40

D) 0.77; 1.25

E) 0.38; 0.45

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

29

The most popular approach to incorporating the investment base into a performance measure is

A) income on return.

B) opportunity cost.

C) return on investment.

D) residual income.

E) economic value added.

A) income on return.

B) opportunity cost.

C) return on investment.

D) residual income.

E) economic value added.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

30

Use the information below to answer the following question(s).

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the value of the total assets belonging to the Alpha Division?

A) $4,333,333

B) $6,000,000

C) $6,500,000

D) $7,151,800

E) $6,434,434

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the value of the total assets belonging to the Alpha Division?

A) $4,333,333

B) $6,000,000

C) $6,500,000

D) $7,151,800

E) $6,434,434

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

31

Use the information below to answer the following question(s).

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

What were the sales for Beta Division?

A) $4,333,333

B) $5,952,380

C) $6,500,000

D) $7,151,800

E) $6,326,787

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

What were the sales for Beta Division?

A) $4,333,333

B) $5,952,380

C) $6,500,000

D) $7,151,800

E) $6,326,787

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following is true concerning the ROI performance measure?

A) ROI is based on cash flow.

B) Is also called the accounting rate of return.

C) Some companies use net assets (assets minus liabilities) as the numerator.

D) The usual formulation is [total assets/ income ].

E) Net assets are sometimes used as the denominator, and net assets are sometimes used as the numerator.

A) ROI is based on cash flow.

B) Is also called the accounting rate of return.

C) Some companies use net assets (assets minus liabilities) as the numerator.

D) The usual formulation is [total assets/ income ].

E) Net assets are sometimes used as the denominator, and net assets are sometimes used as the numerator.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

33

Use the information below to answer the following question(s).

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

Costs recognized in particular situations that are not recognized by accrual accounting procedures are

A) opportunity costs.

B) imputed costs.

C) cash accounting costs.

D) incremental costs.

E) capital costs.

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

Costs recognized in particular situations that are not recognized by accrual accounting procedures are

A) opportunity costs.

B) imputed costs.

C) cash accounting costs.

D) incremental costs.

E) capital costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

34

An automotive dealership, with a book value of $3,000,000, and total assets of $5,000,000, has a long history of earning 18%. Last year, the company earned $900,000. The owner is considering acquiring another dealership in a nearby town. If the expansion increases income by 50%, what is the maximum amount of investment the owner can make in the new dealership in order to maintain his desired 18% return?

A) $1,350,000

B) $9,000,000

C) $5,000,000

D) $3,000,000

E) $2,500,000

A) $1,350,000

B) $9,000,000

C) $5,000,000

D) $3,000,000

E) $2,500,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

35

Use the information below to answer the following question(s).

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

A corporation has a required rate of return of 13% for all subsidiaries. The Calgary subsidiary earned residual income of $200,000 in year 1, and $300,000 in year 2 on an investment base of $4,500,000. What rate of return did the Calgary subsidiary earn in years 1 and 2 respectively?

A) 17.4% and 19.7%

B) 4.4% and 6.7%

C) 13.0% and 13.0%

D) 7.9% and 10.9%

E) 10.00% and 13.00%

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

A corporation has a required rate of return of 13% for all subsidiaries. The Calgary subsidiary earned residual income of $200,000 in year 1, and $300,000 in year 2 on an investment base of $4,500,000. What rate of return did the Calgary subsidiary earn in years 1 and 2 respectively?

A) 17.4% and 19.7%

B) 4.4% and 6.7%

C) 13.0% and 13.0%

D) 7.9% and 10.9%

E) 10.00% and 13.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

36

Use the information below to answer the following question(s).

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the Gamma Division's return on investment?

A) 0.25

B) 0.42

C) 0.60

D) 0.75

E) 0.80

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the Gamma Division's return on investment?

A) 0.25

B) 0.42

C) 0.60

D) 0.75

E) 0.80

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following incorporates the amount of investment into a performance measure?

A) dividend income

B) residual income

C) return on investment

D) both residual income and return on investment

E) both dividend income and residual

A) dividend income

B) residual income

C) return on investment

D) both residual income and return on investment

E) both dividend income and residual

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

38

Use the information below to answer the following question(s).

Thacker Company has two regional offices. The information for each is as follows:

What is the Edmonton Division's return on investment?

A) 0.21

B) 0.27

C) 0.48

D) 2.06

E) 0.25

Thacker Company has two regional offices. The information for each is as follows:

What is the Edmonton Division's return on investment?

A) 0.21

B) 0.27

C) 0.48

D) 2.06

E) 0.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

39

Use the information below to answer the following question(s).

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the Alpha Division's return on sales?

A) 0.25

B) 0.42

C) 0.60

D) 0.75

E) 0.80

The top management at Munchie Company, a manufacturer of computer games, is attempting to recover from a flood, which destroyed some of its accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the Alpha Division's return on sales?

A) 0.25

B) 0.42

C) 0.60

D) 0.75

E) 0.80

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

40

Keeping all other factors constant, which of the following would not cause an increase in the return on investment?

A) actions that increase revenues

B) actions that increase liabilities

C) actions that decrease investments

D) actions that decrease expense

E) actions that increase sales

A) actions that increase revenues

B) actions that increase liabilities

C) actions that decrease investments

D) actions that decrease expense

E) actions that increase sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

41

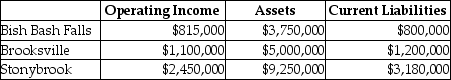

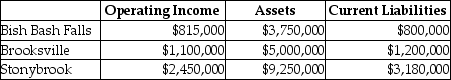

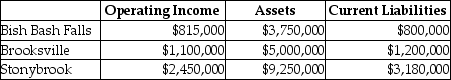

Answer the following question(s) using the information below:

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million). Coldbrook Company has profit centres in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

What is the EVA for Stonybrook?

A) $1,108,000

B) $1,168,700

C) $1,315,063

D) $1,403,063

E) $994,188

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million). Coldbrook Company has profit centres in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

What is the EVA for Stonybrook?

A) $1,108,000

B) $1,168,700

C) $1,315,063

D) $1,403,063

E) $994,188

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which two ratios are used in the DuPont system to create return on assets?

A) Profit margin and asset turnover

B) Asset turnover and return on investment

C) Profit margin and operating leverage

D) Profit margin and return on sales

E) Return on sales and return on assets

A) Profit margin and asset turnover

B) Asset turnover and return on investment

C) Profit margin and operating leverage

D) Profit margin and return on sales

E) Return on sales and return on assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

43

Answer the following question(s) using the information below:

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million). Coldbrook Company has profit centres in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

For the period just ended, Trident Ltd. reported profit of $22.6 million and invested capital of $250 million. Assuming an imputed interest rate of 8%, which of the following choices correctly denotes Trident's return on investment (ROI) and residual income respectively?

A) 8.32%; $20.792 million

B) 9.04%; $20,792 million

C) 9.76%; $4.408 million

D) 9.04%; $2.6 million

E) 9.76%; $2.6 million

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million). Coldbrook Company has profit centres in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

For the period just ended, Trident Ltd. reported profit of $22.6 million and invested capital of $250 million. Assuming an imputed interest rate of 8%, which of the following choices correctly denotes Trident's return on investment (ROI) and residual income respectively?

A) 8.32%; $20.792 million

B) 9.04%; $20,792 million

C) 9.76%; $4.408 million

D) 9.04%; $2.6 million

E) 9.76%; $2.6 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following performance measures is more likely to promote goal congruence?

A) inventory turnover

B) marginal income

C) residual income

D) return on investment

E) contribution margin

A) inventory turnover

B) marginal income

C) residual income

D) return on investment

E) contribution margin

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

45

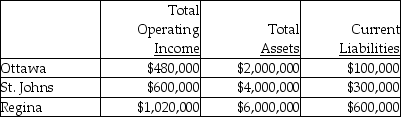

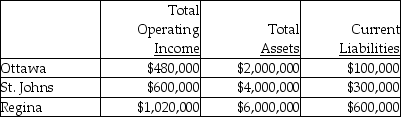

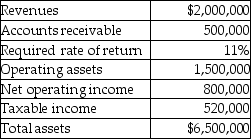

Use the information below to answer the following question(s).

Brandorf Company has two sources of funds: long term debt with a market and book value of $9 million issued at an interest rate of 10 percent; and, equity capital that has a market value of $6 million (book value of $2 million). The cost of equity capital is 5 percent, while the tax rate is 30 percent. Brandorf Company has profit centres in the following locations with the following data:

What is EVA for St. Johns?

A) $142,200

B) $190,600

C) $163,200

D) $200,000

E) $145,000

Brandorf Company has two sources of funds: long term debt with a market and book value of $9 million issued at an interest rate of 10 percent; and, equity capital that has a market value of $6 million (book value of $2 million). The cost of equity capital is 5 percent, while the tax rate is 30 percent. Brandorf Company has profit centres in the following locations with the following data:

What is EVA for St. Johns?

A) $142,200

B) $190,600

C) $163,200

D) $200,000

E) $145,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

46

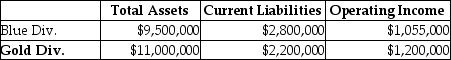

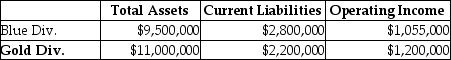

Answer the following question(s) using the information below:

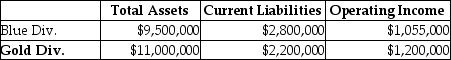

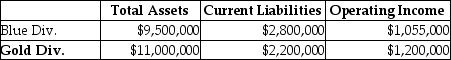

Springfield Corporation, whose tax rate is 40%, has two sources of funds: long-term debt with a market value of $8,000,000 and an interest rate of 8%, and equity capital with a market value of $12,000,000 and a cost of equity of 12%. Springfield has two operating divisions, the Blue division and the Gold division, with the following financial measures for the current year:

What is Economic Value Added (EVA) for the Blue Division?

A) -$233,400

B) $21,960

C) $188,600

D) $433,960

E) -$63,800

Springfield Corporation, whose tax rate is 40%, has two sources of funds: long-term debt with a market value of $8,000,000 and an interest rate of 8%, and equity capital with a market value of $12,000,000 and a cost of equity of 12%. Springfield has two operating divisions, the Blue division and the Gold division, with the following financial measures for the current year:

What is Economic Value Added (EVA) for the Blue Division?

A) -$233,400

B) $21,960

C) $188,600

D) $433,960

E) -$63,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

47

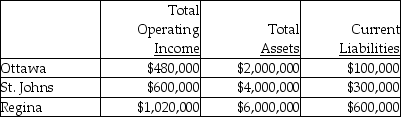

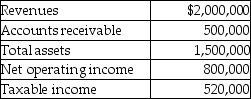

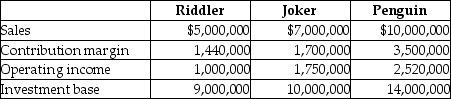

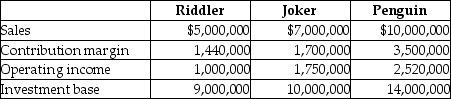

Use the information below to answer the following question(s).

Brandorf Company has two sources of funds: long term debt with a market and book value of $9 million issued at an interest rate of 10 percent; and, equity capital that has a market value of $6 million (book value of $2 million). The cost of equity capital is 5 percent, while the tax rate is 30 percent. Brandorf Company has profit centres in the following locations with the following data:

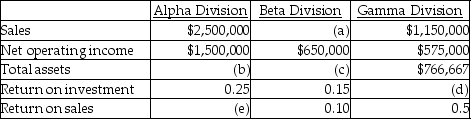

![<strong>Use the information below to answer the following question(s). Brandorf Company has two sources of funds: long term debt with a market and book value of $9 million issued at an interest rate of 10 percent; and, equity capital that has a market value of $6 million (book value of $2 million). The cost of equity capital is 5 percent, while the tax rate is 30 percent. Brandorf Company has profit centres in the following locations with the following data: A company's weighted-average cost of capital [WACC] was 9.6% last year. The company has $6,000,000 of bonds payable (its only debt) with a 9.25% coupon, and has $9,000,000 in equity capital. The tax rate is 35%. What is the company's cost of equity capital? (two decimal places only)</strong> A) 6.00% B) 6.25% C) 6.50% D) 9.25% E) 12.00%](https://d2lvgg3v3hfg70.cloudfront.net/TB2722/11ea8545_3e8c_6f86_a343_59ce3187f8cf_TB2722_00_TB2722_00_TB2722_00_TB2722_00_TB2722_00.jpg)

A company's weighted-average cost of capital [WACC] was 9.6% last year. The company has $6,000,000 of bonds payable (its only debt) with a 9.25% coupon, and has $9,000,000 in equity capital. The tax rate is 35%. What is the company's cost of equity capital? (two decimal places only)

A) 6.00%

B) 6.25%

C) 6.50%

D) 9.25%

E) 12.00%

Brandorf Company has two sources of funds: long term debt with a market and book value of $9 million issued at an interest rate of 10 percent; and, equity capital that has a market value of $6 million (book value of $2 million). The cost of equity capital is 5 percent, while the tax rate is 30 percent. Brandorf Company has profit centres in the following locations with the following data:

![<strong>Use the information below to answer the following question(s). Brandorf Company has two sources of funds: long term debt with a market and book value of $9 million issued at an interest rate of 10 percent; and, equity capital that has a market value of $6 million (book value of $2 million). The cost of equity capital is 5 percent, while the tax rate is 30 percent. Brandorf Company has profit centres in the following locations with the following data: A company's weighted-average cost of capital [WACC] was 9.6% last year. The company has $6,000,000 of bonds payable (its only debt) with a 9.25% coupon, and has $9,000,000 in equity capital. The tax rate is 35%. What is the company's cost of equity capital? (two decimal places only)</strong> A) 6.00% B) 6.25% C) 6.50% D) 9.25% E) 12.00%](https://d2lvgg3v3hfg70.cloudfront.net/TB2722/11ea8545_3e8c_6f86_a343_59ce3187f8cf_TB2722_00_TB2722_00_TB2722_00_TB2722_00_TB2722_00.jpg)

A company's weighted-average cost of capital [WACC] was 9.6% last year. The company has $6,000,000 of bonds payable (its only debt) with a 9.25% coupon, and has $9,000,000 in equity capital. The tax rate is 35%. What is the company's cost of equity capital? (two decimal places only)

A) 6.00%

B) 6.25%

C) 6.50%

D) 9.25%

E) 12.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

48

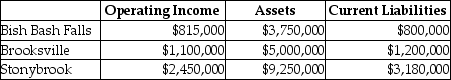

Answer the following question(s) using the information below:

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million). Coldbrook Company has profit centres in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

What is the EVA for Bish Bash Falls?

A) $338,563

B) $305,000

C) $275,500

D) $255,500

E) $220,188

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million). Coldbrook Company has profit centres in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

What is the EVA for Bish Bash Falls?

A) $338,563

B) $305,000

C) $275,500

D) $255,500

E) $220,188

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

49

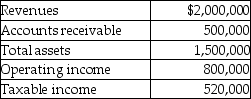

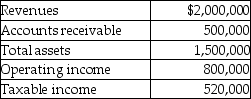

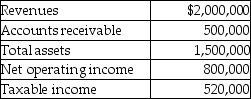

Miller Medical Services provided the following information for it past year's operations in its Hospital Bed Division.  What is the Hospital Bed Division's return on sales if income is defined as operating income ?

What is the Hospital Bed Division's return on sales if income is defined as operating income ?

A) 0.40

B) 0.53

C) 0.92

D) 1.33

E) 2.50

What is the Hospital Bed Division's return on sales if income is defined as operating income ?

What is the Hospital Bed Division's return on sales if income is defined as operating income ?A) 0.40

B) 0.53

C) 0.92

D) 1.33

E) 2.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

50

Answer the following question(s) using the information below:

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million). Coldbrook Company has profit centres in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

What is the EVA for Brooksville?

A) $476,250

B) $428,000

C) $415,525

D) $390,000

E) $318,750

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million). Coldbrook Company has profit centres in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

What is the EVA for Brooksville?

A) $476,250

B) $428,000

C) $415,525

D) $390,000

E) $318,750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

51

Use the information below to answer the following question(s).

Brandorf Company has two sources of funds: long term debt with a market and book value of $9 million issued at an interest rate of 10 percent; and, equity capital that has a market value of $6 million (book value of $2 million). The cost of equity capital is 5 percent, while the tax rate is 30 percent. Brandorf Company has profit centres in the following locations with the following data:

What is EVA for Regina?

A) $685,200

B) $342,000

C) $379,200

D) $648,000

E) $218,200

Brandorf Company has two sources of funds: long term debt with a market and book value of $9 million issued at an interest rate of 10 percent; and, equity capital that has a market value of $6 million (book value of $2 million). The cost of equity capital is 5 percent, while the tax rate is 30 percent. Brandorf Company has profit centres in the following locations with the following data:

What is EVA for Regina?

A) $685,200

B) $342,000

C) $379,200

D) $648,000

E) $218,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

52

The Auto Division of Fran Corporation has $2.5 million in total assets and $200,000 in liabilities, while the Transportation Division has $5 million in total assets and $3 million in liabilities. What are the imputed costs of the Auto division and of the Transportation division, respectively, if the corporation has a required rate of return of 11%?

A) $275,000 and $550,000

B) $253,000 and $330,000

C) $297,000 and $880,000

D) $275,000 and $330,000

E) $200,000 and $3,000,000

A) $275,000 and $550,000

B) $253,000 and $330,000

C) $297,000 and $880,000

D) $275,000 and $330,000

E) $200,000 and $3,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

53

Miller Medical Services provided the following information for its operations in the Hospital Bed Division.  What is the Hospital Bed's residual income?

What is the Hospital Bed's residual income?

A) $30,000

B) $85,000

C) <$195,000>

D) $1,285,000

E) <$250,000>

What is the Hospital Bed's residual income?

What is the Hospital Bed's residual income?A) $30,000

B) $85,000

C) <$195,000>

D) $1,285,000

E) <$250,000>

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

54

Use the information below to answer the following question(s).

Brandorf Company has two sources of funds: long term debt with a market and book value of $9 million issued at an interest rate of 10 percent; and, equity capital that has a market value of $6 million (book value of $2 million). The cost of equity capital is 5 percent, while the tax rate is 30 percent. Brandorf Company has profit centres in the following locations with the following data:

What is EVA for Ottawa?

A) $218,200

B) $42,600

C) $163,200

D) $480,000

E) $140,000

Brandorf Company has two sources of funds: long term debt with a market and book value of $9 million issued at an interest rate of 10 percent; and, equity capital that has a market value of $6 million (book value of $2 million). The cost of equity capital is 5 percent, while the tax rate is 30 percent. Brandorf Company has profit centres in the following locations with the following data:

What is EVA for Ottawa?

A) $218,200

B) $42,600

C) $163,200

D) $480,000

E) $140,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

55

A company has total assets of $500,000, a required rate of return of 10%, and operating income for the year was $200,000. What is the residual income?

A) $150,000

B) $200,000

C) $250,000

D) $480,000

E) $175,000

A) $150,000

B) $200,000

C) $250,000

D) $480,000

E) $175,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

56

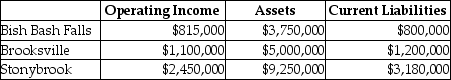

Answer the following question(s) using the information below:

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million). Coldbrook Company has profit centres in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

Novella Ltd. reported a return on investment of 16%, an asset turnover of 6, and income of $190,000. On the basis of this information, the company's invested capital was:

A) $1,187,500

B) $7,125,000

C) $1,140,000

D) $197,917

E) $182,400

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million). Coldbrook Company has profit centres in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 30%.

Novella Ltd. reported a return on investment of 16%, an asset turnover of 6, and income of $190,000. On the basis of this information, the company's invested capital was:

A) $1,187,500

B) $7,125,000

C) $1,140,000

D) $197,917

E) $182,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

57

Miller Medical Services provided the following information for its last year's operations in the Hospital Bed Division.  What is the Hospital Bed Division's asset turnover?

What is the Hospital Bed Division's asset turnover?

A) 0.00

B) 0.53

C) 0.92

D) 1.33

E) 2.50

What is the Hospital Bed Division's asset turnover?

What is the Hospital Bed Division's asset turnover?A) 0.00

B) 0.53

C) 0.92

D) 1.33

E) 2.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following is not a reason for evaluating subunits over a multi-year time horizon?

A) Benefits of actions taken in the current period may not show up in a short-term performance measure.

B) Managers may curtail R & D or plant maintenance in order to increase short-term results.

C) Investments may actually decrease ROI and or RI in the short-term.

D) The NPV of the cash flows over the life of an investment equals [total assets ÷ ROI].

E) Investments may actually decrease ROI and or RI in the short-term, and benefits of actions taken in the current period may not show up in a short-term performance measure.

A) Benefits of actions taken in the current period may not show up in a short-term performance measure.

B) Managers may curtail R & D or plant maintenance in order to increase short-term results.

C) Investments may actually decrease ROI and or RI in the short-term.

D) The NPV of the cash flows over the life of an investment equals [total assets ÷ ROI].

E) Investments may actually decrease ROI and or RI in the short-term, and benefits of actions taken in the current period may not show up in a short-term performance measure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

59

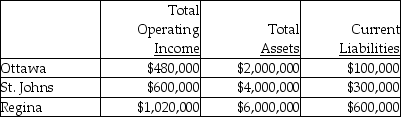

Use the information below to answer the following question(s).

Brandorf Company has two sources of funds: long term debt with a market and book value of $9 million issued at an interest rate of 10 percent; and, equity capital that has a market value of $6 million (book value of $2 million). The cost of equity capital is 5 percent, while the tax rate is 30 percent. Brandorf Company has profit centres in the following locations with the following data:

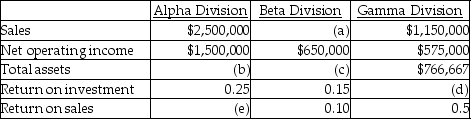

![<strong>Use the information below to answer the following question(s). Brandorf Company has two sources of funds: long term debt with a market and book value of $9 million issued at an interest rate of 10 percent; and, equity capital that has a market value of $6 million (book value of $2 million). The cost of equity capital is 5 percent, while the tax rate is 30 percent. Brandorf Company has profit centres in the following locations with the following data: A company's weighted-average cost of capital [WACC] was 9.6% last year. The company has $6,000,000 of bonds payable (its only debt) with a 9.25% coupon, and has $9,000,000 in equity capital. The tax rate is 35%. What is the company's cost of debt funding? (two decimal places only)</strong> A) 6.01% B) 6.25% C) 6.50% D) 9.25% E) 12.00%](https://d2lvgg3v3hfg70.cloudfront.net/TB2722/11ea8545_3e8c_6f86_a343_59ce3187f8cf_TB2722_00_TB2722_00_TB2722_00_TB2722_00_TB2722_00.jpg)

A company's weighted-average cost of capital [WACC] was 9.6% last year. The company has $6,000,000 of bonds payable (its only debt) with a 9.25% coupon, and has $9,000,000 in equity capital. The tax rate is 35%. What is the company's cost of debt funding? (two decimal places only)

A) 6.01%

B) 6.25%

C) 6.50%

D) 9.25%

E) 12.00%

Brandorf Company has two sources of funds: long term debt with a market and book value of $9 million issued at an interest rate of 10 percent; and, equity capital that has a market value of $6 million (book value of $2 million). The cost of equity capital is 5 percent, while the tax rate is 30 percent. Brandorf Company has profit centres in the following locations with the following data:

![<strong>Use the information below to answer the following question(s). Brandorf Company has two sources of funds: long term debt with a market and book value of $9 million issued at an interest rate of 10 percent; and, equity capital that has a market value of $6 million (book value of $2 million). The cost of equity capital is 5 percent, while the tax rate is 30 percent. Brandorf Company has profit centres in the following locations with the following data: A company's weighted-average cost of capital [WACC] was 9.6% last year. The company has $6,000,000 of bonds payable (its only debt) with a 9.25% coupon, and has $9,000,000 in equity capital. The tax rate is 35%. What is the company's cost of debt funding? (two decimal places only)</strong> A) 6.01% B) 6.25% C) 6.50% D) 9.25% E) 12.00%](https://d2lvgg3v3hfg70.cloudfront.net/TB2722/11ea8545_3e8c_6f86_a343_59ce3187f8cf_TB2722_00_TB2722_00_TB2722_00_TB2722_00_TB2722_00.jpg)

A company's weighted-average cost of capital [WACC] was 9.6% last year. The company has $6,000,000 of bonds payable (its only debt) with a 9.25% coupon, and has $9,000,000 in equity capital. The tax rate is 35%. What is the company's cost of debt funding? (two decimal places only)

A) 6.01%

B) 6.25%

C) 6.50%

D) 9.25%

E) 12.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

60

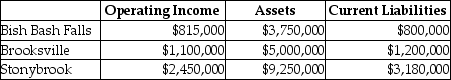

Answer the following question(s) using the information below:

Springfield Corporation, whose tax rate is 40%, has two sources of funds: long-term debt with a market value of $8,000,000 and an interest rate of 8%, and equity capital with a market value of $12,000,000 and a cost of equity of 12%. Springfield has two operating divisions, the Blue division and the Gold division, with the following financial measures for the current year:

What is Economic Value Added (EVA) for the Gold Division?

A) -$283,200

B) -$82,560

C) $196,800

D) $397,440

E) -$195,200

Springfield Corporation, whose tax rate is 40%, has two sources of funds: long-term debt with a market value of $8,000,000 and an interest rate of 8%, and equity capital with a market value of $12,000,000 and a cost of equity of 12%. Springfield has two operating divisions, the Blue division and the Gold division, with the following financial measures for the current year:

What is Economic Value Added (EVA) for the Gold Division?

A) -$283,200

B) -$82,560

C) $196,800

D) $397,440

E) -$195,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

61

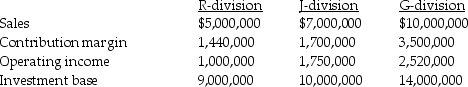

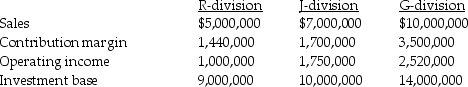

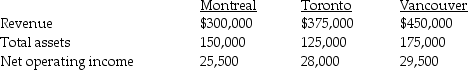

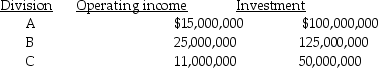

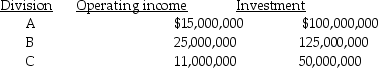

An art distribution company has three divisions which operate autonomously. Their results for 2010 were as follows:

The company's desired rate of return is 20 percent.

The company's desired rate of return is 20 percent.

Required:

a. Compute each division's ROI.

b. Compute each division's residual income.

c. Rank each division by both ROI and residual income.

d. Which division had the best performance in 2011? Why?

The company's desired rate of return is 20 percent.

The company's desired rate of return is 20 percent.Required:

a. Compute each division's ROI.

b. Compute each division's residual income.

c. Rank each division by both ROI and residual income.

d. Which division had the best performance in 2011? Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

62

Provide the missing data for the following situations:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

63

The Coffee Division of Canadian Products is planning the 2011 operating budget. Average total assets of $1,500,000 will be used during the year and unit selling prices are expected to average $100 each. Variable costs of the division are budgeted at $400,000 while fixed costs are set at $250,000. The company's required rate of return is 18 percent.

Required:

a. Compute the volume necessary to achieve a 20 percent ROI.

b. The division manager receives a bonus of 50 percent of the residual income. What is his anticipated bonus for 2011 assuming he achieves the targeted operating income in part a. and the required return is based on 18%?

Required:

a. Compute the volume necessary to achieve a 20 percent ROI.

b. The division manager receives a bonus of 50 percent of the residual income. What is his anticipated bonus for 2011 assuming he achieves the targeted operating income in part a. and the required return is based on 18%?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

64

Chaucer Ltd. has current assets of $450,000 and capital assets of $630,000. Its budgeted production volume for the next fiscal year is 200,000 units. Fixed costs are projected at $400,000 and variable unit costs for the one product produced total $5/unit. The company defines ROI as Operating Income/Total Assets and its required rate of return is 14%.

Required:

a. What selling price should Chaucer charge for its product if it wishes to achieve a 25% ROI? What is the operating income at this price?

b. The general manager for Chaucer receives a bonus equal to 12% of the residual income for the period. Calculate the amount of the bonus assuming the selling price calculated in part a).

c. Prepare a brief memo to the President of Chaucer outlining the advantages and disadvantages of ROI and Residual Income. Include your recommendations for the most appropriate method for calculating the bonus.

Required:

a. What selling price should Chaucer charge for its product if it wishes to achieve a 25% ROI? What is the operating income at this price?

b. The general manager for Chaucer receives a bonus equal to 12% of the residual income for the period. Calculate the amount of the bonus assuming the selling price calculated in part a).

c. Prepare a brief memo to the President of Chaucer outlining the advantages and disadvantages of ROI and Residual Income. Include your recommendations for the most appropriate method for calculating the bonus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

65

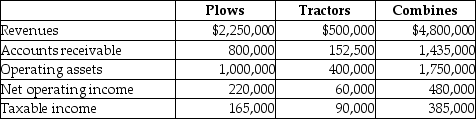

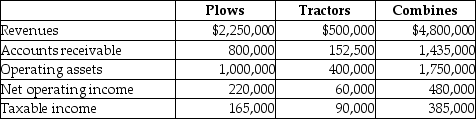

Kase Tractor Company allows its divisions to operate as autonomous units. The tax rate is 35% and other operating data for the past year follow:

Required:

Required:

a. Compute the return on investment for each division.

b. Compute the EVA for each division

c. What other ratio could be calculated for performance evaluation?

Required:

Required:a. Compute the return on investment for each division.

b. Compute the EVA for each division

c. What other ratio could be calculated for performance evaluation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

66

Kase Tractor Company allows its divisions to operate as autonomous units. The operating data for 2009 follow:

Required:

Required:

a. Compute the return on sales for each division

b. Compute the return on investment for each division.

c. Which division manager is doing best? Why?

d. What other factors should be included when evaluating the managers?

For parts (b) and (c) income is defined as operating income.

Required:

Required:a. Compute the return on sales for each division

b. Compute the return on investment for each division.

c. Which division manager is doing best? Why?

d. What other factors should be included when evaluating the managers?

For parts (b) and (c) income is defined as operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

67

R & D Storage is a small, but diversified, moving and storage company. In recent years its corporate income has declined to unacceptable levels. To change the direction of the company, the board of directors hired a new chief executive officer. She is currently considering three alternative ways as to how division managers are rewarded for their performance. They are; ROI, RI, and EVA.

Required:

Evaluate the CEO's plans by comparing the similarities and differences of the three methods.

Required:

Evaluate the CEO's plans by comparing the similarities and differences of the three methods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

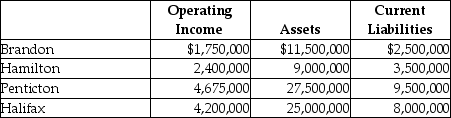

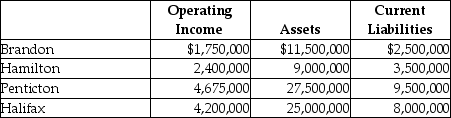

68

Coptermagic Company supplies helicopters to corporate clients. Coptermagic has two sources of funds: long term debt with a market and book value of $32 million issued at an interest rate of 10%, and equity capital that has a market value of $18 million (book value of $8 million). The cost of equity capital for Coptermagic is 15%, and its tax rate is 30%. Coptermagic has profit centres in four divisions that operate autonomously. The company's results for the past year are as follows:

Required:

Required:

a. Compute Coptermagic's weighted average cost of capital.

b. Compute each division's Economic Value Added.

c. Rank the divisions by EVA.

Required:

Required:a. Compute Coptermagic's weighted average cost of capital.

b. Compute each division's Economic Value Added.

c. Rank the divisions by EVA.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

69

The executive vice president of Wicker Pen Company wants to establish an accounting-based performance measurement system for the company's new plant. The company has an accounting information system sufficient to support a fairly sophisticated performance measurement system. The new plant is going to be considered an investment centre since its products will be marketed differently from others the company currently sells and it has no internal dealings with other plants within the company.

Required:

What are some of the key steps that should be undertaken in the establishment of a performance measurement system based on the Performance Measures Decision Process Model?

Required:

What are some of the key steps that should be undertaken in the establishment of a performance measurement system based on the Performance Measures Decision Process Model?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

70

Museum Corporation uses the investment centre concept for the museums that it manages. Select operating data for three of its museums for 2011 are as follows:

Required:

Required:

a. Compute the return on investment for each division.

b. Which museum manager is doing best based only on ROI? Why?

c. What other factors should be included when evaluating the managers?

Required:

Required:a. Compute the return on investment for each division.

b. Which museum manager is doing best based only on ROI? Why?

c. What other factors should be included when evaluating the managers?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

71

Batman Abstract Company has three divisions that operate autonomously. Their results for 2009 are as follows:

The company's desired rate of return is 20%.

The company's desired rate of return is 20%.

Required:

a. Compute each division's ROI.

b. Compute each division's residual income.

c. Rank each division by both ROI and residual income.

The company's desired rate of return is 20%.

The company's desired rate of return is 20%.Required:

a. Compute each division's ROI.

b. Compute each division's residual income.

c. Rank each division by both ROI and residual income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

72

Randall Ltd. reported the following results for its two divisions:

Required:

Required:

a. Using the DuPont method, calculate the return on investment for each division for each year.

b. Comment on the performance of each division.

Required:

Required:a. Using the DuPont method, calculate the return on investment for each division for each year.

b. Comment on the performance of each division.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

73

Outline and discuss the steps involved in making decisions on performance measures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

74

The following table presents information related to three divisions of Bacchus Ltd.:

The company's required rate of return is 10%.

The company's required rate of return is 10%.

Required:

Solve for the unknowns.

The company's required rate of return is 10%.

The company's required rate of return is 10%.Required:

Solve for the unknowns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

75

Stratton Industries has two divisions. These divisions reported the following results for the year just ended:

Required.

Required.

a. Calculate the ROI for each division. Which division would you consider to be the most successful? Why?

b. Now assume that the company requires a 14% minimum rate of return. Calculate the residual income for each division. Which division would you consider to be the most successful? Why?

Required.

Required.a. Calculate the ROI for each division. Which division would you consider to be the most successful? Why?

b. Now assume that the company requires a 14% minimum rate of return. Calculate the residual income for each division. Which division would you consider to be the most successful? Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

76

Capital Investments has three divisions. Each division's required rate of return is 15 percent. Planned operating results for 2011 are:

The company is planning an expansion requiring each division to increase its investments by $25,000,000 and its income by $4,500,000.

The company is planning an expansion requiring each division to increase its investments by $25,000,000 and its income by $4,500,000.

Required:

a. Compute the current ROI for each division.

b. Compute the current residual income for each division.

c. Rank the divisions according to their current ROIs and residual incomes.

d. Determine the effects after adding the new project to each division's ROI and residual income.

e. Which Divisions are pleased with the addition and which ones are unhappy assuming the managers are evaluated on a combination of ROI and residual income? Is a combination of ROI and residual income appropriate for the divisions?

The company is planning an expansion requiring each division to increase its investments by $25,000,000 and its income by $4,500,000.

The company is planning an expansion requiring each division to increase its investments by $25,000,000 and its income by $4,500,000.Required:

a. Compute the current ROI for each division.

b. Compute the current residual income for each division.

c. Rank the divisions according to their current ROIs and residual incomes.

d. Determine the effects after adding the new project to each division's ROI and residual income.

e. Which Divisions are pleased with the addition and which ones are unhappy assuming the managers are evaluated on a combination of ROI and residual income? Is a combination of ROI and residual income appropriate for the divisions?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

77

LaserLife Printer Cartridge Company is a decentralized organization with several autonomous divisions. The division managers are evaluated, in part, on the basis of the change in their return on invested assets. Operating results for the Packer Division for 2011 are budgeted as follows:

Total assets for the division are currently $3,600,000. For 2011 the division can add a new product line for an investment of $600,000. The new product line will generate sales of $1,600,000 and will incur fixed expenses of $600,000 annually. Variable costs of the new product will average 60 percent of selling price.

Total assets for the division are currently $3,600,000. For 2011 the division can add a new product line for an investment of $600,000. The new product line will generate sales of $1,600,000 and will incur fixed expenses of $600,000 annually. Variable costs of the new product will average 60 percent of selling price.

Required:

a. What is the effect on ROI of accepting the new product line?

b. If the company's required rate of return is 6 percent, and residual income is used to evaluate managers, would this encourage the division to accept the new product line? Explain and show computations.

Total assets for the division are currently $3,600,000. For 2011 the division can add a new product line for an investment of $600,000. The new product line will generate sales of $1,600,000 and will incur fixed expenses of $600,000 annually. Variable costs of the new product will average 60 percent of selling price.

Total assets for the division are currently $3,600,000. For 2011 the division can add a new product line for an investment of $600,000. The new product line will generate sales of $1,600,000 and will incur fixed expenses of $600,000 annually. Variable costs of the new product will average 60 percent of selling price.Required:

a. What is the effect on ROI of accepting the new product line?

b. If the company's required rate of return is 6 percent, and residual income is used to evaluate managers, would this encourage the division to accept the new product line? Explain and show computations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

78

Last year Reynolds Ltd. reported the following results:

Required:

Required:

a. Using the DuPont method, calculate the company's return on investment for the year just ended.

b. Assuming the company's sales and assets remain the same as last year, by how much would the gross margin percentage have to increase to achieve a 20% return on investment?

c. Assume the company sets a minimum required return of 13%, what would the residual income be?

Required:

Required:a. Using the DuPont method, calculate the company's return on investment for the year just ended.

b. Assuming the company's sales and assets remain the same as last year, by how much would the gross margin percentage have to increase to achieve a 20% return on investment?

c. Assume the company sets a minimum required return of 13%, what would the residual income be?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

79

Hargrave Products has three divisions which operate autonomously. Their results for 2010 were as follows:

The company's desired rate of return is 15 percent.

The company's desired rate of return is 15 percent.

Required:

a. Compute each division's ROI. Round to three decimal places.

b. Compute each division's residual income.

The company's desired rate of return is 15 percent.

The company's desired rate of return is 15 percent.Required:

a. Compute each division's ROI. Round to three decimal places.

b. Compute each division's residual income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

80

The economic value added concept has attracted considerable attention in recent years. Explain the attractiveness of this number as a measure of performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck