Deck 13: Property Transactions: Determination of Gain or Loss, Basis Considerations, and Nontaxable Exchanges-Part 2

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/92

العب

ملء الشاشة (f)

Deck 13: Property Transactions: Determination of Gain or Loss, Basis Considerations, and Nontaxable Exchanges-Part 2

1

Annette purchased stock on March 1, 2012, for $165,000.At December 31, 2012, it was worth $171,000.She also purchased a bond on September 1, 2012, for $20,000.At year end, it was worth $16,000.Determine Annette's realized and recognized gain or loss.

Annette's realized gain or loss is zero and her recognized gain or loss is zero.Since a sale or other disposition has not occurred, there is no realization or recognition on either the stock or the bond.

2

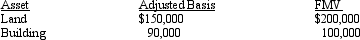

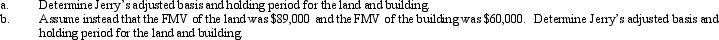

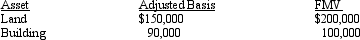

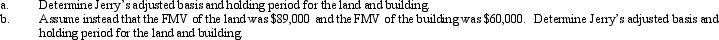

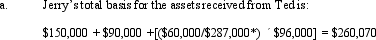

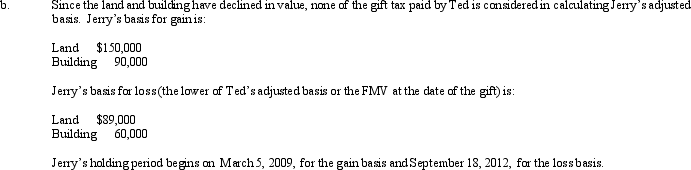

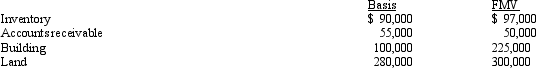

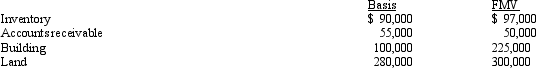

On September 18, 2012, Jerry received land and a building from Ted as a gift. Ted had purchased the land and building on March 5, 2009, and his adjusted basis and the fair market value at the date of the gift were as follows:

Ted paid gift tax on the transfer to Jerry of $96,000.

Ted paid gift tax on the transfer to Jerry of $96,000.

Ted paid gift tax on the transfer to Jerry of $96,000.

Ted paid gift tax on the transfer to Jerry of $96,000.

The basis is allocated to the land and building as follows:

The basis is allocated to the land and building as follows:Land: ($200,000/$300,000) ´ $260,070 = $173,380

Building: ($100,000/$300,000) ´ $260,070 = $86,690

Jerry's holding period begins on March 5, 2009.

*The $287,000 is equal to the fair market value of the land and building of $300,000 reduced by the per donee annual exclusion of $13,000.

3

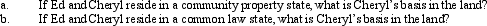

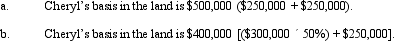

Ed and Cheryl have been married for 27 years.They own land jointly with a basis of $300,000.Ed dies in 2012, when the fair market value of the land is $500,000.Under the joint ownership arrangement, the land passed to Cheryl.

4

Peggy uses a delivery van in her business.The adjusted basis is $39,000, and the fair market value is $34,000.The delivery van is stolen and Peggy receives insurance proceeds of $34,000.Determine Peggy's realized and recognized gain or loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

5

Bill is considering two options for selling land for which he has an adjusted basis of $80,000 and on which there is a mortgage of $75,000.Under the first option, Bill will sell the land for $170,000 with a stipulation in the sales contract that he liquidate the mortgage before the sale is complete.Under the second option, Bill will sell the land for $95,000 and the buyer will assume the mortgage.Calculate Bill's recognized gain under both options.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

6

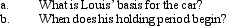

Emma gives her personal use automobile (cost of $29,000; fair market value of $15,000) to her son, Louis, on July 3, 2012. She has owned the automobile since July 1, 2009.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

7

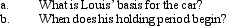

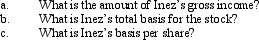

Inez's adjusted basis for 9,000 shares of Cardinal, Inc.common stock is $900,000.During the year, she receives a 5% stock dividend that is a nontaxable stock dividend.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

8

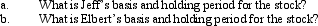

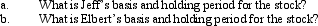

Elbert gives stock worth $28,000 (no gift tax resulted) to his friend, Jeff, on June 8, 2012.Elbert purchased the stock on September 1, 2005, and his adjusted basis is $22,000.Jeff dies on December 8, 2013, and bequeaths the stock to Elbert.At that date, the fair market value of the stock is $31,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

9

Hilary receives $10,000 for a 13-foot wide utility easement along one of the boundaries to her property.The easement provides that no structure can be built on that portion of the property.Her adjusted basis for the property is $200,000 and the easement covers 15% of the total acreage.Determine the effect of the $10,000 payment on Hilary's gross income and her basis for the property.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

10

Hubert purchases Fran's jewelry store for $950,000.The identifiable assets of the business are as follows:

Hubert and Fran agree to assign $110,000 to a 7-year covenant not to compete.How should Hubert allocate the $950,000 purchase price to the assets?

Hubert and Fran agree to assign $110,000 to a 7-year covenant not to compete.How should Hubert allocate the $950,000 purchase price to the assets?

Hubert and Fran agree to assign $110,000 to a 7-year covenant not to compete.How should Hubert allocate the $950,000 purchase price to the assets?

Hubert and Fran agree to assign $110,000 to a 7-year covenant not to compete.How should Hubert allocate the $950,000 purchase price to the assets?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

11

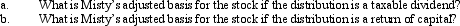

Misty owns stock in Violet, Inc., for which her adjusted basis is $128,000.She receives a cash distribution of $50,000 from Violet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

12

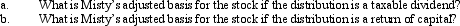

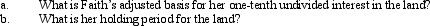

Faith inherits an undivided interest in a parcel of land from her father on February 15, 2012. Her father purchased the land on August 25, 1985 and his basis for the land was $325,000. The fair market value of the land is $12,500,000 on the date of her father's death and is $11,000,000 six months later. The executor elects the alternate valuation date. Faith has nine brothers and sisters and each inherited a one-tenth interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

13

Nigel purchased a blending machine for $125,000 for use in his business.As to the machine, he has deducted MACRS cost recovery of $31,024, maintenance costs of $5,200, and repair costs of $4,000.Calculate Nigel's adjusted basis for the machine.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

14

Felix gives 100 shares of stock to his daughter, Monica. The stock was acquired in 2003 for $20,000, and at the time of the gift, it had a fair market value of $60,000. Felix paid a gift tax of $6,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

15

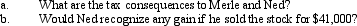

On January 15 of the current taxable year, Merle sold stock with a cost of $40,000 to his brother Ned for $25,000, its fair market value.On June 21, Ned sold the stock to a friend for $26,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

16

Robert sold his ranch which was his principal residence during the current taxable year.At the date of the sale, the ranch had an adjusted basis of $460,000 and was encumbered by a mortgage of $200,000.The buyer paid him $500,000 in cash, agreed to take the title subject to the $200,000 mortgage, and agreed to pay him $100,000 with interest at 6 percent one year from the date of sale.How much is Robert's recognized gain on the sale?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

17

Boyd acquired tax-exempt bonds for $430,000 in December 2012.The bonds, which mature in December 2017, have a maturity value of $400,000.Boyd does not make any elections regarding the amortization of the bond premium.Determine the tax consequences to Boyd when he redeems the bonds in December 2017.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

18

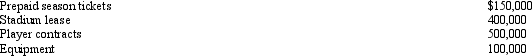

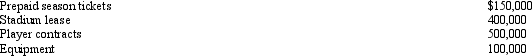

Marge purchases the Kentwood Krackers, a AAA level baseball team, for $1.5 million.The appraised values of the identified assets are as follows:

The Krackers have won the pennant for the past two years.Determine Marge's adjusted basis for the assets of the Kentwood Krackers.

The Krackers have won the pennant for the past two years.Determine Marge's adjusted basis for the assets of the Kentwood Krackers.

The Krackers have won the pennant for the past two years.Determine Marge's adjusted basis for the assets of the Kentwood Krackers.

The Krackers have won the pennant for the past two years.Determine Marge's adjusted basis for the assets of the Kentwood Krackers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

19

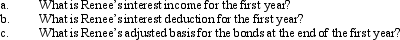

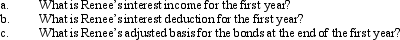

Renee purchases taxable bonds with a face value of $200,000 for $212,000.The annual interest paid on the bonds is $10,000.Assume Renee elects to amortize the bond premium.The total premium amortization for the first year is $1,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

20

Monica sells a parcel of land to her son, Elbert, for $90,000.Monica's adjusted basis is $100,000.Three years later, Elbert gives the land to his fiancée, Karen.At that date, the land is worth $104,000.No gift tax is paid.Since Elbert is going to be stationed in the U.S.Army in Germany for 3 years, they do not plan on being married until his tour is completed.Six months after receiving the land, Karen sells it for $110,000.At the same time, Karen sends Elbert a "Dear John" email.Calculate Karen's realized and recognized gain or loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

21

After 5 years of marriage, Dave and Janet decided to get a divorce.As part of the divorce settlement, Janet transfers to Dave the house she purchased prior to their marriage.Janet's adjusted basis for the house is $125,000 and the fair market value is $200,000 on the date of the transfer.What are the tax consequences to Janet and to Dave as a result of the transfer?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

22

On January 5, 2012, Waldo sells his principal residence with an adjusted basis of $270,000 for $690,000.He has owned and occupied the residence for 15 years.He pays $35,000 in commissions and $2,000 in legal fees in connection with the sale.One month before the sale, Waldo painted the exterior of the house at a cost of $5,000 and repaired various items at a cost of $3,000.On October 15, 2012, Waldo purchases a new home for $600,000.On November 15, 2013, he pays $25,000 for completion of a new room on the house, and on January 14, 2014, he pays $15,000 for the construction of a pool.What is the Waldo's recognized gain on the sale of his old principal residence and what is the basis for the new residence?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

23

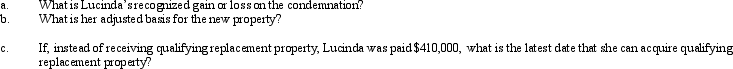

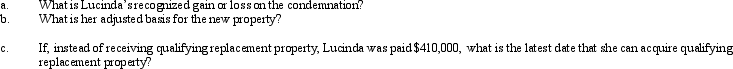

Lucinda, a calendar year taxpayer, owned a rental property with an adjusted basis of $312,000 in a major coastal city.Her property was condemned by the city government on October 12, 2012.In order to build a convention center, Lucinda eventually received qualified replacement property from the city government on March 9, 2013.This new property has a fair market value of $410,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

24

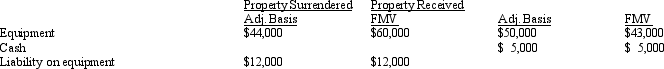

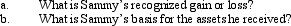

Sammy exchanges equipment used in his business in a like-kind exchange.The property exchanged is as follows:

The other party assumes the liability.

The other party assumes the liability.

The other party assumes the liability.

The other party assumes the liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

25

Don, who is single, sells his personal residence on October 5, 2012, for $380,000.His adjusted basis was $102,000.He pays realtor's commissions of $18,000.He owned and occupied the residence for 14 years.Having decided that he no longer wants the burdens of home ownership, he invests the sales proceeds in a mutual fund and enters into a 1-year lease on an apartment.The detriments of renting, including a crying child next door, cause Don to rethink his decision.Therefore, he purchases another residence on November 6, 2013, for $188,000.Is Don eligible for exclusion of gain treatment under § 121 (exclusion of gain on sale of principal residence)? Calculate Don's recognized gain and his basis for the new residence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

26

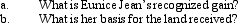

Eunice Jean exchanges land held for investment located in Rolla, Missouri, for land to be held for investment located near Madrid, Spain.Her basis for the land given up is $370,000 and the fair market value of the land received is $390,000.Eunice Jean also receives cash of $25,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

27

Mandy and Greta form Tan, Inc., by transferring the following assets to the corporation in exchange for 5,000 shares of stock each.

Mandy: Cash of $450,000

Greta: Land (worth $450,000; adjusted basis of $90,000).

How much gain must Tan recognize on the receipt of these assets?

Mandy: Cash of $450,000

Greta: Land (worth $450,000; adjusted basis of $90,000).

How much gain must Tan recognize on the receipt of these assets?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

28

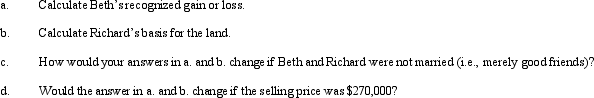

Beth sells investment land (adjusted basis of $225,000) that she has owned for 6 years to her husband, Richard, for its fair market value of $195,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

29

Patty's factory building, which has an adjusted basis of $325,000, is destroyed by fire on March 5, 2012.Insurance proceeds of $475,000 are received on May 1, 2012.She has a new factory building constructed for $450,000, which she occupies on October 1, 2012.Assuming Patty's objective is to minimize the tax liability, calculate her recognized gain or loss and the basis of the new factory building.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

30

Katrina, age 58, rented (as a tenant) the house that was her principal residence from January 1, 2012 through December 31, 2013.She purchased the house on January 1, 2014, for $150,000 and continued to occupy it through June 30, 2015.She leased it to a tenant from July 1, 2015, through December 31, 2016.On January 1, 2017, she sells the house for $350,000.She incurs a realtor's commission of $20,000.Calculate her recognized gain if her objective is to minimize the recognition of gain and she does not intend to acquire another residence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

31

Lynn transfers her personal use automobile to her business (a sole proprietorship).The car's adjusted basis is $35,000 and the fair market value is $12,000.No cost recovery had been deducted by Lynn, since she held the car for personal use.Determine the adjusted basis of the car to Lynn's sole proprietorship including the basis for cost recovery.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

32

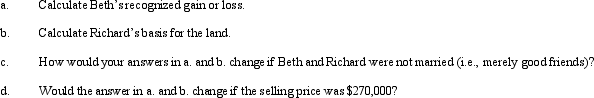

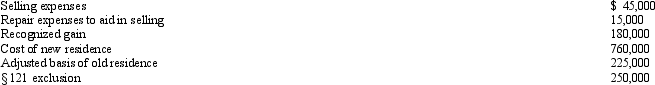

Use the following data to determine the sales price of Etta's principal residence and the realized gain.She is not married.The sale of the old residence qualifies for the § 121 exclusion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

33

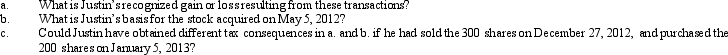

Justin owns 1,000 shares of Oriole Corporation common stock (adjusted basis of $9,800). On April 27, 2012, he sells 300 shares for $2,800, while on May 5, 2012, he purchases 200 shares for $2,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

34

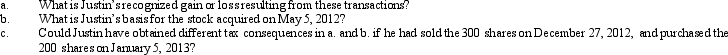

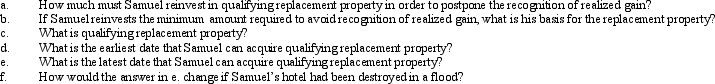

Samuel's hotel is condemned by the City Housing Authority on July 5, 2012, for which he is paid condemnation proceeds of $950,000.He first received official notification of the pending condemnation on May 2, 2012.Samuel's adjusted basis for the hotel is $600,000 and he uses a fiscal year for tax purposes with a September 30 tax year-end.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

35

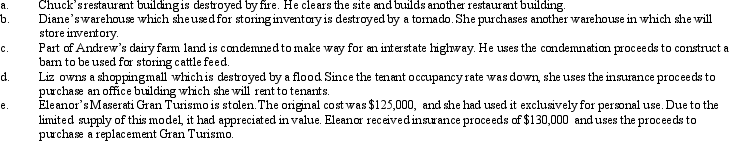

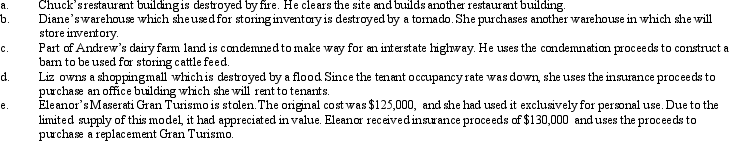

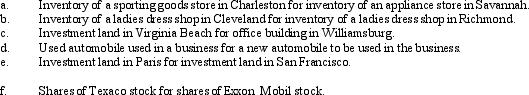

For each of the following involuntary conversions, determine if the property qualifies as replacement property.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

36

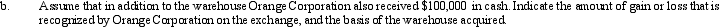

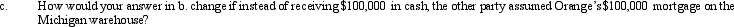

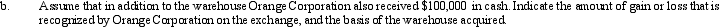

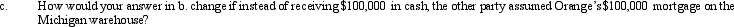

a. Orange Corporation exchanges a warehouse located in Michigan (adjusted basis of $560,000) for a warehouse located in Ohio (adjusted basis of $450,000; fair market value of $525,000).Indicate the amount of gain or loss that is recognized by Orange Corporation on the exchange, and the basis of the warehouse acquired.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

37

When a property transaction occurs, what four questions should be considered with respect to the sale or other disposition?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

38

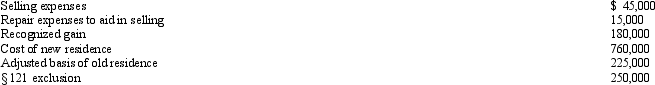

Janet, age 68, sells her principal residence for $500,000.She purchased it twenty-two years ago for $150,000.Selling expenses are $30,000 and repair expenses to get the house in a marketable condition to sell are $15,000.Janet's objective is to minimize the taxes she must pay associated with the sale.Calculate her recognized gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

39

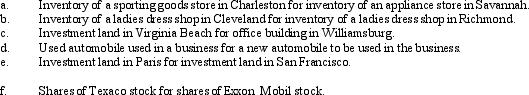

For the following exchanges, indicate which qualify as like-kind property.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

40

Evelyn's office building is destroyed by fire on July 12, 2012.The adjusted basis is $315,000.She receives insurance proceeds of $350,000 on August 31, 2012.Calculate the amount that Evelyn must reinvest in qualifying property in order that her recognized gain be $20,000.Assume she elects § 1033 (nonrecognition of gain from an involuntary conversion) postponement treatment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

41

Define a bargain purchase of property and discuss the related tax consequences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

42

If a taxpayer purchases taxable bonds at a premium, the amortization of the premium is elective.However, if a taxpayer purchases tax-exempt bonds at a premium, the amortization of the premium is mandatory.Explain this difference in the treatment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

43

Lois received nontaxable stock rights with a fair market value of $4,000.The fair market value of the stock on which the rights were received is $24,000 (cost $14,000).Assume the rights are exercised by paying $31,000 plus the rights.Discuss how to calculate the basis of the old stock and the basis of the new stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

44

If a taxpayer purchases a business and the price exceeds the fair market value of the listed assets, how is the excess allocated among the purchased assets?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

45

For a corporate distribution of cash or other property to a shareholder, when does dividend income or a return of capital result?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

46

Maurice sells his personal use automobile at a realized loss.Under what circumstances can Maurice deduct the loss? What if the personal use asset was sold at a realized gain?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

47

What is the general formula for calculating the adjusted basis of property?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

48

What effect does a deductible casualty loss have on the adjusted basis of property?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

49

Under what circumstances will a distribution by a corporation to its only shareholder result in a capital gain?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

50

What is a deathbed gift and what tax consequences apply?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

51

Discuss the application of holding period rules to property acquired by gift and inheritance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

52

Joseph converts a building (adjusted basis of $50,000 and fair market value of $40,000) from personal use to business use.Justin receives a building with a $40,000 fair market value ($50,000 donor's adjusted basis) from his mother as a gift.Discuss the tax consequences with respect to Joseph's and Justin's adjusted basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

53

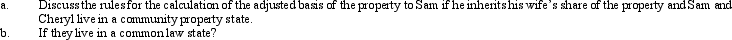

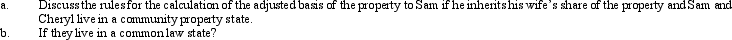

Sam and Cheryl, husband and wife, own property jointly.The property has an adjusted basis of $400,000 and a fair market value of $500,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

54

Define fair market value as it relates to property transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

55

Discuss the effect of a liability assumption on the seller's amount realized and the buyer's adjusted basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

56

Describe the relationship between the recovery of capital doctrine and the realized and recognized gain and loss concepts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

57

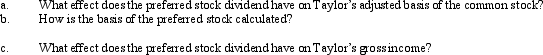

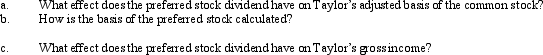

Taylor owns common stock in Taupe, Inc., with an adjusted basis of $100,000.She receives a preferred stock dividend which is nontaxable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

58

How is the donee's basis calculated for the gift of appreciated property for a gift made before 1977? Assume the donor pays gift tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

59

What is the difference between the depreciation (or cost recovery) allowed and the depreciation (or cost recovery) allowable and what effect does each have on the adjusted basis of property?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

60

For gifts made after 1976, when will part of the gift tax paid by the donor be added to the donee's basis?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

61

For disallowed losses on related-party transactions, who has the right of offset?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

62

Discuss the logic for mandatory deferral of realized gain or loss for a § 1031 like-kind exchange.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

63

Discuss the relationship between realized gain and boot received in a § 1031 like-kind exchange.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

64

Discuss the relationship between the postponement of realized gain under § 1031 (like-kind exchanges) and the adjusted basis and holding period for the replacement property.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

65

Under what circumstance is there recognition of some or all of the realized gain associated with the giving of boot by the taxpayer in a like-kind exchange?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

66

Discuss the treatment of losses from involuntary conversions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

67

What effect do the assumption of liabilities have on a § 1031 like-kind exchange?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

68

What kinds of property do not qualify under the like-kind provisions?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

69

Why is it generally undesirable to pass property by death when its fair market value is less than basis?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

70

Alice is terminally ill and does not expect to live much longer.Pondering the consequences of her estate, she decides how to allocate her property to her nieces.She makes a gift of depreciated property (i.e., adjusted basis exceeds fair market value) to Marsha, a gift of appreciated property (i.e., fair market value exceeds adjusted basis) to Jan, and leaves appreciated property to Cindy in her will.Each of the properties has the same fair market value.From an income tax perspective, which niece is her favorite?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

71

Define an involuntary conversion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

72

Tariq sold certain U.S.Government bonds and State of Oregon bonds at a loss to offset short-term capital gain from a previous transaction.He felt that the U.S.Government and State of Oregon bonds were "good" investments, so he repurchased identical securities within one week.Do these transactions constitute wash sales?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

73

What requirements must be satisfied to receive nontaxable exchange treatment under § 1031?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

74

Discuss the treatment of realized gains from involuntary conversions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

75

Identify two tax planning techniques that can be used to avoid the wash sale disallowance of loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

76

To be eligible to elect postponement of gain treatment for an involuntary conversion, what are the three tests for qualifying replacement property?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

77

Explain how the sale of investment property at a loss to a brother is treated differently from a sale to a nephew.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

78

What is the easiest way for a taxpayer who is going to sell property that has declined in value to avoid the § 267 loss disallowance provision?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

79

Mitchell owned an SUV that he had purchased two years ago for $48,000 and which he transfers to his sole proprietorship.How is the sole proprietorship's basis for the SUV calculated? What additional information does Mitchell need?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

80

Can related parties take advantage of the like-kind exchange provisions?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck