Deck 15: Alternative Minimum Tax

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/125

العب

ملء الشاشة (f)

Deck 15: Alternative Minimum Tax

1

Prior to the effect of tax credits, Wayne's regular income tax liability is $175,000 and his tentative AMT is $150,000.Wayne has nonrefundable business tax credits of $40,000.Wayne's tax liability is $135,000.

False

2

In deciding to enact the alternative minimum tax, Congress was concerned about the inequity that resulted when taxpayers with substantial economic incomes could avoid paying regular income tax.

True

3

Keosha acquires 10-year personal property to use in her business in 2012 and takes the maximum cost recovery deduction for regular income tax purposes. As a result of this, Keosha will have a positive AMT adjustment in 2012.

True

4

If circulation expenditures are amortized over a ten-year period for regular income tax purposes, there will be no AMT adjustment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

5

Joel placed real property in service in 2012 that cost $900,000 and used MACRS for regular income tax purposes.He is required to make a positive adjustment for AMT purposes in 2012 for the excess of depreciation calculated for regular income tax purposes over the depreciation calculated for AMT purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

6

The required adjustment for AMT purposes for pollution control facilities placed in service in 2012 is equal to the difference between the amortization deduction allowed for regular income tax purposes and the depreciation deduction computed under ADS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

7

Moore incurred circulation expenditures of $300,000 in 2012 and deducted that amount for regular income tax purposes.Moore has a $100,000 negative AMT adjustment for 2013, for 2014, and for 2015.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

8

After personal property is fully depreciated for both regular income tax purposes and AMT purposes, the positive and negative adjustments that have been made for AMT purposes will net to zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

9

Business tax credits reduce the AMT and the regular income tax in the same way.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

10

If the AMT base is greater than $175,000, the AMT rate for an individual taxpayer is the same as the AMT rate for a C corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

11

Negative AMT adjustments for the current year caused by timing differences are offset by the positive AMT adjustments for prior tax years also caused by timing differences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

12

The net capital gain included in an individual taxpayer's AMT base is eligible for the alternative tax rate on net capital gain. This favorable alternative rate applies both in calculating the regular income tax and the AMT.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

13

The phaseout of the AMT exemption amount for a taxpayer filing as a head of household both begins and ends at a higher income level than it does for a single taxpayer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

14

A tax preference can increase or decrease alternative minimum taxable income while an adjustment can only increase alternative minimum taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

15

Since most tax preferences are merely timing differences, they eventually will reverse and net to zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

16

Altrice incurs circulation expenditures of $180,000 in 2012.No additional circulation expenditures are incurred in 2013 or 2014.The cumulative adjustment for circulation expenditures for 2012, 2013, and 2014 is $180,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

17

If Abby's alternative minimum taxable income exceeds her regular taxable income, she will have an alternative minimum tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

18

Assuming no phaseout, the AMT exemption amount for a married taxpayer filing separately for 2012 is less than the AMT exemption amount for C corporations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

19

The AMT can be calculated using either the direct or the indirect approaches.Both the tax law and the tax forms use the direct approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

20

Julia's tentative AMT is $94,000. Her regular income tax liability is $72,000. Julia's AMT is $22,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

21

Interest on a home equity loan may be deductible for AMT purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

22

Income from some long-term contracts can be reported using the completed contract method for regular income tax purposes, but the percentage of completion method is required for AMT purposes for all long-term contracts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

23

The amount of the deduction for medical expenses under the regular income tax may be different than for AMT purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

24

Evan is a contractor who constructs both commercial and residential buildings. Even though some of the contracts could qualify for the use of the completed contract method, Evan decides to use the percentage of the completion method for all of his contracts. Therefore, no AMT adjustment is required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

25

Kerri, who had AGI of $120,000, itemized her deductions in the current year.She incurred unreimbursed employee business expenses of $8,500.Kerri must make a positive AMT adjustment of $2,400 in computing AMT.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

26

In 2012, Ben exercised an incentive stock option (ISO), acquiring stock with a fair market value of $190,000 for $170,000.His AMT basis for the stock is $170,000, his regular income tax basis for the stock is $170,000, and his AMT adjustment is $0 ($170,000 - $170,000).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

27

If the regular income tax deduction for medical expenses is $0, under certain circumstances the AMT deduction for medical expenses can be greater than $0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

28

Nell has a personal casualty loss deduction of $14,500 for regular income tax purposes. The deduction would have been $26,600, but it had to be reduced by $100 and by $12,000 (10% ´ $120,000 AGI). For AMT purposes, the casualty loss deduction is $26,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

29

The exercise of an incentive stock option (ISO) increases both the AMTI and regular taxable income in the year of exercise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

30

The deduction for charitable contributions in calculating the regular income tax can differ from that in calculating the AMT because the percentage limitations (20%, 30%, and 50%) may be applied to a different base amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

31

The AMT adjustment for mining exploration and development costs can be avoided if the taxpayer elects to write off the expenditures in the year incurred for regular income tax purposes, rather than writing off the expenditures over a 10-year period for regular income tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

32

Tricia sold land that originally cost $105,000 for $112,000.There is a positive AMT adjustment of $7,000 associated with the sale of the land.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

33

The recognized gain for regular income tax purposes and the recognized gain for AMT purposes on the sale of stock acquired under an incentive stock option (ISO) program are always the same because the adjusted basis is the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

34

The sale of business property might result in an AMT adjustment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

35

AGI is used as the base for application of percentage limitations (i.e., 20%, 30%, 50%) that apply to the charitable contribution deduction for regular income tax purposes. Modified AGI is used as the base for application of percentage limitations that apply to the charitable contribution deduction for AMT purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

36

Tammy expensed mining exploration and development costs of $100,000 incurred in 2012.She will be required to make negative AMT adjustments for each of the next nine years and a positive AMT adjustment in the current tax year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

37

If a gambling loss itemized deduction is permitted for regular income tax purposes, there will be no AMT adjustment associated with the gambling loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

38

The deduction for personal and dependency exemptions is allowed for regular income tax purposes, but is disallowed for AMT purposes. This results in a positive AMT adjustment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

39

The AMT adjustment for research and experimental expenditures can be avoided if the taxpayer capitalizes the expenditures and amortizes them over a 10-year period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

40

Because passive losses are not deductible in computing either taxable income or AMTI, no adjustment for passive losses is required for AMT purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

41

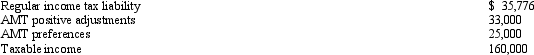

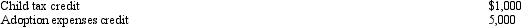

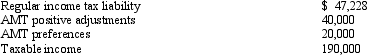

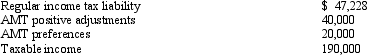

Miriam, who is a head of household and age 36, provides you with the following information from her financial records for 2012.  Calculate her AMTI for 2012.

Calculate her AMTI for 2012.

A)$0.

B)$171,300.

C)$195,925.

D)$218,000.

E)None of the above.

Calculate her AMTI for 2012.

Calculate her AMTI for 2012.A)$0.

B)$171,300.

C)$195,925.

D)$218,000.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

42

For regular income tax purposes, Yolanda, who is single, is in the 35% tax bracket.Her AMT base is $220,000.Her tentative AMT is:

A)$57,200.

B)$58,100.

C)$61,600.

D)$77,000.

E)None of the above.

A)$57,200.

B)$58,100.

C)$61,600.

D)$77,000.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

43

Interest income on private activity bonds issued before 2009, reduced by expenses incurred in carrying the bonds, is a tax preference item that is included in computing AMTI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

44

Ashly is able to reduce her regular income tax liability from $47,000 to $43,500 as the result of the alternative tax on net capital gain.Ashly's tentative AMT is $51,000.

A)Ashly's tax liability is reduced by $3,500 as the result of the alternative tax calculation on net capital gain.

B)Ashly's AMT is increased by $3,500 as the result of the alternative tax calculation on net capital gain.

C)Ashly's tax liability is $43,500.

D)Ashly's tax liability is $47,000.

E)None of the above.

A)Ashly's tax liability is reduced by $3,500 as the result of the alternative tax calculation on net capital gain.

B)Ashly's AMT is increased by $3,500 as the result of the alternative tax calculation on net capital gain.

C)Ashly's tax liability is $43,500.

D)Ashly's tax liability is $47,000.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

45

Jackson sells qualifying small business stock for $125,000 (adjusted basis of $105,000) in 2012. In calculating gross income for regular income tax purposes, he excludes all of his realized gain of $20,000.The $20,000 exclusion is a tax preference in calculating Jackson's AMTI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

46

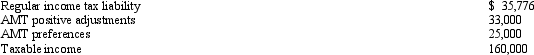

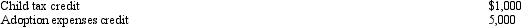

Prior to the effect of the tax credits, Justin's regular income tax liability is $200,000 and his tentative AMT is $195,000.Justin has the following credits:  Calculate Justin's tax liability after credits.

Calculate Justin's tax liability after credits.

A)$190,000.

B)$194,000.

C)$195,000.

D)$200,000.

E)None of the above.

Calculate Justin's tax liability after credits.

Calculate Justin's tax liability after credits.A)$190,000.

B)$194,000.

C)$195,000.

D)$200,000.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

47

Vicki owns and operates a news agency (as a sole proprietorship). During 2012, she incurred expenses of $24,000 to increase circulation of newspapers and magazines that her agency distributes. For regular income tax purposes, she elected to expense the $24,000 in 2012. In addition, Vicki incurred $15,000 in circulation expenditures in 2013 and again elected expense treatment.What AMT adjustments will be required in 2012 and 2013 as a result of the circulation expenditures?

A)$16,000 positive in 2012, $2,000 positive in 2013.

B)$16,000 negative in 2012, $2,000 positive in 2013.

C)$16,000 negative in 2012, $10,000 positive in 2013.

D)$16,000 positive in 2012, $10,000 positive in 2013.

E)None of the above.

A)$16,000 positive in 2012, $2,000 positive in 2013.

B)$16,000 negative in 2012, $2,000 positive in 2013.

C)$16,000 negative in 2012, $10,000 positive in 2013.

D)$16,000 positive in 2012, $10,000 positive in 2013.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

48

If the taxpayer elects to capitalize intangible drilling costs and to amortize them over a 10-year period for regular income tax purposes, there is no adjustment or preference for AMT purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following statements is correct?

A)The AMT calculated under the direct and indirect methods produces the same amount.

B)The AMT calculated under the direct and the indirect methods produces different amounts.

C)The tax forms use the direct method to calculate the AMT.

D)The tax law uses the direct method to calculate the AMT.

E)None of the above is correct.

A)The AMT calculated under the direct and indirect methods produces the same amount.

B)The AMT calculated under the direct and the indirect methods produces different amounts.

C)The tax forms use the direct method to calculate the AMT.

D)The tax law uses the direct method to calculate the AMT.

E)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

50

The AMT does not apply to qualifying "small corporations."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

51

C corporations are subject to a positive AMT adjustment equal to 75% of the excess of ACE over AMTI before the ACE adjustment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

52

Certain adjustments apply in calculating the corporate AMT that do not apply in calculating the noncorporate AMT and certain adjustments apply in calculating the noncorporate AMT that do not apply in calculating the corporate AMT.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

53

For individual taxpayers, the AMT credit is applicable for the AMT that results from timing differences, but it is not available for the AMT that results from the adjustment for itemized deductions or exclusion preferences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following statements is incorrect?

A)If the tentative minimum tax exceeds the regular income tax liability, the AMT is $0.

B)The exemption amount increases as AMTI increases.

C)The AMT tax rate for an individual taxpayer can be as high as 26%.

D)Only a.and b.are incorrect.

E)a., b., and c.are incorrect.

A)If the tentative minimum tax exceeds the regular income tax liability, the AMT is $0.

B)The exemption amount increases as AMTI increases.

C)The AMT tax rate for an individual taxpayer can be as high as 26%.

D)Only a.and b.are incorrect.

E)a., b., and c.are incorrect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

55

All of a C corporation's AMT is available for carryover as a minimum tax credit regardless of whether the adjustments and preferences originate from timing differences or AMT exclusions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

56

Kay had percentage depletion of $119,000 for the current year for regular income tax purposes.Cost depletion was $60,000.Her basis in the property was $90,000 at the beginning of the current year.Kay must treat the percentage depletion deducted in excess of cost depletion, or $59,000, as a tax preference in computing AMTI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

57

Meg, who is single and age 36, provides you with the following information from her financial records.  Calculate her AMT exemption for 2012.

Calculate her AMT exemption for 2012.

A)$0.

B)$23,450.

C)$14,075.

D)$48,450.

E)None of the above.

Calculate her AMT exemption for 2012.

Calculate her AMT exemption for 2012.A)$0.

B)$23,450.

C)$14,075.

D)$48,450.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following statements is correct?

A)If the tentative AMT is $10,000 and the regular income tax liability is $12,000, the AMT is $2,000.

B)If the tentative AMT is $12,000 and the regular income tax liability is $10,000, the AMT is $12,000.

C)If the tentative AMT is $10,000 and the regular income tax liability is $12,000, the AMT is a negative $2,000.

D)If the tentative AMT is $12,000, and the regular income tax liability is $10,000, the AMT is $2,000.

E)None of the above.

A)If the tentative AMT is $10,000 and the regular income tax liability is $12,000, the AMT is $2,000.

B)If the tentative AMT is $12,000 and the regular income tax liability is $10,000, the AMT is $12,000.

C)If the tentative AMT is $10,000 and the regular income tax liability is $12,000, the AMT is a negative $2,000.

D)If the tentative AMT is $12,000, and the regular income tax liability is $10,000, the AMT is $2,000.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

59

The C corporation AMT rate can be higher than the individual AMT rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

60

The AMT exemption for a C corporation is $40,000 reduced by 35% of the amount by which AMTI exceeds $150,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

61

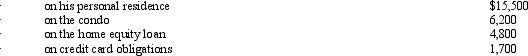

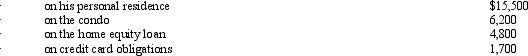

Ted, who is single, owns a personal residence in the city.He also owns a condo near the ocean.He uses the condo as a vacation home.In March 2012, he borrowed $50,000 on a home equity loan and used the proceeds to acquire a luxury automobile.During 2012, he paid the following amounts of interest:  What amount, if any, must Ted recognize as an AMT adjustment in 2012?

What amount, if any, must Ted recognize as an AMT adjustment in 2012?

A)$0.

B)$4,800.

C)$6,200.

D)$11,000.

E)None of the above.

What amount, if any, must Ted recognize as an AMT adjustment in 2012?

What amount, if any, must Ted recognize as an AMT adjustment in 2012?A)$0.

B)$4,800.

C)$6,200.

D)$11,000.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

62

Akeem, who does not itemize, incurred a net operating loss (NOL) of $50,000 in 2012.His deductions in 2012 included AMT tax preference items of $20,000, and he had no AMT adjustments.Assuming the NOL is not carried back, what is Akeem's ATNOLD carryover to 2013?

A)$50,000.

B)$30,000.

C)$20,000.

D)$40,000.

E)None of the above.

A)$50,000.

B)$30,000.

C)$20,000.

D)$40,000.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

63

Vinny's AGI is $220,000.He contributed $130,000 in cash to the Boy Scouts, a public charity.What is Vinny's charitable contribution deduction for AMT purposes?

A)$0.

B)$66,000.

C)$110,000.

D)$130,000.

E)None of the above.

A)$0.

B)$66,000.

C)$110,000.

D)$130,000.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

64

Tad is a vice-president of Ruby Corporation. In 2012, he acquired 800 shares of Ruby Corporation stock under the corporation's incentive stock option (ISO) plan for an option price of $33 per share. At the date of exercise in 2012, the fair market value of the stock was $43 per share. The stock became freely transferable in 2013. Tad sold the 800 shares for $50 per share in 2014. Which of the following statements is incorrect?

A)Acquisition of the stock in 2012 had no effect on Tad's taxable income, but increased AMTI by $8,000 in 2012.

B)Tad's regular income tax basis for the stock is $26,400 and his AMT basis is $34,400 in 2012.

C)Tad must report a negative AMT adjustment of $5,000 in 2013.

D)Tad will have a positive AMT adjustment of $5,000 in 2014.

E)All of the above are correct.

A)Acquisition of the stock in 2012 had no effect on Tad's taxable income, but increased AMTI by $8,000 in 2012.

B)Tad's regular income tax basis for the stock is $26,400 and his AMT basis is $34,400 in 2012.

C)Tad must report a negative AMT adjustment of $5,000 in 2013.

D)Tad will have a positive AMT adjustment of $5,000 in 2014.

E)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

65

Factors that can cause the adjusted basis for AMT purposes to be different from the adjusted basis for regular income tax purposes include the following:

A)A different amount of depreciation (cost recovery) has been deducted for AMT purposes and regular income tax purposes.

B)The spread on an incentive stock option (ISO) is recognized for AMT purposes, but is not recognized for regular income tax purposes.

C)A different amount has been deducted for circulation expenditures for AMT purposes and for regular income tax purposes.

D)Only a.and b.

E)a., b., and c.

A)A different amount of depreciation (cost recovery) has been deducted for AMT purposes and regular income tax purposes.

B)The spread on an incentive stock option (ISO) is recognized for AMT purposes, but is not recognized for regular income tax purposes.

C)A different amount has been deducted for circulation expenditures for AMT purposes and for regular income tax purposes.

D)Only a.and b.

E)a., b., and c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

66

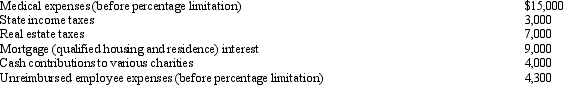

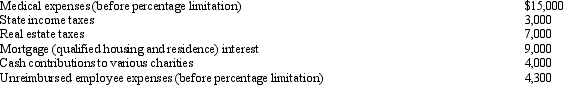

Mitch, who is single and has no dependents, had AGI of $100,000 in 2012.His potential itemized deductions were as follows:  What is the amount of Mitch's AMT adjustment for itemized deductions for 2012?

What is the amount of Mitch's AMT adjustment for itemized deductions for 2012?

A)$14,800.

B)$16,800.

C)$19,300.

D)$25,800.

E)None of the above.

What is the amount of Mitch's AMT adjustment for itemized deductions for 2012?

What is the amount of Mitch's AMT adjustment for itemized deductions for 2012?A)$14,800.

B)$16,800.

C)$19,300.

D)$25,800.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

67

In 2012, Sean incurs $90,000 of mining exploration expenditures, and deducts the entire amount for regular income tax purposes.Which of the following statements is correct?

A)For AMT purposes, Sean will have a positive adjustment of $81,000 in 2012.

B)Sean will have a negative AMT adjustment of $9,000 in 2017.

C)Over a 10-year period, positive and negative adjustments will net to zero.

D)Only a.and c.are correct.

E)a., b., and c.are correct.

A)For AMT purposes, Sean will have a positive adjustment of $81,000 in 2012.

B)Sean will have a negative AMT adjustment of $9,000 in 2017.

C)Over a 10-year period, positive and negative adjustments will net to zero.

D)Only a.and c.are correct.

E)a., b., and c.are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

68

Marvin, the vice president of Lavender, Inc., exercises stock options for 100 shares of stock in March 2012. The stock options are incentive stock options (ISOs). Their exercise price is $20 and the fair market value on the date of exercise is $28. The options were granted in March 2009 and all restrictions on the free transferability had lapsed by the exercise date.

A)If Marvin sells the stock in December 2012 for $3,000, his AMT adjustment in 2012 is a positive adjustment of $800.

B)If Marvin sells the stock in December 2013 for $3,000, his AMT adjustment in 2013 is $0.

C)If Marvin sells the stock in December 2012 for $3,000, his AMT adjustment in 2012 is a negative adjustment of $800.

D)If Marvin sells the stock in December 2013 for $3,000, his AMT adjustment in 2013 is a negative adjustment of $1,000.

E)None of the above.

A)If Marvin sells the stock in December 2012 for $3,000, his AMT adjustment in 2012 is a positive adjustment of $800.

B)If Marvin sells the stock in December 2013 for $3,000, his AMT adjustment in 2013 is $0.

C)If Marvin sells the stock in December 2012 for $3,000, his AMT adjustment in 2012 is a negative adjustment of $800.

D)If Marvin sells the stock in December 2013 for $3,000, his AMT adjustment in 2013 is a negative adjustment of $1,000.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

69

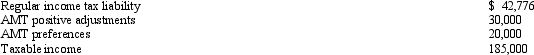

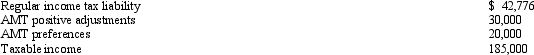

Robin, who is a head of household and age 42, provides you with the following information from his financial records for 2012.  Calculate his AMT for 2012.

Calculate his AMT for 2012.

A)$14,533.

B)$17,825.

C)$42,986.

D)$62,300.

E)None of the above.

Calculate his AMT for 2012.

Calculate his AMT for 2012.A)$14,533.

B)$17,825.

C)$42,986.

D)$62,300.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

70

Eula owns a mineral property that had a basis of $23,000 at the beginning of the year.Cost depletion is $19,000.The property qualifies for a 15% depletion rate.Gross income from the property was $200,000 and net income before the percentage depletion deduction was $50,000.What is Eula's tax preference for excess depletion?

A)$15,000.

B)$23,000.

C)$25,000.

D)$0.

E)None of the above.

A)$15,000.

B)$23,000.

C)$25,000.

D)$0.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following statements is correct?

A)The deduction for personal and dependency exemptions is not permitted in calculating the AMT.Therefore, in converting regular taxable income to AMTI, a positive adjustment is required.

B)To the extent that itemized deductions exceed the standard deduction for regular income tax purposes, a positive AMT adjustment is required in converting regular taxable income to AMTI.

C)The charitable contribution deduction for AMT purposes and for regular income tax purposes can be different. If this occurs, a positive AMT adjustment is required for the amount of the difference.

D)Only a.and b.are correct.

E)a., b., and c.are correct.

A)The deduction for personal and dependency exemptions is not permitted in calculating the AMT.Therefore, in converting regular taxable income to AMTI, a positive adjustment is required.

B)To the extent that itemized deductions exceed the standard deduction for regular income tax purposes, a positive AMT adjustment is required in converting regular taxable income to AMTI.

C)The charitable contribution deduction for AMT purposes and for regular income tax purposes can be different. If this occurs, a positive AMT adjustment is required for the amount of the difference.

D)Only a.and b.are correct.

E)a., b., and c.are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

72

Prior to the effect of tax credits, Eunice's regular income tax liability is $325,000 and her tentative AMT is $312,000.Eunice has general business credits available of $20,000.Calculate Eunice's tax liability after tax credits.

A)$0.

B)$305,000.

C)$312,000.

D)$325,000.

E)None of the above.

A)$0.

B)$305,000.

C)$312,000.

D)$325,000.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

73

Celia and Amos, who are married filing jointly, have one dependent and do not itemize deductions. They have taxable income of $82,000 and tax preferences of $53,000 in 2012. What is their AMT base for 2012?

A)$0.

B)$85,925.

C)$94,450.

D)$158,300.

E)None of the above.

A)$0.

B)$85,925.

C)$94,450.

D)$158,300.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following itemized deductions definitely will be the same amount for the regular income tax and the AMT and thus result in no AMT adjustment in 2012?

A)Real property taxes.

B)Medical expenses.

C)Charitable contributions.

D)Only b.and c.

E)a., b., and c.

A)Real property taxes.

B)Medical expenses.

C)Charitable contributions.

D)Only b.and c.

E)a., b., and c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following normally produces positive AMT adjustments?

A)Real property taxes deduction.

B)Standard deduction.

C)Charitable contribution deduction.

D)Only a.and b.are correct.

E)a., b., and c.are correct.

A)Real property taxes deduction.

B)Standard deduction.

C)Charitable contribution deduction.

D)Only a.and b.are correct.

E)a., b., and c.are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

76

In 2012, Amber had a $100,000 loss on a passive activity.None of the loss is attributable to AMT adjustments or preferences.She has no other passive activities.Which of the following statements is correct?

A)In 2012, Amber can deduct $100,000 for regular income tax purposes and for AMT purposes.

B)Amber will have a $100,000 tax preference in 2012 as a result of the passive activity.

C)For regular income tax purposes, none of the loss is allowed in 2012.

D)In 2012, Amber will have a positive adjustment of $25,000 as a result of the passive loss.

E)None of the above.

A)In 2012, Amber can deduct $100,000 for regular income tax purposes and for AMT purposes.

B)Amber will have a $100,000 tax preference in 2012 as a result of the passive activity.

C)For regular income tax purposes, none of the loss is allowed in 2012.

D)In 2012, Amber will have a positive adjustment of $25,000 as a result of the passive loss.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

77

On January 3, 1998, Parrot Corporation acquired an office building for $300,000 and computed depreciation under ADS (Alternative Depreciation System) for regular income tax purposes. The ADS rate for the first year is 2.396% and for the fifteenth year is 2.50% (MACRS rates would have been 2.461% and 2.564% respectively). What is Parrot's AMT adjustment (or preference) for depreciation with respect to the office building for 1998 and for 2012?

A)$195 positive adjustment in 1998 and $192 positive adjustment in 2012.

B)$195 positive adjustment in both 1998 and 2012.

C)$195 negative adjustment in 1998 and $195 negative adjustment in 2012.

D)$0 adjustment or preference.

E)None of the above.

A)$195 positive adjustment in 1998 and $192 positive adjustment in 2012.

B)$195 positive adjustment in both 1998 and 2012.

C)$195 negative adjustment in 1998 and $195 negative adjustment in 2012.

D)$0 adjustment or preference.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

78

Wallace owns a construction company that builds both commercial and residential buildings. He contracts to build a residential building for $800,000 for which he is eligible to use the completed contract method of accounting. In the current year for regular income tax purposes, Wallace does not recognize any income on the contract. Under the percentage of complete method, the income recognized under the contract would have been $60,000. Wallace's AMT adjustment is:

A)$0.

B)$60,000 negative adjustment.

C)$60,000 positive adjustment.

D)$800,000 positive adjustment.

E)None of the above.

A)$0.

B)$60,000 negative adjustment.

C)$60,000 positive adjustment.

D)$800,000 positive adjustment.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

79

Omar acquires used 7-year personal property for $100,000 to use in his business in February 2012.Omar does not elect § 179 expensing, but does take the maximum regular cost recovery deduction.He elects not to take additional first-year depreciation.As a result, Omar will have a positive AMT adjustment in 2012 of what amount?

A)$0.

B)$3,580.

C)$10,710.

D)$14,290.

E)None of the above.

A)$0.

B)$3,580.

C)$10,710.

D)$14,290.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following can produce an AMT preference rather than an AMT adjustment?

A)Standard deduction.

B)Research and experimental expenditures.

C)Percentage depletion.

D)Incentive stock options (ISOs).

E)None of the above.

A)Standard deduction.

B)Research and experimental expenditures.

C)Percentage depletion.

D)Incentive stock options (ISOs).

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck